Free Invoice Template for Excel 2007 Download

For any business, managing financial transactions efficiently is crucial. Creating professional documents that detail services, payments, and terms can save time and reduce errors. Thankfully, there are simple tools that help you create and track these documents without the need for specialized software.

Using a pre-designed structure in a commonly available program makes generating accurate statements quick and easy. Whether you’re a freelancer, small business owner, or managing a larger company, such tools can streamline your workflow and ensure you maintain a polished, consistent approach to billing.

Efficient solutions can help you focus more on your work and less on administrative tasks. By relying on accessible software, you gain control over important details like pricing, taxes, and contact information with minimal effort. These resources are perfect for anyone looking to simplify financial documentation processes while keeping things professional.

Why Use Excel 2007 for Invoices

When it comes to managing billing and financial documentation, flexibility and ease of use are key. The right tool can simplify the creation of detailed statements, automate repetitive tasks, and ensure accuracy. Many users turn to well-established software for these needs, thanks to its accessibility and powerful features that support a variety of business operations.

This particular program offers a user-friendly environment with extensive customization options. Its versatility allows you to create and modify records, track payments, and calculate totals in just a few clicks. Unlike specialized billing software, it does not require complex setup or learning curves, making it an ideal choice for small businesses or freelancers.

Furthermore, the software’s built-in functions help with organizing and analyzing data, making it easy to calculate taxes, discounts, and totals. Let’s look at some of the key benefits:

| Feature | Benefit |

|---|---|

| Customizable layout | Easy to adjust and fit specific needs |

| Built-in formulas | Automates calculations for faster results |

| Cross-platform compatibility | Works across various devices and operating systems |

| Familiar interface | Users can quickly adapt to the program without steep learning curves |

By using this program, you can easily create professional documents that meet the requirements of clients and regulatory bodies, all while keeping the process simple and efficient. Whether for one-off jobs or recurring services, this approach helps you stay organized and in control of your financial records.

Benefits of Free Invoice Templates

Using ready-made designs for creating financial records can save time and eliminate the need for complex setups. These designs are readily available and allow businesses to focus on more important tasks while ensuring that all essential details are correctly included. By leveraging these solutions, you gain a reliable way to generate professional documents without the hassle of manual formatting or calculations.

One of the main advantages is the simplicity they bring to the table. You can quickly input your information into a structured format, ensuring you don’t miss any critical data. Whether you are handling payments for goods or services, these ready-made designs provide a fast and efficient way to maintain accuracy in your financial paperwork.

Key Advantages of Using Pre-Made Designs

- Time-saving: Ready-made layouts eliminate the need for manual setup, allowing you to focus on your work.

- Consistency: These structures ensure uniformity across all documents, giving your business a professional appearance.

- Accuracy: Built-in fields and calculations reduce the chances of errors in amounts, taxes, and totals.

- Easy to Customize: Simple adjustments can be made to suit the unique needs of your business or industry.

- No Need for Additional Software: These resources can be used with common programs, reducing the need for specialized applications.

Why They Are Perfect for Small Businesses

- Cost-effective: These solutions often come at no cost, which is especially beneficial for small businesses with limited budgets.

- Quick Setup: You don’t need to spend time learning complex systems; just open, input, and save.

- Improved Cash Flow: Fast creation and clear records can speed up payment processing and follow-ups.

Incorporating these ready-made formats into your daily workflow ensures a smooth and professional handling of your financial records, whether you are invoicing clients or tracking your income and expenses.

How to Download Excel Invoice Templates

Finding the right tools to generate professional financial documents is easier than ever. Many platforms offer ready-to-use structures that can be instantly accessed and customized for your needs. By using these resources, you can save time and avoid manual formatting, ensuring that all your records are accurate and neatly organized.

To get started, the process is simple. You just need to identify a trustworthy website or resource that offers these pre-designed documents. From there, you can quickly acquire and use them for your business. Here’s how you can obtain these essential files in just a few steps:

Steps to Access Ready-Made Designs

- Search for a Reliable Source: Look for websites offering financial document solutions. Make sure the source is reputable to ensure you are getting a quality file.

- Choose a Suitable Design: Browse through the available options and select one that fits your needs. Most sources will offer several variations depending on the type of business.

- Click to Access the File: Once you’ve found the right document, click on the link or button to access it. You may be prompted to provide basic details or agree to terms before you proceed.

- Save the File to Your Device: After accessing the file, save it to your computer or cloud storage. This will allow you to easily open and edit it later.

- Open and Customize: Once saved, you can open the file in your preferred software and input your details. Adjust the fields to match your business information and services offered.

Where to Find These Resources

- Official Websites: Many software providers offer free resources on their websites. They may include a variety of pre-designed structures suitable for different types of businesses.

- Online Marketplaces: Platforms such as online marketplaces often feature professional templates created by independent designers.

- Business Blogs and Forums: Bloggers or business communities sometimes share links to valuable resources, including simple tools for managing financial records.

Once you’ve obtained your desired structure, you can begin using it to create professional documents in just a few moments. The entire process is user-friendly, allowing you to stay focused on your work while ensuring your financial paperwork remains organized and accurate.

Step-by-Step Guide to Creating Invoices

Creating accurate and professional financial documents is an essential part of running any business. Having a structured method to record transactions not only helps in maintaining clear records but also ensures that clients receive the correct details regarding their payments. Follow this step-by-step guide to easily create organized, detailed records that reflect your services or products.

The process is straightforward and can be done in just a few steps. With a well-organized framework, you can input all the necessary information quickly, ensuring that your records are precise and professional. Here’s how to get started:

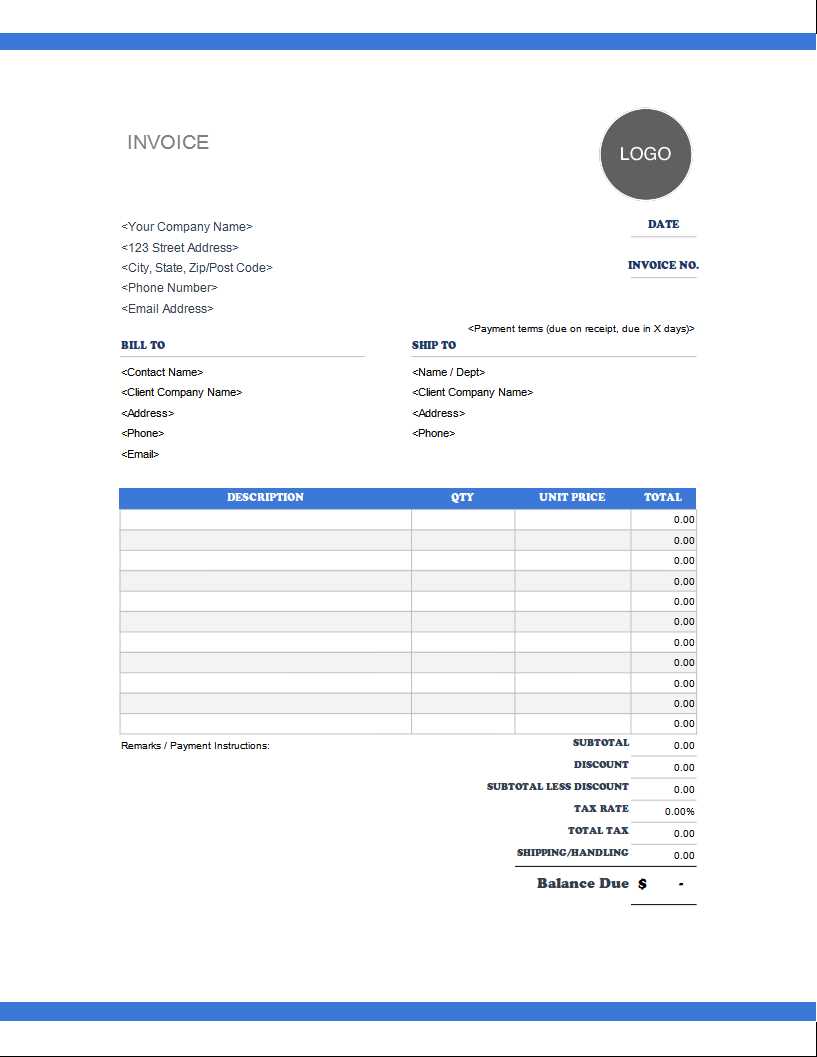

Step 1: Set Up Your Document

Begin by opening the document in your preferred software. Choose a clean, organized layout that allows for easy entry of details. This includes clear sections for your business and client information, as well as areas for itemized services or products.

Step 2: Input Your Company Details

In the top section of the document, include your business name, contact information, and address. This helps identify your company and provides a point of reference for the client. Also, include any relevant identification numbers or business registration information that might be required by law.

Step 3: Enter Client Information

Next, input the name, address, and contact details of the client. This will ensure that the document is correctly linked to the right individual or company. Double-check for accuracy to avoid confusion later on.

Step 4: List the Items or Services Provided

In the main body of the document, create a detailed list of the items or services provided. Include descriptions, quantities, unit prices, and the total cost for each entry. This breakdown helps the client understand exactly what they are being charged for.

Step 5: Add Calculations

If applicable, include any additional calculations such as taxes, discounts, or shipping fees. Ensure that all numbers are correct and add up properly, so the client is not left with any uncertainties regarding the final total.

Step 6: Set Payment Terms and Due Date

Clearly state the payment terms, including accepted payment methods, due date, and any late fees that might apply. Providing this information upfront helps avoid confusion or delays in payment.

Step 7: Review and Finalize

Before sending the document, take a moment to review all the details. Check for any errors in client information, pricing, or dates. A final review ensures that your document is accurate and professional before it reaches the client.

By following these simple steps, you can easily create well-organized financial records that are clear, professional, and ready to be sent to your clients. This approach not only streamlines your administrative tasks but also helps maintain a consistent, efficient process for all future transactions.

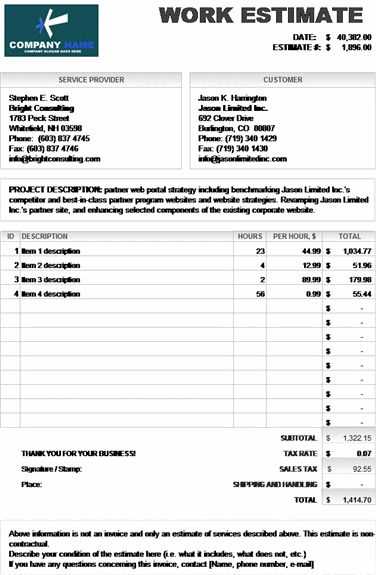

Customizing Invoice Templates in Excel

Once you’ve chosen a pre-designed structure for creating financial documents, the next step is to personalize it to fit your business needs. Customizing your layout not only helps maintain brand consistency but also ensures that all the necessary fields are included, tailored specifically to the services or products you offer. Whether it’s adjusting colors or adding specific details, personalization can make your records more professional and aligned with your business identity.

The process of modifying these layouts is straightforward and involves simple changes, like adding your logo, adjusting text fields, or incorporating new sections for additional details. By taking control of the design, you can create a streamlined document that communicates important information clearly to your clients.

Step 1: Adding Your Logo and Branding

One of the first things you may want to change is the header. By adding your company logo and choosing colors that match your brand, you create a cohesive look. Most software allows you to insert images easily, so uploading your logo is a quick task. Additionally, you can adjust font colors and styles to align with your business’s visual identity.

Step 2: Adjusting Column Layout

Next, you may want to modify the columns based on the services or products you provide. For example, if you sell multiple items, you might add extra columns for item descriptions, quantities, or other necessary details. You can also resize columns to make sure everything fits neatly and is easy to read.

Step 3: Adding Extra Fields for Details

To capture all relevant information, you might need to include additional sections, such as discounts, taxes, or payment terms. These fields can be added to the document with just a few clicks, allowing you to expand or adjust the structure as needed. It’s important to ensure that all necessary details are clearly visible to avoid confusion or errors.

Step 4: Modifying Formulas and Calculations

If the document includes automated calculations, you can edit the formulas to match your pricing structure. For example, if your business offers varying tax rates based on location, you can customize the formulas to automatically calculate the correct amount based on the inputted information.

Step 5: Finalizing and Saving

After making your desired changes, take a moment to review the document to ensure all adjustments are correct. Once you’re satisfied with the layout and content, save the modified file. You now have a fully customized document that aligns with your brand and business operations, ready to be used for future transactions.

By personalizing your records in this way, you not only improve the functionality of the document but also ensure that every interaction w

Top Features of Excel Invoice Templates

When it comes to managing your business’s financial documentation, having access to an efficient and user-friendly structure can make all the difference. These pre-designed frameworks offer a range of features that can help streamline your billing process, save time, and ensure accuracy in your records. Let’s explore the key features that make these layouts so popular among businesses of all sizes.

Key Features of These Structures

- Customizable Layout: You can easily adjust the layout to meet your specific needs, whether it’s adding extra fields for discounts or services or resizing columns for better organization.

- Automated Calculations: Built-in formulas help automatically calculate totals, taxes, and other important figures, reducing the risk of errors and saving time.

- Professional Design: These structures are designed to look polished and formal, helping to present a professional image to clients and partners.

- Clear and Organized Sections: Information is clearly segmented into easily readable sections, such as contact details, itemized lists, payment terms, and totals, making it simple for clients to understand.

- Multiple Payment Options: Many structures allow you to include various payment methods, whether by check, credit card, or bank transfer, ensuring that clients have flexible options.

Additional Functionalities

- Multi-Currency Support: Some formats allow you to change the currency to suit international transactions, making it ideal for businesses with global clients.

- Tax and Discount Fields: Easily add customizable fields for taxes, discounts, or shipping charges, which are calculated automatically based on the inputted information.

- Recurring Billing: Some structures offer options for recurring billing, which can save you time if you have clients on subscription-based services.

- Cross-Device Compatibility: You can open and edit these documents across multiple devices, ensuring you can access and update them from anywhere, at any time.

These advanced features make financial document creation faster, more accurate, and more professional, ultimately improving your overall business efficiency. Whether you are running a small freelance business or managing a larger operation, leveraging these features helps you maintain organization and professionalism in all of your transactions.

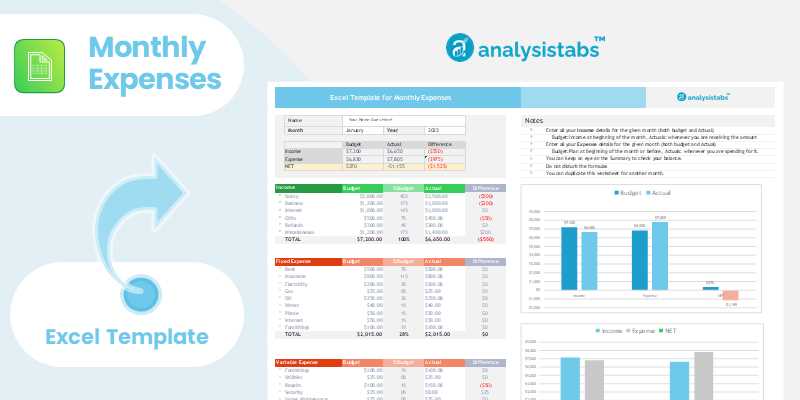

Improving Billing Efficiency with Excel

Managing billing processes efficiently is critical for any business, whether large or small. The ability to create and track financial records quickly and accurately can save significant time, reduce errors, and improve cash flow. By using powerful tools available in common spreadsheet software, businesses can automate many of the time-consuming aspects of billing while ensuring that their records remain organized and precise.

One of the key ways to enhance billing efficiency is through the use of pre-designed structures that allow for rapid input of data. These documents can be customized to suit specific needs, such as adding customer details, adjusting quantities, or calculating totals. This streamlined process reduces the need for manual calculations and minimizes the chance of mistakes, making it easier to focus on other essential business tasks.

Benefits of Using Spreadsheet Tools for Billing

- Automation of Calculations: Built-in formulas automatically calculate totals, taxes, and discounts, reducing human error and speeding up the process.

- Easy Customization: Adjusting layouts and adding or removing fields to fit your business’s needs can be done quickly, allowing you to create tailored documents.

- Time-saving: With a well-organized structure, you can generate and process documents in a fraction of the time it would take manually, making invoicing faster and more efficient.

- Consistency Across Documents: Maintaining a consistent format across all financial records ensures clarity and professionalism in every transaction.

Additional Features to Boost Efficiency

- Templates for Recurring Tasks: If you regularly bill for similar services or products, you can create recurring entries that automatically fill in, saving time on repetitive work.

- Tracking and Organization: Easily sort, filter, and store documents, ensuring that you can quickly locate and update any past transactions.

- Accessibility Across Devices: Spreadsheets are accessible from various devices, so you can manage your financial records from anywhere, keeping your business running smoothly at all times.

By leveraging these tools, businesses can significantly improve their billing efficiency, freeing up valuable time for other tasks. Whether you’re dealing with a few clients or handling high volumes of transactions, utilizing spreadsheet software ensures that you can manage your financial documentation accurately and efficiently.

Managing Client Information in Excel

Keeping track of client details is essential for maintaining smooth business operations. By organizing and storing key information in a structured format, you can easily access contact details, payment history, and specific preferences when needed. Utilizing powerful spreadsheet software for this task helps streamline your record-keeping, ensuring that no important information is overlooked.

Through customizable fields and built-in features, you can create a centralized system that allows you to quickly input, update, and retrieve client data. Whether you are managing a small list of clients or a large database, this approach helps maintain order and saves time when looking up details for future transactions or communications.

Organizing Client Information Efficiently

Here are some of the key elements you can track and manage in a well-structured document:

| Client Name | Contact Details | Address | Payment Terms | Last Transaction Date |

|---|---|---|---|---|

| John Doe | [email protected] | 1234 Main St | Net 30 | 2024-10-15 |

| Jane Smith | [email protected] | 5678 Elm St | Due on receipt | 2024-10-10 |

| Acme Corp | [email protected] | 4321 Business Ave | Net 60 | 2024-09-30 |

Features for Easy Client Management

- Sorting and Filtering: Quickly find specific clients based on certain criteria like payment terms or transaction dates.

- Customizable Fields: Add extra columns to track any unique data related to each client, such as service preferences or special discounts.

- Update and Edit Easily: Modify any information, such as a change of address or new contact details, without hassle.

- Linking to Other Documents: You can connect the

Common Excel Functions for Invoices

When managing financial documents, using the right functions can significantly improve the accuracy and efficiency of your calculations. By leveraging built-in tools, you can automate common tasks such as summing totals, applying taxes, and calculating discounts. These features not only save time but also reduce the risk of human error, ensuring that your records are accurate and professional.

Below are some of the most useful functions that can help streamline the process of generating financial documents and managing business transactions.

Key Functions to Enhance Efficiency

- SUM: The SUM function allows you to quickly add up multiple values, such as the total cost of items or services. It can be used across rows or columns to get a quick total.

- AVERAGE: If you need to find the average price or value of a set of items, the AVERAGE function is an essential tool. It simplifies the process of calculating typical amounts.

- IF: The IF function is helpful for making conditional calculations. For example, you can use it to apply discounts based on the total amount or check whether a payment has been made on time.

- VLOOKUP: This function allows you to search for specific information, such as a client’s details or product pricing, from another table. It’s useful for pulling data automatically into your document without retyping information.

- TEXT: The TEXT function can format dates, numbers, or currencies into a more readable form, ensuring that your documents look polished and easy to read.

Advanced Functions for Complex Tasks

- PMT: This function calculates payment amounts for loans or recurring payments, which is particularly useful if you are billing clients for subscription-based services.

- ROUND: The ROUND function helps in rounding numbers to a specified number of decimal places, which is especially useful when dealing with currency and precise amounts.

- CONCATENATE: If you need to combine different pieces of information, such as first and last names, the CONCATENATE function allows you to merge text from multiple cells into one.

- NOW: The NOW function can automatically insert the current date and time, which is helpful when generating records that include timestamps.

- COUNTIF: This function is useful for counting specific entries based on criteria, such as the number of clients who have paid or the number of pending payments.

Using these functions can greatly improve the speed and accuracy of your document creation process. Whether you are working on simple or complex tasks, these tools can help automate key calculations and data entry, making your financial documentation more efficient and less prone to error.

Excel Formatting Tips for Professional Invoices

Creating professional and visually appealing financial documents is crucial for establishing trust and credibility with your clients. Proper formatting not only makes your records look organized but also ensures that key information is easy to find and read. By applying simple formatting techniques, you can enhance the clarity of your documents and give them a polished, professional appearance.

Here are several formatting tips that can help you create well-organized and visually appealing financial records:

- Use Clear Headings and Subheadings: Start by clearly labeling each section of your document, such as “Client Information,” “Service List,” and “Total Amount Due.” Bold or increase the font size of headings to make them stand out, which improves the document’s readability.

- Apply Consistent Font Styles and Sizes: Choose a professional, easy-to-read font like Arial or Calibri. Maintain a consistent font size across the document, with slightly larger text for headings. This will help your document appear uniform and organized.

- Color for Emphasis: Use subtle colors to highlight important information like totals or payment due dates. Avoid using too many bright colors, as they can be distracting. Stick to a simple color scheme that aligns with your branding.

- Align Text for Readability: Proper alignment of text and numbers is essential for making your document clean and structured. For example, align numeric values (such as amounts) to the right, while text (like client names) should be aligned to the left. This improves the document’s clarity.

- Use Borders and Shading: To separate different sections, use borders or shaded areas. For example, you can use a light shading for the header row of itemized lists to make it stand out. This method adds a visual break, making the document easier to follow.

- Leave Adequate White Space: Ensure there is enough space between sections and rows. Crowded text and numbers can make the document feel overwhelming and difficult to read. A clean, open layout makes it easier for clients to process the information.

- Incorporate Logos and Branding: Add your company logo at the top of the document for a more professional look. Using consistent branding, such as colors and fonts, will help reinforce your company’s identity and make the document feel cohesive.

- Use Date and Number Formats: Ensure that d

Saving Time with Pre-made Invoice Templates

Running a business involves numerous tasks, and managing billing is one of the most time-consuming activities. Using pre-designed structures for creating financial documents can significantly reduce the time spent on repetitive tasks and ensure consistency across all your records. These ready-to-use designs allow you to focus on core business activities while automating much of the paperwork involved in client transactions.

Pre-made layouts offer the benefit of having everything already organized, from the customer’s details to payment terms, which helps eliminate the need for manual formatting and calculations. With just a few updates or adjustments, you can generate professional documents in a fraction of the time it would take to start from scratch.

How Pre-designed Structures Save Time

- Instant Setup: Simply input the relevant information, and the document is ready to go. This eliminates the need to design each document from the ground up.

- Automatic Calculations: Most pre-made designs come with built-in formulas for calculating totals, taxes, and discounts, allowing for quicker and more accurate financial records.

- Consistency Across Documents: Using the same structure ensures that every document maintains a professional and consistent look, saving time on reformatting and improving client trust.

- Pre-set Fields: Essential fields such as client name, service description, and payment terms are already set up. You only need to input the specific details, which reduces the effort required to fill in each document.

Additional Benefits

- Customizable Design: While the layout is pre-made, you still have the flexibility to tailor the design to your needs, adjusting logos, fonts, or colors without starting from scratch.

- Streamlined Workflow: Having a standardized document format speeds up the entire billing process, from creation to sending, allowing you to handle more clients in less time.

- Error Reduction: Pre-designed structures often include error-checking features such as automatic calculations and formatting, which helps reduce the risk of mistakes that could lead to financial discrepancies.

By adopting pre-made structures for your billing needs, you can save valuable time and focus on growing your business rather than getting bogged down with administrative tasks. Whether you’re dealing with a few clients or many, these pre-built systems help you stay organized and efficient.

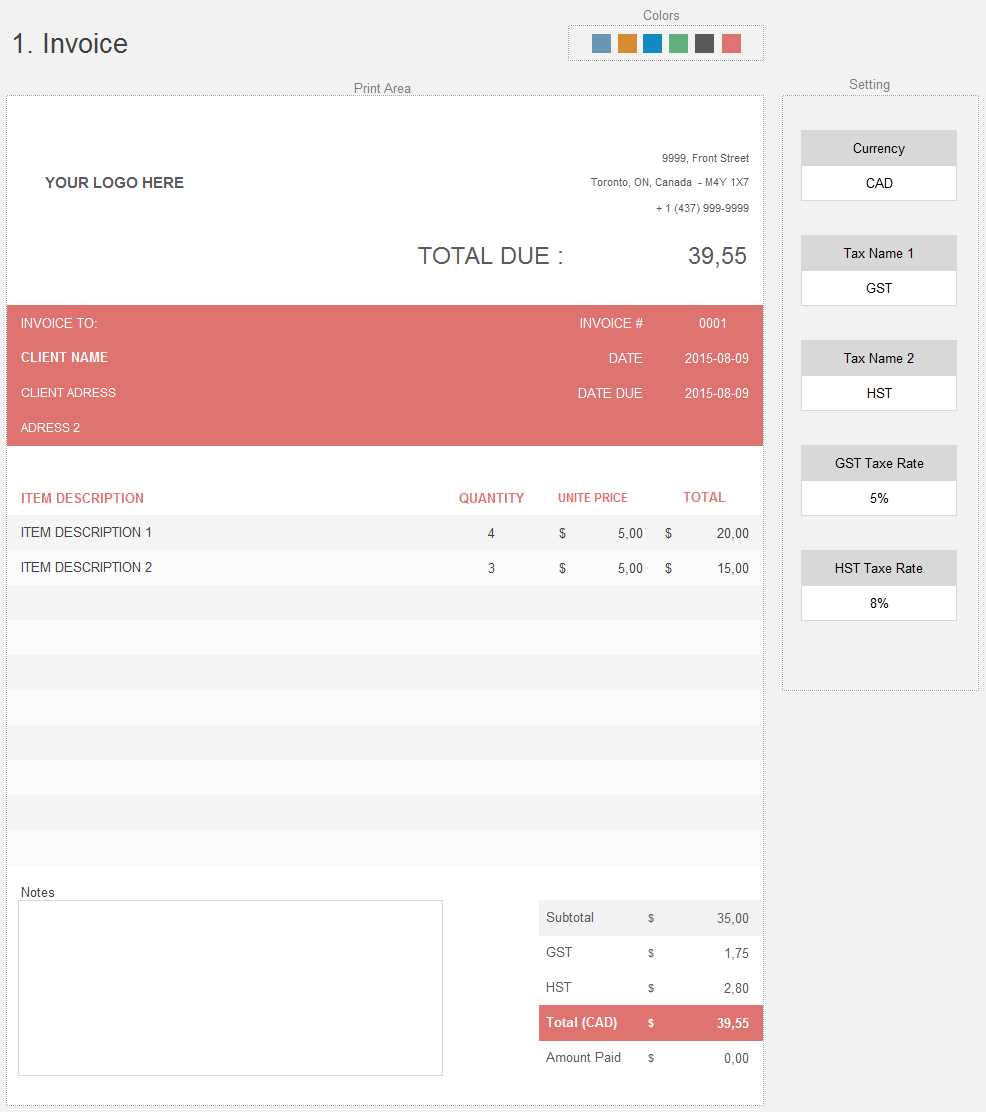

How to Add Taxes and Discounts in Excel

When creating financial documents, including taxes and discounts is a critical step to ensure accurate pricing and payment calculations. Rather than manually calculating these amounts, spreadsheet software allows you to automate the process using simple formulas. This not only saves time but also reduces the risk of errors, ensuring that both taxes and discounts are applied correctly every time.

In this section, we will explore how to efficiently calculate taxes and discounts using basic formulas and how to apply them to your financial records for accurate totals.

Calculating Taxes

To add taxes, you’ll first need to know the tax rate applicable to the transaction. Once you have this, you can use a simple formula to calculate the tax amount and add it to the subtotal.

Item Price Tax Rate Tax Amount Total Price Product A $100.00 8% =$100*8% =$100 + $8 = $108.00 Product B $150.00 8% =$150*8% =$150 + $12 = $162.00 To calculate tax, multiply the price by the tax rate (as a decimal). For example, if the price is $100 and the tax rate is 8%, the formula will be: = Price * Tax Rate. The result will be the tax amount, which you can then add to the subtotal to get the total amount.

Applying Discounts

Discounts can be applied either as a fixed amount or as a percentage of the total. Here’s how you can calculate both types in a spreadsheet:

Item Price Discount Rate Discount Amount Total Price After Discount Product A $100.00 10% =$100*10% =$100 – $10 = $90.00 Product B $150.00 15% Exporting and Printing Invoices from Excel

After creating a financial document, it’s important to know how to easily export and print it for distribution or record-keeping. Whether you’re emailing the document to a client or printing it for physical delivery, knowing how to properly export and print your document can save time and ensure consistency. By following the right steps, you can quickly generate a ready-to-share or print version without losing any formatting or important information.

This section will guide you through the process of exporting your financial document into different formats and printing it directly from your software. Understanding these basic steps ensures that your documents are properly formatted and accessible when needed.

How to Export Documents

Exporting allows you to save your document in different formats such as PDF or CSV, which are ideal for sharing and long-term storage. Below are the steps for exporting your document:

- Export as PDF:

- Click on the “File” tab in your software.

- Select “Save As” and choose “PDF” from the available file types.

- Choose the location where you’d like to save the file and click “Save”. This will create a professional PDF version of your document, which maintains formatting and is ready for sharing or printing.

- Export to CSV:

- Click on the “File” tab and select “Save As”.

- Choose “CSV” from the dropdown menu.

- Save the file in the desired location. The CSV format is typically used for storing raw data, so it may not preserve the full design but will maintain the data structure.

- Export to Other Formats:

- If you need your document in another format, such as XLSX or TXT, follow the same procedure but choose the appropriate format from the “Save As” options.

How to Print Documents

If you prefer physical copies of your document, printing directly from your software is a simple process. Follow these steps for optimal printing:

- Set Up Page Layout: Before printing, adjust the page layout to ensure everything fits neatly on the page. You can modify margins, orientation (portrait or landscape), and scaling options.

- Preview Before Printing: Always use the “Print Preview” option to check how your document will appear on paper. This helps ensure that all important information is visible and properly aligned.

- Print to Paper:

Excel 2007 vs Newer Versions for Invoicing

When it comes to managing financial documents, many businesses still rely on older versions of software, like the 2007 edition. However, with the release of newer versions, many features and enhancements have been introduced that could improve efficiency and ease of use. Choosing between an older version and the latest software depends on your specific needs, familiarity with the interface, and the features required for generating accurate and professional records.

This section compares the 2007 version of the software with newer versions, focusing on key differences that affect billing and financial management tasks.

Key Differences Between Versions

- Interface and Usability: Newer versions have streamlined interfaces with more intuitive tools and options. Enhanced features like the ribbon interface make it easier to navigate, while in the older version, some tools and options are buried in menus, requiring more time to locate.

- Functionality Enhancements: Newer versions offer more advanced functions, such as better data analysis tools, integration with online services, and improved collaboration features. For example, real-time collaboration in newer versions allows multiple users to work on the same document simultaneously, a feature that’s not as seamless in the 2007 edition.

- Templates and Pre-set Features: Modern versions include a wider range of pre-configured designs and automatic calculations that can simplify billing tasks. The older version lacks many of these automated features, requiring more manual adjustments and setups.

- Cloud Integration: Newer editions allow better integration with cloud storage platforms, making it easier to access and share documents from anywhere. This feature is particularly beneficial for businesses that need to share documents on the go, unlike the older software which was more reliant on local storage.

- Security Features: As security threats evolve, newer versions have received numerous updates to enhance document protection. The 2007 version may lack some of the latest security protocols, which could make it more vulnerable to breaches or loss of data.

Why Stick with the 2007 Version?

While newer versions offer enhanced features, some businesses still prefer using the older 2007 edition due to familiarity, simplicity, or because they don’t need the advanced tools available in the newer versions. Additionally, 20

Best Practices for Using Excel Invoices

When creating and managing financial records, it’s essential to follow best practices to ensure that documents are professional, accurate, and easy to understand. Using spreadsheet software for this task offers a range of features, but to maximize its efficiency, you must implement strategies that streamline the process and reduce the risk of errors. In this section, we will explore some key best practices for generating and handling financial documents within a spreadsheet environment.

Organize Your Document Structure

- Use Clear Headings: Ensure your document includes clear and concise headings such as “Billing Information,” “Client Details,” and “Itemized Charges” to make the document easy to read and navigate.

- Include Consistent Formatting: Consistent font style, size, and alignment help improve the overall readability of the document. Avoid clutter and use whitespace effectively to make the content visually appealing.

- Set Up Sections Properly: Separate key sections with visible lines or borders to clearly distinguish between different types of information, such as customer details, transaction items, and totals.

Ensure Accurate Calculations

- Use Built-in Formulas: Leverage formulas for automatic calculations of totals, taxes, and discounts to ensure accuracy and save time. This eliminates the possibility of manual errors in math or missing fields.

- Double-Check Your Formula References: Ensure that all formulas reference the correct cells. For example, if you’re calculating the total, check that all prices and quantities are correctly included in the formula.

- Review Before Sending: Before finalizing any document, take a moment to review all calculated fields. A quick check can prevent costly mistakes like incorrect totals or omitted charges.

Maintain Consistency Across Documents

- Use the Same Structure for All Transactions: Consistency is key when dealing with multiple clients or transactions. Using the same layout ensures that all records are easy to follow, reducing confusion and potential mistakes.

- Standardize Terms and Conditions: Always include clear terms and conditions, payment instructions, and due dates. Consistency in the language and terms you use helps ensure clarity for both you and your clients.

Protect and Back Up Your Data

- Secure Your Documents: Use password protection or restrict editing access to prevent unauthorized changes. This helps safeguard sensitive financial d