Invoice Template for Actors to Simplify Your Billing Process

When working in the entertainment industry, managing your finances can be just as important as your performances. One key aspect of this is ensuring that you receive proper compensation for your work. Having a clear and professional way to request payment is essential to maintaining a smooth financial workflow and protecting your rights as a professional.

Accurate documentation is vital for any freelancer, especially those in the creative fields. Whether you’re working on a short-term gig or a long-term project, presenting clear and concise records for payment helps avoid misunderstandings and ensures timely transactions. It’s important to include all necessary details in your billing records, so clients know exactly what they are paying for and when they should expect to settle the amount.

Creating a reliable system to manage payments can save time, reduce errors, and improve your professional image. With the right tools, you can streamline this process and focus more on your craft, knowing that your financial matters are in order.

Invoice Template for Actors

When working in the entertainment industry, it’s essential to have a professional document that clearly outlines the services rendered and the agreed-upon compensation. A well-organized record not only helps ensure timely payments but also protects both parties in case of disputes. By using an effective billing system, performers can keep track of their earnings and ensure everything is documented accurately.

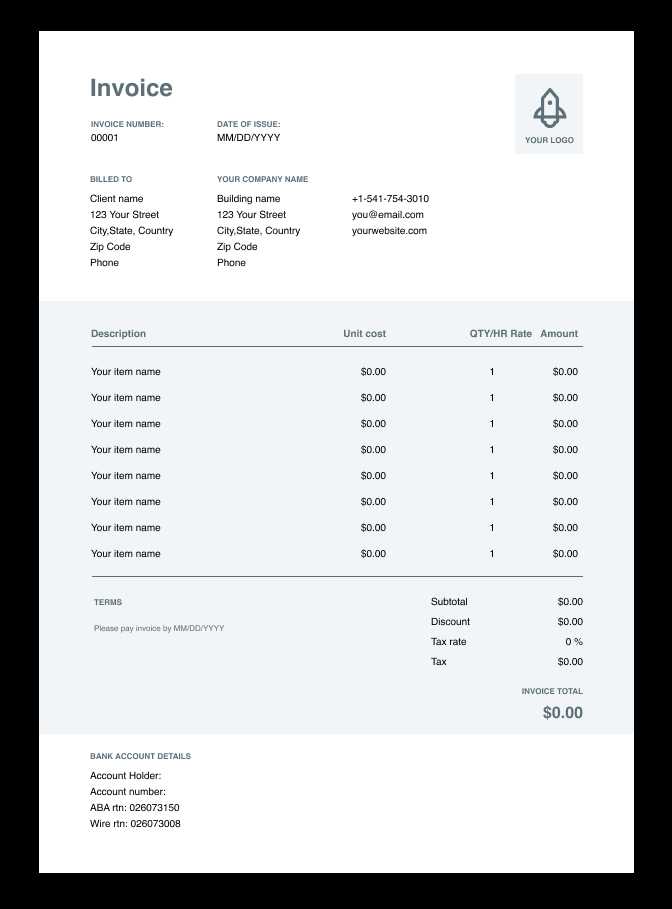

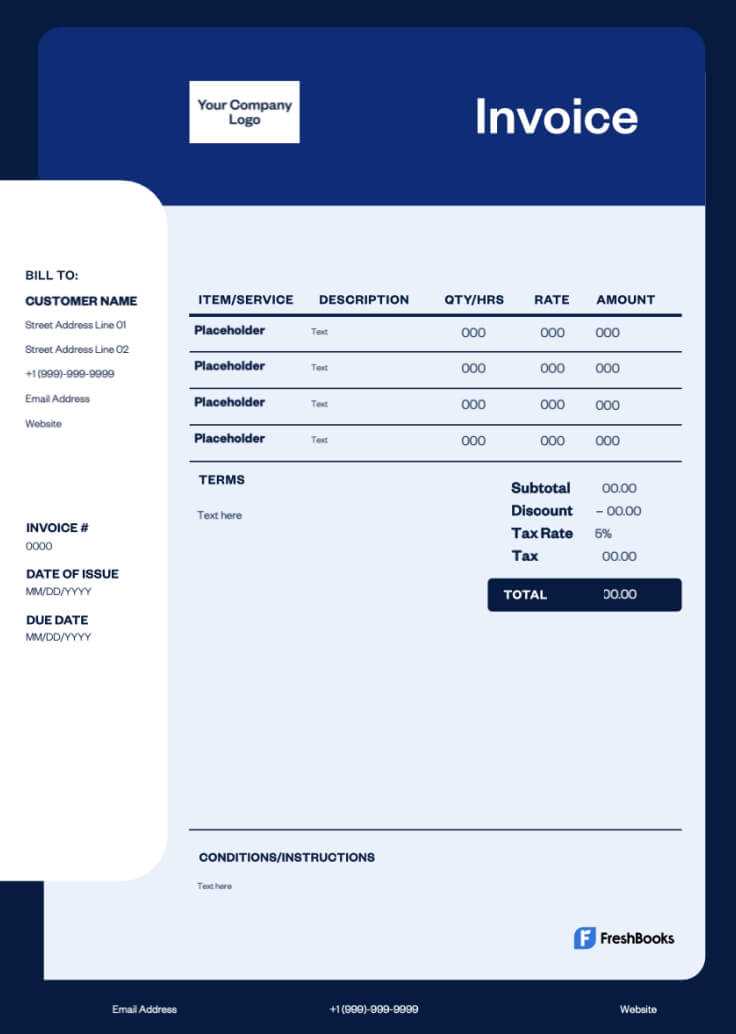

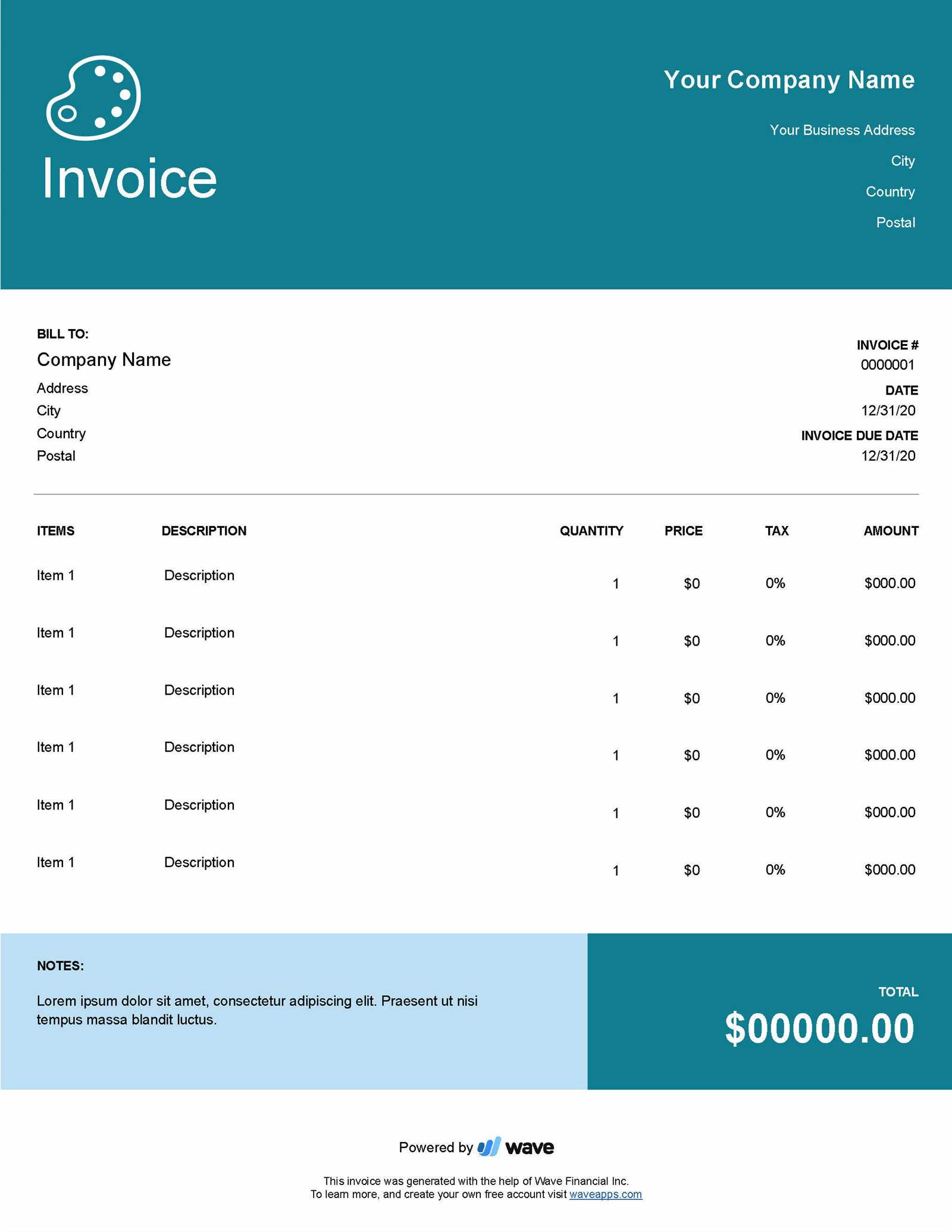

A solid structure for these documents should include basic details such as the performer’s name, contact information, and the services provided, along with the payment amount and due date. It’s also helpful to have space for any additional terms or conditions specific to the project. This level of clarity reassures clients and enhances your professional reputation.

Moreover, customizing this record to match your personal style or business brand can make the document more visually appealing and reflective of your work ethic. With the right layout, you can create a seamless billing process that aligns with your creative profession while maintaining financial transparency and professionalism.

Why Actors Need an Invoice Template

In the entertainment industry, clear and efficient financial documentation is crucial for maintaining professionalism and ensuring prompt payments. Freelancers, including performers, often work on various projects with different clients, making it essential to keep track of earnings and terms in a structured way. A reliable method of requesting payment helps avoid confusion and protects both the individual and the client in case of disputes.

Accurate and organized records are necessary for several reasons. They not only ensure that you are compensated fairly for your work but also provide a transparent breakdown of services rendered. This type of documentation is useful for tax purposes, as well as for maintaining an organized portfolio of all past work. Having a consistent system can also help you manage your finances more effectively, ensuring you never miss a payment.

Moreover, using a professional document template helps reinforce your image as a reliable and serious professional. It shows clients that you are well-prepared and understand the importance of clear agreements, making them more likely to trust you for future projects.

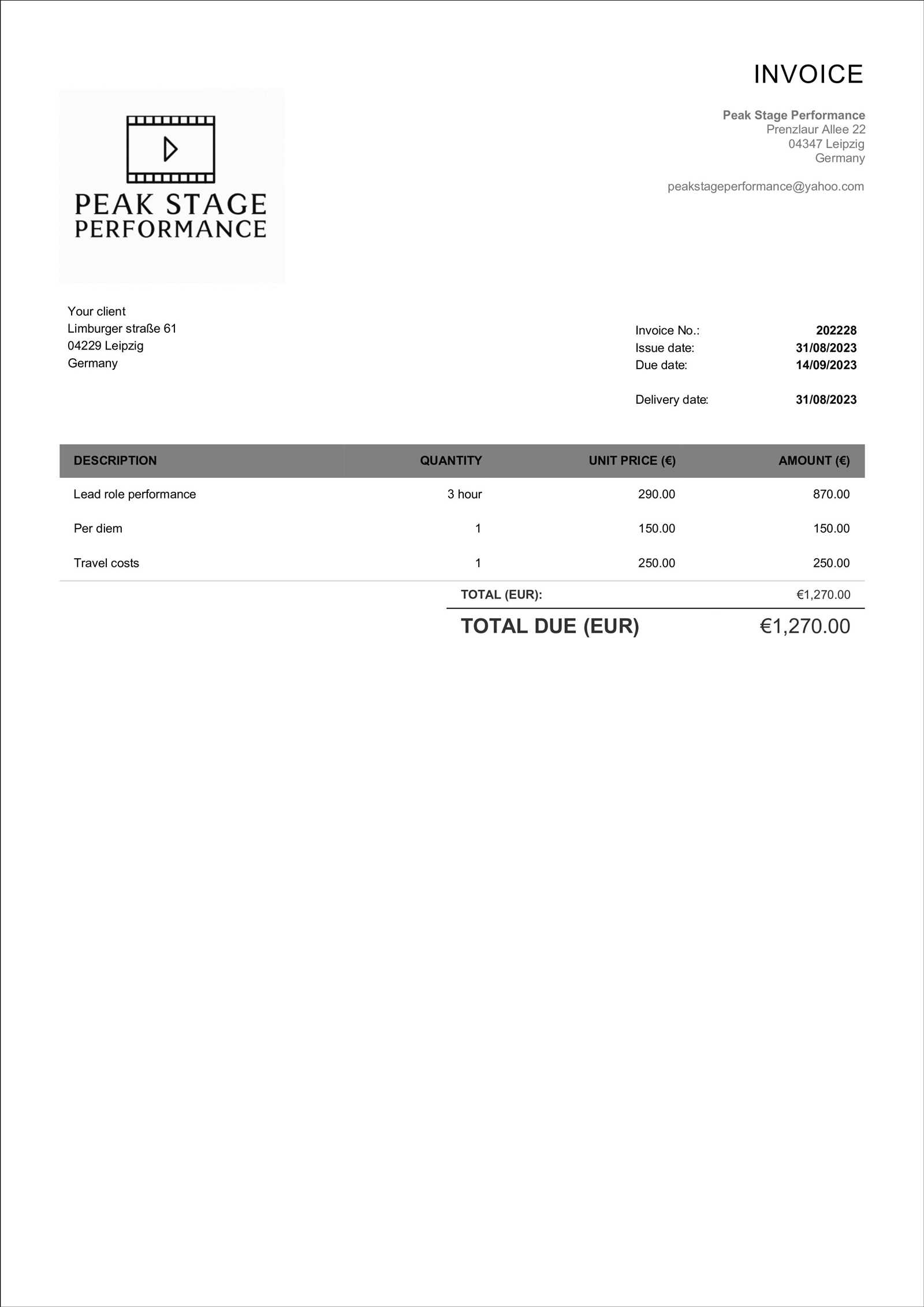

How to Create an Actor Invoice

Creating a professional document to request payment for your work is a straightforward process that involves organizing key details in a clear and logical format. The purpose of this document is to outline the services provided, the agreed-upon compensation, and any other terms, so both you and your client have a mutual understanding of the arrangement.

Step 1: Include Personal Information

Start by including your full name, contact details, and any professional title or business name you might use. It’s important to include your address or email, so the recipient knows how to reach you if needed. Adding this information at the top of the document ensures it’s easy for the client to identify who the billing is coming from.

Step 2: Add Client Details and Project Information

Next, include the name and contact information of the client or agency, along with details about the specific project. This can include the name of the production, dates worked, and a brief description of the services provided. Be sure to list any terms or specific agreements related to the payment, such as deadlines or payment methods.

Details such as the agreed-upon hourly rate or flat fee should be clearly outlined, along with the total amount due. This will prevent misunderstandings and provide both you and the client with a record of the terms agreed upon. By maintaining clarity in these details, you ensure a professional approach to financial transactions.

Essential Information for Actor Invoices

To ensure that you are paid correctly and on time, it’s important to include specific details in your payment request documentation. These details not only protect your interests but also help maintain a professional relationship with clients. A well-structured record should clearly outline the work performed and the terms agreed upon, leaving no room for confusion.

1. Personal and Client Details

Start by providing your full name, contact information, and any business or professional title. Similarly, include the client’s name, company, and contact information. This helps both parties easily identify the parties involved and provides an official reference for future communication.

2. Services and Payment Breakdown

Clearly describe the work completed, whether it’s acting in a production, a voice-over, or a promotional event. Be specific about the dates, hours, or the overall scope of the project. Include an itemized list of services and the corresponding fees, breaking down the total amount due. This level of detail helps the client understand the value of the work and ensures that you are compensated fairly.

Including the payment terms is equally crucial. Specify the due date for payment, whether it’s within 30 days or as per any other agreed-upon timeline. If applicable, mention any late payment fees to encourage prompt settlement.

Essential Information for Actor Invoices

To ensure that you are paid correctly and on time, it’s important to include specific details in your payment request documentation. These details not only protect your interests but also help maintain a professional relationship with clients. A well-structured record should clearly outline the work performed and the terms agreed upon, leaving no room for confusion.

1. Personal and Client Details

Start by providing your full name, contact information, and any business or professional title. Similarly, include the client’s name, company, and contact information. This helps both parties easily identify the parties involved and provides an official reference for future communication.

2. Services and Payment Breakdown

Clearly describe the work completed, whether it’s acting in a production, a voice-over, or a promotional event. Be specific about the dates, hours, or the overall scope of the project. Include an itemized list of services and the corresponding fees, breaking down the total amount due. This level of detail helps the client understand the value of the work and ensures that you are compensated fairly.

Including the payment terms is equally crucial. Specify the due date for payment, whether it’s within 30 days or as per any other agreed-upon timeline. If applicable, mention any late payment fees to encourage prompt settlement.

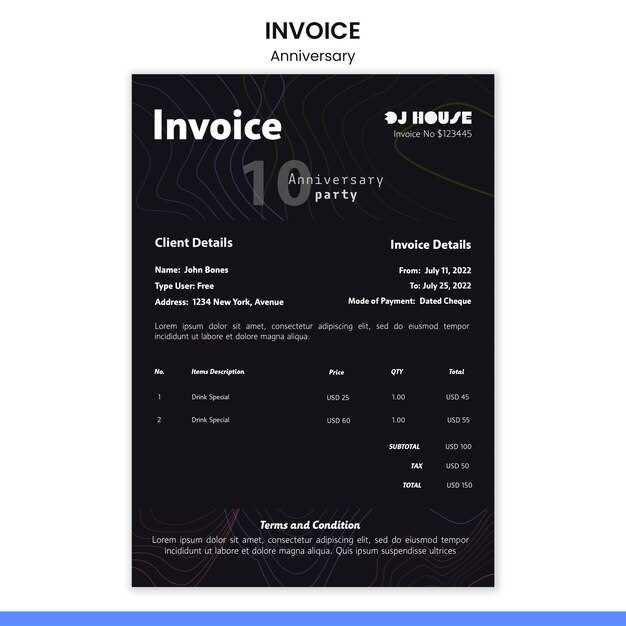

Free Invoice Templates for Actors

When it comes to managing your professional finances, having a clear, organized document to outline services rendered and payment terms is essential. Whether you’re involved in a film, theater production, or any other form of performance, a well-structured billing document ensures both parties understand the agreed-upon amounts and timelines.

Benefits of Using Ready-Made Billing Documents

- Quick setup with minimal effort

- Professional appearance, helping you present yourself as a serious professional

- Ensures all key details are captured: services, hours worked, and agreed compensation

- Helps maintain financial organization for tax and accounting purposes

Where to Find Free Billing Forms

Several platforms provide no-cost documents that you can easily customize with your personal details and project specifics. These resources often include editable fields to fill in names, dates, payment terms, and service descriptions.

- Online document generators that offer templates for different professions

- Word processing programs, which often come with pre-designed forms that can be adapted

- Free business resource websites that offer downloadable files in various formats

With these tools at your disposal, you can quickly create a professional-looking bill and focus on what matters most – your craft.

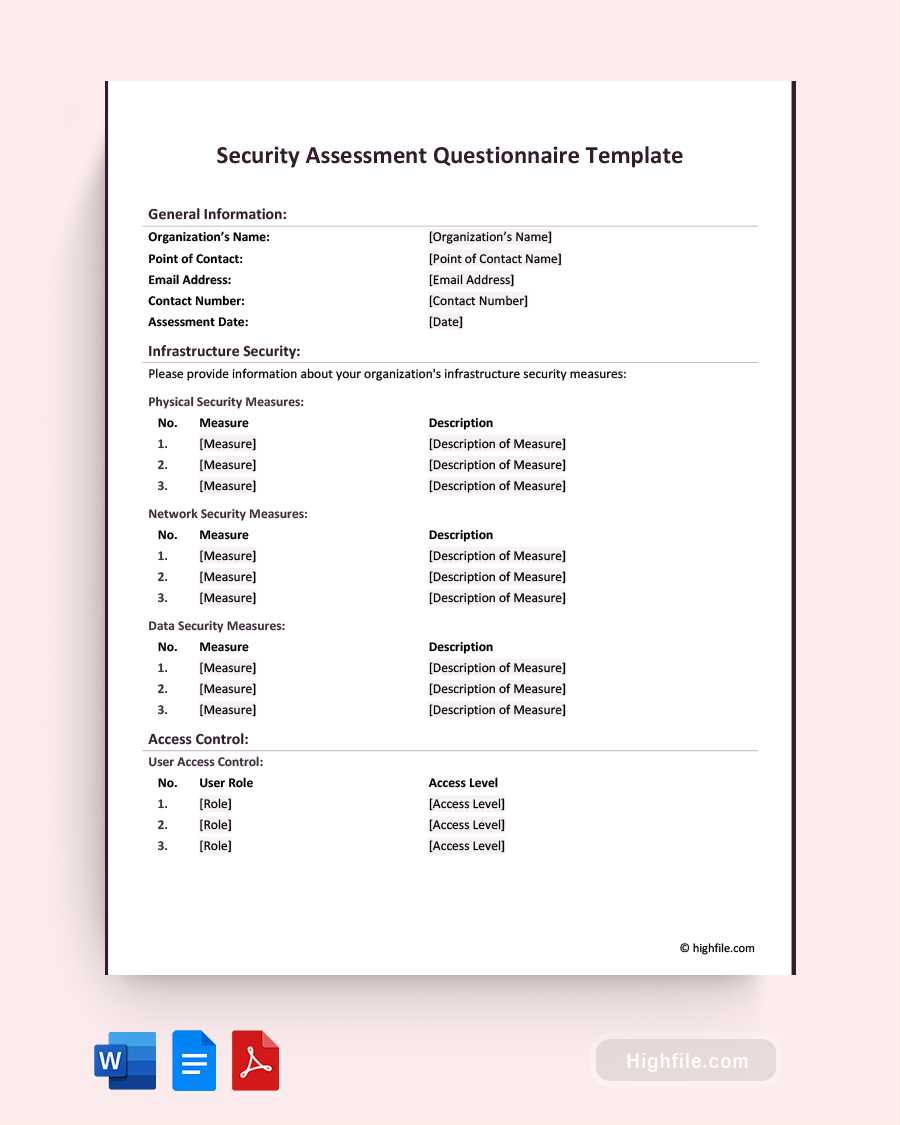

Customizing Your Actor Invoice

Personalizing your billing document is crucial to ensure that all necessary details are clearly communicated and the layout aligns with your needs. Adjusting the format allows you to include specific project information, payment terms, and additional notes that reflect your unique services. Customization helps both you and your client maintain clarity and avoid confusion regarding expectations and payments.

Essential Elements to Include

Every professional statement should contain certain key details to ensure transparency and accuracy. Below are the primary components that should always be present:

| Item | Description |

|---|---|

| Personal Information | Include your name, contact details, and any relevant professional identification numbers (such as tax ID). |

| Client Details | Ensure the recipient’s information, including the production company or individual’s name, is clearly outlined. |

| Project Description | Clearly define the services rendered, such as rehearsals, performances, or other agreed tasks. |

| Rates and Hours | Specify your hourly or flat rate, and include the number of hours worked or agreed fee per service. |

| Payment Terms | Detail your payment method, due date, and any late fees or penalties if applicable. |

Formatting Tips for Clarity

Keep the layout neat and legible. Organize the content in a logical sequence, with sections clearly separated by lines or spaces. Consider using bold text for headings and important

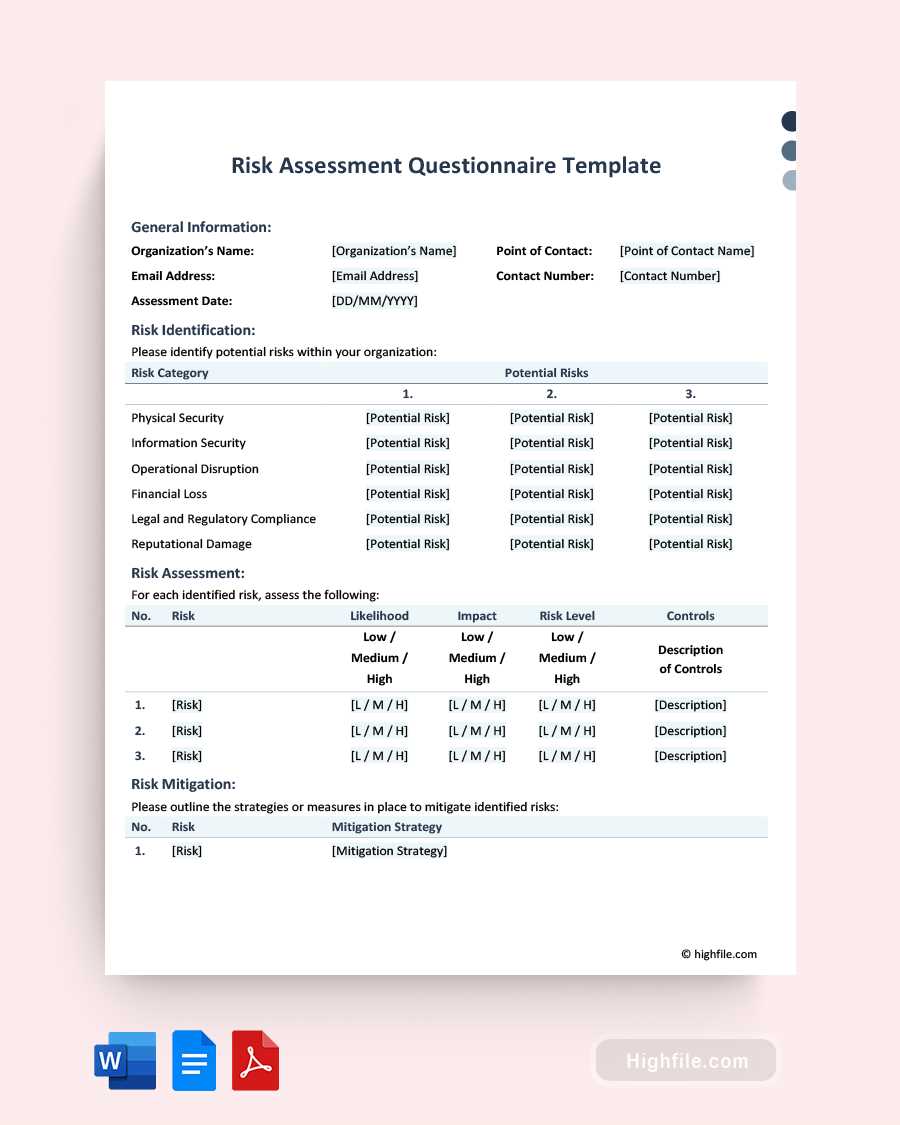

How to Track Payments with Invoices

Keeping track of payments is essential for maintaining financial order and ensuring timely compensation. A well-structured billing document can act as a reliable tool for monitoring the status of payments. By recording each transaction and marking payment statuses, you can easily track any outstanding amounts, helping you stay on top of your financial obligations.

Recording Payment Details

One of the simplest ways to track payments is by documenting the transaction details directly on your billing statement. Once you receive payment, update the document with the payment date, amount received, and method of payment (e.g., bank transfer, check, or cash). This information provides a clear record of when the balance was settled.

Using Payment Status Indicators

It is helpful to include a section on the document that indicates the payment status. You can use labels like “Paid,” “Pending,” or “Overdue” to quickly identify the state of each transaction. For example, if the payment is still pending, you can mark it as “Due” with the payment date clearly stated. If the payment has been received, mark it as “Paid” with the exact payment date.

Additionally, consider using color-coding or symbols to further distinguish between different statuses, making it even easier to identify where payments stand at a glance. This method can also help in cases where you need to follow up with clients regarding overdue amounts.

Choosing the Right Format for Your Invoice

Selecting the appropriate layout for your billing document is an important step in ensuring clarity and professionalism. The format you choose should align with your needs, the nature of the project, and the preferences of your client. Whether you opt for a simple document or a more detailed breakdown, the right format will help avoid confusion and facilitate smooth transactions.

Considerations for Simplicity vs. Detail

If you’re working on smaller projects or short-term engagements, a straightforward layout may be the best option. This could include just the essentials: your contact details, client information, a brief description of services, and the total amount due. On the other hand, larger or more complex projects may require a more detailed breakdown, listing specific tasks, rates, and hours worked.

Digital vs. Paper Formats

In today’s digital age, electronic formats are often the preferred choice for many professionals. They allow for quick customization, easy sharing via email, and can be stored efficiently. However, some clients may prefer physical copies. In such cases, a printed version can be provided. Always ensure that the format you choose is compatible with your client’s preferences and convenient for both parties.

Common Mistakes to Avoid in Invoices

Even a small mistake in a billing document can lead to confusion or delays in payment. Ensuring accuracy is key to maintaining a professional image and avoiding misunderstandings with clients. Below are some common errors to watch out for and how to prevent them.

Frequent Errors in Billing Documents

| Error | Consequences | How to Avoid | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Incorrect Contact Information | Delays in communication and payment issues | Double-check your details and the client’s information before sending | ||||||||||||

| Missing Payment Terms | Confusion over deadlines and payment methods | Clearly state due dates, methods of payment, and any penalties for late payments | ||||||||||||

| Unclear Service Descriptions | Disputes over what was provided or agreed upon | Provide detailed descriptions of the services rendered, including hours worked or specific tasks | ||||||||||||

| Incorrect Amounts | Payment delays and potential legal issues | Review all calculations carefully and verify rates before finalizing | ||||||||||||

| Element | Why It Matters | Best Practice |

|---|---|---|

| Clear Payment Due Date | Ensures that both parties know when payment is expected | Specify an exact date (e.g., “Due within 30 days from the completion date”) |

| Accepted Payment Methods | Reduces confusion by outlining how payment should be made | List all accepted methods (e.g., bank transfer, PayPal, check, etc.) |

| Late Fees | Encourages timely payment and covers potential delays | Clearly state any late fees or interest on overdue amounts (e.g., “A 5% fee will be added after 30 days”) |

| Payment Installments | Provides flexibility for large projects and ensures partial payments | For long-term work, outline when and how installments are due (e.g., “50% upfront, 50% upon completion”) |

By being transparent about th

How to Handle Late Payments

Dealing with overdue payments is a common challenge in many industries. It’s crucial to approach this situation professionally and effectively to maintain cash flow while preserving client relationships. Knowing how to manage late settlements can help avoid unnecessary stress and ensure that you are compensated fairly for your work.

Set Clear Payment Terms at the outset of any agreement. Clearly outline deadlines, accepted payment methods, and any penalties for delays. This proactive step can prevent confusion and set expectations from the start. Having a well-defined payment schedule also gives you leverage if payment issues arise later on.

If a payment is delayed, reach out politely to the client. A friendly reminder via email or phone call can often resolve the situation quickly. Sometimes clients simply forget, and a gentle nudge can prompt them to settle the debt without hard feelings. Be specific about the amount overdue and the original due date.

Be firm but professional if the delay continues. If initial reminders are ineffective, it’s important to remain courteous yet assertive. Consider sending a formal notice outlining the outstanding amount, any late fees, and potential consequences, such as stopping future work or seeking legal action. Keep all communication respectful and direct.

Consider flexible solutions if a client is struggling financially but still values your work. Negotiating a payment plan may be beneficial for both parties. A mutual agreement to split the payment into smaller amounts over time can provide relief while ensuring you eventually receive full compensation.

Legal action should always be a last resort. If multiple attempts to resolve the issue amicably fail, seeking legal counsel or using a collections agency might be necessary. However, it’s always best to try to work things out through open communication first to avoid damaging professional relationships.

Invoicing for International Jobs

When working across borders, it’s essential to understand the complexities involved in getting paid for services. International work often requires navigating different currencies, tax laws, and payment methods. Ensuring smooth transactions requires attention to detail and an understanding of both the client’s and your own country’s financial regulations.

Currency and Exchange Rates are crucial factors when handling payments from foreign clients. Make sure to clearly specify which currency you expect to be paid in. If you’re willing to accept payments in multiple currencies, consider using services that allow for automatic conversion at competitive rates to avoid losing money on exchange fees.

Tax Considerations differ greatly from country to country. Research whether you need to charge taxes based on the location of the client or your own. Some regions require that taxes be included in the amount billed, while others expect you to handle them separately. In some cases, clients may request a tax exemption, depending on local agreements or treaties. It’s advisable to consult with a tax professional who understands international taxation to avoid any complications.

Payment Methods are another critical aspect. While wire transfers and bank deposits are common, international payments can also be made via online platforms such as PayPal or TransferWise. Be sure to discuss payment methods in advance to ensure both parties are comfortable with the process. Some platforms may charge additional fees for international transfers, which you should factor into your pricing or negotiation.

Time Zones and Deadlines can also be a challenge when working internationally. Ensure that deadlines are clear and account for the differences in time zones. Confirm with the client whether you should expect immediate payment or if there are any delays due to their local banking processes or holidays. Communication about payment schedules should be transparent to avoid any misunderstandings.

Legal Considerations are vital when working internationally. In some cases, clients may ask for specific terms that comply with local laws or international trade agreements. It is beneficial to include clauses in your contract addressing potential disputes, how payments will b

Using Accounting Software for Actor Invoices

Managing financial records can be time-consuming and prone to error if done manually. Accounting software streamlines this process by automating calculations, tracking payments, and organizing important documents. This helps ensure accuracy, saves time, and keeps everything in one place, making it an invaluable tool for professionals in the creative industry.

Benefits of Automation

Accounting software simplifies the process by automatically generating financial records and tracking due payments. By inputting project details once, you can generate multiple statements with minimal effort. This not only saves time but also minimizes the risk of human error in calculations. Additionally, most platforms allow you to store records securely, making it easy to access and manage your financial history.

Managing Payments and Expenses

Beyond generating statements, accounting tools also help manage incoming and outgoing funds. You can easily track what has been paid and what remains outstanding. Most systems also allow you to categorize expenses, making it easier to see where your money goes and identify tax-deductible costs. This makes budgeting and planning for future work more efficient, giving you greater control over your finances.