How to Create and Use a Zapier Invoice Template for Effortless Invoicing

Managing financial transactions efficiently is crucial for any business, regardless of size. Automating repetitive tasks like generating and sending payment requests can save valuable time and reduce the risk of errors. By integrating smart tools into your workflow, you can ensure timely, accurate documentation while focusing on more critical aspects of your business.

One of the most effective ways to simplify the financial management process is by using automated solutions that create professional documents with minimal manual input. These systems can automatically populate details such as client information, pricing, and payment schedules, reducing the administrative burden significantly. With the right setup, your invoicing can become a seamless part of your operations, allowing you to concentrate on growth and customer satisfaction.

In this guide, we will explore how automation can enhance your billing strategy, helping you to generate custom payment requests quickly and without mistakes. You’ll learn how to integrate various tools that can automate every step of the process, from document creation to delivery, ensuring a smooth and error-free experience for both you and your clients.

Understanding the Zapier Invoice Template

When it comes to managing financial documentation, automating the creation and distribution of payment requests can significantly streamline your workflow. By using digital solutions that generate structured documents, you can ensure consistency, accuracy, and save valuable time that would otherwise be spent on manual entry. This approach allows businesses to easily maintain professional communication with clients while reducing the chance of errors in critical documents.

How Automated Document Creation Works

The process of automating payment requests involves integrating various tools that can pull information from different sources and populate it into predefined structures. These tools allow you to quickly customize key details, such as client names, amounts due, and dates, while maintaining a professional format. With automation, you eliminate repetitive tasks, reduce manual input, and speed up the entire process.

Key Features of an Automated Document Generator

| Feature | Description |

|---|---|

| Customizable Fields | Allows users to personalize each document with specific client and transaction information. |

| Predefined Layouts | Offers ready-to-use designs that ensure consistency and professionalism across all communications. |

| Integration with Other Tools | Enables seamless connection with accounting software, CRM platforms, and payment systems for automatic data updates. |

| Automation of Recurring Tasks | Facilitates the automatic generation and delivery of documents for ongoing projects or subscription-based services. |

By understanding how these tools work and the features they offer, you can take full advantage of their capabilities, creating an efficient and error-free process for managing financial documentation and ensuring smooth business operations.

Understanding the Zapier Invoice Template

When it comes to managing financial documentation, automating the creation and distribution of payment requests can significantly streamline your workflow. By using digital solutions that generate structured documents, you can ensure consistency, accuracy, and save valuable time that would otherwise be spent on manual entry. This approach allows businesses to easily maintain professional communication with clients while reducing the chance of errors in critical documents.

How Automated Document Creation Works

The process of automating payment requests involves integrating various tools that can pull information from different sources and populate it into predefined structures. These tools allow you to quickly customize key details, such as client names, amounts due, and dates, while maintaining a professional format. With automation, you eliminate repetitive tasks, reduce manual input, and speed up the entire process.

Key Features of an Automated Document Generator

| Feature | Description |

|---|---|

| Customizable Fields | Allows users to personalize each document with specific client and transaction information. |

| Predefined Layouts | Offers ready-to-use designs that ensure consistency and professionalism across all communications. |

| Integration with Other Tools | Enables seamless connection with accounting software, CRM platforms, and payment systems for automatic data updates. |

| Automation of Recurring Tasks | Facilitates the automatic generation and delivery of documents for ongoing projects or subscription-based services. |

By understanding how these tools work and the features they offer, you can take full advantage of their capabilities, creating an efficient and error-free process for managing financial documentation and ensuring smooth business operations.

Benefits of Using Zapier for Invoicing

Automating business processes, especially for routine tasks like generating and sending payment documents, can significantly improve efficiency and accuracy. By leveraging powerful automation tools, you can free up valuable time that would otherwise be spent on repetitive administrative work. These systems ensure that each step is carried out consistently, reducing the potential for errors and improving the overall speed of your operations.

One of the key advantages of automation is the ability to integrate multiple platforms, allowing for seamless data transfer and minimizing the need for manual input. This not only speeds up the document creation process but also ensures that all relevant information is up to date, preventing discrepancies. By connecting tools such as customer relationship management (CRM) systems, accounting software, and payment gateways, you can streamline your entire workflow from start to finish.

Time Savings – Automation significantly reduces the time spent on repetitive tasks. Instead of manually inputting information for each payment request, the system can handle this automatically, allowing you to focus on higher-priority tasks.

Reduced Errors – Human error is a common issue when manually creating payment requests, but automation ensures consistency and accuracy. The system will pull the correct data every time, eliminating mistakes that could lead to delays or confusion.

Seamless Integrations – By connecting your invoicing system with other essential business tools, such as accounting software and CRMs, automation ensures that the most current information is always used, without requiring manual updates or transfers of data.

Professional Appearance – Automation tools offer ready-made designs and formats, ensuring that each document looks polished and professional, helping you maintain a strong brand identity and build trust with your clients.

How to Create a Custom Invoice in Zapier

Creating personalized financial documents tailored to your specific needs is an essential part of managing transactions effectively. With automated tools, you can design these documents to include all necessary details while maintaining a professional format. Customization allows you to adapt the structure, layout, and content based on individual clients or unique projects, ensuring that every communication is relevant and accurate.

The process begins by selecting the right automation platform that connects various data sources, such as customer information, pricing, and payment terms. Once integrated, these platforms can automatically pull in the required data and populate the document fields. From there, you can adjust the style and layout to fit your preferences, creating a consistent and cohesive look for all your communications.

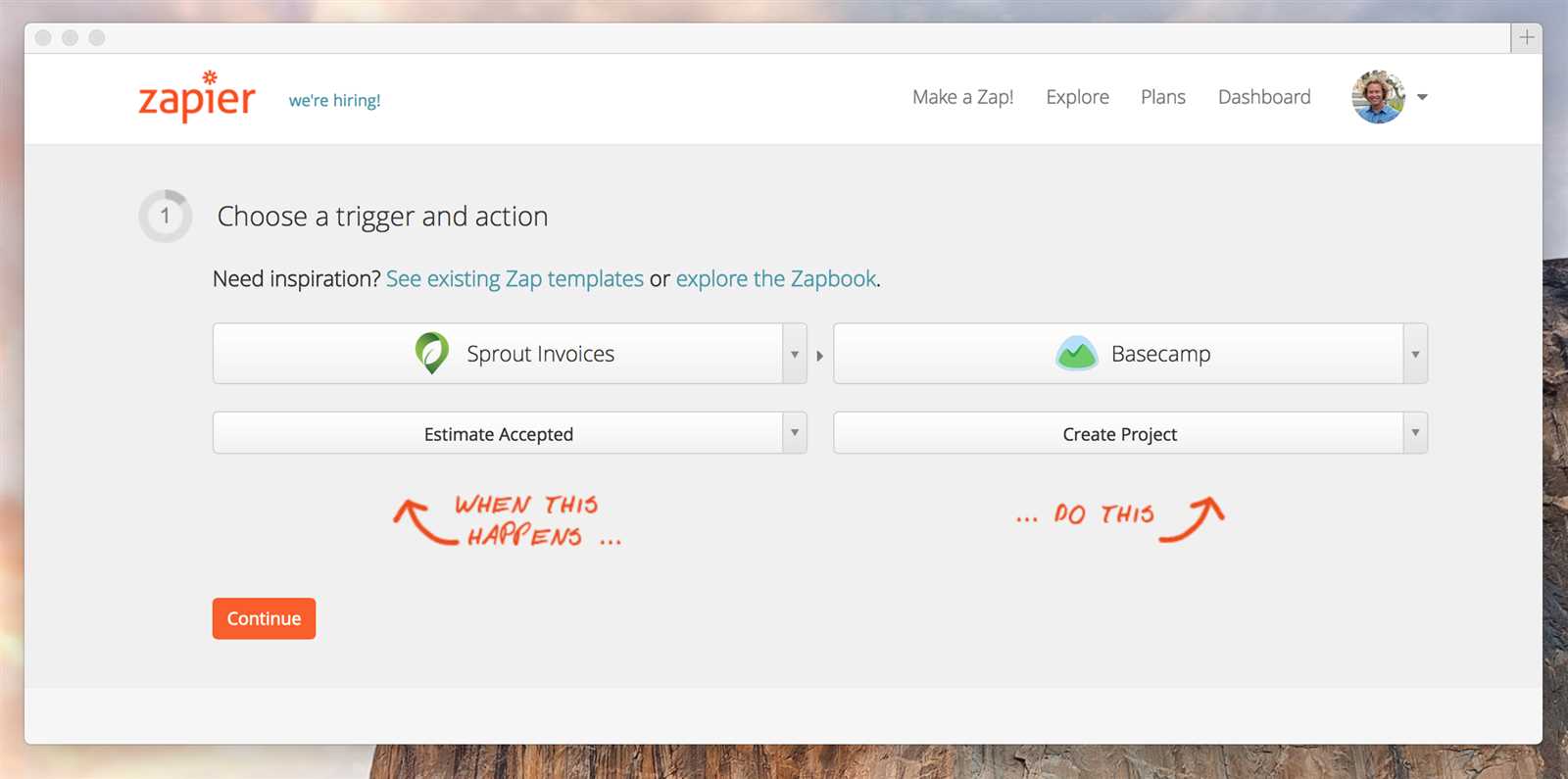

Step 1: Set Up Integration – The first step is connecting the automation tool with your preferred data sources. These may include your CRM, accounting system, or email service. This ensures that all relevant client and transaction data is automatically updated without manual entry.

Step 2: Customize Fields and Layout – After the integration is complete, customize the fields that will be included in each document, such as client name, date, and payment amounts. You can also choose from various pre-designed layouts or create your own to match your brand’s style.

Step 3: Automate Document Creation – Once the structure is set, automate the generation of the documents. This allows you to create new financial records instantly, with the most up-to-date information, without the need for manual intervention.

Step 4: Review and Adjust – Before finalizing the automated process, take a moment to review the generated documents. Ensure that the fields are populated correctly, and the formatting meets your expectations. You can make adjustments as needed to fine-tune the system.

Setting Up Invoice Automations with Zapier

Automating your payment request creation process can save significant time and effort, allowing you to focus on other important aspects of your business. By setting up automation, you can ensure that each document is generated and delivered promptly, without the need for manual intervention. Automation helps maintain consistency, reduces the risk of errors, and allows for seamless integration with other business tools, such as accounting platforms and customer management systems.

To get started with automating your document creation, the first step is to connect the necessary tools that hold relevant data, such as client contact information, payment schedules, or service details. Once connected, you can create specific “workflows” that define what happens when certain conditions are met, such as generating a document once a new customer is added or when a payment is due. These workflows can trigger automatic updates, ensuring that your financial records are always up-to-date and accurately reflect the latest transactions.

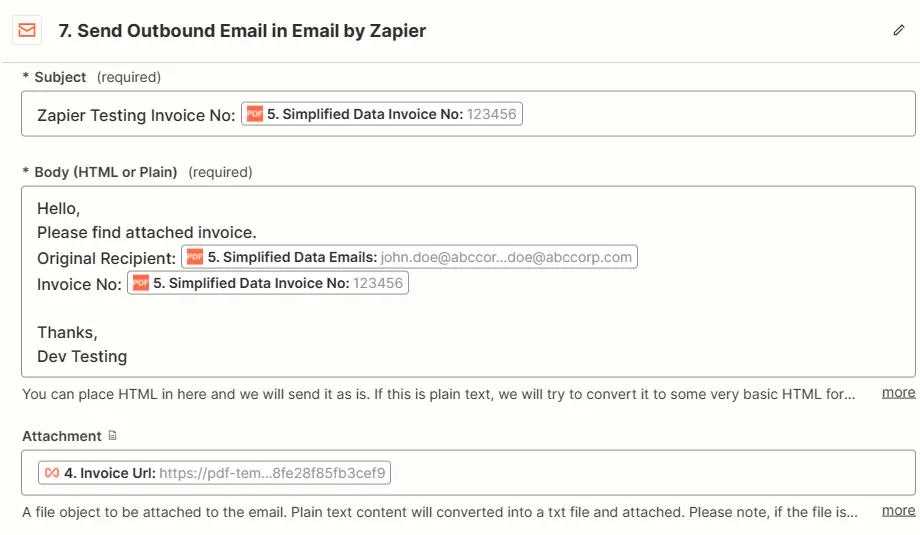

Once your tools are integrated, set up automated actions that dictate how the documents are created, formatted, and sent to the relevant recipients. You can specify the information that should appear in each document and choose how it should be laid out. This process eliminates the need for repetitive tasks and streamlines your entire process, from creation to delivery.

After configuring the automation, it is essential to test the system thoroughly. This ensures that all data is pulled correctly and that the documents meet your expectations. Make adjustments as necessary to fine-tune the workflow, ensuring a seamless experience for both you and your clients.

Key Features of Zapier Invoice Templates

These document layouts offer a seamless solution for automating billing tasks. They are designed to simplify the process of creating professional payment requests while integrating with various software tools to improve efficiency. By utilizing such layouts, users can customize their invoicing workflow with minimal effort and enhance their overall productivity.

Automation and Customization

One of the primary benefits of using such layouts is the ability to automate several steps involved in generating payment documents. Users can easily adjust the structure, add specific fields, and tailor the content to meet their unique needs. Automation minimizes human errors and saves valuable time.

- Automatic population of client details

- Predefined calculations for taxes and totals

- Quick editing options for personalizing each entry

Seamless Integration with Other Platforms

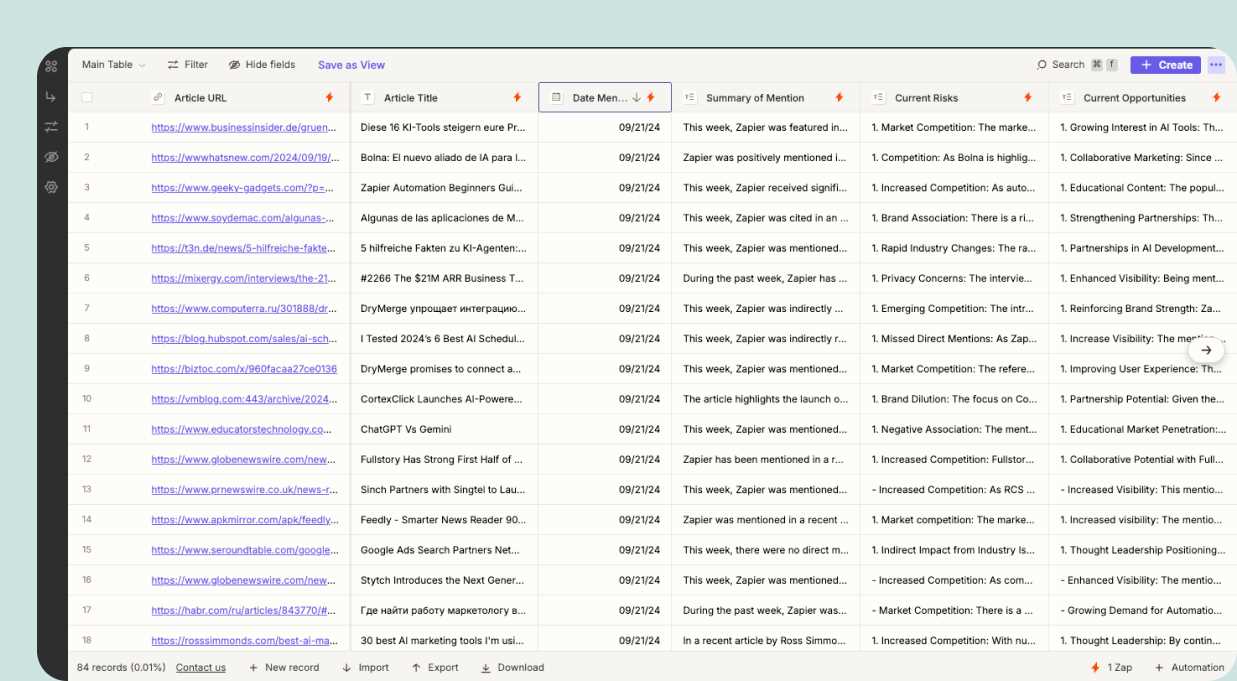

Another noteworthy feature is the ability to integrate with various applications, enabling a smooth data flow between systems. This connectivity allows users to import and export relevant information, eliminating the need for manual data entry and reducing the risk of inconsistencies.

- Sync with accounting software

- Import customer information from CRM systems

- Export data to various formats for easy sharing

How Zapier Streamlines Billing Processes

Automation tools can significantly improve the efficiency of financial operations by reducing manual input and minimizing errors. These tools offer an easy way to automate repetitive tasks, making the entire billing cycle faster and more accurate. By streamlining workflows, businesses can ensure timely payments and reduce the administrative burden associated with generating and managing billing documents.

Through integration with other platforms, these tools connect with accounting software, customer relationship management systems, and payment gateways, allowing for automatic data transfer and synchronization. This seamless flow of information ensures that customer details, payment amounts, and transaction histories are always up to date, eliminating the need for constant manual updates.

Furthermore, the ability to create and customize document layouts on the fly means that businesses can quickly adapt their invoicing processes as needed. Whether for one-time projects or recurring subscriptions, the flexibility to modify the format and content allows for more personalized and professional-looking records that align with brand identity.

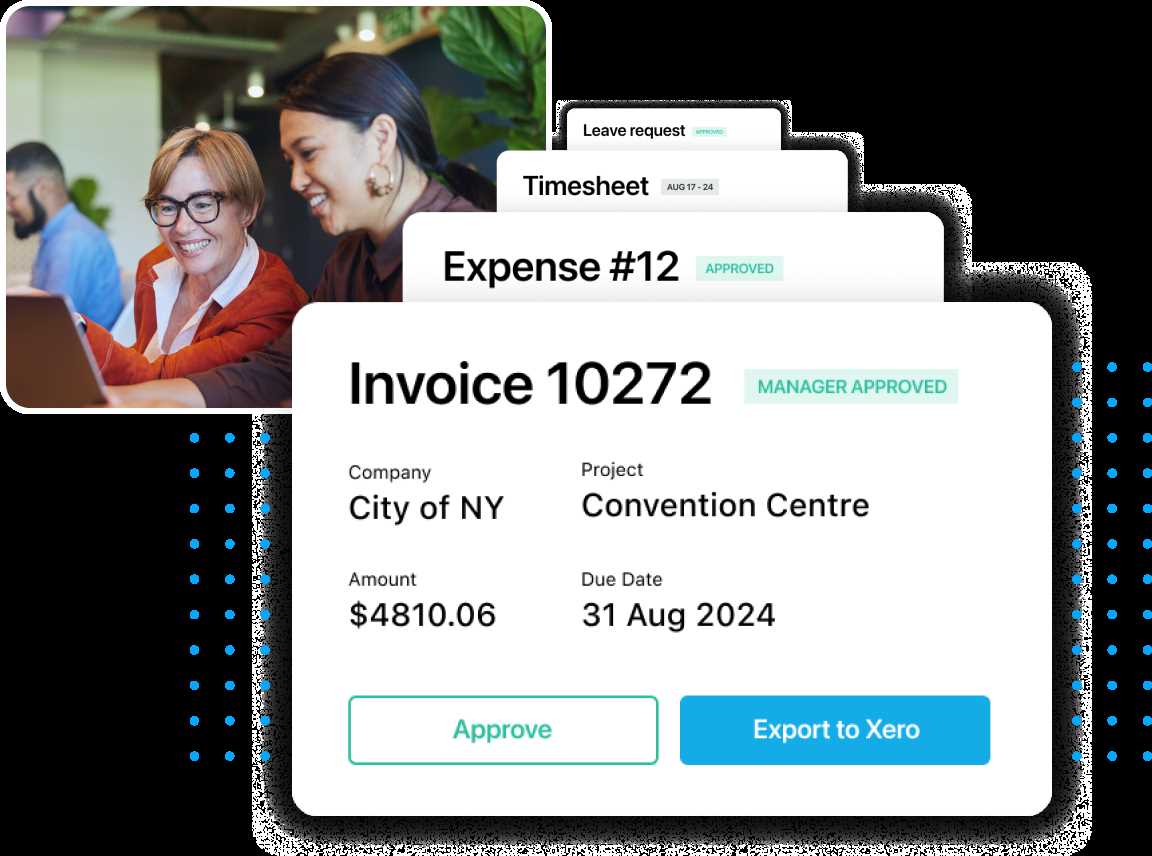

Integrating Zapier with Accounting Tools

Connecting automation tools with financial management software can drastically improve efficiency and accuracy. By linking these platforms, businesses can streamline workflows, reduce manual data entry, and ensure real-time updates across multiple systems. This integration allows for a seamless exchange of information, making financial tasks like expense tracking, budgeting, and payment management much more convenient.

When synced with accounting platforms, automation tools automatically transfer customer details, generate accurate reports, and update transaction records without additional input. This reduces the risk of human error and saves time spent on repetitive tasks, giving users more time to focus on strategic decisions.

Additionally, such integrations make it easy to track expenses, payments, and outstanding balances in real time. With automated notifications and reminders, businesses can stay on top of due payments and ensure that they are meeting financial deadlines, all while maintaining a professional and consistent workflow.

Choosing the Right Invoice Template for Your Business

Selecting the appropriate document layout for your billing process is essential for maintaining professionalism and ensuring that all necessary information is accurately presented. The right format helps to convey clear details about the transaction and reinforces the brand image, while also ensuring that payment processes run smoothly. Businesses must consider various factors when choosing a layout to make sure it aligns with their needs and the expectations of their clients.

When evaluating the options, it is important to consider elements such as customization capabilities, the ability to automate entries, and compatibility with other systems used for financial management. The ideal layout should not only look professional but also make the workflow more efficient by minimizing errors and reducing the time spent on creating each document.

| Feature | Importance |

|---|---|

| Customizable Fields | Ensures personalization for different clients and services |

| Automation Options | Saves time and reduces manual entry errors |

| Integration Capabilities | Allows easy synchronization with accounting and payment systems |

| Professional Design | Enhances brand image and fosters trust with clients |

Customizing Your Invoice Layout in Zapier

Personalizing your billing document layout is an essential step in ensuring that your payment requests reflect your brand’s identity and meet your business needs. With the right customization options, you can adjust the design, fields, and content to create a more professional and tailored experience for both you and your clients.

Most automation platforms allow you to easily modify various aspects of your layout to suit different scenarios, whether it’s for one-time projects or recurring services. Customization options typically include:

- Adjusting the overall design, such as fonts, colors, and logos

- Adding custom fields to include specific information, like discount codes or service descriptions

- Setting up automatic data population for common entries, such as client names and addresses

- Choosing whether to include detailed breakdowns of services or just the total amount due

By taking full advantage of these features, you can ensure that your documents are not only functional but also align with your business’s professional image. This process helps reduce the time spent on manual edits and ensures that the information presented is always up-to-date and accurate.

Automating Recurring Invoices with Zapier

Setting up automation for regularly issued payment requests can save significant time and effort. By eliminating the need to manually generate and send these documents each time, businesses can ensure timely and accurate billing, while also reducing the risk of human error. Automation streamlines the entire process, allowing you to focus on other critical areas of your business.

Streamlining the Billing Process

For businesses that offer subscription-based services or charge on a recurring basis, automating the creation and delivery of payment records is crucial. With the right tools, the entire workflow can be scheduled, from generating the document to sending it to clients. This reduces administrative workload and ensures that payments are consistently tracked and processed.

- Automatic generation of payment requests on set intervals

- Pre-populated fields with client and service details

- Scheduled email notifications to clients with attached documents

Maintaining Accuracy and Consistency

Automation ensures that each document is sent with accurate and up-to-date details, minimizing the possibility of errors. By setting up triggers to account for factors like price changes, new services, or adjusted quantities, the automation process keeps the entire billing cycle consistent, professional, and accurate.

- Automatic updates based on changes to client information or service rates

- Consistency in format and content across all transactions

- Accurate tracking of payment statuses and due dates

Key Features of Zapier Invoice Templates

These document layouts offer a seamless solution for automating billing tasks. They are designed to simplify the process of creating professional payment requests while integrating with various software tools to improve efficiency. By utilizing such layouts, users can customize their invoicing workflow with minimal effort and enhance their overall productivity.

Automation and Customization

One of the primary benefits of using such layouts is the ability to automate several steps involved in generating payment documents. Users can easily adjust the structure, add specific fields, and tailor the content to meet their unique needs. Automation minimizes human errors and saves valuable time.

- Automatic population of client details

- Predefined calculations for taxes and totals

- Quick editing options for personalizing each entry

Seamless Integration with Other Platforms

Another noteworthy feature is the ability to integrate with various applications, enabling a smooth data flow between systems. This connectivity allows users to import and export relevant information, eliminating the need for manual data entry and reducing the risk of inconsistencies.

- Sync with accounting software

- Import customer information from CRM systems

- Export data to various formats for easy sharing

Zapier Invoices for Small Businesses

For small businesses, managing financial documentation efficiently is essential for maintaining cash flow and professionalism. Automating the process of creating and sending billing records helps save time, reduces errors, and ensures consistency in all transactions. By using tools that streamline this process, small businesses can focus more on growth and less on administrative tasks.

Benefits for Small Business Owners

Small business owners can greatly benefit from automating the creation of payment documents. With automated systems, key details like customer information, service descriptions, and amounts are pre-filled, reducing the need for manual input. This leads to faster turnaround times and fewer mistakes in billing. Additionally, automation ensures that documents are sent promptly, which helps maintain a steady cash flow.

- Faster and more consistent document creation

- Reduced risk of human error in financial records

- Timely delivery of payment requests, improving cash flow

Streamlining Client Management

Automation also helps streamline client management by linking billing records to customer profiles. By integrating with CRM systems and other platforms, businesses can ensure that all client data is up to date and that documents reflect any recent changes. This eliminates the need for manual updates and ensures that clients receive accurate and personalized communication every time.

- Integration with client management systems

- Automatic updates to client contact details and services

- Improved personalizatio

Tips for Efficient Invoice Management Using Zapier

Effectively managing billing documents is crucial for ensuring timely payments and maintaining a smooth cash flow. With the right automation tools, businesses can streamline the entire process, from generating documents to tracking payments. By adopting the right strategies and leveraging automation, you can save time, reduce errors, and keep your financial records organized.

Automate Repetitive Tasks

One of the best ways to improve billing efficiency is by automating recurring tasks. For example, you can set up automated workflows to generate documents, fill in client details, and calculate totals. This reduces the need for manual intervention and ensures that your records are consistent every time.

- Set up automatic population of customer and service details

- Automate the calculation of taxes, discounts, and totals

- Schedule recurring document generation for subscription-based services

Integrate with Other Tools

Integrating your automation platform with other business tools can significantly enhance your billing management. By linking to accounting software, customer relationship management systems, and payment gateways, you can ensure that all relevant data is updated in real-time, reducing the chance for discrepancies.

- Sync client data from CRM to avoid manual entry errors

- Automatically update records with payment status from payment processors

- Export data to accounting software for streamlined financial reporting

Zapier vs Traditional Invoicing Methods

Managing billing can be done in various ways, each with its own advantages and challenges. Traditional methods often require manual effort, relying on spreadsheets or paper documents, while modern tools allow for automation and synchronization across platforms. The difference lies in how these approaches handle data, accuracy, and efficiency, with newer solutions focusing on streamlining tasks and minimizing errors.

Efficiency and Time-Saving

When comparing manual methods to automated tools, efficiency is a major factor. Traditional processes often involve significant time spent on creating, sending, and tracking documents, leaving room for human error. In contrast, automation significantly speeds up the workflow by pre-populating fields and sending documents at scheduled intervals. This means fewer delays and less time spent on administrative tasks, enabling businesses to focus on core operations.

- Traditional Methods: Time-consuming and prone to errors

- Automated Tools: Fast, accurate, and consistently reliable

Accuracy and Consistency

With traditional methods, human errors can lead to incorrect data, such as wrong totals or missing information, requiring time-consuming corrections. Automation tools, on the other hand, reduce the chance for mistakes by automatically updating fields and synchronizing data in real-time. This ensures that all documents are consistent and reflect the most up-to-date information, minimizing discrepancies.

- Manual processes: High risk of errors in calculations or missing details

- Automated solutions: Accuracy and up-to-date data with less manual involvement

Key Features of Zapier Invoice Templates

These document layouts offer a seamless solution for automating billing tasks. They are designed to simplify the process of creating professional payment requests while integrating with various software tools to improve efficiency. By utilizing such layouts, users can customize their invoicing workflow with minimal effort and enhance their overall productivity.

Automation and Customization

One of the primary benefits of using such layouts is the ability to automate several steps involved in generating payment documents. Users can easily adjust the structure, add specific fields, and tailor the content to meet their unique needs. Automation minimizes human errors and saves valuable time.

- Automatic population of client details

- Predefined calculations for taxes and totals

- Quick editing options for personalizing each entry

Seamless Integration with Other Platforms

Another noteworthy feature is the ability to integrate with various applications, enabling a smooth data flow between systems. This connectivity allows users to import and export relevant information, eliminating the need for manual data entry and reducing the risk of inconsistencies.

- Sync with accounting software

- Import customer information from CRM systems

- Export data to various formats for easy sharing

Key Features of Zapier Invoice Templates

These document layouts offer a seamless solution for automating billing tasks. They are designed to simplify the process of creating professional payment requests while integrating with various software tools to improve efficiency. By utilizing such layouts, users can customize their invoicing workflow with minimal effort and enhance their overall productivity.

Automation and Customization

One of the primary benefits of using such layouts is the ability to automate several steps involved in generating payment documents. Users can easily adjust the structure, add specific fields, and tailor the content to meet their unique needs. Automation minimizes human errors and saves valuable time.

- Automatic population of client details

- Predefined calculations for taxes and totals

- Quick editing options for personalizing each entry

Seamless Integration with Other Platforms

Another noteworthy feature is the ability to integrate with various applications, enabling a smooth data flow between systems. This connectivity allows users to import and export relevant information, eliminating the need for manual data entry and reducing the risk of inconsistencies.

- Sync with accounting software

- Import customer information from CRM systems

- Export data to various formats for easy sharing