Xero Invoice Templates for UK Businesses and Freelancers

Efficient billing is a key component of any business, and having the right tools can make managing finances much easier. Many UK entrepreneurs and freelancers turn to software solutions that streamline the process of creating and sending payment requests. These digital tools offer a wide range of customizable options, making it simple to tailor documents to meet both client and legal requirements.

Whether you’re a small business owner or a freelancer, having a professional appearance when it comes to payment requests can enhance your credibility. The flexibility of modern platforms allows users to adapt their documents with ease, ensuring consistency and accuracy in every transaction. From adjusting design elements to incorporating specific tax details, the possibilities for personalization are vast.

Understanding how to make the most of these resources not only saves time but also ensures compliance with UK financial regulations. By utilizing well-designed billing solutions, businesses can simplify administrative tasks while maintaining professionalism. In this article, we’ll explore how to set up and optimize such tools for the UK market, offering insights on how to improve your financial workflows effectively.

Xero Invoice Templates for UK Businesses

For businesses in the UK, creating professional payment documents is essential for maintaining smooth financial operations. Using software that allows easy customization of these documents can save time and reduce errors, ensuring that all the necessary details are included. With the right tools, you can produce well-structured, accurate forms that meet both client expectations and regulatory requirements.

When it comes to tailoring payment requests for UK businesses, there are several important factors to consider. These include the layout, currency formatting, tax rates, and legal compliance. The good news is that modern software makes it possible to adjust all of these elements to suit the specific needs of your business.

Here are some key benefits for businesses using customizable solutions:

- Professional Appearance: Create polished documents that reflect the professionalism of your business.

- Time Efficiency: Automate the process of generating payment requests, saving valuable time.

- Tax Compliance: Easily incorporate the correct VAT rates and ensure compliance with UK tax laws.

- Branding Opportunities: Personalize documents with your business logo and colors, creating a consistent brand image.

- Client Convenience: Send documents electronically, making it easier for clients to view and pay quickly.

Using these solutions ensures that businesses can stay organized, meet legal requirements, and maintain professionalism. By choosing the right tools, you can simplify the entire process, making it easier to focus on what truly matters – growing your business.

What Are Xero Invoice Templates?

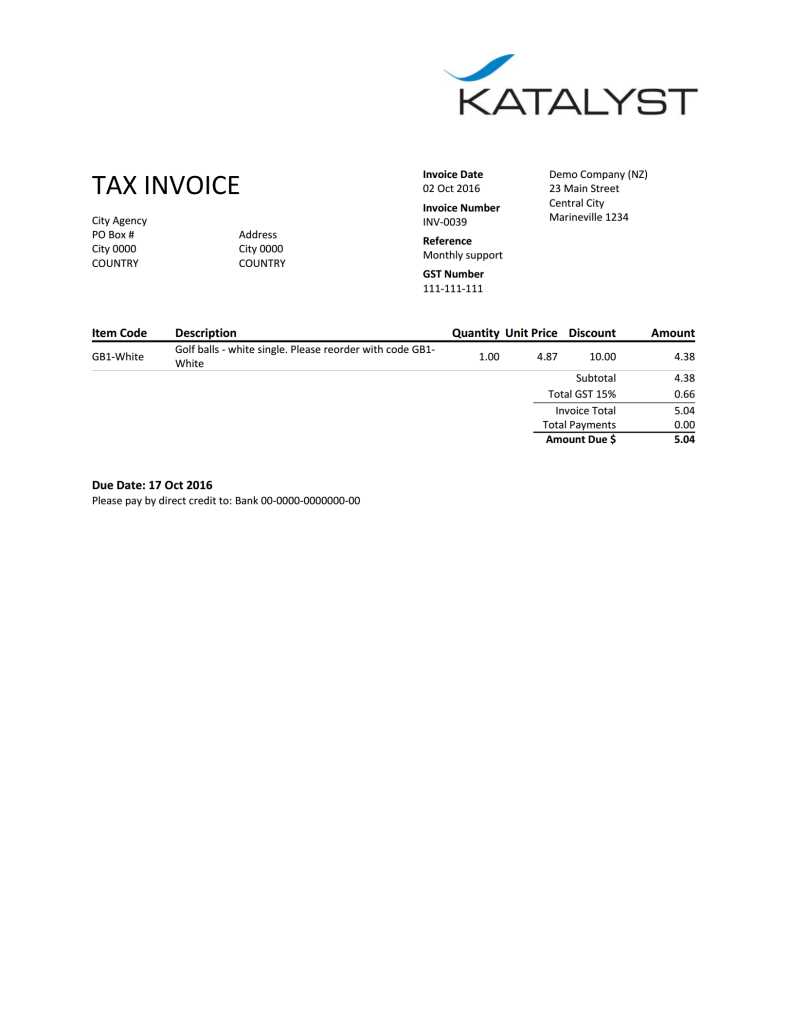

Customized payment documents are an essential tool for any business, enabling smooth communication between a company and its clients. These documents provide a structured way to request payments and keep track of outstanding amounts. They are designed to include all necessary information such as the business’s details, transaction breakdown, and payment terms, making them easy for clients to understand and act upon.

How They Work

These solutions are highly flexible and can be adapted to suit the specific needs of any business. Users can input details such as client names, services rendered, amounts due, and relevant dates. Additionally, businesses can adjust the layout to include branding, tax information, and payment instructions, ensuring that the document aligns with both the business’s image and legal requirements.

Key Features of These Tools

These solutions often come with a variety of useful features that can enhance the billing process. Below is a table outlining some of the most common attributes:

| Feature | Description |

|---|---|

| Customizable Layout | Adjust the design, colors, and branding to suit your business style. |

| Automated Calculations | Automatically calculate totals, taxes, and discounts based on input data. |

| Tax Compliance | Incorporate VAT or other relevant taxes, ensuring compliance with UK regulations. |

| Client Details | Easily store and autofill client information to speed up the process. |

| Digital Delivery | Send the completed document electronically for fast delivery and payment. |

With these features, businesses can create detailed and professional payment requests in a matter of minutes, ensuring accuracy and efficiency in every transaction.

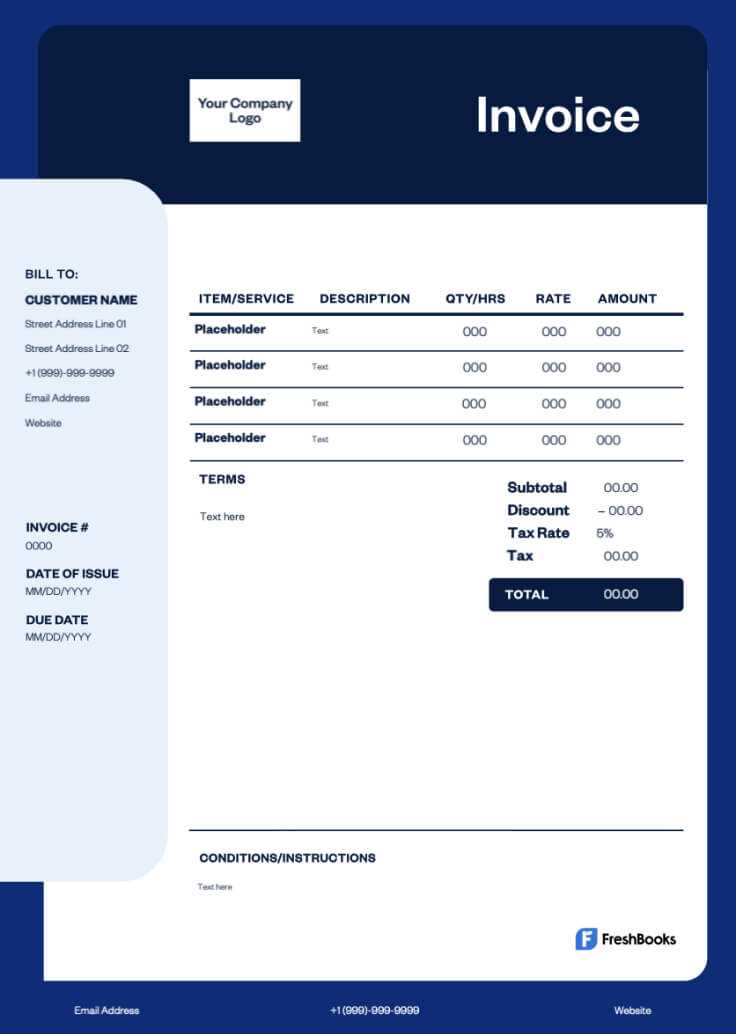

How to Customize Xero Invoices

Creating personalized payment documents is a simple yet effective way to maintain professionalism and consistency in your business operations. Customizing these documents allows you to add your own branding, adjust the layout, and ensure all the necessary information is clearly presented to your clients. With the right tools, you can tailor every detail to reflect your business’s identity and meet legal requirements.

To get started with customization, follow these essential steps:

- Choose the Right Document Format: Select the format that best suits your business, such as a simple itemized list or a more detailed breakdown of services.

- Add Your Branding: Incorporate your company logo, business name, and color scheme to make the document recognizable and consistent with your other materials.

- Input Client Details: Ensure that all relevant client information, such as name, address, and contact details, are included automatically for efficiency.

- Adjust Payment Terms: Customize the payment terms and conditions to align with your business’s policies, whether that involves setting up due dates or applying discounts for early payment.

- Include Tax Information: Add VAT rates or other applicable taxes, making sure they conform to UK tax regulations.

- Set Up Notifications: Configure automated reminders or follow-ups for unpaid amounts to ensure prompt payments.

By following these steps, you can create a professional and personalized document that fits your business needs. Customizing your payment requests not only saves time but also enhances your company’s image, ensuring that clients receive clear, consistent, and accurate documents with every transaction.

Why Use Xero for UK Invoices?

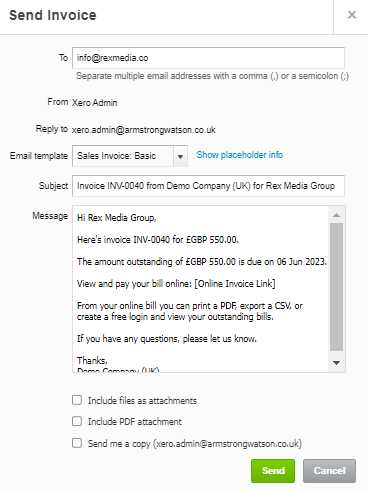

Choosing the right tool for managing financial documents can significantly enhance the efficiency of your business. For UK-based businesses, using an advanced accounting platform simplifies the process of creating, sending, and tracking payment requests. With a reliable solution, companies can ensure accuracy, streamline administrative tasks, and meet regulatory requirements with ease.

One of the main advantages of using such a platform is the seamless integration of various features that enhance the invoicing experience. From automating calculations to ensuring compliance with UK tax laws, this tool eliminates the manual effort traditionally required for financial management.

Key reasons to consider this platform include:

- Ease of Use: The intuitive interface allows users of all experience levels to quickly create and send payment requests without technical expertise.

- Automation: Automated calculations for taxes, totals, and discounts save time and reduce the risk of errors.

- Legal Compliance: This solution ensures your documents meet the necessary UK tax standards, such as VAT regulations, to avoid penalties.

- Customizability: Tailor every document with your business’s branding, ensuring consistency across all communications with clients.

- Accessibility: Cloud-based access allows users to manage their documents from anywhere, ensuring flexibility and convenience.

By using this platform, UK businesses can simplify their financial workflows, enhance professionalism, and stay compliant with local tax laws. It’s a powerful tool that helps businesses focus on growth while handling administrative tasks with ease.

Key Features of Xero Invoice Templates

When it comes to managing billing processes, having the right set of tools can make all the difference. With the right invoicing system, businesses can ensure that their financial documents are both professional and efficient. These tools offer various customisation options to help businesses create detailed, error-free documents that meet their specific needs. Below are some of the key features that streamline the creation and management of financial statements for companies.

Customisable Design

One of the most valuable aspects of these billing formats is the ability to fully customise the design. Users can adjust the layout, colours, and fonts to align with their brand identity, ensuring each document looks professional and cohesive. Whether you need to add your logo or adjust the overall structure, these options provide the flexibility to create visually appealing and unique documents.

Automated Functionality

Another key advantage is the automation of essential tasks. With built-in features like recurring billing and automatic date entries, businesses can significantly reduce the time spent on administrative work. This feature helps to eliminate manual errors and ensures timely delivery of statements, freeing up more time to focus on core business operations.

In addition, integration with payment gateways allows for easy tracking of payments, reducing the need for constant follow-up. These automated tools ensure that businesses remain organised and maintain a steady cash flow, all while offering clients an easy way to make payments directly from the document itself. SummaryFrom design flexibility to automated payment tracking, the tools available for generating professional billing documents are essential for improving efficiency and consistency. These features ensure that the process is simplified while still providing the necessary details to keep financial records up to date and accurate.

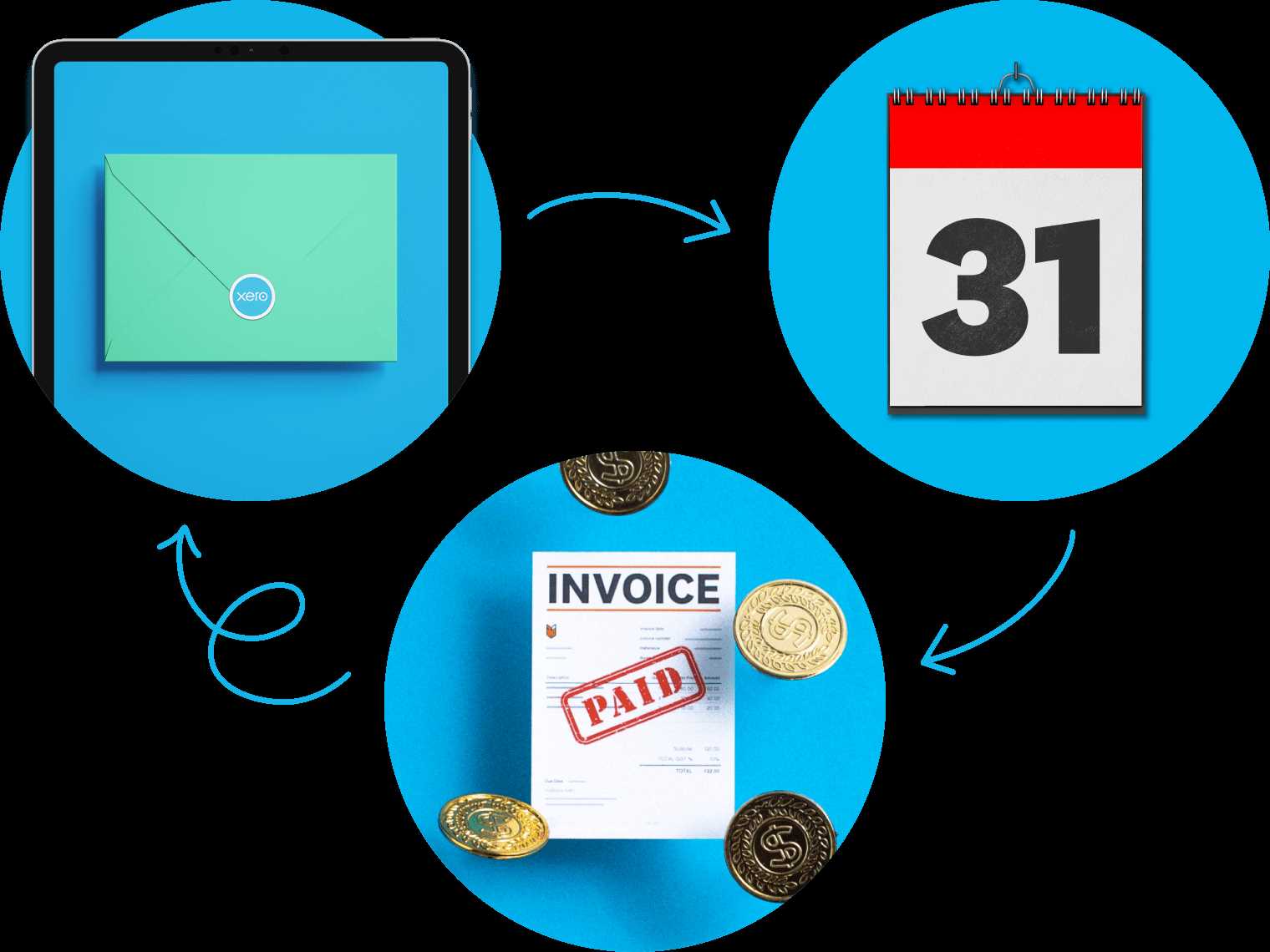

Benefits of Automated Invoicing in Xero

Automation in financial document creation and management has transformed the way businesses handle their billing processes. By reducing manual input and errors, this system offers a streamlined approach that saves time and increases accuracy. Here are some of the key advantages of implementing automated billing procedures in your business operations.

Time and Resource Efficiency

One of the most significant benefits of automation is the amount of time it saves. With automated systems, tasks such as generating, sending, and tracking financial records can be done with minimal human intervention. This allows businesses to allocate their resources more effectively and focus on growth opportunities rather than administrative work.

Improved Accuracy and Consistency

Automated processes help eliminate common errors associated with manual data entry. By reducing human oversight, businesses can ensure that their records are consistent and accurate, preventing costly mistakes. Additionally, the system can be set to automatically update with correct dates, amounts, and client details, further enhancing precision.

Enhanced Cash Flow Management

Automating billing processes allows businesses to track payments in real time. By sending reminders for overdue payments automatically, companies can maintain a steady cash flow and reduce the time spent chasing outstanding balances. These reminders help clients stay informed about their obligations, improving overall payment timelines.

Cost Savings

Automated systems can also help businesses cut down on administrative costs. By reducing the need for paper-based documents, postage, and manual effort, companies can lower operational expenses. The ability to quickly generate and send statements digitally contributes to further cost savings, especially for small businesses.

| Benefit | D

How to Choose the Right TemplateWhen selecting a design for your financial documents, it’s important to find a layout that not only meets your functional needs but also reflects your brand identity. The right design can make a significant difference in how your documents are perceived by clients. It should be easy to understand, visually appealing, and aligned with the professional image you wish to portray. Various options are available, but the key is to choose one that suits the style of your business and enhances the communication of important details. Consider Your Brand and Business NeedsEach business has unique requirements when it comes to the structure and appearance of financial records. If you run a creative agency, you might prefer a more modern, visually striking design. On the other hand, if you’re in a more traditional industry like accounting or law, a simple, professional style may be more appropriate. Think about the following elements when making your choice:

Focus on Usability and CustomizationUsability should be a top priority. A template that is easy to customize will save you time and reduce the likelihood of errors. Look for options that allow you to quickly adjust fields, incorporate your own branding, and ensure that the layout is optimized for printing or electronic submission. A flexible template ensures that you can maintain consistency across all your documents without hassle. Setting Up Your Xero Invoice TemplateCreating a professional document layout for your business transactions is an essential step towards maintaining consistency and efficiency. The process of configuring the design involves ensuring that all necessary fields are correctly aligned, easily accessible, and tailored to your business needs. Customizing the format gives you control over how information is displayed, ensuring it looks polished while remaining functional for both you and your clients. Follow these steps to set up the design for your documents:

Additional elements you may want to adjust include:

Once set up, your documents will maintain a professional, consistent look across all interactions, giving your clients confidence in your business operations. Tips for Personalizing Xero Invoices

Customizing your financial documents can help establish a stronger connection with your clients while reinforcing your brand identity. Personalization goes beyond simply adding your business logo; it allows you to tailor the design and content to reflect the unique nature of your services and customer relationships. By doing so, you ensure that your documents not only look professional but also communicate essential details in a way that is clear and engaging. Here are some effective ways to personalize your financial documents:

By personalizing your financial documents, you can create a more engaging experience for your clients, making the process smoother and more professional. A little extra effort in customizing your templates can lead to better client relationships and a more polished business image overall. Common Mistakes When Using Xero TemplatesWhile customizing your business documents is an essential step in maintaining a professional appearance, it’s easy to overlook certain details that can lead to confusion or errors. Even small mistakes in design or content can have a significant impact on the effectiveness and clarity of your documents. Being aware of common pitfalls can help you avoid issues that may cause frustration for both you and your clients. Here are some of the most frequent mistakes people make when customizing their document designs:

By being mindful of these common mistakes, you can ensure that your documents remain professional, clear, and effective in com How to Track Payments in XeroMonitoring payments is crucial for maintaining accurate financial records and ensuring that your cash flow is on track. Proper tracking not only helps you stay on top of what’s owed to you but also allows you to quickly identify any overdue amounts. Fortunately, accounting software offers tools to easily manage and track the status of payments, helping you avoid confusion and stay organized. Follow these steps to effectively track payments in your system:

For better tracking, consider these tips:

By following these steps and tips, you can ensure your payments are accurately tracked and your financial records remain in good order. Proper tracking helps streamline your accounting process and ensures smoother cash flow management. Managing Taxes with Xero InvoicesProperly managing taxes is an essential part of maintaining accurate financial records and ensuring compliance with local tax laws. Whether you’re dealing with VAT, sales tax, or other regional tax rates, it’s crucial that these charges are correctly applied to your transactions. Accounting software can simplify the process by automatically calculating and recording tax amounts, helping you avoid errors and stay organized. Setting Up Tax RatesTo ensure that tax calculations are applied correctly, it’s important to configure the correct tax rates within your accounting system. This setup involves selecting the appropriate tax codes for different goods and services and specifying the tax rate for each. Here’s how to get started:

Tracking Tax Payments and ReportingOnce your tax rates are set up, the next step is to track tax payments and generate reports for tax filing. Most accounting software offers built-in tax reports that summarize the total tax collected over a specific period, which can help you stay on top of your obligations. Here are some tips for managing taxes effectively:

By effectively managing taxes through your system, you can reduce the risk of mistakes, ensure compliance, and make tax season much easier to navigate. Integrating Xero with UK Accounting SoftwareIntegrating your financial management software with other accounting tools can significantly improve efficiency, streamline processes, and reduce the risk of errors. For businesses operating in the UK, connecting your system with local accounting software is a smart way to ensure that you comply with tax laws and maintain accurate financial records. By syncing data between platforms, you can automate tasks, avoid manual entry, and enhance the accuracy of your financial reporting. Here are the steps to integrate your system with UK-based accounting software:

Once integrated, these benefits can be realized:

|

|---|