How to Design Custom Xero Invoice Templates for Your Business

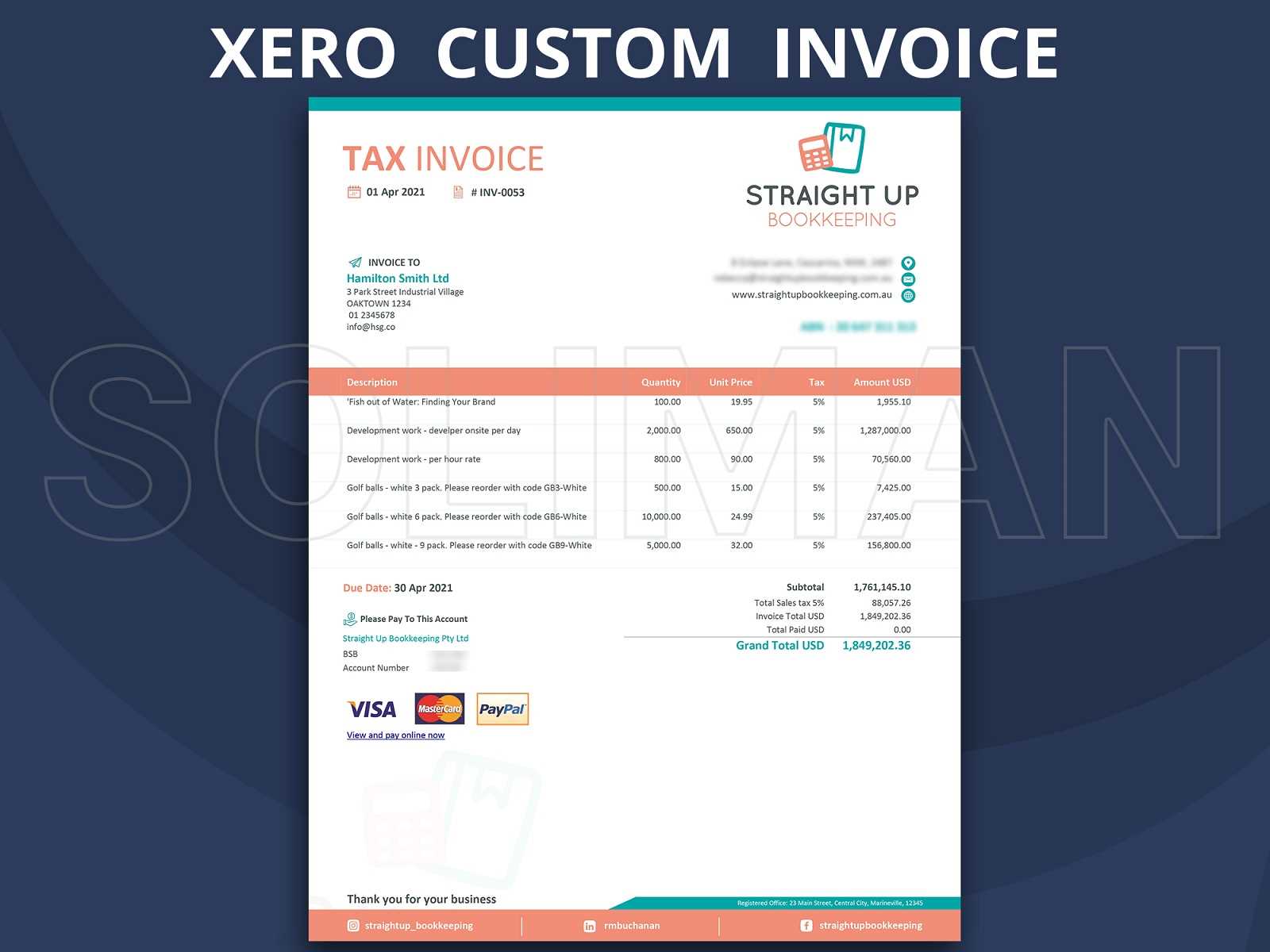

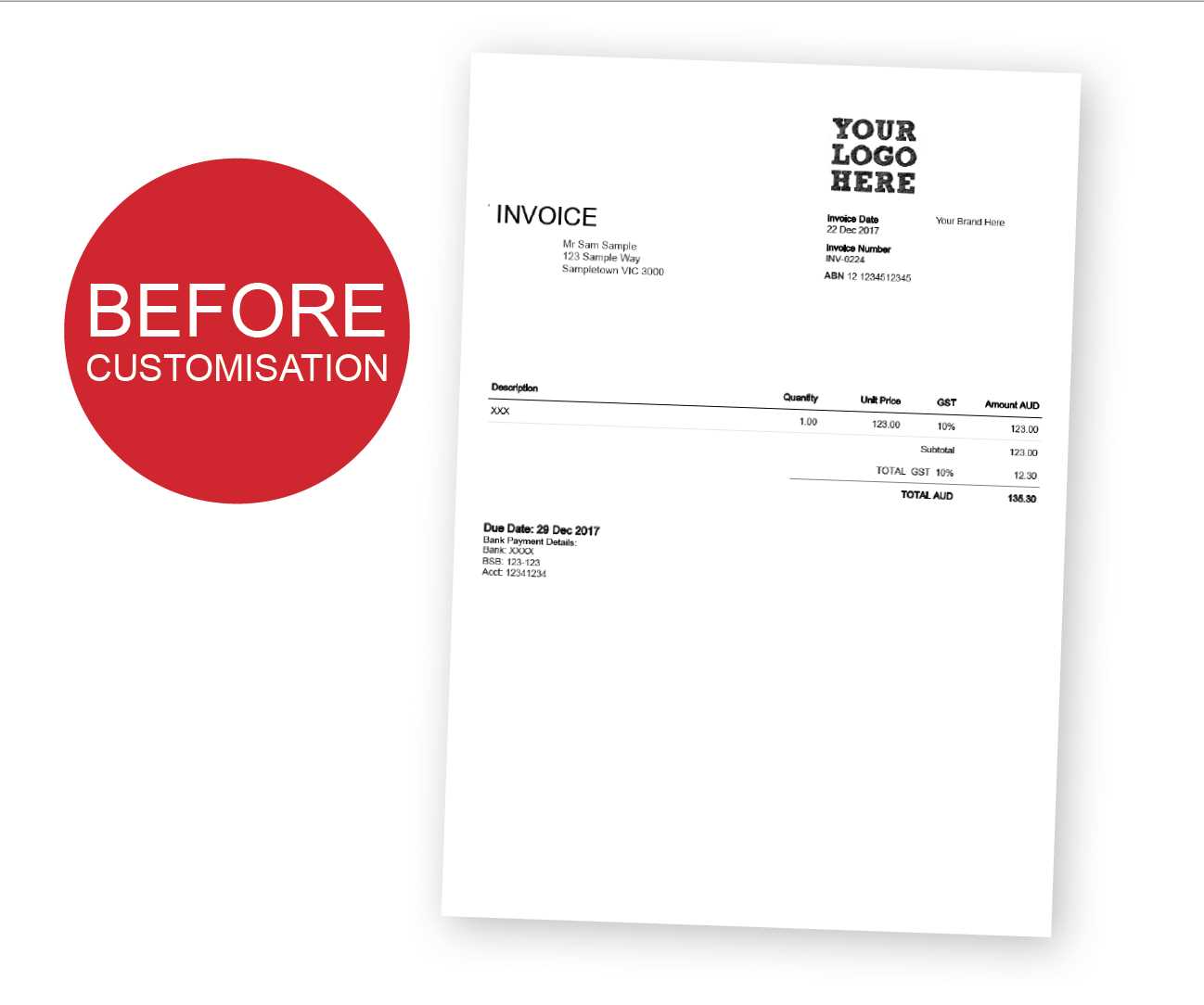

Customizing your business’s billing documents plays a vital role in creating a professional and consistent brand image. Whether you’re sending a bill for services or a product, a well-crafted document can enhance the customer experience, making transactions smoother and more efficient. Tailoring the format and style of these documents to reflect your brand ensures that your business stands out in a competitive market.

In this guide, we’ll walk you through how to personalize these key documents, making them not only functional but also aligned with your company’s identity. From layout choices to incorporating company logos and payment terms, the possibilities are endless when it comes to creating a document that speaks to your professionalism and attention to detail.

Mastering this skill will help you streamline your financial operations, maintain consistency in client communications, and ultimately, leave a lasting impression with every transaction.

Understanding Xero Invoice Template Design

Creating a well-organized and visually appealing billing document is essential for any business. It serves as the primary means of communicating payment details to clients while also reinforcing your brand identity. When setting up your financial documents, it’s important to consider not only the functional aspects but also how the layout, typography, and information flow contribute to a seamless experience for both you and your customers.

Key Components of a Billing Document

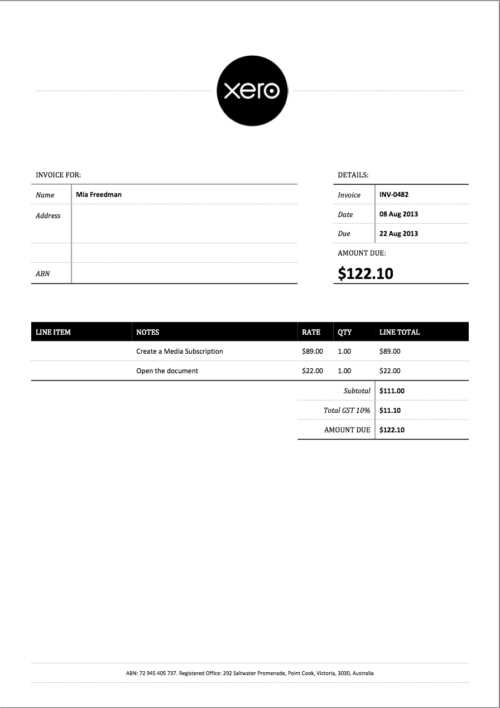

A successful document includes several crucial elements that help convey necessary details clearly and professionally. These components typically include the client’s name, a breakdown of charges, payment terms, and your business’s contact information. Additionally, many businesses choose to add logos, special formatting, or custom fields that make the document uniquely theirs while enhancing readability.

Customizing for Clarity and Efficiency

Customization allows you to adapt the structure of your billing documents to suit your specific business needs. This could involve adjusting font sizes, changing the position of certain fields, or adding company colors and branding elements. The goal is to create a document that is both easy for your clients to understand and efficient for you to manage.

Why Customizing Xero Invoices Matters

Personalizing your financial documents is more than just an aesthetic choice; it has a direct impact on how your business is perceived and how efficiently your transactions are processed. When you take the time to tailor these documents to your specific needs, you improve clarity, strengthen your brand, and enhance professionalism. Customization allows you to communicate essential details in a way that feels personal and structured, making it easier for both you and your clients to manage payments.

Here are a few key reasons why personalization is crucial:

- Brand Recognition: A custom layout with your company’s colors and logo reinforces your brand’s identity, creating a consistent and professional image.

- Improved Clarity: Tailoring fields and sections to suit your workflow ensures that important information is easy to find and understand.

- Enhanced Client Trust: A well-organized and professional document shows your clients that you value their business and are meticulous in your operations.

- Increased Efficiency: Customizing templates allows you to streamline your billing process, saving time by reducing the need for manual adjustments on each document.

- Legal Compliance: Personalizing your documents can also ensure that all the necessary legal terms and conditions are included, reducing the risk of errors or omissions.

Ultimately, taking control of your financial documentation helps you present your business in the best light and can positively impact your bottom line.

Key Elements of an Effective Invoice Template

An effective billing document must do more than just list the charges; it should clearly communicate all relevant details in an easy-to-understand format. The structure and organization of the document play a crucial role in ensuring that both the business and the client can quickly review and process the information. Whether it’s the placement of key details or the clarity of the layout, certain elements must be prioritized to ensure the document serves its purpose effectively.

Essential Information to Include

To ensure that your document is functional, certain details are non-negotiable. These should include:

- Business Contact Information: The name, address, and contact details of your company should be clearly displayed.

- Client Details: Full name or company name, address, and any other relevant information about the recipient.

- Description of Goods/Services: A breakdown of the product or service provided, including quantities, rates, and a clear description.

- Payment Terms: Payment deadlines, late fees, and accepted methods should be clearly outlined to avoid confusion.

- Unique Reference Number: Including a reference number or invoice ID is vital for tracking and record-keeping.

Formatting for Readability

While the content is crucial, the way the document is formatted also makes a significant difference. An organized layout ensures that the recipient can easily navigate the document and locate key information without effort. Important elements, such as the payment due date and total amount, should stand out, perhaps through the use of bold or larger fonts. Clear sectioning and consistent formatting make the document not only professional but also functional.

By focusing on these key elements, your billing document will be well-organized, informative, and easy to read–ensuring smooth transactions and clear communication with your clients.

How to Access Xero Invoice Templates

Getting started with customizing your business’s billing documents is easy once you know where to find the available options. Most accounting platforms offer a built-in section for accessing and managing pre-designed formats. With just a few clicks, you can choose from a variety of layouts and begin tailoring them to suit your specific needs. Understanding how to navigate the platform and access these resources will save you time and ensure a smooth experience when creating and sending your billing documents.

Step-by-Step Process to Access Billing Formats

Follow these simple steps to access and select the right format for your business:

- Login to Your Account: Start by logging into your business account on the accounting platform.

- Navigate to the Settings Menu: Look for the “Settings” section, typically found in the main dashboard or menu.

- Access Document Templates: Within the settings, locate the section dedicated to managing your billing documents or formats.

- Select a Layout: Choose from the available pre-built layouts. You may be able to preview them to see which works best for your business.

- Customize as Needed: Once selected, you can adjust various fields, logos, and other details to fit your preferences.

Additional Tips for Customization

Once you’ve accessed and selected the appropriate layout, keep these tips in mind to ensure your document meets your requirements:

- Review Field Options: Ensure that the key fields, such as payment terms and contact information, are displayed correctly.

- Save Multiple Versions: If you have different clients or services, consider saving multiple customized versions for easy access.

- Test the Layout: Before sending your first document, preview it to ensure all elements appear as expected.

By following these steps, you’ll be able to quickly and easily access and customize your billing documents, helping to streamline your business operations.

Choosing the Right Template for Your Business

Selecting the right layout for your financial documents is essential to creating a professional and efficient system for managing your transactions. The right format not only helps you communicate the necessary details clearly but also ensures consistency in your billing process. It is important to consider various factors, such as the nature of your business, the services you offer, and how you interact with your clients when choosing the most appropriate format.

Here are a few considerations to help guide your decision:

- Industry-Specific Needs: Certain industries may require additional fields or different layouts to suit their specific billing practices. For example, service-based businesses might need a section for hours worked, while product-based businesses may need a section for itemized products and quantities.

- Brand Identity: Choose a format that reflects your brand’s personality and professionalism. Customizing elements such as colors, logos, and font choices can help reinforce your brand identity and ensure your business stands out.

- Client Preferences: Some clients may prefer a more straightforward layout, while others may appreciate additional details or a more creative presentation. Understanding your client’s preferences can help you select the best format for clear communication.

- Functionality and Ease of Use: Look for layouts that are easy to use, both for you and your clients. A clean, intuitive structure with easily accessible sections will streamline the process and minimize confusion.

- Customization Options: Ensure the layout you choose offers enough flexibility to adjust fields and information as your business needs evolve. Being able to add custom fields or rearrange sections can be useful as your services expand or change.

By carefully considering these factors, you can choose the ideal format that will not only meet your business needs but also improve client relationships and overall workflow.

Step-by-Step Guide to Customizing Templates

Customizing your billing documents allows you to create a format that suits your business’s specific needs while also maintaining a professional appearance. By personalizing these documents, you can ensure that all necessary details are included and that the layout reflects your brand identity. The following steps will guide you through the process of customizing your document to streamline your billing and make it more effective.

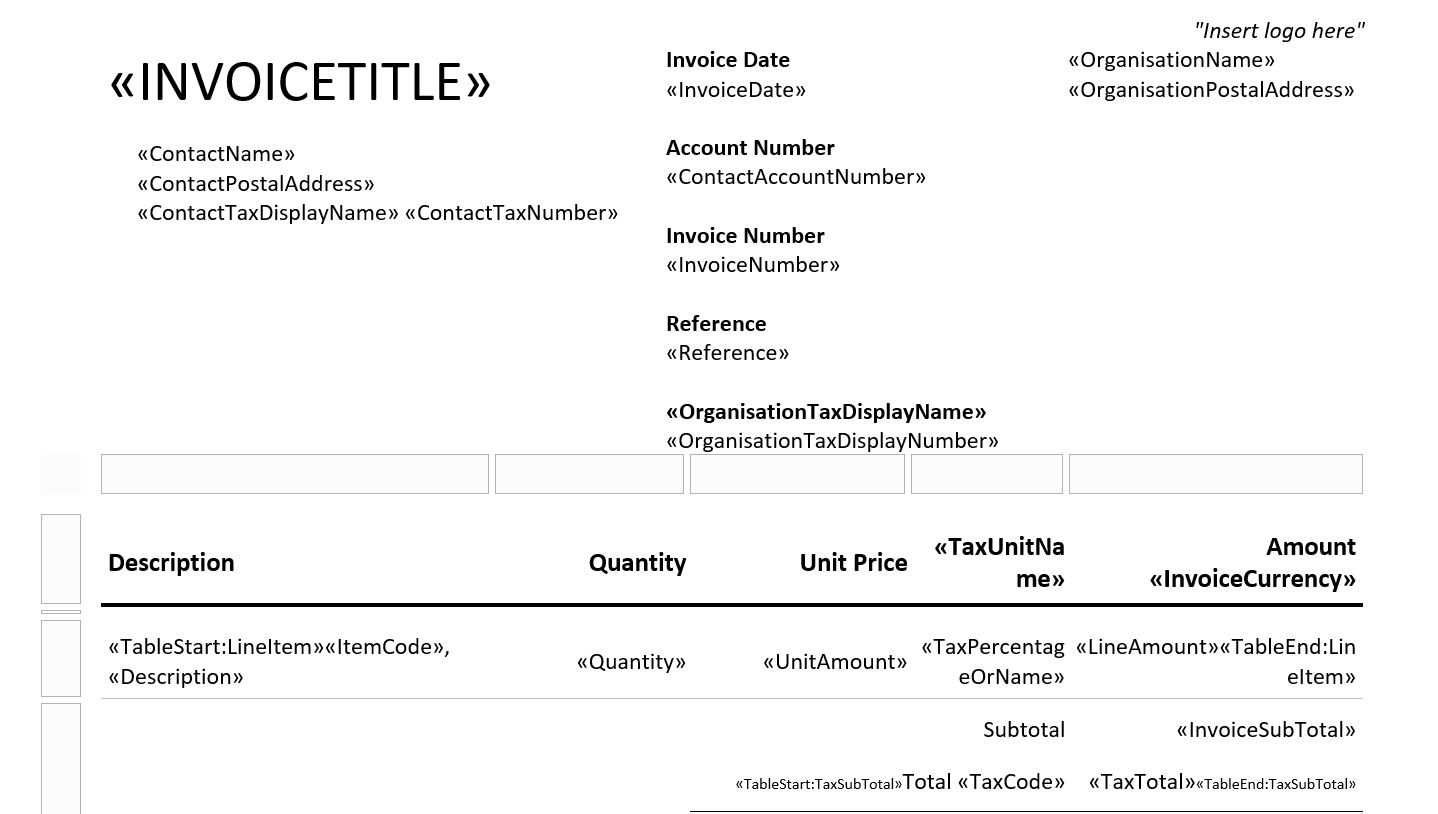

Step 1: Access the Document Editor

Begin by accessing the document management section within your platform. This will typically be found in the settings or administration area. From there, you can select the document format you wish to customize.

Step 2: Modify Layout and Content

Once you’ve selected the layout, it’s time to make adjustments. You can start by editing key sections like client information, service details, or payment terms. You’ll also want to adjust elements like the position of the logo, the font size, and the inclusion of custom fields.

| Section | What to Customize |

|---|---|

| Header | Business name, logo, contact information |

| Client Details | Client name, address, phone number |

| Itemized List | Service or product description, quantity, price |

| Payment Terms | Due date, accepted payment methods, late fees |

Step 3: Save and Test the Document

After making your changes, it’s essential to save the customized document and test it. Preview the document to ensure all fields are aligned correctly, and check for any errors in formatting. Sending a test version to yourself or a colleague can help identify any issues before sending it to clients.

Following these steps will allow you to create a billing document that is both personalized and functional, ensuring clear communication and a professional presentation every time.

Designing Invoices for Different Industries

Each industry has unique needs and requirements when it comes to documenting transactions. Customizing your billing documents to align with industry-specific standards not only ensures that all necessary information is captured but also helps to maintain professionalism and clarity. Whether you’re in the service sector, retail, or construction, tailoring your financial documents to suit your industry will make transactions smoother and provide better communication with your clients.

Industry-Specific Considerations

When tailoring your documents, you must consider the typical data and format needed for your particular industry. Here are a few examples:

| Industry | Custom Features |

|---|---|

| Service-Based Businesses | Breakdown of hours worked, hourly rates, service descriptions, and project milestones |

| Retail | Itemized list of products, SKU numbers, quantities, unit prices, and discounts |

| Construction | Detailed project costs, labor rates, materials, equipment, and completion stages |

| Freelance/Creative Professionals | Project descriptions, creative work provided, license fees, and royalties if applicable |

Customizing Layouts for Clarity and Function

Different industries require different document layouts to ensure clarity. For example, a retail layout might focus on itemization with detailed product descriptions, whereas a service-based business would benefit from sections outlining hours worked and specific services provided. Adjusting the placement of key fields and ensuring the information is easy to read and understand will improve the client experience and ensure no details are overlooked.

By tailoring your document formats to meet industry needs, you not only streamline your processes but also create a more professional and tailored experience for your clients.

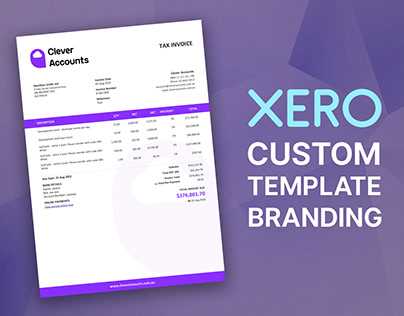

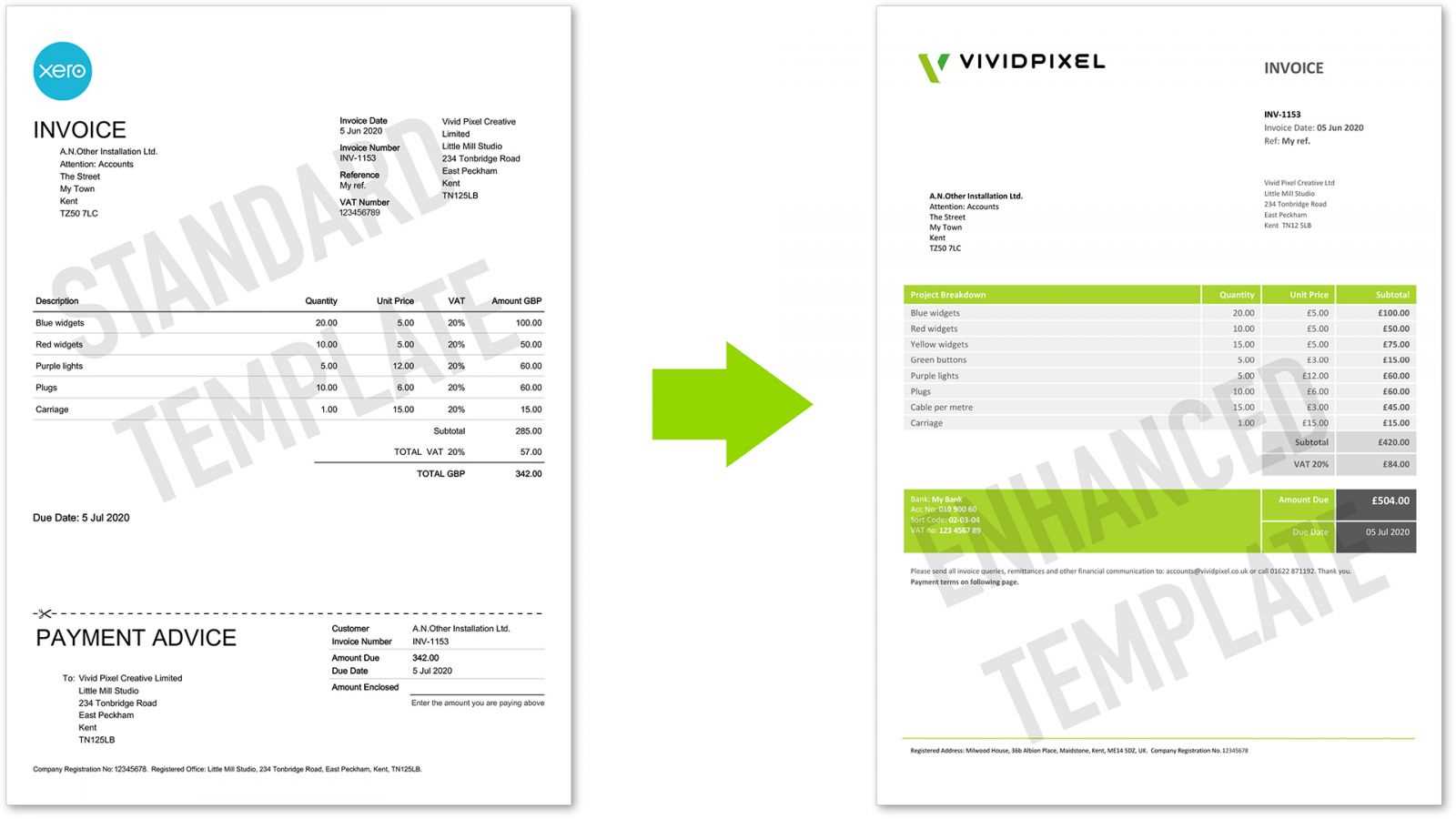

Using Branding Elements in Xero Invoices

Incorporating branding elements into your billing documents is a powerful way to reinforce your company’s identity and leave a lasting impression with your clients. By using your brand’s colors, logos, and fonts, you can transform a standard document into a professional representation of your business. This approach not only enhances your company’s image but also helps clients easily recognize your communications, fostering a sense of consistency and reliability.

Key Branding Elements to Include

To effectively integrate your brand into financial documents, consider the following elements:

- Logo: Place your company’s logo prominently at the top of the document. This will immediately identify the document as coming from your business.

- Colors: Use your brand’s color palette throughout the document. This includes the header, footer, and even the borders of key sections.

- Fonts: Choose fonts that reflect your brand’s tone–whether modern, professional, or creative. Ensure they are easy to read and consistent with other marketing materials.

- Tagline or Slogan: If your business has a tagline, including it on the document can further reinforce your brand’s message and tone.

Why Branding Matters in Billing Documents

Branding isn’t just about visual appeal; it also plays a role in building trust and professionalism. When clients see a well-branded document, it signals that your business is established and cares about the details. Additionally, consistent branding helps reinforce your message, making your company more memorable. Even small touches, like a branded footer or color accents, can contribute to a polished, professional look that enhances your business’s reputation.

By carefully incorporating these branding elements into your billing documents, you can ensure that every interaction with your clients strengthens your company’s identity and builds lasting trust.

How to Add Payment Terms in Xero

Setting clear payment terms in your financial documents is essential for ensuring timely transactions and minimizing confusion with clients. By specifying details such as due dates, late fees, and accepted payment methods, you create a professional framework that helps both parties understand expectations. Adding payment terms not only protects your business but also helps to establish a transparent and respectful relationship with clients.

Follow these steps to easily add payment terms to your financial documents:

- Access the Settings Menu: Start by logging into your account and navigating to the settings section of your platform.

- Select Payment Settings: Within the settings menu, locate the area dedicated to payment preferences or terms.

- Choose Payment Terms: You’ll find options to select standard payment terms, such as “Net 30” (payment due in 30 days) or “Due on Receipt.”

- Customize for Specific Needs: If necessary, you can create custom payment terms, specifying late fees, early payment discounts, or different due dates for certain clients.

- Save and Apply: Once you’ve set your payment terms, save your changes. These terms will now appear automatically on all new documents.

Additional Payment Options to Consider:

- Late Payment Fees: Clearly outline any late fees for overdue payments, specifying both the amount and when it will apply.

- Early Payment Discounts: Offer discounts for clients who pay early, helping to incentivize faster payments.

- Payment Methods: Specify the methods you accept (e.g., credit cards, bank transfers, checks) to avoid confusion.

By adding payment terms to your documents, you ensure that both you and your clients are on the same page regarding payment expectations, which can lead to smoother transactions and better cash flow management for your business.

Optimizing Layout for Clarity and Impact

The layout of your billing documents plays a crucial role in how the information is perceived and processed. A well-organized layout not only makes it easier for your clients to understand the details but also helps reinforce professionalism and trust. By carefully structuring the document and emphasizing key information, you can ensure that your message is communicated effectively and leaves a lasting impact.

To optimize the layout, focus on the following principles:

- Hierarchy of Information: Prioritize the most important details, such as the total amount due and the payment deadline, by making them more prominent. Use larger fonts, bold text, or different colors to highlight these elements, ensuring that they are easily noticed at a glance.

- Whitespace: Avoid clutter by using sufficient whitespace between sections. This creates a clean, readable layout that allows clients to focus on each part of the document without feeling overwhelmed.

- Logical Flow: Arrange the information in a logical order. Start with the header (company details, client info), followed by the itemized list of services/products, and end with payment terms. This natural progression helps guide the reader’s attention where it needs to go.

- Consistent Alignment: Make sure that all text, numbers, and sections are aligned properly. Consistent alignment contributes to a clean, structured look and ensures that the document feels cohesive.

- Clear Labeling: Use labels for each section (e.g., “Payment Terms,” “Total Amount Due”) to make it easy for clients to navigate. Clearly labeled sections also reduce the risk of important information being overlooked.

Additionally, using subtle design elements such as borders, shading, or color blocks can help distinguish sections and improve the visual appeal without distracting from the content. The goal is to create a document that’s not only easy to read but also leaves a strong, professional impression.

By optimizing your document’s layout, you can ensure that clients receive all the necessary information in a clear, impactful way that promotes timely payments and strengthens your brand’s professionalism.

Incorporating Client-Specific Information

Including personalized details in your billing documents is essential for building strong, professional relationships with your clients. Tailoring each document to reflect the specific needs and preferences of individual clients not only enhances communication but also demonstrates attention to detail and a commitment to providing excellent service. By adding client-specific information, you can make your documents more relevant and ensure that every transaction is clear and personalized.

Types of Client-Specific Information to Include

Depending on the nature of your business, there are several important details you can include to customize your documents:

- Client’s Name and Contact Details: Always ensure that the client’s full name, address, phone number, and email address are correctly listed. This helps prevent any confusion and ensures that your client can easily reach you if needed.

- Custom Project or Service Descriptions: If your client has specific requests or if you are providing a tailored service, make sure to clearly describe the work completed or the products provided. This shows that you understand their unique requirements.

- Personalized Payment Terms: Some clients may have negotiated different payment terms. Adjusting the payment due date, late fees, or discounts based on your prior agreements ensures consistency and helps prevent misunderstandings.

- Unique Reference Numbers: If you work with many clients or have multiple ongoing projects, using unique reference numbers (like project IDs or customer codes) helps you and your client easily track the transaction.

- Custom Notes: Including a personalized message, whether thanking the client for their business or reminding them of upcoming deadlines, can enhance the relationship and leave a positive impression.

Benefits of Client-Specific Customization

Incorporating personalized information into your documents offers several key advantages:

- Builds Trust: A personalized approach shows that you value the client and are dedicated to their specific needs, helping to build trust and foster long-term relationships.

- Improves Clarity: Customizing the document ensures that all relevant information is included, making it easier for the client to understand the details of the transaction.

- Enhances Professionalism: Tailoring documents to the client’s specifications demonstrates a high level of professionalism and attention to detail, which can positively impact your brand image.

By incorporating client-specific details, you not only create a more personalized experience but also help ensure smoother transactions and stronger business relationships.

How to Automate Document Customization in Xero

Automating the customization of your financial documents can save significant time and effort while ensuring consistency across all your transactions. By leveraging automation features, you can streamline the process of adding client-specific details, adjusting payment terms, and maintaining professional layouts. This reduces manual work, minimizes errors, and ensures that each document is tailored appropriately for your clients, all while freeing up more time for other important tasks.

Steps to Automate Customization

Follow these steps to set up automation and customize your documents:

- Set Up Client Profiles: Begin by creating detailed client profiles within your platform. Include essential information such as names, addresses, payment preferences, and any specific terms or agreements relevant to each client.

- Enable Document Automation: Access your platform’s automation settings and enable the option to automatically populate documents with client-specific information. This may include the client’s name, contact details, and customized payment terms.

- Define Default Settings: Customize your default document settings, such as payment terms, branding elements (e.g., logo, colors), and specific field formats. These settings will be applied automatically whenever a new document is created.

- Create Document Templates: Create document templates with predefined layouts that match your branding and business needs. Once a template is set up, the system will automatically apply it to the documents created for clients, ensuring consistency.

- Test the Automation: Run a test to ensure that all client information, payment terms, and branding elements are being properly inserted into the document. Review the results to ensure accuracy.

Benefits of Automating Customization

- Consistency: Automation ensures that each document follows a consistent layout, format, and set of terms, reinforcing professionalism and reliability.

- Time Savings: Automating the customization process allows you to focus on other aspects of your business, eliminating repetitive manual entry.

- Fewer Errors: By reducing the amount of manual input, you minimize the risk of errors, such as incorrect client details or mismatched terms.

- Scalability: Automation allows you to easily scale your operations without the added burden of manually customizing each document for every client.

By automating the customization of your financial documents, you can improve efficiency, enhance client satisfaction, and ensure your business runs smoothly without sacrificing accuracy or professionalism.

Creating Templates for Recurring Invoices

For businesses that deal with regular billing, creating custom templates for recurring transactions can significantly reduce the time spent on administrative tasks. By automating the structure of your financial documents, you can ensure that each transaction is consistent, accurate, and tailored to the specific needs of the client. A recurring document template allows you to pre-set key details and have them automatically applied to each new instance, making the process more efficient and less prone to error.

Steps to Create Recurring Billing Templates

Follow these steps to create and set up a recurring billing template:

- Define the Frequency: Start by identifying how often the payment will occur (e.g., weekly, monthly, quarterly). This will help determine the structure of your template and ensure that payments are set to recur on the correct dates.

- Include Regular Services or Products: For recurring transactions, include the same services or products each time. Ensure these are listed clearly with appropriate descriptions, prices, and quantities. You can set this information to be automatically populated each time a new document is generated.

- Set Payment Terms: Customize the payment terms for each client. If necessary, you can apply specific conditions for recurring clients, such as different due dates or discounts for long-term agreements.

- Apply Client-Specific Details: For recurring billing, it’s important to input any client-specific information that will remain constant, such as contact information, reference numbers, and special agreements.

- Save as Template: Once the structure of the document is set, save it as a template that can be reused. The system will automatically pull in the client details, payment terms, and other necessary fields when the billing cycle starts again.

Benefits of Using Recurring Billing Templates

- Efficiency: Automating the process of creating recurring documents saves time and reduces the risk of manual errors.

- Consistency: Templates ensure that each document follows the same structure, which helps maintain professionalism and clarity with clients.

- Customizable: Even though templates are automated, they can still be customized for individual clients, allowing you to adjust specific details while keeping the general structure intact.

- Improved Cash Flow Management: Setting up recurring billing templates can help streamline your revenue collection and ensure that payments are made consistently and on time.

Creating templates for recurring transactions ensures that the process is smooth, accurate

How to Test and Preview Your Design

Before finalizing your billing document structure, it is crucial to thoroughly test and preview it to ensure everything looks correct and functions properly. A preview allows you to spot any potential issues, such as misaligned text, missing information, or visual inconsistencies, before the document reaches your clients. This step ensures that the final product is both professional and error-free, making the process smoother and more reliable.

Steps to Test and Preview Your Documents

Follow these steps to effectively test and preview your customized documents:

- Check for Consistency: Review your document to ensure that all sections (client information, payment terms, itemized list) are consistently formatted. Look for uniform fonts, alignment, and spacing.

- Preview in Different Formats: Before sending out any documents, preview them in various formats (such as PDF or digital view). This helps you see how the document will appear to your clients, especially across different devices or screens.

- Test Client Information: Use a sample client profile to populate the document and verify that all client-specific details are being correctly filled in, including names, addresses, and agreed-upon terms.

- Ensure Readability: Make sure the text is easy to read by checking the font size and color contrast. Avoid using overly small fonts or similar colors that might make it difficult for clients to read the information.

- Verify Payment Terms and Totals: Double-check that payment terms, amounts due, and calculations are correct. Ensure any applicable taxes, discounts, or additional charges are clearly shown.

- Send Test Document: Send a test document to yourself or a colleague. This allows you to see the final product from the client’s perspective and make sure all details appear as expected.

Tools for Testing and Previewing

Common Mistakes to Avoid in Template Design

When creating and customizing your billing documents, it’s easy to overlook small details that can affect their clarity, professionalism, and effectiveness. Even minor mistakes in layout, formatting, or content can lead to confusion, missed payments, or a negative impression. Identifying and avoiding common errors during the creation process ensures that your final product is polished and meets the needs of both you and your clients.

Key Mistakes to Watch Out For

Here are some of the most common mistakes to avoid when customizing your financial documents:

- Inconsistent Formatting: Using different fonts, font sizes, or colors throughout the document can make it look unprofessional. Consistency is key to maintaining a clean, cohesive appearance.

- Overcrowding the Document: Trying to fit too much information onto one page can make the document look cluttered and difficult to read. Use white space effectively to separate sections and allow important details to stand out.

- Missing Essential Information: Always ensure that all necessary details, such as client names, payment terms, itemized charges, and total amounts due, are included. Missing information can lead to confusion or delayed payments.

- Unreadable Fonts: While it might be tempting to use unique or decorative fonts, ensure that the text is legible. Choose clear, easy-to-read fonts and avoid excessive bold or italics, which can make the document harder to read.

- Poor Layout for Calculations: Incorrectly displayed totals, taxes, or discounts can confuse clients and delay payments. Always double-check that calculations are clearly visible and accurately displayed.

- Failure to Brand the Document: A document that lacks consistent branding, such as logos, business colors, or a company name, can come across as impersonal. Branding reinforces your business identity and adds a layer of professionalism.

How to Avoid These Mistakes

By following a few simple guidelines, you can prevent these common errors:

- Plan Your Layout: Before customizing, create a layout plan to determine where each section will go. Prioritize key information and ensure that the document remains clean and readable.

- Use Preview Features: Take advantage of preview tools to spot any errors or inconsistencies before finalizing the document.

- Test with Different Clients: Use sample client profiles to test your documents. Ensure that all client-specific information is correctly populated and formatted.

- Seek Feedback: Get input from colleagues or clients on the appearance and readability of your documents. Fresh eyes can often spot issues you might have missed.

Avoiding these common mistakes will help you create professional, polished financial documents that are both functional and easy to understand, leading to improved client satisfaction and smoother transactions.

Best Practices for Updating Document Templates

Keeping your financial document structures up-to-date is essential to ensure that they remain effective, professional, and aligned with any changes in your business or legal requirements. Regular updates help maintain clarity, reflect your brand, and incorporate any new information that may affect your transactions. By following best practices when making updates, you can ensure consistency and minimize errors while adapting to evolving business needs.

Key Tips for Updating Documents

Here are some best practices to follow when updating your document templates:

- Review for Consistency: Ensure that the layout, fonts, and color schemes remain consistent with your business’s brand identity. Any changes to your logo, colors, or fonts should be reflected in the updated documents to maintain a cohesive look.

- Adjust to Reflect Changes in Business Operations: If there are changes in your pricing structure, payment terms, or services, make sure that these are accurately reflected in the documents. Always double-check the figures, terms, and conditions to ensure they align with the latest updates.

- Ensure Legal Compliance: Make sure that the document includes any new legal information or required disclaimers. If there are changes in tax rates, legal language, or other regulations, update the documents to stay compliant.

- Test the Updated Template: Before finalizing any updates, test the revised document by sending it to yourself or a colleague. This helps ensure that all sections are correctly formatted, that client details are populated as expected, and that no critical information is missing.

- Version Control: Keep track of different versions of your document templates. Document any significant changes you make and ensure that the version being used is always the most up-to-date. This helps avoid using outdated versions that might cause confusion or errors.

How to Make Updates Efficiently

Here are some practical steps for efficiently making updates to your document templates:

- Identify the Need for Updates: Regularly review your templates to determine whether changes are needed. Set a schedule to review templates at least quarterly, or whenever significant changes occur in your business.

- Centralize Updates: If your business uses multiple templates, centralize the process so that updates are made in one place and automatically reflected across all relevant documents.

- Use Automation Tools: Many platforms of