Easy to Use Written Invoice Template for Your Business

Every business, whether small or large, requires a clear and organized way to request payment for goods or services rendered. The ability to present an itemized record of transactions ensures both clarity for the client and proper documentation for the business. A well-structured form for payment requests can save time, avoid confusion, and streamline financial operations.

Having a reliable and customizable form for such requests is crucial for maintaining professionalism and consistency. With the right layout and essential details, the process becomes more efficient, and clients are more likely to respond promptly. From payment terms to detailed breakdowns of services, these documents help set expectations and maintain transparency between parties.

In this guide, we will explore how to create an effective and user-friendly document that can be adapted to various business needs. Whether you’re just starting out or looking to refine your current system, the following tips and suggestions will help you stay organized and ensure smooth transactions.

Essential Guide to Written Invoices

For any business transaction, having a structured document that outlines the terms and details of the payment request is fundamental. This document not only helps ensure that both parties understand what is expected, but it also serves as an official record for both the client and the company. Knowing the key elements that make up such a document is crucial for smooth financial dealings.

Key Elements to Include

To create an effective payment request, it is important to incorporate specific details that clarify the transaction. These include:

- Contact Information: The names, addresses, and contact details of both the business and the client.

- Unique Identification: A distinct reference number for easy tracking and identification.

- Clear Description of Services or Goods: A detailed breakdown of what was provided, including quantities and rates.

- Payment Terms: Information regarding payment deadlines, methods, and late fees, if applicable.

- Total Amount Due: The exact amount owed, including taxes or additional fees.

Why Proper Documentation Matters

Having a properly structured document serves several purposes beyond just requesting payment. It ensures legal protection, helps avoid disputes, and simplifies record-keeping for accounting purposes. A clear record also fosters trust between the client and the business, promoting transparency in financial dealings.

What is a Written Invoice

A formal document used to request payment for goods or services provided is essential in any business transaction. This document outlines the transaction details and serves as an official record for both parties. It ensures that the terms of the agreement are clear and that there is mutual understanding regarding the payment expectations.

Purpose and Function

The primary goal of such a document is to provide clarity and ensure that both the service provider and the client are on the same page. It helps track the exchange, establishes a clear timeline for payment, and functions as evidence in case of disputes. Additionally, it serves as a tool for bookkeeping and accounting.

Common Features

The document typically includes several important components to make sure all necessary information is conveyed. Below is a basic breakdown of the key elements:

| Component | Description |

|---|---|

| Identification Number | A unique number for tracking and reference. |

| Client and Business Information | Contact details of both parties involved in the transaction. |

| Itemized List | A detailed breakdown of the goods or services provided. |

| Total Due | The amount to be paid, including applicable taxes or fees. |

| Payment Terms | Conditions regarding payment deadlines and methods. |

Why You Need an Invoice Template

In any business, having a standardized format for requesting payment is crucial. A pre-designed document ensures that all necessary details are included and presented clearly, reducing the chance of confusion or errors. This consistency streamlines the payment process, helps maintain professionalism, and makes financial tracking more efficient.

Benefits of Using a Structured Format

Using a ready-made structure offers several advantages, including:

- Consistency: It ensures that every payment request follows the same format, making it easy for clients to understand and process.

- Time Efficiency: A reusable structure saves time, as there is no need to create a new document from scratch for every transaction.

- Accuracy: Key details are always included, reducing the risk of missing important information.

- Professionalism: A clean, well-organized document reflects positively on your business and builds trust with clients.

- Recordkeeping: Using a standardized format makes it easier to track and store payment records for accounting and future reference.

How It Improves Payment Processing

Having a consistent format not only saves time but also speeds up the payment cycle. With all the required details clearly outlined, clients can quickly verify the information, approve payments, and avoid delays. Additionally, it reduces the chances of disputes, as all terms are transparent and easy to reference.

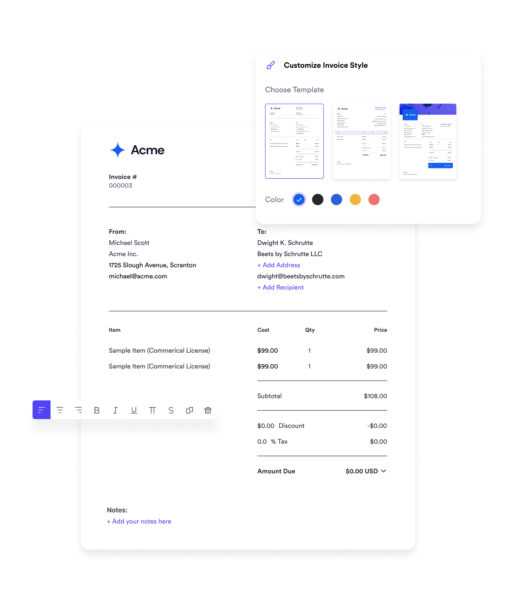

How to Customize Your Invoice

Tailoring a payment request document to suit your business needs is essential for maintaining a professional image and ensuring that all necessary details are included. Customization allows you to reflect your brand identity, highlight important terms, and ensure clarity for your clients. By adjusting the layout and content, you can make the document more relevant to your specific services or products.

To customize your document, consider the following adjustments:

- Branding: Add your company logo, name, and color scheme to give the document a personalized, professional touch.

- Payment Terms: Clearly outline payment methods, deadlines, and any late fees to avoid confusion.

- Item Descriptions: Adjust the format to include detailed descriptions of your services or products, ensuring the client understands what they are paying for.

- Additional Information: Include any extra sections that may be relevant, such as taxes, discounts, or specific conditions related to the payment.

Customizing your payment request document ensures it is not only functional but also aligned with your business values and client expectations.

Key Components of an Invoice

A payment request document is composed of several essential elements that ensure clarity, accuracy, and professionalism. Each component plays a crucial role in communicating important details about the transaction, helping both the business and the client stay on the same page. These parts not only help define the scope of the agreement but also streamline the payment process.

The primary components include:

- Business and Client Information: Clearly state the names, addresses, and contact details of both parties involved in the transaction.

- Unique Identifier: A reference number that distinguishes the document for tracking and record-keeping purposes.

- Itemized List: A detailed breakdown of the goods or services provided, including quantities, rates, and any additional costs.

- Total Amount Due: The total amount to be paid, with any applicable taxes, fees, or discounts clearly shown.

- Payment Terms: Information regarding the due date, accepted payment methods, and any penalties for late payments.

Each of these elements helps ensure transparency and smooth processing of payments, which is vital for maintaining good business relationships.

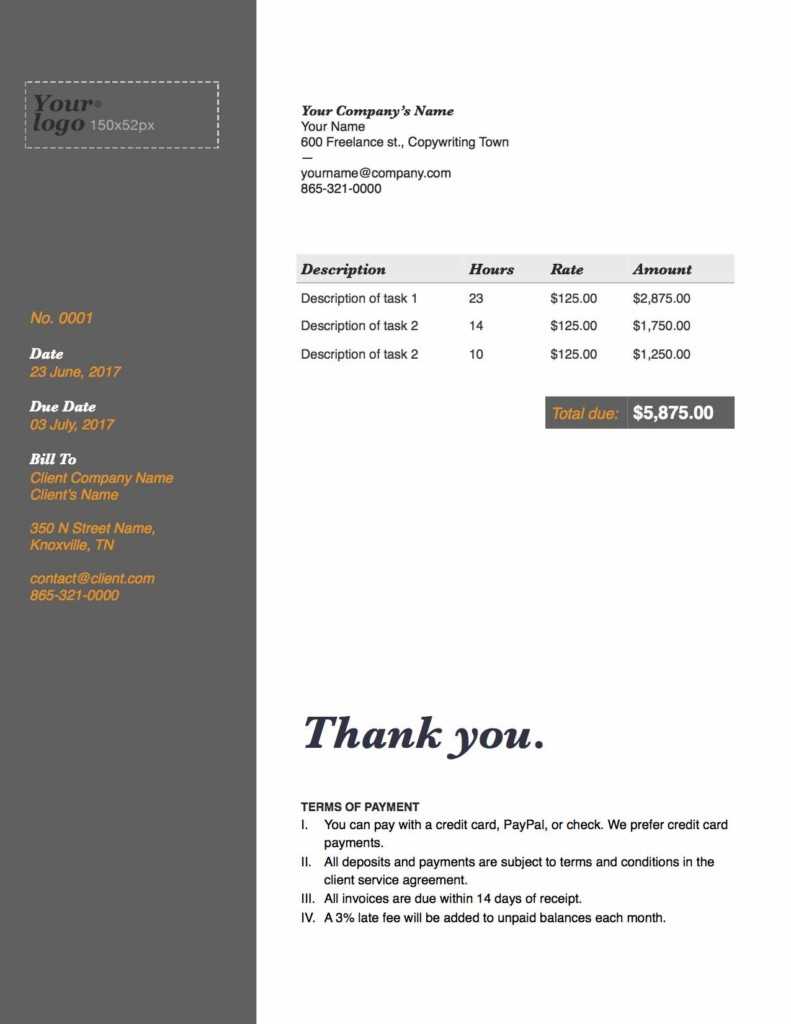

Choosing the Right Invoice Format

Selecting the appropriate structure for your payment request document is essential for ensuring clarity and efficiency. The format you choose should align with your business’s needs while being easy for clients to understand and process. A well-organized design helps present all necessary details in a professional manner and streamlines the transaction process.

Consider Your Business Needs

Different industries may require specific structures depending on the complexity of their services or products. For example, a service-based business may focus more on hourly rates and terms, while a product-based business might need a detailed list of items sold. Choose a format that caters to your particular type of transaction.

Simple vs. Detailed Layout

Depending on the nature of the transaction, you may prefer a simpler format or one that includes more comprehensive details. A straightforward layout works well for small, routine transactions, while a more detailed structure is necessary for complex projects that require itemization or multiple stages of work.

Choosing the right layout is key to providing a seamless experience for your clients while maintaining professionalism and organization in your financial documentation.

Best Practices for Creating Invoices

Creating a well-structured payment request document is key to maintaining professionalism and ensuring smooth transactions. Following certain best practices can help you avoid common mistakes and ensure that both you and your client are clear on the terms of the agreement. Properly formatted documents not only help avoid disputes but also foster trust and clarity.

Here are some best practices to keep in mind when preparing payment requests:

- Be Clear and Concise: Provide a simple, easy-to-read breakdown of services or products provided, without unnecessary jargon or confusion.

- Include All Relevant Details: Always include key information such as business and client contact details, payment terms, due dates, and a unique reference number.

- Ensure Accuracy: Double-check the amounts, quantities, and calculations to ensure there are no discrepancies.

- Set Clear Payment Terms: Clearly outline the payment methods, deadlines, and any late fees to avoid misunderstandings later.

- Maintain Professional Formatting: Use a clean, organized layout with clear headings, bullet points, and consistent fonts to make the document visually appealing and easy to navigate.

By following these best practices, you can improve the efficiency of your payment processes and build stronger relationships with your clients.

Common Mistakes to Avoid on Invoices

When preparing a document to request payment, it’s crucial to ensure that all details are accurate and clearly presented. Small errors or omissions can lead to confusion, delayed payments, and even disputes. By being aware of common mistakes, you can avoid pitfalls that may affect the professional image of your business and slow down your cash flow.

Frequent Errors to Watch For

Here are some common mistakes that should be avoided when creating a payment request document:

- Missing Contact Information: Failing to include the full contact details for both parties can make it difficult for the client to reach out with questions or payments.

- Incorrect Dates: Double-check the date of issue and the payment due date. Incorrect or unclear dates can lead to confusion about when the payment is expected.

- Unclear Item Descriptions: Avoid vague or incomplete descriptions of services or products. Always provide clear, detailed explanations to ensure the client knows exactly what they are paying for.

- Math Errors: Mistakes in calculations, such as incorrect totals, taxes, or discounts, can cause delays in payment and create distrust.

- Failure to Include a Unique Identifier: Every document should have a unique reference number to track payments and avoid confusion in your records.

Consequences of Errors

These simple mistakes can create frustration for both you and your clients. Inaccuracies or missing information may delay payment, cause misunderstandings, or harm your professional reputation. It’s essential to double-check all aspects of your payment request document to ensure its correctness and clarity.

By being mindful of these common mistakes, you can ensure smoother transactions, avoid unnecessary delays, and build stronger business relationships.

How to Properly Number Invoices

Numbering your payment request documents correctly is essential for both organizational and legal reasons. A well-structured numbering system helps keep track of transactions, ensures accurate record-keeping, and makes it easier to identify and reference specific documents when needed. It also enhances professionalism and helps maintain clarity between you and your clients.

Choosing a Numbering System

There are various methods to number your payment documents, and the choice largely depends on your business needs. Some common systems include:

- Sequential Numbering: This is the simplest method where each new document gets the next number in the series (e.g., 001, 002, 003, etc.).

- Year-Based Numbering: Including the year in the reference number helps track documents by year (e.g., 2024-001, 2024-002).

- Client-Specific Numbering: Some businesses use client numbers or project identifiers along with a sequential number (e.g., 1001-001, 1001-002) for easier tracking by client or project.

Best Practices for Numbering

To ensure your system is effective and efficient, follow these best practices:

- Keep it Simple: Choose a format that is easy to follow and does not overcomplicate things.

- Be Consistent: Use the same numbering format for every document to avoid confusion.

- Track and Organize: Maintain a record of all issued numbers to avoid duplication and ensure no gaps in the sequence.

- Consider Automation: If you are generating a large number of requests, using software to automatically assign numbers can save time and reduce errors.

Proper numbering not only ensures a smoother administrative process but also helps establish credibility and clarity in your business transactions.

Legal Requirements for Invoice Templates

When creating a payment request document, it is crucial to ensure compliance with local laws and regulations. Certain details must be included to meet legal standards, prevent disputes, and protect both the business and client. Failing to include these essential components may lead to penalties or legal challenges.

Some of the most important legal requirements that should be included in any payment request document are:

- Business Information: The document must clearly state the name, address, and contact details of the business issuing the request.

- Client Information: The recipient’s name and address must also be included to ensure clear identification of both parties involved.

- Unique Reference Number: A unique identifier for each document is essential for record-keeping and tracking purposes.

- Description of Goods or Services: The document must list the products or services provided, including quantities, unit prices, and any applicable taxes.

- Payment Terms: Include clear terms for payment, such as the due date and accepted methods of payment, along with any penalties for late payments.

- Tax Information: If applicable, the payment request should show the correct tax rate, the total tax amount, and the business’s tax identification number.

Adhering to these legal requirements not only helps avoid potential legal issues but also ensures transparency, builds trust, and supports smooth financial transactions.

Invoice Templates for Small Businesses

For small businesses, having a well-organized and professional document to request payment is essential for maintaining smooth operations. A clear and consistent approach to generating these documents not only streamlines the billing process but also helps project professionalism to clients. Customizing these forms to fit your business needs while keeping them simple and straightforward can save time and reduce errors.

Small businesses can benefit from using tailored formats that cover all essential information, without being overly complex. Here’s an example of a basic structure that works well for small businesses:

| Section | Description |

|---|---|

| Business Information | Include your company name, address, and contact details for easy communication. |

| Client Information | Provide the name and address of the client receiving the payment request. |

| Itemized List of Products or Services | Clearly list the products or services with quantities, unit prices, and total amounts. |

| Payment Terms | Include the payment due date, accepted payment methods, and any applicable late fees. |

| Tax Information | If applicable, provide the tax rate, tax amount, and your business’s tax identification number. |

Using a straightforward and easy-to-follow format not only helps maintain financial organization but also ensures prompt and accurate payments for small businesses.

How to Send Your Invoice Effectively

Sending a payment request in a timely and professional manner is essential for ensuring prompt payment and maintaining strong relationships with clients. The method you choose to deliver your documents, along with the clarity and accuracy of the information, can impact how quickly you receive payment. Here are a few key strategies for sending your documents effectively:

- Choose the Right Delivery Method: Depending on your business and client preferences, you can send the payment request electronically via email or online systems, or opt for traditional mail. Electronic methods are faster and provide immediate confirmation of delivery.

- Use a Clear Subject Line: When sending via email, ensure the subject line is concise and informative. For example, “Payment Request for Invoice #12345” helps the client immediately understand the purpose of the message.

- Attach Supporting Documents: If needed, include supporting documentation such as contracts or purchase orders to give context to the request. This can prevent confusion and ensure that the client has all the necessary details.

- Double-Check the Details: Before sending the request, verify all details, including the payment amount, due date, and client information, to avoid mistakes that could delay payment or cause misunderstandings.

- Set a Follow-Up Plan: If payment is not received by the due date, follow up promptly with a polite reminder. A clear follow-up procedure can encourage timely payments without damaging relationships.

By ensuring your payment request is delivered professionally and with all necessary details, you can reduce delays and foster trust between you and your clients.

How to Track Payments Using Invoices

Tracking payments effectively is essential for maintaining a healthy cash flow and ensuring that all financial transactions are properly recorded. By organizing payment requests and their statuses, businesses can quickly identify outstanding balances and follow up with clients when necessary. Proper tracking also helps in keeping accurate financial records for accounting and tax purposes.

Here are some effective strategies to track payments through your payment request documents:

- Assign Unique Numbers: Give each document a unique reference number to easily track which ones have been paid and which remain outstanding. This also makes it easier to reconcile payments with the appropriate request.

- Include Payment Status Fields: In the document, include a section where you can indicate the payment status, such as “Paid,” “Pending,” or “Overdue.” This helps both you and your client stay informed about the current status of payments.

- Set Up Reminders: Utilize a reminder system, either manually or with accounting software, to notify you when payment is due or when a follow-up is required for overdue amounts.

- Keep Digital Records: Use accounting software or digital spreadsheets to track payments and automatically update the status of your documents. This simplifies the process and reduces the risk of human error.

- Reconcile Regularly: Regularly compare your payment records with your bank statements to ensure that all payments have been received and properly recorded. This helps identify discrepancies early on.

By implementing these strategies, you can ensure that your payment records are always accurate and up-to-date, streamlining your financial processes and improving cash flow management.

Using Invoices for Financial Recordkeeping

Proper financial recordkeeping is essential for any business, ensuring that all transactions are tracked accurately for tax purposes, budgeting, and long-term planning. Payment requests are a critical tool in this process, as they provide a clear, organized record of every transaction. By maintaining accurate and up-to-date records of all issued documents, you can streamline financial management and avoid potential discrepancies in your accounting.

Here are some key ways payment requests contribute to effective financial recordkeeping:

- Documentation of Income: Each payment request serves as proof of the business income, allowing you to track revenue over time. Properly filed requests help in generating financial reports and aid in tax filing.

- Tracking Outstanding Payments: By keeping records of all sent requests and their payment statuses, you can easily monitor unpaid amounts, ensuring you follow up with clients before payments become overdue.

- Budgeting and Cash Flow Management: Tracking your payment records enables better forecasting and management of cash flow, ensuring you can plan for expenses and investments in your business.

- Audit Trail for Taxes: Detailed records of payment requests are invaluable when it comes time for tax reporting. They provide a transparent and verifiable audit trail of income and expenses, helping to prevent errors or issues during tax audits.

- Storing for Future Reference: Keeping a digital or physical archive of all requests allows you to reference previous transactions whenever necessary, helping you resolve potential disputes or review financial history quickly.

Using payment requests as part of your financial recordkeeping system ensures greater accuracy in your business accounts, helping you stay organized and compliant with financial regulations.

Automating Your Invoice Process

Automating the process of creating and sending payment requests can save significant time, reduce errors, and streamline the overall financial workflow of your business. By implementing automation tools, you can focus more on growing your business while ensuring that your documentation remains accurate and timely. This approach is especially useful for businesses that deal with frequent transactions or have multiple clients to manage.

Here are some key benefits and steps for automating your payment request system:

Benefits of Automation

- Efficiency: Automated systems can generate and send payment requests instantly, eliminating the need for manual input and ensuring that no client is overlooked.

- Consistency: Automation ensures that all your documents follow a uniform format, which enhances your brand professionalism and helps in maintaining clear financial records.

- Reduced Human Error: Automation minimizes the risk of errors that often occur during manual data entry, such as incorrect amounts, missed fields, or duplicate entries.

- Faster Payment Collection: By automating reminders and follow-ups, you can encourage faster payments and reduce overdue accounts, improving cash flow.

Steps to Automate Your Payment Request Process

- Choose the Right Software: Select a reliable accounting or billing software that offers automation features such as automatic calculations, customizable designs, and integration with payment systems.

- Set Up Templates: Create reusable designs with pre-filled fields such as client details, pricing, and payment terms. This speeds up the creation of each request.

- Automate Reminders: Set automatic reminders for due dates and follow-ups, ensuring clients are promptly notified of outstanding payments.

- Integrate Payment Gateways: Incorporate payment solutions directly into your system so clients can pay directly from the payment request, streamlining the process even further.

- Monitor and Adjust: Regularly review the automation process and make adjustments based on feedback or changes in your business needs to ensure the system continues to meet your goals.

By automating your payment request process, you can significantly improve efficiency, reduce administrative burdens, and ensure that all transactions are handled smoothly and professionally.

Free Invoice Templates for Quick Setup

Setting up payment requests for your business doesn’t have to be a complex or time-consuming task. With the right resources, you can quickly create professional-looking documents without starting from scratch. Free resources are available that allow you to design and customize your financial documents efficiently, helping you stay organized and save time in the process.

Here are some key benefits of using free resources for your payment documentation needs:

- Cost-Effective: Many free resources are available online, allowing you to access high-quality designs without any financial investment.

- Fast Setup: Pre-designed formats help you get started immediately, without the need to spend time on formatting or calculations.

- Customizable: Most free solutions allow you to tailor your documents to fit your brand, including adding logos, adjusting colors, and modifying sections to fit your specific business needs.

- Professional Appearance: Even free resources provide polished designs that make your financial documents look professional, helping to build trust with clients.

Whether you’re just starting or looking to simplify your existing process, free resources can provide everything you need to generate clear and effective documentation quickly. Here are some tips for making the most out of these free solutions:

- Choose Reputable Platforms: Look for well-known websites or software that offer free financial document templates to ensure you get high-quality designs.

- Understand Customization Options: Explore the customization features to ensure you can adjust the document to meet your business needs, from payment terms to contact information.

- Save Frequently Used Information: Set up templates where you can save recurring client details, services, or products to streamline future document creation.

- Ensure Compliance: Verify that the free resources meet the legal requirements of your location or industry to ensure your documents are valid.

Using free resources for your payment documentation setup allows you to maintain a professional appearance while saving both time and money. This approach is ideal for businesses looking to streamline operations without compromising quality.

Invoice Software vs Manual Templates

When managing your business’s payment requests, you have two primary options: using automated software or relying on manual designs. Both approaches have their own advantages and limitations, depending on the size of your business and your specific needs. Understanding the differences can help you decide which method is most efficient for your situation.

Below is a comparison of the two methods to help you evaluate which one suits your workflow:

Benefits of Using Invoice Software

- Automation: Software can automatically generate, send, and track payment requests, reducing manual input and the risk of errors.

- Efficiency: Once set up, software can generate multiple payment requests quickly, saving time on each transaction.

- Customization: Many tools allow you to personalize the design, add your branding, and configure recurring invoices, making the process tailored to your business.

- Tracking and Reporting: Advanced software often includes features for tracking payments, managing overdue accounts, and generating financial reports.

- Integration: Some programs can integrate with accounting or CRM software, streamlining your workflow and providing better insights into your financial situation.

Benefits of Using Manual Designs

- Cost-Effective: No need for software subscriptions or additional tools; you can create and customize documents using free resources or simple word processors.

- Simple Setup: Manually creating a document does not require a learning curve or setup time, making it ideal for smaller businesses or occasional transactions.

- Complete Control: You have full control over the design and layout, allowing you to tailor each request to a specific client or situation.

- Flexibility: Without being tied to a software system, you can create unique requests for different situations, adjusting content quickly as needed.

Ultimately, the choice between using software or manual documents depends on your business’s needs and resources. If you have a large volume of transactions or need advanced tracking, automated tools may offer the efficiency and features you require. However, if your needs are more basic, manually creating your payment requests could save you both time and money.

How to Handle Invoice Disputes

Disagreements regarding payment requests can arise for various reasons, whether due to unclear terms, incorrect charges, or misunderstandings between businesses and clients. It’s essential to address these disputes professionally and efficiently to maintain positive relationships and ensure timely payment. Handling disputes promptly can prevent escalation and help avoid future issues.

Here are some effective steps to take when managing a dispute:

Steps to Resolve Payment Disputes

- Review the Details: Before taking any action, thoroughly review the request in question, including the terms, items or services listed, payment due dates, and any correspondence related to the transaction. Ensure the information is accurate and aligns with the agreed-upon terms.

- Communicate Clearly: Reach out to the client or recipient of the payment request. Be polite and professional, explaining the situation from your perspective. It’s important to maintain transparency and avoid any confrontational language.

- Listen to Their Concerns: Allow the client to explain their side of the dispute. There may be valid reasons for the disagreement that you weren’t initially aware of. Listening carefully can lead to a quicker and more effective resolution.

- Provide Supporting Documentation: If needed, provide copies of agreements, contracts, or other documents that can support your case. Clear proof of terms or prior communications can help clarify misunderstandings.

- Negotiate a Solution: If the dispute is based on misunderstandings or minor errors, work with the client to resolve the issue amicably. You may agree on a partial refund, a payment plan, or a corrected payment request to settle the matter.

- Document the Agreement: Once a resolution is reached, confirm the new terms in writing. This could be through an email, a revised payment request, or a formal agreement, ensuring that both parties are clear on the outcome.

- Follow Up: After the dispute is resolved, follow up to confirm the client is satisfied with the outcome and that payment is processed according to the new agreement. This helps ensure there are no further issues and reinforces positive relations.

While disputes are an unfortunate part of business, handling them professionally and promptly can help maintain strong client relationships. Clear communication, documentation, and a willingness to negotiate often lead to quick resolutions, allowing both parties to move forward smoothly.