How to Use WPS Invoice Template for Easy and Professional Invoicing

Managing billing efficiently is a crucial aspect of running any business, whether you’re a freelancer, a small business owner, or part of a larger enterprise. With the right tools, the process of creating and sending financial documents can be streamlined, saving time and ensuring accuracy. A well-structured billing document not only facilitates smooth transactions but also promotes a professional image to clients.

One of the most effective ways to handle this task is by using pre-designed formats that can be customized to suit your needs. These ready-made documents can be easily modified to reflect your brand, services, and payment terms. The simplicity and flexibility of such solutions make them an ideal choice for those looking to maintain consistency and professionalism in their financial communications.

In this guide, we will explore the benefits of using customizable billing forms and how they can enhance the efficiency of your financial operations. Whether you’re a startup or an established business, having a reliable system for creating and managing your documents is key to maintaining good relationships with your clients and ensuring timely payments.

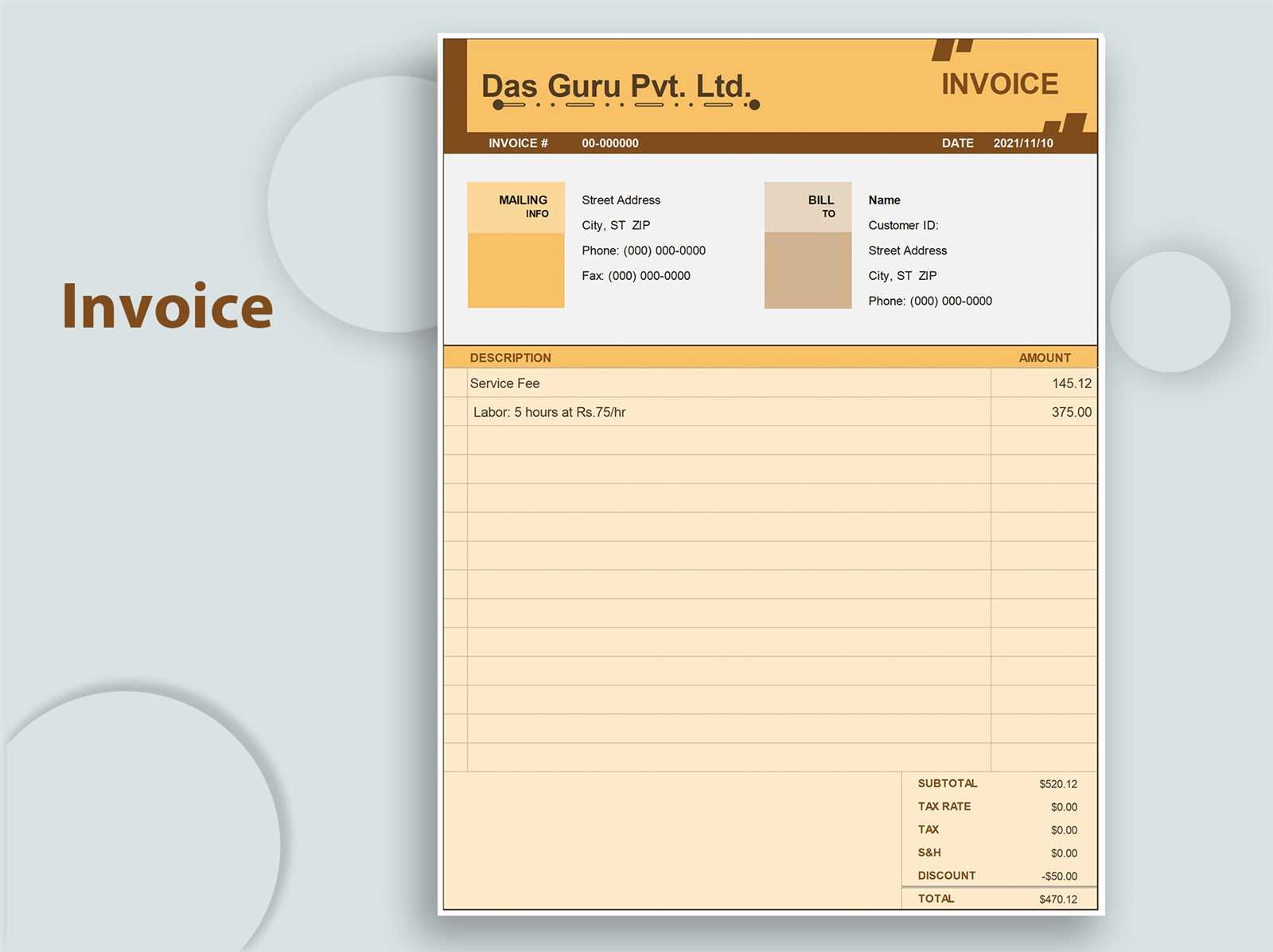

WPS Invoice Template Overview

Creating professional billing documents is essential for businesses of all sizes. Having the right structure to outline services, payment details, and terms can significantly improve the clarity and efficiency of transactions. There are various solutions available that allow users to quickly generate these documents without the need for complex software or design skills.

One such solution offers a user-friendly and customizable format that can be adapted for different business needs. With this option, you can craft clear, professional-looking statements that reflect your company’s branding and ensure accuracy in every transaction. This flexible approach is particularly helpful for entrepreneurs, freelancers, and small business owners who need a simple way to manage their financial communications.

Key features of this tool include:

- Ease of customization for branding purposes

- Pre-set fields for common details like amounts, dates, and payment terms

- Simple integration with various accounting tools

- Ability to save and send documents in multiple formats

By using this solution, businesses can ensure that all necessary information is presented clearly, reducing the chance of mistakes or confusion. Additionally, having a reliable and professional layout enhances your company’s reputation with clients and partners.

What is a WPS Invoice Template

A billing document is a key tool for businesses and freelancers to clearly communicate payment details to clients. This form is designed to provide all necessary information, such as services rendered, payment amounts, and terms. With the right format, creating and managing such documents becomes efficient and professional, ensuring smooth transactions.

One solution offers an easily customizable format that can be adapted to suit different needs. It allows users to quickly insert relevant data, ensuring consistency and accuracy in every transaction. This format provides pre-set sections for various details, making it an ideal option for those who require a simple yet effective way to manage their financial records.

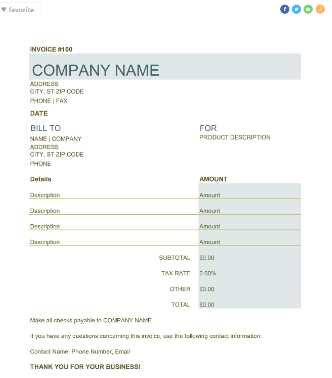

Here’s an example of the typical structure of such a document:

| Section | Description |

|---|---|

| Header | Includes business name, contact information, and document title |

| Client Details | Space for client’s name, address, and contact information |

| Services or Products | List of services provided or products sold, with quantities and rates |

| Payment Terms | Information about payment deadlines, methods, and any discounts or late fees |

| Footer | Business legal details, tax information, and thank-you notes |

This type of document simplifies the process of invoicing and ensures that all essential information is present, helping to avoid confusion or delays in payment.

Benefits of Using WPS Invoice Template

Using a well-structured document format for billing offers numerous advantages for both businesses and freelancers. It streamlines the entire process, from creating and customizing to sending and tracking payments. By relying on an efficient and ready-to-use solution, you can save valuable time while ensuring that all necessary details are included and presented clearly.

Some key benefits of utilizing this format include:

- Time Efficiency: Quickly generate accurate and professional documents without starting from scratch, freeing up time for other important tasks.

- Customization: Easily adjust the format to reflect your company’s branding and specific needs, ensuring consistency in your communications.

- Professional Appearance: A polished, organized format enhances your business’s credibility and leaves a positive impression on clients.

- Accuracy and Consistency: Pre-set fields reduce the risk of errors, ensuring that all essential details, such as dates and amounts, are always correct.

- Easy Record Keeping: Standardized documents make it easier to store and track financial transactions over time, improving organization and accessibility.

- Cost-Effective: Many solutions are free or low-cost, making them an ideal choice for small businesses or freelancers who need an affordable option.

Overall, using this solution simplifies the billing process, helping businesses maintain better organization, improve client relations, and reduce the time spent on administrative tasks.

How to Download WPS Invoice Template

Downloading a ready-to-use billing format is a quick and easy process that can significantly streamline your financial documentation tasks. These pre-designed forms can be accessed from various sources and adapted to fit your specific business needs. Whether you’re using a free or paid version, getting started is simple and only takes a few steps.

Step 1: Choose a Reliable Source

The first step is to identify a trustworthy platform that offers these customizable billing forms. Many websites provide both free and premium options, so it’s important to pick one that matches your requirements and ensures quality. Look for platforms that offer easy navigation, secure downloads, and compatibility with the tools you use for editing or saving the documents.

Step 2: Download and Save the Document

Once you’ve selected the appropriate format, downloading it is straightforward. Typically, you’ll find a download button or link on the website. After clicking it, the file will be saved directly to your computer, often in a popular format such as PDF, Word, or Excel. From there, you can begin customizing it as needed.

Here’s an example of a typical download process:

| Step | Action |

|---|---|

| Step 1 | Visit a reliable website offering free or paid billing documents |

| Step 2 | Choose the format that fits your business needs |

| Step 3 | Click on the download link to save the file to your device |

| Step 4 | Open the file in your preferred editing software to customize it |

After downloading the file, you’re ready to start editing it to suit your branding, services, and payment details. This method saves time and ensures that your documents are both professional and personalized for your clients.

Customizing Your WPS Invoice Template

Personalizing your billing document is essential to reflect your brand identity and ensure clarity in your transactions. Customization allows you to tailor the layout, text, and design elements to match your business style, making your financial communication both professional and unique. This section will guide you through the process of modifying your pre-designed form to better suit your needs.

Step 1: Modify Company Details

The first thing to customize is the header section, where your company’s information is displayed. This includes your business name, logo, contact details, and any other important information. Ensure that the contact details are up to date so clients can reach you easily if needed. You can replace the default text with your own branding, fonts, and colors to make it visually consistent with other business materials.

Step 2: Adjust Payment and Service Information

The next step is to modify the sections related to the services you offer, products sold, or any other items that appear on your documents. Here, you can adjust the item descriptions, quantities, and prices. If you offer different payment terms, such as discounts or additional fees for late payments, make sure these are reflected in the relevant sections. Additionally, you can customize the payment methods and due date to match your preferred processes.

Some key areas to focus on include:

- Client Information: Ensure accurate details for the recipient of the document, such as name, address, and contact information.

- Services and Products: Clearly list each item, including any applicable rates or quantities.

- Footer Details: Add any necessary legal information, tax identification numbers, or thank-you messages to conclude the document professionally.

After these customizations, your document will be tailored to suit your business style while maintaining a professional appearance for clients.

Creating a Professional Invoice with WPS

Crafting a polished and professional document for billing is essential to maintaining strong business relationships and ensuring timely payments. A well-structured financial document not only reflects your business’s attention to detail but also fosters trust and transparency with clients. With the right tools, you can create clear, concise, and professional documents in just a few steps.

Step 1: Choose the Right Format

Selecting the right document format is the first step in creating a professional-looking bill. Make sure to pick a design that suits your business’s image and provides the necessary fields for services, pricing, and payment terms. A clean, organized structure is key to avoiding confusion and ensuring that all essential details are easy to find.

Step 2: Add Essential Information

The next step is filling out the required sections with accurate and up-to-date information. This includes:

- Business Information: Include your company name, logo, and contact details at the top of the document for easy reference.

- Client Information: Clearly list the recipient’s name, company (if applicable), and address to ensure proper delivery and communication.

- Services or Products: Provide a detailed breakdown of the goods or services you have provided, including quantities, rates, and item descriptions.

- Payment Terms: Outline the due date, acceptable payment methods, and any discounts or late fees if applicable.

Step 3: Fine-Tune the Design and Layout

A professional design is not just about the content–it’s also about presentation. Make sure the layout is easy to read by organizing sections clearly and using adequate spacing. Choose simple fonts that are easy to read, and use colors that match your branding. Avoid clutter and ensure that each section is distinct and well-defined. A balanced design will give your document a polished, business-like appearance.

After completing these steps, you’ll have a well-organized and professional document that reflects your brand and facilitates efficient transactions with clients. With minimal effort, you can ensure that every document you send maintains a high standard of professionalism.

WPS Invoice Template for Small Businesses

For small businesses, managing financial documentation can often be a time-consuming and tedious task. However, having a reliable and easy-to-use solution for creating professional billing documents can help streamline the process, ensuring that you can focus more on growing your business. A customizable document format provides a simple way to create accurate and professional records for transactions, reducing administrative workload and avoiding mistakes.

Step 1: Streamlined Document Creation

For small businesses, efficiency is key. Using a pre-designed structure allows you to quickly fill in necessary information without the need to create a document from scratch each time. With fields for services rendered, payment details, and client information, you can ensure that each document is consistent and professional without spending excessive time on formatting.

Step 2: Customization for Branding

Small businesses benefit greatly from customizing their documents to align with their brand identity. A simple, yet professional design can help strengthen your business’s image and build client trust. Customization options typically include:

- Logo Integration: Adding your business logo at the top of the document for a branded look.

- Color Schemes: Matching the color palette to your business’s theme to create visual consistency.

- Contact Information: Displaying your business’s contact details, website, and social media handles clearly on the document.

By customizing these sections, you not only create a polished document, but also ensure that clients remember your brand every time they receive a statement.

In conclusion, using an easily customizable format for your small business’s financial documentation helps maintain professionalism, saves time, and improves the overall client experience. Whether you’re invoicing for services or products, this approach ensures that all details are covered with minimal effort.

WPS Invoice Template for Freelancers

For freelancers, managing payments and maintaining a professional image is crucial to building trust with clients. Having a reliable and easy-to-use document format for creating clear and accurate billing statements can save time and reduce the risk of errors. With the right structure, freelancers can quickly generate statements that reflect their services, rates, and terms without the need for complex software or design skills.

A customizable document format allows freelancers to produce consistent, well-organized statements that can be tailored to suit different clients and projects. Whether you’re working on a one-time project or long-term collaboration, using a pre-designed structure ensures that all key information is presented clearly and professionally.

Customizing the Document for Freelance Work

Freelancers often work with diverse clients across different industries, and a flexible solution is necessary. Customizing your document format allows you to:

- Personalize Client Information: Easily input client names, addresses, and contact details for each project, ensuring that each statement is tailored to the recipient.

- List Services Clearly: Include a detailed breakdown of services rendered, hours worked, and applicable rates, which helps clients understand exactly what they are paying for.

- Set Payment Terms: Add your preferred payment methods, due dates, and any late fee policies to keep clients informed about your payment expectations.

Why Freelancers Should Use a Customizable Billing Format

For freelancers, staying organized and professional is key to maintaining a steady stream of income and fostering good relationships with clients. A customizable billing format ensures that every statement is consistent, accurate, and easy to understand. Additionally, it frees up valuable time that can be spent focusing on projects instead of creating documents from scratch.

By utilizing a well-designed and customizable format, freelancers can ensure timely payments, reduce confusion, and enhance their professional image with clients, ultimately leading to smoother transactions and greater client satisfaction.

Key Features of WPS Invoice Template

Having a customizable billing format offers several advantages that enhance the overall efficiency of managing financial transactions. A well-designed document structure can simplify the process of creating and sending professional statements, making it easy to stay organized and consistent. The following features highlight the most important aspects that make this solution ideal for businesses and freelancers alike.

1. Easy Customization

One of the key features of this solution is its high level of customization. Users can easily modify the document to include their logo, business details, and preferred design elements. Whether you’re a freelancer or part of a larger organization, the ability to adjust the format to match your brand identity ensures that your financial documents look professional and cohesive with other business materials.

2. Pre-Set Fields for Essential Information

This tool comes with pre-set fields designed to capture all essential information, such as client details, item descriptions, quantities, rates, and payment terms. These fields are clearly organized, reducing the risk of missing any crucial details and ensuring that each document is complete and accurate.

Some of the key fields included are:

| Field | Description |

|---|---|

| Business Information | Includes your company’s name, contact details, and logo for a professional presentation. |

| Client Information | Displays client name, address, and contact details for clear communication. |

| Service/Product Breakdown | Lists services provided or products sold, with pricing details and quantities. |

| Payment Terms | Specifies due dates, payment methods, and any late fees or discounts. |

3. Multiple File Formats and Easy Sharing

Once your document is created, you can save it in a variety of file formats, such as PDF, Word, or Excel. This flexibility makes it easier to share the document with clients via email or print it for physical delivery. You can also store your completed forms for future reference, improving your document management system.

These features not only make document creation faster but also ensure that the final result is polished, consistent, and ready for di

Common Mistakes to Avoid with WPS Templates

While using a ready-made billing format can save time and improve the accuracy of your documents, it’s important to be aware of common mistakes that can undermine its effectiveness. Even with a pre-designed structure, errors in key areas can lead to confusion, delayed payments, or a less-than-professional appearance. Avoiding these mistakes will help you maintain consistency and ensure that your financial records are clear, accurate, and easy to understand.

1. Inaccurate Client or Business Information

One of the most frequent mistakes is failing to update or double-check the client or business details. Using outdated or incorrect contact information can delay communication, create confusion, and even lead to missed payments. Always ensure that the client’s name, address, and contact details are accurate before finalizing the document.

2. Overlooking Key Billing Details

Another common issue is forgetting to include important details, such as the payment terms, due date, or service descriptions. Omitting these elements can cause misunderstandings and lead to delayed or incomplete payments. Always double-check that all sections are filled in correctly, including:

| Section | Potential Mistake | Why It Matters |

|---|---|---|

| Service/Item Descriptions | Not clearly stating what is being billed for | Can lead to confusion over the scope of work or products |

| Payment Terms | Leaving out payment methods or deadlines | Can delay payments or cause misunderstandings about due dates |

| Client Contact Info | Using outdated or incorrect client details | Can prevent you from reaching the client or cause payments to be sent to the wrong address |

3. Failing to Proofread Before Sending

Even though the

How to Save and Share Your Invoice

Once your billing document is complete and customized, the next step is to save and share it with your client. This process should be quick, secure, and efficient to ensure timely payments and smooth communication. By following a few simple steps, you can ensure your document is properly saved, easy to retrieve, and delivered in a professional manner.

Saving Your Billing Document

After finalizing the details in your document, it’s essential to save it correctly. Proper file storage not only ensures you don’t lose important records but also helps you stay organized for future reference. Here are a few things to consider when saving your file:

- Choose the right file format: Save your document in a widely used format such as PDF, Word, or Excel. PDF is a great choice as it preserves the document’s layout and ensures compatibility across different devices.

- Name your file clearly: Use descriptive file names that make it easy to identify. For example, include the client’s name, project name, or date to make it easy to locate later.

- Organize your files: Create folders for each client or project to store your documents systematically. This will save you time when you need to retrieve them.

Sharing Your Document with Clients

Once your billing document is saved, you can share it with your client in a professional manner. There are a few options available depending on your preference and the client’s needs:

- Email: Attach the saved document to an email. Write a brief message explaining the contents and specify any important payment details, such as due dates or payment methods.

- Cloud Storage: For larger or multiple documents, you can use cloud services such as Google Drive or Dropbox to share a link. This allows your client to access the document securely anytime.

- Printed Copies: If necessary, you can print a physical copy of your document and mail it to your client. This option may be preferred by clients who prefer hard copies or work in industries that require physical documentation.

By using these methods, you can ensure your billing document is easily accessible to your client while keeping a copy for your records. Clear and timely communication through well-managed file sharing is essential for maintaining a professional relationship and ensuring that your payments are processed smoothly.

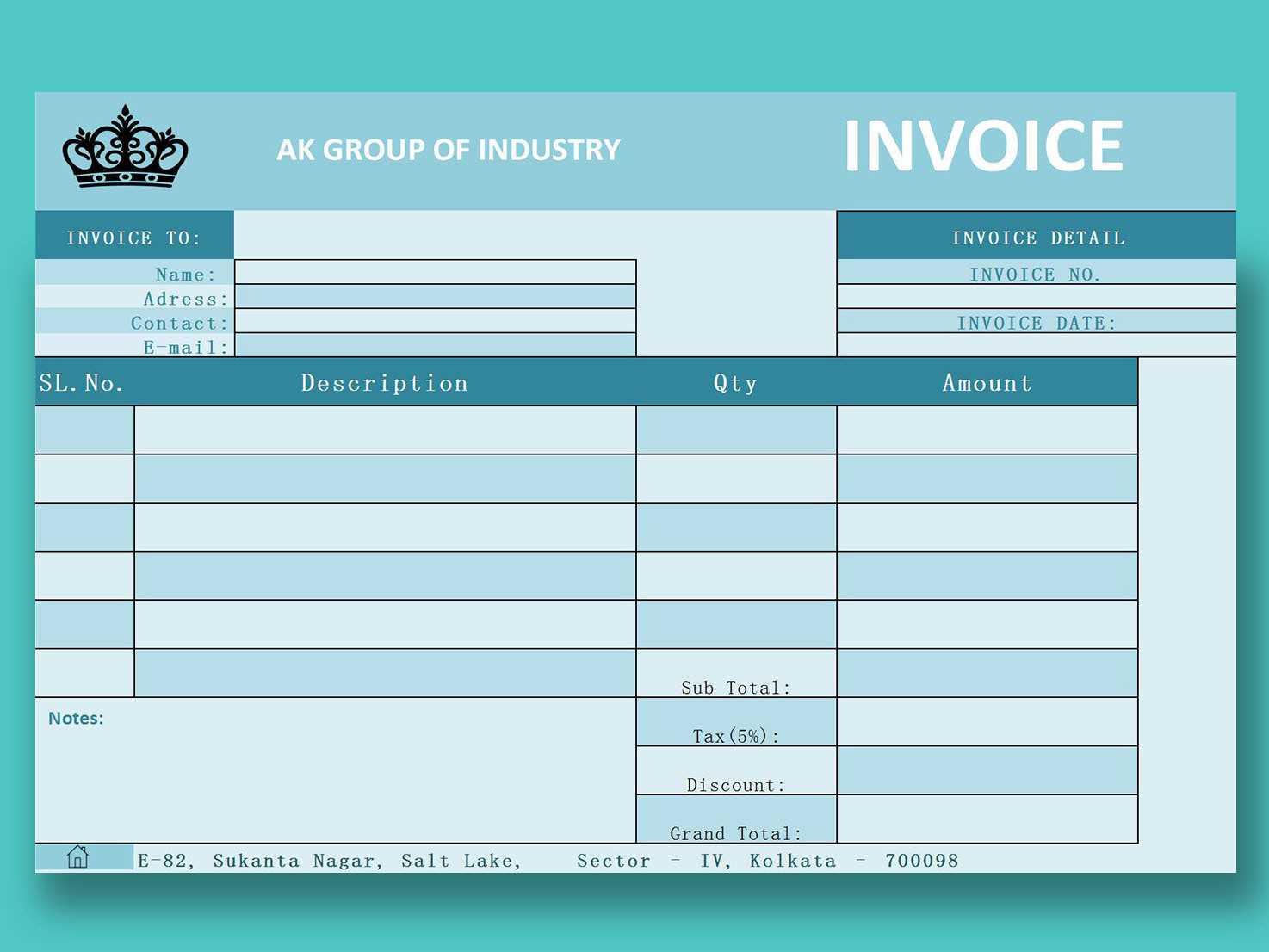

WPS Invoice Template for Different Industries

Every industry has unique requirements when it comes to creating financial documents. Whether you’re a freelancer in the creative field, a contractor in construction, or running a retail business, tailoring your billing documents to meet the specific needs of your sector is essential for clarity, professionalism, and efficiency. By adapting your document layout and content, you can better reflect your services and the expectations of clients in your industry.

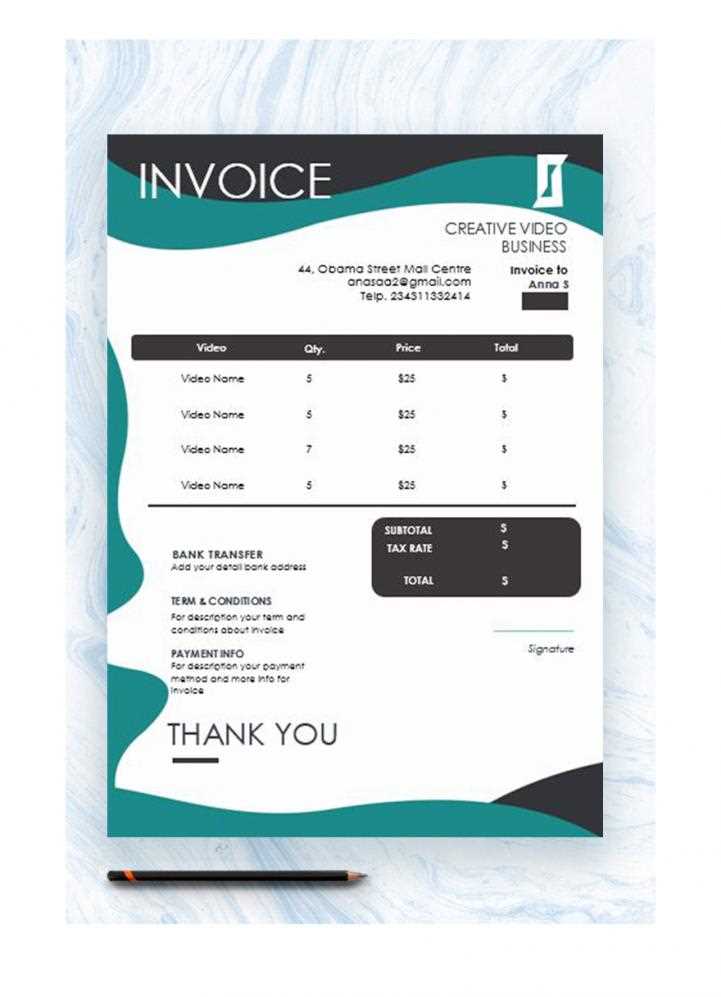

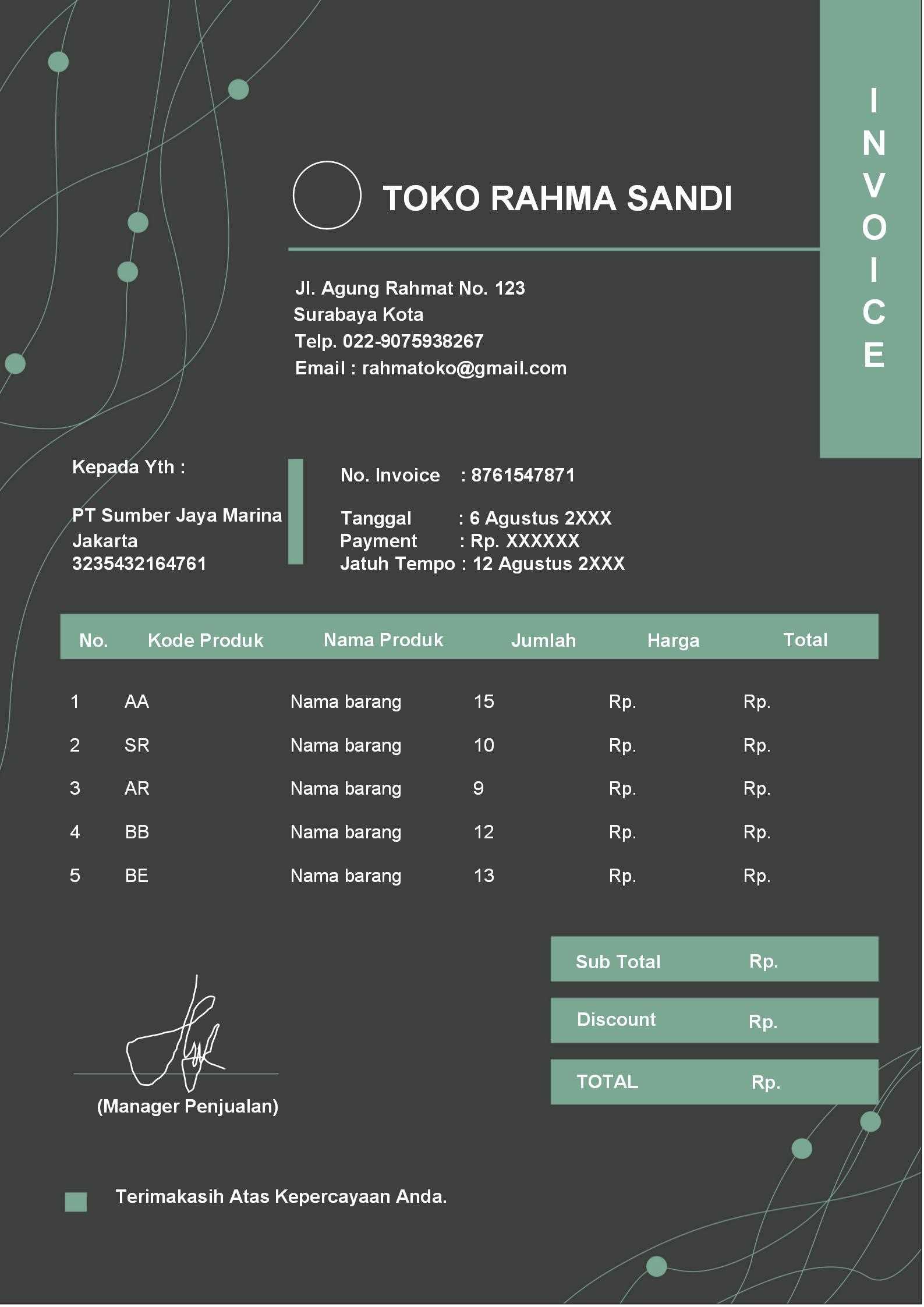

1. Creative and Freelance Services

Freelancers in creative fields, such as graphic design, writing, and photography, often deal with project-based work and custom pricing. When creating billing statements in this field, it’s important to include the following:

- Project Descriptions: Clearly detail the scope of each project, including services rendered, deadlines, and deliverables.

- Hourly vs. Fixed Pricing: Specify whether the charges are based on an hourly rate or a fixed price for the entire project.

- Payment Milestones: For long-term projects, breaking the payment into milestones can help manage expectations and ensure timely payments.

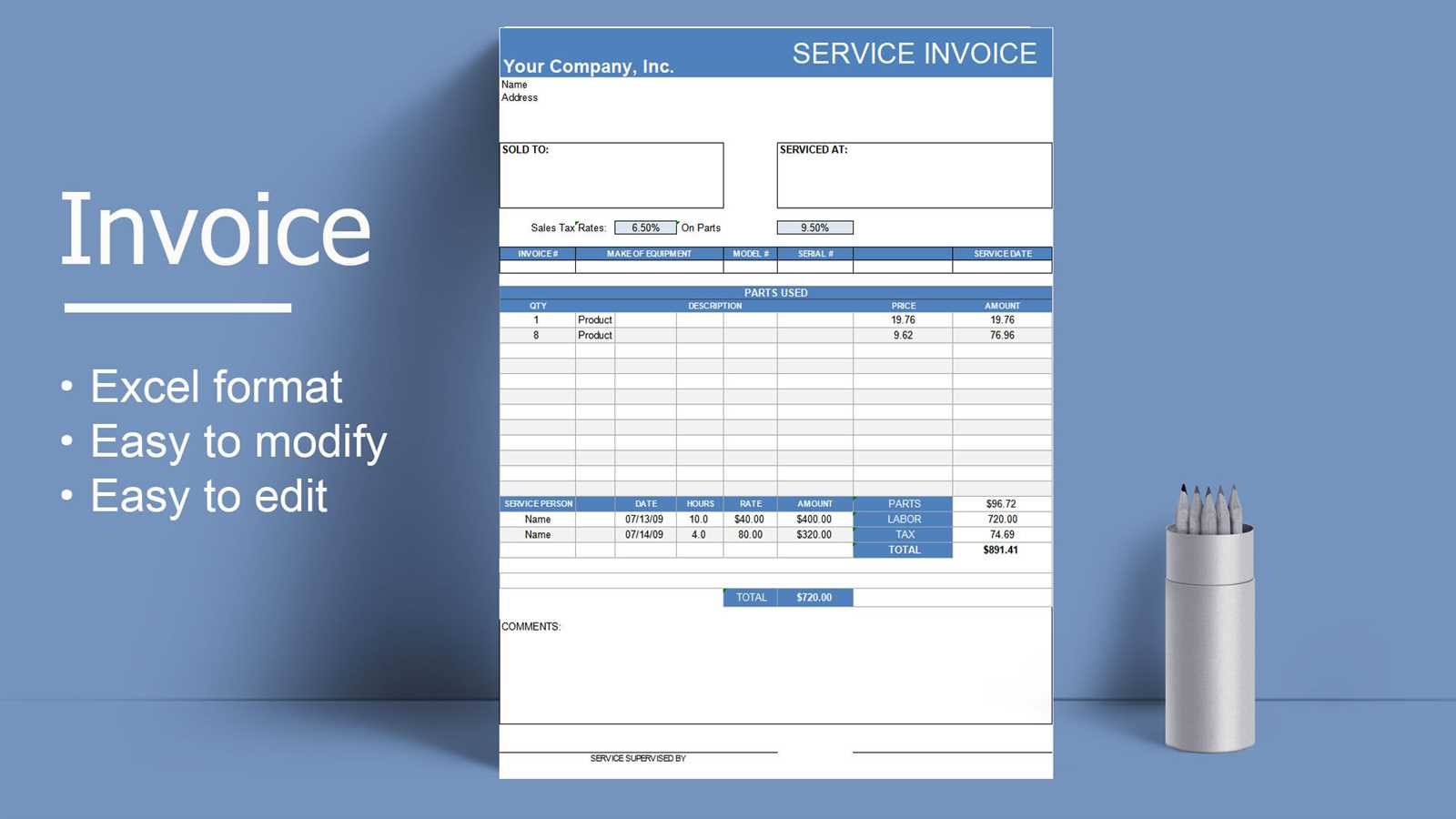

2. Construction and Contracting Services

In industries like construction or contracting, billing documents must account for labor, materials, and various other expenses. The structure for this type of document should be more detailed and precise. Key elements include:

- Material Costs: A breakdown of materials used, including their quantities and costs.

- Labor Charges: Include the number of hours worked and the corresponding hourly rates for different types of work (e.g., labor, management, or supervision).

- Project Phases: If the project is split into different stages, make sure to specify the work completed in each phase and the payment expected for each.

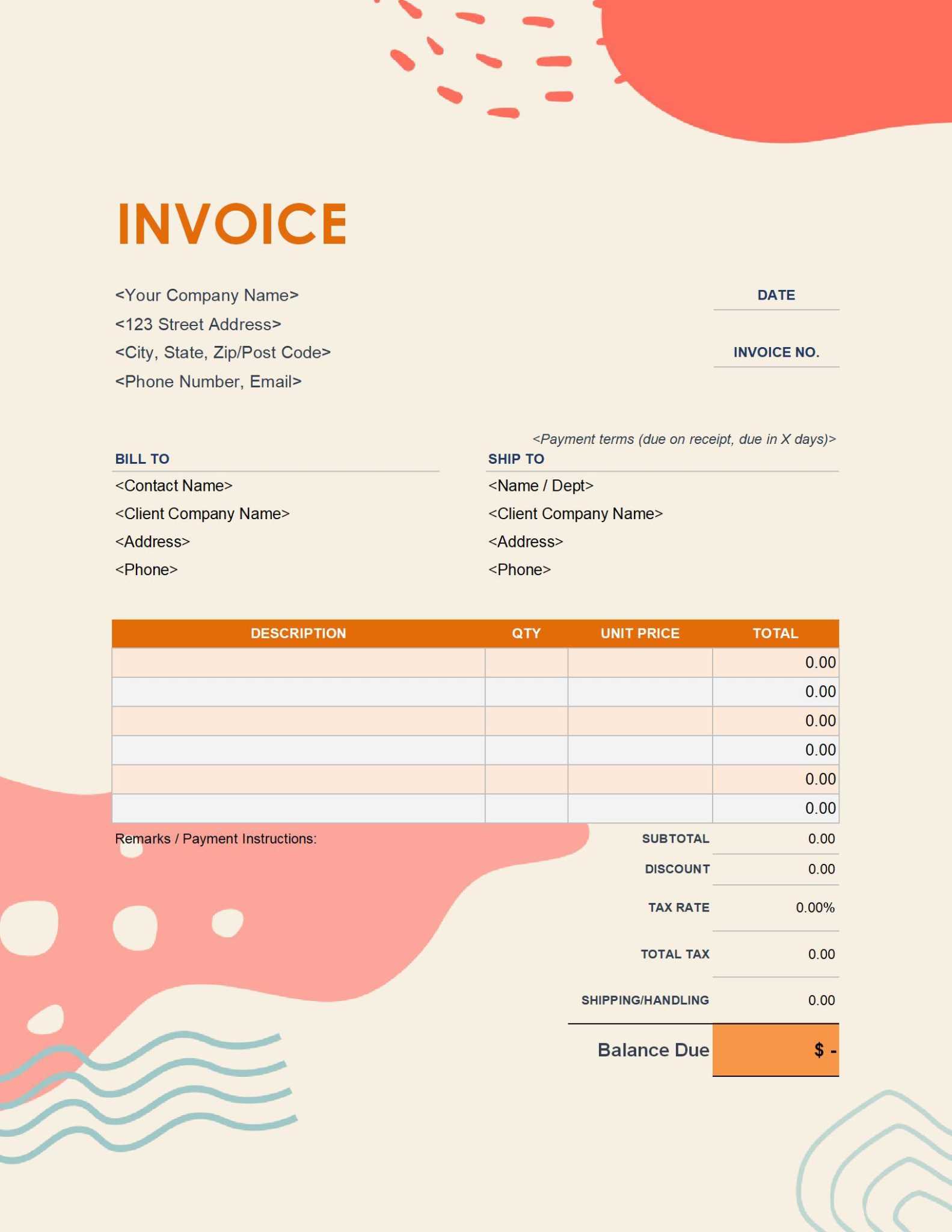

3. Retail and Product-Based Businesses

For businesses in retail or product sales, the billing format should highlight the items or goods purchased, along with their quantities and prices. Here are some essential elements:

- Itemized List: List each product or service separately, including descriptions, unit prices, and quantities.

- Taxes and Discounts: Be sure to clearly state any sales tax and discounts applied to the final amount.

- Shipping and Handling: If applicable, include shipping charges and the method of delivery.

By tailoring the layout and information to the specific needs of your industry, you can create financial documents that are not only professional but also functional. This customization ensures that clients understand exactly what they are paying for and how the charges are calculated, leading to better relationships and more timely payments.

How to Add Your Logo to WPS Template

Incorporating your business logo into your billing documents is an essential step for maintaining a professional appearance and reinforcing your brand identity. A logo not only adds a personal touch but also helps to establish credibility with clients. Fortunately, adding your logo to a pre-designed document format is simple and can be done in just a few steps.

1. Prepare Your Logo File

Before adding your logo, make sure the file is in a suitable format. The most common image formats for logos include PNG, JPG, and JPEG. To ensure that the logo looks clear and sharp on your document, it is best to use a high-resolution image. You can either use your business’s existing logo or design a new one using graphic design software.

2. Adding the Logo to the Document

Once you have the logo ready, follow these steps to add it to your document:

- Open the Document: Open the pre-designed structure you plan to use for your billing records.

- Select the Logo Placement: Typically, your logo will be placed in the top-left or top-center area of the page. Choose the location that best suits your layout.

- Insert the Logo Image: Go to the “Insert” or “Images” section in your document editor and select the option to add an image. Locate the logo file on your computer and click “Insert.”

- Resize the Logo: Once the logo appears in the document, you may need to adjust its size. Make sure the logo is proportionate and not too large or small to avoid disrupting the document’s layout.

- Align the Logo: Use the alignment tools to position the logo correctly. You can adjust the logo to be left-aligned, center-aligned, or right-aligned, depending on your design preference.

Once your logo is in place, make sure it looks balanced and aligns well with other elements of your document, such as client details and the payment summary. This ensures a polished and professional look for your financial records.

3. Saving Your Document with the Logo

After adding your logo, remember to save the document to avoid losing your changes. Save it in your preferred file format, whether it’s PDF, Word, or Excel. This will ensure that your logo stays intact and appears correctly when you share the document with clients.

Adding a logo to your document format is an easy yet impactful way to enhance your branding and create a cohesive, professional image. By following these simple steps, you can

Integrating WPS Invoice with Accounting Tools

For businesses that want to streamline their financial processes, integrating your billing documents with accounting tools can save time and reduce the risk of errors. This integration allows you to automate tasks such as tracking payments, calculating taxes, and reconciling accounts. By linking your billing system with accounting software, you ensure that all your financial records are consistent and up to date, making financial management more efficient and less prone to mistakes.

1. Benefits of Integration

Integrating your billing records with accounting software offers several advantages, particularly in terms of time-saving and accuracy. Here are some key benefits:

- Automated Data Entry: Information from your billing documents can be directly imported into your accounting system, eliminating the need for manual data entry and reducing the risk of human error.

- Real-Time Financial Tracking: With the integration in place, you can instantly track payments, outstanding balances, and financial reports, helping you stay on top of your cash flow.

- Tax Calculations: Many accounting tools can automatically calculate taxes based on the details in your billing records, ensuring compliance with local tax laws.

- Efficient Reporting: Integrated systems allow you to generate detailed financial reports quickly, providing insights into revenue, expenses, and profit margins.

2. How to Integrate with Accounting Software

To integrate your billing records with accounting tools, follow these steps:

- Select Compatible Software: Choose accounting software that supports importing or syncing data from external document formats, such as QuickBooks, Xero, or FreshBooks. Make sure the software you select integrates seamlessly with the format you’re using for your financial records.

- Export Billing Data: After creating a document, export it in a format supported by your accounting software, such as CSV, Excel, or directly as an invoice file.

- Set Up Syncing: Many accounting platforms allow you to set up automatic syncing. This means your billing data can be updated automatically in your accounting tool without requiring manual intervention each time.

- Verify the Connection: Once the integration is set up, check to ensure that all data is syncing correctly and that no information is missing or miscalculated.

Integrating your billing system with accounting tools is an excellent way to simplify financial management and reduce administrative work. It ensures that all financial data is stored in one place, helping you make more informed business decisions and keeping your operations running smoothly.

Updating and Modifying Your Billing Document

As your business evolves, so too should the financial records you send to your clients. Modifying and updating your billing documents ensures they remain relevant, accurate, and reflective of any changes in your services, pricing, or company information. Regular updates to your document layout, terms, or logo help maintain a professional image while keeping everything aligned with current business practices.

1. When to Update Your Billing Document

There are several instances when you might need to revise your billing documents:

- Changes in Business Information: If your company has undergone any changes, such as a new address, phone number, or website, these details should be updated in your documents to reflect the current contact information.

- New Services or Products: Whenever you add or remove products or services, make sure your billing document template includes these changes, with accurate descriptions and pricing.

- Pricing Adjustments: If you’ve modified your rates, it’s crucial to revise the pricing structure in your documents to avoid confusion or disputes with clients.

- Legal or Tax Requirements: Changes in tax laws or industry regulations may require updates to the way you structure or present financial information.

2. How to Modify Your Billing Document

Updating your document is a simple process that allows you to reflect these changes efficiently:

- Edit Business Details: Update your company name, contact information, and branding elements such as your logo or colors to keep everything current.

- Revise Pricing Information: If your pricing has changed, adjust the rates, descriptions, and quantities accordingly. Ensure any discounts, taxes, or fees are properly reflected.

- Adjust Payment Terms: If you’ve modified your payment policies, such as payment deadlines or accepted methods, be sure to update these terms in your document.

- Rearrange Layout or Sections: If you’ve decided to include new sections (e.g., a breakdown of labor vs. material costs), make sure the layout accommodates this new structure without overcrowding.

Updating and modifying your financial documents is an essential practice for keeping your billing system efficient, transparent, and professional. With regular adjustments,

WPS Invoice Template vs Other Templates

When choosing a document format for creating billing statements, businesses often face the decision between using specialized layouts or more general-purpose formats. While many document systems provide pre-designed structures, some options cater specifically to billing needs with features tailored for efficient and professional financial reporting. In this section, we compare one such specialized layout with other general document templates, exploring the unique advantages they offer for businesses in various industries.

1. Specialized Layouts vs General Formats

Specialized formats are designed specifically to handle the nuances of financial records, making them particularly useful for businesses that deal with payments, taxes, and detailed service descriptions. These formats typically include fields for necessary details like payment terms, tax rates, and itemized lists of products or services. On the other hand, general-purpose formats provide flexibility but lack the built-in features that make billing documents more streamlined and accurate. Some key differences include:

- Pre-Formatted Fields: Specialized layouts have predefined fields for important details such as client name, service descriptions, and payment terms, reducing the risk of errors and saving time.

- Professional Design: Dedicated financial document formats often include a polished design that enhances your business’s image, while more general templates may require significant customization to achieve the same look.

- Automation: Certain formats allow for easy integration with accounting software, automating calculations and tracking, something that may be more cumbersome with general-purpose layouts.

2. Flexibility of Other Formats

While specialized formats for financial documents offer efficiency and structure, other types of layouts may appeal to businesses that need more flexibility. For example, a general document layout could be ideal for businesses that do not deal with invoicing on a regular basis or that require more creative freedom in how they present their billing statements. Here are some key advantages of using general-purpose formats:

- Customizable Layouts: General templates offer more room for creativity, allowing users to add custom fields, adjust fonts, and make the design more aligned with their branding.

- Multi-Purpose Use: These layouts can be repurposed for different types of documents, such as quotes, estimates, or receipts, giving you greater flexibility across multiple business needs.

- Simple to Use: For businesses with simpler billing needs, general templates can be quicker to set up and use without the complexity of financial-specific fields.

Ultimately, the decision between specialized layouts and general-purpose formats depends on your business’s specific needs. If you frequently create detailed, professional billing documents and need to integrate with accounting tools, a specialized layout may be the most efficient option. However, if you require a more versatile solution or have less frequent billing needs, a general template might be the better fit.

Why WPS is Ideal for Invoicing

For businesses looking to streamline their billing processes, selecting the right document creation tool is essential. Certain platforms offer a range of features that simplify the creation, customization, and management of financial records, making them ideal for efficient transactions. This particular tool is especially well-suited for producing detailed and professional billing statements due to its comprehensive set of features, ease of use, and versatility.

One of the main reasons why this platform excels at handling financial documents is its user-friendly interface, which allows even those with minimal technical experience to create well-organized billing statements. The software is designed with built-in features that automate many of the tasks involved in creating documents, such as formatting, aligning data, and calculating totals. With the ability to customize fields for client names, product descriptions, tax rates, and payment terms, users can ensure their documents are both accurate and professional.

Additionally, this platform supports seamless integration with other business tools, making it easier to sync billing data with accounting software. This eliminates the need for manual data entry and reduces the risk of errors, leading to smoother financial management. Whether you’re managing a small business or handling transactions for a larger company, the platform’s ability to generate customizable documents and handle complex calculations makes it a powerful tool for invoicing and financial record-keeping.

Tips for Efficient Invoice Management

Managing billing documents efficiently is key to ensuring smooth cash flow and maintaining strong client relationships. Properly handling these records not only helps you stay organized but also ensures timely payments and minimizes administrative errors. By following a few best practices, you can improve your workflow and streamline the entire process, saving both time and resources.

1. Keep Your Records Organized

Organization is the foundation of effective document management. Here are a few tips for staying on top of your records:

- Use Clear Naming Conventions: Label your billing documents consistently with clear and concise names that include relevant details, such as the client’s name or the service date.

- Create Folders by Client or Project: Organize your documents in digital folders, categorized by client or project, to easily locate past records when needed.

- Track Payment Status: Use a tracking system to monitor which records have been paid, which are outstanding, and which are overdue.

2. Automate Where Possible

Manual data entry and calculations can lead to mistakes and delays. Automating repetitive tasks reduces the risk of errors and saves time. Here’s how to automate your process:

- Use Pre-Designed Formats: Many platforms offer customizable document formats that are easy to use and automatically populate standard fields such as tax rates, client information, and payment terms.

- Integrate with Accounting Software: Integrating your billing records with accounting tools allows you to automate the importation of data, simplifying bookkeeping and payment tracking.

- Set Up Recurring Billing: For clients with regular payments, set up automatic billing cycles to generate documents on a fixed schedule.

3. Keep Communication Clear and Consistent

Clear communication with clients can prevent misunderstandings and delays. Here are a few communication best practices:

- Be Transparent with Terms: Clearly outline payment terms, deadlines, and any penalties for late payments within your documents.

- Send Reminders: Don’t hesit