Work Order Invoice Template Excel for Easy Billing and Customization

Managing financial documents efficiently is essential for any business. Having the right tools in place can simplify the way you track services, expenses, and client payments. A well-organized structure not only reduces errors but also saves valuable time for both businesses and clients. In this article, we’ll explore how to create and use a customizable document system to enhance your payment and record-keeping processes.

By incorporating user-friendly software into your daily routine, you can automate many aspects of the billing process. This approach allows for seamless adjustments, quick updates, and easy sharing. Whether you are a small business owner or part of a larger team, understanding the basics of these systems will provide you with greater control over your financial transactions.

Managing financial documents efficiently is essential for any business. Having the right tools in place can simplify the way you track services, expenses, and client payments. A well-organized structure not only reduces errors but also saves valuable time for both businesses and clients. In this article, we’ll explore how to create and use a customizable document system to enhance your payment and record-keeping processes.

By incorporating user-friendly software into your daily routine, you can automate many aspects of the billing process. This approach allows for seamless adjustments, quick updates, and easy sharing. Whether you are a small business owner or part of a larger team, understanding the basics of these systems will provide you with greater control over your financial transactions.

Benefits of Using Excel for Work Orders

Using spreadsheet software for managing service-related documents offers a variety of advantages for businesses. It allows for easy customization, efficient tracking, and quick data updates. This software’s flexibility makes it a go-to tool for managing complex information, enabling companies to stay organized and streamline their operations. Below are some key benefits of using this type of software for handling your business’s service documentation.

Key Advantages

| Advantage | Description |

|---|---|

| Customizability | Tailor documents to suit your business needs by adjusting fields, adding formulas, or changing formats without limitations. |

| Efficiency | Automate calculations such as totals, taxes, and discounts, saving time on manual entry and reducing human error. |

| Data Management | Store and organize important data, such as client details and job histories, in a structured, easily accessible format. |

| Cost-Effective | Many software options are available for free or at a low cost, making them an affordable solution for small businesses. |

| Collaboration | Share and update documents in real time with team members or clients, improving collaboration and communication. |

By leveraging these features, businesses can reduce administrative overhead, improve accuracy, and streamline their workflow processes. The simplicity and power of this tool make it an ideal choice for managing service records efficiently.

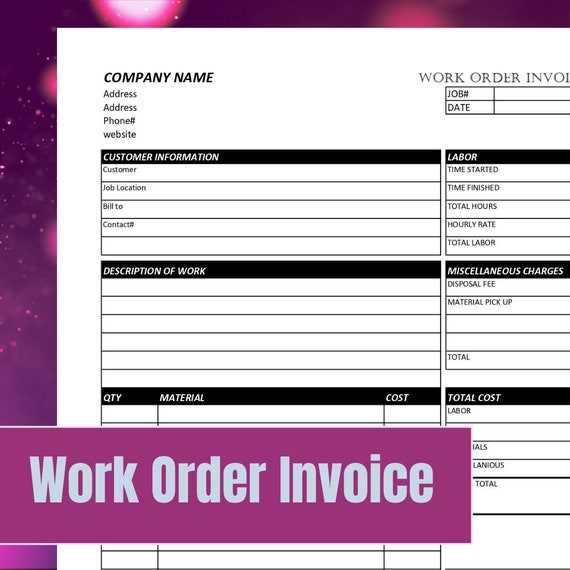

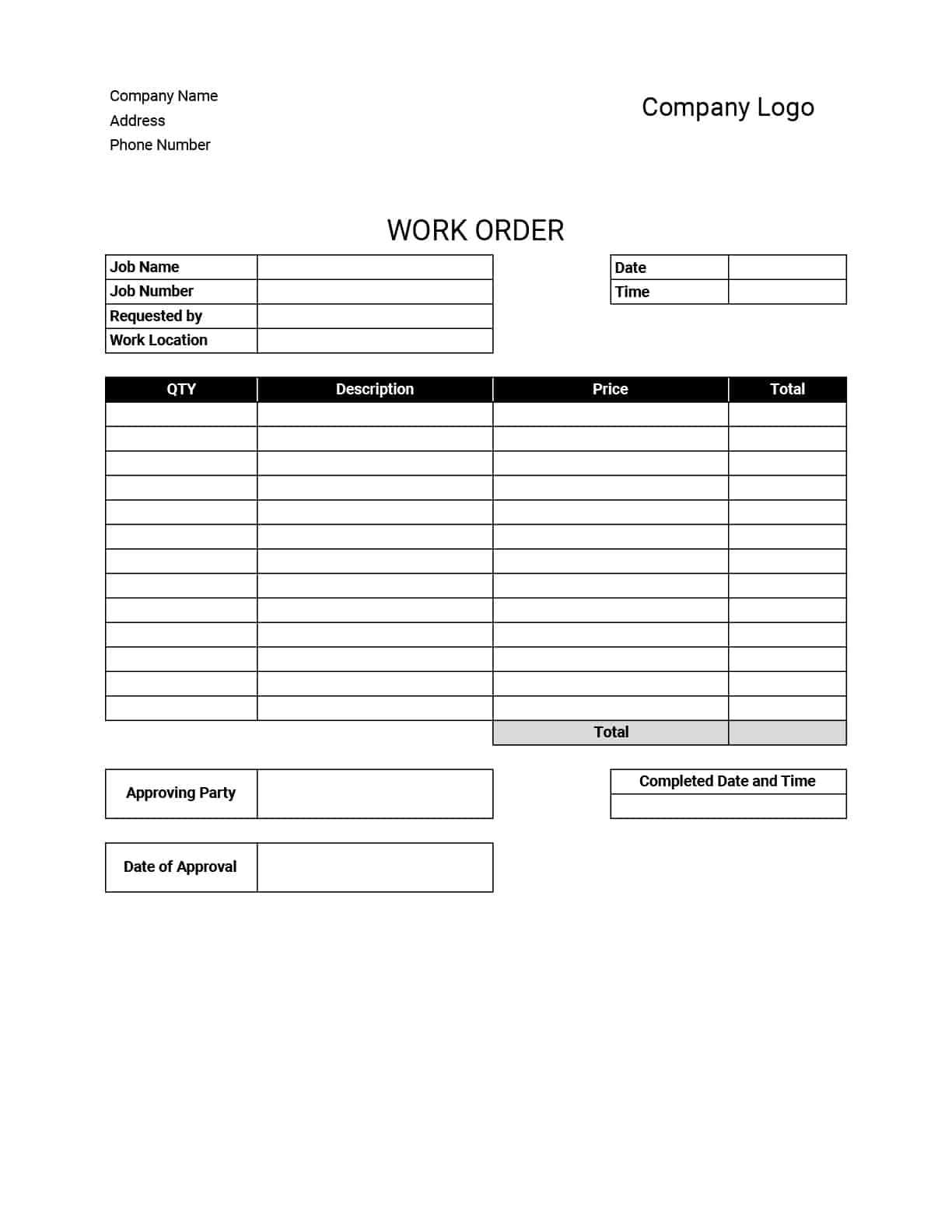

How to Create a Work Order Invoice

Creating a structured document for client billing doesn’t have to be complicated. With the right approach, you can quickly develop a professional-looking record that outlines the services provided, associated costs, and payment details. Below are the essential steps to follow when preparing this type of document.

Step-by-Step Guide

- Gather Information: Collect all necessary details such as client information, service dates, and a list of tasks completed or products delivered.

- Define Structure: Decide how the document will be formatted. This could include sections for service descriptions, charges, payment terms, and total amounts.

- Include Payment Terms: Specify any important payment details, including due dates, accepted payment methods, and late fees if applicable.

- Itemize Charges: Break down the costs into clear categories to ensure transparency. List individual charges for labor, materials, or other services provided.

- Double-Check for Accuracy: Review the document carefully to ensure all data is accurate and complete. Mistakes in the pricing or dates can cause confusion.

- Save and Share: Once finalized, save the document in your desired format and send it to your client. Make sure to retain a copy for your own records.

By following these steps, you can create a well-organized document that provides clear information to your clients and ensures smooth transactions. It also helps build trust and professionalism, fostering long-term business relationships.

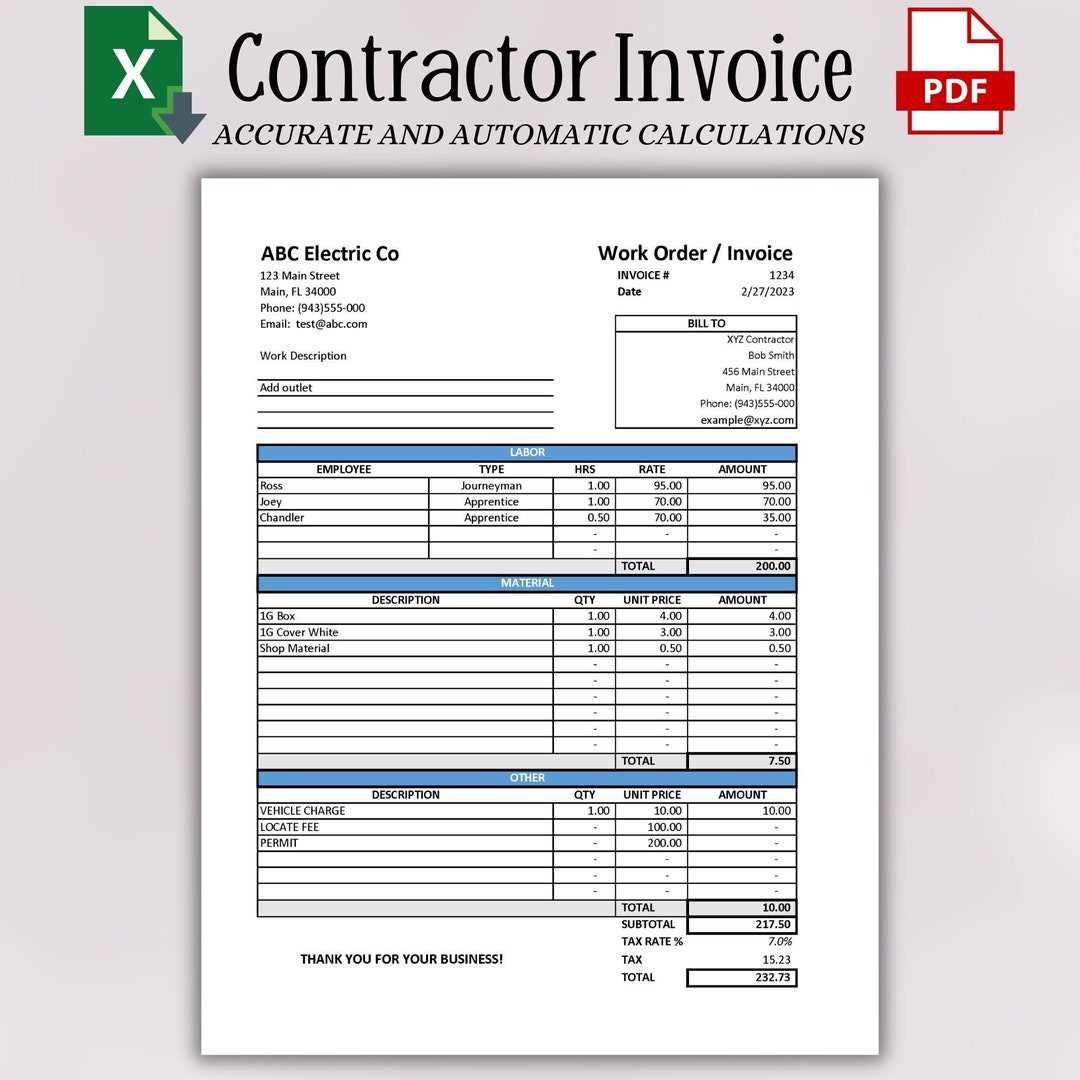

Top Features of Excel Invoice Templates

When it comes to managing service-related documents, the right set of features can significantly enhance productivity and accuracy. A well-designed spreadsheet offers numerous advantages that help businesses maintain professional records and streamline their billing process. Below are some of the top features that make such tools highly efficient for managing client transactions.

Essential Features for Efficiency

- Customizable Fields: Easily adjust sections to suit the specific needs of your business, whether for tracking labor, materials, or additional charges.

- Automated Calculations: Automatically calculate totals, taxes, and discounts to reduce manual errors and save time on repetitive tasks.

- Predefined Formulas: Built-in formulas allow for quick and accurate calculations without the need for complex formulas or external software.

- Professional Design: Ready-made designs provide a clean, organized layout, helping your business look more professional and keeping documents clear and easy to read.

- Data Organization: Keep track of client information, service histories, and payment records all in one document, making it easier to manage and reference past transactions.

- Easy Sharing and Collaboration: Share documents with team members or clients directly through cloud storage or email, ensuring efficient communication and real-time updates.

Additional Benefits

- Template Protection: Add password protection to prevent unauthorized changes and ensure your data stays secure.

- Multiple Currency Support: For international clients, easily switch between currencies and adjust rates accordingly.

- Print-Friendly Format: Print your completed documents with ease, ensuring they maintain a clean and professional look on paper.

These features help streamline the management of client records and billing tasks, ultimately making the entire process more efficient and accurate. Using such tools allows businesses to save time, reduce errors, and focus on providing excellent service.

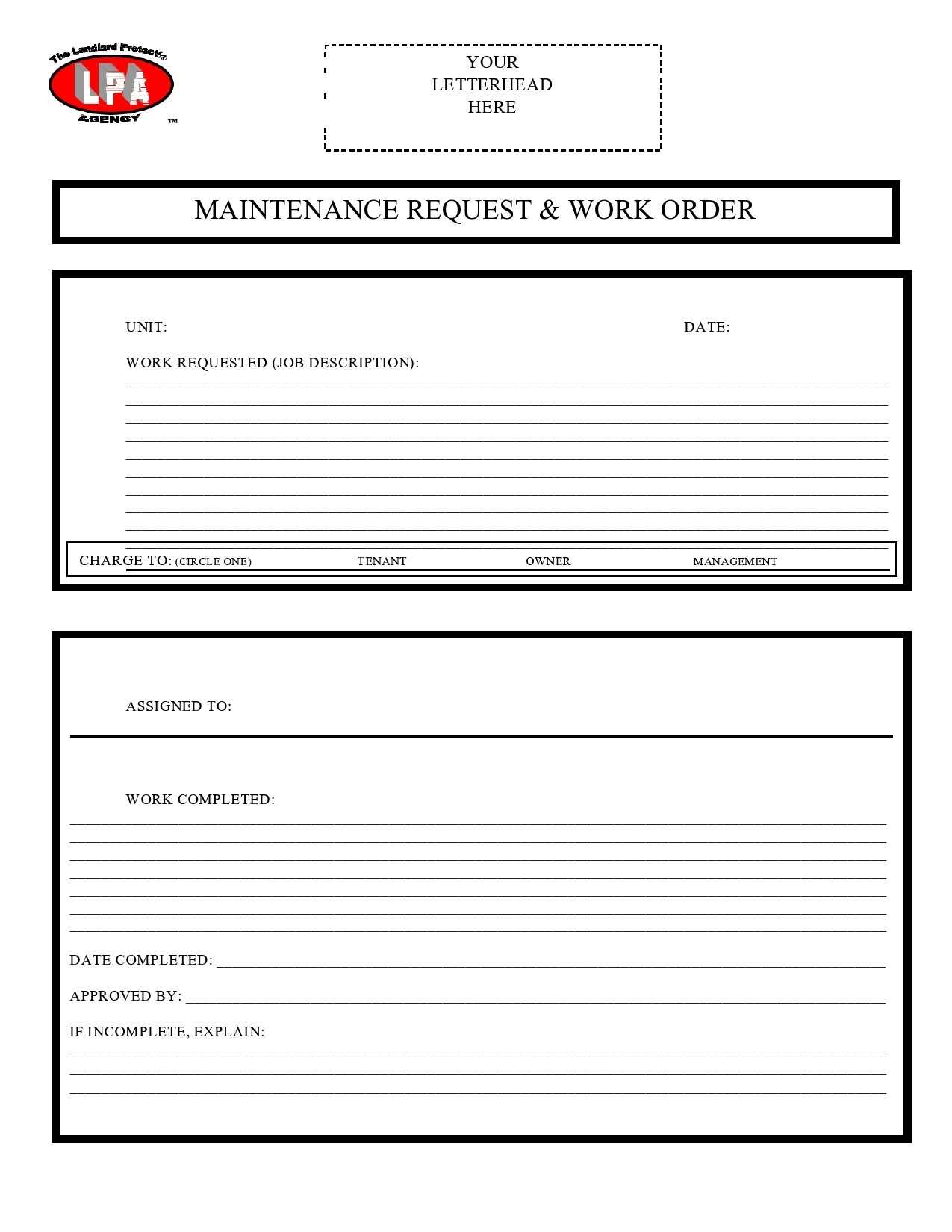

How to Customize Work Order Invoices

Personalizing your service documents is a key step in creating a more professional and client-friendly experience. By adjusting the structure and content, you can tailor these documents to better reflect your business’s unique needs and style. Customization can range from simple visual tweaks to adding specific fields that match your company’s workflow and services.

Basic Customization Options

- Modify Header and Footer: Include your company logo, contact information, or legal disclaimers in the header or footer to give the document a branded look.

- Adjust Field Labels: Change default labels to match the specific services you offer. For example, “Item” could be changed to “Service Description” or “Material” to “Supplies”.

- Update Color Scheme: Select colors that align with your branding or business identity to make the document visually appealing and recognizable.

- Set Payment Terms: Customize payment terms such as due dates, late fees, or early payment discounts to reflect your business policies.

Advanced Customization Options

- Automated Data Entry: Set up predefined fields that automatically pull data from client records or past transactions, saving time and reducing the risk of error.

- Incorporate Discounts or Taxes: Add sections for discounts or tax calculations that can be adjusted based on the nature of the transaction or region-specific rules.

- Enable Multiple Currency Options: If working with international clients, customize the document to include various currencies and exchange rate calculations.

- Create Reusable Templates: Save your customized document as a reusable file that you can quickly update for new clients or projects, maintaining consistency in your records.

Customizing your service documents ensures that your business stands out and operates efficiently. With these modifications, you can create a system that aligns with your workflow, saves time, and enhances professionalism in every transaction.

Steps to Download Free Templates

Finding the right document format for managing client records and billing is an essential first step to streamlining your operations. Fortunately, there are a variety of free resources available online that allow you to quickly download and customize the perfect structure for your needs. Here is a simple guide to help you find and download these free resources for your business.

Guide to Downloading

- Search for Reliable Websites: Look for reputable websites that offer free document resources. Many platforms provide customizable options for various industries, including construction, service, and retail businesses.

- Select the Right Format: Ensure the document you choose is compatible with your preferred software or platform, such as a word processor or spreadsheet application.

- Review Available Features: Examine the features of the available resources to determine if they meet your specific needs, such as customizable fields, pre-filled calculations, and professional layout.

- Download the File: Once you’ve found a suitable option, click the download link, and save the document to your computer or cloud storage for easy access.

- Open and Customize: After downloading, open the file and begin tailoring it to fit your business. Adjust fields, payment terms, and other details specific to your services.

Recommended Download Sources

| Website | Features |

|---|---|

| Template.net | Offers a wide range of customizable business documents with easy-to-fill fields and professional layouts. |

| Office.com | Provides ready-to-use resources compatible with Microsoft applications, ideal for small businesses. |

| Google Docs | Access free, cloud-based options that allow for real-time collaboration and quick editing. |

| Canva | Visual-focused platform with downloadable document options that include customizable graphics and layouts. |

By following these steps, you can quickly download the right documents, customize them to your needs, and start using them to enhance your business processes. Free resources make it easy to get started without the need for costly software or design expertise.

How to Track Payments Using Excel

Managing payments efficiently is critical for keeping your business operations smooth and ensuring timely cash flow. Using spreadsheet software offers an easy and flexible way to keep track of transactions, monitor due balances, and maintain financial records. Below is a guide on how to leverage this tool to stay organized and on top of your client payments.

Setting Up a Payment Tracking System

To begin, create a new sheet dedicated to tracking client payments. You can include the following essential columns:

- Client Name: A column to store the name of each client to easily reference their account.

- Service Date: Keep track of the date when the service was provided or when the product was delivered.

- Amount Due: Record the amount that the client owes for the services or products provided.

- Amount Paid: Track the amount received from the client after payment.

- Balance Due: Subtract the payment from the amount due to determine any remaining balance.

- Payment Date: Enter the date when the payment was made to maintain an accurate payment history.

- Payment Method: Document whether the payment was made by cash, credit, check, or another method.

Using Formulas for Efficiency

To automate calculations, you can set up formulas in the spreadsheet:

- Balance Calculation: Use a simple subtraction formula to calculate the balance due: =Amount Due – Amount Paid.

- Payment Tracking: Highlight any overdue payments by using conditional formatting to show overdue balances in red or with specific rules.

- Summing Total Payments: Use the SUM function to calculate the total payments received over a specific period or by client.

With these simple setup steps, you’ll have an effective system for keeping track of all client payments, ensuring you stay organized and proactive about follow-ups for overdue amounts. This will ultimately help streamline your cash flow and provide valuable insights into your financial health.

Common Mistakes to Avoid with Invoices

Even a small mistake in billing documents can lead to confusion, delays, and lost revenue. It is essential to ensure that all information is accurate and clear to maintain professionalism and avoid unnecessary disputes with clients. Here are some common errors that businesses should be aware of when creating these documents.

Frequently Made Mistakes

- Missing or Incorrect Contact Information: Always double-check client details, such as name, address, and contact information. An incorrect address or phone number can lead to undelivered bills and delayed payments.

- Failure to Include Payment Terms: Clearly state payment terms, including due dates, late fees, and accepted payment methods. Lack of clarity in payment expectations can result in delayed or incomplete payments.

- Unclear Descriptions of Services: Avoid vague or incomplete descriptions of the services or products provided. The more detailed and specific the description, the less likely clients will question the charges.

- Omitting Taxes or Additional Fees: Ensure all applicable taxes, fees, and additional charges are included in the final amount. Omitting these details can cause confusion or legal issues down the line.

- Not Keeping Consistent Formatting: Inconsistent formatting can make the document hard to read and may lead to mistakes. Always use a clean and uniform layout to present the information clearly.

How to Prevent These Errors

- Double-Check All Information: Always review the details of the document before sending it to a client. This includes confirming the client’s information, the services rendered, and the correct amounts.

- Use Templates with Predefined Fields: Pre-designed formats that include fields for all necessary information can help minimize errors and ensure consistency in your billing documents.

- Set Up Automated Reminders: If using digital tools, set up automated reminders for both clients and yourself regarding payment due dates. This ensures that no payment is overlooked or forgotten.

By avoiding these common mistakes, you can maintain professionalism, reduce disputes, and improve your overall payment process, which ultimately leads to smoother business operations and healthier cash flow.

Best Practices for Work Order Invoices

Creating clear, professional, and accurate documentation is vital for maintaining smooth business operations and strong client relationships. By following established best practices, businesses can ensure that their records are organized, transparent, and easy to manage. Here are key strategies to follow when preparing billing records.

Essential Best Practices

- Use Clear and Detailed Descriptions: Always provide detailed descriptions of the products or services rendered. This helps prevent any confusion or disputes from clients regarding what they are being charged for.

- Include Clear Payment Terms: Clearly specify payment terms such as the due date, late fees, and accepted payment methods. This makes it easier for clients to understand expectations and helps ensure timely payments.

- Check for Accuracy: Double-check all details such as dates, amounts, and client information. Accuracy reduces the chance of errors that could delay payments or cause misunderstandings.

- Follow a Consistent Format: Maintain consistency in layout and design across all your documents. This includes using the same fonts, colors, and structure, which enhances readability and professionalism.

- Provide Multiple Payment Options: Offering various payment methods, such as bank transfer, online payment systems, or checks, can make it more convenient for clients and speed up the payment process.

Advanced Practices for Optimization

- Automate Calculations: Utilize built-in formulas for taxes, discounts, and totals. This ensures accuracy, reduces human error, and speeds up the preparation process.

- Regularly Update Records: Keep a detailed record of all issued documents and payments received. This will help you track outstanding balances and make reconciling accounts easier.

- Set Payment Reminders: Implement automatic reminders for clients before due dates to ensure timely payments and avoid delays.

- Keep a Professional Tone: Use professional language and a polite tone in your documentation. This reflects well on your business and fosters positive client relationships.

By adopting these best practices, businesses can create organized, efficient, and clear documentation that facilitates smooth transactions, improves customer satisfaction, and strengthens financial management.

How Excel Templates Save Time and Effort

Streamlining administrative tasks is key to increasing productivity and reducing operational costs. By using pre-made structures for managing financial documents and client records, businesses can save significant time and effort. These ready-to-use formats simplify complex tasks, allowing you to focus on more important aspects of your work.

Efficiency Through Automation

One of the most powerful benefits of using structured formats is the ability to automate repetitive tasks. With built-in formulas and functions, you can quickly calculate totals, taxes, and apply discounts without having to manually adjust every figure. This reduces human error and the time spent on recalculations, ensuring accuracy in every document.

Consistency and Organization

- Uniform Layout: By using a consistent structure, you can quickly generate new documents that look professional and are easy to understand. This helps clients receive a uniform experience with your business.

- Quick Customization: Pre-designed formats can be easily adapted to your specific needs, allowing for fast adjustments to fields like pricing, client information, and service details.

- Data Tracking: Using a structured file ensures that all your client and transaction data is organized in one place. This makes it easier to track payments, manage overdue accounts, and analyze financial trends.

Overall, using pre-built formats saves considerable time by eliminating the need to start from scratch. With automation, consistency, and ease of use, these tools simplify administrative tasks and help businesses stay organized, making day-to-day operations more efficient and less stressful.

Integrating Work Order Templates with Other Tools

Maximizing efficiency in business operations often involves using multiple tools that work seamlessly together. By integrating structured documentation formats with other software, you can streamline workflows, improve data accuracy, and save time. The ability to synchronize these systems enhances the overall management process, ensuring that all aspects of your operations are interconnected and automated where possible.

For example, linking a well-organized document structure with project management or accounting software allows for real-time updates on transactions and progress. This integration eliminates the need for manual data entry and reduces the likelihood of errors. It also allows for quicker access to important information, enabling faster decision-making and improved client communication.

Additionally, connecting these formats to cloud storage services or customer relationship management (CRM) systems makes sharing and collaboration more efficient. Team members and clients can access documents from any location, ensuring that all involved parties have the most up-to-date information at their fingertips.

By integrating structured formats with the tools you already use, you can create a more streamlined and cohesive workflow that saves time, reduces errors, and improves overall productivity.

Ensuring Accuracy in Work Order Invoices

Maintaining precision in financial and client documents is essential for building trust and ensuring smooth operations. Even small errors can lead to delays, disputes, or incorrect financial reporting. It is critical to establish methods that reduce the chances of inaccuracies in these documents, ensuring that all details are correct and reliable.

Key Steps to Ensure Precision

- Double-Check All Information: Always verify client names, addresses, amounts, and service descriptions before finalizing the document. Simple mistakes like misspelled names or incorrect amounts can cause confusion.

- Use Automated Calculations: Implement formulas for totals, taxes, and discounts to reduce human error. By relying on automatic functions, you can ensure that calculations are consistent and accurate every time.

- Establish Standardized Procedures: Set up a uniform process for creating documents. Whether it’s through a digital system or a manual checklist, following a consistent approach helps maintain accuracy across all records.

- Utilize Validation Tools: Use data validation features in your software to limit the type of information that can be entered, ensuring that only appropriate values are recorded in fields like dates, payment amounts, or quantities.

Regular Review and Auditing

- Review Before Sending: Always take a final look at the document before sharing it with the client. This gives you one last opportunity to catch any potential mistakes.

- Audit Transactions Periodically: Regularly review past transactions and documents to ensure consistency and identify any patterns of errors that may require a process adjustment.

By following these best practices and using reliable tools, you can minimize errors, ensuring that your documents remain accurate, professional, and trusted by your clients.

Using Excel for Client Billing Management

Managing client payments efficiently is a cornerstone of successful business operations. By organizing financial records in a structured manner, businesses can easily track services provided, monitor payment statuses, and ensure timely follow-ups for outstanding balances. Leveraging digital tools, particularly spreadsheet software, simplifies the entire process, providing flexibility, automation, and ease of use.

Setting Up an Effective Billing System

To effectively manage client billing, start by creating a clear and detailed record of all transactions. Key components to include in your management system are:

- Client Information: Record essential details such as client name, contact information, and account numbers for easy reference.

- Service Details: For each billing entry, include a description of the services rendered, the corresponding amounts, and the dates they were provided.

- Payment Status: Keep track of whether payments have been received, are pending, or overdue, allowing for better cash flow management.

- Balance Calculations: Automatically calculate remaining balances to reduce manual errors and make it easier to follow up on outstanding amounts.

Automation and Efficiency Features

Using spreadsheet software offers a variety of features that save time and increase accuracy:

- Formulas: Automatically calculate totals, taxes, and balances due by using built-in formulas, ensuring accurate numbers every time.

- Conditional Formatting: Highlight overdue payments or accounts with specific color codes, making it easier to identify areas that need attention.

- Data Validation: Use data validation to restrict the type of entries in fields like payment amounts or dates, reducing errors in the data input process.

- Report Generation: Quickly generate summary reports on payments received, outstanding balances, and other key financial metrics to better assess your business’s financial health.

By implementing these strategies, businesses can streamline their client billing process, reduce administrative burden, and ensure that all financial transactions are accurately documented and easily accessible.

How to Protect Your Work Order Template

Ensuring the security and integrity of your business documents is essential, especially when sensitive financial information and client details are involved. Protecting your files from unauthorized access, accidental edits, and loss is crucial for maintaining professionalism and safeguarding your operations. There are several measures you can take to protect your documents while ensuring they remain functional and accessible when needed.

Steps to Secure Your Files

- Set Password Protection: Use password encryption to prevent unauthorized access to your documents. This will ensure that only individuals with the correct credentials can open or modify the file.

- Limit Editing Rights: For shared documents, restrict the ability to edit or make changes. This can be done by setting specific permissions that only allow certain users to make modifications while others can only view the file.

- Regular Backups: Create regular backups of your files to prevent data loss due to system failures, accidental deletions, or corruption. Store backups on external drives or cloud storage for added security.

- Use Version Control: Keep track of changes by saving multiple versions of the file. This allows you to revert to an earlier version if necessary, reducing the risk of irreversible mistakes or unauthorized alterations.

- Implement User Authentication: Use software that requires authentication to access sensitive files. This adds an extra layer of security and ensures that only authorized users can make changes.

Additional Security Measures

- Audit Trails: Use tools that log and track all activities performed on your documents, such as who accessed or edited the file. This can help you identify unauthorized changes and take appropriate action if needed.

- Encrypt Files: Encrypt sensitive files to add another level of protection. This ensures that even if the file is accessed by unauthorized users, the contents remain unreadable without the decryption key.

- Secure Sharing: When sharing your documents, use secure methods such as encrypted email or file-sharing platforms that offer built-in security features.

By following these security practices, you can protect your business documents from unauthorized access, accidental loss, or modifications, ensuring they remain safe and reliable for future use.

Advanced Excel Functions for Invoices

Managing financial records can become much more efficient when you utilize advanced features in your spreadsheet software. By leveraging various functions, you can automate calculations, create dynamic reports, and enhance data accuracy. These advanced tools can save you time and effort, allowing you to focus on more critical aspects of your business.

Key Functions for Efficient Financial Management

Here are some powerful features and functions that can improve how you manage your billing documentation:

- SUMIF and SUMIFS: These functions allow you to sum values based on specific criteria. For instance, you can calculate the total amount due for a particular client or service type without manually sorting the data.

- VLOOKUP: This function helps you quickly search for data in large datasets. You can use it to look up client details or service information automatically, making it easier to create accurate records without having to search manually.

- IF and Nested IF: Use these to apply conditional logic. For example, you can automatically apply a discount or flag overdue payments based on predefined conditions.

- TEXT Functions: The TEXT function is useful for formatting dates, currency, or other values to match your desired presentation style, making your records more professional and consistent.

Creating a Financial Overview with Advanced Functions

Combining these functions can give you a comprehensive overview of your financial data. Below is an example of a simple table layout that demonstrates how these functions can be used to automate common tasks:

| Client Name | Service Provided | Amount | Payment Due Date | Status |

|---|---|---|---|---|

| Client A | Consultation | $200 | 2024-11-10 | Paid |

| Client B | Development | $500 | 2024-11-15 | Pending |

| Client C | Design | $300 | 2024-11-12 | Overdue |

Using advanced functions like those mentioned above, you can quickly calculate totals, generate customized reports, and track payment statuses efficiently. With just a few formulas, you can automate and streamline the entire process.

How to Update Work Order Templates Regularly

Maintaining up-to-date documentation is essential for accurate records and smooth operations. Regularly reviewing and updating your forms ensures that your business stays compliant with changing standards, reflects accurate pricing, and adapts to evolving client needs. By keeping your system current, you can improve efficiency and avoid the risk of using outdated information that could lead to errors or confusion.

Steps to Regularly Update Your Documents

- Review Changes in Business Practices: If there are any changes in your services, pricing, or internal processes, make sure these are reflected in your documentation. For example, you may need to update rates, add new service categories, or revise terms of service.

- Audit for Compliance: Periodically check that your forms are in compliance with any industry regulations or legal requirements. This might involve updating tax information, payment terms, or contact details.

- Seek Feedback from Users: Regularly ask your team members or clients for feedback on the forms. Are there any fields that are unclear or need adjustment? This feedback will help you identify areas for improvement.

- Incorporate Technological Advancements: If you find new tools or features that can make your documentation more efficient (such as automated calculations or digital signatures), integrate these into your forms to improve overall productivity.

- Test the Forms: After making updates, always test the document to ensure that it functions correctly. Check for any broken formulas, missing fields, or formatting issues before deploying it for regular use.

Tips for Seamless Updates

- Keep Backup Versions: Before making any changes, save a backup of the previous version. This ensures that you can revert to the original if necessary.

- Version Control: Label your updated documents clearly with version numbers and dates. This will help you track changes over time and keep everyone on the same page.

- Automate the Update Process: Consider using tools or software that alert you to changes in industry standards or customer preferences, making it easier to stay ahead of required updates.

By regularly reviewing and updating your forms, you can maintain a streamlined, accurate, and efficient system that supports the ongoing needs of your business and clients.