Free Work Invoice Template for Easy Billing

Creating professional documents for financial transactions is crucial for maintaining clear communication between service providers and clients. These tools help ensure that all details are clearly outlined, including the scope of work, payment terms, and deadlines. By using structured forms, businesses can streamline the process and avoid confusion during billing cycles.

Efficient management of financial records is vital for both freelancers and small enterprises. With the right structure in place, tracking payments, adjusting rates, and handling disputes becomes much simpler. The use of ready-made forms can save significant time and effort, allowing professionals to focus on their core work.

Whether you’re a freelancer or a small business owner, using a pre-designed document can ensure consistency across all transactions. These tools are often customizable, allowing users to adjust key details according to their specific needs. An organized approach to billing enhances professionalism and promotes trust with clients.

Free Work Invoice Templates for Professionals

For professionals, having a standardized method for documenting payments and services is essential. Ready-to-use documents can save time and effort, ensuring all the necessary information is consistently presented. These forms help maintain accuracy in tracking transactions and ensure that each billing is clear and professional.

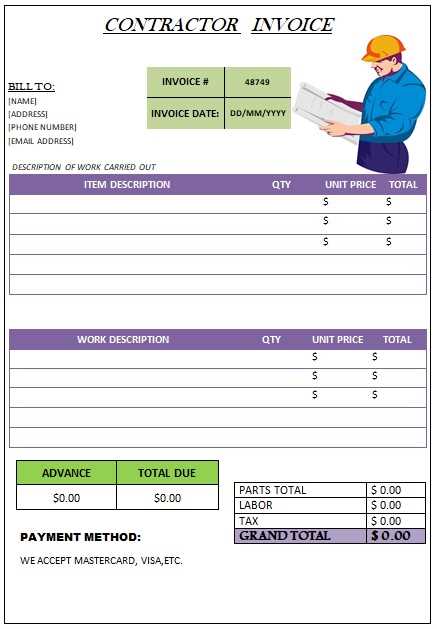

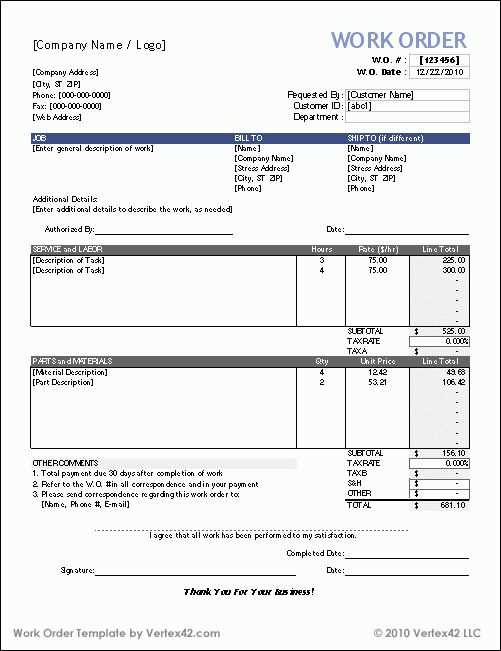

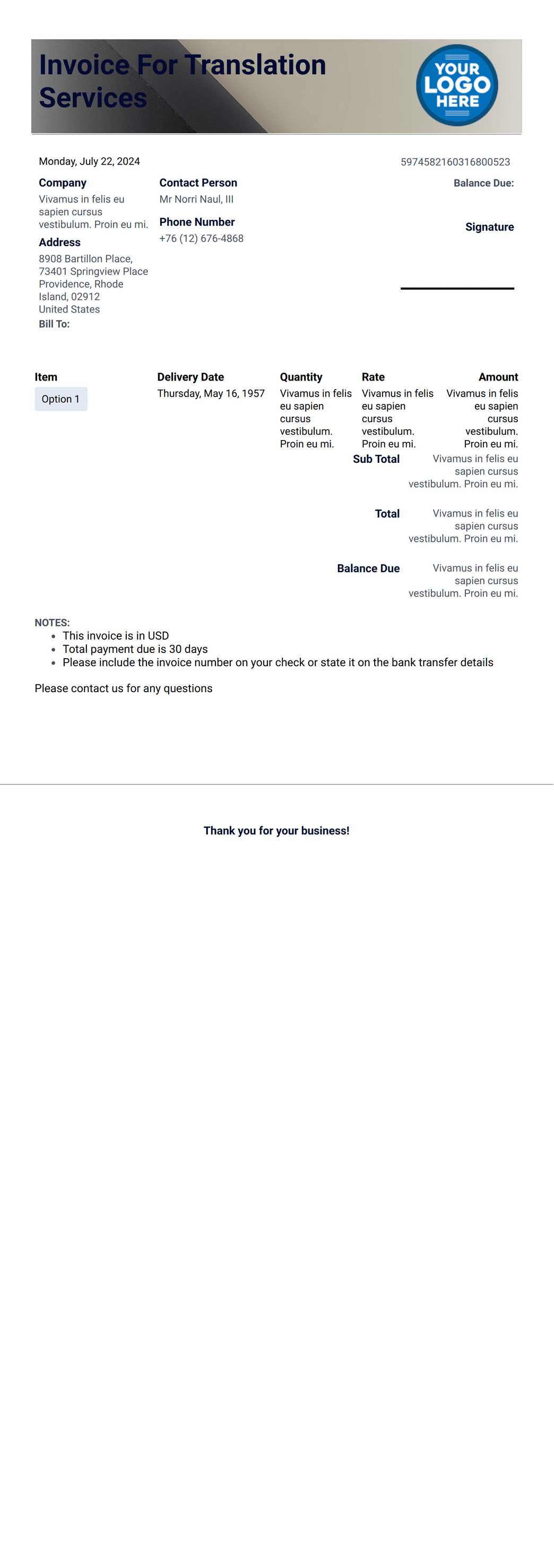

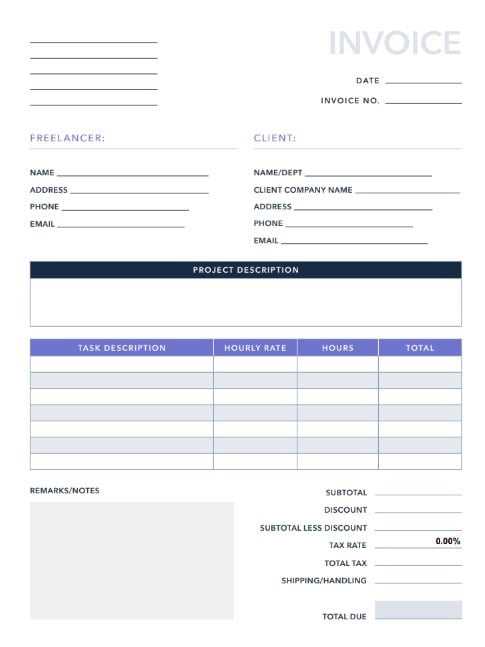

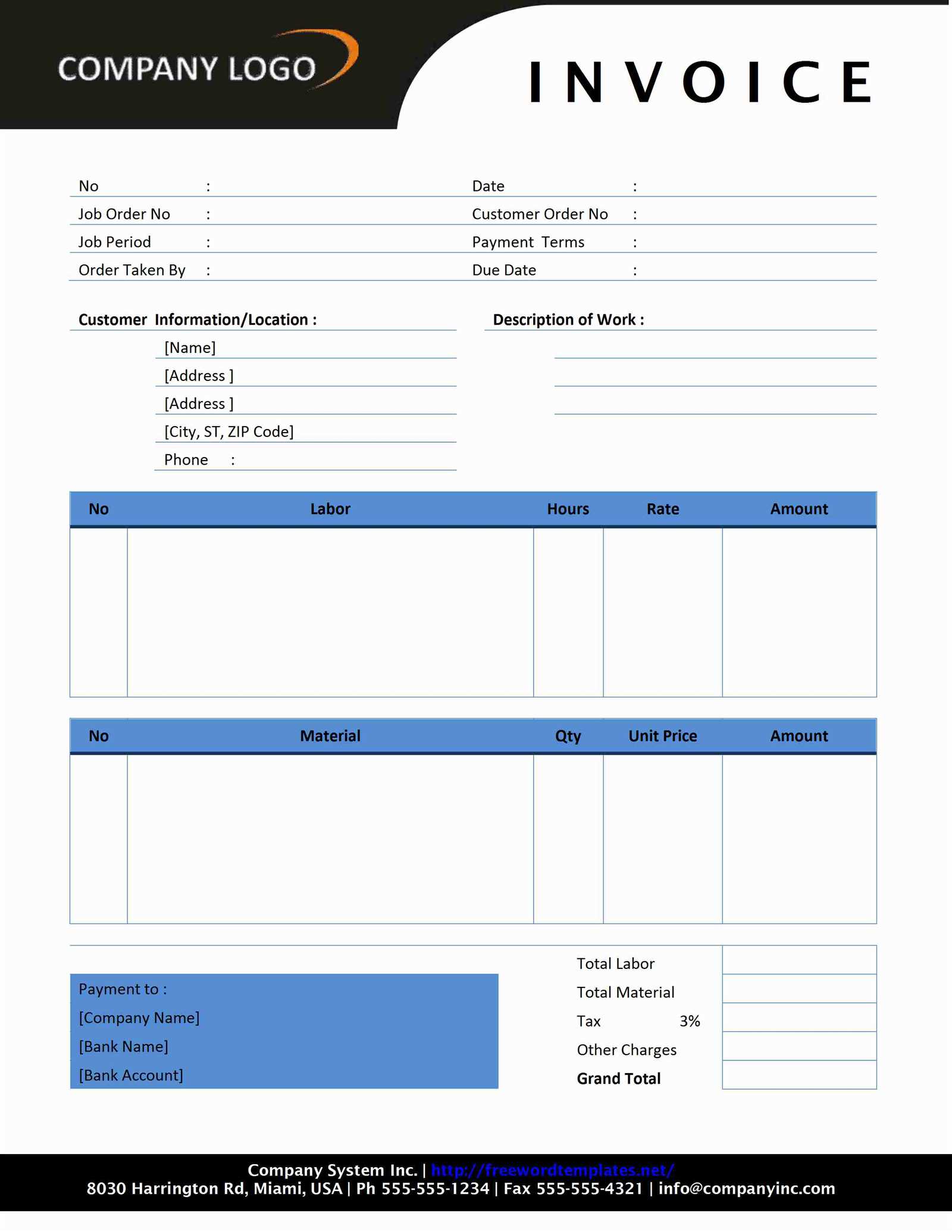

Many businesses, especially freelancers, benefit from utilizing pre-designed forms that they can easily customize for their clients. These tools simplify the process of creating comprehensive records, avoiding the need to design documents from scratch. Below is an example of what such a structure typically includes:

| Item Description | Quantity | Rate | Total |

|---|---|---|---|

| Consultation Services | 5 hours | $50 | $250 |

| Development Work | 10 hours | $75 | $750 |

| Total Amount Due | $1000 | ||

These pre-made forms can help professionals keep their records organized and ensure all the essential details are clearly outlined, making it easier to manage payments and track outstanding balances.

Why Use a Work Invoice Template

Having a consistent structure for documenting transactions is essential for both businesses and freelancers. Using pre-designed documents helps ensure that all critical details are captured in a professional and clear manner. This not only saves time but also minimizes the risk of errors and omissions in financial records.

Time Efficiency and Consistency

Creating a new form from scratch for each client or project can be time-consuming. With ready-made documents, you can focus on the content rather than worrying about the layout and structure. A standard format ensures that all important information, such as services rendered, rates, and payment terms, is included every time.

Professionalism and Accuracy

Using organized forms enhances your business’s image, showing clients that you are detail-oriented and reliable. Well-structured records help avoid confusion and ensure that all financial information is clear. Moreover, these tools assist in keeping track of payments, which can be useful when dealing with multiple clients or projects simultaneously.

Incorporating these simple yet effective tools into your workflow helps establish a more streamlined, organized approach to handling financial documentation, providing both you and your clients with greater confidence in your business practices.

Top Features of Free Invoice Templates

When selecting a pre-designed document for billing purposes, it is important to consider the key elements that make it effective and user-friendly. These tools are designed to simplify the process of creating clear, professional records, while ensuring that all necessary details are included in a structured and organized way.

Customization and Flexibility

One of the main advantages of using ready-made documents is their ability to be easily customized. Whether you need to adjust the layout, add your branding, or update payment terms, these forms can be quickly adapted to fit your specific needs. This flexibility allows you to maintain consistency across all your client interactions.

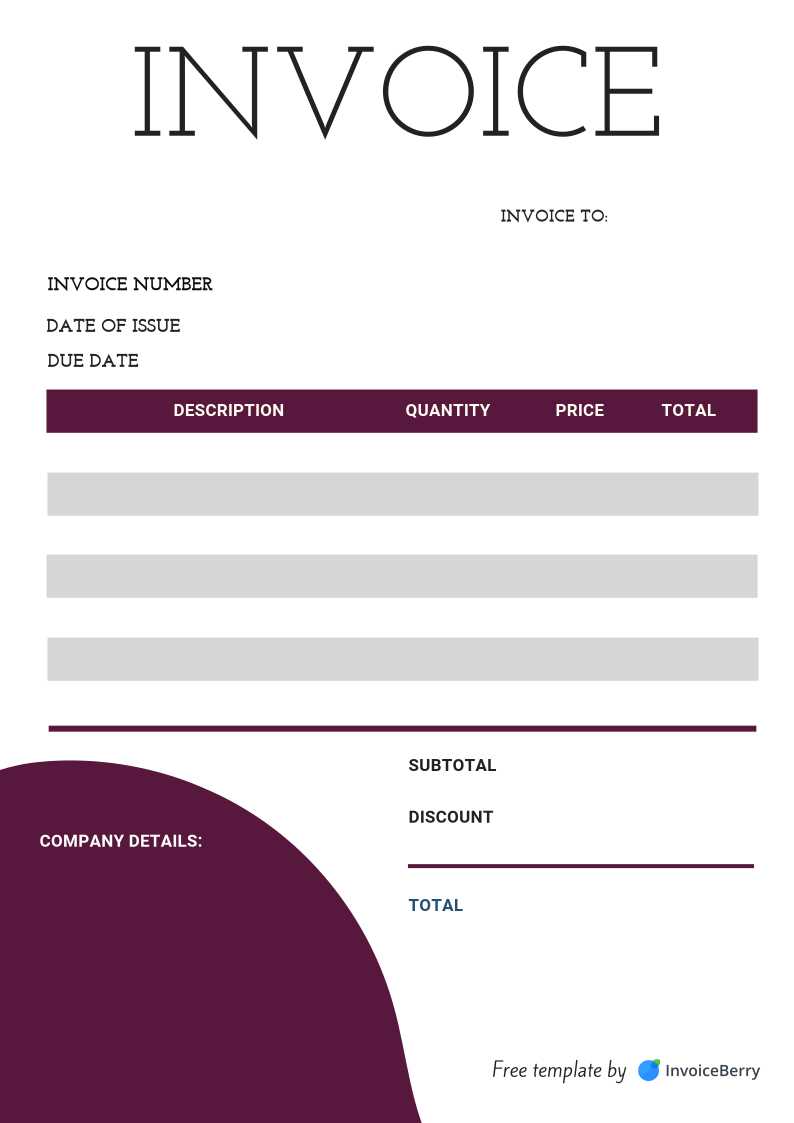

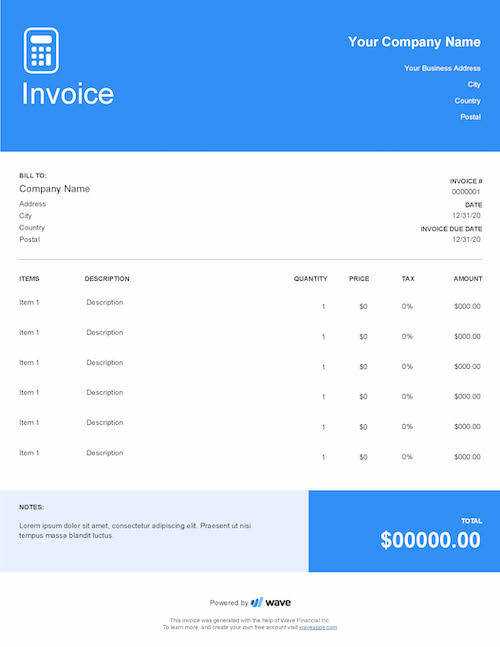

Clear and Professional Layout

Structured forms ensure that all essential information is clearly presented, making them easy to read and understand. These documents typically feature well-organized sections for contact details, service descriptions, and payment instructions, ensuring that nothing is overlooked. The result is a polished, professional look that enhances your business reputation.

With pre-designed options, the time-consuming process of creating new forms from scratch is eliminated, allowing you to focus on what really matters: delivering quality service to your clients.

How to Customize Your Invoice Template

Personalizing your billing document can make it more aligned with your business needs and client expectations. Customizing pre-made forms is a straightforward process that allows you to adjust key details, making the document more reflective of your brand while ensuring it includes all the necessary information for accurate financial transactions.

Adjusting Layout and Branding

One of the easiest ways to customize your form is by adding your company logo, adjusting fonts, and choosing colors that match your brand. A personalized layout not only makes the document more professional but also helps reinforce your business identity. Most pre-designed documents are easily editable, allowing you to tweak the layout to your preference without starting from scratch.

Including Specific Details

Depending on your business model, you may need to add specific fields to the document, such as project milestones, client references, or terms and conditions. These additions ensure that the document is tailored to your needs, while still maintaining a clean, professional format. Customizing the sections for services rendered, rates, and payment instructions will make it easier for clients to understand and process the information.

Benefits of Digital Invoices for Freelancers

For freelancers, adopting digital methods for managing financial records offers numerous advantages. Unlike traditional paper forms, electronic documents can be created, sent, and tracked quickly, reducing administrative burden and ensuring more efficient handling of payments. Digital records also offer the flexibility to access, store, and share important information from anywhere at any time.

Speed and Efficiency

One of the key benefits of using digital methods is the speed with which you can generate and send your billing documents. With just a few clicks, a professional document can be created and emailed to clients, drastically reducing the time spent on administrative tasks. This efficiency helps freelancers focus on their core work rather than getting bogged down by paperwork.

Easy Tracking and Organization

Digital records are easier to organize and track than their paper counterparts. With electronic systems, you can store multiple documents in a well-organized file structure, making it easy to access past transactions when needed. Additionally, many software tools allow you to automatically track payments, helping freelancers stay on top of outstanding balances and manage finances more effectively.

Where to Find Reliable Invoice Templates

For professionals looking for ready-made billing documents, finding a trustworthy source is essential. Reliable platforms offer customizable options that cater to different industries and client needs. Whether you’re a freelancer or a small business owner, having access to well-structured documents can save time and ensure consistency across all transactions.

Online Resources and Platforms

Many websites provide a wide variety of pre-designed forms that can be downloaded or used directly online. These platforms often offer both free and premium options, ensuring that you can find something that suits your specific requirements. Some platforms also allow you to edit and save the forms online, streamlining the process even further.

Software Solutions and Tools

There are numerous software tools available that specialize in creating and managing financial records. These applications typically include pre-built forms and often come with additional features, such as automatic calculation of totals, tax rates, and payment tracking. Using a dedicated tool can help professionals ensure that their documents are always accurate and up to date.

Understanding Invoice Layouts and Structure

Creating clear and well-organized billing documents is essential for effective communication between businesses and clients. A good layout helps ensure that all necessary details are presented in a logical and easy-to-understand format. Understanding the structure of these forms can improve clarity, minimize errors, and enhance professionalism.

Key Elements of a Billing Document

Most billing forms follow a similar structure, consisting of several key sections. These typically include the sender’s and recipient’s contact details, a list of services or products provided, payment terms, and the total amount due. The goal is to make sure that all relevant information is easy to locate and comprehend.

Sample Layout Overview

| Section | Description |

|---|---|

| Contact Information | Includes the names and addresses of both the sender and recipient, ensuring both parties are clearly identified. |

| Service Description | A detailed list of the services provided, including hours worked or items sold. |

| Payment Terms | Clarifies payment deadlines, methods, and any applicable late fees. |

| Total Amount Due | Summarizes the total cost of services or products, including any taxes or discounts. |

By following a clear and consistent structure, businesses can ensure that all essential details are included, making the document easy to process and reducing the chances of confusion or disputes.

Essential Information to Include in Invoices

To ensure smooth transactions and clear communication, it’s crucial to include specific details in any billing document. These key elements help both the service provider and the client easily understand the terms of the agreement, payment expectations, and any other relevant information. Properly including these details reduces the chance of errors and misunderstandings.

Client and Business Details

First and foremost, clear identification of both parties is essential. This includes the business name, contact information, and client details, such as their name or company. This section ensures that the recipient can easily identify the sender and verify the legitimacy of the transaction.

Service or Product Breakdown

One of the most important sections is a detailed description of the goods or services provided. This includes a clear list of each item, the quantity or hours worked, the rate or price per unit, and the total amount for each line item. Such clarity ensures that both parties understand exactly what was agreed upon and can easily review the costs associated with the transaction.

Additionally, payment terms, due dates, and any taxes or discounts should also be specified to avoid confusion later. Providing clear payment instructions is critical to ensure that the client knows how and when to settle the bill.

How to Add Taxes to Your Invoice

When providing goods or services, adding taxes to your billing document is an essential step for ensuring legal compliance and transparency. Including the correct tax rate and properly calculating the amount due helps both you and your clients understand the financial details of the transaction. Here’s how to correctly apply taxes to your financial records.

Determine the Correct Tax Rate

Before adding any taxes, it’s important to know the applicable tax rate based on your location and the type of service or product being sold. Different regions have varying tax rates, and certain items may be exempt or subject to special rates. Be sure to check local tax laws to ensure you’re charging the correct amount.

Calculating and Adding Tax to the Total

Once you’ve established the correct rate, you can calculate the tax amount by multiplying the rate by the price of the product or service. Afterward, the calculated tax should be clearly displayed as a separate line item in the document. This transparency helps clients understand exactly how the tax is applied and ensures that the final amount due is accurate.

Make sure to include any tax identification numbers or other required details if applicable, to further clarify the legitimacy of the charge. Properly handling taxes ensures that your transactions are compliant and professionally managed.

Using Billing Documents for Small Businesses

For small businesses, having a professional and organized way to manage financial transactions is essential. Utilizing pre-designed forms allows businesses to create consistent, accurate records that simplify both the billing process and financial tracking. These ready-made documents can help save time and reduce the risk of errors, ensuring smoother operations and better client relationships.

Benefits for Small Business Owners

Using structured documents for payments offers several advantages:

- Efficiency: Quickly generate and send out billing forms, saving time on administrative tasks.

- Consistency: Maintain a uniform format across all transactions, enhancing professionalism.

- Clarity: Clearly outline services, amounts, and payment terms, ensuring no confusion between parties.

- Legal Compliance: Meet tax and regulatory requirements by including necessary details such as tax rates and identification numbers.

How to Maximize Their Use

To get the most out of these financial documents, consider the following tips:

- Ensure the form includes all essential details like client information, services rendered, and payment instructions.

- Customize the document to reflect your brand, adding your logo and contact details for a personalized touch.

- Keep a digital copy of each document for easy record-keeping and future reference.

- Use automated tools to track payments and issue reminders for outstanding balances.

By integrating these forms into your routine, small businesses can streamline their financial processes and maintain a high level of professionalism with clients.

Saving Time with Pre-Made Invoice Forms

Efficient management of business transactions is crucial, especially for small businesses that need to minimize administrative tasks. Using pre-designed billing documents can significantly cut down on the time spent creating and formatting each record from scratch. These ready-to-use forms streamline the entire process, allowing businesses to focus on their core activities while maintaining accurate financial documentation.

Pre-made billing forms offer several time-saving benefits:

| Benefit | Description |

|---|---|

| Instant Accessibility | Pre-designed documents are readily available and can be filled out immediately, reducing delays. |

| Consistency | Standardized forms ensure a uniform format, eliminating the need for constant adjustments to layout or style. |

| Fewer Errors | By using a template with built-in sections, the chance of missing crucial details is minimized. |

| Customization | Forms can be easily adjusted to fit the specific needs of your business, saving time on manual edits. |

By adopting pre-made documents, business owners can not only save time but also ensure that their transactions are completed efficiently and accurately, without sacrificing professionalism. These tools are especially valuable for those who need to handle a high volume of transactions regularly.

Common Mistakes to Avoid with Invoices

While creating financial documents, there are several common pitfalls that can lead to confusion, delayed payments, or even legal issues. Avoiding these mistakes ensures that your billing process runs smoothly, maintaining clarity and professionalism with clients. Here are some of the most frequent errors that can easily be avoided.

1. Missing Client Information

One of the simplest yet most significant errors is not including complete client details. Always ensure that both your contact information and your client’s details, such as their name or business name and address, are included in the document. Incomplete or incorrect client information can lead to delays in payment or misunderstandings.

2. Forgetting to Add Tax Details

Depending on your location and industry, taxes may be a required part of the transaction. Forgetting to add the appropriate tax information or applying the wrong tax rate can cause complications. Always double-check the tax rates and clearly indicate the tax amount as a separate line item in the document.

3. Lack of Clear Payment Terms

Not specifying the due date or payment terms can create confusion. It’s essential to clearly state when the payment is expected, the method of payment, and any late fees or penalties for overdue amounts. Without this information, clients may delay payment or overlook the transaction altogether.

4. Incorrectly Calculating Amounts

Another common mistake is failing to accurately calculate the total amount due. Double-check all math to ensure that the sums, taxes, and discounts are correct. Incorrect calculations can undermine your credibility and cause unnecessary delays.

By being mindful of these common mistakes, you can avoid complications and ensure that your financial documents are clear, accurate, and professional.

How to Track Invoice Payments Effectively

Efficiently monitoring payment status is a critical part of maintaining healthy cash flow for any business. By staying on top of outstanding balances and ensuring timely payments, businesses can avoid financial issues and build stronger relationships with clients. Here’s how to manage and track payments effectively.

Best Practices for Tracking Payments

Tracking payments doesn’t have to be complicated. Here are some essential tips to keep your financial records organized:

- Use Automated Tools: Leverage invoicing software or online tools that can automatically update payment status and send reminders for overdue amounts.

- Set Clear Terms: Always include payment deadlines and terms on each document to avoid confusion. It’s crucial that clients know when payment is due and any penalties for late payments.

- Maintain Accurate Records: Keep detailed records of every transaction, including payment dates, amounts, and methods. This will make it easier to follow up on outstanding payments.

- Follow Up Regularly: When a payment is overdue, send polite reminders and follow up until the balance is settled. Staying proactive can help prevent delays.

Using Digital Tools for Payment Tracking

Using digital solutions for managing payments can make the process much easier. Many online invoicing systems offer features such as:

- Automatic payment reminders

- Real-time payment status updates

- Integration with accounting software

- Client access to payment history and outstanding amounts

By implementing these strategies and tools, businesses can effectively track payments, minimize overdue balances, and ensure a steady cash flow.

Best Practices for Invoice Design and Clarity

Effective design and clear presentation are key to ensuring that clients understand the details of a financial statement and can process payments smoothly. A well-organized document not only facilitates quicker payments but also fosters professionalism and trust. Here are the best practices to ensure your statements are both functional and easy to comprehend.

Key Design Elements to Include

Start with a clean, structured layout that allows clients to quickly find the information they need. Here are some important design elements to consider:

- Clear Branding: Include your company logo, contact information, and any branding elements at the top for easy identification.

- Readable Fonts: Choose simple, legible fonts and maintain consistency throughout the document. Avoid using too many font styles or sizes, which can make the content look cluttered.

- Sectional Organization: Use headings or sections to separate key parts of the document, such as services rendered, costs, taxes, and total amounts.

- Ample White Space: Keep a good balance of text and space, ensuring the document doesn’t feel cramped or overwhelming.

Clarity in Financial Details

Clear financial details are essential for avoiding confusion or disputes. Make sure that all numbers are easy to understand and the breakdown of costs is transparent:

- Itemized List: Break down charges in a clear and logical way. List individual items or services with their corresponding prices and quantities.

- Tax Information: Clearly show any taxes applied, specifying the rate and amount for each tax type.

- Total Amount: Highlight the total amount due, making it easy for clients to spot the most important figure.

By following these design principles, you can create financial statements that are visually appealing, easy to navigate, and clearly communicate all the necessary details to your clients.

Legal Aspects of Using Invoice Templates

When utilizing pre-designed forms for financial transactions, it’s essential to consider the legal requirements involved. While these tools can streamline your business processes, ensuring compliance with local laws is crucial to avoid disputes and potential fines. This section explores the legal aspects that should be kept in mind when using such documents for business dealings.

Accurate Representation of Transactions

Each financial record must accurately reflect the nature of the transaction. Falsifying information, even unintentionally, can lead to serious legal consequences. It’s important to ensure that all entries, such as amounts and services rendered, are precise and truthful. This not only fosters trust but also helps protect you in case of an audit or dispute.

Compliance with Tax Regulations

Depending on your location, specific tax rules may apply to the amounts charged and reported. Ensure that your financial documents include necessary tax details, such as applicable sales tax or VAT, and that the correct rates are applied. Non-compliance with tax laws can result in penalties or legal action, so it’s essential to stay informed and accurate.

Inclusion of Mandatory Information

Many jurisdictions require certain details to be included in all official transaction records. These might include the legal name and address of the business, registration numbers, or even specific terms regarding payment deadlines and penalties for late payments. Not including these required details could lead to complications should the need arise to validate your records legally.

By understanding and adhering to the legal standards surrounding these forms, businesses can not only simplify their billing processes but also safeguard themselves from legal risks and ensure smooth, transparent financial interactions with clients.

How to Use Invoices for Better Accounting

Effectively managing your finances requires organized documentation of all business transactions. By utilizing well-structured financial forms, you can improve your accounting practices, track income, and ensure accuracy in financial reporting. In this section, we’ll explore how these records can help streamline your accounting tasks and maintain financial clarity.

Tracking Income and Expenses

One of the primary benefits of using financial documents is the ability to track both income and expenditures efficiently. These forms provide a detailed breakdown of each transaction, allowing you to monitor payments received and costs incurred. By keeping a record of every financial interaction, you can maintain a clear overview of cash flow, which is crucial for effective budgeting and forecasting.

Ensuring Accuracy and Reducing Errors

Incorporating these forms into your accounting process helps minimize human error. Pre-designed forms typically contain fields for all essential data, such as client names, services provided, amounts, and payment deadlines, which reduces the chances of overlooking important details. Having a standardized approach ensures consistency and accuracy across all financial records.

Tax Reporting and Financial Transparency

Another advantage of using these records is that they simplify tax reporting. By maintaining detailed and organized documentation, you can easily generate reports for tax purposes, making it easier to calculate liabilities, deductions, and credits. This organized approach provides transparency, ensuring compliance with local tax regulations and reducing the risk of legal issues.

Incorporating structured financial forms into your accounting routine enables you to streamline the management of your finances, improve accuracy, and ensure that your business remains compliant with relevant tax laws. The ease of tracking, organizing, and reporting financial transactions is essential for long-term business success.

Free Invoice Template Resources for Startups

For new businesses, managing financial documentation effectively is crucial for maintaining cash flow and ensuring professional communication with clients. Fortunately, there are a variety of tools and resources available to help startups create accurate and well-organized financial records. Below are some great sources where entrepreneurs can access customizable forms without the need for costly software or design services.

Online Tools and Platforms

- Google Docs and Sheets: These free tools offer simple, customizable templates that can be tailored to suit your business needs. You can create and manage documents directly in the cloud, making it easy to access from anywhere.

- Microsoft Word and Excel: Both platforms provide free templates within their software, which can be easily downloaded and customized for your startup. The basic design and structure are ideal for beginners looking for quick solutions.

- Canva: Known for its user-friendly design tools, Canva also offers free, customizable document templates. These templates feature modern designs that can help give your business a professional appearance.

Specialized Websites Offering Templates

- Invoice Generator: This online tool allows startups to create and download customized forms quickly. It also includes helpful features such as automatic tax calculations and payment terms, which streamline the process.

- Invoice Home: Offering a variety of downloadable templates, this site provides designs suitable for different types of businesses, from freelancers to small enterprises.

- Zoho Invoice: While primarily a paid service, Zoho offers a limited free version, which includes professional, customizable documents tailored to different business needs.

Benefits for Startups

- Cost-effective: Many of these resources are available at no cost, allowing startups to save money on software subscriptions or professional services.

- Time-saving: These platforms and tools offer ready-made structures that can be customized quickly, allowing entrepreneurs to focus on other aspects of growing their business.

- Professionalism: Using well-designed financial documents helps startups present themselves as credible and reliable, fostering trust with clients.

By taking advantage of these resources, startups can create and manage their financial documents efficiently, maintain professionalism, and focus more on growing their business. The variety of free tools available ensures that businesses can find the right solution for their specific needs without the need for heavy investments.