Free Work Invoice Template Download for Easy Billing

Managing financial transactions with clients is a crucial part of any business. To ensure smooth and accurate payments, it’s important to have a well-structured system in place. One of the easiest ways to streamline this process is by using ready-made documents that can be customized quickly to meet your needs.

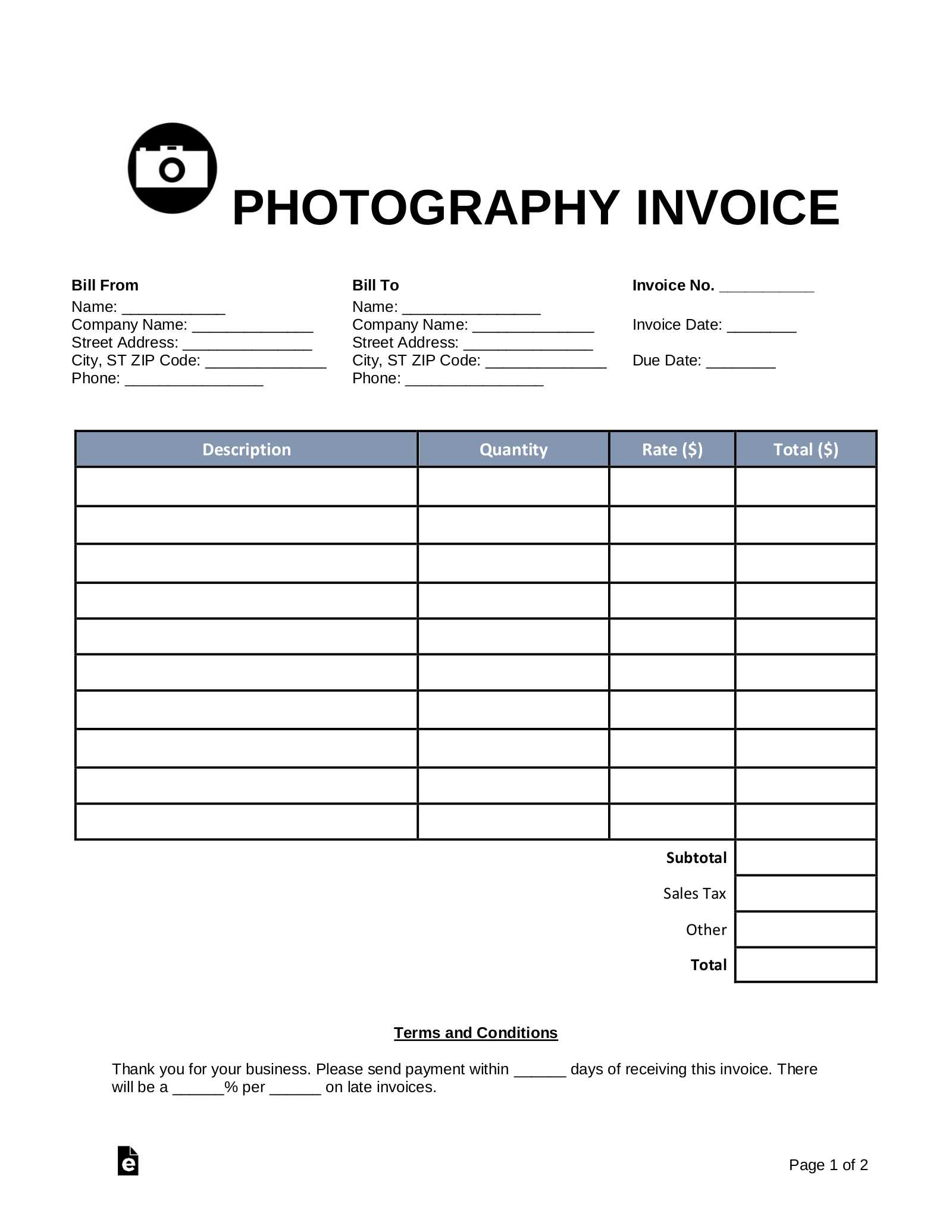

Easy-to-use formats allow individuals and companies to create clear and professional documents without the need for expensive software. These resources offer customizable sections to fit various industries and types of work, from freelance services to large-scale projects.

Whether you’re a small business owner, a freelancer, or a contractor, these pre-designed files help you focus on what matters most–providing your services–while ensuring that payments are tracked and managed efficiently. By utilizing a simple and effective billing method, you can save time and avoid potential errors in your financial records.

Free Work Invoice Templates for Download

Efficient billing solutions are essential for businesses of all sizes. Having access to ready-made documents that can be easily customized saves time and ensures consistency in financial transactions. These resources are particularly valuable for freelancers, small business owners, and contractors who need to quickly create professional records for payments.

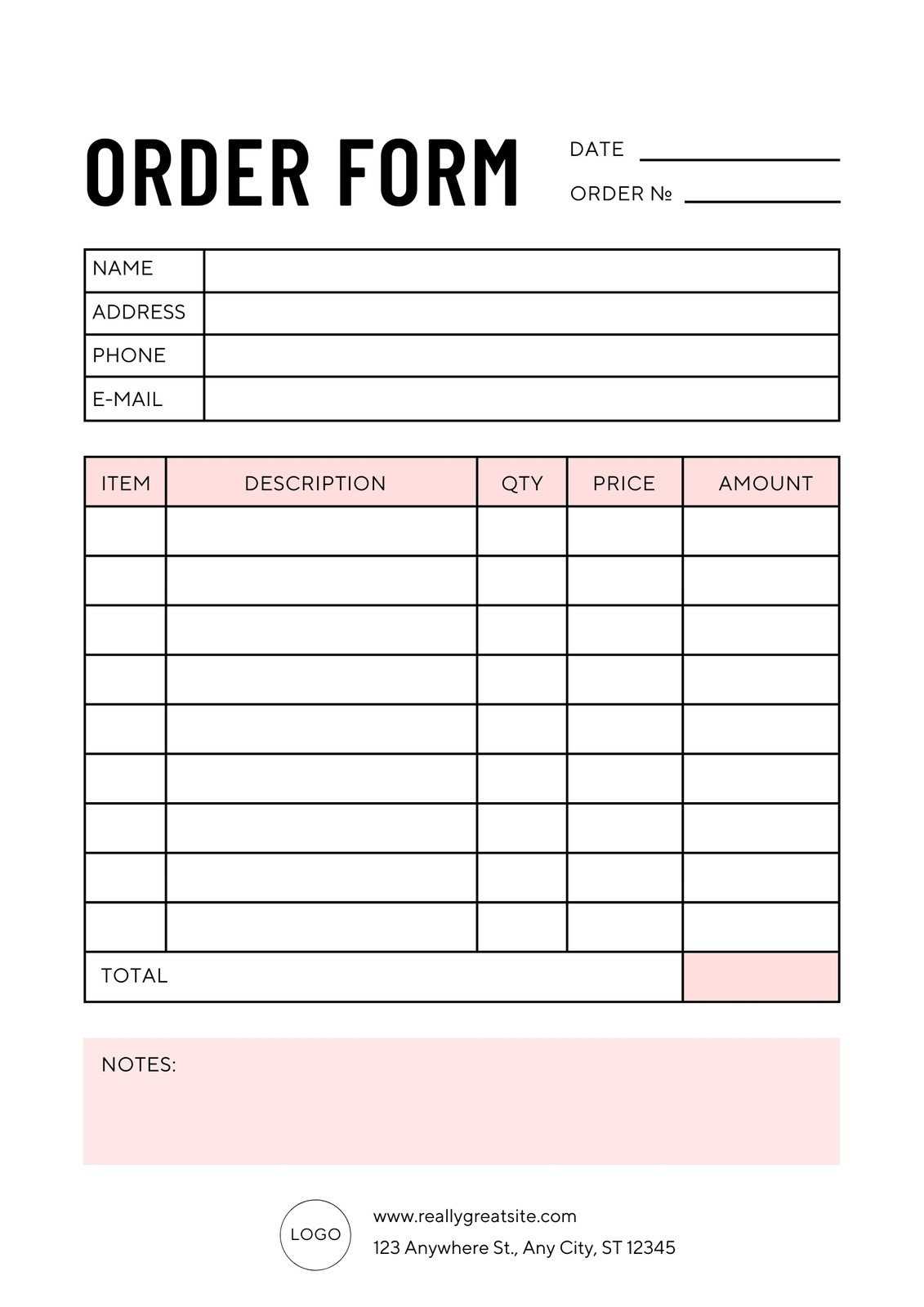

By using readily available formats, you can avoid the hassle of designing a new form from scratch. Many options are available online, offering simple and clean layouts that can be adapted to various industries. These pre-made documents typically include all the necessary fields to ensure that key details–such as services provided, payment terms, and client information–are clearly communicated.

Not only do these resources simplify the billing process, but they also ensure that your financial transactions are documented professionally. Customizing these formats to suit your specific needs is straightforward, and they can be easily updated as your business evolves. Whether you’re invoicing a one-time project or setting up recurring payments, these documents offer a quick and effective solution.

Why Use a Work Invoice Template

Having a standardized document for financial transactions can greatly improve the efficiency and professionalism of your business operations. By using pre-designed formats, you ensure that all necessary details are included, reducing the risk of errors and confusion when managing payments. This not only saves time but also strengthens your relationship with clients by providing them with clear, easy-to-understand records.

Consistency and Professionalism

When working with clients, maintaining consistency in your documentation is essential. A structured form guarantees that every detail, such as services rendered, pricing, and payment terms, is clearly presented. This professional approach reflects positively on your business, enhancing your credibility and trustworthiness in the eyes of clients.

Time and Effort Saving

Creating documents from scratch can be time-consuming and repetitive. By using ready-made resources, you streamline the process, allowing you to focus on other important aspects of your work. These formats are designed to be simple to modify, meaning you can quickly adjust the details for each client or project without starting over each time.

How to Choose the Right Template

Selecting the appropriate document for billing purposes is essential to ensure clarity and accuracy in your financial records. The right format should align with the nature of your business, the services you provide, and the needs of your clients. A well-chosen form not only simplifies the process but also helps to maintain professionalism and avoid common mistakes.

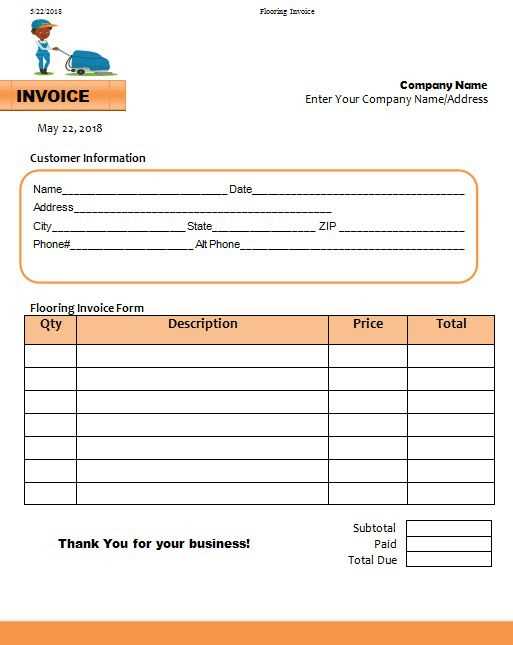

Consider Your Business Type

The first step in choosing the ideal layout is to consider the type of services you offer. For example, if you work on a project-by-project basis, you might need a template that clearly outlines each specific task and corresponding cost. On the other hand, if you have ongoing agreements with clients, a recurring billing structure might be more appropriate.

Look for Customization Options

Ensure that the form you choose is flexible enough to accommodate any unique requirements. Whether you need to add specific fields, adjust formatting, or incorporate your branding, customization options are key to making the document truly yours. A well-structured format will allow for easy modifications without sacrificing clarity or functionality.

Benefits of Free Work Invoice Templates

Using pre-made billing documents can provide numerous advantages for individuals and businesses looking to streamline their financial processes. These ready-to-use solutions eliminate the need for designing custom forms from scratch, allowing you to focus more on your core activities while ensuring your billing is professional and accurate.

Cost-effective solution is one of the main benefits. Instead of spending money on expensive accounting software or professional design services, you can access these pre-designed documents at no cost. This makes them an ideal choice for small business owners, freelancers, and independent contractors who need to manage their finances without a large budget.

Another key benefit is time-saving. With a ready-made form, you can quickly input necessary details and generate accurate records without the hassle of creating them yourself. This is particularly useful when you have a large volume of transactions to handle or need to send out multiple bills in a short time frame.

Additionally, these formats ensure consistency and professionalism in your financial communication. Clients will appreciate receiving clear and well-organized documents that outline the services rendered, the amounts owed, and payment terms. This simple yet effective approach fosters trust and helps prevent misunderstandings in your business dealings.

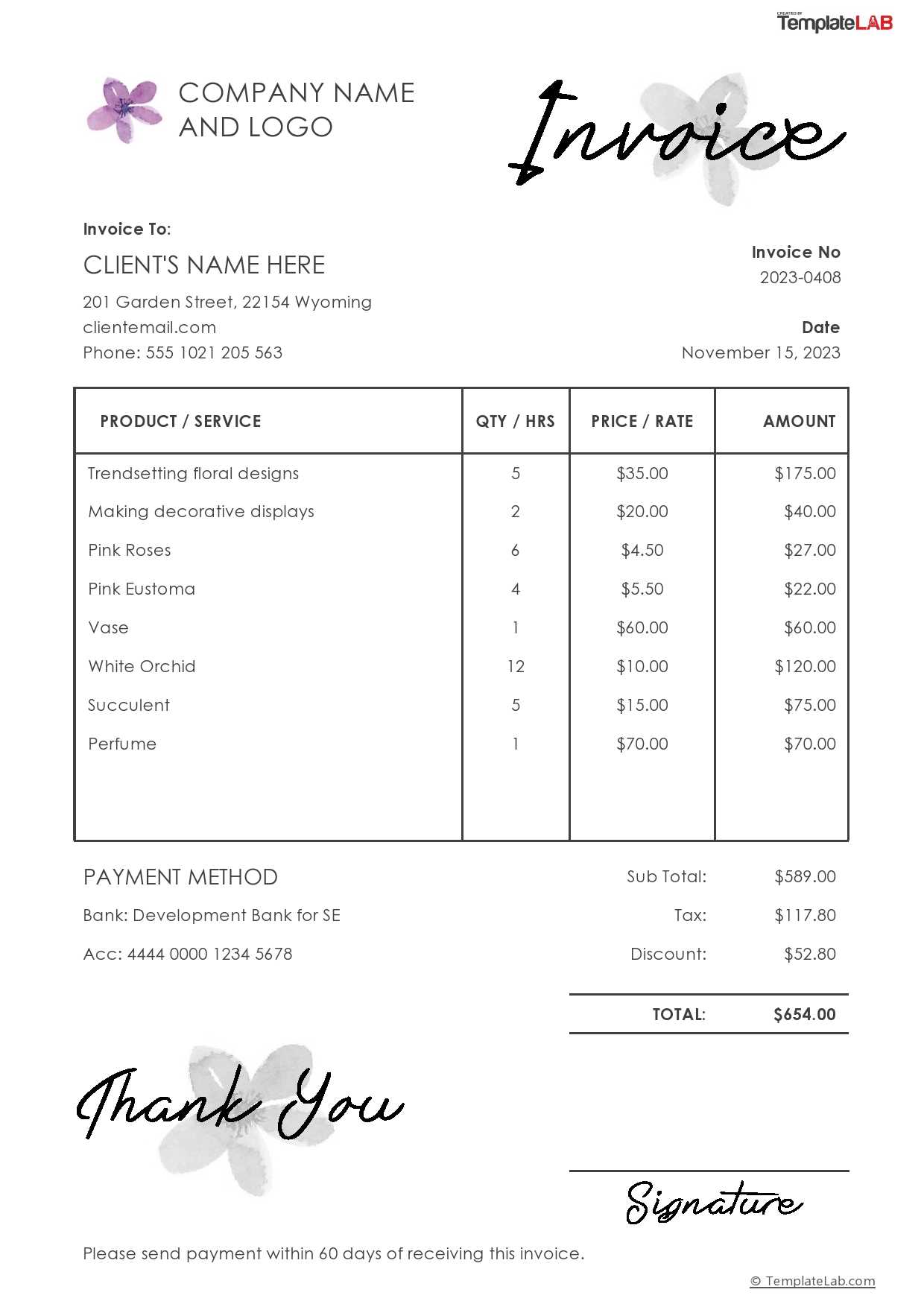

Customizing Your Invoice for Professionalism

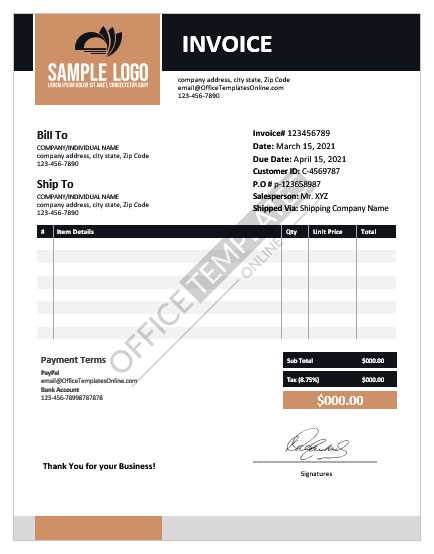

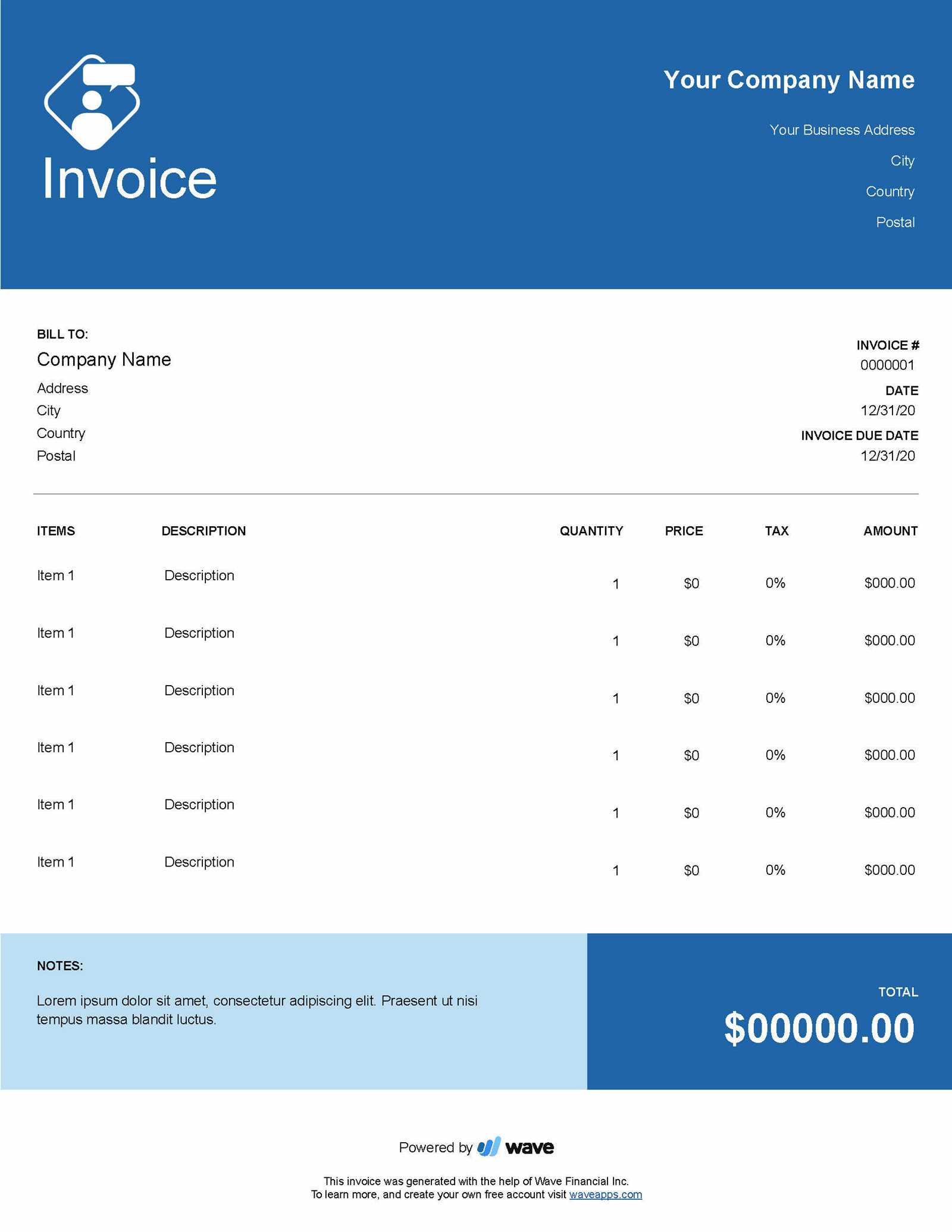

Customizing your billing documents is an essential step to ensure that your business is presented in a professional light. A personalized document not only reflects your brand identity but also helps to build trust with clients by making your transactions clear and easy to understand. Customization can range from simple tweaks, such as adding your logo, to more detailed adjustments, like modifying the layout to suit your specific needs.

Key Elements to Personalize

When tailoring your billing records, consider including the following elements to enhance your professionalism:

- Company Logo – Adding your logo gives the document a branded look, making it instantly recognizable to clients.

- Contact Information – Make sure your business name, address, phone number, and email are clearly displayed for easy communication.

- Payment Terms – Clearly state your payment expectations, such as due dates, late fees, or preferred payment methods.

- Personalized Message – A short thank you note or a custom message can leave a positive impression on clients.

Why Customization Matters

Tailoring your billing documents ensures that every interaction with a client is consistent with your business’s overall image. It demonstrates attention to detail and a commitment to professionalism, which can set you apart from competitors. A well-customized form communicates reliability, helping clients feel confident in doing business with you again in the future.

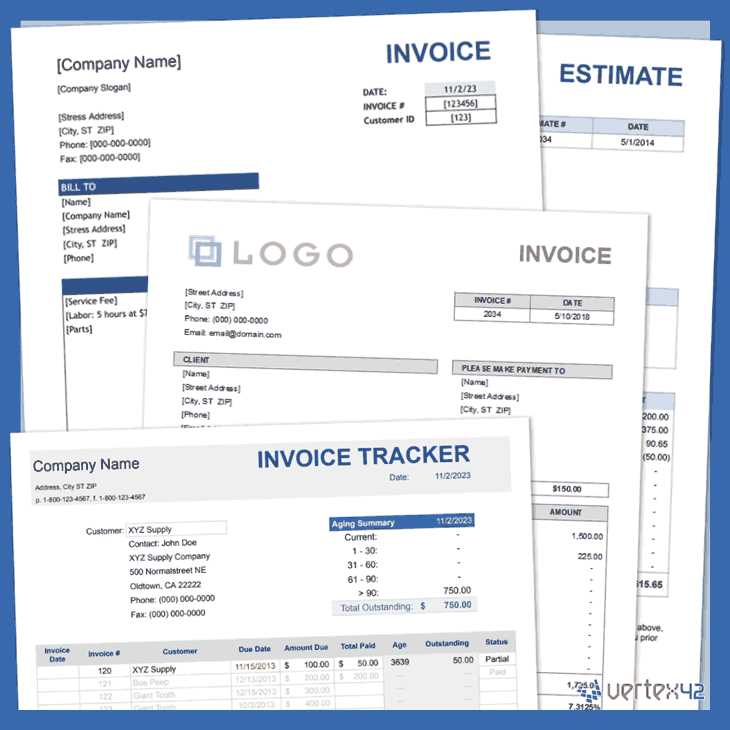

Where to Find Free Invoice Templates

There are several places online where you can find ready-made documents to help with billing and payment processing. These resources range from simple text-based forms to more complex, feature-rich designs that can be customized for different business needs. Accessing these formats is easy and often comes at no cost, allowing you to quickly start managing your transactions with professionalism and accuracy.

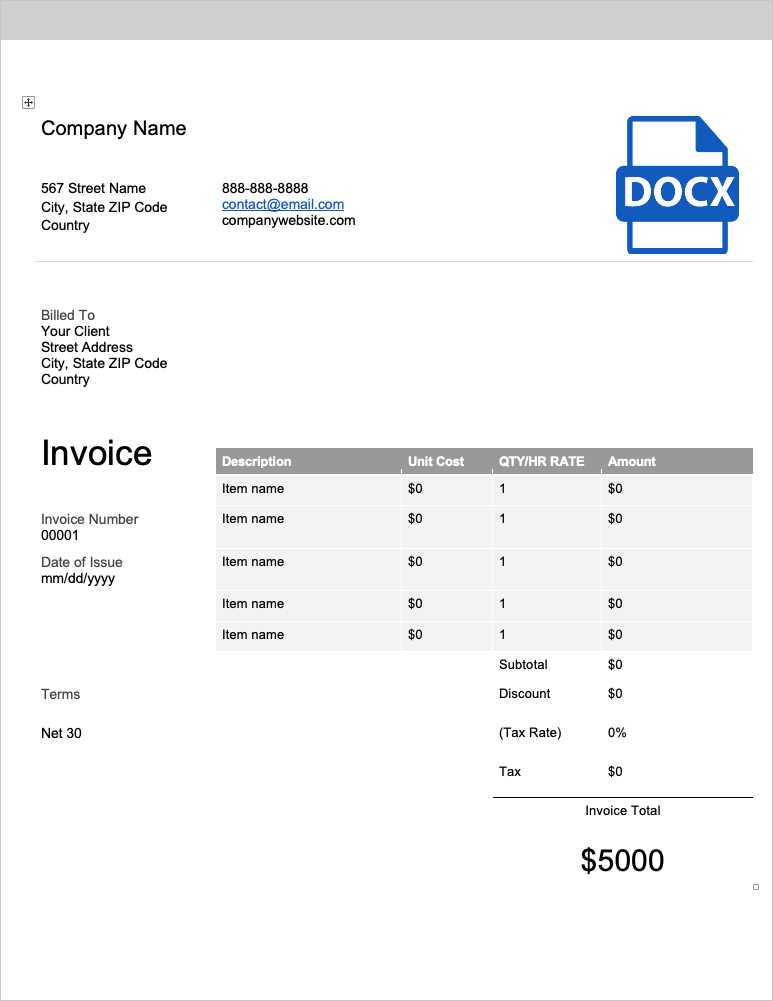

Online Accounting Tools – Many accounting platforms offer basic document designs as part of their free services. These tools often come with the benefit of automation, where you can generate and send forms directly to clients. Popular options include websites like Wave and FreshBooks, which provide straightforward layouts for simple billing.

Document Sharing Platforms – Websites such as Google Docs and Microsoft Office provide a variety of blank forms that can be easily customized. These services allow you to create and store your files online, giving you access from anywhere, which is particularly useful for remote work.

Specialized Template Websites – Numerous websites focus specifically on providing customizable business documents. Sites like Canva and Template.net offer free, downloadable formats in various styles and layouts, allowing you to pick one that best fits your brand’s look and feel.

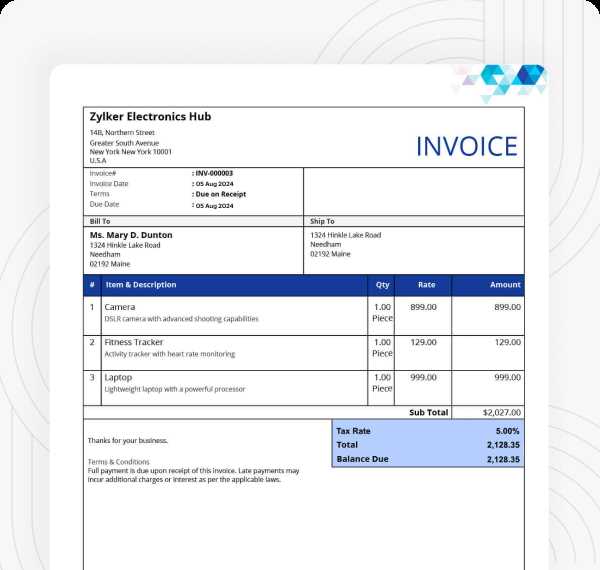

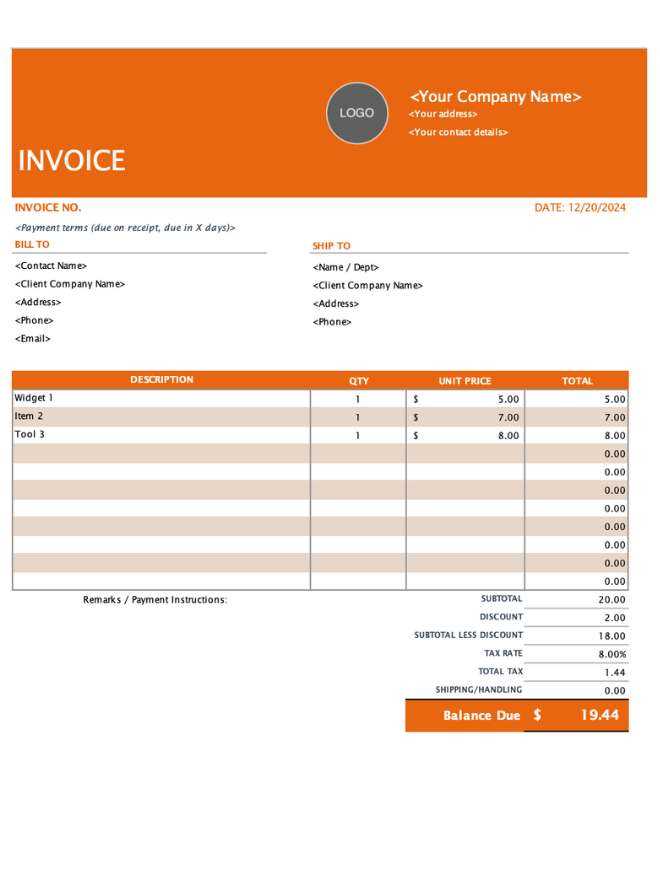

Top Features of an Effective Work Invoice

An effective billing document is more than just a record of services rendered; it is a professional tool that ensures smooth transactions and clear communication between businesses and clients. A well-designed form includes all the essential information needed for prompt payment and helps avoid confusion or delays. To be truly effective, certain key features must be present in every document you issue.

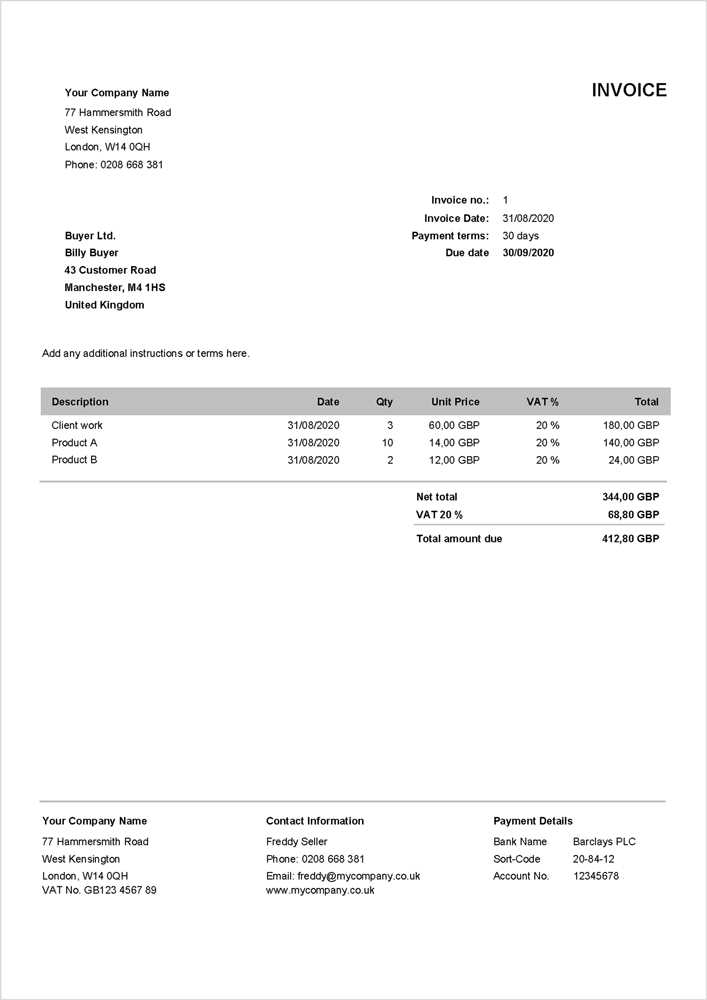

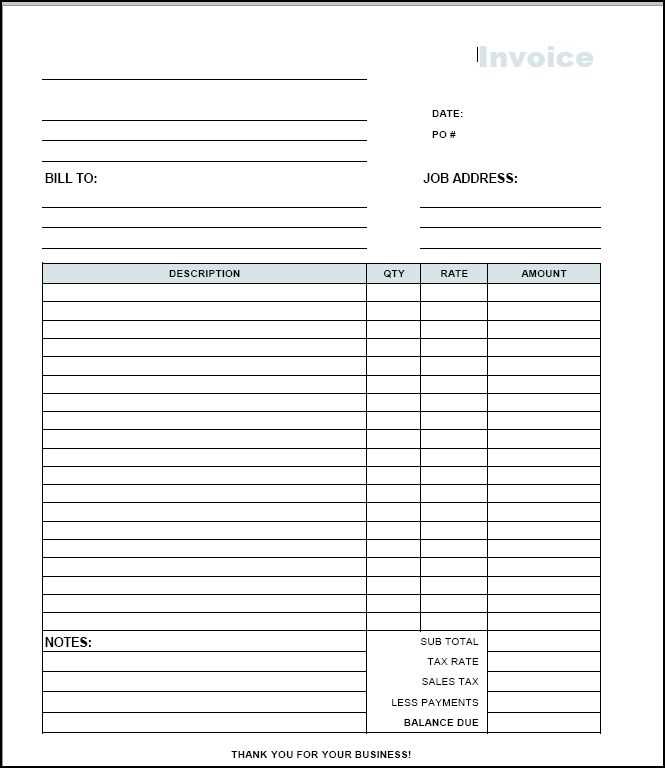

Clear Contact Information – Always include your business name, address, phone number, and email, as well as the client’s details. This makes it easy for clients to reach out if they have questions or concerns about the payment.

Detailed Breakdown of Services – Provide a clear list of services or products provided, including individual costs, quantities, and descriptions. This transparency builds trust and ensures the client understands exactly what they are paying for.

Payment Terms and Due Date – Clearly state your payment expectations, including due dates and any applicable late fees. Clients should easily see when the payment is expected and how to proceed with settling the balance.

Unique Identification Number – Including a unique reference number for each transaction helps both you and your client keep track of payments and resolves any potential disputes quickly. This is especially useful for larger projects or recurring billing arrangements.

Simple and Professional Layout – A well-organized document with legible fonts and a clear, logical flow is essential. It should be easy for the client to navigate and quickly find the information they need, from your contact details to the total amount due.

Customization Options – Whether it’s adding your company logo or adjusting the layout to fit your brand, the ability to personalize your document ensures that it is aligned with your company’s identity and helps reinforce your professionalism.

How to Fill Out Your Invoice Template

Filling out a billing document accurately is crucial for ensuring prompt payment and maintaining professionalism. By carefully entering all the necessary information, you help avoid misunderstandings and keep track of your business transactions. Below is a step-by-step guide to ensure that every form you issue is complete and clear.

First, begin by entering your business details. This includes your company name, address, phone number, and email address. It’s important to also include the client’s contact information, ensuring that both parties can easily reach each other in case of questions or concerns.

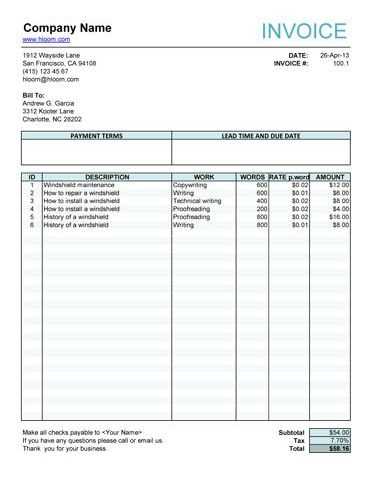

Next, provide a description of the services or products provided. List each item separately, including any relevant details, such as quantities, rates, and the corresponding total amount for each line item. Make sure the descriptions are clear and specific to avoid confusion on the client’s part.

After entering the service details, include the total amount due. Double-check your calculations to ensure the total matches the sum of the individual items. If applicable, also note any discounts or taxes that have been applied.

Don’t forget to clearly state the payment terms. This includes the due date, accepted payment methods, and any late fees that may apply if payment is not received on time. The more specific and clear you are about payment terms, the easier it will be for the client to comply.

Finally, add a unique reference number for easy tracking. This number will serve as an identifier for that particular transaction and can be useful for both you and the client to refer to when discussing payments or resolving any issues.

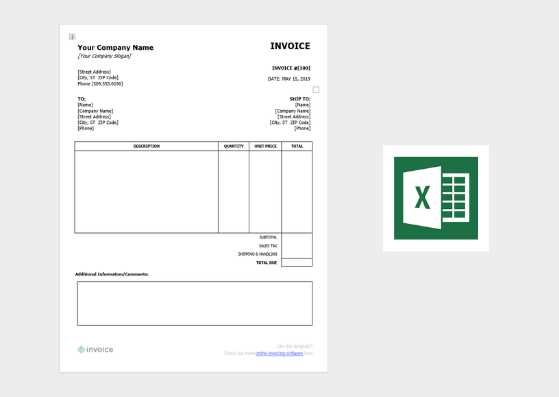

Best Formats for Work Invoices

Selecting the right format for your billing documents is essential to ensure clarity, ease of use, and a professional presentation. Different types of documents may be suited for different industries, client preferences, and business practices. Choosing the best layout can make a significant difference in how your clients perceive your work and help streamline your payment processes.

Simple and Clean Layout

A straightforward and minimalistic format works well for most businesses, particularly for freelancers and small service providers. This design focuses on essential information, such as the services provided, total amount due, payment terms, and contact details. The key benefit of this format is its simplicity, making it easy for clients to understand and process payments quickly.

Detailed and Itemized Breakdown

For larger projects or ongoing services, a more detailed format may be necessary. This layout includes a line-by-line breakdown of the tasks performed, hours worked, materials used, and associated costs. It provides clients with a clearer understanding of what they are being billed for and helps prevent disputes by ensuring transparency in the charges.

Choosing between these layouts depends on the complexity of your services and the preferences of your clients. A well-chosen format not only saves time but also enhances your professionalism and credibility in the eyes of those you do business with.

How to Save Time with Templates

Using pre-designed forms can significantly reduce the time spent on creating and managing financial records. Instead of starting from scratch with every new client or project, you can simply customize an existing layout to fit your needs. This streamlined approach allows you to quickly generate documents without missing key details.

Here are a few ways in which ready-made formats help save valuable time:

- Quick Setup: Pre-designed forms have a standard structure that only requires you to input specific details, such as the client’s name, services provided, and amounts owed. This eliminates the need to design a new document each time.

- Reduced Errors: With a consistent layout, the chances of leaving out important information or making formatting mistakes are minimized. This ensures that all necessary details are included in every document.

- Easy Reuse: Once you have customized a format for a particular client or project, you can save it and reuse it for future transactions. You only need to update the relevant fields, saving you from re-entering repetitive information.

- Streamlined Communication: Clients receive clear and consistent documents, reducing back-and-forth communication about missing or unclear information. This leads to faster processing of payments.

By using a pre-made design, you cut down on administrative tasks and focus more on your core activities, whether that’s delivering services or expanding your business. Time saved in creating documents can be used for more important tasks that contribute directly to business growth.

Creating Clear Payment Terms in Invoices

Clearly defined payment terms are crucial to ensure both parties understand when and how payments should be made. Without clear terms, misunderstandings can arise, leading to delayed payments or disputes. By specifying payment expectations up front, you help set the tone for professional and efficient financial transactions.

Specify the due date – Always include a specific date by which the payment is expected. This helps avoid any confusion about when the client should pay. A clear due date ensures that clients know exactly when they need to settle their balance.

Include late fees – It’s important to define what happens if the payment is not made on time. By outlining late fees or interest charges, you provide an incentive for timely payments and protect yourself from unnecessary delays. Make sure these charges are reasonable and communicated clearly.

Accepted payment methods – Specify the methods through which payment can be made, whether that’s bank transfer, credit card, or online payment platforms. Being clear about acceptable options makes it easier for clients to pay without confusion or delays.

Discounts for early payment – Offering discounts for early settlement can be a great way to encourage faster payments. If you choose to include this, clearly state the terms, such as the percentage of the discount and the time frame in which it is valid.

By setting clear and detailed payment expectations, you create an organized framework for your transactions, reducing the chances of delayed payments and enhancing your professional reputation. Clear payment terms also help clients feel more comfortable and confident in their dealings with you.

Adding Your Branding to Invoice Templates

Incorporating your brand identity into billing documents is an effective way to present a professional image and reinforce recognition with clients. Customizing these forms with your brand elements helps distinguish your business and creates a consistent experience across all client interactions. A branded document not only looks more polished but also builds trust and credibility with your audience.

Here are some key elements to consider when adding your branding:

- Logo – Including your company logo at the top of the document makes it instantly recognizable and reinforces your visual identity.

- Brand Colors – Use your brand’s color scheme for headings, borders, or accent areas to create a cohesive and professional look.

- Font Style – Choose fonts that reflect your brand’s personality. Whether you opt for a formal or casual look, consistency with your website and marketing materials is essential.

- Contact Information – Make sure to prominently display your contact details, including your website, phone number, and email. This provides clients with easy access to your communication channels.

- Tagline or Slogan – Including your tagline or slogan in a subtle way adds an extra touch of personality and can reinforce your brand message.

Customizing your documents with these elements ensures that your business stands out while maintaining a polished and professional appearance. Clients are more likely to remember and trust your services when they consistently see your brand in every communication, including financial documents.

Common Mistakes to Avoid in Invoices

Creating financial documents can be a straightforward task, but there are several common pitfalls that many businesses fall into. These errors, if left unchecked, can cause delays in payments, misunderstandings with clients, and even damage your professional reputation. Being aware of these mistakes and taking the time to avoid them ensures that your billing process runs smoothly and efficiently.

Here are some of the most frequent errors to avoid:

- Missing or Incorrect Client Information – Failing to include accurate details about your client or listing the wrong contact information can cause confusion and delays in payment. Always double-check the client’s name, address, and contact details before sending any documents.

- Unclear Payment Terms – Vague or incomplete payment terms can lead to misunderstandings. Make sure to specify the due date, any applicable late fees, and the preferred payment methods.

- Not Itemizing Charges – Providing a lump sum without breaking down the individual services or products can cause clients to question the charges. Always list each service, quantity, rate, and total to ensure transparency and avoid disputes.

- Forgetting a Unique Reference Number – Not including a unique reference or transaction number makes it difficult for both you and your client to track payments. Always assign a distinct identifier to each document for easy reference and follow-up.

- Incorrect Calculations – Simple math errors can undermine the trustworthiness of your business. Ensure that all calculations, including totals, taxes, and discounts, are accurate before sending any document.

- Failure to Proofread – Typos or grammatical mistakes can make your business appear unprofessional. Take a moment to review the document for any errors before sending it out.

By being mindful of these common mistakes and taking the time to carefully fill out your billing forms, you ensure a smoother, more efficient process. Clients will appreciate your attention to detail, and you will foster a reputation for professionalism and reliability.

Common Mistakes to Avoid in Invoices

Creating financial documents can be a straightforward task, but there are several common pitfalls that many businesses fall into. These errors, if left unchecked, can cause delays in payments, misunderstandings with clients, and even damage your professional reputation. Being aware of these mistakes and taking the time to avoid them ensures that your billing process runs smoothly and efficiently.

Here are some of the most frequent errors to avoid:

- Missing or Incorrect Client Information – Failing to include accurate details about your client or listing the wrong contact information can cause confusion and delays in payment. Always double-check the client’s name, address, and contact details before sending any documents.

- Unclear Payment Terms – Vague or incomplete payment terms can lead to misunderstandings. Make sure to specify the due date, any applicable late fees, and the preferred payment methods.

- Not Itemizing Charges – Providing a lump sum without breaking down the individual services or products can cause clients to question the charges. Always list each service, quantity, rate, and total to ensure transparency and avoid disputes.

- Forgetting a Unique Reference Number – Not including a unique reference or transaction number makes it difficult for both you and your client to track payments. Always assign a distinct identifier to each document for easy reference and follow-up.

- Incorrect Calculations – Simple math errors can undermine the trustworthiness of your business. Ensure that all calculations, including totals, taxes, and discounts, are accurate before sending any document.

- Failure to Proofread – Typos or grammatical mistakes can make your business appear unprofessional. Take a moment to review the document for any errors before sending it out.

By being mindful of these common mistakes and taking the time to carefully fill out your billing forms, you ensure a smoother, more efficient process. Clients will appreciate your attention to detail, and you will foster a reputation for professionalism and reliability.

Free Templates vs Paid Invoice Software

When it comes to creating billing documents, businesses often face the choice between using pre-made forms and investing in specialized software. Both options have their advantages and limitations, and the best choice depends on the specific needs of the business. In this section, we’ll compare the key differences between using free forms and paid software solutions to help you make an informed decision.

Comparison of Features

| Feature | Pre-made Forms | Paid Software |

|---|---|---|

| Customization Options | Basic customization with limited flexibility | Highly customizable with advanced design features |

| Ease of Use | Easy to use, but can require manual adjustments | Streamlined process with automatic calculations and updates |

| Cost | Free to use, no recurring fees | Requires a subscription or one-time payment |

| Advanced Features | Limited to basic fields and formatting | Includes features like automated reminders, payment tracking, and reports |

| Security | May not include encryption or secure cloud storage | Offers advanced security features like encrypted data storage and cloud backups |

Which is Right for You?

The decision between free forms and paid software largely depends on the complexity of your needs. For small businesses or freelancers with simple billing requirements, pre-made forms may be sufficient. They are easy to use, cost nothing, and allow you to quickly generate basic documents. However, if your business is growing or requires more advanced features, paid software can be a more efficient solution. It offers automation, detailed reporting, and better security, making it ideal for larger businesses or those with frequent billing needs.

In the end, choosing between these two options should be based on your budget, the volume of transactions, and how much customization or automation you require in your billing process.

How to Generate Recurring Invoices

For businesses that provide ongoing services or products, creating recurring billing documents can save time and reduce administrative work. Automating the process of generating regular statements ensures that clients are billed consistently and accurately, while also making it easier for businesses to track and manage payments. This section covers how to set up and manage recurring charges effectively.

Setting Up Recurring Billing Details

The first step in generating recurring statements is to establish the key details that will remain consistent across each cycle. These typically include:

- Amount: Specify the fixed amount or fee for the services provided, whether it is weekly, monthly, or annually.

- Billing Frequency: Determine the billing cycle–this could be weekly, bi-weekly, monthly, or yearly, depending on your agreement with the client.

- Start and End Dates: Clearly define when the recurring charges begin and, if applicable, when they should end.

- Payment Methods: Specify how payments will be made–whether through bank transfers, credit card payments, or automated online systems.

Using Software for Automation

For businesses that need to generate recurring documents at scale, using specialized software can streamline the process. Many billing platforms allow you to automate recurring cycles by setting up templates that are automatically filled out with the relevant data each time a payment is due. These platforms can also track payments and send reminders to clients when payment is approaching, ensuring that nothing is overlooked.

By automating the process, businesses can ensure that billing remains consistent and timely without manual intervention. This helps avoid errors, reduces workload, and improves cash flow management.

Ensuring Invoice Accuracy for Clients

Accuracy in billing is essential for maintaining strong relationships with clients and ensuring timely payments. Any discrepancies, whether in pricing, service descriptions, or payment terms, can lead to confusion, delays, or even disputes. By taking the time to double-check your documents, you reduce the chances of errors and ensure that your clients are billed correctly, promoting trust and professionalism.

Key Areas to Focus On

| Key Area | What to Check |

|---|---|

| Client Information | Ensure the client’s name, address, and contact details are accurate and up to date. |

| Service Descriptions | Verify that each service or product is correctly described and matches the agreement or contract. |

| Amounts and Quantities | Double-check the quantities, rates, and totals to ensure no errors in calculations. |

| Payment Terms | Ensure that payment due dates, late fees, and acceptable payment methods are clearly specified. |

| Taxes and Discounts | Verify that any applicable taxes or discounts are correctly applied and calculated. |

By paying attention to these critical details, you can minimize the risk of errors and misunderstandings. Accurate billing documents not only facilitate smoother transactions but also enhance your reputation for reliability and professionalism in the eyes of your clients.

How to Protect Your Business with Invoices

Properly documented financial transactions not only ensure smooth operations but also serve as a critical safeguard for your business. By issuing clear and accurate billing documents, you establish a written record of your agreements, which can help protect you in case of disputes or non-payment. Well-documented transactions provide legal protection, reinforce professionalism, and improve cash flow management.

Here are several ways that billing documents can help protect your business:

- Clear Legal Record: A detailed statement of services or products provided, along with agreed-upon terms, acts as a legal record. This document can be used as evidence in case of disagreements or if payment needs to be pursued through legal channels.

- Payment Terms Enforcement: By specifying payment dates, late fees, and conditions clearly, you ensure clients are aware of their responsibilities. This reduces the chances of late payments and misunderstandings about when payment is due.

- Professionalism and Trust: Issuing formal, organized documents demonstrates professionalism. Clients are more likely to pay promptly when they receive clear, professional documents that outline exactly what they owe and when.

- Financial Tracking and Transparency: Regularly creating and maintaining accurate billing records allows you to track payments and monitor cash flow. This transparency makes it easier to identify overdue accounts and address any financial issues before they escalate.

By using clear and consistent billing practices, you create a structured and reliable process that safeguards your business’s financial health and ensures clients are held accountable for their obligations.