Work Invoice Template Excel for Effortless and Professional Billing

Efficiently managing payment requests is crucial for any business. Creating clear and professional documentation for each transaction helps ensure smooth financial operations. A well-structured form can reduce errors and save time, making it easier to track and manage receivables. This guide will explore how to design and use a simple yet effective solution for all your billing needs.

With the right tools, customizing a payment document for each client or project becomes a quick and straightforward task. In this article, we’ll discuss how to tailor a spreadsheet that not only fits your specific business model but also enhances organization. Whether you’re a freelancer or running a larger operation, adapting this tool to your workflow can lead to greater efficiency and professionalism.

Understanding Work Invoice Templates

Creating clear, organized documents for billing purposes is essential for maintaining a smooth financial process. These documents serve as formal records for transactions, detailing services provided, amounts due, and payment terms. Understanding how to structure these records efficiently can help avoid confusion and ensure timely payments. A well-designed billing form is not only a tool for communication but also a reflection of professionalism in your business practices.

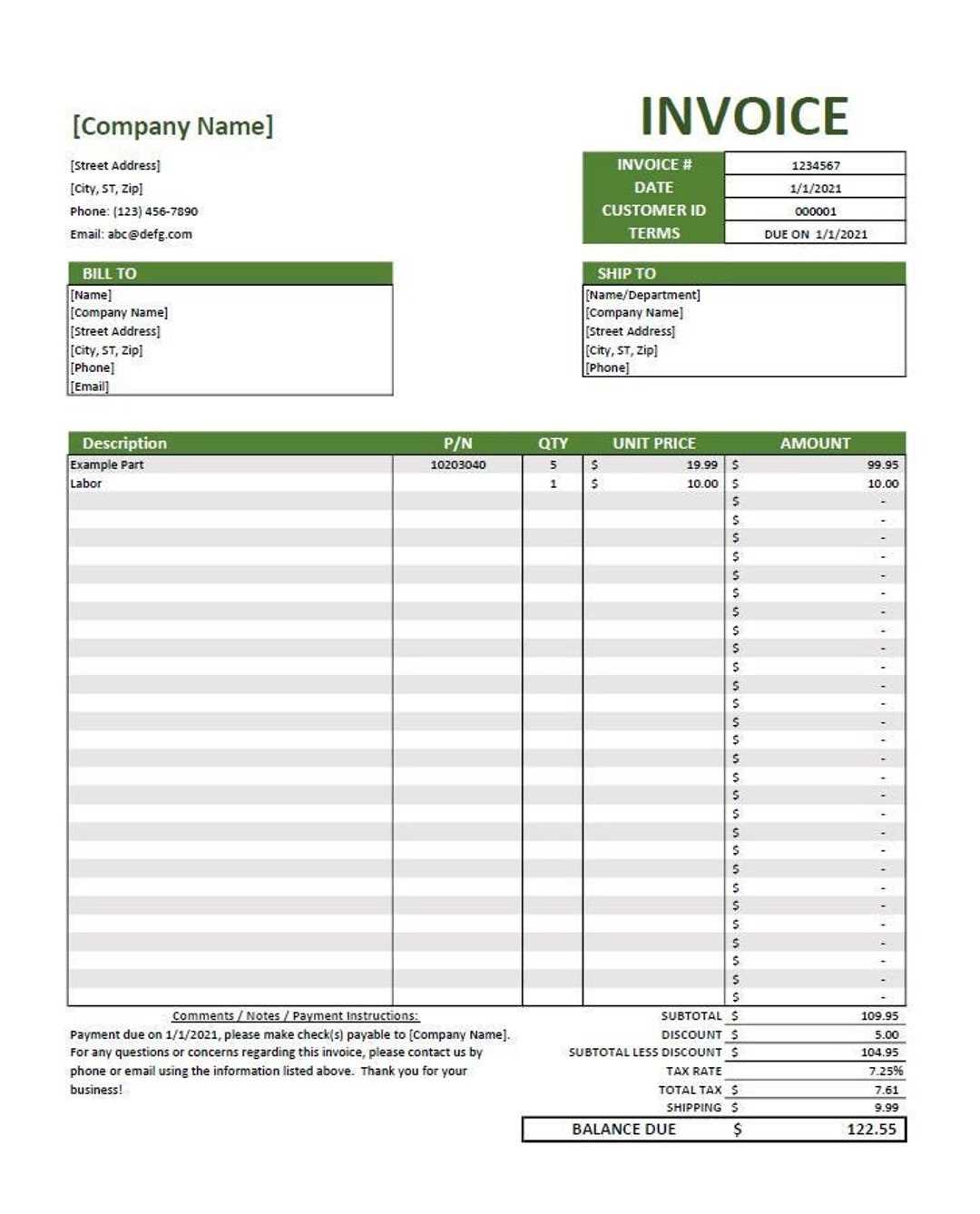

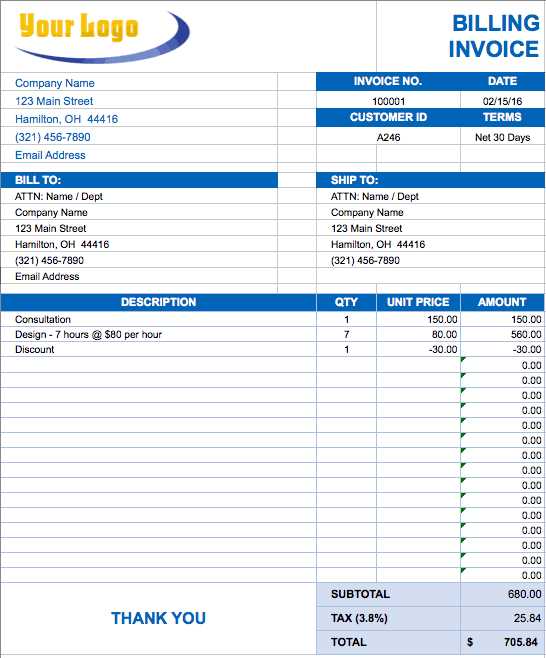

A well-organized billing document should include all the necessary details such as the client’s information, a breakdown of services or goods provided, payment deadlines, and the total amount due. By using a structured approach, these forms make it easier to keep track of outstanding balances, which is vital for managing cash flow. Customizing these documents according to the nature of your business can significantly improve the invoicing process and save time.

Benefits of Using Excel for Invoicing

Utilizing a spreadsheet for managing billing documents offers several advantages that can improve both efficiency and accuracy. The flexibility and features of spreadsheet software make it an ideal choice for creating customizable records that fit specific business needs. By leveraging built-in functions and easy editing options, businesses can streamline their financial processes and save valuable time.

- Customization: Easily tailor the structure of your billing documents to suit different clients, projects, or industries.

- Data Management: Track payments, due dates, and outstanding balances in a clear and organized manner.

- Automation: Use formulas to automatically calculate totals, taxes, and discounts, reducing manual errors.

- Cost-Effective: Spreadsheet software is often free or low-cost, making it an affordable option for small businesses and freelancers.

- Ease of Use: Most people are already familiar with spreadsheet software, making it easy to create, update, and share documents without additional training.

By using this tool, businesses can ensure that their billing process is more efficient and accurate, ultimately helping to maintain a smoother cash flow and stronger client relationships.

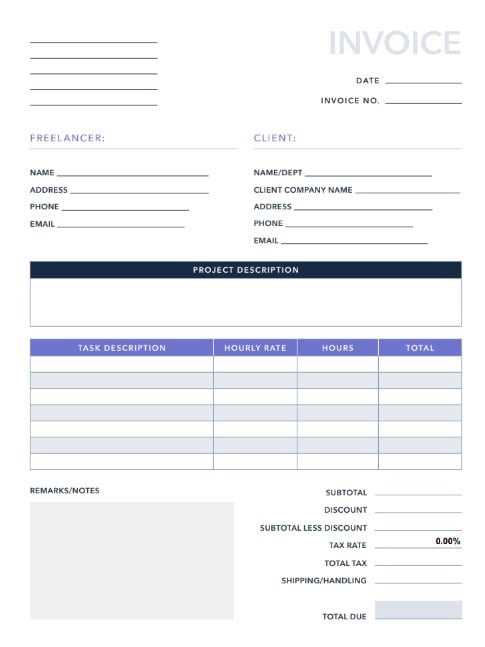

How to Create a Work Invoice

Designing a professional billing document is a key step in ensuring clear communication between you and your clients. By following a few simple guidelines, you can create a document that captures all the necessary details in an organized and easy-to-read format. Below are the essential steps to take when crafting a customized payment record.

- Include Your Business Details: Always begin by adding your name or company name, address, phone number, and email. This ensures your client knows how to contact you if needed.

- Client Information: Add the client’s name, address, and contact information. This helps avoid any confusion about the recipient of the payment request.

- Assign an ID Number: Unique reference numbers are essential for tracking and organizing multiple payment records. This number helps both you and your client stay organized.

- List Services or Products: Clearly outline the services or products provided, including a brief description, quantity, rate, and the total for each item.

- Set Payment Terms: Define the due date for payment, any applicable discounts, and interest rates for overdue amounts. This ensures the client understands your expectations and payment policy.

- Total Amount Due: Calculate the total amount owed, including taxes and any extra charges. This should be clearly visible to avoid confusion.

- Include Payment Methods: Specify how the client can make the payment, whether through bank transfer, credit card, or another method.

Once these steps are completed, review the document for accuracy before sending it to your client. Having a well-structured billing form helps streamline the payment process and creates a professional impression.

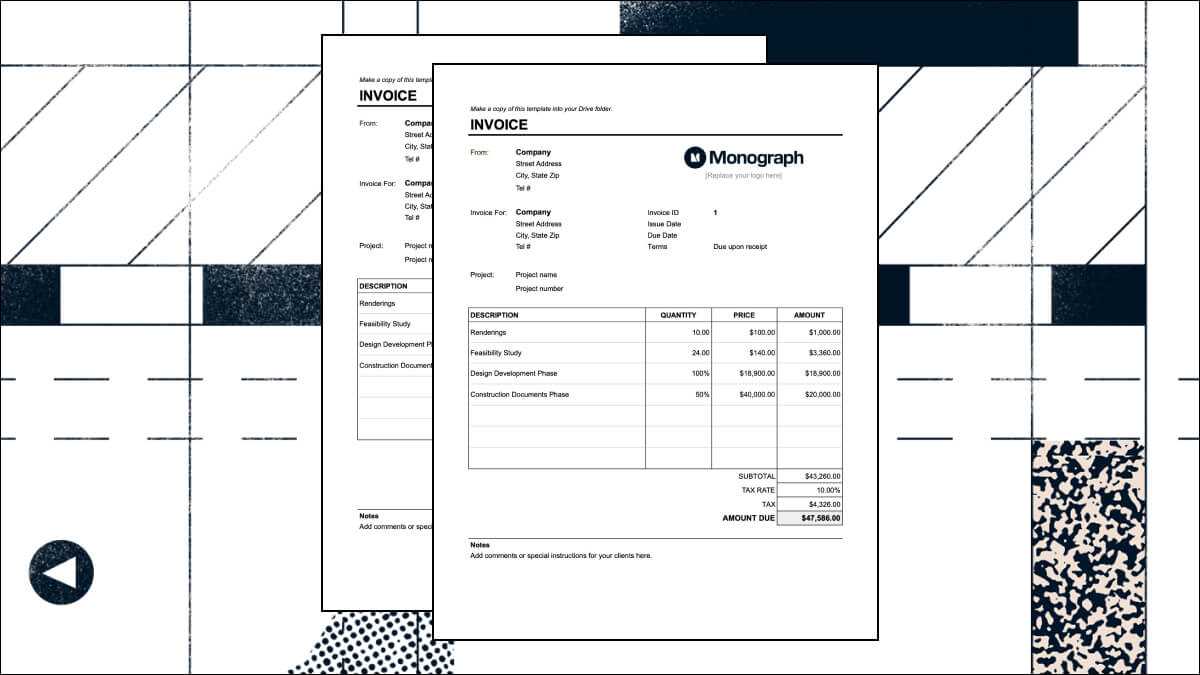

Customizing Your Excel Invoice Template

Personalizing your billing document allows you to reflect your brand and meet the specific needs of your business. By adjusting the layout, design, and content, you can create a unique record that is both functional and professional. Customization helps ensure that all necessary details are included while keeping the format clean and easy to read.

Start by modifying the structure to match your business requirements. For instance, you can add extra sections to include more detailed descriptions or notes. You can also rearrange the existing fields to prioritize the most important information, such as payment deadlines or itemized service lists.

- Branding: Add your logo, business colors, or font style to align with your company’s visual identity.

- Additional Fields: Include extra categories like discounts, project milestones, or special terms that are relevant to your services.

- Formulas and Calculations: Customize formulas for tax calculations, discounts, or total amounts to automatically adjust based on the data you input.

- Organizing Data: Use gridlines, shading, and bold fonts to make the document easier to navigate and more visually appealing.

By taking the time to customize the document, you not only make it more functional but also enhance your professionalism. A well-tailored document leaves a lasting impression and ensures smoother communication with your clients.

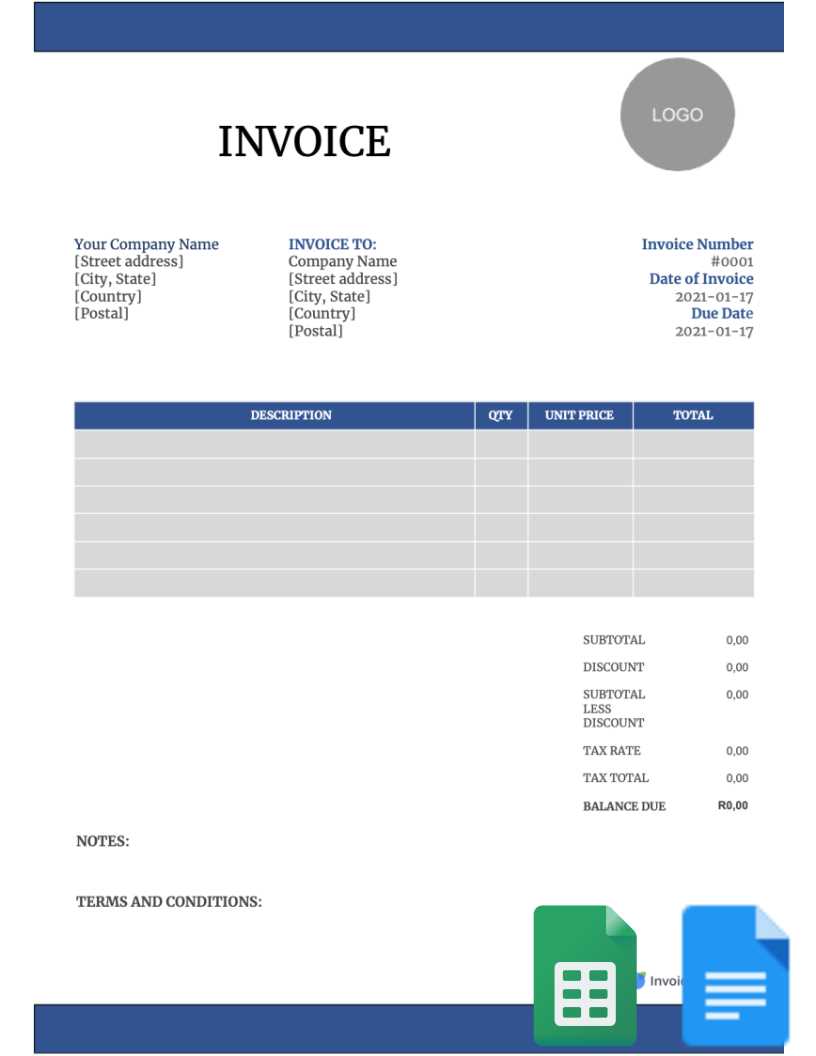

Essential Elements of a Work Invoice

Creating a comprehensive billing document involves including key details that ensure transparency and professionalism. These elements help to clearly communicate the transaction to the client, making it easy to understand the payment breakdown and terms. Here are the most important components that should be part of any billing record.

Key Information to Include

- Business Information: Your name or company name, address, and contact details should be prominently displayed at the top of the document.

- Client Information: Include the recipient’s name, address, and contact details to avoid any confusion.

- Document Number: A unique reference number helps keep track of your records and is essential for proper organization.

- Date: Include the date the document is created and, if necessary, the date the services were rendered or goods were delivered.

Financial Details to Include

- Detailed Description: List all services or goods provided, including quantities, rates, and a breakdown of each item or service.

- Amount Due: Clearly state the total amount due, including taxes, discounts, and any additional charges.

- Payment Terms: Specify the due date, any late fees, and preferred payment methods to set clear expectations.

Including these essential details ensures that your billing documents are clear, accurate, and professional. Properly documenting each transaction helps avoid confusion and establishes trust with your clients.

Why Choose Excel for Work Invoices

Using spreadsheet software for managing payment requests offers significant advantages in terms of efficiency, customization, and ease of use. The flexibility and built-in features make it an excellent choice for businesses of all sizes, helping streamline the billing process and minimize errors. Below are the key reasons why this tool is widely preferred for creating financial documents.

- Ease of Customization: Adjust the layout and content to suit your specific needs, whether for different clients, services, or payment structures.

- Built-in Calculations: Automatically calculate totals, taxes, and discounts with formulas, reducing the chances of human error.

- Data Organization: Keep track of payments, outstanding balances, and due dates in an organized manner, ensuring that nothing gets overlooked.

- Affordable Solution: Most spreadsheet software is either free or low-cost, making it an accessible option for small businesses and freelancers.

- Familiar Interface: Many people are already familiar with spreadsheet software, meaning minimal learning curve and quick setup.

- Easy Sharing and Storage: You can easily share your financial records via email or cloud storage, ensuring quick access for both you and your clients.

Choosing this tool allows you to create professional, accurate documents without needing additional software, providing a simple yet powerful solution for your billing needs.

Common Mistakes in Work Invoices

Creating accurate and clear billing records is crucial for maintaining professionalism and ensuring timely payments. However, there are several common mistakes that businesses often make when preparing these documents, which can lead to confusion, delays, or even disputes. Recognizing and avoiding these errors can help you streamline your billing process and improve client relationships.

Some of the most frequent mistakes include missing or incorrect client information, unclear descriptions of services provided, and failing to specify payment terms clearly. Additionally, omitting tax calculations or not assigning a unique reference number to each document can cause confusion and hinder tracking. By addressing these issues, you can make sure that your billing records are comprehensive, accurate, and easy to understand.

How to Track Payments with Excel

Keeping track of payments is essential for managing cash flow and ensuring that all financial transactions are recorded correctly. Spreadsheet software offers a convenient way to monitor payment statuses, outstanding balances, and due dates in one organized place. By setting up a simple tracking system, you can easily stay on top of payments and avoid any missed deadlines.

Setting Up Payment Tracking

Start by creating a table that includes the following columns:

- Client Name: Record the name or company of each client.

- Amount Due: List the total amount owed for each transaction.

- Payment Received: Track the amount paid by the client so far.

- Due Date: Include the payment deadline to keep track of overdue amounts.

- Balance Due: Calculate the remaining balance, which can be done automatically with formulas.

- Payment Date: Record the date when payment is received.

Using Formulas to Track Payments

Excel offers several useful formulas to make payment tracking easier:

- SUM: Use this to calculate totals for the amounts due, payments received, and balances remaining.

- IF Statements: Set up conditional formatting or formulas to highlight overdue balances or clients with outstanding payments.

- Auto Calculations: Link payment columns with others to automatically update outstanding amounts when new payments are recorded.

By creating a simple tracking system, you can quickly see who has paid, who hasn’t, and which payments are overdue, making it easier to follow up and maintain accurate financial records.

Organizing Work Invoices in Excel

Proper organization of payment records is essential for ensuring efficiency and accuracy in your financial operations. By structuring these documents systematically, you can easily track past transactions, outstanding balances, and upcoming due dates. A well-organized system not only helps maintain clarity but also saves time when you need to access specific records or prepare reports.

One of the best ways to organize billing documents is by creating a central file that includes all relevant details for each transaction. This file can be broken down into separate sheets or sections, depending on your preference, and should include columns for client information, amounts due, payment status, and deadlines. You can also add filters to quickly sort through data by client, due date, or payment status.

- Use Clear Labels: Label each section or column clearly so you can quickly identify which information is in each part of the document.

- Group Data by Category: Organize entries by client, project, or payment status to make it easier to manage and retrieve relevant information.

- Use Date Sorting: Sort payment records by due date or payment date to keep track of upcoming deadlines and overdue amounts.

- Maintain Separate Files: If you handle multiple projects or clients, consider creating separate files for each to reduce clutter and confusion.

By following these organizational strategies, you’ll be able to manage your financial records more effectively, leading to smoother business operations and less time spent on administrative tasks.

Automating Invoice Generation in Excel

Automating the process of generating payment records can significantly reduce time spent on repetitive tasks and minimize human error. By setting up automated features within your spreadsheet, you can quickly create accurate documents with minimal effort. This not only increases efficiency but also ensures consistency across all your financial records.

To automate the generation of payment records, you can use a combination of built-in functions, such as data validation, formulas, and macros. For instance, by creating dropdown lists for client names or service types, you can quickly populate documents with the appropriate details. Additionally, you can set up formulas to automatically calculate totals, taxes, and discounts, ensuring that calculations are always correct.

- Using Macros: Macros can automate repetitive tasks like creating new records, populating fields, and applying calculations, allowing you to generate new documents with a single click.

- Data Validation: Set rules for entering information to ensure consistency and avoid errors when inputting data, such as ensuring numeric values are entered in the correct format.

- Predefined Formulas: Use formulas to automatically calculate totals, taxes, and other values based on the data entered, reducing the need for manual calculation.

- Dropdown Menus: Create dropdown lists for client names, services, or payment methods, making it easier to select the correct options and minimize errors.

By incorporating automation into your process, you can save valuable time, reduce the chance of mistakes, and ensure that your billing records are generated quickly and efficiently.

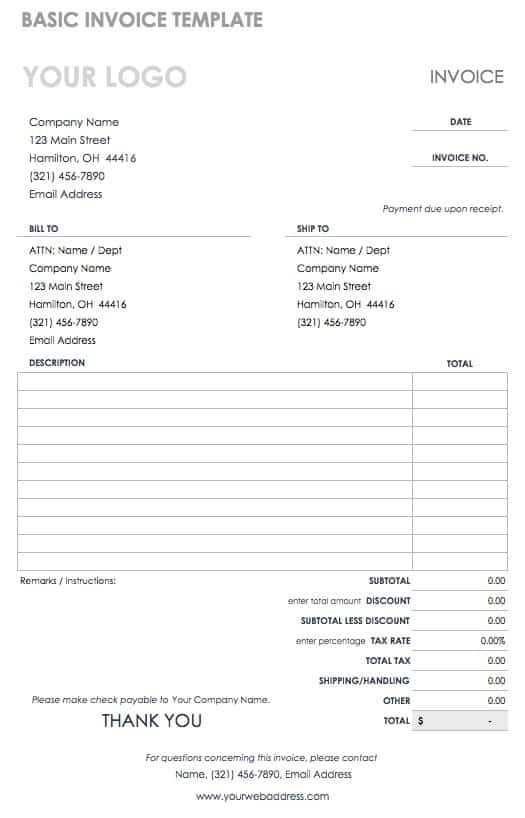

Design Tips for Professional Invoices

The design of your billing documents plays a key role in how your business is perceived. A clean, well-organized layout not only makes the document easy to read but also helps convey professionalism. A well-designed document can make a positive impression on clients and encourage prompt payments. Here are some design tips to ensure your financial records look polished and are functional.

- Keep It Simple: Avoid clutter and unnecessary elements. A minimalist design with clear headings and space between sections makes the document easier to navigate.

- Use Clear Fonts: Choose legible fonts for both headings and body text. Stick to standard fonts like Arial or Times New Roman for professionalism.

- Highlight Key Information: Make important details, such as the total amount due, due date, and payment terms, stand out by using bold or larger fonts.

- Organize with Grids: Use tables or grids to break the document into sections, making it easier to read and ensuring that no information is overlooked.

- Include Branding: Incorporate your logo, company colors, and consistent fonts to ensure the document reflects your brand’s identity.

- Use Proper Spacing: Adequate spacing between lines, sections, and columns makes the document appear more polished and ensures clarity.

- Double-Check Alignment: Ensure that all text, numbers, and columns are aligned properly for a neat, professional appearance.

By applying these design principles, you’ll not only create clear, easy-to-read records but also strengthen your brand’s image and professionalism in the eyes of your clients.

Handling Multiple Clients in Excel

Managing transactions for multiple clients can quickly become overwhelming without a proper organizational system. By using spreadsheet software, you can efficiently track payments, due dates, and balances for each client, ensuring no details are overlooked. Organizing client information in a structured format not only helps you stay organized but also enables easy access to relevant data when needed.

Organizing Client Information

When dealing with numerous clients, it’s important to create a system that allows you to track each one individually. One effective method is to use separate columns for client names, transaction details, payment status, and amounts due. This way, all the information related to each client is grouped together for easy reference.

Using a Table for Tracking

Here is an example of how you can structure your document to track multiple clients:

| Client Name | Service Provided | Amount Due | Amount Paid | Balance Due | Due Date |

|---|---|---|---|---|---|

| John Doe | Web Design | $1,500 | $500 | $1,000 | 12/15/2024 |

| Jane Smith | Consulting | $800 | $800 | $0 | 11/30/2024 |

| ABC Corp | Branding | $2,000 | $1,200 | $800 | 12/10/2024 |

Using a table like this allows you to easily sort or filter data based on the client name, due date, or payment status. It

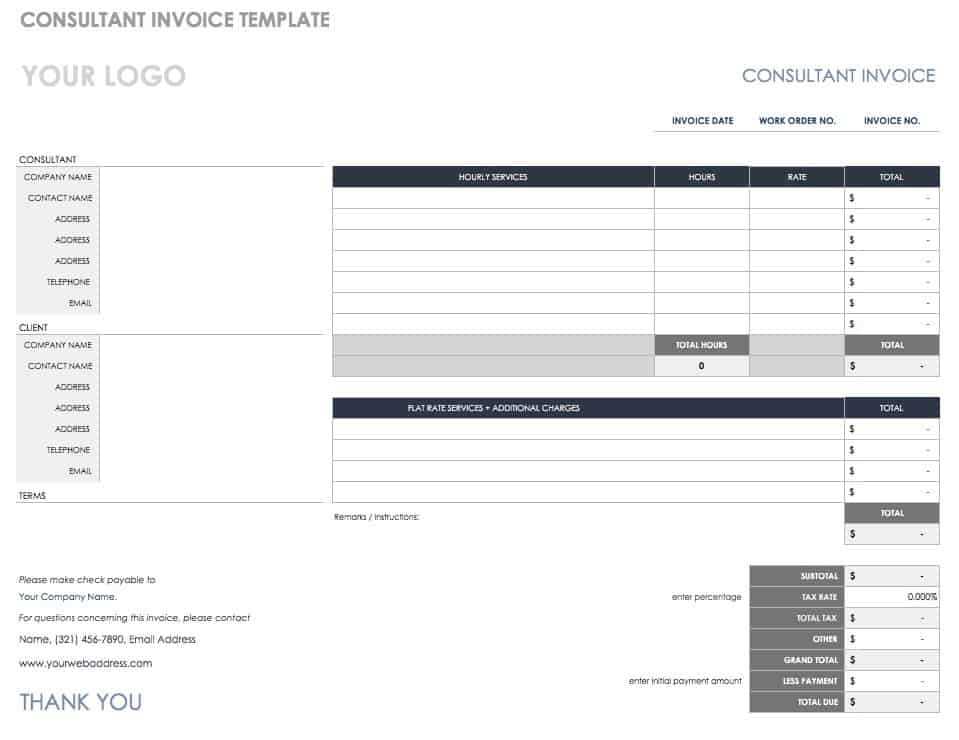

Creating Templates for Different Projects

Every project has unique requirements when it comes to documenting payments and tracking financial details. To streamline your workflow, creating specific layouts for different types of projects is a great strategy. These tailored layouts allow you to capture all the necessary information for each project while maintaining a consistent, professional appearance across all records.

For example, a service-based project may require detailed descriptions of the tasks performed, while a product sale might need sections for quantities, unit prices, and shipping costs. By customizing your document structure for each type of project, you can ensure that all relevant information is included without overloading the document with unnecessary fields.

When creating these custom layouts, be sure to consider the following factors:

- Project Scope: Different projects may involve different types of services, products, or deliverables. Tailor the sections to reflect what’s most relevant for each case.

- Client Requirements: Some clients may have specific preferences for how they receive billing records, such as detailed breakdowns or simpler summaries.

- Consistency: While each project may have unique elements, try to maintain a similar structure across all your records to make them easy to understand and manage.

- Adjustable Fields: Leave room for flexibility. For instance, include optional fields that can be added or removed depending on the type of project.

By creating project-specific layouts, you ensure that each document is optimized for the work at hand, improving clarity and reducing the chances of errors or missing details.

Improving Accuracy with Excel Invoices

Ensuring the accuracy of financial records is essential for maintaining trust with clients and keeping operations running smoothly. By using spreadsheet software, you can significantly reduce human error and enhance the precision of your financial documents. With the right tools and features, you can automate calculations, eliminate manual mistakes, and streamline the entire billing process.

Automating Calculations and Reducing Errors

One of the most powerful ways to improve accuracy is by utilizing built-in functions that automate calculations. By setting up formulas for totals, taxes, and discounts, you can eliminate the need for manual addition, subtraction, or percentage calculations. These functions ensure that all numbers are consistent and accurate, preventing common mistakes that could arise from manual entry.

- SUM: Automatically adds up amounts in specified cells, ensuring that the totals are always correct.

- IF Statements: Helps apply conditions, such as automatic tax calculations based on location, or applying discounts when certain criteria are met.

- ROUND: Rounds off amounts to a specified number of decimal places, preventing issues with inconsistent formatting.

Using Data Validation for Consistency

Data validation features help maintain consistency and prevent mistakes when entering client information or financial figures. By setting rules for acceptable input (such as ensuring only numeric values are entered for amounts), you can prevent errors before they occur. You can also create dropdown lists to standardize the options for payment methods, services, or project types, ensuring the data is entered correctly every time.

By leveraging these tools and techniques, you can enhance the accuracy of your financial records, reducing the likelihood of errors and ensuring that every detail is correct before the document is finalized.

How to Save and Share Invoices

Once you’ve created and finalized your billing documents, it’s crucial to save and share them in a secure and accessible way. Proper storage ensures that you can easily retrieve documents for future reference or audits, while effective sharing methods help streamline communication with clients and ensure timely payments.

When saving your financial records, consider the format and location. It’s essential to keep files organized and easily accessible. Digital formats like PDF are widely accepted and preserve the document’s formatting, making them ideal for sharing. You can also save documents in cloud storage, ensuring that they are backed up and accessible from anywhere.

To share your completed documents, email remains the most common and efficient method. Simply attach the saved file and include a brief message outlining the payment details or next steps. If you’re working with a large volume of records, consider using file-sharing services or project management tools to distribute files to multiple recipients quickly.

- Save as PDF: PDFs preserve the layout and make it easy to open on any device without altering the format.

- Cloud Storage: Services like Google Drive or Dropbox allow for secure storage and easy access from any device.

- Email: Attach the document to an email with a personalized message for your client, making sure to include payment details.

- File-sharing Platforms: Use tools like OneDrive or WeTransfer to send large files or bulk documents.

By following these practices, you’ll ensure your documents are both safely stored and easy to share, keeping your business operations running smoothly and professionally.

Integrating Excel Invoices with Accounting Software

Efficiently managing financial records becomes much easier when your billing documents can seamlessly integrate with your accounting software. By connecting your billing system with accounting tools, you can automate data entry, reduce manual errors, and streamline the overall financial management process. This integration ensures that all records are synchronized, making it simpler to track payments, manage expenses, and generate reports.

Many accounting software solutions offer the ability to import data from spreadsheet files, which allows you to directly transfer transaction details into your accounting system without the need for re-entry. This not only saves time but also ensures consistency between your billing records and financial statements.

- Automated Data Transfer: Import billing details directly into your accounting system, reducing the risk of errors and saving time on manual data entry.

- Consistency Across Records: Sync transaction data from your billing system with your accounting software, ensuring accurate financial reporting and tracking.

- Time Savings: Automate routine tasks like data entry, reconciliation, and report generation to streamline your financial workflows.

- Improved Accuracy: By reducing manual input, you lower the chances of discrepancies between your billing records and financial statements.

To integrate your records with accounting software, check if the software you’re using supports importing spreadsheet files or exporting data in formats like CSV or XLSX. Once set up, this integration can significantly enhance your ability to manage financial operations with minimal effort and maximum accuracy.