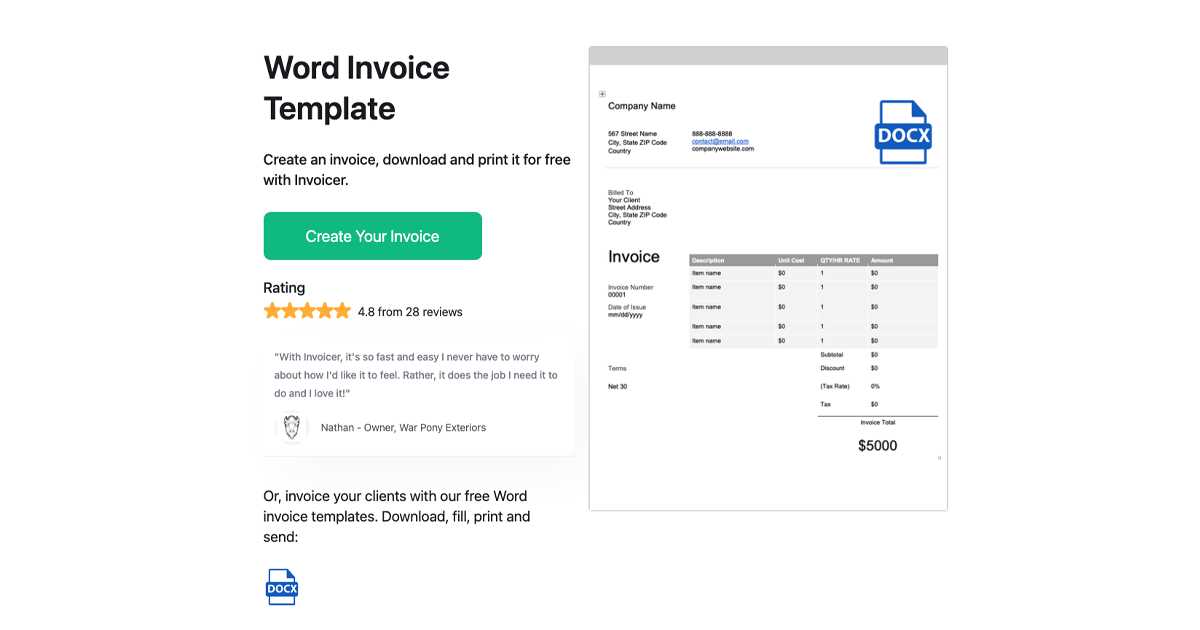

Download Your Free Word Template Invoice for Easy Invoicing

Organizing financial records and creating polished documents for client payments can be a time-consuming task. Fortunately, there are resources designed to simplify this process. With customizable tools, anyone can craft professional-looking billing sheets tailored to specific needs and branding. These adaptable resources save time, reduce errors, and improve client communication, providing a streamlined approach to routine financial interactions.

Ready-made forms for billing offer the perfect balance of structure and flexibility. They help maintain consistency across transactions while allowing you to add your unique elements. Whether it’s for a small business, freelance project, or personal service, these forms let you convey professionalism without the hassle of designing from scratch.

For those managing regular payments, these document tools come with helpful features like adjustable sections for easy updating. This way, anyone can ensure that th

Creating a Professional Invoice with Word Templates

Producing a polished billing document that represents your business well can make a strong impression on clients. By using adaptable document tools, you can maintain a consistent appearance across all client communications, ensuring clarity and reliability in every transaction. Customizable billing forms enable you to align the document’s look with your brand, making your service appear cohesive and professional.

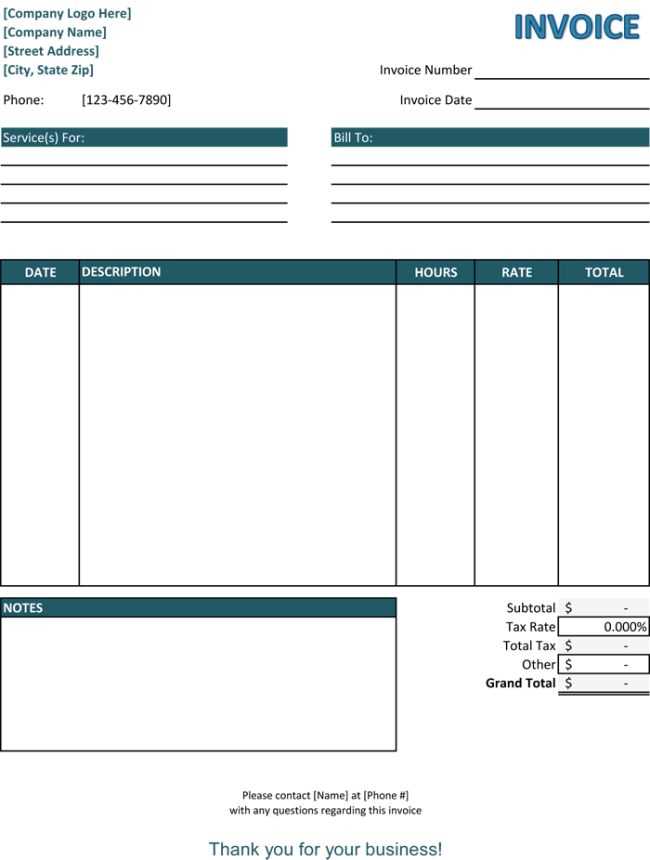

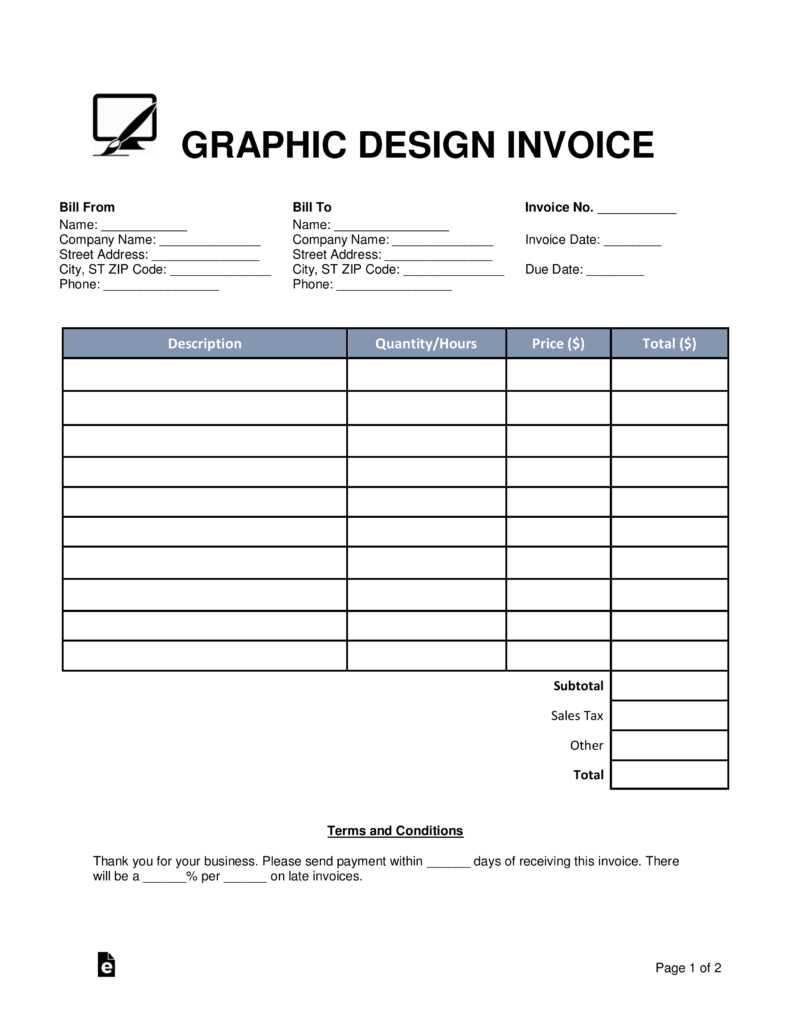

To create a professional document for client billing, begin by organizing essential information, including service details, payment terms, and contact information. Ensure that each section is clearly defined, allowing clients to understand the document quickly. Below is a layout example to guide you:

| Section | Description | |||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Header | Include your business name, contact details, and branding elements

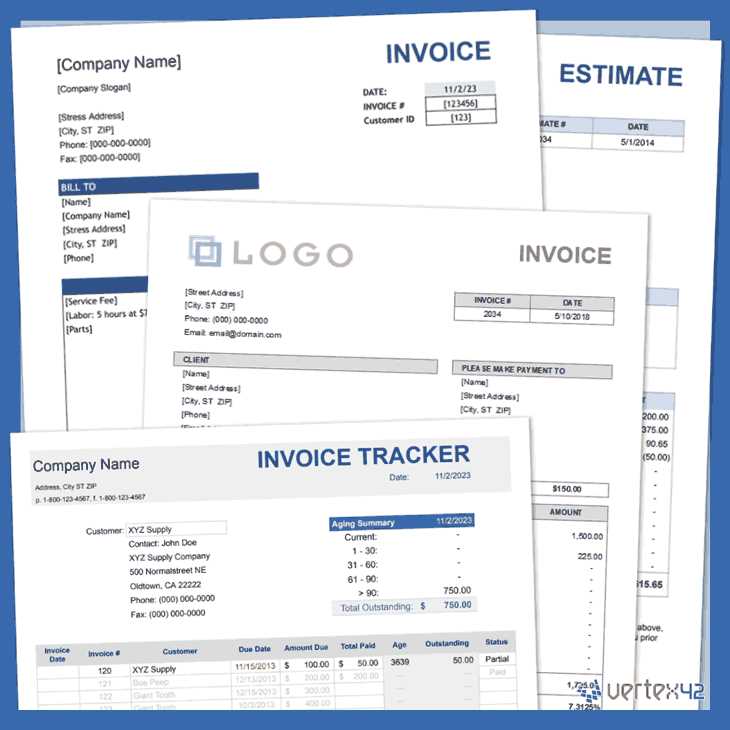

Why Use Word for InvoicingFor many small businesses and freelancers, creating payment documents can be simplified by using versatile and familiar tools. These tools provide the flexibility needed to adjust content, add branding, and organize details without requiring specialized software. This makes it a convenient choice for those looking to streamline their financial documentation processes with a user-friendly approach. Customization to Fit Your BrandOne major advantage of using adaptable document tools is the ability to personalize each file to reflect your brand’s identity. Customizable fonts, colors, and layouts allow you to tailor each detail, ensuring a polished look that resonates with clients. This not only helps create consistent communication but also strengthens your brand’s presence with each document you share. Easy Updates for Recurring UseBilling needs often vary from client to client, and reusable documents make it easy to adjust information as needed. Whether adding new details, updating How to Find the Right Template

Choosing the ideal format for your billing documents is essential to ensure clarity, professionalism, and efficiency. With numerous design options available, finding a document that aligns with your brand and meets your business needs can elevate your client interactions and make financial processes smoother. The key is to select a style that complements your services while remaining easy to customize and update. Consider Your Business NeedsBefore selecting a design, it’s helpful to determine what specific elements your business requires. Here are a few factors to keep in mind:

|