Free Word Invoice Templates for Effortless Billing

Creating effective billing documents is essential for any business looking to maintain a professional image and ensure timely payments. With the right tools, crafting these essential records becomes a straightforward process, allowing you to focus more on your core activities.

Utilizing pre-designed formats can save valuable time and effort, enabling you to produce polished documents that convey all necessary information clearly. These resources not only enhance your credibility but also simplify the customization process, allowing for a personalized touch that reflects your brand.

In this section, we will explore various options for obtaining accessible designs that cater to diverse needs. You will discover how to modify these documents to align with your business requirements, ensuring a seamless experience for both you and your clients.

Benefits of Using Invoice Templates

Utilizing pre-designed billing documents can significantly enhance the efficiency and professionalism of your financial transactions. These resources simplify the process of creating accurate and visually appealing records, making them invaluable for businesses of all sizes.

One major advantage is the time saved during the creation process. With established formats, you can quickly input the necessary details, allowing you to focus on other critical aspects of your operations. Additionally, consistency in your documents fosters a reliable image, which can strengthen relationships with clients.

Moreover, these resources often come with built-in features that ensure compliance with legal and tax requirements. This reduces the risk of errors and discrepancies that can arise from manual entry. Overall, leveraging such tools enhances productivity while promoting a professional appearance in all your financial dealings.

How to Customize Invoices

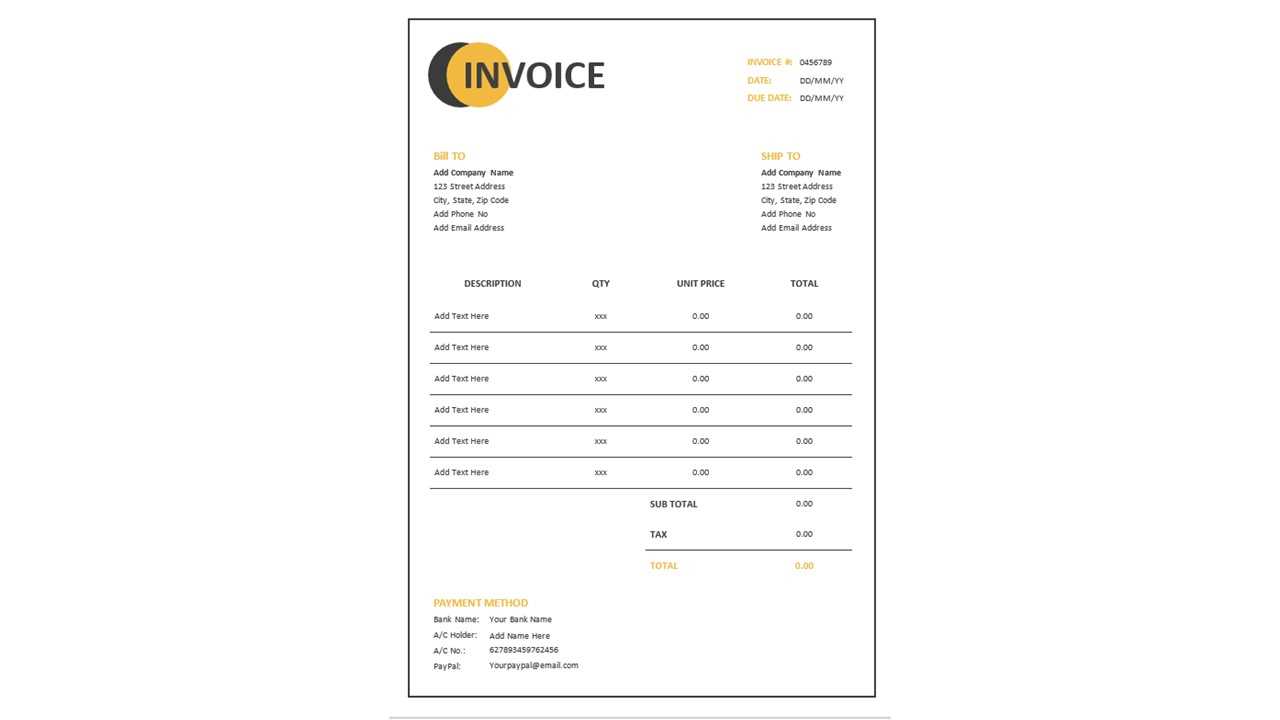

Tailoring your billing documents to reflect your unique business identity is essential for creating a lasting impression on clients. Customization not only enhances the aesthetic appeal but also ensures that all necessary information is clearly presented, which can facilitate smoother transactions.

Selecting the Right Format

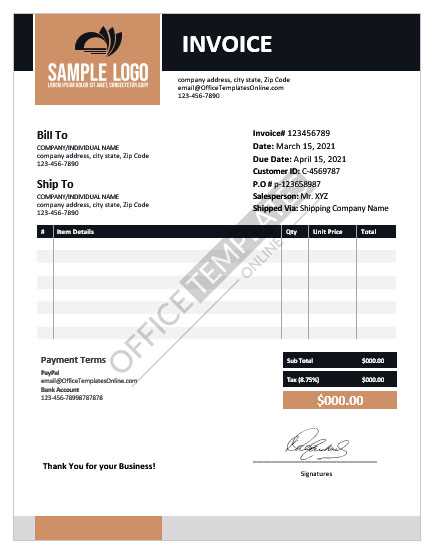

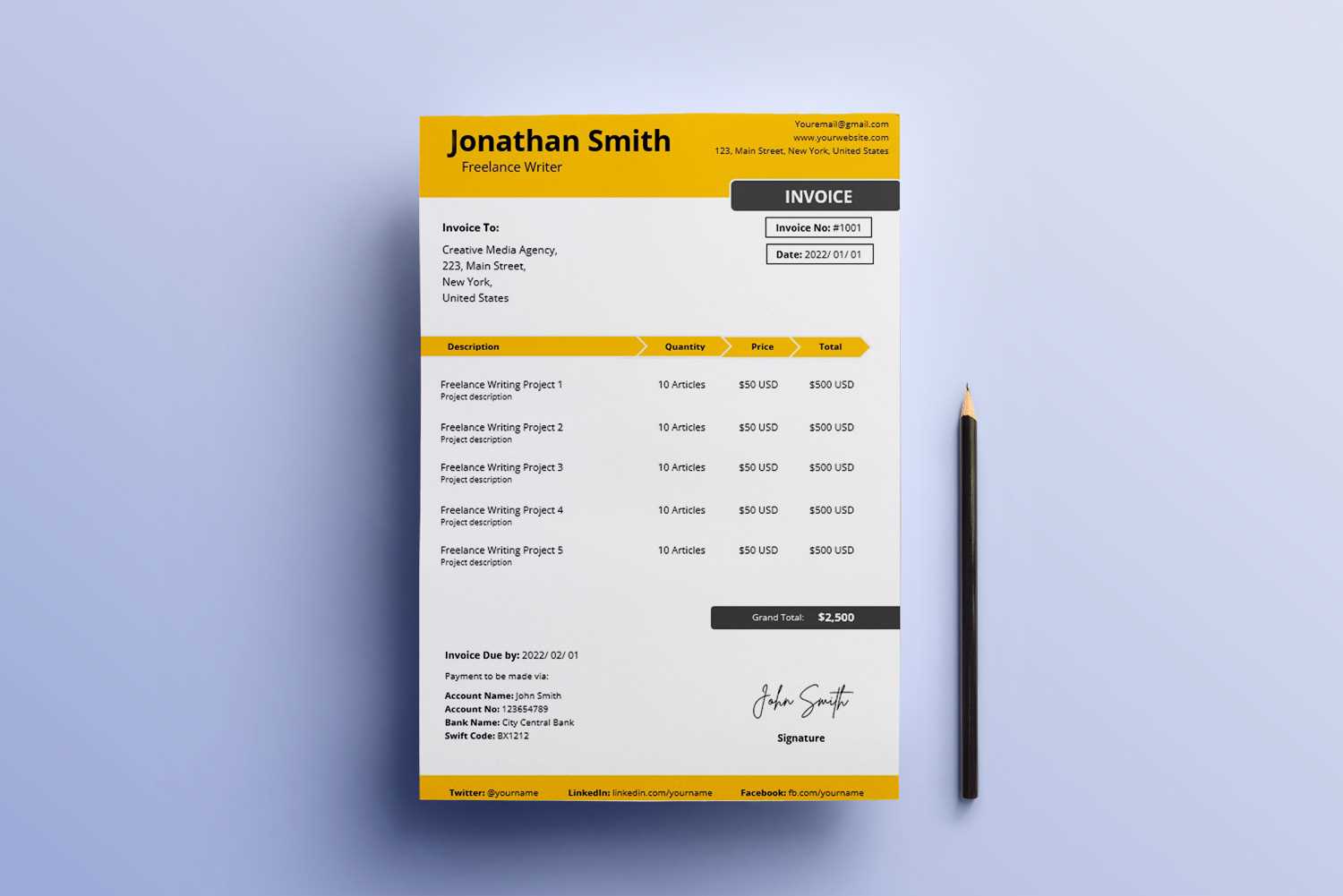

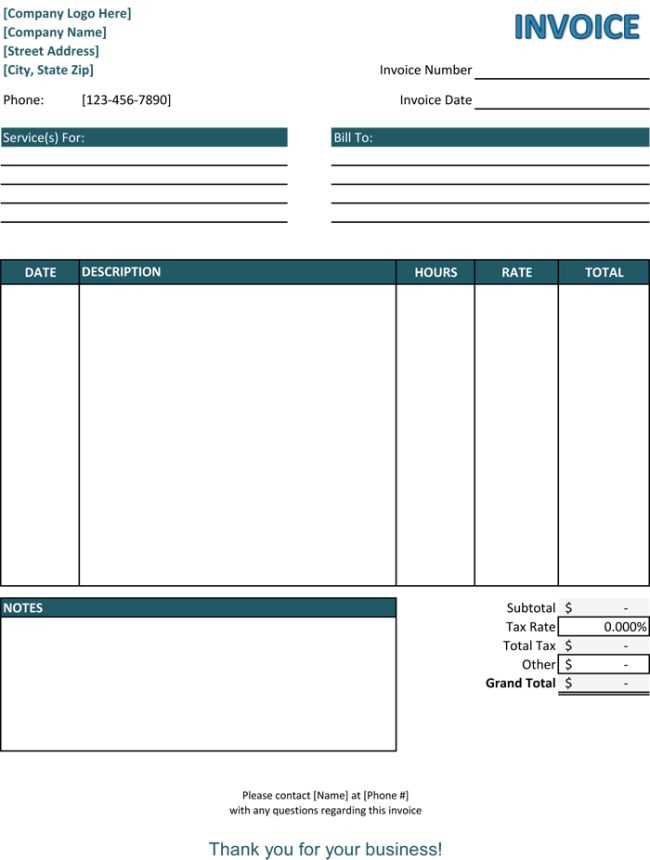

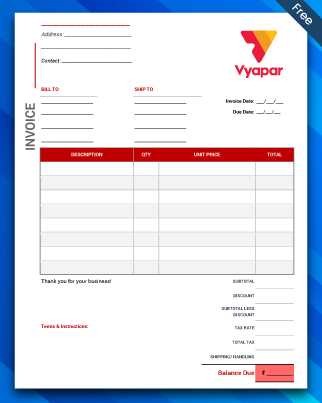

Begin by choosing an appropriate design that suits your industry and brand style. Many resources offer various layouts, from simple to more elaborate designs. Consider what elements are essential for your records, such as your logo, contact details, and payment terms, and ensure these are easily incorporated into your chosen format.

Modifying Content and Layout

Once you have your design, focus on personalizing the content. Input your business name, address, and any other relevant information that clients need. Additionally, you can adjust the layout to prioritize the most important sections, such as services provided and payment instructions. This personalization will not only improve readability but also reinforce your brand’s professionalism.

Steps to Download Accessible Formats

Acquiring easily customizable billing documents is a straightforward process that can significantly enhance your efficiency in managing financial transactions. By following a few simple steps, you can gain access to resources that are ready to use and tailored to fit your specific needs.

Finding Reliable Sources

The first step is to identify trustworthy websites that offer these documents. Look for platforms with positive reviews and a wide selection of designs. It is essential to ensure that the resources provided are compatible with your software for seamless editing.

Downloading the Document

After selecting a suitable design, proceed to download the file. Most platforms will have a clear download button or link. Here’s a brief overview of the process:

| Step | Action |

|---|---|

| 1 | Visit the chosen website |

| 2 | Browse the available designs |

| 3 | Select your preferred format |

| 4 | Click on the download button |

| 5 | Save the file to your device |

Once downloaded, you can open the document in your preferred software and start customizing it to suit your business requirements.

Common Mistakes in Billing Document Creation

Creating accurate financial documents is crucial for maintaining professional relationships and ensuring timely payments. However, many individuals and businesses make several common errors that can lead to confusion and delays. Understanding these pitfalls can help improve the overall quality of your records.

Here are some frequent mistakes to watch out for:

- Incomplete Information: Failing to include all necessary details can lead to misunderstandings. Ensure that client names, addresses, and service descriptions are clearly stated.

- Incorrect Amounts: Double-check all calculations to avoid disputes over payment amounts. Simple arithmetic errors can create significant issues.

- Missing Payment Terms: Clearly outline the payment methods and due dates to prevent delays. Clients should know when and how to pay.

- Poor Formatting: A cluttered or difficult-to-read document can frustrate recipients. Use clear headings and a logical layout to enhance readability.

- Failure to Follow Up: Not tracking outstanding payments can lead to cash flow issues. Regularly follow up on unpaid accounts to maintain financial health.

Avoiding these common errors will not only enhance the professionalism of your documents but also contribute to smoother transactions and better relationships with your clients.

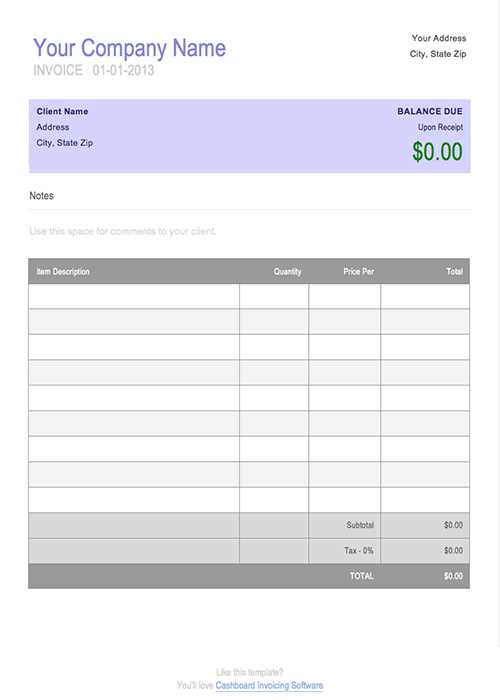

Features of an Effective Billing Document

Creating a successful financial document involves more than just listing services and prices. An effective record should convey clarity, professionalism, and essential details that facilitate the payment process. Understanding the key features that contribute to an outstanding document is crucial for any business.

First and foremost, a well-structured layout enhances readability. Important elements such as your business name, contact information, and client details should be prominently displayed. Using clear headings helps guide the reader through the document.

Additionally, including unique identifiers, such as an invoice number, is essential for tracking purposes. This not only helps you manage your records but also provides clients with a reference for any inquiries or disputes.

Another important aspect is the inclusion of a detailed breakdown of services or products rendered. This transparency builds trust and ensures that clients understand what they are being charged for. Furthermore, stating payment terms and due dates clearly will help prevent any confusion regarding the timeline for payments.

Lastly, a professional appearance, including consistent branding elements like logos and color schemes, can enhance credibility and make a lasting impression. By incorporating these features, you can create billing documents that are not only functional but also reflect your brand’s professionalism.

Integrating Your Branding in Billing Documents

Incorporating your brand identity into financial documents is essential for reinforcing recognition and professionalism. By ensuring that your unique style is reflected throughout these records, you not only create a cohesive experience for your clients but also enhance your business’s credibility.

One of the most effective ways to establish your brand presence is through the consistent use of your logo. Placing your emblem prominently at the top of the document instantly communicates your identity. Additionally, consider using your brand colors in headings, borders, and other design elements to create a visually appealing layout that aligns with your overall branding strategy.

Another important aspect is the tone of voice used in the text. Ensure that the language reflects your brand’s personality, whether it’s formal, friendly, or innovative. This consistency helps clients feel more connected to your business.

Finally, incorporating branded elements like custom fonts or graphics can further distinguish your documents. By thoughtfully integrating these features, you create a memorable impression that not only highlights your professionalism but also reinforces your commitment to quality.

Best Practices for Document Formatting

Effective formatting is crucial for creating clear and professional financial records. A well-structured document not only enhances readability but also facilitates efficient communication with clients. Adopting best practices in formatting can lead to better organization and fewer errors.

Here are some key practices to consider:

- Use a Clear Layout: Organize information logically with distinct sections for contact details, services rendered, and payment terms.

- Choose Readable Fonts: Select fonts that are easy to read, avoiding overly decorative styles that can confuse recipients. Common choices include Arial, Calibri, or Times New Roman.

- Consistent Use of Colors: Utilize your brand colors strategically, but avoid overwhelming the reader with too many hues. Stick to a maximum of three colors to maintain professionalism.

- Incorporate White Space: Ensure there is ample white space to prevent clutter. This helps guide the reader’s eye and makes the document more approachable.

- Highlight Important Information: Use bold or larger fonts for key details such as total amounts due and payment deadlines to draw attention.

- Numbered or Bulleted Lists: Use lists to break down charges or services clearly. This enhances clarity and makes it easier for clients to review.

By following these formatting best practices, you can create documents that are not only visually appealing but also effective in conveying necessary information to your clients.

Using Invoices for Better Cash Flow

Effective management of financial records plays a critical role in maintaining healthy cash flow for businesses. By utilizing structured billing documents, companies can ensure timely payments and improve their overall financial stability. Implementing best practices for issuing and managing these documents can significantly enhance cash flow management.

Establishing Clear Payment Terms

One of the essential aspects of using financial records to improve cash flow is to define clear payment terms. Setting specific deadlines for payments helps clients understand when their obligations are due and encourages timely transactions.

Tracking Outstanding Payments

Regular monitoring of pending payments allows businesses to follow up with clients and reduce delays. Keeping a detailed record of all issued documents and their status enables efficient cash flow management.

| Action | Description |

|---|---|

| Define Payment Terms | Clearly outline when payments are due, including any late fees for overdue accounts. |

| Send Reminders | Prompt clients with reminders a few days before the payment due date to encourage timely payments. |

| Track Payments | Keep a log of all incoming payments and outstanding balances for accurate cash flow analysis. |

By employing these strategies and leveraging billing documents effectively, businesses can enhance their cash flow, leading to improved financial health and stability.

How Invoices Improve Professionalism

Maintaining a professional image is crucial for any business seeking to establish trust and credibility with clients. Utilizing structured billing documents is an effective way to project professionalism and enhance your brand’s reputation. When done correctly, these documents can significantly contribute to how your business is perceived in the marketplace.

Here are several ways that structured financial documents can enhance professionalism:

- Consistency: Using a uniform format across all billing documents helps reinforce your brand identity and creates a cohesive experience for clients.

- Clarity: Clear and organized documents provide essential details in an easily digestible format, making it simpler for clients to understand their charges and payment expectations.

- Timeliness: Sending structured documents promptly demonstrates reliability and respect for your clients’ time, which is a vital aspect of a professional relationship.

- Branding Opportunities: Incorporating your business logo and colors in billing documents offers additional branding exposure and reinforces your business identity.

- Legal Protection: Well-structured documents serve as official records of transactions, providing legal backing in case of disputes or discrepancies.

By integrating these practices into your business processes, you not only improve the presentation of financial interactions but also foster a more professional atmosphere that can lead to lasting client relationships.

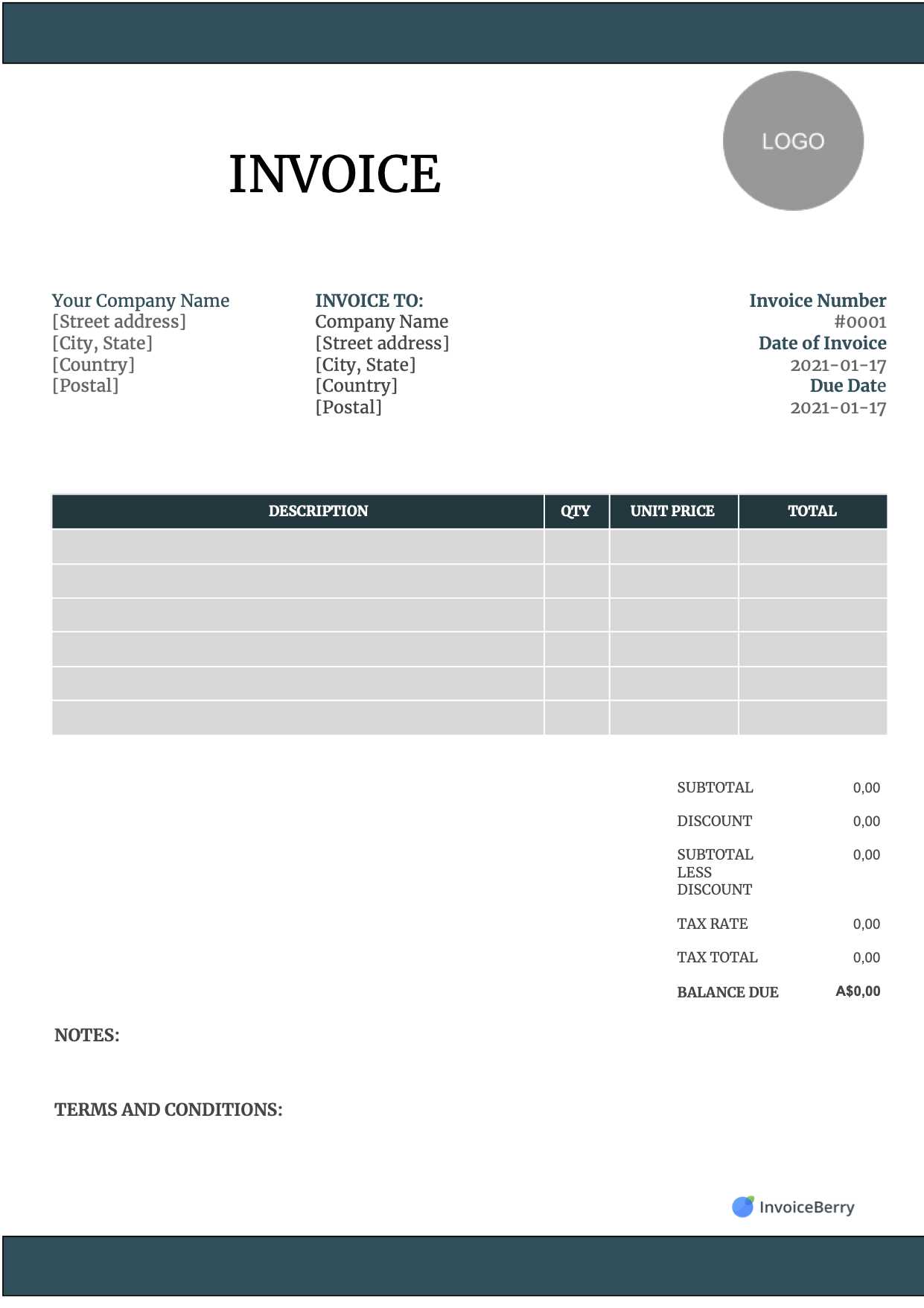

Legal Requirements for Business Invoices

Understanding the legal framework surrounding billing documents is essential for any business. Compliance with regulations not only protects your company but also ensures smooth transactions with clients. Different regions have specific rules regarding what must be included in such documents to make them valid and enforceable.

Essential Components

To ensure that your billing documents meet legal standards, it is important to include the following elements:

- Business Information: Your company name, address, and contact details must be clearly stated.

- Client Information: Include the name and address of the recipient to whom the document is directed.

- Date of Issue: Clearly indicate when the document was generated, which is critical for tracking payment timelines.

- Unique Identification Number: Assign a unique reference number to each document for easy tracking and record-keeping.

- Description of Goods or Services: Provide a detailed breakdown of the products or services rendered, including quantities and prices.

- Payment Terms: Clearly outline the payment terms, including due dates, late fees, and acceptable payment methods.

Regulatory Considerations

Different jurisdictions may have additional requirements. It is advisable to familiarize yourself with local regulations to ensure compliance:

- Tax Information: Ensure that any applicable taxes are included and that you provide the necessary tax identification numbers if required.

- Retention Period: Be aware of how long you are legally required to keep billing documents for record-keeping and potential audits.

By adhering to these legal requirements, businesses can enhance their credibility and reduce the risk of disputes with clients, ensuring a more professional approach to financial transactions.

Tips for Tracking Paid Invoices

Maintaining an organized system for monitoring settled financial documents is crucial for any business. Efficient tracking not only aids in cash flow management but also helps in reconciling accounts and preparing for tax obligations. Implementing effective strategies can simplify the process and enhance overall financial oversight.

Utilize Accounting Software

Investing in reliable accounting software can significantly streamline the process of tracking payments. Here are some advantages:

- Automated Tracking: Most software solutions offer features that automatically update payment statuses, eliminating manual entries.

- Reporting Tools: These programs often come with reporting capabilities, allowing for easy access to financial summaries and payment histories.

- Alerts and Reminders: Set up notifications for upcoming due dates or when payments are received, ensuring that nothing falls through the cracks.

Establish a Clear System

Creating a well-defined process for tracking paid documents can enhance accuracy and efficiency:

- Color Coding: Use a color-coding system to categorize documents based on their payment status, making it easy to identify settled items at a glance.

- Regular Reconciliation: Schedule periodic reviews of your accounts to compare records with bank statements, ensuring everything aligns properly.

- Maintain Detailed Records: Keep comprehensive records of all transactions, including dates, amounts, and payment methods, to support tracking efforts.

By implementing these strategies, businesses can improve their tracking processes, resulting in better financial management and a clearer understanding of their cash flow situation.

Creating Invoices for Different Industries

Tailoring financial documents to meet the specific needs of various sectors is essential for ensuring clarity and professionalism. Each industry has its own unique requirements and standards, which should be reflected in the format and content of the billing statements. By understanding these nuances, businesses can enhance their communication with clients and facilitate smoother transactions.

For instance, the creative services industry may prioritize aesthetic appeal, incorporating vibrant designs and branding elements that reflect their artistic nature. In contrast, industries like construction may require detailed breakdowns of materials and labor to ensure transparency and proper budgeting. Additionally, sectors such as healthcare must adhere to stringent regulations regarding itemization and patient information confidentiality.

By customizing financial documents according to industry standards, businesses can not only improve their operational efficiency but also strengthen client relationships through clear and precise communication. Adapting these documents to fit the specific context of each sector can ultimately lead to better payment outcomes and customer satisfaction.

Comparison of Free and Paid Templates

When selecting documents for billing purposes, individuals and businesses often face the choice between complimentary and premium options. Both categories offer distinct advantages and disadvantages that can impact efficiency, customization, and overall user experience. Understanding these differences is crucial for making an informed decision tailored to specific needs.

Advantages of Complimentary Options

Complimentary options are typically accessible and easy to use, allowing users to quickly generate necessary paperwork without any upfront costs. These options can be a great starting point for new businesses or freelancers who are mindful of their budget. However, while they offer basic functionality, they often lack advanced features and customization possibilities.

Benefits of Premium Choices

On the other hand, premium options generally provide a wider array of features and enhanced customization capabilities. Users can often tailor the design and layout to better fit their branding and professional image. Additionally, premium documents may include better customer support and more regular updates, ensuring compatibility with the latest business practices. While they come at a cost, the investment can result in higher quality and greater satisfaction in the long run.

Ultimately, the choice between complimentary and premium options will depend on individual circumstances, such as budget constraints and specific business needs. By carefully evaluating both choices, users can select the best solution to meet their operational requirements.

How to Convert Invoices to PDF

Transforming billing documents into a universally accepted format is essential for sharing and storing essential records securely. The process of conversion is straightforward and can be accomplished using various methods, ensuring that the final product maintains its original layout and content integrity. Below are some common approaches to achieve this task efficiently.

| Method | Description |

|---|---|

| Using Built-in Features | Most applications allow users to export or save documents directly as PDF files. Simply select the “Save As” or “Export” option and choose PDF as the desired format. |

| Online Conversion Tools | Numerous online platforms enable users to upload their documents and convert them into PDFs without the need for software installation. These services often support various file types and provide quick results. |

| PDF Printer Software | Installing a virtual printer that converts documents into PDF format can be beneficial. Once set up, users can print any document to the PDF printer, resulting in a digital copy saved in the desired format. |

| Mobile Applications | For those on the go, many mobile applications can convert files to PDF. Users can simply open the document within the app and choose the conversion option to generate a PDF file instantly. |

By utilizing one of these methods, individuals and businesses can ensure their documents are easily shareable and professionally presented in a format that is widely recognized.

Organizing Your Invoices Efficiently

Maintaining a well-structured approach to managing billing documents is crucial for any business. An organized system not only saves time but also enhances productivity and ensures accuracy in financial tracking. Here are some effective strategies to streamline the organization of your financial records.

Creating a Filing System

A clear and systematic filing method can greatly improve accessibility to important documents. Consider implementing the following practices:

| Filing Method | Description |

|---|---|

| Chronological Order | Arrange documents by date, making it easier to track payments and outstanding amounts. |

| Client-Based Organization | Group records by customer, allowing for quick reference to past transactions and history. |

| Project or Service Categories | Sort documents according to the type of work or services provided, aiding in budget analysis and reporting. |

| Digital vs. Physical Storage | Decide whether to maintain physical copies, digital files, or a combination of both, ensuring that you have backups available. |

Utilizing Software Solutions

Leveraging technology can significantly enhance your ability to manage billing documents effectively. Consider these options:

- Accounting Software: Use dedicated programs that automatically categorize and store documents based on defined criteria.

- Cloud Storage: Employ cloud-based solutions for easy access and sharing of records, along with robust backup options.

- Automated Reminders: Implement systems that notify you of upcoming deadlines for payments and follow-ups, preventing oversight.

By establishing an organized framework and utilizing available tools, businesses can ensure their financial documentation is managed efficiently, leading to better financial health and operational success.

Using Digital Tools for Invoicing

Embracing technology in managing billing processes can lead to increased efficiency and reduced errors. Various digital solutions offer streamlined approaches for creating and sending financial documents, making it easier to track payments and maintain accurate records. Here are some advantages and options for leveraging digital tools in your financial management.

Benefits of Digital Solutions

- Time Efficiency: Automated systems can significantly reduce the time spent on manual entries and calculations.

- Improved Accuracy: Digital tools minimize human errors through automated calculations and predefined templates.

- Enhanced Tracking: Easily monitor outstanding payments and generate reports to analyze cash flow.

- Professional Appearance: Present polished, professional documents that enhance your brand image.

Types of Digital Tools

When considering digital options for managing your financial documents, explore the following categories:

- Accounting Software: Comprehensive platforms like QuickBooks or FreshBooks allow for integrated management of expenses, revenue, and billing.

- Online Billing Services: Services such as PayPal or Stripe provide simple interfaces for creating and sending requests for payment directly to clients.

- Cloud-Based Solutions: Platforms like Google Drive or Dropbox enable secure storage and easy sharing of documents, enhancing collaboration.

- Mobile Apps: Many services offer apps that allow you to create and manage financial documents on the go, providing flexibility and convenience.

By incorporating these digital tools into your workflow, you can optimize the management of your financial documents, resulting in greater efficiency and professionalism in your operations.

Gathering Customer Information for Invoices

Collecting accurate and comprehensive details about clients is essential for creating effective billing documents. This information not only facilitates a smooth transaction process but also ensures that all necessary elements are present for proper record-keeping and compliance. Understanding what data to gather can help streamline your billing workflow and enhance customer satisfaction.

Essential Customer Details

When preparing to issue requests for payment, it is important to gather the following information:

- Client Name: Ensure you have the correct legal name of the individual or organization to avoid any confusion.

- Contact Information: Collect email addresses and phone numbers to facilitate communication and follow-up regarding payments.

- Billing Address: This information is crucial for determining the appropriate sales tax and ensuring that documents reach the right destination.

- Payment Terms: Clearly define the agreed-upon payment schedule, including due dates and late fees, to set expectations for both parties.

Best Practices for Data Collection

To efficiently gather this information, consider the following practices:

- Use Online Forms: Implement digital forms on your website or through email to make it easy for clients to submit their details.

- Maintain Updated Records: Regularly review and update customer information to avoid discrepancies and ensure accuracy.

- Communicate Clearly: Explain to clients why this information is necessary, emphasizing how it benefits both parties in the transaction process.

By focusing on collecting the right customer information, you can enhance your billing efficiency and foster a professional relationship with your clients.