Customizable Word Tax Invoice Template for Your Business

When managing a business, maintaining clear and organized financial records is essential. One of the most important documents in any business transaction is the billing statement that outlines services rendered or products delivered. Ensuring that these documents are accurate, professional, and easy to understand helps establish credibility and promotes smooth transactions with clients.

Using a customizable document format for generating these records can simplify the process. By choosing a well-structured format, you can create consistent and effective billing statements tailored to your business needs. This method saves time and ensures that each document meets legal and professional standards.

Designing your own billing documents allows for greater flexibility. You can modify key details such as payment terms, dates, or company information to suit each specific transaction. Additionally, having a pre-designed structure reduces errors and ensures compliance with accounting practices.

Understanding Word Tax Invoice Templates

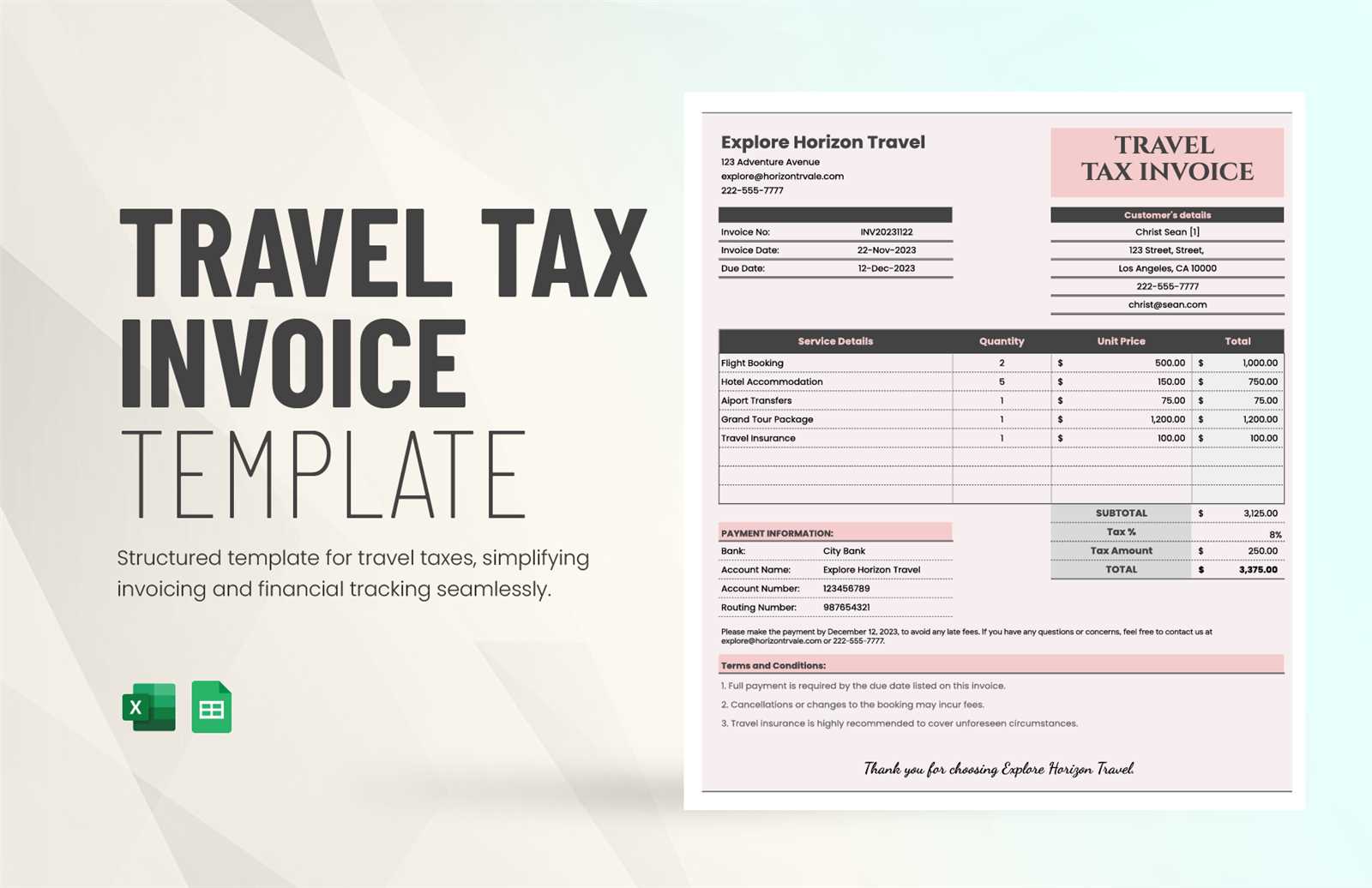

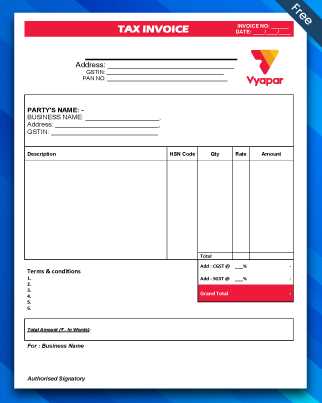

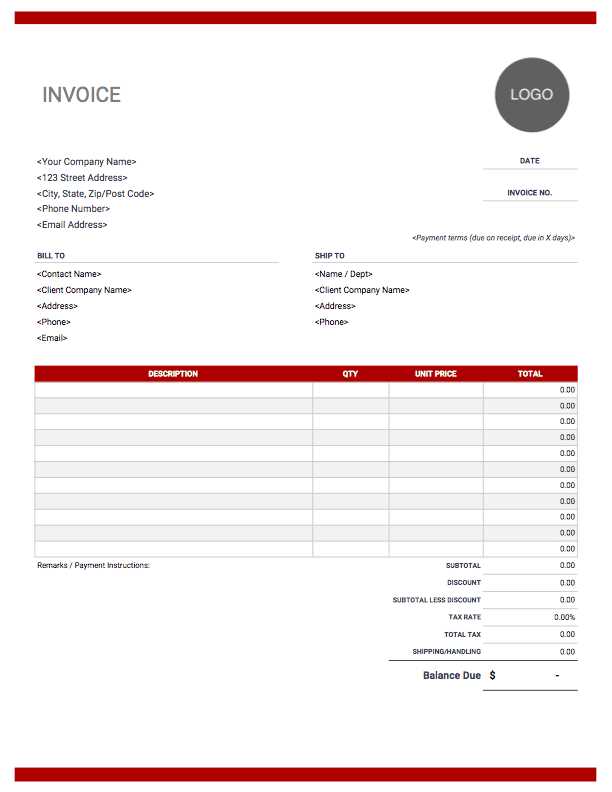

In any business, proper documentation is vital to ensure transparency and accuracy in financial transactions. One key element of this documentation is the structured format used for billing. A well-organized layout allows businesses to easily communicate the details of a transaction, including amounts due, service descriptions, and payment terms, to clients. This structure is often pre-designed, offering flexibility and consistency in each document issued.

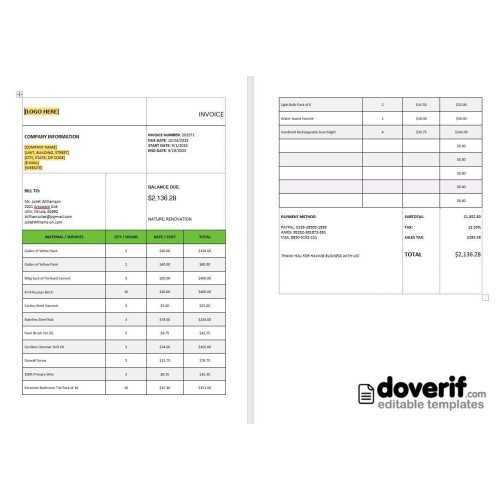

By using a pre-made design for your billing documents, you save time while maintaining a professional appearance. These documents are highly customizable, allowing you to add or remove specific fields to fit the needs of your business. You can also incorporate company logos, contact information, and other important details to make the document reflect your brand identity.

Key Features of a Billing Document Format

The structure of these files often includes several essential fields that must be filled in to ensure clarity and completeness. Below is a typical example of the fields you may encounter:

| Field | Description |

|---|---|

| Business Name | The name of the company or individual issuing the statement. |

| Client Information | Details about the client, such as their name and contact details. |

| Date | The date when the transaction took place or when the document is issued. |

| Itemized List | A detailed list of the products or services provided, along with the amounts due. |

| Total Amount | The total amount that the client needs to pay, including any applicable taxes or fees. |

| Payment Terms | Details of when the payment is due and any late fees that may apply. |

Advantages of Using a Pre-Designed Structure

One of the main advantages of using a pre-made design for billing documents is efficiency. With a standardized layout, businesses can quickly generate professional documents without worrying about formatting each time. Additionally, these designs ensure that all necessary fields are included, reducing the chances of omitting important details that could lead to confusion or disputes with clients.

Why Use a Tax Invoice Template

Efficient document creation is essential for any business, especially when managing customer transactions. Having a ready-made design for billing records simplifies the process, saves time, and ensures consistency. By using a pre-structured layout, businesses can streamline the creation of essential documents and maintain a professional approach to financial management.

Here are some key reasons to consider using a pre-built format for your billing documents:

- Time-saving: Quickly generate professional documents without having to design the layout each time.

- Consistency: Maintain a uniform look across all customer communications, which strengthens your brand image.

- Accuracy: Ensure that all necessary fields are included, minimizing the risk of errors or omissions in important details.

- Customization: Easily modify the design to suit your business needs, whether you’re adding new fields or adjusting the layout.

- Legal Compliance: Standardized formats help ensure that your documents comply with local regulations and industry standards.

By using an established structure for your billing records, you ensure a smoother workflow and reduce the chances of mistakes, leading to better client relationships and faster payments.

Benefits of Customizing Your Invoice

Personalizing your billing documents offers several advantages that go beyond simply listing the amounts due. A customized approach allows you to tailor each record to meet the specific needs of your business and your clients. This flexibility not only enhances the professionalism of your communications but also improves the overall customer experience.

Here are some key benefits of creating personalized billing statements:

- Brand Consistency: Customizing your documents allows you to incorporate your logo, colors, and branding elements, making your communications instantly recognizable to your clients.

- Clear Communication: Personalizing the layout and content ensures that all necessary information is clearly presented, reducing the chance of misunderstandings or disputes.

- Improved Client Relations: A tailored document shows attention to detail, which can enhance customer satisfaction and foster stronger business relationships.

- Efficiency: By including all relevant fields and removing unnecessary elements, you can streamline your billing process and reduce time spent on administrative tasks.

- Compliance: Customizing your records to meet specific industry or legal requirements ensures that your documents comply with local regulations.

Customizing your billing statements helps set your business apart, making your documentation both functional and reflective of your company’s identity.

How to Download a Word Template

Accessing and downloading a ready-made format for your billing documents is a straightforward process that can save you significant time and effort. These pre-designed files are available from a variety of online sources, making it easy to choose the one that best fits your business needs. Once downloaded, you can customize it to suit your specific requirements, ensuring a consistent and professional look for all future records.

Step-by-Step Guide to Downloading a Document Format

To download a customized structure for your business records, follow these simple steps:

- Search for a Suitable Source: Look for reputable websites or platforms that offer free or paid options for document layouts.

- Choose the Right Format: Select the one that matches your business style, industry needs, and any legal requirements you may have.

- Download the File: Once you’ve found the right format, click the download link to save it to your device.

- Open the File: After downloading, open the file in your preferred software to begin customization.

What to Expect After Downloading

Once you have downloaded your document layout, you can expect to see a file with predefined fields and sections for easy data input. Below is an example of what the document structure may look like:

| Field | Description | ||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Company Name | Your business name, often at the top of the document for easy identification. | ||||||||||||||||||||||||||||||||||||||

| Client Information | Spaces to input client details such as name, address, and contact details. | ||||||||||||||||||||||||||||||||||||||

| Tip | Description |

|---|---|

| Use Clear Headings | Divide your document into logical sections with clear headings to make it easy to navigate and find relevant information. |

| Consistent Font Style | Choose a readable, professional font such as Arial or Times New Roman and use consistent sizing for a clean look. |

| Align Text Properly | Ensure that all text is aligned correctly. Typically, the business and client information should be aligned to the left, while monetary values should be aligned to the right. |

| Incorporate Tables for Clarity | Use tables to clearly display itemized lists of products or services, quantities, prices, and totals. |

| Leave Space for Customization | Ensure there is enough room for inputting specific details like dates, client names, and item descriptions. This flexibility is key for personalized records. |

By using these formatting strategies, you can create a professional-looking document that clearly communicates all essential details of the transaction, ensuring smooth and transparent business dealings.

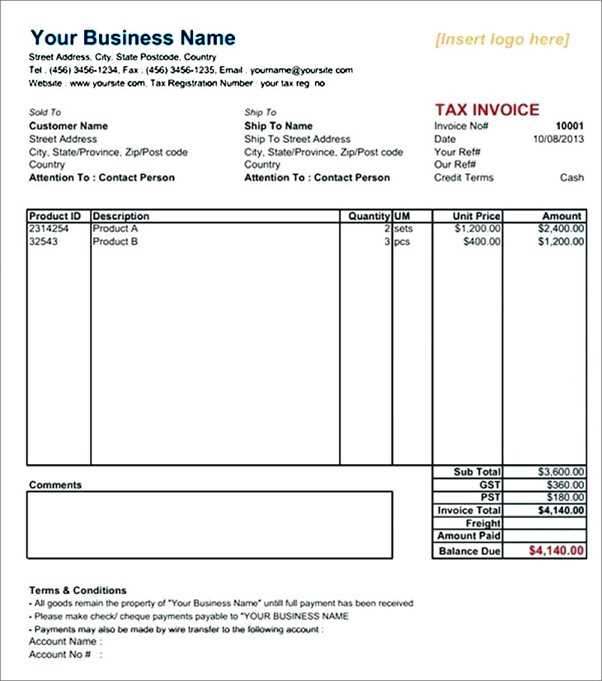

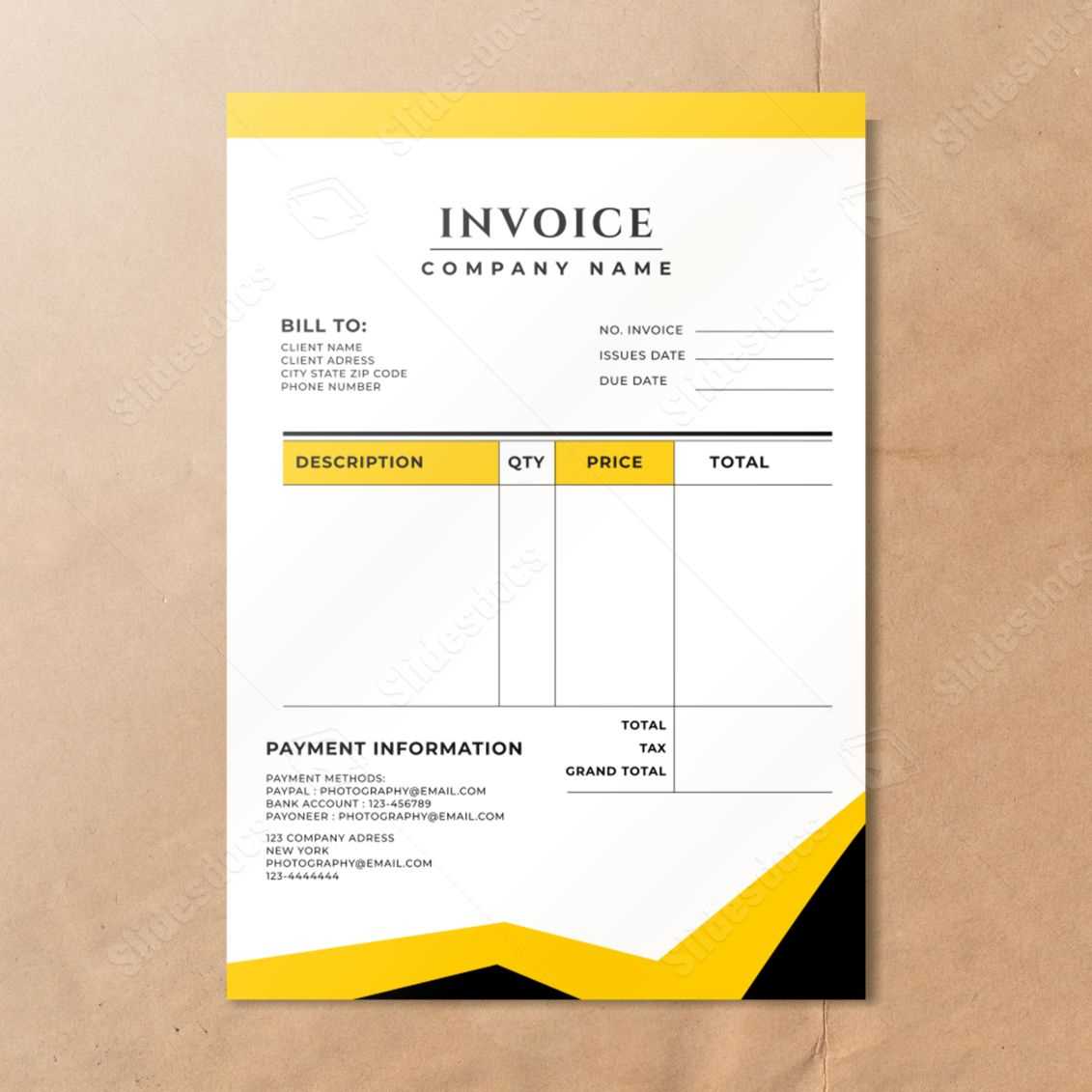

How to Add Business Information

Including detailed business information in your billing document is essential for proper identification and communication. This section ensures that the recipient knows exactly who the document is from and provides the necessary details to contact the company if needed. Properly adding this information helps maintain professionalism and compliance with legal or regulatory requirements.

Key Details to Include

When adding business information to your document, make sure to include the following essential elements:

- Business Name: Clearly display your official company name at the top of the document for easy identification.

- Business Address: Include the physical or mailing address of your business so the client knows where to send correspondence or payments.

- Contact Information: Provide an email address, phone number, or other relevant contact details to facilitate communication.

- Tax Identification Number (TIN): If required by local law, include your tax ID or business registration number to ensure compliance.

- Website or Online Presence: Including your website or social media links is optional but can be helpful for clients seeking more information about your services or products.

Where to Place Business Information

The business information should typically appear at the top of the document, in a prominent position. This allows clients to quickly identify who the document is from. You can align it to the left or center, depending on the layout of your document. The key is to make it easy to spot and ensure the client can easily reach you if needed.

By properly adding your business details, you create a professional image and ensure that your client has all the necessary information to proceed with the transaction.

Setting Up Invoice Numbering

Creating a clear and consistent numbering system for your billing documents is essential for both organization and tracking. A well-structured numbering system helps you maintain accurate records and ensures that each document is easily identifiable. It also plays a key role in avoiding confusion, especially when handling multiple transactions or when clients request a particular document from your past records.

When setting up a numbering system, consider the following points:

- Sequential Numbering: Assign numbers in a simple sequential order (e.g., 001, 002, 003). This method ensures that each document is unique and easy to track chronologically.

- Include the Year or Date: Including the year or date as part of the numbering system (e.g., 2024-001) can make it easier to locate records for specific time periods, especially for tax and accounting purposes.

- Keep It Simple: Avoid overly complex numbering systems that could cause confusion. Stick to simple numbers or a combination of numbers and letters that are easy to read and remember.

- Unique Codes: For businesses with high volumes of transactions, using a more complex code, such as incorporating department codes or client-specific identifiers, can help you further organize your records.

By using a clear and simple numbering system, you create a streamlined process for issuing and managing documents, reducing the chances of errors and enhancing the overall efficiency of your business operations.

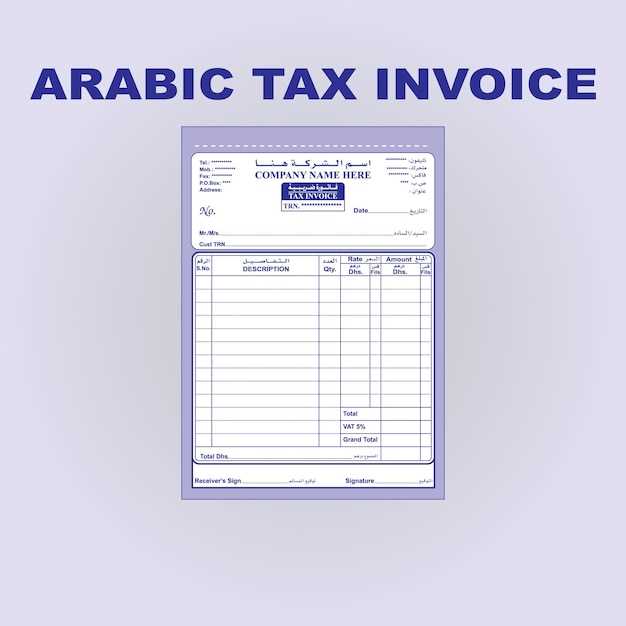

Including Tax Rates on Invoices

Clearly displaying the applicable tax rates on your billing documents is essential for ensuring transparency in your business transactions. Whether you are charging sales tax or another type of fee, it’s crucial to clearly outline these charges so that the recipient knows exactly what they are paying for. Including this information helps prevent misunderstandings and ensures that you comply with local regulations.

How to Calculate Tax Rates

When applying tax rates, it’s important to calculate them accurately based on the applicable laws for your location or the client’s jurisdiction. Typically, you should follow these steps:

- Determine the Tax Rate: Research and apply the correct tax rate based on the region or country in which the transaction occurs.

- Calculate the Amount: Multiply the taxable amount (before tax) by the applicable rate. For example, if the rate is 10% and the total amount before tax is $100, the tax would be $10.

- List the Tax Separately: Clearly display the tax amount as a separate line item on the billing document, so the client can easily distinguish the tax from the subtotal.

Best Practices for Displaying Tax Information

To ensure clarity and accuracy, follow these best practices when including tax rates in your billing records:

- Label Tax Rates Clearly: Use clear labels such as “Sales Tax” or “VAT” next to the applicable amount to avoid confusion.

- Break Down the Calculation: If you are charging multiple taxes, list each tax type and its corresponding rate. This ensures that the client understands exactly what they are paying.

- Include Tax Registration Numbers: In some cases, especially for businesses operating internationally, it may be necessary to include your tax registration number on the document for compliance purposes.

By following these practices, you ensure that the recipient can easily understand the tax applied, and you remain transparent and compliant with the relevant tax laws.

Adding Payment Terms to Invoices

Clearly outlining payment expectations in your billing documents is essential for maintaining a smooth and professional transaction process. Including specific payment terms helps both you and your clients understand the due dates, methods of payment, and any late fees that may apply. These terms protect both parties and ensure there is no confusion about the financial obligations associated with the transaction.

Essential Elements of Payment Terms

When adding payment terms, make sure to include the following key details:

- Due Date: Clearly state when the payment is due. This could be a specific date (e.g., “Due on 15th of each month”) or a time frame (e.g., “Net 30” means payment is due 30 days after the document date).

- Accepted Payment Methods: Specify which forms of payment you accept, such as bank transfers, credit card payments, or digital wallets.

- Late Fees: If applicable, outline any penalties for late payments, such as a fixed fee or a percentage added to the overdue amount.

- Early Payment Discounts: Offer incentives for early payments, such as a small discount if the bill is paid before the due date.

Where to Place Payment Terms

Payment terms should be clearly visible on your document, ideally near the bottom, just above the total amount due. This ensures the recipient sees the terms after reviewing the items and costs, but before making the payment. Some businesses also choose to highlight payment terms with bold text or a different color to make them stand out.

By setting clear and concise payment terms, you help ensure that the transaction proceeds smoothly, with no misunderstandings or delays in payment.

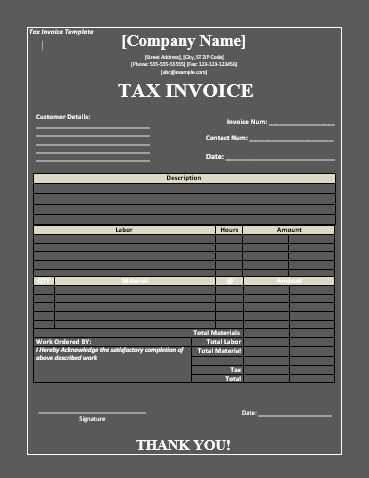

Using Your Template for Different Clients

Customizing your billing documents to suit the specific needs of different clients is a key element in maintaining professionalism and clarity in your business transactions. A flexible design allows you to make adjustments as needed, ensuring that each client receives a document that reflects their particular terms and requirements. This approach helps foster strong client relationships while maintaining consistency and efficiency in your accounting processes.

Here are some essential strategies to consider when using your document design for various clients:

- Client-Specific Branding: Adjust the branding elements, such as logos, colors, and contact information, to align with the preferences or guidelines of each client. This makes the document feel more personalized and tailored to their needs.

- Different Payment Terms: Different clients may have different payment expectations. Customize the payment terms section based on what has been agreed upon for each client, such as varying due dates or discounts for early payment.

- Special Notes or Instructions: If there are any client-specific instructions, include them in the document. This could be additional product details, delivery information, or custom service agreements.

- Multiple Languages: If you work with international clients, consider creating versions of your document in different languages to cater to your client’s preferences or regulatory requirements.

By adjusting the content and layout for each client, you create a more personalized experience while ensuring that your business is represented professionally across all your transactions. This level of customization reflects positively on your attention to detail and commitment to excellent service.

| Client Type | Custom Features |

|---|---|

| Domestic Clients | Standard payment terms, localized branding |

| International Clients | Multiple language options, custom payment methods |

| Repeat Customers | Discounts, loyalty programs, customized services |

Automating Recurring Invoices with Word

Automating your regular billing process can save valuable time and reduce the chances of human error. By setting up recurring documents, you can ensure that your clients are billed consistently without needing to manually create each new record. This method not only improves efficiency but also ensures that all payments are processed on time, contributing to smoother financial operations.

While many invoicing software solutions offer automated billing, you can also set up recurring documents using basic tools like a word processor. By utilizing a pre-designed layout, you can quickly adapt it for each billing cycle with minimal effort. Here’s how you can streamline this process:

- Save a Base Document: Create a master version of your billing document that includes all the standard details. This will serve as your template for all future billing cycles.

- Customize for Each Cycle: Adjust specific details, such as dates, amounts, and other variable information, before sending the document out. This can be done easily by saving the document with a new name for each period.

- Set Reminders: Use calendar tools or reminders within your system to alert you when the next cycle is approaching. This will help you maintain consistency and ensure that documents are sent out on time.

Automating recurring billing in this way reduces administrative tasks and enhances your ability to manage large volumes of transactions. It is an easy yet effective way to streamline operations, ensuring that your clients receive timely and accurate records every billing cycle.

How to Save and Share Invoices

Efficiently managing and distributing billing records is an essential part of maintaining clear financial documentation. Storing and sharing these documents correctly ensures that you have easy access to important information and that your clients receive accurate details in a timely manner. Whether you’re sending them by email or saving them for later reference, knowing how to properly save and share your documents will help streamline your business operations.

Here are a few best practices for saving and distributing your billing documents:

- Organize Your Files: Keep a systematic folder structure for storing your records. Group them by client name, date, or project to ensure that you can easily retrieve specific documents when needed.

- Save in PDF Format: Converting your document to a PDF ensures that the layout and formatting remain intact when sharing with clients. PDFs are widely accepted and provide a professional appearance.

- Cloud Storage for Easy Access: Use cloud storage solutions such as Google Drive, Dropbox, or OneDrive to store your documents securely. This allows you to access them from anywhere and share them with clients effortlessly.

- Emailing and Sharing Links: Once your document is saved, you can attach it to an email or share a link directly from your cloud storage, providing your clients with quick access to the necessary details.

By properly saving and sharing your billing records, you can ensure that your financial documents are both accessible and professionally handled, reducing any potential confusion or delays in payment.

| Method | Advantages |

|---|---|

| PDF Format | Preserves formatting, widely accepted |

| Cloud Storage | Easy access, secure, shareable links |

| Quick distribution, direct communication |

Common Mistakes to Avoid in Invoices

Creating accurate billing records is essential for smooth financial transactions and maintaining a professional reputation. Small errors can cause confusion, delays in payment, or even damage client relationships. By being aware of the most common mistakes, you can ensure that your documents are clear, correct, and effective.

Here are some common mistakes to avoid when creating billing documents:

- Incorrect Dates: Failing to include the correct billing date or payment due date can lead to misunderstandings and delayed payments. Always ensure that both dates are accurate.

- Missing Contact Information: It’s important to include all necessary contact details, such as your business name, address, and phone number. Missing contact info can delay communication and payment processing.

- Unclear Item Descriptions: Lack of clarity in the services or goods provided can cause confusion. Be specific in describing what was delivered to avoid disputes later on.

- Incorrect Amounts: Double-check the numbers, including totals, taxes, and any discounts applied. Simple math errors can create discrepancies that delay payment.

- Omitting Payment Terms: Clearly state payment terms, including due dates, accepted methods of payment, and any penalties for late payments. Failing to do so can lead to payment delays.

By avoiding these mistakes, you ensure that your billing documents are clear, professional, and facilitate prompt payments from clients.

| Error | Consequence |

|---|---|

| Incorrect Dates | Delays in payment and confusion |

| Missing Contact Information | Difficulty in communication and delayed payments |

| Unclear Descriptions | Disputes over delivered goods or services |

| Incorrect Amounts | Discrepancies causing delays in payment |

| Omitting Payment Terms | Unclear expectations, leading to late payments |

Updating Your Template for New Tax Laws

As laws and regulations surrounding financial documentation evolve, it’s crucial to ensure that your billing records are in compliance with the latest requirements. Changes in tax policies, rates, and reporting standards can impact the structure and content of your documents, and keeping your formats up to date is key to avoiding legal issues and maintaining accuracy.

Adapting your records to meet new guidelines may require incorporating additional fields, adjusting existing ones, or modifying how information is displayed. Here are a few important steps to ensure your records remain compliant:

1. Review Legislative Changes Regularly

It’s essential to stay informed about any updates to the financial laws relevant to your industry. Whether it’s a change in rates, new categories for exemptions, or different rules on how to report fees, regularly checking official sources ensures your documents reflect the most current laws.

2. Adjust Document Structure

New regulations might require specific information to be included or reformatted. For example, additional tax identification numbers, updated exemption categories, or different tax rate structures might need to be added. By adjusting the structure of your billing records in line with these changes, you maintain compliance and avoid any potential errors in the future.

By keeping your financial documentation systems updated, you ensure that your business operations are in line with legal standards and that you provide your clients with accurate, legally compliant records every time.

Why Word Is Ideal for Invoices

When creating professional documents for business transactions, it’s important to use a tool that allows flexibility, precision, and ease of use. One such tool is a popular word processing software, which offers numerous features that make it an excellent choice for generating formal business records. These records require accurate formatting, consistent structure, and the ability to easily adapt to changing needs–features that this software excels in.

One of the main reasons this program is ideal for business documents is its user-friendly interface. The layout options are simple to navigate, making it easy to format and organize important details such as dates, amounts, and client information. Additionally, its wide array of formatting tools ensures that all necessary components can be included in a clear, professional manner.

Another key advantage of using this software is its compatibility with a variety of file types, which ensures that your documents can be shared effortlessly across different devices and platforms. Whether you need to send your records by email or print them for physical distribution, this software makes it simple to save and share files in several formats, all while maintaining a polished and uniform appearance.

With these features, it’s easy to see why many businesses rely on this software to create effective and legally compliant business records. Whether you’re managing a small operation or a larger enterprise, it provides all the tools necessary for professional documentation with minimal effort.

Tips for Professional-Looking Invoices

Creating polished and well-organized business documents is essential for maintaining a professional image. These records not only serve as a way to request payment but also reflect your company’s attention to detail and credibility. Whether you are new to business or an experienced entrepreneur, there are a few key practices to follow in order to produce a sleek, professional-looking document every time.

Maintain a Clean and Structured Layout

One of the most important factors in creating a professional-looking record is ensuring the layout is clear and easy to read. A cluttered or chaotic document can leave a negative impression on clients. Start by organizing essential information in a logical order, such as client details, transaction specifics, and payment terms. Use headings, lines, and white space to separate sections, making it visually appealing and straightforward to navigate.

Use Consistent Branding

Consistency is key when presenting your business to clients. Incorporating your company logo, colors, and font style throughout the document adds a personalized touch. By aligning your documents with your brand, you create a sense of familiarity and professionalism. This helps establish trust and makes your company memorable to clients.

By following these tips, you can create documents that not only convey the necessary financial information but also enhance the perception of your business as organized and professional. A well-crafted business record speaks volumes and sets the tone for positive client relationships.

Managing Invoices Efficiently with Templates

Streamlining business processes is crucial for maintaining organization and reducing administrative workload. One of the most effective ways to manage client records and billing is by using pre-designed forms. These pre-structured documents help ensure accuracy and consistency, allowing businesses to save time and avoid mistakes. Instead of starting from scratch each time, using a ready-made structure simplifies the process and enhances efficiency.

By using structured documents, you can:

- Ensure all necessary details are included, such as company name, payment terms, and amounts.

- Quickly generate professional-looking documents without the need to manually create the layout each time.

- Maintain consistency across all records, reinforcing a professional image to clients.

- Save valuable time by eliminating repetitive tasks and focusing on important business functions.

Managing your client records efficiently can significantly improve cash flow and reduce errors. With the help of these pre-arranged forms, you are empowered to focus on growing your business while maintaining a streamlined approach to financial documentation.