Customizable Word Invoice Template with Formulas for Easy Billing

Managing financial transactions and maintaining accurate records is essential for any business. One of the most crucial tasks in this process is preparing clear and precise documents to request payment. While manual calculations can be time-consuming and prone to error, modern tools allow for quick and reliable document creation.

By using a customizable document structure, anyone can generate professional-looking statements in just a few steps. Built-in calculation features eliminate the need for external software, streamlining the billing process. This approach not only saves time but also ensures that all figures are accurate, helping businesses maintain trust and transparency with clients.

In this guide, we’ll explore how you can easily set up a customizable document for your billing needs, ensuring both efficiency and professionalism. Whether you’re a freelancer or running a larger company, learning how to optimize these tools can significantly improve your workflow.

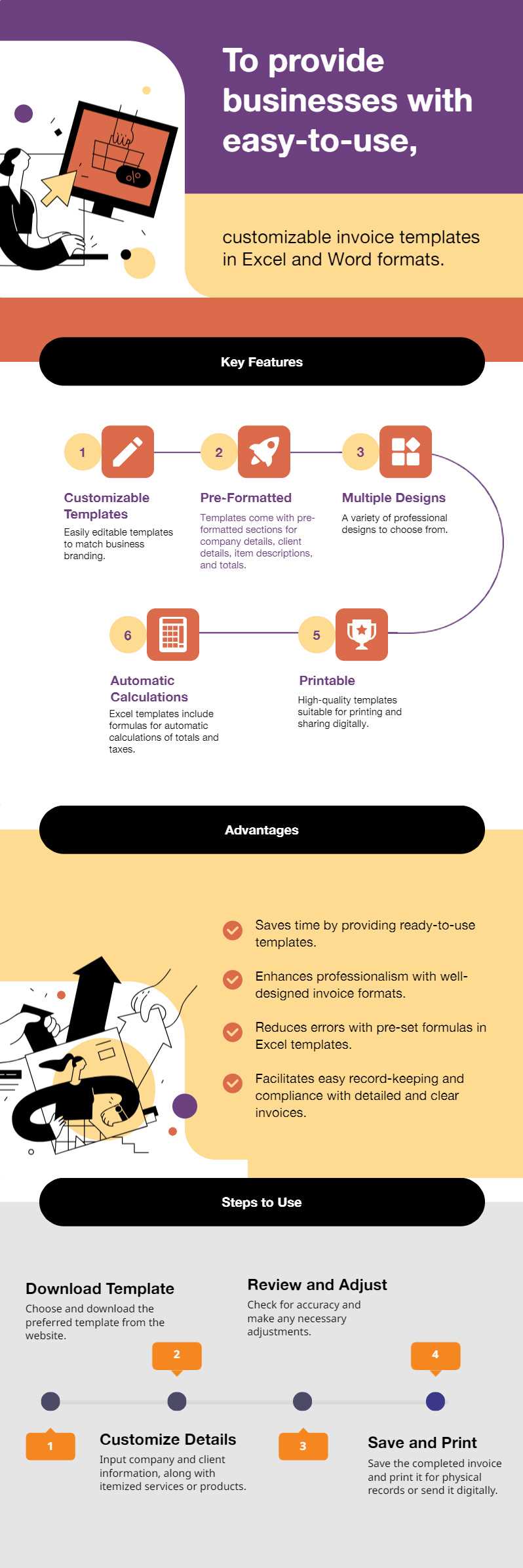

Benefits of Using Invoice Creation Tools

Efficient billing is essential for any business, and choosing the right tools can make the process faster and more accurate. Customizable document structures allow users to easily generate professional statements, saving both time and effort. The built-in features enhance the quality of the document while simplifying the creation process. Below are some key advantages of using such solutions.

Time Savings and Automation

One of the primary benefits of using automated billing structures is the significant amount of time saved. When calculations are done automatically, it reduces the likelihood of human error and eliminates the need for manual input of figures each time a payment request is made.

- Quick setup and ready-made formats

- Automatic calculations for totals, taxes, and discounts

- Instant creation of multiple documents without repetitive tasks

Professionalism and Accuracy

Generating accurate and polished financial documents helps businesses maintain a professional image. These tools allow for clear presentation and precision, enhancing trust with clients and partners. Furthermore, built-in calculation systems reduce the risk of mistakes in pricing or totals.

- Consistent design and format for all documents

- Automatic updates to values based on input changes

- Easy integration with accounting and management systems

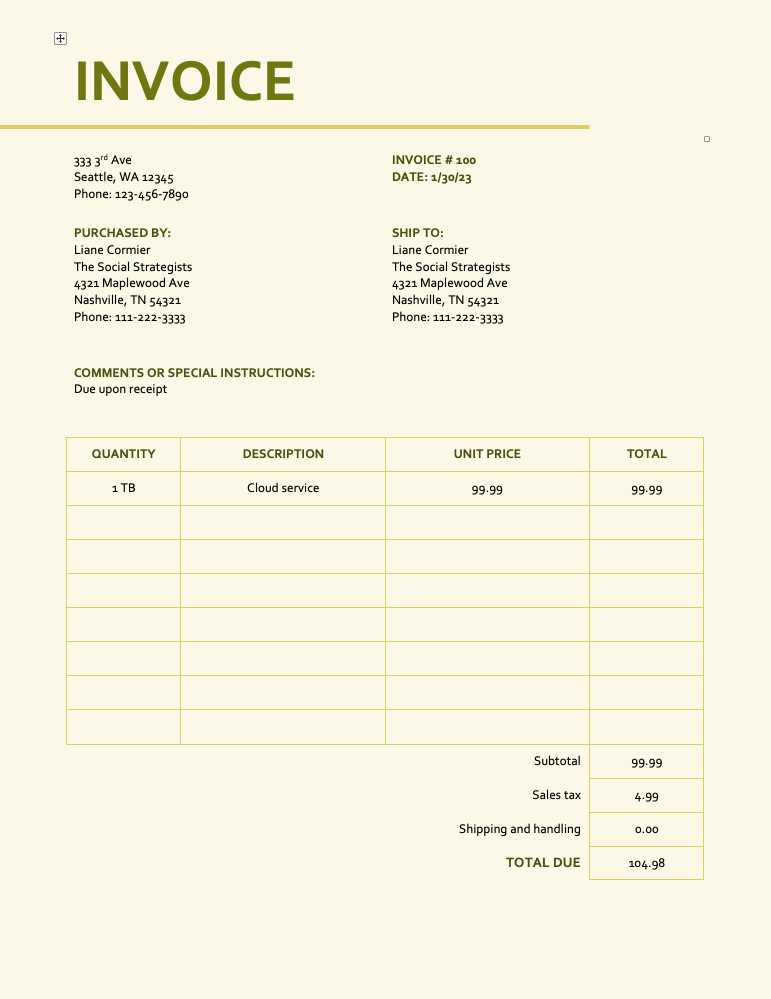

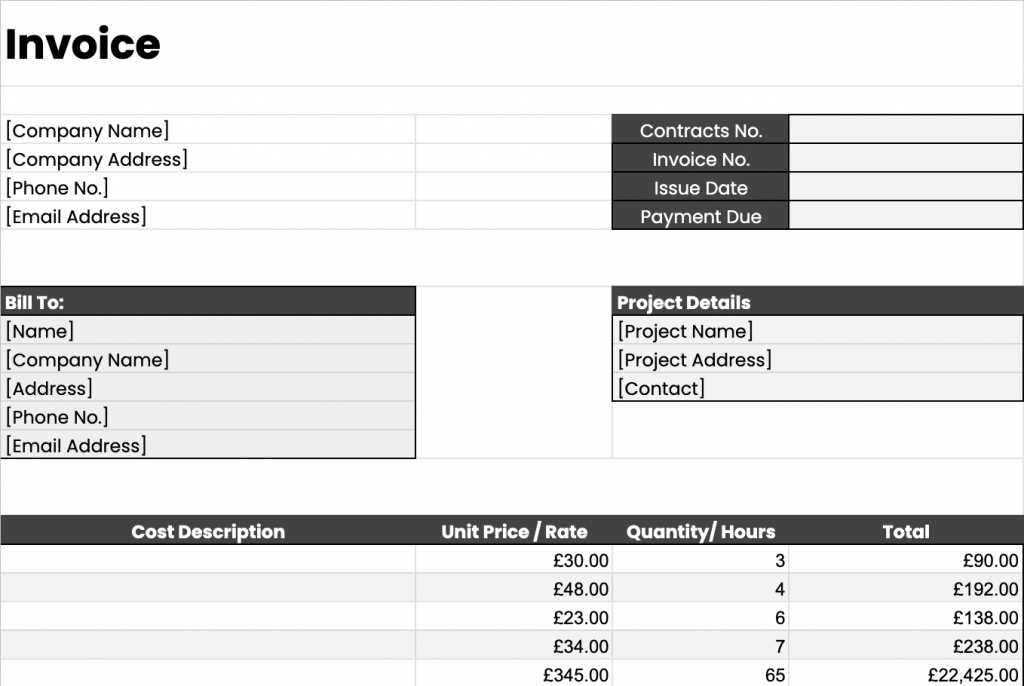

How to Create a Billing Document in Word

Creating a professional payment request doesn’t have to be complicated. By using the right structure, you can easily generate clear and accurate statements that reflect the details of your transaction. The following steps will guide you through the process of setting up an effective document for your business needs.

Step-by-Step Guide to Setting Up Your Document

Follow these simple steps to prepare your billing document:

- Open a new document in your chosen software.

- Choose a layout that suits your needs or create your own from scratch.

- Enter your business name, address, and contact information at the top.

- List the customer’s information, including name, address, and contact details.

- Include a unique reference number for the transaction.

- Provide a detailed list of the products or services, along with their corresponding prices.

- Insert fields for taxes, discounts, and total amounts due.

- Ensure the document is clear and easy to read, with a professional finish.

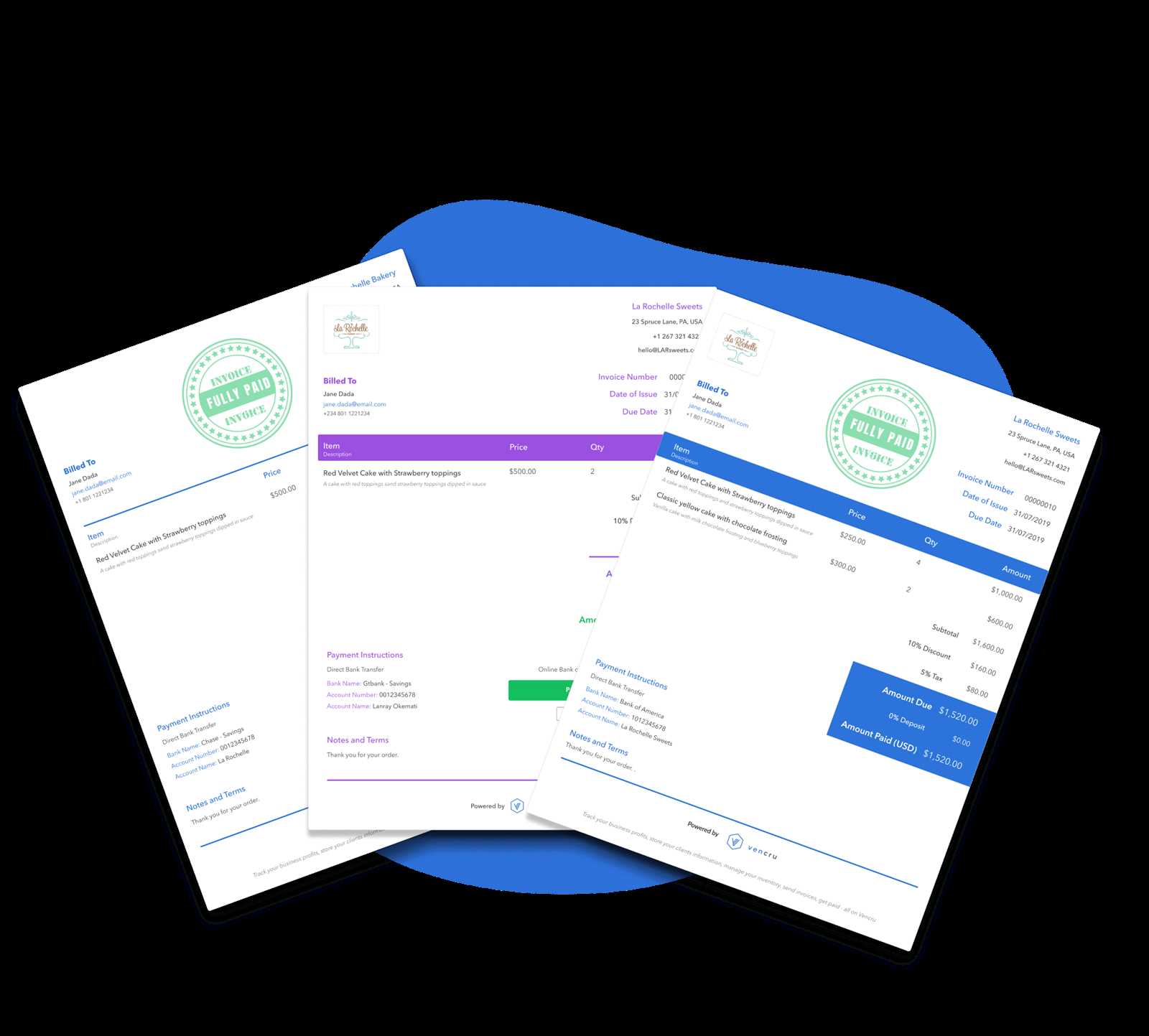

Customizing Your Document

Customization is key to making your billing document stand out. Here are a few options to personalize it:

- Use your company logo for a branded look.

- Adjust fonts and colors to match your business style.

- Add additional notes, such as payment terms or instructions, to clarify expectations.

- Incorporate tax and discount calculations to automatically update totals based on the input values.

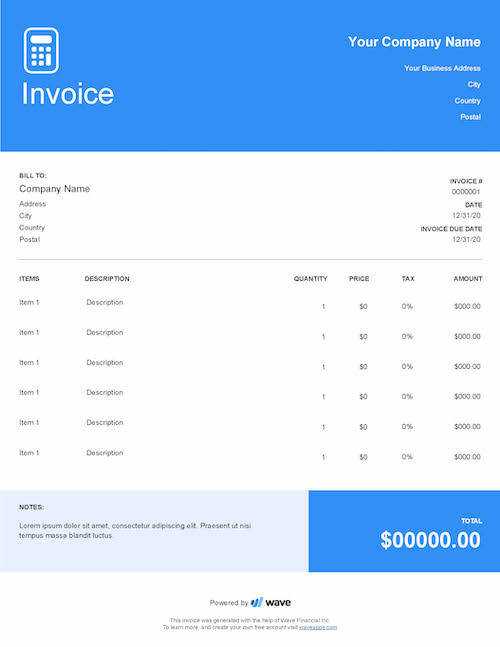

Top Features of a Billing Document Layout

When setting up a billing document, it’s important to utilize a structure that offers both flexibility and accuracy. A well-designed document layout ensures that essential information is clearly presented while allowing for easy updates and calculations. Below are some of the key features that make a document effective and user-friendly.

Key Functionalities for Efficiency

These are the essential elements that can enhance the functionality of your document:

- Automated Calculations: Built-in functions to automatically compute totals, taxes, and discounts, reducing manual effort and errors.

- Editable Fields: Easily adjustable spaces for inputting customer details, product descriptions, and pricing.

- Customizable Layout: Flexibility to modify fonts, colors, and arrangement to fit your branding and preferences.

- Pre-set Sections: Ready-made sections for important data like payment terms, due dates, and contact information, making document creation faster.

Design and Presentation Enhancements

In addition to functionality, a good document layout offers design features that improve the overall presentation:

- Professional Appearance: Clean, modern design elements that create a polished, business-like appearance.

- Clear Structure: Well-organized sections that allow for easy navigation and understanding of the payment request.

- Logo Integration: The option to add your company’s logo for a personalized touch and consistent branding.

- Multiple Currency Support: Ability to specify different currencies, which is especially useful for international transactions.

Step-by-Step Guide to Editing Billing Documents

Editing a payment request document is a straightforward process when you follow the right steps. By using a structured layout, you can easily adjust any details, ensuring the document reflects the most current and accurate information. Below is a simple guide to help you modify the fields and personalize your document efficiently.

Editing Basic Information

The first step in editing your document is updating the essential details:

- Enter Business Details: Update your company name, address, phone number, and email at the top of the document.

- Insert Client Information: Add the client’s name, address, and contact details in the designated section.

- Unique Reference Number: Ensure the document has a unique reference number for tracking purposes.

Updating Itemized List and Pricing

The next step involves reviewing and updating the list of items or services provided:

- Modify Product Descriptions: Adjust the descriptions of items or services to match what was actually provided.

- Update Quantities and Prices: Change quantities or pricing to reflect the correct amounts.

- Check Tax and Discount Values: Ensure that any tax rates or discount values are accurately calculated based on your business rules.

Final Adjustments and Saving

After making the necessary changes, finalize the document:

- Review for Accuracy: Double-check all fields, including totals, tax amounts, and client details.

- Save Your Document: Save the file in a format that works for your needs (e.g., .docx or .pdf).

- Share or Print: Send the document electronically or print it for physical distribution.

Customizing Your Billing Document for Business

Every business has unique needs when it comes to payment requests. Customizing your billing document ensures it aligns with your brand, improves client communication, and makes it easier to track transactions. Tailoring these documents can enhance your professional image and provide clarity to your customers, helping to avoid misunderstandings and delays.

Branding Your Document

Incorporating your brand into the design of your billing statement is a key way to make your documents look more professional and cohesive with other business materials. Here are a few customization options to consider:

- Logo: Add your company’s logo at the top of the document to reinforce your brand identity.

- Color Scheme: Choose colors that match your business’s visual style, ensuring consistency across all documents.

- Fonts: Use your brand’s fonts for a unified look across your website, marketing materials, and business correspondence.

Adding Business-Specific Details

Personalizing the content and structure of your document makes it more functional for your specific business needs:

- Payment Terms: Clearly state your payment expectations, including due dates, late fees, and accepted payment methods.

- Itemized Lists: Adjust the layout to showcase the goods or services you provide, adding relevant descriptions and quantities.

- Custom Fields: Add fields that reflect any additional information, such as project codes, order numbers, or specific discounts for loyal customers.

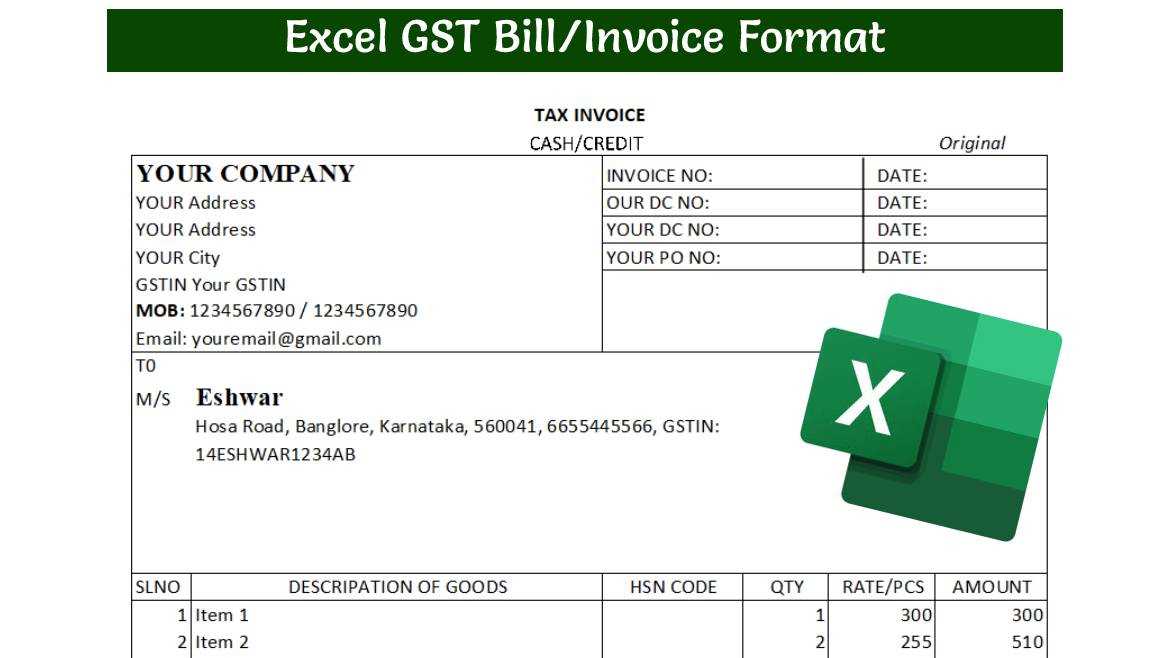

Using Formulas to Automate Calculations

One of the most powerful features of a billing document is the ability to automatically calculate totals, taxes, and discounts. By incorporating calculation functions, you can eliminate manual errors and save time. These built-in capabilities ensure accuracy and allow for quicker document creation, especially when dealing with multiple items or clients.

Here’s how automation can simplify your billing process:

| Item | Quantity | Unit Price | Total |

|---|---|---|---|

| Product A | 3 | $10.00 | =B2*C2 |

| Product B | 5 | $15.00 | =B3*C3 |

| Subtotal | =SUM(D2:D3) | ||

| Tax (10%) | =D4*0.10 | ||

| Total Due | =D4+D5 | ||

In the table above, the total cost for each product is calculated automatically by multiplying the quantity by the unit price. The subtotal is then calculated, followed by the tax amount, and finally the total amount due, all of which update automatically if any figures are changed. This system not only saves time but also ensures that the document remains error-free, even as values are modified.

How to Add Tax and Discounts in Your Billing Document

Including taxes and discounts in a payment request is essential for ensuring that the final amount due is calculated correctly. Automating these steps helps avoid errors and ensures transparency with your clients. By setting up proper fields for tax rates and discount calculations, you can simplify the billing process and maintain accuracy.

Here’s how you can add these elements to your document:

Adding Tax Calculations

To apply a tax to the total amount, follow these steps:

- Determine the Tax Rate: Know the percentage that applies to the total amount (e.g., 10%, 15%, etc.).

- Create a Tax Row: Add a new row beneath the subtotal section to calculate tax.

- Apply the Formula: Use a multiplication function to calculate the tax (e.g., total * tax rate).

For example, if your subtotal is $100 and the tax rate is 10%, the tax amount would be calculated as: =subtotal * 0.10.

Including Discounts

Applying discounts is just as simple and can also be automated:

- Identify the Discount Percentage: Determine whether you are offering a flat discount or a percentage off the total.

- Insert Discount Row: Add a row for the discount either above or below the tax section.

- Apply Discount Formula: For a percentage discount, subtract the discount from the subtotal (e.g., subtotal * discount rate).

For instance, if you’re offering a 10% discount on a $100 subtotal, the formula would be: =subtotal * 0.10.

Final Adjustments

After calculating tax and discounts, you can update the final amount due by adjusting the totals:

- Calculate the Final Total: Add tax and subtract the discount from the subtotal.

- Ensure the Document Updates: All changes to tax or discounts should automatically reflect in the final amount due.

Best Practices for Document Formatting

Creating a clear and well-organized payment request is essential for both professionalism and clarity. Proper formatting helps ensure that all necessary information is easy to locate and understand, minimizing confusion and improving the likelihood of timely payment. Here are some best practices to follow when formatting your payment request documents.

Clarity and Structure

One of the most important aspects of document formatting is clarity. Use simple and logical layouts that guide the reader through the content without distraction. Key elements should be easily identifiable, and there should be enough space between sections for readability.

- Keep Sections Organized: Separate details like client information, services or goods provided, and totals into distinct sections.

- Use Headings: Clearly label each section (e.g., “Billing Information,” “Payment Details”) so clients can find the information they need quickly.

- Ensure Consistency: Use the same font and size for similar content throughout the document to maintain a clean and professional appearance.

Accurate and Readable Data

Accurate data presentation is critical for a smooth transaction. Formatting should highlight the most important details like amounts due and payment deadlines.

- Highlight Important Numbers: Use bold or larger text for totals, taxes, and due dates to make them stand out.

- Itemized Lists: List items or services in a clear, easy-to-read table format to avoid confusion. Make sure to include columns for descriptions, quantities, unit prices, and totals.

- Use Currency Symbols: Clearly display the currency to avoid any ambiguity, especially for international transactions.

Professional Design

A visually appealing design not only makes the document easier to read but also gives your business a polished image. A simple, clean design can go a long way in making a positive impression.

- Use Adequate Spacing: Don’t crowd the document. Leave enough space between sections and rows to make the text legible.

- Incorporate Your Branding: If you have a logo or specific brand colors, include them to reinforce your business identity.

- Choose Readable Fonts: Stick to professional and legible fonts, like Arial or Times New Roman, in an appropriate size (usually between 10-12pt).

Saving and Sharing Your Billing Document

Once you’ve completed your payment request, it’s important to save and share it efficiently. Properly saving the document ensures that all your changes are preserved, while sharing it in the right format allows for easy access and quick action from your clients. There are various options available for saving and sending the document, each suited to different needs.

Saving Your Document

Saving your document correctly is crucial for both future reference and ensuring it’s easily accessible. Here are the best practices:

- Save in Editable Format: Keep a version of the document in an editable format, such as .docx, so you can make updates or modifications later.

- Use a Consistent Naming Convention: Name your document clearly with relevant details, such as the client name or invoice number, followed by the date. For example: “ClientName_Invoice_123_2024.docx.”

- Create Backup Copies: Save a backup version in a cloud storage service, such as Google Drive or Dropbox, to ensure that your document is safe in case of hardware failure.

Sharing Your Document

Once saved, the next step is sharing the document with your client or colleague. Choosing the right format and delivery method ensures the document is received without issues.

- Email the Document: If sending via email, attach the file in .pdf format to prevent alterations, making sure that the client can easily view it on any device.

- Use Secure File Sharing Services: For larger documents or when sending sensitive information, consider using secure file-sharing services like OneDrive or Dropbox to send a link to the file.

- Print and Mail: If needed, print a physical copy and send it via traditional mail, ensuring that you keep a copy for your records.

Why Choose Word Over Other Invoice Tools

When it comes to creating and managing billing documents, there are numerous tools available. However, many business owners prefer using a standard word processing software for its simplicity, versatility, and familiarity. Despite the existence of specialized invoicing software, the flexibility and ease of use offered by word processors make them an appealing choice for many businesses.

Familiarity and Ease of Use

Most people are already familiar with word processing applications, which means there’s little to no learning curve involved. This can save time and reduce frustration, especially for those who don’t have the resources to invest in dedicated invoicing software. Some of the key advantages include:

- User-Friendly Interface: The software is intuitive and easy to navigate, even for beginners.

- Minimal Setup Required: Creating a professional document doesn’t require complex configuration or setup–simply open the application and start typing.

- Instant Customization: You can quickly customize fonts, colors, and layouts without being limited by preset options.

Flexibility and Control

Another significant advantage of using word processing software is the level of control it offers over your documents. Unlike specialized invoicing tools that may limit how you structure or format your bill, word processors give you full creative freedom.

- Unlimited Customization: Tailor the layout and content exactly as you need, whether it’s adjusting fields, adding new sections, or personalizing the design.

- Easy Integration: You can quickly copy and paste data from other documents or spreadsheets, streamlining your workflow.

- Affordable Solution: Since most word processors are already widely available, there’s no need to pay for additional software or subscriptions.

Integrating Billing Documents with Accounting Software

Integrating payment request documents with accounting software is a smart way to streamline financial management. By syncing documents with accounting tools, you can automate data entry, track payments more efficiently, and reduce errors. This integration allows for smoother operations and better financial oversight without having to manually enter each transaction multiple times.

Benefits of Integration

Integrating your documents with accounting platforms offers several key benefits:

- Automation of Data Transfer: Once the document is created, it can be automatically transferred to your accounting system, saving time and minimizing manual input.

- Real-Time Updates: Syncing ensures that any changes to the payment or client details are reflected immediately in your accounting software, keeping all records current.

- Reduced Errors: Automation helps eliminate human errors that may occur when manually entering data into the accounting system.

Integration Process

The process of integrating documents with accounting software can vary depending on the tools you are using, but here’s a general outline:

- Create Your Document: First, generate the payment request using your preferred word processing application.

- Export or Save in Compatible Format: Save the document in a format that can be easily imported, such as CSV, XML, or PDF, depending on the accounting software.

- Import to Accounting Software: Use your accounting software’s import feature to bring in the saved document. Some platforms offer direct integrations, allowing you to link the document automatically.

- Review and Sync: After importing, review the data in your accounting tool for accuracy and ensure it matches the payment request information.

Example of Integration in Action

| Action | Document | Accounting System |

|---|---|---|

| Generate Payment Request | Client XYZ – $500 due | No data entry needed |

| Save and Export | Export as PDF or CSV | Import the document |

| Sync with Accounting | Payment request with client details | Automatic entry into ledger, updated balance |

With this integration, managing your finances becomes much easier, allowing you to focus on growing your business rather than getting bogged down by administrative tasks.

Common Mistakes to Avoid in Billing Documents

When creating payment requests, it’s easy to overlook certain details that can lead to confusion, delayed payments, or even disputes. Making sure the document is clear, accurate, and professional is key to maintaining positive relationships with clients. Below are some of the most common mistakes to avoid when preparing your payment request documents.

Missing or Incorrect Client Information

One of the most frequent errors is failing to include correct or complete client details. Missing names, addresses, or contact information can delay payment processing and may require follow-up communication.

- Double-Check Client Information: Ensure that all contact details are accurate and up-to-date.

- Include Necessary Details: Make sure to include the client’s company name, billing address, and phone number or email for follow-up.

Incorrect or Omitted Payment Terms

Clearly outlining the payment terms is crucial to avoid misunderstandings about when and how payment should be made. Lack of clear terms can lead to delayed payments or confusion over expectations.

- Set Clear Payment Due Dates: Always specify the exact due date to avoid late payments.

- State Accepted Payment Methods: Be explicit about the payment methods you accept, whether it’s bank transfer, credit card, or another method.

Calculation Errors

Calculation mistakes, whether in taxes, discounts, or totals, can result in discrepancies that need to be corrected, leading to potential delays or disputes.

- Automate Calculations: Utilize built-in calculation features to avoid manual errors.

- Double-Check Totals: Always verify the subtotal, tax, discounts, and final amount before sending the document.

Overcomplicating the Layout

While it’s important to include necessary details, overcomplicating the layout or including too much information can make the document hard to read. A cluttered design can confuse the client and reduce the professionalism of your document.

- Keep it Simple: Focus on the most important details and present them in a clear, organized manner.

- Use White Space Effectively: Ensure the document is easy to navigate by leaving space between sections.

Failure to Include Contact Information

Not providing easy access to your own contact details can make it difficult for clients to reach out with questions or concerns, potentially delaying payment.

- Provide Your Contact Details: Include a phone number or email address where clients can reach you for any inquiries regarding the bill.

- Include Business Hours: If applicable, provide your business hours to let clients know when they can expect responses.

How to Ensure Accuracy with Automatic Calculations

Ensuring the precision of your payment documents is essential for maintaining professionalism and avoiding errors. One of the most effective ways to guarantee accurate calculations is by utilizing automatic calculation tools within the document itself. These tools can automatically update totals, taxes, and other critical figures, reducing the risk of human error and saving time during the creation process.

Using Automatic Calculation Tools

By incorporating automatic calculations into your document, you can ensure that all numbers are updated consistently and correctly. Here’s how to make the most of these tools:

- Set Up Automatic Multiplications: Link quantities and unit prices so that when the unit price or quantity changes, the total automatically updates.

- Utilize Summation Functions: Use sum functions to automatically calculate the subtotal, tax, and total amount due without needing manual adjustments.

- Tax and Discount Calculations: Program the document to apply tax rates or discounts based on predefined percentages, ensuring consistent and accurate calculations each time.

Steps to Add Calculations

Here’s a simple guide to adding automatic calculations to your document:

- Step 1: Set up the basic layout with columns for item description, quantity, unit price, and total.

- Step 2: Use the “formulas” feature in your document software to link the appropriate cells for calculation. For example, multiplying quantity by unit price for the item total.

- Step 3: Add a sum function to calculate the subtotal of all items, and apply a tax formula to automatically calculate the tax amount based on the subtotal.

- Step 4: Finally, use a formula to add the subtotal and tax, yielding the final amount due.

Benefits of Using Automatic Calculations

- Reduces Errors: By automating calculations, you minimize the chances of manual mistakes, such as incorrect totals or tax rates.

- Saves Time: Automatic calculations eliminate the need for manual updates, allowing you to focus on other important tasks.

- Consistency: Automated formulas ensure that every document uses the same calculation method, creating consistency across your billing process.

By incorporating these features, you can ensure that your documents are not only accurate but also efficient to produce, helping to maintain a professional image and improve client trust.

Tips for Professional Billing Document Design

A well-designed payment request can make a significant difference in how your business is perceived. A clean, professional layout not only ensures clarity but also reflects your attention to detail. By focusing on essential design elements, you can create a document that is both functional and visually appealing, helping to establish trust with clients.

Keep the Layout Clean and Simple

A cluttered design can make important details harder to find and decrease the overall professionalism of the document. Aim for a layout that is clear, straightforward, and easy to read.

- Use Clear Headings: Divide the document into distinct sections using bold, larger text for headings, such as “Client Information,” “Payment Details,” and “Total Amount Due.”

- Leave White Space: Ensure there’s enough space between sections to prevent the document from feeling crowded. This improves readability and makes it easier to navigate.

- Align Text Consistently: Align text neatly within columns, making sure that numbers, such as totals and taxes, line up in a consistent way across the page.

Choose Readable Fonts

Fonts play a key role in readability and overall design. Opt for fonts that are simple, professional, and easy to read at various sizes.

- Avoid Decorative Fonts: Stay away from overly decorative or cursive fonts that may be difficult to read, especially in professional documents.

- Use a Maximum of Two Fonts: Stick to one or two fonts throughout the document–one for headings and one for body text– to maintain consistency.

- Ensure Sufficient Size: Ensure the text is large enough to be easily readable, typically 10–12 pt for body text and larger for headings.

Incorporate Your Branding

Your billing document is an extension of your brand, so incorporating elements of your branding can make it feel more cohesive and professional.

- Use Your Brand Colors: Include your company’s primary colors in headings, borders, or other design elements to create a branded look.

- Logo Placement: Add your company logo at the top of the document for easy recognition, but keep it subtle so it doesn’t distract from the key details.

- Maintain Consistency: Ensure that your design aligns with the overall look and feel of your other business materials, such as emails, business cards, and your website.

Make Key Information Stand Out

Highlighting the most important details helps clients quickly locate critical information, such as the amount due and the payment deadline.

- Bold Important Figures: Use bold text for total amounts due, payment dates, and any key numbers to make them stand out.

- Use Color for Emphasis: Light shading or accent colors can help highlight key areas like the payment section or the client’s details.

- Group Similar Information: Group related d

Managing Multiple Billing Documents

Handling multiple billing documents efficiently is essential for any business that needs to track payments and maintain organization. Whether you are creating requests for numerous clients or managing recurring payments, a well-organized system can help streamline the process and prevent errors. By leveraging organizational tools and simplifying workflows, you can stay on top of all your transactions.

Organize Documents with Folders

One of the first steps in managing several payment requests is to keep them organized in clearly labeled folders. This prevents confusion and ensures easy access when you need to retrieve specific documents.

- Create Folders for Clients: Group payment requests by client name or company to make searching quicker and more efficient.

- Use Date-Based Folders: Organize documents by month, quarter, or year to track payments over time and avoid losing past records.

Use Document Management Tools

For businesses handling a large number of requests, document management software can be a game-changer. These tools offer features like searchability, categorization, and even the ability to automate document creation.

- Consider Cloud Storage: Use cloud-based storage solutions to ensure easy access from any device and to back up all documents securely.

- Automate Document Creation: Set up templates and use tools that automatically generate new payment requests, reducing time spent on repetitive tasks.

Track Payment Status

To stay organized, it’s important to keep track of which documents have been paid, which are pending, and which are overdue. This can be done through a simple tracking system or more advanced tools depending on your needs.

- Create a Payment Log: Maintain a separate log or spreadsheet that lists all payment requests, their due dates, and current statuses (paid, pending, overdue).

- Use Conditional Formatting: In your tracking document, use color-coding or flags to quickly highlight overdue or pending items.

Consolidate Payment Information

If you regularly handle multiple payments, consolidating payment information into one summary document can make it easier to manage. This helps you keep track of totals, deadlines, and outstanding balances without opening each document individually.

- Summarize Payments: Create a master sheet that summarizes each client’s payments, remaining balances, and any notes.

- Update Regularly: Ensure that the summary sheet is updated regularly to reflect any new payments or changes.

By staying organized and using the right tools, managing multiple billing documents can be a simple and streamlined process, allowing you to focus more on growing your business rather than handling administrative tasks.