Word Invoice Template That Calculates Total Automatically

Managing business finances can be time-consuming, especially when it comes to creating and sending payment requests. Having a solution that automates complex tasks can save valuable time and reduce errors. A well-designed document can simplify the process, allowing you to focus on other important aspects of your work. By using a customizable, self-calculating format, you can ensure that all figures are correct without having to manually add up the numbers.

With the right tools, you no longer have to worry about miscalculations or delays in billing. Whether you’re a freelancer, a small business owner, or working in a larger organization, automated calculations within your billing documents can help streamline your workflow. This method eliminates the need for spreadsheets or external programs, offering a more efficient way to handle payments directly from within your text editor.

Efficient and user-friendly, this approach offers both simplicity and accuracy, making it a perfect choice for anyone looking to optimize their billing system. In the following sections, we will explore how to set up and customize this method, ensuring it fits your business needs while reducing the time spent on administrative tasks.

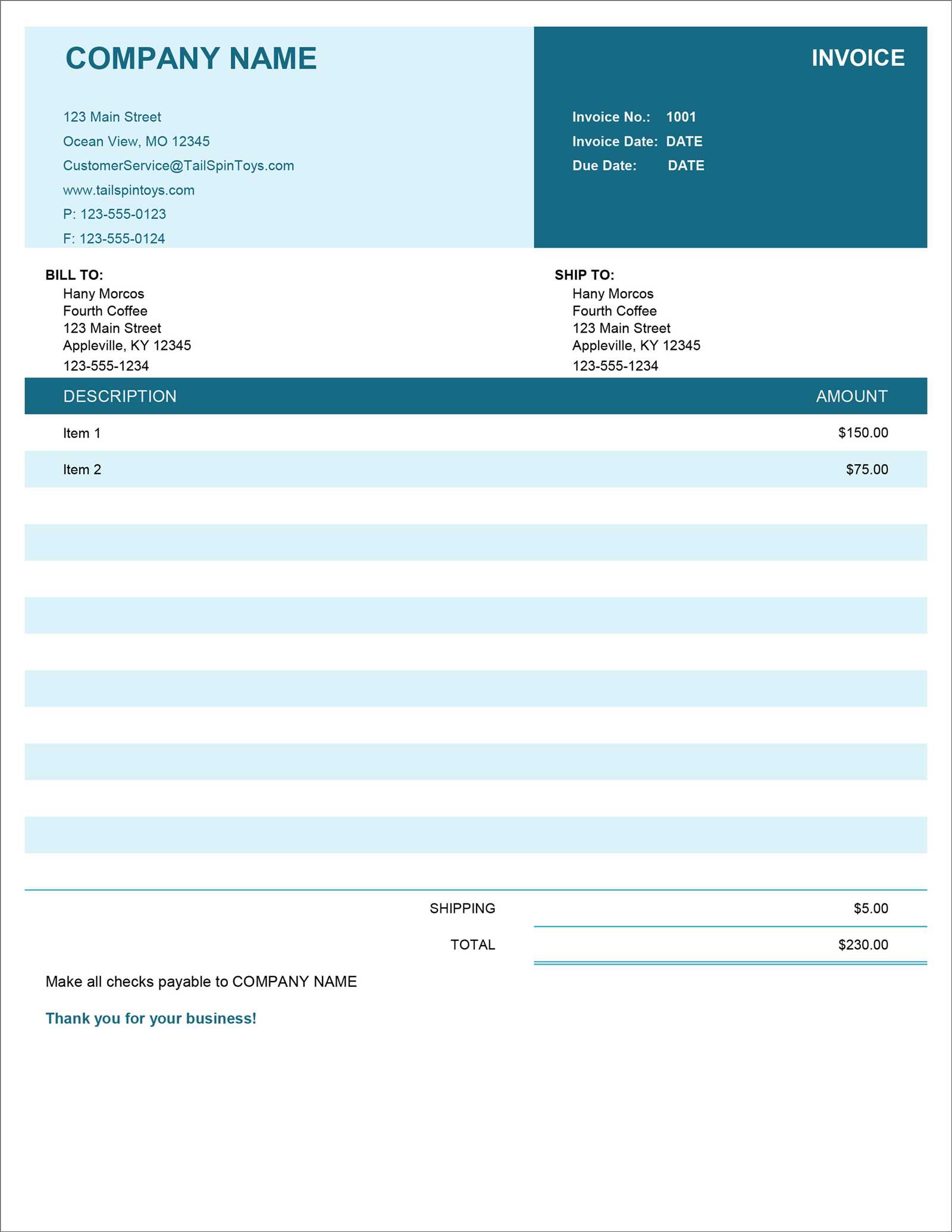

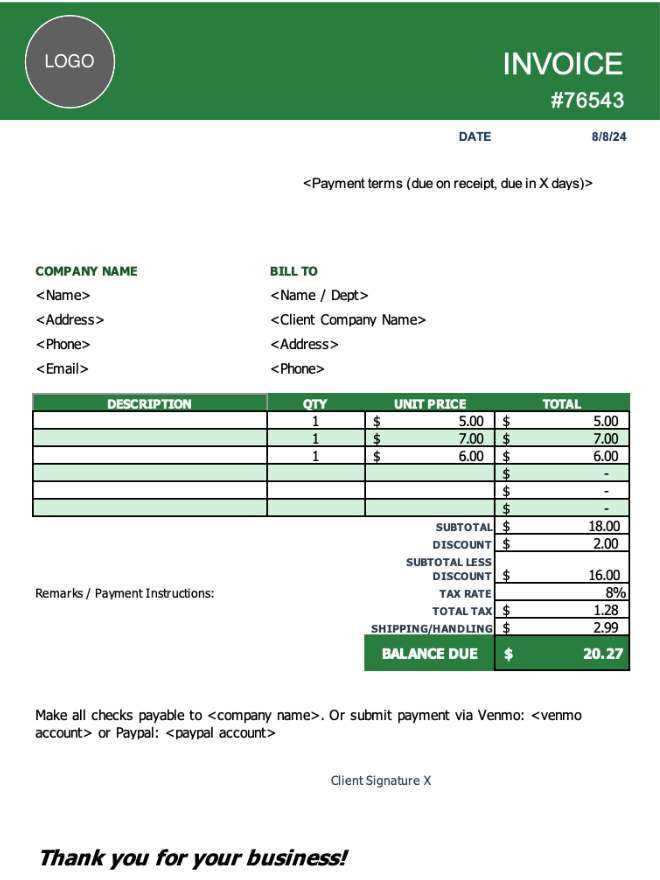

Word Invoice Template Features

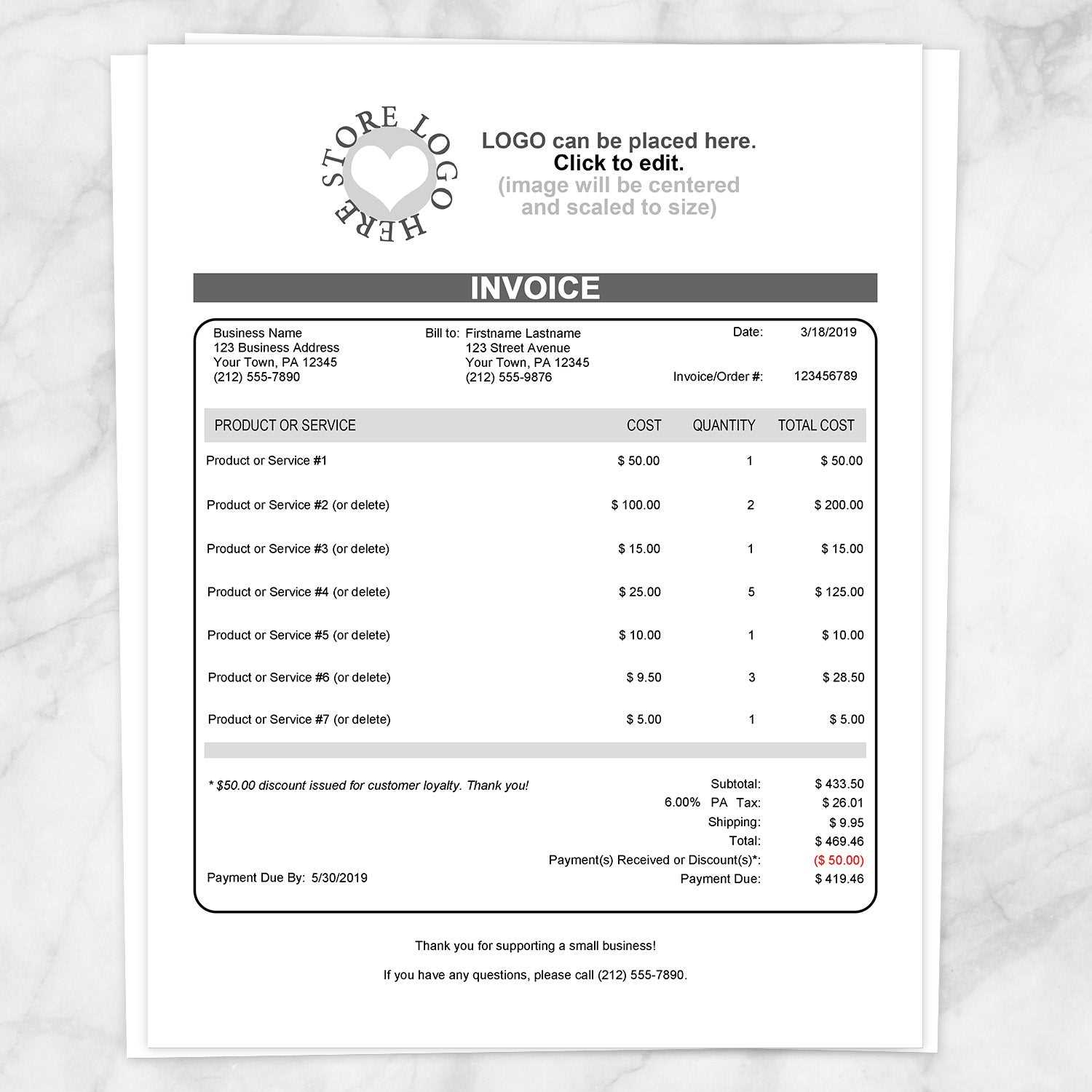

Effective billing solutions are essential for any business looking to maintain accuracy and efficiency in their financial processes. A well-designed document can offer a variety of features that make the creation and management of payment requests both quick and reliable. These features often include automatic number formatting, the ability to adjust details easily, and built-in functions that help with organizing and tracking charges.

One of the key advantages of using an automated system is the reduction of human error. With a setup that pre-fills certain fields or adjusts values based on simple input, the chances of miscalculations are minimized. Additionally, many options provide customizable fields for adding company branding, client details, and payment terms, allowing for a professional appearance without much effort.

Another feature often included is the ability to update and reuse the same structure for multiple transactions. This allows for consistency and speed in producing new documents. Whether you’re invoicing for a single service or a series of products, these tools can help generate accurate, formatted bills in just a few steps.

How to Create an Invoice in Word

Creating a professional document for billing is a straightforward process when you know the essential elements to include. The key is to make sure all necessary details are present while keeping the layout clean and organized. By following a few simple steps, you can quickly generate a customized request for payment that suits your business needs.

Here’s a step-by-step guide to help you create your own billing document:

- Open a New Document: Start by opening your text editor and creating a new, blank document. This will serve as the foundation for your request.

- Insert a Header: Add your business name, address, and contact information at the top. This is crucial for establishing the document’s legitimacy and making it easy for the recipient to get in touch.

- Client Information: Below the header, add the client’s name, address, and contact details. This ensures the payment request is clearly directed to the correct person or company.

- Include an Itemized List: List the goods or services provided. Include descriptions, quantities, and unit prices. Make sure to format this in a way that is easy to read and follow.

- Automate Calculations: For accuracy and convenience, set up basic functions to automatically calculate the subtotal, taxes, and final amount due.

- Add Payment Terms: Specify your payment conditions, such as due date, acceptable payment methods, and any late fees that may apply.

- Include a Footer: Conclude the document with your company’

Benefits of Using Word Invoice Templates

Utilizing a pre-designed document for billing offers a range of advantages that can significantly improve the efficiency and accuracy of financial processes. Whether you’re a freelancer, a small business owner, or managing transactions in a larger organization, using such a solution helps streamline the creation and management of payment requests. The following are some of the key benefits:

Time Savings

One of the primary advantages is the amount of time saved. Instead of creating each document from scratch, you can quickly fill in the relevant details and generate a professional-looking payment request in a fraction of the time. Pre-made structures with built-in fields and automatic functions allow you to focus on the essentials, without having to worry about formatting or layout.

Enhanced Accuracy

Another significant benefit is the reduction of errors. With automated features such as pre-set calculations, the risk of miscalculating amounts, taxes, or discounts is minimized. This ensures that both you and your clients can be confident that the details on the document are correct, reducing the chances of disputes or misunderstandings.

In addition, having a consistent format for all your payment requests gives your business a more professional appearance, helping to build trust with clients and partners. As a result, the use of a pre-designed system can improve both the efficiency and reliability of your billing processes.

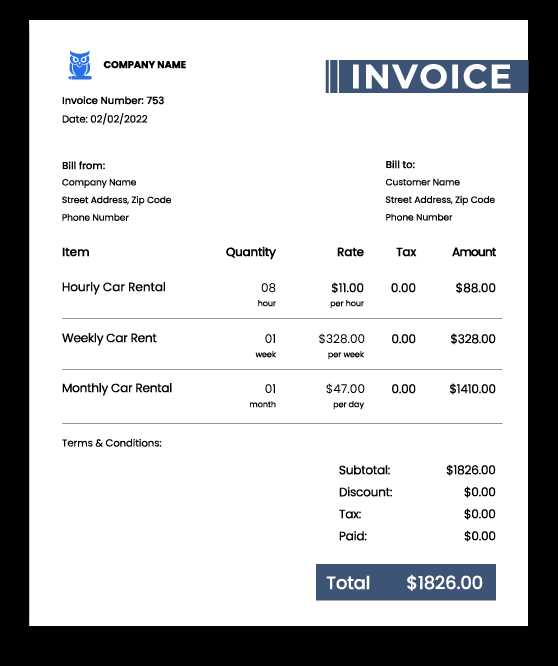

Automated Calculations in Word Invoices

Automating numerical tasks within your billing documents not only improves efficiency but also ensures accuracy. With automated features, manual errors are minimized, and the time spent on completing the document is significantly reduced. These built-in functions allow for quick updates and adjustments, saving you from needing external software or complex calculations.

Here are the main automated functions commonly used:

- Subtotal Calculation: Automatically sums up the individual item costs, saving time and reducing the risk of error.

- Tax Calculations: Easily apply taxes based on predefined percentages, ensuring consistency in how sales taxes are calculated.

- Discounts and Adjustments: Automatically subtract any discounts or promotional offers, updating the final amount due without the need for manual input.

- Grand Total: The final sum, including all costs, taxes, and discounts, is automatically displayed, giving you an accurate and updated amount owed.

By setting up these functions, you can streamline the entire billing process, ensuring precision while saving time on administrative tasks. This level of automation is especially useful for businesses that handle multiple transactions or require consistent formatting across various requests.

Customizing Your Invoice Template for Business

Creating a personalized document for billing purposes is essential for any enterprise. By tailoring this essential tool, businesses can enhance their professionalism and ensure clarity in transactions. Customization not only reflects your brand but also simplifies the payment process for clients.

Incorporating Branding Elements

One of the most impactful ways to modify your billing document is by integrating your brand’s visual identity. This includes adding your logo, selecting appropriate colors, and using fonts that align with your overall branding strategy. Such elements foster recognition and trust among clients, making your communications more engaging.

Enhancing Functionality

Beyond aesthetics, improving the functionality of your billing document can significantly benefit your business operations. Consider including sections for itemized charges, discounts, and due dates. Utilizing built-in formulas can streamline calculations, reducing errors and saving time during the invoicing process. Moreover, ensuring the layout is user-friendly will facilitate easier comprehension for your customers.

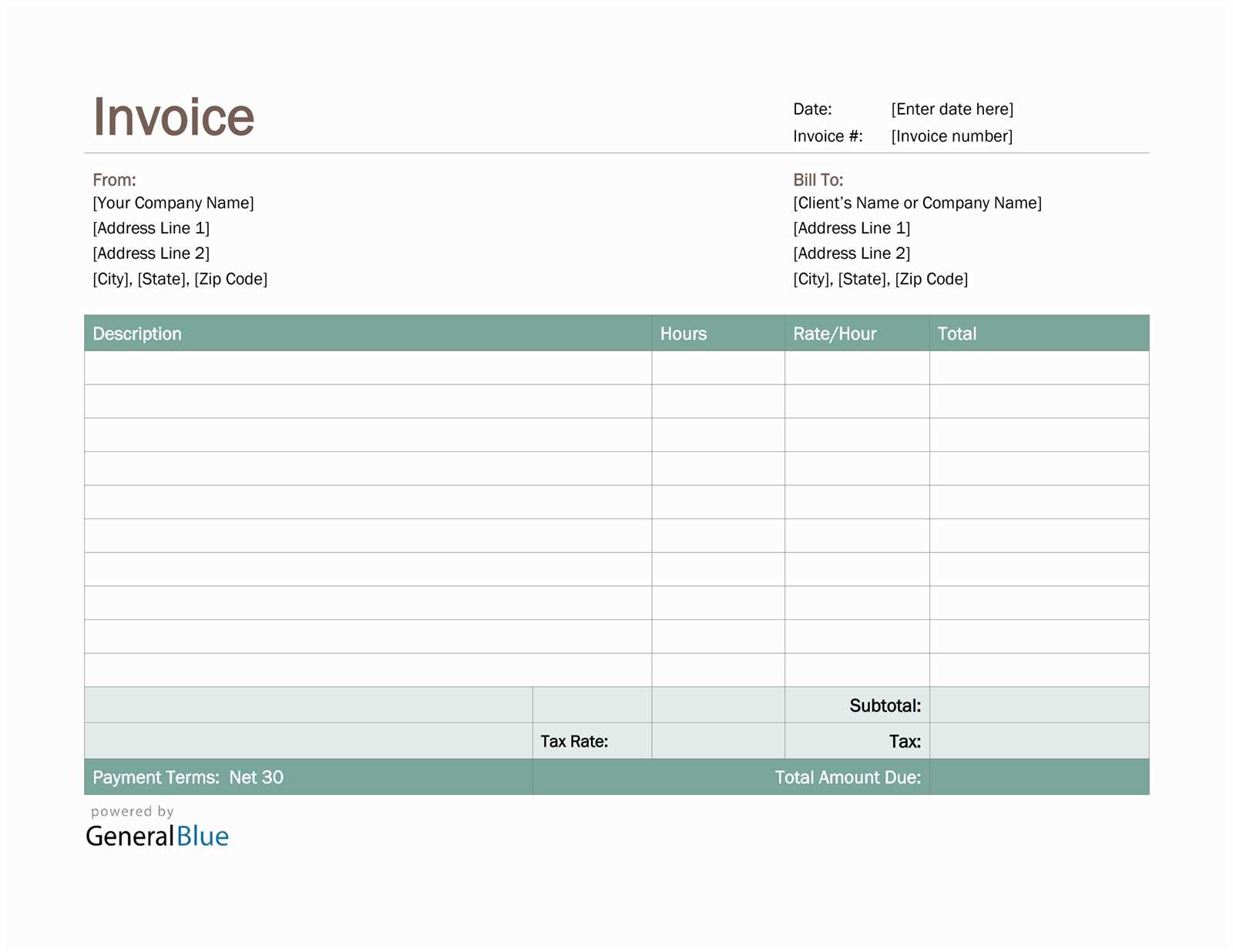

Setting Up Tax Calculations in Word

Accurately applying tax rates is crucial for maintaining compliance and ensuring clarity in financial documents. By effectively integrating tax calculations, businesses can streamline their billing processes and enhance transparency for their clients. This section will guide you through the essential steps to implement these calculations seamlessly.

Determining Tax Rates

Before incorporating tax into your financial documents, it is essential to establish the correct rates based on your location and industry regulations. Research applicable tax laws and guidelines to determine whether you need to apply a single rate or multiple rates for different items. Ensuring you have the correct figures will help maintain accuracy in your billing.

Creating Calculation Fields

To automate the tax computation, you can set up calculation fields within your document. This involves utilizing built-in functions to multiply the item price by the tax rate, providing an accurate amount due. By implementing these calculations, you can minimize manual errors and create a more efficient invoicing experience for both your business and your clients.

Easy Steps to Edit Your Invoice

Modifying your billing documents is an important aspect of maintaining professionalism and ensuring accuracy in financial communications. With a few simple adjustments, you can personalize these documents to better reflect your business needs and improve clarity for your clients. This guide provides straightforward steps for effective editing.

Accessing the Document

To begin, locate the existing file you wish to modify. Ensure you open the correct version to avoid confusion. Once opened, familiarize yourself with the layout and content, so you know where changes are needed. This initial review will help you streamline the editing process.

Making Necessary Adjustments

Identify the sections that require updates, such as client information, service descriptions, or pricing details. Use the editing tools to modify text, adjust formatting, or add new elements as needed. If applicable, make sure to update any calculations to reflect the latest data. After completing your adjustments, save the document to preserve your changes. This will ensure that your billing materials remain accurate and relevant for future transactions.

How to Save and Reuse Templates

Efficiently managing your financial documents is crucial for any business. By saving and reusing established formats, you can streamline your workflow, save time, and maintain consistency in your communications. This section will outline the best practices for preserving your formats and making them readily accessible for future use.

Saving Your Document

To ensure that your customized format is easily retrievable, start by saving the document in a designated folder on your computer or cloud storage. Choose a descriptive file name that clearly indicates its purpose. Additionally, select the appropriate file type to maintain functionality. For future convenience, consider creating a specific folder dedicated to your business documents, allowing for organized access.

Reusing Your Format

When you need to generate a new document, simply open the saved format and make any necessary adjustments for the current transaction. This can include updating client information or modifying item details. By reusing the established layout, you can ensure consistency in your communications while significantly reducing the time spent on formatting each document from scratch.

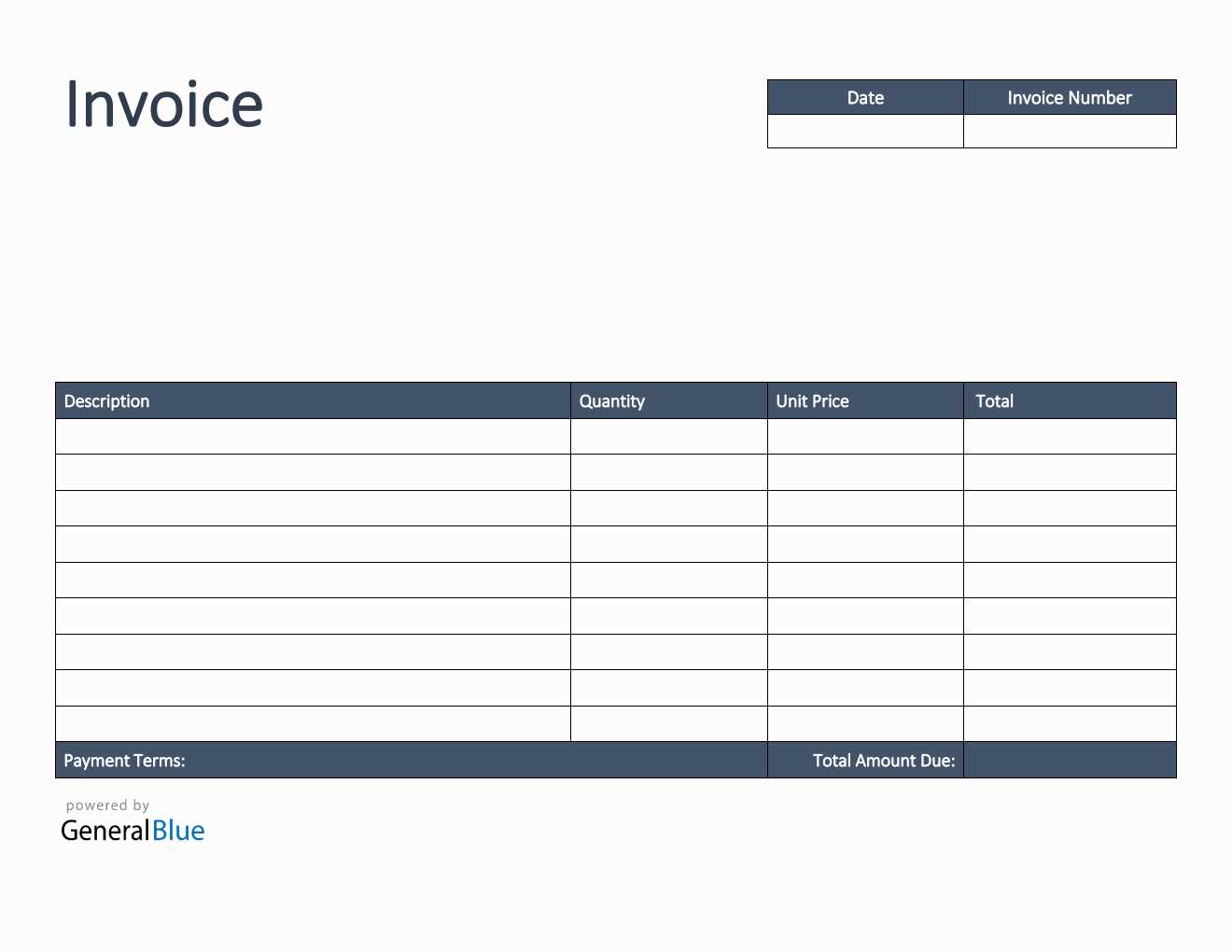

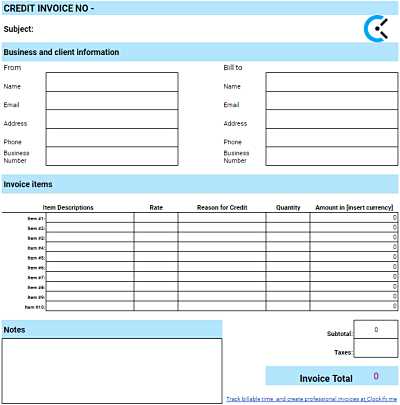

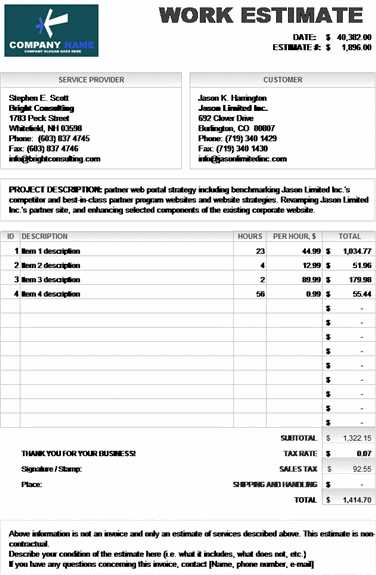

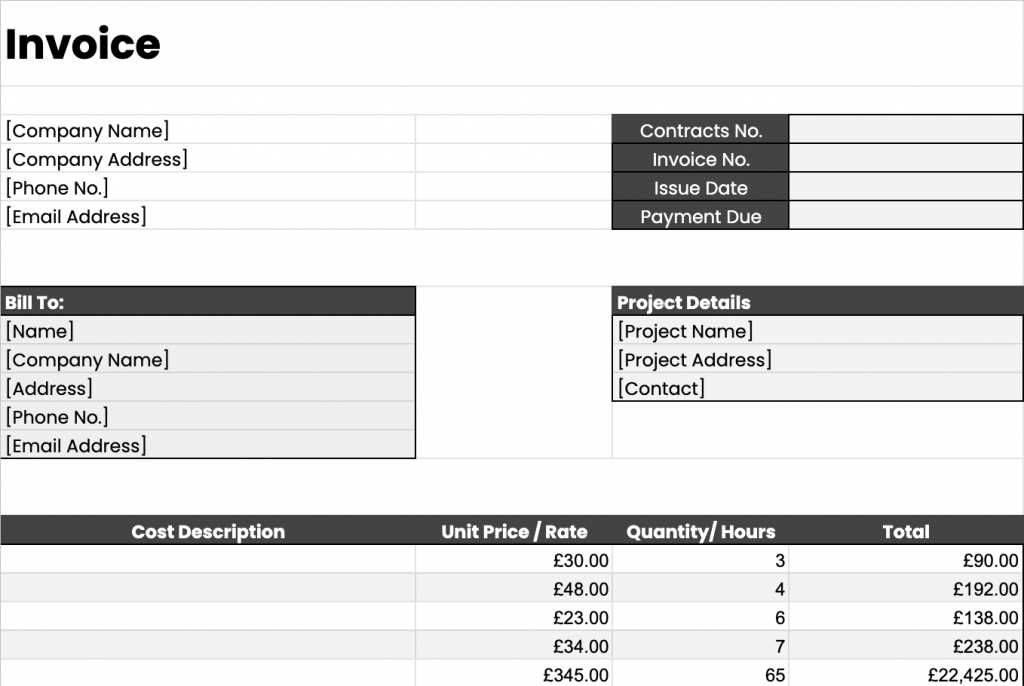

Choosing the Right Template for Your Needs

Selecting the appropriate format for your financial documents is essential for ensuring clarity and professionalism in your transactions. With a variety of options available, it is important to consider your specific requirements and the nature of your business. This guide will help you identify the key factors to consider when making your choice.

First, evaluate the type of services or products you offer. Different industries may benefit from distinct layouts that highlight relevant information. For instance, a service-based business might need a format that emphasizes labor charges, while a retail operation may focus more on itemized products and quantities. Additionally, consider the complexity of your pricing structure. If you have multiple rates, discounts, or tax considerations, ensure the selected format can accommodate these elements efficiently.

Another important factor is the level of customization you require. Some formats offer flexibility for modifications, allowing you to tailor the document to suit various clients or projects. Finally, think about your workflow and how easily you can integrate the chosen layout into your existing processes. By selecting a format that aligns with your operational needs, you can enhance your efficiency and maintain a professional appearance in all your financial communications.

Ensuring Accurate Total Calculations

Maintaining precision in your financial documentation is vital for both your business operations and client relationships. Inaccuracies in sums can lead to confusion, disputes, and loss of trust. To avoid these issues, it is essential to implement strategies that guarantee correctness in all calculations. This section outlines key practices to enhance the accuracy of your financial figures.

Utilizing Automated Features

One effective method to ensure precision is to leverage automated functions within your chosen software. This reduces the likelihood of human error and streamlines the process. Consider the following:

- Use built-in formulas to perform arithmetic operations, such as addition, subtraction, and multiplication.

- Set up fields for automatic calculations of taxes and discounts based on item prices.

- Regularly update any rates or charges to reflect current pricing accurately.

Conducting Regular Reviews

In addition to automation, conducting periodic reviews of your financial documents can catch any discrepancies early. Follow these steps:

- Double-check all input data for accuracy, ensuring that no errors were made during entry.

- Compare calculated sums against original figures to confirm consistency.

- Have a colleague review the document for a fresh perspective and to identify potential mistakes.

By implementing these strategies, you can significantly improve the accuracy of your financial calculations and maintain professionalism in all your business transactions.

Using Word Templates for Freelancers

For freelancers, managing business documentation efficiently is crucial for sustaining operations and maintaining professionalism. Utilizing pre-designed formats can streamline the process of creating essential documents, enabling independent professionals to focus on their core services. This section discusses the benefits and best practices for employing these formats in a freelance environment.

Benefits of Using Pre-Designed Formats

Implementing pre-designed documents offers several advantages for freelancers, including:

- Time Efficiency: Pre-made formats allow for quick adjustments, significantly reducing the time spent on document creation.

- Consistency: Using the same layout across all communications ensures a cohesive brand image and fosters trust among clients.

- Professional Appearance: A well-structured document enhances credibility, making a positive impression on potential clients.

Customizing to Fit Your Brand

While pre-designed documents provide a solid foundation, customization is key to ensuring they reflect your unique brand identity. Consider the following:

- Add Personal Touches: Incorporate your logo, brand colors, and preferred fonts to make the document distinctly yours.

- Tailor Content: Adjust the sections to highlight your specific services, rates, and payment terms.

- Maintain Flexibility: Keep your formats adaptable to accommodate various clients and projects, allowing for quick modifications as needed.

By effectively using pre-designed formats, freelancers can enhance their professionalism while saving time and effort in their business processes.

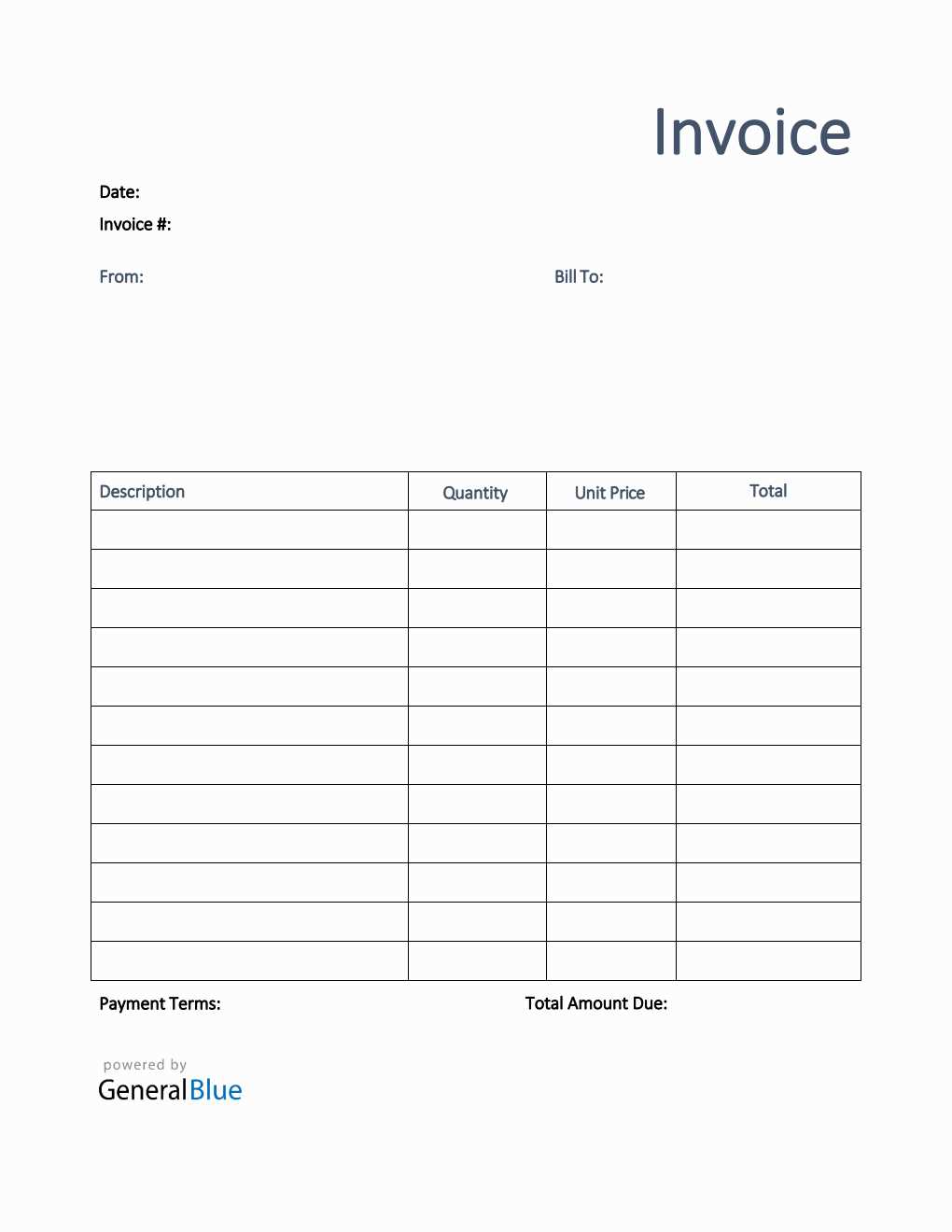

Free vs Paid Word Invoice Templates

When it comes to managing financial documentation, choosing between complimentary and premium options can significantly impact your workflow and overall efficiency. Each category presents unique advantages and disadvantages, making it essential to consider your specific needs before making a decision. This section examines the differences between free and paid formats, helping you make an informed choice.

Criteria Free Options Paid Options Cost Available at no charge, making them budget-friendly for startups or freelancers. Requires a one-time purchase or subscription, which can vary in price. Features Often limited in functionality and may lack advanced features. Typically include more robust functionalities, including customization and automation tools. Customization May offer basic customization options, but often less flexibility. Generally allow for extensive customization, enabling alignment with your branding. Support Limited or no customer support available. Usually come with customer support or detailed documentation to assist users. Quality Quality can vary widely; some may appear unprofessional. Often designed with a professional aesthetic and attention to detail. By weighing these factors, you can determine which option aligns best with your operational requirements and budget, ensuring effective management of your financial documentation.

Integrating Word Invoice Templates with Excel

Combining the capabilities of different software applications can greatly enhance the efficiency of your financial processes. By integrating structured documents with spreadsheet tools, you can streamline data management, improve accuracy, and save time on repetitive tasks. This section explores the advantages of linking these two types of software and how to implement this integration effectively.

Benefits of Integration

Connecting structured documents with spreadsheet applications provides several key advantages:

- Data Accuracy: Automation minimizes the risk of human error, ensuring that figures are consistently accurate across all documents.

- Efficiency: Automatic updates of figures in one application can reflect changes in the other, reducing the need for manual input.

- Professional Presentation: Combining the detailed analytical capabilities of spreadsheets with polished document layouts can enhance the overall professionalism of your communications.

Steps to Implement Integration

To successfully integrate structured documents with spreadsheet software, follow these steps:

- Prepare your spreadsheet with all necessary calculations, ensuring it contains all relevant data.

- Open your structured document and identify the areas where data from the spreadsheet will be linked.

- Use the “Link” or “Paste Special” function to insert data from the spreadsheet into your document, allowing it to update automatically as changes occur.

- Test the integration to ensure all links work correctly and update as expected when data changes.

By effectively linking these applications, you can create a seamless workflow that enhances the accuracy and professionalism of your financial documentation.

Creating Professional Invoices in Minutes

Producing well-structured financial documents quickly is essential for maintaining a smooth workflow and ensuring timely payments. By utilizing ready-made formats, you can generate polished statements in just a few clicks. This section outlines effective strategies for crafting professional records swiftly, allowing you to focus on your core business activities.

Choose the Right Structure: Start by selecting a design that aligns with your brand identity. A visually appealing layout not only enhances readability but also leaves a lasting impression on clients. Look for formats that offer clear sections for important details such as services rendered, pricing, and payment terms.

Utilize Built-in Features: Take advantage of built-in functionalities such as automatic numbering, date insertion, and easy calculations. These features can save you valuable time and reduce the chances of errors, ensuring accuracy in your documents.

Customize for Your Needs: Personalize your chosen format by incorporating your logo, color scheme, and specific service details. This customization helps to create a consistent brand image while providing clients with essential information tailored to their needs.

Save for Future Use: Once you have created a professional document, save it for reuse. This approach not only streamlines your process for future records but also allows for quick modifications to suit different client requirements.

By following these steps, you can efficiently create professional financial documents in minutes, enhancing your productivity and ensuring effective communication with clients.

Common Mistakes to Avoid in Invoices

Creating financial documents can sometimes lead to oversights that may affect payment processes and client relationships. By recognizing and avoiding common pitfalls, you can enhance the clarity and professionalism of your statements. This section highlights frequent errors and offers guidance on how to steer clear of them.

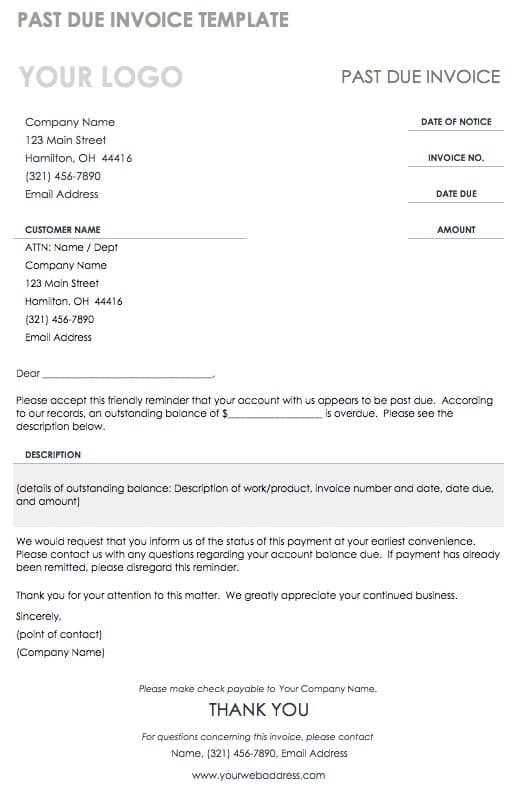

Inaccurate Details: One of the most critical mistakes is providing incorrect information, such as wrong amounts, dates, or client details. Always double-check all entries before sending to ensure accuracy and maintain credibility.

Lack of Clear Payment Terms: Failing to include specific payment terms can lead to confusion and delayed payments. Clearly outline due dates, accepted payment methods, and any late fees to set clear expectations with your clients.

Overcomplicated Format: An overly complex layout can make it difficult for clients to understand the charges. Keep your design simple and organized, with clear sections for services provided, pricing, and any applicable taxes. This simplicity helps in quick comprehension and reduces the likelihood of disputes.

Neglecting to Follow Up: After issuing a financial document, it’s essential to follow up with clients if payment is not received on time. A gentle reminder can prompt action and shows professionalism in managing your accounts.

Ignoring Professional Branding: Presenting a document without any branding can make it look unprofessional. Incorporate your logo and consistent color schemes to enhance your brand identity and leave a positive impression.

By being mindful of these common mistakes, you can ensure that your financial statements are clear, professional, and conducive to timely payments, ultimately strengthening your client relationships.

Printing and Sending Invoices

Once your financial document is prepared, the next crucial steps involve printing and distributing it effectively. Proper handling during these stages ensures that the recipient receives a professional presentation and that all necessary details are communicated clearly. Below are key considerations and steps for successfully executing this process.

Preparation for Printing

Before printing, ensure that the document is visually appealing and correctly formatted. Here are some essential tips:

- Review Formatting: Check margins, fonts, and overall layout to ensure readability.

- Preview Before Printing: Use the print preview function to see how the document will look on paper.

- Use High-Quality Paper: Select professional-grade paper to enhance the appearance of your document.

Methods of Distribution

After printing, consider how you will send the document to your client. The method can vary based on preference and urgency:

- Mail: For a traditional approach, send the printed document via postal service. Ensure it is securely placed in an envelope.

- Email: Sending a digital copy is faster. Convert the document to PDF format for compatibility and to preserve formatting.

- In-Person Delivery: If possible, hand over the document during a meeting. This personal touch can strengthen client relationships.

Regardless of the method chosen, ensure that you confirm receipt, especially if it involves significant amounts or ongoing projects. Clear communication and professionalism in your correspondence will contribute to positive client interactions.

Security Considerations for Invoices

Ensuring the confidentiality and integrity of financial documents is crucial in today’s digital landscape. Protecting sensitive information not only safeguards your business but also fosters trust with clients. This section outlines important security measures to consider when handling these essential documents.

Protecting Sensitive Information

To prevent unauthorized access to financial details, implement the following strategies:

- Password Protection: Use strong passwords to restrict access to electronic versions of the document, ensuring only authorized personnel can view or edit it.

- Encryption: Consider encrypting files to protect sensitive data during transmission, especially when sending documents via email or file-sharing services.

- Access Control: Limit who can create, modify, or send these documents within your organization to minimize the risk of leaks or errors.

Secure Distribution Practices

The way you distribute financial documents plays a significant role in their security. Consider these practices:

- Use Secure Channels: Always use secure email services or file transfer protocols when sending documents electronically.

- Avoid Public Wi-Fi: Refrain from accessing or sending sensitive documents over public networks, which can be susceptible to interception.

- Regular Updates: Keep your software and security systems updated to protect against vulnerabilities that could be exploited by cybercriminals.

By taking these precautions, you can help ensure that your financial documents remain secure and confidential, thereby maintaining the trust of your clients and the integrity of your business operations.

Why Word is Ideal for Invoicing

The choice of software for managing financial documents can significantly influence efficiency and professionalism. Many professionals favor a particular word processing program due to its user-friendly features and flexibility. This platform offers a range of benefits that streamline the creation and management of essential financial records.

User-Friendly Interface

The intuitive design of this software allows users to quickly navigate through its features, making it accessible even for those with minimal technical skills. Key advantages include:

- Easy Formatting: Customizing layouts and styles is straightforward, enabling users to create visually appealing documents without extensive design knowledge.

- Built-in Tools: The inclusion of various tools simplifies the process of adding elements like tables, logos, and headers, which enhance the overall presentation.

- Wide Compatibility: Documents can be easily shared and opened across different platforms, ensuring smooth communication with clients and colleagues.

Flexibility and Customization

This application allows for a high degree of personalization, accommodating specific business needs. Notable features include:

- Custom Fields: Users can create fields tailored to their requirements, allowing for a unique approach to presenting financial information.

- Reusable Documents: The ability to save and reuse previously created formats saves time and promotes consistency across financial records.

- Integration Capabilities: This program can seamlessly work alongside other software solutions, facilitating better data management and tracking.

These attributes collectively contribute to the effectiveness of producing essential financial documents, making it a preferred choice for many professionals seeking efficiency and professionalism in their work.