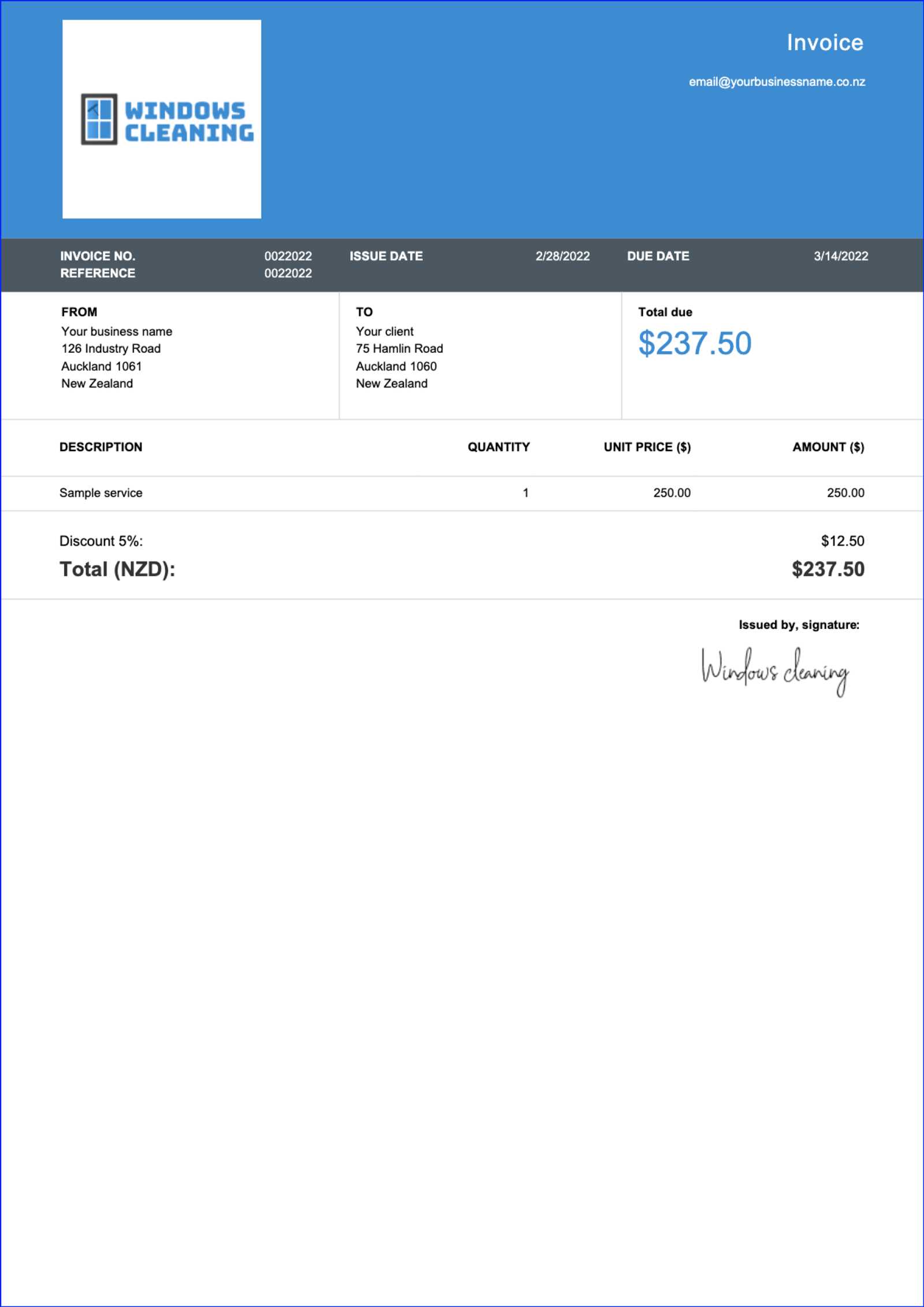

Customizable Word Invoice Template for New Zealand

When managing financial transactions for a business, having an efficient way to request payment is essential. Customizable billing documents provide a flexible solution that can be tailored to suit specific business needs. By creating a document that is both professional and easy to use, you ensure that clients receive clear and accurate information each time.

In New Zealand, businesses often rely on digital documents to streamline their administrative tasks. A well-designed billing format can help ensure that essential details such as amounts, due dates, and payment methods are clearly outlined. This approach not only saves time but also reduces the likelihood of errors in the billing process.

Whether you are a freelancer, a small business owner, or part of a larger enterprise, having the ability to customize your billing documents makes it easier to maintain consistency and professionalism. By using an adaptable structure, you can align your financial requests with your company’s branding while staying compliant with local standards and tax regulations.

Why Use a Billing Document Format

For businesses in New Zealand, having a structured method of requesting payment is crucial. Using a customizable format allows for clear communication with clients while ensuring consistency in how financial details are presented. This approach streamlines the process, reduces errors, and saves valuable time for business owners and their teams.

Efficiency and Time Savings

One of the key reasons to use a flexible document for requesting payments is efficiency. Instead of creating a new layout from scratch for each transaction, a pre-designed format enables quick data entry and minimizes the time spent on administrative tasks. This efficiency allows business owners to focus on growing their operations rather than getting bogged down by repetitive paperwork.

Professional Presentation

A well-crafted billing document helps maintain a professional image. Customization options allow businesses to add logos, branding colors, and necessary legal details, giving a polished look that aligns with the company’s identity. By presenting financial requests in a consistent, formal way, clients are more likely to view the process as legitimate and trustworthy.

Benefits of Customizable Billing Formats

Adapting financial documents to suit your specific needs can offer numerous advantages for businesses. By customizing your billing documents, you gain the ability to better align your requests with your brand, simplify administrative tasks, and ensure compliance with local regulations. Here are some key benefits of using a flexible billing format:

- Brand Consistency: Customize the layout to reflect your business’s colors, logo, and style, creating a cohesive brand image across all communications.

- Time Efficiency: Pre-designed fields allow for quick data entry, reducing the time spent on creating new documents for every transaction.

- Reduced Errors: By using a consistent format, you minimize the risk of missing critical details like payment terms or client information.

- Easy Updates: Custom formats can be easily updated to reflect changes in tax rates, payment methods, or service offerings, ensuring your documents remain accurate.

- Improved Professionalism: A polished, well-organized document can increase trust and improve your business’s credibility with clients.

Incorporating these elements into your business’s financial workflows makes it easier to manage transactions and enhances the overall customer experience. A flexible approach to billing also helps ensure that your documents comply with local requirements and expectations, contributing to smooth operations and prompt payments.

How to Create Your Own Billing Document

Creating a customized billing document for your business is a straightforward process that can help you present financial details clearly and professionally. By following a few simple steps, you can design a document that aligns with your company’s branding and meets all the necessary legal and financial requirements. Here’s a guide to creating your own document:

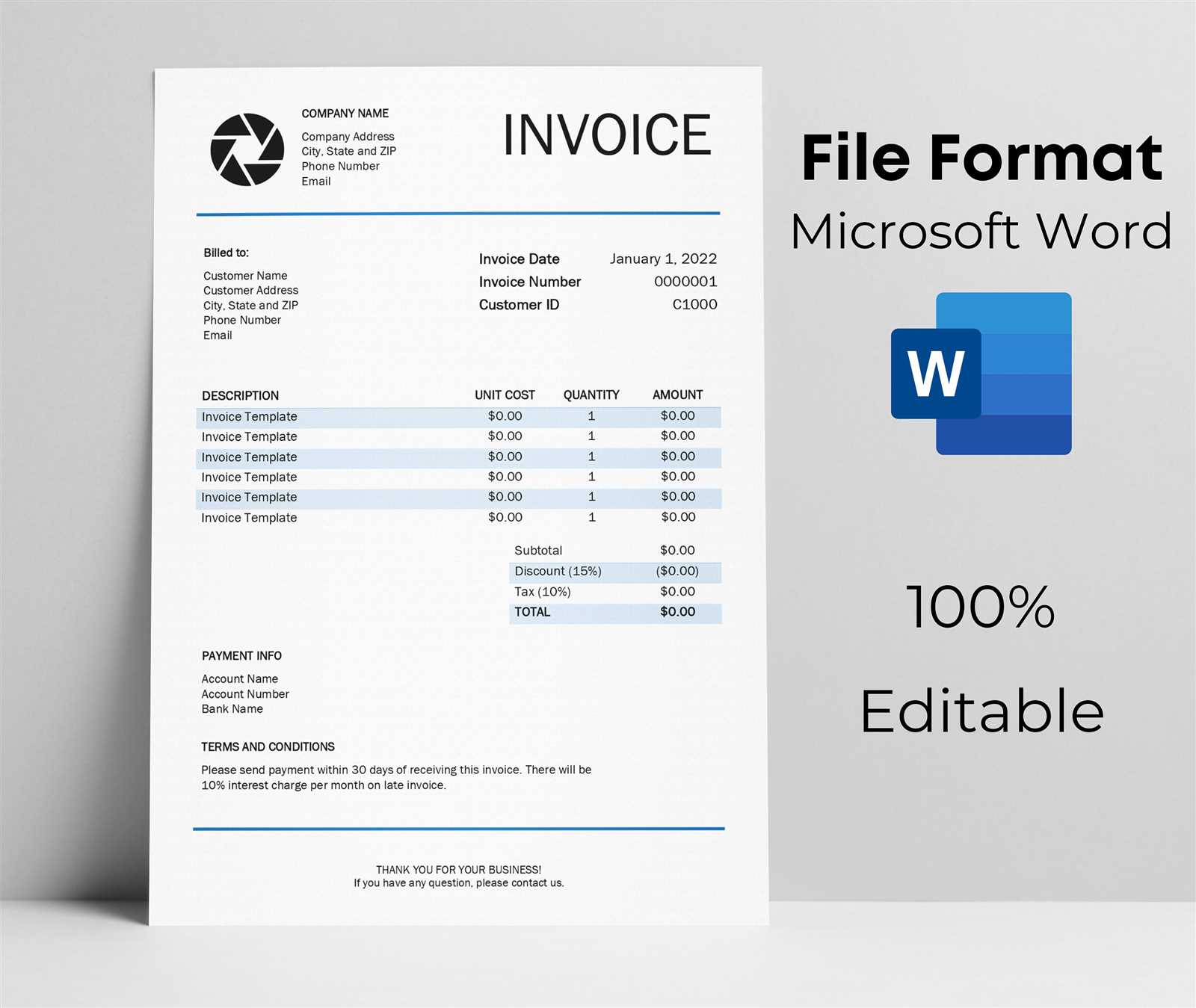

- Step 1: Choose the Right Software – Select an application that allows for customization, such as a word processor or spreadsheet tool.

- Step 2: Set Up Basic Layout – Start with the essential sections, such as company information, client details, payment terms, and service breakdown.

- Step 3: Include Financial Information – Ensure that you include amounts, taxes, and total due. Make it clear and easy to read.

- Step 4: Add Branding Elements – Personalize the document with your logo, business name, and color scheme to maintain brand consistency.

- Step 5: Review Legal and Tax Requirements – Ensure that your document complies with local tax laws and includes any necessary legal disclaimers or payment terms.

By following these steps, you’ll have a customized billing document that simplifies the payment process, strengthens your business’s image, and improves communication with clients.

Key Features of an Effective Document Format

An effective billing document should be both functional and professional, designed to communicate payment details clearly while maintaining a smooth user experience. To achieve this, certain features are essential for ensuring that the document is easy to read, reliable, and aligned with business needs. Below are the key features to consider when designing your own billing format:

- Clear Layout: A well-organized structure with logical sections such as contact details, services rendered, and payment terms makes the document easy to navigate.

- Consistent Formatting: Consistent font styles, sizes, and spacing help enhance readability and professionalism.

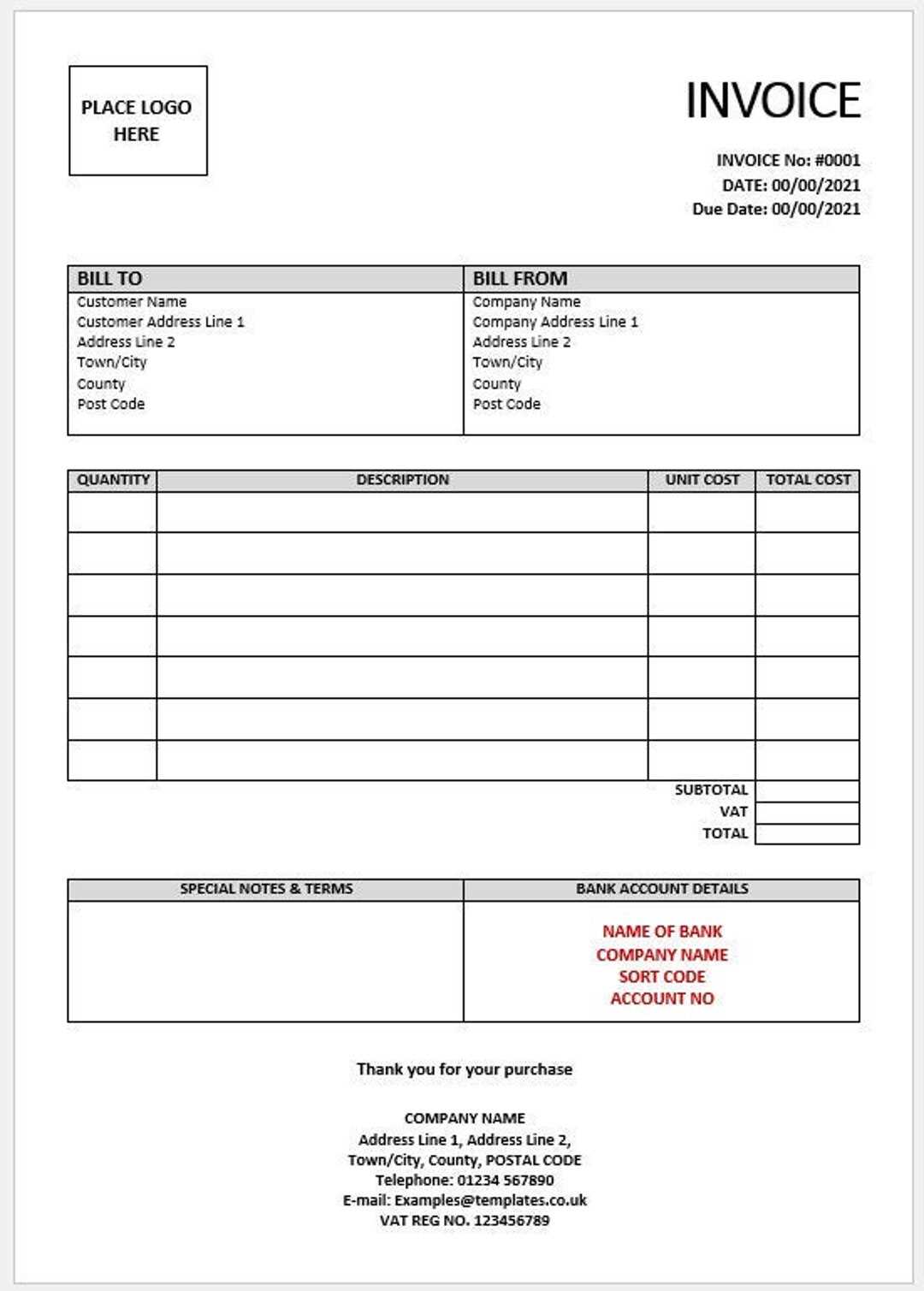

- Client and Company Information: Essential contact details for both the business and the client should be included for clarity and reference.

- Breakdown of Charges: Provide a detailed list of services or products, including quantities, rates, and total amounts, so the client can easily understand the charges.

- Payment Terms and Due Dates: Clearly state the payment terms, including due dates and accepted methods of payment, to avoid confusion and delay.

- Tax and Legal Information: Ensure that all applicable taxes are clearly stated, and any legal disclaimers or terms are visible and accurate.

Incorporating these features into your billing document not only improves the client experience but also helps your business maintain accuracy and professionalism in every transaction.

How Customizable Formats Save Time and Effort

Using a pre-designed document format for financial transactions can significantly reduce the time and effort spent on creating new documents from scratch. By having a structured layout with predefined fields, you can quickly input essential information without having to worry about formatting each time. This allows you to focus on other important tasks, increasing overall productivity and efficiency.

With a ready-made structure, repetitive tasks such as adding client details, payment terms, and itemized charges become much faster. Instead of manually adjusting fonts, spacing, or positioning for each transaction, a well-organized format ensures consistency and minimizes errors. This streamlined approach reduces the chance of mistakes, which can save time on corrections and improve the overall accuracy of your financial records.

Choosing the Right Format for Your Business

Selecting the ideal document layout for your business is a crucial step in managing financial transactions efficiently. The right structure should not only match your company’s branding but also ensure ease of use and accuracy in presenting payment details. Here are some important factors to consider when choosing a layout:

Key Considerations for Selection

- Business Type: Consider the nature of your business. A freelancer may require a simpler layout, while a larger company may need a more detailed format with multiple line items and tax information.

- Customization Needs: Choose a format that allows easy modification of fields to suit different clients, services, or pricing structures.

- Professional Appearance: Ensure the format aligns with your business’s image, incorporating your logo, color scheme, and fonts for a polished and consistent look.

- Ease of Use: A user-friendly layout ensures that your staff or team can quickly create documents without technical expertise or unnecessary complexity.

Why Consistency Matters

- Brand Identity: Consistent use of the same structure across all financial documents reinforces your business’s professional image and makes your communication more recognizable.

- Efficiency: Using a standardized format for all transactions ensures faster document creation and fewer errors.

By carefully selecting a layout that fits your specific needs, you can streamline your billing process, save time, and present a professional, cohesive image to your clients.

Top Billing Document Options for NZ

In New Zealand, there are a variety of billing document formats available to suit different business needs. Choosing the right one depends on factors like your business size, industry, and the level of customization required. Here are some of the top options to consider when selecting a structure for your financial documents:

- Simplified Layouts: Ideal for freelancers or small businesses, these formats offer a straightforward structure with just the essentials: company and client details, itemized services, and payment terms.

- Professional Business Formats: Larger companies often require more detailed documents, which include sections for multiple line items, taxes, and discounts. These are perfect for businesses with complex pricing structures or multiple services.

- Customizable Designs: For businesses looking for full flexibility, customizable designs allow you to adjust fonts, colors, logos, and sections to match your branding and operational needs.

- Online Billing Options: Many businesses in NZ are turning to cloud-based solutions for billing. These platforms often provide ready-to-use layouts that are accessible from any device and come with added features like automated reminders and payment tracking.

- Minimalist Styles: If you prefer a clean and modern look, minimalist layouts emphasize clarity and simplicity, focusing only on key information to maintain a professional yet straightforward appearance.

By exploring these different options, you can find a layout that fits your company’s unique requirements while ensuring accuracy and professionalism in every transaction.

Adjusting Document Layout for Professionalism

Ensuring that your financial documents look professional is essential for creating a positive impression with clients. A well-organized, visually appealing layout can enhance your credibility and help maintain clear communication. Adjusting the structure of your document to emphasize key details while keeping it uncluttered will reflect the professionalism of your business. Here are some tips for fine-tuning the layout to achieve a polished and professional look:

| Layout Element | Best Practice |

|---|---|

| Header Section | Include your company logo, name, and contact information at the top, aligned neatly for easy identification. |

| Client Information | Ensure that client details are presented clearly, with proper spacing and formatting, to avoid confusion. |

| Itemized List | Use well-organized tables with clear columns for services or products, quantities, rates, and totals. This helps the client quickly understand the charges. |

| Payment Terms | Display payment terms and due dates prominently to avoid misunderstandings. Use bold or italic text for emphasis. |

| Consistent Fonts | Choose a clean, professional font and stick to it throughout the document for uniformity and readability. |

By making these adjustments, your documents will not only look more polished but will also communicate your attention to detail and commitment to professionalism. This enhances the overall experience for your clients and contributes to building long-term business relationships.

Incorporating Branding into Your Billing Documents

Your financial documents are an important extension of your business’s brand identity. By incorporating consistent branding elements, you can create a unified, professional appearance that reinforces your business’s values and message. From color schemes to logos, each aspect of the design can help communicate your company’s professionalism and attention to detail. Here’s how to integrate your branding into your documents effectively:

Key Elements of Branding

| Branding Element | How to Use It |

|---|---|

| Logo | Place your logo at the top of the document for immediate recognition. Ensure it is high-quality and aligned with the overall layout. |

| Color Scheme | Choose colors that match your brand’s palette. Use these colors for headings, borders, or highlights to maintain consistency. |

| Font Style | Select fonts that are consistent with your brand’s design guidelines. Keep it simple and readable, avoiding too many different font types. |

| Contact Information | Display your contact information in a clean, consistent format. This reinforces your brand’s reliability and makes it easy for clients to reach you. |

| Custom Tags and Symbols | Incorporate any unique symbols or slogans that reflect your business’s identity, helping make your document more memorable. |

Why Branding Matters

Branding your financial documents helps you stand out in a competitive market. It conveys a professional image and reassures clients that your business is established and reliable. Additionally, consistent branding on all documents strengthens your company’s presence and builds trust with clients, making your business appear more polished and organized.

Adding GST and Other Taxes to Billing Documents

In many countries, including New Zealand, businesses are required to include Goods and Services Tax (GST) and other applicable taxes in their financial documents. Accurately adding these charges ensures compliance with local regulations and provides clients with clear, transparent information about the total cost of goods or services. Understanding how to correctly apply and display taxes is essential for both businesses and their clients.

When adding taxes to your documents, it’s important to specify the tax rate being applied and calculate the correct amount based on the total value of the transaction. In New Zealand, the standard GST rate is 15%, but this can vary depending on the nature of the goods or services being provided. Additionally, businesses must ensure they indicate whether the price is inclusive or exclusive of tax to avoid any confusion for the client.

To make the process even smoother, most document layouts allow you to create distinct sections for taxes, with a separate line for each tax rate applied. This way, clients can clearly see how the total is broken down, which improves transparency and ensures that the correct amount is paid.

Here are some tips for adding taxes effectively:

- Specify the Tax Rate: Always mention the exact rate applied, such as 15% for GST in New Zealand, to avoid ambiguity.

- Itemize the Tax Amount: Break down the tax by product or service so clients can easily understand how the charges add up.

- Highlight the Total: Make sure the final amount due, including taxes, is clearly visible, ideally in bold or with emphasis to avoid confusion.

How to Manage Billing Document Numbers

Managing document numbers effectively is crucial for keeping accurate records and maintaining compliance with accounting standards. Properly sequencing your billing documents helps track payments, avoid duplication, and ensures a systematic way to organize transactions. In any business, especially when dealing with multiple clients, assigning unique and consecutive numbers to each document is essential for efficiency and professionalism.

Steps to Manage Document Numbers

When creating documents, it’s important to establish a clear numbering system. This system can follow a simple incremental method or a more complex format based on date, client, or project codes. Here are some basic steps for managing your document numbers:

| Step | Action |

|---|---|

| 1 | Choose a Numbering Format: Decide whether to use a sequential number (e.g., #001, #002) or a more complex format that includes dates and client identifiers (e.g., 2024-01-001). |

| 2 | Ensure Uniqueness: Each document should have a unique number, preventing confusion and making tracking easier for both you and your clients. |

| 3 | Maintain Consistency: Stick to your numbering format across all documents for easier reference and a more professional appearance. |

| 4 | Record the Numbers: Keep a log or digital record of each document number issued to track which ones have been used and avoid duplication. |

Benefits of Proper Numbering

By managing your document numbers properly, you can streamline your accounting process and improve the clarity of your records. This helps avoid confusion during audits, reduces errors, and makes it easier to find specific documents when needed. A systematic numbering approach also improves client trust by presenting a professional, well-organized business front.

Using Payment Terms in Your Documents

Payment terms are a critical aspect of any financial document, as they establish the expectations for when payments are due and how they should be made. Including clear, precise payment terms in your documents helps avoid misunderstandings and ensures timely payments. These terms not only define the payment schedule but also help in setting professional boundaries between you and your clients.

Incorporating payment terms into your documents is essential for managing cash flow and establishing a formal understanding with clients. Whether you require payments upfront, upon completion, or within a specific timeframe, detailing the terms ensures that both parties are aligned and avoids potential disputes.

Common Payment Terms to Include

- Due Date: Specify the exact date by which payment is expected, such as “Due within 30 days of receipt.”

- Late Fees: Outline any penalties or interest charges that will apply if the payment is not made by the due date.

- Early Payment Discount: Offer incentives for clients who pay before the due date, such as a 2% discount if paid within 10 days.

- Payment Methods: Indicate the acceptable forms of payment, whether it’s bank transfer, credit card, or another method.

- Partial Payments: If applicable, specify whether you accept partial payments or require the full amount upfront.

Why Clear Payment Terms Matter

Having clear payment terms helps to ensure both parties understand their obligations, reducing the chance of disputes. By specifying payment conditions upfront, you set expectations regarding when and how payments will be processed, which can improve the overall payment cycle for your business. Furthermore, it enhances your professionalism, making clients feel more secure in their transactions with you.

Saving and Sharing Billing Files

Efficiently saving and sharing billing documents is a key part of managing business transactions. After creating a professional billing document, it’s essential to save it in a format that is both easy to access and secure for future reference. Additionally, sharing these documents with clients or colleagues should be done in a way that ensures clarity, reliability, and confidentiality.

One of the most effective ways to save these documents is by using widely supported file formats, such as PDF, which ensures that the formatting remains intact regardless of the recipient’s software. For sharing, email is a common method, but cloud-based solutions like Google Drive or Dropbox offer easy access and real-time collaboration opportunities.

Here are some tips for managing your billing documents:

- Choose the Right File Format: Save documents as PDFs to preserve formatting and ensure they can be opened on any device without issues.

- Organize Your Files: Use a clear and consistent naming convention for your files, such as “ClientName_Date_InvoiceNumber,” to help you locate them quickly.

- Utilize Cloud Storage: Store and share your documents via cloud services for easy access and backup. This also reduces the risk of losing important files.

- Limit Access: When sharing files online, use password protection or set access permissions to ensure only authorized individuals can view or edit the document.

By following these practices, you can ensure that your billing documents are securely saved and shared with ease, streamlining communication and improving business efficiency.

Common Mistakes to Avoid in Billing

Creating accurate and professional financial documents is essential for smooth business operations. However, even minor errors in these documents can lead to confusion, delayed payments, and damaged client relationships. It’s important to be mindful of common mistakes that can easily be avoided, ensuring your documents are clear, precise, and reflect the professionalism of your business.

From missing details to inconsistent formatting, these mistakes can affect both the efficiency of your billing process and your business reputation. By paying attention to the following key areas, you can significantly reduce errors and improve your financial documentation practices.

Common Billing Errors to Watch For

- Missing or Incorrect Contact Information: Always ensure that both your business and the client’s details are accurate, including names, addresses, and contact numbers.

- Failure to Include Payment Terms: Be sure to clearly outline payment due dates and late fees to avoid confusion and late payments.

- Inconsistent Pricing: Double-check the pricing for services or products to ensure they match the agreed-upon rates, including any discounts or promotions.

- Not Including Enough Detail: Avoid vague descriptions of products or services. Be specific so that both you and the client understand what is being charged.

- Incorrect Payment Methods: Always specify the accepted methods of payment, such as bank transfer, credit card, or other preferred options.

How to Prevent Billing Mistakes

- Use Clear and Consistent Formatting: Keep your document layout uniform and easy to read to prevent confusion.

- Double-Check Calculations: Ensure that all amounts, taxes, and totals are correctly calculated before sending out the document.

- Review Before Sending: Always review your documents for errors and omissions before sharing them with clients.

By avoiding these common mistakes, you’ll not only ensure that your documents are clear and professional but also build trust and reliability with your clients, helping to maintain positive business relationships.

How to Automate Your Billing Process

Automating the creation and management of your financial documents can save valuable time, reduce human error, and streamline the payment process. By incorporating automation into your workflow, you can ensure that invoices are generated, sent, and tracked without the need for manual intervention. This not only increases efficiency but also improves the accuracy and consistency of your billing system.

Whether you’re running a small business or managing a larger organization, automating key aspects of your billing system can help you focus on other critical tasks while ensuring that your financial operations run smoothly. In this section, we’ll explore the steps you can take to automate your billing process effectively.

Steps to Automate Billing

- Choose the Right Software: Select a billing or accounting tool that integrates automation features, such as recurring billing, client management, and tax calculations.

- Set Up Recurring Payments: For regular customers or subscription-based services, set up automated billing cycles to generate and send invoices at specified intervals.

- Customizable Payment Reminders: Automate payment reminders and late payment notices to reduce the risk of missed or delayed payments.

- Track Payments Automatically: Integrate payment processing systems that automatically update the status of each transaction, ensuring you always know when payments are made.

Key Features of Billing Automation Tools

| Feature | Description |

|---|---|

| Recurring Billing | Automatically generate and send invoices for subscription-based services at regular intervals. |

| Payment Tracking | Track the status of payments in real-time to easily see which invoices have been paid and which are still outstanding. |

| Custom Templates | Create and store personalized billing formats that are automatically filled with client details and transaction information. |

| Automated Reminders | Send email notifications or SMS alerts to clients when payments are due or overdue. |

By implementing these automation steps, you can eliminate manual errors, ensure timely billing, and free up your time for more strategic business activities. The more you automate, the more efficient and professional your billing system will become, benefiting both your business and your clients.

Best Practices for Consistent Billing

Maintaining consistency in your billing practices is essential for building trust with clients and ensuring smooth cash flow. A streamlined and uniform approach helps eliminate confusion, reduces the chance of errors, and creates a professional image for your business. By adopting best practices, you can ensure that your billing system operates effectively and efficiently, leading to timely payments and stronger business relationships.

Consistency in how you generate, present, and track financial documents will not only keep your business organized but will also contribute to customer satisfaction. Here are some key practices to follow for consistent and reliable billing.

- Standardize Your Format: Use a consistent layout for all billing documents to ensure clients recognize and understand them easily. This includes having clear headers, detailed descriptions of services, and transparent cost breakdowns.

- Include All Necessary Information: Always include essential details such as client information, due dates, payment terms, and itemized charges. A missing detail could delay payment or create confusion.

- Establish Clear Payment Terms: Set explicit terms for payment deadlines, late fees, and acceptable payment methods. This helps clients know exactly what is expected of them.

- Timely Issue and Follow-Up: Issue documents promptly and follow up consistently. A delay in sending documents or reminders could cause payment delays.

- Maintain Accurate Records: Keep precise and up-to-date records of all transactions. This will help you track overdue payments and resolve issues quickly if they arise.

- Use Automated Reminders: Set up automated notifications to remind clients of upcoming or overdue payments. This can save you time and reduce the need for manual follow-ups.

By following these best practices, you can ensure a more predictable and professional billing process. Consistency in your financial documents not only makes the process more efficient but also enhances your credibility and strengthens client relationships.

How Pre-designed Documents Improve Record Keeping

Using pre-designed documents can significantly enhance the way businesses organize and track their financial records. With consistent formatting and standardized fields, these documents make it easier to record transaction details, track payments, and manage accounts. By automating much of the process, they reduce the likelihood of errors and improve accuracy, which is crucial for both business operations and compliance.

Implementing structured layouts for record-keeping helps maintain consistency across all business transactions. By having a clear and uniform approach, it becomes much easier to retrieve and analyze past records, monitor payment histories, and ensure timely follow-ups. This organization is essential when preparing for audits or compiling reports at the end of the fiscal year.

Moreover, these pre-designed formats allow for efficient data entry, with fields specifically designed to capture all relevant information. This standardization reduces the time spent manually entering data and ensures that nothing important is overlooked. By improving accuracy and saving time, businesses can focus more on growth while keeping their financial records in perfect order.