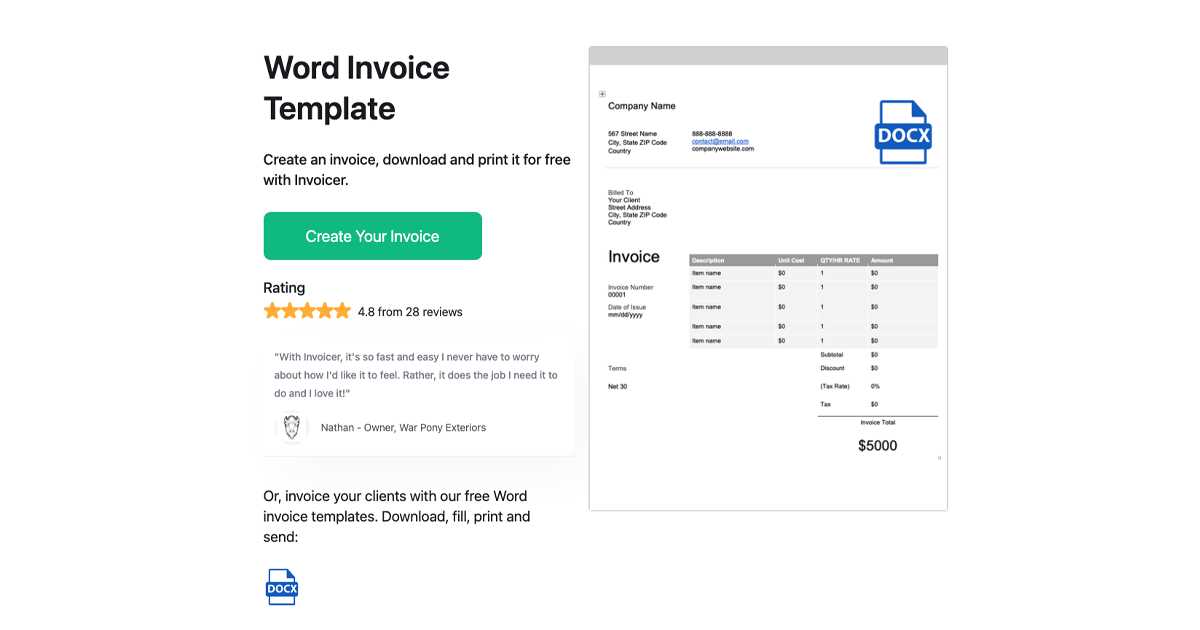

Free Word Invoice Template for Easy Customization

Running a business involves managing numerous administrative tasks, and one of the most important is creating clear and effective payment requests. Having a reliable, easy-to-use document format ensures your transactions are smooth and professional. With the right tools, you can quickly generate the required forms tailored to your needs.

There are various ways to generate these essential documents, but choosing the right format makes all the difference. Utilizing a customizable structure can save time and help you maintain consistency in all your communications. Whether you’re a freelancer or running a large company, simplicity and clarity in your payment forms are essential.

By using accessible document structures, you can craft the necessary forms without needing advanced design skills. Whether it’s personalizing the layout or adjusting specific fields, having the right foundation enables you to keep your process efficient and professional. You’ll be able to manage your billing without the hassle of complicated software, focusing instead on what matters most: growing your business.

Free Word Invoice Template for Businesses

Managing payments and tracking transactions is a crucial aspect of any business, and having a simple yet effective tool for creating billing documents can significantly streamline this process. With the right tools, business owners can generate clear and professional payment forms in just a few steps, helping them maintain a smooth cash flow. Whether you’re a small business owner or a freelancer, an easy-to-use document structure can make all the difference in your administrative efficiency.

Benefits of Using an Accessible Document Format

Having a ready-to-use structure for creating payment requests ensures that your documents are consistent and professional. It eliminates the need to start from scratch each time, saving you time and effort. With an intuitive layout, you can quickly input the necessary details, from client information to payment terms, without getting bogged down in complicated software or design tools. The simplicity of the format allows you to focus on running your business, not on administrative tasks.

How a Customizable Structure Saves Time

One of the key advantages of using a customizable layout is the ability to adjust it according to your specific business needs. Whether you’re working with different payment terms, varying service descriptions, or unique client information, having a flexible format allows for quick modifications. This customization ensures that each document reflects the specific details of your transaction, maintaining accuracy while also keeping the process efficient. By using a pre-made, customizable foundation, you’ll save valuable time while ensuring your documents always meet professional standards.

Why Use a Word Invoice Template

Having an efficient and consistent system for generating payment documents is essential for any business. A structured document format allows you to easily input transaction details, saving time and reducing errors. With the right layout, you ensure that all necessary information is included, and the document maintains a professional appearance each time. This approach eliminates the need to reinvent the wheel for every payment request and ensures accuracy across all transactions.

| Benefit | Description |

|---|---|

| Time-Saving | A ready-to-use document structure eliminates the need for starting from scratch each time you need to create a new payment request. |

| Professional Appearance | Consistency in design ensures that every document looks polished and reflects the professionalism of your business. |

| Customization | Easy adjustments allow you to personalize the format based on your business needs, from payment terms to client-specific information. |

| Accuracy | A structured format ensures that all relevant details are included, reducing the likelihood of missing important information. |

By using a structured layout, businesses can improve their billing process and ensure all payment documents are created with minimal effort and maximum consistency. This method simplifies administrative tasks and helps maintain an organized approach to financial management.

Top Benefits of Word Invoice Templates

Utilizing a pre-designed document structure for creating payment requests offers numerous advantages for businesses of all sizes. It streamlines the process, enhances consistency, and ensures that each billing document is professionally presented. The right setup allows you to focus on your core activities while minimizing the time spent on administrative tasks.

Efficiency and Time Savings

One of the primary benefits of using a structured layout is the time saved by avoiding the need to create new documents from scratch every time. With a set format, you can quickly fill in the necessary information and generate a polished, professional document in minutes.

- Quick Setup: Pre-made forms allow you to jump right into editing, saving you the hassle of formatting each document individually.

- Reduced Errors: Standardizing your documents helps prevent mistakes, ensuring that all required fields are filled in every time.

Customizability and Flexibility

Even though these document structures come with a set layout, they are highly customizable to fit specific business needs. You can easily change elements like payment terms, item descriptions, or client information, making the documents adaptable to a variety of situations.

- Tailored Layout: Adjust the format to suit your brand and the unique requirements of each transaction.

- Easy Updates: Quickly modify fields to reflect changes in pricing, services, or tax rates.

By leveraging these ready-made, customizable tools, you can keep your billing process organized, efficient, and professional. The flexibility of these formats helps businesses stay agile while maintaining consistency across all transactions.

How to Download a Free Template

Accessing a pre-designed document for payment requests is simple and can be done in just a few steps. Many websites offer easy downloads of ready-to-use forms, allowing you to quickly start creating professional documents. Once you find the right format, you can customize it to suit your specific needs and business requirements.

To begin, search for reliable sources that provide these ready-made layouts. Several websites specialize in offering customizable documents that are ready for download with minimal effort. Typically, the process involves navigating to a page, selecting the document that best fits your needs, and clicking a download button.

Once downloaded, open the document in your preferred program to make any necessary edits, from client details to payment terms. With this simple process, you can generate well-structured, professional documents in just a few clicks.

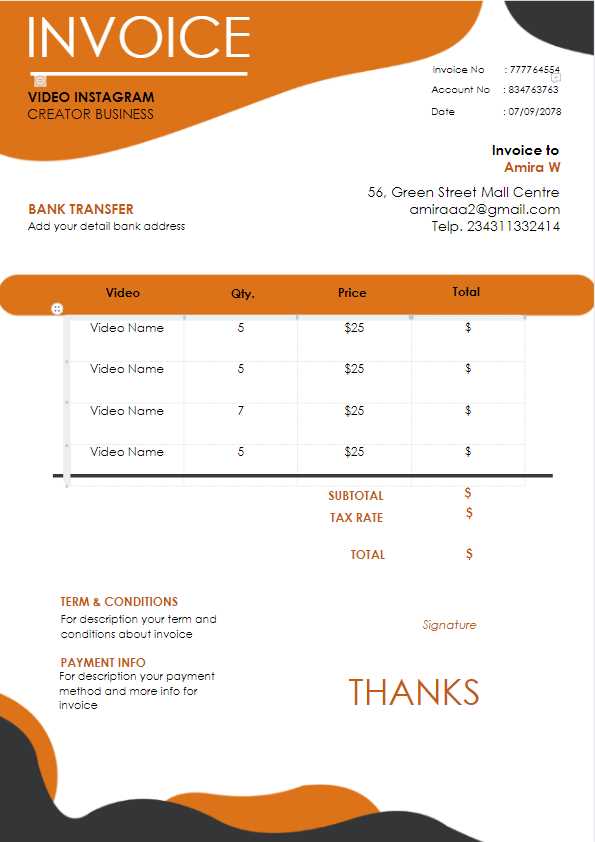

Customizing Your Word Invoice Template

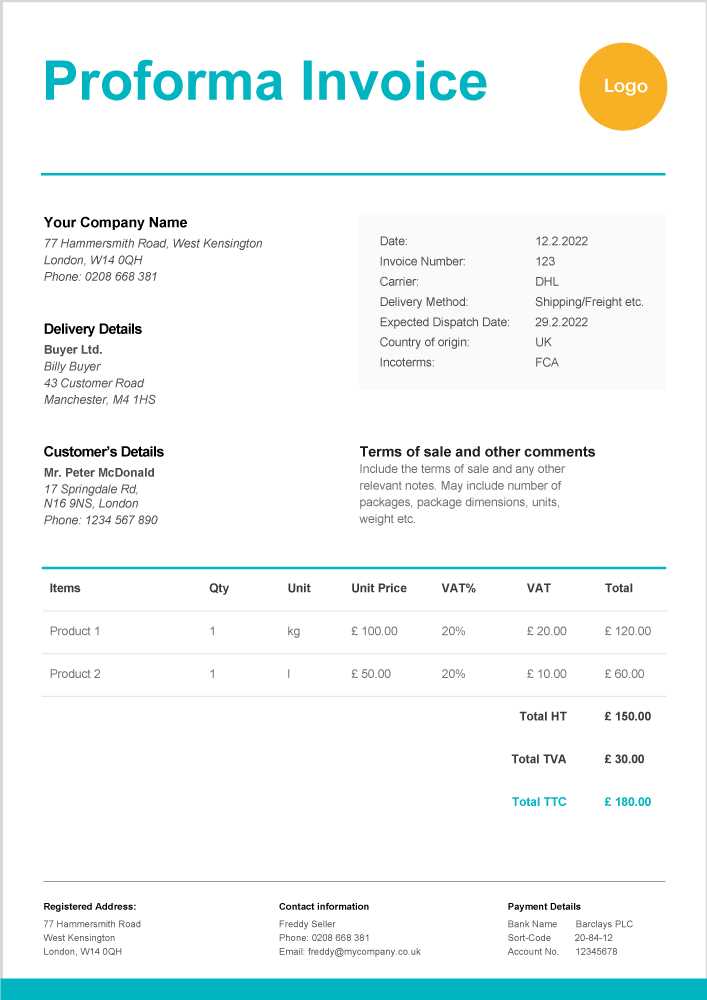

Personalizing your billing documents allows you to align them with your business branding and specific needs. Customization is an important step to ensure that all relevant details are included and presented clearly. Whether you want to change the layout, add your company logo, or adjust payment terms, a structured format makes it easy to tailor documents to your preferences.

Once you’ve selected a suitable document structure, you can begin by modifying the essential fields. You might want to input your business name, contact information, and logo at the top. After that, adjusting the payment terms, adding itemized lists, or including tax information can make the document more specific to each transaction. Customization ensures that your documents reflect your unique business style while maintaining clarity and professionalism.

How to Add Your Company Logo

Incorporating your business logo into your payment documents is a great way to enhance brand recognition and present a polished, professional image. By placing your logo at the top of the document, you make it instantly recognizable to clients, reinforcing your brand identity. The process of adding your logo is simple and can be done in just a few steps.

Steps to Insert Your Logo

- Prepare Your Logo: Ensure that your logo is saved in a commonly supported format, such as .jpg, .png, or .gif.

- Open the Document: Once your billing document is open, locate the header section where you want to add the logo.

- Insert the Logo: Use the “Insert” tab in your document editor, then select the “Picture” or “Image” option. Choose the logo file from your computer and click “Insert.”

- Resize and Position: Adjust the size of the logo to fit the space appropriately, ensuring it doesn’t overpower the text. You can move it to the left, right, or center depending on your preference.

- Save the Document: Once you’re happy with the logo’s placement, save the document to preserve your changes.

Tips for Logo Placement

- Size Matters: Keep your logo proportionate to the document, ensuring it’s visible but not too large to distract from the essential details.

- Keep It Simple: Choose a logo that looks clear and sharp even when resized.

- Maintain Consistency: Use the same logo placement and size for all of your documents to ensure brand consistency.

By following these simple steps, you can easily add your company logo to all your billing forms, creating a more professional and cohesive appearance that clients will recognize and appreciate.

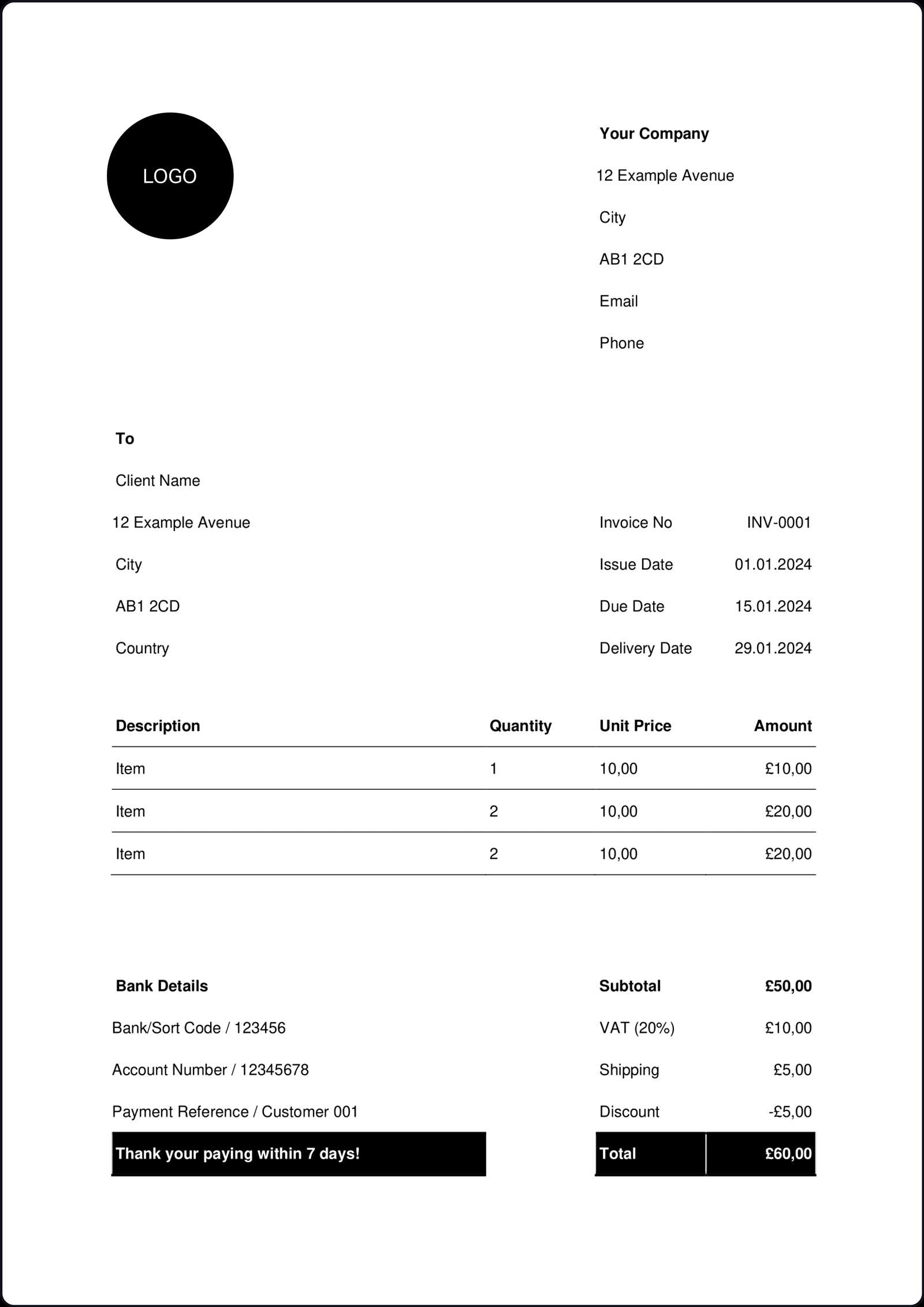

Setting Up Payment Terms on Invoices

Establishing clear and precise payment terms is essential for ensuring smooth financial transactions between businesses and clients. By specifying the conditions for payment, you help avoid misunderstandings and ensure that both parties are aligned on expectations. These terms should be clearly outlined on each billing document to provide clarity and prevent delays in payment.

Payment terms typically include details like the due date, acceptable payment methods, and any discounts or penalties for early or late payments. Clearly communicating these terms helps set expectations and ensures that clients understand their responsibilities. The following steps can help you effectively set up these terms on your documents:

Steps to Set Payment Terms

- Define the Due Date: Clearly state the date by which payment should be made. Common options are “Due upon receipt,” “Net 30,” or a specific date (e.g., 15th of the month).

- Specify Payment Methods: List the methods through which clients can pay, such as bank transfers, credit cards, checks, or online payment services.

- Include Early Payment Discounts: If you offer a discount for early payment (e.g., 5% off if paid within 10 days), clearly indicate this in your terms.

- Penalties for Late Payments: If you impose a late fee, specify the penalty (e.g., 2% per month) for overdue payments.

Best Practices for Payment Terms

- Keep It Simple: Ensure the payment terms are straightforward and easy to understand.

- Be Consistent: Use the same payment terms for all clients to ensure fairness and avoid confusion.

- Review Regularly: Reevaluate your payment terms periodically to ensure they align with your business needs and industry standards.

By carefully setting and displaying payment terms, you help create a clear framework for transactions that reduces the risk of disputes and encourages timely payments.

Including Tax Information in Your Invoice

Accurate tax information is essential for both businesses and clients to ensure compliance with local tax laws. By including relevant tax details on payment documents, you provide transparency and make it easier for clients to process payments while keeping records organized. Clear tax information also helps avoid misunderstandings and ensures that businesses are prepared for audits or reviews by tax authorities.

Types of Tax Information to Include

When including tax details, it’s important to be precise. Here are some common elements you should consider adding to your payment documents:

- Tax Rate: Indicate the applicable tax rate, such as 10%, 15%, or VAT rate depending on your location.

- Tax Amount: Clearly state the amount of tax applied to the transaction. This should be calculated based on the tax rate and the subtotal of the sale.

- Tax Identification Number (TIN): If required, include your business’s tax ID number for verification purposes.

- Exemption Details: If the transaction is exempt from taxes, provide the relevant exemption details or codes.

Best Practices for Including Tax Details

- Ensure Accuracy: Double-check the tax rate and amounts to avoid errors that could lead to compliance issues.

- Use Clear Labels: Make sure tax-related information is clearly labeled and easy to locate on the document.

- Stay Updated: Keep tax rates and laws up to date to ensure that you are complying with the most current regulations.

By properly including tax information, you not only stay compliant with legal requirements but also provide a clear, professional document that clients can easily understand and process.

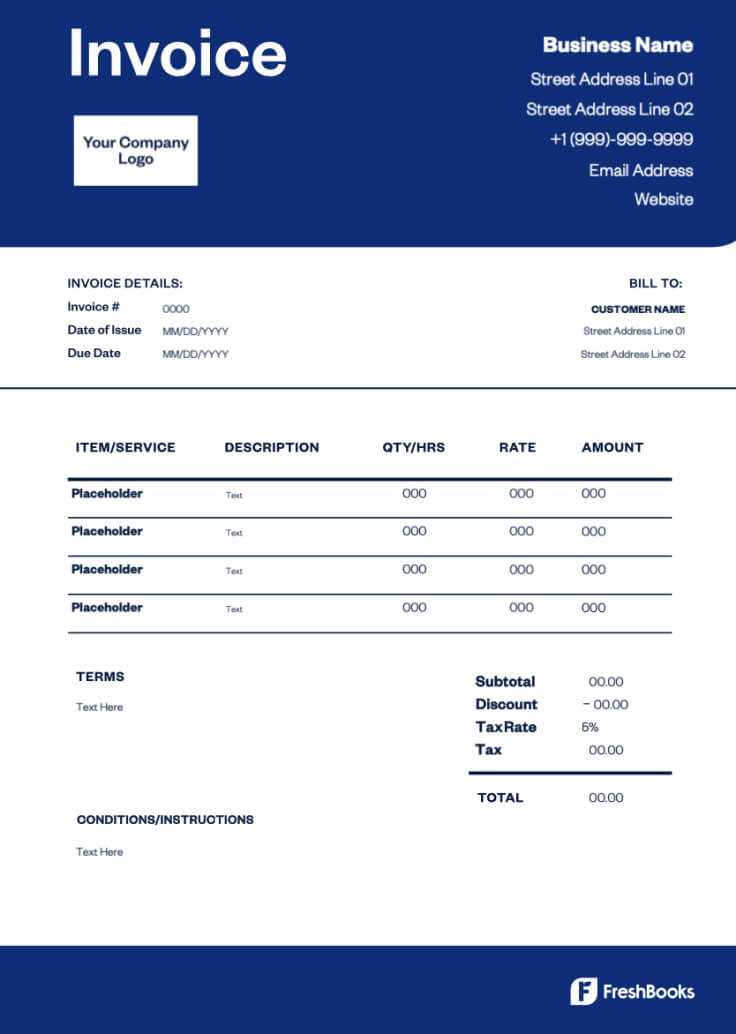

Creating Professional Invoices in Minutes

Generating well-organized, professional payment documents doesn’t have to be a time-consuming task. With the right tools and structures, you can create polished billing statements quickly and efficiently. Whether you’re a small business owner or a freelancer, having an easy-to-use format allows you to focus on your work without worrying about administrative details.

Steps to Create Efficient Payment Documents

Follow these simple steps to produce professional documents in no time:

- Choose a Structured Layout: Select a format that includes all the necessary fields, such as client details, services or products provided, and payment terms.

- Fill in Key Information: Add relevant data such as business name, contact information, and specific billing details like item descriptions and amounts.

- Set Clear Payment Terms: Clearly state when the payment is due and any terms for discounts or penalties to avoid confusion later.

- Personalize with Branding: Include your business logo and choose a color scheme that matches your brand identity to give your documents a professional look.

Why Speed Matters

- Efficiency: Reducing the time spent on creating billing documents allows you to dedicate more effort to your core business activities.

- Consistency: By using a consistent layout and format, you make it easier for clients to understand and process their payments.

- Professional Appearance: A polished document enhances your reputation, showing clients that you take your business seriously.

By following these straightforward steps, you can create clear, professional documents in just minutes, ensuring that you maintain a high standard of communication with your clients while streamlining your billing process.

Why Word Is Ideal for Invoices

Using the right software for creating billing documents is crucial for efficiency and professionalism. Certain tools offer greater flexibility, ease of use, and compatibility, making them ideal for generating clear and structured payment requests. One such tool stands out due to its accessibility, wide range of features, and ability to customize documents quickly and easily.

Advantages of Using Word for Billing Documents

- Familiar Interface: Most people are already familiar with the user interface, which makes the process of creating documents faster and easier.

- Customization Options: You can easily adjust the layout, fonts, colors, and other elements to match your branding, ensuring the document aligns with your business identity.

- Compatibility: It’s widely compatible with other software, making it simple to share, print, or save your billing documents in various formats such as PDF.

- Pre-built Layouts: Many programs offer pre-designed structures that help save time, while still allowing for personalization, ensuring your payment documents look professional.

- Simple to Edit: Making changes is straightforward, allowing you to quickly update any details such as prices, services, or client information as needed.

Why This Is Crucial for Your Business

- Time-Efficient: Quick edits and easy customization save time that can be better spent on other aspects of your business.

- Professionalism: A well-crafted document reflects positively on your business, helping you maintain a professional image with clients.

- Consistency: Using the same software for all your billing documents ensures uniformity, making your communication with clients smoother and more organized.

By using this versatile tool, you can create high-quality, customizable documents in no time, making it an ideal choice for managing your business’s financial communications.

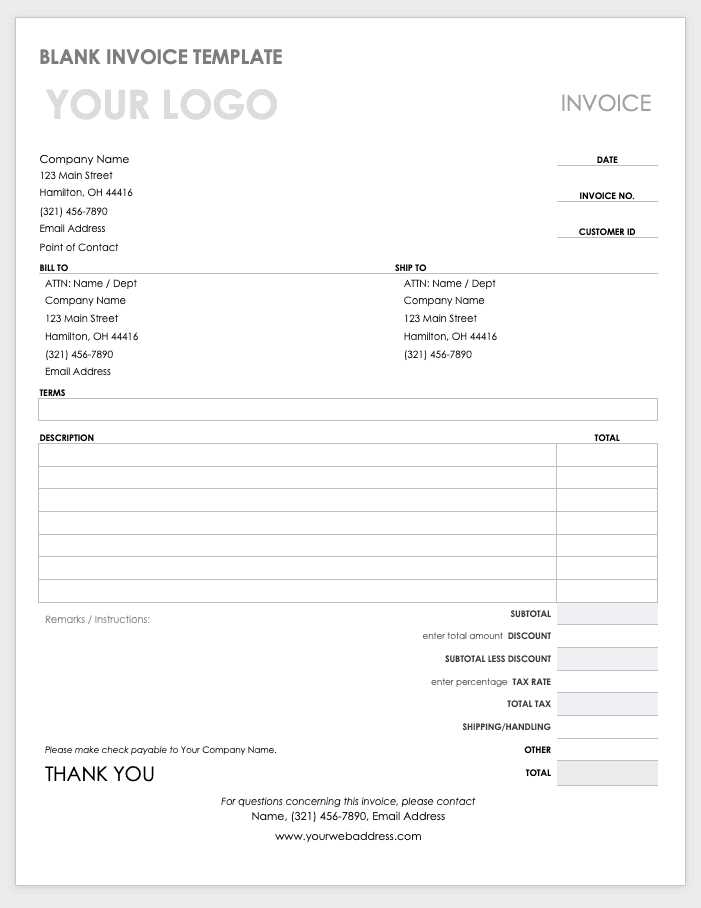

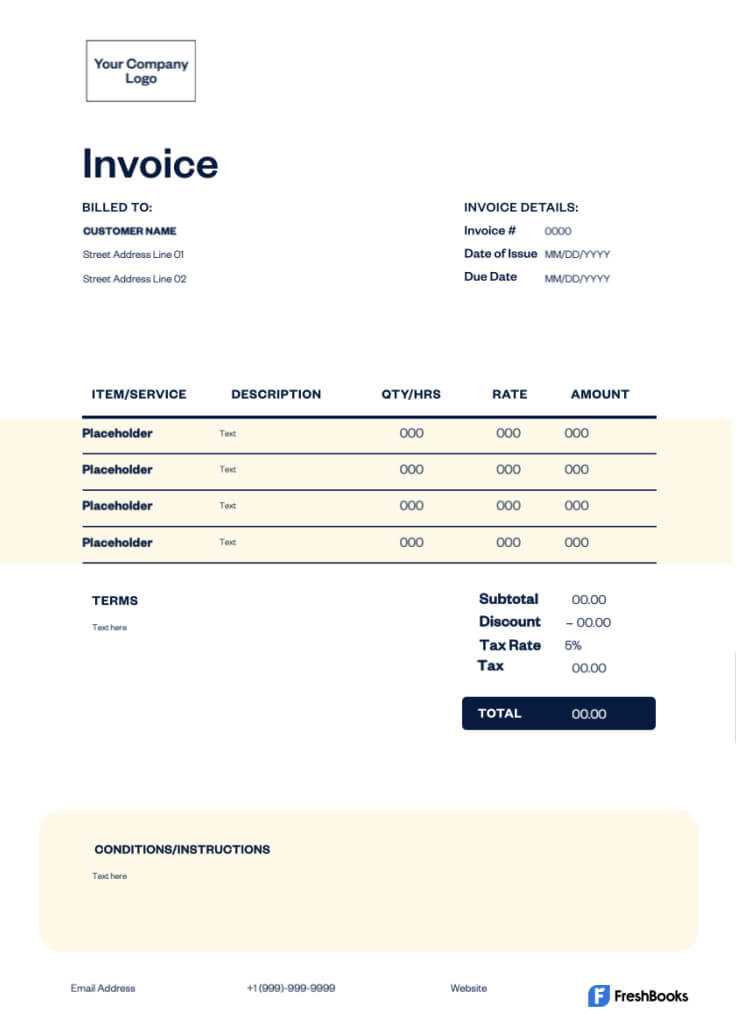

Choosing the Right Template for Your Business

Selecting the most suitable layout for your billing documents is essential for maintaining a professional appearance and ensuring clear communication with your clients. The right structure will help streamline your administrative tasks while ensuring consistency and clarity in every transaction. With a variety of designs available, it’s important to choose one that aligns with your business needs and industry standards.

Factors to Consider When Choosing a Layout

When deciding on the best format, consider these key factors:

| Factor | Why It Matters |

|---|---|

| Industry Requirements | The design should reflect your industry standards and legal requirements, especially if there are specific fields that need to be included, such as tax information or licensing details. |

| Brand Consistency | Pick a layout that complements your branding, including your logo, color scheme, and fonts, to ensure consistency across all your business documents. |

| Client Expectations | Consider what your clients prefer in terms of readability and simplicity. A clear, easy-to-understand design is likely to foster better relationships. |

| Customization Needs | Choose a format that is easy to edit and adapt based on varying details such as pricing, services, or client information. |

Tips for Selecting the Perfect Design

- Keep It Simple: Choose a format that avoids clutter and focuses on the most important details.

- Ensure Readability: Opt for clean fonts, clear headings, and sufficient spacing for easy reading.

- Test Before Use: Create a sample document first to ensure that the layout works well with your business information and that there are no missing elements.

By carefully considering these factors, you can select the most appropriate layout for your business needs, enhancing both efficiency and professionalism in your financial communication.

How to Save and Store Word Invoices

Efficiently saving and organizing your billing documents is essential for smooth business operations. Proper storage not only ensures that you can quickly access documents when needed, but it also keeps your financial records secure and easily retrievable for future reference or audits. Whether you store your files digitally or in physical form, the key is to implement a consistent and organized system.

Digital Storage Methods

Storing your billing documents digitally offers several advantages, including ease of access and enhanced security. Here are some tips for managing your digital files:

- Use Cloud Storage: Cloud services like Google Drive, Dropbox, or OneDrive allow you to store documents safely while providing access from any device.

- Create a Folder Structure: Organize your files in clearly labeled folders by client, project, or date for easy retrieval.

- Use Descriptive File Names: Name your documents with clear identifiers such as the client’s name, date, and document type (e.g., “Smith_Contract_March2024”).

- Back-Up Your Files: Regularly back up your documents to an external drive or another cloud service to prevent data loss.

Physical Storage Options

If you prefer to keep hard copies of your financial documents, consider these tips for physical storage:

- File Cabinets: Use labeled folders or file cabinets to organize your documents by year, client, or project.

- Keep Documents Secure: Store important files in a locked cabinet or safe to protect them from theft or damage.

- Maintain a Backup: It’s always a good idea to have a digital copy in case of physical loss or damage.

By implementing these strategies, you can ensure that your billing records are not only safe but also easily accessible whenever you need them. A well-organized storage system will save you time and effort in managing your business’s financial documents.

Common Mistakes to Avoid in Invoices

Creating clear and accurate billing documents is crucial for maintaining professional relationships and ensuring timely payments. However, there are several common errors that can lead to confusion, delays, or disputes. Being aware of these pitfalls can help you avoid costly mistakes and improve your billing process.

Missing or Incorrect Information

One of the most frequent mistakes in billing documents is missing or incorrect details. This can result in delays in payment or miscommunication with clients. Here are some key details to double-check:

- Client Details: Ensure that the client’s name, address, and contact information are accurate.

- Service or Product Description: Clearly list the items or services provided, including quantities, rates, and any relevant terms.

- Due Date: Specify the due date for payment to avoid confusion and ensure timely processing.

- Payment Instructions: Include clear instructions on how the client can pay, including acceptable methods and any necessary bank details.

Formatting and Layout Issues

Another common error is poor formatting, which can make your documents look unprofessional and difficult to read. Here’s how to improve the overall layout:

- Cluttered Design: Keep the layout clean and organized with sufficient white space to make the document easy to navigate.

- Unclear Totals: Ensure that the total amount due is clearly visible, and that taxes, discounts, and additional fees are itemized properly.

- Inconsistent Fonts and Styles: Stick to one or two font styles to maintain consistency and professionalism.

By taking the time to check for these common mistakes and correcting them before sending out your documents, you can ensure that your billing process runs smoothly and that you maintain a professional image with your clients.

How to Add Discounts and Fees

In business transactions, it’s important to accurately reflect any discounts or additional charges on your billing documents. Properly applying these adjustments ensures transparency and helps avoid confusion. Whether you are offering a special discount or need to add extra fees for services, it’s crucial to present this information clearly.

Applying Discounts

Discounts are a common way to encourage early payment or reward loyal customers. To ensure the discount is correctly applied, follow these steps:

- Specify the Discount Type: Clearly mention whether the discount is a percentage off the total amount or a fixed dollar amount.

- Indicate the Discount Terms: Note any conditions for the discount, such as a specific time frame or payment method requirements.

- Show the Discount Amount: Clearly state the discounted amount either as a percentage or dollar value before showing the total.

Adding Fees

Additional charges, such as late fees or service fees, may apply to the total amount due. Be sure to itemize these charges for full transparency:

- List the Fee Description: Clearly describe the purpose of the fee, whether it’s for expedited service or covering handling costs.

- Detail the Fee Amount: Specify the exact amount for each charge and ensure it’s added before the total.

- Explain Conditions: If the fee applies under certain circumstances (e.g., late payment), make sure the terms are stated clearly.

Example Breakdown

| Description | Amount |

|---|---|

| Service Fee | $20.00 |

| Discount (10%) | -$15.00 |

| Total Amount Due | $205.00 |

By accurately adding any discounts or fees, you provide a clear and professional breakdown of the charges, ensuring both you and your clients understand the final amount due.

Ensuring Invoice Accuracy and Clarity

To maintain a professional relationship with your clients, it’s essential to ensure that all billing documents are clear and free from errors. Accuracy in your records helps prevent misunderstandings and delays in payments, fostering trust and efficiency. Being thorough in presenting all the required details with precision is key to an effective business transaction.

Double-Check Key Information

One of the first steps in creating a reliable document is verifying that all critical data is correct. This includes the business and client’s contact information, dates, and amounts. Failing to confirm these details can lead to confusion and complications. Key areas to review include:

- Client Name and Address: Ensure the correct spelling and complete address details for both your company and the customer.

- Service or Product Descriptions: Clearly describe the services or items being charged, including any relevant quantities or unit prices.

- Payment Terms: Verify the payment due date, terms of payment, and any discounts or additional fees applied.

Formatting for Clarity

Presenting information in an organized manner is crucial for ease of understanding. Use simple, straightforward language and logical grouping of related data. Follow these guidelines for enhanced clarity:

- Structured Layout: Use headings, bullet points, and tables to separate key sections such as total amounts, discounts, and additional charges.

- Consistent Formatting: Ensure all numbers are presented consistently (e.g., decimal places, currency symbols) to avoid confusion.

- Readable Fonts: Choose easy-to-read fonts and ensure there’s adequate spacing between sections to make the document look clean and organized.

By taking the time to verify all information and use a structured layout, you can ensure that your billing statements are both accurate and easy to understand, leading to smoother transactions with your clients.

Integrating Word Invoices with Accounting Software

Connecting billing documents with accounting tools can significantly streamline your financial processes. By automating the transfer of billing details to your accounting system, you can reduce the likelihood of errors and save valuable time spent on manual data entry. This integration not only simplifies record-keeping but also enhances the overall efficiency of your business operations.

Benefits of Integration

Integrating billing documents with accounting software offers several key advantages, including:

- Improved Accuracy: Automated data transfer reduces human errors, ensuring that all financial records are precise and consistent.

- Time Savings: Eliminates the need for manual entry, allowing your team to focus on more important tasks.

- Real-Time Updates: Changes made to billing documents are instantly reflected in your financial records, providing up-to-date information for decision-making.

- Streamlined Reporting: Seamlessly integrates with accounting reports, making it easier to track revenues, expenses, and tax liabilities.

Steps to Integrate Your Documents

To integrate your billing system with accounting software, follow these general steps:

- Choose Compatible Software: Ensure that your accounting platform supports importing data from external sources, such as billing documents in specific formats.

- Set Up Data Transfer: Configure the integration settings to automatically transfer billing information, such as amounts, client details, and payment terms, into your accounting system.

- Test the Process: Run test imports to ensure that all data is transferred correctly and appears as expected in your accounting software.

- Maintain Security: Use secure methods to transfer sensitive financial data and keep your software updated to protect against potential threats.

Integrating your billing system with accounting tools simplifies financial management and enhances the accuracy of your records, providing a seamless experience for both you and your clients.

Free Resources for Word Invoice Templates

When looking to create professional documents for billing purposes, many businesses turn to online platforms that offer customizable and easy-to-use tools. These resources provide a range of document formats that cater to different industries and client needs, without requiring any investment in expensive software. By utilizing these platforms, you can streamline your invoicing process and ensure your documents meet business standards.

Top Resources for Billing Document Templates

Here are some excellent platforms where you can find customizable resources for your business:

| Resource Name | Key Features | Website |

|---|---|---|

| Template.net | Offers a wide variety of customizable business documents, including billing formats, with professional designs. | template.net |

| Canva | Easy-to-use platform with drag-and-drop functionality for creating customized billing documents. | canva.com |

| Microsoft Office Templates | Microsoft provides a selection of ready-made billing document formats that can be customized for different industries. | office.com |

| Google Docs | Provides a variety of templates for creating billing documents in an easy-to-edit format. | docs.google.com |

Why Choose These Resources?

Utilizing these platforms can save you time and effort by offering easy access to well-designed templates. These resources come with built-in customization options, allowing you to add your business’s details, adjust formatting, and ensure that your documents meet all the necessary requirements. Whether you’re a small business owner or a freelancer, these free resources make document creation hassle-free.

How to Print and Send Your Invoice

After creating your billing document, the next crucial steps are to ensure that it is properly printed and sent to your client. This process involves selecting the best format for delivery, ensuring the document’s accuracy, and choosing the appropriate method to send it. With the right tools, printing and sharing can be quick and efficient, ensuring your business receives payment promptly.

Printing Your Billing Document

Before printing, it’s important to review the content to make sure that all the information is correct. You should also check for any formatting issues that may affect the layout. Below are the common steps to follow when preparing your document for printing:

| Step | Description |

|---|---|

| 1. Review the document | Ensure that all client details, services or products, and amounts are accurate. |

| 2. Choose the right printer settings | Set your printer to high-quality printing, and check that paper size and margins match your document. |

| 3. Print the document | Click “Print” and select your desired printer. Review the printed copy to ensure clarity. |

Sending the Document to Your Client

Once the document is printed, you can choose to send it physically via mail or electronically. Below are the most common methods for sending the document to your client:

- Email: Attach the document as a PDF or other accessible file format and send it to your client’s email address.

- Postal Mail: If sending a hard copy, ensure that you use the correct mailing address and consider using tracking services for delivery confirmation.

- Online Billing Platforms: Many online platforms allow you to send billing documents directly to clients with automatic tracking and notifications.

Whichever method you choose, it’s important to follow up with your client if needed to confirm receipt and ensure that payments are processed in a timely manner.