Download Word Invoice Template for Canada to Simplify Your Billing

Managing your financial transactions efficiently is key to running a successful business. One of the most important aspects of this process is ensuring that your billing method is clear, professional, and easy to use. By choosing the right tools and templates, you can save valuable time and avoid common errors that could delay payments or create confusion for your clients.

For entrepreneurs and businesses in need of an effective billing solution, there are various document formats available that simplify the task of creating clear and accurate payment requests. These tools are customizable to fit your specific needs and ensure that all necessary details are included, from service descriptions to payment terms.

By utilizing ready-made documents, business owners can focus more on their core activities and less on administrative tasks. Whether you’re a freelancer, small business owner, or a larger company, having a reliable structure in place will improve your cash flow and strengthen your professional relationships with clients.

Essential Features of Billing Document Formats

When creating a professional payment request, certain features are crucial for ensuring clarity, accuracy, and easy processing. These essential components help both the sender and recipient to easily understand the details of the transaction, fostering smooth communication and faster payments. Customizable structures provide flexibility, while standardized elements maintain consistency and professionalism.

Key Elements to Include

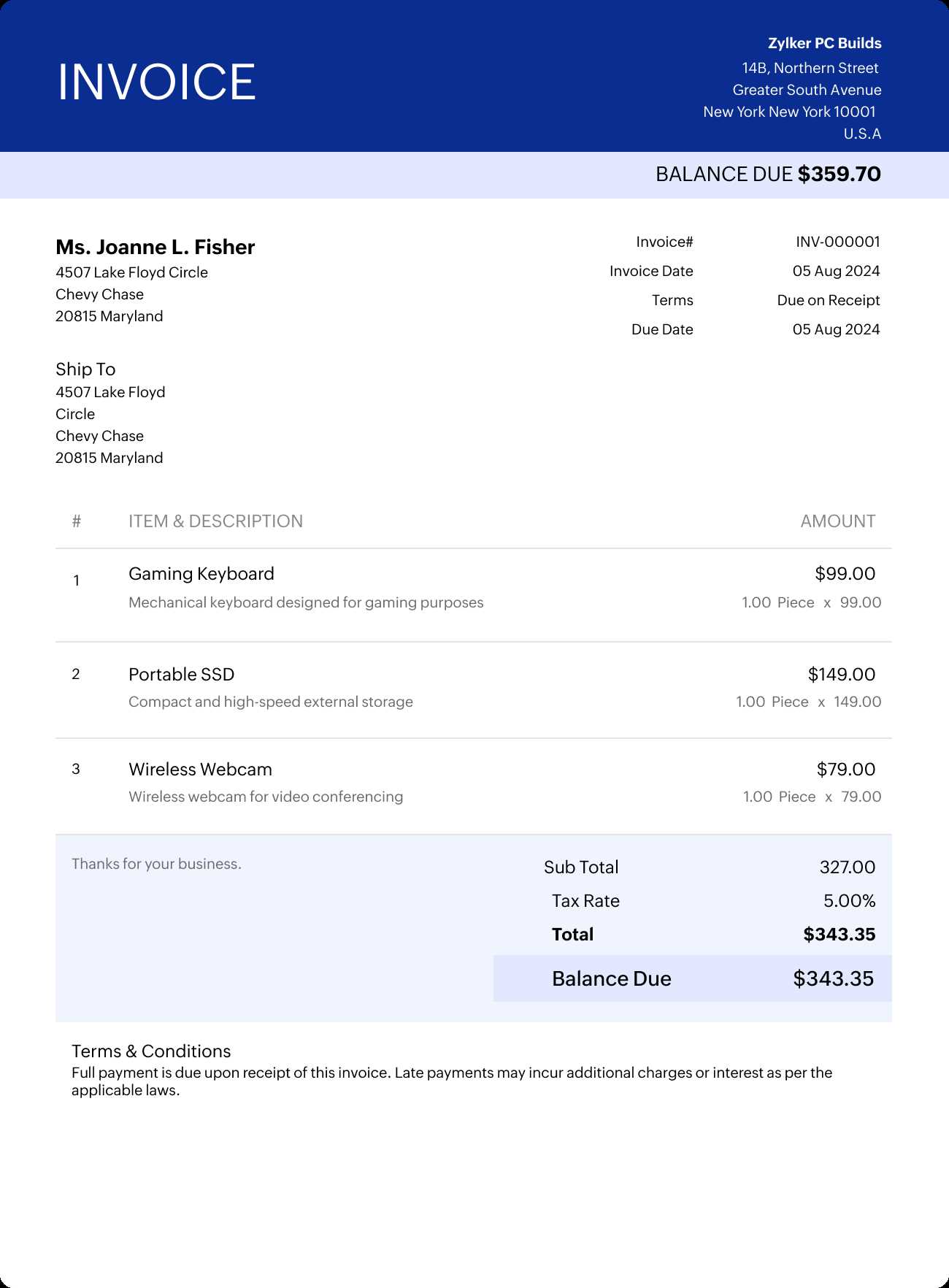

The following elements are fundamental when designing a billing document:

- Business Information: Always include your company name, contact details, and business number for identification purposes.

- Client Details: The recipient’s name, address, and any necessary account numbers should be clearly listed.

- Itemized List: A breakdown of the services or goods provided, including descriptions, quantities, and rates.

- Payment Terms: Clearly state when payment is due, any late fees, and the acceptable methods of payment.

- Unique Reference Number: Each document should have a distinct identification number to help both parties track the transaction.

- Tax Information: Ensure that applicable taxes are calculated and displayed correctly based on local regulations.

Customization Options

The flexibility of these formats allows you to tailor them to your specific needs. Common customization options include:

- Adding your company logo for branding.

- Modifying the layout to suit your business style or industry requirements.

- Adjusting fonts, colors, and formatting for better readability.

These essential features combine to create a comprehensive, professional billing document that can be easily customized and used for any transaction, ensuring accuracy and professionalism in every business interaction.

Why Choose Word for Invoicing

When it comes to creating professional payment requests, simplicity and flexibility are key. Many businesses rely on versatile document editing software to craft customized billing documents. These tools allow users to create clear, professional-looking forms without the need for complex software or technical skills, making them a popular choice for entrepreneurs and small businesses alike.

One of the main reasons for choosing this software is its user-friendly interface. The learning curve is minimal, allowing new users to start creating accurate documents quickly. Furthermore, the wide range of formatting and customization options enables business owners to create documents that reflect their brand’s identity while ensuring all necessary details are included for smooth transactions.

Cost-Effective and Accessible

This option is also highly affordable and widely accessible. Many businesses already have access to this software as part of their standard office suite. There are no additional costs for specialized invoicing tools, and documents can be easily shared across devices, ensuring collaboration and easy distribution.

Customization and Professionalism

With customizable fields and built-in styles, it’s easy to adjust every document to meet specific requirements. The ability to add company logos, adjust fonts, and include personalized terms gives business owners complete control over the presentation and structure of each form. This contributes to a polished, professional look that can build trust with clients.

In summary, using this widely available tool for billing documents offers businesses an easy, affordable, and professional way to handle payments efficiently while maintaining customization options tailored to their specific needs.

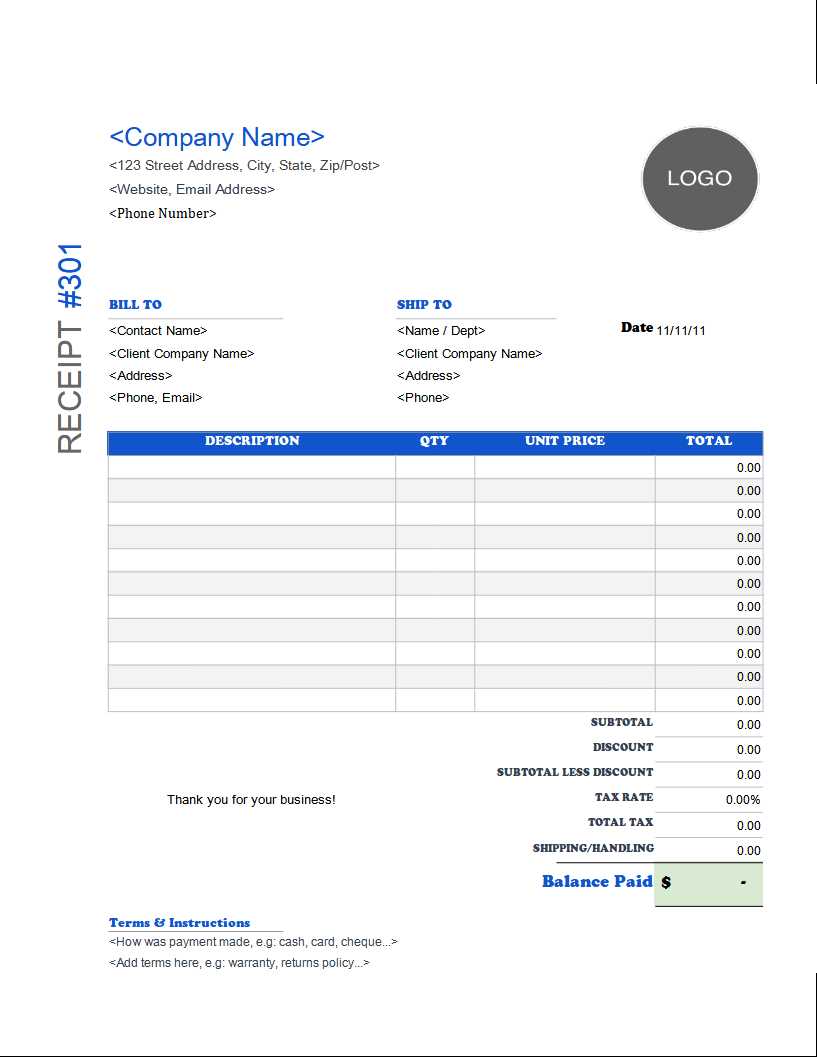

How to Create Custom Billing Documents

Creating a personalized billing document is essential for maintaining professionalism and accuracy in your financial transactions. By using the right software, you can design documents that meet your business needs and reflect your brand. Customization allows you to include all necessary details while presenting them in a clear and organized way. Below are the simple steps to create a custom billing document that ensures your payment requests are both professional and effective.

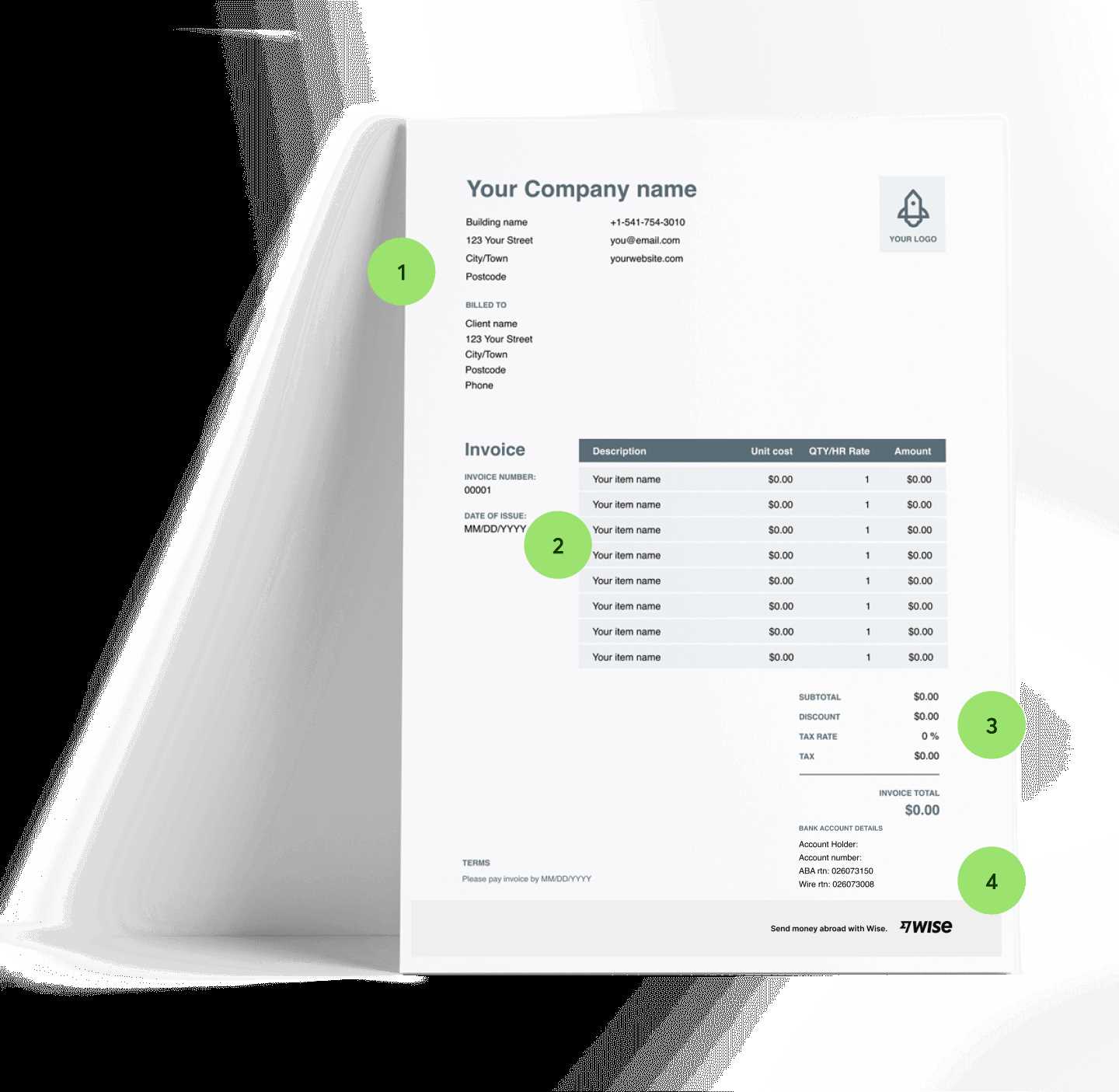

Step 1: Choose a Suitable Format

Start by selecting a blank document or a pre-designed layout. If you’re using a customizable tool, you’ll find multiple options for basic layouts that you can easily modify. Ensure the format you choose supports all the required sections, such as the business and client details, a breakdown of services or products, payment terms, and totals.

Step 2: Input Your Business Information

Include your company name, address, contact details, and business registration number at the top of the document. This ensures your clients can easily reach you if necessary and helps establish credibility.

Step 3: Add Client Information

Below your company details, add the recipient’s information. This includes the client’s name, address, and any relevant account or reference numbers. Including this information is crucial for clear communication and tracking of the transaction.

Step 4: List Products or Services

Create a detailed list of the products or services provided, including the quantity, unit price, and total cost. This breakdown makes it easy for clients to understand what they are being billed for and prevents any potential confusion.

Step 5: Specify Payment Terms

Clearly state the payment due date, accepted payment methods, and any applicable late fees or discounts for early payment. This helps manage expectations and ensures both parties are aware of the terms.

Step 6: Calculate the Total Amount

Once all items have been listed, calculate the subtotal, apply taxes if necessary, and provide the total amount due. This section is vital for transparency and ensures there are no surprises when it comes to payment.

Step 7: Customize the Design

Adjust the fonts, colors, and layout to match your business’s branding. Adding your logo, using your company’s color scheme, and selecting a professional font can help reinforce your brand identity while maintaining a clean, readable design.

By following these steps, you can easily create customized billing documents that are not only accurate and professional but also aligned with your business style and client expectations.

Key Benefits for Canadian Businesses

For businesses operating in Canada, adopting efficient and customizable billing solutions can significantly streamline financial processes. The ability to easily create and modify professional payment documents offers numerous advantages, ensuring accuracy, reducing errors, and enhancing the overall efficiency of transactions. Tailored tools help meet local business needs while simplifying compliance with regional requirements.

Improved Professionalism

Customizable documents enable businesses to present a polished, professional image to their clients. By using structured layouts with clear details and company branding, businesses can instill trust and credibility with customers, making a positive impression during every transaction.

Time Savings and Efficiency

By using pre-designed formats, businesses save valuable time that would otherwise be spent creating documents from scratch. Ready-to-use structures allow for faster creation and distribution of billing documents, speeding up the payment cycle and freeing up time for other important tasks.

Compliance with Local Regulations

For Canadian businesses, ensuring compliance with tax regulations and local financial practices is crucial. Customizable formats make it easier to include required details such as tax rates, HST/GST, and other region-specific requirements, reducing the risk of errors or audits.

Flexibility and Customization

Each business has unique needs. The ability to modify billing documents to reflect specific services, product offerings, and payment terms provides flexibility. Companies can easily adjust the layout to suit industry standards or to match their branding and style, making documents both functional and visually appealing.

Cost-Effective Solution

For many businesses, using readily available document editing tools is a highly cost-effective solution. There is no need to invest in expensive software or additional services when a customizable, accessible tool can fulfill the requirements. This is particularly beneficial for small businesses and startups looking to keep operational costs low.

In conclusion, the advantages of using customizable billing documents for Canadian businesses extend beyond efficiency and professionalism, supporting compliance, flexibility, and cost savings while enhancing client relationships.

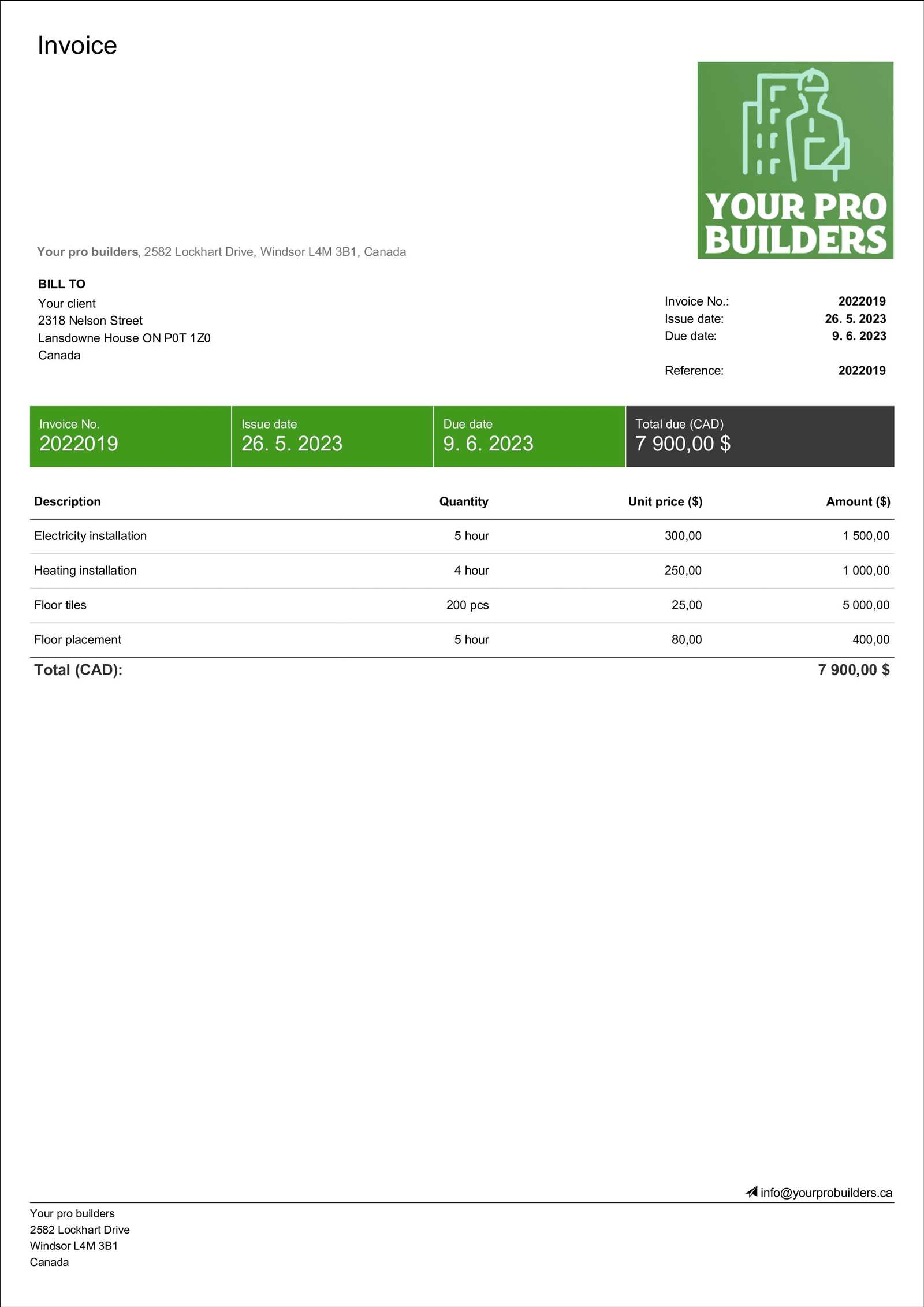

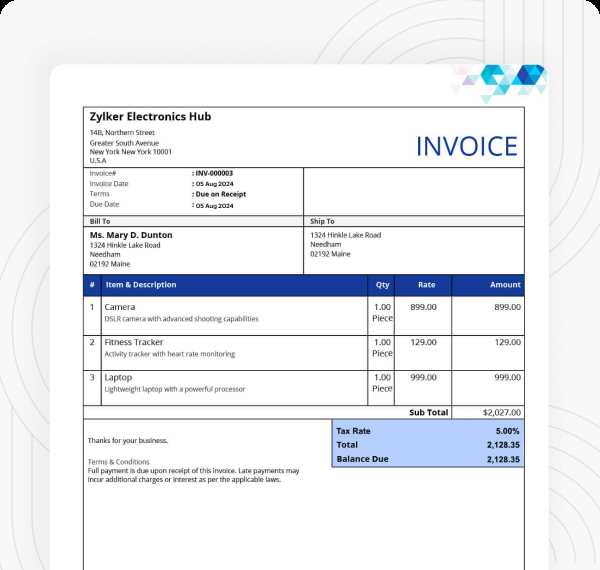

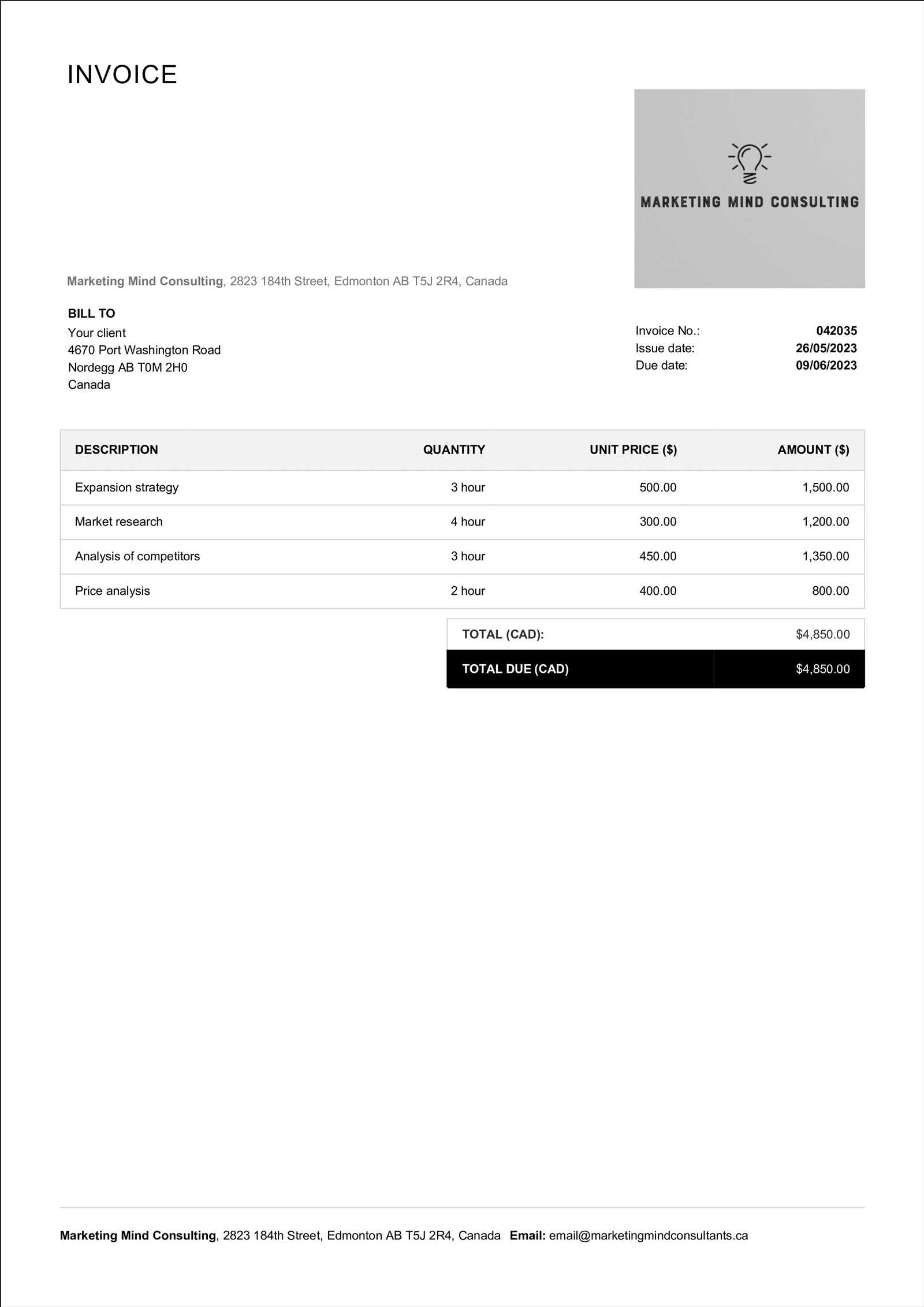

Top Templates for Canadian Entrepreneurs

For entrepreneurs, having access to high-quality and customizable billing formats is crucial for streamlining payment collection and maintaining professionalism. The right document structure can help save time, ensure accuracy, and promote a clear understanding of payment terms. Below are some of the most popular document formats that cater specifically to the needs of business owners in Canada.

| Template Name | Key Features | Best For |

|---|---|---|

| Basic Service Billing | Simple layout, itemized pricing, clear payment terms | Freelancers and service providers |

| Professional Consulting | Detailed breakdown of hours worked, project stages | Consultants, coaches, and contractors |

| Retail Sales | Product descriptions, quantity, and tax calculation | Small businesses and retail shops |

| Hourly Rate Billing | Hourly rate, time tracking, payment due date | Lawyers, accountants, and other hourly professionals |

| Project-Based Billing | Milestone payments, project progress updates | Construction, IT, and creative agencies |

Each of these formats provides unique benefits depending on the nature of your business and the way you charge for services. Whether you’re offering hourly consultations, product sales, or project-based services, there is a document format to fit your needs. These ready-to-use solutions allow entrepreneurs to focus on running their business while ensuring their payment documents are professional, clear, and compliant with Canadian standards.

Free Billing Documents for Canadian Businesses

For businesses looking to save on costs while ensuring accurate and professional payment requests, free billing document formats are a valuable resource. These accessible solutions provide a hassle-free way to generate clear, well-structured payment requests without the need for expensive software. Whether you’re a small business owner, freelancer, or contractor, you can find various options online to suit your needs without any cost.

Many websites offer a range of free document layouts, each designed with simplicity and functionality in mind. These formats allow businesses to quickly create and send professional documents to clients, helping streamline financial processes. From basic models to more detailed ones with sections for taxes, discounts, and payment terms, these free solutions cater to a variety of industries and billing scenarios.

Using these free resources, entrepreneurs can easily customize fields to include their branding, business details, and specific payment terms. By eliminating the need to design documents from scratch, you can focus more on your core business activities, knowing your financial transactions are handled efficiently and professionally.

Simple Steps to Customize Your Billing Document

Personalizing your payment request is a simple yet important step in maintaining professionalism and clarity in your business transactions. Customizing your document not only ensures that it meets your specific needs but also helps in presenting a consistent brand image to your clients. Follow these easy steps to tailor your billing format and make it your own.

- Step 1: Add Your Business Details

Start by entering your company’s name, address, contact information, and business number. This ensures your clients know exactly who the bill is coming from and how to contact you for any inquiries. - Step 2: Include Client Information

Add your client’s name, address, and any specific account or reference numbers. This is essential for clarity and helps keep track of your transactions. - Step 3: Customize the Item List

Create a detailed list of the services or products provided. Include descriptions, quantities, unit prices, and total amounts for each item. You can also add discounts or promotional offers if applicable. - Step 4: Set Payment Terms

Clearly state the payment due date, accepted payment methods (bank transfer, credit card, etc.), and any penalties for late payments. Customizing these details helps avoid confusion and sets clear expectations for both parties. - Step 5: Add Tax Information

If applicable, include the correct tax rates for your region. Ensure you calculate and display the tax amounts in the appropriate sections to comply with local regulations. - Step 6: Choose the Right Design

Adjust the fonts, colors, and layout to match your brand identity. You can add your logo, change font styles for readability, and use colors that represent your company’s image.

By following these simple steps, you’ll be able to create a professional, personalized document that not only facilitates smooth transactions but also reinforces your brand and credibility with clients.

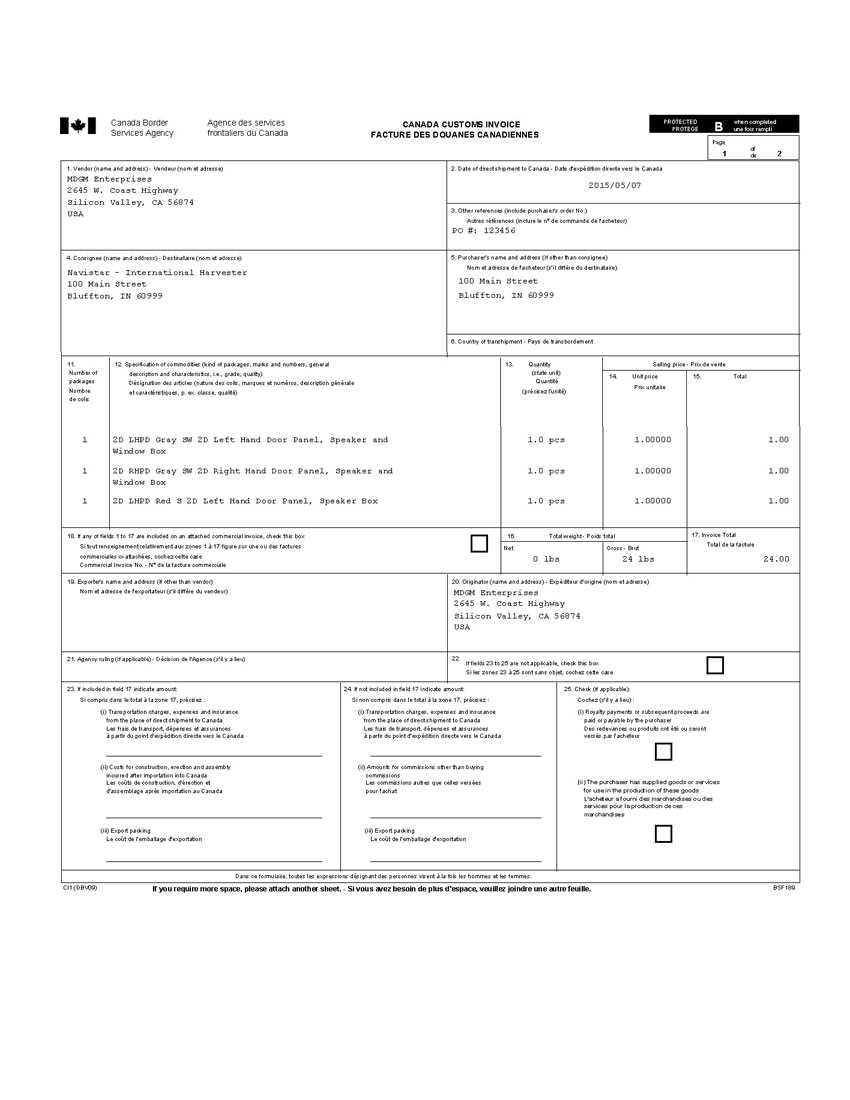

Understanding Canadian Tax Requirements on Invoices

When creating billing documents, it’s essential for businesses in Canada to include the appropriate tax information to ensure compliance with national and provincial regulations. The accurate application of taxes on transactions not only avoids legal issues but also helps maintain transparency and professionalism with clients. Canadian tax laws can vary depending on the province and the nature of the goods or services provided, making it important to understand what should be included in your financial documents.

Here are the key tax considerations to keep in mind when preparing billing documents for Canadian clients:

- Goods and Services Tax (GST) and Harmonized Sales Tax (HST)

GST is applied across most of Canada, while HST is used in certain provinces that have combined provincial and federal sales tax. Ensure that you include the correct rate based on the client’s location and the type of product or service offered. - Provincial Sales Tax (PST)

Some provinces, such as British Columbia and Saskatchewan, charge a separate Provincial Sales Tax (PST) on certain goods and services. Be sure to check if your product or service is taxable under PST in the relevant province. - Tax Exemptions

Certain goods and services may be exempt from taxes. For example, basic groceries, prescription drugs, and medical devices may be tax-exempt. Always verify whether your offerings qualify for exemption under Canadian tax laws. - Tax Number Requirements

If your business is registered for GST/HST, you must include your tax identification number on your payment documents. This helps ensure that clients know you’re a registered business and can claim the tax credits where applicable. - Tax Rates

The tax rates can differ depending on the province, and in some cases, on the type of service or product. Be sure to apply the correct rate based on both the client’s location and your business’s tax status.

To summarize, understanding and applying the correct taxes is a critical part of generating payment requests that comply with Canadian regulations. Including the appropriate tax information on each document will help maintain trust with your clients and prevent potential legal issues down the line.

Common Mistakes to Avoid with Billing Documents

When preparing payment requests, small errors can lead to confusion, delays in payment, and strained client relationships. By understanding and avoiding these common mistakes, you can ensure that your financial documents are both clear and professional. Below are some frequent issues that businesses should be aware of and steps to prevent them.

| Mistake | Explanation | How to Avoid |

|---|---|---|

| Missing Business Information | Omitting essential details such as your company name, contact information, or business registration number can make it difficult for clients to verify the payment request or reach out for clarification. | Always include your full business details at the top of the document for easy identification. |

| Incorrect Client Information | Inaccurate or incomplete client information can lead to confusion and delays, particularly when multiple clients or accounts are involved. | Double-check the client’s name, address, and account numbers before sending the document. |

| Failure to Include a Payment Due Date | Not specifying when payment is due can result in late payments or misunderstandings about the terms. | Always clearly state the due date and any late fee policies to set clear expectations. |

| Unclear Breakdown of Charges | A lack of clarity in the list of services or products can cause confusion about what the client is being charged for. | Ensure each product or service is clearly itemized, with descriptions, quantities, and prices listed in an easy-to-read format. |

| Errors in Tax Calculation | Incorrect tax rates or failing to apply taxes properly can create legal and financial issues. | Verify the correct tax rates for your region and ensure all tax amounts are accurately calculated and displayed. |

| Unprofessional Design | A poorly designed document can look unprofessional and may reduce the perceived value of your services. | Use a clean, organized layout with consistent fonts and branding to present a polished appearance. |

By avoiding these common mistakes, you can ensure that your billing documents are accurate, clear, and professional, which helps improve payment cycles and client trust.

How to Include Payment Terms Properly

Including clear and concise payment terms in your billing documents is essential for ensuring both parties are on the same page regarding payment expectations. Properly defined terms not only help avoid confusion but also improve cash flow by setting clear deadlines and outlining payment methods. Here’s how you can ensure your payment terms are accurately and professionally included in your documents.

Key Elements to Include

Payment terms should cover several important details to ensure clarity and prevent any misunderstandings:

- Due Date – Clearly state when the payment is due, whether it’s within a set number of days (e.g., 30 days from the issue date) or a specific date.

- Accepted Payment Methods – Indicate the methods you accept, such as bank transfer, credit card, or cheque. This helps set expectations on how payments should be made.

- Late Fees – If you charge a late fee for overdue payments, specify the amount or percentage and when it will be applied (e.g., 1.5% per month after the due date).

- Discounts for Early Payment – Offer incentives for clients who pay early, such as a small discount. For example, “2% discount if paid within 10 days.”

- Installment Payments – If applicable, outline the terms for payments in installments, including dates and amounts.

Best Practices for Clarity

For payment terms to be effective, they must be easy to understand. Here are a few tips to ensure they are clearly presented:

- Be Specific – Use exact dates or periods (e.g., “Due by 15th March 2024” rather than “Due soon”).

- Highlight Key Terms – Make your payment terms stand out by using bold text or a separate section to draw attention.

- Avoid Ambiguity – Use simple language and avoid jargon or complex phrases that may confuse the reader.

By ensuring your payment terms are clear and well-defined, you help avoid delays in receiving payment and set a professional tone with your clients. This practice not only supports your business’s financial health but also builds trust with those you work with.

Best Practices for Professional Billing

Creating professional payment documents is a crucial part of maintaining a positive relationship with clients and ensuring smooth financial transactions. A well-crafted billing document not only ensures clarity and accuracy but also reflects your company’s commitment to professionalism. By following these best practices, you can create documents that help avoid misunderstandings and foster trust with your clients.

- Use a Consistent Format

Stick to a uniform structure for all your payment documents. This includes placing key information such as your business details, client details, service descriptions, and payment terms in the same layout each time. Consistency creates a professional image and makes it easier for clients to review the details. - Provide Clear Descriptions

Avoid vague language when describing products or services. Be specific and provide enough detail so that the client understands exactly what they are being charged for. This is especially important for hourly or project-based work, where detailed breakdowns of time or stages can prevent confusion. - Include Accurate Dates

Always include the correct issue date and payment due date. A missing or unclear due date can delay payments and create unnecessary disputes. It’s a best practice to allow ample time for clients to make payments, but also make sure the terms are clear. - Specify Payment Methods

Indicate all accepted methods of payment, such as bank transfer, credit card, or cheque. This removes ambiguity and makes it easier for clients to make payments promptly. Providing bank details or payment links can also facilitate the process. - Be Transparent About Taxes

Ensure that any applicable taxes are clearly listed and calculated. Specify the tax rates for the relevant region, including any exemptions or discounts, to avoid confusion or disputes later on. Clients appreciate transparency when it comes to financial matters. - Maintain Professional Design

A clean, organized design speaks volumes about your business. Use easy-to-read fonts, appropriate spacing, and professional colors that match your brand. Ensure that all elements are aligned and well-organized so that the document looks polished and structured. - Keep Records

It’s essential to keep a copy of each billing document for your records. This helps with future references, tax purposes, and any potential disputes that may arise. You can store these copies digitally to save space and ensure easy access. - Follow Up on Late Payments

If a payment is overdue, don’t hesitate to send a polite reminder. A friendly follow-up is often all that is needed to prompt clients to settle their account. Include any late fees or interest charges as per your payment terms to encourage timely payment in the future.

By following these best practices, you can enhance your professional image, improve cash flow, and maintain healthy client relationships. Ensuring your payment documents are clear, organized, and precise sets the foundation for successful financial interactions.

How Billing Documents Save Time and Effort

Creating payment requests from scratch can be time-consuming, especially when the process involves entering repetitive information like business details, client names, and payment terms. However, using pre-made document layouts designed for this purpose can significantly reduce the effort required to produce professional documents. These ready-to-use solutions save time, help avoid mistakes, and ensure consistency across all client transactions.

Key Time-Saving Benefits

- Pre-set Structure

By using a pre-designed layout, you already have a clear structure in place. Fields for important details such as client information, products or services, and payment terms are already set, saving you the time spent organizing the document from scratch. - Consistent Formatting

Consistency is key to professionalism. With a pre-made layout, you don’t have to worry about formatting each document individually. Everything from font size and color to alignment is taken care of, ensuring all your billing documents look polished. - Customization Made Easy

Pre-designed documents can still be easily customized. You can quickly edit fields like client names, service descriptions, and prices without having to redesign the entire layout. This flexibility allows you to tailor each document without losing valuable time. - Error Reduction

Pre-made documents reduce the likelihood of making formatting mistakes, such as missing essential fields or having inconsistent tax rates. These templates often come with built-in fields and guidelines to ensure that all necessary information is included. - Quick Updates

If you need to update your business details or payment terms, changes can be made quickly across all future documents. This reduces the time spent manually updating each document individually, allowing you to focus on running your business.

How These Documents Boost Efficiency

- Streamlined Workflow

With a ready-to-use layout, the entire billing process becomes more efficient. Instead of spending time thinking about the layout or formatting, you can focus on adding the specific details for each transaction and sending it off to clients. - Improved Client Communication

When your billing documents are professional and consistent, they convey reliability and trustworthiness. Sending well-organized documents that clearly communicate payment expectations helps foster positive client relationships.

Using pre-made document layouts is an effective way to streamline your financial processes, reduce administrative workload, and maintain a professional appearance. By saving time on repetitive tasks, you can allocate more resources to growing your business and focusing on your clients’ needs.

Integrating Billing Documents with Accounting Tools

Efficient financial management often requires synchronization between various business processes, especially when it comes to creating and tracking payments. Integrating billing documents with accounting software allows for seamless data transfer, accurate tracking, and reduced manual work. By automating this integration, businesses can improve accuracy, streamline workflows, and ensure their financial records are always up to date.

Benefits of Integration

- Time Savings

When billing documents are directly linked to accounting tools, you eliminate the need to manually input payment details into your accounting system. This reduces the risk of errors and speeds up the process of updating financial records. - Improved Accuracy

Automated data transfer ensures that the information from your billing documents matches the details in your accounting software. This reduces the likelihood of mistakes such as duplicate entries or miscalculations in your financial records. - Streamlined Workflow

Integration allows for a more efficient workflow, as your billing and accounting systems work in tandem. The details from each payment document are automatically recorded in your accounting tool, saving time and effort that would otherwise be spent on manual data entry. - Real-Time Financial Insights

By syncing billing data with your accounting software, you get a clearer, real-time view of your business’s financial situation. This enables you to make more informed decisions about cash flow, upcoming expenses, and financial planning.

How to Integrate Billing Documents with Accounting Software

- Choose Compatible Tools

Ensure that your billing system and accounting software can be integrated. Many accounting tools, such as QuickBooks or Xero, offer built-in integration features or plugins for popular billing solutions. - Export and Import Options

Some systems allow you to export your billing data (in formats like CSV or Excel) and import it directly into your accounting software. This is a simple yet effective way to ensure consistency across both systems. - Automated Syncing

Many modern accounting tools allow for direct syncing between your billing documents and accounting software. This can be set up to run automatically, ensuring that your records are always current without requiring manual intervention. - Utilize Cloud-Based Platforms

Cloud-based accounting solutions often allow for real-time integration with other business tools. This means you can access your financial data from anywhere and your billing and accounting systems will always stay synchronized.

Integrating your billing documents with accounting software not only saves time but also ensures that your financial records are accurate and up to date. This connection streamlines your business operations and helps you maintain better control over your financial health.

Why Consistency Matters in Billing

Maintaining consistency in your payment requests is essential for ensuring clarity, reducing errors, and establishing a professional reputation. When all your financial documents follow the same format, structure, and design, it creates a sense of reliability and trust with clients. Consistency in billing not only facilitates easier communication but also helps streamline business processes, reducing confusion and improving the overall efficiency of your financial management.

Here are some reasons why consistency in billing is so important:

- Professional Image

Consistent billing practices present a professional image to your clients. When every payment request looks the same, it reinforces your brand identity and shows attention to detail. It also signals that your business is organized and reliable. - Clear Communication

By using a consistent structure in your documents, clients can quickly understand the details, such as payment due dates, services provided, and amounts owed. This reduces the chances of confusion or disputes regarding the charges. - Fewer Errors

When you standardize the layout and content of your billing documents, the chances of leaving out important information or making formatting mistakes are significantly reduced. This consistency ensures that no critical detail, like taxes or payment terms, is overlooked. - Improved Efficiency

Having a set format for your payment documents allows for faster document creation. You can simply input the specific details of each transaction without needing to reformat or adjust the layout each time, which saves time and effort. - Faster Payments

When your billing documents are easy to read and clearly organized, clients are more likely to make payments promptly. A consistent structure helps clients quickly review their obligations and encourages timely settlements.

In summary, consistency in billing is not just about having the same format for each document; it’s about creating a streamlined, professional process that benefits both your business and your clients. By adhering to a consistent approach, you improve communication, reduce errors, and establish stronger, more trustworthy relationships with your clients.

Design Tips for Clear Billing Documents

The design of your payment request is crucial to ensure that clients can easily understand the details and make payments without confusion. A well-organized layout not only conveys professionalism but also helps in preventing errors and delays. Clear design elements guide the reader’s eye to the most important information, making the document easier to navigate. Here are some design tips to make your billing documents more effective and user-friendly.

- Keep It Simple

Avoid cluttering the document with unnecessary information or complex designs. Stick to the essentials: your business name, client details, services provided, amount due, and payment instructions. A clean, minimal design makes it easier for the recipient to focus on the important details. - Use a Consistent Layout

Make sure all your documents follow the same structure. A consistent layout helps clients become familiar with your format, so they can quickly locate key details like the due date, total amount, and payment terms. Standardizing the layout also streamlines the process of creating new documents. - Organize Information Clearly

Use sections, headings, and bullet points to break up the content. For example, list the items or services provided in a table format to make them easy to read. Use bold or larger fonts for important details, such as the total amount due and the payment deadline. - Use Legible Fonts

Choose simple, easy-to-read fonts like Arial or Helvetica, and make sure the text size is large enough for comfortable reading. Avoid decorative fonts that can be difficult to read, especially for important details. Consistency in font style and size throughout the document helps improve readability. - Incorporate White Space

White space, or empty space, is essential for making a document look less crowded. It allows the content to breathe and makes the layout appear more organized. Proper margins, line spacing, and spacing between sections will ensure your document is visually appealing and easy to navigate. - Highlight Key Information

Make important details stand out by using bold or larger fonts for items like the total amount due, the due date, and payment terms. Highlighting these key pieces of information ensures that your client can immediately find the most critical details. - Use Color Sparingly

While using color can make a document visually appealing, it’s important not to overdo it. Use color to emphasize important sections or headings but avoid using too many bright colors that can make the document look chaotic. Stick to a simple color scheme that aligns with your brand. - Include Clear Payment Instructions

Ensure that your payment instructions are easy to follow. Clearly indicate your accepted payment methods and provide all necessary details such as bank account numbers, online payment links, or mailing addresses. This reduces confusion and helps clients make payments on tim

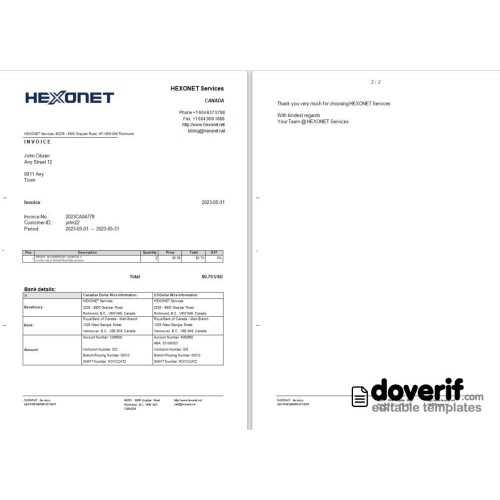

Understanding Document Numbering in Canada

Proper document numbering is an essential part of any business’s financial process. It helps keep track of each transaction, ensures compliance with local regulations, and maintains organized records for accounting purposes. In Canada, businesses must follow specific rules regarding how to number their billing documents. This section will provide a detailed overview of how to approach numbering, why it’s important, and what to keep in mind to ensure you’re compliant with local standards.

Why Numbering is Crucial

Numbering each document sequentially ensures that each transaction is uniquely identifiable, reducing the risk of errors, double entries, or fraud. A clear numbering system allows both businesses and clients to track the status of payments and disputes easily. Additionally, it’s an essential part of maintaining good accounting practices, especially when it comes to tax reporting and auditing.Best Practices for Numbering Documents

While there is no one-size-fits-all rule, there are several best practices to consider when numbering your payment documents:- Use Sequential Numbers

The most common method is to number each document in a continuous sequence. This approach provides an easy-to-follow trail and ensures that every document is accounted for. Typically, numbering begins with the first document issued in a new fiscal year. - Incorporate Year or Date

To prevent confusion and to easily identify documents from different years, many businesses include the year or date in their numbering system. For example, a document number could include the year followed by a unique sequential number, such as “2024-001” for the first document issued in 2024. - Consider Client or Project Codes

Some businesses choose to incorporate client or project codes into the numbering system. This is useful for businesses that manage multiple clients or projects simultaneously. A numbering format like “C1001-001” can help link the document to a specific client and make tracking easier. - Ensure Uniqueness

Every document number must be unique to avoid confusion. Reusing document numbers or failing to maintain a proper sequence could lead to errors in accounting and discrepancies in payment tracking. - Avoid Gaps in the Sequence

If a document is voided or canceled, make sure the number is not skipped in the sequence. It is essential to keep a continuous, uninterrupted numbering system for clarity and audit purposes.

Compliance with Local Regulations

In Canada, while the specifics can vary by province, businesses must ensure that their numbering system aligns with tax reporting requirements. The Canada Revenue Agency (CRA) has clear guidelines on record-keeping, including maintaining accurate and complete financial records for audit purposes. Using a proper and consistent numbering system helps businesses stay in compliance with these regulations.Conclusion

Document numbering is more than just a logistical step in creating payment requests–it is a critical element for maintaining organized, compliant, and professional business practices. By following best practices for numbering, businesses can reduce errors, improve record-keeping, and ensure compliance with tax laws in Canada.Adapting Billing Documents for Different Industries

Different industries often require specific formats and details on financial documents to suit their unique needs and ensure compliance with industry standards. Whether you are running a retail business, offering services, or working in construction, adapting your payment documents to fit the requirements of your field is essential. Tailoring your forms can help improve client relationships, streamline internal processes, and ensure accurate record-keeping. In this section, we will explore how to adjust your financial documents for various industries.

Key Adjustments for Industry-Specific Documents

- Retail

Retail businesses typically deal with a high volume of transactions, which means that payment documents should be simple, quick to generate, and easy for customers to understand. Include clear itemized lists of products or services, including quantities, prices, and applicable taxes. Also, consider adding return policies and payment method options for customer convenience. - Service Providers

For service-based businesses, it’s important to outline the scope of work clearly, as well as any ongoing or hourly rates. Payment documents should include detailed descriptions of the services provided, timelines, and agreed-upon terms. Adding a section for any recurring charges or payment schedules will help clients manage expectations. - Freelancers

Freelancers should focus on clearly defining the terms of the contract, such as deliverables, payment milestones, and deadlines. A well-organized payment document can include project phases or hourly rates, along with payment deadlines tied to specific milestones or completion stages. This provides transparency for both the freelancer and the client. - Construction & Trades

For industries like construction or contracting, payment documents often require more detailed breakdowns of labor, materials, and equipment costs. It’s important to itemize these charges with precise measurements, materials used, and hours worked. Additionally, you may need to include progress payment schedules based on project milestones. - Nonprofits

Nonprofit organizations typically require payment documents that reflect donations, grants, or service fees. It’s important to include sections for donation amounts, tax receipts (if applicable), and any associated funding details. Ensuring clarity on these elements helps with donor relations and ensures tax-exempt status compliance. - Healthcare

In healthcare, billing documents should be tailored to include detailed medical services rendered, insurance information, and co-payment details. Clear breakdowns of individual treatments, procedures, and any applicable insurance coverage are essential for both patients and insurance companies.

Practical Considerations for Customization

- Compliance and Regulations

Each industry may have specific compliance requirements that must be reflected in payment documents. For example, tax laws, labor regulations, or industry-specific terms may dictate how information is displayed. It’s essential to ensure that your forms align with these legal or regulatory standards. - Branding and Client Expectations

Your payment documents should also reflect your brand’s identity, regardless of the industry. C

- Use Sequential Numbers