How to Create a Professional Invoice with Word Document Templates

Designing a clear and professional payment request is essential for businesses and freelancers alike. A well-structured document ensures both clarity and professionalism, helping to avoid confusion and ensure prompt payments. With the right tools, creating such statements becomes quick and efficient, saving time while presenting a polished image to clients.

By using a ready-made layout, it is possible to tailor each section to meet specific business needs. This approach allows for easy customization, making it simple to adjust pricing, add terms, or incorporate branding elements. Whether for a small service or a large project, having an organized format provides consistency and accuracy across all transactions.

Customization options allow businesses to add their unique touch to each request, while also ensuring that all necessary details, like contact information and payment deadlines, are included. These prepared formats can streamline the invoicing process, enabling users to focus more on their work and less on administrative tasks.

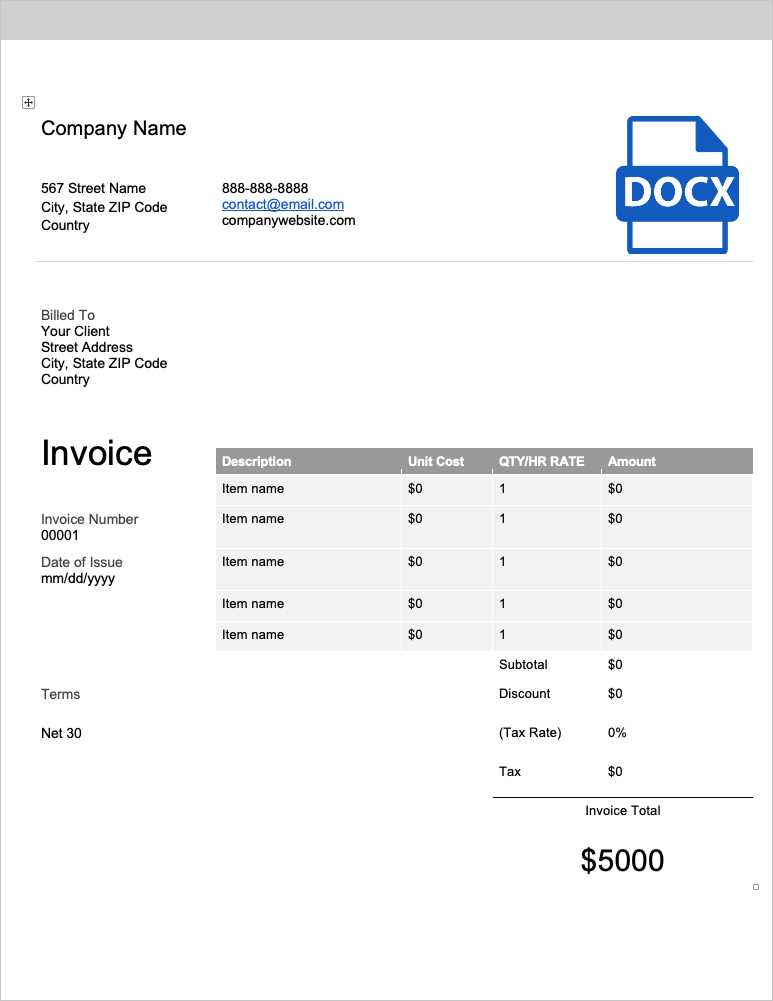

Word Document Invoice Templates for Businesses

For any business, having a clear and standardized format for billing is crucial. When dealing with clients, it’s important to present payment requests that are not only accurate but also professional. Using a pre-designed layout can save valuable time and ensure consistency across all transactions. These layouts can be customized to suit specific business needs, helping to streamline the entire process of requesting payments.

Benefits of Ready-Made Billing Layouts

Ready-made billing formats offer businesses a simple and effective solution for generating professional statements. They reduce the time spent on design and formatting, allowing business owners to focus on their core activities. Additionally, these layouts can be easily modified to fit the unique requirements of any service or product. Whether it’s adding taxes, discounts, or payment terms, the flexibility of these designs ensures they can adapt to various industries and business models.

Customizing for Brand Identity

Another significant advantage is the ability to personalize the format to reflect your company’s identity. By incorporating logos, business colors, and fonts, these ready-made structures help create a cohesive look that aligns with the company’s branding. Customization options also allow for adding contact details, payment instructions, and due dates, which are essential for clear communication with clients. A personalized approach not only builds trust but also reinforces your professionalism in every interaction.

Why Use Word for Invoices

Using a versatile software to create billing requests offers numerous advantages for businesses of all sizes. It provides an intuitive platform where customizations can be made quickly and efficiently. With simple tools for editing and formatting, the process of generating payment requests becomes both straightforward and flexible, allowing for easy adaptation to different business needs.

Ease of Use and Accessibility

One of the main reasons businesses choose this software for their payment requests is its user-friendliness. The platform is widely accessible and familiar to most users, requiring little to no technical expertise. Most people can easily create, edit, and format their documents without needing specialized skills or software. This ease of use helps to save time and minimizes errors, ensuring a smooth workflow for administrative tasks.

Professional Appearance and Customization

Another key advantage is the ability to produce polished and professional-looking documents. With a range of formatting options, users can create a customized layout that suits their brand’s style and image. Adding logos, adjusting fonts, and organizing content in a clear, readable format helps to present the business as professional and organized. Customization options make it simple to include necessary details such as payment terms, contact information, and tax calculations, all of which are essential for clear and effective communication.

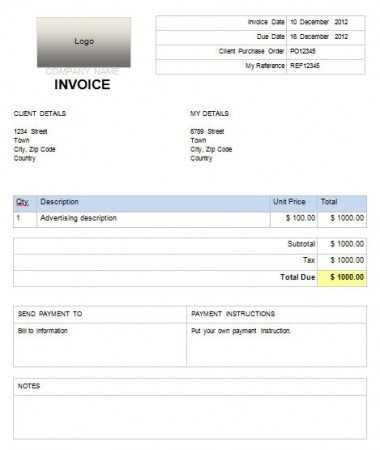

Choosing the Right Invoice Layout

Selecting the right structure for your billing requests is essential for clear communication and smooth transactions. The layout you choose can significantly impact how your clients perceive your business and the ease with which they process payments. A well-designed format not only ensures that all necessary information is included but also creates a professional impression that helps build trust with your clients.

Consider the nature of your business and the preferences of your clients when choosing a layout. For instance, service-based businesses may require more detailed descriptions of tasks performed, while product-based companies may focus more on itemized lists. It’s important to select a structure that best suits your needs while ensuring that the document remains easy to read and understand. Opt for a format that highlights key information such as pricing, payment terms, and due dates, ensuring clients can quickly find what they need.

How to Customize Your Invoice Template

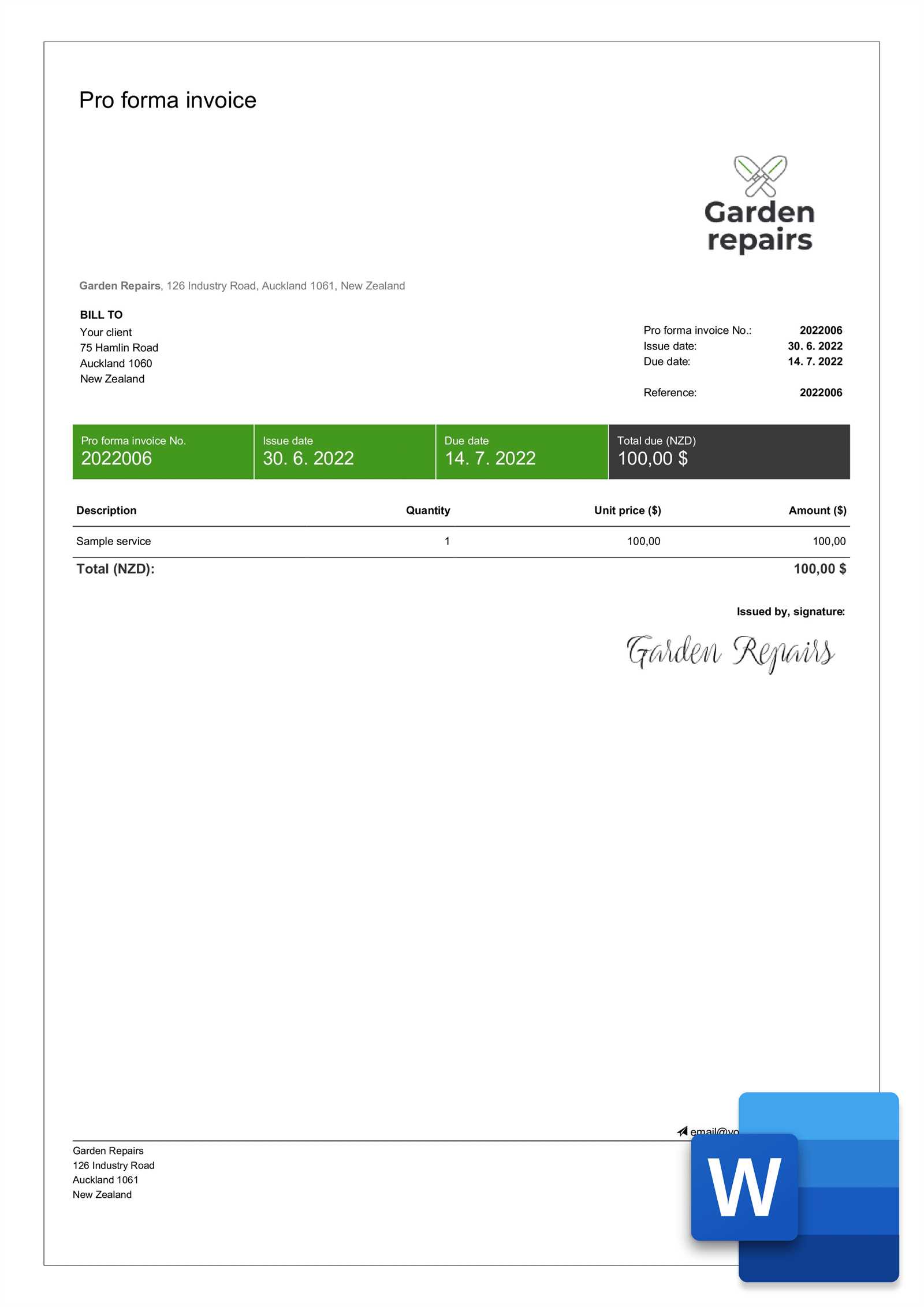

Customizing your billing format is key to making it align with your business’s unique identity and ensuring it meets specific needs. By adjusting the layout, design elements, and content, you can create a document that is not only functional but also reflective of your brand. Personalizing these documents allows you to present professional and clear payment requests tailored to your clients’ expectations.

Start by adding your company logo and any relevant contact details at the top of the page. This makes the document immediately recognizable and builds trust with the recipient. You can also customize the header with your business name, address, and phone number. Incorporating your brand’s color scheme into the design further strengthens the connection between the billing statement and your company’s identity.

Next, make sure to adjust the sections to match your services. Include any relevant pricing, descriptions, and quantities for products or services provided. Don’t forget to set up payment terms, due dates, and other critical details, ensuring the document is easy to follow. The flexibility of these designs allows for a variety of customizations, from adjusting text alignment to adding or removing specific sections as needed.

Top Features of Word Invoice Templates

When choosing a pre-designed structure for billing requests, it’s essential to consider the features that make these layouts effective and user-friendly. The right layout offers both functionality and flexibility, ensuring that all necessary details are clearly presented while also aligning with your business’s needs. These features not only save time but also enhance the professionalism of each statement.

Easy Customization Options

Customization is one of the top features that make these layouts so popular. They allow you to quickly modify the content, such as adding company logos, adjusting colors, and updating pricing structures. With simple editing tools, users can tailor each section to meet the specific requirements of their business or service, making the billing process both efficient and personal.

Clear and Structured Layout

Another key benefit is the well-organized structure of these formats. The layout typically includes clearly defined sections for client information, services rendered, prices, payment terms, and due dates. This helps ensure that both the business and the client can easily understand the information, which minimizes the chances of confusion or errors. A clear layout also gives a polished and professional appearance, which can help build trust with clients.

Step-by-Step Guide to Create an Invoice

Creating a clear and professional payment request doesn’t need to be complicated. By following a simple process, you can quickly generate an effective document that ensures all important details are covered. From adding business information to including payment terms, each step plays a key role in delivering an accurate and reliable statement to your client.

1. Include Your Business Details

The first step is to add your company’s name, address, contact information, and logo. This helps the recipient identify who the bill is from and makes the document look more official. Including your phone number and email address ensures that clients can easily reach you in case of any questions or issues.

2. List the Goods or Services Provided

Next, add a clear description of the products or services provided. Be specific about each item, including quantities, unit prices, and any other relevant details. If applicable, include a breakdown of different categories of goods or services, and make sure to use a well-organized format for easy readability.

Once all items are listed, calculate the total amount due. Be sure to include any applicable taxes, fees, or discounts in separate lines to keep everything transparent for your client. Lastly, include the payment due date and the preferred payment methods.

Best Practices for Invoice Design

Designing a billing statement that is both functional and professional is crucial for maintaining good business relationships. A well-organized and visually appealing layout helps ensure that all necessary details are easy to find, while also enhancing the professionalism of your business. The key to a successful design is clarity, simplicity, and consistency.

First and foremost, ensure that the document is easy to read by using clear fonts and a clean layout. Avoid cluttering the page with too much information or excessive design elements. Use headings, bullet points, and tables to organize content logically, making it easier for clients to find the information they need. Also, make sure to include all relevant details, such as your business name, client details, itemized list of services or products, and payment terms.

Another important aspect of design is consistency. Stick to a uniform style throughout the document, including consistent use of colors, fonts, and spacing. This not only makes the statement more aesthetically pleasing but also ensures that it aligns with your brand’s identity. A professional design reflects positively on your business and helps build trust with clients.

How to Add Logo and Branding

Incorporating your company’s logo and branding elements into your billing statements is an important step in presenting a professional image. Customizing these documents with your business identity helps build recognition and trust with clients. It also ensures that your brand is consistently represented across all communications, creating a cohesive look that reinforces your business values.

1. Inserting Your Logo

Start by adding your company’s logo to the top of the document, ideally in the header section. This placement ensures that the logo is the first thing clients see, helping to instantly recognize the source of the bill. Make sure the logo is high-quality and appropriately sized, so it doesn’t appear pixelated or distorted. You can adjust the size of the image to fit the layout without overwhelming the content.

2. Customizing Color Scheme and Fonts

Next, align the color scheme and fonts with your brand guidelines. Using your company’s signature colors throughout the layout adds consistency and reinforces brand identity. Choose fonts that are easy to read and match the professional tone of your business. Avoid using too many different fonts or colors, as this can create a cluttered and unprofessional appearance. Instead, stick to a few complementary elements that align with your overall brand style.

Ensuring Legal Compliance in Invoices

It’s crucial for businesses to ensure that their billing statements meet all legal requirements to avoid complications or disputes. Complying with local regulations helps maintain transparency, protects against potential legal issues, and builds trust with clients. Legal requirements for billing vary depending on your location and the nature of your business, so it’s important to stay informed and include all necessary elements in each request for payment.

To ensure compliance, businesses should include the following key information in their billing statements:

- Business and Client Details: Include your company’s full name, contact information, and legal status (e.g., Ltd, Inc.) along with the client’s full name or business name, and contact details.

- Tax Identification Numbers: Many regions require businesses to display their tax ID or VAT number on bills to ensure proper tax tracking.

- Payment Terms: Specify the due date, payment methods, and any penalties for late payments as required by law.

- Itemized List of Services or Goods: Provide clear descriptions of the goods or services provided, including prices, quantities, and applicable taxes.

Additionally, businesses should be aware of the legal requirements regarding the storage and submission of payment records. Keeping accurate and compliant billing records can help prevent misunderstandings or legal challenges down the line.

Using Payment Terms on Your Invoices

Clearly stated payment terms are essential for ensuring smooth financial transactions between your business and clients. By setting expectations upfront, you help avoid confusion and late payments. These terms outline when the payment is due, what methods are accepted, and any penalties for overdue balances, creating a more professional and organized billing process.

1. Define Clear Payment Due Dates

It’s important to include specific due dates on your billing statements. Whether it’s 30, 60, or 90 days from the date of issue, clearly stating when payment is due helps avoid misunderstandings. Ensure the due date is prominently displayed and easily visible, so clients know exactly when to pay.

2. Outline Accepted Payment Methods

Specify the methods through which clients can pay. This can include credit cards, bank transfers, or online payment systems. By providing a variety of options, you make it easier for clients to settle their balance promptly. Additionally, ensure that your payment information, such as bank account numbers or PayPal details, is clearly listed.

Including payment terms helps to maintain a professional and efficient billing system. It sets clear expectations and reduces the risk of delayed payments, which is beneficial for both your business and your clients.

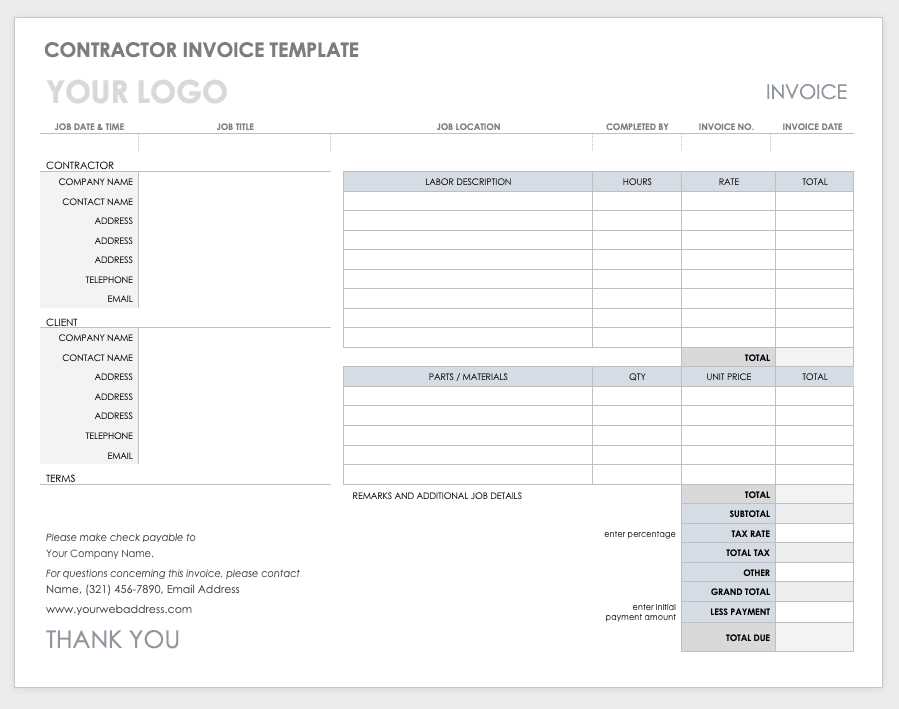

How to Include Itemized Charges

Including an itemized list of charges in your billing statement is crucial for maintaining transparency with your clients. A detailed breakdown allows clients to clearly see the cost for each product or service, ensuring that there are no misunderstandings or disputes. Organizing this information in a structured format not only makes it easier to read but also reflects professionalism and clarity.

1. List Each Product or Service

Start by clearly describing each item provided, including the quantity, unit price, and total amount. Be as detailed as possible, so the client can quickly understand what they are being charged for. This transparency helps build trust and reduces the likelihood of confusion or disputes.

2. Organize with a Table

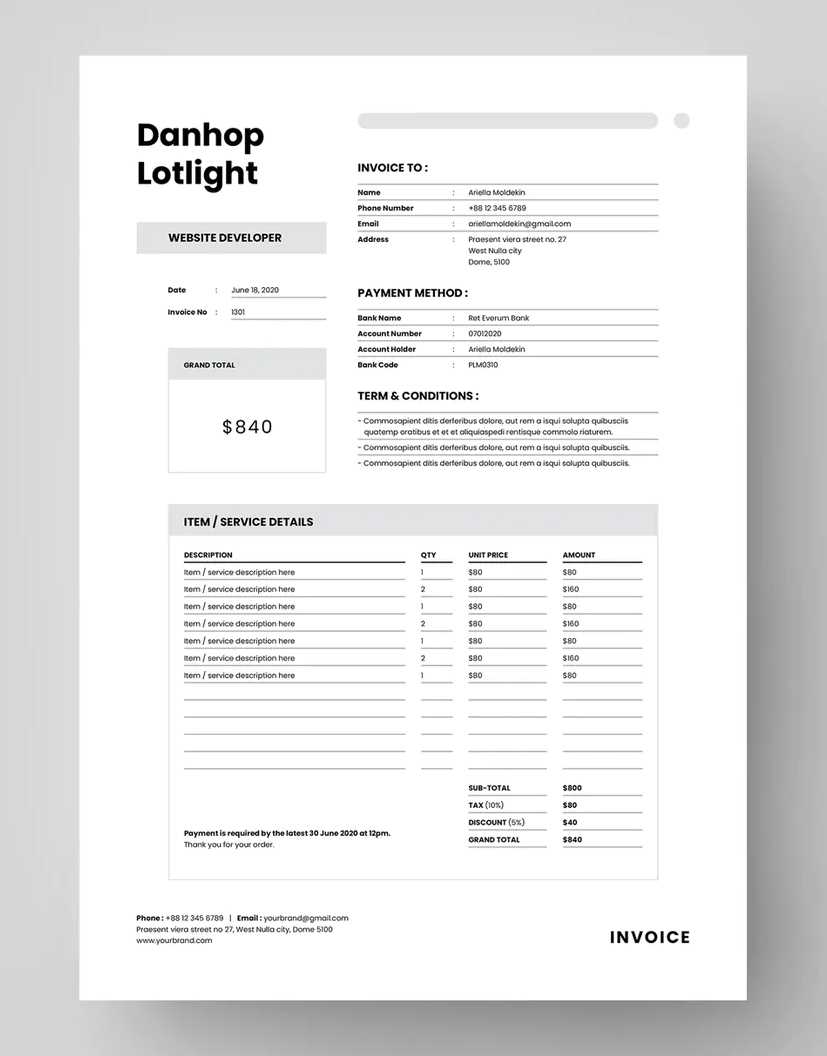

Using a table to present itemized charges is an effective way to organize information. The table format makes it easy for clients to follow the costs and calculate the total amount themselves. Here’s an example of how to structure the charges:

| Description | Quantity | Unit Price | Total |

|---|---|---|---|

| Consulting Service | 5 hours | $50.00 | $250.00 |

| Website Design | 1 | $500.00 | $500.00 |

| Total | $750.00 |

By using this format, your clients can easily review the individual charges, making the billing process clear and straightforward.

Saving and Reusing Invoice Templates

Creating consistent and professional billing statements for your business is essential, and saving custom formats allows you to quickly generate new ones without starting from scratch each time. By designing a reusable layout, you streamline your billing process and save valuable time. Reusing these files for each new transaction ensures uniformity in appearance and structure while maintaining efficiency.

To effectively save and reuse your billing layouts, it’s important to establish a simple system for storing and organizing these files. Here are a few tips:

| Tip | Description |

|---|---|

| Use Clear Naming Conventions | Save each layout with a clear and recognizable name, such as “Standard Billing Format” or “Client A Invoice.” This way, you can quickly identify the file you need for future use. |

| Store in a Central Location | Keep your saved formats in a central folder or cloud storage for easy access. This makes it simple to find the correct layout whenever needed, especially if your team needs to use it too. |

| Customize Each Time | While the layout remains the same, make sure to customize specific details like client names, amounts, and dates before sending each new bill. |

By following these practices, you ensure that your billing process is both consistent and efficient, helping to maintain a professional image and minimize errors.

Adding Tax and Discounts in Invoices

Incorporating taxes and discounts into your billing statements is crucial for maintaining accuracy and complying with regulations. By clearly indicating these adjustments, you ensure that both you and your clients understand the final amount due. Whether it’s applying local sales tax or offering a promotional discount, these elements can significantly impact the total cost and should be presented transparently.

Taxes should be calculated based on the applicable rate in your region or industry. It’s essential to specify the tax rate and the amount being added, so clients can see how much of the total charge is due to taxes. Make sure to check local tax laws to apply the correct rate and remain compliant with tax authorities.

Discounts, on the other hand, are often used as incentives or rewards for early payment or bulk purchases. Clearly stating the discount percentage or amount and how it affects the total balance can help your clients appreciate the value you’re offering. Ensure that the discount is applied after calculating the subtotal, so taxes are only levied on the reduced amount.

To avoid confusion, provide a breakdown in your billing statement, showing both the tax and discount calculations. Here’s an example:

| Description | Amount |

|---|---|

| Product Subtotal | $500.00 |

| Discount (10%) | -$50.00 |

| Sales Tax (8%) | $36.00 |

| Total | $486.00 |

By presenting these charges clearly, you ensure that clients understand the breakdown and the final amount they owe, leading to a smoother transaction process.

How to Share Your Invoice Easily

Sharing billing statements efficiently is a key part of ensuring timely payments. Whether you’re sending an updated bill to a client or providing a receipt for a recent purchase, choosing the right method to distribute your statement can make a significant difference. Streamlining this process allows you to avoid delays and confusion, and ensures that your clients have easy access to the necessary details for payment.

Here are several easy methods to share your billing details with clients:

- Email: The most common and convenient way to send a billing statement is via email. Simply attach the finalized file and include a short message explaining the details. Make sure to use a professional subject line, such as “Your Invoice from [Business Name].”

- Cloud Storage: Using cloud storage platforms like Google Drive, Dropbox, or OneDrive allows you to upload the file and share a link with your client. This is especially useful for large files or when you need to store multiple statements in one location.

- Client Portals: If you offer a client portal or billing system, you can upload the statement directly to the platform, where clients can securely log in and download or review it at their convenience.

- Physical Delivery: For clients who prefer paper or those in need of official hard copies, consider mailing a printed version. However, this is slower and less efficient than digital options.

Choosing the right method depends on your client’s preferences, the urgency of the payment, and your own convenience. Email is often the fastest, but cloud storage or client portals are ideal for long-term access and organized management of all statements.

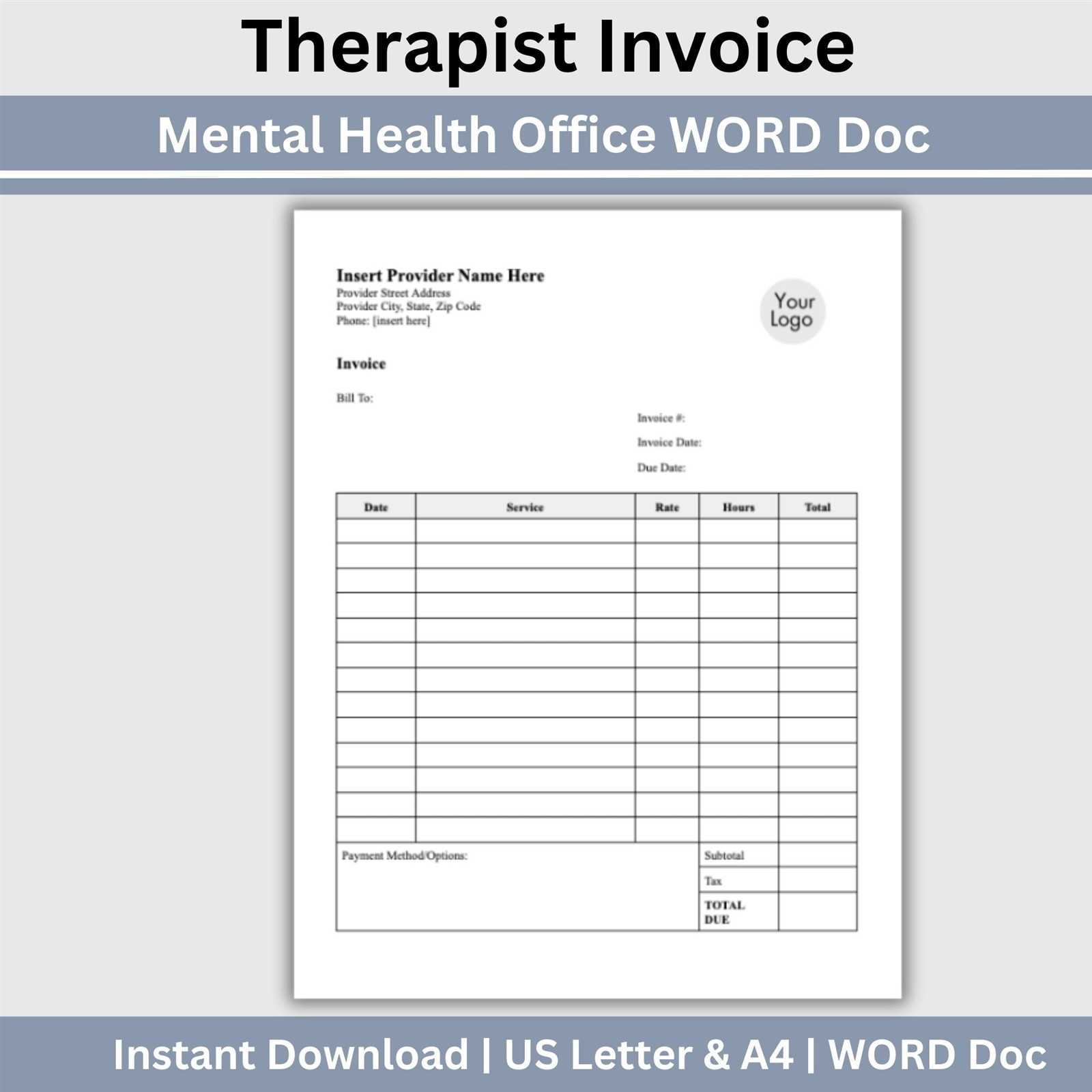

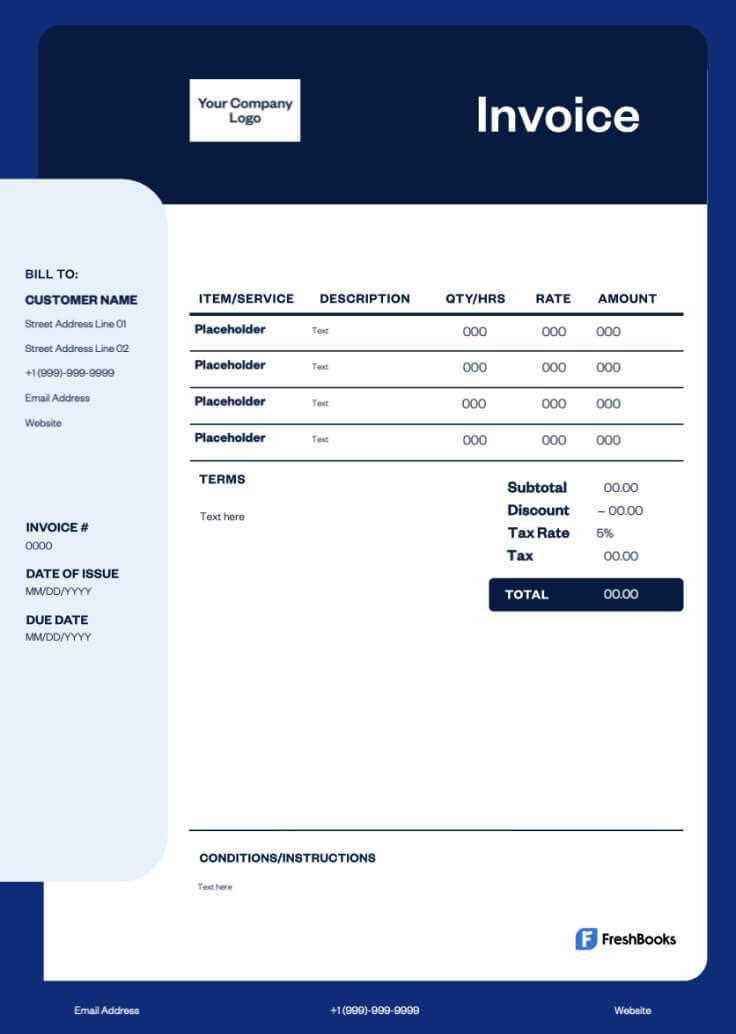

Top Free Templates for Word Users

For users looking to streamline their billing process, there are plenty of free options available that can help create professional-looking statements without much effort. These resources provide ready-to-use designs that can be customized to meet your business needs. From simple layouts to more detailed formats, you can choose the style that suits your preferences and branding.

Here are some of the best free options for creating a billing statement:

| Template Name | Features | Best For |

|---|---|---|

| Simple Billing Format | Basic layout with sections for services, amounts, and payment terms | Small businesses or freelancers |

| Professional Invoice Design | Stylish layout with customizable color options and logo space | Companies looking for a modern look |

| Detailed Statement | Includes multiple sections for detailed itemization, taxes, and discounts | Businesses with complex pricing structures |

| Minimalist Bill Format | Clean, simple design focusing on clear communication of charges | Freelancers or service providers |

These free designs are easy to access and can be customized to include your logo, business name, and payment information. Whether you need a quick and simple layout or a more complex design, these options are great for getting started without the need for expensive software or services.

How to Convert Word Invoices to PDF

Converting your billing statements into PDF format is an essential step for secure sharing and professional presentation. PDFs are universally accessible and ensure that your layout, fonts, and other design elements stay intact regardless of the device or software being used by the recipient. Fortunately, the process of converting your files to PDF is quick and simple, and it can be done directly from most editing software.

Here’s a step-by-step guide to convert your files to PDF:

- Step 1: Open the File – First, open the billing statement you want to convert on your computer using your preferred software.

- Step 2: Go to the Export or Save As Option – In most programs, click on the “File” menu and select the “Export” or “Save As” option.

- Step 3: Select PDF Format – From the list of available formats, choose PDF. You may also be able to select specific settings, such as whether to include images or set the quality of the file.

- Step 4: Choose a Destination – Choose where to save the converted file on your computer or cloud storage and give it an appropriate name.

- Step 5: Save the File – Click “Save” or “Export,” and your file will be converted and saved as a PDF document.

Additional Tip: If you prefer, you can use online tools to convert your files without needing to open any software. These tools are user-friendly and often allow for batch conversions if you need to convert multiple files at once.

Converting your billing statements into PDF format ensures that your recipients receive a high-quality, secure, and easily accessible version of the file. Whether you are sending your documents by email or sharing them on a website, PDF files are a reliable choice for professional communication.

Common Mistakes to Avoid in Invoices

Creating accurate and clear billing statements is crucial for maintaining a professional reputation and ensuring timely payments. However, certain errors can undermine this process, leading to confusion, delayed payments, and a strained relationship with clients. Recognizing and avoiding common mistakes can help streamline your business operations and build trust with customers.

Missing or Incorrect Details

One of the most frequent errors in billing is the omission or inaccuracy of important information. These include:

- Client Information: Failing to include the correct name, address, or contact details can lead to miscommunication.

- Business Information: Not providing your own company’s details, such as business name, tax ID, or address, can create confusion and hinder payments.

- Transaction Details: Missing descriptions of services rendered or products delivered may result in misunderstandings and disputes.

Incorrect Payment Terms

Clear payment terms are vital for setting expectations regarding when payments are due and how they should be made. Some common mistakes include:

- Unclear Deadlines: Not specifying due dates or payment periods can cause delays in payment processing.

- Confusing Payment Methods: Ambiguity around accepted payment methods can confuse clients and delay payments.

- Overlooking Late Fees: Not mentioning late payment penalties can result in clients delaying payment without consequences.

Final Thoughts: Avoiding these common mistakes in your billing process is essential to maintaining smooth business transactions. Make sure every detail is checked and clearly outlined before sending any bills to clients, ensuring transparency and professionalism in every communication.