Free Printable Invoice Templates in Word Document Format

In today’s fast-paced world, managing financial transactions efficiently is crucial for maintaining a successful business. Having the right documents ready to issue payments and receipts helps streamline the process, saves time, and ensures clarity in communication with clients. With customizable solutions, businesses of all sizes can easily stay organized and professional without needing specialized software.

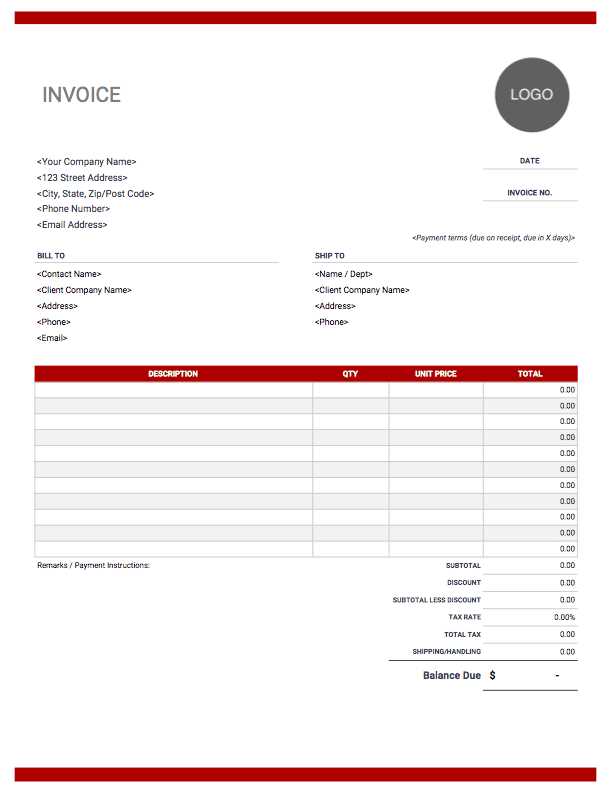

Pre-designed formats allow you to create custom records quickly, offering a simple yet effective way to track sales, services, or products provided. These layouts come in a variety of styles and structures, enabling flexibility to meet different business needs. Whether you’re a freelancer, small business owner, or part of a large enterprise, these tools can help you maintain accurate records while saving time on repetitive tasks.

By using easily accessible formats, you can ensure your paperwork looks polished and contains all necessary details. With minimal effort, you can input your information, adjust for personal branding, and keep consistent with your accounting practices. This approach not only saves money on outsourcing but also enhances efficiency in your day-to-day operations.

Free Printable Word Invoice Templates

When it comes to managing financial records, using pre-made formats can be a game-changer. These ready-to-use layouts help streamline the process of creating payment requests, ensuring that all necessary details are included in a clear and professional manner. By choosing from a variety of options, businesses can easily customize documents to suit their specific needs.

These layouts offer several advantages, including:

- Time-saving: Quickly generate structured documents without starting from scratch.

- Consistency: Maintain uniformity in every transaction, promoting a professional appearance.

- Customization: Easily adjust text, design, and layout to match your brand identity.

- Cost-effective: Avoid the need for paid software or external services to create official records.

Many platforms offer a wide range of these ready-to-use formats for various business needs. Whether you’re dealing with one-time transactions or recurring services, you can find options that work best for your workflow. The simple structure ensures ease of use for both seasoned professionals and newcomers alike.

By using these tools, businesses can stay organized and maintain a professional reputation with minimal effort. With a few clicks, you can create a polished, customized document that’s ready for distribution, whether it’s printed or shared digitally with clients and partners.

Why Use Word for Invoices

When managing business transactions, using a versatile software program to create financial records can save both time and effort. A widely accessible platform offers an easy-to-use interface for crafting structured documents that meet legal and professional standards. The simplicity and flexibility of this tool make it a popular choice for small business owners and freelancers alike.

Here are some key reasons why this approach is beneficial:

| Advantage | Description |

|---|---|

| Familiarity | Most people are already comfortable using this software, making it quick to start creating professional documents. |

| Customization | Adjust layouts, fonts, and styles to match your brand identity and business requirements. |

| Cost-Efficiency | There’s no need to purchase expensive invoicing software; this tool is often already part of your office suite. |

| Ease of Distribution | Save files in different formats for printing or emailing, making it easier to share with clients and partners. |

Using this program for financial records offers a straightforward and reliable solution that meets various business needs. Whether you need to quickly generate a document or make adjustments on the fly, it provides the tools to maintain accuracy and professionalism in your business transactions.

Top Features of Invoice Templates

When creating financial records, having key features in place can help ensure the process runs smoothly. Well-designed layouts are equipped with essential elements that streamline billing and reduce the chances of errors. These built-in features offer convenience, accuracy, and flexibility for businesses of all sizes.

Here are some of the most important features to look for in these pre-made structures:

- Pre-filled Fields: Common fields such as client name, date, and service/product description are already set up, allowing for quick input of relevant details.

- Automatic Calculations: Many of these layouts include built-in formulas to calculate totals, taxes, and discounts, reducing the need for manual math.

- Customization Options: You can easily modify the design, font, and layout to reflect your business’s branding and style.

- Legal Compliance: Most pre-designed structures ensure that you include necessary legal details like payment terms, tax information, and due dates.

- Multiple File Formats: Save and export the final version in various formats such as PDF, Excel, or plain text, making it easy to share with clients.

- Professional Design: Built with a clean and organized layout, these designs present your records in a polished manner that enhances your business’s credibility.

By choosing the right format, businesses can ensure their financial documents are clear, organized, and professional, with all the necessary details at their fingertips. These features help to save time, improve accuracy, and ultimately enhance the overall efficiency of the billing process.

How to Customize Word Invoices

Customizing your financial documents is key to making them professional and tailored to your business needs. Whether you’re creating a new template or adjusting an existing one, the ability to personalize each record ensures that it matches your branding and includes all necessary information. With just a few simple steps, you can transform any pre-designed layout into a fully customized tool for your transactions.

Modify Layout and Structure

The first step in personalizing your records is adjusting the overall layout and structure. You can easily change sections, move fields around, or add new rows to suit your needs. This helps you organize the information in a way that’s most relevant to your business. For example, you might want to add extra space for shipping details or include specific terms of service.

Adjust Branding and Style

Customizing colors, fonts, and logos helps reinforce your business identity. Start by choosing colors that match your brand’s palette, and update the font style to keep everything consistent. Adding your company logo to the top or footer of the page gives it a professional look and helps clients recognize your business. A clean, branded design enhances the overall credibility of the document.

To further customize, you can also include payment instructions, adjust the header with your contact details, or even change the default currency and tax rates to reflect your local standards. These modifications help ensure that your financial records align with your business practices and legal requirements.

Remember to save your modified layout as a new version to preserve the original format for future use. Regularly updating your records and keeping them aligned with your branding not only ensures consistency but also streamlines the process of issuing documents to clients.

Benefits of Printable Invoice Templates

Using pre-designed formats for creating financial records offers several significant advantages. These ready-to-use designs streamline the billing process, saving businesses valuable time and ensuring accuracy in every transaction. With the ability to quickly input data, these tools provide a simple yet effective way to maintain consistency and professionalism in your paperwork.

Time-Saving Efficiency

One of the biggest benefits of using these pre-made designs is the amount of time saved in creating each record. Instead of manually formatting each document from scratch, you can focus on entering the necessary details, such as product or service descriptions, pricing, and client information. This allows for quick generation of documents, especially for businesses with high-volume transactions.

Consistency and Professionalism

Using a standardized layout ensures that all of your records maintain the same structure and appearance. This consistency helps build trust with clients and partners, as they receive documents that look polished and reliable. Additionally, the inclusion of all required fields, such as payment terms and tax information, ensures that your records meet legal and business standards every time.

Furthermore, these formats often allow for easy customization, letting you adjust them to suit your branding. By adding your company logo, changing the design, or modifying certain sections, you can create a document that not only looks professional but also reflects your brand’s identity.

In short, using these pre-designed solutions saves time, enhances professionalism, and helps maintain consistency across all your financial paperwork. Whether you’re a small business owner or a freelancer, they are a practical and efficient way to manage your business transactions with ease.

Choosing the Right Template for Your Business

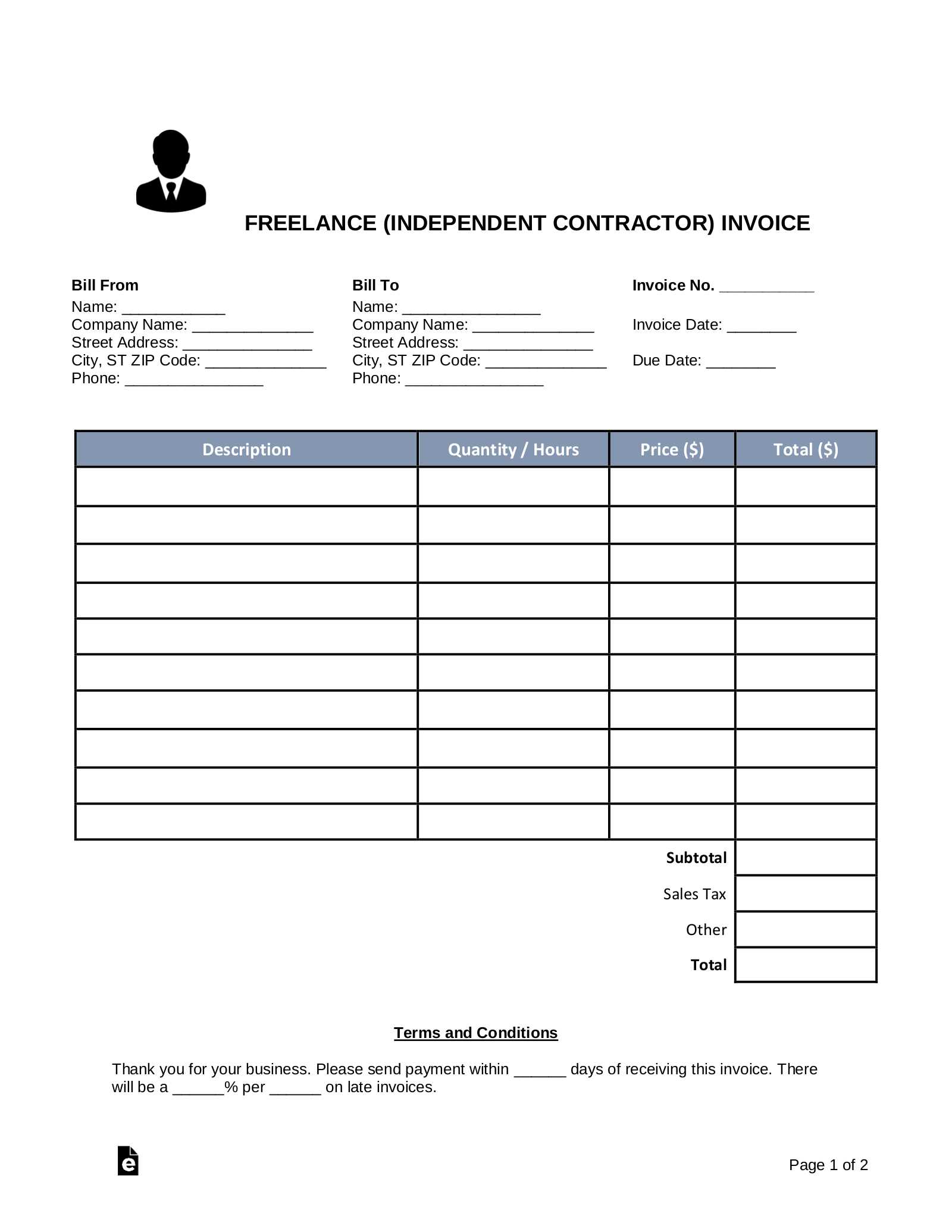

Selecting the right layout for your financial records is an important decision that can have a significant impact on your business operations. The correct design should be both practical and professional, enabling you to efficiently track transactions while presenting your company in the best light. With a variety of options available, it’s essential to find a format that suits your specific needs and workflow.

First, consider the nature of your business. If you’re offering a service, you may require a layout that allows for detailed descriptions of the work performed. For product-based businesses, a simple structure with fields for quantity and price might be more appropriate. Regardless of the type of business, ensure that the structure is easy to read and includes all the necessary details like payment terms, tax information, and due dates.

Key factors to consider:

- Clarity: Ensure the layout is easy to navigate, with clearly defined sections for each piece of information.

- Flexibility: Look for a structure that allows you to easily add or remove sections based on your specific needs.

- Customization: Choose a format that lets you modify fonts, colors, and logos to match your brand identity.

- Legal Compliance: Select a design that includes the essential legal fields such as tax ID, payment terms, and business address.

Once you’ve narrowed down your options, test a few layouts to see which one aligns best with your business style and administrative needs. Having a flexible and professional layout not only improves efficiency but also contributes to building a more trustworthy image with clients and partners.

Where to Download Free Invoice Templates

Finding the right layout for your financial paperwork is essential for smooth business operations. Fortunately, there are numerous sources where you can easily download ready-to-use structures for your payment requests. Many of these options are available without cost and provide a variety of designs to suit different business types and styles.

Online Marketplaces and Platforms

Several online platforms offer a wide range of pre-designed formats for various needs. Websites such as Template.net, Canva, and Microsoft Office Online provide free access to various options. These platforms often allow you to customize the layout and then download it in a format that best suits your needs. You can browse through dozens of designs, select the one that fits your brand, and start using it immediately.

Business and Financial Websites

Many business-related websites, accounting blogs, and financial services providers offer downloadable records for small business owners and freelancers. Websites such as FreshBooks or QuickBooks often provide free basic layouts as a way to attract new users. These can be a great starting point for anyone new to creating professional financial documents.

In addition, certain government and tax-related websites may also provide templates that meet local regulatory requirements, which can be beneficial for ensuring your documents are compliant with tax laws.

Regardless of where you download your layout from, be sure to check that it aligns with your business needs and allows for sufficient customization. By selecting a reliable source, you can quickly access high-quality formats to streamline your billing process.

How to Edit and Save Your Invoice

Once you’ve chosen a suitable layout for your financial records, the next step is to edit it to reflect the details of your transaction. Customizing the document to fit the specifics of each sale, service, or product is crucial for accuracy and professionalism. After making the necessary edits, saving your document properly ensures it’s ready for distribution and future reference.

Editing Your Document

To begin, open the layout you’ve selected and start replacing the placeholder text with your business’s information. This typically includes:

- Client details: Name, address, and contact information.

- Transaction information: Date, description of services/products, quantities, and unit prices.

- Payment terms: Due dates, tax rates, and any additional fees.

Most pre-made structures allow you to easily modify text fields, adjust the layout, and even insert your company logo. Make sure all sections are complete and the details are accurate before finalizing the document. You can also adjust font styles, colors, and alignment to make the document more visually appealing or to match your company’s branding.

Saving and Storing Your Record

After editing, saving the file correctly is essential. Always choose a format that is easy to access, whether you plan to print it or send it electronically. Common options include:

- PDF: Ideal for sharing via email or storing digitally while preserving the format and layout.

- Excel: Useful if you need to track multiple records or perform calculations.

- Editable Format: Keep a version in an editable format for future use, allowing you to quickly modify the document for new transactions.

Be sure to name your files clearly and save them in an organized folder to keep your records easy to find. By maintaining an orderly system, you can quickly access past documents when needed and ensure that your financial records are always up-to-date and accurate.

Common Invoice Template Mistakes to Avoid

Creating financial records can be a straightforward task when using pre-designed formats, but even with these tools, mistakes can still happen. It’s important to be mindful of common errors that can lead to confusion, delays, or even legal issues. Avoiding these pitfalls ensures that your records are accurate, professional, and effective for both you and your clients.

Here are some of the most frequent mistakes to watch out for when preparing your documents:

- Missing Contact Information: Always double-check that your business name, address, phone number, and email are included. Missing contact details can cause delays or misunderstandings with clients.

- Incorrect Dates: Ensure that both the transaction date and the due date are correct. An error here can lead to confusion regarding payment deadlines.

- Unclear Payment Terms: Clearly state the terms of payment, including the accepted methods, due dates, and any late fees. Lack of clarity can lead to delayed or missed payments.

- Omitting Tax Information: Make sure to include applicable tax rates and clearly mark the total tax amount. Failing to do so can lead to compliance issues and misunderstandings with clients.

- Incorrect or Missing Item Descriptions: Avoid vague or incomplete descriptions of the products or services provided. Clear itemization helps both parties understand the details of the transaction.

- Overcomplicating the Design: A clean, simple layout is often more effective than a cluttered one. Too many graphics or unnecessary sections can distract from the key information.

By avoiding these common mistakes, you ensure that your financial records are clear, professional, and legally sound. Double-checking your details and maintaining a streamlined, organized layout can save you from potential issues down the road, allowing you to focus on growing your business.

Creating Professional Invoices in Word

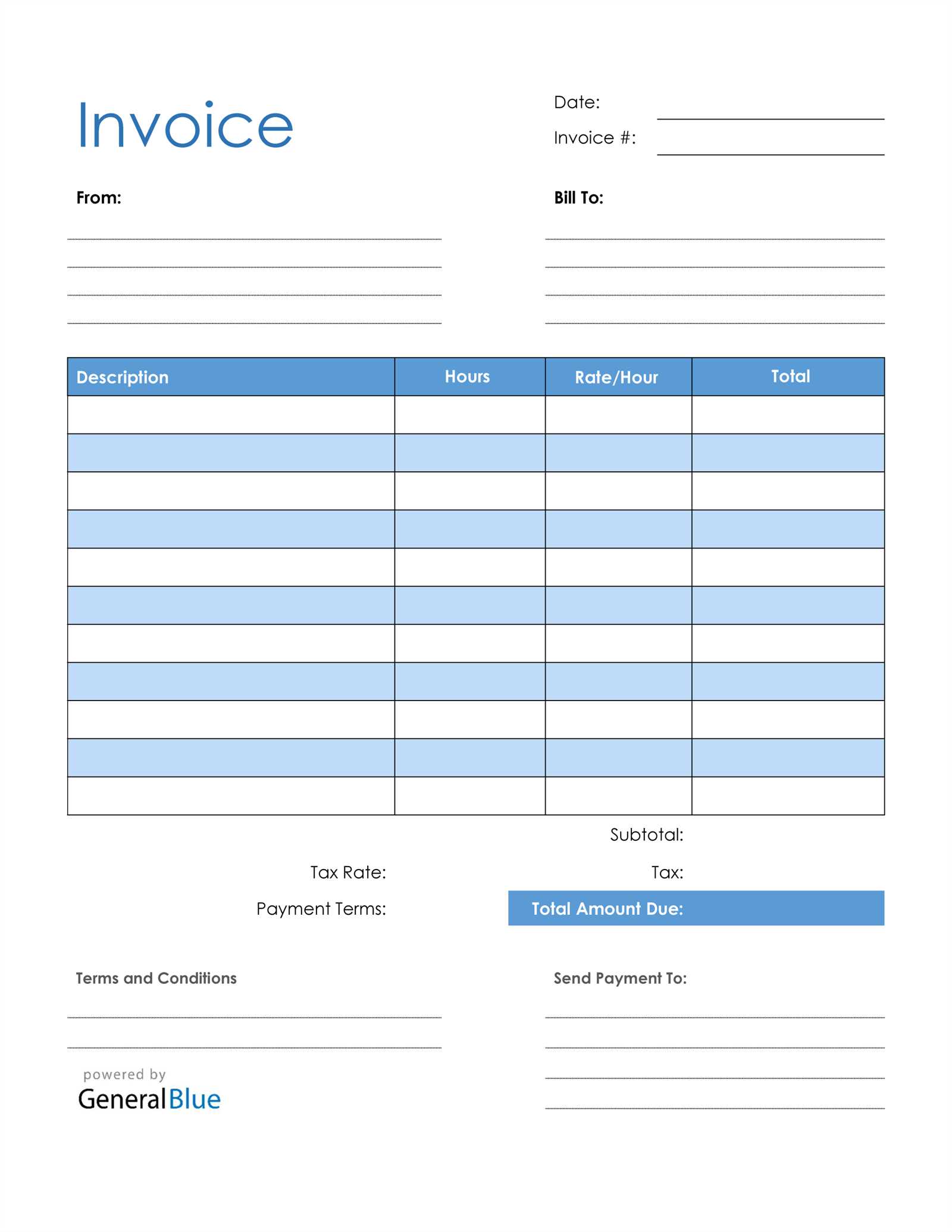

When it comes to managing your business finances, producing polished and professional records is crucial for maintaining a strong reputation and ensuring smooth transactions. By using a versatile software tool, you can easily craft custom billing documents that not only convey all the necessary information but also reflect the professionalism of your business. With the right approach, creating a high-quality record can be quick and efficient.

Start by selecting a clean, simple layout that includes all the required fields such as client details, a description of services or products provided, and the payment terms. Customizing your design further by adding your company logo, adjusting the fonts, or choosing your brand colors helps reinforce your identity and creates a lasting impression with clients.

Next, focus on accuracy. Make sure that all fields are correctly filled in, with the correct pricing, dates, and terms. It’s important to ensure there are no spelling or arithmetic errors, as even small mistakes can undermine your credibility.

Finally, once your layout is ready and all details are correctly entered, save the file in a format that is easy to share and access. You can choose to save the record in PDF for a professional look or in an editable format for future use. This approach ensures that each record is ready for distribution while maintaining consistency and professionalism in every transaction.

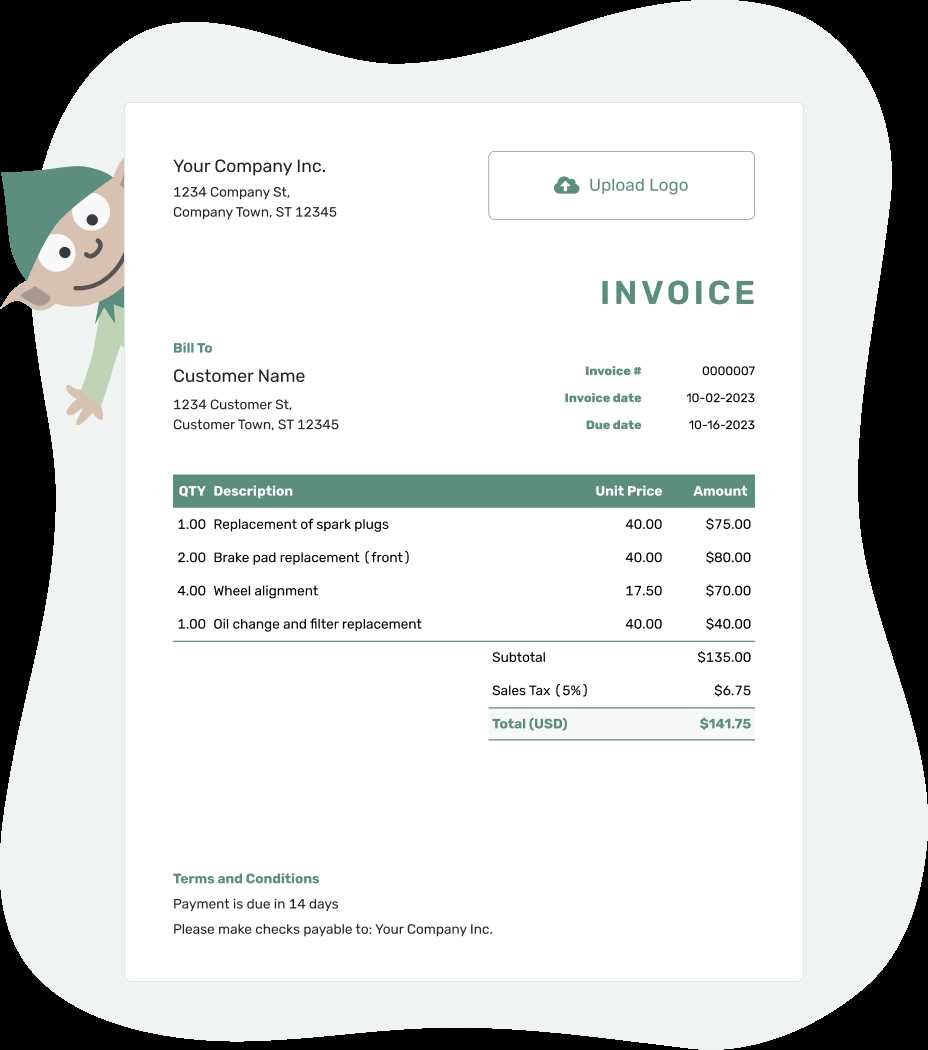

How to Add Your Logo to an Invoice

Including your business logo on financial records is a simple yet effective way to enhance your brand identity and create a more professional appearance. A logo helps reinforce your company’s presence and ensures that your documents are easily recognizable. Whether you’re creating a new record or updating an existing one, adding your logo is a quick process that can make a significant impact.

Inserting the Logo

To begin, ensure that you have a high-quality image of your logo saved on your computer. It’s best to use a transparent PNG or high-resolution JPEG to maintain the clarity and quality of the image when placed in the document.

Follow these steps to add your logo:

- Open your file and locate the header or top section where you want the logo to appear.

- Click on the “Insert” tab in your software, then choose “Picture” or “Image” from the options.

- Select the logo file from your computer and click “Insert.” The logo will appear on the page.

- Resize and position the logo as needed. Ensure it is aligned properly and does not overpower the text or other elements of the record.

Adjusting the Layout

After adding your logo, take a moment to check the overall layout. You may need to adjust the spacing or margins to ensure everything is neatly aligned. It’s important to ensure that the document looks clean and professional, with your logo complementing the other elements rather than distracting from them.

Tip: If your logo is too large, resize it proportionally to maintain a balanced appearance. The logo should be clearly visible but not overwhelming.

By following these simple steps, you can add your logo to any financial record, creating a polished and professional document that reflects your brand identity and fosters trust with your clients.

Adjusting Template Layout and Design

Customizing the layout and design of your financial records is essential for ensuring they are clear, professional, and aligned with your brand’s identity. A well-organized structure not only makes your documents easier to read but also improves their visual appeal. By adjusting key elements like spacing, font size, and section arrangement, you can create a polished look that enhances the overall presentation.

Here are some key areas to focus on when adjusting your layout:

- Spacing and Margins: Ensure there’s adequate space around the edges of your document to avoid a crowded look. Adjusting the top, bottom, left, and right margins can help create balance and make your document easier to read.

- Font Choices: Select clean, easy-to-read fonts for both headers and body text. Avoid using too many different fonts, as this can create visual clutter. Stick to one or two complementary fonts to maintain consistency.

- Text Alignment: Proper alignment helps guide the reader’s eye through the document. Ensure headings are centered or left-aligned, and the body text is aligned consistently for a neat and organized appearance.

- Header and Footer Design: A header that includes your business name or logo helps reinforce your branding, while the footer can include important details such as payment terms or your contact information. Make sure both are aligned and not overly cluttered.

- Section Organization: Clearly define sections such as “Services Provided,” “Payment Terms,” and “Total Amount Due.” This helps the reader easily locate information and prevents confusion. Using lines or boxes can also visually separate different sections for added clarity.

By paying attention to these details, you can adjust the layout and design of your document to make it look both professional and aligned with your business needs. A well-designed structure not only improves readability but also leaves a lasting impression on your clients.

Why Word is Ideal for Invoicing

When managing financial transactions, having a flexible and user-friendly tool to create and edit billing records is essential. A versatile software platform is crucial for producing professional and accurate records without unnecessary complexity. With its intuitive interface and wide range of customizable features, this tool provides an ideal solution for anyone looking to generate organized and visually appealing financial paperwork.

One of the key advantages is the ease of use. You don’t need advanced technical skills to create polished documents. The software offers various pre-designed layouts and tools that allow for quick customization. Additionally, the ability to insert text, images, tables, and company logos ensures that your documents can be tailored to suit your specific business needs.

Key Benefits:

- User-Friendliness: Its simple interface makes it easy for anyone to create and edit documents without extensive training.

- Customization: You can personalize each document with your company’s branding, add images, adjust layouts, and more.

- Compatibility: Files created on this platform are easily shared and accessible across various devices and operating systems.

- Formatting Tools: With built-in formatting options like tables, bullet points, and alignment features, you can organize your data clearly and professionally.

For small business owners, freelancers, or anyone in need of reliable billing solutions, this platform offers an excellent balance of simplicity, flexibility, and functionality. It ensures that every record is clear, accurate, and ready to be shared with clients.

Making Your Invoice Legally Compliant

Creating accurate and compliant financial records is crucial for both business operations and legal purposes. Each transaction document must meet certain legal requirements, which vary depending on your location and the nature of your business. Ensuring that your paperwork adheres to local regulations will help avoid disputes, penalties, and unnecessary complications in the future.

Here are key elements that should be included to ensure your document meets legal standards:

- Business Information: Always include your company name, address, and contact details. If applicable, include your business registration number or tax identification number.

- Client Details: Include the full name and address of the customer receiving the service or product. This is important for proper record-keeping and taxation purposes.

- Unique Reference Number: Assign a unique number to each transaction record. This makes it easier to track and reference in case of audits or disputes.

- Clear Description of Services or Goods: Provide a detailed description of the product or service provided, including quantities, unit prices, and any applicable tax rates. This ensures transparency and helps avoid misunderstandings.

- Payment Terms: Specify the payment due date, accepted methods, and any penalties for late payments. Clear terms protect both parties and help ensure timely payments.

- Tax Information: Depending on local laws, you may need to include specific tax rates or indicate tax-exempt status. Be sure to follow the proper guidelines to ensure compliance with tax regulations.

By including these crucial details, you ensure that your financial documents are both professional and legally sound. Regularly reviewing local laws and consulting with legal or tax professionals will help keep your documents up-to-date and compliant with any changes in regulations.

Tips for Streamlining Invoice Management

Efficient management of billing records is essential for maintaining cash flow, ensuring timely payments, and keeping track of financial transactions. By organizing and automating processes, businesses can reduce errors, save time, and improve overall efficiency. Streamlining your workflow not only makes it easier to manage but also helps you stay on top of deadlines and client communications.

1. Automate Recurring Billing

If your business involves regular transactions with clients, consider automating the creation and sending of billing documents. Many platforms allow you to set up recurring billing cycles, so invoices are generated and sent on a set schedule. This eliminates the need for manual entry each time, reducing the chances of forgetting or overlooking important details.

2. Use Digital Filing Systems

Instead of relying on paper records, store all your billing documents digitally. By using cloud storage or specialized invoicing software, you can keep all records in one easily accessible location. This also allows for better organization with clear naming conventions, searchable files, and the ability to back up data for security. Digital filing systems can also make it easier to retrieve past transactions and track payment histories.

Additional Tips for Efficiency:

- Set Up Payment Reminders: Send automated reminders to clients about upcoming payment due dates to encourage timely payments and reduce follow-ups.

- Organize by Categories: Categorize your records by client, project, or service type to quickly find specific information when needed.

- Standardize Your Billing Process: Use consistent formats and structures for all billing records, making it easier to create, understand, and manage them.

- Keep Track of Expenses: Include a section for expenses related to the service or product you provided to ensure all costs are covered in the billing record.

By adopting these practices, you can significantly improve the efficiency of your billing process, reduce the time spent on administrative tasks, and ensure a more organized approach to financial management. Streamlining these tasks will ultimately free up more time for focusing on business growth and customer relationships.

How to Handle Multiple Invoices in Word

Managing multiple billing records can become overwhelming, especially when handling numerous clients or projects. However, with a structured approach, you can efficiently manage several transactions without losing track of important details. The key lies in using organization techniques, automation tools, and keeping your files consistently formatted for easy access and reference.

Here are several strategies to effectively manage multiple billing documents:

- Organize Files by Client or Project: Create separate folders for each client or project, where all related documents can be stored together. This makes it easier to find specific records when needed and keeps your files well organized.

- Use Unique Identification Numbers: Assign each record a unique number or reference code. This allows for easy tracking, searching, and referencing of specific transactions, especially when dealing with large volumes of paperwork.

- Standardize Format: Use the same structure for all your billing records. Consistency helps streamline the process and ensures that all documents include the same essential information, such as client details, payment terms, and product/service descriptions.

Additional Tips for Efficient Management:

- Batch Processing: If you’re managing multiple records at once, batch your tasks. For example, gather all necessary details (client names, amounts, descriptions) before creating or editing each record to streamline your workflow.

- Group by Due Dates: Sort your records by payment due dates to prioritize follow-ups and ensure timely payments. This can be done digitally by using spreadsheet software or simple date-sorting methods in your file system.

- Consider Using a Digital Management System: If you are handling a large number of transactions, explore invoicing software that integrates with other business systems. These tools can help automate repetitive tasks, create records quickly, and maintain a secure, searchable database of all your financial documents.

By implementing these methods, you can keep your transactions well-organized and ensure that managing multiple records becomes an efficient, streamlined task. With the right approach, handling a large volume of financial paperwork no longer needs to be time-consuming or stressful.

Printing and Sending Word Invoices

Once you’ve created and customized your financial documents, it’s important to ensure that they reach your clients in a timely and professional manner. Whether you prefer to send physical copies or digital versions, there are several considerations to keep in mind for both methods to ensure smooth delivery and secure receipt.

Printing Physical Copies

If you need to send a hard copy of your records, printing them clearly and professionally is essential. Here are some key steps to ensure the document is prepared properly for printing:

- Choose the Right Paper: Use high-quality paper to give your document a professional appearance. Standard letter-size paper (8.5″ x 11″) is typically used, but you can select a thicker paper type for a more formal look.

- Check Margins and Layout: Before printing, make sure your margins are set appropriately to avoid any text being cut off. Double-check the layout, ensuring that all sections are properly aligned.

- Preview Before Printing: Always preview the document to check for any formatting issues or missing information. This allows you to make adjustments before committing to print.

- Print in Color or Black & White: Depending on your preferences and the document’s importance, you can choose to print in color to highlight branding or print in black and white for a more formal, cost-effective approach.

Sending Digital Versions

For faster delivery, many businesses choose to send their documents via email or through secure online portals. Here’s how to ensure your digital versions are ready for sending:

- Save in a Universal Format: Save your file as a PDF to ensure it maintains its formatting and can be opened by clients on any device without alteration.

- Double-Check the Recipient’s Information: Ensure that the recipient’s email address is correct and that all necessary documents are attached before sending.

- Set Up Email Reminders: If payment is due soon, consider setting up an automated reminder email or include a gentle nudge in your message to encourage timel

Updating Your Templates for New Needs

As your business evolves, so too will your billing requirements. What worked for you at the start may no longer be suitable as you grow, take on new clients, or expand your services. Regularly updating your financial documents to reflect changes in your business is crucial for maintaining consistency, professionalism, and legal compliance. Modifying your forms to accommodate new needs ensures they remain relevant and effective as your operations develop.

Assessing Your Current Needs

Before making changes, it’s important to assess how your requirements have shifted. Review your existing paperwork to identify areas that need modification. Ask yourself the following questions:

- Have there been changes in your services or products? If you now offer additional services or packages, make sure your forms reflect these updates.

- Do your payment terms or policies need updating? Adjust payment due dates, late fees, or accepted payment methods to ensure that they align with your current business practices.

- Is there new legal or tax information to include? If tax rates or other regulations have changed, update your records accordingly to remain compliant.

How to Make Changes

Once you’ve assessed your needs, you can start making adjustments. Consider these steps:

- Modify Layout and Sections: If your offerings or policies have expanded, add new sections to capture the necessary information. You might need additional fields for new products, services, or payment terms.

- Incorporate Branding Elements: As your brand identity strengthens, make sure your financial documents are aligned with your branding. Update logos, colors, or fonts to match your current visual identity.

- Review Legal Requirements: If there have been changes in local laws or tax regulations, ensure that your forms reflect the latest compliance standards.

Regularly updating your forms helps keep them in line with your growing business and ensures that your operations run smoothly without unnecessary delays or legal issues. A well-maintained set of records not only streamlines your workflow but also creates a more professional image for your company.