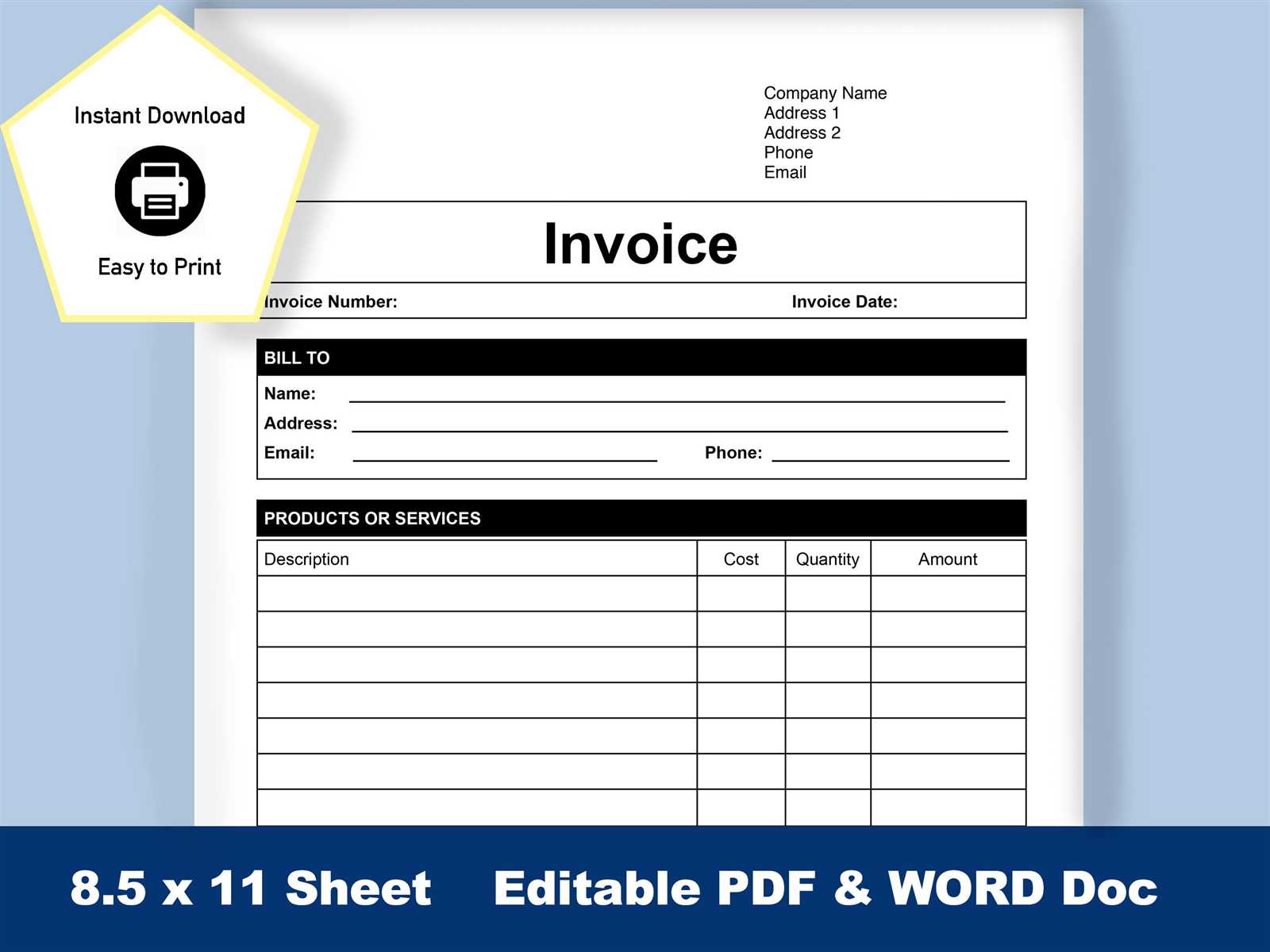

Easy to Use Word Doc Template for Professional Invoice Creation

Managing financial transactions effectively is crucial for any business. A well-structured document can make the billing process smooth, clear, and professional. By using simple tools, you can create customized documents that reflect your brand’s image while ensuring accuracy and clarity for your clients.

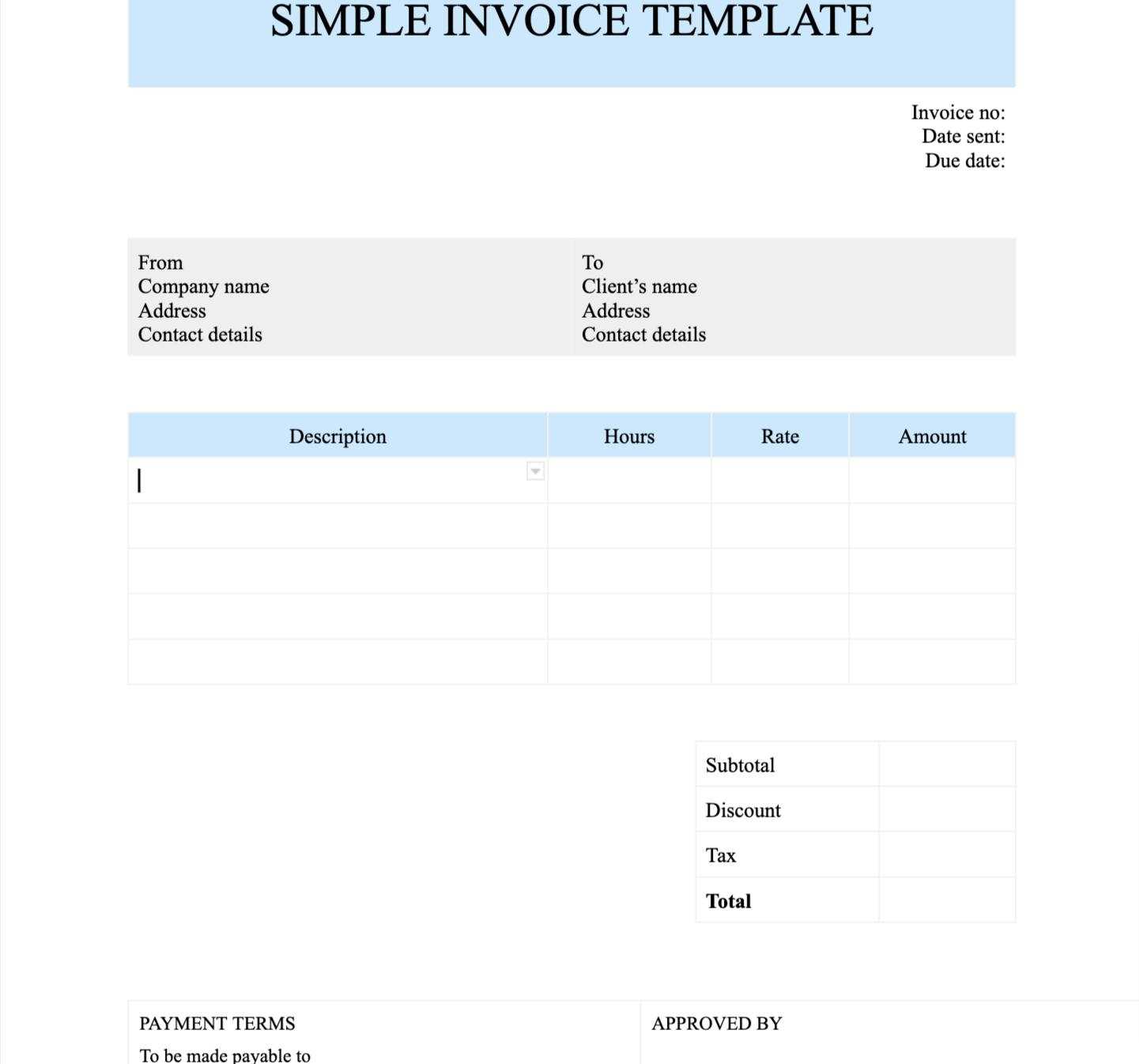

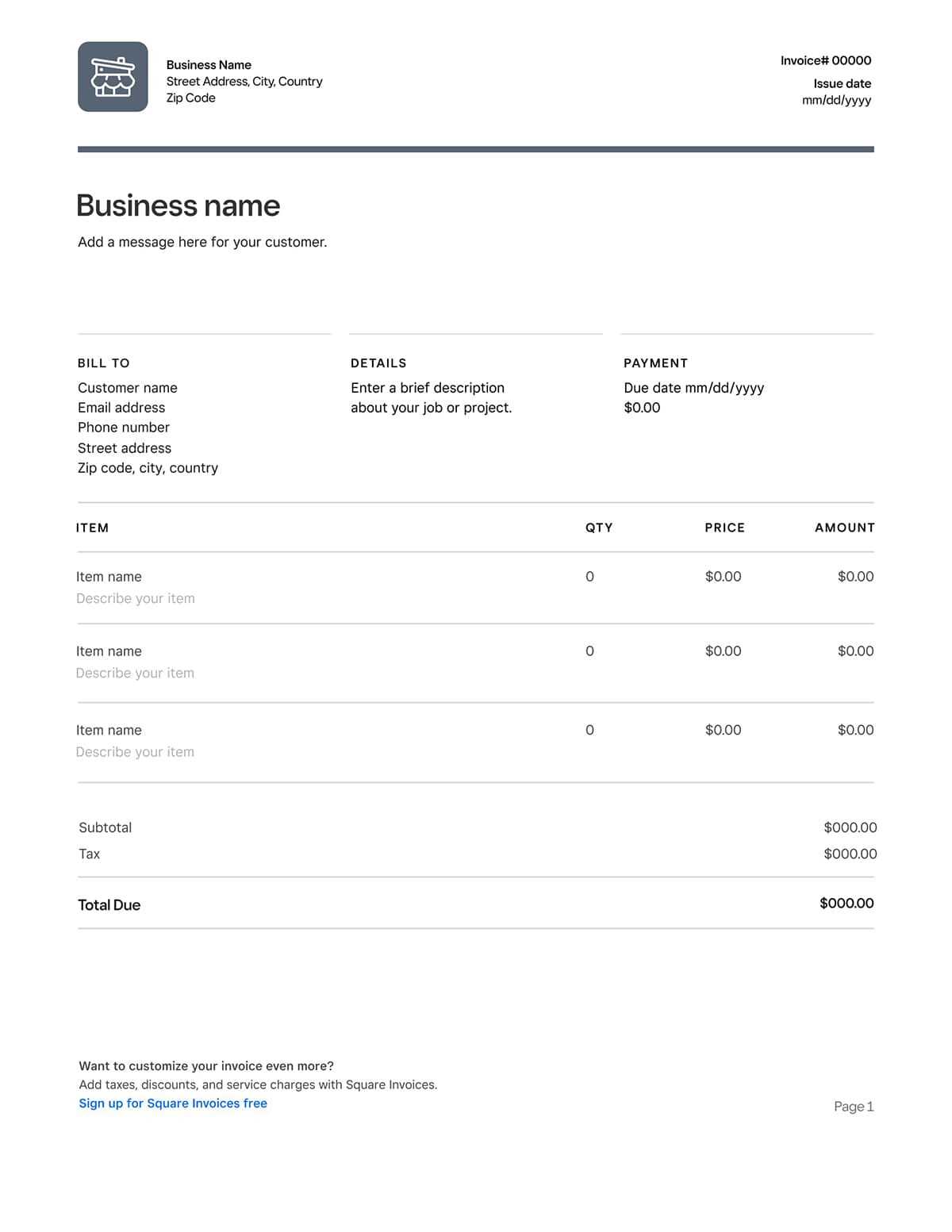

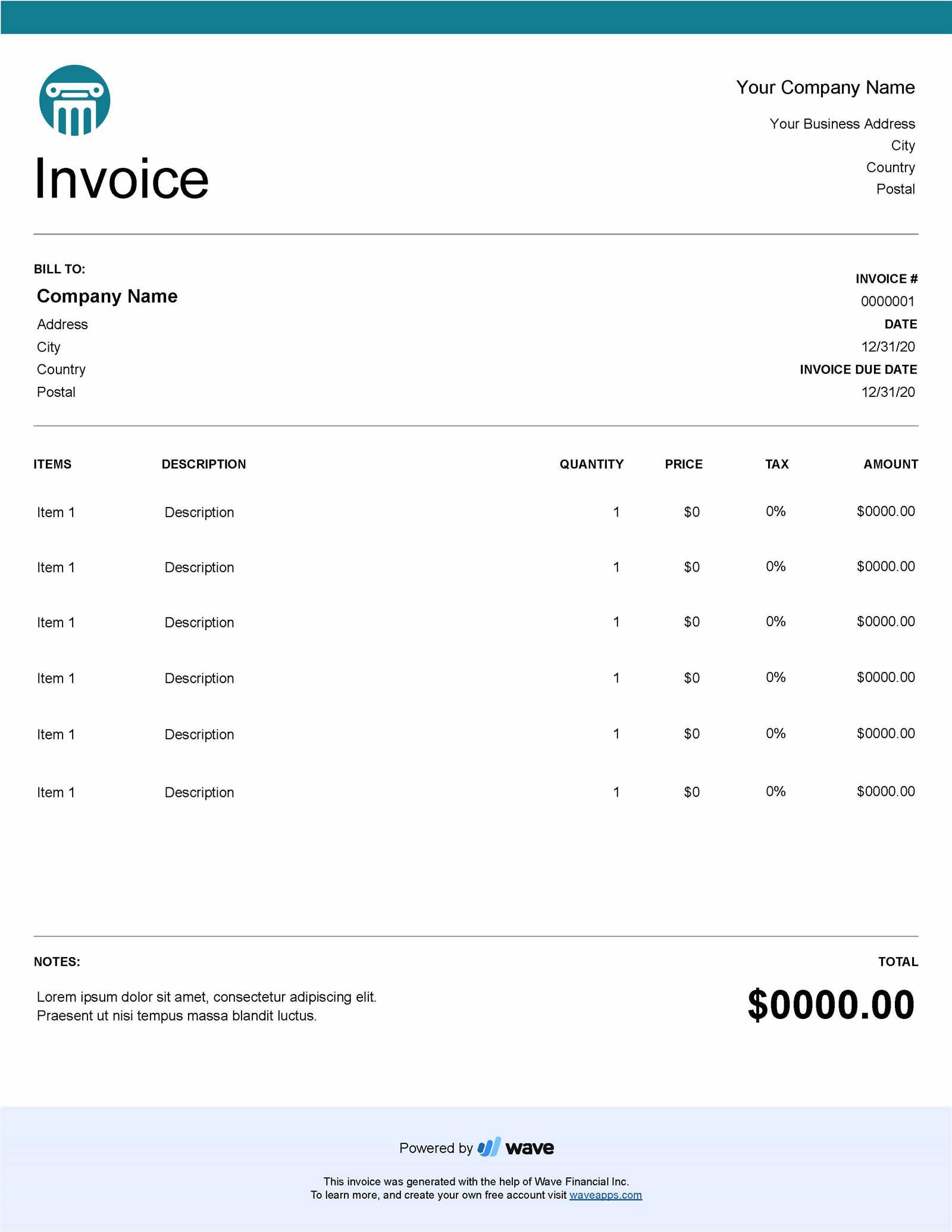

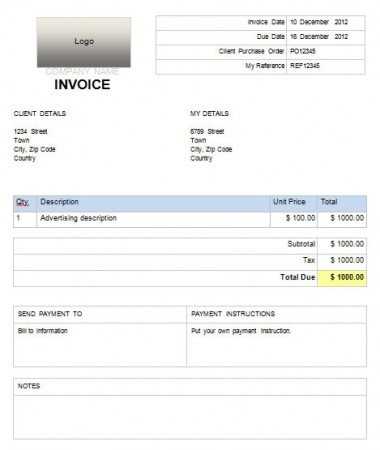

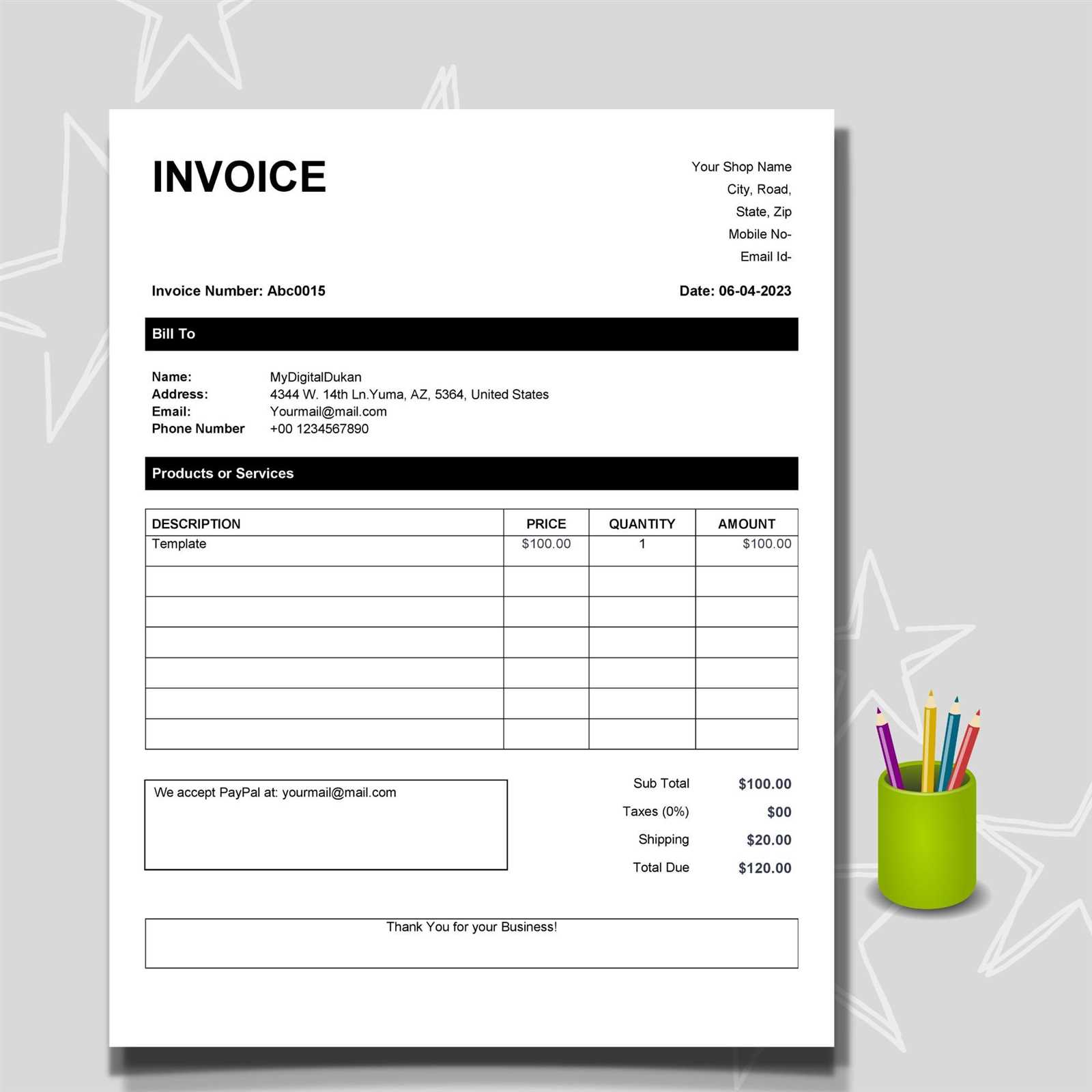

Customizable formats allow users to quickly adapt the layout and design to suit their needs. Whether you are an entrepreneur, freelancer, or a small business owner, a flexible approach to generating billing records can save you time and effort. These documents can be tailored to include essential details such as service descriptions, due dates, and payment instructions.

Effective design plays an important role in ensuring your clients easily understand the charges. By utilizing an editable format, it’s possible to quickly update or reuse documents as needed, streamlining your workflow. The result is a clean, professional appearance that helps maintain positive business relationships.

Why Choose a Billing Document Format

When managing financial records, using an easily editable and customizable format is essential. With the right tool, you can create professional-looking statements that align with your business needs. This approach offers several benefits, such as streamlining the creation process and maintaining consistency across all your transactions.

Ease of Customization

A flexible document format allows you to adjust each section according to your requirements. Whether it’s altering the layout, changing fonts, or adding new sections, the customization options are endless. This adaptability ensures that your records are tailored to the specific needs of each client, enhancing the overall customer experience.

Consistency and Professionalism

Using a structured format ensures that all details are consistently presented, reducing the likelihood of errors. It helps maintain a professional image for your business, which is essential for building trust with clients. With a standardized layout, all of your documents will follow the same format, making it easier to track transactions and manage your finances.

| Benefits | Details |

|---|---|

| Customizable | Easily adjust sections like client details, payment terms, and descriptions |

| Time-saving | Pre-designed formats speed up document creation without sacrificing quality |

| Professional appearance | Clean, well-structured layouts enhance the perception of your business |

| Easy updates | Make quick changes to any section without needing a new design |

Benefits of Customizing Your Billing Document

Adapting your financial records to suit your specific business needs offers a range of advantages. Customization allows you to reflect your brand identity, improve client communication, and ensure accuracy in every detail. With the ability to modify various elements, you gain complete control over the appearance and content of your billing statements.

Enhanced Professionalism and Branding

By personalizing your documents, you can incorporate elements of your brand, such as logos, colors, and fonts. This not only helps create a cohesive brand image but also adds a layer of professionalism that clients will appreciate. A customized document communicates that you care about the details and enhances your business reputation.

Improved Client Experience

Customization enables you to tailor the structure of the document to make it clearer and more understandable for your clients. Including specific payment terms, service descriptions, and contact information in an organized layout makes it easier for clients to process payments on time. A well-structured document can prevent confusion and reduce the chances of disputes.

Key Benefits:

- Brand Identity: Include your logo and company colors for a consistent appearance.

- Client Satisfaction: Customizing payment terms and details enhances clarity.

- Time Efficiency: Streamlined formats reduce time spent creating each document.

- Flexibility: Adjust sections to reflect different services or clients’ unique needs.

How to Download Billing Document Formats

Downloading editable formats for your financial records is a straightforward process that can save you time and effort. With just a few simple steps, you can access ready-made layouts that are easy to customize to suit your needs. These documents are available from various online sources, making it easy to find one that aligns with your business style.

Finding Reliable Sources

To begin, search for trusted websites that offer free or paid downloadable formats. Many platforms specialize in providing high-quality, professional layouts designed for different business needs. Look for those that offer files in common formats, which can be easily edited on your computer. Always check for reviews or recommendations to ensure you are downloading from a reliable source.

Steps to Download and Use

Once you’ve selected the format you need, the process typically involves clicking a download button or link. After downloading, open the file in an appropriate program where you can begin editing. Most documents are designed to be user-friendly, so you can quickly add your company details, services, and payment terms.

Download Tips:

- Choose a trustworthy site: Make sure the source is reputable to avoid potential security risks.

- Check file compatibility: Ensure the format works with your preferred software before downloading.

- Review the layout: Look at the document before customizing to ensure it meets your needs.

Best Practices for Billing Document Formatting

Creating clear and professional financial records is essential for smooth transactions. Proper formatting ensures that all necessary details are easily readable and accessible, helping to avoid confusion and errors. By following best practices, you can ensure that your documents not only look polished but also provide all the required information in an organized manner.

- Keep it simple and clean: Use a minimalistic design to ensure your document is easy to read and professional-looking. Avoid clutter and unnecessary details.

- Organize information logically: Ensure that each section of the document is clearly defined, such as client details, itemized services, payment terms, and total amounts.

- Use consistent fonts: Choose easy-to-read fonts such as Arial or Times New Roman. Avoid using too many font styles or sizes, as this can make the document look unprofessional.

- Highlight important details: Bold or underline key information, such as the total amount due, due dates, and client contact information.

- Include clear payment instructions: Make sure that your payment terms and instructions are easy to understand and follow.

Organizing Sections

Proper organization is crucial to ensuring that the document flows logically. Group similar information together and use headings and bullet points where necessary. Here’s a simple format to follow:

- Header with company details

- Client information

- Service description

- Itemized costs

- Payment terms and due date

- Additional notes or contact information

Final Check

Before sending the document, double-check for any errors in calculations or spelling. A small mistake could lead to confusion or delays in payment, so it’s essential to review everything thoroughly.

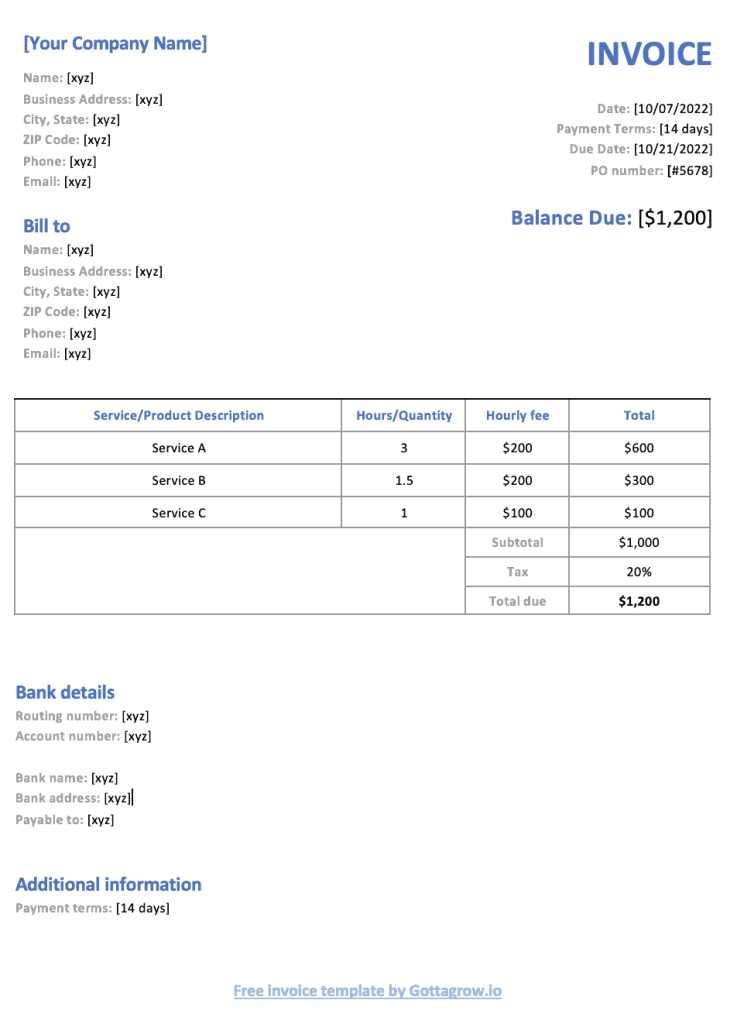

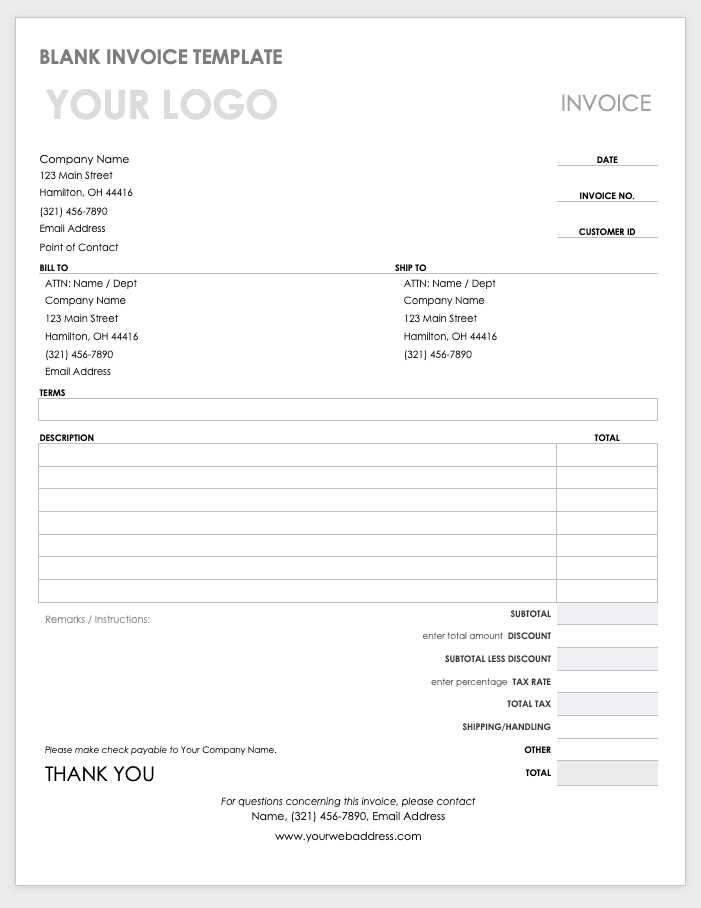

Creating a Professional Billing Document

Designing a polished and functional record for your business transactions is key to maintaining professionalism. By organizing essential details in a clear and structured manner, you can create a document that looks trustworthy and communicates information effectively. Here’s a guide on how to build a well-crafted billing statement that leaves a lasting impression on your clients.

- Start with a clean layout: Begin by choosing a simple, easy-to-read design. Avoid overcomplicating the structure, as clarity is the top priority.

- Incorporate branding elements: Include your logo, company name, and contact details in the header to make the document uniquely yours. Consistent branding increases trust and professionalism.

- Organize client details: Include the client’s name, address, and contact information clearly at the top of the document. Make sure this section is easy to find and read.

- List services or products: Provide a detailed breakdown of the services rendered or products sold. Include the quantity, description, and price for each item or service.

- Summarize charges: Add a section for the total amount due, including any taxes or additional fees. Be sure to use bold or larger text to highlight the final amount.

- Define payment terms: State the due date, accepted payment methods, and any late payment penalties clearly to avoid confusion.

- Provide additional notes: If necessary, include any extra instructions or disclaimers that could be helpful for the client, such as return policies or payment instructions.

Step-by-Step Guide

Follow these steps to ensure you create a professional document:

- Set up the page layout with your branding elements at the top.

- Insert the client’s information and your business details in a readable format.

- List each service or product with detailed descriptions and pricing.

- Include a clear and concise total amount due, including taxes.

- Clearly state payment instructions, including due dates and methods.

- Review the document for accuracy and completeness before finalizing.

By following these simple guidelines, you can create a professional and well-organized document that will help maintain strong business relationships and ensure smooth financial transactions.

Key Elements to Include in a Billing Document

Creating a clear and comprehensive billing record is crucial for both businesses and clients. To ensure that all necessary information is included, it’s important to structure the document with key details that facilitate smooth transactions and avoid confusion. A well-designed record should cover all aspects of the transaction, from identifying both parties to outlining payment terms.

- Business Information: Include your company name, address, phone number, email, and any other relevant contact information. This ensures that clients can easily reach you with questions.

- Client Information: Clearly list the client’s name, address, and contact details. This helps to identify the recipient of the payment.

- Unique Identifier: Assign a unique reference number to each document for easy tracking and record-keeping. This can be a sequential number or a custom code.

- Date of Issue: Clearly state the date the document was created. This helps to set the timeline for payment and ensures that both parties are on the same page.

- Description of Services or Products: Provide a detailed list of the items or services provided. Include the quantity, unit price, and any specific details to avoid confusion.

- Payment Amount: Clearly list the total due, including any applicable taxes, discounts, or additional fees. This should be prominently displayed for easy reference.

- Payment Terms: Include the due date and any other relevant payment conditions, such as late fees or accepted methods of payment.

- Additional Notes: If applicable, include any relevant terms and conditions, return policies, or instructions that might be useful for the client.

Structure and Presentation

The layout should be clean and professional, with all elements organized in a logical flow. A consistent and easy-to-read format will ensure that the document is easy to understand and that no crucial details are overlooked.

- Start with your company and client information at the top.

- Provide a unique reference number and issue date for easy tracking.

- List the details of the transaction clearly, breaking down costs where needed.

- Highlight the total amount due and payment instructions for clarity.

- Finish with any additional terms or notes that could impact the transaction.

By including these key elements, you ensure that your billing document is both thorough and easy for clients to navigate, helping to maintain professionalism and trust.

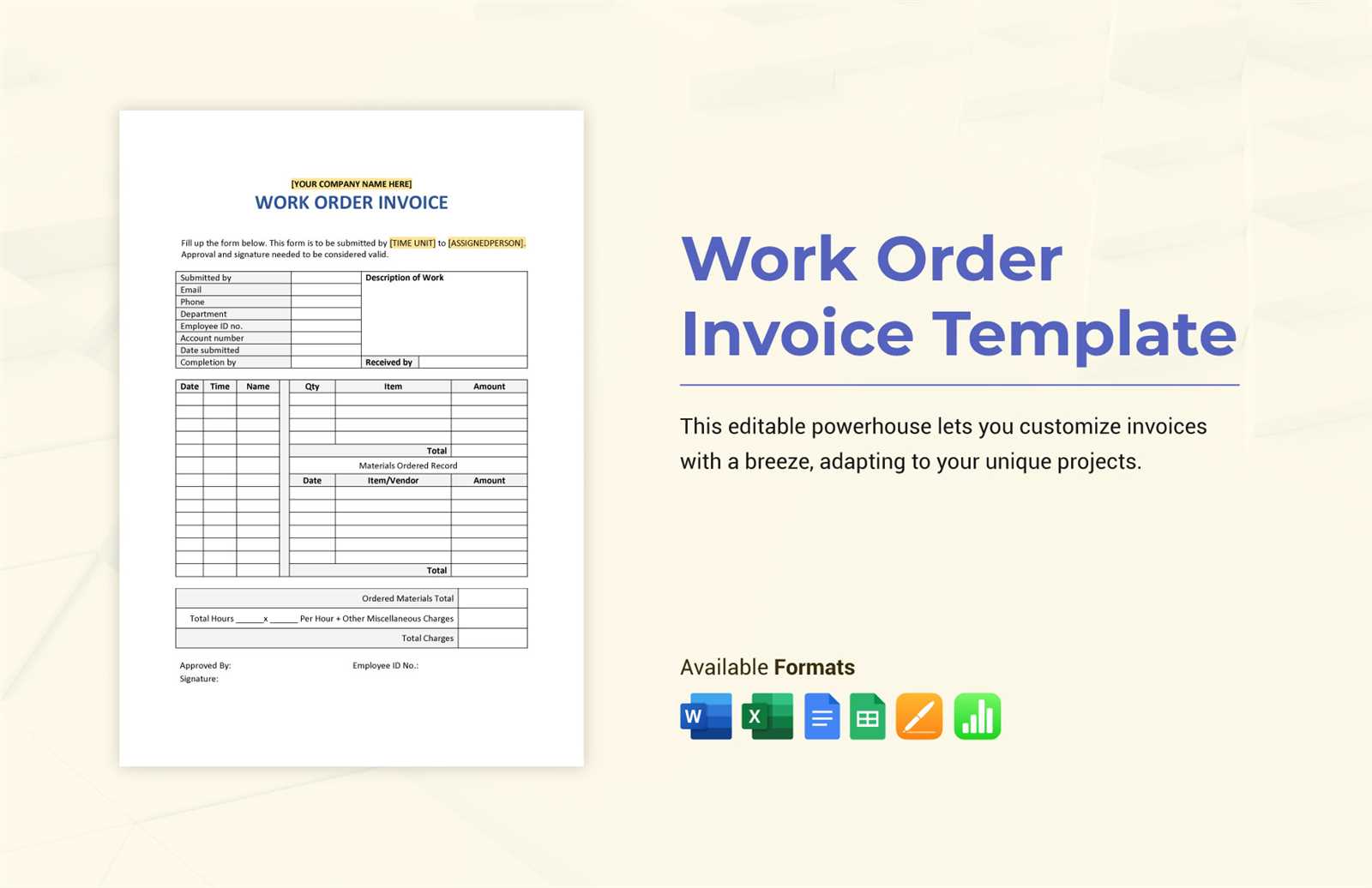

Using Billing Documents for Different Industries

Across various sectors, businesses rely on structured records to manage financial transactions. These documents are essential tools that help maintain clarity and accuracy in dealings with clients. Depending on the industry, the format and content of these records can vary, but the core purpose remains the same: to ensure that the transaction details are clearly communicated and that the payment process is smooth.

Tailoring Records for Service-Based Industries

For service-based industries, such as consulting or repair services, the primary focus is often on detailing the work provided. In these cases, it’s important to break down the specific services rendered, the hourly rates, and any additional charges. This transparency helps clients understand what they are paying for and fosters trust between the service provider and the client.

- Hourly Rates: Clearly specify the hourly charge for services rendered.

- Service Descriptions: Provide a detailed description of each task or service performed.

- Time Frames: Include the time period during which the services were completed.

Adapting for Product-Based Industries

For industries focused on physical goods, such as retail or manufacturing, the document format should emphasize product details, including quantities, unit prices, and product descriptions. Accurate tracking of inventory and product-related charges ensures that both buyer and seller are aligned on the order specifics.

- Product Details: List each product with clear descriptions and unit prices.

- Quantity: Specify the number of units for each item purchased.

- Shipping Costs: Include any applicable shipping fees or delivery charges.

By customizing the format to suit the unique needs of each industry, businesses can create documents that are not only practical but also professional and tailored to their customers’ expectations.

How to Automate Your Billing Process

Streamlining the process of creating and managing financial documents can significantly improve efficiency and reduce human error. Automation helps businesses save time, ensure consistency, and enhance accuracy by minimizing manual input. By integrating automated systems into your workflow, you can generate, send, and track transactions effortlessly, allowing you to focus on other critical areas of your business.

One of the simplest ways to automate is by using software that can generate financial documents based on pre-set parameters, such as client information and service details. These systems allow you to set up recurring transactions, track payment history, and send reminders to clients automatically. By doing so, you can eliminate the repetitive task of manually creating each record and ensure that all details are accurate and up-to-date.

Additionally, integrating your billing system with accounting or CRM platforms can provide a seamless process from sales to payment. This integration ensures that all data flows smoothly between systems, further reducing the need for manual intervention and improving the accuracy of your financial records.

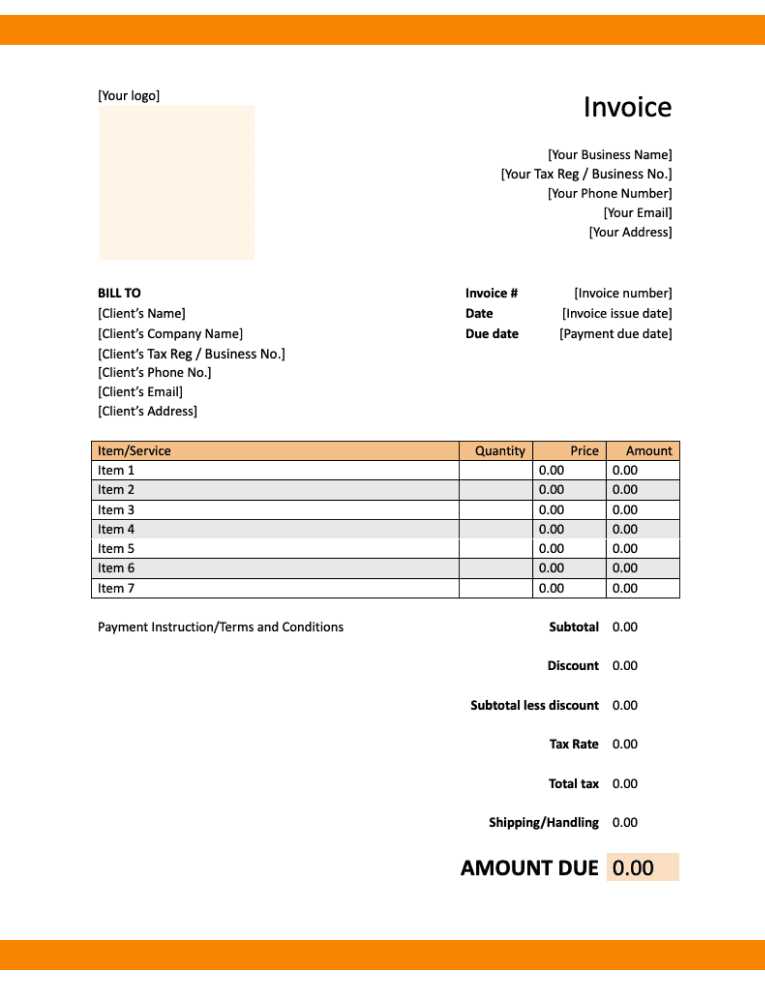

Customizing Fonts and Colors in Documents

Personalizing the appearance of your business records is essential for creating a professional and cohesive look. Customizing fonts and colors can help emphasize key information, maintain brand consistency, and improve readability. These visual elements not only make the document more appealing but also provide a clear structure, making it easier for clients to read and understand.

Choosing the Right Fonts

When selecting fonts for your business documents, it’s important to choose those that are easy to read and align with your brand image. Generally, sans-serif fonts like Arial or Helvetica work well for clean, modern looks, while serif fonts such as Times New Roman can convey a more traditional feel. It’s best to avoid overly decorative fonts that can make the document look unprofessional.

| Font Style | Best Use |

|---|---|

| Arial | Professional, modern, and easy to read. |

| Times New Roman | Traditional, formal tone. |

| Georgia | Elegant, easy-to-read serif option. |

| Helvetica | Clean and contemporary, often used in corporate documents. |

Choosing the Right Colors

Colors play an important role in setting the tone and reinforcing your brand identity. It’s recommended to use a limited color palette to maintain professionalism. Stick to neutral tones for the background, like whites or light grays, and use your brand’s primary color for headings or highlights. Avoid bright or excessive colors that can be distracting.

| Color | Best Use |

|---|---|

| Dark Blue | Professional and trustworthy, ideal for headings and borders. |

| Gray | Neutral, often used for text or background elements. |

| Red | Used sparingly to highlight important information or deadlines. |

| Black | Classic and bold, perfect for main text and formal documents. |

By carefully selecting the fonts and colors, you can create a visually attractive and functional business record that not only reflects your brand but also enhances the clarity of the information presented.

Billing Document for Small Business Owners

For small business owners, managing financial transactions efficiently is crucial for maintaining a smooth workflow. Having a well-structured billing document ensures that clients receive clear details about the products or services rendered, which helps in receiving timely payments. A customized record can also reflect your brand’s professionalism, making it easier to track income and manage accounting tasks.

Using a consistent format that includes essential details such as payment terms, itemized charges, and contact information allows small business owners to stay organized and keep a professional image. Customizing this document according to the business’s specific needs will streamline operations and reduce the chances of errors or misunderstandings with clients.

Key elements to include:

- Client Information: Name, address, and contact details.

- Product or Service Descriptions: A breakdown of what was provided, including quantities and pricing.

- Payment Terms: The due date, any late fees, and preferred payment methods.

- Unique Identifier: An invoice number for tracking purposes.

By creating a professional and accurate billing document, small business owners can ensure that their financial transactions are well-organized and that clients understand the specifics of the charges. This not only helps in maintaining good client relationships but also in simplifying the process of bookkeeping and financial planning.

How to Add Payment Terms to Your Billing Document

Clearly outlining payment terms is essential for setting expectations with your clients and ensuring timely compensation for services or products provided. Including payment terms in your financial record not only helps to avoid confusion but also establishes a professional approach to managing transactions. This section explains how to effectively incorporate payment conditions into your billing statements.

To add payment terms, you should specify the agreed-upon conditions for payment, such as due dates, accepted payment methods, and any penalties for late payments. By detailing these terms, you clarify the expectations and prevent delays or misunderstandings. Here are some key elements to include:

- Due Date: Clearly state when the payment is due, whether it’s immediate, within 30 days, or a specific date.

- Late Fees: Mention any additional charges for overdue payments to encourage timely settlement.

- Accepted Payment Methods: List the methods you accept, such as bank transfer, credit card, or checks.

- Discounts for Early Payment: If applicable, offer a discount to clients who pay before the due date.

By specifying these terms, both you and your clients will have a clear understanding of when and how the payments should be made. This transparency not only promotes a smooth financial process but also fosters trust and professionalism in your business relationships.

Saving and Sharing Billing Documents

Once your business record is created, it’s important to save it properly and share it with clients efficiently. Properly saving your files ensures you can easily access them for future reference, while effective sharing helps in timely communication and payment processing. By understanding how to store and distribute these documents, you can maintain a well-organized financial system.

There are several ways to save and share your business documents, depending on your preferred method of communication and file storage. Below are some popular options for saving and distributing these records:

| Method | Pros | Cons |

|---|---|---|

| Cloud Storage | Easy access from anywhere, secure backup, and sharing links with clients. | Requires internet access, potential security concerns if not managed properly. |

| Fast and direct method for sharing with clients, easy to track. | Risk of documents being lost in spam or overlooked. | |

| Physical Copies | Ideal for clients who prefer paper records. | Can be time-consuming and impractical for international clients. |

Once you choose the appropriate method for saving and sharing your documents, make sure to organize your files systematically, using clear naming conventions for easy identification. Whether you prefer digital or physical methods, ensuring the process is seamless and efficient will help foster stronger relationships with clients and keep your financial processes organized.

Security Tips for Protecting Your Billing Files

Protecting your financial documents is crucial to avoid unauthorized access and potential fraud. As these records contain sensitive client and transaction information, securing them ensures both business integrity and client trust. Implementing robust security measures to safeguard your files will help you maintain confidentiality and prevent data breaches.

Here are some key security tips to protect your financial records:

- Use Strong Passwords: Ensure that files are protected with complex passwords, and change them regularly to enhance security.

- Enable Encryption: Encrypt your files before storing or sending them, ensuring that even if they are intercepted, the data remains unreadable.

- Back Up Files Regularly: Store copies of your records in multiple secure locations to protect against data loss due to hardware failure or cyberattacks.

- Use Secure File Sharing Services: When sharing financial documents, use trusted services that provide encryption and security features, like password protection and access controls.

- Limit Access: Only grant file access to trusted personnel and clients, using role-based access control when possible to minimize exposure.

By implementing these security measures, you can significantly reduce the risk of unauthorized access and ensure the safety of your financial records. Taking proactive steps to secure your documents not only protects sensitive data but also strengthens your business’s reputation for professionalism and trustworthiness.

Using Templates for Recurring Billing Statements

For businesses that provide ongoing services or products on a regular basis, managing payments can become time-consuming. Automating the creation of billing records for recurring charges ensures efficiency, saves time, and reduces the risk of errors. Utilizing pre-designed structures can streamline this process, making it easier to send accurate and timely records to clients.

With the right approach, you can set up recurring payment statements quickly and avoid the hassle of starting from scratch each time. Below are some benefits of using a pre-made structure for this purpose:

| Benefit | Description |

|---|---|

| Time Efficiency | Pre-configured layouts allow for quick adjustments, reducing the time spent on manual creation of each record. |

| Consistency | Using a consistent format ensures that all statements look professional and contain the necessary information every time. |

| Reduced Errors | By reusing the same structure, you minimize the risk of missing key details or making formatting mistakes. |

| Easy Customization | Templates can be easily adjusted for each new cycle, whether it’s updating dates, amounts, or additional services. |

By leveraging these structures, you not only improve efficiency but also enhance client experience by providing clear, accurate, and timely billing statements. This approach ensures you can focus more on delivering services while maintaining a smooth and professional financial operation.

Design Tips for Eye-Catching Billing Statements

A well-designed billing document not only conveys important financial information but also creates a positive impression on your clients. A visually appealing layout can help reinforce your brand identity and make the payment process more efficient by ensuring all necessary details are easily accessible. Thoughtful design elements can transform a simple bill into a professional and polished representation of your business.

Use Clean and Clear Layouts

One of the most important design principles is clarity. Ensure that the layout is simple and easy to read, with clear headings and ample white space. This allows your clients to quickly understand the amounts, services provided, and deadlines without unnecessary distractions. Avoid overcrowding the document with excessive text or images.

Incorporate Your Branding

Your branding should be present in the design to help reinforce your business identity. Include your logo, use brand colors, and choose fonts that reflect your business’s style. Consistent branding creates a sense of professionalism and familiarity, which can build trust and recognition with your clients.

Key Design Elements to Focus On:

- Typography: Use easy-to-read fonts for both headings and body text. Keep font sizes consistent and clear.

- Color Scheme: Limit your color palette to a few complementary colors to create a cohesive look.

- Branding: Incorporate your logo and business colors to make the document instantly recognizable.

- Minimalism: Keep the design clean, with well-organized sections and clear labels to guide the reader’s eye.

- Visual Hierarchy: Highlight important information like total amount due and payment due date by making it bold or using larger font sizes.

By applying these design principles, you can create billing documents that are not only functional but also memorable, helping to establish a professional relationship with your clients and ensuring that all necessary information is clearly communicated.

How to Track Payments with Billing Documents

Tracking payments effectively is crucial for maintaining accurate financial records and ensuring timely payments from clients. Using organized billing documents not only helps in the creation of clear statements but also assists in monitoring the status of each transaction. With the right structure, you can easily keep track of paid and outstanding amounts, which aids in managing cash flow and ensuring that no payments are overlooked.

Organizing Payment Information

When creating a billing document, it is essential to include fields for payment tracking. These fields should clearly differentiate between the amount due, the amount paid, and any remaining balance. Including a section where you can mark the payment status (e.g., “Paid,” “Pending,” or “Overdue”) will help you monitor transactions with ease.

Using a Payment History Table

For recurring payments or long-term projects, it is useful to include a payment history table in your documents. This table can summarize all payments made, their dates, and outstanding balances, giving both you and your clients a clear overview of the financial status. A simple table can ensure that all the necessary information is in one place and easy to reference.

| Payment Date | Amount Due | Amount Paid | Balance | Status |

|---|---|---|---|---|

| 01/05/2024 | $500 | $500 | $0 | Paid |

| 01/06/2024 | $300 | $0 | $300 | Pending |

By utilizing these simple techniques, you can create a streamlined process for monitoring payments, ensuring that you always have a clear picture of your business’s financial situation. Having a dedicated section for payment tracking not only boosts professionalism but also minimizes the risk of overlooking transactions.

Common Mistakes to Avoid in Billing Documents

Creating clear and professional billing documents is essential for smooth business operations. However, many people make mistakes when designing or filling out these documents, which can lead to confusion or even payment delays. Avoiding common errors ensures that your clients understand the charges, payment terms, and other details, helping maintain a positive business relationship.

Incorrect or Missing Client Information

One of the most frequent mistakes in billing documents is neglecting to include the correct client information or failing to update outdated details. Always ensure that your client’s name, address, and contact details are accurate. Additionally, verify that you have the correct billing address if it differs from the shipping address. Missing or incorrect client information can cause delays or payment issues.

Unclear Payment Terms

Another common error is failing to clearly specify payment terms. Whether it’s the due date, accepted payment methods, or late fees, these details must be easy to read and understand. Without clear instructions, clients may get confused about when and how to pay, leading to unnecessary delays.

| Issue | Impact | Solution |

|---|---|---|

| Missing Client Details | Payment delays, confusion | Verify client information before issuing |

| Unclear Payment Terms | Late payments, disputes | Clearly state due dates and payment methods |

Additionally, incorrect calculations or failing to include all applicable charges can lead to disputes or financial discrepancies. Always double-check the math and ensure that any taxes or additional fees are clearly stated. By avoiding these common mistakes, you can ensure smoother transactions and a more professional image for your business.

Why Word is Ideal for Invoice Creation

When it comes to preparing professional billing documents, the right software can make all the difference. A widely used tool offers flexibility, ease of use, and customization options that cater to both small businesses and large organizations. Whether you’re creating a one-time request for payment or setting up a recurring document, using a reliable text editor provides numerous advantages that streamline the entire process.

Ease of Use

One of the main reasons why this program is ideal for creating payment requests is its simplicity. Most users are already familiar with its interface, making it easy to create a professional document without a steep learning curve. The user-friendly layout allows for quick adjustments, ensuring that even those with minimal technical skills can generate effective documents with ease.

Customizability and Formatting Options

Another key advantage is the ability to personalize your document. This software provides a wide range of formatting tools that enable you to design documents to reflect your brand, using customized fonts, logos, and colors. Whether you need to highlight payment deadlines, itemize services, or include payment terms, these features allow for precise adjustments to suit your needs.

| Feature | Benefit | Why It Matters |

|---|---|---|

| Ease of Use | Simplifies document creation | Reduces time spent on creating documents |

| Customizability | Personalizes document design | Enhances professional presentation |

Moreover, this program offers compatibility with a variety of other file formats, making sharing and saving documents easier. You can convert your work into PDFs or other commonly used formats, ensuring that your documents are accessible across different devices and platforms. This versatility further cements it as an excellent tool for generating professional payment requests.