Word Contractor Invoice Template for Quick and Easy Billing

For independent workers and service providers, managing payments efficiently is crucial to maintaining a steady income flow. A well-structured billing document not only ensures prompt payment but also enhances your professionalism. Customizable formats allow you to quickly create professional-looking statements, tailored to your specific needs.

Streamlining the billing process can save time and reduce errors, ensuring that you never miss an important detail. A properly designed document can help you track services provided, amounts owed, and payment terms clearly, giving both you and your clients peace of mind.

By using editable formats, professionals can easily modify and update their billing documents for each project or job, keeping everything organized and accurate. Whether you’re a freelancer, consultant, or small business owner, the right invoicing tool can significantly simplify financial management.

Why Use a Professional Billing Format

When it comes to requesting payment for services rendered, having a structured document can make a significant difference. Using a customizable format ensures that you present a clear and professional image, while also providing all the necessary details for prompt payment. A well-organized document can streamline the process, minimizing confusion and enhancing communication with your clients.

Flexibility is a key advantage of using a digital format. With editable fields, you can quickly update and adapt the document for each new job, making it easier to manage your finances on the go. This level of customization is essential for professionals who work on multiple projects or have varying payment terms.

Another reason to choose a digital format is consistency. By using the same layout for every billing statement, you ensure that your clients receive a uniform experience, which reinforces your credibility. A clear, standardized document helps clients understand your terms and reduces the likelihood of misunderstandings.

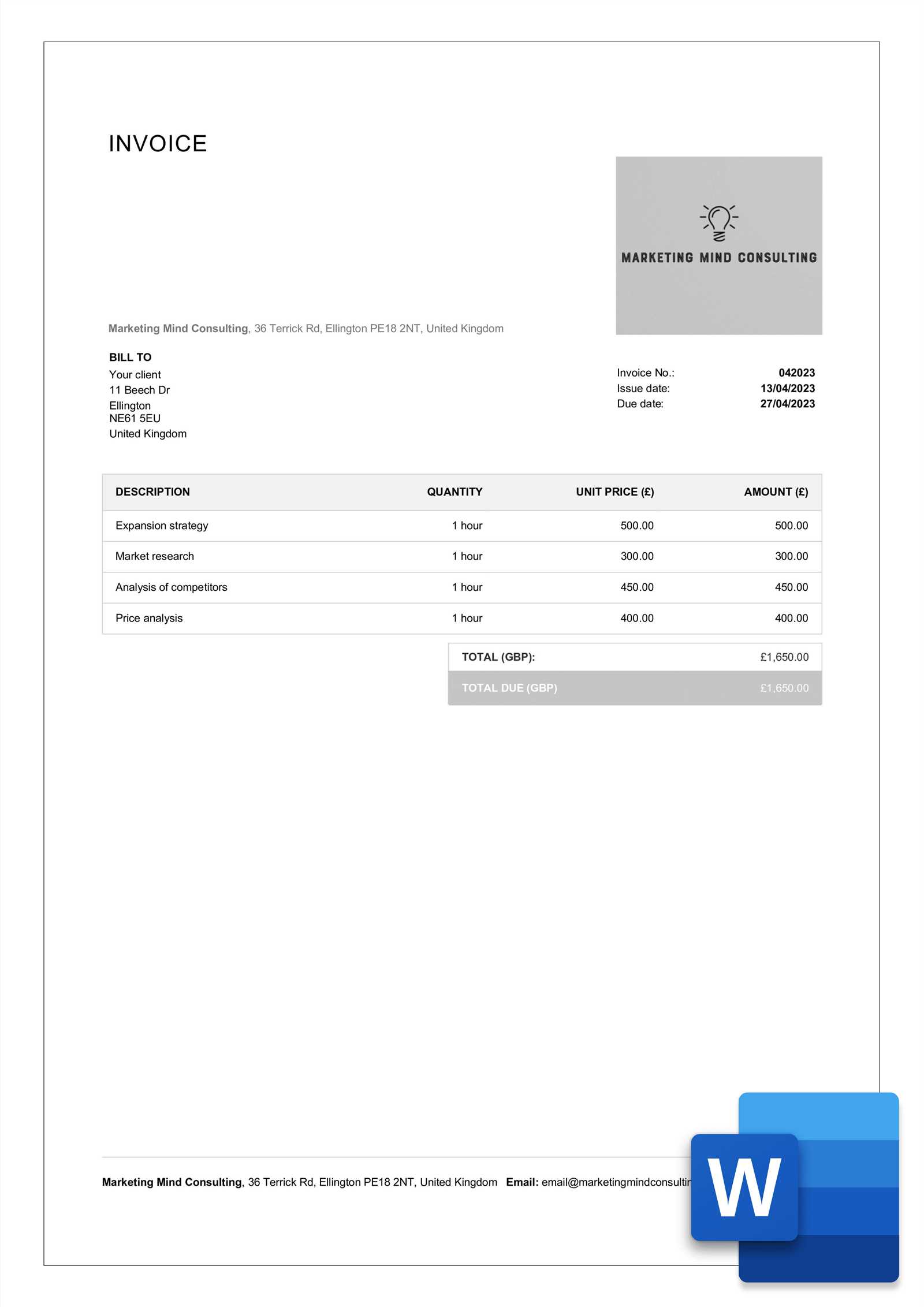

Customizing Your Billing Statement for Clients

Tailoring your billing document to meet the specific needs of each client can enhance your professional image and improve payment clarity. By including relevant details and adjusting the layout to fit the context of the service provided, you can create a document that is not only functional but also easy for your clients to understand and process.

Key areas of customization include adding personal details, adjusting the format for different types of work, and specifying unique payment terms. This level of attention ensures that the client receives a statement that matches their expectations and reflects the nature of your business relationship.

| Client Name | Service Description | Amount | Due Date |

|---|---|---|---|

| John Doe | Website Development | $1200 | 15th November 2024 |

| Jane Smith | Consulting | $850 | 20th November 2024 |

Including a clear breakdown of services, specific deadlines, and payment options can help avoid confusion and make the transaction smoother for both you and your client. Customization is a simple way to ensure that the document reflects the value you provide while maintaining consistency in your financial communications.

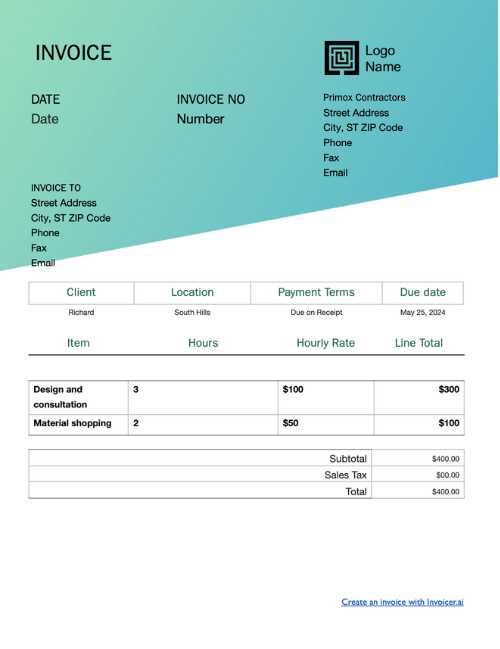

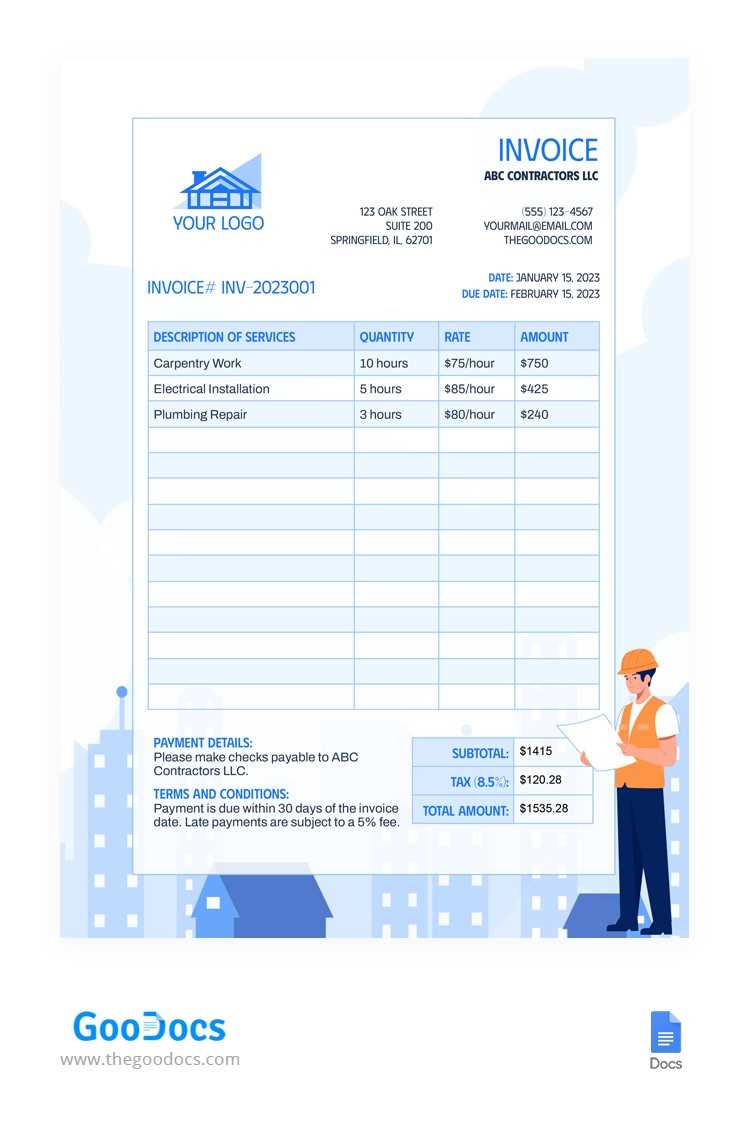

How to Create a Simple Billing Statement

Creating a straightforward and effective billing document is easier than you might think. A clear and concise statement not only helps ensure timely payments but also presents a professional image to your clients. The key is to include all essential details without overwhelming the recipient with unnecessary information.

Essential Components of a Billing Document

- Business and Client Information: Include your name, business name, and contact details, as well as the client’s information.

- Service Description: List the services rendered, including specific details such as time spent or materials used.

- Total Amount: Clearly show the amount owed, with or without tax, depending on your agreement.

- Due Date: Specify when the payment is expected to be made.

- Payment Instructions: Provide details on how to pay, such as bank transfer or online payment methods.

Step-by-Step Guide

- Start with a header that includes your contact information and the client’s details.

- List the services you provided with dates and descriptions.

- Calculate the total cost and include any applicable taxes or discounts.

- Set the payment due date and add clear instructions on how the client can pay.

- Review the document for accuracy and send it to the client.

By following these simple steps, you can create a professional document that is clear, concise, and easy to process, helping you get paid faster.

Essential Elements of a Professional Billing Document

For any service provider, creating a billing document that is both clear and comprehensive is essential to ensure timely payment. A well-constructed statement should include key details that leave no room for confusion. By organizing this information in a logical and consistent manner, you present a professional image while protecting yourself financially.

Key Information to Include

- Your Business Details: Include your full name or company name, address, contact number, and email address. This makes it easy for clients to reach you with any questions.

- Client Information: Clearly state the client’s name, address, and contact details to ensure the document is personalized and easy to reference.

- Work Description: Provide a clear breakdown of the services rendered, with dates and any specific details to avoid misunderstandings. This can include hours worked, tasks completed, or materials used.

- Total Amount Due: List the total cost, including any taxes or discounts. Be transparent about any additional charges to avoid confusion.

- Payment Terms: Include the payment deadline and preferred payment methods (e.g., bank transfer, check, or online payment). This makes it clear how and when you expect to be paid.

Why These Details Matter

Including these essential components not only ensures that your client has all the necessary information but also protects you by setting clear expectations. Clear work descriptions prevent disputes, while payment terms ensure that both parties are aligned on deadlines and methods.

With all key information outlined, your statement serves as a professional, legally sound document that can help speed up the payment process and maintain a positive client relationship.

Benefits of Word Over Other Formats

Choosing the right format for your billing documents can make a significant difference in terms of usability, flexibility, and professionalism. While there are many options available, one format stands out for its ease of use and wide compatibility. This particular format offers several advantages over others, making it the preferred choice for many professionals.

Key Advantages

- Ease of Use: This format is user-friendly and widely recognized. Even those with minimal technical expertise can quickly create, edit, and update their billing documents.

- Customization: You can easily adjust the layout and design to suit the specific needs of each client or project. Adding logos, headers, or custom sections is straightforward and efficient.

- Compatibility: Files created in this format can be opened and edited on almost any device, ensuring that clients and colleagues can easily view or modify the document without issues.

- Professional Appearance: The format supports a clean, organized structure that enhances the visual appeal of your billing statements, making them look polished and professional.

- File Size: This format typically results in smaller file sizes compared to others, making it easier to share via email or store on cloud platforms.

Why Choose This Format

The combination of accessibility, customization options, and compatibility makes this format ideal for creating professional documents. It allows you to produce consistent, high-quality billing statements that maintain a professional image, while offering the flexibility to meet diverse client needs.

Free Resources for Professional Billing Documents

Creating a customized billing document doesn’t have to be expensive or time-consuming. There are a variety of free resources available online that can help you design a professional and effective statement without starting from scratch. These resources provide ready-made layouts that can be easily adapted to suit your needs.

Top Free Sources to Explore

- Online Document Libraries: Websites offering free downloadable files in various formats that can be quickly edited to match your specific business requirements.

- Spreadsheet Tools: Many spreadsheet applications provide customizable templates for billing, which allow for easy adjustments to suit different services and payment structures.

- Business Websites and Blogs: Numerous business-focused sites share free billing layouts that you can download and use without charge.

- Open-Source Platforms: Communities and open-source platforms often offer free resources that are customizable and can be easily adapted to specific business needs.

How to Make the Most of These Resources

- Choose a resource that best fits the style and complexity of your business needs.

- Download and edit the document to reflect your branding, payment terms, and service details.

- Ensure that the document is clear, professional, and easy for clients to understand.

- Save the final version in a format that is compatible with your email or cloud storage system for easy access and sharing.

By taking advantage of these free resources, you can create high-quality, tailored billing statements that enhance your professional image and simplify the payment process.

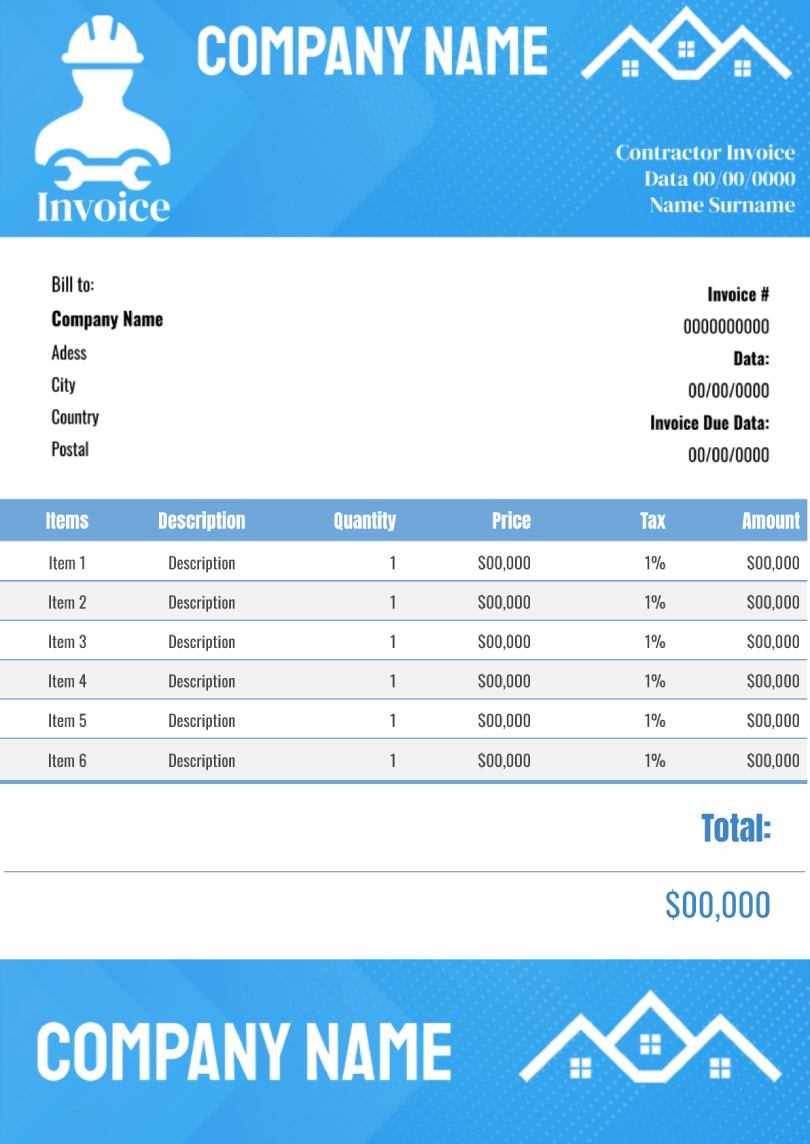

Step-by-Step Guide to Editing Templates

Editing a ready-made document to suit your specific needs is a straightforward process that allows you to save time and maintain a consistent professional image. By following a few simple steps, you can easily customize a layout to include all the necessary details, ensuring that your document is both functional and personalized.

Editing Process

- Open the Document: Start by opening the downloaded or pre-existing file in your preferred word processing application. Ensure that the file format is compatible with your software.

- Update Your Information: Replace the placeholder text with your business name, contact details, and client information. This ensures that the document is tailored to your specific project.

- Modify the Work Description: Adjust the service descriptions to reflect the work you have completed. Include relevant details such as hours worked, materials used, or project milestones.

- Adjust Payment Terms: Specify payment methods, deadlines, and any applicable taxes or discounts. Be clear about your expectations to avoid confusion.

- Save and Finalize: After making all necessary changes, review the document for accuracy. Once satisfied, save the final version and prepare it for distribution or printing.

Additional Customization Tips

- Design Adjustments: You can modify fonts, colors, and logos to align with your brand identity, giving the document a polished look.

- Check for Errors: Double-check all amounts, dates, and client details to ensure there are no mistakes that could delay the payment process.

- Consider Export Options: Depending on your needs, you may want to save the final document as a PDF for easy sharing and printing.

With these simple steps, you can quickly create a customized, professional document that reflects your services and helps streamline your payment process.

How to Add Payment Terms Easily

Clearly stating the terms of payment in your billing document is crucial for ensuring that both parties are aligned on expectations. Including these details helps avoid confusion and can speed up the payment process. Fortunately, adding payment terms to your document is simple and can be done in just a few steps.

To begin, it’s important to be clear and concise. Specify the payment deadline, acceptable methods, and any additional fees or discounts that may apply. This can include information like whether payments are due upon receipt, within 30 days, or after a specified period. You can also outline any late fees for overdue payments, or even offer a discount for early payment.

Here’s how to easily add payment terms:

- Include a Section for Payment Terms: Create a dedicated area on your document to outline the payment details, usually placed near the bottom or in a section marked clearly for terms and conditions.

- State the Payment Deadline: Mention the exact date or number of days after the service is completed when payment is due.

- List Accepted Payment Methods: Specify how the payment can be made (e.g., bank transfer, credit card, PayPal, check). This removes ambiguity for the client.

- Include Late Fees: If applicable, indicate any penalties or interest charges for late payments, including the percentage rate or flat fee.

- Offer Discounts for Early Payment: If you wish, you can offer a discount for payments made before the due date, such as a 5% reduction for early settlement.

By adding these terms clearly and directly, you help manage expectations and streamline the process, leading to faster payments and fewer misunderstandings.

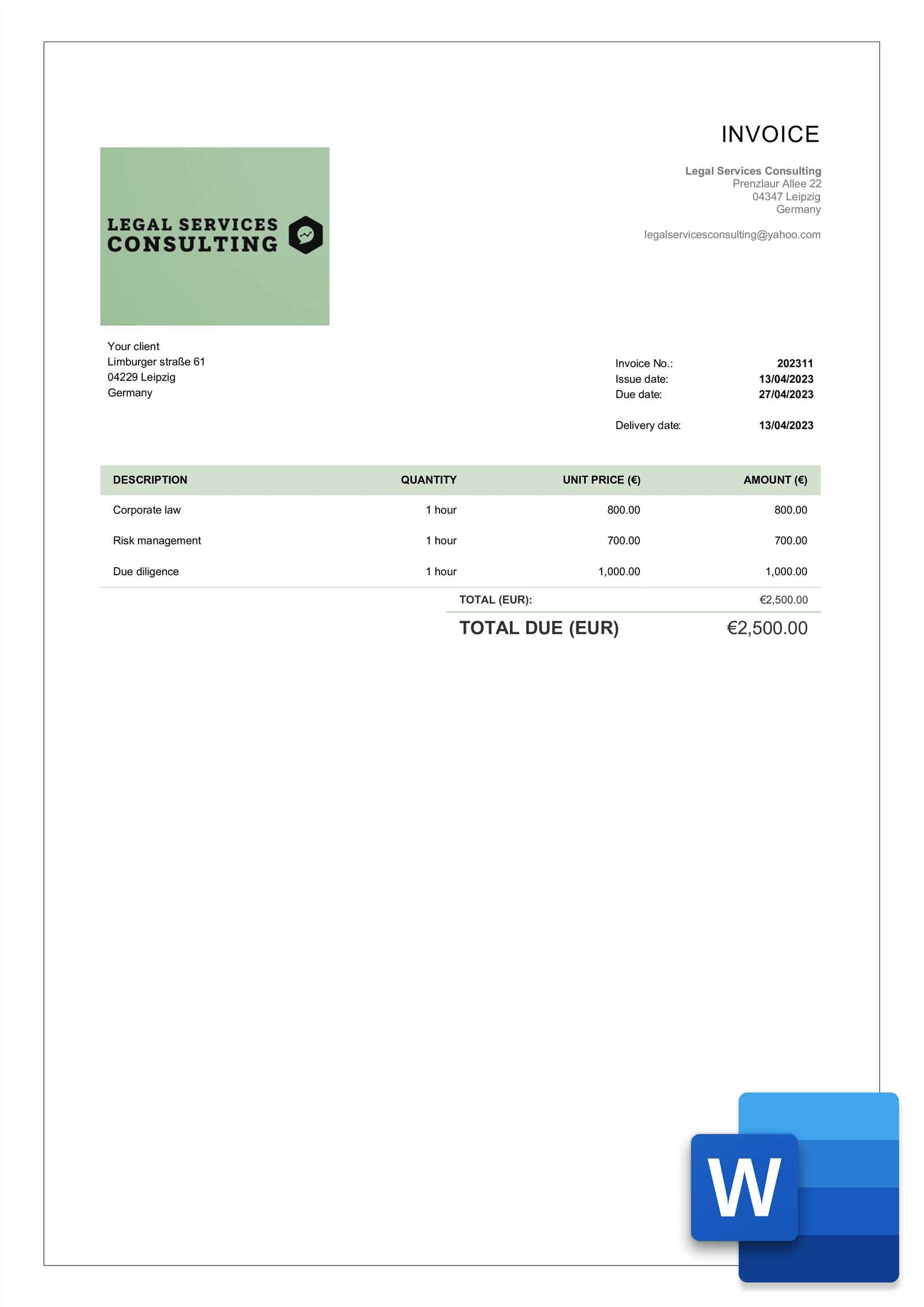

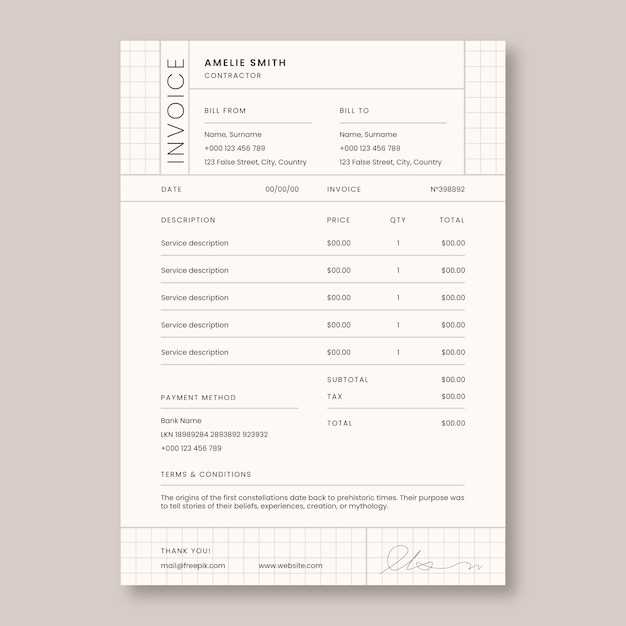

Design Tips for Professional Invoices

Creating a visually appealing and well-organized billing document is essential for making a strong impression on clients. A clean and professional layout not only enhances readability but also boosts your credibility. By following a few design principles, you can ensure that your documents are both functional and attractive.

Key Design Elements

- Consistent Branding: Use your company’s logo, color scheme, and fonts to maintain a cohesive brand image across all your documents.

- Clear Hierarchy: Ensure that important information, such as client details, payment terms, and the total amount, stands out. Use larger or bold fonts for headings and key sections.

- Spacing and Alignment: Adequate white space and properly aligned text make your document easy to navigate and visually balanced.

- Legible Fonts: Use simple, easy-to-read fonts. Avoid overly decorative styles that can distract from the main content.

- Professional Layout: Organize sections logically. Include distinct areas for service descriptions, amounts, payment terms, and contact information.

Creating a Balanced Layout

| Section | Purpose |

|---|---|

| Header | Includes business name, logo, and contact information. Sets the tone for the document. |

| Service Breakdown | Details the work completed, including itemized descriptions and quantities. Ensures clarity. |

| Payment Information | Clearly states payment terms, methods, and any discounts or late fees. |

| Footer | Contains legal disclaimers, business details, or additional contact information. |

By focusing on these elements, you can create documents that not only look polished but also provide all the necessary information in a

Automating Invoices with Templates

Automating the creation of billing documents can save you significant time and effort. By using pre-built layouts, you can easily generate accurate and consistent statements for your clients without having to manually enter the same information every time. This process streamlines your workflow, reduces errors, and allows you to focus more on your core tasks.

How Automation Simplifies the Process

Automation helps reduce the repetitive nature of preparing documents. Once you have a standard format set up, it becomes easy to quickly input new client details, work descriptions, and payment terms. With just a few clicks, you can update the necessary fields and generate a ready-to-send document without starting from scratch each time.

- Predefined Fields: Templates with customizable fields allow you to enter client names, service descriptions, and pricing without worrying about layout adjustments.

- Consistency and Accuracy: By automating document generation, you ensure uniformity across all your statements, minimizing the risk of errors that can occur with manual data entry.

- Time Savings: Instead of creating each document from the beginning, automation speeds up the process, enabling faster billing and payment cycles.

Integrating Automation Tools

Many word processing applications offer built-in automation features, such as mail merge or form fields, that can help you streamline the document creation process. These tools allow you to link a database or spreadsheet with your document, automatically filling in specific details like client names, amounts, and dates. This integration further enhances efficiency and ensures that you don’t miss any critical information.

With the right approach, automating your document preparation can transform your workflow, providing a smooth and error-free experience for both you and your clients.

Tracking Payments and Due Dates

Effectively managing payment deadlines and monitoring outstanding balances is key to maintaining a healthy cash flow. By keeping track of when payments are due and confirming when they have been received, you ensure that your business operations run smoothly. This practice also helps you stay on top of overdue amounts and follow up promptly with clients when necessary.

Setting Up Payment Reminders

One of the most important steps in managing payments is setting up reminders for upcoming due dates. This can be done manually or by using automated tools that help you track when payments are expected. The earlier you prepare, the more likely you are to avoid late fees and interruptions in service.

- Use Calendar Alerts: Set up calendar reminders to alert you a few days before the payment due date. This gives you time to send reminders to clients or address any issues.

- Automate Notifications: Use tools that send automatic payment reminders to clients, reducing the need for you to manually follow up.

- Establish Clear Payment Terms: Clearly state your payment deadlines on your documents to prevent misunderstandings and provide a reference point for clients.

Tracking Outstanding Payments

To stay organized, it’s important to keep track of which clients have paid and which balances are still due. This can be done with simple spreadsheets or more advanced accounting software. By monitoring payments, you can avoid the risk of overlooking overdue amounts.

- Create a Payment Log: Maintain a log that tracks payment dates and amounts, and update it regularly to ensure accuracy.

- Follow Up on Overdue Payments: When a payment becomes overdue, take the necessary steps to remind the client and discuss any issues preventing payment.

- Offer Multiple Payment Methods: Providing various payment options can increase the likelihood of receiving payments on time, as clients can choose the method most convenient for them.

By actively monitoring due dates and payment statuses, you’ll maintain a better overview of your financials and ensure timely payments, leading to smoother business operations and stronger client relationships.

How to Organize Your Invoice Files

Keeping your billing documents organized is essential for maintaining efficiency and ensuring that important information is easily accessible when needed. Whether you are managing a few files or a large volume, having a structured system in place helps you quickly locate past records, stay on top of payments, and maintain a clean record for accounting purposes.

Creating a Consistent Filing System

A well-organized filing system is the foundation of managing your business records. Organizing your files by date, client, or project can simplify the process of locating specific documents. Choose a method that suits your workflow and stick with it to avoid confusion.

- By Client Name: Store documents in folders named after clients for easy retrieval of records associated with each one.

- By Date: Use a date-based folder system where files are organized monthly or quarterly, making it easy to track recent documents.

- By Project: If you work on multiple projects for the same client, organizing files by project name or number ensures each job has its own set of records.

Utilizing Digital Tools for Easy Access

In today’s digital age, software tools can help you keep your documents organized and easily accessible. Cloud storage platforms, file management apps, and accounting software offer a variety of solutions for keeping track of your documents. Using these tools allows you to store and search your files quickly, while also ensuring they are safe and backed up.

- Cloud Storage: Platforms like Google Drive or Dropbox allow you to store files securely and access them from any device.

- File Management Apps: Tools such as Evernote or Notion can help you organize documents with tags, labels, and custom categories.

- Accounting Software: Many accounting tools automatically categorize and store your financial records, streamlining your workflow.

Backing Up Your Records

Backing up your files is crucial to prevent data loss. Make sure to regularly back up your organized documents to a secondary storage system. This could be an external hard drive or an additional cloud service. Having a backup plan in place ensures your records are safe in case of hardware failure or other unexpected issues.

- Automated Backups: Set up automated backups to ensure that new doc

Ensuring Legal Compliance in Invoices

When managing billing documents, it is crucial to adhere to legal requirements to protect both your business and your clients. Complying with local, state, and international laws ensures that your financial documents are valid, minimizing the risk of disputes, audits, or legal issues. By following key guidelines, you can ensure that your records are not only professional but also legally sound.

Essential Legal Information to Include

To make sure your billing records meet legal standards, include the necessary information that confirms the legitimacy of the transaction. This typically includes identifying details, payment terms, and tax-related information. Below are some essential elements that should be included:

- Business Information: Include your business name, address, and registration number, along with any relevant tax IDs, to verify your identity and legal status.

- Client Details: Make sure to include the client’s name and contact information to ensure clarity in who is being billed.

- Tax Information: Depending on the region, you may need to list tax rates, the amount charged for tax, or a breakdown of tax categories like VAT.

- Payment Terms: Clearly state the terms of payment, including due dates, penalties for late payments, and accepted methods of payment.

Understanding Local Tax Requirements

Tax laws vary from region to region, and it’s essential to understand the specific regulations that apply to your business. Make sure to include accurate tax information according to your location or that of your client. Failing to do so could result in legal issues or fines.

- Sales Tax: Depending on the jurisdiction, you may be required to charge sales tax. Be sure to specify the tax rate and the total amount in your document.

- Tax Exemption: If applicable, include any exemptions or deductions for taxes, especially when dealing with non-profit organizations or government entities.

- International Transactions: For international clients, ensure you are following the proper tax guidelines for cross-border tran

Common Mistakes to Avoid in Invoices

When creating financial documents for your clients, it’s important to avoid common pitfalls that can cause confusion or delays in payment. Small mistakes can lead to misunderstandings, missed payments, or even legal issues. Understanding these common errors and how to correct them will help you maintain a professional image and ensure smoother transactions.

Incorrect or Missing Client Information

Accurate client information is crucial for proper record-keeping and payment processing. Missing or incorrect details can cause significant delays in payment and create confusion. Here are some common errors to avoid:

- Incorrect Contact Information: Double-check the client’s name, address, and other relevant contact details to ensure there are no typos or outdated information.

- Wrong Company or Client Name: Make sure to address the document to the correct legal entity or individual to avoid disputes.

- Missing Client Identification: Some clients may have specific reference numbers, purchase order codes, or account IDs that should be included for clarity.

Failure to Specify Payment Terms

Without clear payment instructions, you risk delayed or missed payments. It’s essential to outline the expectations in a detailed and understandable manner. Common mistakes include:

- Unclear Payment Deadlines: Always specify the due date clearly. Vague terms like “payment due soon” can lead to confusion and late payments.

- Lack of Late Payment Fees: If you plan to charge penalties for overdue payments, ensure this is mentioned in the document.

- Unspecified Payment Methods: State the acceptable payment methods upfront (e.g., bank transfer, credit card, online payments) to avoid confusion.

Missing or Incorrect Tax Information

For both legal compliance and transparency, it is vital to include the correct tax information. Common mistakes in this area include:

- Forgetting to Include Tax Rates: In some regions, tax rates must be included in the document. Always double-check if taxes are applicable and specify the rate and amount.

- Incorrect Tax Calc

When to Update Your Invoice Template

Keeping your financial documents up to date is essential for maintaining accurate records and ensuring smooth business operations. As your business evolves or as regulations change, there may be times when it’s necessary to modify the format, structure, or content of your documents. Regularly reviewing and updating your documents can help you stay organized and professional, avoiding costly mistakes or miscommunication.

Changes in Tax Rates or Regulations

One of the most common reasons to update your document is a change in tax laws or rates. Tax authorities may update the applicable rates, exemptions, or other legal requirements that you need to reflect on your financial records. To avoid discrepancies, make sure to:

- Verify tax rates: Check regularly for any changes in local, state, or federal tax rates.

- Update tax fields: Adjust the tax calculation section if the rates have shifted to ensure compliance.

Business Growth or Service Changes

As your business grows or diversifies, the way you bill clients may change. Whether you introduce new services, adjust pricing, or start offering discounts, it’s important to make sure that your financial documents reflect these updates. Consider:

- Adding new service categories: If you’re expanding your offerings, create sections for new services or products.

- Updating pricing structures: Reflect any adjustments in pricing, hourly rates, or flat fees in your document.

Rebranding or Updating Your Logo

If your business undergoes a rebrand or you refresh your logo, updating your documents to match the new branding is essential. This ensures your materials look cohesive and professional across all platforms. When updating for rebranding, make sure to:

- Incorporate new branding elements: Update your logo, color scheme, and font choices to align with the new look.

- Maintain brand consistency: Ensure that all your documents follow the same visual style for a unified brand image.

Incorporating Feedback from Clients

Sometimes, the need for updates arises from direct feedback from your clients. If they mention difficulties in understanding the document o