How to Use a Word Billing Invoice Template for Efficient Invoicing

Every business, whether a small startup or a large corporation, needs a reliable way to document its transactions. A well-structured document helps ensure that clients have a clear record of charges and services rendered, enhancing both professionalism and trust. Using customizable documents is a simple and effective way to improve efficiency while maintaining a polished look.

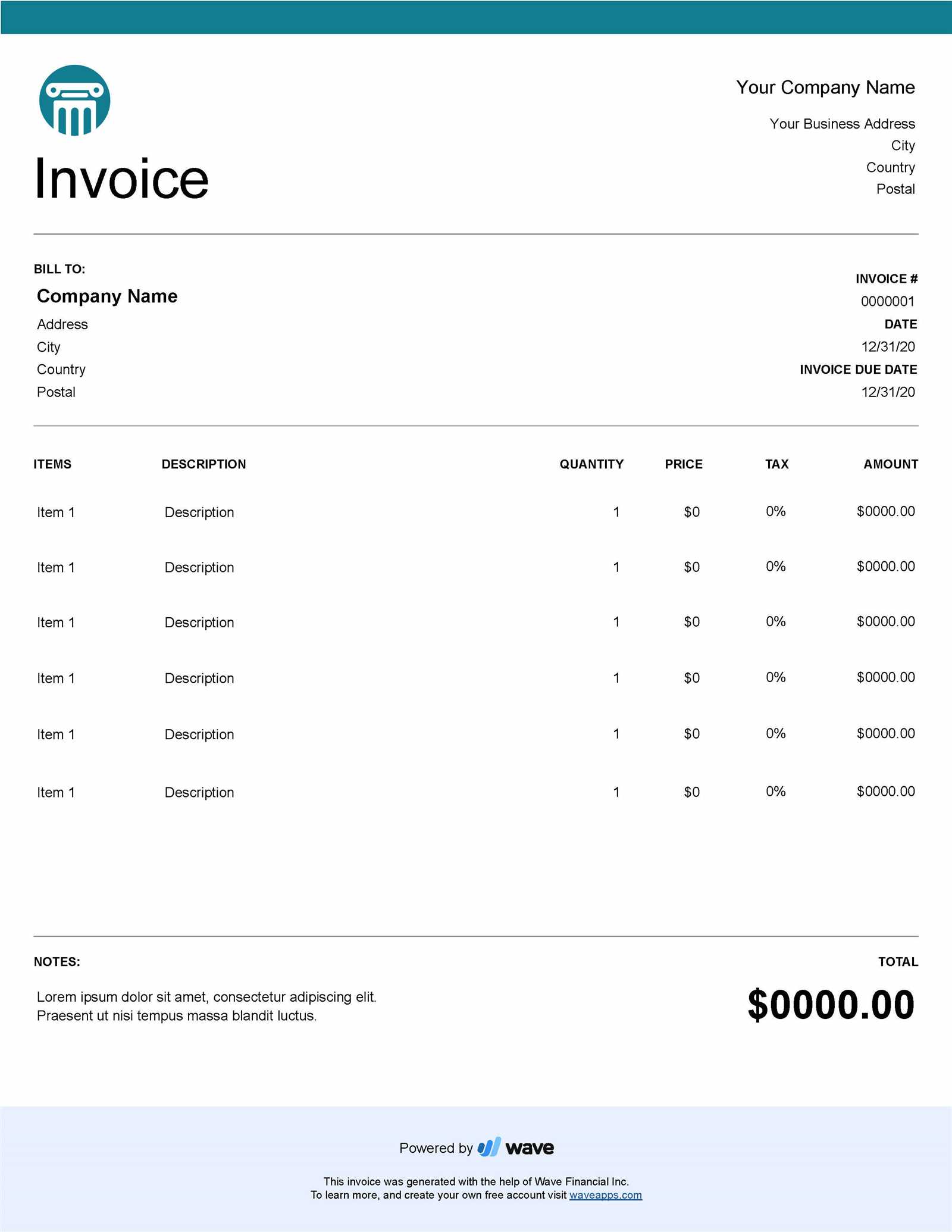

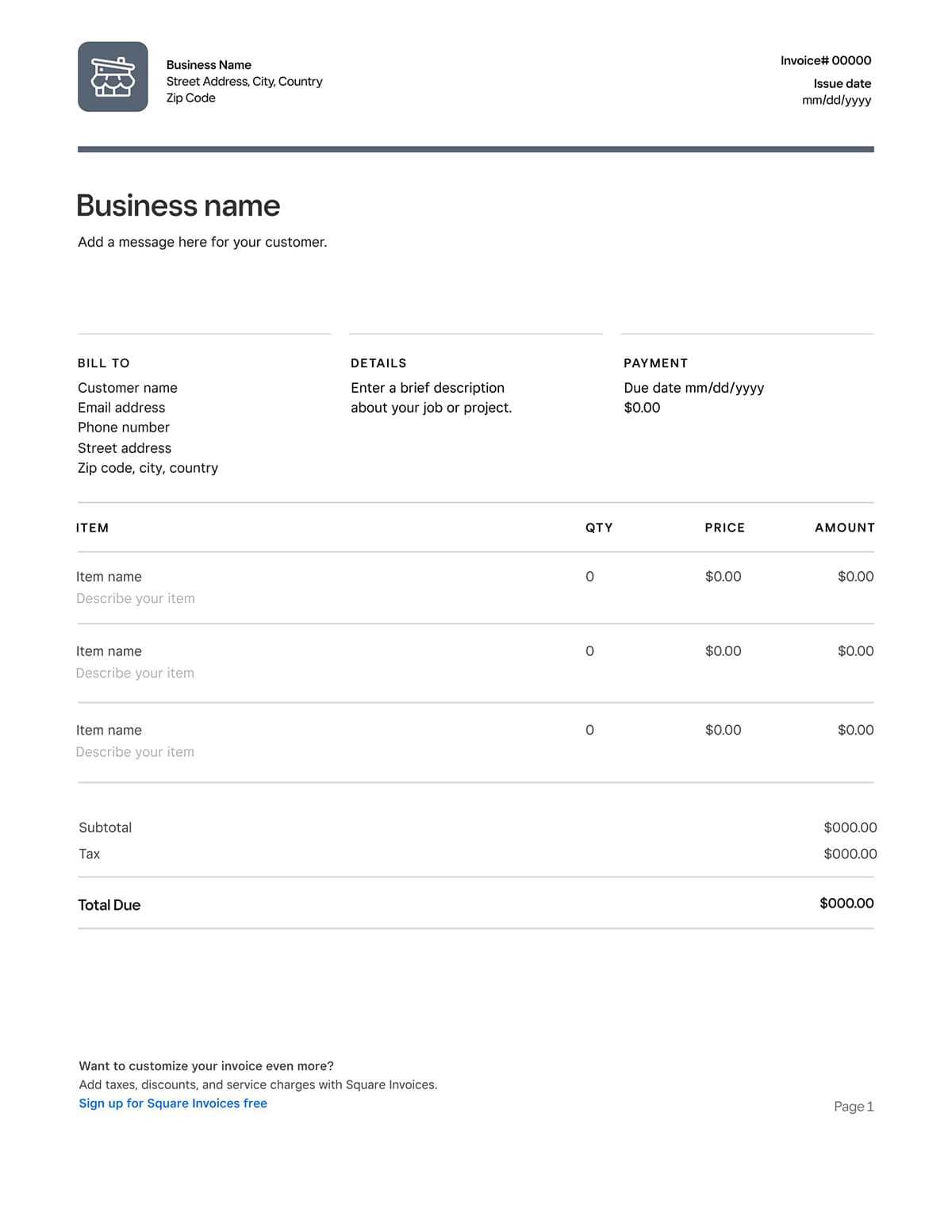

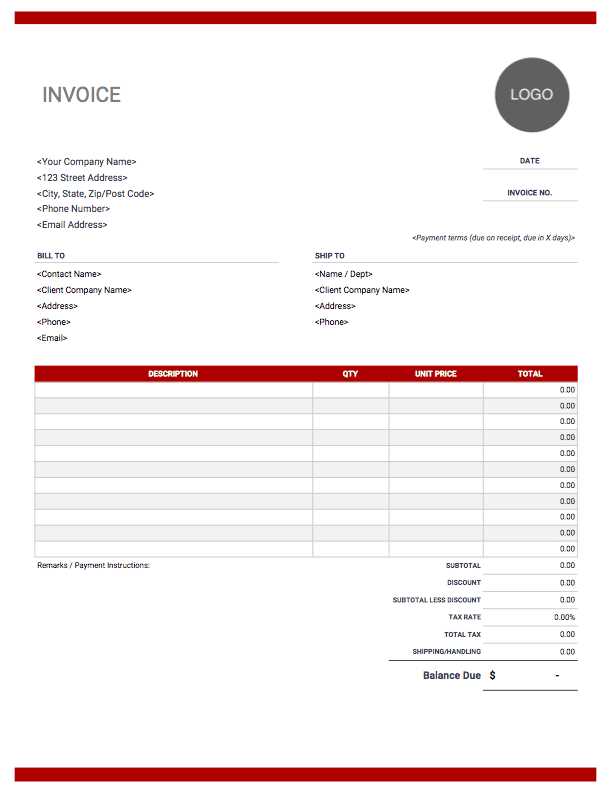

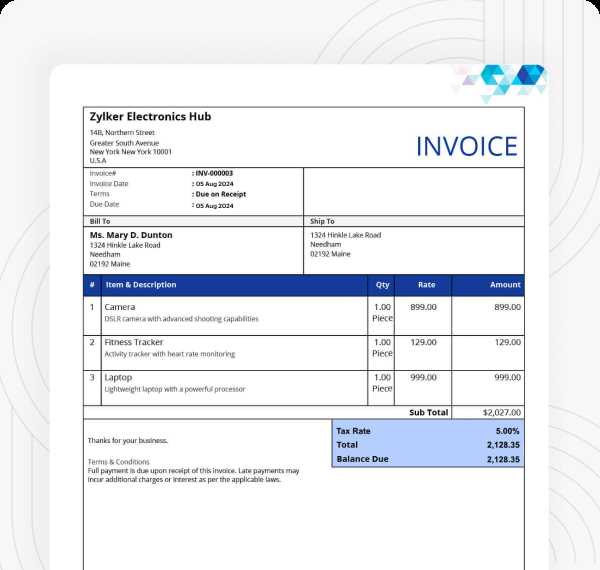

These ready-to-use documents allow you to record crucial details, from itemized services and costs to client information and payment deadlines. They are versatile, easy to personalize, and require no design skills. For businesses looking to simplify their workflow, these digital tools offer a practical solution that streamlines the transaction process.

Customized templates can include essential elements such as logos, colors, and contact details, reinforcing your brand identity with each document you send. With user-friendly features, they can be tailored to suit various industries, providing flexibility for freelancers, small businesses, and larger companies alike. These resources save time and ensure consistency, enabling you to maintain professional standards with minimal effort.

Complete Guide to Word Billing Templates

Creating structured documents for financial transactions is essential for any business. These files serve as a clear record, offering transparency to clients and providing an organized way to manage accounts. With user-friendly tools, businesses can streamline their workflow, making it easy to document and share details of each transaction efficiently.

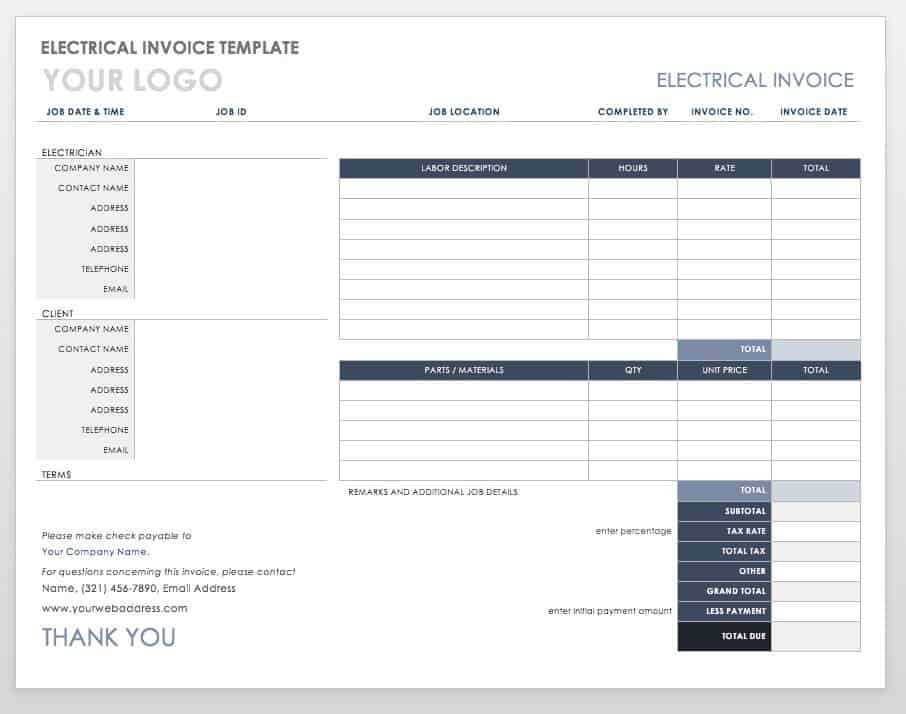

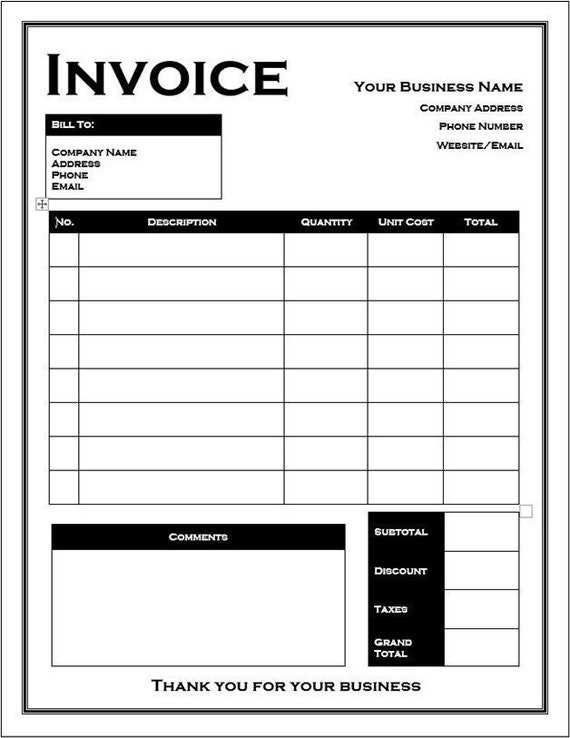

Key Elements to Include

To ensure clarity and professionalism, each document should include essential components. These details make it easy for both the business and the client to understand the breakdown of costs and services.

- Client and Business Information – Names, addresses, and contact details for easy identification and future reference.

- Detailed List of Services or Products – An itemized list that specifies each service or product provided, along with descriptions if needed.

- Total Amount and Currency – Display the total due, ensuring the currency is clear to avoid confusion.

- Payment Terms – Outline payment deadlines, accepted payment methods, and any late fees.

- Unique

Understanding the Benefits of Invoice Templates

Adopting structured document formats for transactions offers significant advantages for businesses of all sizes. These formats simplify the documentation process, enhancing professionalism while reducing time spent on administrative tasks. For small businesses and freelancers, they can be particularly valuable, as they provide an organized way to track payments and communicate charges transparently to clients.

Advantages of Using Pre-Formatted Layouts

Pre-designed layouts offer various benefits, making it easy to maintain consistency and clarity in financial documents. They help businesses project a polished image while ensuring accuracy and clarity in records.

Benefit Description Time Savings Ready-made layouts reduce the need for repetitive formatting, allowing quick adjustments and consistent document creation. Improved Accuracy Pre-set fields minimize errors by prompting the user to fill in required details, helping to avoid missed information. Professional Presentation Organized layouts improve the appearance of documents, reinforcing a business’s commitment to quality and detail. Why Choose Word for Invoicing

When it comes to creating documents for client transactions, finding a tool that balances ease of use and customization is essential. Many businesses rely on flexible software that allows for quick edits, personalization, and a professional appearance, all of which make it easier to manage routine tasks efficiently. Selecting a familiar program with a wide range of features is a practical choice for both new and established businesses.

One of the main benefits of using a well-known word processor is its intuitive interface. This software is widely accessible and user-friendly, allowing even those with limited design experience to produce polished, clear documents. Built-in formatting options provide structure, helping users quickly create and edit documents as needed. Additionally, customizable options allow for adjustments to colors, fonts, and layout, offering full control over the document’s appearance.

Another key advantage is the program’s compatibility and flexibility. Since these documents can be saved and shared in various formats, including PDF, they are easily accessible across devices and platforms. This flexibility ensur

How to Set Up an Invoice in Word

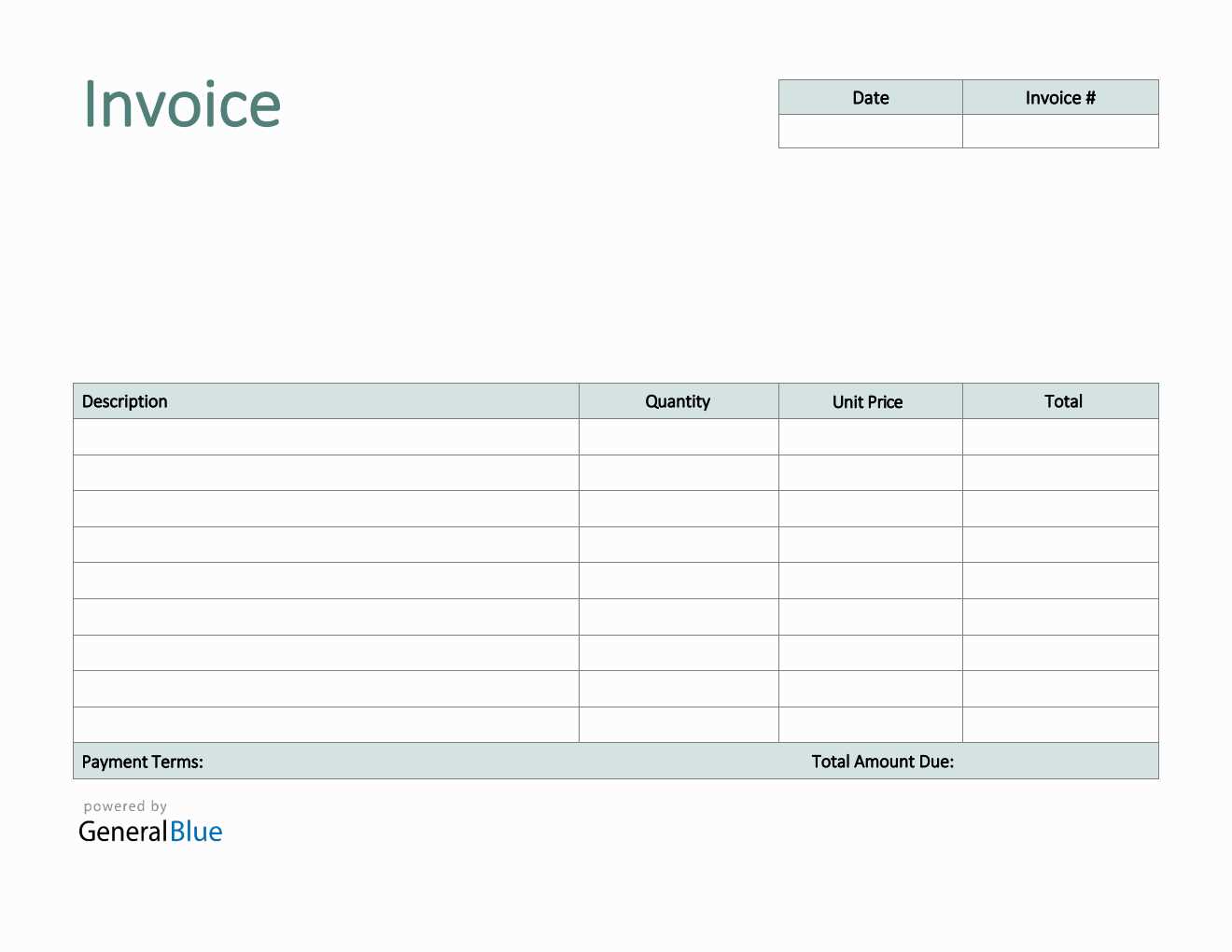

Creating a structured document for client transactions can be done easily with a few straightforward steps. This process involves setting up a layout that organizes key details clearly, ensuring that both the service provider and client have a complete record of the transaction. With basic tools, you can quickly customize the document to suit your business needs, adding a professional touch to each interaction.

Step 1: Choose a Layout

Start by selecting a layout that allows for clear organization of information. Look for a format that includes sections for itemizing services, listing prices, and providing payment instructions. Many pre-designed formats are available, or you can set up your own structure by creating tables or using text boxes. A well-organized layout will ensure that each section is easy to read and follow.

Step 2: Customize the Details

Once your layout is in place, begin adding personalized details. This includes your business name, logo, contact information, and any

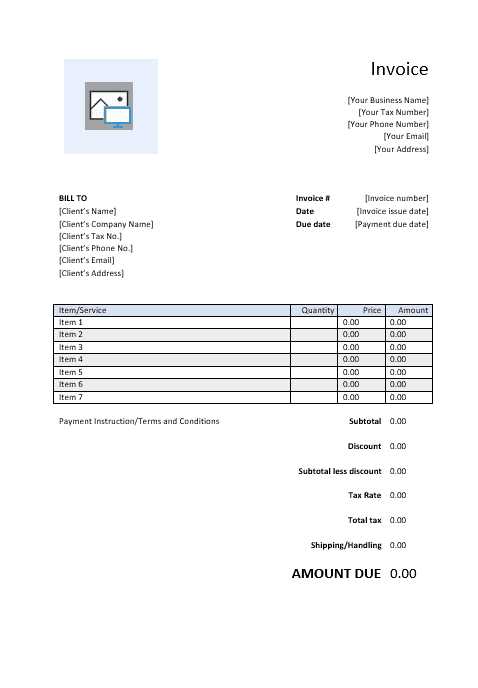

Essential Elements of a Billing Invoice

A professional transaction document should clearly present all necessary details to ensure transparency and ease of processing for both parties involved. Including specific elements in each document helps organize information, makes it simple for clients to review the charges, and streamlines record-keeping. By understanding the key components, you can create a well-structured document that communicates all essential details effectively.

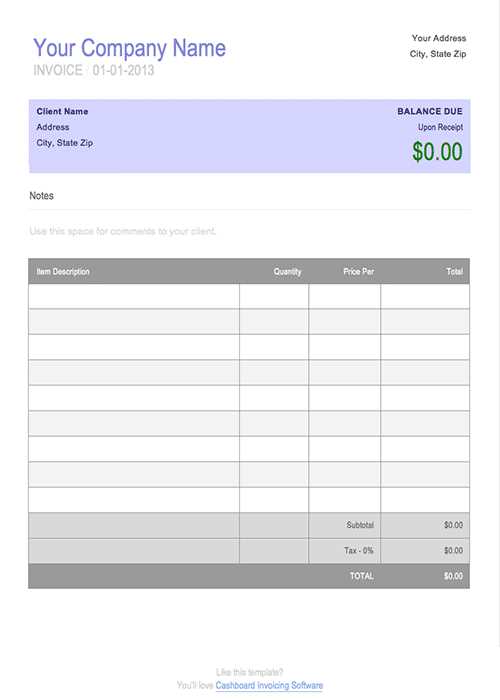

Element Description Header This section typically includes the business name, logo, and contact details, providing clients with quick access to your contact information. Client Information Details about the client, such as their name, company name, and contact information, to ensure accurate delivery and reference. Customizing Invoice Templates in Word

Adapting a document layout to fit your specific needs is essential for creating a professional and functional tool for client transactions. Tailoring the design allows businesses to reflect their unique branding and provide clear communication to clients. By making adjustments to an existing layout, you can ensure that all critical information is easily accessible and aesthetically pleasing.

The first step in customization is to select a suitable format that serves as a foundation for your document. Once a base layout is chosen, you can modify various elements, such as fonts, colors, and logos, to align with your brand identity. Incorporating your company’s color scheme and using consistent typography helps create a cohesive look, enhancing your professional image.

Additionally, consider rearranging sections to prioritize the most relevant information. For instance, you might want to position the summary of services prominently or adjust the layout of payment instructions to make them stand out. This strategic placement can guide clients through the document, making it easier for them to understand their charges and obligations.

Finally, ensure that your personalized document remains user-friendly. Avoid overly complicated designs that may confuse clients or obscure important details. A well-organized layout that balances aesthetics and functionality will ultimately facilitate smoother transactions and promote positive relationships with clients.

Tips for a Professional Invoice Design

Creating a polished document is essential for establishing credibility and ensuring that transactions are clear and efficient. A well-designed layout not only reflects your brand’s professionalism but also enhances the client experience by making information easy to navigate. Here are some key strategies to consider when designing your document.

Maintain Consistency

- Color Scheme: Use a consistent color palette that aligns with your brand identity to create a cohesive look.

- Font Choices: Stick to one or two complementary fonts throughout the document for readability and a polished appearance.

- Logo Placement: Position your logo prominently to reinforce brand recognition and enhance professionalism.

Enhance Readability

- Clear Layout: Organize sections logically and use headings to separate different parts of the document, making it easy for clients to find information.

- White Space: Incorporate ample white space to avoid clutter and allow the reader to focus on key details.

- Bullet Points: Use bullet points or numbered lists to present information succinctly and improve comprehension.

By implementing these tips, you can create a professional document that not only showcases your brand but also enhances communication with your clients, ultimately leading to smoother transactions and better relationships.

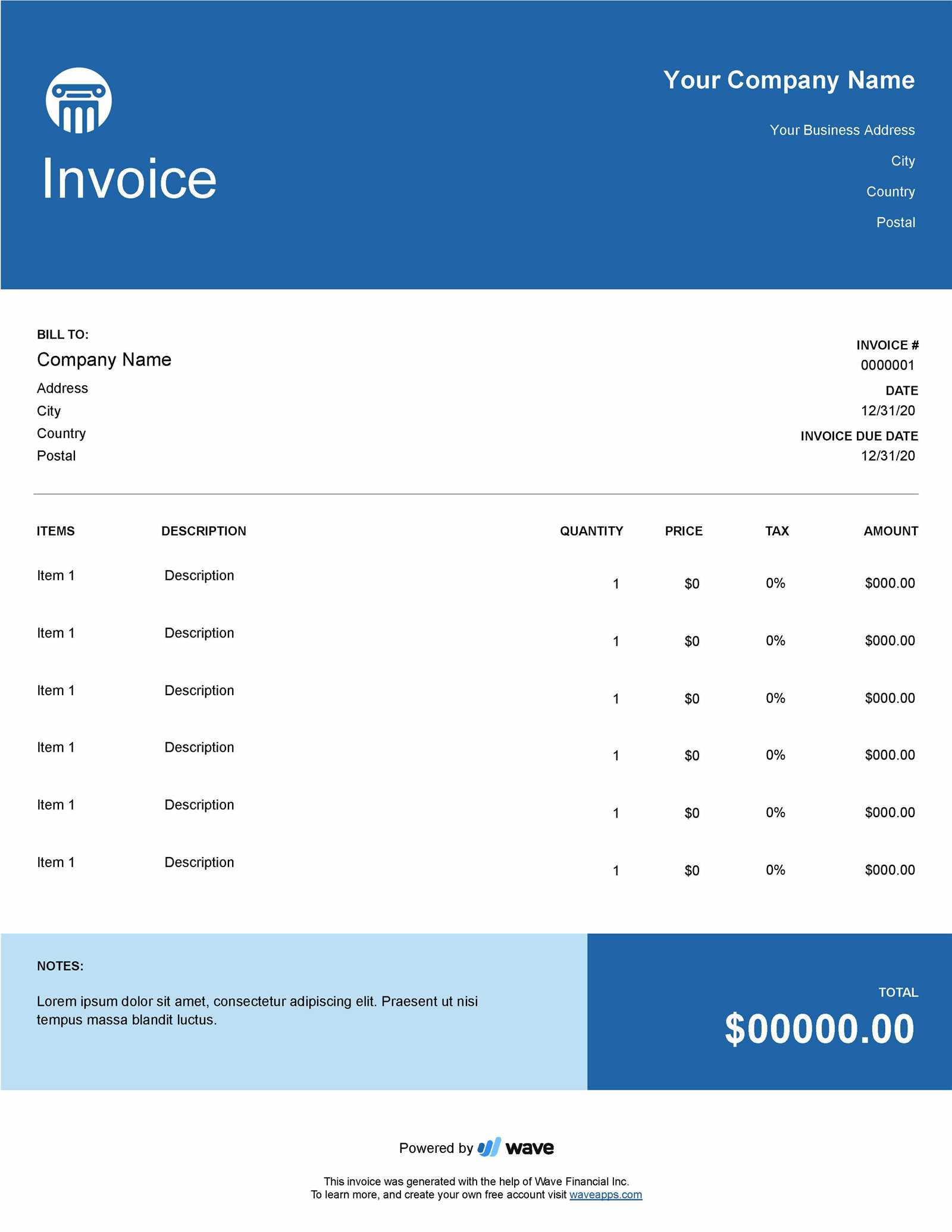

Adding Company Branding to Invoices

Incorporating your company’s identity into financial documents is crucial for establishing a professional image and fostering trust with clients. Effective branding not only enhances recognition but also communicates a sense of reliability and consistency in your business dealings. By strategically embedding elements of your brand into these documents, you can create a cohesive look that resonates with your audience.

Start by including your logo prominently at the top of the document. This serves as a visual anchor and reinforces brand recognition every time a client receives a statement. Additionally, consider using your company’s color palette throughout the design. Consistent use of colors can evoke feelings associated with your brand, whether it’s trust, creativity, or professionalism.

Another effective strategy is to adopt a specific font style that aligns with your brand’s personality. Whether you prefer a modern sans-serif or a classic serif font, maintaining consistency across all documents reinforces your identity. Don’t forget to include contact information, such as your website and social media links, allowing clients to connect with you easily and enhancing your brand’s visibility.

Finally, ensure that the overall layout reflects your brand’s values. A clean, well-organized design can convey professionalism, while unique artistic touches can showcase creativity. By carefully considering how to integrate your branding into these essential documents, you create not just a tool for transactions but also a representation of your brand’s ethos.

Using Colors and Fonts for Impact

Utilizing the right colors and typography is essential for creating a visually appealing document that captures attention and conveys your message effectively. The strategic selection of hues and fonts can influence how clients perceive your communications and the overall professionalism of your brand. By understanding the psychological effects of colors and the readability of different font styles, you can enhance the impact of your financial documents.

Choosing Effective Colors

Colors play a vital role in evoking emotions and associations. When designing your documents, consider the following:

Color Association Blue Trust and Dependability Green Growth and Prosperity Red Urgency and Attention Gray Neutrality and Balance Selecting the Right Fonts

The font you choose can significantly impact readability and the tone of your document. Here are a few considerations:

- Serif Fonts: These fonts, like Times New Roman, convey tradition and reliability, making them suitable for formal documents.

- Sans-Serif Fonts: Fonts like Arial or Helvetica offer a modern look and are easier to read on screens, ideal for digital communications.

- Font Size: Ensure that the text is large enough to be legible but not so large that it disrupts the layout. Typically, 10 to 12 points is a good range for body text.

By carefully choosing colors and fonts, you can create a document that not only looks professional but also effectively communicates your brand’s identity and values.

How to Calculate Totals and Taxes

Accurate calculations of totals and applicable taxes are essential for ensuring clarity and professionalism in your financial documents. Properly determining the final amount due not only helps in maintaining transparency with clients but also aids in effective financial management. Understanding the steps involved in these calculations is crucial for any business or freelance operation.

To calculate the total amount due, follow these fundamental steps:

Step Description 1. List Items Compile all services or products provided along with their individual prices. 2. Calculate Subtotal Add together all item prices to get the subtotal before taxes. 3. Determine Tax Rate Identify the appropriate tax rate applicable to your services or products. 4. Calculate Taxes Multiply the subtotal by the tax rate to find the total tax amount. 5. Calculate Total Amount Add the subtotal and the total tax to arrive at the final amount due. For example, if the subtotal is $500 and the tax rate is 10%, the calculation would be as follows:

Tax Amount = $500 × 0.10 = $50

Total Amount Due = $500 + $50 = $550

By following these steps, you can ensure that your documents are not only precise but also provide a clear breakdown of costs, which enhances client trust and satisfaction.

Saving and Sharing Invoices as PDFs

Converting your financial documents into a widely accepted format not only enhances their accessibility but also preserves their formatting, ensuring that recipients view them as intended. The PDF format is a preferred choice for sharing such materials, as it provides a professional appearance and maintains the integrity of the layout across different devices and platforms.

Steps to Save Documents as PDFs

Follow these straightforward steps to convert your documents into PDFs:

Step Description 1. Finalize the Document Ensure all information is accurate and formatted correctly before saving. 2. Choose Save As Go to the file menu and select the ‘Save As’ option. 3. Select PDF Format In the file type dropdown menu, choose PDF as the format. 4. Name the File Give the document a clear and descriptive name for easy identification. 5. Save the File Click ‘Save’ to create the PDF document in the desired location. Sharing PDFs with Clients

Once your documents are saved as PDFs, sharing them with clients or colleagues becomes seamless. Here are some common methods for distribution:

- Email: Attach the PDF file directly to an email for quick delivery.

- Cloud Storage: Upload the document to a cloud service and share the link for access.

- Print: If necessary, print the PDF to provide a physical copy.

By utilizing the PDF format, you ensure that your documents remain professional, easy to share, and accessible, facilitating better communication with your clients.

Common Errors to Avoid in Billing

Ensuring accuracy in financial documents is essential for maintaining professionalism and fostering trust with clients. However, there are several common pitfalls that individuals and businesses encounter when creating these records. By being aware of these mistakes, you can improve your processes and enhance your financial communication.

Typical Mistakes to Watch For

Here are some frequent errors that should be avoided:

- Incorrect Calculations: Double-check all sums and taxes to ensure accuracy.

- Missing Information: Ensure that all necessary details, such as dates and payment terms, are included.

- Inconsistent Formatting: Use a uniform layout to present a professional appearance.

- Neglecting to Follow Up: Always follow up on sent documents to confirm receipt and address any questions.

- Using Vague Descriptions: Provide clear and specific descriptions of services or products to avoid confusion.

Best Practices for Accurate Documentation

To further minimize errors, consider implementing these best practices:

- Review each document thoroughly before sending it out.

- Utilize software tools that offer validation and automated calculations.

- Maintain a checklist of required information to ensure nothing is overlooked.

- Standardize your process to create consistency across all documents.

By being mindful of these common errors and adhering to best practices, you can enhance the quality of your financial documentation and strengthen your relationships with clients.

Free vs. Paid Invoice Templates

When it comes to creating financial documents, choosing the right resources can significantly impact efficiency and professionalism. There are various options available, ranging from complimentary formats to premium designs. Understanding the differences between these choices can help you make an informed decision that best suits your needs.

Advantages of Free Options

- Cost-Effective: As the name suggests, these options are available without any financial investment.

- Basic Functionality: Many free designs provide essential features that are sufficient for simple transactions.

- Accessibility: Easy to find and download from numerous online sources.

- Good for Startups: Ideal for individuals and small businesses that are just beginning and have budget constraints.

Benefits of Paid Options

- Professional Quality: Premium designs often come with advanced features that enhance visual appeal and functionality.

- Customization: Paid resources typically offer more options for personalization to align with your brand identity.

- Support and Updates: Purchasing a design often includes customer support and regular updates, ensuring you have access to the latest features.

- Time-Saving: High-quality designs can save you time with pre-built layouts and automated calculations.

Ultimately, the choice between free and paid options depends on your specific requirements, budget, and the level of professionalism you wish to convey in your financial documents. Evaluating your needs will guide you toward the most suitable choice.

Updating Invoices for Repeat Clients

Maintaining strong relationships with recurring customers is essential for any business. One effective way to foster these connections is by ensuring that financial documents are consistently accurate and tailored to their needs. Updating statements for loyal clients not only reflects professionalism but also enhances the overall customer experience.

Key Considerations for Modifying Statements

- Accurate Details: Always verify that the client’s information, such as name and address, is correct to avoid confusion.

- Consistent Formatting: Use a uniform layout that aligns with previous documents to provide a familiar look and feel.

- Reflect Changes: Update any alterations in services or rates since the last transaction to ensure clarity.

- Include Payment History: Consider adding a summary of previous transactions to remind clients of their history with your business.

- Personal Touch: Including a brief note expressing appreciation for their continued patronage can enhance client loyalty.

Benefits of Regular Updates

- Improved Accuracy: Regularly reviewing and updating documents minimizes errors and discrepancies.

- Enhanced Professionalism: A well-organized statement reflects positively on your business and builds trust.

- Streamlined Processes: Keeping records current allows for easier tracking of ongoing projects and financial arrangements.

- Increased Client Satisfaction: Clients appreciate the attention to detail, leading to stronger relationships and potential referrals.

By prioritizing the updating of financial documents for repeat customers, businesses can cultivate loyalty and encourage long-term partnerships.

Streamlining Invoicing for Small Businesses

For small enterprises, managing financial documents efficiently is crucial to maintaining healthy cash flow and ensuring timely payments. Simplifying the process of creating and sending financial statements can save valuable time and reduce stress, allowing business owners to focus on growth and customer satisfaction. Implementing effective strategies can make a significant difference in how these documents are handled.

Effective Strategies for Simplification

To optimize the process, consider the following approaches:

- Utilize Automation Tools: Leverage software that automates the creation and delivery of financial documents, minimizing manual entry and errors.

- Standardize Layouts: Develop a consistent format for your statements to streamline preparation and enhance professionalism.

- Organize Client Information: Maintain an updated database of customer details to expedite the process of populating documents.

- Set Clear Payment Terms: Clearly define payment expectations within the documents to avoid misunderstandings and delays.

Benefits of Streamlined Processes

Implementing these strategies not only simplifies the creation of financial documents but also offers several advantages:

- Increased Efficiency: Reducing the time spent on paperwork allows for more focus on core business activities.

- Enhanced Cash Flow: Timely and accurate financial statements contribute to faster payments from clients.

- Improved Client Relations: Professional and organized documentation fosters trust and satisfaction among customers.

By adopting these practices, small businesses can streamline their financial documentation process, ultimately contributing to their overall success.

Alternatives to Word for Invoicing

While many individuals and small businesses rely on traditional word processing software for generating financial documents, there are numerous alternative solutions available that can enhance efficiency and functionality. Exploring these options can lead to improved document management, streamlined processes, and a more professional appearance for your financial communications.

Popular Options to Consider

Here are several noteworthy alternatives that can effectively meet your documentation needs:

- Online Accounting Software: Platforms like QuickBooks, FreshBooks, and Xero offer comprehensive features for creating, sending, and managing financial documents. They also provide tools for tracking payments and expenses.

- Spreadsheet Programs: Applications such as Microsoft Excel and Google Sheets allow for customized document creation, with flexible formulas for calculating totals and taxes. They are particularly useful for those who prefer more control over their layouts.

- Dedicated Invoicing Tools: Services like Zoho Invoice and Invoice Ninja specialize in creating financial documents and include features such as automated reminders and customizable designs.

- PDF Editors: Software like Adobe Acrobat enables users to design and edit documents in PDF format, ensuring a professional look and preserving formatting.

Choosing the Right Solution

Selecting the best alternative depends on your specific needs and business size. Consider factors such as:

- Ease of Use: Choose a solution that is user-friendly and requires minimal training.

- Integration Capabilities: Look for tools that can seamlessly integrate with your existing systems, such as payment processors or accounting software.

- Cost: Assess the pricing structures of different options to ensure they fit within your budget.

By evaluating these alternatives, you can find a solution that enhances your financial document processes while ensuring professionalism and accuracy.

Choosing the Right Template for Your Needs

Selecting the most suitable design for your financial documents is crucial to ensure clarity and professionalism. The right format not only enhances your brand image but also makes it easier for clients to understand the details of transactions. Understanding your specific requirements can guide you toward a more effective choice.

Key Factors to Consider

When deciding on a design, keep the following elements in mind:

- Business Type: Different industries may have varying standards and expectations. For instance, creative businesses might prefer more visually appealing designs, while legal or financial firms may opt for a more traditional layout.

- Content Needs: Consider what information is essential for your documents. Ensure that the format allows you to include all necessary details such as services provided, payment terms, and contact information.

- Customization Options: Look for formats that allow easy customization to reflect your brand identity. This can include adding logos, adjusting colors, and modifying layouts.

Popular Designs Overview

Design Style Best For Features Minimalist Freelancers and Startups Clean lines, simple layout, focus on key details Modern Creative Industries Bold colors, artistic elements, unique fonts Classic Corporate and Financial Services Formal design, traditional fonts, structured layout Customizable Businesses Seeking Brand Alignment Flexible elements, brand colors, adjustable sections By carefully considering these factors, you can select a design that effectively communicates your brand while meeting your specific business needs.