Free Word 2013 Invoice Template for Easy Customization

For businesses and freelancers, having the right tools to generate professional billing documents quickly and easily is essential. Customizable solutions allow for consistent and clear communication with clients while streamlining the invoicing process. Whether you’re managing a small business or handling occasional freelance projects, the ability to produce neat and accurate records is crucial.

Using a pre-made document format offers the advantage of saving time and effort, especially when you need to focus on other aspects of your business. These formats come with built-in structures, allowing you to simply add relevant details like services provided, amounts due, and payment instructions.

In this guide, we will explore how you can utilize an editable document in your daily operations. With just a few adjustments, you can craft a document that reflects your brand, ensures clarity, and meets the expectations of your clients.

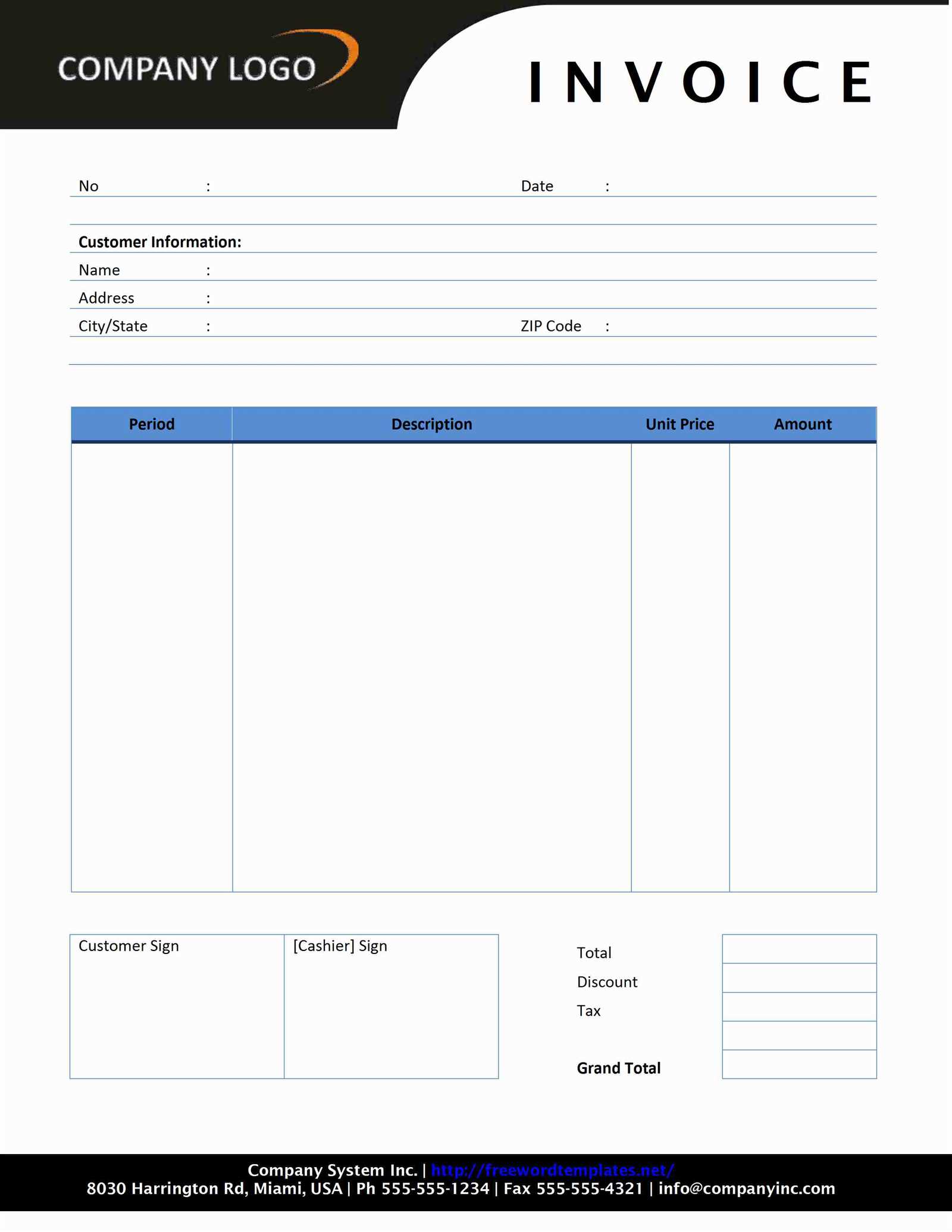

Word 2013 Invoice Template Overview

Creating professional billing documents doesn’t need to be a complicated process. With a pre-designed format, you can easily generate accurate and clear records that help you maintain a smooth workflow. A structured document makes it easier to add important details such as service descriptions, amounts, and payment terms, all while ensuring consistency and a polished appearance for your clients.

These ready-to-use documents are especially useful for small businesses, freelancers, or anyone who regularly needs to send payment requests. They come with essential sections already in place, saving time on formatting and layout, allowing you to focus on the details.

Here are the key benefits of using this kind of pre-made document:

- Time-saving: Ready-made structures eliminate the need to start from scratch.

- Consistency: Using a uniform format ensures that all your documents look professional.

- Customizability: You can easily modify details such as company name, client information, and payment terms.

- Efficiency: Quickly create accurate and error-free records without missing key components.

By using such a solution, you can streamline your billing process and present a more organized, professional front to your clients.

How to Download Word 2013 Invoice

If you’re looking to quickly generate a professional billing document, downloading a pre-designed format is an excellent solution. These ready-made files provide a convenient way to get started without needing to build a layout from scratch. Fortunately, there are various online platforms where you can easily access and download these files for free or for a small fee.

Follow these simple steps to get your hands on a customizable document:

- Search Online: Use a search engine to find trusted sources offering free or paid templates for billing documents. Be sure to choose a reliable website to ensure the file is safe to download.

- Select the Right File: Look for a document that meets your needs in terms of structure and design. Many sites offer a variety of options tailored to different industries or business types.

- Download the Document: Click the download link provided on the website. Depending on the platform, you may be asked to enter your email address or create an account to access the file.

- Open the Document: After the download is complete, open the file in the program that supports the format, and you’re ready to start editing it to suit your needs.

By following these steps, you can easily access a high-quality, pre-formatted document that will help you create professional billing records with minimal effort.

Why Use a Word Invoice Template

Using a pre-designed document for generating billing records offers several advantages, making the process faster, easier, and more professional. Instead of starting from scratch every time, you can leverage a format that already includes all the essential elements, allowing you to focus on providing accurate information rather than worrying about the layout or design.

Efficiency and Time-Saving

One of the biggest reasons to use a pre-made document is efficiency. Instead of spending time formatting each page or designing from the ground up, you can quickly fill in client details, services, and payment terms. This helps you save valuable time, especially when you need to create multiple documents or work under tight deadlines.

Professional Appearance

Another key benefit is the polished, professional look that these documents provide. With consistent formatting and a structured layout, your records will appear well-organized and visually appealing. This not only makes the process of billing easier for you but also enhances your reputation in the eyes of clients, giving them confidence in your business practices.

Benefits of Word 2013 for Invoices

The software provides a versatile platform for creating and managing billing documents. It combines ease of use with powerful features, allowing users to generate professional-looking records without the need for specialized design skills. The flexibility of the program ensures that you can create customized documents that suit your specific business needs.

Here are some key advantages of using this program for your billing needs:

- Customizability: Easily modify layouts and designs to match your brand’s style and preferences.

- Built-in Tools: Access a wide range of formatting and editing tools to structure your documents effectively.

- Wide Compatibility: Open and edit files across multiple devices, making it convenient for those on the go.

- Professional Appearance: Create polished and consistent documents with minimal effort.

- Cost-Effective: If you already use the software, there are no additional expenses for creating billing records.

By utilizing these features, you can streamline your billing process, save time, and present a professional image to clients, all while maintaining full control over the document’s content and design.

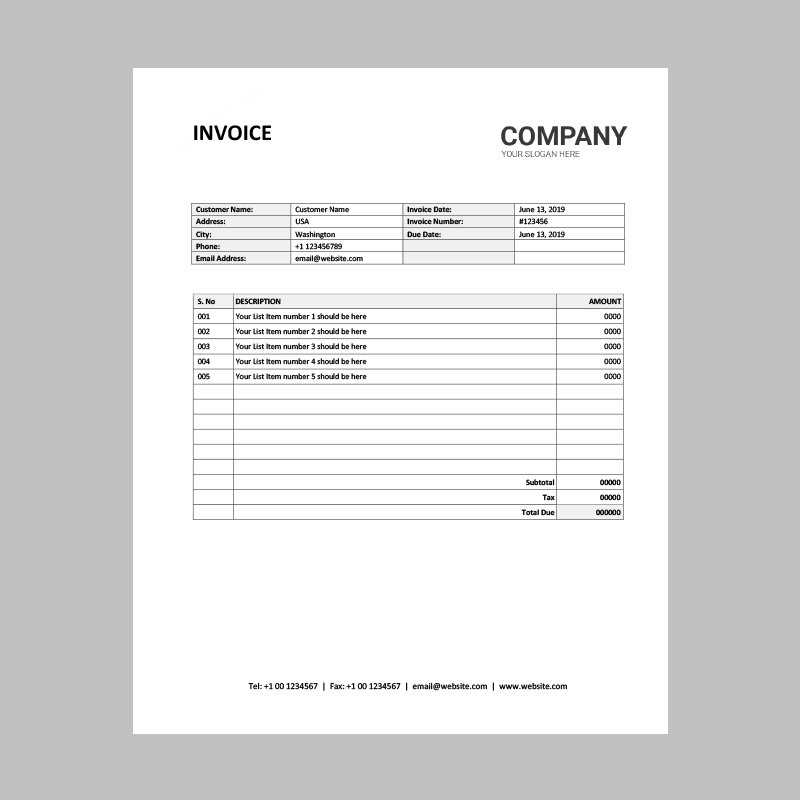

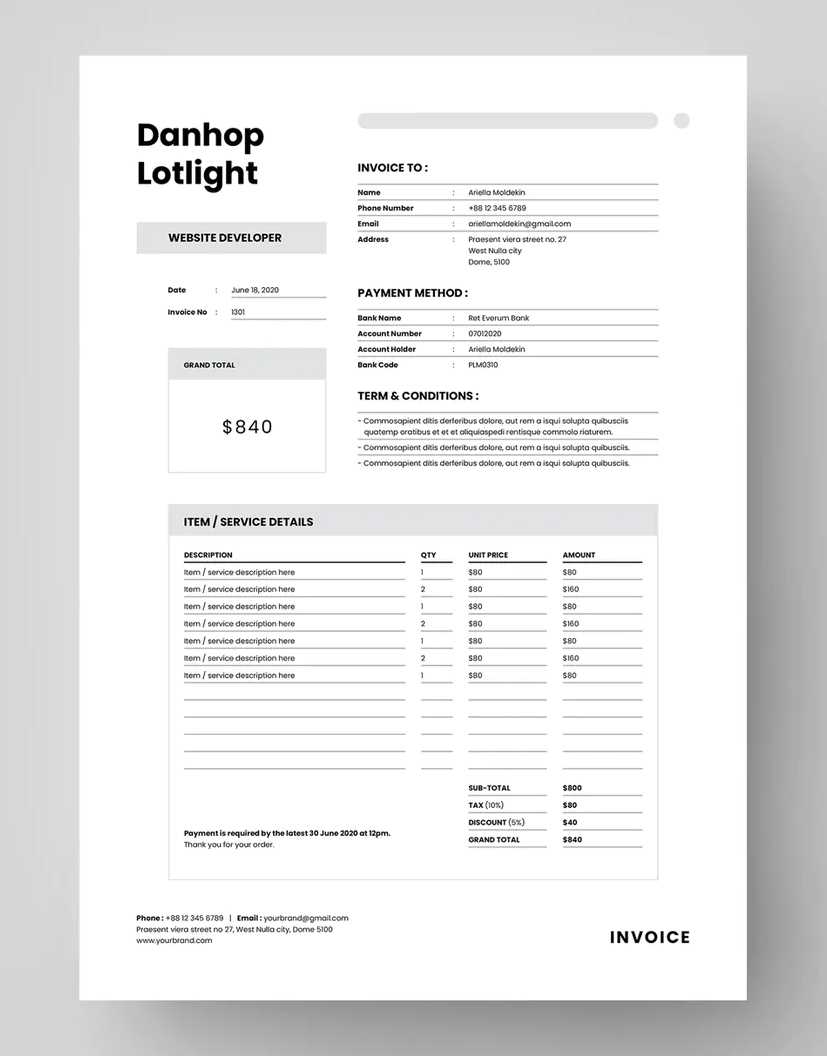

Customizing Your Word 2013 Invoice

When creating a billing document, personalizing the layout and design can significantly enhance its professionalism. By adjusting various elements such as fonts, colors, and section placements, you can craft a document that aligns with your brand or specific needs. The following steps will guide you through customizing essential features to create a polished and efficient financial record.

- Change the Header: Modify the title or business details at the top of the document to match your branding. This could include your company name, logo, and contact information.

- Adjust the Table Layout: Edit the grid structure to suit the flow of information, whether it’s adding more rows for services, adjusting column widths, or changing borders for clarity.

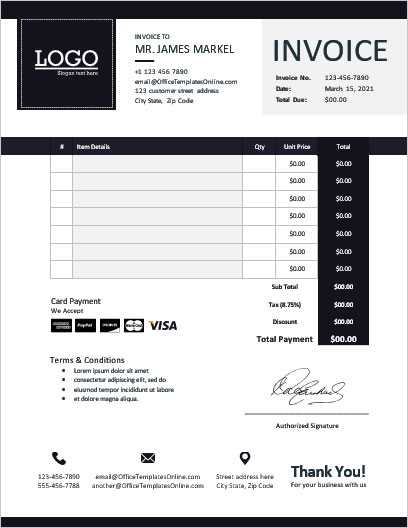

- Incorporate Your Branding: Insert custom logos, change the color scheme to reflect your corporate identity, and select fonts that complement your overall style.

By focusing on these aspects, you ensure that the billing statement is not only functional but also a reflection of your professional image.

How to Add Company Logo to Invoice

Incorporating your business’s logo into a financial document not only enhances its professional appearance but also strengthens brand recognition. Whether you’re creating a new record or modifying an existing one, placing your company’s emblem in the right spot can make a significant impact. Follow these steps to easily add your logo to the document.

- Position the Logo: Choose where you want to place the logo, typically in the header area, to ensure it’s visible and enhances the layout. The top left or top center are popular choices.

- Insert the Image: Use the “Insert” tab to select “Picture” and choose the logo file from your computer. Once inserted, you can resize and adjust its position.

- Adjust Layout Settings: After inserting the logo, adjust its alignment and text wrapping settings to make sure it does not interfere with other information on the page.

With these simple steps, your document will have a polished, professional look, instantly reflecting your company’s identity in the document’s design.

Tips for Professional Invoice Design

Creating a sleek and well-organized financial document requires attention to detail and thoughtful design. A clean, professional layout not only makes the document easier to read but also reinforces the credibility of your business. Below are several key design tips to enhance the presentation and functionality of your billing statements.

1. Keep it Simple and Clean

A minimalist design is often the most effective. Avoid clutter and focus on clarity. Use ample white space to separate different sections and ensure the content is easy to follow. Stick to a clear, consistent font and appropriate sizing for readability.

2. Use a Consistent Color Scheme

Choose a color palette that complements your brand and maintains a professional tone. Avoid using too many colors, as this can overwhelm the viewer. A simple combination of one or two primary colors, along with neutral tones, will keep the focus on the content.

| Section | Recommendation |

|---|---|

| Header | Use your brand’s primary color for the header background or text. |

| Text | Use neutral colors like black or dark gray for the body text for maximum legibility. |

| Subheadings | Highlight subheadings with a secondary accent color to make them stand out. |

By following these design principles, your financial document will not only appear polished but also effectively convey the professionalism and reliability of your business.

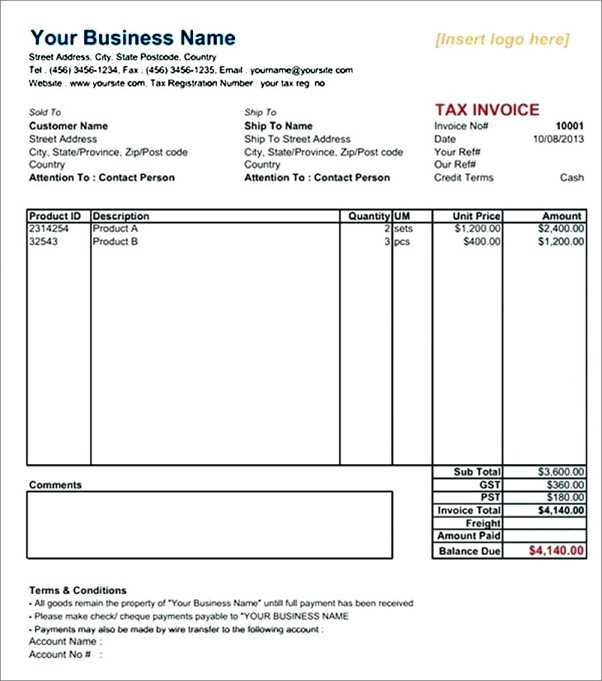

Creating Detailed Invoice Sections

A well-structured document should clearly outline each aspect of the transaction. Detailed sections ensure that the recipient understands the services provided, the charges involved, and any applicable terms. By breaking the document into clear, logical sections, you make it easier to navigate and more professional in appearance. Below are some essential sections to consider when creating a comprehensive financial record.

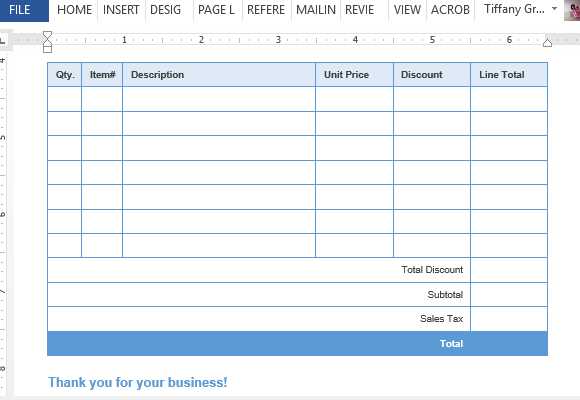

1. Itemized List of Services or Products

Providing a detailed list of the goods or services offered is crucial. This section should include:

- Description: A clear and concise description of each item or service.

- Quantity: The number of items or hours worked.

- Unit Price: The cost per unit or hourly rate.

- Total: The total cost for each individual line item.

Using this format allows the recipient to easily review and verify each charge, ensuring transparency and preventing misunderstandings.

2. Taxes and Additional Charges

If applicable, this section should outline any extra fees, taxes, or discounts associated with the transaction. Including these details will provide clarity and ensure that both parties are on the same page regarding the final amount due.

- Sales Tax: Indicate the percentage or amount of tax applied.

- Shipping Costs: If applicable, include any delivery charges.

- Discounts: Specify any discounts or promotions applied to the total cost.

Clearly labeling each additional charge will help the recipient understand the breakdown of the final amount, avoiding confusion.

Using Word 2013 for Quick Billing

Creating billing documents quickly and efficiently is crucial for businesses that need to manage their cash flow. Using a word processor can streamline the process, allowing you to generate detailed records in just a few minutes. By leveraging pre-built features and customizing them to fit your needs, you can easily produce professional financial documents without wasting time.

1. Start with a Pre-Formatted Layout: Many word processors offer built-in formats that are already designed to meet basic billing needs. These layouts often have all the necessary sections such as client details, services, and payment terms, which can be modified to suit your specific situation.

2. Quick Modifications: Customizing the layout is simple–just edit the placeholders for business names, addresses, and transaction details. You can also add or remove sections as required, ensuring the document reflects the exact nature of the transaction.

3. Add Your Branding: Personalize the document by including your company logo, adjusting colors, and using your brand’s font style. This not only gives the document a professional look but also helps reinforce brand identity with every transaction.

By utilizing these features, you can easily create well-organized, customized financial records in no time, ensuring that your billing process remains efficient and professional.

Formatting and Styling Your Invoice

The appearance of a billing document plays a key role in how professional and polished it looks. Proper formatting and styling ensure that all information is presented clearly and is easy to read. A well-designed document reflects positively on your business and makes a lasting impression on clients. Below are some essential tips for refining the layout and style of your financial records.

1. Adjusting the Layout

To ensure your document is both functional and visually appealing, focus on creating a clean layout with well-defined sections. Organize your content logically so that clients can quickly find the information they need.

- Headers: Make your headers stand out by using larger, bold fonts. This makes it easier to navigate through sections like the company information, client details, and the summary of charges.

- Spacing: Use adequate spacing between sections to avoid clutter. This helps improve readability and ensures each part of the document is visually separated.

- Tables: If you include an itemized list of services or products, use a table with clearly defined rows and columns. This organizes the information and ensures it is easy to follow.

2. Styling the Document

Beyond layout, styling elements such as fonts, colors, and borders can add a personalized touch to your financial record.

- Font Choices: Select professional, easy-to-read fonts like Arial or Times New Roman for body text. For headings, you can use bold or slightly larger fonts to create a hierarchy of information.

- Color Scheme: Stick to a simple color palette that aligns with your brand. Use a primary color for headings or key details and a neutral tone for the main content.

-

Word 2013 Invoice for Small Businesses

For small business owners, managing finances efficiently is critical to maintaining a healthy cash flow. One of the easiest ways to do this is by using a reliable document creator to generate billing statements. With the right layout and structure, these documents can convey professionalism while ensuring clarity for both the business and its clients. Below are several key considerations for creating effective billing records for your small business.

1. Essential Sections for Small Business Billing

To ensure that all relevant information is included, structure your document with the following key sections:

- Business and Client Details: Clearly list your business information and the client’s contact details. This should include the business name, address, phone number, and email.

- Service or Product Breakdown: Include a detailed list of services provided or products sold, along with their respective costs. A breakdown helps clients understand the charges and promotes transparency.

- Payment Terms: Specify your payment terms, including due date, accepted payment methods, and any late fees for overdue payments.

- Total Amount Due: Ensure that the final amount due is clearly highlighted, including any taxes, discounts, or additional charges.

2. Benefits of Using Pre-Designed Formats

Using pre-designed structures can save time and effort for small business owners. These ready-made layouts allow for quick customization to meet specific needs without starting from scratch. Additionally, these formats often include essential elements such as:

- Standardized Design: A clean, consistent layout ensures that the document looks professional every time.

- Editable Fields: Easily update o

Adding Payment Terms in Word Invoice

Including clear payment terms in your billing document is essential for ensuring smooth transactions between you and your clients. Payment terms specify when and how payments should be made, helping to avoid confusion and potential delays. Below are some key elements to include when outlining payment expectations in your financial record.

Payment Term Description Due Date Indicate the specific date by which payment is expected. This provides a clear deadline for the client. Late Fees Specify any penalties or additional charges if payment is not received by the due date. Accepted Payment Methods List the types of payment you accept, such as bank transfer, credit card, or PayPal, so the client knows their options. Early Payment Discounts Offer a discount for clients who settle their bills before the due date, which can encourage prompt payments. By clearly stating these terms, you ensure both you and your client have mutual expectations, which reduces the risk of payment issues and fosters professional relationships.

Invoice Templates for Different Industries

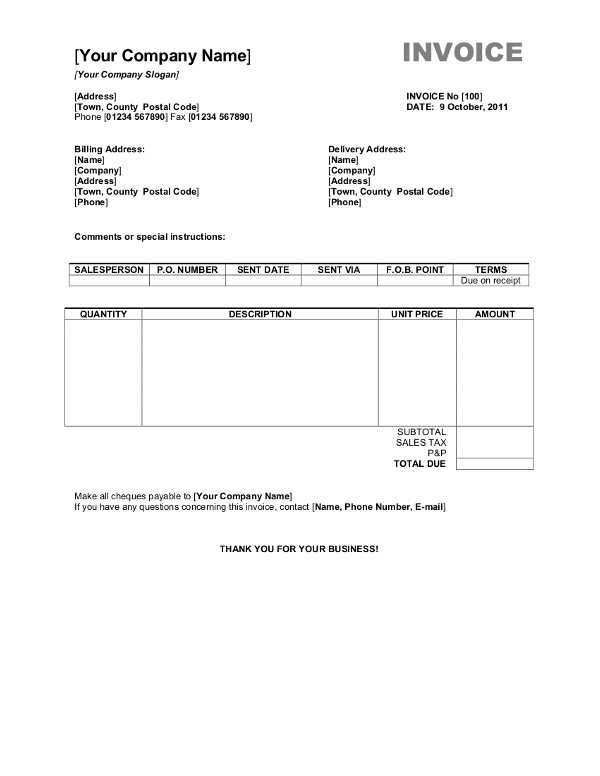

Each industry has its own unique needs when it comes to creating billing documents. Whether you’re in the service sector, retail, or any other field, tailoring your financial records to reflect industry-specific requirements can help streamline processes and ensure clarity. Below are examples of how billing statements can be adjusted for various industries.

1. Service-Based Industries

For businesses that provide services rather than physical products, the structure of the billing statement should focus on detailing the hours worked, the type of service rendered, and the rate applied. Common elements include:

- Hourly or Project-Based Rates: Clearly specify the hourly rate or project fee.

- Service Description: List each service or task performed with a brief explanation.

- Labor Charges: If applicable, include the total cost based on time spent or task completion.

2. Retail and Product-Based Businesses

For retail or businesses selling physical products, the document should include a detailed list of items, quantities, and prices. Key points to include are:

- Product Descriptions: A clear description of each item, including any variations like size or color.

- Quantity: List the number of items purchased.

- Unit Price: Include the price per unit and the total for each line item.

- Shipping Information: If applicable, include delivery charges or tracking information.

3. Freelancers and Consultants

Freelancers and consultants often have unique billing needs due

How to Save and Share Invoices

Efficiently saving and sharing financial documents is crucial for smooth business operations. It ensures that both you and your clients have easy access to records, helping to maintain transparency and prompt payments. Below are some practical steps for saving and distributing your billing statements securely and efficiently.

1. Saving Your Billing Document

Once your document is complete, it’s important to save it in a format that ensures it remains unchanged and easily accessible. Common options include:

- PDF Format: Saving as a PDF preserves the formatting and prevents any accidental edits. This is the most professional format for sharing with clients.

- Cloud Storage: Use cloud-based storage services like Google Drive or Dropbox to keep your documents accessible from any device, anywhere, while also maintaining backups.

- File Naming: Use clear and consistent file names that include the client’s name, invoice number, and date for easy identification (e.g., “ClientName_Invoice123_2024-11-05.pdf”).

2. Sharing Your Billing Documents

Once saved, it’s time to share your document with the client. This can be done securely and efficiently through various channels:

- Email: Attach the saved document to an email. Make sure to use a professional tone and include a message summarizing the billing details. Always verify the recipient’s email address before sending.

- Cloud Sharing: If the document is stored in the cloud, you can generate a sharing link and send it to the client. Be sure to set the appropriate permissions to ensure the document remains secure.

- Client Information: Verify the client’s name, address, and contact details are correct. Mistakes in this area can lead to confusion and delays.

- Itemized List: Ensure that all products or services are listed with correct descriptions, quantities, and pricing.

- Dates: Double-check the billing date and payment due date to avoid any discrepancies.

- Tax Calculations: Review tax rates and ensure they are correctly applied based on the location and product type.

- Clear Section Divisions: Separate sections like client information, item descriptions, and payment terms with visible headings for easy readability.

- Use of Tables: When listing products or services, tables can help keep everything aligned, making it easier to spot any mistakes in quantities or prices.

- Uniform Currency Formatting: Make sure all currency values are formatted the same way, using the appropriate symb

Free Alternatives to Word 2013 Invoice

If you’re looking for a cost-effective way to create professional billing statements, there are several free tools available that offer a variety of features to suit your needs. These alternatives provide easy-to-use options for generating well-structured financial documents without requiring expensive software. Below are some free solutions that can help you produce accurate and professional records.

1. Google Docs

Google Docs offers a free, cloud-based word processor that can be used to create and customize billing records. With a variety of templates available, it’s easy to get started quickly. Key features include:

- Collaboration: Share documents easily with clients or team members for real-time collaboration.

- Cloud Storage: Save your documents in the cloud for easy access and secure backup from any device.

- Pre-made Templates: Choose from a wide range of pre-designed formats to streamline the document creation process.

2. Zoho Invoice

Zoho Invoice is a free, online billing tool designed specifically for small businesses. It offers features tailored to invoicing, such as automatic reminders and customizable billing templates. Features include:

- Customizable Designs: Personalize your billing records with your business logo and branding.

- Automated Reminders: Set up automated reminders to send to clients for overdue payments.

- Cloud Access: Like Google Docs, Zoho provides cloud storage, ensuring your documents are accessible anywhere.

These free tools provide easy, accessible, and efficient alternatives to paid software, allowing you to create professional billing documents without incurring additional costs.

Common Mistakes to Avoid with Invoices

Creating accurate and professional billing statements is essential for ensuring timely payments and maintaining positive relationships with clients. However, even minor mistakes can lead to confusion, delayed payments, or disputes. By being aware of common errors, you can avoid complications and streamline your financial processes.

- Incorrect or Missing Client Information: Failing to include accurate client details, such as name, address, or contact information, can cause delays or issues with payment processing.

- Unclear Item Descriptions: If the products or services provided are not described in sufficient detail, it can lead to confusion about what was purchased and the cost associated with it.

- Errors in Pricing or Tax Calculations: Double-check all prices, quantities, and tax rates to ensure they are correct. Even a small miscalculation can impact the total amount due and affect client trust.

- Not Including Payment Terms: Clearly outline the payment due date, accepted methods of payment, and any late fees or penalties to avoid misunderstandings and ensure timely settlements.

- Missing Invoice Number: Always assign a unique number to each document. This helps with record-keeping and ensures that both you and your client can easily reference specific transactions.

- Formatting Inconsistencies: Using inconsistent fonts, colo

Best Practices for Invoice Accuracy

Ensuring accuracy in your billing statements is crucial for maintaining professional relationships and avoiding disputes. Correct and detailed documents help both parties understand the payment expectations clearly and minimize the chances of errors that could delay payment. Below are best practices to ensure your financial records are always precise and clear.

1. Double-Check the Details

One of the most important steps in ensuring accurate documents is reviewing all details before finalizing. This includes:

2. Implement Consistent Formatting

Consistency in design and structure not only ensures clarity but also prevents errors. Use a format that makes it easy to locate key information, such as: