How to Choose the Best Woocommerce Invoice Template for Your Online Store

When running an online business, having a well-organized and visually appealing method of providing customers with financial statements is essential. Properly designed records not only help maintain transparency but also enhance the overall customer experience. Crafting these documents to meet specific needs ensures both efficiency and professionalism in your operations.

With the right tools, customizing and automating these documents becomes an easy process, saving time and reducing manual errors. Whether you’re looking to adjust the layout, include additional details, or integrate your branding, there’s a wide range of options available. The key is to choose solutions that align with your store’s workflow and customer expectations.

In this guide, we’ll explore various ways to create polished financial records that reflect your brand’s identity. You’ll learn how to make them informative, legally compliant, and user-friendly, all while ensuring a smooth experience for your customers.

Woocommerce Invoice Template Guide

Creating effective billing documents is a vital step in managing an online store. These documents not only provide customers with essential information but also serve as a reflection of your business professionalism. The right approach ensures clarity, legality, and a smooth transaction process, all of which enhance customer trust and satisfaction.

To build the perfect document for your needs, it’s crucial to understand the tools available to you. From layout options to automated generation, each feature can be tailored to suit your workflow. This guide will help you navigate the process, offering tips on customization, functionality, and best practices for making these documents an asset to both you and your customers.

Why Use a Woocommerce Invoice Template

Having a standardized document for all transactions is essential for running an efficient online business. It ensures that each customer receives the same level of professionalism and clarity, making the purchasing experience more seamless and transparent. This consistency helps build trust and reduces confusion, both for the customer and the business owner.

By using an automated solution to generate these documents, you save valuable time and reduce the risk of human error. These tools often come with customization options, allowing you to adjust the layout, include necessary details, and reflect your brand’s identity. Additionally, they can streamline the process of handling payments, taxes, and order details, providing a more organized system for record-keeping and future reference.

Efficiency is key when managing a growing online store. By relying on automated documents, you ensure that your transactions remain organized, accurate, and legally compliant without the need for manual intervention. This not only frees up time but also helps your business run smoothly and look professional at every step.

Customizing Your Invoice Template in Woocommerce

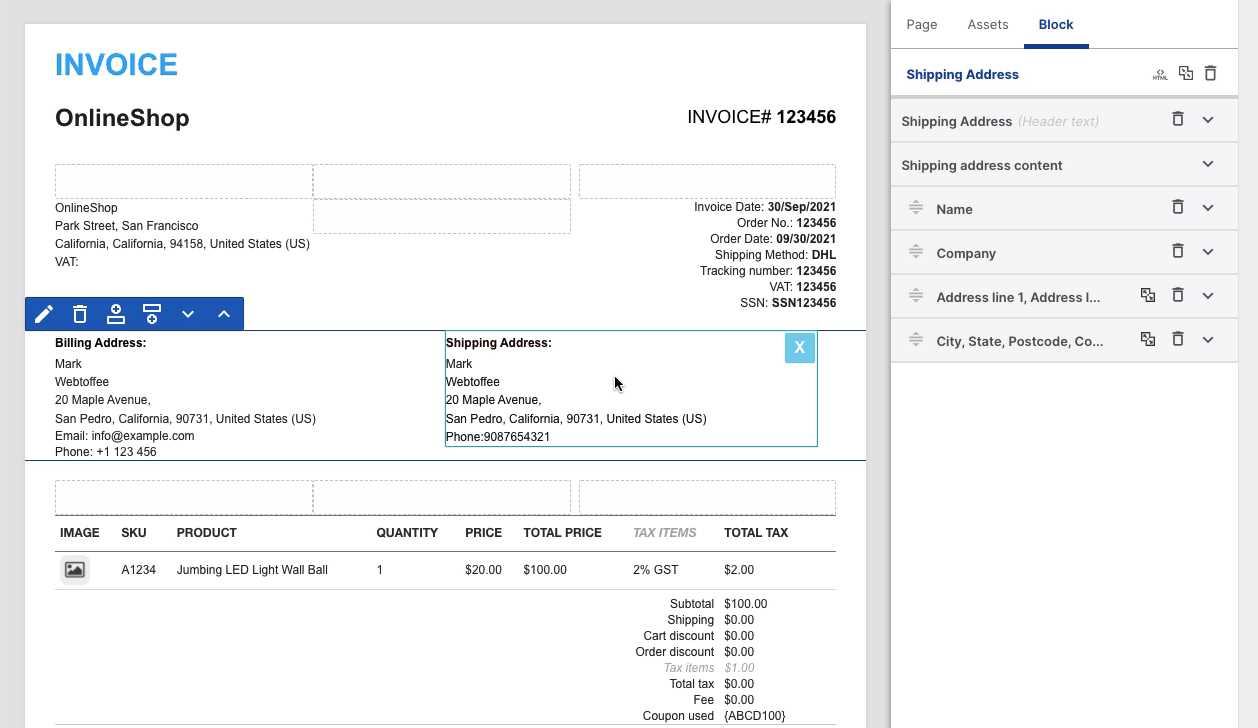

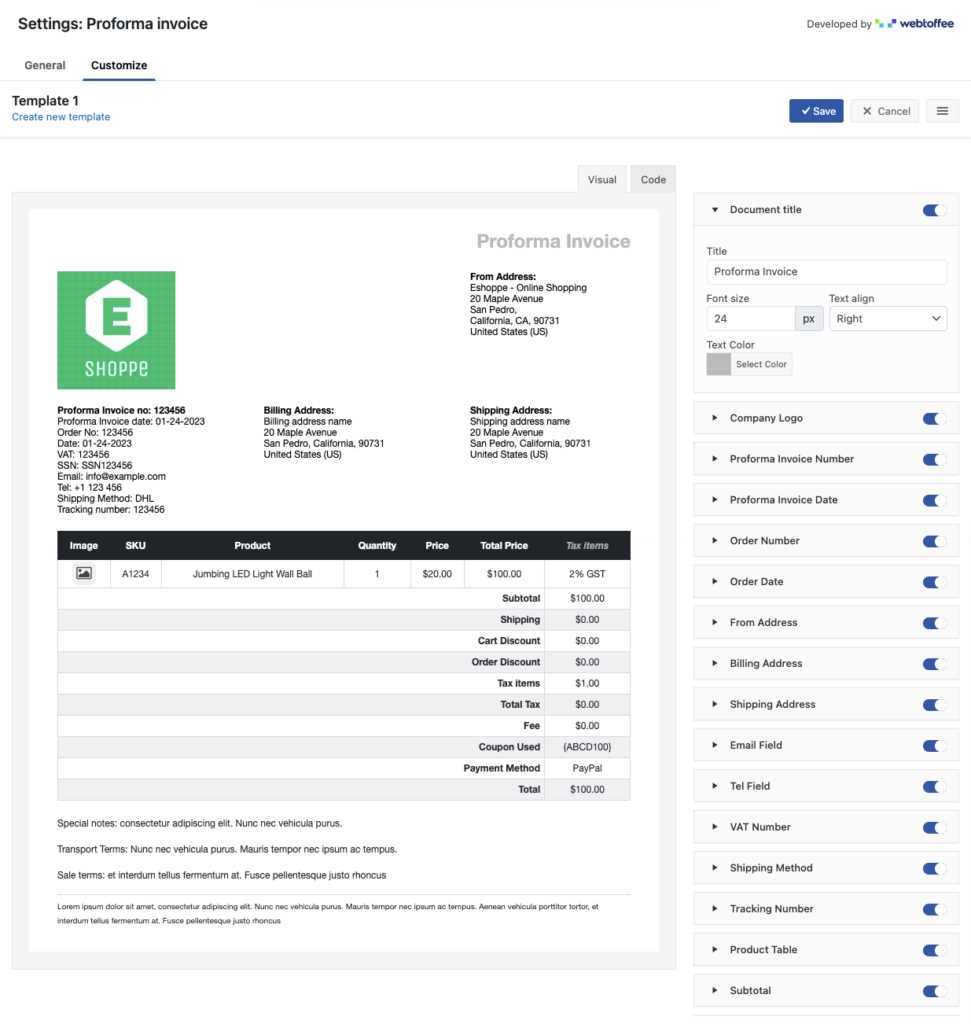

Personalizing your transaction documents allows you to reflect your brand’s identity while providing a professional and clear experience for customers. With the right tools, you can adjust various elements of these records to ensure they align with your business style and meet all necessary requirements. Customization can include anything from adding your company logo to modifying the layout to highlight specific details.

Key Customization Options

Here are some important aspects you can modify when designing these records:

- Branding Elements: Incorporate your company logo, colors, and fonts to create a branded look.

- Layout Adjustments: Change the order of information or add new sections such as payment terms or discount details.

- Legal Requirements: Ensure that the document includes the necessary tax, business registration, or other legal details based on your location.

- Customer Information: Include or remove fields such as billing address, shipping address, or order notes.

Steps to Customize

Follow these steps to personalize your transaction documents effectively:

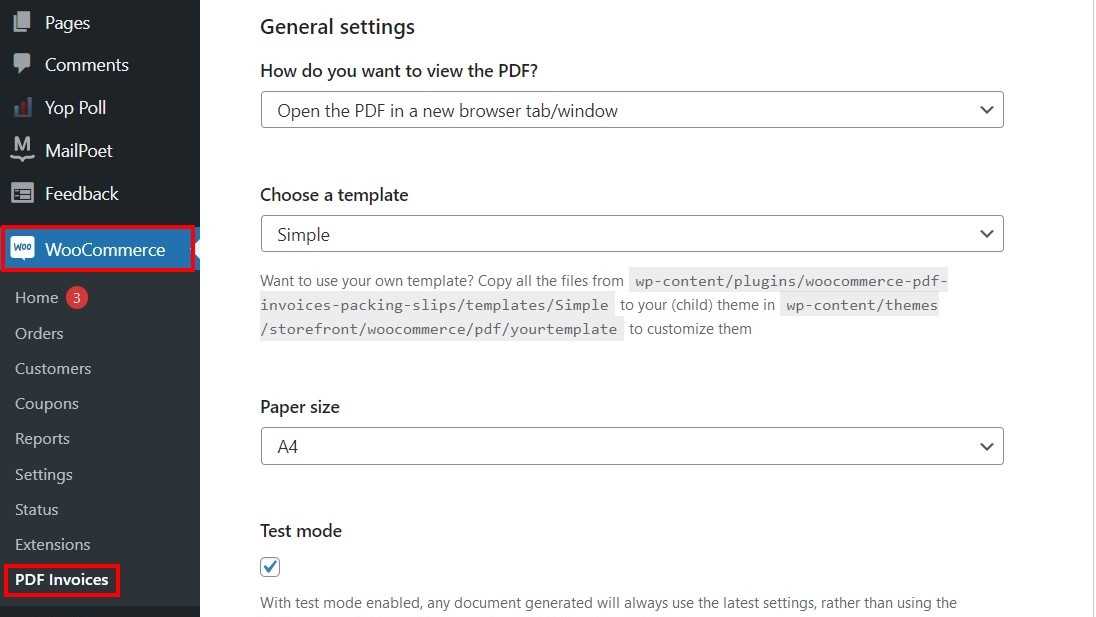

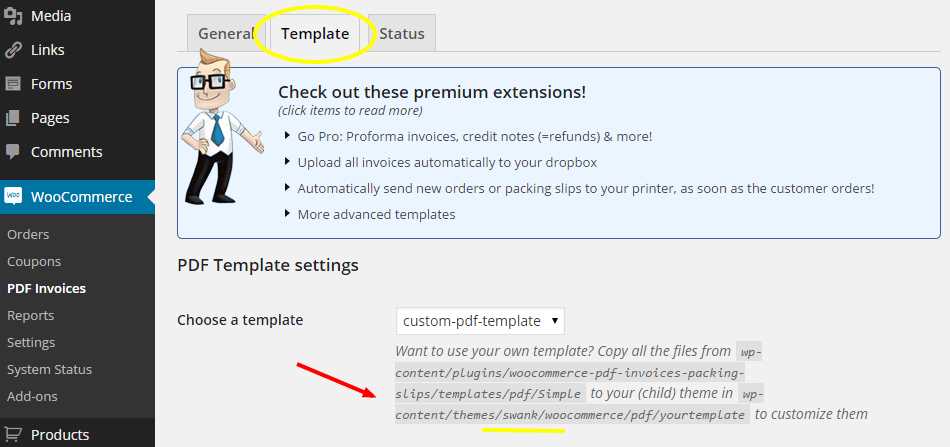

- Choose a customization plugin or tool that integrates with your store.

- Access the settings and explore the available options for layout and content changes.

- Upload your logo and select colors and fonts that match your brand’s design.

- Save your changes and test the document to ensure everything appears correctly for customers.

By taking the time to customize your records, you enhance both the customer experience and the professionalism of your online store. Tailored documents not only look better but also contribute to a more organized and efficient business operation.

Top Features to Look for in Templates

When selecting a solution for generating billing records, it’s essential to focus on features that can streamline your business operations, improve customer communication, and maintain a professional appearance. A well-rounded system should not only meet functional needs but also offer flexibility and ease of use. Here are some key features to consider when choosing the best solution for your online store.

Customization Options

A great document generator should provide ample customization capabilities. Look for a solution that allows you to adjust:

- Layout and Design: The ability to change the order of fields, font styles, and colors.

- Branding: Options to add your logo and adjust the appearance to match your brand identity.

- Additional Fields: The option to include or exclude details like payment terms, discount codes, or custom messages.

Automation and Integration

Another important aspect is how well the system integrates with your store’s workflow. A good solution should offer:

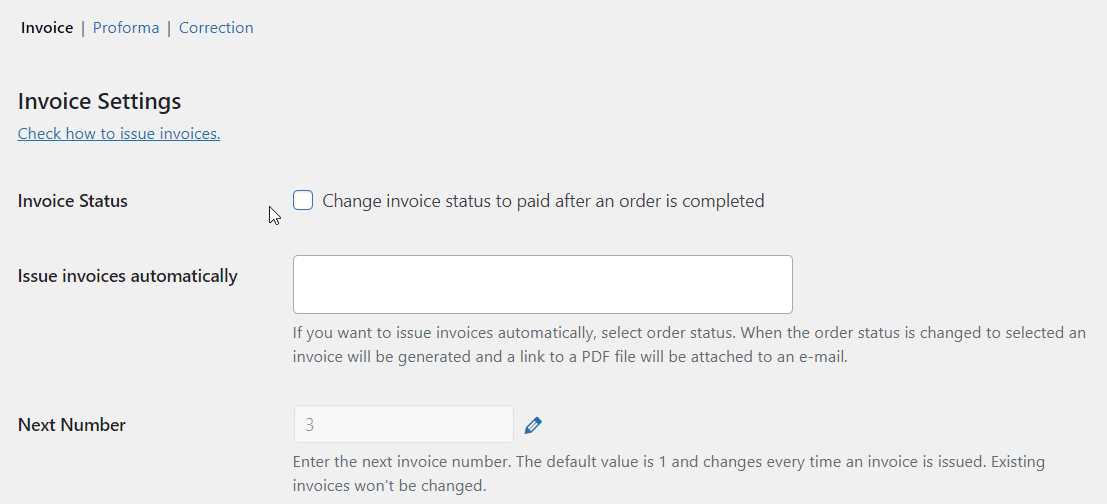

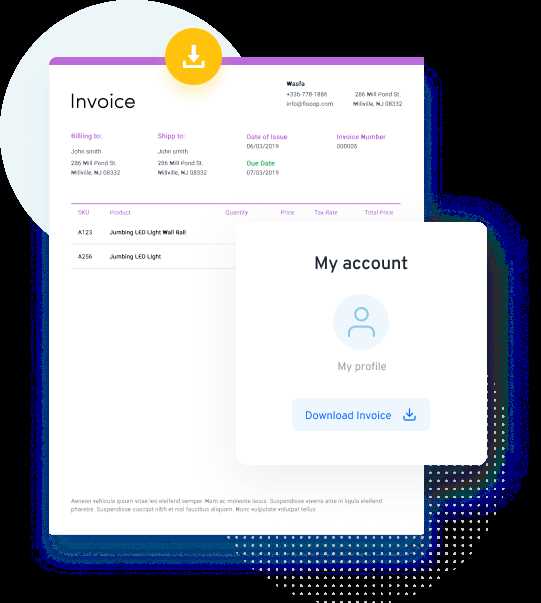

- Automatic Generation: The ability to generate documents automatically after a purchase or transaction is completed.

- Seamless Integration: Easy syncing with payment gateways, tax systems, and customer data.

- Email Delivery: Direct emailing of the document to customers upon completion of their order.

By focusing on these features, you ensure that your document system is efficient, adaptable, and aligned with your business’s needs. Whether you’re looking for customization flexibility or automated processes, these attributes help save time while maintaining professionalism.

Best Woocommerce Invoice Plugins for 2024

As the eCommerce landscape continues to evolve, the need for efficient, automated solutions grows. One of the key areas where businesses can improve their operations is in generating professional billing documents. In 2024, there are several plugins that stand out for their features, ease of use, and integration capabilities. These tools not only automate the process but also offer advanced customization options to ensure that each document meets your specific requirements.

Below is a comparison of the best options available in 2024, offering a range of features to help streamline your workflow.

| Plugin Name | Key Features | Best For | Price |

|---|---|---|---|

| PDF Invoices & Packing Slips | Automatic document generation, custom fields, logo integration, multilingual support | Small to medium-sized businesses | Free (with paid add-ons) |

| Print Invoice & Delivery Notes | Simple and easy design, bulk printing, export options | Businesses looking for straightforward solutions | Free |

| WooCommerce PDF Invoices & Packing Slips Professional | Custom templates, advanced customization, multiple document types | Large businesses needing advanced features | $49 per year |

| YITH WooCommerce PDF Invoice | Advanced document customization, automatic generation, email integration | Businesses requiring flexibility and customization | F

How to Automate Invoices in Woocommerce

Automating the generation and delivery of billing records is a critical step in streamlining your business operations. By setting up automation, you eliminate the need for manual processing, saving valuable time and reducing human error. This ensures that customers receive their documents promptly, with all the necessary details included, and that your business maintains an organized, efficient workflow. Here are the key steps to automate the creation and distribution of financial documents for your online store:

Automating this process not only saves time but also enhances the customer experience by providing immediate access to transaction records. Additionally, it helps maintain consistency and accuracy across all generated documents, making it easier to manage your business’s financial records. Designing a Professional Invoice LayoutCreating a visually appealing and well-structured document is essential for leaving a lasting impression on your customers. A professional layout not only improves readability but also reflects the credibility and reliability of your business. The design should be clean, clear, and aligned with your brand’s identity while ensuring all necessary details are easily accessible. Key Elements of a Professional DesignWhen designing your billing records, consider incorporating the following elements for a polished look:

Improving Readability and User ExperienceIn addition to aesthetics, functionality should be a priority. A well-designed document is not only attractive but also practical. To enhance usability:

By focusing on these design principles, you ensure that your billing records are not only functional but also leave a professional, lasting impression on your clients, helping to strengthen your brand’s reputation. Integrating Your Invoice with Payment Gateways

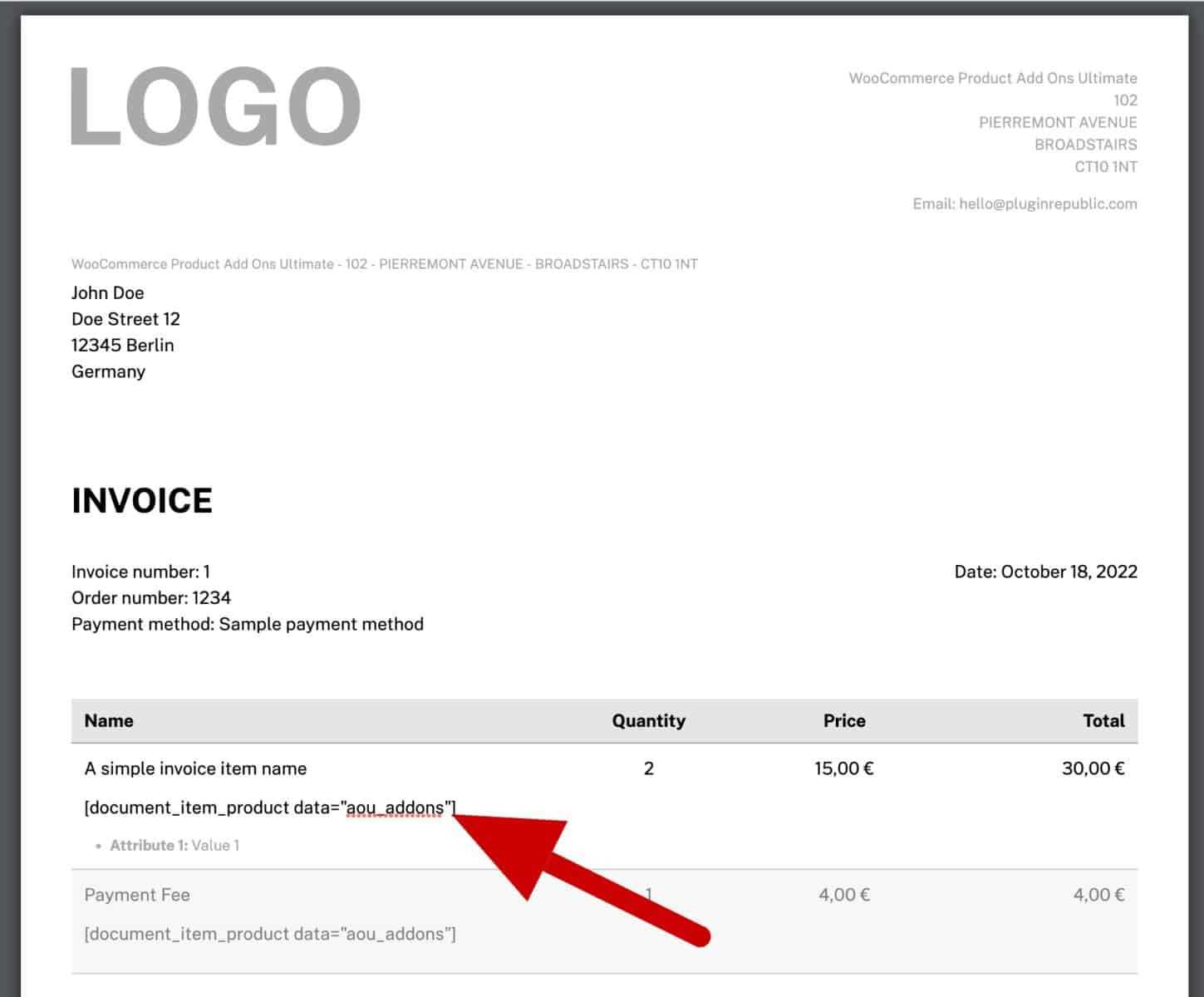

Seamless integration between your billing system and payment processors ensures a smooth, automated workflow. By connecting your transaction documents directly with payment gateways, you can automatically capture relevant payment details and update your financial records without manual input. This not only saves time but also reduces errors, ensuring that customers receive accurate and timely statements. Here’s how you can effectively integrate your payment system with your billing documents: 1. Choose a Compatible Payment GatewayFirst, ensure that your payment gateway is compatible with your online store’s system. Popular solutions like PayPal, Stripe, and others often offer built-in integration features that make it easy to connect payment data with generated documents. This enables the automatic inclusion of transaction details, such as payment status and amount paid, directly into the document. 2. Enable Automatic Payment SyncOnce integration is set up, enable automatic synchronization between the payment processor and your billing system. This will allow payment confirmations to be reflected in the generated records as soon as a transaction is completed. The system will also update any order status changes and include payment information, reducing the need for manual updates. 3. Customize Payment DetailsCustomize how payment details appear on your billing documents. You can add sections for payment method, transaction IDs, and even a payment breakdown. This helps customers understand how their payment was processed and provides them with clear references for future inquiries. By integrating your payment processing system with your billing documents, you ensure that all information is synchronized, error-free, and instantly available to your customers. This improves both operational efficiency and customer satisfaction by providing accurate records and timely updates. Legal Requirements for Invoices in WoocommerceWhen running an online business, it’s crucial to ensure that your transaction records meet the legal requirements set by your local government and tax authorities. These requirements vary depending on your location, business size, and industry, but there are common elements that should be included in every document to maintain compliance and protect your business from potential legal issues. Essential Information for Legal ComplianceTo ensure your records meet legal standards, include the following details in each document:

Additional Legal ConsiderationsDepending on your country or region, there may be other specific legal requirements to be aware of:

By including these elements, you ensure that your billing records are legally compliant and help protect both your business and customers. Keeping accurate and thorough documentation is not only good practice but also a necessary step for running a transparent and trustworthy business. Optimizing Invoice Templates for Customer Experience

Providing customers with a seamless and clear experience during their purchase journey doesn’t end at checkout. The transaction records you send should not only be functional but also enhance the customer’s overall experience with your business. A well-designed document can improve satisfaction, reduce confusion, and build trust by delivering the right information in a user-friendly format. To optimize these documents for an exceptional customer experience, consider the following best practices:

By making your records clear, accessible, and personalized, you not only enhance the customer experience but also increase the likelihood of repeat business. Customers will feel confident in their transactions and more connected to your brand, ultimately fostering loyalty and trust. How to Add Company Branding to InvoicesIncorporating your company branding into transaction documents is an essential step in maintaining a professional and consistent customer experience. It helps reinforce your business identity and creates a memorable impression. By adding brand elements such as your logo, colors, and fonts, you ensure that every communication with customers feels cohesive and aligned with your overall brand presence. Here are the key ways you can add branding to your documents: 1. Add Your Logo

2. Use Your Brand Colors

3. Choose Consistent Fonts

4. Add a Personalized Message

5. Maintain a Consistent Layout

By incorporating these elements, you create a cohesive, professional, and branded experience that strengthens customer trust and loyalty. Customizing your transaction records is a small but effective way to ensure your business stands out and feels consistent across all customer Handling Multiple Currencies with InvoicesFor businesses that operate globally, managing transactions in multiple currencies is essential. It’s important that your transaction records accurately reflect the correct currency, ensuring both clarity and compliance for your customers. By implementing currency handling features, you can provide customers with a seamless experience, regardless of where they are located, while keeping financial records consistent and transparent. 1. Automatically Detecting Customer’s Currency

Many modern platforms allow you to automatically detect a customer’s location and adjust the currency accordingly. This feature ensures that your customer sees prices in their local currency, which simplifies the purchasing process and improves customer satisfaction.

2. Displaying Multi-Currency Information ClearlyWhen dealing with multiple currencies, it’s important to present the information in a clear and concise manner. Ensure that all relevant currency details are visible, so customers understand what they are being charged and in what currency. Transparency is key to avoiding misunderstandings.

By handling multiple currencies effectively in your transaction records, you make the purchasing experience easier for international customers, reduce the risk of errors, and maintain transparency in your financial dealings. This also helps build trust with your global audience, knowing they are being charged fairly and accurately, no matter where they are located. Common Mistakes to Avoid in InvoicingWhen generating financial documents for your customers, it’s essential to ensure accuracy and clarity. Mistakes in billing can lead to confusion, delayed payments, and even disputes with customers. Understanding and avoiding common errors can help streamline your financial processes, improve customer satisfaction, and maintain professionalism in your business operations. Here are some of the most frequent mistakes to avoid when creating billing documents: 1. Missing or Incorrect Information

2. Failure to Include Essential Terms

3. Not Sending Documents in a Timely Manner

By avoiding th How to Troubleshoot Invoice IssuesDealing with issues related to transaction records can be frustrating, especially when they affect payment processing or customer satisfaction. Common problems include discrepancies in amounts, missing details, or technical errors in the system. Troubleshooting these issues efficiently ensures smooth financial operations and prevents delays or misunderstandings with customers. 1. Verify the Information

Start by reviewing the document for any obvious mistakes. Check for incorrect or missing data, such as customer contact details, order descriptions, or pricing information. Simple errors like these are often the root cause of issues.

2. Check for System or Integration ErrorsIf the information seems correct but the issue persists, it may be related to the technical side of your business system. Errors can arise when there’s a problem with your billing or payment processing integration. Follow these steps to troubleshoot:

By systematically verifying the information and checking for technical issues, you can quickly identify the source of the problem. Keeping your documents accurate and ensuring the proper functionality of your system Improving Invoice Clarity and Detail

Clear and detailed financial documents are essential for a smooth transaction process and to maintain a positive relationship with customers. By providing comprehensive and easy-to-understand documents, you reduce the chance of confusion, disputes, and delayed payments. A well-organized record can also enhance your professionalism, making it easier for customers to review their purchases and understand their charges. 1. Organize Information LogicallyEnsure that the information is presented in a clear and structured way, with logical sections that make it easy to find relevant details. Organizing the document properly allows customers to quickly access the information they need without having to search through cluttered content.

2. Provide Detailed Descriptions and CalculationsCustomers should have all the necessary information to fully understand the charges. Be specific in your descriptions and ensure that calculations are transparent.

By ensuring that your transaction records are clear and well-detailed, you make it easier for your customers to review and confirm their purchases. This not only improves customer satisfaction but also helps prevent payment delays and disputes, ultimately supporting smoother and more efficient business operations. Ensuring Invoice Security and PrivacyIn today’s digital world, securing financial documents is critical to protect both your business and your customers from potential data breaches or unauthorized access. Safeguarding sensitive information such as customer details, payment amounts, and transaction history helps build trust and ensures compliance with privacy laws. Taking proactive steps to secure and protect these records is an essential part of your business operations. 1. Use Secure Channels for TransmissionSending sensitive financial documents over unsecured or public networks can expose them to risks. Ensure that all electronic communications, including the sending of transaction records, are protected by encryption and secure protocols.

2. Limit Access to Sensitive InformationRestricting access to financial records within your organization is key to preventing unauthorized use or exposure of sensitive information. Implement strong access controls and ensure that only those who need the data have access to it.

By focusing on security measures such as encryption, restricted access, and secure storage, you can protect sensitive financial data from being exposed or misused. This not only ensures compliance with data privacy regulations but also fosters trust with your customers, knowing their information is being handled with the utmost care and security. |