Wire Transfer Invoice Template for Efficient Payment Processing

In today’s fast-paced business world, ensuring smooth and secure payments is a top priority. One of the key elements for managing financial exchanges effectively is having a clear, structured way to document each transaction. Properly formatted financial documents not only streamline payment processing but also help maintain transparency between parties involved.

Whether you’re sending or receiving funds, using a well-organized billing format can eliminate confusion and prevent costly errors. These documents should include all relevant details such as payment amounts, due dates, and recipient information. By adopting a standardized approach, businesses can ensure that every transaction is recorded accurately and efficiently.

Customizing your billing documents to suit your specific needs can further enhance clarity and professionalism. Many companies opt for digital formats that can be easily tailored, saved, and sent with just a few clicks. This not only reduces paperwork but also improves overall workflow.

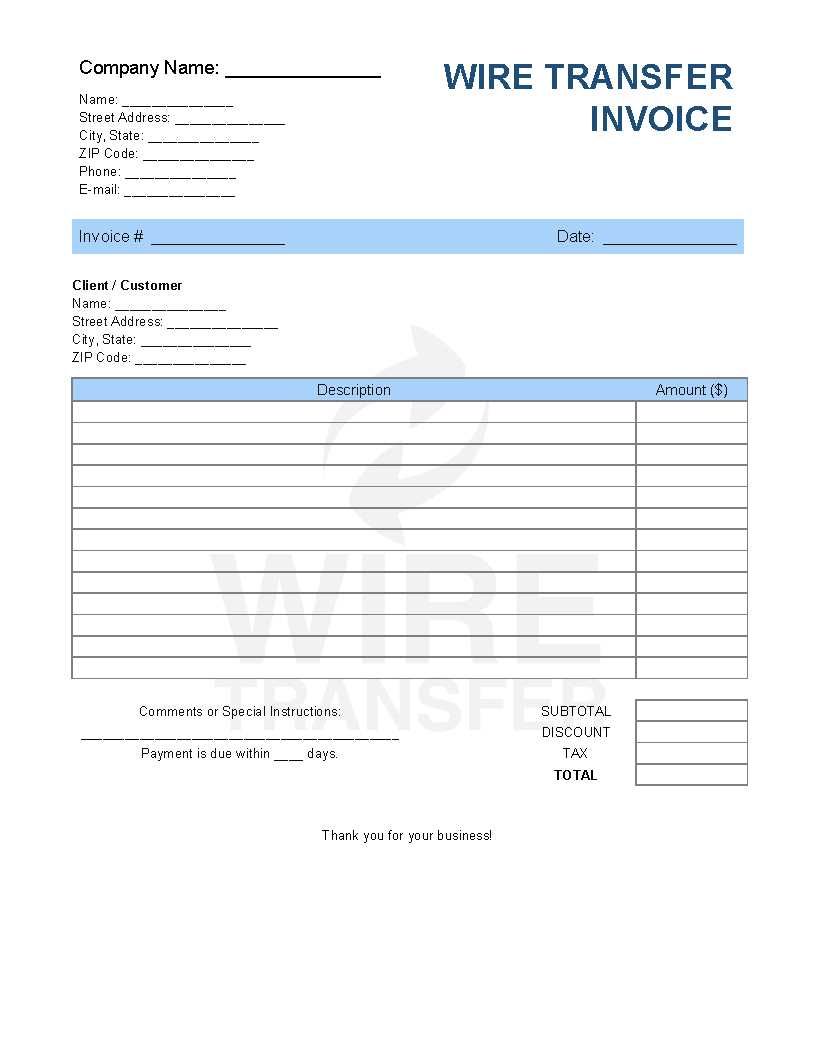

Wire Transfer Invoice Template Overview

In the business world, accurate and organized documentation is essential for managing financial transactions. Whether you’re handling payments between companies or dealing with international clients, having a standardized format to record details can help ensure that everything is clear and transparent. A structured document can reduce confusion, prevent errors, and serve as a reliable reference for both parties involved.

Such documents typically include vital information like transaction amounts, payment dates, and the specific terms agreed upon. These details are crucial for smooth processing and for keeping a professional record of all exchanges. Below is an example of what such a document might look like:

| Field | Description |

|---|---|

| Sender’s Name | The name of the individual or company initiating the payment. |

| Recipient’s Name | The name of the individual or company receiving the payment. |

| Payment Amount | The total amount of money being sent. |

| Payment Date | The date when the payment is processed or scheduled. |

| Payment Method | Details about how the funds are being transferred (e.g., bank wire, online transfer). |

| Transaction Reference | A unique code or number for tracking the payment. |

By following a consistent structure, businesses can ensure that each transaction is processed smoothly, providing both parties with a clear and organized record of the financial exchange.

Why Use a Wire Transfer Invoice

Proper documentation is crucial when it comes to financial exchanges. Whether you’re paying for services or receiving funds, having a structured record of each transaction provides clarity and ensures that all parties are on the same page. Without clear documentation, misunderstandings can arise, leading to potential delays or disputes. A standardized record can help streamline the process and keep everything organized.

Here are some reasons why such a document is important:

- Transparency: Both parties can clearly see the details of the transaction, ensuring that there are no discrepancies in the payment amount or terms.

- Record Keeping: It serves as an official record for both sender and recipient, which can be used for future reference or financial reporting.

- Clarity: Including all relevant details, such as payment method, amounts, and dates, helps prevent confusion and ensures smooth communication between parties.

- Professionalism: Using a standardized document gives your business a more polished and credible appearance, which can foster trust with clients and partners.

- Compliance: A properly documented payment can be crucial for meeting legal or regulatory requirements, especially for large or international payments.

Ultimately, having a clear, well-organized document is an essential tool for ensuring smooth, error-free financial transactions in both personal and business contexts.

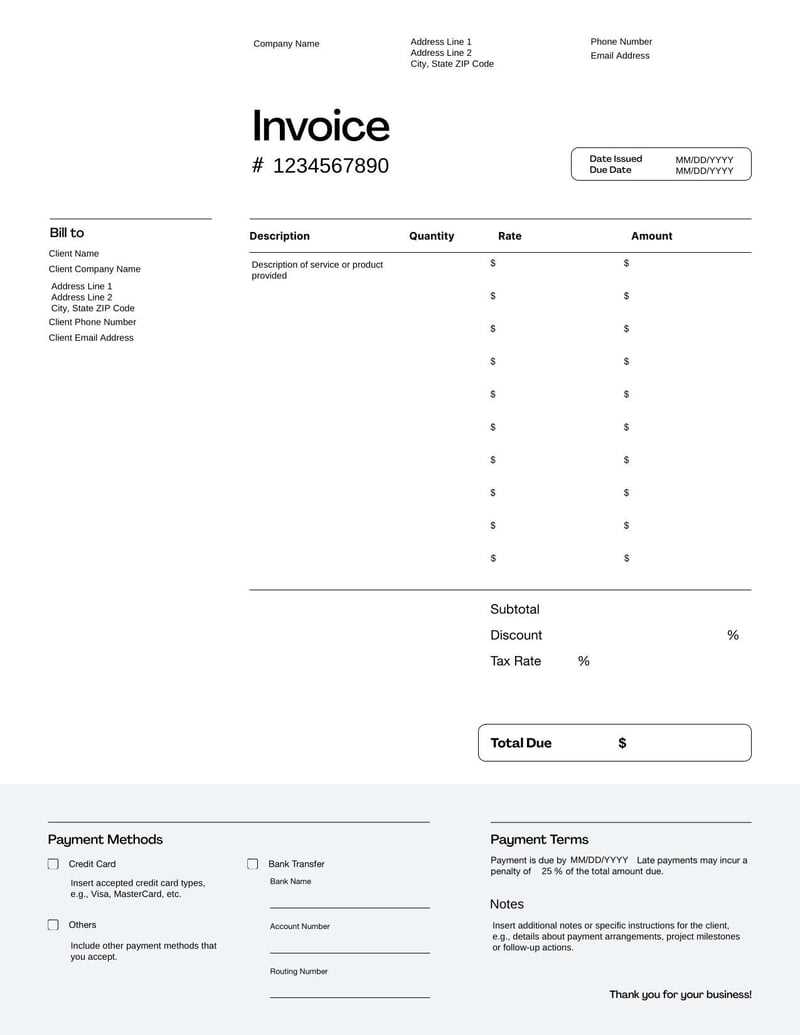

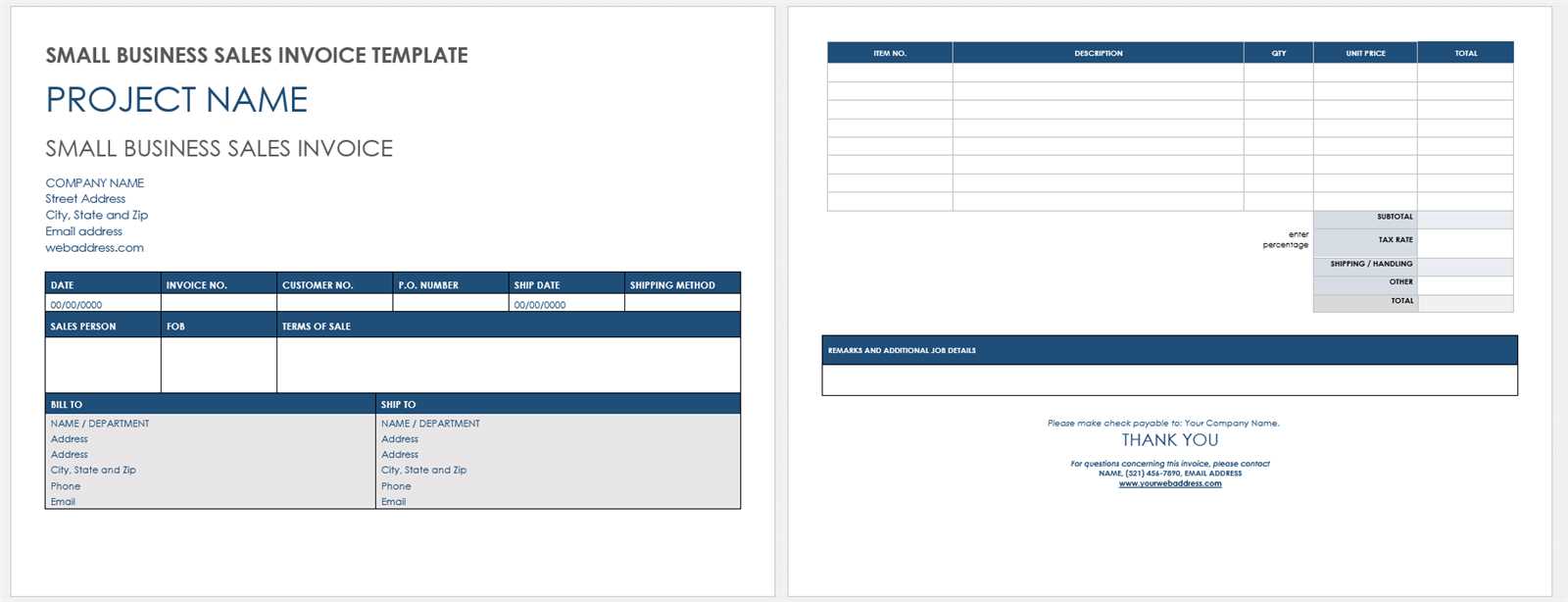

Key Features of an Effective Template

When creating a document for financial transactions, it’s essential to include all relevant details in a clear and organized manner. The right structure not only helps prevent errors but also ensures that both the sender and recipient understand the terms of the payment. A well-designed document should be simple yet comprehensive, making it easy to track, process, and reference each transaction.

Essential Elements to Include

An effective document format should contain the following key details to ensure smooth processing:

| Element | Description |

|---|---|

| Sender Information | Name, address, and contact details of the person or company making the payment. |

| Recipient Information | Name, address, and contact details of the person or company receiving the payment. |

| Transaction Amount | Total sum of money being sent, clearly stated in the relevant currency. |

| Payment Date | The exact date the funds are being sent or expected to arrive. |

| Payment Method | Details on how the payment is being processed (e.g., bank, online platform, etc.). |

| Transaction Reference | A unique identification number or code for tracking the payment. |

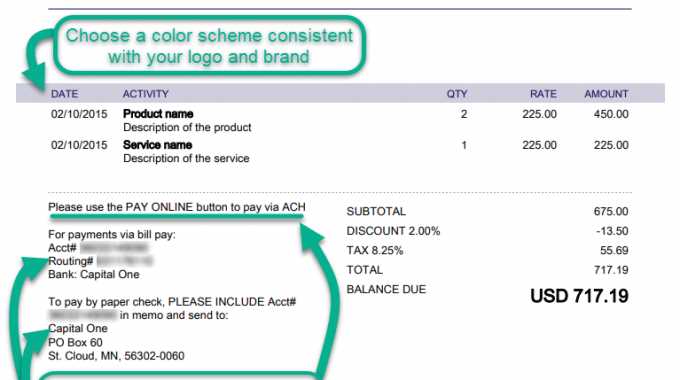

Design and Usability

The design of your document should also be user-friendly. A clear layout with easy-to-read fonts, logical section breaks, and consistent formatting helps avoid confusion. Having fields or sections that are easy to fill out ensures that the document is functional for both parties, saving time and reducing the chances of errors.

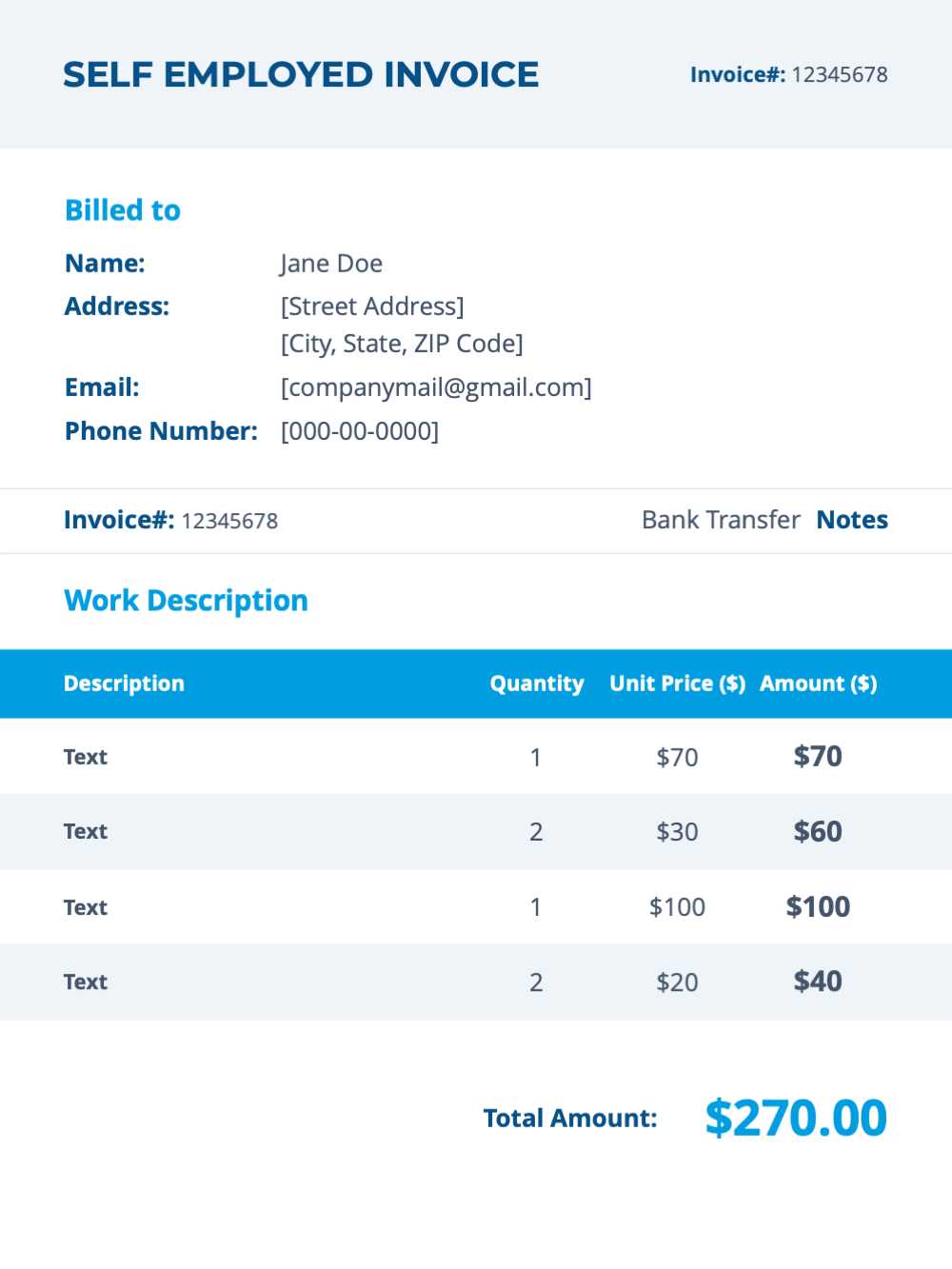

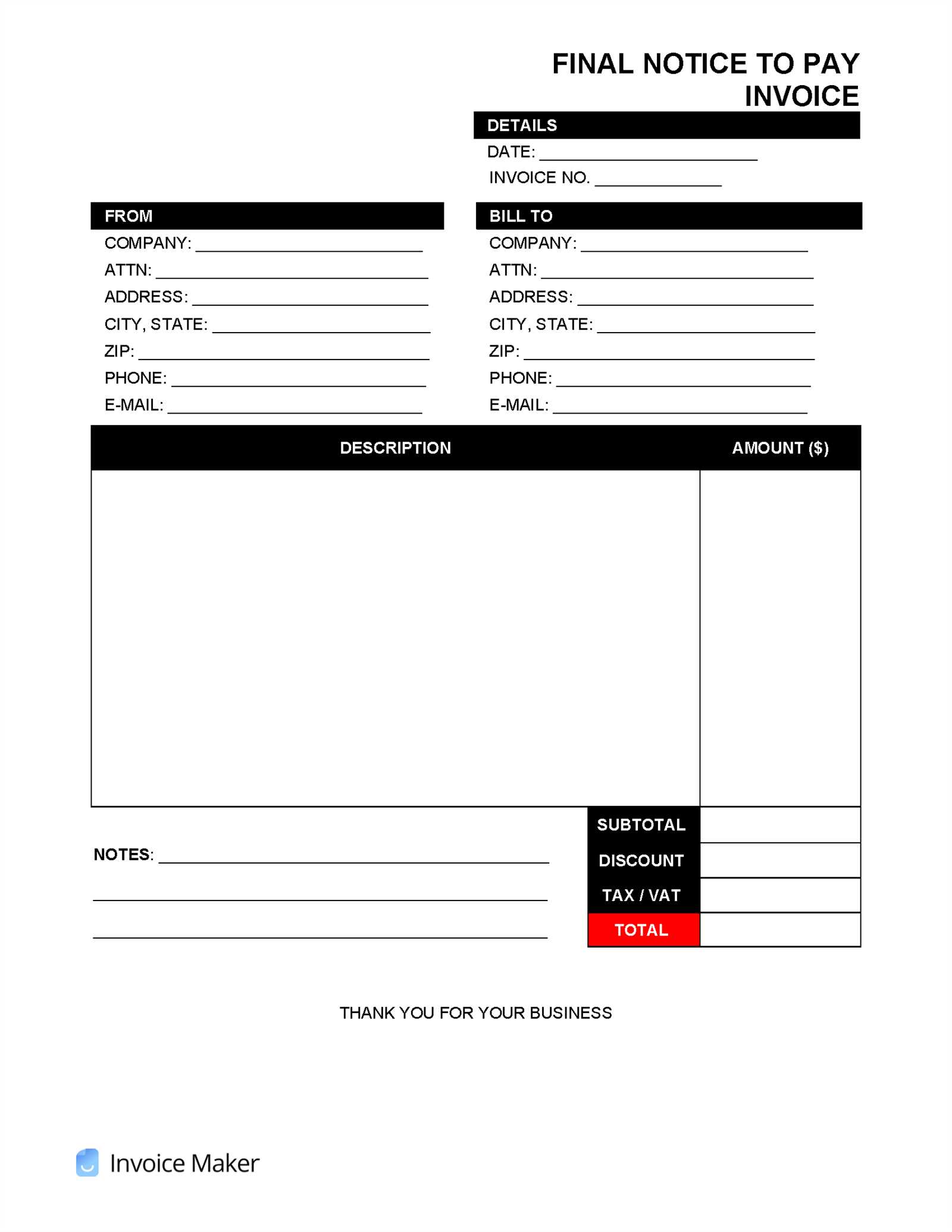

How to Customize Your Invoice

Customizing your financial documentation is an important step to ensure it aligns with your business needs and provides clear, professional communication. Tailoring your document allows you to reflect your company’s branding, accommodate specific payment details, and ensure that both you and your client are on the same page. Whether you’re handling routine transactions or one-off payments, a personalized format can improve efficiency and professionalism.

Here are some key areas to focus on when customizing your document:

- Company Branding: Include your company logo, name, address, and contact details. This not only adds a professional touch but also reinforces your brand identity.

- Payment Terms: Adjust payment terms based on your agreement with the client, such as due dates, late fees, or early payment discounts.

- Design Elements: Choose the appropriate fonts, colors, and layout that match your business style. Consistent design will make your document visually appealing and easy to read.

- Payment Instructions: Clearly state how and where the payment should be made, especially if there are multiple methods of payment available.

- Unique Reference Codes: If necessary, assign a unique transaction or order number for tracking purposes. This is helpful for both you and your client to identify the transaction quickly.

Customizing your document allows you to create a seamless experience for both parties. Ensuring that all details are clear and specific to the transaction reduces the chances of misunderstandings and helps maintain a smooth payment process.

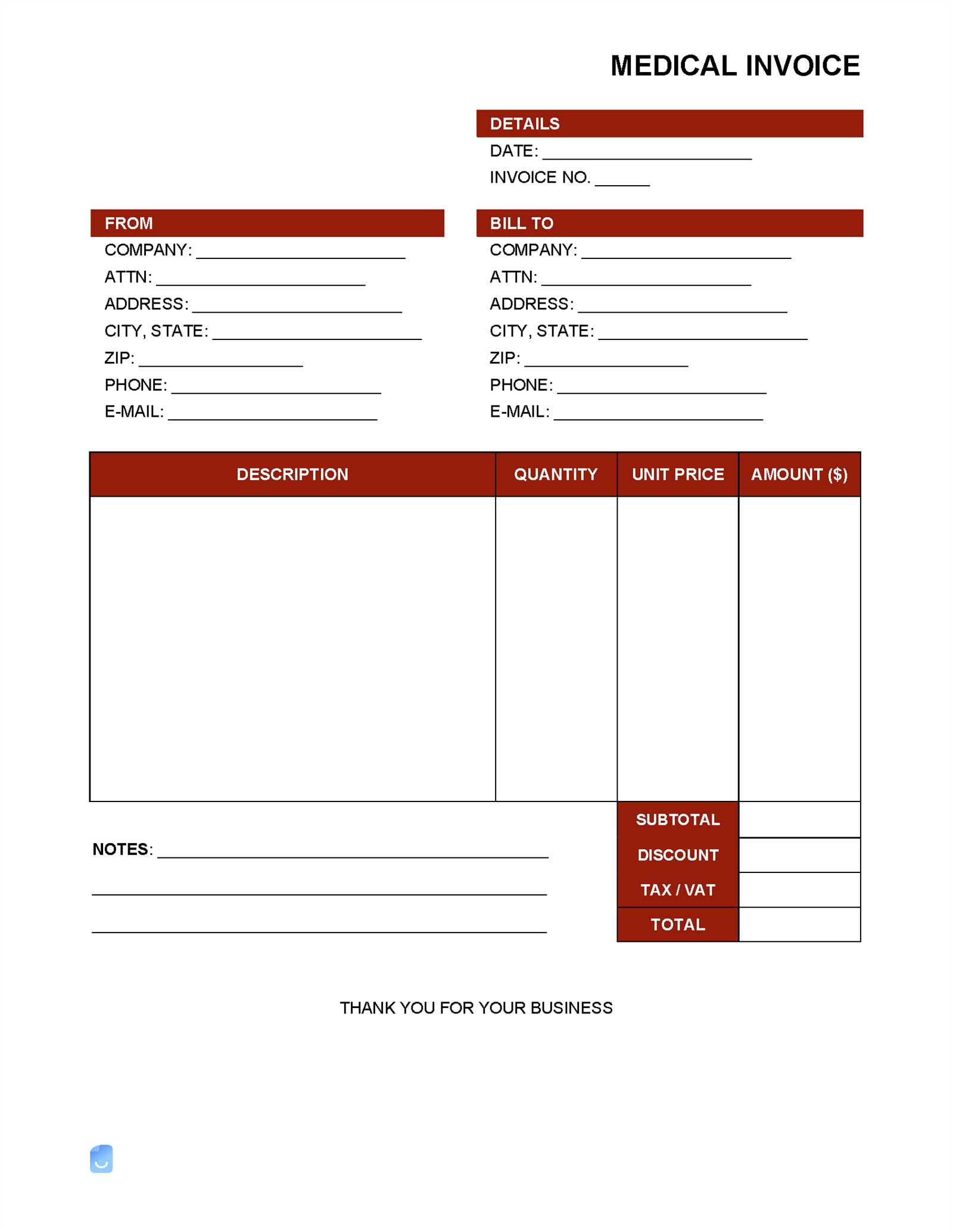

Wire Transfer Invoice for International Payments

When handling global transactions, it’s crucial to ensure that all necessary details are included in your financial documentation to avoid confusion and delays. International payments often involve different currencies, exchange rates, and legal requirements, making it essential to clearly outline these factors in your payment record. Properly structured documents can simplify the process, ensuring that both parties understand the terms and that payments are processed smoothly across borders.

In the case of international transactions, there are additional pieces of information that should be included to facilitate seamless processing:

| Element | Description |

|---|---|

| Sender’s Bank Information | Bank name, account number, and SWIFT/BIC code for the sender’s financial institution. |

| Recipient’s Bank Information | Details of the recipient’s bank, including bank name, account number, and SWIFT/BIC code. |

| Currency and Exchange Rate | The currency being used and the applicable exchange rate for the transaction. |

| Payment Reference | A unique reference number or code to track the transaction for both parties and the banks involved. |

| International Payment Fees | Any additional fees associated with the payment, such as service charges or intermediary bank fees. |

Including these details helps prevent payment delays and ensures that both the sender and recipient have the necessary information to complete the transaction. Clear documentation is especially important in international deals to maintain transparency and trust between parties, no matter where they are located.

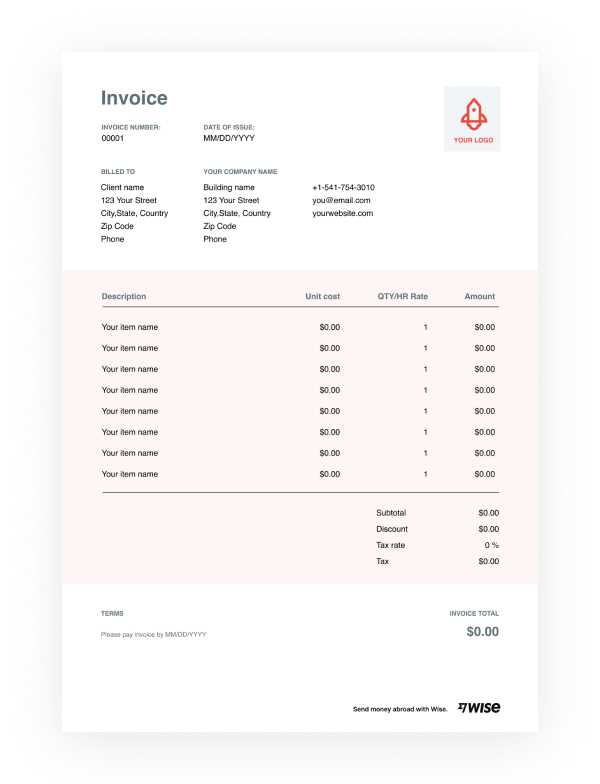

Essential Elements to Include in Your Template

For any payment documentation to be effective, it is important to include all the relevant details in a clear and concise manner. This ensures that both the sender and recipient have a full understanding of the transaction, minimizing confusion and the risk of errors. Whether you’re creating a document for regular business use or a one-time payment, certain elements must be included to maintain professionalism and transparency.

Key Information to Include

To ensure accuracy and clarity, the following details should be present in any well-structured financial document:

- Sender’s Details: Include the name, address, and contact information of the individual or company making the payment.

- Recipient’s Details: Clearly state the name, address, and contact information of the party receiving the funds.

- Transaction Amount: Specify the total amount of money being transferred, including the currency in which the payment is made.

- Payment Date: Indicate the date the payment is being sent or expected to be received.

- Payment Method: Describe how the funds are being processed (e.g., bank, online payment system, etc.).

- Unique Reference Code: Include a transaction reference number to help track and identify the payment.

Additional Considerations

Besides the basic elements, there are a few more items to consider including for smoother processing:

- Payment Terms: Specify the due date, any early payment discounts, or late fees, as applicable.

- Transaction Fees: List any service charges, intermediary fees, or other costs associated with the transaction.

- Currency Exchange Information: If the payment involves multiple currencies, ensure the exchange rate is clearly stated and that both parties are aware of the conversion process.

Including these elements ensures that the transaction is fully documented and easy to reference in the future. Properly outlining the details not only increases professionalism but also helps prevent misunderstandings during the payment process.

Common Mistakes in Wire Transfer Invoices

Even a small mistake in financial documentation can lead to confusion, delays, and even disputes between the parties involved. When creating payment records, it’s crucial to ensure that all the necessary details are accurate and clearly presented. Common errors can often be overlooked, but they can have significant consequences, especially when dealing with large sums or international transactions. Identifying and correcting these mistakes is essential for smooth and efficient payment processing.

Here are some of the most frequent mistakes people make when creating financial records:

- Incorrect or Missing Recipient Information: One of the most common errors is failing to include accurate contact details or banking information for the recipient. Without this, the payment could be delayed or misdirected.

- Ambiguous Payment Amount: If the amount of the transaction is not clearly stated or if there are discrepancies between the amount mentioned in the document and the actual payment, it can lead to confusion and payment errors.

- Unclear Payment Terms: Failing to specify the payment due date, terms of service, or late fees can cause misunderstandings between the parties involved. It’s important to clearly outline expectations.

- Omitting Transaction Fees: Neglecting to include additional charges, such as service fees or conversion rates, can create conflicts later, especially if the recipient is unaware of the costs involved.

- Not Using a Reference Number: Without a unique reference code or transaction number, it becomes difficult to track payments, especially for large volumes or international transactions.

- Incorrect Currency Information: If the transaction involves multiple currencies, failing to list the correct currency or exchange rate can result in incorrect amounts being transferred.

By paying attention to these potential issues, you can ensure that your payment records are accurate, clear, and complete. Taking the time to double-check all details will prevent unnecessary problems and ensure a smooth transaction process.

Legal Considerations for Wire Transfers

When engaging in financial transactions, it is important to be aware of the legal requirements and regulations that govern the process. Each payment, whether domestic or international, may be subject to different laws, depending on the jurisdiction and the nature of the transaction. Ensuring that all legal aspects are properly addressed is crucial for protecting both the sender and the recipient, as well as for preventing potential disputes or legal issues.

Some key legal considerations to keep in mind when documenting and processing payments include:

- Compliance with Local and International Regulations: Financial transactions, especially those involving multiple countries, must comply with regulations such as anti-money laundering (AML) laws, know your customer (KYC) guidelines, and sanctions lists. Failing to adhere to these regulations could result in penalties or the freezing of funds.

- Clear Payment Terms: It is essential to outline payment terms explicitly in any financial document, including deadlines, late fees, and refund policies. This protects both parties and ensures that the transaction is carried out according to agreed-upon terms.

- Tax Obligations: Depending on the size of the transaction and the countries involved, there may be tax reporting requirements. Ensure that any applicable taxes, such as value-added tax (VAT) or sales tax, are clearly stated and that both parties are aware of their obligations.

- Currency and Exchange Rates: When making payments in foreign currencies, it is important to clearly specify the exchange rate and how it will affect the total amount. Disputes may arise if there is ambiguity in the conversion process.

- Data Protection: Both parties must ensure that sensitive financial information, such as banking details, is handled in accordance with data protection laws like the GDPR (General Data Protection Regulation) or other privacy laws, particularly when dealing with cross-border transactions.

By addressing these legal factors, businesses and individuals can avoid complications and ensure that their financial dealings are legitimate and compliant with the law. Taking these precautions also helps foster trust between the parties involved, which is key to maintaining a professional relationship.

Best Practices for Creating Clear Invoices

Creating clear and professional payment documents is essential to ensure that transactions are processed smoothly and without confusion. A well-structured record helps both the sender and the recipient understand the terms of the payment, reducing the risk of errors, disputes, and delays. By following best practices, you can ensure that your financial documentation is both effective and easy to understand.

Here are some best practices for creating clear and organized payment records:

- Use a Clean and Simple Layout: Keep the document layout organized with distinct sections. Ensure that the text is legible by using a simple font and appropriate font size. A clean design makes it easier for both parties to read and verify the information quickly.

- Clearly Label All Sections: Label all relevant sections of the document, such as sender information, recipient details, payment amount, and due date. This helps avoid confusion and allows for quick referencing of specific information.

- Include Complete Contact Information: Always include full contact details for both the sender and recipient. This makes it easy to reach out in case of discrepancies or clarifications.

- Specify Payment Terms: Clearly state the payment due date, any late fees, discounts, or other conditions. Providing this information upfront helps prevent misunderstandings and ensures that both parties are aligned on expectations.

- Break Down Charges: If there are multiple components to the payment, such as taxes, fees, or services rendered, clearly break down the costs in a detailed manner. This transparency avoids confusion about the total amount due.

- Double-Check All Details: Always review the document for accuracy before sending it. Ensure that all names, amounts, and transaction details are correct to avoid potential disputes.

- Highly secure

- Ideal for large transactions

- Supports international payments

- Can take several business days

- May involve fees, especially for international transactions

- Requires accurate bank details

- Instant payment processing

- Widely accepted for both domestic and international payments

- Transaction fees may apply

- Subject to credit limits and potential fraud risks

- Fast and convenient

- Minimal setup required

- Widely used for online purchases and services

- Fees for transactions

- Not as secure for large transactions

- Common in some regions and industries

- Can be used for large payments

- Processing can be slow

- Risk of bounced checks

- Automatic Data Sync: Integration allows payment information to be automatically transferred into your accounting software, reducing the need for manual input and minimizing the risk of errors.

- Real-Time Financial Tracking: As soon as payments are recorded, they update your balance sheet and other financial records in real time, providing up-to-date insights into your financial status.

- Improved Tax Reporting: Linking payment records with accounting software makes it easier to generate accurate tax reports, ensuring compliance and simplifying tax preparation.

- Faster Reconciliation: Integration allows for quicker reconciliation of accounts, as the payment data can be matched with bank statements and other financial records with ease.

- Reduced Administrative Costs: By automating the process of documenting and processing payments, you can save time and reduce the cost of manual accounting work.

Wire Transfer Invoices vs Other Payment Methods

When choosing a method for processing payments, businesses and individuals must consider a variety of factors including speed, security, cost, and ease of use. Different payment methods offer different advantages and drawbacks, depending on the nature of the transaction and the parties involved. Understanding the distinctions between various options can help you choose the most appropriate method for your needs.

Below is a comparison of different payment methods, highlighting the pros and cons of each:

| Payment Method | Advantages | Disadvantages |

|---|---|---|

| Bank Transfers |

|

|

| Credit and Debit Cards |

|

|

| Online Payment Systems (e.g., PayPal, Stripe) |

|

|

| Checks |

|

|

Choosing the right method depends on the specific needs of the transaction. For example, bank transfers are often preferred for large, secure payments, while online payment systems offer fast, convenient options for smaller amounts. Ultimately, it’s important to weigh the benefits and costs of each method before deciding on the most suitable one for your business or personal transactions.

Integrating Your Template with Accounting Software

Integrating payment documents with accounting software can significantly streamline your financial processes. By linking your payment records with your accounting system, you ensure seamless tracking of transactions, automatic updates to your accounts, and better overall financial management. This integration helps minimize manual entry errors, improves efficiency, and provides more accurate financial reporting.

Here are some benefits and steps for integrating your payment documentation with accounting software:

To integrate your payment system with accounting software, follow these steps:

- Choose Compatible Software: Make sure the accounting software you use supports integration with your payment system or platform. Many modern accounting tools offer built-in integrations.

- Set Up Integration: Follow the software’s instructions to connect your payment system with the accounting platform. This may involve API keys, authorization protocols, or syncing your accounts.

- Test the Integration: Before fully relying on the system, test the integration by making a few transactions and verifying that the data appears correctly in your accounting software.

- Monitor Regularly: Ensure that the integration is running smoothly by regularly reviewing the records and making adjustments if necessary.

By integrating your payment documents with accounting software, you not only improve the accuracy and efficiency of your financial operations but also ensure that your business remains organized and compliant with financial regulations.

Automating Wire Transfer Invoice Generation

Automating the creation of payment documentation can significantly improve efficiency and accuracy in financial processes. By setting up an automated system for generating payment records, businesses can save time, reduce human error, and ensure consistency across all transactions. This approach is especially beneficial for organizations that handle high volumes of payments or work with multiple clients, as it allows for seamless generation of documents without the need for manual input each time a payment occurs.

Here are some key benefits of automating the creation of payment documents:

- Efficiency Gains: Automation reduces the time spent manually generating payment records, allowing your team to focus on other important tasks. Payments can be processed and documented almost instantly.

- Improved Accuracy: By eliminating human error, automated systems ensure that the details in your payment records, such as amounts, dates, and recipient information, are correct every time.

- Consistency: Automated generation ensures that every payment record follows the same structure and includes all necessary information, maintaining consistency across all transactions.

- Faster Turnaround Time: With automation, documents are created in real-time as payments are processed, speeding up the overall financial workflow and reducing delays.

- Integration with Other Systems: Automated systems can be integrated with accounting software, CRMs, and other platforms, ensuring that payment records are seamlessly synced with your financial and client management systems.

To set up an automated payment document generation system, follow these steps:

- Choose Automation Tools: Select software or platforms that allow for automated document creation. Many accounting and payment platforms offer built-in automation features for generating payment records.

- Set Up Payment Templates: Create predefined document structures that include all the necessary fields for payment details, such as recipient information, amounts, payment method, and terms. These templates can be customized for different clients or payment scenarios.

- Integrate with Payment Systems: Connect your payment system to the automation tool so that payment details can be automatically pulled into the generated documents as soon as a transaction is processed.

- Review and Test: Before fully automating the process, conduct thorough testing to ensure the system generates accurate documents and functions smoothly across different scenarios.

- Monitor and Update: Regularly review the system’s performance to ensure everything runs as expected and make updates as necessary to adapt to any changes in payment processes or business requirements.

Automating the generation of payment records not only increases efficiency but also helps ensure a smooth, error-free payment process. By reducing the manual effort required, businesses can streamline their operations, improve accuracy, and maintain consistency in their financial

How to Track Payments Using Invoices

Tracking payments is an essential part of managing financial records, especially for businesses that handle multiple transactions. By using structured documents to monitor each payment, you can ensure that all amounts due are paid on time and that you have a clear record of all completed and outstanding transactions. A proper tracking system provides transparency, helps prevent errors, and allows you to quickly identify overdue payments or discrepancies.

Here are some strategies and steps for tracking payments using financial records:

- Assign Unique Reference Numbers: Each payment document should have a unique identifier, such as an invoice number, which helps you easily track and locate specific transactions within your records.

- Include Payment Due Dates: Make sure that all documents clearly indicate the payment due date. This will help you stay on top of deadlines and follow up with clients if a payment is overdue.

- Record Payment Status: Keep track of the status of each transaction, whether it’s “Paid,” “Unpaid,” or “Pending.” This can be noted directly on the document or within a separate tracking system.

- Use a Payment Log or Spreadsheet: Maintain a payment log that tracks each document, the payment amount, due dates, and payment status. This allows you to have an overview of all payments at a glance.

- Set Up Automatic Reminders: If you are using accounting software, set up automated reminders to notify you when payments are approaching or overdue. This can help you manage follow-ups without manually checking each document.

Below is a sample table format that can be used to track payment statuses for multiple transactions:

| Reference Number | Client Name | Amount Due | Due Date | Status | Payment Date | |||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 00123 | Client A | $500.00 | 2024-11-15 | Paid | 2024-11-14 | |||||||||||||||||||||||||

| 00124 | Client B | $300.00 | 2024-11-20 | Pending | – | |||||||||||||||||||||||||

| 00125 | Client C | $700.00 |

| Section | Details to Include |

|---|---|

| Header | Company name, logo, and contact information |

| Recipient Details | Client name, address, and contact details |

| Payment Breakdown | Itemized list of services, products, or fees, along with corresponding amounts |

| Total Amount | Clearly indicate the total payment due |

| Payment Terms | Due date, payment methods accepted, and any late fees or discounts |

By following these design tips, you can create professional documents that not only convey necessary information but also make a positive impression on your clients. A well-designed payment document is a reflection of your br

Handling Disputes and Refunds with Invoices

Disputes and refund requests are common in business transactions, and handling them efficiently is crucial for maintaining strong client relationships and ensuring smooth financial operations. When clients raise concerns or request refunds, it is important to approach the situation professionally and have clear, structured records to resolve the issue quickly. Well-organized payment documents play a key role in managing these situations effectively, as they help clarify the terms, the nature of the transaction, and the agreed-upon amounts.

Here are some best practices for managing disputes and refunds through payment documents:

- Clear Documentation: Ensure that all payment records are clear, accurate, and complete, including detailed descriptions of services or products provided. This transparency can help avoid misunderstandings when disputes arise.

- Review Terms and Conditions: Include clear payment terms in the document, such as refund policies, deadlines for payment, and conditions under which refunds or adjustments will be made. Having this information readily available can help settle disputes more quickly.

- Maintain Communication: If a client disputes a charge, respond promptly and professionally. Reference the relevant payment document to clarify details and show the agreed-upon amounts or terms.

- Refund Process: When a refund is required, clearly state the refund policy on the document and outline the procedure for processing it. Be sure to include the original payment details, refund amount, and any applicable conditions for returning funds.

- Document Adjustments: If a refund or adjustment is made, update the original record to reflect the new payment status. This will help ensure that both parties have an accurate record of the transaction and any changes made.

Steps to Handle Disputes and Refunds:

- Step 1: Verify the details of the dispute by reviewing the original transaction record and confirming the terms of the agreement.

- Step 2: Communicate with the client to understand the nature of the issue and ensure both parties are aligned on the facts.

- Step 3: If a refund is necessary, calculate the correct amount and determine if any conditions apply (e.g., restocking fees, service charges).

- Step 4: Issue the refund according to the agreed-upon terms and update your payment records to reflect the change.

- Step 5: Notify the client of the refund or adjustment and provide updated documentation, ensuring that the transaction is resolved in a professional manner.

By following these steps, businesses can resolve disputes and process refunds effectively, ensuring that both the business and the client are satisfied with the outcome. Clear, accurate, and well-maintained payment records not only facilitate smoother transactions but also protect both parties in case of disputes.

Benefits of Using a Digital Invoice Template

Adopting digital payment documents for your business can offer numerous advantages over traditional paper-based methods. Digital documents streamline the process of creating, sending, and storing financial records, saving time, reducing errors, and providing greater flexibility. By using a well-structured digital system, businesses can improve their efficiency, maintain better control over finances, and enhance customer satisfaction.

Key Advantages of Digital Payment Documents

- Efficiency: Digital payment records can be created, edited, and sent with just a few clicks. This eliminates the need for printing, mailing, or manually filling out forms, saving significant time and effort for both the business and the client.

- Automation: Many digital solutions offer automation features, allowing for the automatic generation of payment documents based on predefined parameters, such as recurring billing cycles or payment milestones.

- Cost Savings: By switching to digital formats, businesses can save on paper, ink, postage, and storage costs. Additionally, digital documents reduce the need for manual data entry, decreasing the chance of costly human errors.

- Accessibility and Convenience: Digital payment documents can be accessed and shared quickly from any device with internet connectivity, making them more convenient for both the sender and recipient.

- Environmental Impact: Reducing paper usage contributes to sustainability efforts by minimizing waste and conserving natural resources.

Tracking and Organizing Digital Records

Digital payment documents can be easily organized and tracked in secure systems, providing businesses with easy access to their financial records. Whether stored in cloud-based software or local directories, these records can be searched and retrieved quickly, ensuring that your financial history is always at your fingertips.

Here’s an example of how digital records can be organized in a digital system:

| File Name | Date Created | Status | Amount |

|---|---|---|---|

| Payment_00123 | 2024-11-01 | Paid | $500.00 |

| Payment_00124 | 2024-11-03 | Pending | $300.00 |

| Payment_00125 | 2024-11-05 | Unpaid | $700.00 |

Using digital payment records not only streamlines your workflow but also provides a more organized and efficient way to handle transactions. This approach allows for faster invoicing, easier access to financial information, and a greater ability to track payment status, making it an essential tool for modern businesses.