Best Windows Invoice Templates for Simple and Professional Billing

Efficient financial management is essential for businesses of all sizes. A well-organized system for creating professional receipts and tracking transactions can save time and reduce errors. By using pre-designed formats, companies can easily ensure consistency and accuracy in their documentation.

Choosing the right format for your financial documents can greatly simplify the process. With customizable options available, it becomes easier to adapt the layout and structure to fit your specific needs, whether for a small business or a large corporation. These solutions not only offer convenience but also present a polished and professional image to clients.

Automating the process of generating these records can help minimize human error and ensure compliance with industry standards. Through seamless integration with software and digital tools, business owners can streamline the entire procedure, making it faster and more reliable. Whether it’s tracking payments, issuing receipts, or managing account details, adopting digital solutions brings noticeable improvements to day-to-day operations.

Windows Invoice Templates Overview

Managing financial records can be a daunting task, especially when accuracy and professionalism are paramount. Using structured document designs can make the process more efficient and less time-consuming. These ready-made layouts are specifically created to simplify the creation of payment records, allowing businesses to focus on their core activities while ensuring their paperwork is consistently clear and organized.

There are various types of these formats, each catering to different business needs. These formats are not only functional but also offer customization options, enabling users to tailor them to their specific requirements. Here are some key features and benefits:

- Time-saving: Pre-designed structures eliminate the need for creating documents from scratch.

- Professional appearance: Consistent layouts convey credibility and reliability to clients.

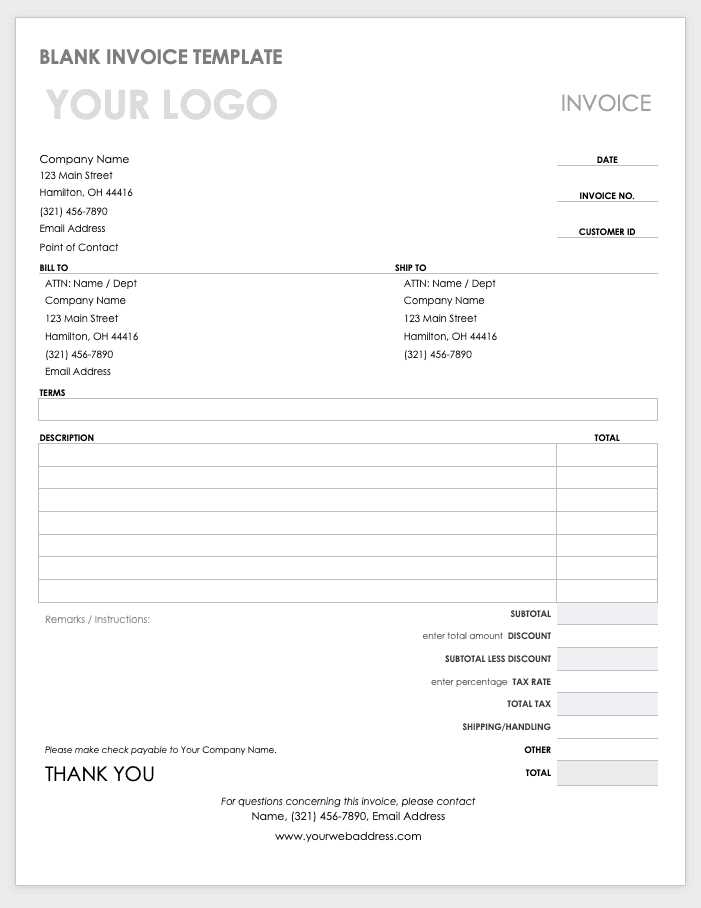

- Customizable: Users can adjust fields and add branding elements like logos and company details.

- Easy to use: Simple interface ensures that even non-experts can create accurate documents quickly.

- Integration-ready: These structures can often be integrated with other business software for smoother operations.

Whether for small or large businesses, adopting such solutions ensures consistency and accuracy in financial reporting. By automating much of the process, these tools reduce the risk of human error, streamline workflows, and improve overall efficiency. Most importantly, they help maintain a professional image in dealings with clients and partners.

Why Use Invoice Templates on Windows

For businesses of all sizes, creating accurate and professional financial records is essential. Using pre-designed formats can significantly streamline the process, saving both time and effort. These tools help users generate well-organized documents quickly, ensuring that all necessary details are included without the need for manual formatting or calculations.

Efficiency and Time Savings

One of the main reasons to use such pre-built solutions is the efficiency they offer. Rather than spending valuable time designing each document from scratch, businesses can simply input the required information and generate a polished record in minutes. This saves time and reduces the chances of errors, enabling professionals to focus on more critical tasks.

Consistency and Professionalism

Another key benefit is the consistency these solutions provide. By using a uniform design across all documents, businesses ensure that their financial records appear professional and organized. This helps maintain a positive image with clients, suppliers, and partners, while also ensuring compliance with industry standards.

How to Choose the Right Template

Selecting the right layout for your financial documents is crucial to ensure that they meet both your business needs and professional standards. The right choice can enhance your workflow, reduce errors, and improve client satisfaction. It’s important to consider several factors when choosing a suitable format, as the wrong one can lead to confusion or a lack of clarity in your records.

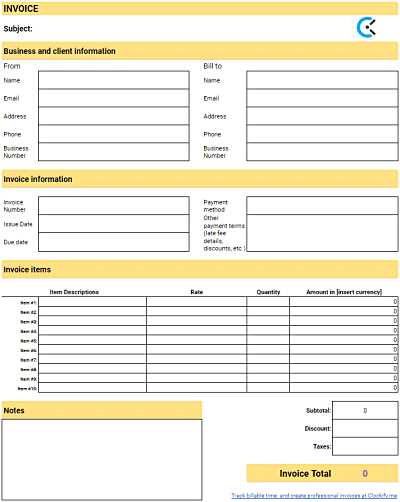

Consider the type of transactions you typically deal with. Different industries have different requirements for financial documentation. For example, service-based businesses may need a design with customizable fields for hourly rates and work descriptions, while product-based companies might prioritize inventory tracking and unit pricing. Choosing a structure that reflects your business operations will save time and ensure accuracy.

Evaluate the level of customization you need. Some formats are highly customizable, allowing you to add logos, adjust field sizes, or modify the layout. If branding and a tailored appearance are important for your company, look for a layout that offers flexibility. On the other hand, if you just need something simple and functional, a more straightforward option might be better suited to your needs.

Lastly, consider ease of use. Even the most sophisticated design won’t be effective if it’s difficult to use. Choose a solution that offers an intuitive interface, allowing you to create documents quickly and without hassle. This will help you save time and maintain efficiency across all your transactions.

Free Invoice Templates for Windows Users

For businesses looking to streamline their financial documentation without spending money on software, free pre-designed formats are an excellent solution. These layouts offer all the essential elements needed to create clear and professional records, helping business owners stay organized while keeping costs low. Available for use on most operating systems, many of these tools are both accessible and user-friendly, allowing for quick customization and efficient document generation.

Free options come in a variety of styles, making it easy to find a design that fits your business needs. Whether you require a simple structure for basic billing or a more detailed format with itemized lists and tax calculations, there are free solutions that cater to different industries and transaction types. These resources provide the flexibility to adjust fields and content, ensuring that the final document aligns with your company’s requirements.

Additionally, many of these no-cost designs integrate seamlessly with popular office programs, such as word processors and spreadsheet applications. This makes them easy to customize and share across different platforms, whether for internal use or client-facing communication. For small businesses and freelancers, free options provide a cost-effective way to create professional-looking records without the need for expensive software subscriptions.

Benefits of Customizable Invoice Templates

When it comes to financial documentation, flexibility is key. Having the ability to adjust a document’s layout and content allows businesses to tailor their records to specific needs and preferences. Customizable formats offer several advantages that can enhance both the efficiency and professionalism of your business operations.

Improved Branding and Professionalism

One of the most significant benefits of customizable designs is the ability to incorporate branding elements. This includes adding your company logo, adjusting colors, and selecting fonts that align with your brand identity. Customizing your documents not only enhances their appearance but also helps build a consistent brand image, making your business appear more credible and professional.

Enhanced Functionality and Adaptability

Another major advantage is the flexibility these formats offer. Businesses can modify fields to include only the relevant information for their specific operations, whether that’s adding new sections or removing unnecessary ones. This adaptability ensures that the document fits the exact requirements of each transaction or client.

- Tailored to industry needs: Adjust sections for products, services, taxes, and discounts.

- Multiple layout options: Customize the structure to suit your style, from minimalist designs to more detailed formats.

- Flexible content fields: Add or remove fields depending on the complexity of each transaction.

- Easy integration: Incorporate custom designs into existing business workflows and software systems.

By choosing a format that can be easily personalized, businesses can ensure that their documents not only meet industry standards but also reflect their unique identity and specific needs. This level of customization reduces errors and ensures that financial records are as accurate and professional as possible.

Top Features in Windows Invoice Templates

When selecting a pre-designed format for creating financial documents, certain features can make a significant difference in terms of functionality and ease of use. The best layouts are equipped with a variety of tools that help users streamline their processes, maintain accuracy, and ensure professionalism in every transaction. Here are some of the top features to look for in any financial document design.

Customizable Fields

One of the standout features is the ability to modify fields according to your business needs. Whether it’s adjusting the quantity of items, adding extra descriptions, or changing the payment terms, customizable fields give users the flexibility to ensure that each document accurately reflects the transaction details. This flexibility is especially useful for businesses with varying services or products that require different billing structures.

Automatic Calculations

Another essential feature is the inclusion of automatic calculations, which help eliminate errors when adding up totals or applying taxes. Many pre-designed layouts come with built-in formulas to calculate the sum of items, tax percentages, and final amounts. This feature not only saves time but also enhances accuracy, ensuring that all financial records are correct and professional.

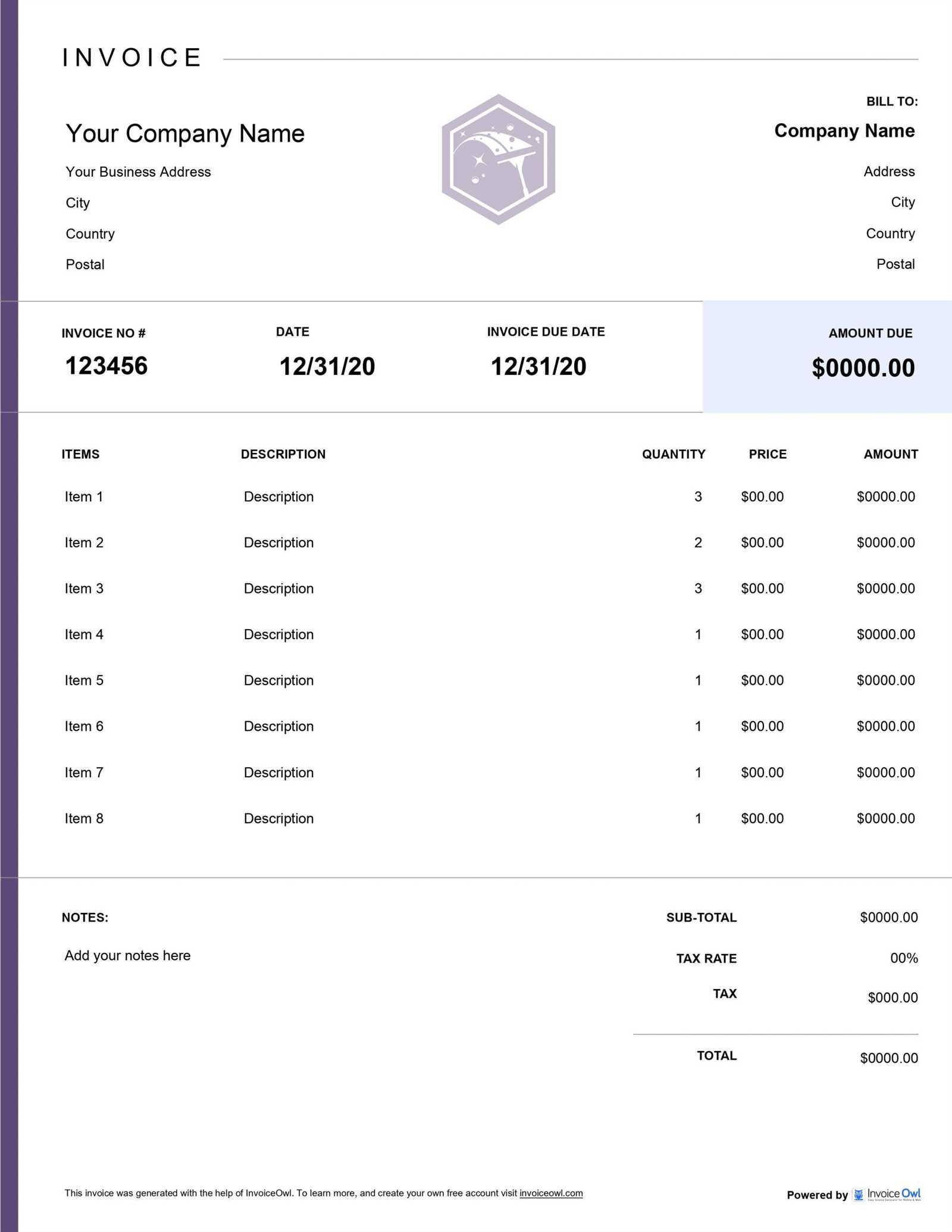

- Itemized Billing: Detailed line items that can be customized for product or service listings.

- Tax and Discount Calculations: Automatic application of taxes and discounts to ensure accurate final amounts.

- Branding Options: Ability to insert your company logo and adjust design elements to match your business’s brand.

- Multiple Payment Methods: Predefined options for clients to choose their preferred payment method.

- Ease of Sharing: Simple formats that allow for quick sharing via email or printing.

These advanced features ensure that your financial documents are not only easy to create but also accurate, customizable, and professional. By incorporating such tools, businesses can automate routine tasks and maintain a consistent approach to billing and record-keeping.

How to Create an Invoice on Windows

Creating a professional financial document doesn’t have to be a complex process. By using a pre-structured design, businesses can easily generate accurate records that include all necessary details without spending hours on formatting. Whether you’re a freelancer, a small business owner, or part of a larger organization, following a simple set of steps can help you quickly produce clear and error-free documents.

Step 1: Choose a Suitable Layout

First, select a pre-designed layout that matches the needs of your business. Most formats come with basic structures that can be customized for different types of transactions, whether for a product sale, service rendered, or recurring subscription. Choose one that allows you to input specific details such as item descriptions, quantities, and payment terms.

Step 2: Customize the Fields

Next, input the necessary information into the fields provided. This includes your company details, the client’s information, and any specific terms for the transaction. Make sure to add a clear description of the items or services provided, along with the corresponding prices, taxes, and any discounts if applicable. Ensure that all fields are filled out correctly to avoid any confusion later.

Step 3: Review and Adjust

Once all information is entered, review the document for accuracy. Double-check the amounts, tax calculations, and payment due date. Many designs have built-in automatic calculations to help with totals, but it’s always a good practice to verify everything manually. If needed, adjust any of the layout’s elements, such as adding your company logo or changing the font for a more professional appearance.

Step 4: Save and Send

After reviewing, save the file in your preferred format (PDF, DOCX, etc.) for easy sharing. Most tools allow for quick emailing or printing directly from the software. Whether you are sending the document to a client or keeping it for internal records, ensure it’s stored securely and accessible when needed.

Managing Templates in Microsoft Excel

Microsoft Excel is a powerful tool for managing financial records, including creating professional documents with predefined structures. By using ready-made designs, you can easily generate consistent, error-free documents while saving valuable time. Excel offers a range of features that make it easy to handle, customize, and save these designs, providing businesses with the flexibility to adapt them to their specific needs.

Setting Up a New Document

To begin using a pre-structured format in Excel, start by selecting a template that suits your business requirements. Excel provides various pre-built designs that are simple to customize. Once you’ve chosen the appropriate layout, follow these steps:

- Open Excel and navigate to the “File” tab.

- Select “New” and choose from the available designs, such as a billing or payment record format.

- Download the chosen design to open it as a new workbook.

- Customize the fields with your company and client information, along with any relevant transaction details.

Saving and Managing Your Files

Once you’ve filled in the necessary information, Excel allows you to save your work in a variety of formats for easy sharing and record-keeping. Here’s how you can manage your documents:

- Save as a template: If you want to reuse the same layout for future records, save the file as an Excel template (.xltx) to easily access it whenever needed.

- Organize in folders: Keep all your financial documents organized by creating separate folders for each client or month to help with easy retrieval.

- Use cloud storage: Storing your documents in cloud storage services like OneDrive ensures they are backed up and accessible from any device.

Excel’s flexibility and functionality make it an excellent tool for managing pre-designed structures, allowing you to create, edit, and maintain your financial records efficiently.

Best Software for Windows Invoice Templates

When it comes to generating professional financial documents, the right software can make a significant difference in terms of efficiency, customization, and ease of use. Various programs are available to help businesses create structured records, manage transactions, and maintain a consistent professional image. The best options provide intuitive features, seamless integration with other tools, and flexibility to adapt documents according to specific needs.

1. Microsoft Excel

Microsoft Excel is a widely used tool for creating customized financial records. It offers a variety of pre-built designs that can be easily modified to include the necessary fields for any business transaction. With its robust calculation functions, users can quickly generate accurate totals, taxes, and discounts without the risk of errors. Excel’s versatility also allows businesses to save documents in various formats and integrate them with other software solutions.

2. QuickBooks

QuickBooks is one of the leading accounting software solutions for small businesses. It provides users with customizable record-keeping formats that can be easily adapted to different types of transactions. QuickBooks also simplifies the process of tracking payments, managing taxes, and generating reports. For businesses looking for an all-in-one accounting tool, QuickBooks is a solid choice that streamlines financial workflows and ensures compliance.

Key features:

- Customizable fields for products, services, and payments.

- Automatic tax calculations and real-time updates.

- Integration with bank accounts and other financial tools.

- Cloud-based access for remote work and data storage.

3. Zoho Invoice

Zoho Invoice is a popular online solution for creating professional documents. It offers a range of customizable designs that can be tailored to your business’s needs. Users can quickly create and send bills to clients, automate payment reminders, and track outstanding balances. Zoho also integrates with other Zoho applications, making it an excellent choice for businesses that already use the Zoho ecosystem.

Key features:

- Multiple currency and language support for international clients.

- Customizable templates with logos and branding options.

- Automated reminders and recurring billing for subscription-based businesses.

- Easy integration with payment gateways like PayPal and Stripe.

Choosing the right software largely depends on your specific needs, whether you prioritize simplicity, advanced functionality, or seamless integration with other systems. Each of these tools offers unique features that can help businesses streamline their financial documentation process while maintaining accuracy and professionalism.

How to Personalize Invoice Templates

Customizing your financial documents allows you to create a professional and consistent look while ensuring they meet your specific business needs. Personalizing a ready-made structure can include adding branding elements, adjusting the layout, and tailoring the fields to match your business operations. These adjustments not only enhance the document’s visual appeal but also make it more relevant and functional for your transactions.

Step 1: Add Your Branding Elements

- Logo: Include your company’s logo at the top or in the header section to give the document a branded appearance.

- Colors: Customize the colors to match your company’s branding, whether it’s for headings, borders, or text.

- Fonts: Adjust the font style and size to reflect your brand’s identity, ensuring it’s clear and easy to read.

Step 2: Adjust the Layout and Structure

- Remove Unnecessary Sections: Eliminate any default fields that don’t apply to your business, such as extra service categories or payment terms that aren’t relevant.

- Rearrange Sections: If you prefer certain information to appear at the top or in a different order, many formats allow you to move sections around, such as item descriptions or payment details.

- Add Custom Fields: For businesses with specific needs, adding custom fields like order numbers, special discounts, or customer references can make the document more useful.

Step 3: Update the Content for Each Transaction

- Client Information: Ensure that the customer’s name, address, and contact details are accurately included for each transaction.

- Details of Products/Services: Clearly describe the products or services provided, ensuring that pricing, quantities, and any applicable taxes are listed correctly.

- Payment Terms: Specify your payment terms, including due dates, accepted methods of payment, and any late fees or discounts offered.

Personalizing your document is not just about making it look better; it’s about making it functional and aligned with your brand and workflow. These customizations will not only enhance your image but also improve the experience for clients, making them more likely to engage with your business in the future.

Importing Data into Windows Invoice Templates

Importing data into pre-designed documents can significantly speed up the process of generating accurate financial records. By automatically transferring information from external sources such as databases, spreadsheets, or customer management systems, businesses can save time and reduce the chances of manual errors. This process helps to quickly fill in the required fields without having to re-enter repetitive data, streamlining the workflow and ensuring consistency in your records.

Here’s how you can import data into your document:

1. Importing from a Spreadsheet

If you maintain customer or transaction data in a spreadsheet, most programs allow you to easily import this information into your financial record. This is especially useful for businesses with large amounts of data, as it eliminates the need to input each detail manually.

For example, if you have the following data in a spreadsheet:

| Customer Name | Product | Quantity | Price | Total |

|---|---|---|---|---|

| John Doe | Web Design Services | 1 | $500 | $500 |

| Jane Smith | SEO Optimization | 2 | $150 | $300 |

This data can be imported into a billing format, automatically filling in customer names, item descriptions, quantities, prices, and totals. Many spreadsheet programs like Microsoft Excel or Google Sheets offer export options in CSV or Excel format, which can be easily imported into your document.

2. Using Software Integration

Many accounting and customer relationship management (CRM) tools provide integration with document creation software. By syncing your CRM or accounting system with your billing format, customer information such as addresses, payment terms, and product details can be automatically transferred into the document.

This integration allows for seamless data updates and eliminates the need for manual data entry, making the process faster and more accurate. It’s ideal for businesses with frequent transactions or those that need to generate many documents in a short amount of time.

By importing data, businesses can significantly reduce the manual workload and minimize human error, all while ensuring that their documents are consistently formatted and up to date.

Common Mistakes in Invoice Creation

Creating professional financial documents requires attention to detail, as even minor mistakes can lead to confusion, delayed payments, or even damage to your business’s credibility. While many people rely on pre-designed formats to streamline the process, it’s still easy to make errors that can cause problems down the line. Being aware of common mistakes can help you avoid costly issues and ensure that your documents are clear, accurate, and professional.

1. Missing or Incorrect Client Information

One of the most common errors is failing to include accurate or complete client details. Omitting vital information, such as the client’s full name, address, or contact details, can delay processing or cause confusion regarding where the payment should be sent. Always double-check that all fields are filled out correctly, including company names and addresses, to ensure smooth communication and prompt payment.

- Double-check client contact info: Ensure email and phone numbers are correct.

- Include complete addresses: Make sure both billing and shipping addresses are accurate if relevant.

2. Incorrect or Missing Payment Terms

Another common mistake is failing to clearly state payment terms or including incorrect due dates. Whether you are offering standard 30-day terms, requesting immediate payment, or allowing installments, it’s crucial to make these terms clear on the document. Failure to specify the payment due date or forgetting to include late fees can lead to misunderstandings and delays in payment.

- Specify due dates: Clearly mention when the payment is due, whether it’s net 30, net 15, or another agreed term.

- Include late payment terms: If applicable, note any late fees or interest that will be charged if the payment is overdue.

To avoid these common pitfalls, always take the time to carefully review each financial document before sending it out. A little extra attention to detail can go a long way in ensuring smooth transactions and a positive relationship with your clients.

Invoice Template Compatibility with Different Formats

When creating professional documents, it’s important to ensure that the design you choose can be easily shared and viewed across different platforms. Compatibility with various formats ensures that the final document will appear correctly regardless of the software or device being used to open it. This is particularly important for businesses that need to send their documents to clients, partners, or vendors who may use different systems.

1. Popular File Formats for Document Sharing

Most users need to choose between several file formats when creating and sharing their documents. Each format has its own set of benefits and limitations, and understanding these can help you choose the best one for your needs. Here are some common formats:

- PDF: A widely used format that preserves the layout and appearance of the document, regardless of the software or device used. PDFs are ideal for professional sharing, as they are easily viewable and do not require the recipient to have the same program.

- Excel/CSV: These formats are useful for businesses that need to work with data in a spreadsheet format. They allow for easy customization and editing, but may not be as visually polished as a PDF or Word document. Excel files are compatible with accounting and data processing software.

- Word Document: Word files are easily editable and commonly used for office documents. While this format is compatible with a variety of systems, it may require the recipient to have Microsoft Office or a compatible viewer installed to open and edit the file properly.

2. Considerations for Cross-Platform Compatibility

When choosing a format, consider whether your document will be shared with recipients using different operating systems or software. For instance, a design created in a specific program might appear differently when opened in another software or operating system. To prevent formatting errors, it is essential to:

- Test the document: Before sending a document, test how it appears on different platforms to ensure the formatting stays intact.

- Choose a flexible format: Use formats like PDF for sharing to ensure the document appears the same across various systems and devices.

- Embed fonts and graphics: If using Word or Excel formats, ensure fonts and images are embedded to prevent them from being replaced with default settings on other devices.

By understanding the compatibility of your document with different file formats, you can ensure that your records are accessible, professional, and easy to share, regardless of the recipient’s system or preferences.

How to Automate Invoice Generation

Automating the creation of financial documents can significantly reduce the time and effort involved in generating records for each transaction. By setting up automated workflows, businesses can streamline their processes, ensuring consistent and accurate document creation without the need for manual input. This not only saves time but also minimizes the risk of human error, especially for companies that generate large volumes of documents on a regular basis.

1. Use Accounting Software for Automation

One of the most efficient ways to automate document generation is through accounting or financial management software. These platforms can automatically populate fields, calculate totals, and generate structured records based on pre-set rules. Many of these tools allow for the creation of recurring billing cycles, which can be particularly useful for subscription-based services or regular payments.

- Automated Billing: Set up recurring payment schedules for regular clients to generate records automatically at specified intervals.

- Data Integration: Sync your software with your customer relationship management (CRM) system to automatically pull client information and transaction details.

- Customizable Workflows: Tailor automated document generation to suit your business needs, from payment terms to item descriptions.

2. Implement Cloud-Based Solutions

Cloud-based platforms provide a highly flexible and scalable solution for automating financial document creation. These tools enable real-time updates, remote access, and collaboration, making it easy to generate and send documents automatically to clients, even on the go.

- Cloud Storage Integration: Connect your cloud storage to save and access generated documents from anywhere, ensuring they are always up-to-date.

- Automatic Delivery: Set up the software to automatically email completed records to clients, reducing the need for manual follow-ups.

- Real-Time Updates: Ensure that all generated documents reflect the most current data, such as payment status or transaction history.

By automating document creation, businesses can not only save valuable time but also ensure that their financial records are always consistent and error-free. Whether you choose accounting software or cloud-based solutions, automation can significantly enhance your operational efficiency and improve client satisfaction.

Printing and Sharing Your Invoices

Once your financial documents are ready, the next step is ensuring they are delivered to your clients in a professional and timely manner. Whether you need to print them for physical delivery or share them digitally, it’s important to choose the right method to maintain a smooth transaction process. Ensuring proper formatting, quality, and security in the delivery of your records will help maintain professionalism and improve client satisfaction.

1. Printing Your Documents

For businesses that prefer physical copies, printing your documents is an essential step. It’s important to ensure the print layout matches the original design and maintains readability. Here are some best practices for printing:

- Check the Layout: Before printing, make sure all elements such as headers, tables, and images are properly aligned and visible on the page.

- Choose the Right Paper: Use high-quality paper for printed documents to give them a professional appearance. A thicker paper stock can be ideal for formal financial documents.

- Use a Reliable Printer: Ensure your printer is capable of producing clear, high-resolution prints to avoid blurry text or images.

- Print Multiple Copies: Always print multiple copies for your records, especially if you’re mailing the document or keeping physical files for your business.

2. Sharing Your Documents Digitally

Sharing documents digitally is faster and more efficient for many businesses, especially for clients who prefer email or online access. However, it’s important to ensure your digital records are secure and formatted correctly for easy viewing. Consider the following when sharing electronically:

- PDF Format: Save your document as a PDF to preserve the original formatting and prevent alterations. PDFs are widely accepted and easy to open on most devices.

- Emailing: When sending your document via email, make sure the file size is manageable and the subject line is clear and professional.

- Cloud Sharing: For larger files or for clients who need regular access, using a cloud storage service like Google Drive or Dropbox can be an efficient solution. Ensure you set appropriate access permissions to maintain privacy.

- Security: If your document contains sensitive information, consider encrypting the file or using password protection to ensure it remains secure during transmission.

By choosin

Legal Aspects of Invoice Creation

Creating accurate and legally compliant financial documents is a critical aspect of running any business. These documents not only serve as records of transactions but also help ensure transparency and protect both businesses and clients in case of disputes. There are various legal requirements regarding the information that must be included, how long these records should be kept, and how they should be handled to comply with tax laws and business regulations.

1. Essential Information to Include

To meet legal requirements, certain information must be present on each document. This helps ensure that the document is valid and can be used for accounting, tax filing, or legal purposes. Below are some key elements that must be included:

- Business Information: Your business name, address, and tax identification number (TIN) should be clearly visible on the document. This ensures that the recipient knows who issued the document and can reference your business if needed.

- Client Information: Include the name and contact details of the client receiving the goods or services, along with their billing address.

- Unique Document Number: Every document should have a unique identification number for tracking and reference purposes.

- Date of Issue: This helps establish when the transaction took place and can be important for tax and legal deadlines.

- Detailed Description of Goods/Services: A clear breakdown of the products or services provided, including quantities, unit prices, and total amounts.

- Tax Information: If applicable, include tax rates, amounts, and VAT (Value Added Tax) numbers. Failure to list taxes properly could result in legal issues.

2. Record Keeping and Compliance

In addition to including the right information, businesses must also adhere to specific regulations regarding how long they must retain these documents and the ways they must be handled. Legal compliance often varies based on local jurisdiction and industry, but here are some general guidelines:

- Retention Period: Many jurisdictions require businesses to keep financial records for a specified period, often ranging from 3 to 7 years, in case of audits or legal disputes.

- Electronic Records: If documents are stored electronically, ensure they are securely stored and easily accessible. Some regions have specific rules about maintaining digital records.

- Tax Filings: Properly filed documents are necessary for tax reporting and audits. Failure to comply with tax laws may result in penalties or fines.

- Dispute Resolution: In case of disputes, legally compliant documents serve as proof of transaction and terms agreed upon by both parties, ensuring smoother resolution processes.

Ensuring that your financial recor

Future Trends in Invoice Templates for Windows

As businesses continue to evolve, the tools used for generating financial records are also advancing. With technology rapidly changing, it’s essential to stay ahead of emerging trends that can improve efficiency, accuracy, and the overall user experience. In the near future, we can expect increased automation, better integration with other business systems, and enhanced customization options for creating professional documents.

1. Automation and AI Integration

Artificial Intelligence (AI) is expected to play a more significant role in automating document creation processes. By analyzing previous transactions and customer data, AI can automatically populate fields, calculate totals, and generate documents without requiring manual input.

| Benefit | Description |

|---|---|

| Time Savings | AI can automate routine tasks, reducing the need for manual data entry and improving overall efficiency. |

| Accuracy | AI systems can reduce human error by automatically populating fields and verifying information. |

| Personalization | AI can customize records based on customer preferences and past behavior, improving client satisfaction. |

2. Integration with Other Business Tools

As more businesses move to integrated cloud-based platforms, the ability to link document creation tools with other software solutions will become more crucial. Integration with CRM systems, payment gateways, and accounting software will allow for seamless data flow, reducing the need for manual entry and ensuring that all information is up to date.

- Real-Time Data Sync: Integration with financial management tools will ensure that records are automatically updated with the latest transaction data.

- Cross-Platform Access: Users will be able to access their records from any device, improving flexibility and collaboration.

- Improved Analytics: Integration with other tools will provide deeper insights into financial trends, helping businesses make better decisions.

As the future of business tools continues to evolve, adapting to these trends will ensure that companies remain competitive and efficient in generating and managing their financial documentation. Whether through AI-driven automation or more seamless integrations, the tools of