Window Tint Invoice Template for Easy and Professional Billing

Managing billing efficiently is key to maintaining a smooth and professional operation, especially when offering specialized services. Creating consistent, accurate, and easy-to-read receipts can streamline your workflow and improve client satisfaction. This section will explore how you can create a billing document that meets both your needs and those of your customers.

With the right tools, businesses can automate and personalize their billing process, ensuring clear communication and reducing the risk of errors. Whether you’re a freelancer or a growing business, having a structured form for charging clients is vital. You will learn how to build a document that includes all the necessary details while presenting a polished and professional image.

Customize your billing forms to reflect the nature of your service, include relevant charges, and maintain a professional appearance. These documents not only serve as a record of the transaction but also as a tool to establish trust and reliability with your clients.

Window Tint Invoice Template Overview

For any service provider, creating a clear and professional document for billing is essential. A well-structured receipt ensures accuracy and fosters trust between the business and the client. Whether you offer automotive, residential, or commercial services, having a standardized document can help streamline your payment process and prevent misunderstandings.

Importance of Professional Billing Forms

When you provide specialized services, like applying protective coatings or films, a customized billing sheet serves as more than just a receipt. It acts as a formal agreement, detailing all charges and services rendered. A well-organized form can reflect your professionalism and attention to detail, leaving a positive impression on your clients.

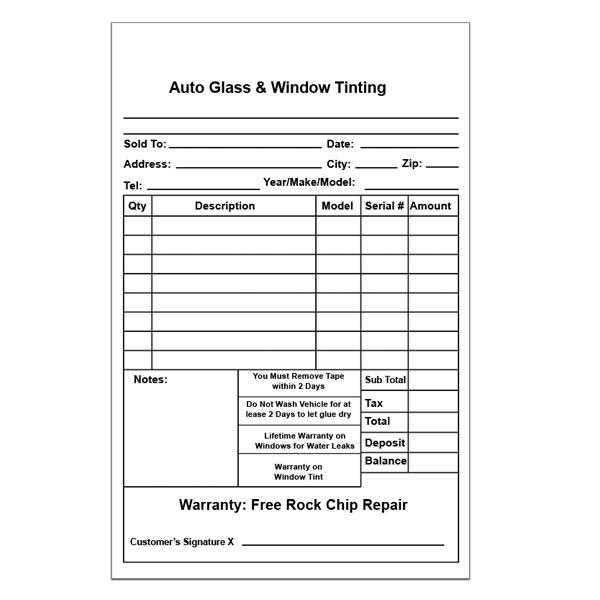

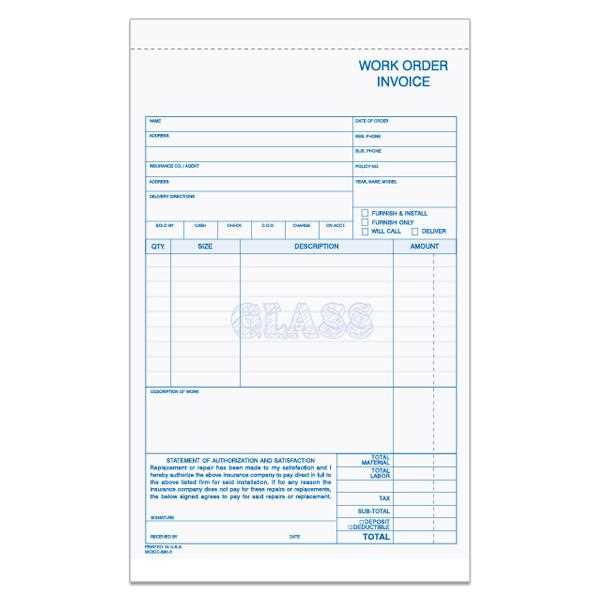

Key Elements of a Billing Document

While the layout and design of your document can vary, there are several key elements that should always be included. These include customer details, service descriptions, dates, itemized charges, and payment terms. A clear and precise summary of the transaction helps prevent disputes and ensures both parties are on the same page. By using a properly structured format, you can ensure all relevant details are covered in an easily digestible manner.

Why Use an Invoice Template?

Using a standardized form for billing offers numerous advantages for any business, particularly when providing specialized services. It simplifies the billing process, reduces the risk of errors, and saves time. By adopting a consistent structure, service providers can ensure that all necessary information is captured accurately, creating a more efficient workflow.

One of the main reasons for using a pre-designed document is to enhance professionalism. A well-organized receipt not only improves your business image but also ensures that clients understand the charges clearly. Here are some key reasons why having a set structure is beneficial:

| Benefit | Explanation |

|---|---|

| Efficiency | Streamlines the billing process, allowing for quicker creation and fewer mistakes. |

| Consistency | Ensures uniformity across all client transactions, making your business look more organized. |

| Clarity | Clearly outlines the services provided, helping clients understand their charges better. |

| Legal Compliance | Helps ensure that all necessary legal information is included, protecting both parties in case of disputes. |

| Customization | Can be easily adjusted to reflect specific service types, payment terms, and business branding. |

By using a structured document, you not only reduce the chances of missing crucial details but also present your business in a more polished and reliable light. The time saved can be reinvested into growing your business and serving your clients better.

Key Features of a Good Template

A well-designed billing document is essential for any service provider looking to maintain professionalism and efficiency. It should be clear, concise, and include all relevant details to ensure accurate communication with clients. A high-quality form will make the billing process smoother for both you and your customers, while also reducing the risk of errors or confusion.

Here are some key elements to look for when creating or selecting a billing document:

- Clear Layout – A clean, easy-to-read design helps avoid confusion and makes it easier for both the business and the client to understand the charges.

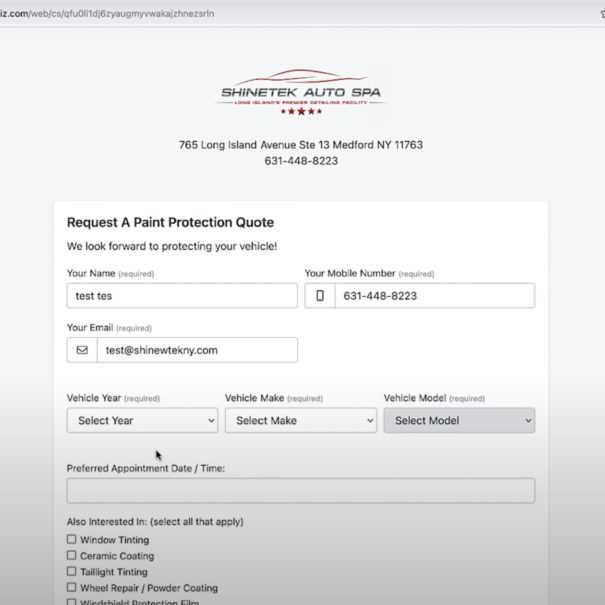

- Customizable Fields – The ability to add or adjust information such as service details, client information, and payment terms ensures flexibility for various needs.

- Itemized Charges – A breakdown of services or products provided, including individual pricing for each, ensures transparency and prevents disputes.

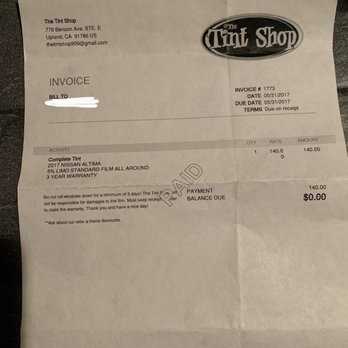

- Professional Branding – Adding your logo, business name, and contact information reinforces your company’s image and builds trust with clients.

- Payment Terms – Including details about payment deadlines, late fees, or accepted payment methods helps set clear expectations.

- Legal Compliance – Make sure the form includes all necessary information required by law, such as tax identification numbers or disclaimers, if applicable.

- Summary of Services – Clearly listing what was provided, along with dates and specific details, prevents confusion and ensures accuracy.

By incorporating these essential features, you can create a professional and reliable billing form that meets your needs and ensures a smooth transaction process for both parties involved.

How to Customize Your Invoice

Customizing your billing document is crucial for ensuring it aligns with your business needs and communicates the right information to your clients. A personalized receipt can make your business appear more professional while also helping to avoid confusion or mistakes. Adjusting certain elements will make the document fit the specific services you offer and create a more tailored experience for both you and your customers.

Here are some steps to help you customize your billing form effectively:

- Add Your Branding – Include your business logo, name, contact information, and address to make the document reflect your company’s identity.

- Adjust Service Descriptions – Tailor the descriptions of the services rendered to match what was provided. Be clear and specific about what was done to avoid any ambiguity.

- Set Payment Terms – Customize payment instructions, deadlines, and penalties for late payments. Make sure this information is easy to find and clearly outlined.

- Include Discounts or Promotions – If applicable, you can add fields to account for any discounts, special offers, or loyalty incentives provided to the client.

- Modify Pricing Structure – Depending on your pricing model, adjust the layout to reflect hourly rates, flat fees, or itemized charges. This allows you to match your business style more accurately.

- Include Legal and Tax Information – Depending on your location, make sure to add any necessary legal disclaimers, tax identification numbers, or VAT details to comply with local regulations.

- Personalize the Footer – Add a thank-you note or a call to action in the footer. A small gesture can go a long way in building client loyalty.

By tailoring the design and content of your form, you ensure it meets your specific needs, reflects your brand’s personality, and builds trust with your customers. Customization not only helps maintain consistency but also improves the overall customer experience.

Essential Information to Include

For any business, it’s crucial to include the right details in your billing form to ensure accuracy and clarity. A complete and well-organized document helps avoid misunderstandings and ensures that both parties are on the same page regarding the transaction. Below are the key pieces of information that should always be included to ensure a smooth and transparent billing process.

Key Elements for Accurate Documentation

To provide clients with all necessary information, your document should include several important sections. Here’s a breakdown of the essential details that should always appear:

| Information | Description |

|---|---|

| Business Information | Include your company name, address, contact details, and any relevant business registration numbers. |

| Client Information | Include the client’s name, address, and contact details to ensure the document is correctly addressed. |

| Service Description | Provide a detailed breakdown of the services rendered, including dates, specifics, and quantities if applicable. |

| Pricing | Clearly list the costs for each service or item provided, including any discounts or promotions applied. |

| Total Amount | Ensure the final total is clearly stated, showing any applicable taxes or additional charges. |

| Payment Terms | Specify the payment methods accepted, the due date, and any penalties for late payments. |

| Invoice Number | Assign a unique reference number for easy tracking and future reference. |

| Tax Details | Include your tax identification number and any relevant tax information, especially if required by local laws. |

Why These Details Matter

Including these essential comp

Benefits of Professional Invoicing

Utilizing a professional billing document provides numerous advantages for both businesses and clients. It ensures clarity, reduces the potential for disputes, and enhances the overall customer experience. By using a well-structured form that includes all the necessary details, you not only streamline your accounting processes but also present a more reliable and trustworthy image to your clients.

Advantages for Business Operations

For service providers, maintaining professionalism in all financial transactions is crucial. Here are some of the key benefits of using a formal and well-designed document:

| Benefit | Description |

|---|---|

| Improved Cash Flow | Professional billing can help you receive payments faster by clearly outlining payment terms and deadlines. |

| Reduced Errors | Having a standardized format ensures that all necessary details are included and reduces the chances of mistakes in calculations or omitted information. |

| Legal Protection | A properly formatted document helps protect your business by providing a clear record of the transaction in case of disputes or legal matters. |

| Enhanced Brand Image | A clean, professional document reflects well on your business and can strengthen your brand identity, making your business appear more credible. |

Advantages for Clients

Clients also benefit from receiving a clear and professional document. This fosters trust and encourages repeat business. Here’s how:

| Benefit | Description |

|---|---|

| Clarity of Charges | Clients appreciate transparency, knowing exactly what they’re paying for without confusion or hidden fees. |

| Easy Record Keeping | A clear and detailed receipt helps clients track their expenses and keep proper records for tax or reimbursement purposes. |

| Professional Communication | Clients are more likely to view your business as trustworthy and organized, leading to higher satisfaction and loyalty. |

In summary, professional billing practic

Free vs Paid Invoice Templates

When it comes to choosing a billing document, there are two primary options available: free and paid formats. Each has its own set of benefits, depending on your business needs and resources. While free options can be a good starting point, paid versions often come with additional features that may be worth the investment in the long run.

Advantages of Free Options

Free billing forms are accessible to anyone and can be a great way to get started without any upfront costs. However, they may come with some limitations. Below are some of the key benefits of free formats:

- Cost-Effective – Free options are, as expected, completely free to use, making them an ideal choice for businesses on a tight budget.

- Quick Setup – These forms are often easy to find and download, allowing you to start billing immediately without complex customization.

- Basic Features – Most free options offer essential fields for service description, pricing, and payment terms, which may be sufficient for small businesses or freelancers.

Benefits of Paid Options

Paid forms typically offer more advanced features and customization options, making them a better choice for businesses looking for a more professional and tailored solution. Here’s why you might consider upgrading:

- Customizable Design – Paid versions often come with more flexibility in design and layout, allowing you to brand your documents and create a more personalized experience for clients.

- Advanced Features – You may gain access to additional tools, such as automatic tax calculations, recurring billing, or integration with accounting software.

- Premium Support – Paid options often include customer support, so you can get help when you encounter any issues or need assistance with customization.

- Legal Compliance – Some paid versions are designed to help ensure your documents meet specific industry or regional legal requirements, reducing the risk of errors or omissions.

Ultimately, the choice between free and paid formats comes down to the complexity of your needs and your budget. Free versions may be perfect for smaller businesses or those just starting out, but paid options provide added features and customization that can be valuable as your business grows.

Choosing the Right Format for Your Business

Selecting the appropriate document structure for billing is an important decision for any business. The format you choose should align with the size and complexity of your operations, ensuring that it meets both your needs and those of your clients. Whether you’re a small freelancer or a growing company, finding the right solution can improve workflow, reduce errors, and enhance your professional image.

Factors to Consider When Choosing a Format

When deciding on the right format for your billing documents, several factors should influence your choice. Below are some key elements to keep in mind:

| Factor | Consideration |

|---|---|

| Business Size | Smaller businesses may benefit from simple forms, while larger businesses or those with more complex transactions might require more detailed layouts or advanced features. |

| Customization Needs | If branding and client-specific details are important to your business, you might prefer a more flexible option that allows for a personalized look. |

| Frequency of Use | For frequent billing, a digital format that can be quickly filled out or auto-generated might save time. For occasional use, a manual or simpler version could suffice. |

| Integration with Other Tools | If you use accounting software or other business tools, you may want to select a format that integrates seamlessly with these systems. |

| Legal Requirements | Ensure that the format you choose adheres to any specific legal or regulatory requirements in your industry, such as tax details or compliance with local business laws. |

Choosing Between Manual and Digital Formats

Another key consideration is whether to use a manual, paper-based format or a digital one. Both options have their own advantages depending on your business setup:

- Manual Formats – Best for businesses with minimal transactions or those in industries where physical copies are preferred. Manual formats can be customized easily but require more time and effort to fill out and track.

Common Mistakes to Avoid in Invoices When preparing a billing document, small errors can lead to confusion, delayed payments, or even disputes with clients. It’s essential to ensure that every detail is correct and clear. By avoiding common mistakes, you can streamline your payment processes, improve your professional reputation, and avoid unnecessary complications.

Here are some of the most frequent mistakes to watch out for when creating your billing documents:

Mistake Explanation Missing or Incorrect Contact Information Always double-check client and business details. Incorrect information can lead to delays or confusion about payment instructions. Failure to Include Payment Terms Not specifying payment deadlines, late fees, or accepted payment methods can result in clients delaying payments or misunderstanding expectations. Omitting Itemized Charges Failing to break down services or products provided can lead to confusion about the cost, and may cause clients to question the total amount. Not Including an Invoice Number Each billing document should have a unique reference number to help both parties track payments and avoid confusion in case of disputes. Incorrect or Missing Tax Information For businesses subject to tax laws, missing or inaccurate tax details can create legal problems and may delay payments if clients question the charges. Unclear Descriptions of Services Ensure the descriptions of the services provided are clear and detailed. Vague descriptions can lead to misunderstandings about what was delivered. Not Using Consistent Formats Using inconsistent formats or layouts can confuse clients. Stick to a standard format to maintain clarity and professionalism in all your transactions. Avoiding these common errors can save you time, reduce confusion, and help maintain positive relationships with your

How to Automate Invoice Generation

Automating the creation of billing documents can save time, reduce errors, and streamline your business operations. By implementing an automated system, you can generate consistent and accurate records for each transaction, while minimizing manual input. This not only improves efficiency but also allows you to focus more on delivering quality service to your clients.

Steps to Automate Billing Creation

Here are the key steps to automate your billing document generation process:

- Choose the Right Software – Look for software or online tools that allow you to create and customize forms, set payment terms, and automate calculations. Many platforms offer free or subscription-based options that are suitable for different business sizes.

- Set Up Client Information – Input client details, such as names, addresses, and contact information, into the system. Many tools allow you to store this data, making it easy to auto-fill details for future transactions.

- Define Your Products or Services – Pre-enter your offerings, prices, and any relevant descriptions. This allows the system to generate detailed line items without manual input.

- Automate Recurring Billing – For businesses with subscription models or regular clients, set up recurring invoices. These can be generated automatically at set intervals, reducing the need to manually create new documents each time.

- Set Payment Terms and Deadlines – Define your standard payment terms, including due dates, late fees, and accepted payment methods. This ensures consistency and reduces confusion for both you and your clients.

Benefits of Automation

Once your automation system is set up, you’ll notice several advantages:

- Time Efficiency – Automating repetitive tasks allows you to focus more on core business activities, such as service delivery and client management.

- Reduced Errors – Automated systems minimize the risk of human errors, such as incorrect calculations or missing information, ensuring consistency in all documents.

- Faster Payments – With automatic reminders and payment tracking, your clients are more likely to pay on time, improving cash flow.

- Professional Appearance – Automated billing creates consistent, professional documents that help enhance your company’s image and build client trust.

By implementing an automation system, you can simplify your financial processes, reduce administrative workload, and provide a more efficient and professional experience fo

Best Practices for Invoice Organization

Proper organization of billing documents is essential for maintaining smooth business operations and ensuring that transactions are easily tracked and managed. By following a few simple yet effective practices, you can reduce errors, speed up payments, and keep your accounting in order. Here are some key strategies for organizing your financial records effectively.

1. Implement a Consistent Naming System

Each billing document should have a unique reference number for easy identification and tracking. A consistent naming system ensures that you can quickly find specific records when needed. For example, you could include the date or client name in the reference number to make it easier to locate later.

2. Keep Detailed Records

Ensure that every transaction is fully documented, with clear descriptions of services, quantities, and costs. The more details you provide, the less chance there is for confusion in the future. This practice will also help you during tax season or when addressing any potential disputes with clients.

3. Use Folders and Subfolders

Digital and physical records should be stored in an organized folder structure. Create main folders for each client, and within those, maintain subfolders for individual transactions. Digital tools can help you organize and search for past records easily. For physical documents, clearly labeled folders or binders will keep everything in order.

4. Schedule Regular Reviews

Set aside time each week or month to review your financial documents and ensure everything is up-to-date. This will help you catch any discrepancies early, avoid bottlenecks in your payment cycle, and stay on top of your financial situation.

5. Keep Backup Copies

Always back up your records, whether they’re stored digitally or in paper form. Digital backups can be stored on secure cloud services, while physical records should be scanned and saved electronically. This will protect you from losing important files in case of technical issues or accidental damage.

6. Track Payments and Due Dates

Maintaining a separate log of all payments and their due dates is essent

Legal Requirements for Billing Documents

Ensuring that your billing records comply with local laws and industry standards is critical to maintaining a legitimate and professional business operation. Different regions and industries may have specific requirements regarding the information that needs to be included in each transaction record, as well as the process of delivering and storing these documents. Understanding these legal requirements helps you avoid costly mistakes and potential legal complications.

Key Legal Elements to Include in Your Billing Records

To stay compliant, be sure your billing documents contain all the required details, which may vary depending on jurisdiction and business type. Below are some common elements that should always be included:

Required Information Explanation Business Information Include your business name, address, and contact details. This ensures that clients know how to reach you, and it is also important for legal and tax purposes. Client Information Always include the client’s full name or company name, their address, and contact details to ensure proper identification of the parties involved in the transaction. Unique Document Number Each transaction should have a unique reference number to make tracking and record-keeping easier, and to avoid any confusion in case of disputes or audits. Tax Information Ensure that all applicable taxes (e.g., VAT, sales tax) are clearly listed. Your document should indicate the tax rate applied and the total tax amount, as this is often required by tax authorities. Payment Terms Clearly state the payment due date, penalties for late payments, and any other terms regarding the payment process. This ensures clarity on both sides and helps avoid legal is How to Track Payments Efficiently

Efficiently monitoring payments is essential for maintaining a steady cash flow and avoiding overdue balances. By implementing a systematic approach to tracking, businesses can quickly identify which clients have paid, which are overdue, and take necessary actions accordingly. This process not only ensures you stay organized but also helps improve communication with clients and reduces the risk of missed payments.

Methods for Effective Payment Tracking

There are several methods you can use to stay on top of your financial records and ensure no payments slip through the cracks. Below are some practical ways to track payments effectively:

- Use Payment Management Software – Many tools offer automated features that allow you to record payments in real time, send reminders for overdue payments, and even track the status of multiple transactions at once. Integrating this software with your billing system can save you significant time and effort.

- Set Up an Organized Spreadsheet – For small businesses or those who prefer a manual approach, creating a spreadsheet with columns for invoice numbers, payment dates, amounts, and client details is an effective way to keep track of transactions. Regularly updating this document ensures you have a comprehensive overview of your financial status.

- Integrate with Accounting Software – If you already use accounting software, many solutions allow you to automatically link incoming payments to specific transactions. This ensures everything is synced and reduces the chances of manual errors.

Best Practices for Monitoring and Follow-Up

To further optimize the payment tracking process, consider implementing these best practices:

- Establish Clear Payment Terms – Always define clear payment deadlines and penalties for late payments. This helps set expectations and encourages clients to pay on time.

- Send Timely Payment Reminders – Sending reminders ahead of the due date–and if necessary, follow-up reminders for overdue payments–helps keep clients on track and demonstrates your professionalism.

- Regularly Reconcile Accounts – Periodically compare your records with bank statements to ensure all payments have been received and correctly logged. This helps catch any discrepancies early and keeps your financial records accurate.

By tracking payments efficiently, you can reduce the time spent on follow-ups, maintain accurate financial records, and ensure a smoother, more professional relationship with your clients. Proper tracking ultimately supports b

Design Tips for Your Billing Document

Creating a well-organized and visually appealing document for financial transactions is key to presenting a professional image and ensuring clarity for both you and your clients. A thoughtfully designed record can help make the payment process smoother, increase trust, and reduce confusion. Here are several design tips that can elevate the quality of your transaction records.

1. Prioritize Simplicity and Clarity

The layout should be clean and easy to follow. Avoid cluttering the page with unnecessary elements that might distract from the important details. A simple, straightforward design will make it easier for clients to understand the charges and any relevant information, such as payment terms or due dates.

2. Use a Professional Font and Color Scheme

Select fonts that are legible and professional. Stick to standard fonts like Arial or Times New Roman, and ensure that the text is large enough for easy reading. When choosing a color scheme, opt for neutral tones that align with your brand’s style. Too many bright colors can make the document appear unprofessional.

3. Include Clear Section Headings

Organizing the content with clear headings such as “Client Information,” “Payment Details,” and “Services Provided” makes it easier for your clients to find specific information. A well-structured design improves user experience and ensures that key details stand out.

4. Utilize Tables for Itemized Lists

When listing services, products, or charges, tables can provide a neat and organized layout. Each item, its description, quantity, rate, and total amount can be displayed clearly in rows and columns. This makes it easier for clients to verify the details of the transaction.

Item Description Quantity Unit Price Total Service A 2 $50.00 $100.00 Service B 1 $75.00 $75.00 How to Handle Late Payments

Late payments are a common challenge faced by many businesses. When clients delay settling their bills, it can disrupt cash flow and impact overall financial stability. However, having a clear strategy for addressing overdue payments can help minimize the impact and maintain a positive client relationship. Here are several steps you can take to handle late payments professionally and efficiently.

1. Send a Friendly Reminder

The first step is always to send a polite reminder. Sometimes clients simply forget, and a gentle nudge can prompt them to make the payment. You can send an email or a message with a clear statement of the amount due, the due date, and any applicable late fees.

2. Offer Flexible Payment Terms

If the client is struggling to make the payment, consider offering alternative payment options. This could include breaking the amount into smaller installments or extending the deadline if necessary. Being flexible can help maintain goodwill and encourage prompt payment.

3. Charge Late Fees

To encourage timely payments and cover the costs of delays, consider charging late fees. Be sure to clearly outline this policy in your original agreement or transaction records. A late fee should be reasonable and reflect the inconvenience caused by the delay.

4. Maintain Regular Communication

It’s important to stay in touch with your clients throughout the process. If the payment continues to be delayed, follow up regularly. Use polite yet firm communication to remind them of the outstanding balance and its impact on your business. Document all correspondence for future reference.

5. Use Collection Services if Necessary

If your client still refuses to pay despite your efforts, consider using a collection agency to recover the funds. This should be a last resort, as it may strain your relationship with the client, but it can be an effective way to recoup payments if the situation escalates.

6. Legal Action

As a final option, you may need to take legal action. Depending on your location and the size of the unpaid amount, small claims court may be an option. However, always weigh the potential costs and benefits before pursuing this route.

Action When to Use Incorporating Branding into Your Billing Document

Incorporating your brand into transaction records not only reinforces your business identity but also adds a professional touch that enhances client trust. A well-branded document leaves a lasting impression, ensuring that your clients immediately recognize your business, which can improve their overall experience. From the logo to the color scheme, each design element communicates a message about your company’s values and attention to detail.

Key Elements to Include for Strong Branding

To create a cohesive brand presence in your documents, ensure that key design elements align with your company’s visual identity. Here are several ways to incorporate branding effectively:

- Logo Placement – Your logo should be prominently displayed at the top of the document. It serves as a visual anchor and immediately lets the client know which business is associated with the record.

- Consistent Color Scheme – Use the same color palette from your website, business cards, or other marketing materials. Consistency in color reinforces brand recognition and makes the document look more cohesive.

- Typography – Choose fonts that align with your brand’s personality. For instance, a corporate brand might use sleek, professional fonts, while a creative business might opt for something more playful. Ensure that the font is legible and maintains a professional appearance.

Adding a Personal Touch

Beyond logos and colors, consider adding small personal touches to your transaction documents to make them feel unique. A short thank-you note or personalized message can create a positive connection with the client, making them feel valued. These subtle additions contribute to a more memorable experience, increasing the chances of future business.

Incorporating your brand into your billing documents elevates their professionalism and communicates your commitment to quality. It also provides an opportunity to reinforce your business’s values and create a consistent client experience across all touchpoints.

Billing Documents for Small Businesses

For small businesses, having a clear and professional record for every transaction is essential. These documents help maintain a good relationship with clients and provide a solid foundation for managing finances. By using well-designed billing documents, businesses can streamline their payment processes, enhance professionalism, and ensure transparency in every transaction. A properly structured billing document also helps businesses stay organized, reducing errors and improving cash flow management.

Why Small Businesses Need Professional Billing Records

For small businesses, professionalism is key to building trust with clients. A polished and consistent document can help establish your business as reliable and competent. Below are some reasons why it is important to have professional records for every service or product provided:

- Clarity – Clear and concise documentation helps clients understand the breakdown of services, making it easier to address any questions or concerns.

- Efficiency – Having a standardized format for records saves time and reduces the chances of mistakes when managing multiple clients or projects.

- Consistency – Consistency in billing reinforces your brand identity, giving clients a sense of professionalism and reliability.

Customizing Your Billing Records for Your Small Business

Customizing your documents according to your business’s needs can add a personal touch and ensure they meet your unique requirements. Key features to consider when customizing include:

- Company Branding – Incorporate your company logo, colors, and fonts to align with your overall brand identity.

- Detailed Descriptions – Include clear descriptions of products or services, ensuring transparency for both you and your clients.

- Payment Terms – Always specify payment terms, such as due dates, accepted methods, and late fees if applicable.

By using well-crafted billing documents tailored to your small business, you can keep financial transactions organized, maintain professionalism, and enhance client trust. A good document not only facilitates easier payments but also helps ensure that your business stays financially organized and successful.

Where to Find Free Templates Online

Finding ready-made, customizable documents online can save time and effort for businesses that need professional-looking records. There are numerous platforms offering free resources that cater to various industries. Whether you are starting a new business or simply looking for an efficient way to streamline your paperwork, free templates can provide a solid foundation. These resources help you create professional documents quickly, without the need for design skills or expensive software.

Popular Websites Offering Free Templates

Many websites provide a variety of free document designs that can be easily customized for your specific needs. Here are some popular platforms where you can find free document templates:

- Canva – Known for its user-friendly design tools, Canva offers free, customizable templates for businesses of all sizes. You can search for and edit various document formats directly on their platform.

- Microsoft Office Templates – If you use Microsoft Office software, you can access a large library of free templates through their official website or within the Office apps, such as Word and Excel.

- Google Docs – Google Docs provides free, cloud-based templates that can be edited directly in your browser. They offer several types of templates for businesses looking to simplify record-keeping.

- Zoho – Zoho offers free business templates, including sales receipts and other transactional records, which are easy to use and modify for your business.

- Template.net – A comprehensive resource for all kinds of business templates, Template.net offers a variety of free and paid options that can be customized based on your business needs.

How to Customize Templates for Your Needs

While free templates can be a great starting point, it’s essential to personalize them to reflect your branding and business requirements. Here’s how you can make the most of free templates:

- Branding – Add your company logo, colors, and fonts to ensure consistency with your overall brand identity.

- Details – Customize the fields to include your specific