What is an Invoice Template and How Can It Benefit Your Business

Efficient billing is crucial for any business, ensuring smooth transactions and timely payments. A well-structured document can streamline this process, reducing errors and saving time. By using a predefined format, companies can maintain consistency, improve accuracy, and project a professional image to clients.

For many businesses, especially small enterprises and freelancers, these documents serve as a key tool for invoicing clients. Whether you are offering a service or selling products, having a ready-made structure for your billing can significantly enhance efficiency. This approach eliminates the need for creating each bill from scratch, making financial management easier and faster.

Utilizing such a document not only simplifies the creation process but also ensures that all necessary information is included, reducing the likelihood of disputes. Moreover, it helps to track payments and maintain organized records. In this article, we will explore how these tools work and how they can benefit your business operations.

What is an Invoice Template

In the business world, having a structured document for billing is essential for maintaining clarity and professionalism. These documents serve as a formal request for payment, containing all the necessary details about the products or services provided. By using a predefined layout, businesses can create consistent and accurate records with minimal effort, reducing the chances of mistakes and improving efficiency.

Key Components of a Billing Document

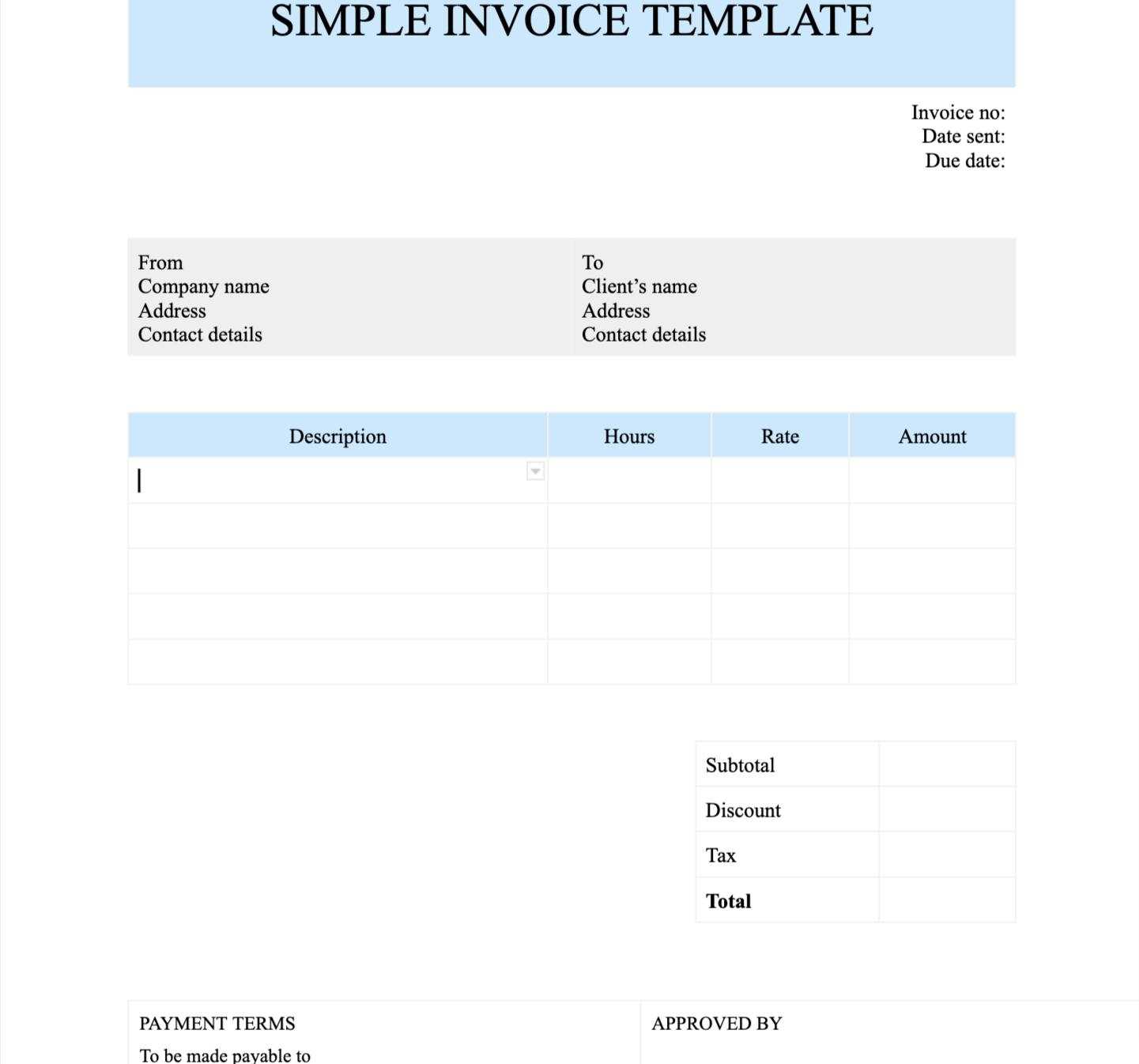

Every properly structured bill typically includes several key elements to ensure that both the sender and the recipient have a clear understanding of the transaction. These elements help to avoid confusion and ensure that all necessary information is readily available for review.

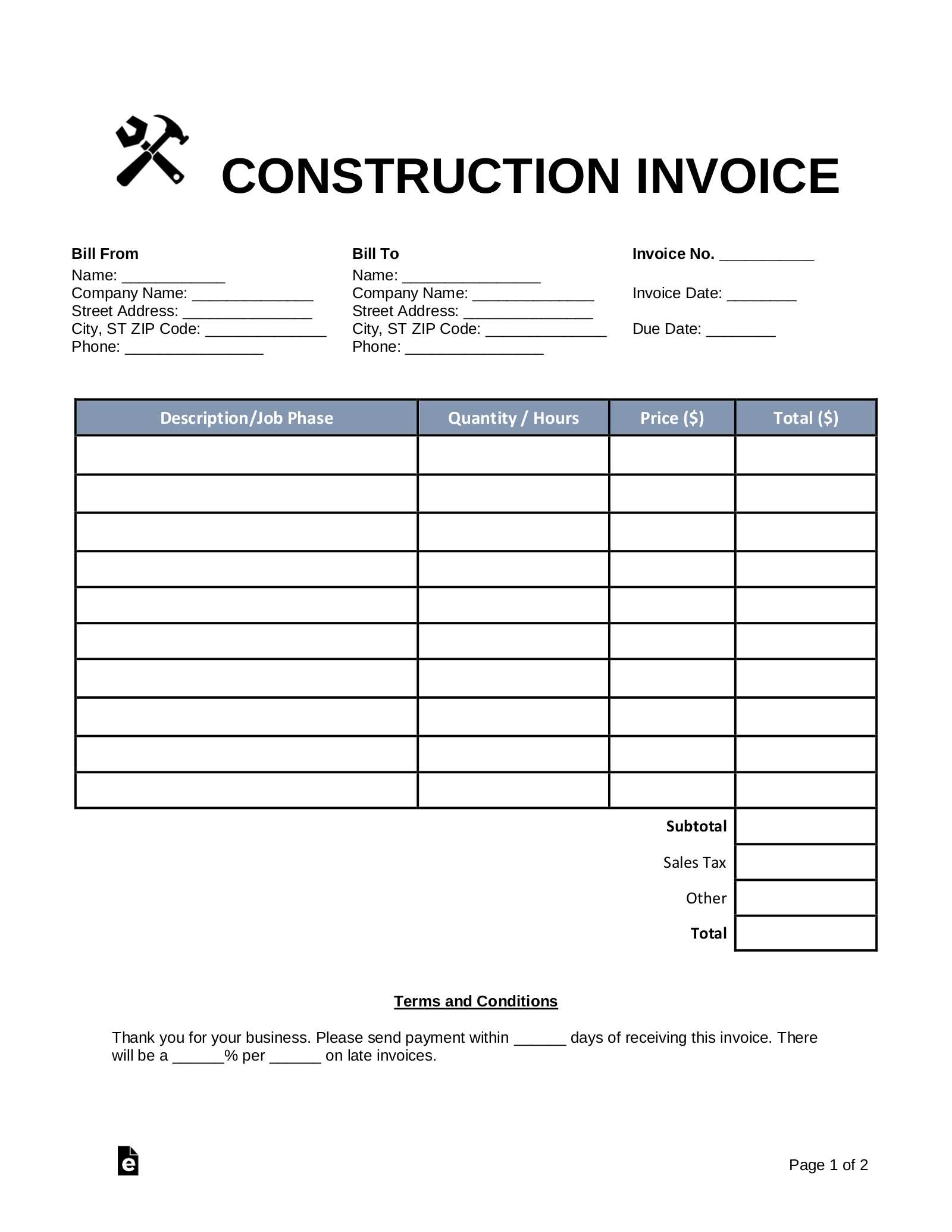

| Component | Description |

|---|---|

| Sender’s Information | Name, address, contact details of the company or individual issuing the bill |

| Recipient’s Information | Name, address, and contact information of the client or customer |

| Services or Products Provided | A clear breakdown of what was delivered, including quantity and cost |

| Payment Terms | Details of when payment is due, including accepted payment methods and any late fees |

| Unique Identifier | A reference number or code to distinguish each bill from others |

Advantages of Using a Predefined Billing Document

By utilizing a structured form, businesses can save valuable time and resources. Rather than manually creating each bill from scratch, the format ensures consistency and completeness. Furthermore, having a clear and organized document can help businesses stay compliant with legal requirements and make it easier to track payments for accounting purposes.

Understanding the Basics of Invoice Templates

A well-designed billing document simplifies the process of requesting payment for goods or services. It ensures that all critical information is included in a clear and organized manner, making it easy for both the business and the customer to understand the transaction. These forms are essential tools for maintaining professionalism, consistency, and accuracy when handling financial exchanges.

Structure and Organization

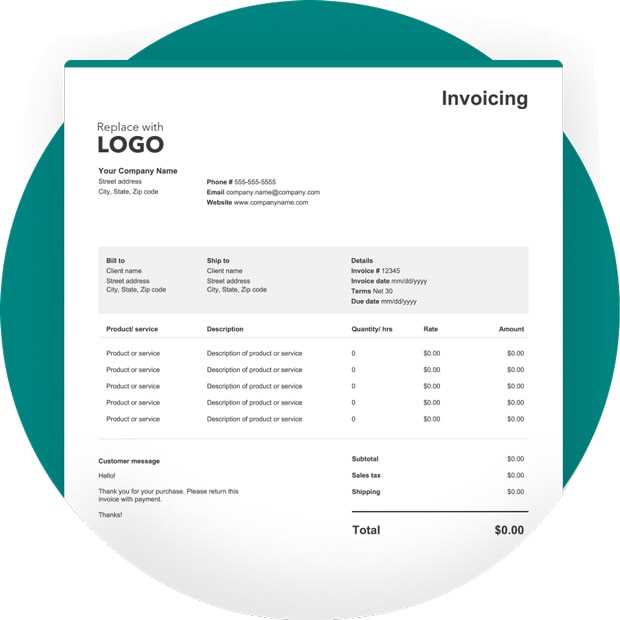

The key to an effective billing document is its structure. It must contain all the necessary details, from the names and contact information of both parties to the specific items or services being charged. These documents typically follow a consistent layout, which helps businesses avoid missing important information and minimizes the risk of disputes or misunderstandings.

Automation and Customization

While these documents follow a specific format, they can be easily customized to fit the needs of different businesses. Automation tools allow companies to generate these forms quickly and consistently, reducing the time spent on manual work. The ability to personalize the layout ensures that businesses can maintain their brand identity while still providing clients with a clear and professional bill.

Why Businesses Need Invoice Templates

For businesses, having a predefined structure for billing is essential for efficiency, accuracy, and professionalism. Without a consistent approach to generating payment requests, companies risk errors, delays, and confusion that could harm relationships with clients and disrupt cash flow. Using a ready-made format ensures that businesses can issue clear, comprehensive, and legally compliant documents without having to create them from scratch each time.

Time and Cost Efficiency

Creating each billing document manually can be time-consuming and prone to mistakes. By adopting a standardized form, businesses can streamline the process and save valuable time. This approach not only speeds up billing but also reduces the chance of human error, which can lead to costly mistakes or disputes with clients.

- Predefined formats allow for quick completion, cutting down the time spent on paperwork.

- Minimizes the need for rework or corrections, saving resources and effort.

- Automated systems can generate documents instantly, improving overall workflow.

Professionalism and Consistency

Using a standardized format helps businesses present a consistent and professional image. A well-structured document reflects positively on the company and builds trust with clients. It ensures that every bill sent is clear, complete, and aligned with the business’s brand identity.

- Ensures that clients always receive the same level of clarity and detail.

- Promotes a consistent brand image across all business communications.

- Improves customer satisfaction by making the payment process straightforward and transparent.

How to Create an Invoice Template

Designing a standardized billing document is an essential step for any business looking to streamline its payment processes. With the right structure, companies can ensure that each bill is clear, professional, and contains all the necessary information. Creating such a document involves understanding the key elements that must be included and ensuring the format is consistent and easy to use.

Step-by-Step Process

Follow these steps to create an efficient and effective billing document for your business:

- Choose a Format: Decide whether you want to create your document from scratch, use a software tool, or download a pre-made layout. Ensure the format suits your business needs and is easy to customize.

- Include Key Details: The document must contain all necessary information, such as:

- Sender’s name and contact details

- Recipient’s name and address

- Description of goods or services provided

- Payment terms and due dates

- Unique reference number for tracking

Customization and Branding

While consistency is key, it’s also important to reflect your brand identity in your document. Customizing the layout with your company’s logo, color scheme, and contact information helps maintain professionalism and strengthens your brand image.

- Choose colors and fonts that align with your business identity.

- Incorporate your logo at the top or bottom of the document.

- Ensure that your contact details are

Essential Elements of an Invoice

A well-crafted billing document is more than just a request for payment; it serves as a formal record of the transaction between a business and its client. To ensure clarity and avoid any confusion, certain key elements must be included in every document. These components provide the necessary information for both parties to understand the details of the exchange, including the goods or services provided, payment terms, and deadlines.

Here are the essential components that should always be included:

- Sender’s Details: The name, address, and contact information of the business or individual issuing the bill. This makes it clear who is requesting payment.

- Recipient’s Information: The name and contact details of the customer or client being billed. This ensures the document is addressed correctly.

- Unique Reference Number: A distinct number or code that identifies the transaction. This helps with record-keeping and makes it easier to track payments.

- Description of Products or Services: A clear and itemized list of what was delivered, including quantities, unit prices, and any applicable taxes or fees.

- Payment Terms: The agreed-upon conditions for payment, including the due date, accepted payment methods, and any late fees or discounts for early payment.

- Total Amount Due: The sum of all charges, taxes, and fees, clearly stated at the bottom of the document. This ensures both parties are aware of the exact amount to be paid.

Incorporating these elements ensures that the document is professional, comprehensive, and easy for clients to understand. By doing so, businesses can facilitate smoother transactions and avoid misunderstandings about payments.

Customizing Your Invoice Template

Personalizing a billing document is essential for businesses that want to reflect their brand identity while ensuring functionality and clarity. Customization allows you to tailor the layout, style, and structure to better suit your specific needs, making the process of billing smoother and more efficient. Whether you’re a freelancer, a small business owner, or part of a larger organization, a customized form helps you stand out and maintain professionalism.

Key Elements to Customize

When adapting a standard layout, focus on these important elements to ensure the document aligns with your business’s image and requirements:

- Logo and Branding: Adding your company logo and matching the document to your brand’s color scheme and font style is a great way to reinforce your identity.

- Contact Information: Customize the contact details section to ensure clients can easily reach you, whether for inquiries or support. Include phone numbers, email addresses, and physical addresses where necessary.

- Payment Instructions: If you accept various payment methods, include the relevant information for bank transfers, online payment portals, or checks. Ensure these details are clear and easily accessible.

- Legal Disclaimers or Terms: Add any necessary legal terms or disclaimers specific to your business, such as late payment penalties, warranty terms, or return policies.

Creating Consistency Across Documents

Once the layout is customized, ensure that all future documents maintain the same structure and design. Consistency in format not only boosts professionalism but also helps clients easily recognize and process your bills. Consider using an automated system or soft

Choosing the Right Invoice Template

Selecting the right billing document format is crucial for ensuring both efficiency and professionalism. The right layout helps streamline the process of requesting payment, ensuring clarity and reducing the chances of confusion or delays. Factors like your business type, the complexity of the products or services offered, and your preferred payment methods all influence the choice of a suitable format.

Factors to Consider

When choosing the best structure for your needs, keep these important factors in mind:

- Business Type: Different industries may require different layouts. For instance, freelancers might prefer simpler forms, while larger companies may need more detailed breakdowns of products or services.

- Customization Needs: Ensure the format allows for easy customization to fit your brand’s style and specific requirements, such as including logos or special terms.

- Complexity of Transactions: If your business involves multiple products or services, look for a format that supports itemized lists, quantities, pricing, and taxes.

- Payment Methods: Choose a layout that can accommodate various payment options, such as credit cards, bank transfers, or online payments, and ensure that these details are clearly presented.

Different Layout Options

There are many layout options available, ranging from simple designs to more advanced ones with detailed breakdowns. Consider these options when making your decision:

- Basic Format: Suitable for small businesses or freelancers who need a straightforward, no-frills layout. Includes essential details such as the payment amount and due date.

- Itemized Format: Ideal for businesses offering multiple products or services. It allows for detailed descriptions, quantities, prices, and taxes.

- Profession

Common Invoice Template Formats

When it comes to billing documents, there are several formats available, each designed to suit different business needs and transaction types. Choosing the right structure ensures that all necessary details are included while maintaining clarity and professionalism. Each format offers its own set of features and is tailored to meet the requirements of specific industries or business models.

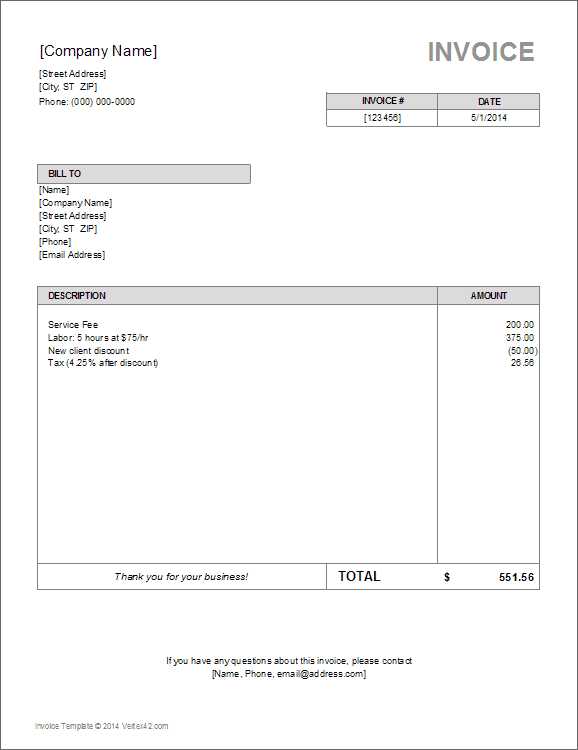

Basic Format

This is the most straightforward design, ideal for small businesses or freelancers who need to quickly request payments without a lot of complexity. It typically includes the essential elements such as the business and client details, payment amount, and due date.

- Simple Layout: Contains the most basic information required to facilitate a transaction.

- Quick Processing: Easy to generate and understand, making it ideal for one-time or low-value transactions.

- Minimal Customization: Limited in terms of design and style, focusing primarily on clarity and brevity.

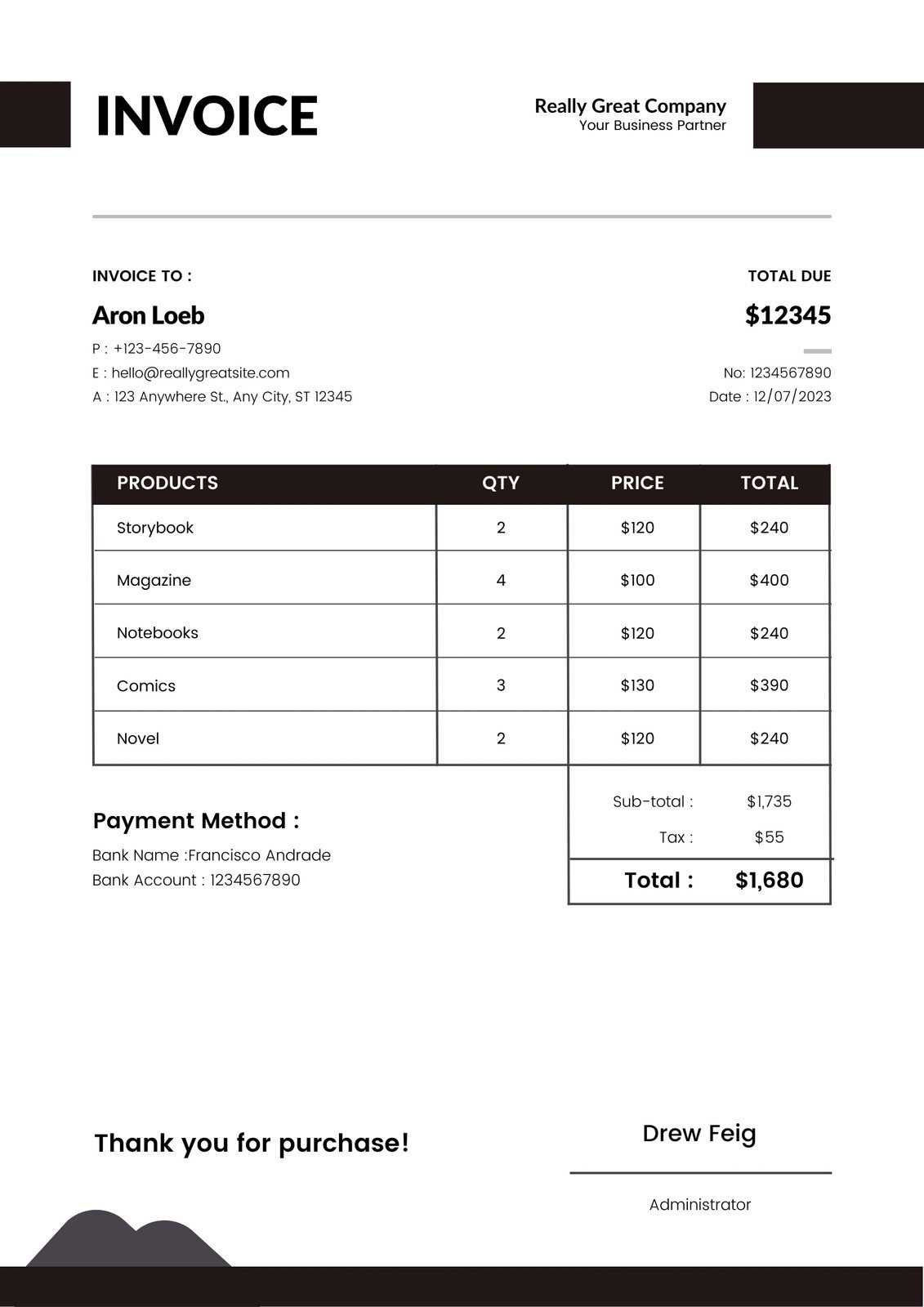

Itemized Format

The itemized format is perfect for businesses that provide multiple products or services. It includes a detailed breakdown of each item, its quantity, individual price, and total cost. This is particularly useful for retail businesses, contractors, and those offering complex services.

- Detailed Breakdown: Shows each item or service separately, ensuring full transparency with the customer.

- Taxes and Discounts: Allows for adding any applicable taxes, discounts, or additional charges, making it easier for customers to understand the full cost.

- Clear Itemized List: Helps avoid confusion and ensures accurate payment processing by providing a transparent list of charges.

Profession

Benefits of Using Invoice Templates

Utilizing a standardized document for billing purposes offers several advantages for businesses of all sizes. By adopting a consistent and organized structure, companies can streamline their financial processes, minimize errors, and maintain a professional image. Whether you’re a freelancer or a large corporation, using a pre-designed format can enhance efficiency and improve client relationships.

Time-Saving and Efficiency

One of the primary benefits of using a pre-made format is the significant time savings. Rather than manually creating each bill from scratch, businesses can simply fill in the relevant details, speeding up the process. This efficiency is especially valuable for companies with frequent transactions or high volumes of clients.

- Faster Billing: Quickly generate documents without the need for designing each one individually.

- Less Manual Work: Avoid repetitive tasks by using a consistent structure, reducing the chance of errors.

- Automated Features: Many formats come with automated fields for dates, amounts, and payment terms, making the process even faster.

Professional Appearance and Consistency

A well-organized billing document contributes to a company’s professional image. By using a consistent format, businesses can ensure that all of their billing communications are uniform, clear, and aligned with their brand identity. This level of consistency fosters trust and confidence with clients.

- Consistency: Every document will follow the same design and structure, making it easier for clients to recognize and understand.

- Branding Opportunities: Customize your document with company logos, color schemes, and fonts to reinforce your brand identity.

- Clear Communication: A

Invoice Templates for Freelancers and Contractors

Freelancers and contractors often work on a project basis, which means they need clear and professional billing documents to ensure prompt payment. A well-structured document helps to outline the work completed, the agreed-upon payment terms, and other essential details. By using a standardized format, freelancers can streamline their invoicing process, save time, and maintain a consistent professional image.

Key Elements for Freelancers and Contractors

For those in freelance or contract work, it is important to include certain elements in each document to ensure that both parties are on the same page. A clear breakdown of services provided, payment rates, and deadlines is critical to avoid misunderstandings.

- Project Description: Clearly state the work completed or services provided. Be specific about the tasks performed to avoid any ambiguity.

- Hourly or Flat Rates: Specify the payment method used, whether it’s hourly rates, flat project fees, or milestone payments.

- Payment Schedule: Outline the agreed-upon payment terms, including the due date and any late fees or early payment discounts.

- Additional Costs: Include any additional charges, such as travel expenses or materials, if applicable.

Benefits for Freelancers and Contractors

Using a consistent format helps freelancers and contractors in various ways, from maintaining professionalism to ensuring timely payments. With a standardized document, freelancers can focus on their core work without spending too much time on administrative tasks.

- Professional Image: A clean and organized document builds trust with clients, demonstrating that you are serious and reliable.

- Time-Saving: With a pre-designed structure, you can quickly generate and send invoices without having to create them from sc

How Invoice Templates Save Time and Money

Using a standardized billing document can significantly reduce the time and effort required to generate and process payments. By eliminating the need to create each document from scratch, businesses can focus on more important tasks, while ensuring accuracy and consistency in their financial communications. This efficiency not only saves time but also minimizes the potential for costly errors.

Time-Saving Benefits

One of the most notable advantages of using a pre-designed billing document is the time it saves. With a ready-made format, businesses can quickly create and send invoices without having to spend time on formatting or designing each new bill. This streamlined process helps businesses save valuable time and reduces the chances of delays in the payment cycle.

- Faster Creation: No need to start from scratch. Simply fill in the relevant details and send.

- Reduced Administrative Tasks: Automating common fields like client details and payment terms reduces repetitive work.

- Consistency Across Documents: A uniform format ensures you don’t waste time redesigning each new document.

Cost-Effective Advantages

Beyond saving time, using a standardized billing structure can also save businesses money. It minimizes the risk of errors that could lead to payment disputes or missed revenue, and it eliminates the need for external invoicing services or software subscriptions. Furthermore, by improving efficiency, businesses can allocate resources to other critical areas of operation.

- Reduced Errors: Pre-built fields and calculations lower the chances of mistakes in billing, preventing costly corrections.

- Lower Operational Costs: Save on administrative overhead by reducing the time spent on manual invoicing tasks.

- Improved Cash Flow: Quicker invoicing and fe

Free vs Paid Invoice Templates

When it comes to creating billing documents, businesses have the option to choose between free and paid options. Each has its advantages and disadvantages, depending on the specific needs of the business. While free formats can be appealing due to their no-cost nature, paid options often provide more advanced features, better customization, and professional support. Understanding the differences between these two choices can help businesses make the best decision based on their requirements.

Advantages of Free Options

Free billing document layouts are widely available and are often sufficient for small businesses, freelancers, or those with simple needs. These options allow users to create and send bills quickly without any upfront investment. However, free layouts typically come with limitations in terms of design, features, and customization.

- No Cost: The biggest advantage is, of course, that they are free to use, which is beneficial for startups or businesses on a tight budget.

- Simplicity: Free formats often have basic designs, making them easy to understand and use without a steep learning curve.

- Basic Functionality: While they may not offer extensive customization, free options still provide the core elements necessary for billing.

Benefits of Paid Options

Paid formats, on the other hand, offer more robust features, such as advanced customization options, integration with accounting software, and improved designs. For businesses that need more flexibility, branding opportunities, and support, investing in a paid version may be worth the cost.

- Advanced Features: Paid options often come with built-in features like automated calculations, recurring billing, and payment tracking, which can save time and reduce errors.

- Customization: Paid layouts provide more freedom to adjust designs, fonts, logos, and branding elements to align with your company’s identity.

- Support and Updates: Many paid versions come with customer support, regular updates, and bug fixes, which is helpful for businesses that need ongoing assistance.

While free layouts may be suitable for basic billing needs, businesses that require advanced functionality, greater customization, and professional design may find that investing in a paid option is a worthwhile expense in the long run. Ultimately, the right choice depends on your business’s size, needs, and budget.

Legal Requirements for Invoice Templates

When creating a billing document, businesses must ensure that it meets the legal requirements set by local tax authorities or industry regulations. A properly structured billing document not only ensures timely payment but also helps in avoiding legal issues or disputes. In various regions, there are specific details that must be included to comply with tax and commercial laws.

Essential Information for Legal Compliance

To be legally valid, a billing document must include certain key elements that provide clarity about the transaction and fulfill statutory requirements. These elements help both the seller and the buyer track financial transactions and meet tax obligations.

- Business Information: The name, address, and contact details of the seller, as well as their tax identification number or business registration number, are often required by law.

- Client Details: The name and address of the buyer must be included to clearly identify the parties involved in the transaction.

- Invoice Number: Each document must have a unique number for reference and tracking purposes. This ensures proper record-keeping and auditing.

- Date of Issue: The date the document is issued is a mandatory field. This helps in tracking payment deadlines and avoiding disputes over due dates.

- Payment Terms: Terms related to payment methods, due dates, and any late fees or discounts should be clearly stated to avoid confusion and ensure legal clarity.

- Itemized List of Goods or Services: A breakdown of the products or services provided, including descriptions, quantities, and prices, is necessary for tax purposes and transparency.

- Tax Information: Depending on the jurisdiction, it may be necessary to include tax rates, amounts, and relevant tax identification numbers for both the seller and the buyer.

Regulations and Compliance by Region

The specific legal requirements for billing documents can vary by country or region. While some businesses may only need to include basic information, others may face stricter regulations, particularly when dealing with international clients. It is important to stay informed about the local laws and tax codes that apply to your business.

- Choose a Suitable Tool: Select an automation tool or accounting software that supports pre-made document layouts and integrates with your business systems.

- Upload or Create Layouts: Upload an existing layout or create one using the tool’s features. Customize it to reflect your business branding and standard billing structure.

- Input Client Details: Link your client database to the tool so that client information can be automatically populated into the billing document, reducing the chances of errors.

- Set Up Payment Terms: Define payment terms and deadlines in the software so that they are automatically included in every document generated.

- Automate Reminders: Set up automated reminders to notify clients about due dates and late payments. This

Invoice Templates for Small Businesses

For small businesses, managing finances effectively is crucial, and a key part of this is having a clear and efficient method for billing clients. Using standardized billing documents helps ensure accuracy and professionalism, while also simplifying the administrative process. A well-designed document can save time, reduce errors, and help businesses maintain good relationships with their clients by ensuring that all necessary information is provided in an organized manner.

Benefits of Using Billing Documents for Small Businesses

For entrepreneurs and small business owners, using pre-designed billing structures can bring several advantages. These documents help streamline operations, avoid confusion with clients, and ensure timely payments.

- Professional Appearance: A consistent and polished format gives a professional impression to clients, helping build trust and credibility.

- Time Efficiency: Using pre-made layouts speeds up the creation of each bill, allowing businesses to focus on their core activities.

- Cost-Effective: Many free and low-cost options are available for small businesses, providing a budget-friendly solution for invoicing.

- Reduced Errors: Automated fields and consistent structure reduce the chances of errors in billing, ensuring accuracy and clarity.

Key Elements to Include in Billing Documents

Regardless of the format used, certain elements should always be included to ensure that your billing document is both complete and legally compliant. These elements help clarify the transaction, reduce disputes, and provide a clear payment timeline for both parties.

Element Description Digital vs Paper Invoice Templates

Businesses today have the option to choose between digital and physical formats for their billing documents. Both methods have their benefits and drawbacks, depending on the nature of the business, customer preferences, and available resources. While digital documents offer efficiency and ease of use, paper-based ones can still hold value in certain situations, particularly where clients or industries prefer more traditional methods.

Advantages of Digital Billing Documents

Digital documents are becoming increasingly popular due to their numerous benefits, particularly in terms of convenience and speed. With modern accounting software and tools, businesses can automate and streamline the entire process, making it much easier to manage transactions.

- Efficiency: Digital formats can be generated quickly and sent instantly via email, saving time and postage costs.

- Automation: Automated features can fill in details, calculate totals, and track payments, reducing human error and manual effort.

- Environmental Impact: Digital formats are more eco-friendly, reducing the need for paper and contributing to sustainability efforts.

- Easy Record-Keeping: Storing and organizing digital documents is straightforward and requires less physical space than paper documents.

Benefits of Paper Billing Documents

Despite the advantages of digital formats, some businesses and clients still prefer or require paper-based billing documents. These documents can provide a tangible, formal record that some individuals find easier to reference or file.

- Physical Record: Paper documents can be physically stored and may be required by some clients or industries for official purposes.

- Client Preferences: Certain customers may prefer receiving paper do

Common Mistakes to Avoid in Invoices

Creating accurate and professional billing documents is essential for maintaining good client relationships and ensuring timely payments. However, even experienced businesses can make errors when preparing these documents. Small mistakes can lead to confusion, delayed payments, and even legal issues. It’s crucial to be aware of common pitfalls to ensure smooth and efficient billing practices.

Common Errors in Billing Documents

To avoid unnecessary complications, here are some of the most common mistakes to watch out for when creating billing records:

- Missing or Incorrect Information: Failing to include critical details, such as the client’s contact information, business number, or transaction date, can delay processing or cause confusion.

- Incorrect Totals: Mathematical errors, such as incorrect tax calculations or miscalculating the total amount due, can lead to disputes and delays in payment.

- Not Including Payment Terms: Omitting clear payment terms, such as due dates, acceptable payment methods, or late fees, can result in late payments and misunderstandings.

- Lack of Unique Identification Number: Every document should have a unique reference number for easy tracking. Without it, records become harder to organize and track, leading to administrative issues.

- Unclear Descriptions of Goods or Services: Vague or incomplete descriptions can lead to confusion about what is being billed. Ensure each item or service is clearly detailed, including quantity and price.

- Not Addressing Tax Requirements: Inaccurate or missing tax information, such as VAT or sales tax, can result in legal consequences and cause issues with accounting departments or tax authorities.

- Failure to Proofread: Typos or formatting errors can reduce the professionalism of the document. Always proofread your records before sending them out to ensure everything is correct.

How to Avoid These Mistakes

To ensure your billing process runs smoothly and efficiently, here are some helpful tips:

- Use Automated Software: Consider using accounting or billing software that auto-ge

Best Practices for Managing Invoice Templates

Efficient management of billing documents is crucial for maintaining smooth operations and ensuring timely payments. When these documents are handled properly, businesses can reduce errors, improve workflow, and strengthen client relationships. Establishing best practices for creating, storing, and managing these documents will help ensure consistency and professionalism in every transaction.

Effective Organization and Maintenance

To make the process of managing billing documents more streamlined, it’s essential to implement an organized approach that focuses on consistency and easy accessibility. Here are some best practices for ensuring that billing documents are well-managed:

- Centralized Storage: Store all document formats in one central location, either on a local drive or a cloud-based system, for easy access and retrieval.

- Use Version Control: Keep track of changes and updates to each document by implementing version control, ensuring that the most current format is always in use.

- Standardized Naming Conventions: Use a consistent naming convention for each document to make it easy to locate and track. For example, including the date and document number in the file name can make searching for specific records faster.

- Maintain Backups: Always have backups of your documents, particularly if you store them on physical servers or local drives, to avoid data loss in case of technical issues.

Regular Updates and Customization

It’s important to periodically review and update your billing documents to reflect any changes in business processes, regulations, or client needs. By keeping these documents up-to-date, you can avoid potential legal issues and ensure they remain relevant for your clients.

- Periodic Reviews: Schedule regular reviews of your billing formats to make sure they still comply with the latest legal requirements, tax rates, or business practices.

- Customization for Clients: Customize documents for specific clients when needed. This can include adding personalized payment terms, project details, or other client-specific information to improve communication and reduce disputes.

- Update Payment Methods: Ensure that payment methods listed on the documents

How to Automate Invoices with Templates

Automation can significantly simplify the billing process, saving time and reducing errors. By using pre-designed formats and integrating automation tools, businesses can streamline the creation, sending, and tracking of financial documents. This allows for greater efficiency and consistency, ensuring that no important details are missed and that clients receive their bills on time.

To automate billing, businesses can follow several steps to integrate templates with software tools that handle repetitive tasks. These tools can populate fields such as client information, transaction details, and payment terms, eliminating the need for manual entry. This not only speeds up the process but also ensures accuracy.

Steps to Automate Billing

To automate billing processes with pre-designed layouts, follow these key steps: