Free Wedding Invoice Template for Easy Budgeting and Planning

Planning a significant celebration involves managing numerous financial aspects, from vendor payments to overall budgeting. Organizing these costs efficiently is crucial for avoiding misunderstandings and ensuring everything stays within budget. Many couples or event planners find it helpful to have a structured way to track all payments and due amounts for services rendered.

Pre-designed documents allow you to easily input and modify the necessary details, making the process of keeping track of expenses far more manageable. These tools are especially useful when managing multiple suppliers and service providers, helping to maintain clear records and streamline payment processes.

Taking advantage of readily available resources can save you both time and effort, while also ensuring that all financial transactions are properly documented. Whether you’re handling small or large-scale events, having a solid record system in place will make a significant difference in how smoothly everything runs from start to finish.

Free Wedding Invoice Template Benefits

Using pre-made documents to track expenses offers a range of advantages, especially when managing the financial side of a major event. These resources simplify the process of monitoring payments and organizing charges, ensuring that no detail is overlooked. By relying on readily available tools, you can eliminate the need for manual tracking and focus on other aspects of your planning.

Key Advantages

- Time Savings: With a structured format, it’s quicker to fill in and update payment details, reducing time spent on financial tasks.

- Consistency: Pre-built documents ensure you use the same format throughout, minimizing the chance of errors or inconsistencies.

- Ease of Use: These resources are designed to be user-friendly, even for those with no accounting background, making them accessible to anyone handling event finances.

- Cost-Effective: Accessing these documents at no cost saves money, especially when compared to purchasing software or hiring a professional to create custom financial records.

- Customizability: Most pre-made options are flexible, allowing you to adjust the details to suit your specific needs without starting from scratch.

Practical Applications

- Managing multiple payments to vendors or service providers.

- Tracking deposits, final balances, and due dates for each vendor.

- Providing a clear overview of total event costs to stay within budget.

By utilizing such tools, event planners and couples can enjoy a smoother financial planning process, knowing that all records are clearly organized and easy to update.

Why You Need a Wedding Invoice

When organizing an event, keeping track of all financial transactions is essential to ensure that everything stays on budget. Having a structured record of payments helps you stay organized and avoid misunderstandings with vendors or service providers. This type of document acts as both a reminder of amounts due and proof of agreements made, making it an indispensable tool for anyone managing event finances.

Key Reasons for Using Payment Records

- Clear Financial Overview: It provides an organized summary of all charges, deposits, and balances, helping you understand the total cost.

- Avoiding Misunderstandings: Having a detailed breakdown ensures both parties (client and vendor) are on the same page regarding what has been paid and what is still due.

- Tracking Payments: It helps monitor which payments have been made, preventing late fees and missed deadlines.

- Legal Protection: Detailed documentation protects both parties in case of disputes, offering a reference point for terms and conditions agreed upon.

- Budget Management: By organizing payments in a clear format, you can more easily compare projected and actual costs, helping you stay within your budget.

When to Use Payment Records

- When confirming agreements with vendors and service providers.

- After receiving payments or making deposits to document transactions.

- As a reference for final payments and any outstanding balances.

Utilizing such a tool ensures that every payment is tracked, accounted for, and transparent, helping you navigate the financial side of event planning with confidence.

How to Customize Your Invoice

Personalizing your financial document is essential to ensure it reflects the specific details of your event and meets your individual needs. Customizing these records allows you to include the necessary information, such as vendor names, amounts due, payment terms, and any additional notes. This tailored approach helps both you and your service providers stay organized and ensures that no important details are missed.

Steps to Personalize Your Record

- Insert Event Details: Add the name of the event, the date, and the location to make the document specific to your occasion.

- Include Vendor Information: Clearly list all vendors, their services, and the agreed-upon costs to avoid confusion.

- Specify Payment Terms: Define payment deadlines, deposit requirements, and any other relevant conditions.

- Add a Payment Breakdown: Detail the amounts for each service and track any payments already made, showing a clear outstanding balance.

- Custom Notes: Include additional remarks such as discounts, special requests, or contact information for each vendor.

Tools for Customization

- Spreadsheets: Use software like Excel or Google Sheets for easy data entry and flexibility in adjusting categories.

- Document Editors: Customize your document with programs like Microsoft Word or Google Docs, which allow you to add logos and style the layout.

- Online Resources: Many online platforms provide pre-designed structures that you can modify to suit your specific needs.

Customizing your financial document ensures that all the details are clearly communicated and easy to reference throughout the planning process. It also helps keep things professional, giving both you and your vendors confidence that everything is handled correctly.

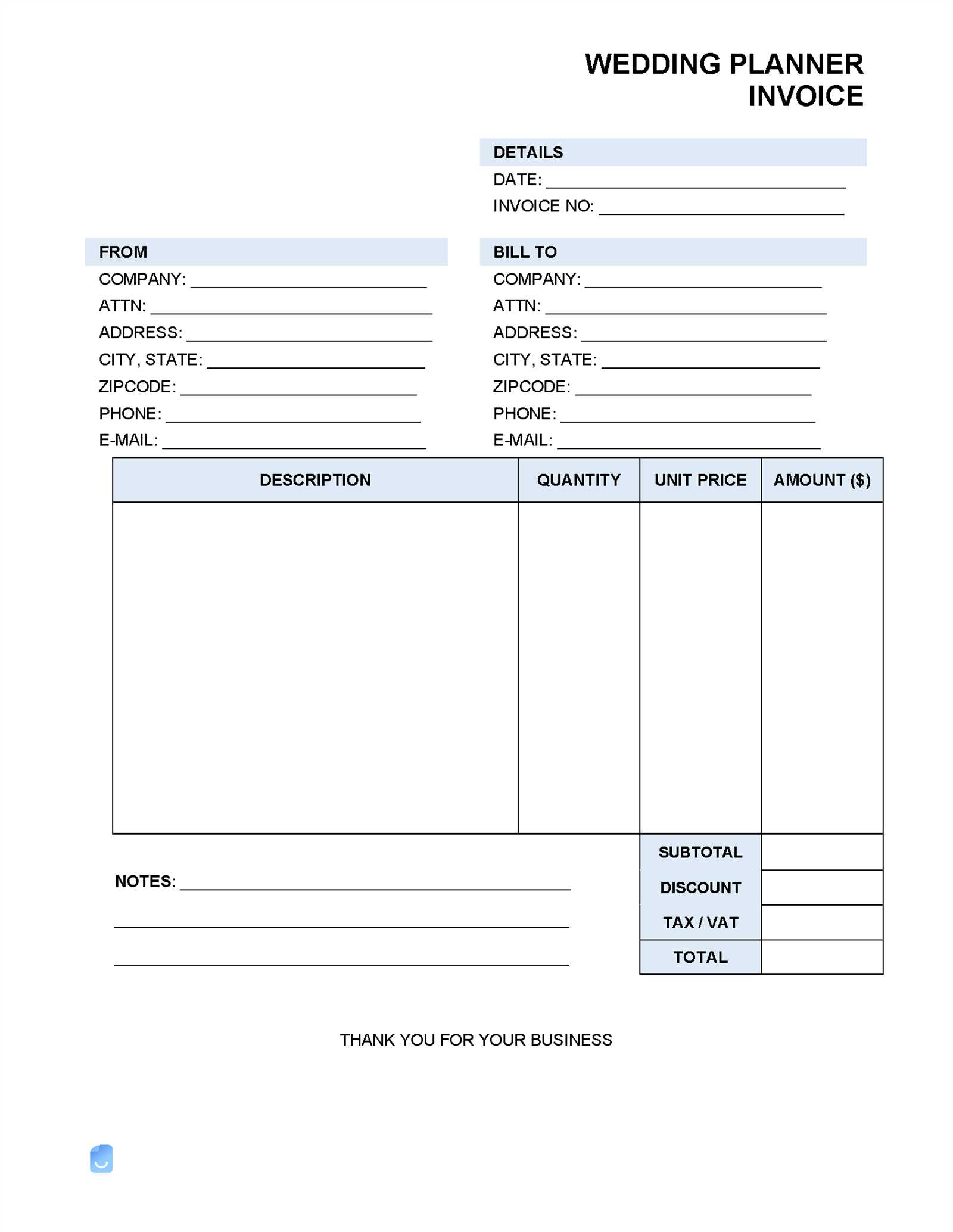

Essential Information for Wedding Invoices

When managing the financial side of a large event, having the right details in your payment records is crucial. Accurate and comprehensive information helps ensure that both you and your service providers have a clear understanding of what’s owed and when. Including all necessary elements in your documents can prevent confusion and keep your planning process smooth.

Key Details to Include

- Event Information: Start with the event name, date, and location to give the document context and relevance.

- Vendor Details: List the name of each service provider along with their contact information, so it’s easy to identify who is responsible for what.

- Description of Services: Clearly outline the services rendered, whether it’s catering, photography, or entertainment. Include any specific packages or agreements made.

- Payment Breakdown: Include a detailed list of costs, highlighting deposits, balances, and any discounts or additional charges.

- Payment Due Dates: Specify when payments are due, and whether installments or lump sums are required.

- Payment Methods: Clearly outline acceptable payment methods (e.g., credit card, bank transfer, check) to avoid confusion.

- Terms and Conditions: Include any agreed-upon terms, such as refund policies, cancellation fees, and late payment charges.

Why These Details Matter

- Clarity: These details ensure that both you and your vendors are on the same page, preventing misunderstandings.

- Legal Protection: A complete record protects both parties in case of disputes or confusion over payments.

- Financial Organization: Having all the information in one place helps you keep track of costs and stay within budget.

Including these elements ensures that your financial records are clear, comprehensive, and professional, making the entire planning process more efficient and stress-free.

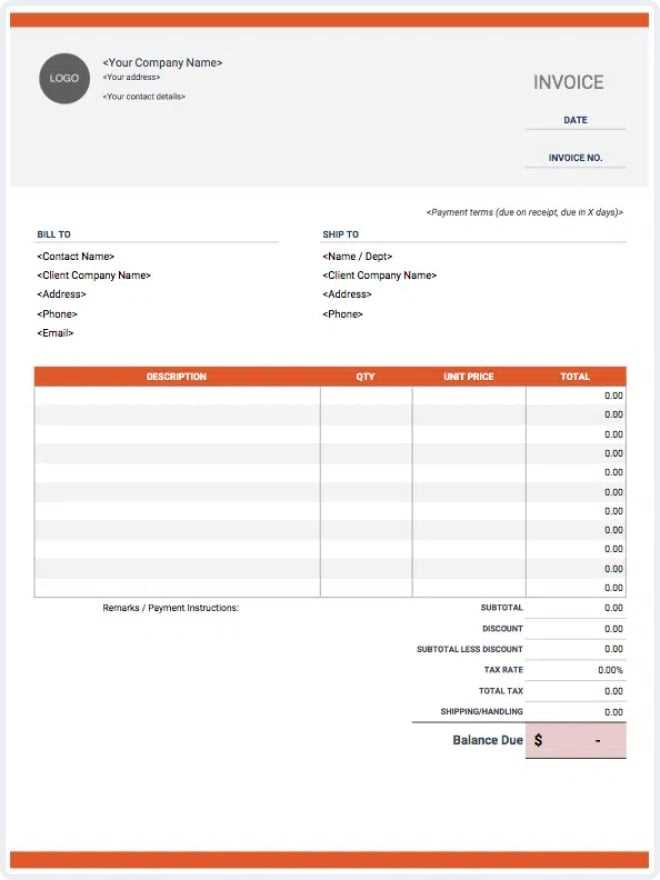

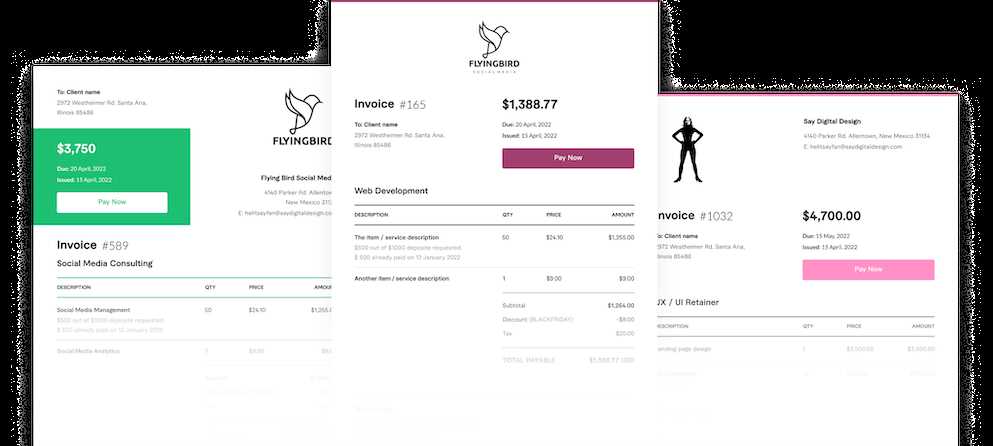

Best Formats for Wedding Invoices

Choosing the right format for your financial documents is essential for keeping everything organized and professional. The format you select will influence how easily you can enter information, track payments, and share details with vendors. Whether you prefer simplicity or more complex features, selecting a format that suits your needs will make the process smoother and more efficient.

Popular Document Formats

- Spreadsheet Formats (Excel, Google Sheets): Ideal for those who want to track multiple expenses and payments over time. These formats offer flexibility and ease of use, allowing for quick updates and calculations.

- Word Documents (Microsoft Word, Google Docs): Perfect for a clean, professional appearance. Word formats are easy to customize with logos, fonts, and layouts, providing a formal look.

- PDF Format: A non-editable option that provides a secure, professional appearance when sending finalized documents. PDFs ensure that your document will appear the same to all recipients.

- Online Platforms: Websites like Canva and FreshBooks offer customizable, user-friendly designs. These platforms often provide additional features, such as automatic calculations and online payment links.

Advantages of Different Formats

- Spreadsheets: Great for ongoing tracking and easy adjustments. They are particularly useful when you need to calculate totals and view financial trends over time.

- Word Documents: Offers a polished, formal look. Customization allows for more personalized details to be added, making it ideal for high-end events.

- PDFs: Ensures consistency and security, especially when sharing finalized documents. This format also prevents accidental changes to the content.

- Online Tools: Streamlines the entire process with built-in features like auto-calculations, easy sharing options, and even payment tracking.

Selecting the right format depends on your specific needs, whether you prioritize flexibility, professionalism, or simplicity. Each format has its benefits, so choose the one that best fits your event’s requirements.

How to Track Wedding Expenses

Keeping track of expenses is a critical part of managing any large event. With so many different services, vendors, and costs involved, staying organized ensures you don’t go over budget. A solid tracking system helps you monitor where the money is going, identify potential areas to save, and prevent unexpected financial surprises as you move through the planning process.

Steps to Effectively Track Expenses

- Create a Budget: Start by setting a clear budget for each category (e.g., venue, catering, entertainment). This helps you allocate funds wisely and see how much you have left for other items.

- Use a Spreadsheet: A simple spreadsheet can be one of the most effective ways to track costs. List all expenses, including vendor payments, deposits, and any miscellaneous costs. Update it regularly to stay on top of your budget.

- Record All Payments: Every time you make a payment, record it immediately, noting the vendor, amount, and payment method. This ensures that nothing is forgotten.

- Track Deposits: Make sure to document any deposits made to vendors, and be sure to keep a record of outstanding balances for each service.

- Review Regularly: Set aside time weekly or bi-weekly to review your expenses and adjust your budget if necessary. This helps prevent overspending in any one category.

Tools to Help Track Expenses

- Spreadsheets: Programs like Microsoft Excel and Google Sheets allow for easy data entry and formula calculations, which can automatically update totals as you add or modify entries.

- Expense Tracking Apps: Many apps are available that let you track payments, set reminders, and categorize spending. Some examples include Mint, YNAB (You Need A Budget), and Wedding-specific planners like The Knot.

- Receipts and Notes: Always keep digital or physical copies of receipts and notes. This can help verify payments and clarify any discrepancies later on.

By keeping detailed records and reviewing them regularly, you can avoid unexpected costs and stay on top of your financial plan.

Understanding Wedding Invoice Terms

When handling the financial side of an event, it’s essential to understand the key terms and conditions that are commonly used in payment documents. These terms not only clarify the financial obligations between you and your service providers but also help prevent misunderstandings. Knowing what each term means ensures you are better equipped to manage payments, deadlines, and any unexpected charges that may arise.

Key Terms to Know

- Deposit: A partial payment made in advance to secure a service. Deposits are often required to confirm a vendor’s commitment to your event and are typically deducted from the total cost.

- Balance Due: The remaining amount that needs to be paid after the initial deposit or any partial payments. This is usually due before or on the day of the event.

- Due Date: The specific date by which the total amount or remaining balance must be paid. It’s important to be aware of these deadlines to avoid late fees or cancellations.

- Late Fee: A charge added if payment is not made by the agreed-upon date. Understanding this fee helps you stay on track and avoid additional costs.

- Final Payment: The last installment that clears the remaining balance for a service. This payment is often due closer to the event date.

- Refund Policy: The terms that dictate whether and how you can receive a refund in the case of a cancellation or change in plans. Be sure to review this in detail to understand your options.

- Terms and Conditions: The agreement outlining all expectations, responsibilities, and rules for both parties, including cancellation policies, payment schedules, and liability details.

Why Understanding Terms Matters

- Prevent Disputes: Clear understanding of each term ensures both you and your service providers are aligned on expectations, reducing the risk of conflict.

- Financial Planning: Knowing payment schedules and deadlines helps you manage your budget effectively, avoiding last-minute surprises.

- Protection: Having a clear agreement

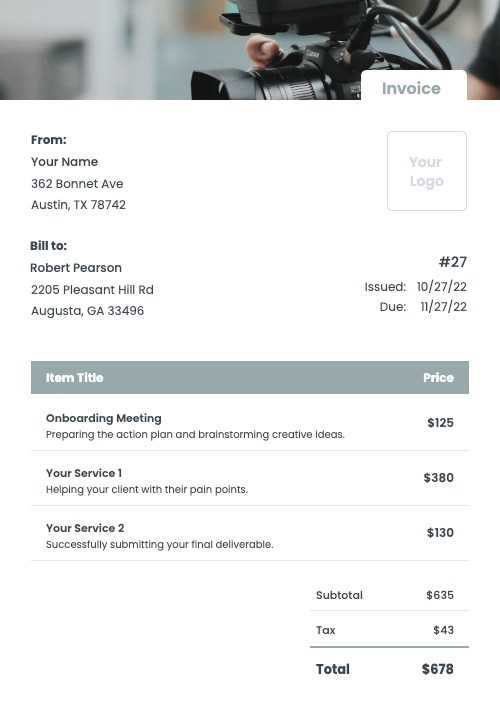

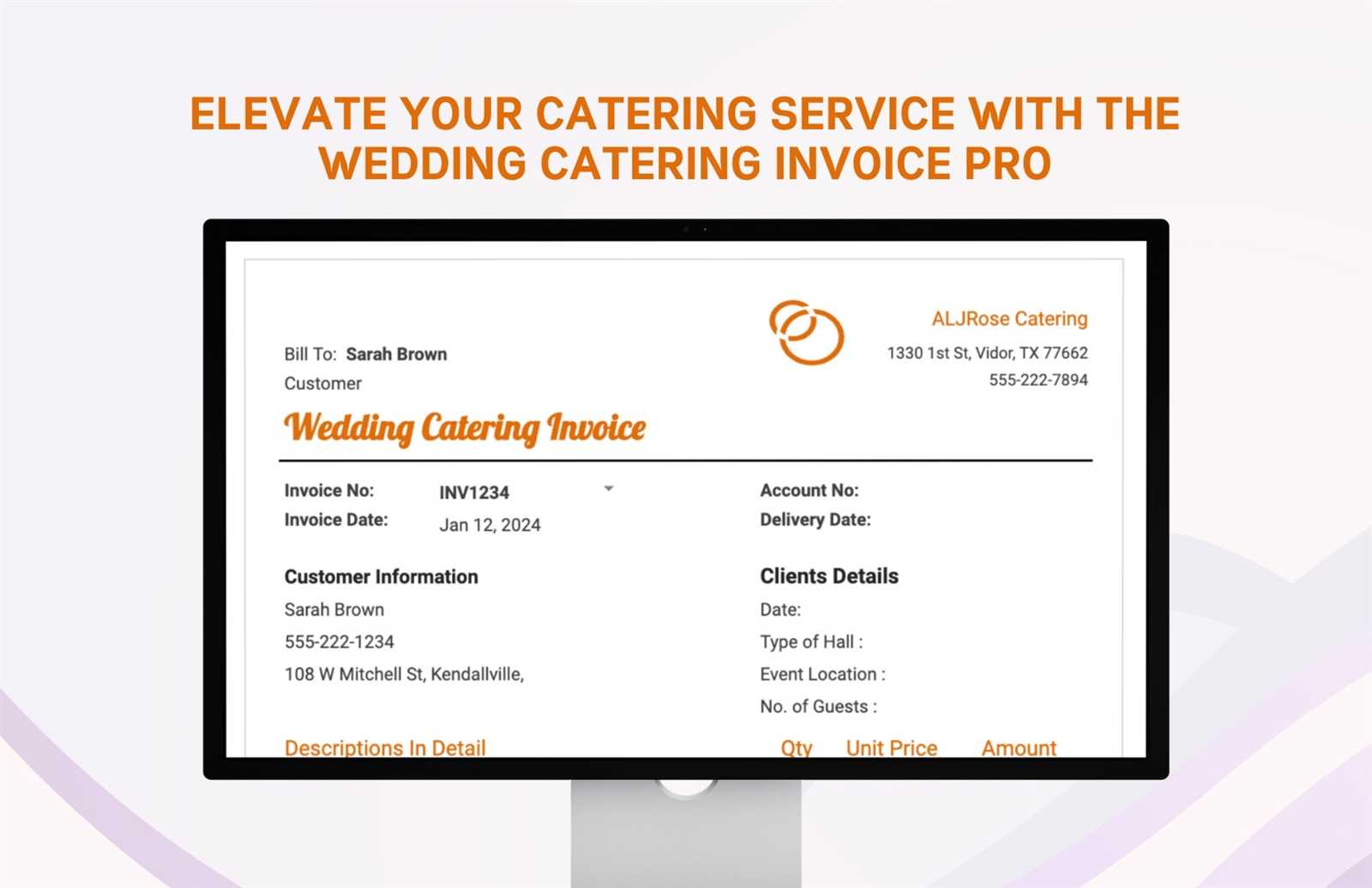

Free Templates vs Paid Options

When it comes to organizing financial records for any event, one of the decisions you’ll face is whether to use a no-cost option or invest in a paid version. Both choices have their pros and cons, and understanding the differences can help you make the best decision based on your needs and budget. Free resources can be an excellent starting point, while paid tools might offer additional features and customization options for those seeking a more professional touch.

Benefits of No-Cost Options

- Cost-effective: The most obvious advantage is that they come with no financial investment. They can be ideal for those on a tight budget or who are managing a smaller event.

- Ease of Access: Free resources are often available immediately and are easy to download or use online without any long-term commitments or subscriptions.

- Basic Functionality: For those who need a straightforward, simple way to track payments and expenses, free versions typically offer all the essential features without unnecessary complexity.

Advantages of Paid Options

- Customization: Paid versions often allow for greater personalization, with more design templates, branding options, and customizable fields that can better reflect your event’s specific needs.

- Advanced Features: These tools may come with extra functionalities, such as automated calculations, integration with payment platforms, or the ability to track multiple payments over time.

- Professional Appearance: Paid options often offer polished, high-quality layouts that create a more professional and cohesive look for your documents, which can be important when dealing with multiple vendors.

- Customer Support: Many paid services include access to customer service or technical support, which can be invaluable if you encounter any issues or need help with customization.

Ultimately, the choice between free and paid options depends on the scale of your event, your budget, and the level of customization or features you require. If you’re planning a small-scale event and need something simple, free resources may suffice. However, if you’re managing a larger event and need a more polished, feature-rich solution, investing in a paid service could be worthwhile.

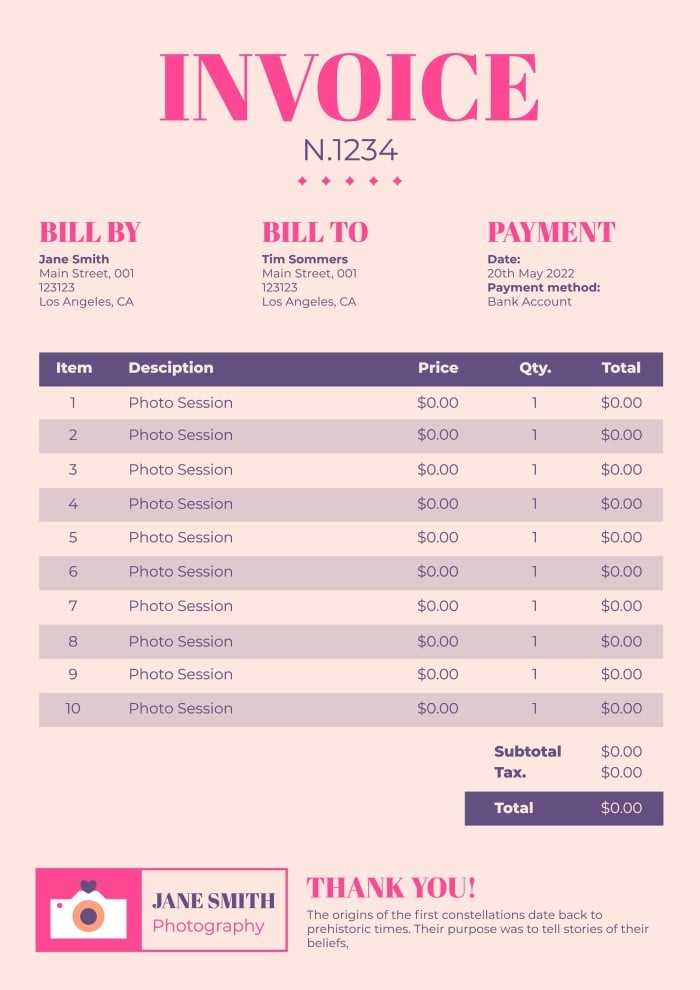

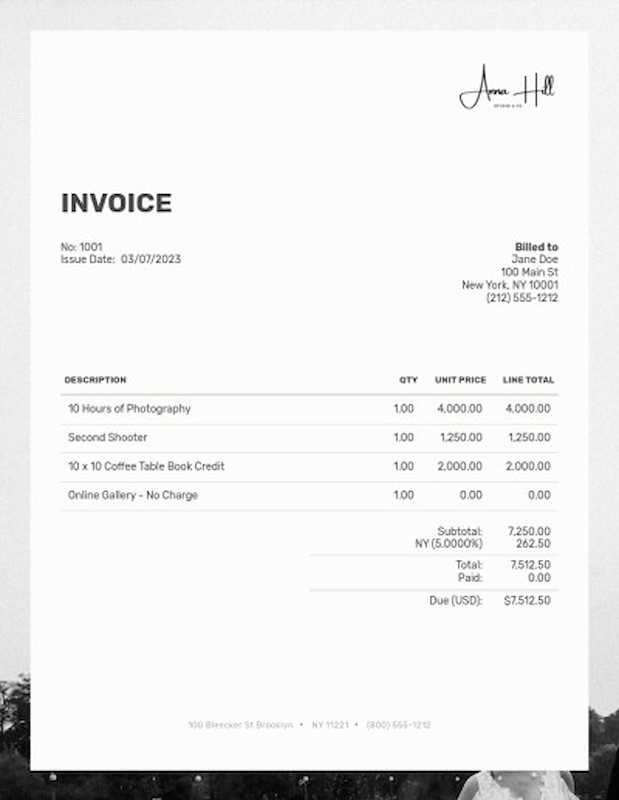

Design Tips for Wedding Invoices

When creating financial documents for an event, the design plays an important role in making the information clear, organized, and professional. A well-designed document not only conveys all the necessary details but also leaves a positive impression on vendors and clients alike. Attention to layout, font choice, and overall structure ensures that your documents are both functional and aesthetically pleasing.

Essential Design Elements

- Clean Layout: Ensure that the layout is simple and easy to follow. Use sections to clearly separate different categories like services, payments, and totals. This makes it easier for recipients to find the information they need.

- Consistent Branding: Incorporate colors, logos, or fonts that reflect the overall theme or tone of the event. Consistent branding adds a professional touch and can help create a cohesive look across all event documents.

- Readable Fonts: Choose clear, legible fonts for all text. Avoid overly decorative fonts that may be difficult to read, especially for important details like amounts or payment terms.

- Whitespace: Don’t overcrowd the document with too much text or too many graphics. Ample spacing between sections, lines, and text helps keep everything clear and easy to digest.

- Highlight Key Information: Use bold or larger fonts to emphasize crucial details such as totals, due dates, and vendor names. This ensures important points stand out at a glance.

Additional Tips for a Professional Touch

- Use Icons or Visuals: Small icons (such as a calendar for due dates or a dollar sign for amounts) can help break up the text and make the document more visually engaging.

- Stay Organized: Group related information together (e.g., payment schedule, services provided, outstanding balances) to create a logical flow that’s easy to follow.

- Proofread: Double-check all information for accuracy, spelling, and grammar. A polished document reflects your attention to detail and professionalism.

By following these design tips, your financial documents will not only be clear and easy to understand but will also leave a lasting, professional impression. This attention to detail enhances the overall experience for everyone involved in the event.

Common Mistakes in Wedding Invoices

When managing the financial aspects of an event, it’s easy to make small errors that can lead to confusion or even disputes later on. Whether it’s a minor oversight or a bigger mistake, these errors can complicate your planning process and affect your relationships with vendors. Being aware of the most common pitfalls can help you avoid them and ensure that all transactions are handled smoothly and professionally.

Frequent Errors to Watch Out For

- Missing or Incorrect Details: Failing to include essential information such as event dates, vendor contact details, or service descriptions can lead to confusion. Always double-check that all the key details are accurate and up-to-date.

- Unclear Payment Terms: Not specifying clear payment schedules or deadlines can cause misunderstandings. Ensure that due dates, deposit requirements, and balance payment terms are well-defined and easy to follow.

- Overlooking Taxes or Fees: Forgetting to add taxes, service charges, or additional fees can lead to discrepancies later on. Make sure these are clearly indicated and added to the total cost.

- Inconsistent Totals: Double-check calculations to avoid errors in total amounts due. Small mistakes in adding or subtracting can cause confusion and delays in payment.

- Not Providing a Payment Breakdown: If you don’t break down the cost of each service or vendor, it can be difficult for recipients to understand what they are paying for. A detailed payment breakdown ensures transparency and clarity.

- Not Keeping a Record of Payments: Failing to track payments already made or received can lead to misunderstandings about outstanding balances. Always keep a record of each transaction to ensure that both parties are clear on what has been paid.

- Lack of Professional Appearance: A poorly designed document may make it harder to read and understand. Ensure that the document is clean, organized, and easy to navigate.

How to Avoid These Mistakes

- Double-check Details: Always review the document carefully before sending it out to ensure all information is correct.

- Use a Standardized Format: Using consistent formats for dates, payments, and service descriptions can help reduce confusion.

- Break Down Payments: Provide a clear breakdown of the total amount, listing each service and its cost. This adds transparency and helps recipients understand the charges.

- Set a Budget for Each Category: Break down your total budget into specific categories such as venue, catering, entertainment, attire, and decor. Allocate a set amount to each category based on priority and your overall financial limits.

- Estimate Vendor Costs: Research and get quotes from vendors to estimate the cost of each service. Don’t forget to account for tips, travel fees, or additional services they might offer.

- Include Additional Charges: Many vendors may have extra fees that are not included in the initial quote, such as overtime charges or delivery fees. Be sure to include these in your total estimate.

- Track Deposits and Payments: Keep a detailed record of deposits made to vendors and any payments you have already completed. Subtract these from your total amount due to get an accurate sense of what’s left to pay.

- Account for Contingency: It’s always wise to include a small contingency fund (usually 5-10% of the total budget) to cover any unexpected expenses that may arise during planning or on the day of the event.

- Prioritize Expenses: Some elements of the event may be more important than others, so focus your budget on the areas that matter most, like the venue or catering, and cut costs on less critical aspects.

- Negotiate with Vendors: Don’t hesitate to negotiate prices with vendors to stay within your budget. Many will be willing to offer discounts or package deals, especially if you book multiple services from them.

- Track Payments Regularly: Make sure you keep track of all incoming and outgoing payments. This will help you stay on top of expenses and ensure there are no surprises as the event date approaches.

- Establish Clear Payment Terms: From the beginning, agree on the payment schedule with your vendors. This should include when deposits are due, how much they will be, and when the final balance is expected to be paid.

- Keep Track of Deadlines: Set reminders for when each payment is due. This will help ensure you never miss a deadline and avoid late fees or service interruptions.

- Get Written Agreements: Always have written agreements that outline the payment terms, including deposit amounts, due dates, and any applicable fees. This protects both parties in case of any confusion later on.

- Record Each Payment: Keep a detailed record of each transaction, including the date, amount, and method of payment. This helps track what has been paid and what is still outstanding.

- Use Secure Payment Methods: When making payments, use secure methods such as bank transfers, credit cards, or reputable payment services to ensure both security and a clear record of the transaction.

- Request Deposits Early: To secure services and protect against cancellations, ask for a deposit as soon as possible after booking the vendor. Deposits often range from 20% to 50% of the total cost.

- Be Transparent About Refunds: Make sure both you and the vendor agree on the refund policy for deposits in case of cancellations. Understand when deposits are refundable and when they are not.

- Track Remaining Balances: After making deposits, keep track of how much is still owed. This will help you stay on top of your payments and avoid last-minute financial stress.

- Track Deadlines: Keep a calendar or reminder system to ensure that you never miss a payment deadline. This helps prevent last-minute stress or late fees.

- Consolidate Information: Organize all payment terms in one place. You can create a spreadsheet or a dedicated folder to store contracts

Legal Considerations for Wedding Invoices

When handling financial transactions for an event, it’s essential to ensure that all agreements and payments are legally sound. Clear and properly documented terms help protect both parties involved, avoiding potential disputes down the line. From the initial agreement to payment terms and cancellation policies, understanding the legal requirements of financial documents is critical in maintaining transparency and ensuring the legality of the transactions.

Key Legal Elements to Include

- Written Agreements: Always have a signed contract with vendors outlining the scope of services, payment amounts, deadlines, and cancellation policies. This contract serves as a legal reference in case of disagreements.

- Clear Payment Terms: Specify the exact payment schedule, including deposit amounts, due dates, and total fees. This clarity helps prevent misunderstandings regarding when payments are expected.

- Tax Compliance: Ensure that all applicable taxes are included in the final amount. Depending on your location, taxes such as sales tax, VAT, or service charges may need to be calculated and added to the total cost.

- Refund and Cancellation Policies: Clearly outline any terms for cancellations, including deposit refunds or penalties for changes in plans. Having a detailed refund policy protects both parties and sets expectations in case of cancellations or modifications.

- Legal Rights for Disputes: Include a clause detailing the resolution process in case of a dispute. This could involve mediation or legal action, and it’s important to define the process to avoid lengthy legal battles.

Best Practices for Legal Protection

- Keep Detailed Records: Retain all written agreements, payment receipts, and communication with vendors. This documentation will serve as evidence should any issues arise.

- Consult a Legal Expert: If you’re unsure about the legal language or need help drafting contracts, consider consulting a lawyer to ensure that everything is legally binding and fair for both parties.

- Stay Transparent: Make sure that all parties fully understand the terms and conditions before signing any agreements. Transparency fosters trust and helps prevent future legal conflicts.

By considering these legal aspects, you can help avoid potential problems and ensure that all transactions are handled professionally and within the legal framework. This not only safeguards your interests but also establishes a sense of trust and clarity with the vendors involved.

Why Digital Invoices Are Ideal

In today’s fast-paced world, managing financial transactions digitally offers numerous advantages over traditional methods. Digital documents streamline the process, offering enhanced organization, faster communication, and easier tracking. Whether you’re managing a large or small event, using digital records for financial transactions simplifies the entire process and provides numerous benefits that paper-based methods simply cannot match.

Benefits of Using Digital Financial Records

- Easy Accessibility: Digital documents can be accessed anywhere, anytime, from any device. This makes it incredibly convenient to review, update, and share financial details without having to rely on physical copies or storage space.

- Reduced Risk of Errors: When creating financial records digitally, many tools come with built-in validation and calculation features, which can reduce human error. Additionally, automatic updates and alerts can help keep all data accurate and up to date.

- Environmentally Friendly: Moving away from paper documents helps reduce waste and supports sustainability efforts. Digital records not only save trees but also reduce the need for physical storage and filing systems.

- Faster Transactions: Sending and receiving digital financial documents is quicker than mailing paper copies. Payments can be processed faster through digital channels, speeding up the entire financial process.

- Improved Security: Digital files can be encrypted, password-protected, and backed up, offering higher levels of security than paper-based records. Sensitive financial information is safer from loss, theft, or damage.

Organizing and Tracking Digital Records

- Search and Filter Capabilities: With digital documents, you can quickly search for specific transactions or vendors, making it much easier to manage large amounts of data.

- Automatic Backups: Digital financial records can be backed up to cloud storage, ensuring they’re never lost or damaged. Even if a device is lost or broken, you can still access your information from another location.

- Professional Appearance: Digital records can be formatted and designed to look polished and professional. Customized documents can enhance your credibility with vendors and clients, creating a more streamlined business process.

Overall, digital solutions not only save time and effort but also offer a more efficient and secure way to manage transactions. Whether for personal or business purposes, the convenience, security, and organizational benefits of digital financial documents make them an ideal choice in the modern world.

How to Organize Your Budget

When planning an event, managing your finances effectively is key to ensuring everything runs smoothly without exceeding your limits. Organizing your financial plan allows you to allocate resources where they are most needed, track your spending, and make adjustments as necessary. By maintaining a well-structured budget, you can avoid unexpected costs and achieve a balance between your expectations and financial capabilities.

Steps to Organize Your Budget

Start by breaking down all the possible expenses and estimating costs for each category. This will help you get a clear picture of your total financial requirements. It’s important to allocate a portion of your budget for each service or item, ensuring that nothing is overlooked. A detailed record of payments and expenses will also help you monitor your progress and make necessary adjustments.

Category Estimated Cost Actual Cost Difference Venue $2,500 $2,400 $100 Catering $3,000 $3,200 -$200 Entertainment $1,000 $950 $50 Photography $1,500 $1,500 $0 Decorations $800 $750 $50 Transportation $600 $650 -$50 Best Practices for Budget Organization

- Prioritize Expenses: Start by determining which services or items are most important to you, and allocate more of your budget to those areas. For example, if photography i

Saving Time with Pre-Made Templates

Managing financial records can be time-consuming, especially when you’re starting from scratch. Using pre-designed documents can significantly speed up the process by providing a ready-made structure, eliminating the need to build from the ground up. This approach not only saves valuable time but also ensures that you don’t miss any essential details that might be overlooked in custom-made forms.

Benefits of Using Pre-Made Documents

- Quick Setup: Pre-made options are already structured, so you don’t have to spend time creating sections, formatting, or worrying about layout. You can simply fill in the details, and you’re ready to go.

- Consistency: These documents follow standardized formats, ensuring that all the necessary information is included and presented in a clear, professional way. This consistency also makes it easier to track and compare multiple transactions.

- Customization Flexibility: While pre-designed forms offer a solid starting point, they can still be easily customized to fit specific needs. You can add or remove sections, adjust design elements, or change language to suit your particular requirements.

- Reduced Stress: Pre-made documents help take the guesswork out of the process. By relying on an established framework, you avoid the stress of having to create everything from scratch, allowing you to focus on other important tasks.

How Pre-Made Documents Save You Time

- Faster Creation: Rather than building a document from scratch, you can simply input the required details, saving hours of design and formatting work.

- Minimized Errors: With a structured design, the chance of forgetting key details is minimized. This ensures that your records are both complete and accurate, reducing the need for time-consuming corrections later on.

- Efficient Reuse: Once you have a pre-made document that fits your needs, you can reuse it multiple times with minimal adjustments. This makes future transactions much quicker to process.

In summary, using pre-made forms allows you to quickly and efficiently handle financial transactions while ensuring that all necessary information is included. The ability to save time, reduce errors, and maintain consistency makes pre-designed documents an invaluable tool for anyone managing finances, no matter the scale of the event or project.

How to Calculate Wedding Costs

Managing the financial aspect of any event requires a clear understanding of all the costs involved. Accurate calculations help ensure that you stay within budget and avoid any unexpected expenses. Knowing how to properly account for every detail–whether it’s vendor fees, additional charges, or miscellaneous costs–can help you plan effectively and avoid surprises later on.

Steps to Accurately Calculate Event Expenses

Important Tips for Managing Costs

By carefully calculating costs and staying organized, you can effectively manage your finances and ensure that your event stays within budget without compromising on quality.

How to Handle Deposits and Payments

Properly managing deposits and payments is a crucial aspect of any large event planning. It ensures that both you and your service providers are on the same page regarding financial expectations, and it helps maintain cash flow throughout the planning process. Handling these transactions carefully, with clear documentation and timely payments, can help avoid misunderstandings and keep the budget on track.

Steps to Manage Deposits and Payments

Best Practices for Handling Deposits

By staying organized and adhering to payment schedules, you can ensure a smooth financial experience throughout the event planning process. Proper handling of deposits and payments helps maintain a professional relationship with vendors and ensures that all financial obligations are met in a timely manner.

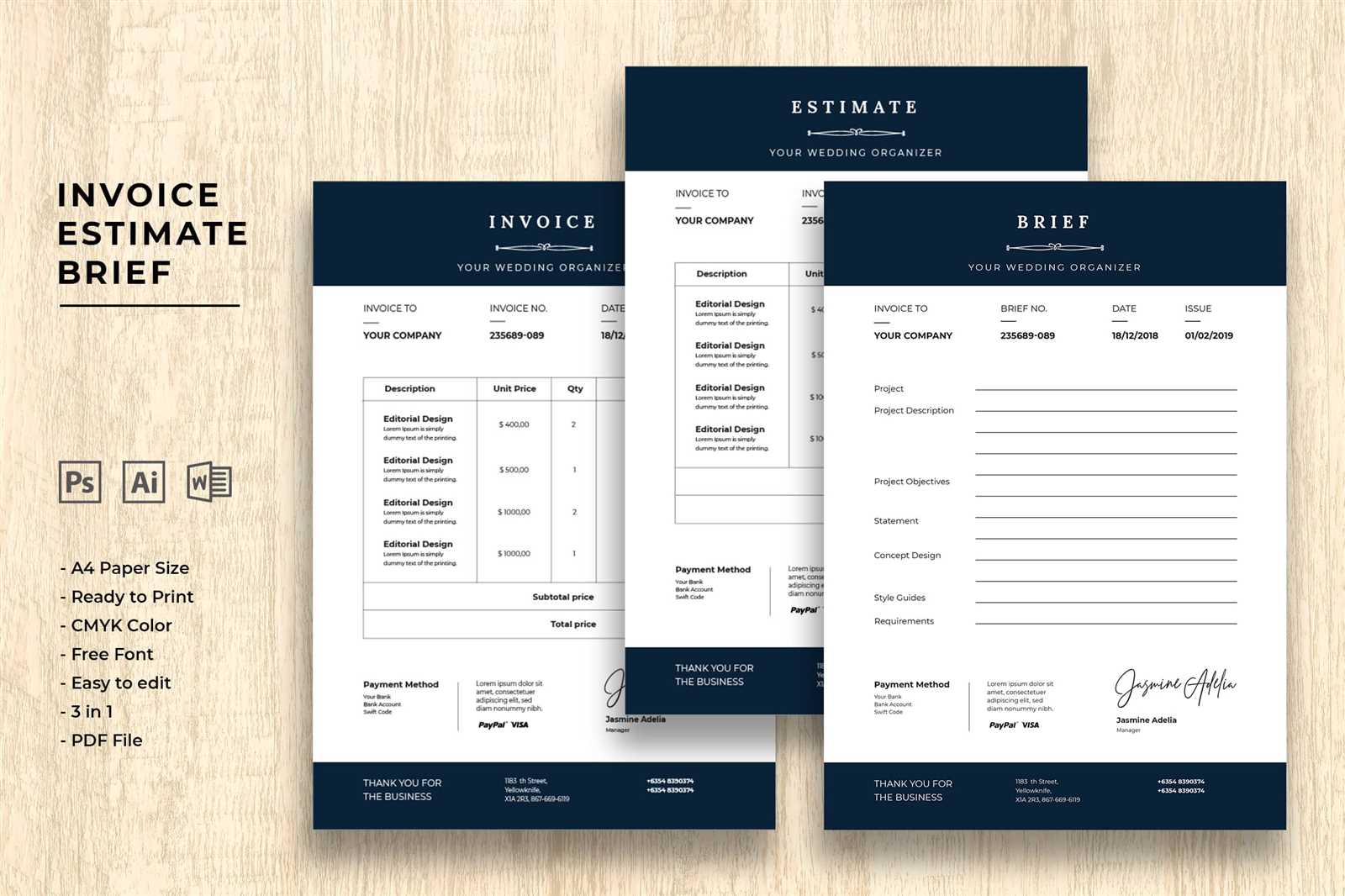

Managing Multiple Vendors with Invoices

When planning a large event, managing multiple service providers can quickly become overwhelming. Each vendor will have its own terms, payment schedules, and expectations. To ensure everything runs smoothly and financial transactions are handled correctly, it’s crucial to stay organized and keep track of all transactions. One of the best ways to manage this complexity is by using organized financial records, which clearly outline what has been paid, what remains outstanding, and any important terms related to each vendor.

Organizing Vendor Payments

One of the first steps in managing multiple service providers is to create a clear system for tracking all payments. This can be done using a spreadsheet, financial management software, or even physical records. A good practice is to maintain a detailed record for each vendor, which includes the total cost of their service, the payment terms, the due dates, and any deposits or partial payments already made.

Vendor Name Service Provided Total Amount Deposit Paid Balance Due Payment Due Date Vendor 1 Catering $5,000 $1,500 $3,500 30th March Vendor 2 Photography $2,000 $500 $1,500 15th April Vendor 3 Flowers $800 $300 $500 10th April Best Practices for Vendor Payment Management