Free Web Designer Invoice Template for Easy Professional Billing

For freelancers and independent contractors, proper documentation is essential to ensure smooth transactions and timely payments. A well-crafted billing statement not only serves as a record of services rendered but also reflects the professionalism of the individual or business. When it comes to providing detailed financial summaries for creative projects, having a customizable document ready can save time and avoid misunderstandings with clients.

Whether you’re working on a single project or handling multiple tasks, an effective billing structure is crucial. A solid format helps outline the scope of work, payment terms, and other essential details clearly. This way, clients can easily review and process payments without confusion, allowing you to focus on the next assignment. By using the right format, you can ensure that every detail is covered, from pricing to deadlines, fostering stronger professional relationships and financial stability.

Understanding the Importance of Invoices

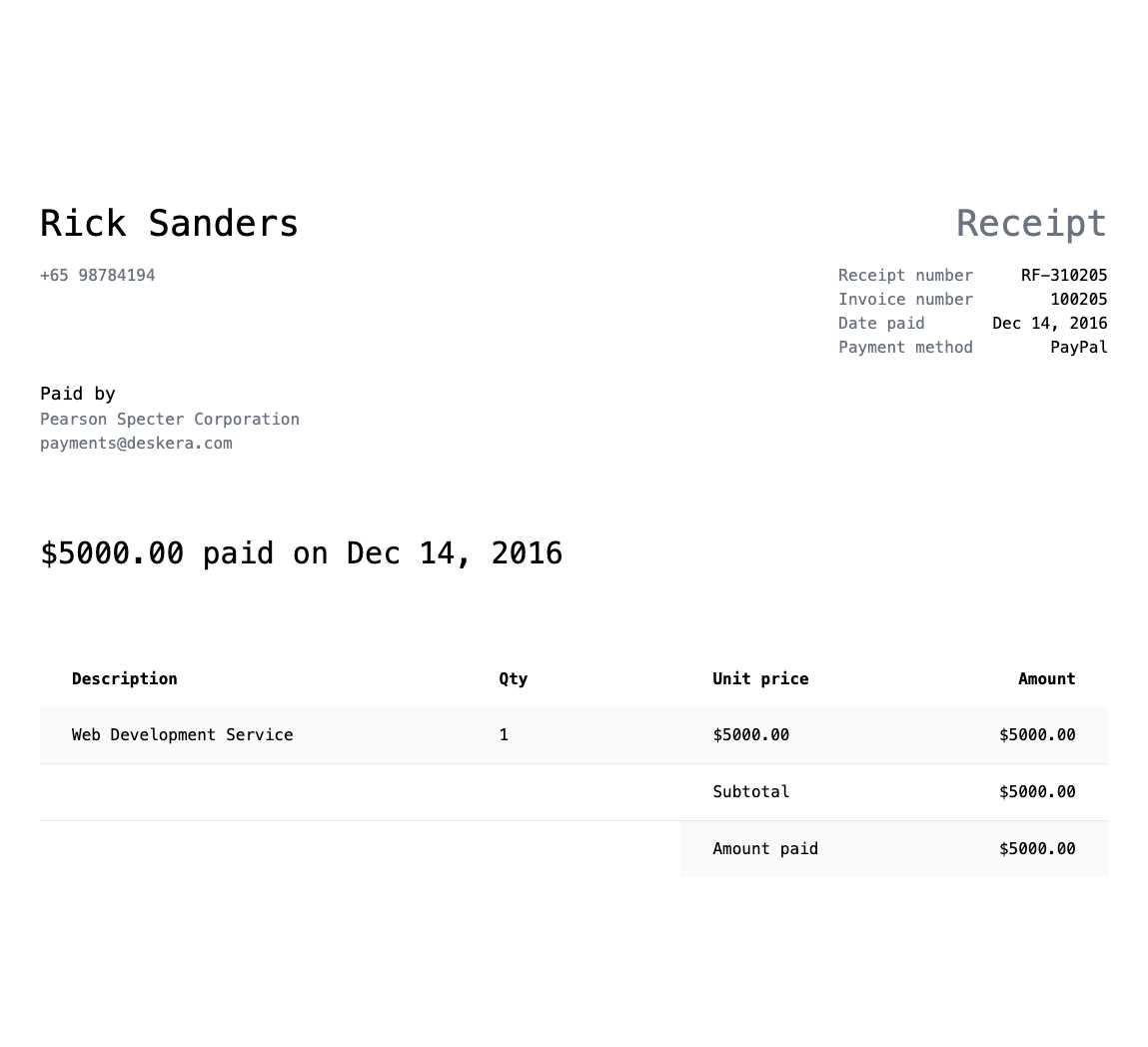

For any business or freelancer, properly documenting transactions is crucial for maintaining a professional image and ensuring prompt payment. Clear and organized records of work completed help both parties involved in the agreement to stay on the same page regarding expectations and financial obligations. A well-structured financial document is more than just a receipt; it is a formal agreement that can prevent misunderstandings and protect both the service provider and the client.

Reasons to Prioritize Financial Documents

- Clarity: A detailed summary of services allows both parties to see exactly what has been provided and what is owed.

- Legal Protection: In case of disputes, an accurate financial document can serve as legal evidence in protecting both parties’ interests.

- Professionalism: A polished document adds credibility to your work, showcasing your attention to detail and commitment to business practices.

- Tax Compliance: Proper records help track income and expenses for tax reporting, making filing easier and more accurate.

How Proper Documentation Benefits Both Parties

- For Clients: They can easily understand the services rendered, what they are paying for, and when the payment is due.

- For Service Providers: Timely and accurate financial records ensure that payment is received on time and reduce the risk of disputes.

- For Record Keeping: A well-organized record system helps track past projects, payments, and outstanding amounts, streamlining the business’s financial management.

Why Creatives Need Custom Billing Documents

For freelancers and independent professionals in the creative field, having personalized billing documents is essential for several reasons. A standard form might not capture the full range of services provided, especially when each project can vary greatly in scope, duration, and complexity. Customizing financial summaries helps ensure that all relevant details are included, making the payment process smoother and more transparent for both parties.

Customization allows for flexibility. Every project has unique elements that need to be clearly outlined–whether it’s for a one-time service, ongoing work, or a package deal. A tailor-made financial document enables professionals to include specific project details, from design hours to added revisions, providing clarity for both the client and the provider.

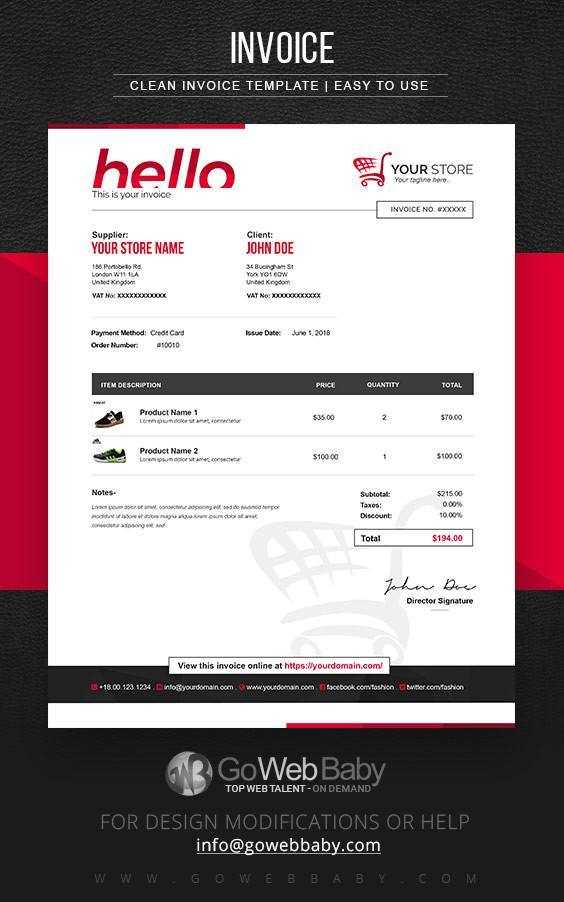

It also strengthens professionalism. A custom document reflects the individual’s brand and commitment to their work. It can include logos, contact information, payment terms, and specific guidelines, making the document more formal and credible. This added touch of professionalism fosters trust, which is crucial in building long-term client relationships.

Custom billing documents also improve efficiency. By streamlining the information relevant to each job, professionals can minimize errors, ensure the client understands the breakdown of charges, and ultimately receive payments faster. Having a structured, repeatable format saves time for both the creative and the client, ensuring that no important details are overlooked.

Key Elements of a Professional Billing Document

A well-structured financial document is essential for ensuring clear communication and prompt payment. It serves as a formal agreement between the service provider and the client, outlining the specifics of the work completed and the corresponding payment. To be effective, this document should contain several key components that help both parties understand the terms and expectations clearly.

Essential Components of a Professional Billing Document

- Contact Information: The document should include the service provider’s name, business name (if applicable), address, phone number, and email, as well as the client’s contact details.

- Invoice Number: A unique reference number helps track payments and makes it easier to manage records.

- Project Description: Clear details about the services provided, including any milestones or deliverables, will ensure that both parties understand what was agreed upon.

- Payment Terms: This section should specify the total amount due, due date, and acceptable payment methods. Payment terms can also include any late fees or discounts for early payment.

- Payment Breakdown: A detailed breakdown of the charges, such as hourly rates, flat fees, or other costs, ensures transparency and prevents disputes.

- Tax Information: If applicable, include relevant taxes and explain how they are calculated.

Additional Features for Professional Documents

- Logo and Branding: Including a company logo and using branded colors or fonts can help create a more professional and cohesive image.

- Terms and Conditions: This section can outline any additional agreements, such as revisions or deadlines, ensuring that both parties are aligned on expectations.

- Thank You Note: A polite message expressing gratitude for the business adds a personal touch, reinforcing positive client relationships.

How to Create a Billing Document for Creative Projects

Creating a detailed and professional financial document is a key part of managing your business and ensuring prompt payment. It should reflect the specifics of the work performed, include all relevant details, and be easy to understand for your client. A well-crafted document not only helps ensure accurate payment but also serves as a formal record of the transaction.

Step-by-Step Guide to Creating a Billing Document

Follow these steps to create a clear, professional document for your creative services:

- Gather All Relevant Information: Before starting, collect all necessary details, including the client’s contact information, a description of the work completed, and any agreed-upon terms.

- Include Payment Terms: Be sure to specify the total amount due, the due date, payment methods, and any penalties for late payments.

- Provide a Breakdown of Costs: For larger projects, list each service provided along with its cost to ensure clarity and transparency.

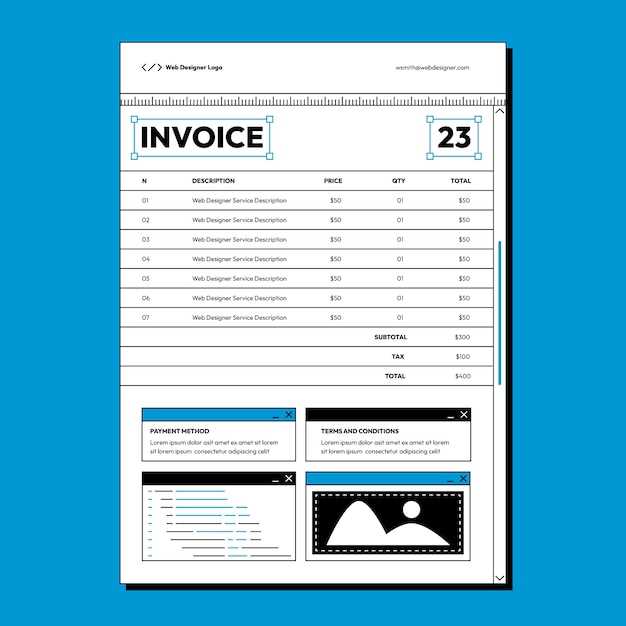

- Format the Document Clearly: Use a clean layout with clear headings, bold text for important details, and adequate spacing to make the document easy to read.

Example of a Billing Document for Creative Services

| Service Description | Hours/Units | Rate | Total |

|---|---|---|---|

| Initial Consultation | 1 | $50/hr | $50 |

| Project Concept and Design | 10 | $75/hr | $750 |

| Revisions and Final Delivery | 5 | $60/hr | $300 |

| Total | $1,100 |

Once the document is complete, double-check all details for accuracy before sending it to the client. Ensure that all the relevant components, such as service descriptions, rates, and payment terms, are clearly outlined. This will help avoid confusion and ensure a smooth transaction.

Choosing the Right Billing Document Format

Selecting the appropriate format for your financial documents is crucial for maintaining professionalism and ensuring clarity. A well-chosen layout not only helps present your services in an organized manner but also ensures your clients understand the charges and terms. The right format can save you time, streamline your workflow, and make the entire billing process more efficient.

Factors to Consider When Choosing a Format

- Clarity and Simplicity: The chosen layout should be easy to understand and free from unnecessary complexity. Make sure that all key details are clearly visible, such as the total amount due, service breakdowns, and payment terms.

- Customization Options: A flexible design will allow you to tailor the document to suit the specific needs of each project. Whether it’s including itemized lists, hourly rates, or special terms, customization is important to ensure accuracy.

- Branding Potential: Consider choosing a format that allows you to include your business logo, brand colors, and other branding elements. This adds a professional touch and helps reinforce your identity.

- Ease of Use: Choose a format that is easy for you to use and for your clients to read. If you’re using a digital document, make sure the file can be easily opened and understood by recipients, whether it’s in PDF, Word, or another accessible format.

Where to Find the Right Format

There are many resources available online that offer free and paid layouts. Some options include:

- Online Tools: Many platforms provide customizable options where you can quickly generate and personalize a document, adding your details and adjusting the layout as needed.

- Software Solutions: Programs like Word or Excel offer pre-made templates, which can be adjusted to fit the specifics of your work. These allow you to fine-tune every detail and easily save multiple versions.

- Pre-made Downloads: Numerous websites offer downloadable formats in various styles, from simple to more complex designs, which can be edited with ease.

Choosing the right format ensures that your billing documents not only meet legal requirements but also reflect the level of professionalism you want to convey. By selecting a well-structured, customizable layout, you create an impression of competence and attention to detail, which is crucial for building strong client relationships.

Customizing Your Billing Document Format

Customizing your financial document allows you to create a professional and personalized experience for both you and your client. A tailored layout ensures that all relevant details are included, makes your brand stand out, and helps maintain clarity in your transactions. Adjusting the design and structure of the document to suit the specifics of each project will not only enhance its effectiveness but also reinforce your credibility as a service provider.

Key Customization Options to Consider

- Branding Elements: Incorporating your logo, business name, and color scheme helps create a cohesive look and feel that aligns with your brand identity. This adds a layer of professionalism and makes your documents instantly recognizable.

- Project-Specific Details: Modify the format to include specific service descriptions, project timelines, and agreed-upon terms. Custom fields for additional notes or special conditions can make the document more relevant to each client.

- Flexible Payment Information: Make sure the payment section can easily accommodate different pricing structures, such as hourly rates, flat fees, or bundled packages. Include clear instructions on accepted payment methods and due dates to avoid confusion.

- Clear Breakdown of Charges: Depending on the complexity of the work, you may want to add detailed line items or categorize charges. This helps the client understand the scope of the work and the value of each part of the project.

Practical Steps for Customizing Your Format

- Choose the Right Tool: Select software or an online platform that allows easy customization. Tools like Google Docs, Word, or dedicated invoicing platforms offer flexible layouts that can be adjusted with ease.

- Adjust Layout and Sections: Edit the document’s layout to include all the necessary sections, such as client details, service descriptions, pricing, and payment terms. Ensure that each section is clearly defined and easy to read.

- Use Client-Specific Information: Tailor the document for each client by inserting their name, address, project details, and other personal information. This adds a personal touch that helps strengthen client relationships.

- Save as a Reusable Format: Once you’ve customized your document, save it in a reusable format (such as PDF) so you can easily update it for future projects without starting from scratch.

By customizing your billing format, you not only ensure clarity and precision but also demonstrate your commitment to providing a top-tier experience for your clients. Personalization helps build trust, enhances professionalism, and makes the process smoother for everyone involved.

Best Tools for Designing Billing Documents

Creating a polished and professional billing statement requires the right tools to help streamline the process and ensure consistency. Whether you’re working with a simple layout or need something more complex, using the best software can make the design process faster and more efficient. These tools offer various features, from customizable templates to automatic calculations, making them essential for anyone who needs to send financial documents regularly.

Top Software Solutions for Creating Billing Statements

- Microsoft Word: A widely used word processor that offers pre-built layouts, easy customization, and the ability to add logos, branding, and client-specific details. Word is simple to use and allows you to adjust formats quickly, making it ideal for creating basic documents.

- Google Docs: A free, cloud-based tool with many customization options. Google Docs allows you to create and store your documents online, making it easy to access and edit from any device. Its sharing features also make it simple to collaborate with clients if needed.

- Canva: Known for its user-friendly interface, Canva provides visually appealing templates that can be customized to fit your needs. It offers a wide range of design elements, which is ideal for creating creative, visually striking documents that stand out.

- FreshBooks: A specialized tool for freelancers and small businesses, FreshBooks allows you to create professional-looking statements with minimal effort. It includes features like time tracking, automatic tax calculations, and payment reminders, all integrated into one platform.

Online Platforms for Billing Documents

- Zoho Invoice: Zoho offers a comprehensive invoicing solution that lets you generate invoices, track payments, and set reminders for overdue bills. With customizable templates and automatic payment reminders, it’s a great choice for streamlining the billing process.

- PayPal: Besides being a payment processor, PayPal provides an easy-to-use invoicing feature for users. You can create and send simple statements, add your branding, and even integrate payment options directly into the document.

- Wave: A free accounting software tool that allows users to create invoices, track payments, and manage financial reports. With its drag-and-drop functionality and clean designs, it’s perfect for small businesses or freelancers looking for a cost-effective solution.

Each of these tools offers a variety of features suited to different needs. Whether you’re looking for a simple document editor or an all-in-one billing and accounting solution, these platforms can help you create professional, accurate financial documents with ease.

Free vs Paid Billing Document Layouts

When creating financial documents, one of the first decisions to make is whether to use a free or paid layout. Both options come with their own sets of benefits and limitations, depending on your needs and the level of professionalism you wish to present. Free formats are often quick and easy to use, but paid layouts typically offer more customization options and advanced features that may be worth the investment for long-term use.

Choosing between free and paid formats largely depends on how frequently you need to create such documents, the complexity of the work, and your desire for a tailored solution. Let’s take a look at the key differences to help you decide which option suits you best.

Comparison of Free and Paid Layouts

| Feature | Free Formats | Paid Formats |

|---|---|---|

| Customization Options | Basic, limited to text and simple layout adjustments | Highly customizable, with options for branding, colors, and advanced design elements |

| Design Quality | Basic design, often minimalistic | Professional, polished designs that enhance the appearance of the document |

| Features | Basic features like text fields and simple calculations | Advanced features such as automatic calculations, payment tracking, and integration with accounting software |

| Support | Limited or no customer support | Access to customer service, technical support, and updates |

| Cost | Free of charge | Subscription-based or one-time payment |

Free formats are great if you’re just starting out or if you have simple needs and want to get things done quickly. However, as your business grows or if you want to present a more professional image, paid options offer greater flexibility and long-term value. These formats provide enhanced functionality, customer support, and a more refined design, making them ideal for businesses that send invoices regularly.

Common Mistakes in Billing Documents

Creating accurate and professional financial documents is an essential part of running a successful business, but mistakes are easy to make, especially when managing multiple projects. These errors can lead to confusion, delayed payments, or even disputes with clients. It’s important to be aware of the common pitfalls when drafting financial documents, so you can avoid them and ensure smooth transactions.

Here are some frequent mistakes to watch out for when creating financial statements:

Common Pitfalls to Avoid

| Mistake | Explanation | Impact |

|---|---|---|

| Missing or Incorrect Contact Information | Not including your own contact details or the client’s correct address can lead to confusion or delayed payments. | Lost communication, difficulty following up, or late payments. |

| Unclear Project Descriptions | Failing to clearly outline what services were provided and for how long can leave room for misunderstandings. | Disputes about services delivered, confusion about what was agreed upon, and delayed payment. |

| Incorrect Payment Terms | Forgetting to specify payment deadlines, methods, or late fees can cause clients to miss deadlines or make partial payments. | Delayed or partial payments, missed deadlines, or loss of income. |

| Lack of a Unique Reference Number | Not including a unique identifier for each document makes it hard to track payments or resolve issues. | Difficulty keeping track of payments, accounting errors, or missed follow-ups. |

| Inconsistent Formatting | Using inconsistent fonts, text sizes, or layouts makes the document harder to read and less professional. | Loss of professionalism, confusion, and difficulty understanding the document. |

| Not Including Taxes | Forgetting to account for taxes or not properly calculating them can lead to confusion or financial discrepancies. | Discrepancies in the final amount owed, leading to underpayment or disputes. |

By paying attention to these common mistakes, you can ensure your financial documents are clear, accurate, and professional, helping you maintain smooth and efficient business operations.

Avoiding Payment Delays with Clear Billing Documents

One of the most common challenges in business is ensuring timely payment for services rendered. Often, delays occur not because clients are unwilling to pay, but because the billing document itself lacks clarity or essential information. A well-structured and transparent document can significantly reduce confusion and expedite the payment process. By providing all the necessary details upfront, you can make it easier for clients to understand the charges and settle their dues on time.

Key Tips for Preventing Payment Delays

- Be Clear on Payment Terms: Clearly state the payment deadline and the accepted payment methods. If applicable, include penalties for late payments to encourage prompt settlement.

- Provide a Detailed Breakdown: List all services provided along with their corresponding costs. This transparency helps the client understand exactly what they are paying for and prevents disputes.

- Use a Unique Reference Number: Include a unique number for each billing document. This allows both you and the client to easily reference and track payments, reducing the chances of missed payments or confusion.

- Ensure Accurate Contact Information: Double-check that your business details, such as your name, address, phone number, and email, are up-to-date. Missing or incorrect contact information can lead to delays in communication and payment.

- Set Clear Payment Instructions: Specify the methods through which payments can be made (e.g., bank transfer, credit card, PayPal), and include relevant details like account numbers or links to payment portals.

- Include a Reminder for Overdue Payments: If the payment deadline has passed, remind your client about the outstanding amount. This gentle reminder can prompt action and prevent further delays.

Why Clarity Helps Avoid Delays

A well-organized document reduces the likelihood of disputes and confusion. When all terms are clearly spelled out, clients are more likely to trust that the transaction is straightforward, leading to faster payment. Additionally, by offering multiple payment options and including all the necessary details, you remove barriers that could otherwise cause a delay. Ensuring your billing documents are complete, accurate, and easy to understand is an essential step in maintaining a smooth cash flow and a positive relationship with clients.

How to Calculate Project Costs

Accurately calculating the cost of a project is essential for ensuring profitability and maintaining transparency with clients. Understanding how to price your services requires taking into account a variety of factors, including the time and effort involved, the complexity of the tasks, and any additional expenses. By breaking down the costs methodically, you can ensure that both you and your client are on the same page when it comes to the final amount due.

Steps to Calculate Project Costs

- Determine Your Hourly Rate or Fixed Fee: Depending on your pricing model, decide whether you will charge an hourly rate or a flat fee for the entire project. If you opt for hourly billing, calculate your rate based on your experience, expertise, and industry standards. If you prefer a flat fee, ensure it covers all tasks and time commitments.

- Estimate Time and Resources Needed: Make a detailed estimate of the time each phase of the project will take. This includes research, design, revisions, testing, and any communication with the client. Don’t forget to account for any tools, software, or external services you may need to purchase or subscribe to.

- Account for Additional Expenses: If you will incur any costs outside of your own time–such as purchasing stock images, paying for third-party plugins, or covering hosting fees–make sure to include these in the overall calculation.

- Factor in Contingency Costs: Unexpected challenges or client revisions can add additional work. It’s a good idea to factor in a contingency amount, typically 5-10% of the project cost, to cover any unforeseen expenses.

- Communicate the Cost Clearly: Once you’ve calculated the total cost, break it down clearly in the agreement or billing document. This ensures the client understands what they are paying for and helps avoid confusion later on.

Tips for Accurate Cost Calculation

- Track Your Time: Use time-tracking software to ensure you are accurately estimating the time spent on each phase of the project. This can help you fine-tune your pricing for future projects.

- Understand the Scope: Clearly define the scope of the project before you start. The more detailed your agreement, the easier it will be to calculate costs and avoid scope creep, which can lead to unexpected costs.

- Know Your Value: Don’t undersell yourself. Ensure your pricing reflects the quality and expertise you bring to the project. If you’re not sure, research industry standards to get a sense of what others charge for similar services.

Calculating project costs requires careful planning and attention to detail. By considering all factors–time, resources, and unexpected costs–you can provide a fair and transparent price that benefits both you and your client. Clear cost calculation helps build trust and ensures a smooth financial process throughout the project.

Formatting and Design Tips for Billing Documents

Creating a clean, professional, and easy-to-read financial document is crucial for maintaining a positive image with your clients. The way you format and design the document can make a significant impact on how quickly it’s processed and paid. A well-structured layout ensures that the client can easily find important information, reducing confusion and the potential for delays in payment.

Best Practices for Clear Layout

- Keep It Simple: Avoid clutter. A simple, clean design is easier to read and looks more professional. Use whitespace effectively to make the document feel less congested and more organized.

- Use a Consistent Font: Stick to one or two professional fonts. Sans-serif fonts like Arial or Helvetica are typically easier to read, especially on digital screens. Use bold or larger font sizes for headings and important details like the total amount due.

- Include Key Information First: Position important details like your contact information, the client’s contact details, and the total amount due near the top. This helps the client quickly find the most essential information.

- Use Clear Section Headings: Organize the document into clearly defined sections, such as “Services Provided,” “Payment Terms,” and “Total Amount Due.” This allows the client to quickly scan and understand the information.

- Balance Design with Function: While it’s important to have an appealing layout, the primary goal is functionality. Make sure that any design elements you incorporate don’t interfere with the document’s legibility or clarity.

Design Tips for Professional Appearance

- Incorporate Your Branding: Add your logo, brand colors, and other branding elements to make the document reflect your business identity. This can help reinforce your professional image and make your documents more recognizable.

- Align Items Neatly: Ensure that all text and numbers are aligned properly. Consistent alignment improves readability and makes the document look more polished. Use grid lines or a table structure to organize information like service descriptions and amounts.

- Highlight Payment Details: Use bold text or color to draw attention to the payment due date, payment methods, and total amount. This ensures that clients can easily identify the most crucial parts of the document.

- Use Tables for Itemized Details: If you’re listing multiple services or charges, consider using a table format to organize each item clearly. This helps prevent any ambiguity about what services are being billed and what the cost of each is.

By following these formatting and design tips, you can create billing documents that are both professional and functional, ensuring that clients have all the information they need and can easily process payments without unnecessary delays. A well-designed document reflects well on your business and can make a significant difference in how

Making Your Billing Document Client-Friendly

Creating a billing document that is easy for your clients to understand and navigate is essential for maintaining positive business relationships. A well-designed, client-friendly document can help reduce confusion, prevent disputes, and ensure faster payments. The goal is to make the process as simple and straightforward as possible, providing all necessary details in a clear and organized manner.

Key Tips for Client-Friendly Billing

- Use Simple Language: Avoid technical jargon or overly complex terms. Keep the language simple and direct so that your clients can easily understand what they are being charged for and what the payment terms are.

- Clearly List Services and Charges: Make sure every service you provided is clearly listed with a detailed description, including the corresponding cost. This helps clients see exactly what they’re paying for and why the charges are justified.

- Show Payment Options: Offer various payment methods such as bank transfer, PayPal, or credit card. Clearly indicate how the client can pay, making the payment process as convenient as possible.

- Provide Contact Information: Include your phone number or email address in case the client has questions or needs clarification. A client-friendly document invites communication and shows you’re approachable and ready to assist.

Organizing Information for Clarity

| Section | Description |

|---|---|

| Client Information | Ensure that the client’s name, address, and contact details are accurate and up-to-date for easy communication. |

| Service Breakdown | Clearly list each service provided, including a description and the respective cost for each task or deliverable. |

| Payment Terms | State the payment due date, accepted payment methods, and any late fees or discounts for early payment. |

| Total Amount | Ensure that the total amount due is clearly stated, ideally in bold, for easy reference. |

By following these steps, you ensure that your billing documents are not only professional but also considerate of the client’s perspective. Clear, well-organized, and approachable documents reduce confusion, promote transparency, and foster trust, ultimately leading to faster payments and stronger client relationships.

How to Add Payment Terms to Billing Documents

Clearly outlining payment terms is an essential part of any financial document, as it helps set expectations and ensures both parties are aligned on deadlines and payment methods. Well-defined terms prevent confusion and reduce the risk of late or missed payments. By specifying when and how you expect to be paid, you create a transparent process that encourages timely settlements.

Key Elements of Payment Terms

When including payment terms, it is important to cover the following key elements to ensure clarity and avoid misunderstandings:

- Payment Due Date: Specify the exact date by which the client is expected to pay. For example, “Payment is due within 30 days from the date of issue.” This helps set a clear timeline for the client to make payment.

- Accepted Payment Methods: List the methods of payment you accept, such as bank transfer, credit card, PayPal, or checks. Be clear about which options are available to avoid any confusion about how the client can pay.

- Late Payment Fees: To encourage timely payment, specify any penalties for late payments. This could be a flat fee or a percentage of the total amount due for every week or month the payment is delayed.

- Discounts for Early Payment: Offering a small discount for early payments can be an effective way to incentivize clients to pay ahead of the due date. For example, “A 5% discount will be applied if payment is received within 10 days of the invoice date.”

- Payment Instructions: If necessary, provide specific instructions for how the client can make the payment. This may include bank account details, PayPal information, or other necessary payment platform details.

Where to Place Payment Terms in Your Document

Payment terms should be prominently displayed in the billing document to ensure they are easy to find. Here are the best places to include them:

- At the Top or Bottom: You can place the payment terms either at the top of the document (after your business and client details) or at the bottom (before the total amount due). Either way, it should be easy for the client to locate.

- Near the Total Amount: If you want to emphasize the payment date and amount, placing the payment terms near the total amount due can be effective.

By clearly stating payment terms in your billing documents, you ensure that both parties are on the same page regarding deadlines and expectations. This helps foster a professional relationship with your clients and encourages timely payments.

Using Billing Documents to Build Professionalism

How you present your billing documents can significantly influence how clients perceive your business. A well-designed and organized document demonstrates your professionalism and attention to detail, helping to establish trust and credibility with your clients. When done right, billing documents not only serve as financial tools but also as reflections of your business’s values and commitment to quality.

Why Professional Billing Documents Matter

Billing documents go beyond just being a request for payment; they act as a tangible representation of your business standards and how you manage client relationships. Here are some key reasons why having well-structured financial documents is important for maintaining a professional image:

- Builds Trust: A clear, error-free billing document shows that you are reliable and serious about your work. Clients are more likely to pay on time if they see your documents are organized and easy to understand.

- Reflects Your Brand: A customized, branded document with your logo and business information makes your services feel more legitimate and gives clients a sense of consistency and professionalism.

- Encourages Timely Payments: A professional document with clear payment terms and deadlines communicates to clients that you value punctuality and expect the same in return.

- Improves Client Communication: When your financial documents are well-organized and thorough, clients have less need to ask questions, reducing the time spent on clarifications and fostering smoother communication.

What to Include for a Professional Appearance

When designing a billing document that reflects professionalism, make sure to include the following key elements:

| Element | Description |

|---|---|

| Branding | Incorporate your logo, business name, and contact details to ensure your document is easily identifiable and reflects your brand’s identity. |

| Clear Breakdown of Charges | List each service provided, along with its cost, in an organized manner so clients can easily understand what they are being charged for. |

| Professional Language | Use formal and respectful language in your document, avoiding overly casual wording or slang that might undermine your professionalism. |

| Payment Details | Include payment terms, due dates, and available payment methods in a prominent place to make it easy for the client to know how and when to pay. |

| Contact Information | Provide multiple ways for clients to contact you, whether by phone, email, or messaging app, to maintain open lines of communication. |

By focusing on these elements, your financial documents can serve as a tool for not just requesting payment but also reinforcing the professionalism and trustworthiness of your business. A well-crafted document is more than just a bill–it’s a way to showcase y

Legal Considerations for Billing Documents

When creating financial documents for your clients, it’s essential to ensure that they comply with legal requirements. An error or omission could lead to disputes or delayed payments. Being aware of the legal aspects of these documents helps protect both your business and your clients, ensuring that your agreements are clear and enforceable. Proper legal wording and structure can prevent future issues and maintain professionalism in your financial dealings.

Key Legal Elements to Include

To avoid legal complications, there are several important details that must be included in your billing documents to make them legally sound:

- Accurate Client Information: Ensure that the client’s full legal name and business details are correctly listed. This ensures clarity in case of any disputes regarding payment or services rendered.

- Service Descriptions: Clearly outline the work completed, including dates, deliverables, and specifics of the project. This prevents ambiguity about the scope of the services provided and helps both parties stay on the same page.

- Payment Terms: Include specific payment terms such as due dates, late fees, and acceptable payment methods. Legal clarity around deadlines and penalties helps avoid payment disputes.

- Tax Compliance: Depending on your location, you may need to charge sales tax or other business-related taxes. Be sure to follow the local tax regulations and include tax amounts where applicable.

- Refund and Dispute Clauses: Consider including terms on refunds or dispute resolution in case of dissatisfaction with the services rendered. This can save time and resources if conflicts arise and help both parties understand their options.

Protecting Your Business Legally

In addition to ensuring your documents are legally compliant, it’s also important to protect your business interests. Here are a few steps to consider:

- Clearly Stated Ownership of Work: Define who owns the work once payment has been made. Be explicit about intellectual property rights, especially for digital content or designs.

- Payment Deadlines and Late Fees: Ensure that the payment deadlines are clearly set and that any penalties for late payments are outlined to encourage timely settlements.

- Contractual Agreement References: If you’ve signed a contract with the client before providing services, reference it in the document. This helps connect the financial request to the original terms and conditions agreed upon by both parties.

By taking these legal considerations into account when creating your billing documents, you protect your business and build a transparent relationship with your clients. Ensuring that the document is both clear and legally compliant can prevent future conflicts and promote smoother financial transactions.

How to Handle Tax on Digital Services

When providing digital services, understanding how to manage taxes is essential for both compliance and financial planning. Different regions and countries have varying tax laws that may apply to your work, making it crucial to determine whether your services are taxable, the applicable tax rates, and how to collect and remit taxes. Failing to properly address tax responsibilities can lead to penalties and financial complications, so it’s important to stay informed and organized when handling taxes on your services.

Understanding Taxable Services

The first step in handling taxes is to determine whether your services are taxable in your jurisdiction. In many cases, services related to digital content, software, or design work can be subject to sales tax or VAT (Value-Added Tax), but this depends on local laws. It’s essential to research the specific tax rules for the area in which your business operates and where your clients are based.

- Sales Tax: In some regions, digital services are considered taxable, and you are required to charge your clients sales tax on the work provided.

- Exempt Services: In other cases, digital services may be exempt from taxation, or only certain types of digital work (such as creative design services) may be taxable, while others are not.

- Tax Jurisdiction: Tax laws can also vary depending on whether your client is located in the same jurisdiction or in another country, so it’s important to understand where the service is being rendered and where tax should be applied.

How to Calculate and Apply Taxes

Once you have determined that tax applies to your services, the next step is to correctly calculate and apply it to your billing documents. Here’s how you can handle it:

| Step | Action |

|---|---|

| Research Local Tax Laws | Understand the sales tax or VAT rates that apply to your services based on your location and the location of your clients. |

| Determine the Taxable Amount | Calculate the tax based on the agreed-upon fee for your services. The taxable amount is often the total price before any discounts or deductions. |

| Apply the Tax Rate | Multiply the taxable amount by the applicable tax rate to determine the total tax owed. |

| Include Tax on Billing Documents | Clearly indicate the tax amount on your financial documents, ensuring that it is separated from the total service fee and displayed for transparency. |

By following these steps, you can accurately apply taxes to your services and avoid legal issues. Additionally, clearly

Ensuring Billing Document Accuracy for Quick Payments

Accurate financial documents are key to receiving payments promptly and avoiding misunderstandings with clients. A well-prepared document that is clear, complete, and error-free builds trust and encourages quicker payment. Mistakes in calculations or missing details can delay processing or prompt requests for clarification, leading to unnecessary delays in your cash flow. Therefore, ensuring precision in every aspect of your billing document can significantly improve the speed and reliability of payment receipt.

Common Areas to Double-Check

To guarantee that your financial documents are flawless and ready for quick payment, be sure to carefully review the following sections:

| Section | What to Check |

|---|---|

| Client Information | Ensure the client’s name, address, and contact details are correct. An error in these details can cause confusion or delay payment processing. |

| Service Descriptions | Verify that all services provided are listed accurately with clear descriptions. Each task should be detailed to avoid ambiguity about what is being charged for. |

| Amount Charged | Check that the total amount matches the agreed-upon price and that any applicable discounts, taxes, or additional fees are clearly calculated and displayed. |

| Payment Terms | Review payment terms such as due dates, accepted methods, and late fees. Make sure they align with the initial agreement to prevent confusion or delays. |

| Contact Information | Confirm that your business contact details (phone, email, or other) are accurate so the client can easily reach out with questions or issues. |

How to Avoid Common Errors

Here are a few strategies to avoid the most frequent mistakes in billing documents:

- Use Automation Tools: Utilize accounting or invoicing software that automatically populates client details, service descriptions, and amounts to reduce human error.

- Review Details Before Sending: Always proofread your document to ensure accuracy. Consider asking a colleague or using an automated tool to check for mistakes.

- Be Consistent: Ensure the format and language used across all your financial documents are consistent, making them easier to understand and less likely to be disputed.

- Have a Standard Process: Establish a checklist or process to follow each time you create a financial document. This helps ensure that no crucial elements are overlooked.

By focusing on accuracy and clarity, you can create billing documents that lead to faster payments and minimize any chance of confusion. A small investment in time and attention to detail can significantly enhance your cash flow and client relationships.