How to Use a Wages Invoice Template for Payroll Processing

When managing employee compensation, clear and accurate records are essential. Having a structured way to document earnings, deductions, and hours worked ensures both employers and employees are on the same page. These records play a crucial role in maintaining transparency and meeting legal obligations.

With the right format, tracking employee payments becomes streamlined and efficient. The ability to easily adjust for various pay structures, including hourly rates, salary, or bonuses, can save time and reduce errors. By using a standardized system, businesses can stay organized and reduce administrative costs.

Effective payroll documentation not only simplifies payment processing but also ensures compliance with tax regulations and labor laws. Whether you are a small business owner or managing a large team, having a reliable method for issuing payment statements can significantly enhance your operational efficiency.

Wages Invoice Template Overview

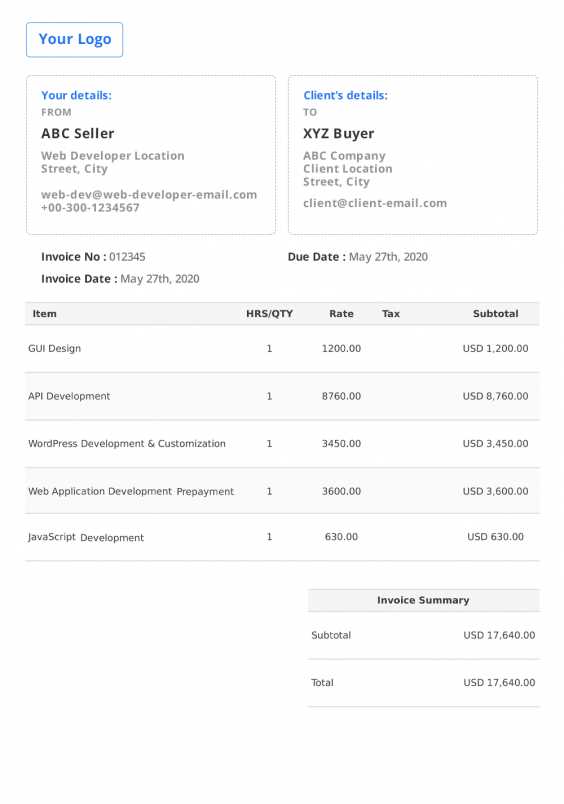

When managing employee compensation, having a systematic way to document and communicate payment details is crucial. A well-structured document ensures transparency, reduces errors, and simplifies administrative tasks for both employers and workers. These records typically include information such as hours worked, hourly rate, deductions, and net pay, all presented in an easy-to-read format.

Employers often rely on pre-designed forms that can be customized to fit specific payment schedules, from weekly wages to monthly salaries. Using such a document helps standardize payroll procedures, ensuring that all necessary information is captured correctly and in a consistent manner.

Key Elements of a Payment Statement

A proper payroll statement includes several critical components. These parts not only help employees understand their pay but also ensure that employers meet legal and tax reporting requirements. Here are some of the most common elements:

| Component | Description |

|---|---|

| Employee Information | Name, position, and identification number of the employee. |

| Hours Worked | Total number of hours the employee worked during the pay period. |

| Rate of Pay | Hourly wage or salary rate applicable to the employee. |

| Deductions | Any legal or voluntary deductions such as taxes, insurance, or retirement contributions. |

| Net Pay | The total amount the employee receives after deductions are subtracted. |

Advantages of Using a Structured Payment Record

Utilizing a standardized method for recording employee payments has multiple benefits. Not only does it reduce the likelihood o

What is a Wages Invoice?

A payment statement is a document used by employers to detail the earnings of their employees for a specific period. This document serves as a formal record, outlining the total amount earned, deductions, and the final amount the employee will receive. It is an essential tool for both parties to ensure that all compensation is correctly calculated and documented.

The statement typically includes a breakdown of hours worked, pay rates, and any adjustments such as overtime or bonuses. In addition, it lists any deductions that may be required by law or agreed upon, such as taxes, health insurance, or retirement contributions. This ensures full transparency in how the final amount is determined.

Why is it Important?

These documents are not only useful for employees to track their earnings, but they also help employers maintain accurate financial records and comply with tax regulations. A well-structured payment statement can serve as proof of income, assist with budgeting, and simplify the process of filing taxes.

How it Benefits Both Parties

For employees, having a clear summary of their earnings and deductions provides peace of mind and helps with personal financial planning. For employers, using a standardized approach to documenting compensation can improve payroll accuracy and efficiency, reducing the risk of errors and potential disputes.

Benefits of Using an Invoice Template

Utilizing a pre-designed document for tracking employee compensation brings a range of advantages for businesses and workers alike. These documents ensure consistency, reduce manual errors, and simplify the overall process of recording and communicating payment details. By adopting a standardized format, employers can streamline their payroll operations while ensuring clarity and accuracy in financial reporting.

Efficiency is one of the main benefits. Pre-built forms save valuable time, eliminating the need to create a new document from scratch for each pay cycle. With a clear layout and sections that cover all necessary details, employers can quickly fill in the relevant data without missing crucial information.

Improved Accuracy

By using a structured format, the chance of making mistakes is significantly reduced. Calculations for earnings, deductions, and net pay are often automated, minimizing human error. This helps maintain trust and transparency between the employer and employee while ensuring that everyone is paid correctly and on time.

Consistency and Professionalism

Having a consistent approach to documenting payments reflects professionalism and reliability. Using a formal system not only helps employees understand their earnings but also reassures them that the employer is organized and follows established procedures. This builds trust and can improve employee satisfaction.

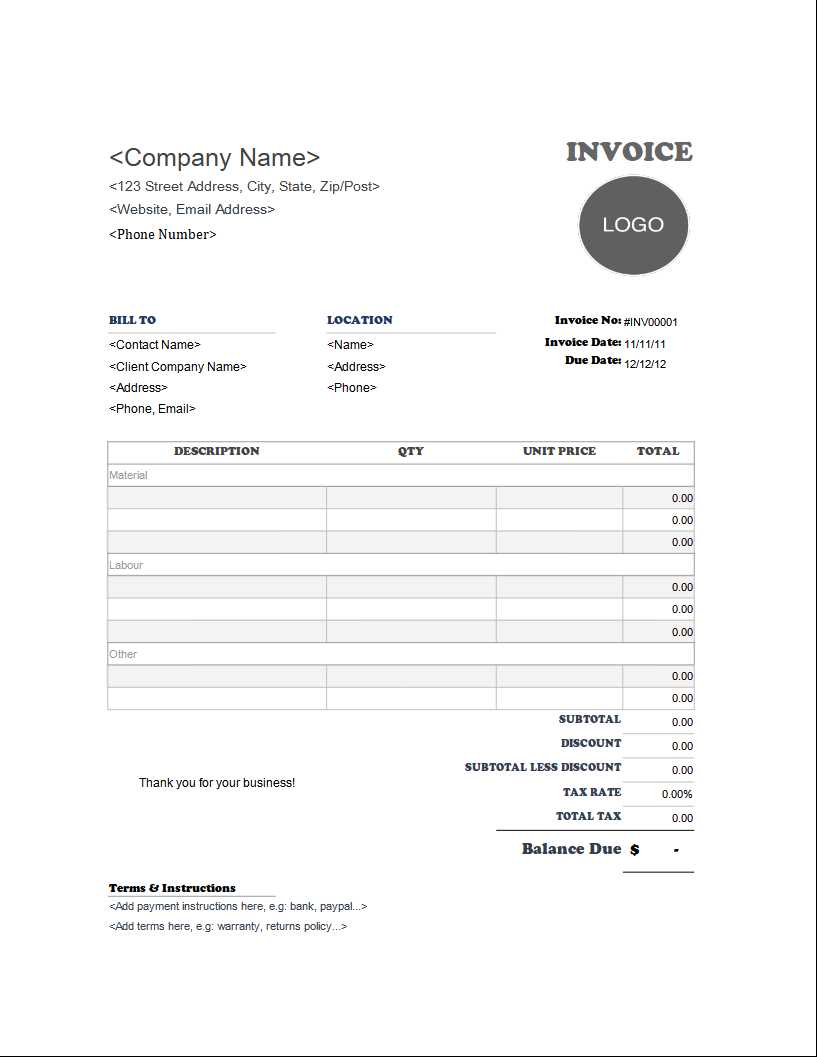

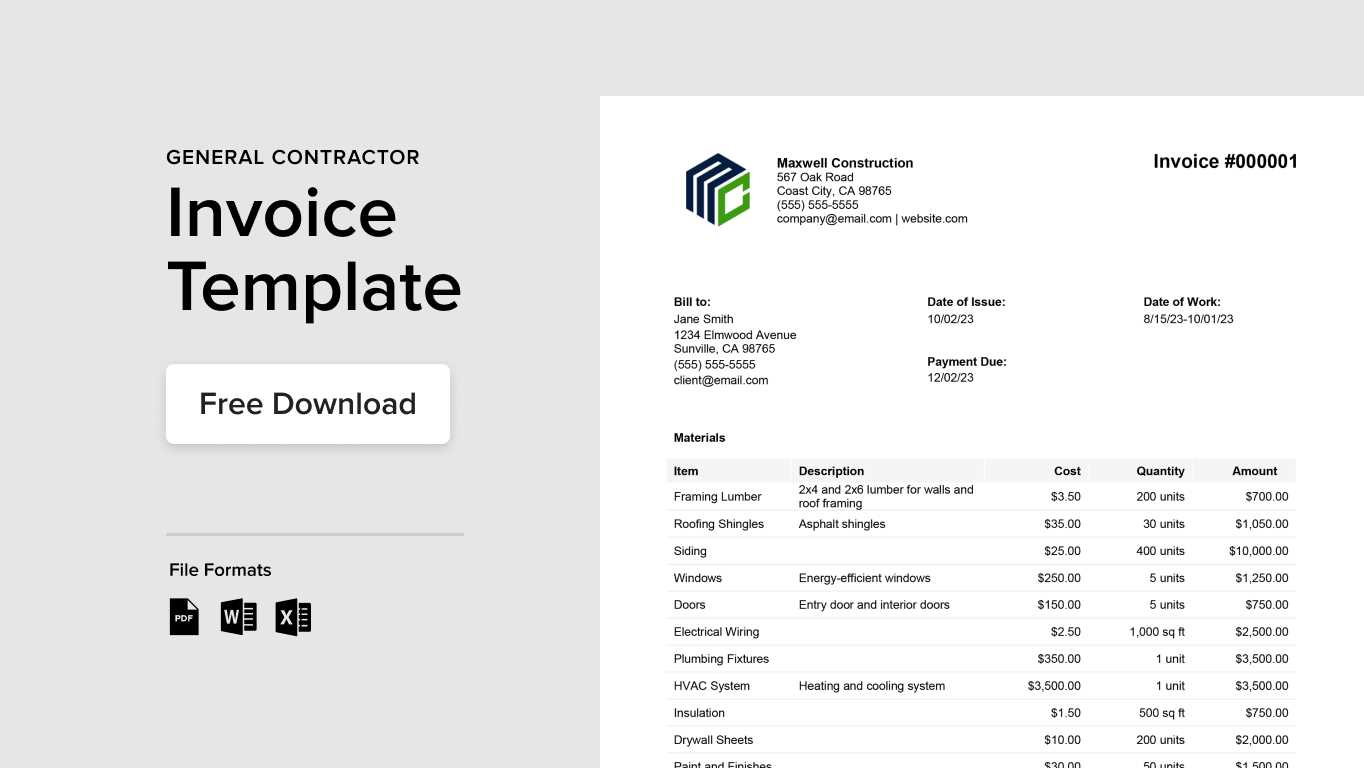

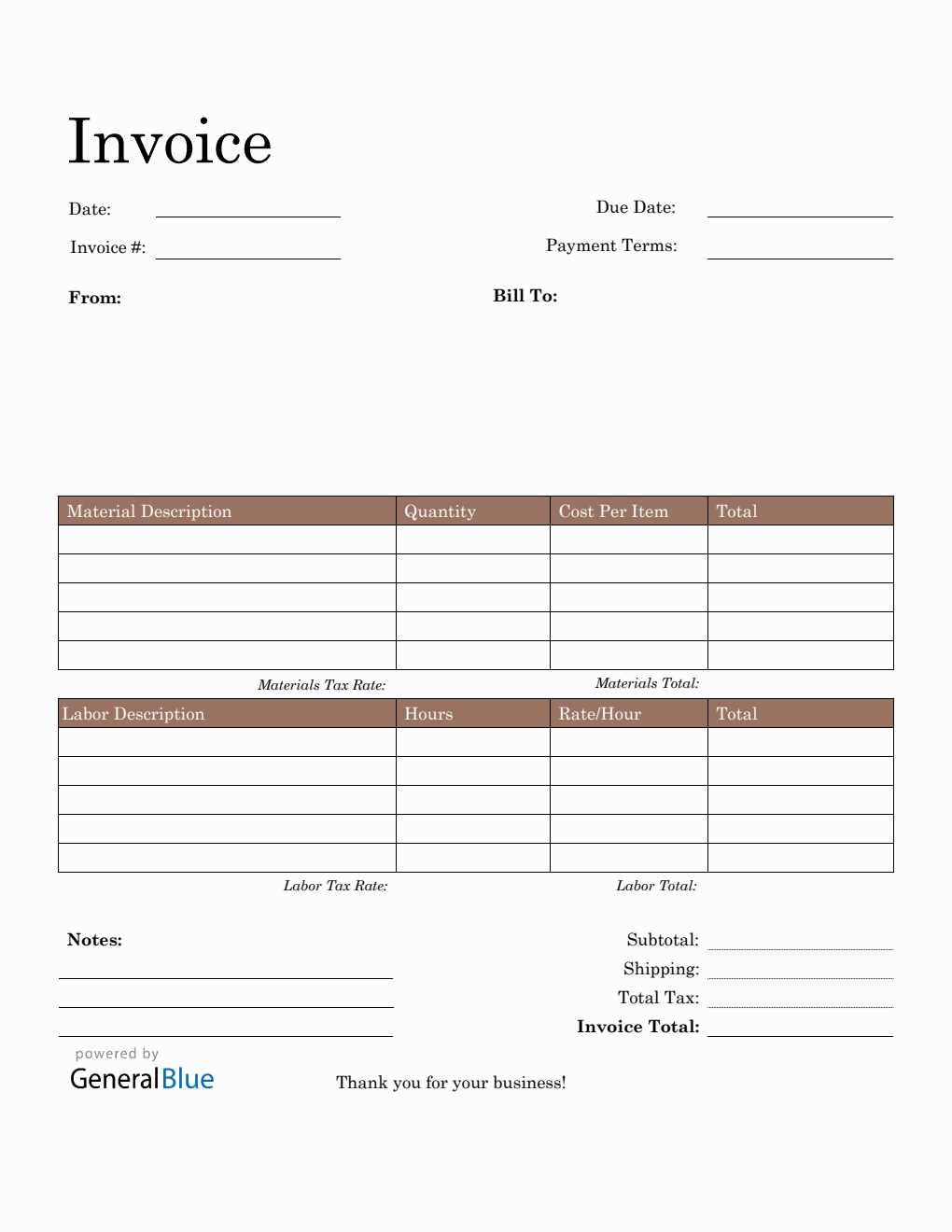

Key Elements of a Payroll Invoice

A comprehensive document for employee compensation should contain several key components to ensure transparency and accuracy. Each section plays a crucial role in communicating important information to both the employer and the employee. By including all relevant details, the document can help prevent misunderstandings and ensure that the payment process runs smoothly.

Employee details are essential for identifying who is receiving the payment. This typically includes the employee’s name, position, and employee identification number. These details ensure that the compensation is directed to the correct individual and help with record-keeping.

Hours worked is another vital component. This section records the total number of hours the employee worked during the pay period. It can also reflect overtime, if applicable, to ensure that additional hours are properly accounted for and compensated.

Rate of Pay and Deductions

The next key element is the rate of pay, which specifies the employee’s hourly wage or salary. This is multiplied by the total number of hours worked to calculate the total earnings before deductions. Deductions such as taxes, insurance, and retirement contributions are then subtracted, providing a clear picture of what the employee will actually take home.

Final Payment Details

The last section details the net pay, or the final amount the employee will receive. This is after all necessary deductions have been applied. It is essential for this

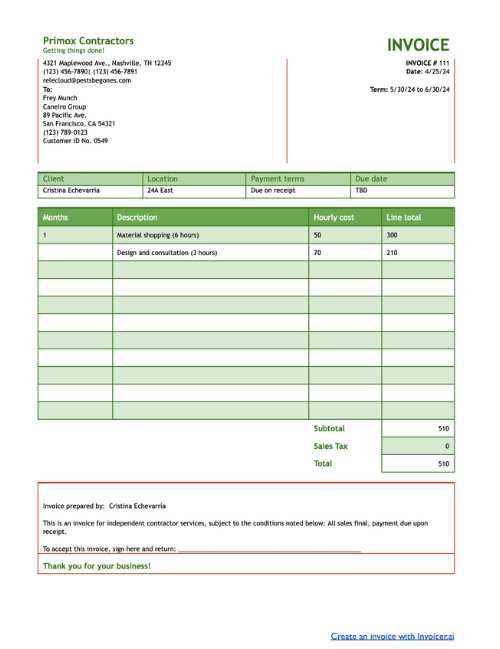

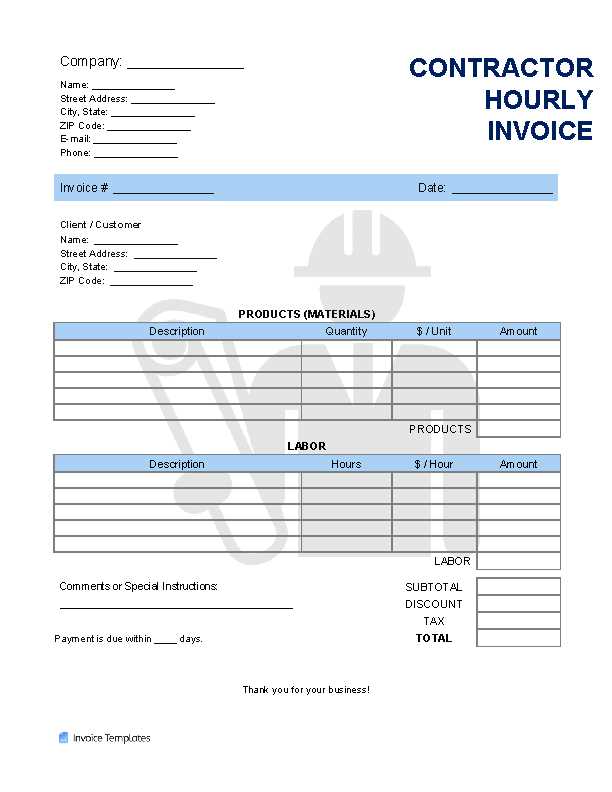

How to Customize Your Invoice Template

Customizing a document to track employee compensation can greatly improve its relevance and functionality for your business. A flexible format allows you to tailor the layout, categories, and calculations to fit your specific needs, whether you’re handling hourly, salaried, or commission-based payments. This ensures that all necessary details are included, while also providing a professional and organized appearance.

One of the first steps in customizing your record-keeping document is to define the key elements that should appear. These may include employee details, work hours, pay rates, and deductions. By adjusting the sections and their order, you can ensure that the format aligns with your business practices and provides the clearest breakdown for both the employer and the employee.

Adjusting Layout and Sections

To start, you should consider how each section of the document should be organized. You may want to include additional fields for bonuses, overtime, or reimbursement expenses. If your business has specific requirements, you can easily add or remove sections to streamline the document. For example, some businesses may need separate columns for different types of pay or deductions.

Using Formulas for Calculations

Many pre-designed forms allow you to add automated calculations, which can save time and ensure accuracy. By setting up formulas, such as for multiplying hourly rates by hours worked or subtracting taxes from the gross pay, you can eliminate manual errors and speed up the process. Here’s an example of the key fields that may need to be calculated:

| Component | Calculation | |||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Total Earnings | Hourly

Best Practices for Payroll InvoicingTo ensure smooth and error-free employee compensation processing, it is essential to follow best practices when creating and managing payment records. A well-organized and transparent approach not only helps maintain accurate financial records but also builds trust between employers and employees. Implementing standardized procedures ensures that both parties are clear about the details of the compensation and avoids any confusion or disputes. One of the most important practices is maintaining consistency in how payment records are structured. This helps avoid mistakes and ensures that all necessary information is included. Additionally, ensuring timely delivery of these documents is crucial, as it shows professionalism and reliability, contributing to positive employee relations. Standardizing Record LayoutA standardized format helps in maintaining uniformity and clarity. Every pay record should follow the same structure, whether it is a weekly, bi-weekly, or monthly payment. This consistency allows employees to easily understand their earnings, deductions, and net pay. Below is an example of a basic structure for a clear and organized document:

Automation and AccuracyUsing automated systems can significantly reduce human errors and increase efficiency. Many software tools allow for automatic calculation of pay, deductions, and taxes, ensuring that all figures are correct and consistent. This helps save time and ensures that employees are paid accurately without manual errors. Setting up automated reminders or schedules for when documents should be issued also ensures timely delivery, keeping the process organized and on track. Choosing the Right Template Format

When selecting a format for documenting employee compensation, it’s essential to choose one that aligns with your business needs and ensures ease of use. The right structure will allow for quick and accurate record-keeping, while also providing employees with clear and detailed payment information. Several factors should be considered to ensure the document is both functional and professional. There are various formats available, each offering unique benefits. The key is to choose a format that suits your company’s payroll practices and allows for easy customization when necessary. Below are some important aspects to consider when deciding which format is best for your business: Factors to Consider

Popular Format Types

|