Veterinary Invoice Template for Easy Billing

Managing financial records in an animal care practice can be complex, but with the right tools, it becomes much easier to ensure accuracy and professionalism. Proper documentation of services rendered is crucial for maintaining clear communication with clients and ensuring timely payments. Having a structured approach helps streamline the overall process and minimizes errors.

By using a well-organized system, practitioners can not only simplify their administrative tasks but also improve client satisfaction. Clear, concise records are essential for both the business and legal aspects of the practice. Whether you are a solo practitioner or part of a larger team, this guide will help you understand the key elements needed for smooth billing operations.

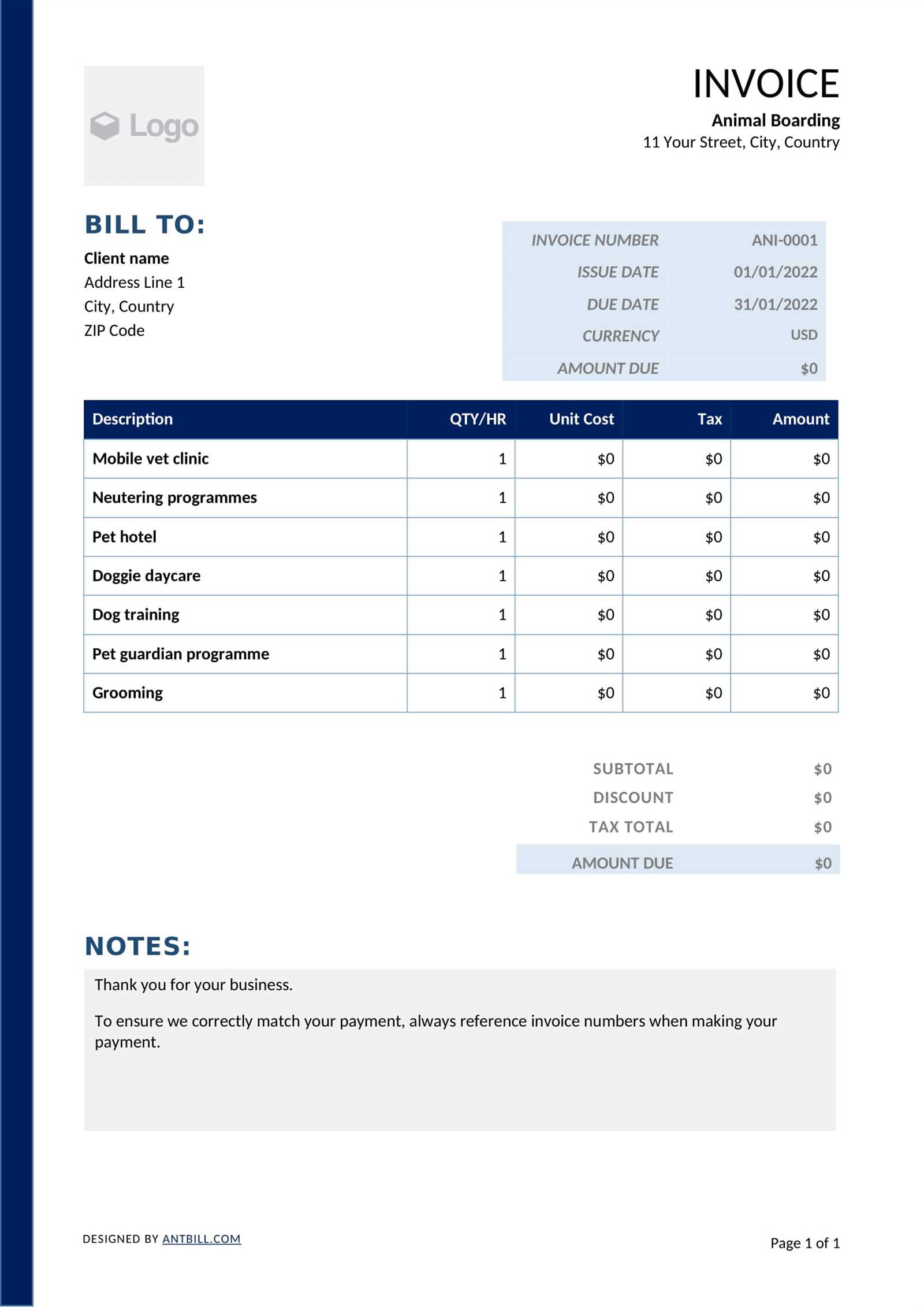

Veterinary Invoice Template Guide

Creating a structured billing document is essential for every animal care provider. It ensures that all services are clearly documented and helps maintain transparency between practitioners and clients. The right format not only makes it easier to track payments but also strengthens the professionalism of the practice.

Key Elements for Accurate Billing

A comprehensive record should include several important details to make the payment process seamless. Client information, service descriptions, and payment terms are crucial components. By ensuring these elements are consistently included, businesses can avoid misunderstandings and improve payment collections.

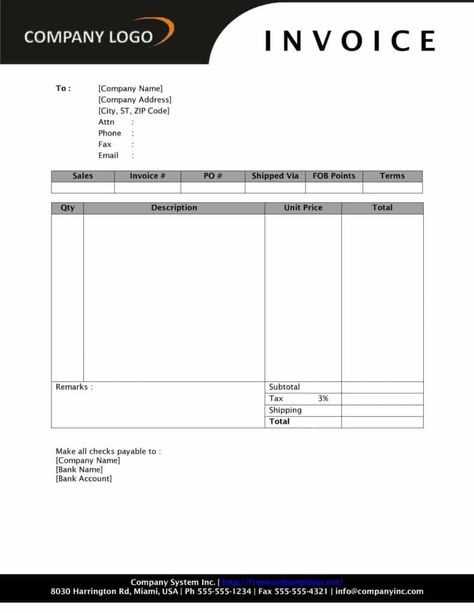

Choosing the Right Format for Your Practice

Each animal care practice may have different needs when it comes to structuring their financial documents. Customizable formats allow for flexibility while still adhering to basic professional standards. Selecting a suitable format that aligns with your practice’s workflow is essential for efficiency and accuracy.

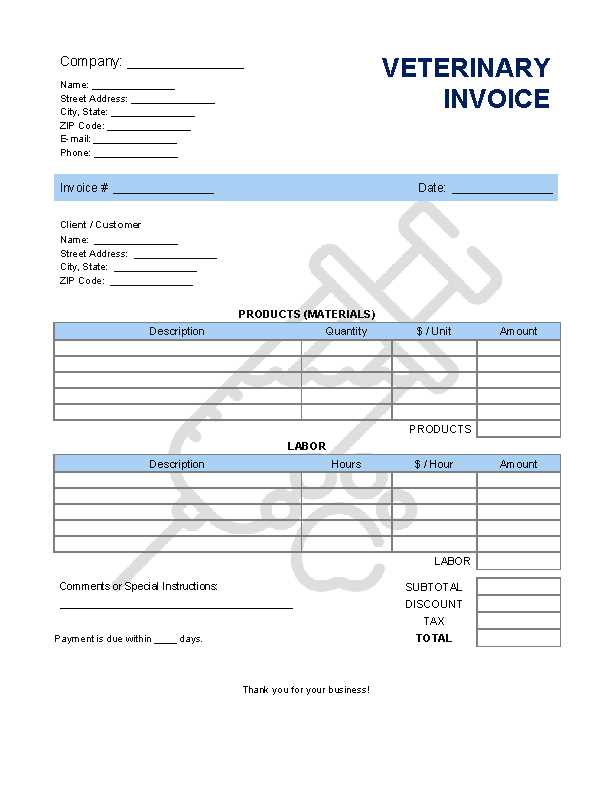

What is a Veterinary Invoice Template

A well-organized billing document is a tool that helps animal care providers maintain accurate financial records. It serves as a detailed list of services offered to clients, ensuring both parties are on the same page when it comes to payments. This document simplifies the process of collecting fees and can be customized to fit different types of animal care practices.

Structure of a Billing Record

A clear and concise financial record should include specific components that ensure both transparency and professionalism. These elements might include details about the client, the services rendered, and the amounts due. Below is an example of the key sections often found in such records:

| Section | Description |

|---|---|

| Client Information | Includes name, contact details, and address. |

| Service Descriptions | Detailed list of treatments or consultations provided. |

| Charges | Breakdown of costs for each service provided. |

| Payment Terms | Information about payment deadlines and methods. |

| Contact Information | Details of the animal care provider or clinic. |

Benefits of Using Invoice Templates

Utilizing a structured billing document offers numerous advantages for animal care providers. It streamlines the process of recording transactions, improves accuracy, and saves time by eliminating the need for manually creating records from scratch. This simple tool enhances professionalism and ensures that all required details are included for smooth financial operations.

Key Advantages of Structured Billing Records

Here are some of the key benefits that come with using organized billing documents:

| Benefit | Description |

|---|---|

| Time Efficiency | Pre-designed documents save time by avoiding the need to start from scratch. |

| Accuracy | Reduces the chance of human error by having fields clearly marked for required information. |

| Professional Appearance | Using a standardized format increases the professionalism of the business. |

| Consistency | Ensures uniformity across all billing records, making tracking and organization easier. |

| Customization | Allows tailoring the document to fit the unique needs of the practice. |

How to Customize Your Template

Customizing a billing document allows you to tailor it to the specific needs of your animal care practice. By adjusting various sections, you can ensure that the final document reflects your branding, services, and payment policies. This flexibility helps maintain consistency and professionalism in all client communications.

Steps to Personalize Your Billing Record

Here are some key adjustments you can make to customize the structure of your billing document:

| Step | Action |

|---|---|

| Add Logo | Include your clinic’s logo at the top for branding consistency. |

| Modify Service Descriptions | Adjust service categories and descriptions to reflect your specific offerings. |

| Adjust Payment Terms | Set up clear payment terms that fit your preferred billing cycle. |

| Client Information Section | Customize fields for client details to include all necessary contact information. |

| Contact Information | Ensure your practice’s contact information is accurate and easy to find. |

Essential Information for a Veterinary Invoice

To ensure that billing records are complete and accurate, it’s important to include all necessary details. These elements not only help in tracking services provided but also facilitate clear communication between service providers and clients. By including key information, you ensure that there are no misunderstandings when it comes to payments.

Key Elements to Include in Your Billing Record

Here are the essential details that should be present in every financial record:

- Client Information: Include the client’s name, address, and contact details.

- Service Description: List all treatments or consultations provided, with a brief description.

- Itemized Charges: Break down the cost of each service or item provided.

- Payment Terms: Outline the payment due date, methods of payment, and any applicable late fees.

- Practitioner or Clinic Information: Include the name, address, and contact information of the animal care provider.

- Invoice Number: Assign a unique number for record-keeping and reference.

- Tax Information: If applicable, include details about tax rates or exemptions.

Importance of Accuracy

Ensuring all the details are accurate and up-to-date not only prevents confusion but also promotes professionalism. The clearer the record, the easier it will be for clients to understand their charges and make timely payments.

Creating a Professional Veterinary Invoice

To maintain a high standard of professionalism, it’s essential that billing records reflect the quality and care provided to clients. A well-structured document not only aids in financial transactions but also fosters trust and credibility between service providers and customers. The key is to present all relevant details in a clear, concise, and organized manner.

Steps to Ensure Professionalism

Follow these guidelines to create a polished and professional billing document:

- Consistent Branding: Include your clinic’s logo, contact details, and a consistent color scheme to reinforce your brand identity.

- Clear Layout: Organize the document with clearly labeled sections such as services provided, charges, and payment terms.

- Accurate Information: Double-check the accuracy of client information, service descriptions, and pricing to prevent errors.

- Easy-to-Understand Language: Use simple and direct language to explain charges and terms.

- Professional Tone: Maintain a formal tone throughout, showing respect and courtesy to your clients.

Tools for Creating Professional Documents

There are various tools available that can help streamline the process of creating professional billing records. Many software solutions offer customizable templates, making it easy to adjust the layout and content to suit your practice’s needs. Choose one that fits your workflow and ensures consistency across all documents.

Common Mistakes in Veterinary Invoices

Even the most experienced professionals can occasionally make errors when preparing financial records. These mistakes can lead to confusion, delayed payments, and damaged client relationships. It’s crucial to recognize and avoid common pitfalls to ensure smooth transactions and maintain professionalism.

Frequent Errors in Billing Documents

Here are some of the most common mistakes to watch out for when preparing your financial records:

- Missing Client Information: Failing to include accurate client details, such as the name, address, or contact number, can cause delays or miscommunication.

- Unclear Service Descriptions: Vague or ambiguous descriptions of the services provided can lead to misunderstandings about what was charged.

- Incorrect Pricing: Errors in pricing, such as charging the wrong rate or omitting discounts, can lead to dissatisfaction and disputes.

- Lack of Itemization: Not breaking down services into individual line items can make the document look unclear and difficult to understand.

- Omitting Payment Terms: Failing to specify payment due dates, methods, or late fees may result in delayed or missed payments.

- Inconsistent Formatting: Using different fonts, sizes, or spacing throughout the document can make it appear unprofessional and harder to read.

- Not Including Tax Information: Forgetting to include tax details or exemptions can cause complications for both the service provider and the client.

By paying close attention to these areas and avoiding common errors, you can ensure that your billing documents are clear, professional, and accurate.

Automating Your Billing Process

Automating financial documentation and payment processing can save valuable time and reduce human error. With the right tools, tasks such as creating, sending, and tracking bills can be streamlined, allowing you to focus more on your core services and client care. By implementing an automated system, you ensure that all records are consistent, accurate, and sent on time, which leads to more efficient operations and improved cash flow.

Benefits of Automation

Here are the key advantages of automating your billing process:

- Time Savings: Automating repetitive tasks, such as generating and sending payment requests, allows you to dedicate more time to client-facing activities.

- Accuracy: Automated systems minimize the risk of human errors in calculations and data entry, ensuring accurate financial records.

- Consistency: Automation ensures that all documents follow the same format, maintaining a professional appearance and reducing confusion.

- Improved Cash Flow: With automated reminders and payment tracking, you can reduce delays in receiving payments, improving your overall cash flow.

- Easy Integration: Many automation tools can integrate with other software systems, such as accounting or client management platforms, creating a seamless workflow.

Steps to Automate Billing

Follow these steps to successfully automate your financial processes:

- Select an Automation Tool: Choose a tool that fits your needs and integrates with your existing systems.

- Set Up Payment Reminders: Schedule automatic reminders for clients about due payments to ensure timely receipts.

- Create Recurring Billing: If applicable, set up recurring billing for repeat clients to avoid manual input every time.

- Track Payments Automatically: Use software that can track payments and notify you of any outstanding balances.

By integrating these practices into your workflow, you can enhance efficiency, reduce errors, and improve client satisfaction.

Legal Requirements for Veterinary Invoices

When managing billing documents, it is essential to comply with legal standards to ensure that all records are properly documented and can stand up to any legal or financial scrutiny. Specific rules exist regarding the content and format of these records to guarantee transparency and prevent disputes. These requirements can vary depending on the jurisdiction and the type of business, so understanding the local regulations is key to maintaining compliance.

For any business that deals with payments, certain elements must be included in the documentation, especially when dealing with clients and services that require formal agreements. Compliance with these legal standards helps to safeguard both the business and the clients, ensuring that the process is fair and transparent.

Key Legal Requirements

- Business Information: Include the name, address, and contact details of your establishment to ensure that clients know who they are dealing with.

- Client Information: Properly include the client’s details, such as name, address, and contact number, to make it clear to whom the charges are addressed.

- Clear Description of Services: A detailed list of the services provided is necessary for transparency and clarity, including the type of service, duration, and any related charges.

- Payment Terms: Ensure that payment terms are clearly stated, including due dates, accepted methods, and any late fees or discounts applicable.

- Tax Information: If applicable, include tax identification numbers and any relevant sales tax information to comply with taxation laws.

- Legal Disclaimers: Some regions require specific disclaimers to be included, such as refund policies, dispute resolution procedures, and consumer rights.

Ensuring that all these elements are clearly laid out in your financial documentation not only helps with legal compliance but also builds trust with clients. By adhering to these guidelines, you demonstrate professionalism and avoid potential legal issues.

Choosing the Right Template for Your Practice

Selecting the appropriate document layout for your business is crucial to ensure smooth financial transactions and maintain professionalism. A well-structured document not only ensures clarity and consistency but also reflects your commitment to quality and detail. The right layout can simplify the billing process, helping you save time while ensuring that all necessary information is included in a clear and organized manner.

Factors to Consider

- Professional Design: Opt for a clean, organized layout that looks professional and enhances the perception of your services. A cluttered document can give the wrong impression.

- Customizability: Choose a layout that can be easily modified to fit the specific needs of your business. You may want to personalize sections such as service descriptions, payment terms, and contact details.

- Compliance Requirements: Ensure that the layout you choose includes all mandatory elements required by local laws, such as tax information, payment due dates, and client details.

- Ease of Use: Pick a layout that is intuitive to use, whether you are working with physical documents or digital files. You should be able to fill out and edit information with ease.

Choosing Between Digital and Paper Formats

- Digital Formats: Digital layouts can streamline your workflow and make it easier to send and store documents. They can also be customized quickly and shared with clients via email or other online platforms.

- Paper Formats: While digital formats are convenient, physical documents may still be preferred in certain industries. Make sure your layout is optimized for printing if you choose to go this route.

Ultimately, the right layout depends on your practice’s needs and the type of client interaction you have. Whether you prefer a simple, straightforward design or a more detailed, branded version, choosing the best document structure will help improve your billing process and maintain professionalism.

Incorporating Payment Terms in Invoices

Clearly outlining payment terms in your documents is essential for ensuring timely and accurate transactions. By specifying when payment is due, how much is owed, and the accepted methods of payment, you create transparency and avoid misunderstandings with your clients. Well-defined payment terms also help to streamline your accounting process and improve cash flow management.

Key Elements to Include in Payment Terms:

- Due Date: Clearly state the date by which payment is expected. This helps clients plan their payments and reduces delays.

- Late Fees: Specify any penalties for late payments, such as interest rates or fixed fees, to encourage timely settlement.

- Accepted Payment Methods: List the payment options available, such as credit cards, bank transfers, or online payment platforms, to offer convenience to your clients.

- Discounts for Early Payments: If applicable, you can offer a discount for early settlement, which can motivate clients to pay ahead of the due date.

Why Payment Terms Matter:

- Clarity and Professionalism: Transparent terms project professionalism and help avoid disputes over payment deadlines and amounts.

- Improved Cash Flow: Clearly defined terms help ensure that payments are received on time, contributing to steady cash flow for your practice.

- Legal Protection: Well-documented terms provide legal safeguards in case of non-payment or disputes over the terms of service.

By incorporating comprehensive and clear payment terms, you enhance the professionalism of your billing system and foster good relationships with clients. Ensuring that these terms are easy to understand will make the payment process smoother and more efficient for both parties.

Managing Multiple Invoices Efficiently

Handling multiple billing documents simultaneously can be a daunting task without proper organization. Efficient management ensures that all transactions are recorded accurately, payments are tracked, and your workflow remains smooth. By using systematic approaches, you can minimize errors, reduce stress, and save time on administrative tasks.

Key Strategies for Efficient Management:

- Use of Billing Software: Leveraging automated billing systems can help streamline the creation, tracking, and processing of multiple records. These tools often include features like reminders, recurring charges, and detailed reporting, all of which simplify managing a high volume of transactions.

- Organized Record-Keeping: Keeping records organized by client, due date, or service type can prevent confusion. A simple categorization system helps you easily track outstanding amounts and avoid double-billing or overlooking payments.

- Batch Processing: Process multiple records at once by setting aside dedicated time for managing all transactions. Batch processing can speed up the review and follow-up process, helping you stay on top of your financial duties.

- Electronic Payment Tracking: Encourage electronic payment methods for faster processing and better tracking. Integrating payment systems directly with your billing platform can automatically update your records, reducing manual entry and the risk of mistakes.

Benefits of Efficient Management:

- Improved Cash Flow: By staying on top of payment schedules and follow-ups, you ensure that payments are received on time, improving your cash flow.

- Minimized Errors: Automation and organized tracking reduce the likelihood of errors in calculations or missed payments, ensuring accurate records.

- Time-Saving: Streamlining your process allows you to allocate less time to administrative work, freeing you up for other tasks that require attention.

Efficiently managing multiple billing documents not only enhances your workflow but also improves client satisfaction and financial stability. The right tools and strategies can make this process straightforward and hassle-free, ensuring your practice runs smoothly.

Integrating Billing Documents with Software

Integrating your billing system with specialized software is an efficient way to automate and streamline your practice’s financial processes. This approach allows for accurate tracking, automated updates, and reduces the need for manual data entry. By adopting this integration, you can simplify your workflow and ensure smooth operations for both your team and your clients.

Advantages of Integration

Efficiency: Integrating your billing records with software reduces the time spent on administrative tasks. It eliminates the need for manual calculations and updates, ensuring faster processing and reducing errors.

Accuracy: With software integration, you reduce the chances of human error in data entry. Automated systems pull data directly from your service records, ensuring that billing information is accurate and consistent.

How to Integrate Your Billing System

- Choose the Right Software: Select software that is compatible with your existing systems and meets your specific needs. Ensure it offers features like client management, payment tracking, and reporting.

- Sync Billing Data: Make sure that your billing system is linked to other relevant software, such as appointment schedulers or patient records. This will allow for seamless updates and reduce the chances of discrepancies.

- Automate Payments and Reminders: Integration allows for the automation of payment tracking, invoice generation, and payment reminders. This ensures clients receive timely notifications, improving cash flow and reducing overdue payments.

By integrating your billing records with software, you can manage your finances more effectively, saving both time and effort. The integration ensures smoother operations, allows better financial tracking, and provides greater transparency, helping your practice grow and succeed.

How to Send and Track Billing Documents

Sending and tracking billing documents efficiently is essential for maintaining a smooth cash flow and ensuring timely payments. Implementing a structured approach for dispatching and monitoring these documents can help prevent delays, reduce errors, and improve client satisfaction. This process can be automated, allowing you to focus more on your core services.

Sending Billing Documents

To send your billing records, it’s important to choose a method that aligns with your practice’s needs and your clients’ preferences. Here are the most common methods:

- Email: Digital copies sent via email are convenient and fast. Ensure that your documents are professionally formatted and attached in a secure file format like PDF.

- Postal Mail: For clients who prefer physical documents, ensure that your address details are up to date. Consider using a reliable mail service to avoid delays.

- Online Billing Platforms: Using an online system for dispatching documents allows clients to view and pay directly from the platform. Many of these systems also offer automatic reminders for unpaid bills.

Tracking Billing Records

Tracking the status of your billing documents helps ensure that all payments are processed promptly. Here’s how to efficiently manage tracking:

- Use Billing Software: Leverage integrated software to track sent documents, payment statuses, and client details. Many tools offer features like automated reminders for overdue payments and updates on payment status.

- Maintain a Manual Log: If you’re not using automated systems, keep a physical or digital log to track the details of each document, including the date sent, client details, and payment due date.

- Send Payment Reminders: Set up automated reminders for unpaid documents. Sending friendly reminders at regular intervals ensures that clients are aware of their outstanding balance.

By following these practices, you can send and track billing documents more efficiently, reducing administrative work and ensuring a consistent and reliable payment process.

Ensuring Accurate Billing Practices

Maintaining precise billing practices is critical to avoid discrepancies, prevent disputes, and build trust with clients. When billing is handled accurately, businesses can ensure timely payments, reduce errors, and improve overall efficiency. By adopting a structured approach to documentation and double-checking all details, you can maintain accuracy in all billing-related tasks.

Key Steps for Accuracy

Here are some essential steps to follow when ensuring accuracy in your billing processes:

- Double-Check Client Information: Before sending any document, verify the client’s details, such as name, address, and contact information, to ensure accuracy.

- Clear and Detailed Descriptions: Ensure that the descriptions of services or products are clear and specific. Provide detailed breakdowns of each charge to prevent confusion.

- Review for Correct Rates: Ensure that the rates and pricing match what was agreed upon with the client. This helps avoid discrepancies and potential conflicts.

- Audit Regularly: Perform routine audits of your billing records to identify any potential mistakes or missing details.

Using Technology for Accuracy

Technology can significantly reduce human error in billing practices. Consider the following tools:

- Automated Billing Systems: These systems allow you to input the necessary information and generate billing documents automatically, reducing the risk of manual errors.

- Tracking and Reminders: Set up automatic reminders for clients, ensuring that no document is missed and that payment due dates are clearly communicated.

- Digital Tools for Reconciliation: Use software that can integrate with your financial systems, allowing for easier reconciliation of payments and records.

By following these steps and utilizing technology, you can significantly enhance the accuracy of your billing practices, leading to improved financial management and client satisfaction.

Design Tips for Effective Billing Documents

Creating well-designed billing documents is essential to ensure clarity and professionalism. A clean, easy-to-read layout helps clients understand their charges while reinforcing the credibility of your business. By focusing on key design elements, you can make sure your documents are not only functional but also visually appealing.

Essential Design Elements

Here are some design tips to help you create effective billing documents:

- Simple and Clean Layout: Keep the design simple with a clear structure. Avoid clutter by using enough white space to make the document easy to read.

- Legible Fonts: Choose fonts that are easy to read, such as sans-serif fonts. Avoid using more than two or three different fonts to maintain consistency.

- Consistent Branding: Incorporate your business logo and use your brand’s color scheme. This ensures that the document reflects your company’s identity.

- Clear Sections: Organize the document into distinct sections–such as client information, service description, and total cost–so that clients can quickly find relevant details.

Enhancing User Experience

To further improve the readability and user-friendliness of your billing documents, consider these additional tips:

- Highlight Important Information: Use bold text or larger fonts for key information like due dates, amounts owed, and payment instructions.

- Incorporate Visual Elements: Use simple icons or graphics to highlight specific items, such as a payment status or contact details.

- Provide Clear Payment Instructions: Include a separate section for payment methods, ensuring it is easy for clients to understand how to settle their balance.

By following these design principles, you can create billing documents that are professional, clear, and visually appealing, leading to a more efficient and positive experience for both you and your clients.

Keeping Records of Billing Documents

Maintaining accurate and organized records of all billing documents is crucial for any business. Proper record-keeping helps you track payments, monitor outstanding balances, and ensure compliance with tax regulations. It also provides a reference for resolving disputes or verifying transaction details in the future.

To keep track of your billing records effectively, consider the following practices:

- Use Digital Systems: Storing records electronically makes them easier to search, organize, and back up. Many software solutions offer secure storage and automatic updates.

- Label Documents Clearly: Give each document a unique identifier, such as an invoice number or date, to make it simple to retrieve when needed.

- Keep Records Organized by Date: Sort your documents chronologically or by fiscal year to make financial reviews and tax filing more manageable.

- Track Payment Status: Mark paid and unpaid documents clearly to prevent any confusion and help you manage follow-up actions for overdue payments.

Adopting these methods will help streamline your record-keeping process, ensuring that you can quickly access essential information whenever required.