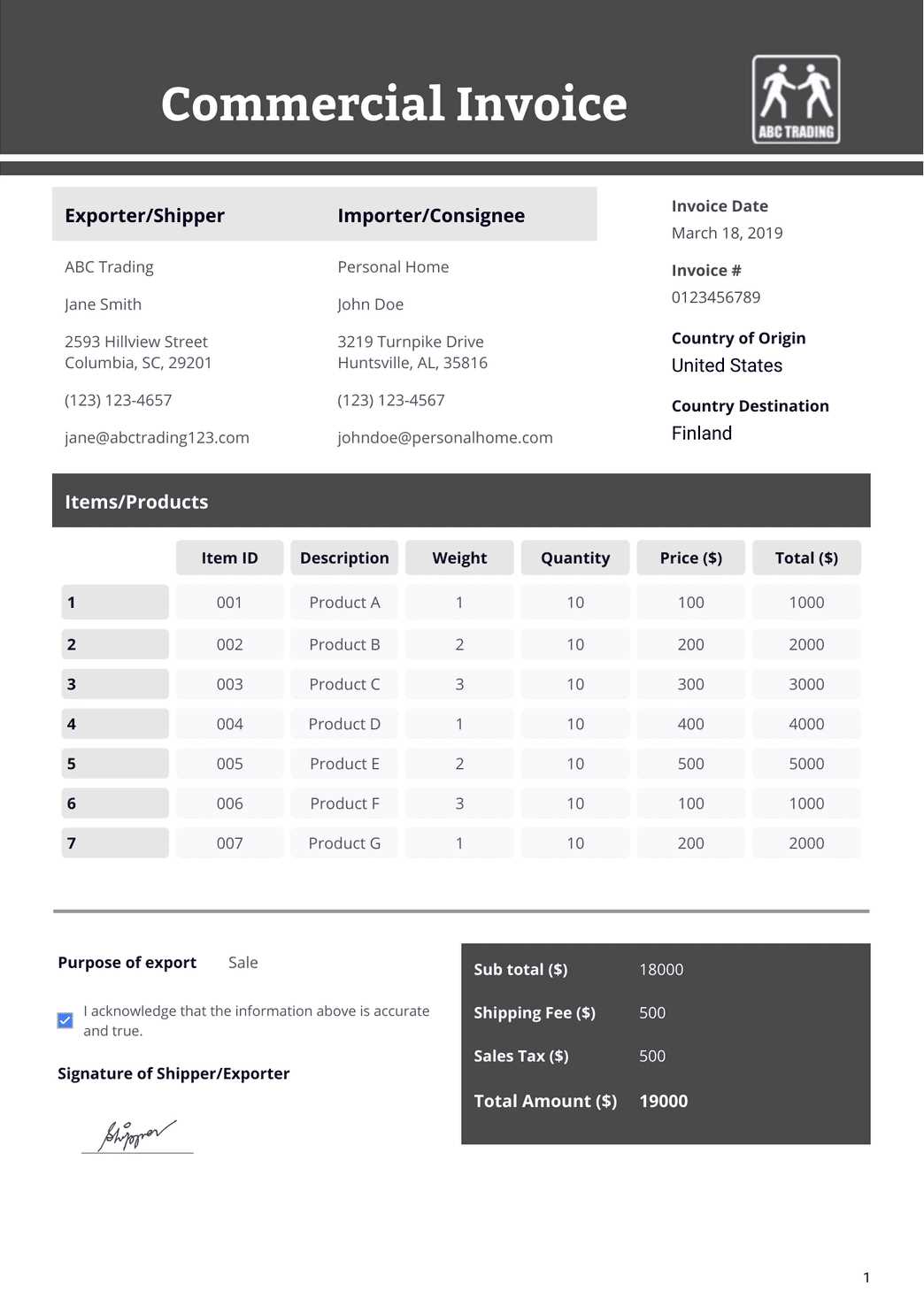

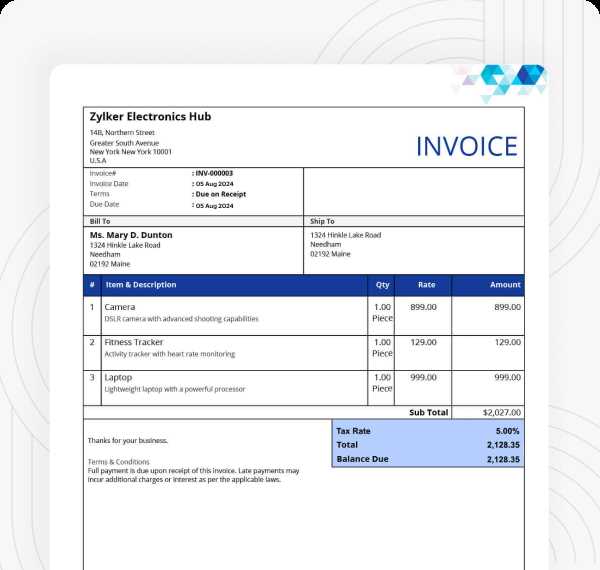

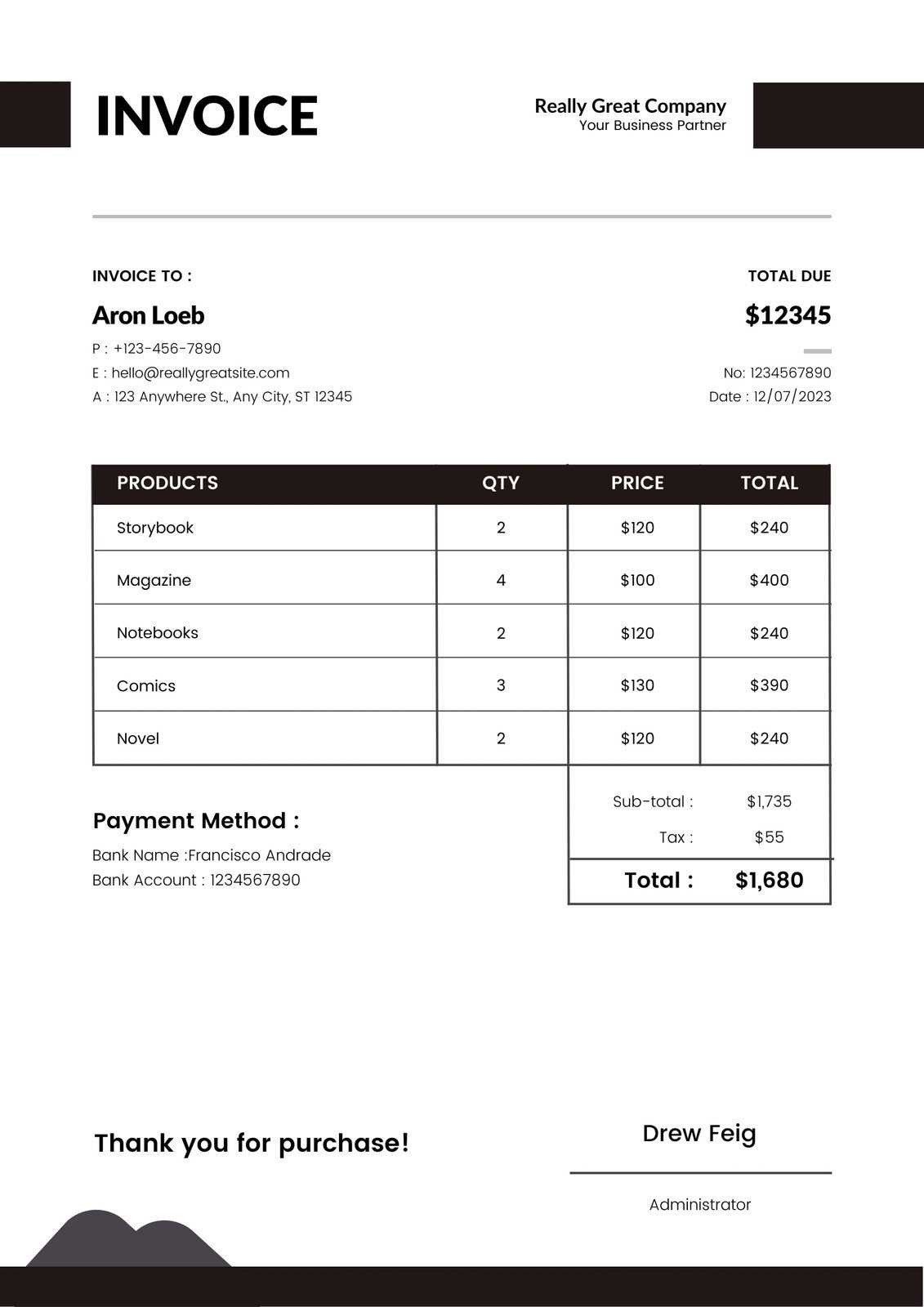

Very Simple Invoice Template for Effortless Billing

Managing payments and keeping track of transactions can be a time-consuming task for any business. A well-organized method of documenting charges is essential for smooth financial operations. Whether you’re a freelancer, small business owner, or part of a larger organization, having a straightforward tool to handle this process is invaluable.

With the right design, creating professional-looking records for your clients becomes quick and hassle-free. A structured approach to billing ensures clarity, reduces errors, and helps maintain a consistent financial process. This can be particularly beneficial when working with multiple clients or handling frequent transactions.

By utilizing an intuitive format, you can easily generate documents that include all necessary details, such as services rendered, payment terms, and contact information. These records not only reflect professionalism but also help establish trust and transparency with your clients. Simplifying this aspect of your business allows you to focus more on growth and less on administrative tasks.

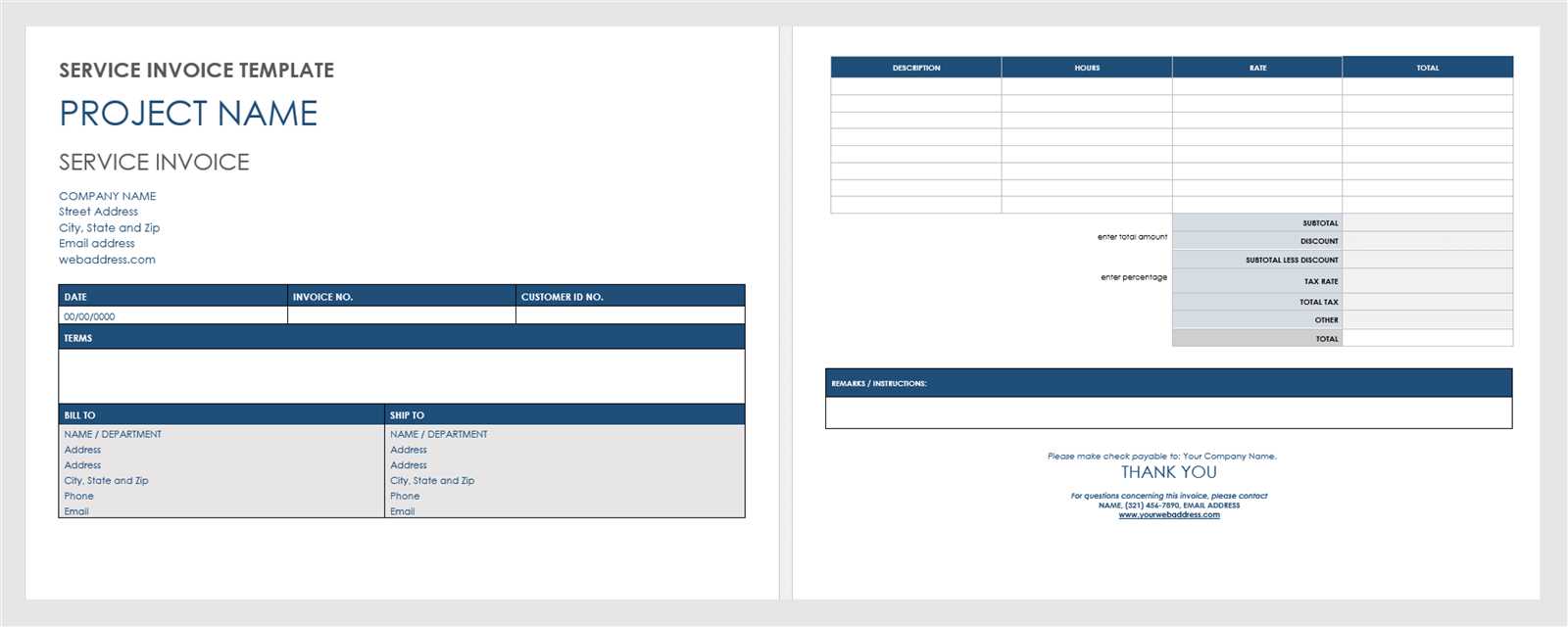

Easy-to-Use Billing Document Format

Having a clear and concise document to record transactions is essential for any business. The goal is to create a straightforward and efficient record that both you and your clients can easily understand. This format simplifies the process of capturing important payment details, ensuring accuracy and professionalism.

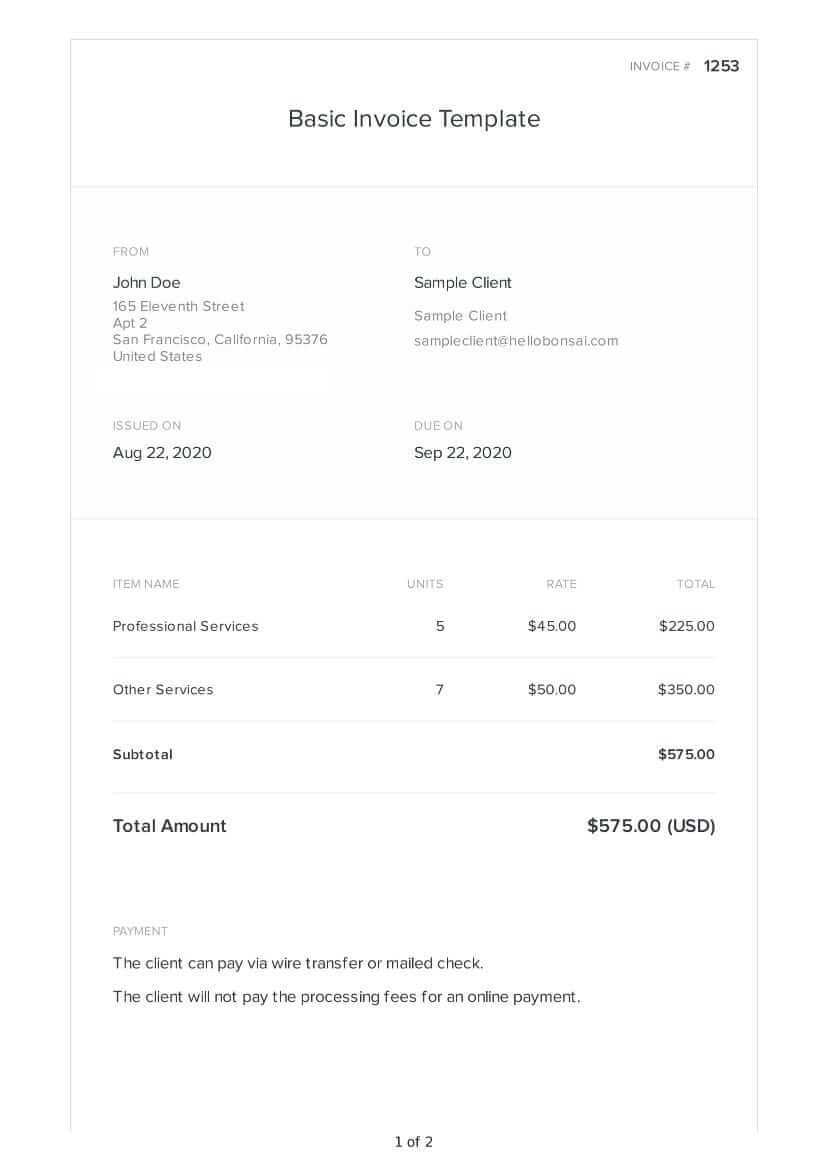

When designing a billing document, the focus should be on keeping the structure simple while including all the necessary information. A well-organized layout helps prevent confusion and makes it easier for clients to make timely payments. Here are the key elements to include in a basic billing document:

- Client Information: Include the client’s name, address, and contact details.

- Business Details: Provide your business name, contact information, and any relevant identifiers (e.g., tax ID).

- Transaction Date: Clearly state when the goods or services were provided.

- Description of Services: List each item or service offered, along with its cost.

- Total Amount: Sum up the charges and provide the final amount due.

- Payment Terms: Specify the due date and acceptable payment methods.

- Notes: Include any additional terms, like late fees or discounts, if applicable.

This approach allows for an organized and professional record without overwhelming your clients or yourself with unnecessary details. With a simple structure, you can focus on delivering excellent service while maintaining efficient financial practices.

What is a Billing Document Format?

A billing document format is a pre-designed layout that helps businesses record transactions clearly and consistently. It ensures that all necessary details are included, making it easy for both the service provider and the client to understand the charges and terms of the agreement. This type of format is essential for maintaining accurate records and facilitating smooth financial exchanges.

In essence, a well-organized document serves as a formal request for payment, outlining the services provided or goods delivered, along with their respective costs. It also includes vital information, such as due dates, payment methods, and terms of service, allowing for seamless processing of payments. Here are the core components:

Key Elements of a Billing Document Format

- Identification Information: Details of the business and the client, including names and contact information.

- Description of Services or Products: A breakdown of the services or products provided, with corresponding prices.

- Total Amount Due: The sum of all charges, clearly displayed for the client to review.

- Payment Instructions: The methods of payment accepted and the due date for the transaction.

Why Use a Standardized Document?

Using a standardized layout makes it easier to track payments and reduce errors. It creates a consistent approach to billing, saving time and avoiding confusion. Whether you are a freelancer, a small business owner, or managing a larger organization, this format provides a professional way to handle financial transactions.

Why Use a Basic Billing Document?

Keeping financial records clear and straightforward is crucial for efficient business operations. A minimalistic approach to documenting transactions ensures that both parties–whether it’s a freelancer, small business, or large company–can easily understand the charges and payment terms. Using an uncomplicated layout helps avoid confusion and errors, making the entire process more transparent and manageable.

When you use a straightforward billing format, you remove unnecessary complexities that could slow down payment processing or lead to misunderstandings. The focus shifts to essential details, improving professionalism and trust with clients. Below are a few reasons why opting for an uncomplicated document format can benefit your business:

Key Advantages of a Clear Billing Format

| Advantage | Description |

|---|---|

| Clarity | Easy-to-read documents reduce confusion and ensure both parties understand the payment terms. |

| Efficiency | Minimalistic layouts save time, making it quicker to create and send billing records. |

| Professionalism | Simple yet organized documents enhance your business’s credibility and trustworthiness. |

| Faster Payments | With less complexity, clients can review and process payments more quickly, leading to faster cash flow. |

Who Benefits from a Basic Format?

Freelancers, small businesses, and startups often find this type of approach especially useful, as it allows them to focus on their core services rather than spend excessive time on administrative tasks. By maintaining a straightforward method for billing, you can reduce the risk of errors and focus on building stronger client relationships.

Benefits of a Basic Billing Format

Using a straightforward structure to document payments brings multiple advantages to any business. By focusing on essential details and eliminating unnecessary elements, it becomes easier to manage transactions, maintain organization, and provide clarity to clients. A clean and functional layout improves efficiency and reduces the potential for errors in financial documentation.

Here are some key benefits of using an uncomplicated billing structure:

- Improved Clarity: A minimalistic approach ensures that both businesses and clients can quickly understand the charges and payment terms.

- Faster Processing: With fewer elements to review, both parties can process payments more swiftly, reducing delays in cash flow.

- Time Savings: Creating and sending clear, concise records takes less time, allowing businesses to focus on their core operations.

- Consistency: A basic structure helps create uniformity in all transactions, making it easier to track payments and maintain financial records.

- Professionalism: Simple yet organized documents convey a sense of order and trustworthiness, enhancing the business’s image.

- Less Room for Errors: Fewer complicated sections mean fewer chances for mistakes in calculations or details, reducing the risk of disputes.

By adopting a clean, easy-to-follow format, businesses can streamline their billing processes, create better customer experiences, and maintain accurate financial records with minimal effort. This approach is especially useful for freelancers, small enterprises, and those just starting out, where time and resources are limited.

How to Create a Billing Document Easily

Creating a clear and organized document for transactions doesn’t have to be complicated. With a few essential steps and a well-structured layout, you can quickly prepare a professional record for your clients. Whether you’re handling one-time services or ongoing contracts, the process can be streamlined to save you time and effort.

To create a billing record with ease, follow these simple steps to ensure you capture all necessary information in a clear format:

| Step | Action |

|---|---|

| 1. Add Contact Information | Include your business name, address, and phone number along with your client’s contact details. |

| 2. Specify Transaction Date | Clearly indicate the date the service was provided or the product delivered. |

| 3. List Services or Products | Describe each service or product with quantities, individual prices, and total costs. |

| 4. Calculate Total Amount | Sum the individual charges and provide a final amount due, including any applicable taxes. |

| 5. Include Payment Terms | State the due date and preferred payment methods to make the transaction smooth. |

| 6. Review for Accuracy | Double-check all details for any errors or missing information before sending. |

With these basic steps, you can easily generate a clear, professional billing record that will help both you and your clients keep track of payments efficiently. Using a straightforward layout reduces the time spent on administrative tasks and helps ensure that payments are processed without delays.

Key Elements of a Billing Record

When creating a record for a transaction, certain essential components must be included to ensure clarity and proper documentation. These elements provide both the business and the client with all the necessary information to process payments smoothly and without confusion. A well-structured record not only helps with the transaction but also serves as a reliable reference for future financial management.

Below are the fundamental components that should be present in every billing document:

Essential Components

| Element | Description |

|---|---|

| Business Information | Include the name, address, and contact details of the company or individual sending the record. |

| Client Details | Provide the name and contact information of the recipient for accurate communication. |

| Transaction Date | Specify the date the service was provided or the product was delivered to ensure accurate timing. |

| Description of Goods or Services | List the products or services provided, including quantities, unit prices, and any additional details. |

| Total Due | Calculate the sum of all charges, including applicable taxes or discounts, and present the final amount due. |

| Payment Terms | State the payment due date, the acceptable payment methods, and any penalties for late payments. |

Why These Elements Matter

Each of these components ensures transparency and helps avoid confusion, allowing both parties to have a clear understanding of the transaction. Accurate and complete records also support financial planning, accounting, and tax reporting, making them invaluable for business operations.

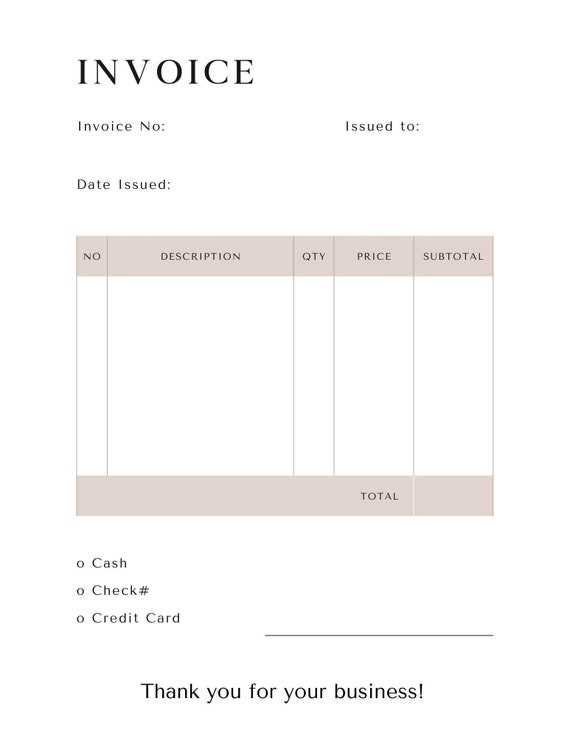

Free Easy-to-Use Billing Documents Available

There are numerous resources online that offer free, ready-to-use layouts for documenting payments. These resources can help businesses of all sizes quickly generate clear and professional transaction records without the need for design expertise. Whether you’re a freelancer, small business owner, or part of a larger organization, these free formats can save valuable time and effort.

By using free billing formats, you can ensure that your records meet professional standards while also being cost-effective. These documents typically come with a basic, user-friendly design that includes all necessary fields, making them perfect for everyday transactions. Below are some of the key benefits of using these free resources:

Advantages of Free Billing Documents

- Cost Savings: No need to invest in expensive software or design services to create professional records.

- Ease of Use: Most free options are designed with simplicity in mind, requiring little to no customization.

- Quick Setup: These formats can be downloaded and used immediately, speeding up the billing process.

- Customization Options: Many free resources offer customizable fields, allowing you to adapt the document to your needs.

- Professional Appearance: Even the most basic formats provide a polished and organized layout, enhancing your business’s credibility.

Where to Find Free Billing Layouts

There are a variety of websites that provide free, downloadable documents, including Google Docs, Microsoft Word, and specialized platforms dedicated to business resources. These sites often allow you to either download a document directly or fill it out online, making it even easier to create and send records without hassle.

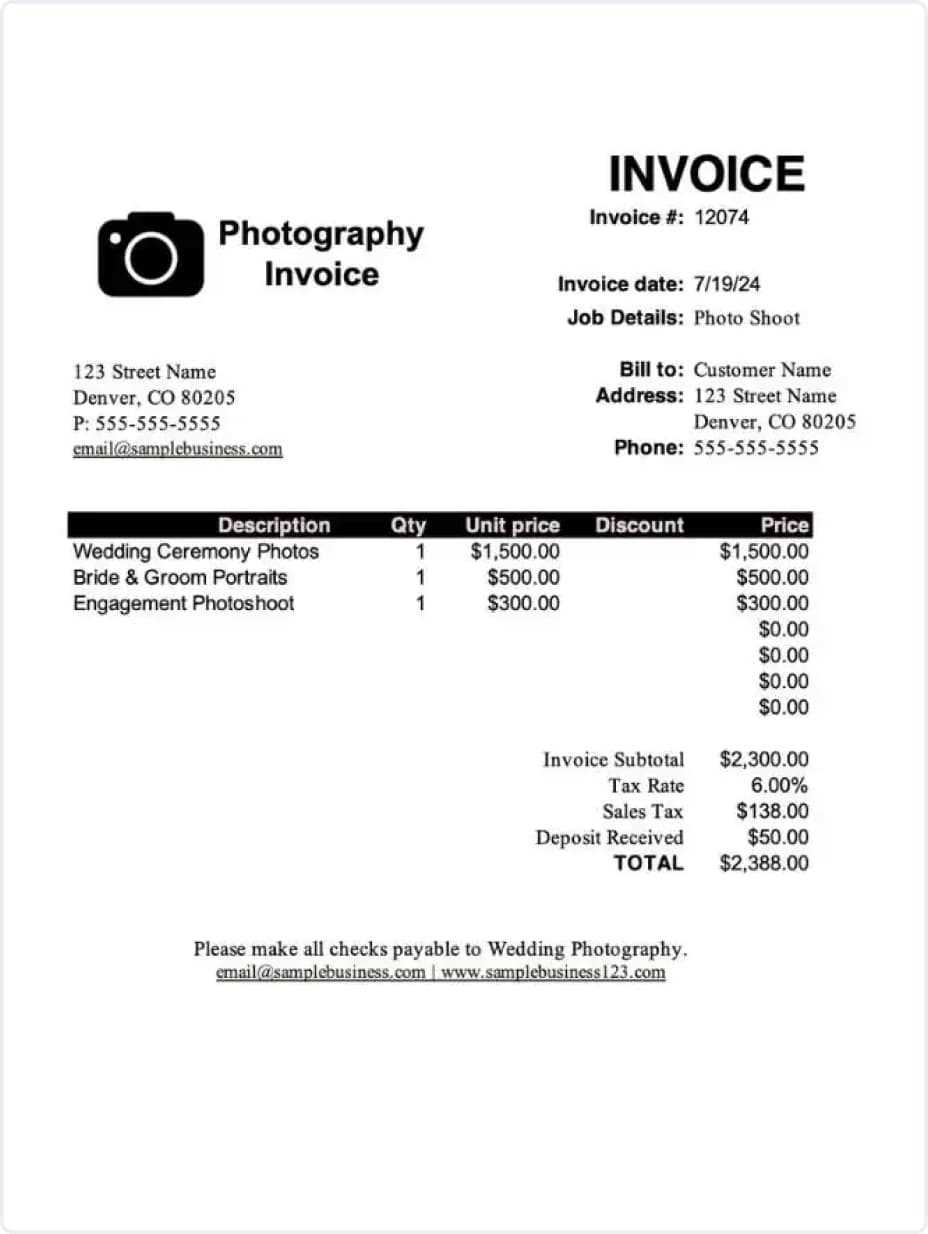

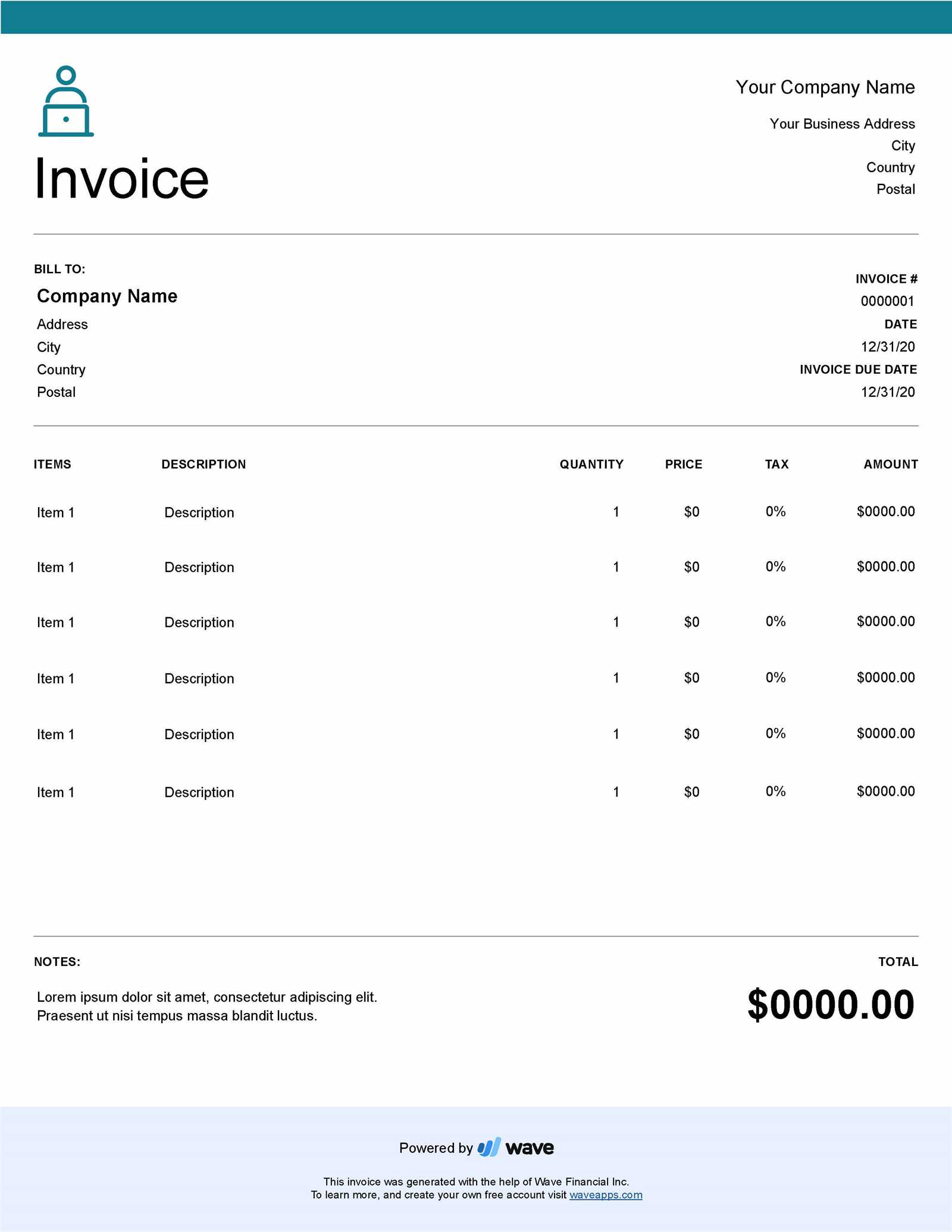

How to Customize Your Billing Document

Customizing a transaction record is an important step in ensuring it aligns with your business’s unique needs and branding. By adjusting the design and content, you can create a personalized document that reflects your company’s identity while keeping all the necessary details intact. Personalization not only enhances professionalism but also helps your documents stand out to clients.

Here are a few key areas where you can modify a standard layout to make it more tailored to your business:

Modify Design Elements

- Logo and Branding: Add your business logo and use your company’s color scheme to match your brand identity.

- Font Style and Size: Adjust fonts to suit your business’s tone, ensuring they are professional and easy to read.

- Headers and Sections: Customize section titles to better suit your business, such as changing “Product Description” to “Service Provided” or “Itemized Costs”.

Adjust Content Fields

- Payment Terms: Modify the payment deadlines or add any special terms, such as discounts for early payments or late fees.

- Additional Information: Include extra fields for custom data, such as project codes or purchase order numbers, to make the document more specific to the transaction.

- Contact Details: Update your contact information regularly to ensure clients always have the correct way to reach you.

Customizing these aspects allows you to create a document that reflects your business’s professionalism and ensures clarity for your clients. With just a few adjustments, you can enhance both the functionality and appearance of your billing records.

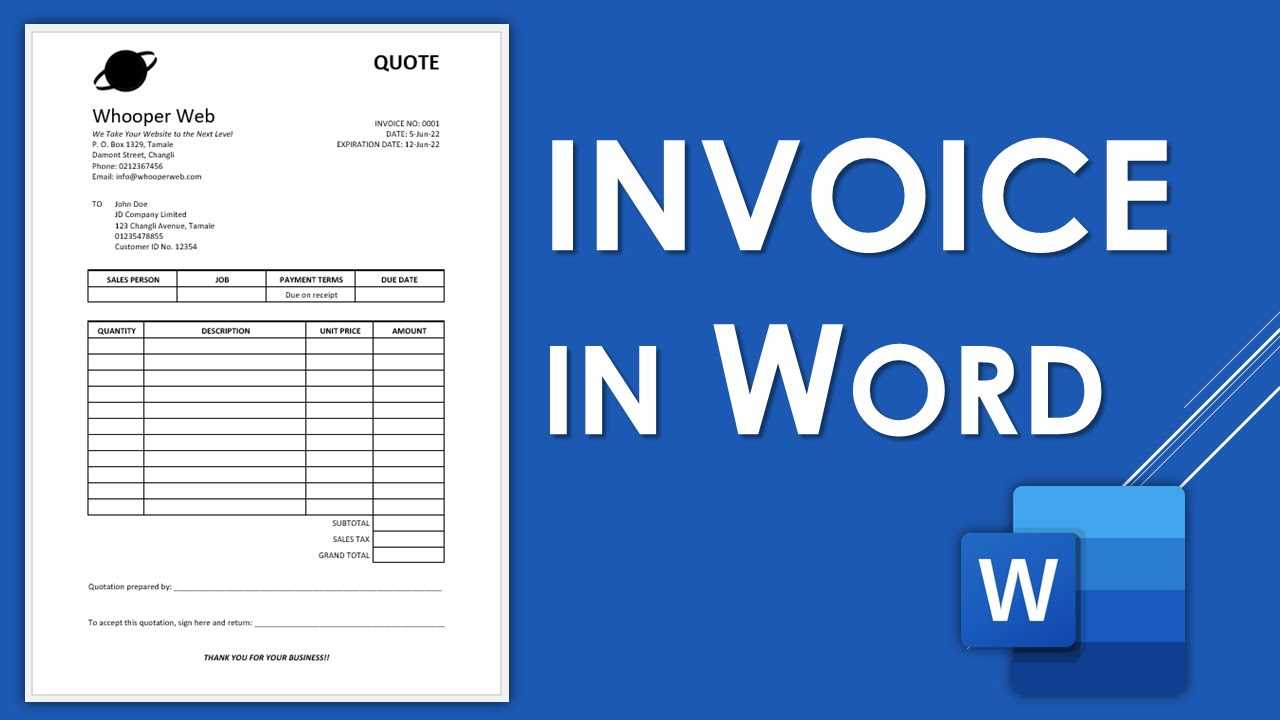

Best Tools for Billing Document Creation

Creating professional and accurate billing records can be a quick and easy process with the right tools. There are various software and online platforms that simplify this task, allowing you to generate clear, organized documents in just a few minutes. These tools not only help in saving time but also ensure that your records are consistent and error-free.

Here are some of the best tools available for creating billing documents:

Top Billing Tools to Consider

- Wave: A free, easy-to-use platform that allows you to create and send personalized billing records. It also offers features for accounting and payment tracking.

- FreshBooks: A popular tool for small businesses and freelancers, offering an intuitive interface, automated payment reminders, and customizable templates.

- Zoho Invoice: A comprehensive tool with multiple features for creating and managing billing documents, including customizable designs and multi-currency support.

- PayPal: Known for its payment processing, PayPal also allows you to create and send professional billing records directly through your account.

- Invoicely: A cloud-based platform offering both free and paid versions, with advanced features like recurring invoices, time tracking, and detailed reporting.

- QuickBooks: A leading accounting software that includes an invoicing feature, allowing you to create detailed billing records while managing finances in one place.

Why Use These Tools?

- Time Efficiency: These tools automate many tasks, such as calculations and reminders, helping you save time.

- Customization: Most tools offer options to personalize documents with your company logo, colors, and specific payment terms.

- Integration: Many platforms can integrate with accounting software, helping you streamline both your billing and financial tracking.

- Professionalism: These tools generate polished, organized documents that convey professionalism and enhance your business’s image.

By using these tools, you can simplify the process of creating billing records, ensuring accuracy and efficiency while also providing a better experience for your clients.

Common Mistakes to Avoid in Billing Documents

Creating clear and accurate records is crucial for maintaining professional relationships and ensuring timely payments. However, there are several common errors that can occur when preparing these documents, leading to confusion or delays. Avoiding these mistakes can help ensure that your transactions are smooth, transparent, and hassle-free for both you and your clients.

Here are some of the most frequent mistakes to watch out for when creating transaction records:

Key Errors to Avoid

- Missing Contact Information: Failing to include complete contact details for both parties can lead to confusion or delays in communication.

- Incorrect Dates: Errors in the transaction or due date can cause misunderstandings about payment deadlines or lead to late payments.

- Unclear Descriptions: Vague descriptions of services or products can lead to disputes over what was delivered. Always provide clear, detailed information.

- Wrong Calculations: Mistakes in adding up totals, taxes, or discounts can create problems. Double-check your calculations before sending the document.

- Omitting Payment Terms: Not specifying payment methods, due dates, or penalties for late payments can create confusion and delay the payment process.

- Failure to Include a Unique Reference Number: Without a reference number, it may be difficult for both you and your client to track specific transactions, especially when dealing with multiple records.

- Overcomplicating the Layout: A cluttered or overly complicated document can confuse clients. Keep the layout clean, with easy-to-follow sections and headings.

How to Avoid These Mistakes

- Proofread: Always review your document carefully before sending it out to ensure all the details are correct.

- Use Automated Tools: Using software or online platforms can help reduce the chances of making errors, as many tools offer automated calculations and templates.

- Stay Organized: Keep a record of all issued billing documents, including reference numbers, to avoid confusion in future communications.

- Clear Communication: Make sure your client knows exactly what they are being charged for, including clear descriptions of products and services.

By avoiding these common mistakes, you can streamline your billing process, maintain

How to Send Your Billing Document Effectively

Sending a well-organized and clear payment request is just as important as creating it. How you deliver the document can affect its reception and the speed of payment. Whether you’re sending it via email or a physical copy, taking the right steps ensures that the recipient receives all the necessary details in a timely and professional manner.

Here are some essential tips for sending your payment request effectively and ensuring smooth communication with your client:

Best Practices for Sending a Payment Request

- Use a Professional Subject Line: When sending via email, include a clear subject line such as “Payment Due for [Project Name]” or “Billing for [Service/Product] – [Invoice Number]”. This helps your email stand out and alerts the recipient to the importance of the message.

- Choose the Right Delivery Method: If your client prefers digital communication, email is the fastest and most efficient method. For clients who prefer paper records, send a printed copy via post.

- Attach the Document Properly: Attach the billing record as a PDF to prevent formatting issues and ensure the document cannot be easily edited. Include the file name with the invoice number or client’s name for easy reference.

- Include a Payment Reminder: If applicable, include a polite reminder about the payment terms and due date in the email body or message. This provides clarity and emphasizes urgency.

- Provide Clear Instructions: Specify the payment methods accepted, and include any necessary details such as bank account numbers or links to online payment platforms.

Follow Up When Needed

- Set a Reminder: If you haven’t received a response or payment by the due date, set a polite reminder email or message to follow up on the status of the payment.

- Be Professional: Even if the payment is late, maintain professionalism in your communication. A respectful approach increases the likelihood of a positive outcome.

By ensuring the document is properly delivered and all details are clearly stated, you set the stage for efficient transactions and prompt payments. A well-managed process helps build trust and reinforces your professionalism with clients.

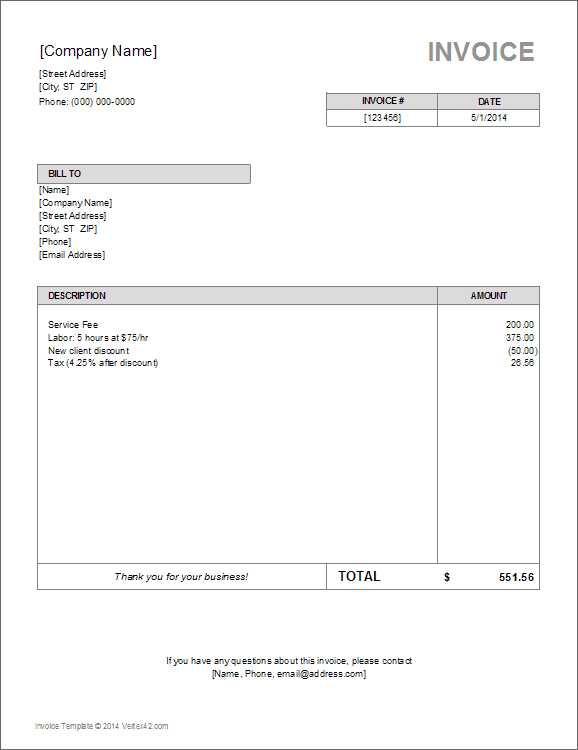

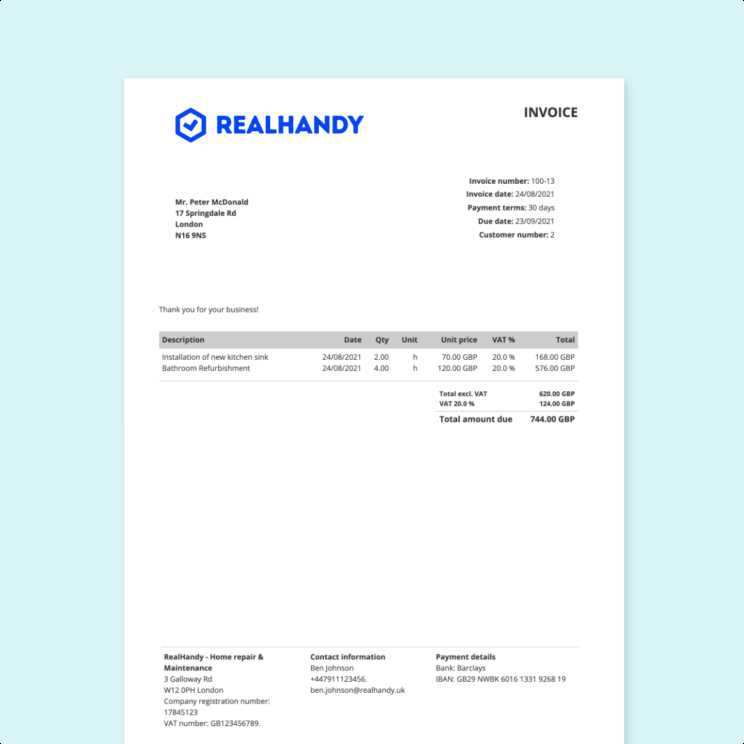

Billing Document for Small Businesses

For small businesses, maintaining a smooth and efficient payment process is crucial for cash flow and long-term success. One of the most effective ways to ensure timely payments is by using a well-structured record that outlines all transaction details. A clear and professional document not only helps in managing payments but also builds trust with clients, making them more likely to return for future business.

Here’s how a small business can create an effective payment request that meets its unique needs:

Essential Features for Small Business Billing Documents

- Custom Branding: Include your company logo, business name, and contact information. This adds professionalism and ensures clients know exactly who the document is from.

- Detailed Services and Products: Clearly list the products or services provided, including quantities, rates, and any relevant descriptions. This ensures the client understands exactly what they are paying for.

- Payment Terms: Specify the payment due date, accepted methods, and any late fees or early payment discounts to ensure both parties are aligned on expectations.

- Unique Reference Number: Assign each document a unique reference number to track and manage payments more efficiently, especially when handling multiple transactions.

Benefits for Small Businesses

- Clarity: A clear and concise document helps avoid misunderstandings, reducing the chance of disputes or delayed payments.

- Efficiency: Using a consistent and standardized approach streamlines your billing process, saving you time and effort.

- Professional Image: Well-designed records give your small business a polished and professional appearance, boosting credibility with clients.

- Better Financial Management: Accurate records allow for easier tracking of income and outstanding payments, aiding in better financial planning.

For small businesses, creating and sending clear, professional billing records is an essential part of maintaining a healthy financial flow. By customizing these documents to suit your business, you can simplify the payment process while enhancing your reputation in the marketplace.

Using Billing Documents for Freelancers

As a freelancer, maintaining a professional approach to payments is essential for building strong client relationships and ensuring timely compensation. One of the most effective ways to manage this is by using pre-designed formats that clearly outline the work completed and the payment terms. These ready-to-use records simplify the process, reduce errors, and give your business a polished look, even if you work solo.

Here’s why freelancers should consider using structured billing records:

Advantages for Freelancers

- Professionalism: A well-organized document helps establish credibility with clients, showing that you run your freelance business with attention to detail and professionalism.

- Time Efficiency: Pre-made formats save time by eliminating the need to create new records from scratch for each project. You can simply fill in the details and send it out.

- Clear Payment Terms: Structured records ensure both you and your clients have a clear understanding of the payment amount, due date, and acceptable payment methods.

- Consistency: Using the same format for every project ensures consistency in your billing practices, making it easier for clients to track their payments and for you to manage your finances.

How to Customize for Freelance Work

- Project-Specific Details: Customize the document by adding project names, descriptions, and specific milestones to ensure that the billing record reflects the unique work completed.

- Payment Frequency: If you work on hourly, per-project, or retainer-based terms, adjust the document to reflect the correct payment structure and schedule.

- Client Details: Ensure you include your client’s name, business name, and contact details, which helps in maintaining organized records for future reference.

By using structured records, freelancers can streamline their payment processes, maintain a professional image, and ensure that nothing is overlooked. This practice not only helps in tracking payments but also in improving the overall efficiency of your business operations.

How to Track Payments with Billing Records

Effectively managing and tracking payments is essential for any business to ensure consistent cash flow and financial health. By using well-structured payment requests, you can keep track of which transactions have been completed and which are still pending. This not only helps in maintaining organized financial records but also aids in avoiding misunderstandings or missed payments.

Here are some practical ways to track payments using billing records:

Key Methods for Payment Tracking

- Assign Unique Reference Numbers: Each document should have a unique reference number that helps both you and your client easily identify the transaction. This makes it easier to track payment status and quickly resolve any issues that may arise.

- Include Payment Status Fields: Clearly indicate whether the payment is “Paid,” “Pending,” or “Overdue.” This visual cue helps you stay organized and reminds clients of their obligations.

- Use Payment Dates: Always include both the invoice date and the payment due date. By doing this, you can easily compare when the payment is expected and when it was actually received, helping you to manage your cash flow efficiently.

Best Practices for Effective Payment Management

- Record Payment Receipts: Once a payment is made, mark the record as paid and note the payment date. Keep a copy of the receipt or confirmation for your records. This will help you maintain accurate financial statements and resolve any disputes if they arise.

- Set Up Automated Reminders: To avoid missed payments, use tools or software that can automatically send reminders to clients about upcoming or overdue payments. This ensures you don’t have to manually track each due date.

- Consolidate Payment Records: Regularly update your financial system or ledger with the payment status of each request. Keeping everything in one place allows for easy reconciliation and helps you see any outstanding amounts at a glance.

By following these steps and keeping your billing records up to date, you can stay on top of payments, reduce the likelihood of late payments, and maintain a clear and organized financial picture for your business.

How Simple Billing Documents Improve Professionalism

When it comes to managing payments, presenting clear and organized documents plays a significant role in enhancing your business’s professionalism. By using straightforward and easy-to-understand records, you create a positive impression on your clients, making it clear that you pay attention to detail and value clarity in your financial transactions. This approach not only fosters trust but also simplifies the payment process, leading to smoother business interactions.

Here’s how using clear and concise payment documents can elevate your professional image:

Benefits for Your Professional Image

- Clarity and Transparency: When your documents are clear and easy to read, clients feel confident about the terms and conditions, reducing any confusion or misunderstandings about the charges or payment expectations.

- Consistency: Using a standardized format for each request makes your business appear organized and consistent. Clients appreciate reliability, which boosts their trust in your services.

- Efficiency: A streamlined, uncomplicated document helps expedite the payment process, showing that you value your clients’ time and aim to make the transaction as efficient as possible.

How Clients Perceive Your Business

- Professional Appearance: A well-structured payment request with all the relevant details gives the impression of a business that is serious and well-managed. This professional image can set you apart from competitors.

- Reliability: When clients receive consistent, clear documents, they are more likely to view your business as trustworthy and dependable, increasing the likelihood of repeat business and positive referrals.

- Respect for Client Time: By providing easy-to-read records, you show that you respect your client’s time, making it easier for them to process payments quickly and accurately.

In summary, clear and straightforward billing records not only help streamline the payment process but also contribute to building a positive, professional reputation. When clients see that you care about clarity and detail, they are more likely to view your business as trustworthy and reliable.

Legal Requirements for Billing Documents

When creating billing records, it is essential to ensure that they comply with legal requirements. A properly structured document not only facilitates smooth transactions but also protects both the service provider and the client in case of disputes. Various countries and regions have different rules about what must be included in these documents, and understanding these requirements is crucial for maintaining transparency and avoiding potential legal issues.

Here are some common legal elements that should be included in your billing documents to ensure compliance:

Essential Information for Legal Compliance

| Required Element | Description |

|---|---|

| Business Information | The document should include your business name, address, and contact details. This establishes the legal entity responsible for the transaction. |

| Client Information | Include the client’s name, business name (if applicable), and address to ensure both parties are clearly identified. |

| Unique Document Number | Each document must have a unique reference or serial number to help track and distinguish between transactions. |

| Detailed Description of Goods or Services | Clearly list the products or services provided, along with quantities, rates, and total charges. This is necessary for transparency and potential audits. |

| Payment Terms | Include payment due dates, accepted payment methods, and any applicable late fees or discounts for early payment. |

| Tax Identification Number (TIN) | Depending on the country, including your tax identification number may be required for tax purposes, especially for businesses that are VAT registered. |

Why Legal Compliance Matters

- Avoid Penalties: Failure to include the necessary details can result in fines or legal issues. Ensuring compliance protects your business from these risks.

- How to Store and Manage Billing Records

Effective organization and management of billing records are crucial for any business. Proper storage not only ensures easy access to documents but also helps in maintaining accurate financial records, staying compliant with tax regulations, and resolving disputes quickly. Whether you’re running a small business or working as a freelancer, knowing how to efficiently store and manage these documents will save you time and reduce the risk of errors.

Here are some best practices for storing and managing your billing records:

Best Practices for Storing Documents

- Digital Storage: Storing records electronically helps keep your documents organized and easily accessible. Use cloud storage services or dedicated accounting software to ensure your files are secure and backed up regularly.

- Physical Storage: If you prefer to keep paper copies, ensure that they are stored in a safe, organized manner. Use filing cabinets or folders labeled by date or client to make it easier to locate records when needed.

- Organize by Date or Client: Organize your records in a way that makes sense for your workflow. Sorting by date allows for easy tracking of payments, while sorting by client helps quickly locate records specific to a project or customer.

How to Manage Billing Records Effectively

- Use Accounting Software: Leveraging accounting tools can automate much of the record-keeping process. These tools allow you to easily generate and store billing records, track payments, and generate financial reports.

- Label Files Clearly: Whether storing documents digitally or on paper, use clear and consistent labeling methods. Include important details like the client name, project, and payment date to make searching for specific records easier.

- Monitor Payment Status: Regularly check the status of each transaction, marking whether payments have been received or are overdue. This helps you stay on top of your finances and reduces the chance of missing important follow-ups.

- Set Reminders for Document Review: Schedule periodic reviews of your stored records to ensure that everything is up to date. This will also help you identify any discrepancies or missing information early on.

By implementing these practices for storing and managing your billing records, you can streamline your financial processes, stay compliant with regulations, and maintain a clear overview of your business’s financial health. Proper document management is key to reducing stress and avoiding errors when it comes

Updating Your Billing Documents Regularly

Maintaining up-to-date billing documents is an important practice for any business. Regularly updating these records ensures that all relevant information is accurate, compliant with the latest regulations, and reflective of any changes in your business. Keeping your documents current also helps avoid confusion with clients and streamlines your financial operations.

Here are a few reasons why updating your billing documents on a regular basis is essential:

Why You Should Update Your Billing Records

- Stay Compliant: Changes in tax laws, business regulations, or financial reporting standards may require adjustments to your records. Regular updates ensure that your documents remain compliant with the latest requirements.

- Reflect Changes in Your Business: If you introduce new services, change pricing structures, or update your business contact details, your records should reflect these changes to avoid errors or misunderstandings with clients.

- Improve Accuracy: Regular updates help to catch any mistakes or discrepancies early. This can include correcting outdated pricing, adjusting due dates, or ensuring payment methods are properly listed.

How to Update Your Billing Records

- Review Regularly: Set a schedule to review and update your billing documents periodically. This could be quarterly, bi-annually, or whenever major business changes occur.

- Update Company Information: Ensure that your business name, contact information, and tax identification number (if applicable) are up to date on every document.

- Adjust Payment Terms: As your business evolves, your payment terms may need to be adjusted (e.g., due dates, late fees, or early payment discounts). Make sure your documents reflect these changes consistently.

- Incorporate New Features: If you add new options such as payment portals or digital payment methods, make sure these are incorporated into your records to streamline client transactions.

By updating your billing documents regularly, you not only maintain professionalism and compliance but also ensure smoother transactions and better client relationships. An up-to-date system helps you stay organized, reduces confusion, and makes your business appear more reliable and responsive.