How to Use a Vehicle Invoice Template for Easy and Accurate Billing

Efficient documentation is crucial for smooth transactions, especially when dealing with the sale or transfer of automobiles. Having a well-structured document that captures all necessary details can save time, reduce errors, and ensure both parties are on the same page. This type of document acts as a formal record, outlining key aspects of the deal, such as the agreed price, buyer information, and payment terms.

Whether you’re a car dealership, a private seller, or a service provider, using a standardized document can simplify your workflow and help maintain professionalism. Customizable forms allow for quick adaptation to various business needs, making the process seamless and efficient. By adopting the right format, you can focus on closing sales without worrying about the accuracy of the paperwork.

In this guide, we will explore how to create, customize, and use these essential documents effectively. You’ll learn how they help streamline operations, avoid disputes, and ensure that every transaction is properly documented. With the right tools, managing your sales and agreements becomes much easier.

Understanding the Importance of Transaction Records

Proper documentation is essential for any business transaction, especially when dealing with high-value assets like automobiles. A clear and accurate record of the deal serves as a safeguard for both parties involved, providing legal protection and clarity. Without a structured document, misunderstandings or disputes could arise, potentially leading to complications or delays in completing the transaction.

Key Benefits of Having a Formal Record

- Legal Protection: A well-prepared document helps to formalize the agreement, reducing the likelihood of legal issues in the future.

- Clear Terms: It ensures that both buyer and seller understand the terms of the sale, including price, payment methods, and other important conditions.

- Tracking Transactions: These records provide a reliable way to track all sales, making it easier for businesses to maintain organized financial records.

- Tax Compliance: A structured document is often necessary for tax purposes, ensuring that all relevant taxes are correctly calculated and reported.

How Proper Records Facilitate Business Operations

Having a standardized document format can also improve operational efficiency. For businesses, it speeds up the process of completing a sale by clearly outlining what is required from both sides. Furthermore, it helps avoid mistakes, such as incorrect pricing or missing information, which could delay transactions or lead to financial discrepancies.

In summary, keeping accurate and well-structured records not only benefits the immediate transaction but also contributes to long-term business success. It fosters trust between parties and ensures that each deal is conducted smoothly and legally, which is crucial for maintaining a strong reputation and avoiding complications down the line.

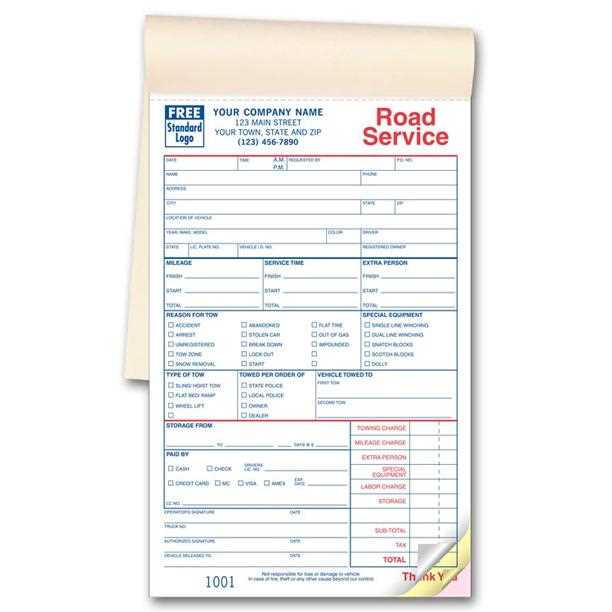

What is a Transaction Record Form

A transaction record form is a standardized document used to capture the details of a sale, including the product, the parties involved, and the terms of the agreement. It serves as an official receipt and a legal proof of the transaction, ensuring that all relevant information is accurately noted and easily accessible. These forms are crucial in business dealings, particularly for large items like cars, where precise details about the sale are necessary for both parties.

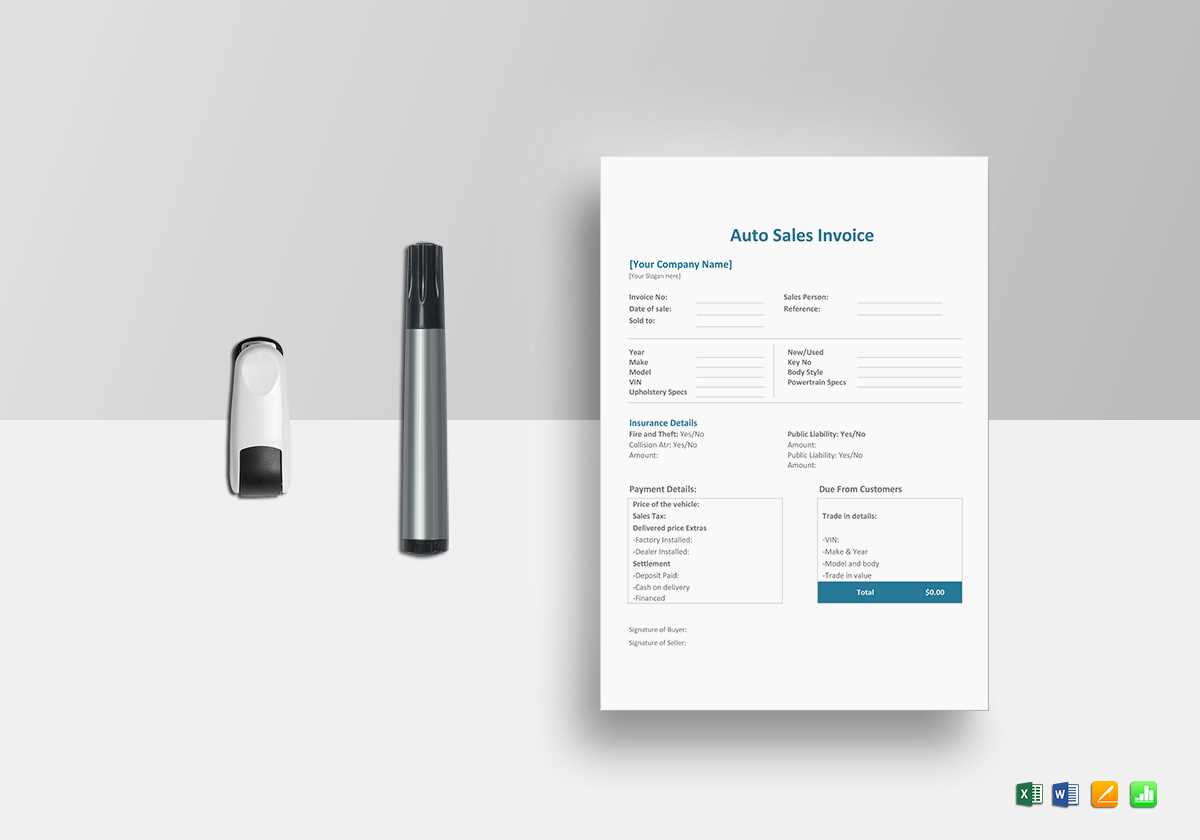

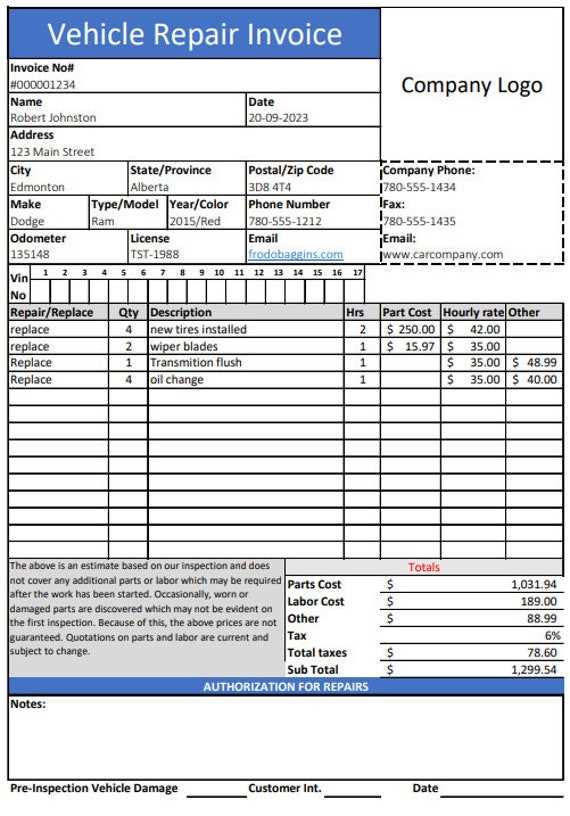

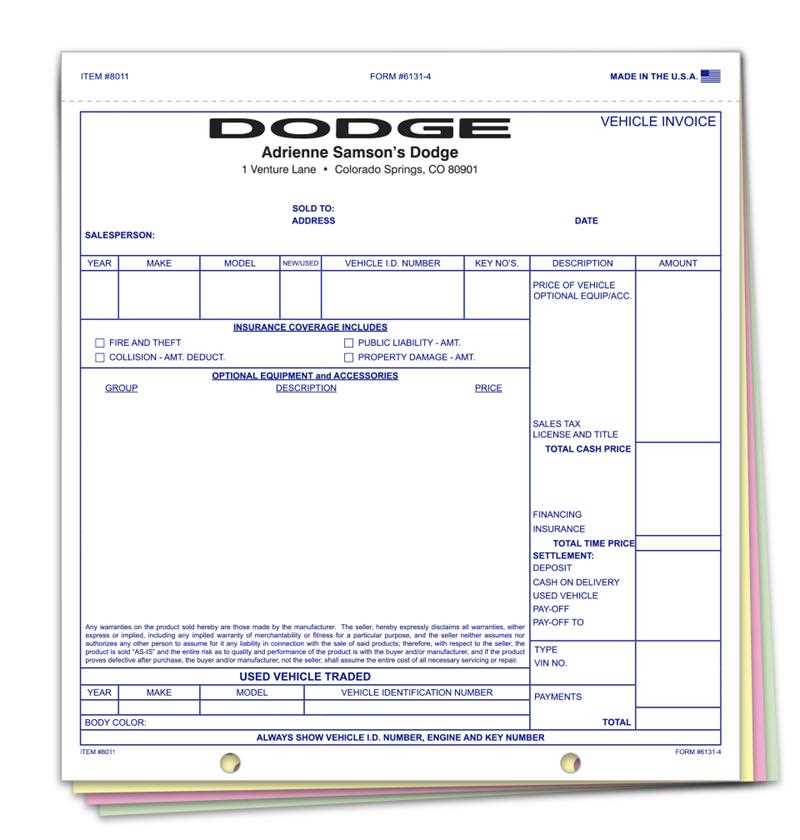

Typically, a well-structured record includes the buyer’s and seller’s information, the item description, sale price, payment methods, and any warranties or terms agreed upon. These elements help prevent confusion and ensure that both parties understand their responsibilities and rights. In many cases, such forms are customizable to accommodate various business needs, making them adaptable to different types of transactions.

By using this standardized document, businesses can avoid errors, expedite the sale process, and maintain a clear and legally sound transaction history. It helps to ensure transparency, which in turn fosters trust between the buyer and seller.

Key Elements of an Effective Transaction Record

For a transaction record to be effective, it must contain certain essential details that ensure clarity, accuracy, and legal validity. A well-structured document minimizes the risk of disputes and makes it easier to track and manage financial dealings. Below are the core components that every formal sales document should include.

- Seller and Buyer Information: This includes names, addresses, and contact details of both parties involved in the transaction.

- Transaction Date: The exact date when the sale took place, ensuring that both parties agree on the timeline of the deal.

- Item Description: A detailed account of the item being sold, including model, make, year, and any relevant specifications.

- Sale Price: The agreed-upon amount for the item, including any additional costs, taxes, or fees that apply to the transaction.

- Payment Terms: A clear outline of payment methods, deadlines, and any deposits made or balances due.

- Signatures: Signatures of both parties, confirming their agreement to the terms set out in the document.

Including these elements not only helps prevent misunderstandings but also ensures that both parties are protected and can refer back to the document if needed in the future. A complete and clear record fosters trust and simplifies any potential future processes related to the transaction.

How to Create a Sales Record Document

Creating a sales record document is a straightforward process, but it requires attention to detail to ensure all necessary information is included. A well-prepared document serves as a clear and legally binding agreement between the buyer and seller. Whether you are a dealership or a private seller, following a simple step-by-step approach will help you create a comprehensive and professional document.

Step 1: Gather All Relevant Information

Before you begin, ensure you have all the necessary details about the transaction. This includes personal information for both the buyer and seller, a description of the item being sold, and the agreed-upon price. It’s also important to have any special terms, such as payment schedules or warranties, ready for inclusion.

Step 2: Choose a Suitable Format

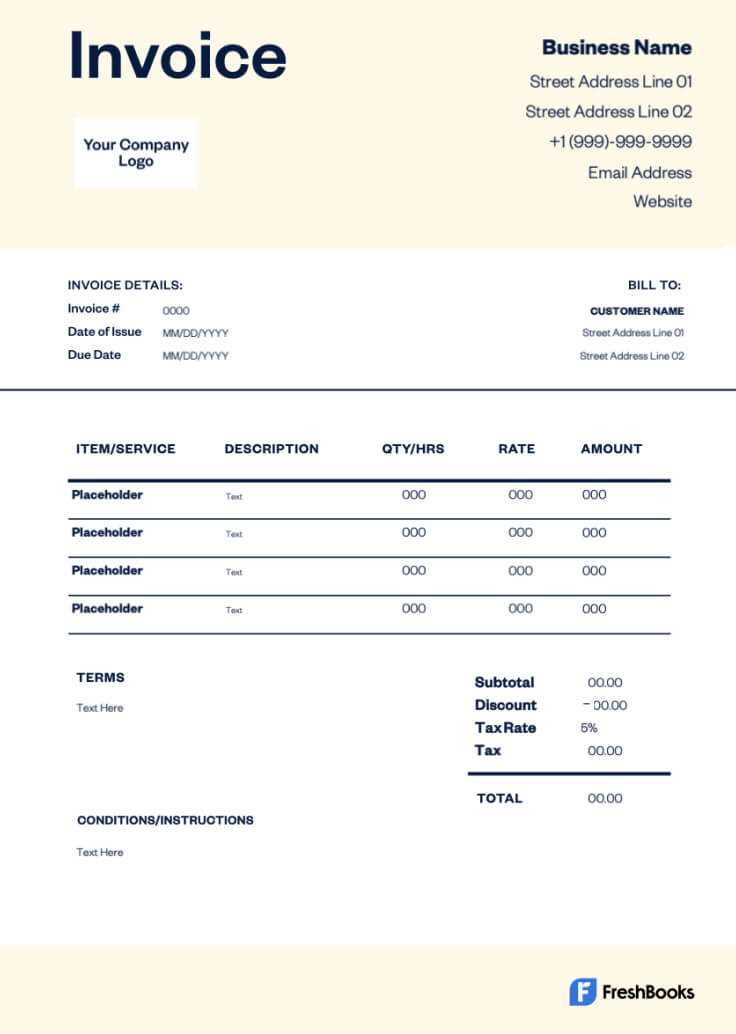

You can create a sales record document manually or by using digital tools. Digital formats, such as editable Word documents or online templates, are often the most efficient. These allow you to quickly fill in the relevant details and customize the document as needed. Many online platforms also offer pre-built formats that can simplify the process significantly.

Once you’ve chosen your format, fill in the required fields, ensuring that all the information is accurate and complete. Double-check the item description, payment terms, and personal details to avoid any errors that could lead to confusion or disputes later on.

By following these steps, you can create a thorough, accurate document that protects both parties and ensures the transaction is conducted smoothly.

Why Use a Digital Sales Record Form

In today’s fast-paced business environment, having a digital version of your sales documents can significantly improve efficiency and reduce the chances of errors. A digital form offers many advantages over traditional paper records, especially when it comes to managing large volumes of transactions or working across multiple locations. From accessibility to customization, there are several compelling reasons to opt for a digital format.

Benefits of Digital Sales Record Forms

- Efficiency: Digital forms can be quickly filled out, edited, and shared, saving time compared to manual processes. You can easily duplicate records for multiple transactions without starting from scratch each time.

- Accessibility: Once created, digital documents can be accessed from anywhere, making it easier to manage records on the go or when working remotely.

- Accuracy: Digital records reduce the likelihood of mistakes, such as typos or missing information, which can occur when filling out paper forms. Many software tools also offer automatic calculations for totals, taxes, and other values.

- Storage and Organization: Electronic files are easier to store and organize, whether in a cloud system or on a local drive. This helps with long-term record-keeping and quick retrieval when needed.

- Environmental Impact: Using digital records reduces the need for paper, making it a more eco-friendly option for your business.

How Digital Formats Enhance Professionalism

Using a digital sales record form not only streamlines internal operations but also enhances your professionalism in the eyes of your customers. A well-designed, clear, and consistent digital document reflects positively on your business and helps build trust with buyers. It shows that your company is organized and capable of managing transactions with ease and accuracy.

Ultimately, transitioning to digital forms is a smart move that helps businesses stay competitive, efficient, and well-organized while reducing human error and improving customer satisfaction.

Customizing Your Sales Record Form

Personalizing your sales documentation allows you to create a more tailored and professional experience for both your business and your clients. Customization helps ensure that the document reflects your brand, meets legal requirements, and includes all necessary details specific to your transactions. Whether you’re selling cars, machinery, or any other goods, having a customized form can improve efficiency and streamline your sales process.

Key Elements to Customize

- Business Information: Include your company name, logo, and contact details to maintain brand consistency and ensure customers can easily reach you.

- Document Layout: Adjust the layout to make the document easy to read and understand. Arrange sections logically, with clear headings for each part of the record.

- Terms and Conditions: Add specific terms relevant to your business, such as warranties, return policies, or payment deadlines. Customizing these sections ensures clarity and prevents potential disputes.

- Additional Fees or Discounts: Customize sections to account for special offers, taxes, or any extra charges that may apply to the transaction. This provides a transparent breakdown for both parties.

- Payment Methods: Specify acceptable payment options and include fields for any necessary details, such as bank account numbers or payment references.

Using Software for Customization

Many digital tools and software allow you to easily customize your sales records. Platforms like Microsoft Word, Google Docs, or specialized invoicing software offer drag-and-drop features and pre-built designs that you can tailor to fit your needs. By using these tools, you can quickly modify your forms to reflect changes in your business practices or specific client requirements.

By customizing your sales record, you not only create a document that fits your unique business needs but also enhance the customer experience, ensuring that every transaction is clear, professional, and organized.

Common Mistakes in Sales Documentation

When creating a formal sales record, it’s easy to overlook small details that can cause significant issues later. Mistakes in these documents can lead to confusion, delays in payment, or even legal disputes. Being aware of common errors and knowing how to avoid them can save time, prevent misunderstandings, and ensure a smooth transaction process for both the seller and the buyer.

| Common Mistakes | Consequences | How to Avoid |

|---|---|---|

| Missing or Incorrect Buyer/Seller Information | Disputes or delays in communication, difficulty tracking the transaction | Double-check all contact details before finalizing the document |

| Incorrect Item Description | Confusion or disagreements about the item being sold, potential legal issues | Ensure detailed and accurate descriptions, including model, year, and condition |

| Failure to Include Payment Terms | Disputes over payment deadlines, confusion about due amounts | Clearly outline payment methods, deadlines, and any special terms in the document |

| Not Including Taxes or Additional Fees | Unexpected costs for the buyer, legal or financial complications | Include a breakdown of all taxes, fees, and other costs to ensure transparency |

| Omitting Signatures or Confirmation | Legal issues if either party denies the agreement, lack of binding evidence | Ensure both parties sign and confirm the record before finalizing the transaction |

By paying attention to these common pitfalls, you can create a complete, accurate, and professional sales record that benefits both parties involved. Double-checking each detail before finalizing ensures a smoother and more secure transaction process.

How to Calculate Sales Tax for a Transaction

Calculating the correct sales tax is a crucial part of any sale, especially for high-value items like cars. The tax amount is determined based on the sale price of the item and the applicable tax rate in the seller’s location or the buyer’s jurisdiction. Ensuring accuracy in tax calculations helps prevent legal issues, financial discrepancies, and customer complaints.

Steps to Calculate Sales Tax

- Step 1: Determine the sales tax rate. This rate can vary depending on the location of the transaction, so it is important to verify the local or state tax rate.

- Step 2: Identify the sale price of the item. This is the agreed-upon amount before taxes and any additional fees.

- Step 3: Multiply the sale price by the sales tax rate. For example, if the sale price is $20,000 and the tax rate is 6%, the tax amount would be $20,000 * 0.06 = $1,200.

- Step 4: Add the tax amount to the sale price. In this example, the total amount due would be $20,000 + $1,200 = $21,200.

Additional Considerations

- Exemptions: Some items may be tax-exempt, or certain buyers (such as non-profit organizations or government entities) may qualify for tax breaks. Always check for any applicable exemptions before calculating.

- Additional Fees: Ensure that taxes are calculated only on the sale price and not on other fees, such as registration or delivery costs, unless specified by local laws.

- Different Rates: Some jurisdictions may have different rates for different types of goods or services, so it’s important to apply the correct rate based on the item being sold.

By following these steps and considering any special rules in your area, you can ensure that the sales tax is calculated accurately, helping you avoid errors and maintain compliance with tax regulations.

Legal Considerations for Sales Documentation

When preparing formal sales documents, it’s important to consider the legal implications to ensure that both parties are protected and the transaction is fully compliant with local laws. A well-constructed sales record can serve as a binding contract in the event of a dispute, and understanding the key legal elements involved helps minimize the risk of legal challenges. Below are some critical legal factors to consider when creating and managing sales documentation.

| Legal Consideration | Importance | How to Ensure Compliance |

|---|---|---|

| Accurate Identification of Parties | Ensures both buyer and seller are correctly identified, preventing confusion or fraud | Include full names, addresses, and contact information for both parties |

| Clear Terms and Conditions | Defines the rights and responsibilities of both parties, reducing potential conflicts | Specify payment terms, warranties, return policies, and delivery arrangements |

| Legal Tax Compliance | Failure to apply the correct tax rate can result in penalties or legal issues | Check local tax regulations and include the proper sales tax in the document |

| Signature of Both Parties | Verifies that both parties agree to the terms, making the document legally binding | Ensure both buyer and seller sign the document, either physically or digitally |

| Compliance with Local Laws | Adhering to local laws and regulations helps avoid fines or legal disputes | Review local commercial laws to ensure that your documentation meets regulatory standards |

By carefully considering these legal aspects, you can protect yourself and your business, ensuring that all transactions are valid and enforceable. Legal awareness is crucial to ensuring smooth, dispute-free sales and building trust with your customers.

Free vs Paid Sales Document Forms

When it comes to creating formal records for transactions, businesses often face the decision of whether to use free or paid solutions. Both options come with their advantages and drawbacks, and the choice largely depends on the specific needs of the business. Free solutions can be a great starting point, but paid options might offer more advanced features and customization for businesses with greater demands.

Advantages and Disadvantages

| Type | Advantages | Disadvantages |

|---|---|---|

| Free Forms |

|

|

| Paid Forms |

|

|

Which One to Choose?

The choice between free and paid forms depends on the scale of your business and the complexity of your transactions. If you’re just starting out or only handling a small number of simple transactions, free solutions might be sufficient. However, for businesses that require more professional features, branding, or security, investing in a paid option can provide greater benefits in the long term. Ultimately, it’s important to evaluate your needs and determine which option best aligns with your business goals.

How to Save Time with Sales Record Forms

Creating formal sales records manually can be time-consuming, especially when you have to repeatedly enter the same information for each transaction. Using pre-made forms allows you to streamline this process, reducing the amount of time spent on document creation. By automating certain aspects of your sales records, you can focus more on running your business while maintaining accuracy and professionalism in your paperwork.

Benefits of Using Pre-Formatted Sales Documents

- Quick Setup: Pre-made forms allow you to fill in the necessary details quickly, eliminating the need to start from scratch each time.

- Consistency: Using the same format for all your transactions ensures that every record is structured uniformly, reducing the chances of missing important information.

- Automated Calculations: Many digital forms can automatically calculate totals, taxes, and other fees, saving you the effort of doing manual math.

- Customization for Specific Needs: Pre-made forms often offer fields for customization, letting you easily adjust them to fit your particular sales requirements.

How to Maximize Efficiency with Sales Records

To make the most of these pre-formatted documents, consider setting up a digital system where you can store and easily retrieve your forms. This could include using cloud-based tools or invoicing software that allows you to save and reuse your documents with just a few clicks. By having templates ready, you can reduce the time spent on repetitive administrative tasks and speed up your transaction process.

Overall, adopting pre-formatted sales records is a simple yet effective way to save time, reduce errors, and maintain a smooth, professional workflow in your business.

Best Software for Sales Record Forms

When managing transactions, using the right software can greatly enhance your efficiency and accuracy in creating formal sales documentation. Many tools offer specialized features for creating professional-looking records, automating calculations, and streamlining the entire process. Choosing the best software depends on the features you need, your business size, and your preferences for ease of use. Below are some of the top software solutions that can help you create and manage your sales forms effectively.

Top Software for Creating Sales Documents

- QuickBooks: Known for its robust accounting features, QuickBooks also offers customizable sales records that automatically calculate taxes and totals, making it a popular choice for small to medium-sized businesses.

- Zoho Invoice: This cloud-based software is ideal for businesses of all sizes. It provides customizable templates, integrates with payment gateways, and offers invoicing automation tools for recurring transactions.

- FreshBooks: A user-friendly option for freelancers and small business owners, FreshBooks offers simple yet professional sales forms, including automated reminders, payment tracking, and customizable fields.

- Invoice Ninja: This open-source tool offers a free version as well as premium features, allowing for highly customizable documents and seamless integration with multiple payment systems.

- Wave: A free, cloud-based option with professional features for creating and managing sales documents, including tax calculations and the ability to accept online payments directly through the software.

Factors to Consider When Choosing Software

- Ease of Use: Choose software that is intuitive and easy to navigate, allowing you to create and send records quickly.

- Customization Options: The ability to personalize your forms, including adding your company logo, adjusting field names, and modifying layout, can help create a professional image.

- Automation Features: Look for software that automates calculations, reminders, and recurring transactions to save time and reduce errors.

- Integration with Other Tools: Ensure that the software integrates well with other business tools like accounting software, payment gateways, and inventory management systems.

By selecting the right software, you can simplify the process of creating and managing your sales records, ensuring greater efficiency and professionalism in your business operations.

How to Add Payment Terms to Sales Records

When preparing formal sales documents, it’s essential to clearly define the payment terms to avoid confusion and ensure smooth transactions. These terms outline when and how payment should be made, helping both parties understand their obligations. Including precise payment instructions not only improves cash flow management but also builds trust between the buyer and seller.

Steps to Add Payment Terms

- Step 1: Specify the due date. Clearly state when the payment is expected. For example, “Due within 30 days of the transaction date” or “Payment due on [specific date].”

- Step 2: Outline payment methods. Indicate which payment methods are acceptable, such as bank transfer, credit card, or online payment systems.

- Step 3: Include late fees or penalties. If applicable, specify any charges that will apply if payment is not received by the due date. For example, “A late fee of 1.5% will be added for every 30 days past due.”

- Step 4: Mention early payment discounts. If you offer any discounts for early settlement, make sure to include these terms, such as “5% discount if paid within 10 days.”

Important Considerations

- Clarity: The terms should be easy to understand. Avoid using overly complex language or jargon that could confuse the buyer.

- Consistency: Always use the same payment terms for similar types of transactions to maintain consistency and avoid misunderstandings.

- Legality: Ensure the terms are in compliance with local laws and regulations regarding payment deadlines and penalties.

By clearly stating payment expectations, you help avoid disputes and ensure that both parties know exactly when and how payments should be made. Including these terms in your sales records provides clarity and legal protection for both you and your clients.

Securing Payment Information on Sales Records

When handling financial transactions, protecting sensitive payment information is crucial to ensure both your business and your customers are safeguarded from potential fraud or theft. Including payment details in formal transaction records requires implementing secure practices to avoid exposing critical data. By taking the necessary precautions, you can help maintain trust and security throughout the sales process.

Best Practices for Securing Payment Data

- Encryption: Always use encryption methods when storing or transmitting sensitive payment data. This ensures that any financial information shared between you and the buyer is protected from unauthorized access.

- Limit Access: Restrict access to payment information to authorized personnel only. Implement user access controls to ensure that only those who need the data to process transactions can view it.

- Secure Payment Gateways: If you accept payments online, use trusted payment processing platforms that are PCI DSS compliant. These systems ensure secure transactions and protect cardholder data.

- Mask Sensitive Information: Avoid displaying full payment card details on any documents, such as the full credit card number or CVV code. Only show the last few digits if necessary for reference.

Additional Security Measures

- Two-Factor Authentication (2FA): Implement 2FA for online payments and accounts to add an extra layer of security, ensuring that only authorized users can complete financial transactions.

- Regular Audits: Conduct regular security audits to assess vulnerabilities in your payment processes and ensure compliance with the latest security standards.

- Secure Email Communications: If sending sales documents electronically, use encrypted email services to prevent interception of sensitive payment information during transmission.

By following these best practices, you can significantly reduce the risk of exposing payment data and enhance the security of your financial transactions. Taking these precautions not only helps protect your business but also builds trust with your customers, assuring them that their payment information is secure.

How to Print and Share Sales Records

Once you’ve created a formal sales document, it’s important to know how to properly print and share it with your clients or other relevant parties. Whether you need a physical copy for your records or an electronic version to send quickly, understanding the best methods to handle these documents can save time and ensure professionalism. Below are some key methods for printing and sharing your sales documentation effectively.

Printing Sales Records

- Choose the Right Format: Before printing, ensure that your sales document is formatted correctly for printing. Ensure the layout is clear, with well-defined margins and sections. Most word processors or accounting software will have a “print-friendly” version.

- Use High-Quality Paper: For formal transactions, use high-quality paper to print your records. This not only ensures durability but also conveys professionalism.

- Double-Check for Errors: Before printing, review the document to ensure all the information is correct, including amounts, dates, and buyer details. This will prevent having to reprint due to errors.

- Save Paper and Ink: Consider printing in black and white unless color is essential for branding purposes. Using draft or eco-friendly settings can also reduce printing costs.

Sharing Sales Records

- Email: The most efficient way to share a sales document is by email. Attach the file in a PDF format to ensure the recipient can view it without any formatting issues. Use a secure email service, especially if you’re sending sensitive information.

- Cloud Storage: Use cloud storage platforms like Google Drive, Dropbox, or OneDrive to store and share your documents. You can easily generate a shareable link and control access with permissions.

- Fax: Though less common today, faxing is still an option for certain industries or clients who prefer it. Make sure the document is legible and the transmission is secure.

- Physical Delivery: In cases where electronic sharing is not possible, print the document and mail it or hand-deliver it to the client. Be sure to use a secure method such as registered mail for valuable documents.

Whether you choose to print or share electronically, it’s important to ensure that the document reaches the recipient securely and in a timely manner. By selecting the right method for printing and sharing, you can maintain a smooth workflow and ensure professionalism in your transactions.

Why Accurate Sales Records Matter for Your Business

Having precise and well-organized transaction documents is essential for any business. When you provide clear, accurate records to your clients, it not only ensures smooth financial processes but also builds trust and credibility. Errors in sales documentation can lead to misunderstandings, delayed payments, and even legal issues. Maintaining accuracy in these records is crucial for the long-term health of your business, from cash flow management to customer relationships.

Accurate records help avoid disputes by clearly outlining the terms of the sale, payment expectations, and any additional fees or taxes. This transparency reduces the chances of confusion, ensuring that both parties are on the same page. In addition, having correct documentation allows for easier audits, tax filings, and financial reporting, ultimately saving time and resources.

Furthermore, businesses that consistently deliver accurate and professional sales records are more likely to build a strong reputation and retain loyal customers. In an increasingly competitive market, attention to detail in all aspects of business operations, including documentation, can set you apart and contribute to your company’s success.