VAT Invoice Template for Easy Tax Compliance and Business Use

For any business, having a structured and professional approach to documenting financial transactions is essential. Properly formatted records not only help maintain transparency but also ensure smooth compliance with tax laws. These documents play a crucial role in tracking sales, services provided, and the amount of tax due, making it easier for both businesses and authorities to manage financial obligations.

By using ready-made or customizable billing formats, companies can streamline their accounting processes, reduce human error, and ensure consistency. These pre-designed documents can be tailored to suit the specific needs of a business, whether it’s for a one-time transaction or regular invoicing. Additionally, having a standard format helps enhance professionalism, ensuring that clients and partners receive clear and accurate details of the transaction.

In this guide, we’ll explore the key components of effective billing documents, how to create them, and the benefits of using pre-designed formats. Whether you’re a small startup or an established business, learning how to manage your financial records efficiently can save time and reduce the risk of costly mistakes.

What is a VAT Invoice Template

A billing document used by businesses to record transactions involving taxable goods or services is essential for tax compliance. Such records are necessary for both business operations and legal requirements, ensuring transparency and proper calculation of taxes owed. These documents often follow a specific structure that includes key details like the seller’s information, the amount charged, and the tax rate applied.

A pre-designed format for creating these financial records simplifies the process. By using a standard structure, businesses can save time, avoid errors, and make sure all required information is consistently included. These standardized forms can be easily customized to suit specific business needs while maintaining legal and regulatory standards.

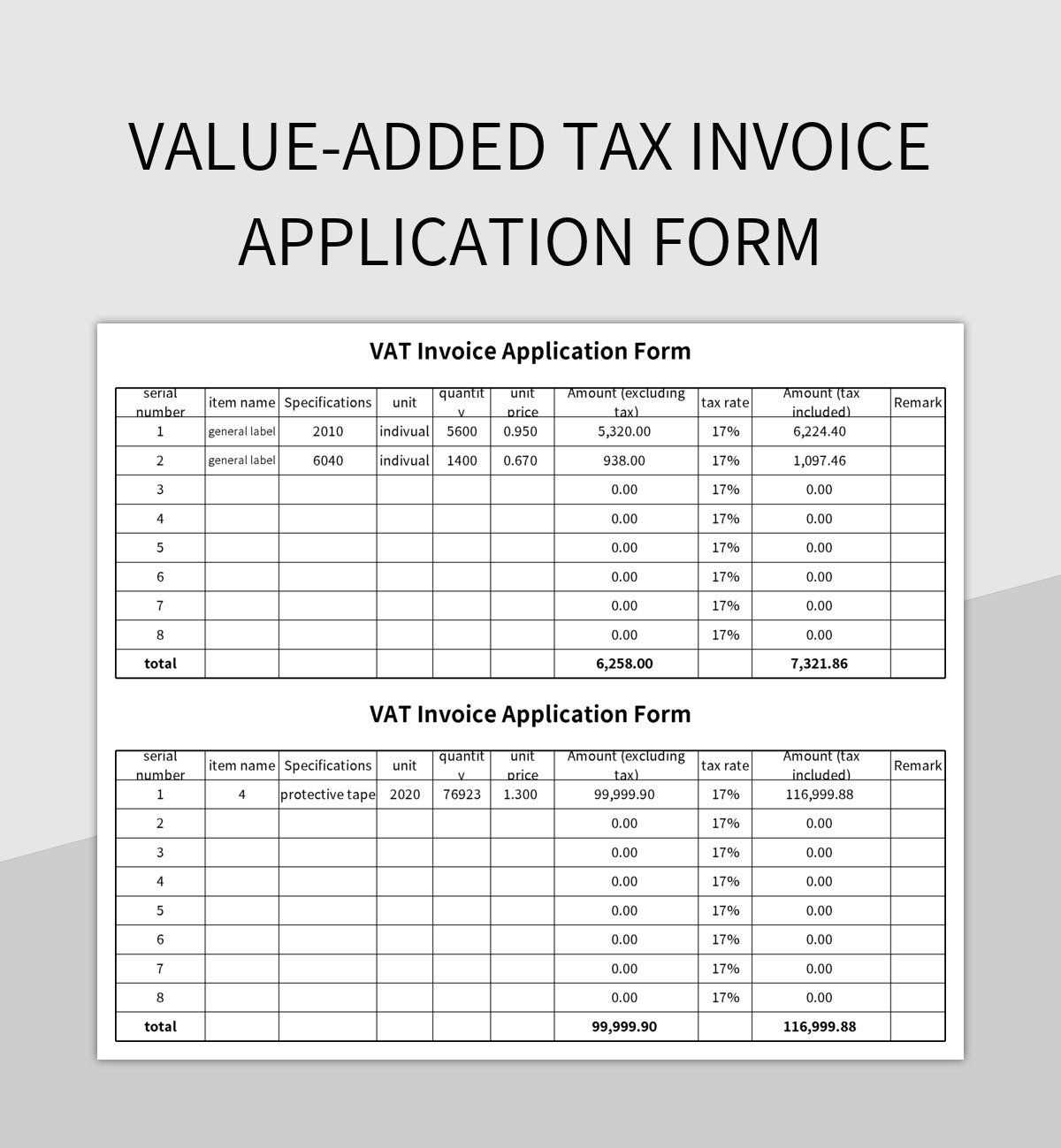

Key Features of a Standard Billing Document

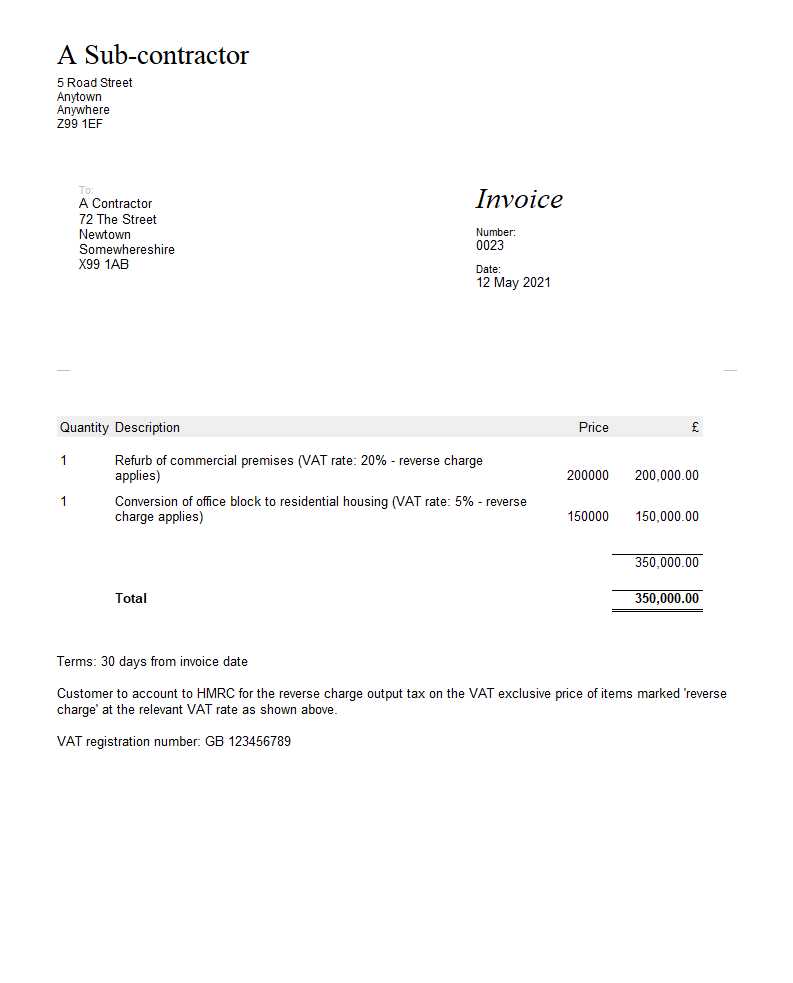

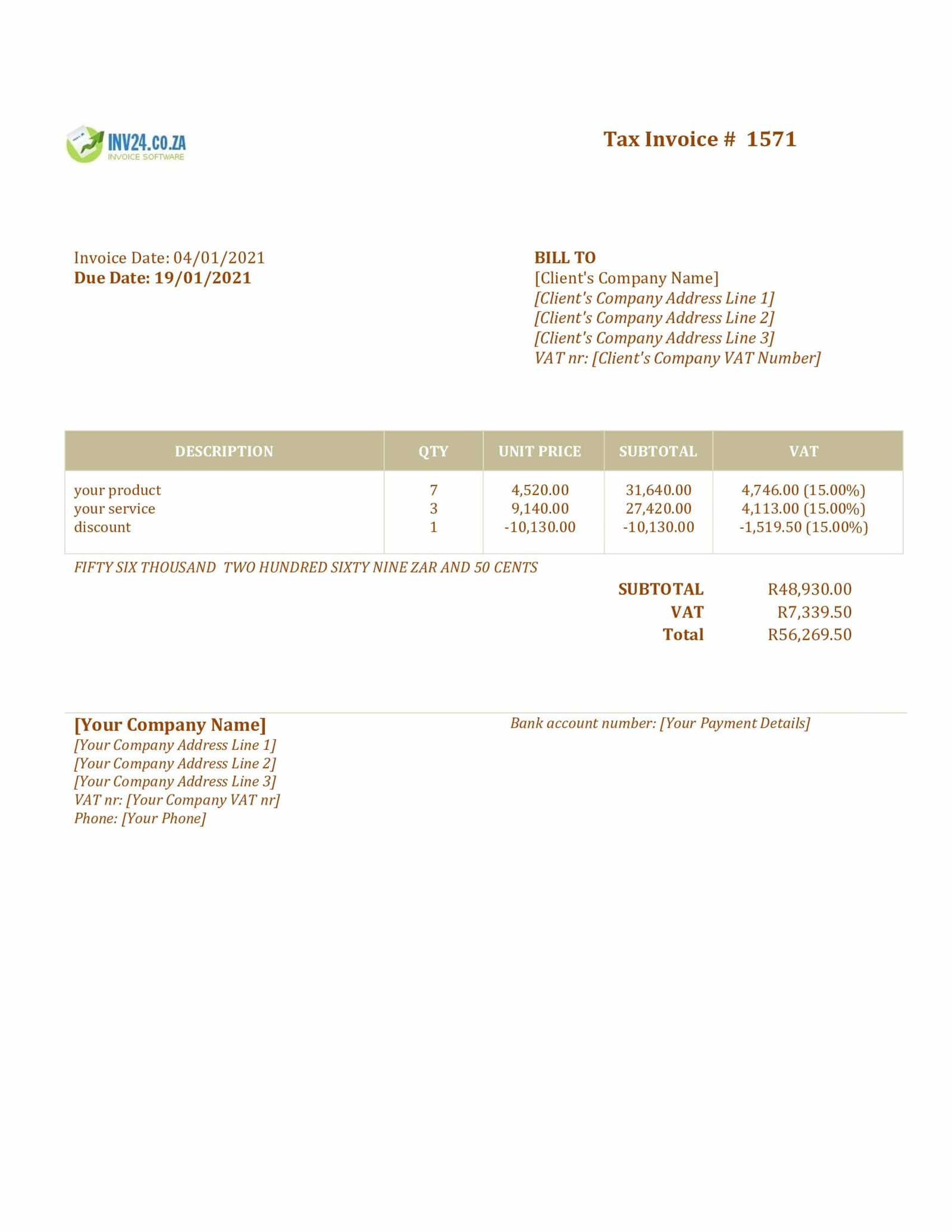

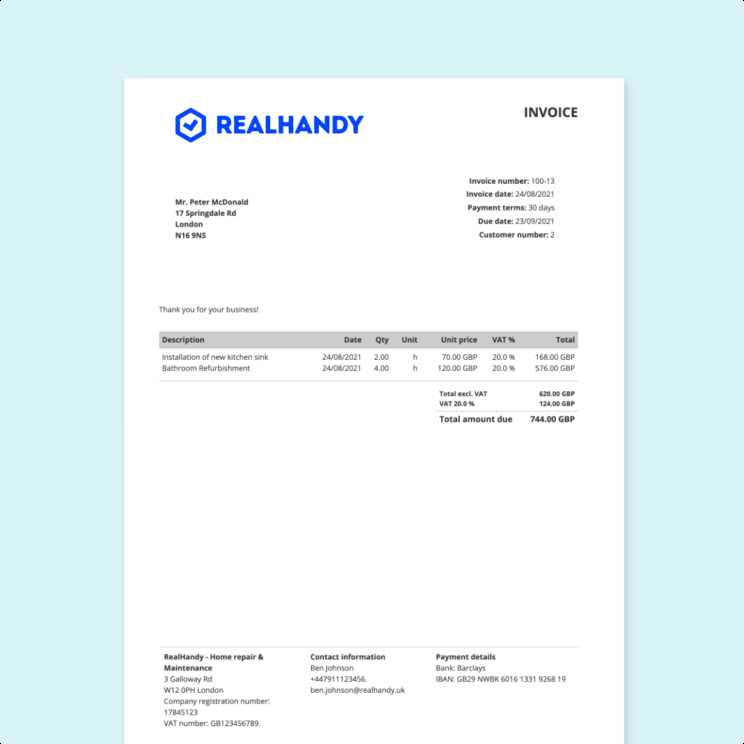

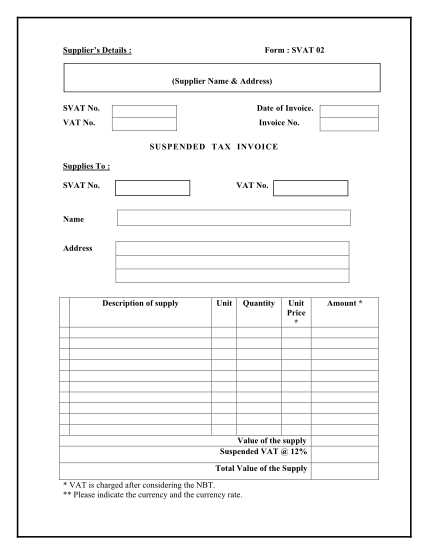

A typical document of this nature includes several important fields to ensure full tax compliance and clarity for both parties involved. Below is an example of what such a document usually includes:

| Field | Description |

|---|---|

| Seller’s Information | Name, address, and tax identification number of the business or individual issuing the document. |

| Buyer’s Information | Name, address, and tax identification number of the recipient of goods or services. |

| Transaction Details | List of items or services sold, including descriptions, quantities, and prices. |

| Tax Amount | Total tax applied to the transaction, usually calculated based on a percentage of the amount before tax. |

| Total Amount | Sum of the transaction amount plus the tax, which is the final amount payable. |

Why Use a Pre-Formatted Document?

Using a pre-structured form ensures that all necessary information is included and formatted correctly. It helps businesses stay organized and minimizes the chance of overlooking important details, which could lead to tax-related complications. Furthermore, it speeds up the process of creating these records, making it easier to handle a high volume of transactions without compromising accuracy.

Why VAT Invoices are Important for Businesses

For any business, maintaining accurate records of financial transactions is crucial. Not only does it help ensure smooth operations, but it also ensures compliance with tax regulations and avoids potential legal issues. Properly structured billing documents serve as evidence of sales and purchases, making it easier to track cash flow and manage tax liabilities. Without these essential records, a business could face difficulties in audits, tax returns, and maintaining transparent financial practices.

Benefits of Proper Billing Records

- Tax Compliance: Properly documenting taxable transactions ensures that a business meets all legal tax obligations and avoids fines or penalties.

- Financial Clarity: These documents provide a clear breakdown of amounts due and paid, helping businesses track their finances and better manage their cash flow.

- Auditing and Reporting: Well-organized records simplify the process of preparing tax returns and undergoing audits, saving time and reducing errors.

- Professionalism: Using a standardized format demonstrates professionalism to clients, showing that the business is reliable and transparent in its dealings.

- Tax Deduction Support: A proper record helps businesses claim eligible tax deductions and exemptions, reducing their overall tax burden.

Legal and Financial Protection

Having these documents in place also acts as legal protection. If any disputes arise with clients or suppliers regarding payment, product delivery, or service provision, these records can serve as reliable proof. In addition, maintaining accurate and timely billing records prevents businesses from overpaying taxes or missing out on deductions. They help avoid tax-related complications, ensuring that the business is not only legally compliant but also financially efficient.

How to Create a VAT Invoice

Creating a proper billing document is an essential step for any business to ensure that sales are accurately recorded and taxes are correctly calculated. A well-structured record not only helps track transactions but also ensures that your business remains compliant with tax laws. The process involves gathering key details of the transaction, such as buyer and seller information, the items or services sold, and the applicable tax rate. By following a clear, consistent format, you can easily generate accurate documents every time.

Here’s a step-by-step guide on how to create a proper document for taxable transactions:

- Include Business Information: Ensure that the seller’s full name, business name, contact details, and tax identification number are included at the top of the document.

- Specify Buyer Details: List the recipient’s name, address, and any relevant tax identification number if required. This helps confirm that the transaction is linked to the correct party.

- Detail the Products or Services: Describe each item or service sold. Include quantities, unit prices, and a brief description. This ensures transparency and avoids misunderstandings.

- Apply the Tax Rate: Clearly show the amount of tax being charged. Specify the rate applied to the transaction, ensuring it matches the current legal requirements in your country or region.

- Show the Total Amount: Add up the cost of the products or services and the tax, then clearly display the final amount due. This helps both the business and the client see the total payable amount.

- Assign a Unique Reference Number: Each document should have a unique number for easy tracking and future reference. This is critical for maintaining organized records and for auditing purposes.

- Set the Payment Terms: Include payment due dates and the preferred method of payment. Providing clear instructions ensures that both parties know how and when payment is expected.

By following these steps, you can create a complete and accurate billing document that is both professional and compliant. Whether you are handling one-time transactions or recurring business, a properly structured form saves time and reduces the risk of mistakes in financial management.

Essential Elements of a VAT Invoice

For any business, having a well-structured document to record taxable transactions is crucial. This document serves as proof of the transaction, outlining all necessary details for both the seller and the buyer. To ensure accuracy, transparency, and compliance with legal requirements, certain key elements must be included in every document. These elements not only help businesses maintain organized financial records but also ensure that tax obligations are met without errors.

Here are the essential components that should appear in any billing record related to taxable transactions:

- Seller’s Information: The document must include the seller’s full name, business name, contact details, and tax identification number. This ensures that the buyer knows exactly who is issuing the document.

- Buyer’s Information: Similarly, the recipient’s details, such as name, address, and, if applicable, tax identification number, should also be clearly stated. This confirms the transaction party and establishes accountability.

- Unique Document Number: Each record should have a unique reference number. This allows businesses to track transactions and prevents any confusion or duplicate records.

- Transaction Date: The date of the transaction should be included, specifying when the sale or service was completed. This is important for both accounting and legal purposes.

- Description of Goods or Services: A clear description of the items or services sold, including quantities and unit prices, should be included. This ensures clarity for the buyer and prevents any disputes regarding the details of the sale.

- Tax Rate and Amount: The amount of tax charged must be clearly indicated, along with the rate applied. This ensures that both parties understand how the tax was calculated and ensures compliance with the correct tax regulations.

- Total Amount Due: The total amount payable, including both the cost of the products/services and the applicable tax, should be clearly stated. This ensures that the buyer knows the final amount they are required to pay.

- Payment Terms: Specify the payment due date and accepted payment methods. This helps both parties understand when payment is expected and how it should be made.

Including these key elements in every document ensures that your financial records are complete, professional, and compliant with tax regulations. Proper documentation helps businesses avoid confusion, maintain transparency, and reduce the risk of errors or legal issues down the road.

Common Mistakes in VAT Invoices

When creating billing records for taxable transactions, small errors can lead to significant problems. Incorrectly filled-out documents not only create confusion but also risk tax non-compliance, which can lead to penalties or delays in payments. Understanding and avoiding common mistakes in creating these records ensures smoother transactions, better financial management, and compliance with the law. Below are some of the most frequent errors businesses make when preparing financial documentation.

Frequent Mistakes to Avoid

- Missing Required Information: One of the most common mistakes is failing to include all the essential details, such as the seller’s or buyer’s tax identification number, transaction date, or a unique reference number. Missing any of these elements can cause the document to be invalid or unclear.

- Incorrect Tax Calculation: Not calculating the correct amount of tax is a critical error. Whether it’s applying the wrong tax rate or not correctly calculating the total amount of tax due, this mistake can result in penalties or underpayment.

- Failure to Use a Clear Format: A document that lacks a clear and consistent format can confuse both the seller and the buyer. The layout should be organized logically, making it easy for both parties to verify the details of the transaction.

- Omitting Payment Terms: Not specifying payment due dates, accepted payment methods, or late fees can lead to misunderstandings between the buyer and the seller, potentially delaying payments or causing disputes.

- Not Issuing Timely Records: Delaying the issuance of financial documents can cause issues with cash flow and tax reporting. It’s essential to issue the document immediately after the transaction is completed to maintain accurate and up-to-date financial records.

- Incorrect Product or Service Descriptions: Inaccurate descriptions of products or services, including quantities and prices, can create confusion or disputes. A clear and detailed breakdown ensures that both parties agree on the terms of the transaction.

How to Avoid These Mistakes

- Double-Check Information: Always review the document before sending it. Ensure that all the required fields are filled correctly, including the tax rate and total amount.

- Use Digital Tools: Using accounting software or pre

Benefits of Using a VAT Invoice Template

Utilizing a pre-designed format for creating financial documents can significantly improve the efficiency and accuracy of your business’s record-keeping process. These structured forms save time, reduce human error, and ensure that all necessary details are included in every transaction. By relying on a ready-made structure, businesses can focus on other critical aspects of operations while maintaining accurate and professional documentation.

Key Advantages of Using a Pre-Structured Document

- Time Efficiency: A standardized document reduces the amount of time spent creating each record from scratch. With a pre-designed structure, businesses can quickly input the necessary details and generate the document in a fraction of the time.

- Consistency and Accuracy: Using a template ensures that all required fields are filled out in the correct order, reducing the chances of forgetting crucial information like tax rates, payment terms, or client details.

- Improved Professionalism: A well-organized and standardized document presents a professional image to clients and partners, reinforcing your business’s credibility and trustworthiness.

- Compliance with Tax Regulations: Pre-designed formats are often created with tax laws in mind, ensuring that your documentation meets the necessary legal requirements and helps prevent costly mistakes related to tax reporting.

- Reduced Risk of Errors: With set fields and clear sections, there is less room for mistakes when inputting data. This helps ensure that all details are accurate, avoiding costly corrections later on.

- Customizability: While using a standardized format, businesses can still customize certain aspects, such as adding their logo, adjusting text, or including additional information that suits their specific needs.

Why It Matters for Your Business

By incorporating a structured form into your accounting practices, you streamline your workflow, reduce the chances of missing important details, and ensure smoother financial transactions. This not only helps with daily operations but also enhances long-term efficiency, making it easier to maintain accurate records for auditing, reporting, and tax purposes. Ultimately, using a pre-designed form allows businesses to maintain compliance, build trust, and operate more efficiently.

How VAT Invoice Templates Save Time

Efficient document management is essential for any business, especially when it comes to tracking transactions and maintaining proper financial records. Using pre-designed forms to record taxable transactions can significantly reduce the time spent on creating these documents from scratch. By utilizing a ready-made structure, businesses can streamline their processes, focus on core operations, and minimize the effort needed to generate accurate records for every sale or service provided.

Quick and Easy Creation

With a pre-structured format, businesses can eliminate the need to manually write out all the necessary details for each transaction. Instead of starting with a blank page and inputting information each time, all essential fields are already laid out. This allows you to quickly enter the relevant data, such as product descriptions, prices, and tax rates, and generate a professional document in just a few minutes.

Automation and Consistency

When using standardized forms, there is no need to worry about repeating the same steps for every transaction. Fields like the business name, tax identification number, or company address can be saved as defaults, making it easier to create new records without repeatedly typing the same details. This automation helps maintain consistency across all financial documents and speeds up the overall process.

- Reduced Human Error: By following a fixed structure, the chance of missing critical information is significantly lowered, preventing time-consuming mistakes or corrections.

- Faster Processing: With everything in place, businesses can process a larger number of transactions in less time, improving cash flow and reducing the administrative burden.

- Instant Accessibility: Many pre-designed forms can be stored digitally, enabling quick access and reducing the time spent searching for previously created records.

By reducing the amount of time spent on creating and managing records, businesses can allocate resources to more productive tasks, leading to better overall efficiency and streamlined operations. This time-saving approach not only enhances productivity but also improves the ability to scale business activities without overburdening administrative staff.

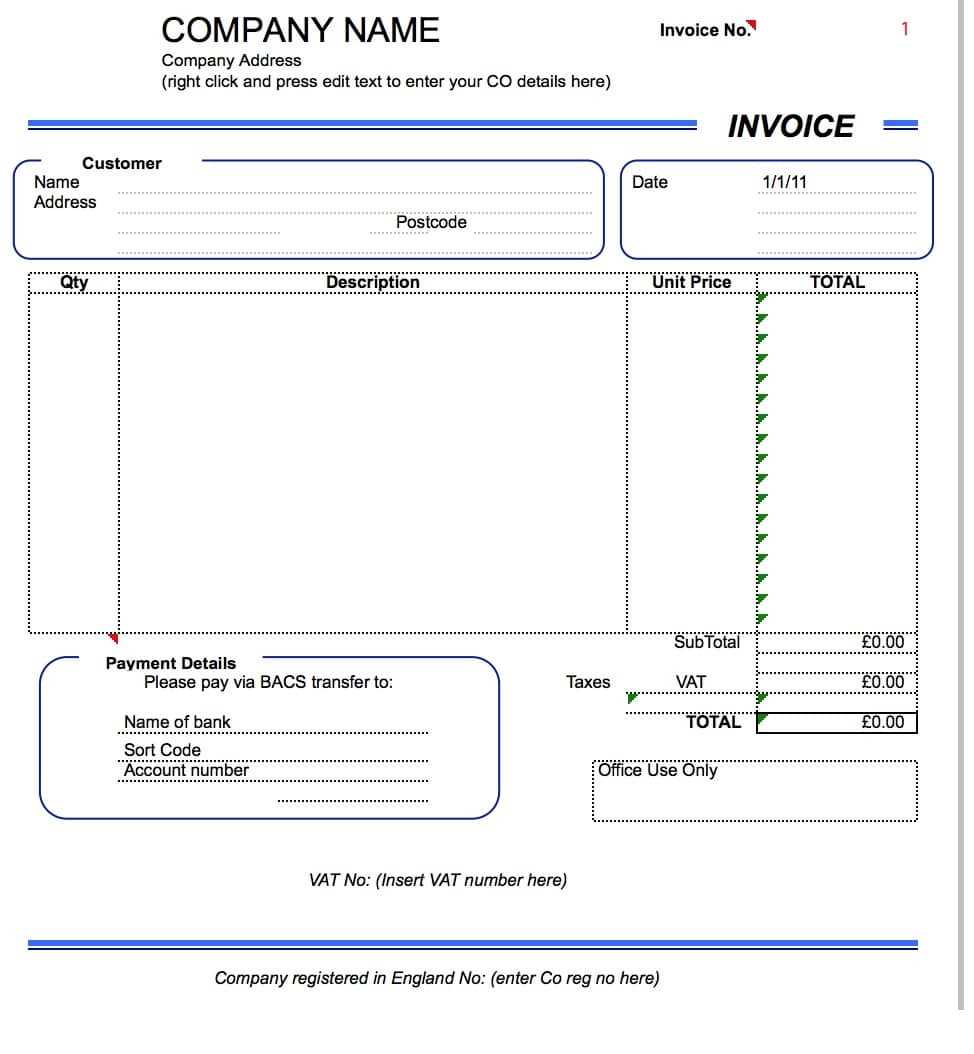

Where to Find Free VAT Invoice Templates

For businesses looking to streamline their billing process and ensure proper documentation, finding free, ready-made forms can be a real time-saver. There are several online platforms and resources that offer customizable and downloadable templates for generating financial records. These pre-designed forms are convenient and often come in a variety of formats to suit different business needs, making them accessible to both small and large companies.

Online Resources for Free Forms

Numerous websites offer free access to templates for recording taxable transactions. Some of the most popular platforms include:

- Google Docs and Microsoft Word: Both of these widely used platforms have free, customizable document templates available. Users can easily search for and download templates that are ready to be used with minimal adjustments.

- Accounting Software Websites: Many accounting software providers offer free downloadable forms to attract new users. These templates are often designed to integrate with their software, making it easier to create and manage your records.

- Business Websites and Blogs: Various business and entrepreneurship websites provide downloadable files, including Excel sheets and Word documents, that can be used for financial documentation. These resources typically offer a range of options, from basic to more complex templates.

- Template-Specific Platforms: Websites like Template.net and Invoice Generator allow you to find a variety of business document formats. These platforms often allow for free downloads or offer basic templates with premium customization options.

Customizing Free Templates

Once you’ve found the right format, most online resources allow you to modify the template to suit your business’s specific needs. You can add your company logo, update fields for tax rates, or adjust layout and design elements to reflect your brand’s identity. Customizing a free form ensures that it not only meets your needs but also presents a professional image to clients and partners.

By utilizing these free resources, businesses can save money on costly accounting software or design services while ensuring their records are compliant and accurate. Access to customizable forms provides flexibility, enabling companies to adapt the document to their particular industry or transaction types.

Customizing Your VAT Invoice Template

Personalizing your financial records is a great way to ensure that your business maintains a professional appearance while meeting specific needs. Customizing a pre-designed document allows you to adapt it to your business’s branding, policies, and transaction types. Whether you want to add your logo, change the layout, or modify specific fields, a customizable document can help improve the clarity and efficiency of your billing process.

Key Customization Options

Here are several elements you can adjust to personalize your document and make it more suitable for your business:

- Business Branding: Include your company’s logo, colors, and fonts to create a branded document that reflects your business’s identity. This adds a professional touch and makes your documents easily recognizable.

- Header and Footer Sections: Customize the header with your business name, address, contact details, and tax identification number. The footer can include payment terms, business registration information, or any other legal disclaimers you want to highlight.

- Payment Information: Adjust the payment terms to reflect your business’s policies. Whether it’s specifying the due date, late fees, or accepted payment methods, clear payment instructions ensure that both parties are on the same page.

- Product or Service Description: Tailor the descriptions of the goods or services to suit your offerings. You can add columns for additional details like SKU numbers, discounts, or product codes, depending on your business requirements.

- Tax Information: Ensure that tax rates are updated based on your location and legal requirements. You can also add any relevant tax exemptions or special tax codes if your business qualifies for specific tax rules.

- Additional Fields: Customize the document to include fields that are important for your business. For example, adding reference numbers, project codes, or custom notes can help you better track transactions and communicate with clients.

Using Software for Customization

If you’re using an accounting or document management tool, many programs allow you to customize forms easily with drag-and-drop features. These tools often provide pre-set fields that you can simply adjust or replace with your specific information. Additionally, software solutions may allow you to automate the process by saving customer details, making the customization even quicker for recurring transactions.

Customizing your financial records not only ensures accuracy but also helps convey your professionalism to clients and business partners. By making these forms reflect your brand and specific needs, you improve the overall bus

Best Software for VAT Invoice Templates

Choosing the right software for creating and managing your financial documents can significantly simplify your business’s administrative tasks. With the right tools, you can streamline the process of generating, customizing, and storing transaction records. The best software not only allows you to create professional documents but also helps you maintain compliance, track payments, and automate recurring transactions, saving both time and effort.

Top Software Solutions for Business Records

Here are some of the best software options that offer easy-to-use features for creating and managing your transaction records:

- QuickBooks: QuickBooks is one of the most popular accounting tools, offering a range of customizable options for generating financial documents. It helps businesses create accurate records with pre-set formats and allows for easy integration with other accounting features.

- FreshBooks: FreshBooks is an excellent choice for small businesses and freelancers, offering intuitive tools to create professional-looking documents. It also provides time tracking, expense management, and payment reminders, making it a comprehensive solution for managing client transactions.

- Zoho Books: Zoho Books provides an easy-to-use interface for creating transaction records, along with a robust set of features such as automatic reminders, tax calculation, and multi-currency support. It’s ideal for businesses with international clients.

- Wave: Wave is a free, cloud-based accounting software that offers simple templates for generating business records. It’s particularly useful for small businesses looking for a cost-effective solution that includes accounting, invoicing, and receipt scanning tools.

- Xero: Xero is another popular choice for small and medium-sized businesses. It allows you to create customizable documents, track payments, and reconcile bank transactions. Xero also integrates seamlessly with third-party apps for enhanced functionality.

- Invoice Ninja: Invoice Ninja offers both free and paid plans with customizable options for creating professional transaction records. It’s a great solution for freelancers and small businesses that need simple yet flexible document creation tools.

Why Use Software for Creating Documents?

- Automation: With the right software, you can automate recurring transactions, reducing the time spent on manual entry and minimizing errors.

- Customization: Most software solutions offer customizable formats, allowing you to adjust fields, add branding, and tailor documents to your specific business needs.

- Easy Tracking and Reporting: Many tools come with built-in reporting features, allowing you to easily track payments, manage cash flow, and generate tax reports.

- Cloud Integration: Cloud-based software ensures that your records are stored securely and accessible from anywhere, which is particularly useful for businesses that work remotely or with international clients.

Choosing the right software for generating business records can save valuable time, ensure accuracy, and help your business stay organized. By selecting a solution that fits your needs, you can streamline your accounting processes and improve overall efficiency.

Understanding VAT Compliance for Invoices

Ensuring your financial records are compliant with tax regulations is crucial for any business. Compliance not only helps avoid penalties and legal issues but also ensures that your transactions are transparent and accurate. For businesses dealing with taxable goods and services, adhering to local and international tax laws is essential. This includes ensuring that all transaction documents meet the specific requirements set forth by tax authorities.

Key Compliance Elements for Business Records

When preparing transaction documentation, there are several essential elements that must be included to comply with tax laws:

- Correct Tax Rates: The applicable tax rate must be clearly displayed on the document. Different goods and services may be subject to different tax rates, so it’s important to ensure the correct rate is applied.

- Business Details: Documents should include accurate information about your business, such as your business name, tax identification number, and contact details. This helps identify your business for tax purposes.

- Clear Transaction Breakdown: The document should clearly list each item or service provided, along with its price before and after tax. This transparency helps ensure accuracy and prevents disputes.

- Tax Amounts: The total amount of tax charged should be separately listed, showing both the tax rate and the total value of the tax applied to the transaction.

- Unique Reference Number: Each document should have a unique number for identification and record-keeping. This helps both you and your clients track transactions easily and ensures compliance with tax reporting requirements.

- Payment Terms: Ensure that the payment terms, including the due date and any applicable late fees, are clearly specified to avoid misunderstandings with clients and to maintain financial clarity.

How to Ensure Compliance

- Stay Informed: Tax laws can change frequently, so it’s important to stay updated on the latest regulations and rates in your region.

- Use Automated Tools: Accounting software can help ensure your documentation is always in compliance by automatically applying the correct tax rates and generating standardized records.

- Consult an Expert: If you’re unsure about the legal requirements for your business, it’s advisable to consult with an accountant or tax professional to ensure that your documentation is compliant.

By understanding and following the tax rules for your records, you can minimize the risk of non-compliance and ensure your busines

Key Differences Between VAT and Standard Invoices

When managing financial documentation, it’s important to understand the distinctions between different types of business records. Two common formats businesses often encounter are standard and tax-inclusive records. These documents serve similar purposes in terms of recording sales, but they differ in how they handle tax information and compliance requirements. Understanding these differences ensures that businesses can select the right format for each transaction and meet regulatory requirements.

Comparison of Standard vs Tax-Related Documents

Aspect Tax-Related Records Standard Records Tax Information Must clearly show the tax rate and amount applied to the transaction. No specific tax-related details are provided, as tax may not be included in the document. Legal Requirements Required by law for businesses that charge taxes to clients or customers. Must meet regulatory standards. Not subject to the same strict regulations, as it may not involve tax collection. Business Identification Includes specific business details, such as tax identification number, to ensure proper reporting. May not require a tax ID, depending on the transaction type. Transaction Breakdown Requires detailed breakdown of each item or service and the tax charged for each. Typically shows a simple list of products or services without detailed tax breakdown. Use Case Used in transactions where tax needs to be applied and reported to tax authorities. Used for simple business transactions that do not involve tax reporting or where tax is not applicable. While both formats serve the purpose of documenting transactions, tax-related records are crucial for businesses that must collect and remit tax to authorities. These records require additional information, such as tax rates and breakdowns, that are not necessary in standard forms. Understanding when to use each format ensures both compliance and efficiency in managing business transactions.

How VAT Invoices Affect Your Business Taxation

Tax documents play a significant role in determining how your business is taxed and how much you owe to tax authorities. For businesses that are required to collect taxes on goods or services sold, these records become a critical part of managing tax liabilities. Understanding the way such documents affect taxation can help businesses better manage their tax obligations, claim refunds, and ensure compliance with local and international tax laws.

Impact on Tax Collection and Reporting

When your business uses these documents to record taxable transactions, they not only serve as proof of the sale but also as a way to report tax amounts to the government. The tax collected on sales is typically paid to the tax authority periodically. Here’s how these records can influence your business taxation:

- Tax Collection: Every sale made with the proper documentation will include a specified amount of tax. This tax is collected from customers and must be passed on to the relevant authorities.

- Tax Reporting: These records help businesses keep track of the total amount of tax collected, which must be reported during tax filings. This ensures that businesses pay the correct amount to tax authorities.

- Tax Deductions: By keeping accurate records of the tax paid on business expenses (such as purchases), companies can offset the tax they owe by deducting the tax on those expenses, lowering their overall tax burden.

- Compliance and Audits: These documents are essential during tax audits. Authorities often review them to verify that businesses are following tax laws correctly and ensuring that all applicable taxes are accounted for.

Managing Tax Liabilities and Refunds

Properly maintained records not only help businesses meet their tax obligations but also manage tax refunds. In many regions, businesses that collect more tax than they owe can claim refunds. These documents provide the necessary proof to support such claims, offering businesses a way to reclaim overpaid amounts. Here’s how managing these records effectively can benefit your business:

- Tax Refund Claims: If your business has paid more tax on purchases than you’ve collected from sales, accurate records will allow you to claim the difference back from tax authorities.

- Tax Audits: Proper documentation ensures that your tax filings are correct. In the event of an audit, having the necessary records makes it easier to prove that you’ve met your tax obligations.

- Accurate Tax Payments: Keeping detailed records ensures that the right amount of tax is paid at the correct time, preventing late payments and penalties.

In summary, the way you manage taxable transaction records directly impacts your tax compliance, reporting, and liability. By maintaining accurate and up-to-date documents, your business can ensure smooth

Tips for Managing VAT Invoices Effectively

Managing financial documents efficiently is crucial for keeping track of business transactions and ensuring compliance with tax laws. Organizing and maintaining accurate records not only simplifies your accounting process but also helps prevent errors and legal issues. Here are some practical tips to manage your transaction records effectively and ensure smooth financial operations.

Organizing Your Financial Documents

Efficient organization is key to managing your records. By having a structured system, you can quickly locate necessary documents when needed and maintain accuracy in your financial reporting:

- Use Digital Tools: Switching to digital systems for creating and storing documents can significantly reduce the risk of losing records. Cloud-based software offers secure and accessible storage options that can be accessed from anywhere.

- Maintain a Record Log: Create a log that tracks each transaction. Include relevant details like transaction dates, amounts, customer information, and any applicable tax rates. This helps you stay organized and simplifies reporting.

- Separate Business and Personal Records: Keeping your business transactions separate from personal finances ensures that your documents are more organized and your tax filings are accurate.

Ensuring Accuracy and Compliance

Inaccurate records can lead to financial mistakes and potential legal issues. To stay compliant and accurate, consider the following:

- Double-Check Tax Details: Always verify the tax rates applied to each transaction to ensure you’re charging the correct amounts. Keep up with any changes in tax laws to avoid miscalculations.

- Implement Regular Audits: Periodically review your financial documents to ensure consistency and accuracy. Audits help identify mistakes early on and can prevent costly errors later.

- Consult with a Professional: If you’re unsure about how to manage your financial records or handle complex tax requirements, consult with an accountant or tax expert. Professional guidance can help streamline your processes and keep you compliant.

By following these tips, you can maintain organized and accurate records, reduce the risk of errors, and ensure that your business remains compliant with tax regulations. Efficient management of financial documentation not only saves time but also gives you peace of mind knowing that your business operations are running smoothly.

Legal Requirements for VAT Invoices

When creating transaction records that include tax details, businesses must adhere to certain legal requirements to ensure compliance with local and international regulations. These requirements are essential not only for maintaining transparency but also for avoiding potential penalties or legal disputes with tax authorities. Properly structured documents help businesses meet their tax obligations and provide clear proof of transactions for both customers and tax authorities.

Essential Legal Information

There are specific details that must be included in financial documents when taxes are involved. These elements ensure the records are legitimate and acceptable under the law:

- Tax Identification Number: Both the seller and the buyer must have their tax identification numbers clearly listed. This ensures that both parties are registered and accountable for tax reporting purposes.

- Transaction Date: The exact date of the transaction must be recorded. This helps establish the timeline for when taxes were applied and when payments were due.

- Itemized Breakdown: A clear listing of all goods or services provided, along with their individual prices before and after tax, is necessary to demonstrate how the tax was calculated.

- Tax Rate and Amount: The applicable tax rate and the total amount of tax charged must be specified. This ensures transparency and helps both the business and customer understand the total cost of the transaction.

- Unique Document Number: Each document should have a unique reference number for easy identification and record-keeping, which is also crucial in case of audits or disputes.

- Business Information: The business issuing the document should include its legal name, contact details, and address to verify its legitimacy and location.

Compliance with Local and International Laws

Different regions may have specific laws and regulations that govern how financial documents should be structured. Businesses must familiarize themselves with these local laws to ensure they are meeting the requirements. Some key considerations include:

- Tax Law Variations: Tax laws can vary greatly between countries and even within regions of a country. Businesses must stay updated on the tax rates and rules that apply to their specific industry and location.

- Retention Period: Many jurisdictions require businesses to keep financial records, including documents with tax information, for a specific

How to Track VAT Invoices Digitally

In today’s digital age, managing financial records electronically is an efficient way to stay organized, save time, and ensure compliance. Tracking tax-related documents digitally not only simplifies your accounting processes but also helps you quickly retrieve and update records when necessary. Digital systems also reduce the risk of losing important paperwork and make it easier to monitor the status of payments and taxes owed.

Benefits of Digital Tracking Systems

Tracking documents electronically offers numerous advantages over traditional manual methods. Here are some key benefits of using a digital system:

- Improved Organization: Digital systems allow you to categorize and tag records, making it easier to search and access them when needed.

- Reduced Risk of Errors: Automated calculations and built-in checks in digital systems reduce the chances of human error when entering tax data.

- Time-Saving: Digital tracking systems can generate reports quickly, automate reminders for upcoming deadlines, and even provide real-time updates on the status of payments or refunds.

- Data Security: With cloud-based storage, your records are secure, backed up, and accessible only by authorized personnel, reducing the risk of losing important documents.

How to Set Up a Digital Tracking System

To effectively track documents, consider implementing a structured digital system that includes the following steps:

- Choose the Right Software: Select software that allows you to create, store, and manage documents with tax details. Many accounting software options also include features specifically designed for managing financial transactions and tax reporting.

- Set Up a Categorized System: Organize your records by client, date, or tax period. Categorizing will help you stay organized and locate specific records quickly when needed.

- Automate Record Entry: Look for systems that allow you to input transaction data automatically from your sales platform or accounting system, reducing manual data entry.

- Track Payments and Deadlines: Set up automated reminders for important dates, such as tax payment deadlines or submission dates for financial reports, to ensure you never miss a critical deadline.

Example of a Digital Tracking Dashboard

Document Number Customer Name Amount Tax Amount Payment Status Due Date 1001