Used Car Invoice Template for Word Easy Customization and Download

When selling a vehicle, having a formal record of the transaction is crucial for both parties. A well-structured document helps ensure that all necessary details are properly captured, making the process smoother and legally sound. This type of record serves not only as proof of the deal but also as a reference in case of future issues or inquiries.

By using a customizable format, you can tailor the document to fit the specific terms of the transaction. Whether you’re a seller or a buyer, a clear, professional record can provide peace of mind and avoid misunderstandings. With the right tools, creating such a document is quick and efficient, even if you don’t have advanced technical skills.

Efficiently organizing key details like the buyer’s and seller’s information, vehicle specifications, and payment terms is essential. Fortunately, modern software makes it easier than ever to draft and customize these documents. By following simple steps, you can create a reliable contract that is both comprehensive and easy to understand.

Vehicle Sale Record in Word Format

Creating a formal document for a vehicle sale is essential to ensure clarity and legal protection for both the seller and the buyer. This type of document captures all vital information related to the transaction, ensuring both parties are on the same page. Using a customizable format allows for quick adjustments, ensuring the document meets the specific needs of each sale.

By utilizing a commonly used word processing program, creating a professional sales record becomes a straightforward task. With just a few simple steps, you can easily add relevant details such as vehicle description, payment terms, and the identities of the buyer and seller.

| Field | Details |

|---|---|

| Seller’s Name | [Enter Seller’s Name] |

| Buyer’s Name | [Enter Buyer’s Name] |

| Vehicle Make and Model | [Enter Vehicle Details] |

| VIN Number | [Enter VIN] |

| Sale Price | [Enter Sale Price] |

| Payment Method | [Enter Payment Method] |

| Date of Transaction | [Enter Date] |

Once the necessary fields are filled, the document is ready to be saved and printed. With a properly structured form, both parties can feel confident that all key details of the sale have been accurately recorded and agreed upon.

Why Use a Document Format for Vehicle Transactions

Opting for a customizable format to create official records for transactions offers a number of advantages. This approach not only ensures that essential details are accurately documented but also streamlines the process of drafting a professional document. A structured and easy-to-edit layout allows for quick adjustments based on specific needs, making it a valuable tool for both buyers and sellers.

Using a flexible document format gives you the ability to add or modify sections as necessary, ensuring all relevant information is included. This is especially helpful when dealing with complex transactions or when different parties have unique requirements. Moreover, the simplicity of such formats makes it accessible for those without specialized software or technical skills.

| Benefit | Explanation |

|---|---|

| Customization | Easy to adapt to various transaction details and requirements. |

| Accessibility | Compatible with widely used software, making it easy to edit and print. |

| Professional Appearance | Ensures a clean, organized presentation for all involved parties. |

| Efficiency | Speeds up the documentation process without sacrificing accuracy. |

| Legal Protection | Helps safeguard both buyer and seller with a clear record of the transaction. |

By using this format, you can ensure the transaction is well-documented, minimizing misunderstandings and protecting all parties involved. The ease of use, combined with its adaptability, makes it an ideal choice for anyone looking to formalize a sale or purchase in a straightforward manner.

How to Customize Your Vehicle Transaction Document

Customizing your transaction record is a crucial step in ensuring that all the details of the sale are accurately reflected. Whether you’re the seller or the buyer, adjusting the document to match the specific terms of the deal helps avoid misunderstandings and provides a clear, professional record. Customization allows you to include important information relevant to the transaction while maintaining a consistent and organized layout.

Steps to Modify Your Document

Here are some key steps to help you tailor the document to your needs:

- Enter the Basic Details: Add the names, addresses, and contact information of both parties involved in the transaction.

- Fill in the Vehicle Information: Specify the make, model, year, VIN, and any additional details about the vehicle being sold.

- Update Payment Terms: Indicate the agreed-upon sale price, payment method, and any deposit or installment arrangements.

- Specify the Date: Include the date of the transaction, ensuring that both parties are aware of when the sale occurred.

Additional Customization Tips

- Adjust the Layout: Ensure the document is clean and well-organized, making it easy to read and understand.

- Include Warranty or “As-Is” Clause: Specify whether any warranties apply or if the vehicle is being sold as-is.

- Customize the Terms and Conditions: If needed, add any specific terms related to the transaction that both parties need to agree on.

By following these steps and making the necessary adjustments, you’ll have a fully customized document that suits your specific sale, ensuring that all the relevant details are accurately recorded and clearly communicated.

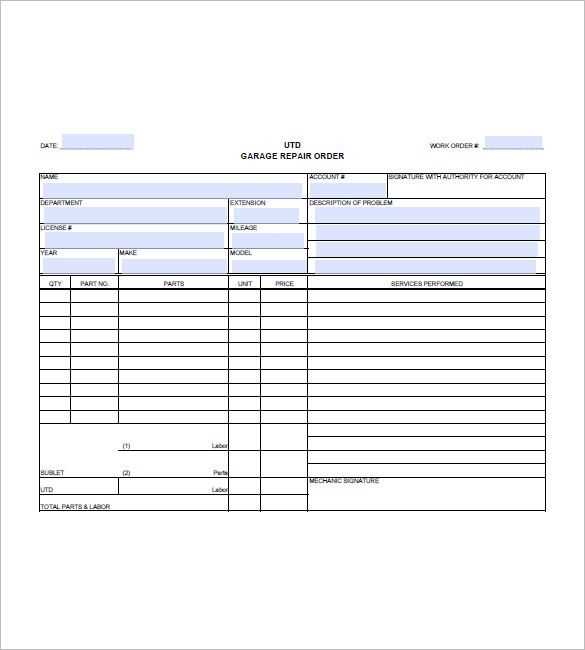

Key Information for a Vehicle Transaction Document

When creating a formal record for a vehicle sale, it’s essential to include all relevant details to ensure clarity and protect both parties involved. The document should provide a comprehensive overview of the transaction, including the identities of both the buyer and the seller, as well as specific details about the vehicle. These key elements help prevent misunderstandings and serve as a legal reference if any issues arise in the future.

To create a thorough and accurate document, make sure to include the following information:

- Seller’s and Buyer’s Information: Full names, addresses, and contact details of both parties.

- Vehicle Details: Make, model, year of manufacture, Vehicle Identification Number (VIN), mileage, and any distinguishing features.

- Sale Price: The agreed-upon amount for the transaction, including any taxes or additional charges.

- Payment Terms: Method of payment (cash, check, bank transfer, etc.), along with any deposit or payment schedule, if applicable.

- Transaction Date: The exact date when the sale took place.

- Signature Lines: Signature spaces for both the seller and the buyer to confirm the transaction.

By including these critical details, both parties can ensure that the transaction is fully documented, legally binding, and transparent. This not only facilitates a smoother process but also serves as a reference point if any issues arise later on.

Benefits of Using Word for Invoices

Creating professional billing documents can be a simple yet effective way to streamline financial transactions. By opting for a commonly used software, individuals and businesses can ensure that their records are both clear and easy to manage. This method provides a straightforward approach to generate consistent and customizable documents for different purposes.

Ease of Customization

One of the major advantages of using a popular text editor is the ability to easily tailor the layout and content. Users can modify fonts, colors, and sections according to their specific needs, ensuring the final document aligns with their branding or personal preferences. This flexibility makes it an ideal choice for those who need to personalize their billing records.

Accessibility and Compatibility

Another significant benefit is the universal availability of the software. It can be accessed on most computers, regardless of the operating system, which ensures that files are easily shareable and compatible across different devices. This makes it a reliable tool for both local and international communication, as recipients can open and review documents without hassle.

Moreover, documents created with this software are highly compatible with various formats, making it easier to store or send them electronically. With just a few clicks, they can be converted to PDF or other widely accepted formats, offering more options for sharing and archiving important records.

Efficiency and Time-Saving

Using such a solution also saves time, as it allows for quick generation of documents with pre-built styles and structures. The integration of automatic numbering, date insertion, and item lists helps to reduce manual errors and enhances productivity, ensuring that the process remains smooth and efficient.

Step-by-Step Guide to Create Invoices

Creating clear and professional documents to track transactions is a straightforward process that can be achieved with the right approach. Following a systematic method ensures that all necessary information is included and that the final document is both organized and easy to understand. Below is a step-by-step guide to help you create effective records for your transactions.

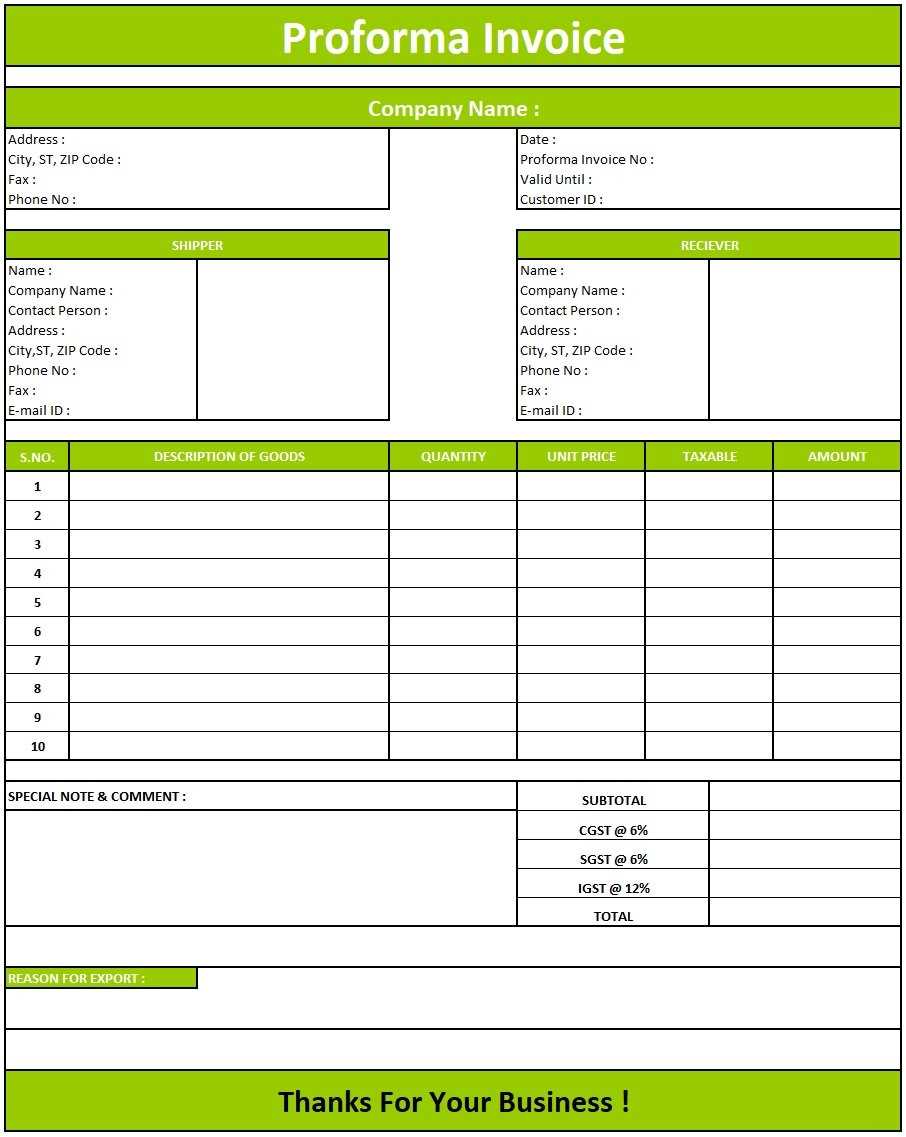

Step 1: Set Up Basic Information

- Document Title: Begin by labeling your document appropriately, such as “Receipt” or “Transaction Record”. This helps distinguish the document’s purpose.

- Your Details: Include your full name, company name (if applicable), address, and contact information at the top of the document.

- Recipient Information: Add the name and contact details of the individual or business involved in the transaction.

Step 2: Add Transaction Details

- Date of Transaction: Clearly specify the date when the exchange took place.

- Itemized List: Provide a detailed description of the goods or services provided, including quantity, unit price, and total cost for each item.

- Subtotal: Calculate the total cost before taxes or any discounts.

- Taxes or Additional Charges: Include any applicable taxes or fees, ensuring the rate and total amount are visible.

- Total Amount: Sum up the subtotal, taxes, and any additional charges to determine the final amount due.

Step 3: Provide Payment Instructions

- Payment Methods: Specify the accepted methods of payment (e.g., bank transfer, credit card, cash).

- Due Date: State the payment deadline to ensure timely settlement.

- Late Fees: If applicable, mention any penalties for late payment to encourage prompt transactions.

Once all the information is in place, review the document for clarity and accuracy. A well-structured record not only ensures you maintain accurate financial tracking but also reflects professionalism in your dealings.

Common Mistakes in Car Invoices

When creating documents to confirm a transaction, it’s easy to overlook important details that can lead to confusion or legal issues. Ensuring accuracy and completeness is crucial to avoid unnecessary complications. Below are some common errors that often occur when preparing financial records.

1. Missing Contact Information

- Omitting Seller or Buyer Details: Failing to include the full name, address, or contact details of either party can cause delays or disputes.

- Incorrect Contact Information: Typos or outdated information may prevent communication, making it harder to resolve any issues.

2. Inaccurate Transaction Descriptions

- Vague Descriptions: Not providing enough detail about the items or services involved can lead to confusion. Always include specifics like make, model, year, or serial numbers.

- Missing or Incorrect Prices: If prices are not listed correctly or are left out entirely, it can create discrepancies when it comes time for payment.

3. Calculation Errors

- Incorrect Subtotal or Total: Simple math errors in calculating totals, taxes, or discounts can cause financial discrepancies. Always double-check your calculations.

- Omitting Tax Information: Failing to specify tax rates or leave out applicable taxes can lead to confusion and potential legal issues.

4. Lack of Clear Payment Terms

- Unclear Due Dates: Without a clearly stated due date, both parties may have different expectations on when the payment is due.

- Missing Payment Methods: Not specifying how the payment should be made can lead to delays or missed payments.

By avoiding these mistakes, you ensure the document is clear, accurate, and legally sound, which helps prevent future issues and builds trust between both parties involved.

How to Add Taxes to Your Invoice

Including tax information in your transaction documents is essential for transparency and compliance with local regulations. Adding taxes correctly ensures that both you and the buyer understand the full amount due and avoids future misunderstandings. Here’s a guide on how to properly include tax charges in your financial records.

Step 1: Identify the Applicable Tax Rate

- Determine the Tax Rate: Research the applicable tax rate for your region or industry. This could be a general sales tax or a specific tax rate depending on the product or service.

- Consider Different Tax Types: Some transactions may require additional taxes such as VAT, state tax, or municipal taxes. Ensure you understand the specific taxes that apply to your situation.

Step 2: Calculate the Tax Amount

- Calculate the Pre-Tax Total: Begin by summing the cost of all items or services before applying any taxes.

- Apply the Tax Rate: Multiply the pre-tax total by the applicable tax rate. For example, if your total is $1,000 and the tax rate is 8%, the tax amount would be $80.

- Show the Breakdown: Clearly list both the pre-tax total and the tax amount on the document to ensure transparency.

Step 3: Add the Tax to the Total

- Sum the Amounts: Add the tax amount to the pre-tax total to determine the full amount due. For example, if the subtotal is $1,000 and the tax is $80, the total amount due would be $1,080.

- Clearly Label the Tax: Ensure that the tax charge is labeled clearly as “Tax”, “Sales Tax”, or any other relevant term to avoid confusion.

Step 4: Review and Finalize the Document

- Double-Check Calculations: Always double-check your calculations to avoid any errors in tax application.

- Include Tax Details: If necessary, add any relevant information about the tax rate or special tax exemptions that apply to the transaction.

By following these steps, you can ensure that tax charges are applied accurately and clearly, providing a transparent transaction for both parties.

Ensuring Legal Compliance with Invoices

When preparing transaction documents, it is crucial to follow specific regulations and requirements to avoid legal complications. These records not only serve as a formal agreement between buyer and seller but also as an official document that can be reviewed by authorities if needed. By ensuring your documents are legally compliant, you protect your business and provide clear, transparent information to your clients.

Key Legal Elements to Include

- Full Business Details: Include your legal business name, address, and tax identification number (TIN). This ensures that your transactions are easily traceable.

- Clear Description of Goods/Services: Provide a detailed description of what was sold, including quantities, models, serial numbers (if applicable), and any special terms or conditions related to the sale.

- Accurate Tax Information: Ensure the applicable tax rate is clearly indicated and applied to the subtotal. Depending on your location, sales tax or other regulatory taxes must be added and clearly shown on the document.

- Payment Terms: Specify payment deadlines, late fees, and acceptable payment methods. This ensures both parties are aware of their obligations and timelines.

Other Compliance Considerations

- Legal Language: Use precise language to avoid ambiguity. Phrases such as “final sale” or “as-is” help protect both parties in case of disputes.

- Consumer Protection Laws: Familiarize yourself with local consumer protection laws, including warranty requirements, cancellation policies, and return conditions. Some jurisdictions may require specific disclosures regarding warranties or guarantees.

- Record Retention: Keep a copy of each transaction record for the required period, as per local tax regulations. Failing to retain these documents could lead to penalties during audits or legal disputes.

By ensuring your transaction records meet legal requirements, you reduce risks and build trust with your clients, all while staying compliant with the law.

Where to Download Free Invoice Templates

There are numerous online resources where you can access ready-made billing documents without any cost. These documents allow you to quickly create professional records without starting from scratch. Many websites offer free options that cater to different needs and industries. Below are some reliable platforms to find high-quality, free templates for your transactions.

Popular Platforms to Find Free Billing Documents

| Website | Features | Download Format |

|---|---|---|

| Template.net | Wide range of customizable templates for various industries | PDF, Excel, Google Docs |

| Invoice Generator | Simple and user-friendly interface for quick creation | |

| Zoho Invoice | Free software with pre-designed documents and automated features | PDF, Excel |

| Microsoft Office | Offers basic templates with customization options via Office programs | Excel, Word |

| Canva | Modern, visually appealing templates with drag-and-drop functionality | PDF, PNG |

Considerations Before Downloading

- Customization Options: Ensure the website offers enough flexibility to adapt the document to your needs, such as adding logos, changing colors, or adjusting layouts.

- File Format: Choose a platform that offers the format most compatible with your preferred software or system (e.g., PDF for easy sharing, Excel for more complex calculations).

- Legality and Compliance: Ensure that the template includes all required fields and complies with your local regulations, such as tax identification or warranty disclaimers.

By using these resources, you can save time and create professional transaction records with minimal effort. Choose the platform that best suits your needs and industry requirements.

Editing Your Invoice for Accuracy

Ensuring the correctness of your transaction document is crucial for both professional integrity and legal compliance. Mistakes in the details can lead to confusion, delays in payments, or even disputes. To avoid such issues, it’s important to carefully review and edit your records before sending them to the recipient. Below are key steps to follow when reviewing your billing document for accuracy.

- Check Personal and Business Information: Ensure that your contact details and the recipient’s information are correct, including names, addresses, and contact numbers. Incorrect details can cause delays and affect communication.

- Verify Item Descriptions: Double-check that the items or services listed are described clearly and accurately, including quantities, model numbers, and any relevant specifications. Any ambiguities can lead to misunderstandings about the products or services provided.

- Confirm Pricing: Review the unit prices, subtotals, and total amounts. Small errors in calculations, like missing discounts or incorrect unit prices, can result in significant discrepancies. Use a calculator or automated tool to ensure all numbers are accurate.

- Ensure Proper Tax Calculation: Make sure that the correct tax rate is applied and that the tax amount is calculated accurately. Include the necessary tax information, such as the rate and the total tax amount.

- Check Payment Terms and Dates: Verify that payment terms, including due dates and late fees (if applicable), are clearly stated. Ensure that both the payment methods and due date are accurately listed to avoid confusion.

Once all elements are carefully reviewed and edited, it’s a good idea to have someone else look over the document as well. A fresh pair of eyes can help catch errors you might have missed. Only after confirming everything is correct should you send or print your document for submission.

Tracking Car Sales with Invoices

Maintaining accurate records of vehicle transactions is crucial for both business operations and financial management. Proper documentation helps ensure that each sale is recorded clearly and legally, providing transparency for both the seller and buyer. By using detailed transaction documents, sellers can track sales, manage payments, and monitor the financial health of their business.

These records serve as an essential tool for keeping track of individual transactions, providing a clear overview of the sale, payment status, and any warranties or additional terms that may apply. Having organized documentation not only helps with inventory management but also makes it easier to review financial performance over time.

Benefits of Properly Documenting Vehicle Sales

- Financial Tracking: By using detailed records, sellers can easily track how much revenue is generated from each sale, aiding in budgeting and financial planning.

- Legal Protection: A clear and accurate transaction record protects both parties in case of disputes, as it outlines the terms of sale, payment schedules, and any warranties or guarantees.

- Inventory Management: Tracking sales helps businesses keep accurate counts of their inventory, ensuring that they know which vehicles have been sold and which are still available.

- Tax Compliance: Keeping accurate documents helps ensure that sales are reported correctly for tax purposes, reducing the risk of errors or audits.

How to Effectively Track Sales

- Organize Sales Chronologically: Sort records by date or transaction number to make it easy to locate specific sales when needed.

- Include Detailed Vehicle Information: Each document should list the make, model, year, VIN (Vehicle Identification Number), and any special features or conditions associated with the vehicle being sold.

- Track Payment Status: Clearly indicate whether payment has been received in full, and if not, include information about any payment installments or due dates.

- Store Records Electronically: Consider storing your sales records in digital format for easy access, retrieval, and long-term preservation.

By keeping detailed and organized records, sellers can ensure a smooth and transparent sales process, reducing the risk of financial confusion or legal issues down the road.

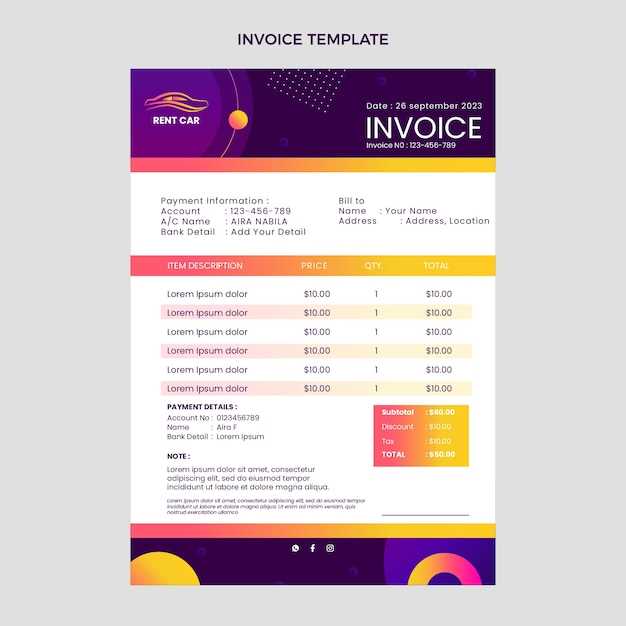

Invoice Design Tips for Better Clarity

The design of your transaction documents plays a crucial role in ensuring that all information is presented clearly and is easy for both parties to understand. A well-organized layout not only improves the professional appearance of the document but also minimizes the chances of confusion or errors. Below are some practical tips for enhancing the clarity of your financial records.

1. Keep It Simple and Clean

- Avoid Clutter: Too much information or overly complicated designs can distract from key details. Use ample white space to separate sections and make the document easier to read.

- Use Simple Fonts: Stick to basic, readable fonts like Arial, Helvetica, or Times New Roman. Avoid using more than two fonts to maintain consistency.

2. Organize Information with Clear Headings

- Break Sections Into Categories: Divide the document into distinct sections such as “Seller Information,” “Transaction Details,” and “Payment Terms.” This helps guide the reader’s eye and makes finding specific information faster.

- Highlight Key Sections: Use bold or slightly larger text for headings to make important information stand out, such as totals, payment due dates, and terms of sale.

3. Use Tables for Itemized Lists

- Clearly List Products or Services: Use a table format to itemize the products or services provided, including quantities, individual prices, and totals. This makes it easy for both parties to verify the details.

- Align Information Properly: Ensure that numbers are aligned to the right (e.g., prices and totals), and that descriptions are aligned to the left to maintain a clean, organized look.

4. Emphasize Key Financial Information

- Highlight Totals: Make the total amount due bold or use a larger font size to ensure it stands out. This reduces the chances of overlooking the final amount.

- Include Clear Tax and Discount Details: Break down any taxes, discounts, or additional charges so that the reader can easily see how the final amount was calculated.

5. Ensure Consistency

- Consistent Formatting: Ensure that fonts, colors, and headings are uniform throughout the document. Consistency improves readability and presents a polished, professional appearance.

- Use Brand Colors (If Applicable): Incorporate your brand’s colors subtly to make the document more personalized while still maintaining clarity and professionalism.

By focusing on simplicity, organization, and consistency, you can create a transaction document that is not only clear but also professional, making it easier for your clients to understand the details and for you to maintain accurate records.

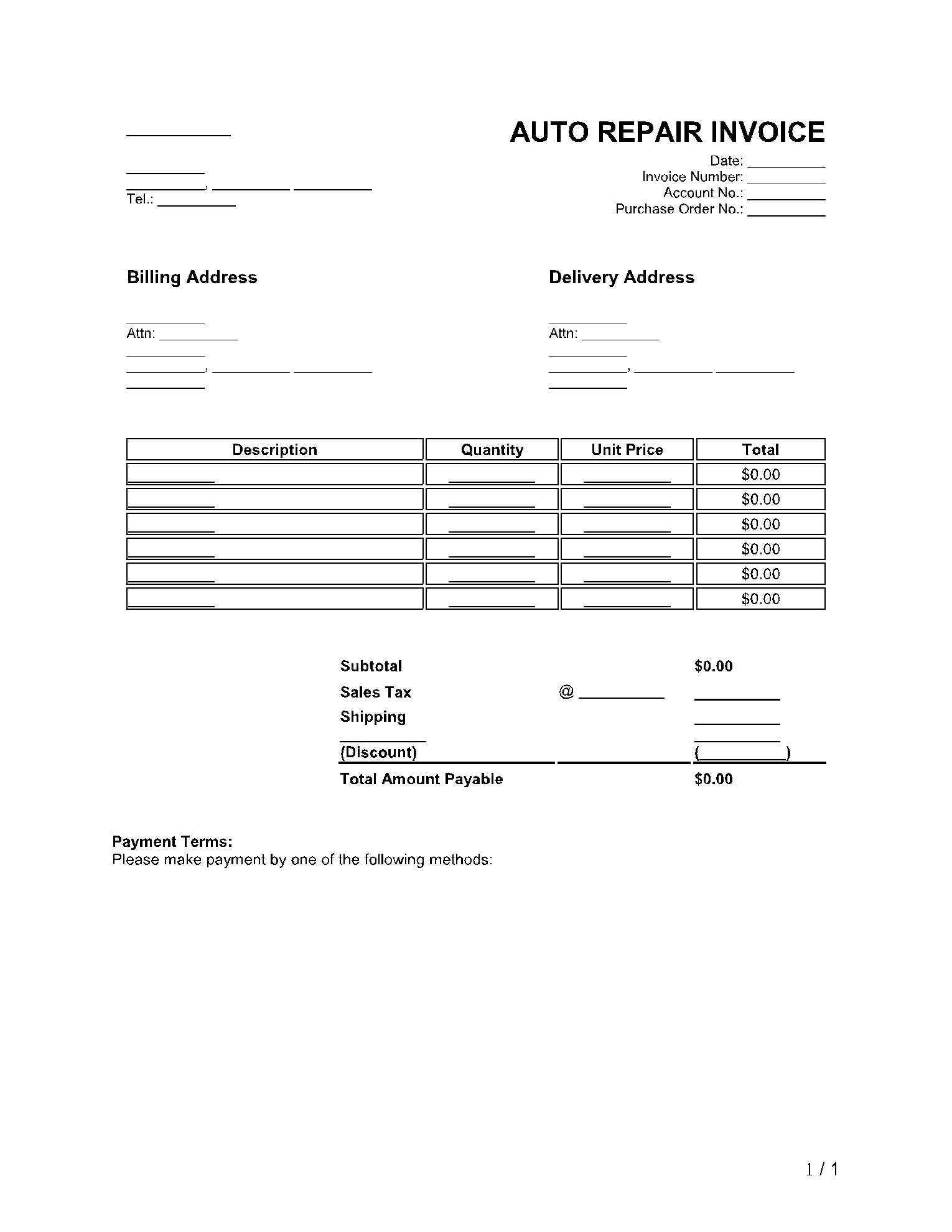

What to Include in a Used Car Invoice

When creating a document to confirm the sale of a vehicle, it’s essential to ensure that all relevant details are clearly included. This helps to protect both parties and provides a clear record of the transaction for legal and financial purposes. A well-structured document can prevent confusion and disputes in the future. Below is a list of key information that should be included in any vehicle sale record.

Essential Information to Include

- Seller’s Details: The name, address, and contact information of the seller should be clearly stated at the top of the document.

- Buyer’s Details: Include the buyer’s full name, address, and contact information to ensure the transaction is properly attributed.

- Vehicle Information: Provide a detailed description of the vehicle, including make, model, year, VIN (Vehicle Identification Number), mileage, color, and any other distinguishing features.

- Date of Transaction: Clearly state the date the transaction was completed to avoid confusion regarding the timing of the sale.

- Price Breakdown: Include the price of the vehicle, any additional fees (such as taxes, title transfer, or registration fees), and the total amount due.

Additional Terms to Consider

- Payment Method: Specify how the buyer will pay, whether through cash, check, credit card, or financing.

- Condition of the Vehicle: Describe the vehicle’s condition at the time of sale, noting any defects, damages, or maintenance records. If the sale is “as-is,” be sure to include this as a clause to avoid future disputes.

- Warranties or Guarantees: If the vehicle comes with any warranty or guarantee, include the terms clearly. If there is no warranty, make sure to note that the sale is final and “as-is.”

- Signatures: Both the seller and the buyer should sign the document to confirm that both parties agree to the terms of the sale.

Including all of these elements ensures that both the buyer and the seller are clear on the terms of the transaction and protects both parties legally. A well-documented sale can prevent misunderstandings and provides an official record for both parties’ reference.

Invoice Formatting Best Practices

Effective formatting is crucial when creating any business document, as it ensures that all essential information is clear, professional, and easy to read. A well-structured document not only improves communication between parties but also helps avoid potential errors and misunderstandings. Below are some best practices to follow when formatting your transaction records for

Invoice Formatting Best Practices

Effective formatting is crucial when creating any business document, as it ensures that all essential information is clear, professional, and easy to read. A well-structured document not only improves communication between parties but also helps avoid potential errors and misunderstandings. Below are some best practices to follow when formatting your transaction records for