USA Invoice Template for Simple and Professional Billing

Efficient billing is essential for maintaining smooth financial operations in any business. Having a clear and well-structured document for requesting payment ensures that transactions are processed without confusion, promoting trust between businesses and clients.

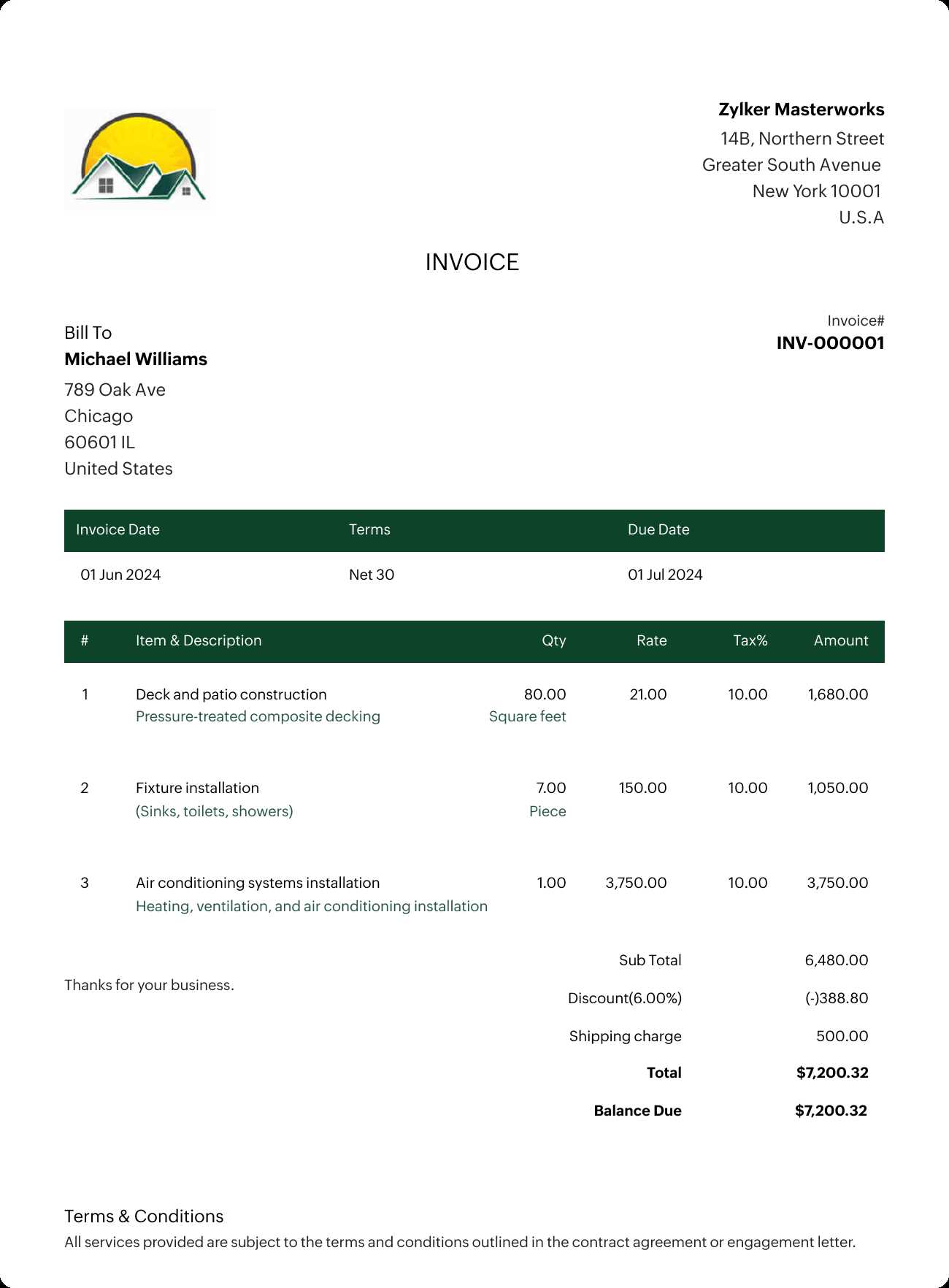

Creating an effective billing document requires careful consideration of essential details, such as item descriptions, payment terms, and tax calculations. A customizable and easy-to-use document format can simplify this process and save valuable time.

Designing and organizing your billing document properly can also reduce errors, improve communication with customers, and ensure compliance with legal standards. Whether you run a small business or a large enterprise, a professionally crafted billing solution is a must-have for financial success.

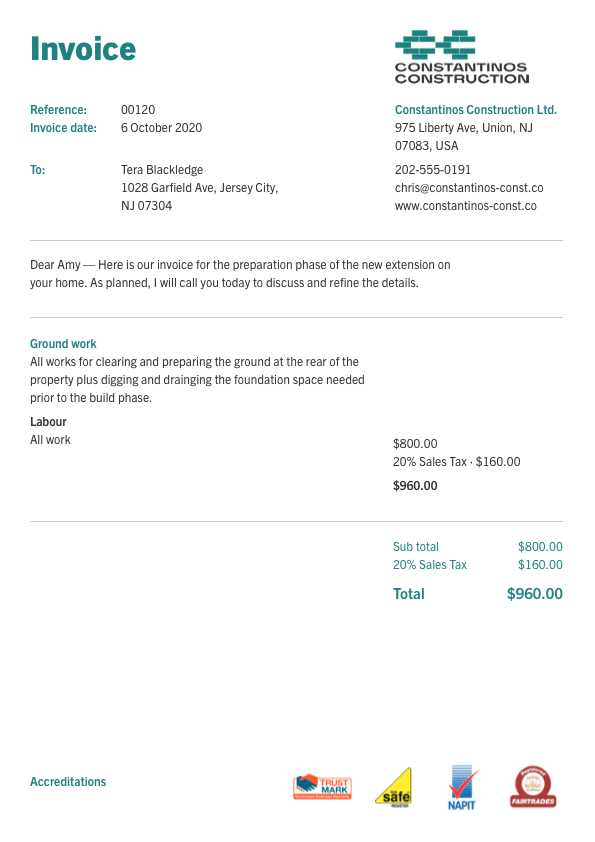

USA Invoice Template Overview

A well-structured billing document is crucial for any business, ensuring clear communication and smooth financial transactions. It serves as an official request for payment, outlining the services or products provided, along with the total amount due. A professional format not only helps avoid misunderstandings but also enhances the credibility of the business.

The key to a successful billing document lies in its simplicity and comprehensiveness. It should include important details such as the company name, customer information, an itemized list of goods or services, and payment terms. By using a standardized format, businesses can streamline the process and ensure consistency across all their transactions.

Having a ready-made format can save significant time, allowing businesses to focus on their core operations. The flexibility to adjust the document according to specific needs ensures it can be adapted for various industries, from small startups to large corporations.

How to Create an Invoice Template

Designing a well-organized billing document is a simple yet essential task that ensures professionalism and clarity in financial transactions. A properly created document not only helps with collecting payments efficiently but also maintains a positive relationship with clients. Here is a step-by-step guide to creating a functional and cleanly designed document for your business needs.

Essential Elements to Include

When constructing a billing document, there are several key elements that should always be included:

- Business Information: Include the name, address, and contact details of your company.

- Client Information: List the customer’s name, company (if applicable), and address.

- Itemized List: Clearly detail the goods or services provided, with corresponding prices.

- Payment Terms: Specify due dates, payment methods, and any late fees, if applicable.

- Invoice Number: Assign a unique number for tracking and reference purposes.

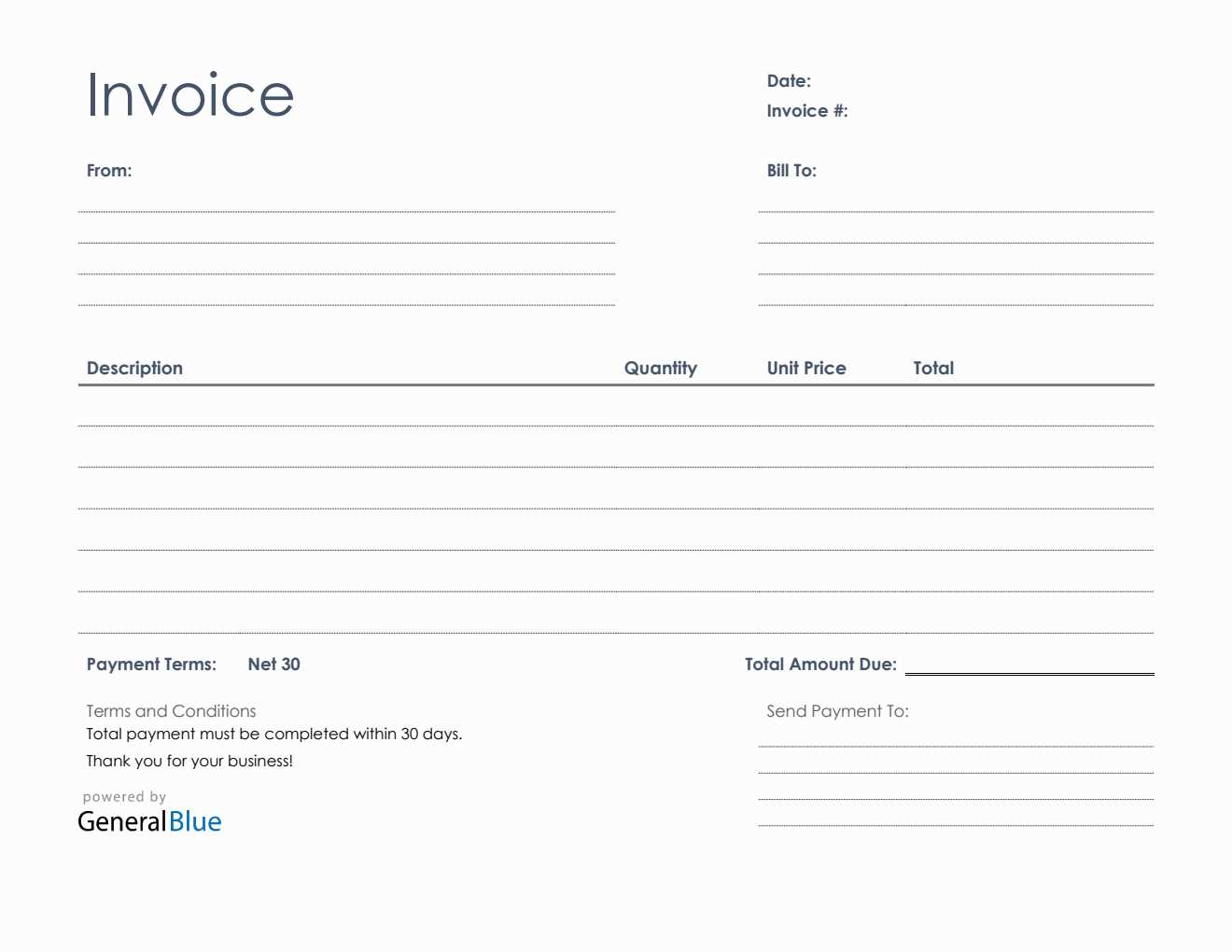

Design Tips for Professional Presentation

Once you’ve included the necessary information, consider the design of the document itself. A clean, straightforward layout helps avoid confusion and makes the payment process smoother. Use professional fonts and adequate spacing for readability.

- Choose a minimalistic design that doesn’t overwhelm the reader.

- Keep the document organized by using grids or tables to separate information.

- Highlight important details such as total amounts and payment deadlines.

By focusing on these core aspects, you’ll be able to create a document that is not only functional but also visually appealing and easy to understand.

Key Features of a USA Invoice

To ensure smooth transactions and avoid misunderstandings, a properly structured billing document must contain all the necessary details in an organized manner. The features of such a document play a crucial role in providing clarity to both the business and the customer. Understanding these key elements ensures that your billing process is both professional and efficient.

Essential Information for Clear Communication

The most important components of any billing document are those that allow both parties to clearly understand the transaction. These include:

- Business and Client Information: Clearly display both the company’s and client’s name, address, and contact details.

- Document Number: A unique reference number is crucial for tracking and organizing all financial records.

- Product or Service Description: Each item provided should be listed with an accurate description, quantity, and unit price.

- Amount Due: Total charges should be calculated and displayed in a clear and easy-to-read format.

- Payment Terms: The deadline for payment and any applicable late fees should be clearly outlined.

Formatting and Presentation Tips

A well-organized layout helps improve readability and gives a professional appearance. These tips will help maintain consistency and clarity:

- Ensure adequate spacing between sections to separate different pieces of information.

- Use bold text for important details such as the total amount and payment due date.

- Consider using a table format to organize the itemized list of products or services.

By including these key features and focusing on a clean, professional design, your billing document will effectively communicate the necessary information and simplify the payment process for both you and your clients.

Importance of Customizing Invoice Templates

Personalizing your billing documents is essential for creating a professional image and ensuring clarity in your financial transactions. Customization allows businesses to align their billing documents with their brand identity and specific business needs. It also provides flexibility in managing various transaction details while keeping everything consistent and organized.

Benefits of Tailoring Billing Documents

When you adapt a document to fit your business, you ensure that all necessary details are present and formatted correctly. Here are some key benefits:

- Brand Consistency: Adding your company logo, colors, and contact information helps maintain brand recognition and professionalism.

- Flexibility: Customizing allows you to adjust the document to reflect specific services, payment terms, or client requirements.

- Clear Communication: Tailoring the layout and sections makes it easier for clients to understand the charges, deadlines, and payment methods.

- Enhanced Efficiency: By creating a document suited to your business, you streamline the billing process, reducing errors and the need for revisions.

Practical Ways to Customize Your Document

Customizing your billing document is simple, and small changes can have a big impact. Here are some practical steps:

- Modify the header to include your business name, logo, and contact information.

- Adjust the layout to reflect the services or products you offer, using clear sections for descriptions, quantities, and prices.

- Include any legal or tax-related information specific to your location or industry.

- Set payment terms, such as late fees or early discounts, that are relevant to your business practices.

By customizing your billing documents, you create a streamlined and professional process that benefits both your business and your clients.

Understanding the Layout of an Invoice

The layout of a billing document plays a crucial role in ensuring that both the business and the client can easily understand and process the financial transaction. A well-structured document allows all the necessary details to be clearly presented, making it easier to track payments and avoid confusion. The key is to create a layout that is both functional and visually appealing, promoting efficient communication between both parties.

Key Sections of a Billing Document

When designing a billing document, certain sections must be included to ensure it serves its purpose effectively. Below is a typical layout that includes all the essential components:

| Section | Description |

|---|---|

| Header | Includes business name, logo, and contact information for easy identification. |

| Client Information | Displays the client’s name, address, and contact details for proper identification. |

| Itemized List | A detailed breakdown of the products or services provided, including quantity and price. |

| Total Amount | The total due, including taxes and any applicable fees. |

| Payment Terms | Includes payment methods, due dates, and any penalties for late payments. |

| Footer | Additional information such as thank you notes, business terms, or legal disclaimers. |

Organizing the Information for Clarity

Once you have these key sections in place, it’s important to ensure the layout is easy to navigate. Keep the design simple, using headings and lines to separate the different sections. Consistent font sizes and clean spacing also help in making the document more readable. This structured approach ensures that clients can quickly find the information they need, reducing the chances of misunderstandings or errors.

Best Practices for Invoice Design

A well-designed billing document plays a significant role in fostering clear communication between businesses and clients. A clean, organized design not only makes the document easy to read but also enhances professionalism. By following a few best practices, you can ensure that your financial documents are both functional and visually appealing, ultimately contributing to smoother transactions and better relationships with your customers.

Keep the Design Simple and Clean

The design should be straightforward, avoiding unnecessary elements that can make the document feel cluttered. Here are some tips for keeping the layout minimal and effective:

- Use White Space Wisely: Ensure there’s enough space between sections to make the document look neat and easy to read.

- Limit Fonts and Colors: Stick to one or two fonts and a limited color palette to maintain consistency and readability.

- Separate Information Clearly: Use headings, borders, and lines to visually separate key sections like the itemized list, total amount, and payment details.

Ensure Readability and Accessibility

Even the most beautiful design can fall short if the information is hard to read or confusing. Consider these practices to ensure your billing document is user-friendly:

- Choose Legible Fonts: Use clear, professional fonts for easy reading, avoiding decorative or overly stylized text.

- Consistent Formatting: Align text properly and use bold or italics to highlight critical details such as the total amount or payment due date.

- Mobile-Friendly: Keep in mind that clients may access the document on their phones or tablets. Test the design to ensure it displays well across devices.

By adhering to these best practices, you can create a billing document that not only looks professional but also enhances the overall user experience, leading to smoother financial interactions with your clients.

How to Add Payment Terms on Invoices

Clearly outlining payment terms is a critical part of any billing document. Payment terms provide both the business and the client with clear guidelines regarding the due date, accepted payment methods, and any penalties or discounts associated with payment. Properly communicated terms help to ensure timely payments and avoid misunderstandings, creating a smoother financial process for both parties.

Key Elements to Include in Payment Terms

When specifying payment conditions, it is important to cover all relevant details to avoid confusion. Here are the key elements you should include:

- Due Date: Clearly state the exact date by which the payment is expected. For example, “Payment due within 30 days from the date of this document.”

- Late Fees: Mention any penalties for delayed payments, such as a fixed fee or a percentage added for each overdue day.

- Accepted Payment Methods: List the available options for payment, including bank transfer, credit card, checks, or online payment systems.

- Early Payment Discounts: If applicable, offer discounts for early settlement of the bill, e.g., “2% discount for payments made within 10 days.”

- Currency and Taxes: Specify the currency of the transaction and any applicable tax rates, such as VAT or sales tax, which may apply to the final amount.

Where to Place Payment Terms

Payment terms should be prominently displayed in your billing document so that the client can easily find them. Here are some guidelines for placement:

- Place the terms in the footer or at the end of the document, but make sure they are still visible and clear.

- Highlight important dates, such as the payment due date or discount deadline, using bold text.

- Ensure that the language is simple and direct to avoid any ambiguity.

By carefully structuring and clearly stating the payment terms, you can improve cash flow, build trust with your clients, and minimize delays in receiving payments.

How to Use Templates for Multiple Clients

Using pre-designed documents for billing can significantly streamline the process of managing multiple clients. By leveraging customizable structures, businesses can save time while ensuring consistency and accuracy across all transactions. Customizing templates to fit individual client needs allows for efficient handling of recurring transactions, without having to start from scratch every time.

Benefits of Using Pre-Designed Billing Documents

Adopting a standardized format for all clients provides several advantages:

- Consistency: Using the same structure for all clients ensures uniformity and minimizes the risk of missing important details.

- Efficiency: You don’t need to create a new document from scratch each time you bill a client. Instead, you can quickly adjust existing structures.

- Professionalism: Customizable formats maintain a high level of professionalism while giving you the flexibility to personalize for each client.

How to Customize Billing Documents for Different Clients

Even with a standardized structure, it’s essential to customize certain details for each client. Here’s how you can make these adjustments:

- Insert the client’s name, address, and specific contact information in the appropriate fields.

- Modify the itemized list to reflect the unique products or services provided to each client.

- Adjust payment terms or discounts to fit the agreement with each individual client, such as specific due dates or special payment arrangements.

- Ensure that taxes or applicable fees are accurately calculated based on the client’s location or agreement.

By customizing your billing documents for each client while maintaining a consistent structure, you create a more efficient and professional process that saves time and helps ensure clear communication with all your clients.

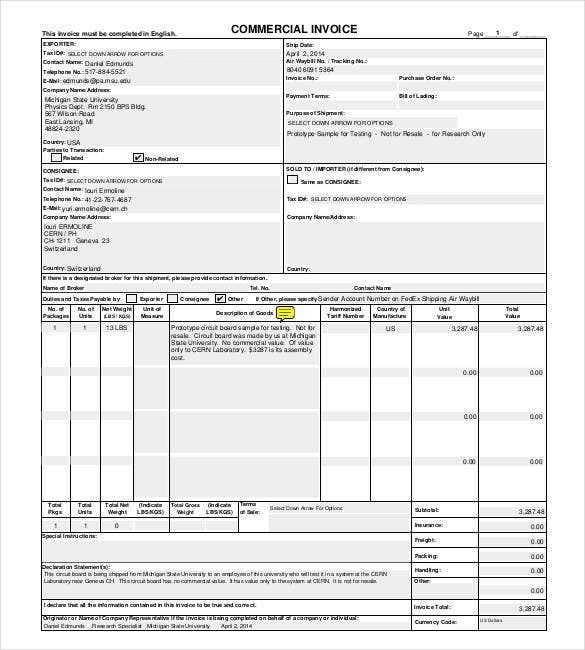

Choosing the Right Invoice Format

Selecting the appropriate format for a billing document is essential for maintaining clarity and professionalism in financial transactions. The format you choose should not only suit your business needs but also provide the client with all the necessary information in an organized manner. A well-chosen layout helps prevent confusion, ensures timely payments, and reinforces your brand’s credibility.

Factors to Consider When Choosing a Format

There are several key factors to keep in mind when selecting a format for your billing document. Each of these elements plays a role in ensuring the document is both functional and user-friendly:

| Factor | Considerations |

|---|---|

| Business Type | Choose a format that fits your industry. For example, service-based businesses may need a more detailed breakdown of time and rates, while product-based businesses may focus more on quantity and prices. |

| Client Preferences | Some clients prefer a minimalist design, while others may want more details included. Tailor the layout to match your client’s preferences where possible. |

| Payment Method | If your business uses specific payment platforms, ensure that the document includes relevant instructions or links for payment processing. |

| Complexity of Transactions | For businesses with complex pricing structures or multiple items, consider using a detailed, itemized format that clearly outlines all charges. |

Types of Formats to Choose From

There are different formats available depending on the nature of your business and the needs of your clients. The most common ones include:

- Simplified Format: A clean and straightforward layout, ideal for businesses with simple transactions, where few details need to be included.

- Itemized Format: Best suited for companies offering multiple products or services, this format breaks down each charge individually to provide full transparency.

- Professional Format: Includes branding elements such as logos and business colors, creating a polished look while maintaining clarity and structure.

Choosing the right format will depend on the specific needs of your business and the preferences of your clients. By aligning the design with your brand and customer expectations, you can improve communication and efficiency in financial transactions.

Why Templates Save Time and Effort

Using pre-designed structures for financial documents significantly reduces the time and effort involved in preparing each transaction. Rather than creating a new document from scratch for every client, these ready-made formats allow for quick adjustments, ensuring consistency and accuracy. This not only speeds up the process but also ensures that key details are never overlooked, saving businesses from costly mistakes.

Efficient Document Creation

One of the primary advantages of using pre-made structures is the ability to rapidly generate documents with minimal effort. By filling in specific details such as amounts, dates, and client information, you can produce a complete, professional-looking document in a fraction of the time it would take to start from scratch. This efficiency is especially beneficial for businesses that handle large volumes of transactions.

Consistency and Accuracy

Templates ensure that all required fields are included, reducing the risk of missing important information. By using the same format repeatedly, you can eliminate inconsistencies between different documents. This uniformity not only enhances professionalism but also makes it easier to manage records over time, ensuring that every document meets the same standards.

Ultimately, relying on pre-designed structures helps streamline your billing processes, making tasks faster, easier, and more accurate. Whether you run a small business or a larger operation, templates are a valuable tool for managing financial paperwork efficiently.

How to Include Tax Information on Invoices

Including tax details on financial documents is a critical part of maintaining transparency and complying with local regulations. Properly displaying tax rates, amounts, and any exemptions ensures that clients understand the charges applied and can help avoid disputes. This section will guide you through the essential elements that need to be included when calculating and presenting taxes on a document.

Key Information to Include

When adding tax details to a financial document, make sure to include the following:

- Tax Rate: Specify the tax rate applicable to the transaction. This could be a percentage or a fixed amount depending on the type of tax.

- Tax Amount: Clearly state the amount of tax being charged, calculated based on the taxable subtotal.

- Tax Identification Number (TIN): If applicable, include your business’s tax ID number to comply with legal requirements.

- Tax Exemptions: If any items or clients are exempt from taxes, clearly note this on the document to avoid confusion.

Displaying Tax Information Clearly

To avoid errors or misunderstandings, ensure that the tax information is easy to read and located in a visible section of the document. Here are some tips:

- Include a separate line item for taxes, clearly labeled as “Sales Tax” or “VAT” to distinguish it from other charges.

- Show both the subtotal before tax and the total amount after tax, so the client can easily see how taxes affect the overall cost.

- If multiple tax rates apply (e.g., local and state taxes), itemize them separately with corresponding rates and amounts.

By providing clear tax information, you ensure that your clients are well-informed and reduce the likelihood of disputes related to tax charges. It also helps you stay compliant with tax laws and fosters trust in your business practices.

Tips for Tracking Invoice Payments

Efficiently tracking payments for billing documents is essential for maintaining cash flow and ensuring financial accuracy. Without a reliable system in place, it can be difficult to know when payments are due, which clients have paid, and which transactions still need attention. By implementing a few simple practices, businesses can streamline this process and reduce the risk of errors or missed payments.

Here are some key tips to help you track payments effectively:

- Use a Payment Management System: Implementing a digital tool or software for managing payments allows you to keep all transaction details in one place. This can automate the tracking process and provide real-time updates on outstanding amounts.

- Set Clear Payment Terms: Clearly communicate payment deadlines and methods to your clients. Including specific payment terms on each document can help ensure that both parties are on the same page.

- Monitor Due Dates: Keep a record of when each document was issued and the payment deadline. This helps you identify overdue amounts quickly and follow up accordingly.

- Send Reminders: If payments are overdue, sending polite reminders can prompt clients to pay on time. Setting up automatic reminders through your payment software can save you time and effort.

- Track Partial Payments: In some cases, clients may make partial payments. Make sure to update the payment status to reflect this and keep track of remaining balances to avoid confusion.

- Keep Detailed Records: Always keep detailed records of payments, including dates and amounts. This information will help in resolving any future disputes and will provide a clear financial history.

By following these simple yet effective tips, you can streamline the process of tracking payments, ensuring a more organized and efficient approach to financial management.

Common Mistakes to Avoid with Invoices

While preparing financial documents for clients, it’s easy to overlook certain details or make errors that can cause confusion or delay payments. Whether it’s missing key information, providing unclear terms, or making arithmetic mistakes, these issues can harm the professional image of your business and disrupt your cash flow. Being aware of common mistakes and learning how to avoid them can help ensure smooth transactions and maintain good relationships with clients.

Missing Key Information

One of the most common mistakes is failing to include essential information that clients need to process payments. Some critical details to avoid leaving out include:

- Client’s full name and contact details: Always ensure that the client’s name, address, and other contact details are correctly listed.

- Clear payment terms: Specify the payment deadline, any late fees, and accepted payment methods to avoid misunderstandings.

- Unique reference number: Assigning a unique number to each document helps in identifying and tracking payments efficiently.

Arithmetic and Calculation Errors

Simple math mistakes can cause confusion and delay payments. Ensure that you double-check calculations, especially when dealing with multiple items or services. Here are a few things to watch out for:

- Incorrect tax calculations: Make sure the correct tax rate is applied and check the math to ensure the amounts are accurate.

- Subtotal and total mismatches: Ensure that the subtotal before tax matches the sum of the individual items, and verify that the total includes all additional charges and taxes.

- Discounts and adjustments: If offering a discount, clearly show the amount deducted and recalculate totals accordingly.

By addressing these common mistakes, you can avoid unnecessary complications and ensure that your financial documents are accurate and professional, fostering trust and efficiency in your business transactions.

Legal Requirements for USA Invoices

In the United States, businesses must comply with certain legal requirements when preparing billing documents. These legal standards ensure that both the seller and the buyer are protected and that the transaction is properly documented for taxation and auditing purposes. Understanding and adhering to these requirements is crucial for avoiding potential legal issues and maintaining a smooth, professional business operation.

Here are some key legal aspects to consider when creating billing documents:

- Business Information: The document must clearly display the seller’s legal business name, address, and tax identification number (TIN). This is crucial for both record-keeping and tax reporting purposes.

- Client Details: It’s essential to include the buyer’s full name or business name and their address, especially for business-to-business transactions.

- Clear Payment Terms: Legally binding payment terms, including the due date, payment method, and any late fees or penalties, should be specified to avoid disputes.

- Itemized List of Goods/Services: An accurate and detailed breakdown of all goods or services provided, including quantities, prices, and any applicable taxes, is necessary for transparency and tax calculations.

- Tax Information: Depending on the location, the applicable sales tax rate must be listed, along with the amount charged for tax. Different states have varying rules about tax, so be sure to apply the correct rates.

- Unique Reference Number: A unique document number should be assigned to each transaction to track and reference the billing record easily.

- Compliance with State Regulations: Some states may have additional requirements for specific industries or business types, so it’s important to stay informed about regional legal obligations.

Ensuring that all of these requirements are met not only protects your business from potential disputes but also ensures compliance with state and federal tax regulations. By staying organized and following these guidelines, you can maintain a trustworthy and legal financial record-keeping system.

How to Personalize Your Invoice Template

Personalizing billing documents can significantly enhance your brand identity and customer experience. By customizing the design, structure, and content of your billing forms, you can make a lasting impression on clients while ensuring your business stands out. A well-crafted and personalized document not only reflects your professionalism but also creates a cohesive, branded look for your communications.

Here are some essential tips for tailoring your billing forms to align with your business needs:

1. Include Your Branding

Start by adding your company logo, business name, and contact information at the top of the document. This helps clients immediately recognize the source of the bill and ensures consistency across all your communications. Customizing the colors, fonts, and layout to match your brand’s style guide can further reinforce your business identity.

2. Customize Content Fields

Adapt the fields and sections of the document to suit the nature of your business. For example, if you’re providing a service, you can include a detailed description of the work done, including dates and hours worked. For product-based businesses, you might want to list product specifications, quantities, and individual prices. Adjusting the language and adding personalized notes or payment terms tailored to each client also adds a personal touch.

Additional Customization Ideas:

- Include personalized payment terms or discounts for loyal clients.

- Make use of custom fields for specific project or order numbers to keep track of multiple transactions.

- Use a professional yet friendly tone in the notes section to enhance the client relationship.

Personalizing your billing forms is a simple yet effective way to create a more engaging and professional experience for your clients. By adding these personal touches, you not only streamline the billing process but also reinforce the value you provide in a way that feels bespoke and thoughtful.

Free vs Paid Invoice Templates

When choosing a billing form for your business, you may encounter two primary options: free and paid options. Each has its advantages and limitations depending on the specific needs of your business. Understanding the differences between the two can help you make a more informed decision that aligns with your workflow, branding, and overall business requirements.

Free Options

Free billing documents are readily available and typically easy to access. Many online resources offer downloadable forms with basic layouts and functionality. These forms can be a great choice for small businesses or startups looking to save on costs. However, free options often come with limitations in design, customization, and additional features.

Advantages of Free Forms:

- Zero cost involved, ideal for businesses on a tight budget.

- Quick and easy to use, with no need for additional software or design skills.

- Basic structure that covers essential billing needs.

Disadvantages of Free Forms:

- Limited customization options for branding and layout.

- May lack advanced features like automated calculations, tax inclusion, or payment reminders.

- Potential for lower quality or less professional appearance.

Paid Options

Paid billing forms typically come with advanced features, customization options, and greater support. These forms are designed to provide a more polished, professional look and feel, which can be essential for businesses seeking to enhance their branding. Whether you choose to purchase individual forms or subscribe to a service, these options are often more feature-rich and flexible.

Advantages of Paid Forms:

- Customizable design that can be tailored to fit your brand’s identity.

- Advanced features like auto-calculation of totals, tax, and discounts.

- Regular updates and customer support for troubleshooting.

Disadvantages of Paid Forms:

- Cost associated with purchasing or subscribing to a service.

- May require additional time or learning to fully utilize advanced features.

In conclusion, the decision between free and paid forms depends largely on your business’s needs and priorities. If you’re just starting out and have minimal requirements, free forms might be sufficient. However, for businesses looking to scale, create a more professional brand, or automate the billing process, paid options provide greater flexibility and value in the long run.

How to Download and Use Templates

Finding and utilizing the right billing forms can significantly streamline your business operations. Whether you’re just starting or looking for a more efficient way to manage your transactions, downloading and using pre-designed documents can save you time. Here’s a simple guide to help you get started with these forms, from finding them to customizing and using them effectively.

Finding the Right Forms

The first step is to search for a suitable document that fits your needs. Many online platforms offer free and paid options for downloading these forms. You can search through various websites, such as online marketplaces or business management sites, to find the perfect form for your business. Look for forms that match your specific requirements, such as professional layout, clear itemized lists, and easy-to-fill fields.

- Visit trusted online platforms offering professional forms.

- Choose a format that works with your preferred software (e.g., Excel, Word, PDF, etc.).

- Check reviews or recommendations to ensure quality and reliability.

Customizing and Using the Forms

Once you’ve downloaded a form, you can personalize it to better reflect your business. Most downloaded documents are editable, allowing you to add your business logo, contact details, payment terms, and tax information. Make sure to replace any placeholders with your specific information to ensure the document is correct and professional.

- Open the downloaded form in the relevant software.

- Edit the form with your company name, address, payment instructions, and other necessary details.

- Save the document as a new file to avoid overwriting the original template.

- Consider using automated tools to streamline recurring tasks such as calculations and totals.

Once customized, the form is ready to be used for your next transaction. Simply fill in the required client information and items, and you’re all set to issue the billing document. Make sure to keep a copy for your records and send the customized document to your clients promptly.