Upholstery Invoice Template for Easy and Professional Billing

Managing financial transactions efficiently is essential for any service-based business. Properly documenting the work completed and payments received ensures clear communication with clients and simplifies accounting. By having a structured document, you can maintain a professional image and avoid misunderstandings about charges or services rendered.

When running a business, it’s crucial to have a clear and consistent method for detailing the products or services you provide, along with the associated costs. A well-organized form not only helps streamline your business operations but also ensures that payments are processed smoothly and on time. This article explores how you can design and implement such documents, offering a variety of customizable options to fit your needs.

Creating these essential documents doesn’t need to be complicated. By using the right approach, you can create forms that look professional, are easy to use, and clearly outline what your client is paying for. Whether you’re just starting out or looking to refine your current system, it’s important to understand how to structure these records for maximum impact.

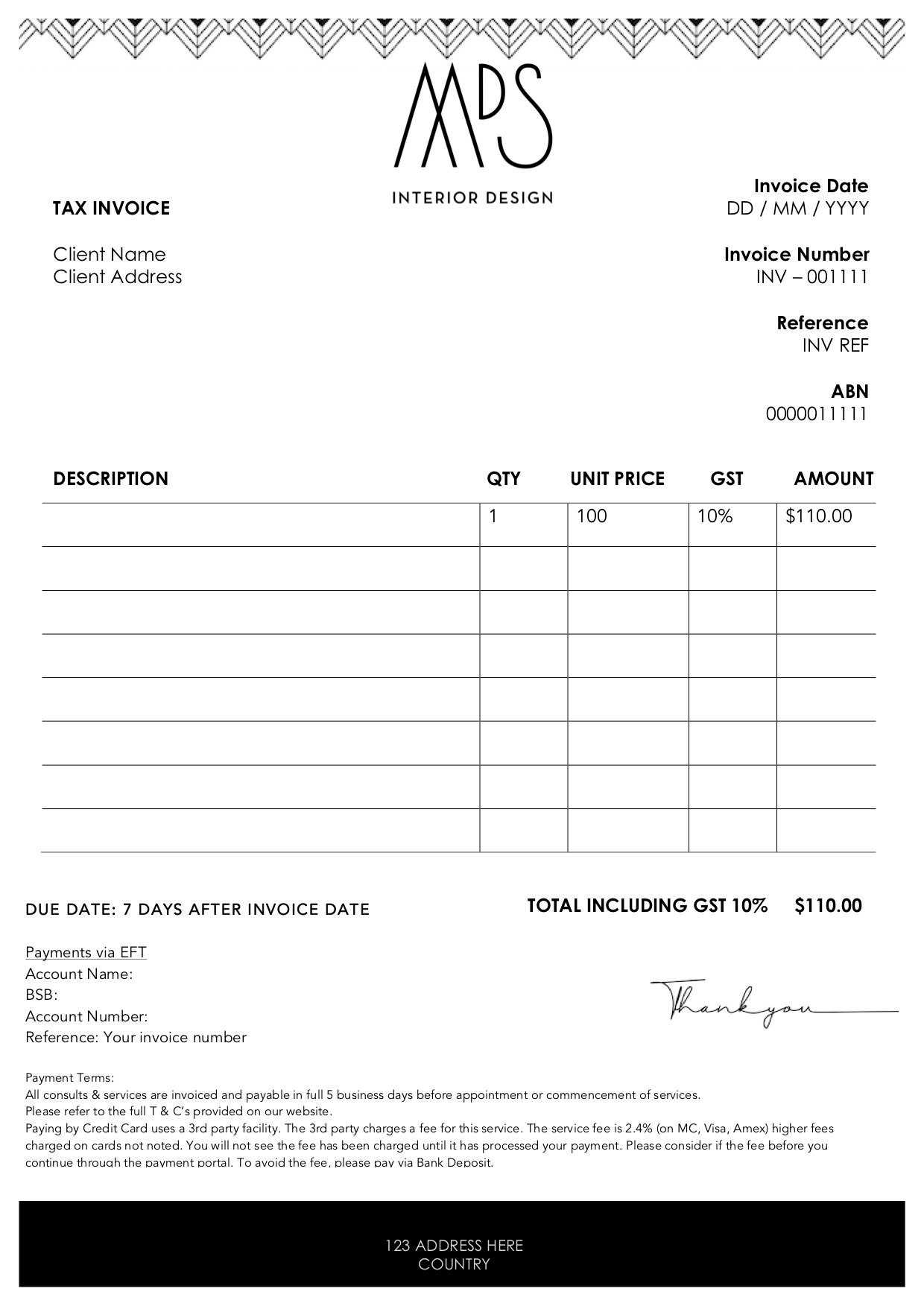

Upholstery Invoice Template Overview

For any business providing custom fabric work, it’s essential to have a formal document to detail the services rendered and the associated costs. This structured document not only ensures clarity for clients but also simplifies the financial management process. By using a predefined format, service providers can ensure consistency, professionalism, and accuracy in all transactions.

Why Consistent Documentation Matters

Clear and well-organized records are key to maintaining a smooth workflow. Using a structured approach for each transaction eliminates confusion and ensures that both the client and business owner are on the same page. Proper documentation allows for quicker payment processing and offers a transparent overview of the services provided.

Customization and Flexibility

The flexibility of a structured document allows for easy customization according to individual business needs. You can add details such as labor costs, materials, and delivery fees, making the document adaptable to various types of services. Personalizing your forms helps reflect your business’s unique offerings and builds trust with your clients.

Why Use an Upholstery Invoice

Having a well-organized and formal record of services rendered is crucial for any business. Such a document not only outlines the work completed but also serves as a clear reference for both the service provider and the client. It ensures transparency, accuracy, and fosters trust, providing a professional approach to managing transactions.

By utilizing a structured billing form, businesses can avoid misunderstandings regarding costs and payment terms. It serves as proof of the agreed-upon services and acts as a tool for tracking financial transactions. This ensures smooth operations, timely payments, and helps in maintaining a strong relationship with clients.

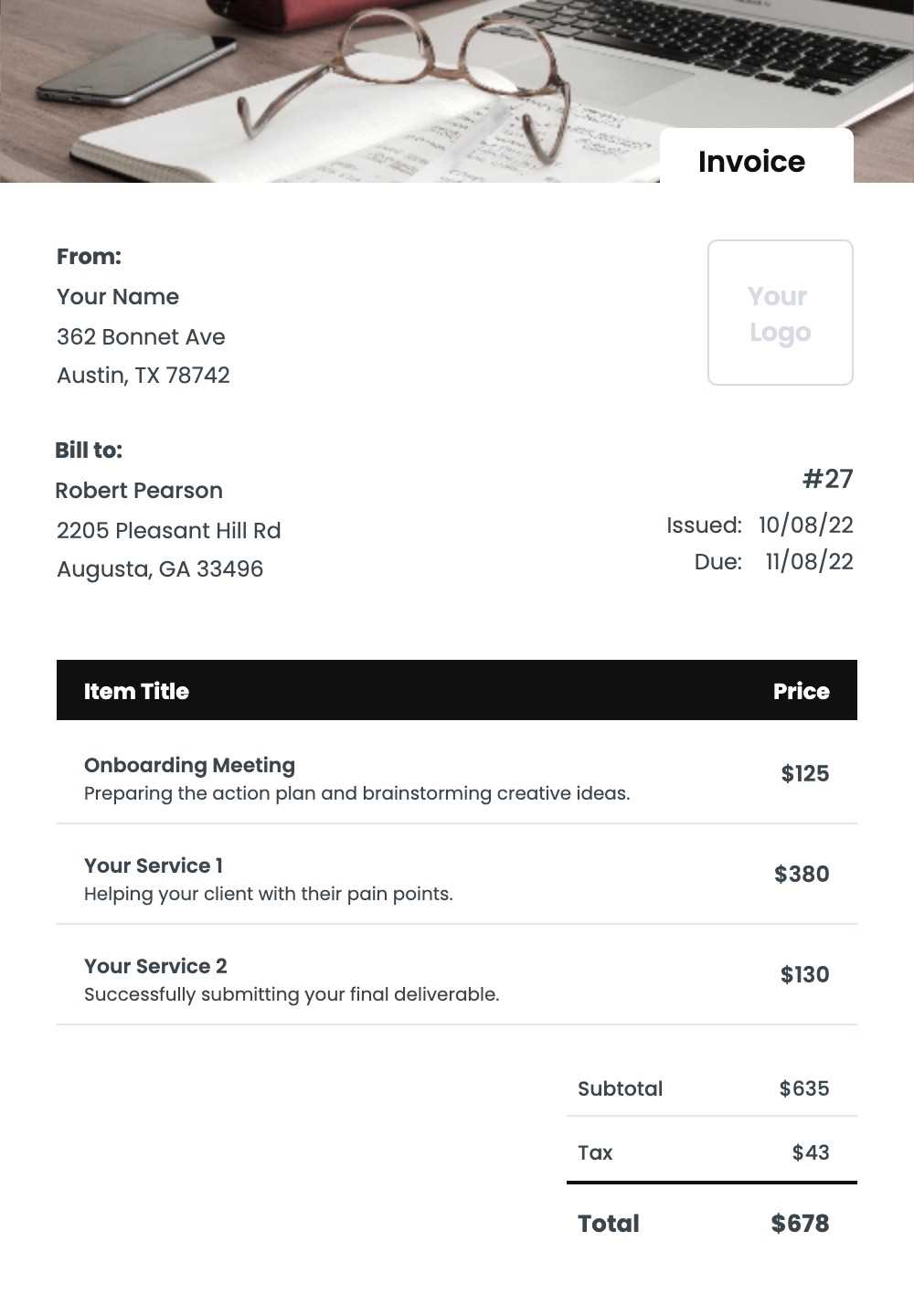

Key Elements of an Upholstery Invoice

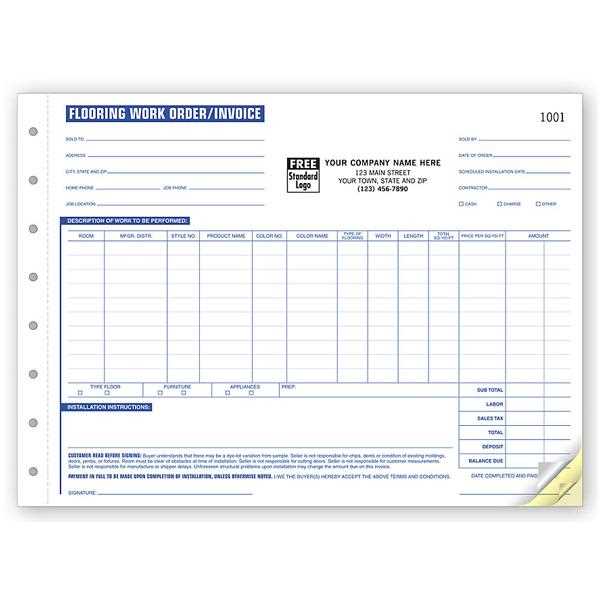

For a billing document to be effective, it must include certain key components that clearly communicate the details of the services rendered and associated costs. These elements ensure that both the client and service provider have a clear understanding of the transaction, minimizing confusion and promoting prompt payment.

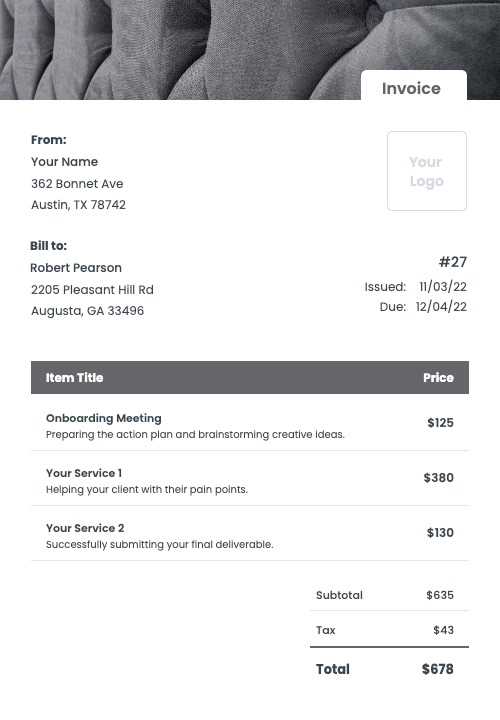

| Element | Description |

|---|---|

| Business Information | Includes the service provider’s name, address, and contact details, ensuring the client knows how to reach them for any inquiries. |

| Client Details | Contains the client’s name, address, and contact information for proper record-keeping and communication. |

| Service Description | Outlines the specific tasks completed, providing transparency about what the client is being charged for. |

| Cost Breakdown | Lists individual charges for labor, materials, and any additional fees, ensuring a detailed overview of the total cost. |

| Payment Terms | Specifies the due date and accepted payment methods, helping set clear expectations for when and how payments should be made. |

| Unique Invoice Number | Assigns a unique identifier to each document for easy reference and tracking, both for the client and the business. |

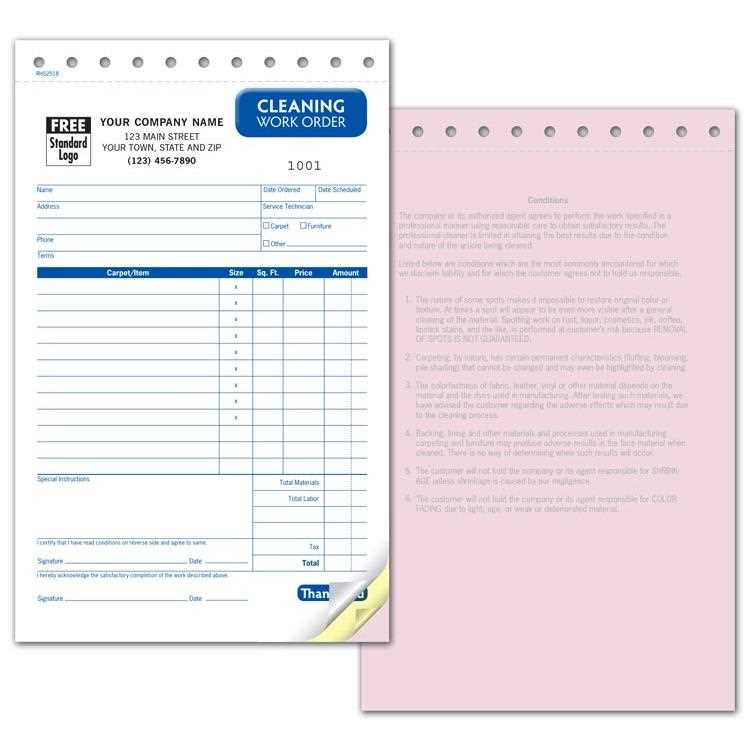

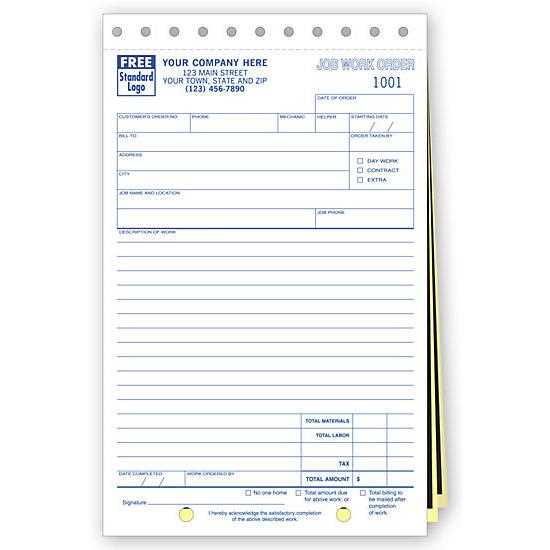

How to Create a Custom Template

Creating a personalized document for tracking services and payments is essential for streamlining your business operations. A well-designed form allows you to communicate clearly with clients while maintaining a professional appearance. Customizing your document ensures that it fits your specific business needs, making it easier to manage financial transactions.

Here are the essential steps to create your own custom billing form:

| Step | Description |

|---|---|

| 1. Choose a Layout | Start by deciding on the overall structure, ensuring that all necessary details have enough space for clarity and easy navigation. |

| 2. Add Business Details | Include your business name, logo, and contact information at the top to create a professional look and ensure clients can reach you if needed. |

| 3. Define Service Sections | Designate areas where the description of completed work and associated costs can be listed clearly and concisely. |

| 4. Include Payment Terms | Specify due dates, accepted payment methods, and any late fees to set clear expectations for financial transactions. |

| 5. Add a Unique Reference Number | Ensure each document has a unique number for easy reference and tracking, helping you stay organized. |

Benefits of Using an Invoice Template

Using a predefined structure for billing provides several advantages that can help improve efficiency and professionalism in business transactions. Whether you are just starting or have an established business, employing a standardized form can save time, reduce errors, and maintain consistency across all financial documents.

Improved Efficiency

A pre-designed billing structure streamlines the process by eliminating the need to manually input common details for each transaction. This not only speeds up the billing process but also ensures accuracy every time. Key benefits include:

- Time-saving: Quickly fill in the essential details without starting from scratch each time.

- Consistency: Use the same layout for all documents, promoting a professional appearance.

- Accuracy: Reduce errors by having fixed fields that guide you through each step of the process.

Professional Appearance

Presenting a uniform, polished document to your clients helps establish trust and credibility. A structured form gives the impression of an organized and professional business, ensuring clients feel confident in your services. Key points include:

- Brand Identity: Incorporate your business logo, colors, and branding elements to maintain a consistent identity.

- Clear Communication: The standardized format helps convey important details clearly, minimizing misunderstandings.

Common Mistakes to Avoid in Invoices

When preparing a billing document, it’s easy to overlook details that could lead to confusion or delays in payment. Small errors can create frustration for both the client and the service provider, affecting business operations and customer satisfaction. It’s essential to identify and avoid these common pitfalls to ensure smooth and timely transactions.

Incorrect Information

One of the most common mistakes in billing documents is providing inaccurate or incomplete information. This can lead to misunderstandings, delayed payments, or even disputes. To avoid this, ensure all the following are correct:

| Element | Potential Issue |

|---|---|

| Business and Client Details | Incorrect contact information may result in missed communication. |

| Service Descriptions | Vague or unclear descriptions may cause confusion about what was provided. |

| Payment Terms | Failure to clearly define due dates and methods can lead to late or missed payments. |

Failure to Include Key Elements

Another common mistake is leaving out essential components of the document. Missing details can make it difficult for clients to understand what they are being charged for or how to proceed with payment. Always ensure the following are included:

| Essential Element | Importance |

|---|---|

| Unique Reference Number | Helps track and organize documents for both the business and the client. |

| Clear Cost Breakdown | Shows clients exactly what they are paying for and how the total is calculated. |

| Payment Instructions | Clarifies how and when payment is expected, avoiding misunderstandings. |

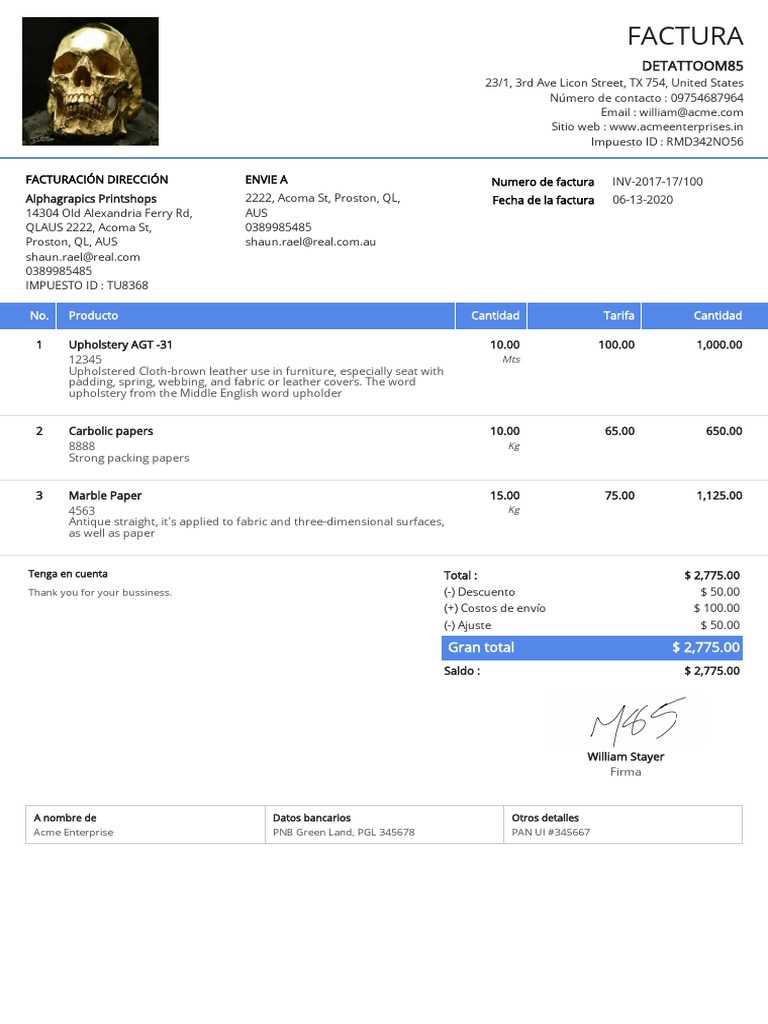

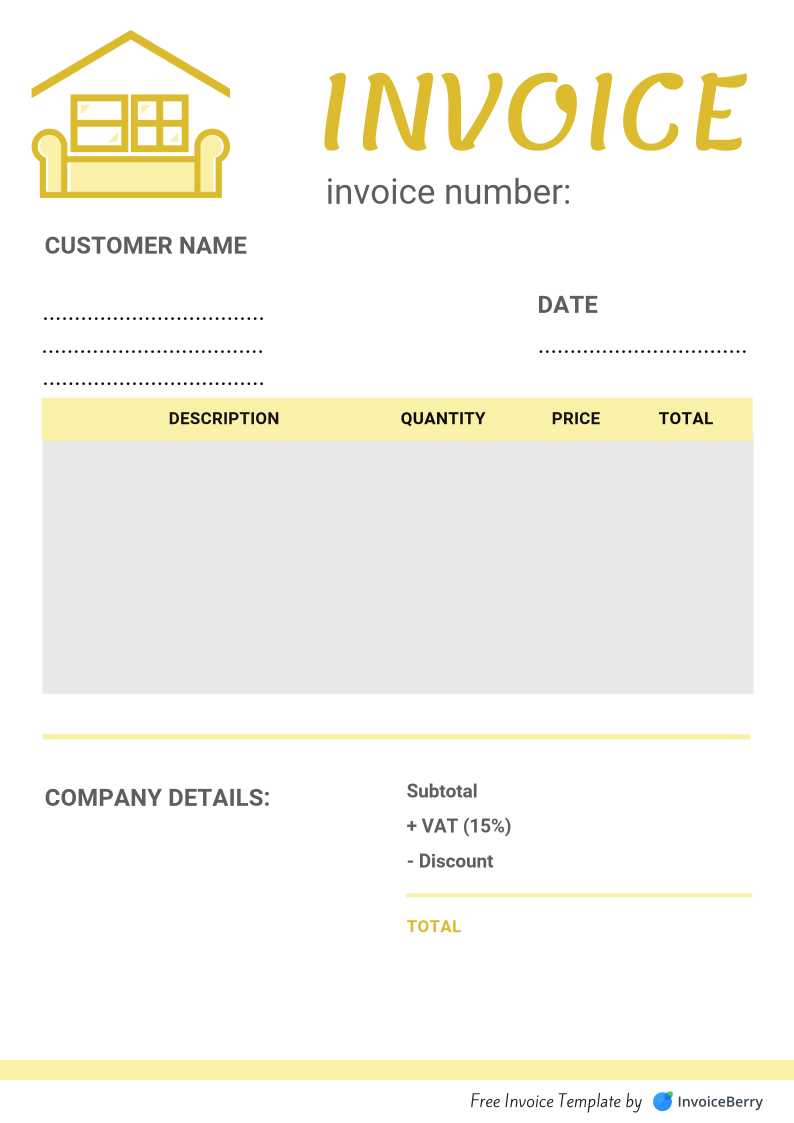

How to Add Discounts to Invoices

Offering discounts is a common way to incentivize customers and build loyalty, but it’s important to apply them correctly on financial documents to ensure clarity and accuracy. Including discounts can reduce the final amount due, and it’s crucial to present them in a transparent way to avoid confusion or misunderstandings. This section will explain how to properly incorporate discounts into your billing process.

Types of Discounts

There are different ways to apply discounts depending on your pricing structure and the type of offer you wish to give. Understanding the various discount types can help you choose the most appropriate one for your situation:

| Discount Type | Description |

|---|---|

| Percentage Discount | A specific percentage is deducted from the total cost of the service or product. |

| Flat Rate Discount | A fixed amount is subtracted from the total cost, regardless of the service or product price. |

| Volume Discount | Discount applied when a customer purchases a large quantity of goods or services. |

Steps to Apply Discounts

To ensure that your discount is applied correctly, follow these steps when preparing the document:

- Calculate the original amount before applying any discount.

- Clearly label the discount in the billing document, specifying the type and amount of the discount given.

- Ensure that the discount is reflected in the total amount due, providing a new final figure for the client.

Setting Payment Terms in Templates

Clearly defined payment terms are essential to ensure smooth transactions and avoid misunderstandings. When preparing financial documents, it’s crucial to specify when and how payments should be made, including the due date and any penalties for late payments. Setting clear payment terms helps both the service provider and the client manage expectations and improve cash flow management.

Here are key considerations when setting payment terms:

- Payment Due Date: Specify the exact date when payment is expected, whether it’s a fixed number of days from the date of the service or upon receipt.

- Accepted Payment Methods: Clearly list the payment methods you accept, such as bank transfer, credit card, or checks, to avoid any confusion.

- Late Payment Penalties: Include details about any penalties or interest charges for overdue payments. This encourages timely payments and protects your business.

- Early Payment Discounts: Offer a discount for early settlement to incentivize prompt payments and strengthen customer relationships.

By incorporating these elements, you provide a clear understanding of expectations and reduce the risk of delayed payments. Ensure these terms are highlighted so that both parties are aware of them from the outset.

Choosing the Right Invoice Software

Selecting the appropriate software for creating and managing your billing documents is a critical decision for any business. The right solution can streamline your financial processes, improve accuracy, and save time. With numerous software options available, it’s essential to choose one that suits your specific needs, whether you’re managing small-scale transactions or handling larger, more complex billing operations.

Key Features to Consider

When evaluating different software solutions, consider the following features to ensure you select the best tool for your business:

- User-Friendliness: Ensure the software is intuitive and easy to navigate, even for those with limited technical expertise.

- Customizability: Look for software that allows you to customize your billing documents to align with your brand and business needs.

- Integration Capabilities: Choose software that can integrate with your existing accounting, CRM, or payment systems for seamless workflow.

- Security Features: Make sure the software provides secure data storage and payment processing to protect sensitive client information.

- Mobile Accessibility: Consider solutions that offer mobile applications so you can manage your billing from anywhere.

Popular Software Options

There are various software tools that cater to different business needs. Some popular options include:

- QuickBooks: Known for its comprehensive accounting features and ease of use, it’s ideal for small to medium businesses.

- FreshBooks: A user-friendly option that offers customizable templates and time tracking, perfect for freelancers and small businesses.

- Zoho Invoice: A flexible tool with excellent customization options and integrations with other Zoho software.

- Wave: A free, cloud-based solution with invoicing and accounting features suitable for small businesses or startups.

Carefully assess your business requirements to choose the best software that supports your financial processes while ensuring efficiency and accuracy in every transaction.

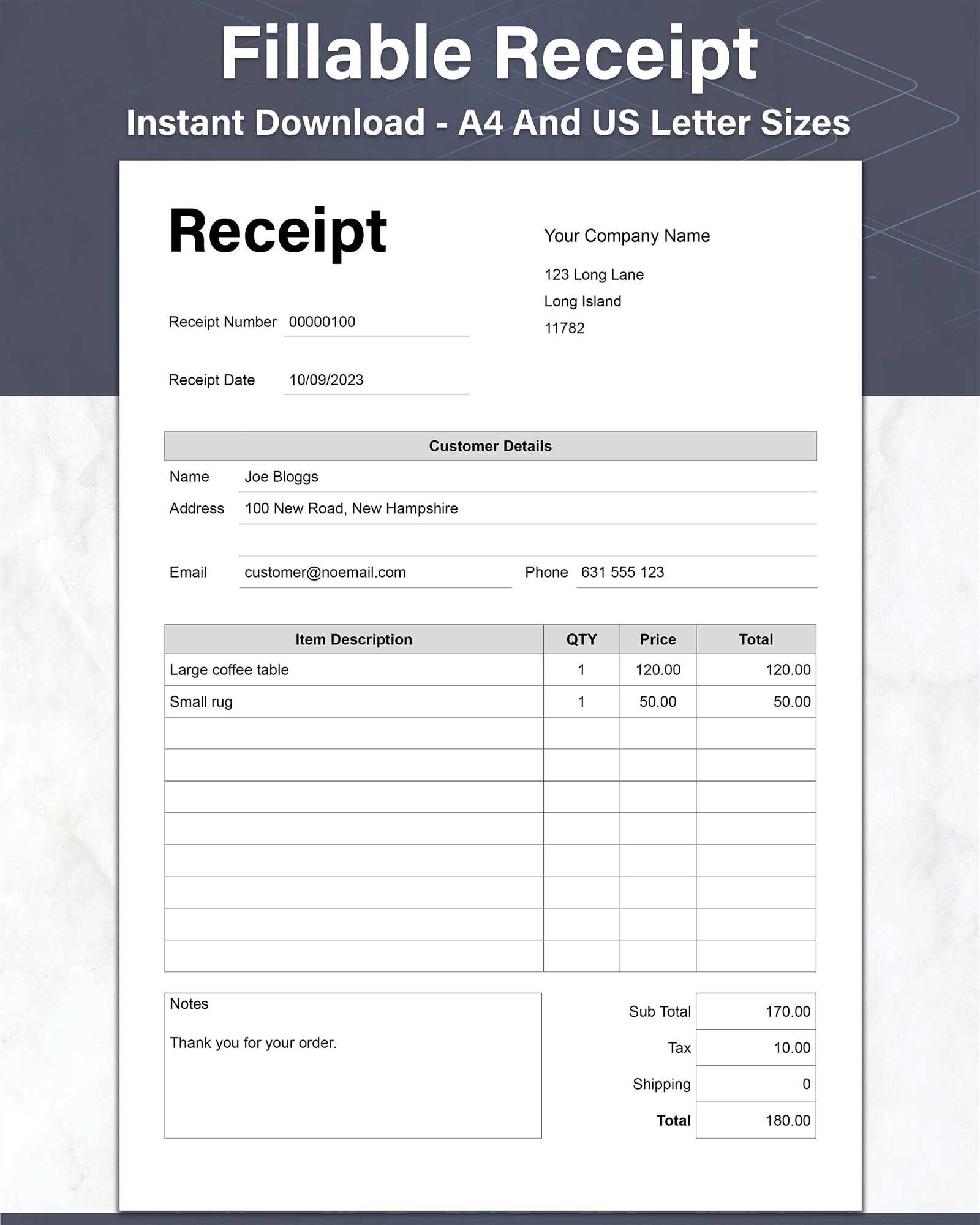

Tips for Designing Professional Invoices

Creating well-structured and clear billing documents is essential for maintaining professionalism and ensuring prompt payments. The design of your documents can significantly impact how your clients perceive your business and the overall transaction process. A clean, well-organized document not only helps avoid confusion but also reinforces trust and reliability in your services.

To achieve a professional look, consider the following tips:

- Use a Clear Layout: Keep the structure simple and organized, with clearly labeled sections such as item descriptions, quantities, and totals. This makes it easy for your clients to understand the charges.

- Incorporate Your Branding: Include your company logo, brand colors, and fonts to create a cohesive and personalized appearance that reflects your business identity.

- Maintain Consistency: Use the same font style, size, and color scheme throughout the document to create a uniform look. Consistency helps make your billing documents easy to read and professional.

- Provide Clear Payment Details: Specify payment terms, accepted methods, and due dates. The more detailed and transparent the payment instructions, the easier it will be for your clients to comply.

- Ensure Readability: Choose legible fonts and ensure proper contrast between the text and background. Avoid cluttering the document with unnecessary graphics or excessive text.

- Use Itemized Lists: Break down the charges into specific items or services to help clients understand exactly what they are being billed for. This promotes transparency and avoids misunderstandings.

By following these design principles, you can create professional and effective billing documents that enhance your business image and facilitate smooth financial transactions.

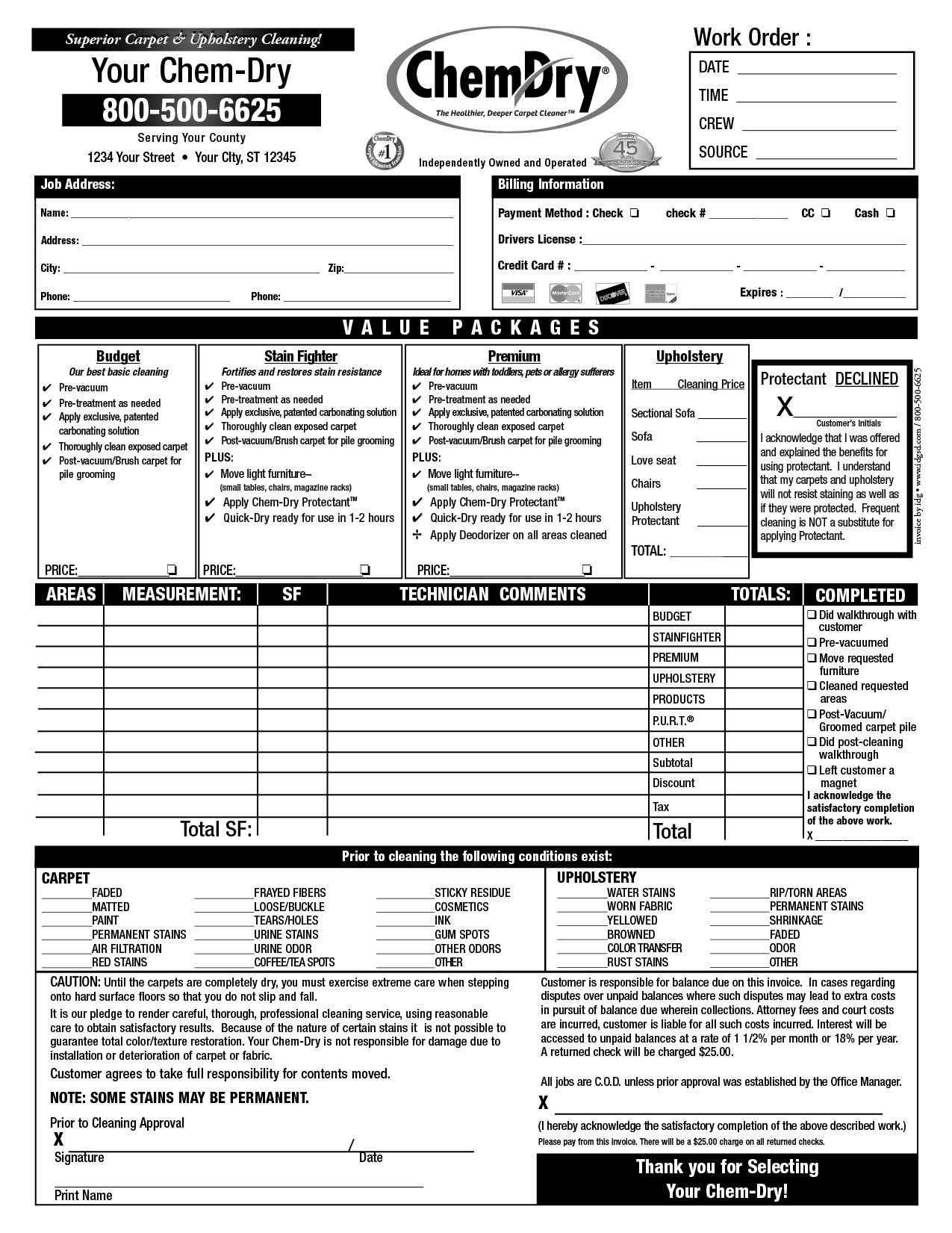

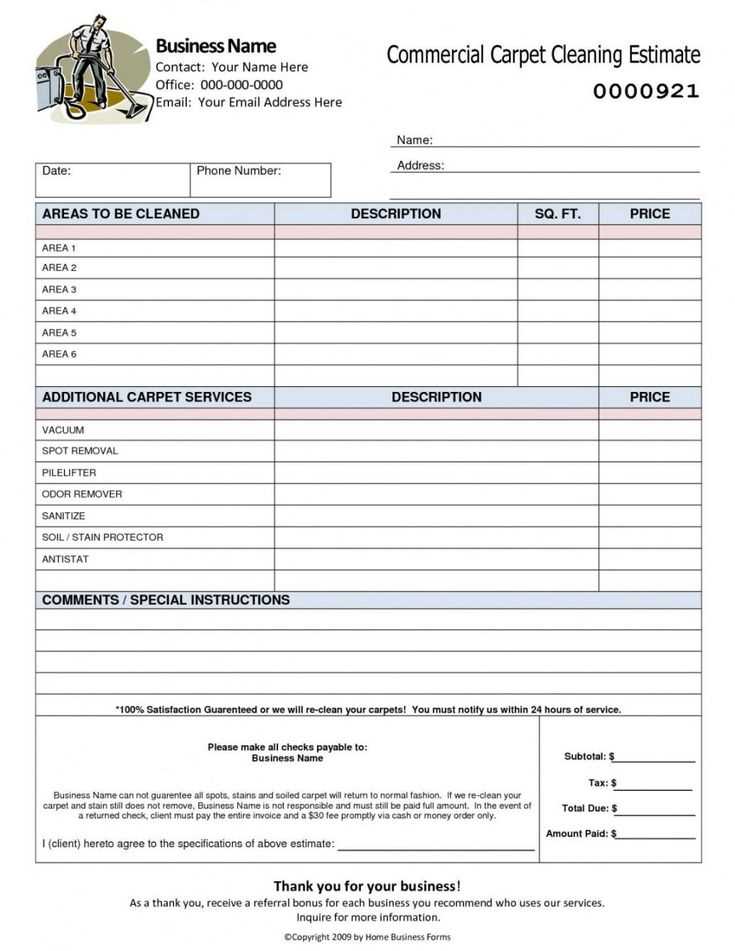

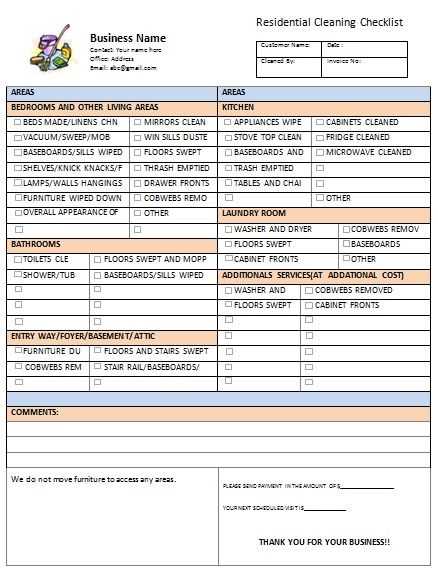

Essential Details for Upholstery Services

When providing furniture restoration and fabric replacement services, it is crucial to include key information that clearly outlines the scope of work and ensures transparency for both the service provider and the customer. This not only helps in setting expectations but also guarantees a smooth transaction process.

Here are some important details to include when outlining your services:

- Service Description: Clearly define the type of work being performed, such as fabric replacement, repair, or cushioning restoration. Specify any materials used, including fabric type, color, and texture.

- Itemized List of Services: Break down each service into individual tasks. For example, if repairing a chair, list steps like “removal of old fabric,” “replacing padding,” and “installation of new fabric.”

- Cost Estimates: Provide a detailed breakdown of the cost for each service or material used. Include hourly rates, labor charges, and any additional fees that may apply.

- Timeframe: Clearly specify the estimated completion time for each service, including any potential delays. This helps manage customer expectations and fosters trust.

- Payment Terms: Clearly state the payment schedule, including deposit requirements, total amount due, and acceptable payment methods.

- Warranty and Guarantees: Specify any warranties or guarantees offered for your work, including the duration and conditions. This provides added confidence for the client.

Including these essential details ensures that both parties are fully informed and prevents potential disputes, promoting a positive relationship between the service provider and client.

Handling Taxes on Upholstery Invoices

When providing furniture restoration or fabric-related services, it’s important to factor in the applicable taxes. This ensures that the transaction is fully compliant with local tax laws and helps both businesses and customers maintain transparency. Accurately calculating and presenting taxes is a vital part of any service-based transaction.

Key Tax Considerations

- Determine Tax Rate: Understand the sales tax rate for your region and apply it to the cost of services or materials provided. This may vary depending on the type of service or product.

- Taxable vs. Non-Taxable Items: Some services or materials might be tax-exempt, depending on local laws. Make sure to clearly distinguish which parts of the service are taxable and which are not.

- Include Tax Information: Ensure that the tax amount is clearly listed separately from the total amount due. Include the percentage applied and the specific tax rate used.

- Document Tax Exemptions: If a customer qualifies for tax exemption, such as being a non-profit organization, document the exemption status to avoid errors.

Best Practices for Tax Inclusion

- Accurate Calculations: Always double-check the calculations to ensure compliance with tax rates. Use software tools if needed to automate the process.

- Invoice Customization: Many billing systems allow you to automatically add tax fields to your documents, simplifying the process for both you and the customer.

- Stay Updated: Tax laws change frequently, so it’s important to keep up with the latest regulations to avoid penalties or errors.

Handling taxes effectively ensures a smooth transaction and avoids any potential legal issues. By keeping these best practices in mind, you can ensure accurate, transparent billing for your services.

Integrating Payment Methods into Templates

Incorporating various payment options into your billing documents is essential for ensuring ease of transaction for both businesses and customers. By providing a range of payment methods, you allow clients to choose the most convenient and secure way to complete their purchase, fostering a positive customer experience. It’s important to make payment instructions clear and easily accessible within the document.

Common Payment Methods to Include

- Credit/Debit Cards: This is one of the most widely used payment methods. Including card payment details ensures that customers have an easy and quick way to pay online or in person.

- Bank Transfers: For larger transactions, many clients prefer to transfer funds directly to your bank account. Providing your banking details helps streamline this process.

- Online Payment Systems: Popular services like PayPal, Venmo, or Stripe offer secure and convenient ways for customers to pay using their preferred online accounts.

- Checks: While becoming less common, some clients still prefer paying by check. Ensure you include the correct mailing address for these payments to be processed.

- Cash on Delivery: This method allows customers to pay when goods or services are delivered, which can be an option for in-person transactions.

Best Practices for Payment Integration

- Clear Instructions: Make sure to provide clear, concise instructions on how to proceed with the payment. Specify any necessary details, like account numbers or links to online payment portals.

- Multiple Options: The more options you offer, the more likely customers will find a payment method that suits them. Try to include at least two or three different methods.

- Security: Always ensure that payment methods provided are secure. Use trusted, encrypted payment gateways and clearly communicate any security measures taken to protect sensitive customer data.

By offering multiple payment methods, you enhance customer satisfaction and streamline your financial processes. Integrating payment options within your documentation can lead to faster transactions and fewer delays.

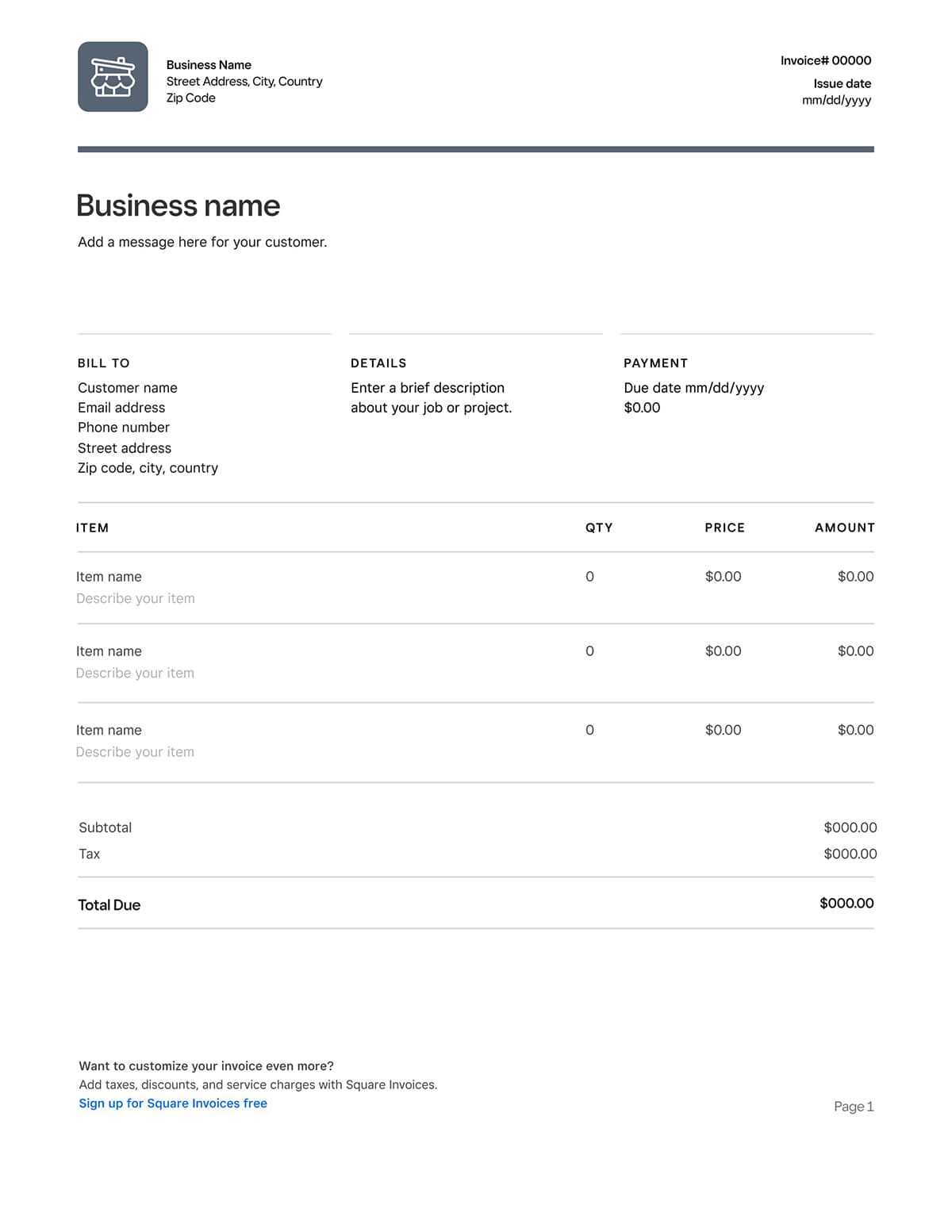

Tracking Payments with Invoice Templates

Accurately monitoring payments is crucial for maintaining financial control in any business. A well-structured document can help you track which payments have been made, identify outstanding amounts, and manage cash flow effectively. By adding payment tracking features to your billing forms, you can keep a clear record of each transaction, making financial management more straightforward.

Key Elements to Include for Payment Tracking

| Element | Description |

|---|---|

| Payment Status | Indicate whether the payment is completed, pending, or overdue. This helps in easily identifying any follow-up actions. |

| Amount Paid | Include a section that shows the amount the customer has paid so far. This helps avoid confusion and ensures transparency. |

| Remaining Balance | Clearly display any remaining balance due. This allows the client to understand the amount they still owe. |

| Payment Due Date | Make sure to include a due date for payments to be made. This serves as a reminder and helps in enforcing deadlines. |

Benefits of Tracking Payments Effectively

- Improved Cash Flow Management: Tracking payments helps ensure that funds are coming in as expected and allows for better planning of future expenses.

- Faster Follow-Ups: With clear payment statuses, you can promptly follow up with clients who have not yet paid or have outstanding amounts.

- Clear Financial Records: Keeping track of all payments through organized documents ensures that you can easily access accurate financial information when needed.

By integrating payment tracking features into your billing forms, you enhance both efficiency and accuracy in managing client transactions, ultimately supporting the financial health of your business.

How to Personalize Your Invoices

Customizing your billing forms is a great way to create a professional and unique experience for your clients. Personalization not only helps reinforce your brand identity but also adds a touch of professionalism that makes your transactions more memorable. Whether it’s adding a logo, adjusting the color scheme, or including specific terms, personalization can make your documents stand out.

Key Personalization Options

- Logo and Branding: Include your business logo and consistent color schemes to maintain brand consistency and create a cohesive look across all client communications.

- Custom Message: Adding a personalized thank you note or a brief message at the bottom of your forms can help build a stronger relationship with your clients.

- Contact Information: Ensure your business contact details are prominently displayed, including phone numbers, email addresses, and website links, for easy access.

- Payment Terms: Personalize the payment terms section to reflect the specific needs of your business, such as offering discounts for early payments or specifying deadlines.

Benefits of Personalizing Your Documents

- Stronger Brand Recognition: Adding your business branding makes your documents easily recognizable and can help reinforce brand loyalty.

- Improved Client Experience: Personalized forms show that you care about details, enhancing the overall client experience and making them feel valued.

- Professionalism: Customizing your paperwork demonstrates professionalism and attention to detail, helping to set your business apart from others.

By making these adjustments, you not only improve the appearance of your forms but also strengthen your professional presence, leaving a lasting impression on your clients.

Why Invoices are Crucial for Business

Proper documentation of transactions plays an essential role in the smooth operation of any business. By clearly outlining the details of sales and services, businesses can ensure timely payments, maintain accurate financial records, and uphold a professional image. These formal records not only serve as proof of agreements but also help in managing cash flow and meeting legal requirements.

Benefits of Proper Documentation

- Payment Tracking: Clear records help track payments, ensuring that clients pay on time and that there are no discrepancies in the amounts due.

- Legal Protection: Detailed forms provide a legal reference in case of disputes, helping businesses avoid potential conflicts by providing proof of transactions and agreed terms.

- Tax Compliance: Maintaining organized transaction records ensures that businesses comply with tax regulations, making it easier to file returns and avoid penalties.

- Cash Flow Management: By tracking what clients owe, businesses can better forecast income, manage expenses, and maintain healthy cash flow.

How Proper Documentation Improves Business Operations

- Professionalism: Providing clear and well-organized records builds trust with clients and reflects a business’s attention to detail.

- Efficiency: Organized paperwork streamlines payment collection, allowing businesses to focus on growth and customer relationships.

- Financial Clarity: Accurate financial records help business owners assess their financial health, identify trends, and make informed decisions.

In summary, having a reliable system for managing transactions is not just about facilitating payments; it’s about establishing credibility, ensuring smooth operations, and safeguarding the business’s financial integrity.

Best Practices for Follow-Up on Payment Requests

Ensuring that payments are received in a timely manner is vital for maintaining a healthy cash flow in any business. Following up on pending payments can be a delicate process, but doing so effectively helps to maintain professional relationships while ensuring that all due amounts are collected. A strategic and thoughtful approach to following up can prevent misunderstandings and delays.

Key Tips for Effective Follow-Up

- Send Timely Reminders: As soon as a payment is due, send a polite reminder. This can be an email or a call, depending on the nature of the transaction. Sending a reminder promptly helps avoid unnecessary delays.

- Be Professional and Courteous: Always approach the client with respect and professionalism. A polite tone helps maintain a positive relationship, which is crucial for future business opportunities.

- Offer Multiple Payment Options: Make it as easy as possible for your clients to pay by offering different payment methods. Providing options, such as bank transfers, credit card payments, or digital platforms, can speed up the process.

- Follow a Structured Process: Create a clear process for follow-ups, including timelines and methods of communication. For example, you might start with an email, follow up with a phone call, and escalate to a formal letter if necessary.

Escalation Strategies

- Set Clear Deadlines: Let your clients know the consequences of not paying by a certain date. This can include late fees or service interruptions. A deadline creates urgency.

- Provide Detailed Statements: If payments are overdue, provide a detailed breakdown of the outstanding amounts, including original due dates, services rendered, and any interest or late fees incurred. This transparency helps clients understand their obligations.

- Consider a Payment Plan: If the client is facing financial difficulties, offering a payment plan may be a good way to secure payment without jeopardizing the relationship.

By implementing these best practices, businesses can minimize delays in payments and ensure smoother financial operations while maintaining positive client relationships.