How to Update Invoice Template in QuickBooks Online

In any business, ensuring your billing documents reflect your brand’s professionalism and meet your specific needs is crucial. Whether you’re looking to modify the look or structure, having the flexibility to adjust these forms helps improve communication with clients and maintain consistency. With the right tools, this process can be simple and efficient, allowing you to stay organized and focused on growing your business.

Customizing your forms allows you to tailor the layout, fields, and design to match your company’s image. This means you can highlight essential information like payment terms, due dates, and amounts in a way that suits both your preferences and your clients’ expectations. Additionally, an intuitive system makes it easy to manage and apply changes across your documents, keeping everything aligned with your brand’s style.

Whether you’re aiming for a sleek modern look or maintaining a more traditional approach, having the ability to adjust these documents ensures your business remains adaptable and responsive to customer needs. Let’s walk through the process of personalizing your billing forms and ensuring they meet all your requirements.

How to Access Billing Document Layouts

To begin customizing your business forms, the first step is to locate the section where you can manage all available formats. This area is where you can adjust the structure and design of your documents, ensuring they match your company’s branding and functional needs. With the right tools, accessing these options is simple and intuitive, allowing you to focus on personalizing your forms without any confusion.

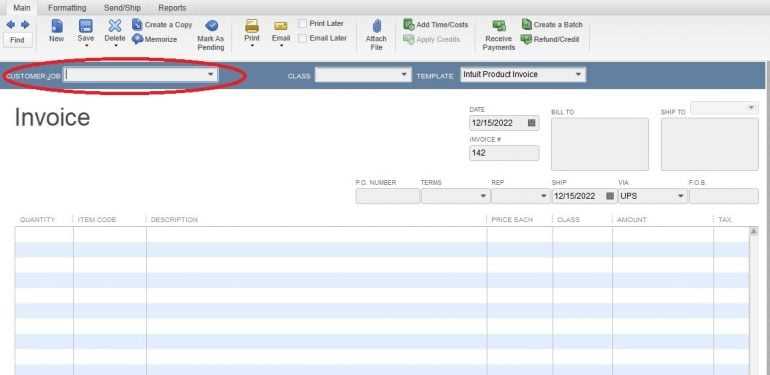

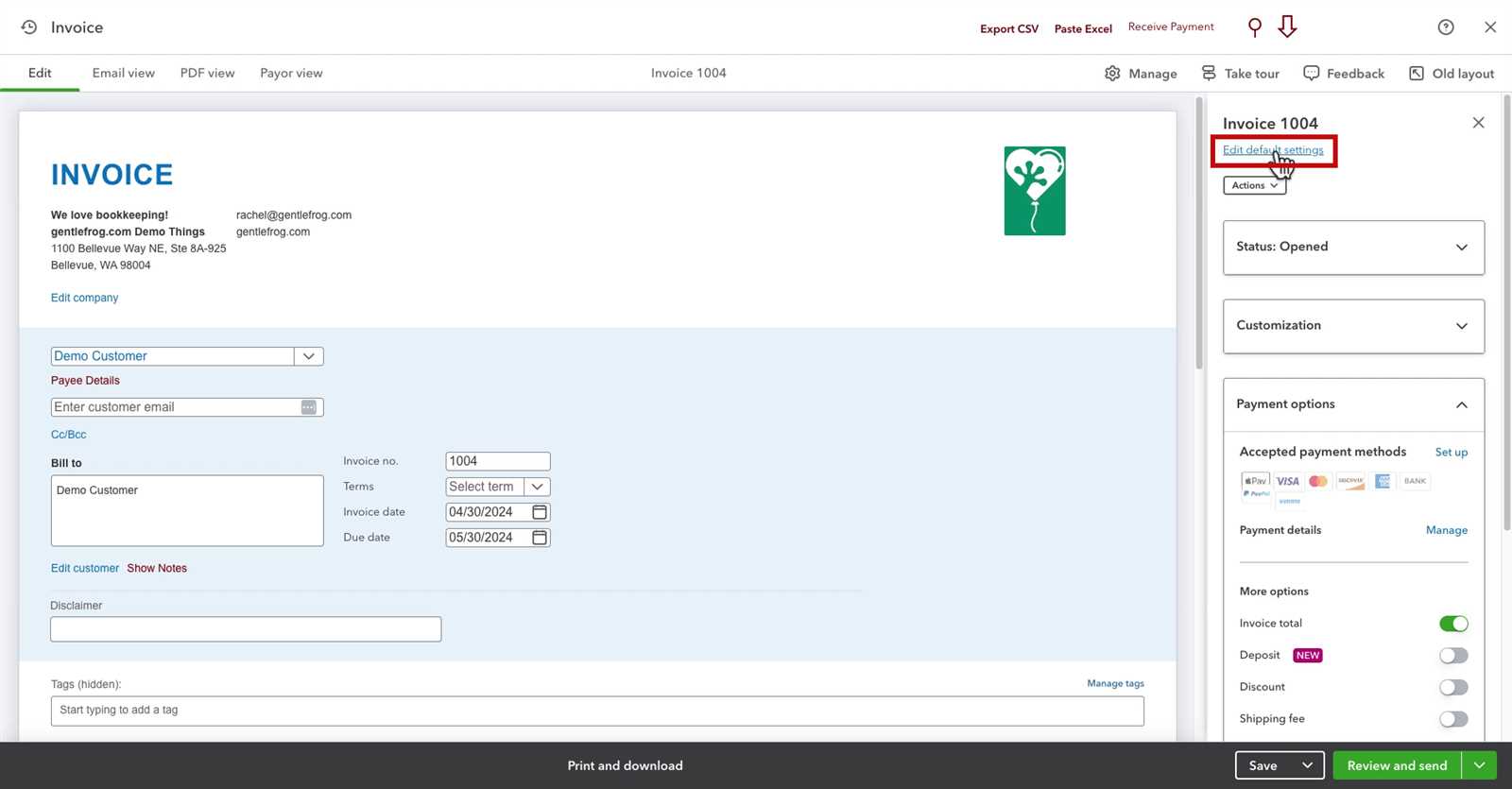

Navigating the System Dashboard

Start by logging into your account and heading to the main dashboard. Look for the section that handles financial management or document creation. This area typically houses all the necessary options for managing your business documents. From there, you can easily select and modify any available layout.

Finding the Right Section for Customization

Once in the appropriate section, look for an option related to design or form management. This will lead you to a list of pre-built layouts that you can choose from. Whether you want to create a new design or edit an existing one, the system provides a straightforward way to access and make adjustments to these layouts.

By familiarizing yourself with these steps, you can ensure that your documents are not only functional but also tailored to your specific business needs.

Understanding the Importance of Document Customization

Personalizing your business documents is more than just about aesthetics; it plays a significant role in how your brand is perceived by clients and partners. Customizing these documents allows you to add specific details that reflect your company’s identity and values. When designed thoughtfully, they not only enhance professionalism but also improve communication and streamline business processes.

Why Customization Matters

- Brand Consistency: Customization helps ensure that your documents match your company’s branding, from logo placement to color schemes, fonts, and overall style.

- Professional Appearance: A well-designed layout can create a lasting impression, helping to establish credibility and trust with clients.

- Efficiency and Clarity: Customizing fields and sections allows you to highlight important information such as payment terms, due dates, and product details, making it easier for clients to process and understand.

- Personalized Experience: Adding your company’s specific details can make your documents more relatable and tailored to your audience, showing attention to detail and customer care.

How It Impacts Your Business

Customizing your documents is not just a way to stand out but also a tool for improving efficiency and client relations. By ensuring that each document aligns with your business processes and customer expectations, you can create a more seamless experience for both parties. Moreover, streamlined communication can reduce errors, improve payment timelines, and enhance overall business operations.

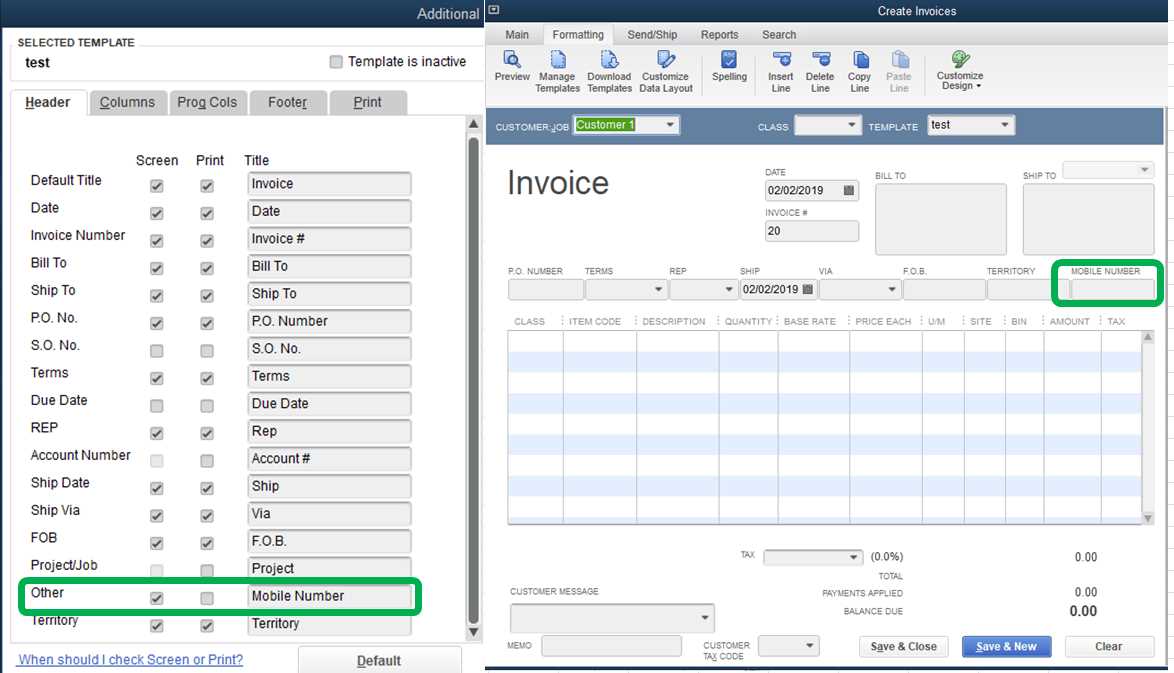

Step-by-Step Guide to Modifying Document Formats

Customizing your business documents is a straightforward process that allows you to personalize various elements such as layout, content, and style. By following a few simple steps, you can ensure that your documents align perfectly with your business needs, while also enhancing their professional appearance. This guide will walk you through the essential steps to adjust the structure and presentation of your forms, making them more effective and tailored to your company’s preferences.

Follow these steps to get started:

- Log into your account: Begin by accessing the platform where you manage your business documents. Make sure you’re logged into your account with the necessary permissions to modify forms.

- Navigate to the document management section: Once logged in, locate the section where you can manage your business forms. This is typically found under the financial or settings menu.

- Select the document format to modify: Browse through the available formats and select the one you wish to customize. You may need to choose from a list of pre-existing layouts or select the option to create a new one.

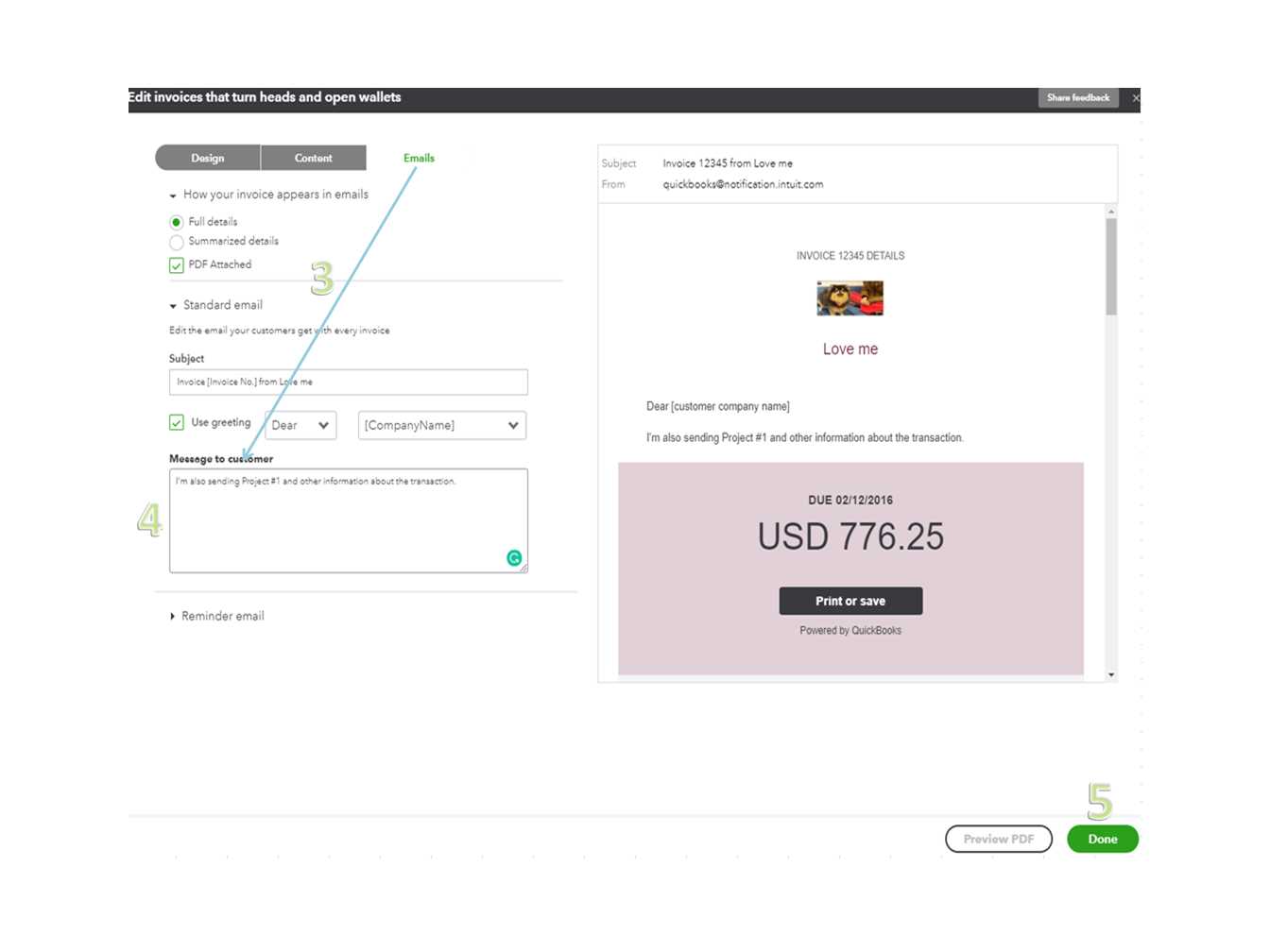

- Edit content and design: Make the necessary changes to the document’s content, such as adding fields, adjusting text size, or changing color schemes. You can also reposition elements to better suit your needs.

- Save and preview: After making your changes, save the new layout and preview it to ensure everything looks as expected. This allows you to check for any errors or misalignments before finalizing the modifications.

- Apply to future documents: Once you’re satisfied with the design, you can set it as the default layout for all new documents. This will ensure consistency for all future business interactions.

By following this simple process, you’ll be able to modify and personalize your documents with ease, enhancing both their functionality and professionalism.

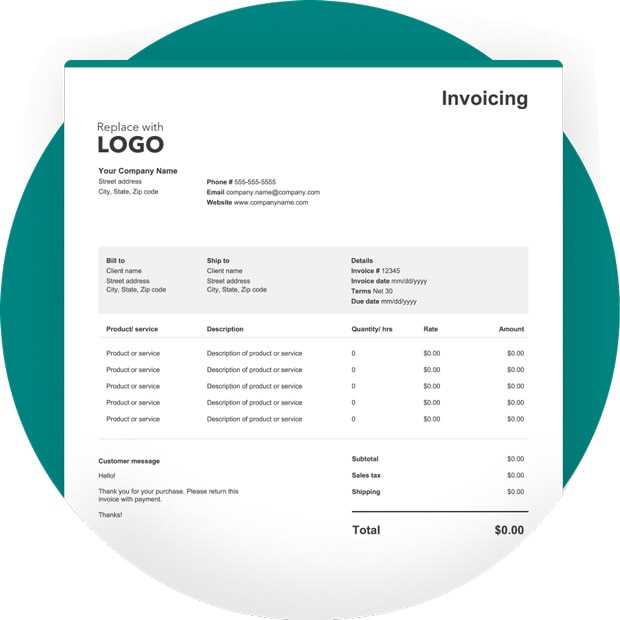

Choosing the Right Billing Document Layout for Your Business

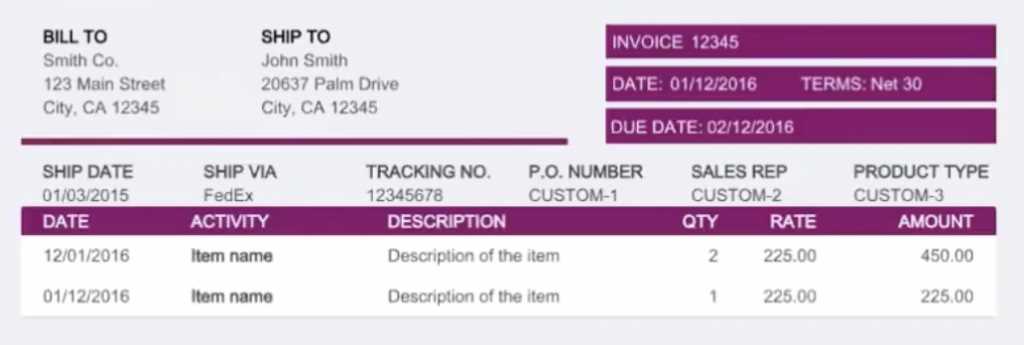

When it comes to managing business transactions, selecting the right structure for your billing documents is essential. A well-organized layout not only ensures that your clients easily understand the details but also reflects your brand’s professionalism. The right design helps highlight important information like payment terms, due dates, and services or products, making the process smoother for both you and your clients.

Factors to Consider When Selecting a Layout

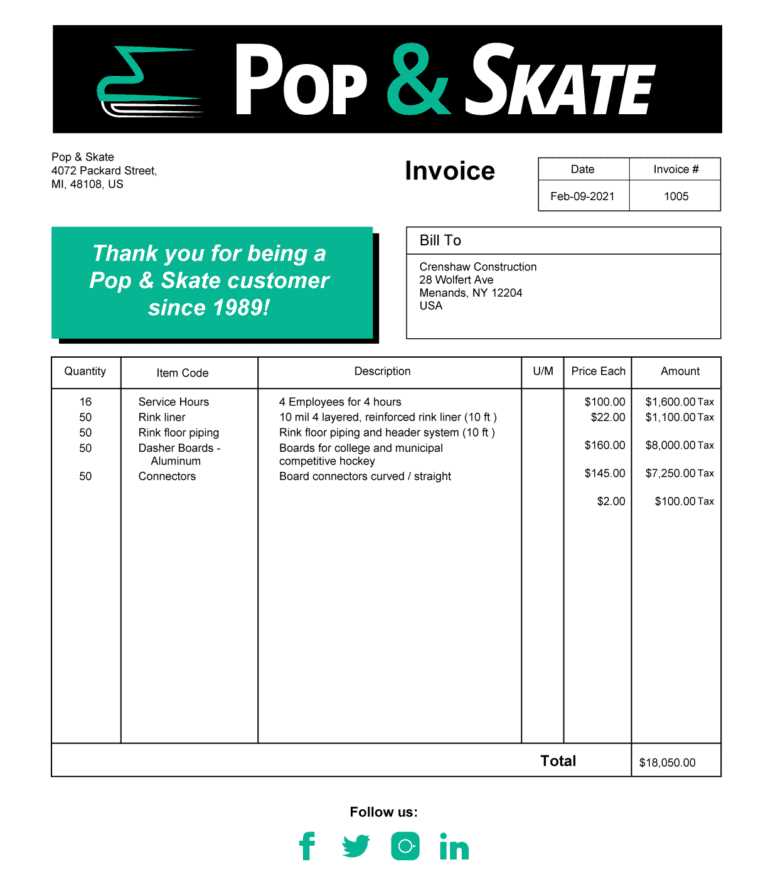

- Brand Identity: Choose a format that aligns with your company’s logo, colors, and overall branding. A consistent design helps reinforce your brand’s presence and credibility.

- Clarity and Simplicity: Select a layout that is clean and easy to read. Avoid clutter by organizing information in a logical sequence, with clear headings and sections.

- Customization Options: Ensure that the format allows you to add any relevant fields or modify existing ones. Customizable options provide flexibility as your business evolves.

- Client Preferences: Consider the type of clients you have. For example, some clients may prefer detailed breakdowns of services, while others may prefer a simple summary.

How the Right Layout Benefits Your Business

Choosing the appropriate layout not only improves communication but also reduces confusion, leading to quicker payments and fewer disputes. A well-structured document helps clients understand what they’re being charged for, how much is due, and when the payment is expected. This clarity strengthens your professional image and fosters stronger client relationships.

Adding Your Company Logo to Billing Documents

Incorporating your company’s logo into your business forms is a simple yet effective way to strengthen your brand identity. A logo serves as a visual representation of your company, making your documents instantly recognizable to clients. This small addition helps improve the professionalism of your documents while reinforcing your branding in every transaction.

Steps to Add Your Logo

- Prepare Your Logo File: Ensure that your logo is in a suitable format (such as PNG, JPG, or GIF) and is high-resolution for clarity.

- Log into Your Account: Access the platform where you manage your business forms and navigate to the section for document customization.

- Select the Document to Edit: Choose the layout you wish to modify and look for the option to add a logo or image.

- Upload Your Logo: Click on the “Upload” button and select the logo file from your computer. Make sure it fits within the designated space without being distorted.

- Position the Logo: Place the logo in an appropriate location, typically at the top of the document, where it will be clearly visible. Ensure it does not interfere with other important information.

- Save and Preview: After adding and positioning your logo, save the changes and preview the document to ensure the logo appears correctly.

Why Adding a Logo is Important

- Brand Recognition: A logo creates a lasting visual impression, making it easier for clients to identify your business.

- Professionalism: Displaying your logo adds a polished, professional touch to your forms, enhancing your company’s credibility.

- Consistency: Including your logo in all documents maintains consistency across all your communications, reinforcing your brand identity in every interaction.

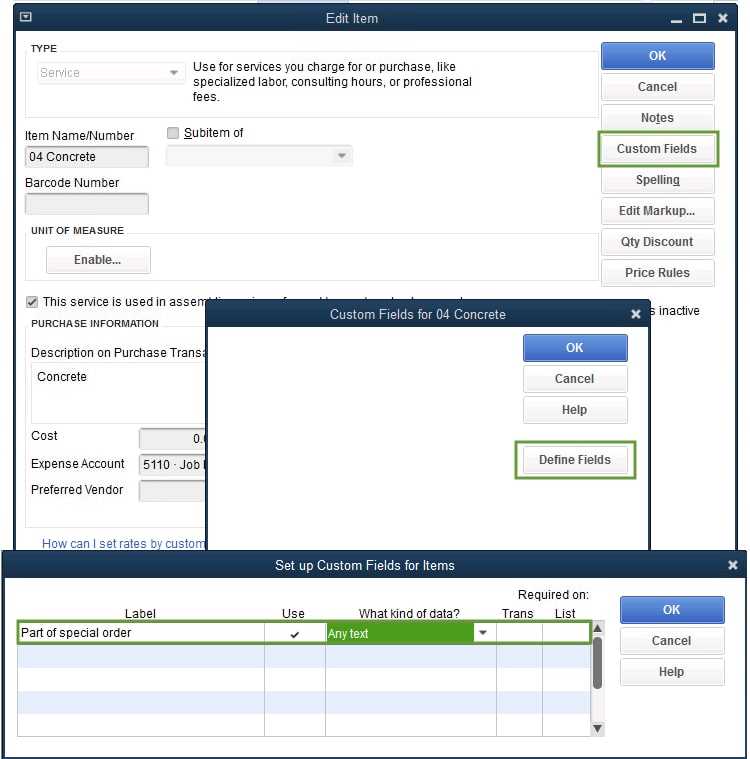

How to Modify Billing Document Fields

Customizing the fields within your business documents is essential for tailoring them to your specific needs. By adjusting these fields, you can ensure that all relevant details are captured and displayed in a way that aligns with your company’s processes. Whether you need to add new information, remove unnecessary fields, or adjust the layout, modifying the structure of these sections is a straightforward process.

Steps to Modify Fields

- Access Your Document Settings: Log in to your account and navigate to the section where you manage your business forms. Look for options related to document customization.

- Select the Document to Modify: Choose the document format you wish to update and click on the option to edit or customize it.

- Edit the Fields: Once in the editing section, you can modify existing fields, add new ones, or remove unnecessary sections. You can adjust labels, field sizes, and even the order of the information.

- Save Your Changes: After making the desired modifications, save the updated document format to apply the changes. It’s a good practice to preview the document to ensure everything is in place.

Why Modify Fields?

- Enhanced Accuracy: Adjusting fields ensures that all critical information is included and properly displayed, reducing errors and miscommunication.

- Improved Workflow: Tailoring the document layout to your specific needs allows for a smoother and more efficient process when creating and sending forms.

- Better Client Experience: Customizing the details helps clients better understand the document and its contents, leading to fewer questions or misunderstandings.

Best Practices for Billing Document Date Formatting

Properly formatting dates in your business documents is essential for clarity and consistency. A well-organized date format ensures that clients and partners can easily identify important timelines, such as when a payment is due or when a service was provided. Choosing the right format not only enhances the professional appearance of your documents but also avoids confusion, especially when dealing with international clients who may have different date conventions.

Key Considerations for Date Formatting

- Use a Standard Format: Choose a consistent date format that is easy to understand. The most common formats are MM/DD/YYYY or DD/MM/YYYY. However, YYYY-MM-DD is increasingly popular for its clarity in digital systems.

- Include Full Date Information: Always provide the full date, including the year, to avoid ambiguity. For example, use “March 5, 2024” rather than “3/5/24” to make it clear which century the date refers to.

- Be Mindful of Time Zones: If you’re working with clients in different time zones, it may be useful to include the time zone along with the date, especially if the document is related to a time-sensitive issue.

- Avoid Abbreviations: While it’s tempting to abbreviate months or days of the week, it’s better to spell them out to ensure clarity, especially in international contexts.

Why Correct Date Formatting Matters

- Reduces Errors: A clear and consistent date format minimizes the risk of misunderstandings regarding deadlines and payment schedules.

- Improves Professionalism: Proper date formatting reflects attention to detail and shows clients that you take your business processes seriously.

- Enhances Clarity: A correctly formatted date makes it easier for your clients to track important dates, avoiding confusion and ensuring that both parties are aligned on expectations.

Updating Payment Terms and Due Dates

Adjusting the payment conditions and due dates in your business documents is a critical task to ensure clear communication with clients. Properly setting these terms helps define expectations for both parties, ensuring timely payments and reducing the risk of misunderstandings. Whether you’re offering flexible payment options or setting strict deadlines, customizing these elements is essential for maintaining smooth financial operations.

How to Modify Payment Terms

- Set Clear Payment Deadlines: Specify the exact date by which payment should be made. Common options include “Due Upon Receipt,” “Net 30,” or “Net 60,” depending on your business model and client relationships.

- Offer Early Payment Discounts: To encourage quicker payments, consider offering a discount for early settlement. For example, “2% discount if paid within 10 days” is a popular choice.

- Define Late Fees: If you charge penalties for late payments, ensure this is clearly stated in your payment terms. This encourages timely payments and prevents delays.

Adjusting Due Dates for Flexibility

- Provide Flexibility When Needed: Some clients may need more time to settle their accounts. Offering extended due dates or customized payment schedules can help build stronger relationships without compromising your cash flow.

- Adjust for Holidays or Weekends: If the due date falls on a public holiday or weekend, adjust the date to the next business day. This ensures that clients aren’t penalized for delays beyond their control.

- Automate Payment Reminders: Setting up automatic reminders before the due date can help ensure payments are received on time, reducing the need for follow-up communication.

By refining the payment terms and due dates, you can streamline your billing process, improve client relations, and ensure more predictable cash flow for your business.

Customizing Your Billing Style and Colors

Adjusting the overall design and color scheme of your business documents is an effective way to reinforce your brand identity and create a professional, polished appearance. A well-designed layout can make a strong first impression, enhance readability, and make your documents stand out in the client’s inbox. Customizing the style and colors of your forms helps communicate your company’s values and personality while maintaining a clear and consistent message.

Choosing the Right Design Elements

When customizing the style of your business documents, it’s important to choose elements that reflect your brand and ensure easy readability. These elements include font styles, header arrangements, and overall layout. Here are some key points to consider:

- Consistent Branding: Use colors, logos, and fonts that align with your brand’s visual identity. This helps create a cohesive experience for your clients and reinforces your professional image.

- Clear Layout: Ensure the document is easy to read with a well-organized layout. Avoid cluttering the page and leave space for essential details such as dates, amounts, and payment terms.

- Highlight Important Information: Use bold or different colors to make key details, like amounts owed or due dates, stand out. This can help your clients focus on the most critical information.

Setting the Color Scheme

Colors play a significant role in setting the tone and mood of your documents. Below is a simple guide to help you choose a color scheme:

| Color | Impact | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Blue | Associated with trust and professionalism. Ideal for businesses that want to convey reliability. | |||||||||||

| Green | Represents growth, stability, and harmony. Perfect for eco-friendly or financial services. | |||||||||||

| Red | Conveys urgency or action. Good for highlighting important deadlines or offers. | |||||||||||

| Black | Classic and sophisticated. Often used for formal or high-end businesses. | |||||||||||

Orange

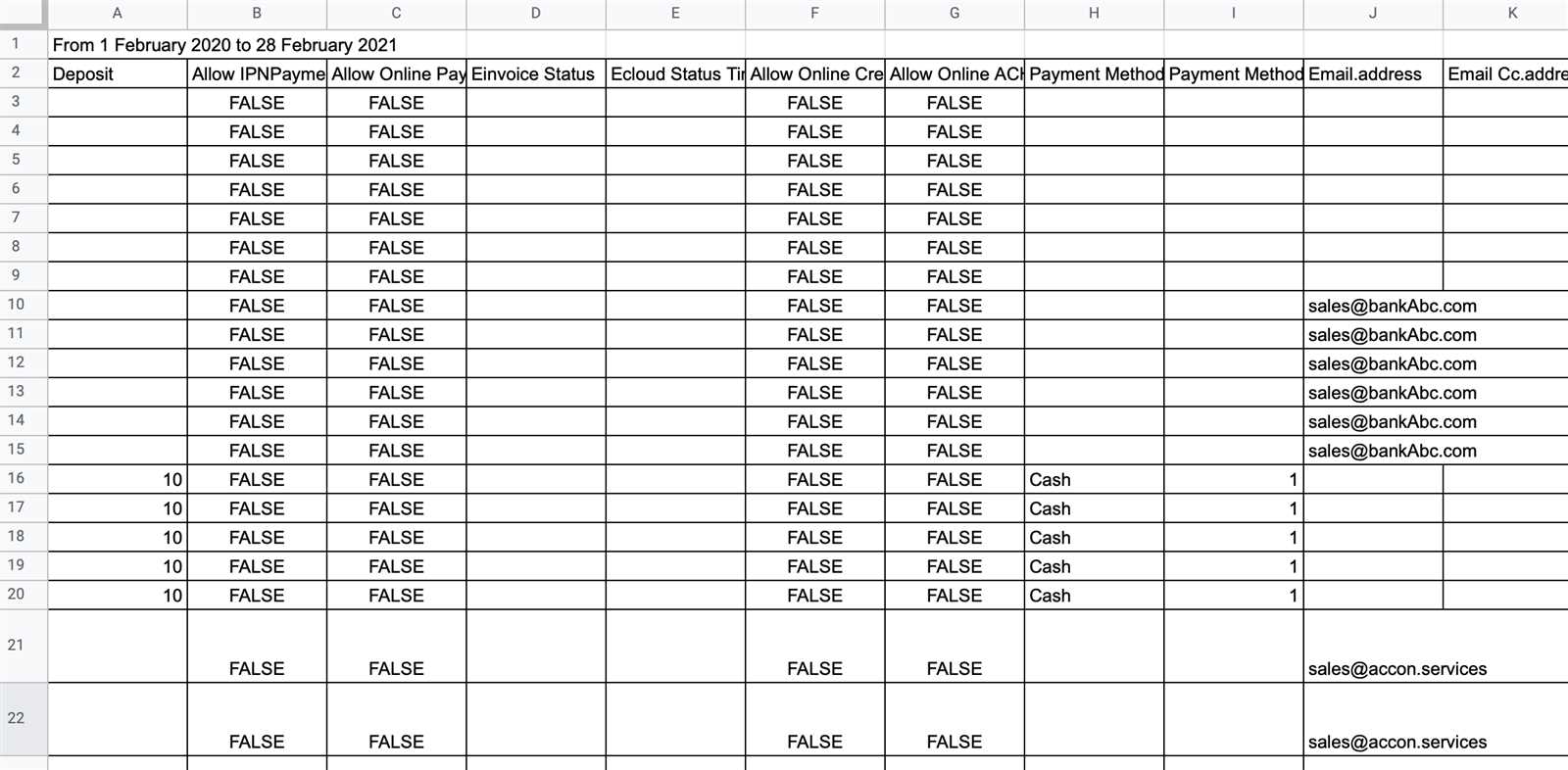

Saving Multiple Document VersionsMaintaining different versions of your business forms allows you to easily tailor documents for various clients, projects, or needs. By saving multiple versions, you can ensure that each document reflects the specific requirements or branding preferences, without having to redesign the layout every time. This flexibility is essential for businesses that need to manage multiple accounts or offer customized options to their clients. Why Save Multiple Versions?

Saving various document styles provides several advantages for businesses, particularly when handling diverse clients or different types of transactions. Here are some key reasons why having multiple versions is beneficial:

How to Save Different VersionsHere’s a simple process for saving and managing multiple versions of your documents:

By following these steps, you can efficiently manage and save multiple docume How to Test Your Updated DesignOnce you’ve made changes to your document layout, it’s crucial to ensure everything works as expected before sending it to clients or using it for business transactions. Testing helps identify any potential issues such as formatting errors, misplaced fields, or incorrect information. This step guarantees that the final document looks professional and is fully functional for its intended purpose. Why Testing Is ImportantTesting your design ensures that all elements are positioned correctly, that the document is clear and legible, and that no details are overlooked. Without proper testing, small mistakes can lead to misunderstandings or client dissatisfaction. Here’s why you should test your design:

Steps to Test Your DesignFollow these steps to properly test your document before using it in real transactions:

By thoroughly testing your Linking New Designs to Client AccountsOnce you’ve created a new document layout, the next step is to associate it with the appropriate client accounts. This ensures that whenever you generate a document for a particular client, it reflects the correct branding, structure, and necessary information. Properly linking these designs can streamline your process, saving you time and reducing the risk of sending incorrect or outdated formats. Why Linking Is EssentialConnecting new designs to client accounts ensures that each client receives a tailored document according to their preferences or business requirements. It also allows for better consistency across all communications, ensuring that your business maintains a professional appearance. Here are some reasons why linking is important:

Steps to Link a New Design to a Client AccountFollow these steps to connect your newly created layout to client accounts:

By linking new designs to client accounts, you ensure that all future documents will be generated with the correct layout, saving time and avoiding errors. This also helps in maintaining a professional and consistent appearance with every communication sent out to clients. Setting Default Document Layout for New Entries

Configuring a default design for your new records ensures that every new transaction automatically uses the preferred structure and style. This approach helps maintain consistency across your communications, saves time, and reduces the need for manual adjustments. By setting a default, you streamline the process and avoid the risk of forgetting to apply the correct layout for each new entry. Why Set a Default Layout?Establishing a default design for all new entries offers several key advantages:

Steps to Set a Default DesignTo set a default design for new entries, follow these simple steps:

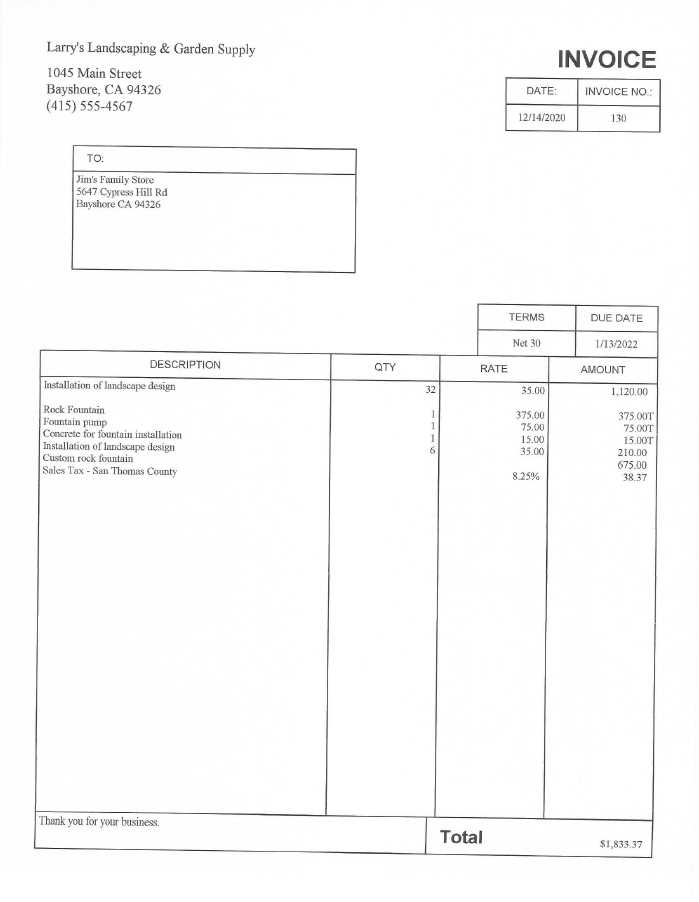

By following these steps, you can ensure that every new entry is automatically formatted according to your chosen layout. This setup will help you maintain consistency and professionalism in your transactions, while also saving you valuable time in the long run. Why Use QuickBooks Online for InvoicingUtilizing an efficient system for generating and managing payment requests can significantly enhance your business operations. A cloud-based solution offers several advantages, including seamless integration with accounting functions, automation, and ease of access from anywhere. These features streamline your processes and help maintain accuracy in financial tracking and communication. Flexibility and Convenience With a cloud-based platform, you can create and send payment requests from any device with internet access. Whether you are in the office, at home, or on the go, you can ensure your records are up to date without the need for additional software installations or complicated setups. This flexibility saves time and allows you to manage tasks efficiently from any location. Automation Features One of the key benefits of using a cloud-based solution is the automation capabilities. You can schedule recurring transactions, set reminders for overdue payments, and generate customized records with minimal manual input. This automation reduces human error and increases consistency, allowing you to focus more on core business activities. Real-Time Updates and Access Cloud-based systems provide real-time data synchronization, ensuring that all changes are instantly reflected across all devices. This immediate access to updated information ensures that your financial records remain accurate and up-to-date, allowing for better decision-making and smoother operations. Customization and Integration The ability to customize the structure and content of your payment requests ensures that they align with your company’s branding and professional image. Additionally, these systems integrate with other business tools, such as accounting software, bank accounts, and payment gateways, making it easier to track and manage transactions. Incorporating a cloud-based solution for payment management not only simplifies the process but also improves accuracy, efficiency, and accessibility. These features make it an excellent choice for businesses looking to streamline their financial workflows while maintaining a professional image. Fixing Common Invoice Template ErrorsWhile creating and managing payment request layouts, it’s common to encounter issues that may hinder the smooth flow of your business operations. These errors can range from formatting inconsistencies to incorrect data fields, affecting both the appearance and functionality of your documents. Identifying and fixing these issues promptly can help maintain a professional image and avoid any misunderstandings with clients. 1. Misaligned or Inconsistent Formatting

One of the most frequent issues faced when working with customized document layouts is misalignment in text, numbers, or fields. This can occur when different sections don’t align properly, or when there’s inconsistency in font sizes or styles.

2. Missing or Incorrect Data Fields

Another common issue is missing or incorrectly populated fields, such as customer names, addresses, or payment details. This can be caused by incorrect data mapping or accidental deletion of essential fields.

3. Inconsistent Branding and DesignConsistency in branding is key to maintaining a professional appearance. Issues can arise when the design elements, such as logos, colors, and fonts, aren’t uniform across your documents.

4. Incorrect Date and Payment TermsAnother error often found in payment request layouts is incorrect dates or terms, which can cause confusion for clients and potential delays in payments.

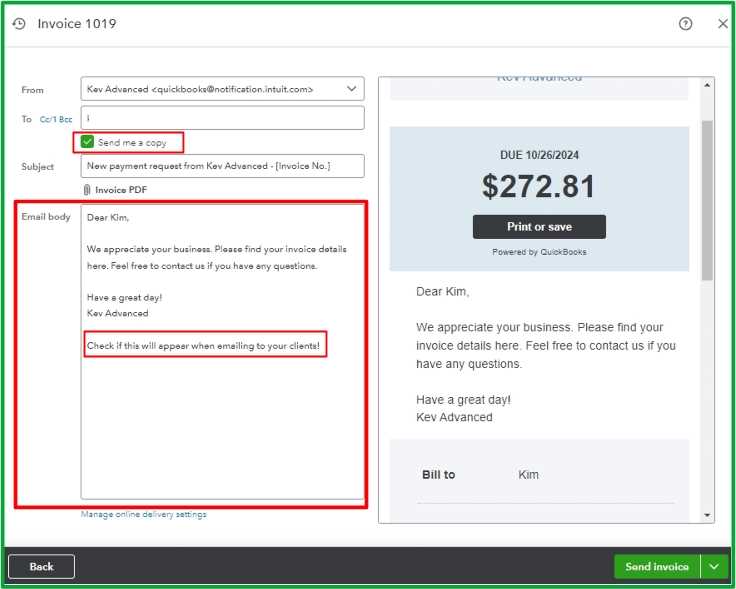

By addressing these common errors, you can ensure that your payment request documents are accurate, professional, and easy to understand. Taking the time to review and fix these issues can help strengthen relationshi How to Share and Export InvoicesOnce your billing documents are prepared, the next step is to share or export them for further use. Whether you’re sending the documents to clients or transferring them to external accounting systems, knowing how to easily share and export these files is essential for efficient business management. In this section, we’ll explore the various methods to share and export your financial documents seamlessly. 1. Sharing Documents via EmailEmail is one of the most common ways to send completed documents to clients. Most platforms allow you to send a document directly through email with just a few clicks. This method is convenient and ensures that your clients receive the document quickly and securely.

2. Exporting Documents to Different File FormatsAnother useful method is exporting documents in a variety of formats, such as PDF, Excel, or CSV. This is especially helpful when you need to keep a digital copy for records or send the documents in a format that is more convenient for the recipient. Exporting also allows you to integrate the data with other software or systems for accounting or reporting purposes.

3. Using Cloud Storage for Easy Access

Cloud storage platforms allow you to store your documents in a secure, accessible location, making it easy to share them with clients or colleagues. By storing your documents in the cloud, you can also access them from multiple devices and ensure they are al Tips for Streamlining Your Invoice ProcessEfficiently managing your billing workflow is essential for maintaining cash flow and minimizing administrative workload. By optimizing certain aspects of the process, you can ensure faster processing times, fewer errors, and improved client satisfaction. Here are some key strategies to help streamline your billing procedures and save valuable time. 1. Automate Recurring PaymentsFor clients with regular billing cycles, consider automating the payment process. Setting up recurring payments for subscriptions or regular services can reduce the need for manual entries, ensuring that payments are processed on time without needing frequent intervention.

2. Use Pre-Filled DetailsBy pre-filling common fields such as client names, addresses, and payment terms, you can speed up the creation of each billing document. Storing frequently used information in a central database eliminates the need to re-enter it every time, minimizing data entry errors and saving time.

3. Simplify Payment MethodsOffering multiple payment options can make it easier for clients to pay promptly. Consider integrating online payment gateways, which allow clients to pay via credit cards, bank transfers, or other digital methods. Providing a variety of options can reduce delays and improve payment compliance.

4. Set Clear Payment TermsEnsure that your payment terms are clear and easy to understand. Including specific due dates, late fees, and payment methods can help prevent confusion and encourage timely payments. Being transparent with your clients about when payments are expected fosters better relationships and reduces payment delays.

|