University Invoice Template for Efficient and Professional Billing

Managing financial transactions within educational organizations requires precise documentation and clear communication. Having a structured approach to billing ensures smooth operations, enhances professionalism, and minimizes errors. Whether you’re handling tuition fees, research costs, or administrative charges, using a well-organized system can save time and reduce misunderstandings.

With the right tools, institutions can streamline their accounting practices, making the process faster and more reliable. This approach not only simplifies record-keeping but also ensures that all involved parties understand their financial obligations. A consistent method also helps maintain transparency, building trust between educational bodies and students or service providers.

By utilizing customizable formats and following best practices, it’s possible to create clear, concise, and legally compliant documents. This guide will explore the essential components of a billing document, offering helpful tips for creating the most efficient and accurate records possible.

University Invoice Template Overview

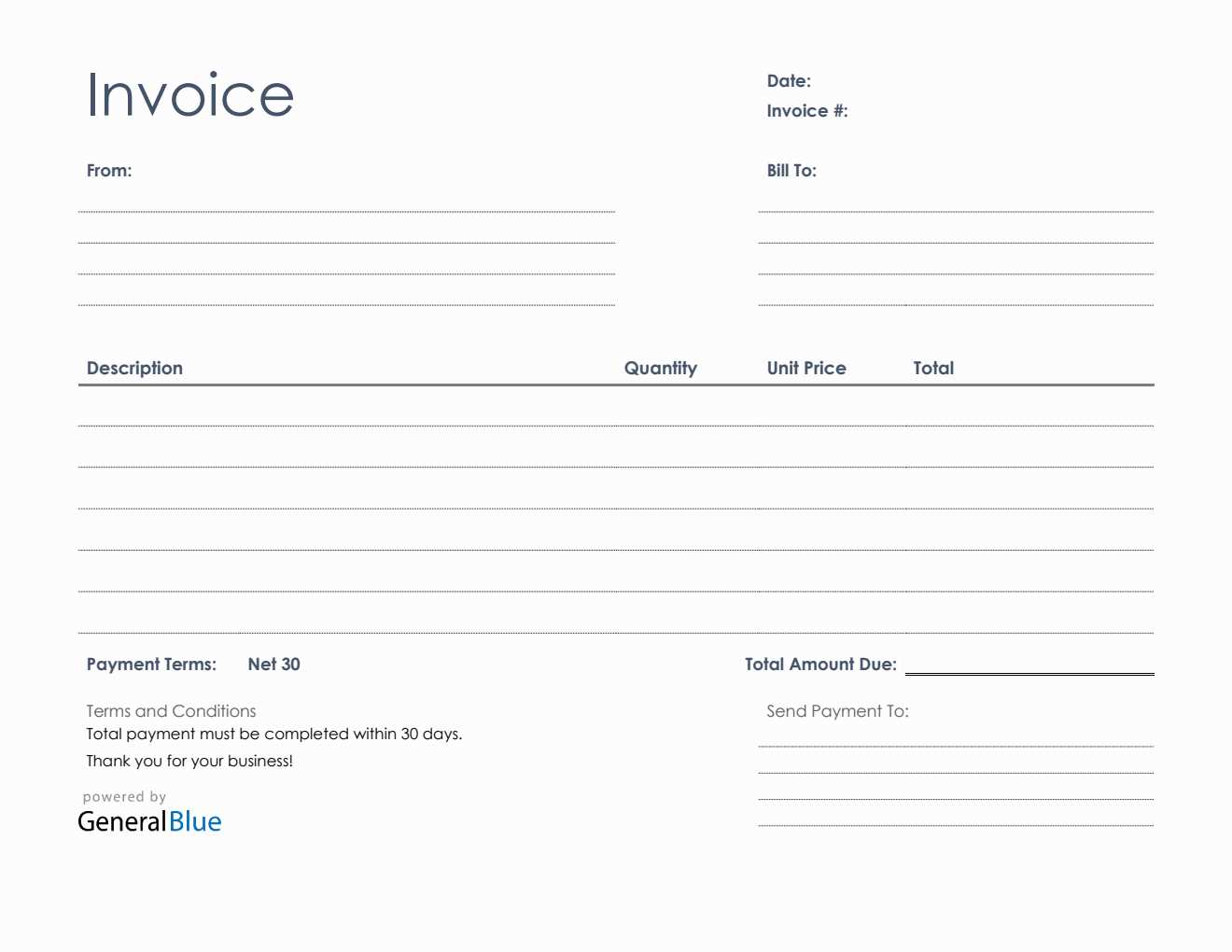

When managing financial transactions within an educational institution, having a well-structured document is crucial. This document serves as an official record of the amounts owed for services, tuition, or other fees, ensuring clarity and accountability. A properly designed form allows both the sender and the recipient to easily understand the financial terms and details, reducing the risk of errors or disputes.

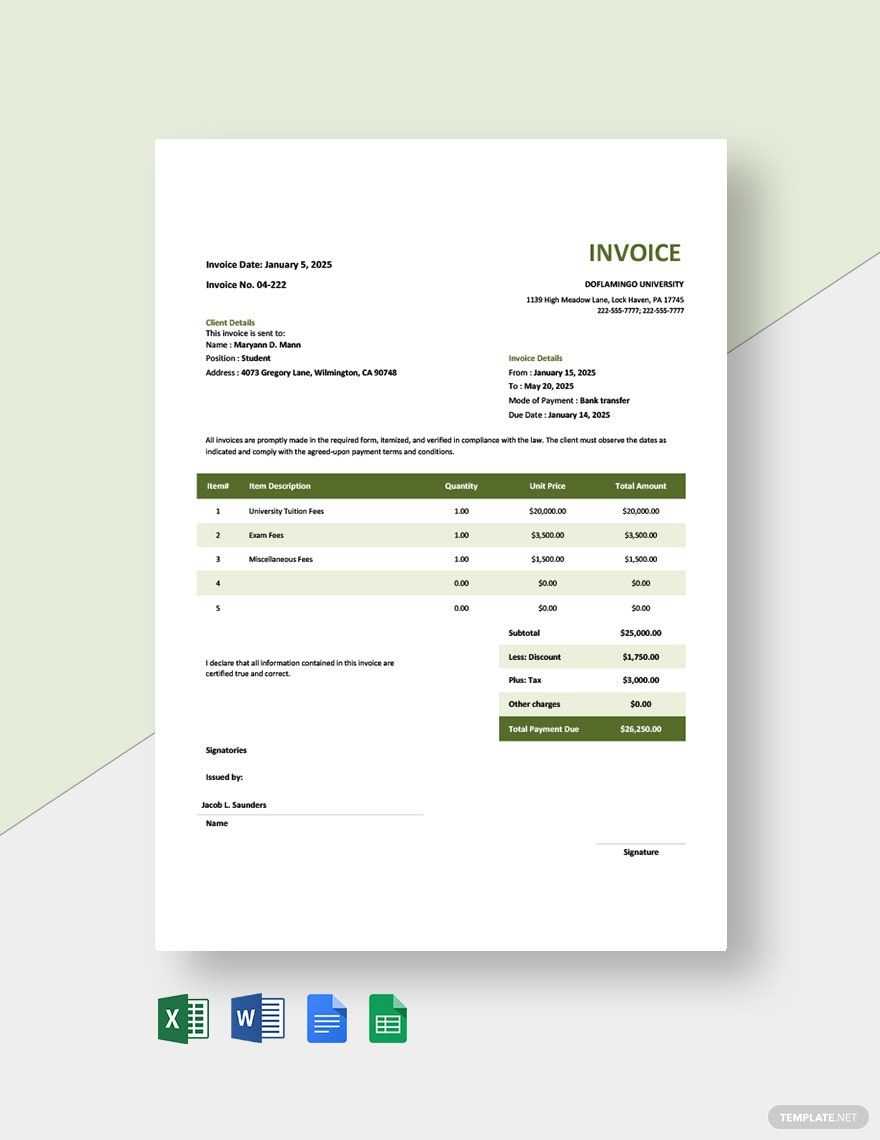

There are several key elements that contribute to an effective financial record. A clear breakdown of charges, payment terms, and due dates are just the beginning. Customizable features can further enhance the document, ensuring that it aligns with the specific needs of the institution and the services provided. Below, we explore the essential components of a well-organized financial document.

Essential Components of a Financial Document

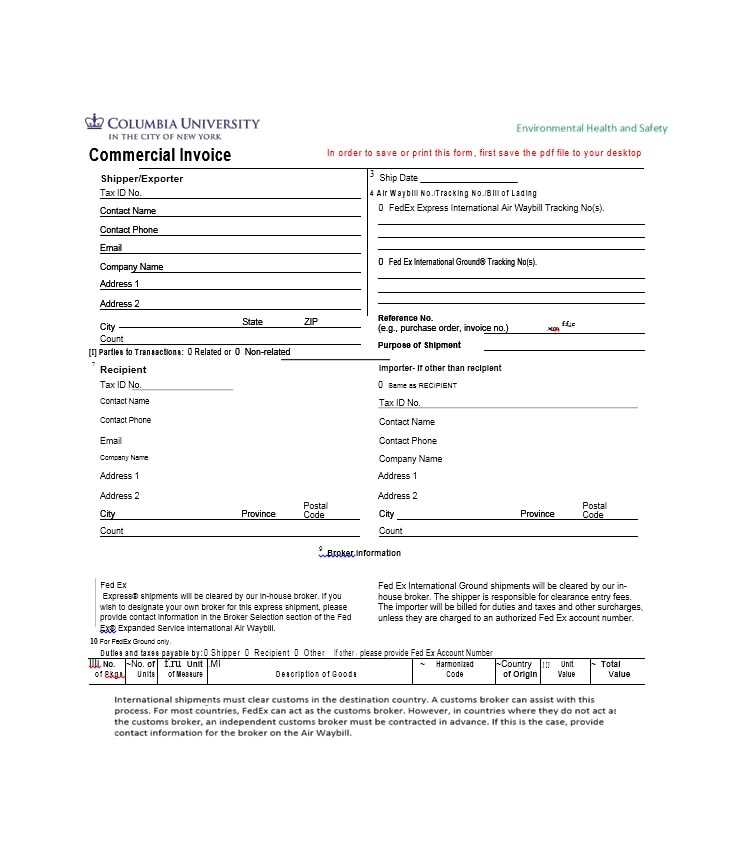

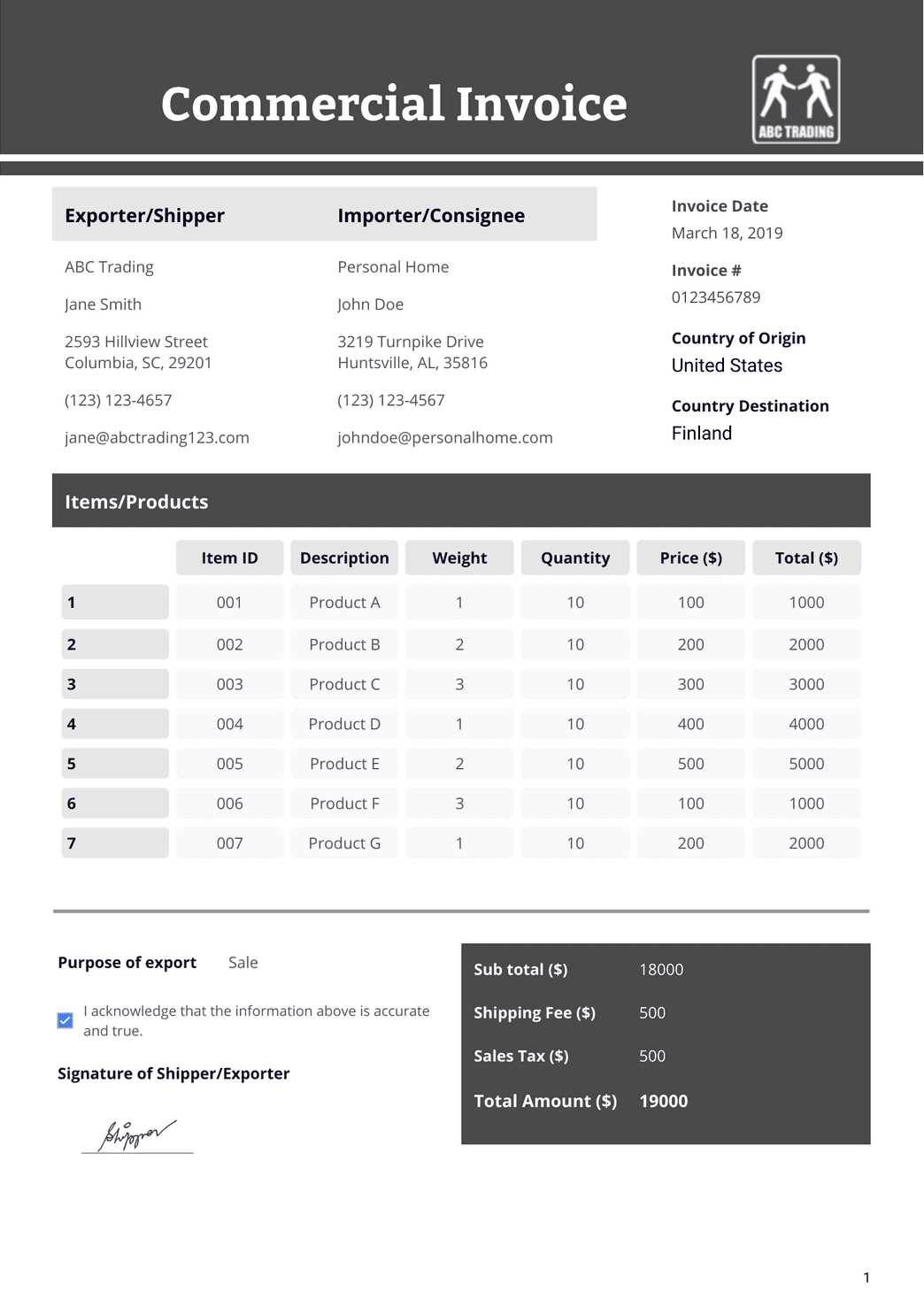

The most important sections of a billing document include the date, a unique reference number, the contact information of both parties, and a detailed description of the services rendered. This level of transparency is vital for both the institution and the recipient, ensuring that the financial relationship remains professional and clear.

Customization for Different Use Cases

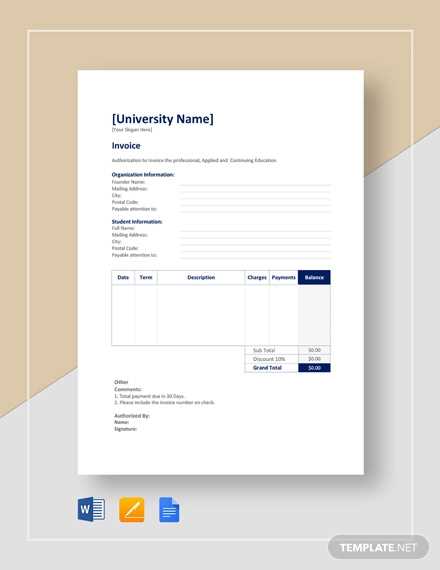

Every institution may have unique billing needs, from different fee structures to varying payment schedules. Customizable documents make it easy to accommodate these differences, allowing for flexibility in how information is presented. Whether it’s adjusting the layout or adding specific fields, the ability to modify the format ensures that it serves the institution’s specific purpose effectively.

Why Universities Need Invoice Templates

Educational institutions handle a wide range of financial transactions on a daily basis, from tuition fees to administrative charges and research costs. To ensure smooth operations and maintain accurate records, a standardized method of documenting these transactions is essential. Without a consistent system, the likelihood of errors, delays, and confusion increases, leading to potential financial disputes and inefficiencies.

Having a structured format for billing provides numerous benefits. It streamlines the process of charging for services, helps with tracking payments, and ensures compliance with legal and financial regulations. By using a clear and concise system, institutions can avoid ambiguity, prevent miscommunication, and improve their overall accounting practices.

Furthermore, a professional and organized document helps build trust and transparency with students, faculty, and service providers. It shows that the institution takes its financial processes seriously and values clear communication. This is particularly important for maintaining positive relationships and avoiding any misunderstandings related to payments.

Key Features of a University Invoice

An effective financial document must include certain elements to ensure clarity, professionalism, and accuracy. These features not only help in keeping track of charges but also provide a structured way for both the educational institution and the recipient to review the details of the transaction. From identifying the parties involved to outlining payment terms, each component plays a critical role in smooth financial operations.

Essential Information to Include

The most basic but crucial features include the contact details of both the sender and the recipient, the date of the transaction, and a unique reference number. These elements make it easier to track payments and ensure that each document is clearly identifiable for record-keeping. Along with this, a detailed breakdown of the charges helps recipients understand exactly what they are paying for, whether it’s tuition, accommodation, or other fees.

Payment Terms and Deadlines

Another key aspect of a well-structured financial document is the inclusion of payment terms and deadlines. These details outline when the payment is due, any late fees that may apply, and the available methods of payment. Having these terms clearly stated ensures that there are no misunderstandings and that the payer is fully aware of their financial obligations. It also helps the institution maintain consistent cash flow by setting clear expectations for payment timing.

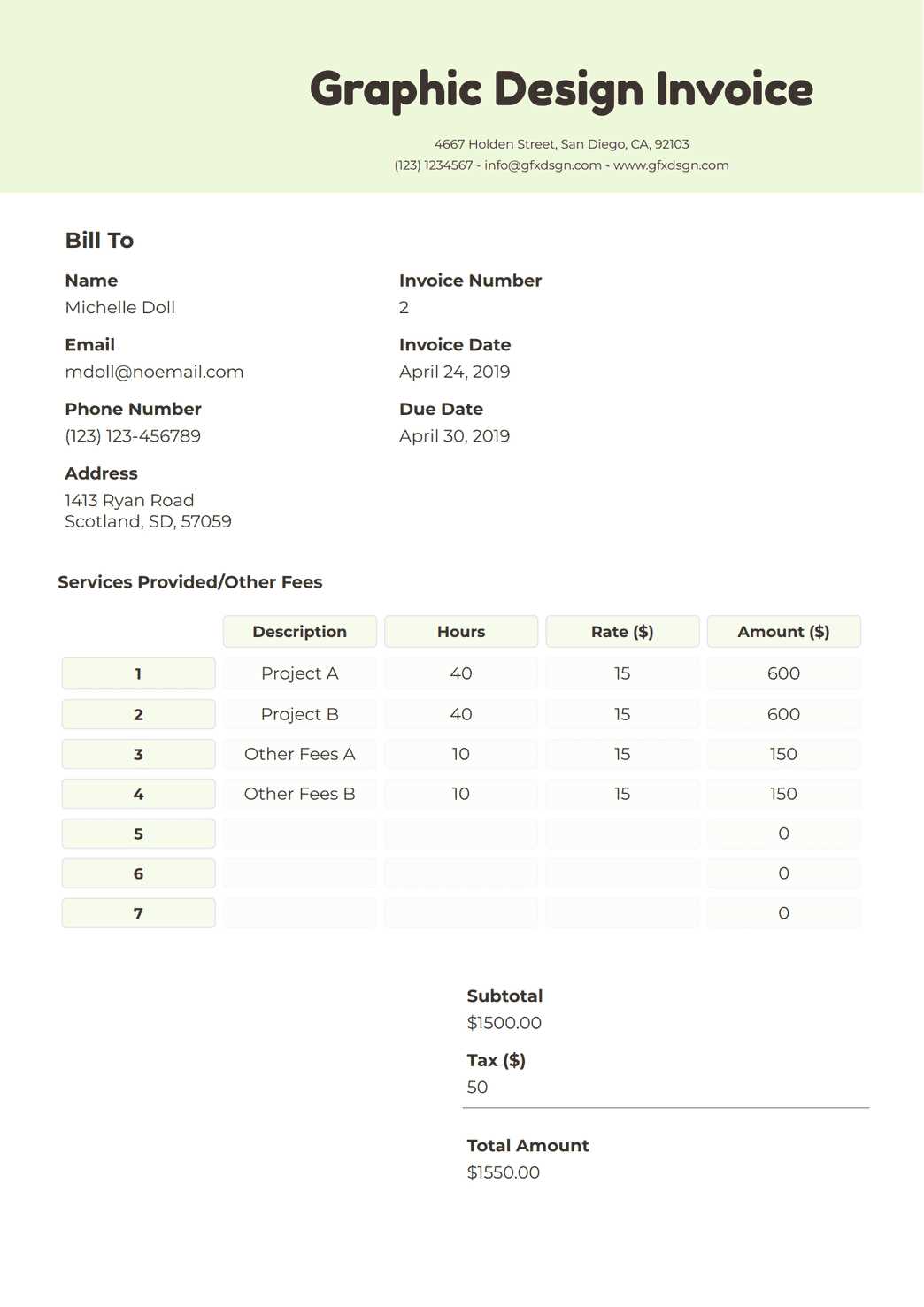

How to Customize Your Invoice Template

Creating a personalized financial document allows you to tailor it to the specific needs of your institution or organization. Customization ensures that the document reflects your branding, includes all necessary information, and adheres to any legal or regulatory requirements. Adjusting key sections such as layout, content, and formatting can make the process of billing more efficient and aligned with your institution’s practices.

Adjusting Layout and Design

The layout of your financial document is one of the first things that should be customized. Make sure the structure is easy to follow, with clearly defined sections for contact details, payment breakdown, and due dates. Using your institution’s official colors, logos, and fonts can help make the document look professional and consistent with your branding. Keep the design simple and clean, ensuring that important information stands out.

Adding Custom Fields and Information

Depending on your specific needs, you may want to include custom fields to capture additional information. For instance, adding a “course code” or “department name” field can help categorize charges. You can also create sections for various discounts, special fees, or payment plans, ensuring that every possible charge is accounted for. Flexibility in these areas ensures that the document can handle different billing scenarios without needing a complete redesign.

Common Mistakes to Avoid in Invoices

While creating financial documents may seem straightforward, several common errors can easily occur, leading to confusion, payment delays, or even legal issues. Avoiding these mistakes is essential for maintaining smooth transactions and ensuring that both parties involved have clear expectations. Below are some of the most frequent errors made when preparing billing documents and how to avoid them.

- Missing or Incorrect Contact Information: Failing to include or inaccurately listing the contact details of both the institution and the recipient can lead to communication issues. Always double-check that the names, addresses, and phone numbers are up to date.

- Omitting Important Dates: Without a clear issue date and due date, there can be confusion about when payments are expected. Always specify the date the document was issued and the exact deadline for payment.

- Unclear Payment Terms: If payment instructions and deadlines are vague, it can cause misunderstandings. Clearly outline the terms, including accepted methods of payment, any late fees, and penalties for non-payment.

- Failing to Itemize Charges: A lump sum without a detailed breakdown of services or fees may confuse the recipient. Always list the charges clearly with descriptions, quantities, and amounts for transparency.

- Not Including a Unique Reference Number: Without a unique reference number, tracking payments and resolving discrepancies can become difficult. Always assign a distinct number to each document.

- Incorrect Calculations: Simple math errors can be costly. Always double-check totals, tax calculations, and discounts to ensure they are accurate before sending out the document.

By paying attention to these potential pitfalls, you can create a more efficient and professional document, ensuring that both the educational institution and the recipient have a clear understanding of the transaction.

Benefits of Using a Professional Invoice

Utilizing a professionally designed financial document offers numerous advantages for both the sender and the recipient. It ensures that transactions are clear, organized, and easily traceable, while also enhancing the credibility of the institution or organization. A polished, well-structured document can simplify payment processing and foster stronger relationships between the parties involved.

Improved Accuracy and Transparency

One of the most important benefits of using a professional format is the accuracy it provides. Clear itemization of services and charges prevents confusion and errors, making it easy for recipients to understand exactly what they are paying for. This level of transparency reduces the likelihood of disputes and promotes trust between the institution and its clients or students.

Enhanced Professionalism

A carefully crafted document reflects the professionalism and attention to detail of the organization. It helps establish a formal tone and demonstrates that the institution values its financial transactions. This not only makes a positive impression on recipients but also sets a standard for how business is conducted, promoting consistency across all communications.

Additionally, using a professional design ensures that your documents are visually appealing and easy to navigate. A well-organized format helps recipients quickly find key details like payment terms, due dates, and totals, streamlining the entire billing process.

How to Include Payment Terms in Invoices

Including clear payment terms in financial documents is crucial for ensuring that both parties understand the expectations around timing and methods of payment. By specifying the agreed-upon conditions, you can avoid confusion and help maintain positive relationships. Well-defined terms also encourage timely payments and reduce the risk of disputes over money.

Key Elements to Specify

When outlining payment terms, it’s important to include several key details. First, clearly state the due date for the payment, making it evident when the balance is expected to be settled. You should also mention the accepted methods of payment, such as bank transfers, credit cards, or checks. This eliminates any ambiguity and allows the recipient to choose the most convenient option.

Late Fees and Discounts

Another essential aspect of payment terms is addressing late fees and early payment discounts, if applicable. Specify the penalty for overdue payments, including the interest rate or flat fee that will be applied after the due date. On the flip side, if your institution offers discounts for early payments, this should also be clearly outlined, providing an incentive for prompt settlement of accounts.

Essential Information for University Invoices

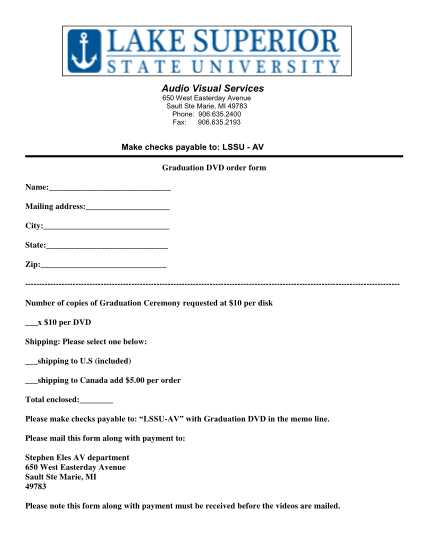

When preparing a financial document for an educational institution, it’s crucial to include specific details to ensure the transaction is clear and professional. Accurate and complete information not only helps to avoid confusion but also ensures that both the institution and the recipient have a solid understanding of the charges and payment expectations. Below are the most important elements to include in a billing record.

Key Components to Include

- Contact Information: Always include the full contact details of both the sender (institution) and the recipient. This should include names, addresses, phone numbers, and email addresses to ensure easy communication in case of questions or issues.

- Reference Number: A unique reference or identification number helps to track and differentiate each transaction. This makes it easier to locate and resolve any discrepancies.

- Date of Issue and Due Date: The issue date marks when the document was created, while the due date indicates when the payment should be made. Both are crucial for setting expectations regarding payment timelines.

- Detailed Breakdown of Charges: A thorough itemization of services provided or fees charged allows recipients to understand exactly what they are paying for. This could include tuition, accommodation, administrative fees, or other services.

- Amount Due: The total amount due should be clearly highlighted. Any applicable taxes, discounts, or adjustments should also be indicated, showing how the final amount is calculated.

- Payment Terms and Methods: Clearly specify when and how payment should be made. Include accepted payment methods (e.g., bank transfer, credit card) and any late fees or discounts for early payments.

Additional Considerations

Depending on the nature of the charges, you may also need to include additional information such as course codes, department names, or specific project details. Customizing the document with these extra fields ensures that all relevant information is captured and prevents any ambiguity.

Best Practices for Sending Invoices

Sending billing documents correctly is just as important as creating them. Timeliness, accuracy, and professionalism play a crucial role in ensuring prompt payments and maintaining a good relationship with the recipient. By following established best practices, you can ensure that your financial records are processed efficiently and without issues.

Key Tips for Sending Financial Documents

- Send Early: It’s always best to send financial records as soon as possible after the service is provided or the charge is incurred. This gives the recipient enough time to review the details and make the payment before the due date.

- Double-Check for Accuracy: Before sending, make sure all the details are correct. Verify amounts, dates, recipient information, and any discounts or additional charges. Sending an incorrect document can delay payments and lead to confusion.

- Choose the Right Delivery Method: Depending on your relationship with the recipient, choose the appropriate delivery method–email, postal mail, or even via an online payment system. Email is the quickest, but make sure to follow up with a physical copy if necessary.

- Use Clear Subject Lines: When sending documents by email, make sure the subject line is clear and specific, such as “Payment Request for [Service] – Due [Date]”. This helps recipients identify the document easily and know its purpose.

- Include Payment Instructions: Always provide clear instructions on how payments should be made, including the accepted methods (e.g., bank transfer, credit card) and any relevant account details. This eliminates confusion and makes it easier for the recipient to process the payment.

Follow-Up and Tracking

- Set Reminders: If payment hasn’t been received by the due date, it’s important to send a polite reminder. Automated systems or calendar alerts can help track payment timelines and avoid delays.

- Maintain Records: Keep a record of all sent documents, including when they were sent and any follow-ups. This ensures that you have documentation in case of any disputes or misunderstandings.

By adhering to these best practices, you can ensure that the process of sending billing records runs smoothly, improving both your cash flow and your professional relationships.

Understanding Invoice Numbering Systems

Having a clear and consistent numbering system for financial documents is essential for efficient tracking, organization, and future reference. A structured numbering system helps differentiate between different transactions, making it easier to manage accounts and resolve any disputes. Whether you’re dealing with a handful of transactions or hundreds, a good numbering system allows for quick identification and retrieval of any document.

Why a Numbering System is Important

A systematic numbering approach offers several advantages, including better organization and streamlined record-keeping. By assigning each document a unique number, you can easily track payments, identify outstanding balances, and quickly access previous records if needed. This reduces the risk of confusion or duplicate entries and ensures that your financial data is orderly and easy to manage.

Common Numbering Formats

There are several formats you can use for numbering, depending on the complexity of your transactions and the level of detail required:

- Sequential Numbering: The simplest approach, where each document is assigned a number in order, such as #001, #002, and so on. This format is ideal for smaller institutions or organizations.

- Chronological Numbering: This system uses a combination of dates and numbers, such as “2024-001” or “04/2024-001”, which helps to easily identify when the document was created and in what order it was issued.

- Custom Numbering with Categories: For organizations with various departments or services, you might use a more complex system. For example, “AC-001” for accounting-related charges, “STU-001” for student fees, etc. This allows you to categorize documents based on their type or source.

Choosing the right numbering system depends on your institution’s needs, the volume of transactions, and how you prefer to organize your financial records. Consistency is key to making sure everything is easy to track and manage over time.

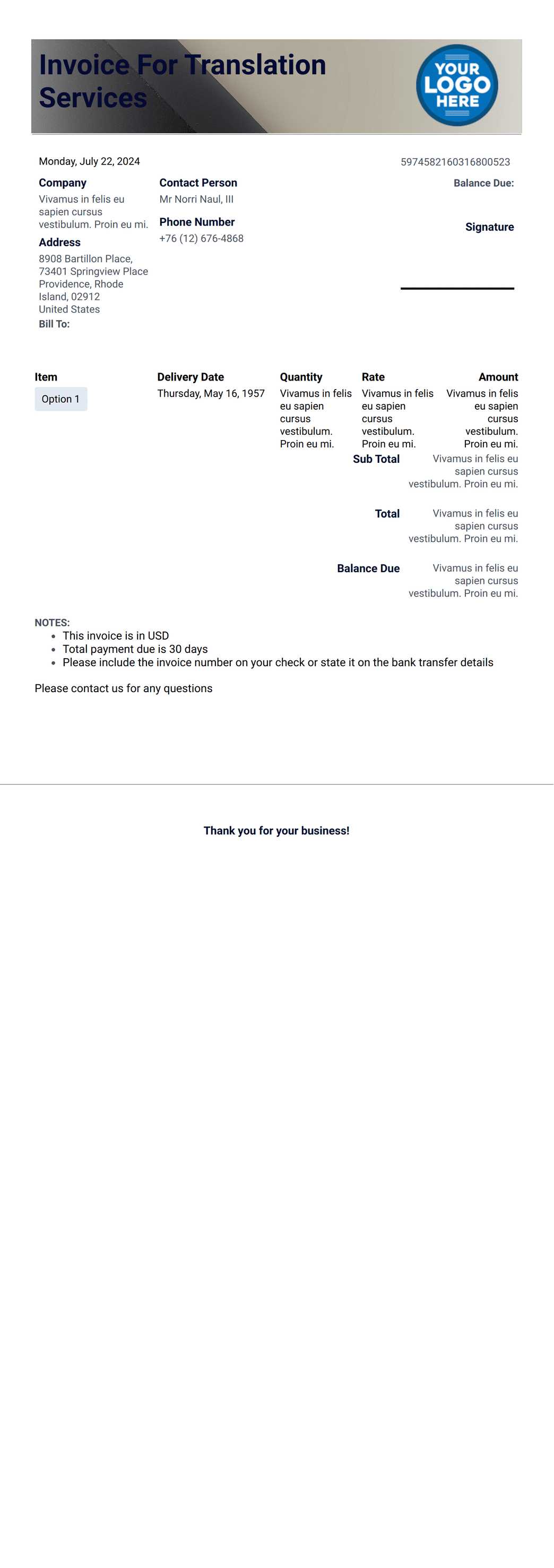

Invoice Template Formatting Tips

Formatting plays a crucial role in making financial documents both professional and easy to read. A well-organized document helps ensure that all relevant information is quickly accessible, reducing the chances of confusion or errors. Proper formatting not only enhances clarity but also reinforces the credibility of your institution or organization. Below are some essential tips to keep in mind when formatting your billing records.

Key Formatting Tips for Financial Documents

- Use a Clean and Simple Layout: Avoid clutter by keeping the design simple and using plenty of white space. A clean layout helps recipients quickly find key information, such as payment amounts, terms, and dates.

- Consistent Font and Size: Stick to one or two readable fonts and avoid using too many sizes or styles. Typically, a professional sans-serif font like Arial or Helvetica is ideal, with the body text in 10-12 point size.

- Highlight Important Information: Use bold text or a larger font size to emphasize key details like the total amount due, payment due date, and payment methods. This draws attention to the most crucial parts of the document.

Using Tables for Clarity

Tables are a great way to organize information such as itemized charges, payment breakdowns, and taxes. This format ensures that each component is easily identifiable and legible. Here’s an example of how to structure your document:

| Item | Description | Amount |

|---|---|---|

| Tuition Fee | For Fall 2024 Semester | $4,500 |

| Library Fee | Access to library resources | $150 |

| Activity Fee | Extracurricular programs | $200 |

| Total | – | $4,850 |

Using tables to break down costs allows the recipient to easily see how the total is calculated. This not only makes the document more visually appealing but also ensures transparency in billing.

How to Track Payments Efficiently

Efficient payment tracking is vital for maintaining smooth financial operations and ensuring timely collections. By implementing a structured system to monitor incoming payments, institutions can reduce errors, prevent overdue accounts, and keep their cash flow healthy. Proper tracking also helps quickly identify any discrepancies and allows for proactive follow-ups with clients or students.

Key Strategies for Tracking Payments

- Use Payment Management Software: Investing in payment management software can automate much of the tracking process, allowing for real-time updates and detailed records of all transactions. These tools can generate reports and send reminders for overdue payments, saving time and reducing human error.

- Create a Payment Log: If you prefer a manual approach, maintaining a payment log is essential. Keep a detailed record of each payment, including the date received, the amount, the method of payment, and the associated reference number. This log can be kept in a spreadsheet for easy access and quick updates.

- Match Payments with Documents: Whenever a payment is received, cross-reference it with the corresponding financial document. This ensures that payments are properly matched with the right accounts, avoiding any mistakes or misapplications of funds.

Additional Tips for Efficient Tracking

- Set Up Automated Reminders: Use your software or email to automatically send reminders to recipients before and after the payment due date. Automated reminders help reduce late payments and encourage timely action from the recipient.

- Use Payment Reference Numbers: Include a unique reference number on each document and require recipients to use it when making payments. This will help you easily match payments to specific records and minimize errors in tracking.

- Regularly Reconcile Accounts: Periodically compare your payment records with bank statements to ensure everything matches up. Regular reconciliation helps catch any discrepancies early and keeps your financial records accurate.

By applying these strategies, you can streamline the payment tracking process, minimize errors, and maintain a more organized and efficient financial system.

Automating University Invoice Generation

Automating the creation of financial documents can significantly improve efficiency and reduce manual errors in any institution. By setting up an automated system, you can streamline the entire billing process, from generating and sending documents to tracking payments. This not only saves time but also ensures consistency and accuracy across all transactions.

Benefits of Automation

Automating the creation of billing records offers several key advantages:

- Increased Efficiency: Automated systems can generate documents instantly based on predefined data, such as student information or service fees, eliminating the need for manual entry. This saves valuable time and reduces administrative workload.

- Consistency and Accuracy: Automation ensures that each document is generated according to the same format, reducing the risk of errors. It also guarantees that all required information is included, from payment terms to itemized charges, without missing any details.

- Reduced Human Error: By eliminating manual data entry, automation reduces the chances of miscalculations or incorrect entries, which can lead to disputes or delays in payments.

How to Automate Billing Document Generation

To automate the process of generating billing records, institutions can follow these steps:

- Choose the Right Software: Select an automation tool or software that integrates well with your existing systems. Many accounting platforms offer automation features, allowing you to create, send, and track financial documents automatically.

- Set Up Templates: Create a standardized format for your financial documents. Once a template is set up, automation tools can use this template to generate new records with minimal input, pulling data from your institution’s database or student management system.

- Define Triggers and Rules: Set up triggers that automatically initiate the document generation process, such as when a payment is due or when a new service is provided. Define rules to calculate fees, discounts, and taxes automatically based on pre-established criteria.

By automating the creation of billing documents, your institution can ensure that all financial transactions are handled efficiently, accurately, and in a timely manner, allowing your team to focus on other important tasks.

Legal Requirements for University Invoices

Financial documents must comply with certain legal requirements to ensure that they are valid and enforceable. These requirements vary depending on jurisdiction, but there are some fundamental elements that must always be included. Ensuring that all required details are present helps avoid legal disputes and ensures that the document can be used as evidence in case of disagreements.

Essential Legal Elements

There are specific pieces of information that should always be included to meet legal standards for billing records:

- Correct Identification of the Parties: The name and contact details of both the issuer (institution) and the recipient (student, client) must be clearly stated. This is essential for proving the legitimacy of the transaction.

- Unique Reference Number: Every financial document should have a unique reference number that differentiates it from other transactions. This is vital for record-keeping and for legal tracking of payments.

- Detailed Description of Services: It’s essential to itemize the charges, providing a clear and detailed breakdown of the services rendered or fees incurred. This helps prevent misunderstandings and serves as a legal record of the terms agreed upon.

- Payment Terms: Include specific terms regarding payment deadlines, accepted methods, and any penalties for late payments. Clear payment terms are necessary to avoid potential legal issues regarding overdue payments.

- Legal Entity Information: The legal name, registration number, and tax identification number (TIN or VAT number) of the issuing institution must be included. This provides verification of the institution’s legitimacy and ensures compliance with tax laws.

- Date of Issue and Due Date: The date the document was issued and the due date for payment should always be included to clarify the timeline for both parties involved.

Compliance with Local Laws

Each country or region may have additional requirements, such as specific tax information or extra documentation for certain services. It’s important for institutions to familiarize themselves with local tax laws and business regulations to ensure full compliance. Failing to meet these requirements can result in penalties, fines, or disputes over payments.

By adhering to these legal requirements, institutions can protect themselves from potential legal issues and ensure that their financial documents are valid and enforceable in any legal context.

How to Handle Invoice Disputes

Disputes over financial documents are common, but addressing them promptly and professionally can prevent long-term issues. When discrepancies arise between the amount billed and the amount paid, it’s important to have a clear process in place to resolve the situation. Addressing disputes quickly and efficiently helps maintain a positive relationship with clients or students and ensures that payments are processed without delay.

Steps to Resolve Disputes

When a dispute occurs, follow these steps to ensure a fair and smooth resolution:

- Review the Dispute: Carefully review the details of the dispute. Compare the original document with any supporting correspondence or contracts to verify whether the disagreement is based on a misunderstanding or an error.

- Communicate Clearly: Contact the party involved and acknowledge the issue. Acknowledge their concerns and ask for clarification if needed. Open and respectful communication is key to resolving any dispute.

- Provide Evidence: If the dispute is based on missing or unclear information, provide the necessary evidence. This could include the original contract, any emails or agreements that outline the terms, or other supporting documents that clarify the situation.

- Negotiate and Adjust if Necessary: If there is an error or oversight on your part, consider offering a resolution that works for both parties. In some cases, a simple correction or an updated financial document may be enough to settle the matter.

- Document the Outcome: Once the dispute is resolved, ensure that both parties have a record of the final decision. This could be a written agreement or an updated statement that clearly shows the adjusted charges or payments.

Common Causes of Disputes

Disputes often arise due to misunderstandings or administrative errors. Here are some of the most common causes:

| Cause of Dispute | Description |

|---|---|

| Incorrect Billing Amount | Errors in calculating the total amount, such as overcharges or missed discounts. |

| Missing Information | Unclear descriptions of services or missing fees that were expected to be included. |

| Payment Confusion | Payments not being properly

Choosing the Right Invoice SoftwareSelecting the appropriate software for generating and managing financial documents is essential for streamlining your billing processes. With the right tool, you can automate many tasks, improve accuracy, and save valuable time. The key is finding a solution that fits the specific needs of your institution, whether it’s handling large volumes of transactions or ensuring compliance with tax regulations. Key Features to Look ForWhen evaluating different software options, consider the following important features:

Popular Invoice Software OptionsThere are numerous software solutions available on the market, each with its own set of features and pricing models. Some popular options include:

When choosing the right software, it’s important to weigh your institution’s specific needs, the level of support required, and your budget. By selecting the right tool, you can improve your billing processes, enhance efficiency, and ensure accurate financial records. Improving Cash Flow with Timely InvoicesEffective cash flow management is vital for any institution, and one of the most straightforward ways to improve it is by issuing financial documents promptly. By sending accurate and timely records, you can reduce delays in payment, avoid cash shortages, and ensure that your financial operations run smoothly. The quicker payments are collected, the more predictable and stable your institution’s cash flow will be. Importance of Timely Document IssuanceSending bills on time is crucial for several reasons:

Strategies for Timely BillingTo improve cash flow, it’s important to implement strategies that ensure timely generation and delivery of financial documents:

By ensuring that your financial documents are accurate and issued on time, your institution can foster better cash flow, reduce late payments, and maintain a stable financial position. Implementing these strategies can make a significant difference in how smoothly your institution’s finances are managed. |