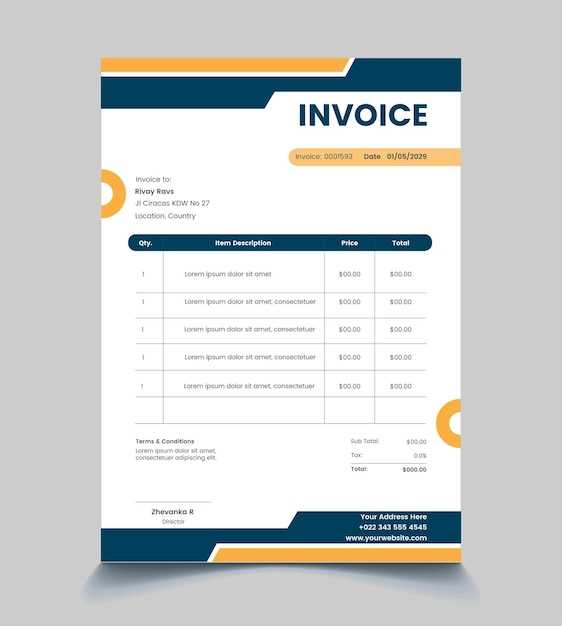

Unique Invoice Template for Customizable and Professional Billing

Managing payments efficiently is crucial for any business. A well-structured document that clearly outlines the details of transactions not only ensures smooth operations but also helps maintain professionalism. Tailoring such a document to your specific needs can improve both clarity and presentation.

Whether you’re a freelancer, small business owner, or large enterprise, having the ability to adjust and personalize these records allows for a seamless billing experience. From adding your logo to customizing payment terms, personalization can reflect your brand’s identity while providing clients with the necessary information in an organized manner.

In this guide, we will explore various ways to create a flexible, functional document that suits your business style. Learn how to design a layout that speaks to both professionalism and simplicity, ensuring you stand out while maintaining accuracy in all transactions.

Custom Billing Solution for Your Business

Creating a customized document for billing can significantly enhance your business’s professionalism and streamline payment processing. A personalized approach ensures that all essential details are presented clearly, while also giving your brand a distinct presence. This tailored solution not only reflects your company’s identity but also meets the specific needs of both your business and your clients.

When designing such a document, consider the following elements to make it both functional and visually appealing:

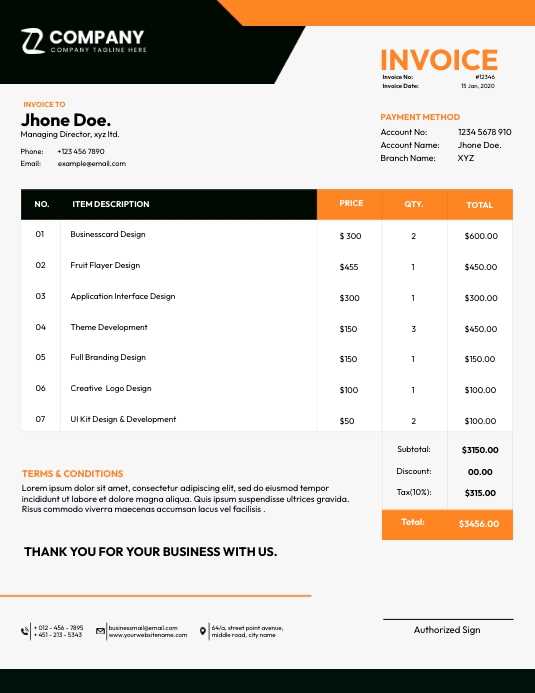

- Branding elements: Incorporate your logo, brand colors, and fonts to give the document a cohesive look aligned with your overall marketing strategy.

- Clear payment terms: Specify payment due dates, late fees, and any relevant terms to avoid confusion and ensure timely transactions.

- Itemized breakdown: Offer a detailed list of services or products provided, with pricing information for full transparency.

- Legal compliance: Make sure to include any necessary legal disclaimers, tax information, or business registration details, depending on your location and industry.

By integrating these elements into a single, cohesive document, you not only create a smooth billing experience but also reinforce your business’s professionalism. The ability to modify and personalize these aspects will allow you to adjust to different clients and situations, maintaining flexibility and consistency at the same time.

Why Choose a Custom Billing Document

Opting for a personalized billing solution offers businesses greater control over their financial communications. Unlike generic formats, custom designs allow you to align your documents with your brand’s image and meet the specific needs of your clients. This tailored approach not only simplifies transaction tracking but also enhances professionalism and consistency in every interaction.

Brand Consistency

Customizing your billing documents provides an opportunity to reinforce your brand’s identity with every transaction. By adding your company logo, colors, and font styles, you create a seamless and recognizable experience for your clients. This small yet impactful detail helps distinguish your business and builds trust over time.

Flexibility and Control

Personalized billing formats give you the flexibility to include the exact information you need. Whether it’s specific payment terms, additional notes, or custom fields for discounts, a tailored approach allows you to create the perfect document for any situation. This control not only helps you manage your accounts better but also ensures clarity and transparency with clients.

In the end, choosing a custom solution for billing processes boosts efficiency and strengthens your business’s reputation. It shows attention to detail and demonstrates a commitment to providing clients with an organized, professional experience that meets their needs and expectations.

Key Features of an Effective Billing Document

For any business, a well-crafted billing record is essential to ensure clear communication and smooth financial transactions. The most effective documents provide all necessary details in an organized manner, making it easy for both the client and the business to track and manage payments. Certain features are critical to make sure these records are not only functional but also professional and transparent.

Clarity and Detail

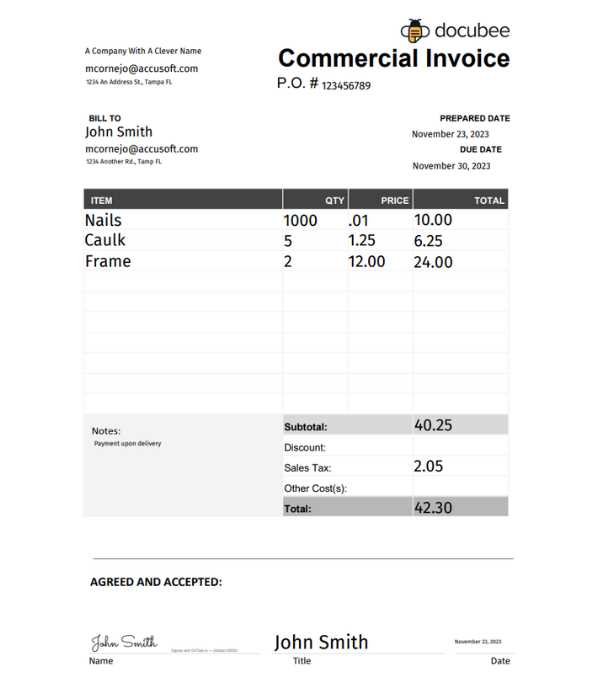

One of the most important aspects of a billing document is clarity. Each item or service should be listed with a clear description and accurate pricing. A breakdown of costs helps avoid misunderstandings and ensures that the client knows exactly what they are being charged for. The inclusion of tax, discounts, and any additional fees should be transparent, leaving no room for confusion.

Contact Information and Payment Terms

Essential contact details for both the business and the client are necessary for proper communication. Including the company name, address, phone number, and email ensures that the client can easily reach out if they have any questions. Additionally, clear payment terms–such as the due date, late fees, and accepted payment methods–help set expectations and encourage timely payments.

Incorporating these key elements into your billing documents not only ensures accuracy but also fosters a sense of professionalism and trust with your clients. A well-structured, easy-to-read record can significantly improve your financial processes and contribute to long-term client relationships.

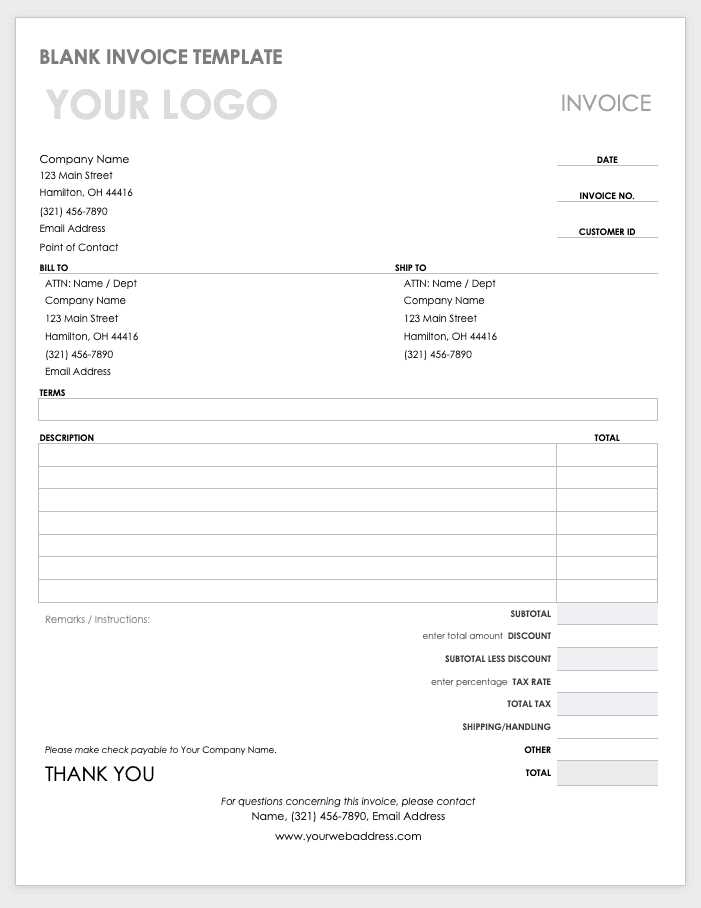

How to Personalize Your Billing Design

Personalizing your billing records not only makes them more professional but also ensures that they align with your brand’s identity. Customizing the appearance of these documents can help create a consistent and cohesive experience for your clients. Below are key ways to tailor the design to reflect your business’s personality and values.

- Incorporate Your Brand’s Logo: Adding your company’s logo at the top of the document reinforces brand recognition and makes the record feel official.

- Choose Custom Colors and Fonts: Use your brand’s color palette and font styles to create a uniform look across all your business materials. This helps maintain a professional appearance while staying consistent with your overall branding.

- Include a Personalized Message: Adding a short thank-you note or a message of appreciation at the bottom of the document can go a long way in building positive client relationships.

- Adjust Layout and Spacing: Customize the layout to suit your business’s needs, whether it’s a clean, minimal design or a more detailed, professional format. Adjust the spacing to ensure the document is easy to read and visually appealing.

Personalizing your billing records ensures that each one reflects your company’s style while maintaining clarity and professionalism. With these simple adjustments, you can enhance the overall presentation, helping to leave a lasting impression on your clients and improve the payment process.

Benefits of Using a Customized Billing Document

Adopting a pre-designed billing format offers several advantages for businesses of all sizes. With a ready-made structure, you can save valuable time, reduce errors, and ensure consistency in your financial communications. Customizable designs allow you to focus on the content while maintaining a professional and cohesive presentation for every transaction.

| Benefit | Description |

|---|---|

| Time-Saving | By using a pre-designed structure, you eliminate the need to create billing records from scratch, allowing you to process payments more quickly. |

| Consistency | A standard format ensures that every billing document follows the same layout and style, reinforcing your brand’s image and professionalism. |

| Accuracy | Templates reduce the risk of errors in calculations and formatting, ensuring that all the necessary details are included and correctly displayed. |

| Customization | Personalizable formats give you the flexibility to adjust sections as needed, such as adding discounts, taxes, or custom notes for specific clients. |

| Efficiency | Once the design is set up, generating new documents becomes a quick and easy task, freeing up time for other important business activities. |

By incorporating a customized format into your billing process, you can streamline your operations, maintain a high level of professionalism, and ensure that your financial communications are always clear and consistent.

Common Mistakes to Avoid in Billing Documents

When preparing billing records, it’s easy to overlook small details that can lead to confusion or delays in payment. Avoiding common mistakes ensures that your documents are clear, accurate, and professional, helping to maintain good relationships with clients and streamline your financial processes. Here are several key errors to watch out for:

- Missing or Incorrect Contact Information: Ensure that both your business and client’s contact details are accurate and up-to-date. This includes phone numbers, addresses, and email addresses. Missing or incorrect information can cause delays in communication.

- Unclear Payment Terms: Always specify payment due dates, late fees, and accepted payment methods. Vague or missing terms can lead to misunderstandings and delays in receiving payment.

- Incomplete Item Descriptions: Be sure to provide detailed descriptions of products or services provided, including quantities and unit prices. Lack of clarity can create confusion and leave clients unsure of what they’re being charged for.

- Failing to Include Taxes: If applicable, ensure that taxes are calculated and listed clearly on the document. Omitting tax details can create legal issues and lead to disputes over the final amount owed.

- Overcomplicated Layout: Keep the design simple and easy to read. Overcrowded or complex layouts can confuse clients and make it difficult for them to find the information they need quickly.

- Ignoring Legal Requirements: Depending on your location and industry, certain legal information, such as tax identification numbers or business registration details, may be required. Be sure to include these to avoid potential legal issues.

By paying attention to these common mistakes, you can ensure that your billing documents are not only accurate but also enhance your professionalism and client trust. Clear, error-free records will streamline your payment process and minimize the risk of misunderstandings.

How to Customize Your Billing Document for Branding

Customizing your billing documents to align with your brand identity not only enhances professionalism but also helps create a consistent experience for your clients. By integrating your brand elements into every aspect of your documents, you ensure that each transaction reinforces your business’s values and image. Below are several ways to personalize these records for branding purposes:

- Add Your Logo: Position your company’s logo prominently at the top of the document to ensure brand visibility. This helps clients immediately associate the document with your business.

- Use Brand Colors: Incorporate your brand’s color palette into the design of the document. Choose colors for headers, borders, or text that align with your overall visual identity.

- Customize Fonts: Select fonts that are consistent with your brand’s style guide. Using the same typefaces throughout all your communications creates a unified and professional appearance.

- Include a Personalized Message: Add a brief thank-you note or a personalized message at the end of the document. A friendly closing remark helps reinforce customer loyalty and adds a personal touch to the transaction.

- Adjust Layout and Design: Customize the layout to match your brand’s aesthetics. Whether you prefer a minimalist, bold, or elegant style, ensure that the document’s design reflects your business personality.

- Incorporate Your Tagline: If your business has a memorable tagline, consider including it on the document. This reinforces your message and helps clients recall your brand with each interaction.

Customizing billing records to reflect your branding helps you stand out in a competitive market. It ensures that every client interaction reinforces your company’s professionalism and attention to detail, making your business more memorable and trustworthy.

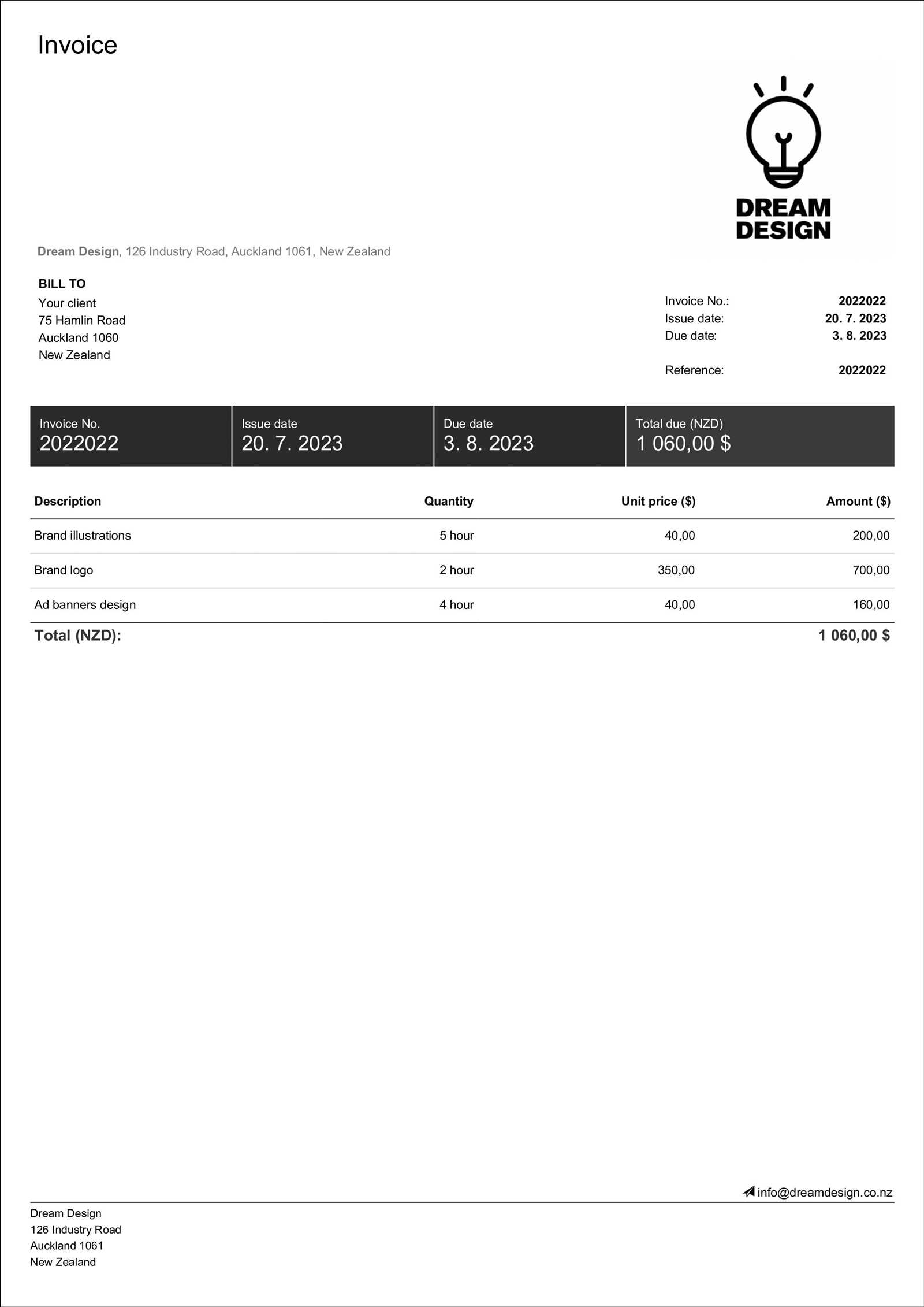

Understanding Different Billing Document Formats

There are various formats available for creating billing records, and choosing the right one depends on your business needs and client preferences. Each format serves a specific purpose, and understanding their differences will help you decide which is best suited for your workflow. Whether you are handling one-time projects, recurring payments, or a mix of both, the format you choose can impact clarity and ease of use.

Standard Billing Record: This is the most common format, used for one-off transactions. It typically includes essential details such as service descriptions, pricing, taxes, and total amounts. This format is straightforward and easy to understand, ideal for most businesses.

Recurring Billing Format: For businesses that offer subscription-based services or ongoing contracts, recurring billing formats are the best choice. These documents automatically generate periodic charges and often include information on payment cycles, renewal dates, and subscription terms.

Proforma Document: A proforma record is a preliminary version of a final billing document. It’s often used to provide clients with a cost estimate before the final services or products are delivered. This format is especially useful for large or complex projects where costs may vary.

Credit Note Format: A credit note is issued when there is an adjustment to a previously issued bill, such as a refund, discount, or correction of an overcharge. It’s important to use a separate format for this to clearly differentiate it from the original billing document.

Electronic Billing: Many businesses are moving toward digital formats, which offer the advantages of automation, quick transmission, and easier record-keeping. Electronic formats can include PDF, Excel, or even integrated systems for automated invoicing and payment tracking.

By understanding these different formats, you can select the right one for each type of transaction, ensuring that your billing process is smooth and efficient. Tailoring your document format to your business needs will not only improve clarity but also enhance the overall client experience.

How to Save Time with Pre-Designed Billing Documents

Using pre-designed structures for your billing records can significantly streamline your workflow, allowing you to focus on running your business rather than spending time on repetitive administrative tasks. By leveraging customizable formats, you can quickly generate accurate and professional documents without starting from scratch each time. Below are several ways that using a ready-made structure can save you valuable time.

Automating Repetitive Tasks

Pre-built formats allow you to automate the most time-consuming elements of creating billing documents. Once you’ve set up your design, you only need to enter the client’s details and transaction information. This can save you from re-entering the same information multiple times, reducing the chance of errors and speeding up the process.

- Standardized Fields: Fields like business name, client contact info, or payment terms can be pre-filled, saving time on every new document.

- Quick Calculations: Built-in formulas for calculating taxes, discounts, and totals allow you to generate accurate billing amounts instantly.

Improved Consistency and Professionalism

Using a consistent structure ensures that every document you create looks professional and follows the same layout. This consistency not only saves time on formatting but also enhances your brand image by providing clients with a polished experience every time.

- Customizable Sections: You can easily adjust sections for special offers or additional services without needing to design them from scratch each time.

- Predefined Layout: A clear, clean layout reduces the need to reformat or adjust spacing, making it easier to focus on content rather than design.

By utilizing ready-made billing structures, you can create accurate, consistent, and professional documents in a fraction of the time. This efficiency not only frees up your time for other important tasks but also ensures that your business operations run smoothly and effectively.

Best Tools for Creating Billing Documents

Creating accurate, professional billing records requires the right set of tools. Whether you are a small business owner or a freelancer, the right software can help streamline the process, reduce errors, and improve the overall client experience. There are various options available, each offering different features to suit your needs. Below are some of the best tools that can help you design and generate customized billing documents with ease.

Top Software for Simple Billing

If you need a quick and straightforward solution for creating and managing your billing records, the following tools provide easy-to-use interfaces and essential features for basic billing needs:

- Wave: A free, cloud-based tool that allows you to create, send, and track billing records. It also includes features for managing expenses and accounting, making it ideal for small businesses.

- Zoho Invoice: A user-friendly tool offering professional designs and customizable fields. You can automate recurring bills and track payments, making it a great choice for growing businesses.

- FreshBooks: Known for its time-tracking and invoicing features, FreshBooks is perfect for service-based businesses. It also integrates with other financial tools to streamline your workflow.

Advanced Tools for Customization and Automation

If you need more advanced features, such as automation, detailed customization, and integration with other business processes, the following tools are worth considering:

- QuickBooks: A powerful accounting software with robust billing features. It offers detailed customization options for design and tax calculations and integrates with accounting and financial management tools.

- Invoice2go: This tool is ideal for businesses that require quick and easy document creation with an emphasis on customization. You can choose from a variety of pre-designed layouts and personalize them as needed.

- AND.CO: A great solution for freelancers and small businesses that need a blend of easy-to-use features and in-depth customization options. This tool includes automated reminders and payment tracking.

By using the right tool, you can simplify your billing process, reduce administrative time, and ensure your records are both accurate and professional. Whether you need a simple solution or advanced automation features, these tools offer the flexibility and functionality to suit your needs.

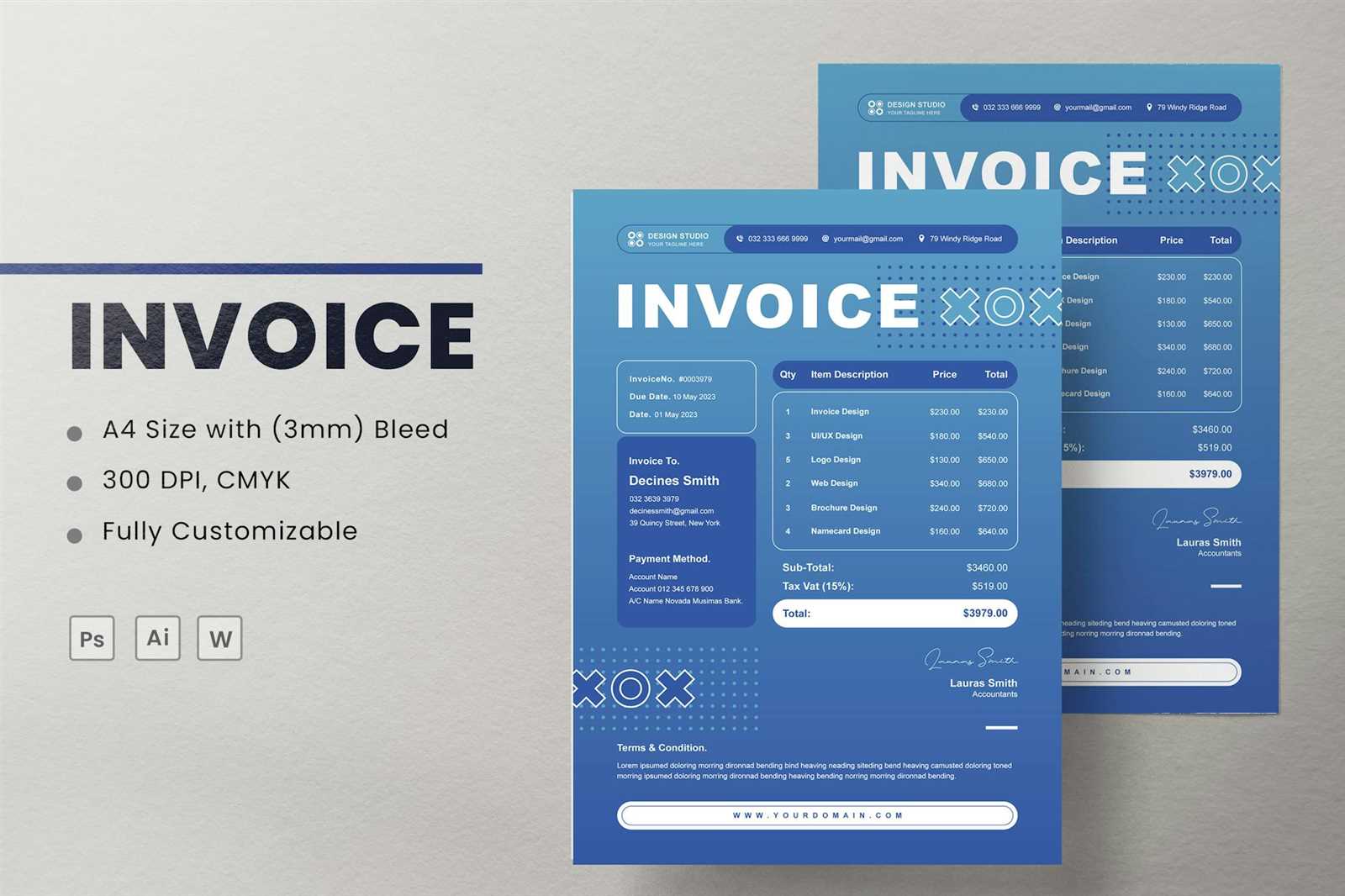

Free vs Premium Billing Document Designs

When creating professional billing records, businesses often face a decision: should they use free resources or invest in premium designs? Both options have their advantages and drawbacks, depending on your specific needs and budget. Understanding the differences between free and paid designs can help you make an informed choice that best suits your business operations.

Advantages of Free Billing Designs

Free billing record designs offer a cost-effective solution for businesses that are just starting or those with tight budgets. While they may have limitations, they still provide the essential features necessary for generating professional documents.

- Cost-effective: The most obvious advantage of free designs is that they come at no cost, making them ideal for small businesses or freelancers just getting started.

- Basic Functionality: Free resources often include the essential fields like company information, item descriptions, pricing, and total amounts. They can handle basic billing needs effectively.

- Easy to Use: Many free designs are simple and user-friendly, meaning you can create a record quickly without a steep learning curve.

Benefits of Premium Billing Designs

On the other hand, premium designs offer a higher level of customization, advanced features, and a more polished appearance, making them a worthwhile investment for businesses looking for a more professional and streamlined solution.

- Customization Options: Premium designs often come with a wide range of customization features, allowing you to adjust colors, fonts, and layout to match your brand’s identity.

- Advanced Features: Paid resources may include added functionalities such as automated calculations, recurring billing options, or integrations with other business tools, making your workflow more efficient.

- Professional Appearance: Premium designs often feature more polished and visually appealing layouts, which can help elevate your brand’s image and impress clients with a high-quality presentation.

- Customer Support: Many paid services offer customer support to assist with troubleshooting or any customization needs, which can be beneficial for businesses that require ongoing assistance.

Choosing between free and premium billing document designs depends on your specific business requirements. If you’re just starting and have limited resources, free designs can get the job done. However, if your business is growing and you want to maintain a professional image with more flexibility and advanced features, premium designs may be the better option.

Incorporating Legal Information into Billing Records

When creating billing documents, it is crucial to include specific legal information to ensure compliance with local regulations and to protect your business. Legal requirements can vary depending on the location, industry, and the nature of the transaction. Including this information not only helps avoid potential legal issues but also adds an extra layer of professionalism to your documents.

Below are some essential legal elements that should be incorporated into your billing records:

| Legal Information | Description |

|---|---|

| Business Registration Number | This is a unique identifier assigned to your company by the government. It is often required by law to be included on all official financial documents. |

| Tax Identification Number (TIN) | If applicable, include your TIN to ensure tax compliance. This number is essential for businesses to report income and pay taxes to the authorities. |

| VAT Number (if applicable) | For businesses that operate in countries with VAT (Value Added Tax), including this number on your documents ensures that transactions are compliant with tax regulations. |

| Terms and Conditions | Clearly outline payment terms, including due dates, penalties for late payments, and any other relevant clauses. These terms help avoid misunderstandings with clients. |

| Refund Policy | State the conditions under which refunds are accepted. This protects both your business and the customer in case of disputes. |

Incorporating these legal details helps ensure that your documents are both compliant and professional. By adhering to local laws and regulations, you can build trust with clients and avoid legal complications down the road.

Mobile-Friendly Billing Design Tips

With more clients accessing documents on their mobile devices, it’s crucial to ensure that your billing records are optimized for smaller screens. A mobile-friendly design not only improves the user experience but also helps maintain the clarity and professionalism of your documents when viewed on smartphones or tablets. Below are some essential tips to ensure your documents are easy to read and navigate on any device.

Keep the Layout Simple and Clean

A cluttered design can be difficult to navigate on smaller screens. To make your documents mobile-friendly, focus on a clean, streamlined layout that highlights key information. Avoid overly complex structures, and ensure that your content is organized logically.

- Use clear headings: Make sure each section is clearly labeled, such as “Client Information,” “Services Provided,” and “Total Amount Due.”

- Limit the number of columns: Multiple columns can get distorted on mobile devices. Stick to a simple, single-column layout to ensure everything fits neatly on the screen.

- Use large fonts: Ensure that text is large enough to be read without zooming. Small fonts can be hard to read on mobile screens, so aim for a minimum of 12-14pt for body text.

Optimize for Easy Scrolling

Mobile users typically scroll through documents, so it’s important to ensure that your design is scrollable without excessive horizontal movement or awkward text breaks.

- Avoid wide tables: Tables with many columns or large images can cause horizontal scrolling, which is cumbersome on mobile. Make sure any tables are condensed and easy to read without scrolling side to side.

- Use legible fonts: Stick to web-safe fonts like Arial, Helvetica, or sans-serif that render clearly on mobile screens, ensuring readability at all times.

- Optimize image sizes: Ensure that logos and images are appropriately resized for mobile viewing. Large images may need to be compressed to fit the screen without slowing down load times.

By following these tips, you can create billing documents that look professional and are easy to read, regardless of the device your clients use. A mobile-optimized design ensures that your business appears tech-savvy and client-focused, enhancing the overall customer experience.

Making Billing Records Clear and Easy to Understand

One of the most important aspects of managing your business’s financial documents is ensuring they are easy for your clients to read and comprehend. A well-organized and clear document helps prevent misunderstandings, delays in payment, and unnecessary follow-ups. Simplicity, clarity, and consistency are key when creating a billing document that clients can easily navigate and understand.

Here are some effective strategies for making your billing records straightforward and clear:

Use Simple and Direct Language

Avoid jargon and overly complex terms. Your billing documents should be written in simple, plain language that any client can easily understand. Be clear about the services provided, the charges applied, and any other details that may be relevant.

Structure the Document Clearly

A well-structured document makes it easier for clients to find the information they need quickly. Organize your content in a logical flow, grouping related items together. Consider breaking your document into sections with clear headings, such as “Description of Services,” “Total Amount Due,” and “Payment Terms.”

| Section | Description |

|---|---|

| Header | Include essential details such as your business name, contact information, and the client’s information at the top of the document. |

| Service Description | List each service or product provided, with clear descriptions and unit pricing. This helps clients understand exactly what they’re being charged for. |

| Totals | Display subtotals, taxes, and final amounts in a clear, easy-to-read format, ensuring clients can quickly calculate their total bill. |

| Payment Terms | Clearly state the payment methods accepted, due dates, and any late fees or discounts. This helps manage client expectations and reduces confusion. |

By focusing on clear organization and straightforward language, you ensure your clients can easily navigate your billing documents without confusion. A simple, well-structured record not only improves professionalism but also fosters trust and helps facilitate timely payments.

Automating Billing Document Generation with Pre-Designed Formats

Automation is one of the most effective ways to streamline your business processes, and billing document creation is no exception. By using pre-designed formats and automation tools, you can significantly reduce the time spent on generating documents while ensuring accuracy and consistency. Automating the creation of billing records allows you to focus on other aspects of your business, all while ensuring that clients receive timely, professional documents.

Benefits of Automating Billing Document Creation

Automating the process of generating billing records provides numerous advantages that improve both efficiency and professionalism.

- Time Savings: Instead of manually creating a document for each transaction, you can automatically generate a new record in seconds, saving hours of administrative work.

- Consistency: Automation ensures that every document follows the same format and includes all necessary information, minimizing the risk of errors or omissions.

- Reduced Errors: By using predefined fields and calculations, you reduce the chances of making mistakes in totals, taxes, and other essential details.

- Faster Payments: Clients appreciate timely, accurate documents. By automating your billing process, you can send documents as soon as the service is rendered, improving cash flow.

How to Automate the Process

There are several tools and methods available to automate the creation of your billing documents. Here are some common approaches:

- Use Billing Software: Many accounting and billing software solutions, such as QuickBooks or FreshBooks, offer features to automate the creation and sending of documents. These tools allow you to set up recurring billing schedules and pre-fill client information.

- Integrate with CRM Systems: If you’re using a Customer Relationship Management (CRM) system, you can often integrate it with your billing software. This allows you to automatically generate billing records based on client interactions and transactions recorded in your CRM.

- Cloud-Based Automation Tools: Cloud tools such as Zoho Invoice or Wave offer automation features, allowing you to create and send billing records from anywhere. These tools can automatically calculate totals, taxes, and other variables, reducing manual input.

- Set Up Recurring Invoices: For businesses with ongoing clients or regular billing cycles, recurring billing automation ensures that the correct amount is billed at the right time without any manual intervention.

By implementing these automation tools, you can create a seamless and efficient billing process that saves time, reduces errors, and enhances your overall w

How to Create Recurring Billing Documents

For businesses that offer subscription-based services or ongoing contracts, creating recurring billing documents can simplify the payment process for both you and your clients. By automating this process, you ensure that payments are consistently made on time without the need to manually create new documents each billing cycle. Setting up recurring billing can save time, reduce errors, and help maintain steady cash flow.

Step-by-Step Guide to Setting Up Recurring Billing

Creating recurring billing records requires setting up specific parameters to automate the process. Here’s how you can do it effectively:

- Choose a Billing Platform: Select a billing or accounting platform that supports recurring billing. Many tools such as QuickBooks, FreshBooks, or Zoho Invoice offer this feature, allowing you to automate the process.

- Define the Billing Cycle: Decide how often the client will be billed–weekly, monthly, quarterly, or annually. Make sure the billing cycle aligns with the agreement you have with the client.

- Set the Payment Amount: Ensure that the correct amount is entered for each cycle. This may include a flat rate or a variable amount depending on usage, services, or products provided.

- Input Client Information: Add the client’s details, including their billing address and payment method. Make sure this information is updated regularly to avoid payment failures.

- Set Up Payment Reminders: Many billing platforms allow you to automatically send reminders to clients before each payment is due. This ensures clients are prepared and can make payments on time.

Managing Recurring Billing

Once recurring billing is set up, it’s important to monitor and manage it regularly to ensure everything runs smoothly:

- Review Statements: Periodically review the billing records to make sure that the correct amounts are being charged and that no discrepancies occur.

- Handle Payment Failures: Have a system in place for dealing with failed payments, whether it’s automatically retrying the payment or notifying the client to update their information.

- Adjust for Changes: If the terms of the agreement change (e.g., a price increase or a change in the services provided), make sure to update the recurring billing settings accordingly.

By automating the creation of recurring billing records, you can save significant time and reduce administrative overhead. This approach ensures that payments are handled efficiently and consistently, benefiting both your business and your clients.

Staying Professional with Custom Billing Records

Maintaining a high level of professionalism is essential for any business, and the documents you send to clients play a big role in shaping your image. Customized billing records not only reflect your brand identity but also help establish trust and credibility with your clients. By tailoring your documents to meet your business’s specific needs and style, you can create a lasting impression and ensure clarity in your communications.

Key Elements for a Professional Design

When creating custom billing documents, it’s important to focus on several key elements to ensure they look professional and convey the right message:

- Brand Consistency: Incorporate your company’s logo, colors, and fonts to create a cohesive look that aligns with your brand identity. This consistency builds recognition and trust with clients.

- Clear Structure: A well-organized format with clearly defined sections such as “Billing Information,” “Services Provided,” and “Total Amount Due” ensures that the document is easy to navigate and understand.

- Professional Language: Use polite, professional language throughout the document. Make sure all terms are clear and concise, avoiding jargon or confusing terminology.

- Accurate Details: Double-check all the information included, such as client names, payment terms, and amounts. Any mistakes can harm your professionalism and lead to delays in payments.

Using Tables for Clarity

Tables are an excellent way to present billing information in an organized and easy-to-read format. A well-structured table helps clients quickly understand the breakdown of charges, taxes, and totals.

| Description | Unit Price | Quantity | Total |

|---|---|---|---|

| Service A | $100 | 2 | $200 |

| Service B | $50 | 3 | $150 |

| Subtotal | $350 | ||

By following these best practices for customization and design, you’ll ensure that your billing documents not only look professional but also contribute to smoother transactions and stronger client relationships.