Free UK Invoice Template for Small Businesses and Freelancers

For businesses in the UK, managing payments and keeping financial records organized is crucial. A professional and clear method of requesting compensation is essential to maintaining good relations with clients and ensuring timely payment. The right tools can streamline this process, offering an easy way to create documents that align with business needs and local regulations.

Utilizing a customizable solution for generating payment requests is highly advantageous for entrepreneurs and freelancers alike. These tools simplify the process of documenting transactions, making it easier to track financial details and maintain compliance with local laws. A well-organized document can also improve your business’s professionalism and make your operations more efficient.

Whether you’re just starting or managing an established company, having access to a practical and adaptable method to produce these essential records is key to your financial success. This guide will explore options and important considerations for UK businesses when it comes to creating effective and reliable billing documents.

UK Billing Document Overview

Creating a professional document to request payment is a fundamental part of any business operation. In the UK, it is essential to have a well-structured and compliant document that reflects the details of the transaction clearly. These tools are designed to simplify the process, allowing businesses to produce professional-looking records with ease. By using customizable options, business owners can tailor the document to their specific needs while meeting legal requirements.

Having access to a simple solution for generating these records can save time and reduce errors, ensuring that payment requests are accurate and meet the standards expected by clients. With the right setup, businesses can focus on their core activities without worrying about the technicalities of record-keeping.

Here are some key aspects to consider when selecting a tool to create these important documents:

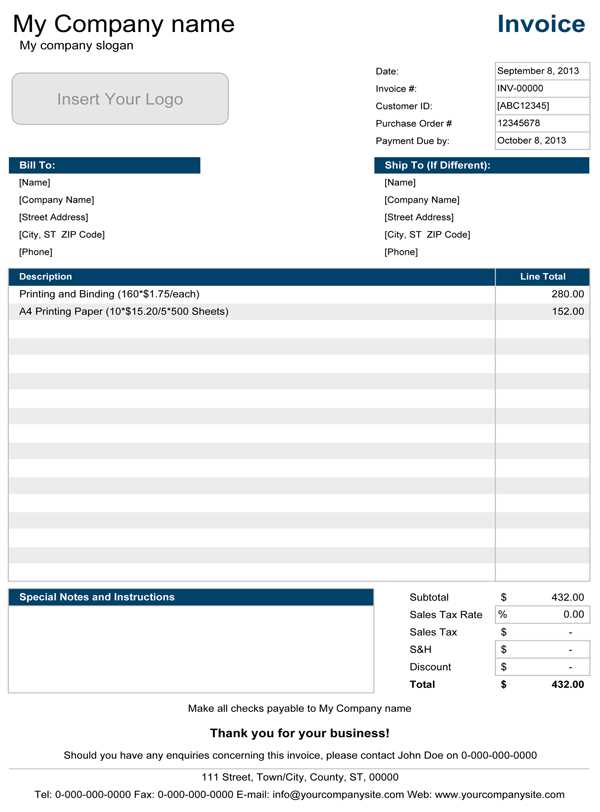

| Feature | Description |

|---|---|

| Customizability | The ability to adjust fields to suit business requirements. |

| Legal Compliance | Ensures the document meets UK regulations. |

| Professional Appearance | Helps businesses present themselves in a formal and organized manner. |

| Ease of Use | Simple design that can be filled out quickly and without confusion. |

| Payment Terms | Option to clearly define payment deadlines and conditions. |

By understanding these key features, UK businesses can choose the right document creation tool that best suits their needs and helps manage finances efficiently.

Why Use a Free Billing Document Solution

Having an efficient and easy-to-use method for generating payment requests is crucial for any business. Many business owners, especially freelancers and small enterprises, often seek cost-effective options to streamline this process. Utilizing a ready-made, customizable solution allows you to focus on your core business activities while ensuring that your payment requests are clear, professional, and legally compliant.

There are several advantages to using a tool that helps create these essential documents:

- Cost Savings: No need to invest in expensive software or hire professionals to design your documents.

- Time Efficiency: With a pre-designed solution, you can quickly generate payment requests, reducing time spent on administrative tasks.

- Customization: These tools often allow you to add or adjust essential information, such as payment terms, contact details, and services provided, to suit your specific needs.

- Professional Appearance: A well-organized document gives a polished and credible impression to clients, boosting trust and professionalism.

- Legal Compliance: Many solutions are designed to meet local regulations, ensuring that your documents comply with UK tax laws.

By choosing a straightforward, no-cost option, businesses can easily create documents that meet both their needs and industry standards without unnecessary complexity or expense.

Benefits of Customizable Billing Documents

The ability to modify and adapt business documents to meet specific needs provides significant advantages for any company. Customization allows for greater control over how payment requests are structured, enabling businesses to present a more personalized and professional appearance to clients. A customizable solution ensures that every essential detail can be included or adjusted as necessary, aligning perfectly with both business practices and client expectations.

Here are some key benefits of using a customizable approach:

- Branding Flexibility: You can incorporate your company’s logo, colors, and contact details, reinforcing your brand identity with every document.

- Tailored Information: The ability to adjust fields such as services rendered, payment terms, and due dates ensures accuracy and clarity in each request.

- Improved Professionalism: A well-structured and personalized document enhances the credibility of your business, fostering trust with clients.

- Time-Saving: By customizing once and reusing the document, you save time on future transactions while maintaining consistency.

- Legal Compliance: Tailoring your document to meet specific legal and tax requirements ensures that your business stays compliant with UK regulations.

Ultimately, the flexibility to adjust essential details not only streamlines your workflow but also helps build stronger relationships with clients through clear, professional communication.

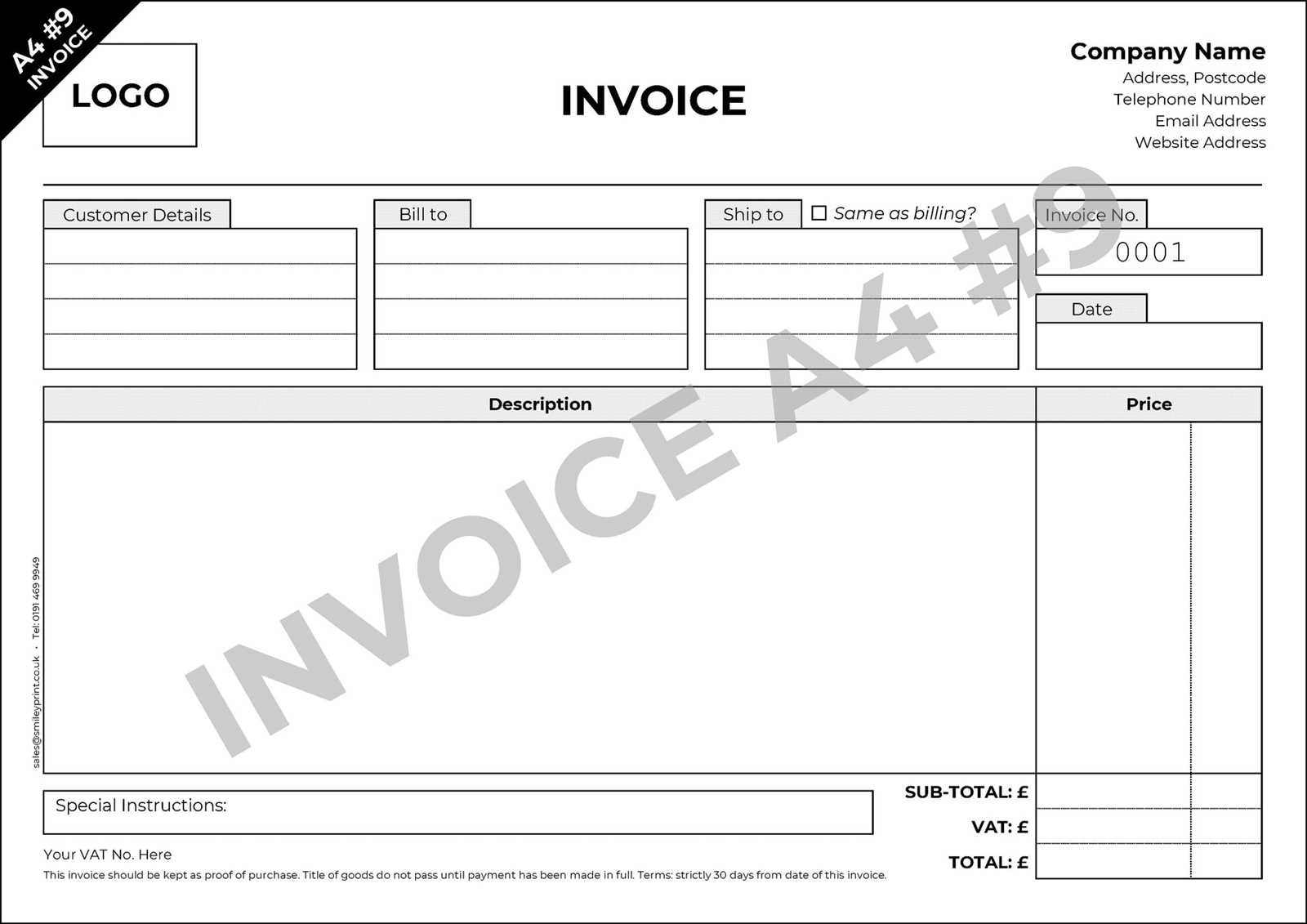

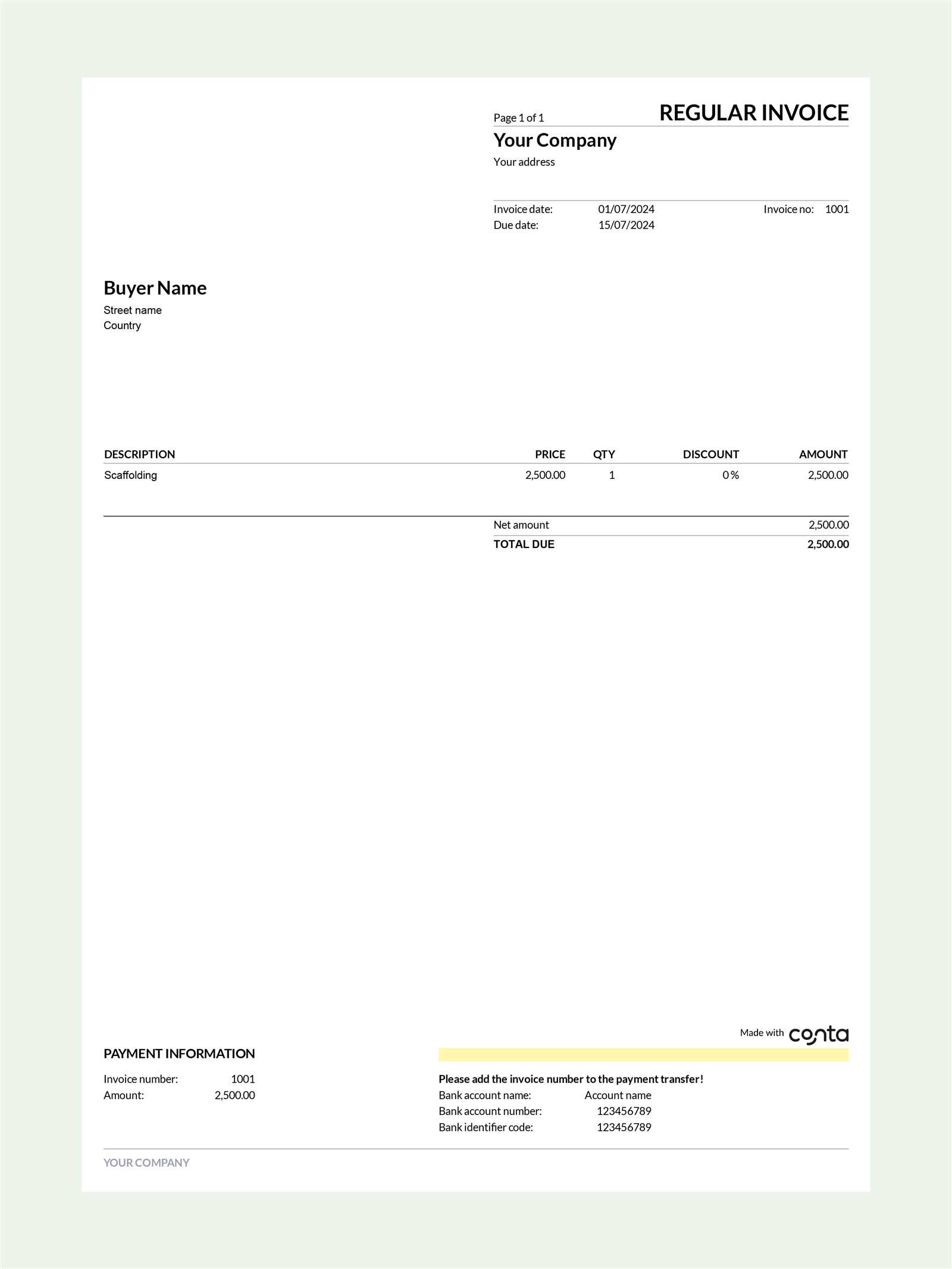

How to Create a Payment Request in the UK

Creating a payment request in the UK involves more than just listing the amount owed. It’s a formal document that needs to include specific information to ensure clarity and legal compliance. Whether you are a small business owner or a freelancer, understanding how to structure and produce a proper document is essential for smooth transactions and maintaining professional relationships.

Follow these steps to create a proper document in the UK:

- Include Your Business Information: Always start by adding your name or company name, address, phone number, and email. This helps clients identify the sender and make direct contact if needed.

- Client Details: Clearly state the name and address of the person or company you are requesting payment from. This ensures there is no confusion regarding who the document is intended for.

- Assign a Unique Reference Number: Every document should have a unique reference number to keep track of all transactions easily.

- Describe Goods or Services Provided: Specify what products or services were delivered, including quantities and rates, to avoid disputes and ensure transparency.

- Specify Payment Terms: Mention the total amount due and the agreed payment terms, including any taxes or additional fees. Also, indicate the payment deadline to avoid delays.

- Include Bank Details: Provide your bank details or preferred method of payment so the client can complete the transaction without confusion.

- Review Legal Requirements: Ensure that the document meets UK legal requirements, such as VAT (if applicable) and business registration details, to remain compliant with tax laws.

By following these steps, you ensure that your documents are clear, professional, and legally compliant, helping to facilitate timely payments and avoid any misunderstandings with clients.

Top Features to Look for in Billing Document Solutions

When selecting a solution for creating payment requests, it’s important to choose one that offers a balance of functionality, ease of use, and professional design. The right tool should help you maintain organization, streamline your financial processes, and ensure compliance with legal requirements. Below are the key features to consider when evaluating your options:

- Customizability: A flexible solution that allows you to adjust fields such as payment terms, client details, and services offered is essential. This ensures that each document can be tailored to specific transactions and needs.

- Clear Layout: The design should be clean and easy to read, with sections clearly divided to help both you and your clients understand the document at a glance.

- Professional Appearance: Choose a solution that enables you to incorporate your company’s branding, such as logos, colors, and fonts, to create a polished and cohesive look.

- Legal Compliance: Ensure the tool includes all necessary fields and information to meet UK regulations, such as tax rates and registration numbers, to avoid potential legal issues.

- Automatic Calculations: A good solution should automatically calculate totals, taxes, and discounts, reducing the chances of errors and saving you time.

- Save and Reuse: Look for a tool that allows you to save your documents for future use. This will make it easier to generate similar records quickly and consistently.

- Multi-Format Support: The ability to generate documents in different file formats (PDF, Word, etc.) provides flexibility for sharing with clients and for archiving purposes.

- Multi-Currency Support: If you work with international clients, ensure the tool can handle different currencies and automatically convert amounts where necessary.

By selecting a tool with these essential features, you can create professional, efficient, and legally compliant documents with ease, helping to maintain smooth and transparent financial transactions with your clients.

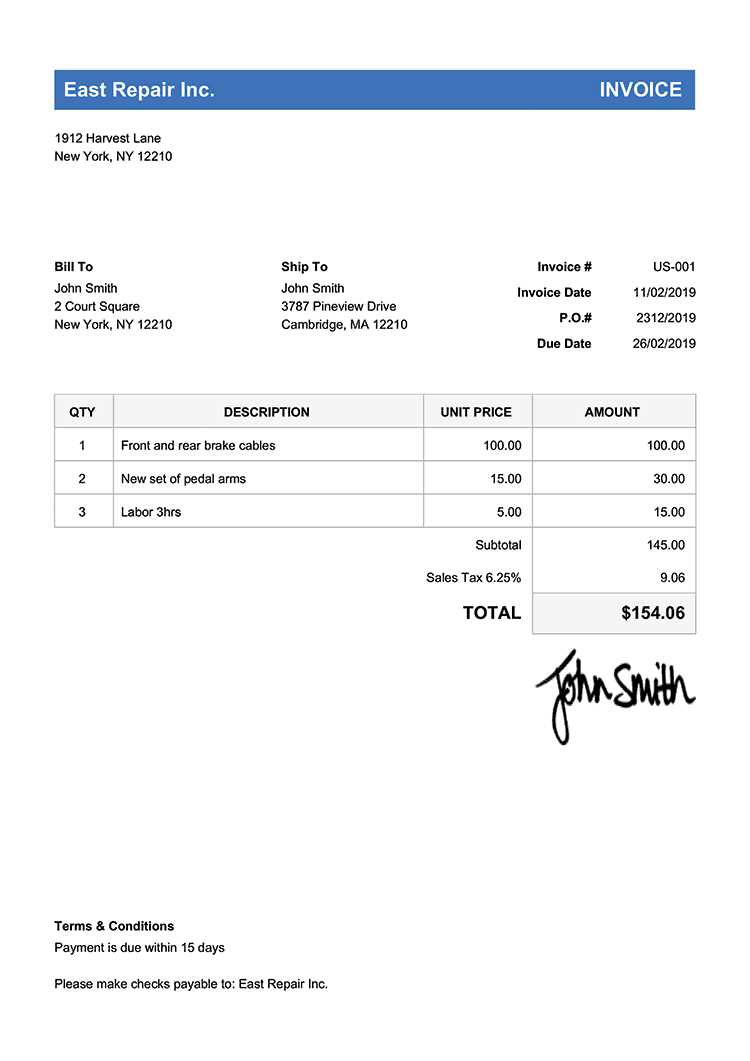

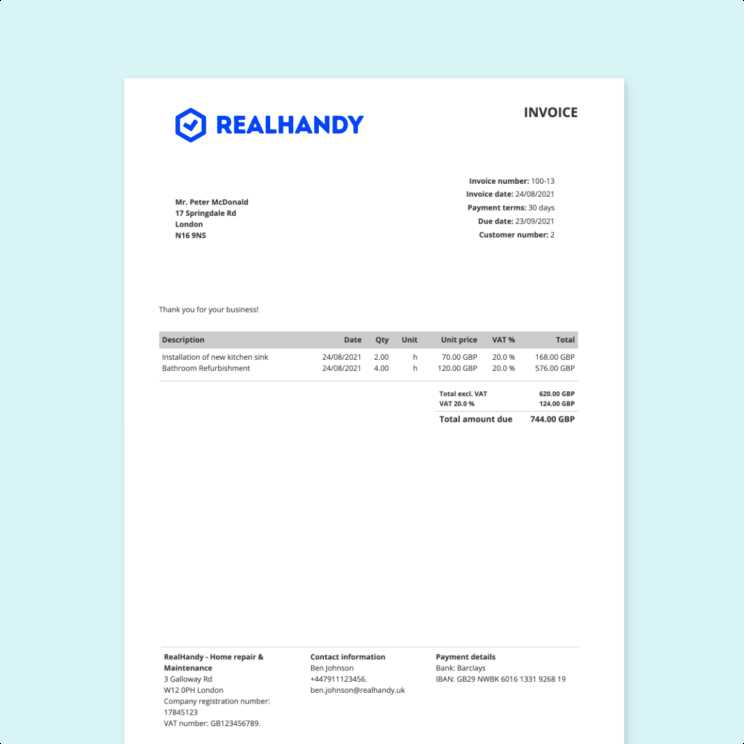

Essential Elements of a UK Billing Document

Creating a clear and accurate payment request is vital for ensuring smooth financial transactions. In the UK, there are specific elements that need to be included in every document to ensure that it meets both legal and professional standards. These essential components not only help avoid confusion but also guarantee that the document complies with UK tax and business regulations.

Key Information to Include

When drafting a payment request, ensure the following key details are included:

- Your Business Information: Include your full name or business name, address, phone number, and email to make it easy for clients to contact you.

- Client’s Information: Provide the client’s full name or company name and address. This ensures there is no ambiguity about who the document is intended for.

- Unique Reference Number: Each document should have a unique identification number for tracking purposes and to help organize records efficiently.

- Issue Date: Clearly indicate the date the document is created or sent to ensure there is no confusion about when the payment request was made.

- Payment Due Date: Specify when the payment is due, which helps avoid late payments and sets clear expectations.

Financial Details and Legal Requirements

The financial components of the document are critical to ensure transparency and legal compliance:

- Breakdown of Goods or Services: Describe the products or services provided, including quantities, descriptions, and individual prices. This clarity helps prevent misunderstandings and disputes.

- Subtotal, Taxes, and Discounts: Clearly state the subtotal before tax, any applicable taxes (such as VAT), and any discounts provided. This ensures the client understands the full cost breakdown.

- Total Amount Due: Include the total amount due after all taxes, discounts, and other adjustments. This is the final sum the client needs to pay.

- Payment Details: Include your payment method details, such as bank account information or online payment options, to make it easy for clients to complete the transaction.

- Legal Information: Depending on the type of business, you may need to include your VAT registration number or any other legal business identifiers required by UK law.

By including these key elements, businesses in the UK can ensure their payment requests are not only professional but also legally sound, providing a smooth experience for both the business and the client.

Legal Requirements for UK Billing Documents

In the UK, when requesting payment from clients, it is essential that your documents adhere to legal standards. These documents must include specific information to comply with UK tax regulations and business practices. Failing to include the necessary elements may lead to complications with tax authorities or result in delayed payments. Understanding the legal requirements helps ensure your documents are both professional and compliant with UK law.

Key Legal Elements

Here are the primary elements that must be included to ensure your payment request meets UK legal standards:

| Required Element | Description |

|---|---|

| Business Information | Your name or company name, address, and contact details (email and phone number). For limited companies, the company number and registered office address must also be included. |

| Client Details | The full name or company name and address of the client to whom the request is addressed. |

| Unique Reference Number | A unique reference number for record-keeping and to ensure the transaction can be easily identified. |

| VAT Registration Number | If you are VAT registered, your VAT registration number must be included. This is required for businesses that exceed the VAT threshold. |

| Issue Date and Due Date | The date the document was created and the payment due date. It helps to define the time frame for payment and track payment history. |

| Goods or Services Provided | A clear description of the goods or services provided, including quantities and prices. |

| Tax Information | If applicable, include any tax rates (e.g., VAT) and the total amount of tax charged. |

| Total Amount Due | The final amount to be paid, including all charges and taxes. |

Additional Considerations

In addition to the basic requirements above, businesses should also ensure that they follow any industry-specific guidelines or additional local regulations that might apply. For example, some industries may have additional requirements for providing payment instructions or detailing specific terms and conditions. It’s essential to review these guidelines to ensure compliance and avoid any legal issues down the line.

How to Add Your Business Details

Including accurate and complete business information in your payment requests is essential for maintaining professionalism and ensuring that clients can easily contact you if needed. Your business details serve as a clear point of reference for your clients and help establish trust. Additionally, providing proper information ensures that your documents are legally compliant and meet UK business regulations.

What to Include in Your Business Information

Your business details should be prominently displayed on every document. Here’s a list of key information to include:

- Business Name: Always use your registered business name or your full legal name if you are a sole trader.

- Business Address: Include your registered office address or the address where you conduct business operations.

- Contact Information: Provide a phone number and email address that clients can use to reach you quickly.

- Company Number: If your business is a limited company, include your company registration number. This is a legal requirement for all registered companies in the UK.

- VAT Registration Number: If your business is VAT registered, ensure that your VAT number is clearly stated on all documents.

- Bank Details (Optional): If appropriate, you may include your bank account information to make it easier for clients to complete payments.

Where to Place Your Business Information

Your business details should be easy to find on the document. Typically, they are placed in the header section or at the top of the page to ensure they are visible to your clients right away. This allows them to easily identify who the document is from and how to contact you if needed. It’s also a good practice to keep the information organized and consistent across all documents for a professional appearance.

By providing clear and comprehensive business details, you not only meet legal requirements but also build trust and transparency with your clients, ensuring smooth and timely payments.

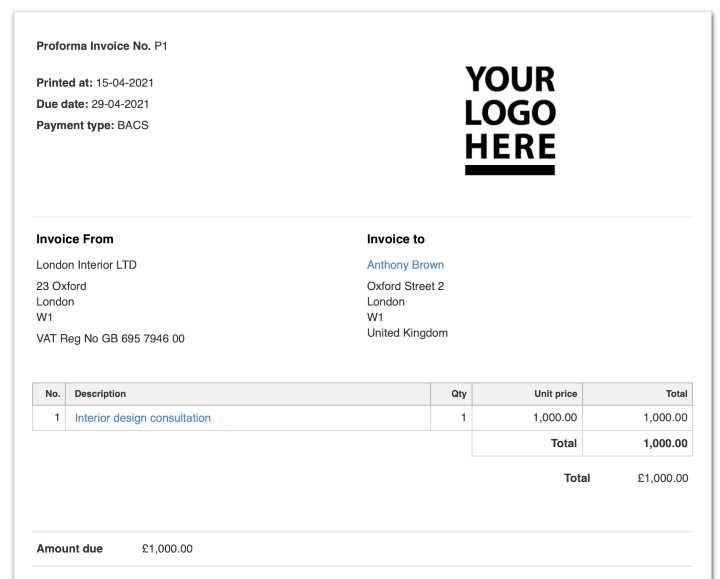

Choosing the Right Format for Your Billing Document

Selecting the appropriate format for your payment request is crucial for ensuring clarity, ease of use, and compatibility with your business processes. The format you choose will determine how easy it is to fill out, share, and store the document. It should also meet the needs of your clients, allowing them to process the payment efficiently. Understanding the different formats available can help you make an informed decision that best suits your workflow and professional needs.

Common Formats for Billing Documents

There are several formats to choose from, each offering different benefits. Below are some of the most popular options:

- PDF (Portable Document Format): This is one of the most widely used formats for payment requests. It preserves the layout and design across all devices and operating systems, ensuring that your document appears exactly as intended.

- Word (DOC/DOCX): Word documents are editable and easy to customize. This format is useful if you need to make regular changes or update details frequently. However, they may not appear the same on all devices unless the client has the appropriate software.

- Excel (XLS/XLSX): Excel is ideal for businesses that require frequent calculations or itemized breakdowns. It allows automatic calculations for taxes, totals, and discounts. However, it is not as professional as PDF for sharing with clients.

- Online Platforms: Some businesses opt for cloud-based solutions like Google Docs or invoicing software platforms. These allow for real-time collaboration and easy access, but may require clients to have accounts or access to the same platform.

Considerations When Choosing a Format

When selecting the right format for your payment request, consider the following factors:

- Client Preferences: Understand your clients’ preferred methods of receiving documents. Some may prefer PDF for its professional appearance, while others might appreciate the flexibility of Word or Excel files.

- Device Compatibility: Ensure that the format is easily accessible on multiple devices. PDFs are usually the best choice for ensuring consistent appearance across devices and platforms.

- Security: If the document contains sensitive information, such as payment details or client data, make sure the format allows for secure transmission and storage.

- Ease of Use: Choose a format that you and your team are comfortable with. If you need to make frequent updates or adjustments, an editable format like Word or Excel may be ideal.

By selecting the right format for your payment request, you ensure that your documents are not only functional but also professional, making it easier for both you and your clients to

How to Calculate VAT on UK Billing Documents

When issuing a payment request in the UK, businesses that are VAT-registered are required to include VAT (Value Added Tax) on applicable goods or services. It’s essential to correctly calculate and display VAT to ensure compliance with UK tax laws. This process involves understanding the applicable VAT rates, knowing what goods and services are taxable, and properly adding the tax to the total amount due.

Understanding VAT Rates in the UK

The UK has several VAT rates, and the correct rate depends on the type of goods or services being provided. Below are the main VAT rates in the UK:

- Standard Rate (20%): The most common rate applied to most goods and services.

- Reduced Rate (5%): Applies to specific goods and services, such as home energy and children’s car seats.

- Zero Rate (0%): Some goods and services are VAT-exempt but still require reporting, such as food, books, and public transport.

- Exempt from VAT: Certain services, like insurance, education, and healthcare, are exempt from VAT but do not count as taxable sales.

How to Calculate VAT

To calculate VAT on your billing documents, follow these simple steps:

- Determine the VAT Rate: Identify which VAT rate applies to the goods or services you are providing. This will depend on whether your products or services fall under the standard, reduced, or zero rate.

- Calculate the VAT Amount: Multiply the net amount (the price before VAT) by the applicable VAT rate. For example, if the net price of an item is £100 and the VAT rate is 20%, the calculation will be: 100 x 0.20 = £20.

- Add VAT to the Net Amount: Once you have calculated the VAT amount, add it to the net price to get the total amount due. For example, if the VAT amount is £20 and the net price is £100, the total will be £120.

For example, if you sell a product for £150 (net price), and the VAT rate is 20%, you would calculate the VAT as follows:

- £150 (net price) x 20% (VAT rate) = £30 (VAT amount)

- Total amount due: £150 + £30 = £180

Always remember to display both the net price and the VAT amount separately on your document, along with the total amount due. This ensures that your clients understand how the VAT was calculated and what they are being charged.

Document Format Compatibility with Accounting Software

When managing your business finances, integrating your payment request documents with accounting software can significantly streamline your workflow. By using a compatible format, you can ensure that all relevant financial data is automatically recorded and processed, reducing manual entry and the likelihood of errors. This integration allows for more efficient tracking of income and expenses and can help you stay on top of your financial reporting.

Why Compatibility Matters

Choosing the right format for your financial documents is crucial for ensuring smooth integration with your accounting software. Compatibility ensures that all details, such as amounts, tax calculations, and client information, can be automatically imported into your system. This not only saves time but also ensures accuracy in your accounting records.

- Data Import: Many accounting systems allow you to upload documents directly, saving time on manual data entry. Formats like CSV, Excel, or PDF can often be imported into these systems, making it easier to transfer information.

- Automation: Software can automatically update your financial records when the right format is used, including tracking overdue payments, generating financial reports, and reconciling bank statements.

- Accuracy: A compatible format reduces the risk of errors in data entry, ensuring that all figures are consistent and correctly recorded in your accounts.

Popular Formats for Accounting Software Integration

Different accounting platforms support various formats, so it’s important to choose one that suits both your document requirements and the software you use. Below are some commonly supported formats:

- CSV (Comma-Separated Values): Widely accepted by most accounting software, CSV files allow you to import line-by-line data such as payments, taxes, and item descriptions.

- Excel (XLS/XLSX): Many platforms support Excel files for their flexibility in organizing and calculating financial data. This format is especially useful for businesses that require detailed breakdowns.

- PDF: Although not as easily imported into accounting software, PDF files are still useful for creating professional and standardized documents. Some advanced accounting systems have OCR (Optical Character Recognition) capabilities to extract data from PDFs.

- Online Software Integration: Some cloud-based accounting platforms (like Xero, QuickBooks, or FreshBooks) offer direct integration with document creation tools, allowing for seamless synchronization without manual uploading.

By ensuring your billing documents are compatible with your accounting software, you can significantly improve efficiency and accuracy in managing your business finances, helping to save time and reduce administrative workload.

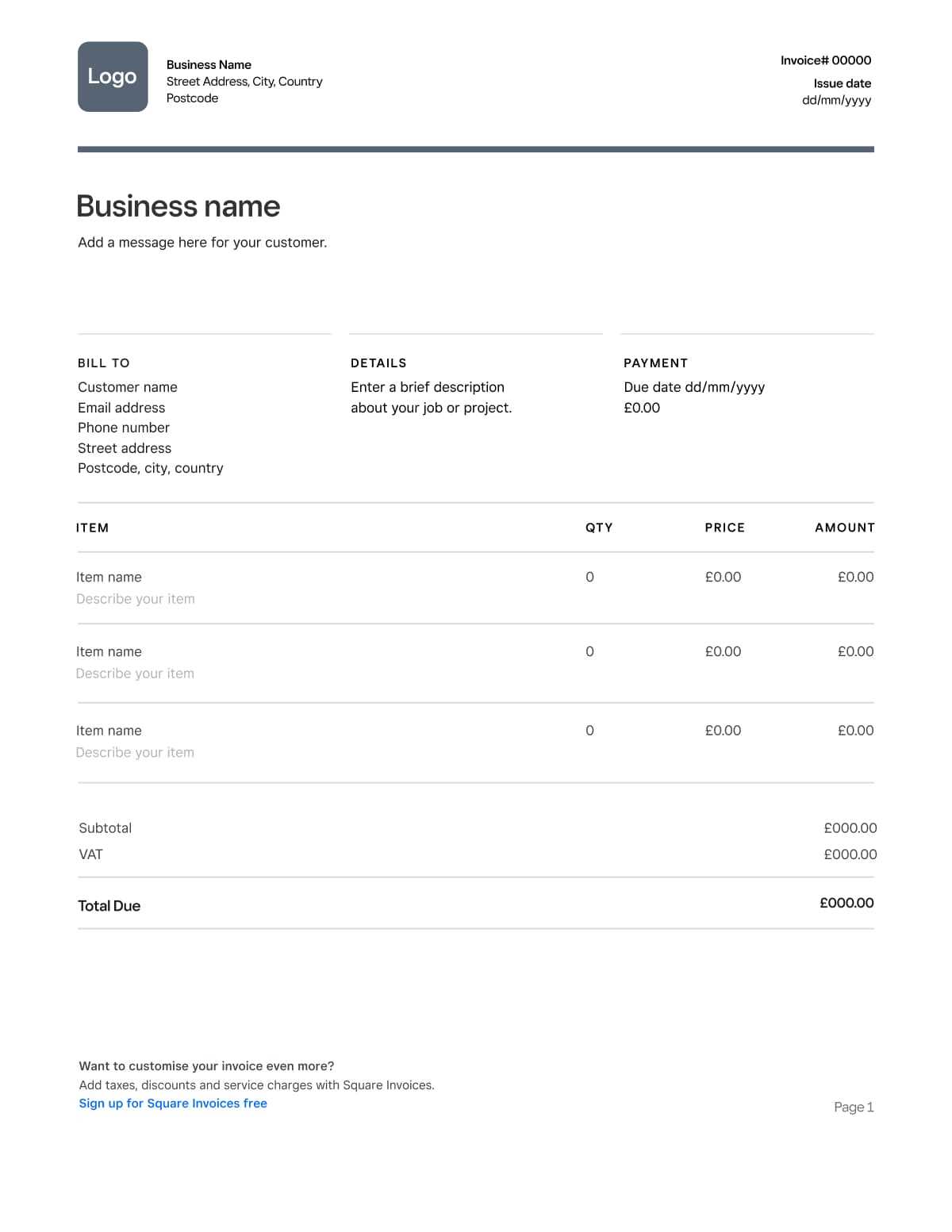

How to Customize Your Billing Document

Customizing your payment request documents is a key step in making them align with your business brand and ensuring they meet your specific needs. A well-designed and personalized document not only enhances your professionalism but also helps to present all relevant details in a clear, organized manner. Customizing your document allows you to include your business logo, adjust the layout, and tailor the fields to suit the services or products you offer.

Steps to Customize Your Payment Request

Follow these steps to make your document truly reflect your business and ensure it’s fully functional:

- Include Your Brand Identity: Adding your business logo, selecting a color scheme, and using a consistent font style will help your document match your company’s branding. This makes your document look professional and memorable.

- Adjust Layout and Sections: Depending on the nature of your business, you may want to rearrange sections to highlight the most important details. For example, some businesses may prefer to list payment terms and conditions at the top, while others may focus on the breakdown of services or goods provided.

- Modify Fields and Columns: If your business offers a variety of products or services, you can add or remove fields to match your specific needs. This might include custom descriptions, unit pricing, quantity, or discounts. Tailoring these fields ensures that your document includes only the relevant information.

- Set Up Payment Terms: Clearly state your payment terms, such as the due date, late fees, or available payment methods. You can customize these terms based on the specific agreements you have with clients or industry standards.

- Include Additional Information: You may need to add extra sections for things like tax numbers, order numbers, or delivery details. Including this information ensures that your payment request meets any legal requirements and is clear to your client.

Tools for Customizing Your Billing Documents

There are various tools available to help you customize your documents easily:

- Microsoft Word/Excel: These tools provide flexibility for editing and designing your documents. You can manually adjust text, add logos, and modify layouts to fit your preferences.

- Online Invoicing Software: Platforms like QuickBooks, Xero, and FreshBooks offer pre-built designs that you can quickly customize with your logo, colors, and payment terms. These platforms also allow for seamless integration with your accounting records.

- Google Docs/Sheets: If you need a simple and free option, Google Docs and Sheets provide templates that are easy to customize and share with clients.

By customizing your payment request document, you not only enhance your professional image but also make the process more efficient for both you and your clients. A personalized document helps ensure that all key details are clear and easily understood, making transactions smoother and reducing the risk of confusion.

Common Mistakes to Avoid on Billing Documents

Creating clear and accurate payment request documents is essential for maintaining smooth transactions and ensuring timely payments. However, there are several common mistakes that businesses often make, which can lead to confusion, delays, or even disputes with clients. Avoiding these errors is crucial for presenting a professional image and ensuring that your financial documents are legally compliant and easily understood.

1. Missing Contact Information

One of the most critical details to include in your document is your business contact information. Failing to provide a valid phone number, email address, or physical address can make it difficult for clients to reach you with questions or concerns, potentially delaying payment.

2. Inaccurate or Inconsistent Details

Ensure that all the details on your document are correct and consistent. This includes the client’s name and address, the date, payment terms, and the itemized breakdown of products or services. Any discrepancies can lead to confusion or delays in payment processing.

3. Not Including Payment Terms

Clearly stating payment terms, such as the due date, payment methods, and any late fees, is essential for setting expectations with your clients. Omitting this information can lead to misunderstandings or clients delaying payments due to a lack of clarity.

4. Incorrect Tax Calculations

Tax errors, such as applying the wrong VAT rate or omitting tax altogether, can result in legal complications and incorrect payments. Always ensure that tax is calculated accurately based on the correct rate and that the tax amount is clearly separated from the net amount on the document.

5. Missing Invoice Number

Every billing document should have a unique identifier, such as an invoice number. This helps both you and your client track payments and serves as a reference for any future communications. Failing to include an invoice number can complicate record-keeping and payment tracking.

6. Not Providing a Clear Breakdown of Charges

It’s important to provide a detailed, itemized list of the goods or services being charged for. Without this breakdown, clients may question the charges or request clarification, leading to potential delays or disputes. Be sure to list each item separately along with the corresponding price, quantity, and total.

7. Forgetting to Include Late Fees

If you have agreed on late fees for overdue payments, make sure to clearly state these charges on the document. This helps ensure that clients are aware of any additional costs they might incur if they don’t pay on time.

8. Lack of Clear Formatting

A poorly formatted document can confuse the client and make it difficult to read. Use clear headings, bullet points, and appropriate spacing to ensure that your document is easy to navigate. Avoid cluttered text or ambiguous terms that might cause misunderstandings.

9. Not Using a Professional Design

Your billing document represents your business, so it’s important to ensure it looks professional. Using a generic or unpolished design can diminish the credibility of your business. Invest in a professional-looking layout that reflects your brand identity and instills trust in your clients.

By being mindful of these common mistakes, you can ensure that your payment request documents are accurate, clear, and professional, helping to facilitate smooth transactions and build positive client relationships.

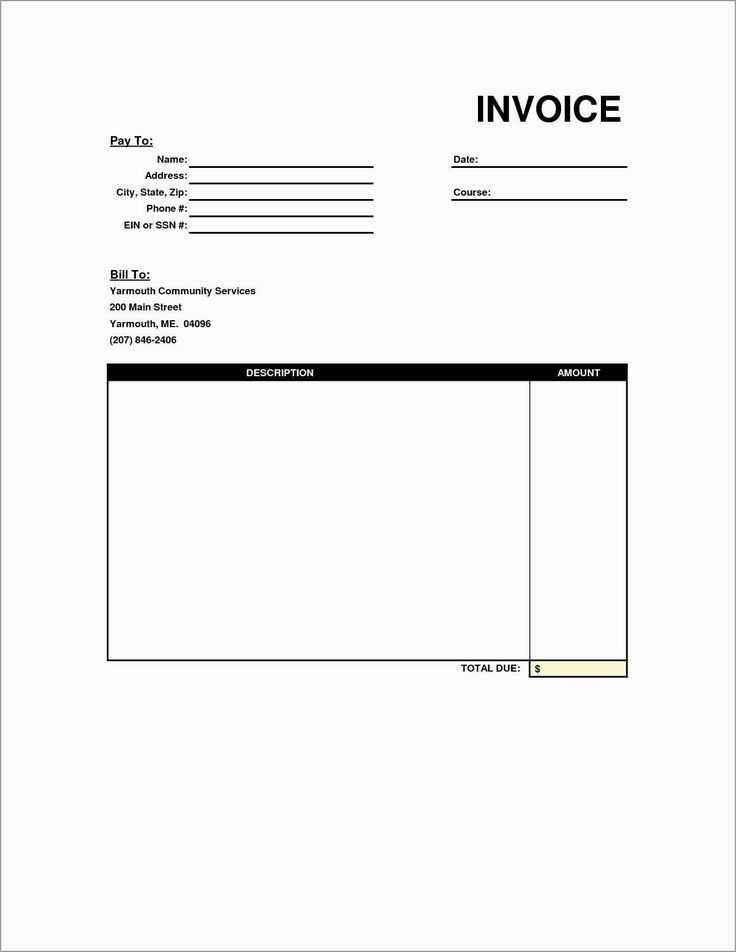

Free vs Paid Billing Documents: Which to Choose

When it comes to creating payment requests for your business, you have the option to choose between no-cost solutions and paid options. Both approaches have their pros and cons, depending on your business needs and the level of customization or functionality you require. Understanding the differences between these two choices can help you determine which one will best suit your operational workflow and professional image.

Advantages of No-Cost Billing Documents

Free billing document formats are often a great starting point, especially for small businesses or freelancers who are just getting started. These options are easily accessible, and many can be downloaded or used online without any financial commitment. Here are some advantages:

- No Initial Investment: No-cost options are appealing because they require no upfront payment, making them a great choice for startups or those with limited budgets.

- Simple to Use: Many free document formats are straightforward and easy to set up, which is perfect for businesses that need quick, simple documents without too many complexities.

- Basic Features: Free options often provide the essential sections required for a professional payment request, such as client information, item descriptions, and totals.

Disadvantages of No-Cost Billing Documents

While free solutions can be convenient, they may come with some limitations that could impact your business’s growth or efficiency:

- Limited Customization: Many free formats offer limited design options, making it difficult to align them with your company’s branding or personal preferences.

- Basic Functionality: No-cost solutions often lack advanced features like automated tax calculations, integration with accounting software, or payment tracking.

- Risk of Generic Design: Free options may result in a standard, unprofessional look that doesn’t differentiate your business from others.

Benefits of Paid Billing Documents

On the other hand, paid billing document solutions come with additional features and benefits that are often necessary for growing businesses or those looking to enhance their professional image:

- Customization Options: Paid formats often offer a wide range of customization options, including adding your logo, changing colors, and adjusting the layout to better reflect your brand.

How to Download UK Billing Documents

When creating payment request documents for your UK-based business, downloading the right format can save you time and effort. Whether you are looking for a basic layout or something more customized to suit your business needs, downloading the appropriate document structure is the first step. There are several reliable sources where you can obtain these formats, both free and paid, each offering a variety of designs and features.

Steps to Download UK Billing Documents

Follow these simple steps to download a suitable payment request format for your business:

- Choose the Right Source: There are multiple platforms available, such as accounting websites, online document providers, or specialized business software platforms, where you can find downloadable formats. Some offer both free and paid options depending on the features you require.

- Select the Format: Depending on your preferences, you may need a Word document, Excel file, or PDF format. Make sure the chosen file type is compatible with the software you plan to use for managing your business documents.

- Customize the Document: Once downloaded, you can personalize the format by adding your company details, logo, and adjusting the layout. Many downloadable options allow for easy editing and customization to better suit your business’s branding.

- Ensure Compliance: Make sure the downloaded document complies with UK legal requirements for payment request documents. This includes fields for VAT registration, tax rates, and business details such as your company number.

Where to Find UK Billing Documents

Below are some common sources for downloading UK-based payment request formats:

Source Features Accounting Software (e.g., QuickBooks, Xero) Customizable formats, easy integration with accounting records, automated tax calculations Document Sharing Platforms (e.g., Microsoft Office, Google Docs) Variety of basic to advanced designs, editable, compatible with most office tools Freelance Websites (e.g., Fiverr, Upwork) Professionally designed formats tailored to specific business needs, available for a fee Business Resource Websites (e.g., Simply Business, Gov.uk) Official formats compliant with UK regulations, easy to download Downloading a well-designed and legally compliant document for your payment requests is an essential step in ensuring that your business operates smoothly. By selecting the right format, you can maintain

Ensuring Professionalism with Billing Documents

In the business world, the documents you send to clients play a crucial role in shaping their perception of your company. A well-crafted payment request not only reflects your professionalism but also helps establish trust and confidence in your brand. To ensure that your billing process is taken seriously, there are several key elements that can elevate your documents and make them appear polished and business-savvy.

Key Elements for a Professional Look

To maintain a professional image when sending payment requests, consider the following aspects:

- Clear Branding: Make sure your company’s logo, colors, and brand fonts are incorporated into the design. This helps reinforce your brand identity and makes the document look cohesive with other business materials.

- Consistent Formatting: Consistency in layout, font size, and spacing is vital for readability. A well-structured document looks organized and makes it easier for clients to review.

- Accurate Information: Always double-check that all details, such as client names, product descriptions, amounts, and payment terms, are correct. Inaccurate information can lead to delays or disputes, damaging your credibility.

- Legal Compliance: Ensure that the document complies with relevant legal requirements, including tax rates and business registration numbers. This not only ensures legality but also gives clients confidence in your professionalism.

- Professional Language: The tone and language used in your documents should always be polite, clear, and concise. Avoid overly casual language, as this can come across as unprofessional.

Design Tips for Polished Documents

A professional design can make a significant impact on how your clients perceive your company. Here are some design tips to follow:

- Use a Clean Layout: Opt for a minimalistic, well-spaced layout. Avoid clutter, and make sure that key information is easy to locate.

- Legible Fonts: Use simple, easy-to-read fonts. Stick with standard, professional typefaces like Arial, Helvetica, or Times New Roman.

- Incorporate Visual Hierarchy: Make important information stand out by using bold headings, larger font sizes, or different text styles for section titles. This helps guide the reader’s eye to the most crucial details.

Why Professional Documents Matter

Maintaining a professional appearance for your billing documents is not just about aesthetics. A polished document helps establish your business as reliable and organized, creating a positive impression with clients. It also reduces the risk of errors, delays, or misunderstandings, leading to smoother transactions and stronger business relationships.

By investing time and effort into making sure your payment requests look professional, you demonstrate your commitment to quality and your dedication to your client

Frequently Asked Questions About UK Billing Documents

When it comes to creating and managing payment request documents in the UK, there are often many questions that arise, especially for small businesses or freelancers. Understanding the essentials of these documents is key to ensuring your business runs smoothly and stays compliant with UK regulations. Below, we address some of the most commonly asked questions about creating and using payment documents in the UK.

What Information Should Be Included in a Payment Request?

In the UK, a well-crafted payment request should contain the following key elements:

- Business Details: Your company name, address, and contact information should be clearly listed.

- Client Information: Include the client’s name and address to ensure proper identification.

- Unique Reference Number: Each document should have a unique identifier for easy tracking.

- Item Descriptions: Clearly list the goods or services provided, along with quantities and rates.

- Total Amount Due: The total sum, including any applicable taxes, should be clearly stated.

- Payment Terms: Specify the due date and accepted methods of payment.

Do I Need to Charge VAT?

If your business is VAT-registered, you are required to charge VAT on taxable goods and services. The standard VAT rate in the UK is currently 20%, but certain goods and services may be subject to reduced or zero rates. It’s important to ensure that the correct VAT rate is applied to your charges and that your registration number is displayed on the document.

Can I Use Online Tools to Create Billing Documents?

Yes, there are many online platforms that allow you to create professional payment request documents. Some tools offer customizable formats that can help you generate and manage documents quickly. These platforms also often provide features like automatic tax calculations, reminders, and payment tracking, making it easier to manage your accounts.

Is It Necessary to Have a Physical Document?

In most cases, electronic versions of payment requests are perfectly acceptable and widely used. However, some clients may still prefer or require a physical copy. Always confirm with your client whether they need a paper version or if an electronic one is sufficient.

What Are the Consequences of Not Issuing Payment Requests Properly?

Failure to issue accurate and compliant payment documents can lead to delays in payment, disputes, or even legal challenges. It is important to ensure that all required information is included and that the document meets UK business regulations. This will help maintain professionalism and ensure that your business is operating within the law.

By addressing these key questions, you can ensure that your payment documents are both professional and compliant, which will contribute to smoother transactions and a more trustworthy relationship with your clients.