UAE VAT Invoice Template for Easy Tax Compliance

In the business world, maintaining accurate financial records is essential for smooth operations and compliance with regulations. For companies operating under specific tax regimes, having proper documentation is crucial not only for internal record-keeping but also for submitting necessary reports to authorities. Having a standardized document format ensures consistency and helps avoid common errors that can lead to delays or fines.

Creating a well-structured financial record for every transaction is a critical part of doing business, especially for organizations that need to account for tax-related matters. This document serves as a formal record, outlining key transaction details that both the company and the tax authorities can refer to. It is vital to ensure the format complies with local requirements, making it easier to manage audits or any future inquiries.

Using a pre-designed format is a practical way to ensure that all required elements are included. This approach minimizes the risk of missing important details and ensures that your business stays compliant with regulatory demands. Whether you’re an established company or just starting out, implementing this strategy can help streamline your operations and maintain clear, organized financial documentation.

Understanding UAE VAT Invoice Requirements

When running a business, it’s important to keep proper documentation for all transactions, especially when it comes to taxes. Having clear and standardized records is not only a good business practice but also a legal requirement in many jurisdictions. These documents need to contain specific information that helps authorities assess and verify tax obligations. Understanding the required components for such documentation ensures compliance and simplifies audits or reviews.

In the UAE, certain key details must appear on every official record for a sale or service transaction. These elements help the tax authorities track taxable transactions and determine whether the correct amount of tax has been charged. Missing or incomplete information could result in penalties or delays, which can disrupt business operations.

The following table outlines the essential components that must be included in every tax document to ensure compliance:

| Required Information | Description |

|---|---|

| Document Number | A unique identification number for each document, ensuring it can be easily referenced. |

| Seller’s Details | Name, address, and tax registration number of the company issuing the document. |

| Buyer’s Details | Name and address of the customer or business receiving the goods or services. |

| Transaction Date | The date when the goods or services were delivered or the payment was made. |

| Transaction Description | A detailed list of the items or services provided, including quantities and prices. |

| Amount Charged | The total value of the goods or services provided before taxes. |

| Tax Amount | The exact amount of tax added to the total price, based on applicable rates. |

| Total Amount | The final amount due, including the tax amount. |

Having all of this information included in each transaction document is crucial to staying compliant with local tax laws and avoiding unnecessary complications. With the right structure, businesses can efficiently manage their tax obligations and ensure smooth operations.

What is a VAT Invoice in UAE

In a business context, a formal document that records a transaction between a seller and a buyer is essential for both parties, especially for regulatory purposes. This document serves to confirm the exchange of goods or services and is crucial for tracking tax liabilities. It provides all necessary details about the transaction, including the total amount due and the tax that is applicable based on the local tax regime.

Such a document is required in many countries, especially where businesses are obligated to collect taxes on behalf of the government. It helps authorities verify that the correct tax has been charged and facilitates the proper filing of returns. Without this document, it would be difficult to prove the legitimacy of the transaction and fulfill tax-related obligations.

In many cases, businesses are legally required to issue this kind of document whenever they sell goods or offer services. It includes detailed information such as the names and addresses of both the buyer and seller, a breakdown of the transaction, and the specific tax amounts charged. Failure to comply with these requirements can result in fines or penalties, making it essential to adhere to the guidelines when creating such records.

Importance of Accurate VAT Invoices

Ensuring that all financial records are accurate is a critical element of any business’s operations. The accuracy of transaction documents, especially those related to tax, not only affects internal accounting but also ensures compliance with tax regulations. Mistakes or omissions in these records can lead to serious consequences, including penalties, audits, and even legal action. This is why it is vital to maintain precision in every transaction detail.

Consequences of Inaccurate Tax Records

- Financial Penalties: Incorrect details may result in fines from tax authorities for non-compliance.

- Increased Audits: Discrepancies can trigger audits, which take time and resources to resolve.

- Loss of Trust: Frequent errors can damage the trust between businesses and their clients, leading to potential loss of business.

- Tax Payment Issues: Miscalculations could cause the business to overpay or underpay taxes, leading to further complications.

Benefits of Accurate Tax Documents

- Ensures Compliance: Accurate records help businesses stay in line with local tax regulations and avoid legal issues.

- Improved Business Management: Precise financial data enables better cash flow management and informed decision-making.

- Enhances Reputation: A company that consistently produces correct and reliable records is more likely to gain the trust of partners and customers.

- Saves Time and Resources: Correct documentation reduces the need for rework, audits, and corrections down the line.

In the end, attention to detail and accuracy in these documents not only protects the business from unnecessary risks but also promotes smoother, more efficient operations. It is an essential part of maintaining financial transparency and integrity in all transactions.

Key Elements of UAE VAT Invoices

For businesses that are required to collect taxes, creating proper documentation for each transaction is essential. Such records must contain specific details to meet legal requirements and to ensure that both buyers and sellers can accurately track the amount of tax applied. The presence of these key components not only facilitates smooth tax filing but also helps businesses maintain compliance with local regulations.

Essential Information for Tax Records

- Document Identification Number: A unique reference number for each transaction, allowing for easy identification and tracking.

- Business Information: The seller’s name, address, and tax registration number should be included to confirm the legitimacy of the document.

- Buyer Details: The name and address of the buyer, as well as their tax registration number (if applicable), must be present to verify the transaction.

- Transaction Date: The exact date of the sale or service provision, confirming when the goods or services were delivered or paid for.

- Product or Service Description: A clear description of the goods or services sold, including quantities and unit prices to ensure full transparency of the transaction.

- Total Amount Before Tax: The total cost of goods or services before any tax is added, providing clarity on the base value.

- Tax Amount: The total amount of tax charged on the transaction, broken down by applicable rates and amounts.

- Total Amount Due: The final total, which includes the base cost plus the tax amount, showing the complete amount the buyer is required to pay.

Why These Elements Matter

- Legal Compliance: Including all required details ensures that the business adheres to local regulations, avoiding penalties and fines.

- Clarity and Transparency: These components help both parties understand the transaction and its associated tax obligations.

- Audit Readiness: Complete and accurate documents are essential in case of an audit, ensuring that the business can provide proper evidence of tax payments.

By ensuring that all key elements are present, businesses can streamline their financial processes, maintain compliance, and avoid complications related to tax reporting and audits.

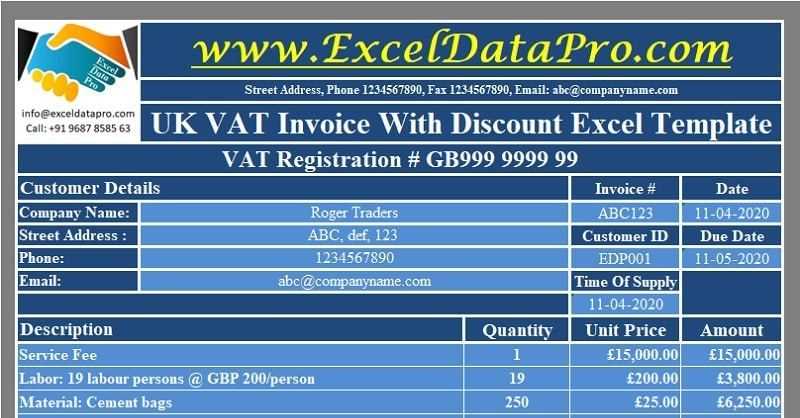

How to Create a UAE VAT Invoice

Creating a formal transaction document is an essential part of managing business finances, especially when taxes are involved. This document should include all necessary information to ensure that both parties can track the sale and the tax applied. Whether you’re creating one from scratch or using a digital tool, following a clear and structured approach is key to ensuring accuracy and compliance.

Here’s a step-by-step guide on how to create a proper tax document:

- Choose the Right Format: Select a format that is easy to follow and can accommodate all required information. This can be done manually on paper or using accounting software to automate the process.

- Include Business Details: Start by adding the name, address, and tax registration number of the seller. Make sure this information is clear and legible to confirm the business’s identity.

- Provide Buyer’s Information: Add the customer’s name, address, and any relevant tax registration number. This ensures that both parties are clearly identified in the transaction.

- Detail the Goods or Services: Describe each item or service being sold, including quantities, unit prices, and total costs before tax. This provides transparency and clarity for both parties.

- Calculate the Tax Amount: Apply the relevant tax rate to the total amount of the transaction, and clearly state the tax amount charged. This step ensures that the correct tax is being collected.

- Calculate the Total: Add the tax to the base amount to determine the final amount due. This total should be clearly indicated as the amount the buyer is expected to pay.

- Include a Unique Reference Number: Each document should have a unique identification number to track and reference it in case of future inquiries or audits.

- Specify the Date: Ensure the transaction date is included, which marks the day the goods or services were provided or the payment was made.

Once these steps are completed, review the document for accuracy and ensure all required fields are filled out correctly. Keeping a copy for your records is also a best practice for future reference or in case of audits.

Common Mistakes to Avoid in VAT Invoices

Creating accurate transaction records is crucial for any business, especially when taxes are involved. However, mistakes in the document creation process can lead to significant issues, including penalties, delays, and misunderstandings. Even small errors can create confusion, potentially resulting in costly consequences for both the business and the customer. Understanding and avoiding common mistakes can help businesses ensure compliance and maintain a smooth financial process.

Common Errors to Watch For

- Missing Transaction Details: Failing to include essential information such as the buyer’s details, transaction date, or a clear description of the goods or services can lead to confusion and delays. Every document should be complete and accurate.

- Incorrect Tax Calculation: One of the most common mistakes is incorrectly calculating the tax amount. Always double-check the applicable tax rate and ensure it is correctly applied to the total value of the goods or services before tax.

- Omitting a Unique Document Number: Not assigning a unique identification number to each record can make it difficult to reference or track the document in the future, which is especially important in case of audits or disputes.

- Failing to Include Total Amounts: Omitting the total amount due, including both the pre-tax value and the tax amount, can create confusion and lead to misunderstandings between the buyer and seller.

- Incorrect Business Information: Providing inaccurate business details, such as the tax registration number or address, can result in the document being deemed invalid by tax authorities.

- Not Updating Records: If any changes occur, such as price adjustments or returns, it’s important to update the document promptly. Failing to do so may lead to discrepancies in the business’s financial records.

How to Avoid These Errors

- Double-Check All Details: Review all information before finalizing the document to ensure everything is accurate, from the buyer’s details to the tax amount.

- Use Accounting Software: Utilize digital tools or accounting software to automate calculations and ensure the proper format and structure are followed for each transaction.

- Train Employees: Ensure that all team members involved in document creation are well-trained on the requirements and standards for accurate record-keeping.

By being mindful of these common mistakes and taking proactive steps to avoid them, businesses can ensure they stay compliant with tax regulations and maintain accurate financial records.

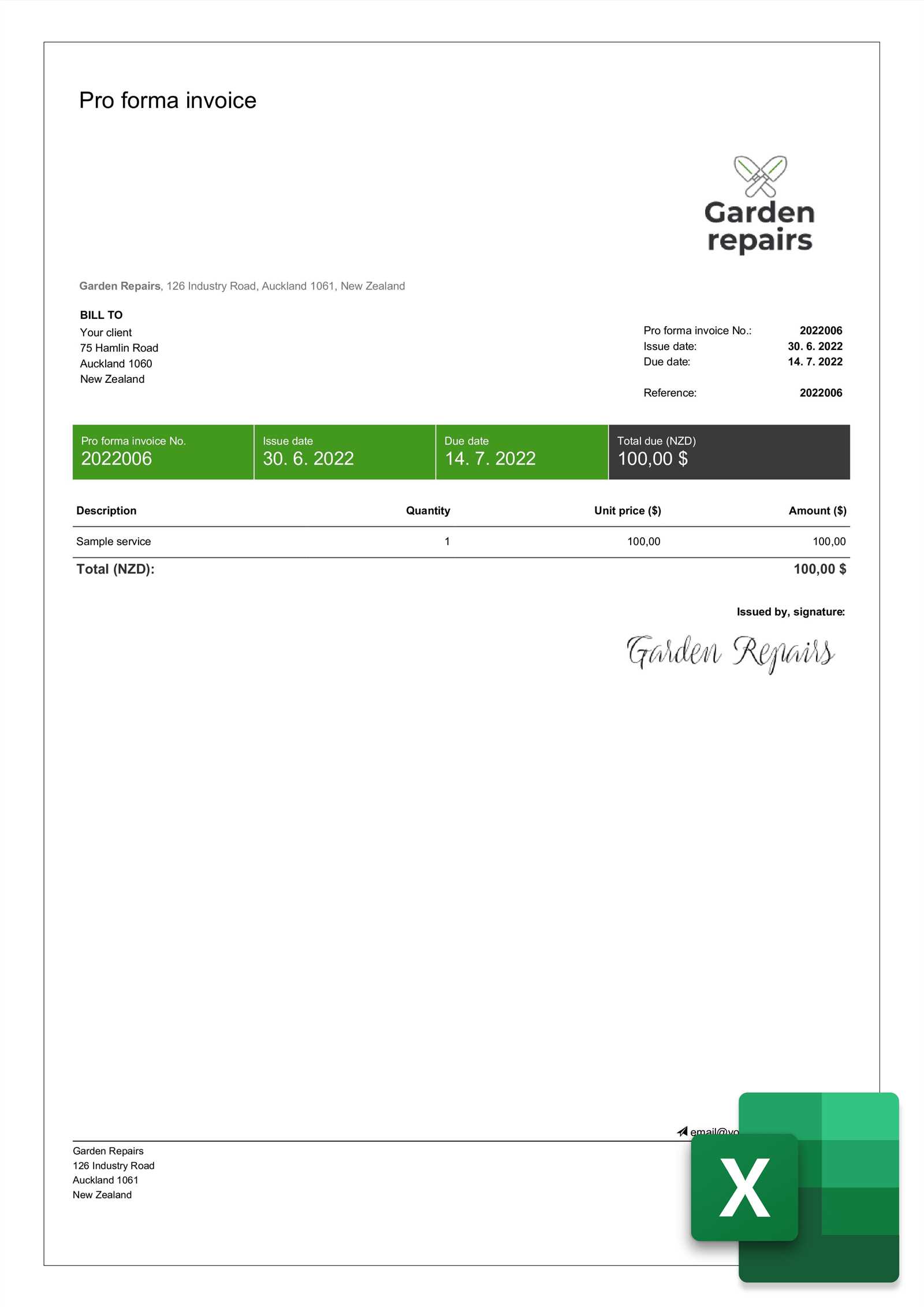

How to Download a VAT Invoice Template

For businesses that need to create standardized transaction documents, downloading a ready-made format can save time and ensure compliance with tax regulations. These pre-designed formats can be customized to fit your business’s needs, providing an easy way to generate accurate records for every transaction. The process of downloading such formats is simple, and many tools are available online to make this task even easier.

Follow these steps to download and use a pre-designed document format:

- Search for Reliable Sources: Look for reputable websites or accounting platforms that offer downloadable formats. Ensure that the source is trustworthy and that the document adheres to local legal requirements.

- Choose the Right Format: Select a format that suits your business needs. Some platforms offer customizable files, while others provide fixed formats that meet specific regulatory standards.

- Download the File: Once you’ve selected the format, click the download button and save the file to your computer or cloud storage for easy access.

- Check for Compatibility: Ensure that the file is compatible with the software you use, whether it’s a spreadsheet program like Excel or an accounting tool that can integrate with your financial system.

- Customize the Format: After downloading, customize the document by adding your business details, such as your name, address, and tax registration number, along with any other relevant transaction information.

Using a pre-made format not only speeds up the process but also helps ensure that you don’t miss any critical information that could lead to mistakes. With the right tools, you can quickly generate accurate and compliant transaction records for your business.

Many software tools and online platforms also offer templates that can be filled out digitally, reducing the need for manual entry and minimizing the risk of errors. Be sure to keep your downloaded format updated as tax regulations may change over time.

Customizing Your UAE VAT Invoice Template

Once you have downloaded or selected a standard document format for your business transactions, the next step is to customize it to reflect your specific business needs. Customization ensures that the document not only complies with legal requirements but also aligns with your brand and business processes. Personalizing your records allows for consistency and professionalism in all financial communications.

Here are the key areas you should focus on when tailoring your transaction document format:

- Add Business Information: Ensure that your company name, address, contact details, and tax registration number are prominently displayed on the document. This provides essential identification for both the seller and the buyer.

- Include Branding Elements: Customize the design by adding your company’s logo, colors, and font styles. This creates a professional appearance and reinforces your brand identity.

- Set Up Automatic Calculations: If you’re using a digital document or software, make sure to set up automatic tax calculations based on the applicable rate. This minimizes errors and ensures the tax amount is always correct.

- Define Product or Service Categories: Customize the item description section to suit your specific products or services. Include categories, SKU numbers, or product codes if necessary, to make tracking easier.

- Custom Fields: If your business requires additional information, such as delivery dates or payment terms, customize the format to include these fields for better tracking.

- Footer Information: Add any necessary disclaimers or payment instructions at the bottom of the document. This can include bank account details, refund policies, or terms and conditions.

Customizing the format to fit your business needs helps to ensure that your documents are both accurate and professional. It also makes the process of generating transaction records more efficient, saving time and reducing the likelihood of errors. Make sure to regularly update the format as your business evolves or as tax regulations change.

With the right adjustments, you can create a document that works seamlessly for your operations while staying compliant with local laws.

Benefits of Using a VAT Invoice Template

Using a pre-designed document format for financial transactions offers numerous advantages for businesses, especially when dealing with tax-related records. These ready-made formats help streamline the creation of transaction documents, ensuring that all necessary details are included and correctly formatted. By using a standardized approach, businesses can improve accuracy, reduce errors, and save time in the document creation process.

Key Advantages

- Consistency: A standardized format ensures that all transaction records are consistent, making it easier to review and compare documents over time.

- Time Efficiency: Pre-designed formats eliminate the need to manually design a new document each time, speeding up the process of generating transaction records.

- Accuracy: By using a structured format, businesses are less likely to forget critical information or make errors when filling out the document. This helps maintain correct tax calculations and data.

- Compliance: A properly structured format is often designed to meet regulatory requirements, ensuring that the document complies with local tax laws and reducing the risk of fines or audits.

- Professional Appearance: A well-designed format gives a professional look to your financial records, which can improve your business’s credibility and build trust with clients.

Additional Benefits

- Easy Customization: Many digital tools allow for easy customization of the format, enabling businesses to tailor the document to their specific needs without starting from scratch.

- Record Keeping: A standardized document helps with organization and better record-keeping. It’s easier to search for and retrieve transaction records when they follow a consistent format.

- Audit Preparedness: When your documents are structured and complete, they are easier to present during an audit, reducing the stress and effort required to gather information.

Incorporating a standardized document format into your business workflow can greatly enhance the efficiency and accuracy of your transaction record-keeping process. By using a well-structured and customizable format, you can ensure smoother operations and avoid potential complications.

Legal Guidelines for VAT Invoices in UAE

In many countries, businesses are required to follow specific legal guidelines when creating transaction records that include tax charges. These regulations ensure that both the buyer and seller are protected, and that tax authorities can easily verify that the correct amounts are being collected and paid. For businesses operating in regions with a formal tax system, adherence to these legal standards is essential to avoid penalties and maintain good standing with tax authorities.

Key Legal Requirements

- Mandatory Information: Each document must include essential details, such as the name, address, and tax registration number of both the seller and the buyer. Without this information, the document may not be considered valid.

- Document Number: Every transaction record should have a unique identifier, which helps businesses and authorities track individual sales or services.

- Transaction Date: The date of the transaction must be clearly indicated, as it marks when the goods or services were provided or paid for, ensuring proper tax reporting.

- Clear Tax Breakdown: It is required to show the amount of tax charged separately from the base price of the goods or services, allowing for transparency in the total payment due.

- Tax Rates: The applicable tax rate must be specified on the document. It should be clear whether the tax is included in the price or added separately, as this impacts the total amount due.

Consequences of Non-Compliance

- Fines and Penalties: Businesses that fail to meet these legal requirements risk facing financial penalties, which can vary based on the severity of the infraction.

- Audit Risk: Incomplete or inaccurate records can trigger audits, which may result in additional scrutiny of the business’s financials and tax filings.

- Invalid Transactions: If the required details are missing or incorrect, the transaction record may not be legally recognized, potentially leading to disputes or issues with clients or suppliers.

To avoid these risks, it’s crucial for businesses to follow the established legal guidelines when creating tax-related documents. Adhering to these standards not only ensures compliance but also helps maintain trust with customers and tax authorities.

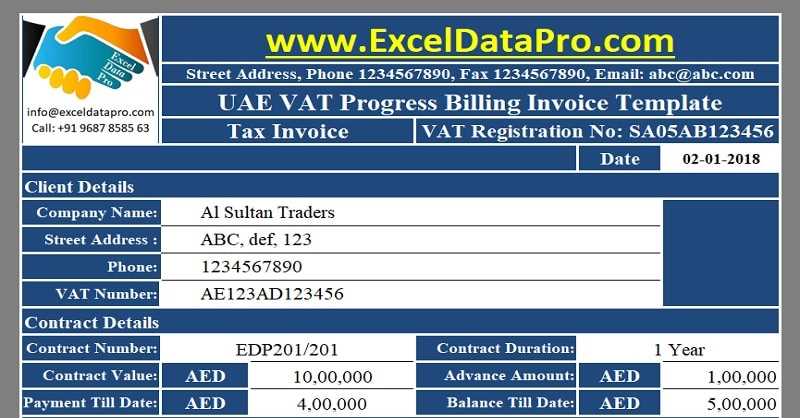

UAE VAT Invoice Format Explained

Understanding the structure of a tax document is essential for businesses to ensure that all necessary details are included for compliance and clarity. A properly formatted document provides transparency, helps track financial transactions, and simplifies tax reporting. Knowing the key elements of the document structure ensures that businesses meet legal obligations while maintaining accurate records.

The following is a breakdown of the key components of a tax document format that complies with regional standards:

- Document Identification Number: A unique reference number for each transaction helps both parties easily identify and track the document, reducing the chance of errors or duplication.

- Seller’s Information: The name, address, and tax registration number of the seller must be clearly displayed to establish the identity of the business providing the goods or services.

- Buyer’s Information: The name, address, and tax registration number (if applicable) of the buyer must be included to properly document the transaction between the two parties.

- Transaction Date: This should reflect the exact date the goods or services were provided or when payment was made. It is crucial for determining tax periods and ensuring the accuracy of financial records.

- Description of Goods or Services: Each item or service being sold should be clearly described, with quantities, unit prices, and total amounts before tax. This section ensures transparency and accountability in the transaction.

- Tax Rate and Amount: The tax rate should be applied to the total value of the transaction, and the total tax amount must be clearly listed separately from the base cost of the goods or services.

- Total Amount Due: The final total should include both the pre-tax amount and the tax amount, clearly indicating the total payment due from the buyer.

Having a well-organized format with these elements in place ensures that both parties understand the financial details of the transaction. It also supports compliance with tax regulations, helping to avoid legal issues and simplifying the auditing process if necessary.

VAT Invoice Requirements for Different Businesses

Every business must ensure that their transaction records meet certain standards, especially when dealing with tax-related documentation. However, the specific requirements can vary depending on the type of business and the nature of the goods or services provided. Understanding these distinctions is important for ensuring compliance and avoiding issues with tax authorities. Tailoring your documentation to meet the specific needs of your business helps maintain clarity and legal accuracy.

Here is an overview of key requirements for different types of businesses:

Service-Based Businesses

- Service Description: For businesses that provide services rather than physical products, it is crucial to clearly describe the nature of the service provided. This includes the scope, duration, and any additional charges associated with the service.

- Hourly or Project-Based Billing: If services are billed on an hourly or project basis, ensure that the number of hours or the phases of the project are clearly stated, along with the associated costs.

- Tax Rate Application: In some regions, different tax rates may apply depending on the type of service being rendered. Ensure that the correct rate is applied and indicated on the document.

Product-Based Businesses

- Itemized Listing: For businesses selling physical products, it’s essential to include a detailed list of each product sold, including the name, quantity, unit price, and total price for each item before taxes.

- Inventory Codes or SKUs: Including inventory codes or stock-keeping units (SKUs) helps to track each item and simplifies inventory management.

- Shipping Costs: If shipping or delivery costs are applicable, these should be separated from the product prices and clearly indicated as additional charges.

Online Businesses

- Digital Products or Services: If the business offers digital products, such as software, e-books, or online subscriptions, it’s important to specify the type of digital product and the relevant delivery method (e.g., downloadable, online access).

- Country-Specific Regulations: Online businesses may have different tax obligations depending on the country of sale, so be sure to account for different tax rates or exemptions depending on the customer’s location.

Freelancers and Independent Contractors

- Clear Payment Terms: Freelancers and contractors must include clear payment terms on their documents, such as deadlines for payments, late fees, and other relevant conditions to avoid misunderstandings.

- Scope of Work: A detailed description of the work provided, including hours worked or deliverables produced, is essential to prevent disputes about what was completed.

By understanding and applying the correct documentation standards, businesses in different sectors can ensure that their transaction records are clear, accurate, and legally compliant. This helps build trust with clients and ensures that the business remains in good standing with tax authorities.

Digital vs. Paper VAT Invoices in UAE

When it comes to financial documentation, businesses can choose between digital or paper formats for recording transactions. Both methods have their advantages and drawbacks, depending on the business needs, the volume of transactions, and the infrastructure available. The choice between these two options also impacts how efficiently companies can manage records, comply with regulations, and interact with clients or tax authorities.

Advantages of Digital Documents

- Efficiency: Digital formats can be created, stored, and sent quickly, streamlining the process of issuing transaction records. Businesses can easily email or upload documents without waiting for printing or postal services.

- Cost-Effective: By switching to a digital format, businesses can save on paper, ink, and printing costs. Additionally, there’s no need to maintain physical storage space for paper records.

- Automation: Digital tools can automatically calculate tax amounts, apply discounts, and generate transaction records, reducing the risk of human error and improving accuracy.

- Easy Accessibility: Electronic records can be accessed from anywhere, facilitating remote work or quick retrieval of documents when needed. Cloud-based storage also provides secure backup options.

- Environmentally Friendly: Reducing the use of paper lowers the environmental impact, contributing to sustainability efforts.

Advantages of Paper Documents

- Traditional and Familiar: Some businesses or customers prefer paper documents because they are tangible and easier to review physically. It can be particularly useful for in-person transactions or situations where clients need a hard copy for records.

- Less Technology Dependency: Paper records don’t rely on technology, which can be helpful for businesses in areas with limited internet access or for customers who are not comfortable with digital formats.

- Legal Accep

How to Submit a VAT Invoice for Refund

Submitting a request for a tax refund involves providing the appropriate documentation to demonstrate that you are eligible for a reimbursement of the taxes paid. This process generally requires submitting a well-documented record of the transaction along with supporting information to ensure compliance with tax regulations. Understanding the necessary steps and requirements will help you avoid delays and complications when seeking a refund.

The following outlines the process for submitting a tax refund request based on your transaction records:

Step 1: Verify Eligibility

- Confirm Refund Criteria: Ensure that your business qualifies for a refund based on the relevant tax laws. This typically applies to situations where you have overpaid taxes or are entitled to a refund due to specific exemptions.

- Check Documentation: Ensure that the transaction records are complete, accurate, and meet the legal requirements for tax refund submissions. Missing or incorrect information could result in delays or rejections.

Step 2: Gather Required Documents

- Transaction Record: You will need to provide a clear record of the transaction, including the goods or services provided, the total amount, and the tax charged. This record should match the format required by tax authorities.

- Proof of Payment: Provide evidence that the tax was paid, such as bank statements, payment receipts, or proof of the transaction being completed.

- Other Supporting Documents: Depending on the type of refund, additional documents such as purchase orders, delivery notes, or contracts may be required.

Step 3: Submit the Refund Request

- Complete the Form: Fill out the official refund request form provided by the relevant tax authority. This form will typically ask for information about your business, the transaction, and the tax refund amount.

- Submit Documents: Attach all required documents to your submission. Ensure that everything is accurate and complete to avoid delays in processing.

- Follow Submission Guidelines: Follow the specific guidelines provided by the tax authority for submitting your request, whether it’s through an online portal, by mail, or in person.

Step 4: Monitor the Status of Your Request

- Track Your Submission: Keep track of the status of your refund request, either through an online system or by conta

Understanding VAT Compliance for Small Businesses

Ensuring compliance with tax regulations is essential for any business, particularly for small enterprises that may face more scrutiny due to their size and resources. Meeting the necessary requirements helps businesses avoid penalties, maintain accurate records, and build trust with clients and tax authorities. Understanding the key aspects of tax compliance, including when and how to charge, report, and pay taxes, is vital for smooth operations.

Key Compliance Requirements

- Registration: Small businesses that exceed a certain threshold in annual sales may be required to register with the relevant tax authority. Registration allows a business to charge and remit taxes correctly and legally.

- Record-Keeping: Proper record-keeping is a fundamental aspect of tax compliance. Businesses must keep accurate and detailed financial records, including sales and purchases, in order to calculate taxes owed and file returns appropriately.

- Tax Returns: Businesses are generally required to submit tax returns on a regular basis, whether monthly, quarterly, or annually. These returns should include the total sales, taxes collected, and taxes owed, among other relevant financial details.

Best Practices for Small Businesses

- Accurate Documentation: It is essential to maintain accurate transaction records, including receipts, contracts, and sales statements. This ensures that you can properly calculate taxes and provide evidence in case of an audit.

- Stay Updated: Tax laws and regulations may change over time, so it is important for small businesses to stay informed about any updates or adjustments that may affect their tax obligations.

- Consult with Professionals: Small businesses can benefit from consulting with tax professionals to ensure compliance and optimize their tax strategy. A knowledgeable accountant can help navigate complex regulations and avoid costly mistakes.

For small businesses, understanding and adhering t

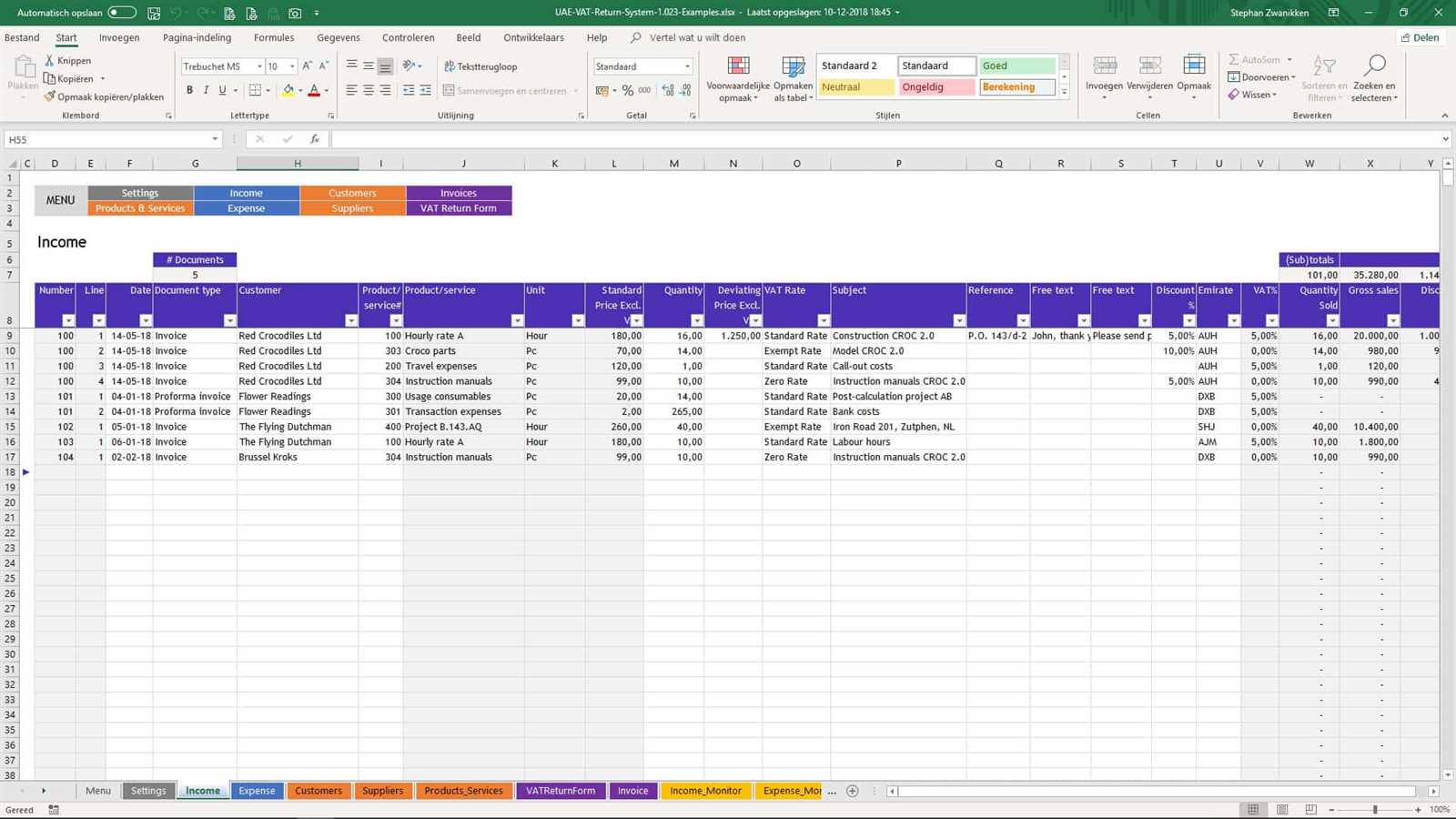

Best Practices for Managing VAT Invoices

Effective management of transaction records is crucial for any business, not only to ensure accuracy but also to remain compliant with tax regulations. By implementing best practices in handling financial documents, businesses can streamline their operations, minimize errors, and avoid legal issues. Consistency, organization, and proper systems for tracking and storing these documents are essential for maintaining transparency and efficiency.

- Use a Standardized Format: Implement a consistent format for all transaction records. This ensures that every document contains the same essential information, making it easier to process, track, and verify each transaction. Standardization reduces the risk of missing critical details.

- Automate Record Generation: Leverage accounting software or digital tools to automatically generate financial documents. This reduces the chance of human error, speeds up the process, and ensures that calculations are accurate.

- Maintain Clear and Detailed Records: Include all necessary details such as transaction dates, amounts, and tax rates. The more comprehensive and transparent the record, the easier it is to audit and verify. Make sure all documents are clear and legible for both internal and external review.

- Regular Audits and Reviews: Conduct regular checks and audits of your financial documents to ensure that everything is accurate and up to date. This helps prevent errors from accumulating and ensures your records comply with current tax rules.

- Proper Storage and Organization: Whether digital or physical, it’s important to store records in an organized manner. Use cloud storage or document management systems to store electronic files securely and to allow easy retrieval when necessary. For physical documents, use filing systems to keep everything categorized and accessible.

- Train Your Team: Ensure that all staff involved in financial record-keeping are properly trained in your system and best practices. Knowledgeable employees will contribute to a smoother process and reduce the likelihood of mistakes.

By following these best practices, businesses can manage their financial documentation more effectively, stay compliant, and ensure smooth operations. The key is consistency, organization, and the use of the right tools to support the process.

Where to Find Reliable VAT Invoice Templates

For businesses looking to streamline their transaction documentation, finding a reliable and professional document format is crucial. A well-designed structure not only ensures compliance but also enhances the business’s image. There are several trusted sources available where businesses can find customizable formats that meet the necessary legal and organizational requirements.

1. Online Platforms and Software

Many accounting software platforms provide customizable document templates that can be easily adjusted to suit a business’s specific needs. These platforms are convenient and often come with built-in features to help automate calculations, store records, and track transactions. Some popular options include:

- Cloud Accounting Services: Websites such as QuickBooks, FreshBooks, and Xero offer free and paid templates that integrate directly with their systems. These tools can automatically generate professional records with accurate tax calculations.

- Online Document Editors: Platforms like Google Docs and Microsoft Office 365 often offer templates for financial records that can be downloaded or modified. These are usually free and accessible, though they may require manual updates for tax rates or calculations.

2. Template Marketplaces and Websites

There are many websites where businesses can find downloadable templates designed specifically for transaction documentation. These platforms often feature a wide range of options, from basic designs to more complex layouts. Key sources include:

- Template Marketplaces: Websites such as Template.net and Etsy offer a variety of customizable document formats. You can find templates created by professionals, ensuring high-quality designs and compliance with relevant regulations.

- Free Template Websites: Platforms like Canva and Invoice Simple provide free templates that are easy to edit and customize. Many of these websites also allow users to create custom designs or tweak existing templates to fit their brand.

When selecting a document format, it is important to ensure that the template is fully customizable, complies with local regulations, and fits your business’s needs. Whether you opt for an online platform, a template marketplace, or a free resource, always choose a source that offers professional-quality documents and provides ongoing support for updates and customization.