Free Tutoring Invoice Template in Word Format

When providing educational services, it’s essential to have a well-structured system for managing payments. A clear, easy-to-understand billing document not only helps you get paid on time but also strengthens your professional image. A well-crafted statement outlines the details of each session, ensuring both parties are on the same page and preventing any confusion down the line.

Many educators seek simple, ready-to-use solutions to streamline their payment processes. Having a customizable form that can be quickly adjusted to suit each client’s needs can save valuable time and reduce errors. These documents can be tailored to reflect the specifics of your services, making them more personal and professional.

Whether you’re a seasoned instructor or just starting, finding an efficient way to manage finances is crucial. With a few adjustments, a pre-made document can be easily adapted to your workflow, allowing you to focus on what truly matters–teaching your students and helping them achieve their goals.

Free Word Invoice Template for Tutors

For educators managing payments, having a straightforward and customizable document is a vital tool. It allows for clear communication of fees, services, and session details. Using a pre-designed format helps save time, reduce errors, and ensures that all necessary information is included. The right solution can be quickly adapted to suit each client, making the billing process both efficient and professional.

Key Features of an Effective Billing Document

- Clear payment breakdown: Specify the cost per session and total amount due.

- Customizable design: Easily adjust the format to match your branding and services.

- Space for client details: Include name, contact info, and session dates for clarity.

- Professional layout: A clean and organized structure that enhances credibility.

- Tax and discount fields: Easily include taxes or applicable discounts in the total.

How to Get Started with a Ready-Made Document

Using a ready-to-go document eliminates the hassle of creating one from scratch. Here’s how you can start:

- Download a pre-designed file suitable for your needs.

- Open it in any text editing program that supports easy customization.

- Fill in your personal information, session details, and payment instructions.

- Save or print the document and send it to your client for payment processing.

This simple approach ensures that your billing is both professional and consistent, giving you more time to focus on your teaching rather than paperwork.

Why Use a Billing Document Format

Having a well-organized document to manage payments is essential for any educator. It helps clarify the terms of service, ensuring both the teacher and the student are on the same page when it comes to costs and scheduling. By using a pre-made design, you can streamline the process and reduce errors, allowing you to focus more on teaching rather than administrative tasks.

Efficiency is one of the biggest advantages of using a pre-designed form. It saves time by eliminating the need to create a new document from scratch for every student or session. With a ready-to-use format, you can quickly adjust the details, making the process of billing seamless and quick.

Accuracy is another reason to rely on these ready-made formats. Having all the necessary fields in place ensures that nothing is overlooked. It prevents the common mistake of forgetting important information, such as session dates, rates, or additional fees. A well-structured document helps avoid misunderstandings and ensures that payments are processed correctly.

Finally, a professionally designed billing document can help you present yourself as a serious professional. It communicates to your clients that you are organized, reliable, and committed to maintaining a professional relationship. A clean, well-organized statement enhances your image and builds trust with those you work with.

Benefits of Word Format Invoices

Choosing the right document format for managing payments is crucial for smooth business operations. A flexible and widely-used file type allows for easy customization and ensures that you can quickly make necessary changes to suit your specific needs. The compatibility of this format with most devices and software makes it an excellent choice for creating professional payment records.

Ease of customization is one of the main advantages of using this format. You can effortlessly adjust text, fonts, and layouts to match your preferences or your branding. Unlike some other formats, it doesn’t require advanced technical skills, making it accessible to anyone who needs to create clear and accurate payment records.

Universal accessibility is another key benefit. Documents in this format can be opened and edited on virtually any device, including PCs, laptops, and even mobile devices, without worrying about software compatibility. This means you can work on your records anywhere, at any time, without needing specialized tools or applications.

Furthermore, professional presentation is guaranteed. Documents created in this format look polished and structured, which contributes to a positive impression of your business practices. With just a few clicks, you can generate a document that is ready for printing or emailing to clients, ensuring smooth transactions and clear communication.

How to Customize Your Billing Document

Creating a personalized payment record is simple and can be done in just a few steps. Customizing your document ensures it reflects your unique services, branding, and the specific details of each transaction. By tailoring the design, layout, and content, you can make your billing process both efficient and professional.

Steps to Personalize Your Document

- Open the pre-designed file in your preferred text editor.

- Edit your business details, including your name, contact information, and logo.

- Update the session information, such as dates, rates, and any special notes for the client.

- Include any applicable taxes or discounts that should be reflected in the final amount.

- Ensure the payment instructions are clear, including the due date and accepted payment methods.

Design Tips for a Professional Look

- Keep it clean and simple: Avoid clutter and focus on the essential details.

- Use consistent fonts and colors: Choose professional fonts and colors that match your branding.

- Highlight key information: Use bold or italics to draw attention to important points like total amount or due date.

By following these steps, you can easily create a tailored payment document that suits your specific needs and helps maintain a professional image when dealing with clients.

Key Details to Include in Your Billing Document

When creating a document to request payment, it’s essential to include specific information that ensures clarity and avoids confusion. A well-structured record not only outlines the terms of the transaction but also provides all the details needed for the client to process the payment correctly. Here are the key elements that should always be present.

Important Elements to Include

- Your business name and contact details: Make sure to include your full name, address, phone number, and email address. This allows your clients to contact you easily if needed.

- Client’s information: Include the client’s name, address, and contact information for reference.

- Services provided: List the sessions or services you provided, along with the dates, duration, and rates for each service.

- Total amount due: Clearly state the total sum that the client needs to pay, including any taxes or additional charges.

- Payment terms: Specify the due date and the acceptable methods of payment (e.g., bank transfer, online payment platform, check).

- Invoice number: Give each document a unique number for easy tracking and reference.

Additional Helpful Information

- Late payment penalties: If you charge a fee for late payments, make sure to clearly state the terms and any penalties.

- Discounts or promotional offers: If applicable, include any discounts that apply to the total amount.

- Notes or special instructions: Any other important details, such as terms of service or reminders about future sessions.

Including these essential details in your billing document ensures that both you and your client are on the same page, promoting smooth and efficient financial transactions.

Where to Find Free Billing Document Formats

For those who need a professional, easy-to-use format for managing payments, there are several places online where you can find customizable and ready-made documents. These resources help save time and effort by offering a starting point that can be quickly tailored to your needs. Whether you’re looking for simple or more advanced options, there are many platforms that offer high-quality, no-cost solutions.

Online Platforms Offering Free Files

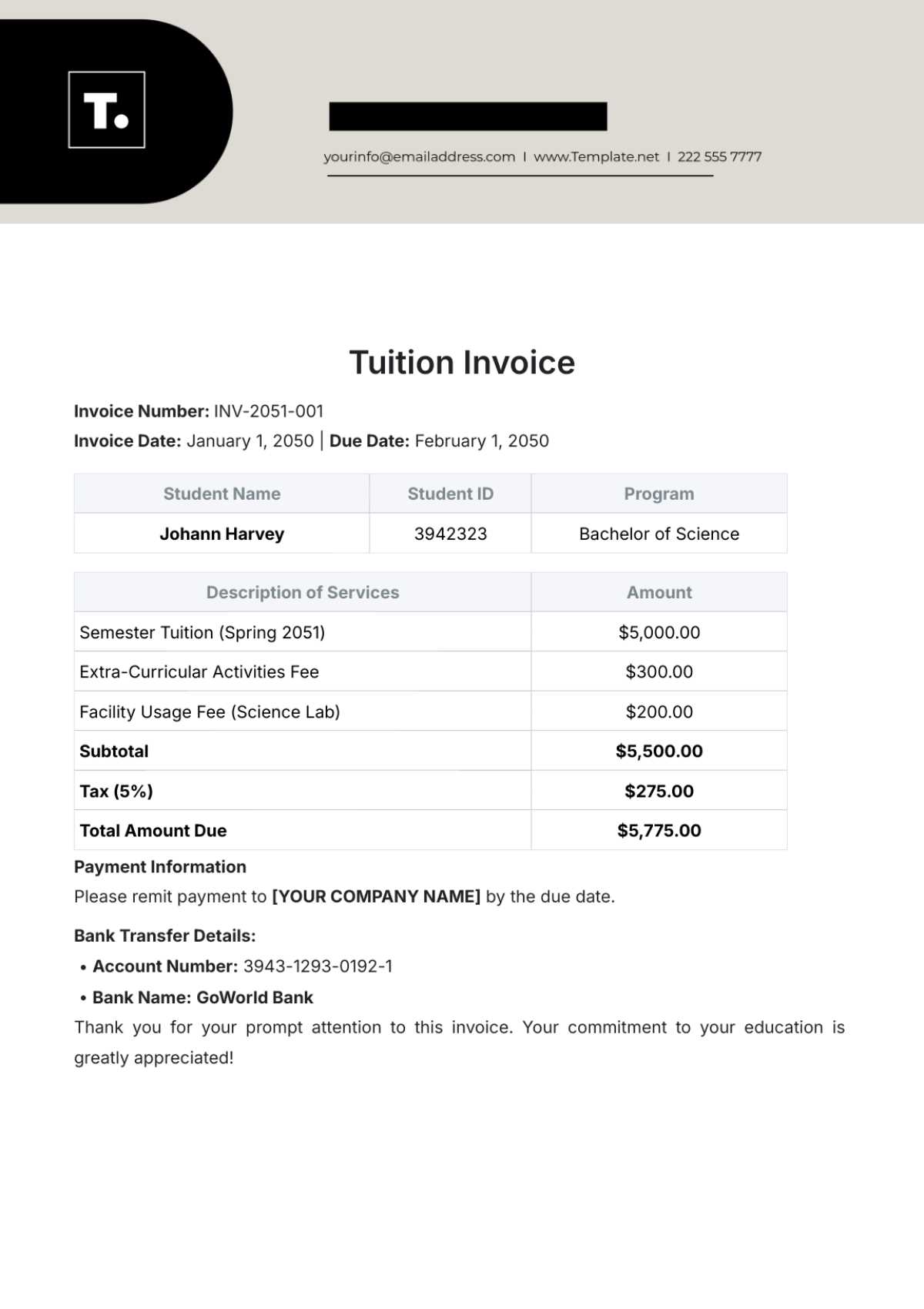

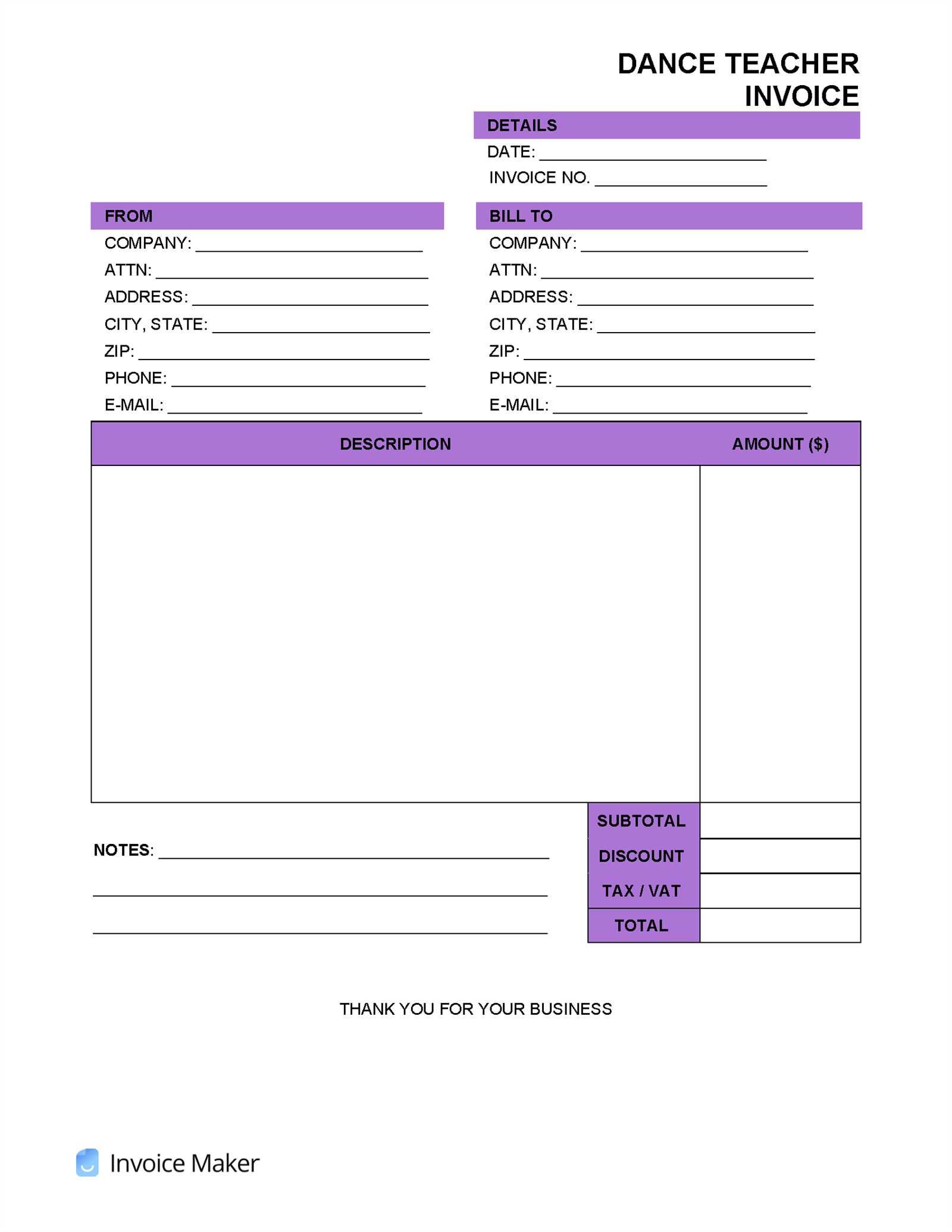

- Template websites: Popular sites like Template.net and Canva provide a wide range of editable documents that are perfect for billing purposes. You can select a format that suits your needs and adjust it to reflect your services.

- Office suites: Both Google Docs and Microsoft Office offer a variety of downloadable options in their template galleries. These files are easy to access and customizable, often requiring only basic text editing to match your business requirements.

- Freelancer platforms: Websites such as Upwork or Fiverr sometimes offer templates for billing as part of their free resources or through community exchanges. These options are usually designed for freelancers and small businesses.

Other Useful Sources

- Community forums: Online communities such as Reddit or professional Facebook groups often share free templates. Members upload and exchange their custom documents, allowing you to find a format that others recommend.

- Blogs and educational websites: Many educators and small business owners post downloadable files on their blogs or websites. These can be simple, effective designs created by others in your field.

By utilizing these resources, you can easily access ready-to-use formats without having to invest in expensive software or hire a designer, helping you maintain a professional image while focusing on your core work.

Creating Professional Billing Documents in Minutes

Creating a polished and professional payment request doesn’t have to be time-consuming. With the right resources, you can quickly generate a clean, organized document that looks professional and is ready to send. Whether you’re handling a few clients or managing multiple projects, an efficient approach allows you to focus on your work without getting bogged down by administrative tasks.

Step-by-step simplicity is key to creating a polished billing document in no time. By using a pre-designed structure, all you need to do is fill in the relevant details, such as session dates, rates, and payment instructions. This eliminates the need for formatting from scratch, which can be a hassle and take up valuable time.

Pre-made fields ensure that you don’t miss important information. Most templates come with built-in spaces for your name, client details, and a breakdown of charges, ensuring nothing is overlooked. With a few adjustments, these fields can be customized to meet your specific needs, all while maintaining a professional layout.

Moreover, the quick editing process means you can adjust the document for each client in just a few minutes. Simply update the rates, session details, or payment instructions, and the document is ready to be printed or emailed. This efficiency streamlines the entire billing process, helping you stay organized and maintain professionalism in your business transactions.

Saving Time with Pre-designed Documents

When managing multiple clients or projects, efficiency is key. Using a pre-designed document can save you significant time and effort, allowing you to focus on what really matters–your work. These ready-made formats provide a solid foundation that only requires minor adjustments, helping you avoid the time-consuming process of creating a new file from scratch each time.

Quick customization is one of the biggest advantages. With a pre-built structure, you can simply fill in the necessary information, such as session dates, rates, and client details. This eliminates the need for formatting or starting from scratch, which speeds up the entire process. In just a few minutes, you can have a professional document ready to send.

Consistency is another benefit. By using the same format each time, you ensure that your documents look polished and standardized. This not only saves time but also builds a sense of professionalism and reliability in the eyes of your clients.

With these pre-designed formats, you streamline your workflow, allowing for faster turnaround and greater accuracy. The more time you save on administrative tasks, the more you can dedicate to providing excellent service to your clients.

How to Track Payments with Billing Documents

Tracking payments is essential for maintaining a clear financial record and ensuring that all dues are settled on time. A well-structured document can serve as an excellent tool for keeping track of what has been paid and what remains outstanding. By including specific details and organizing your records efficiently, you can monitor transactions and ensure accurate financial management.

Payment status tracking is made easier by including a section in your document that allows you to note the current status of each transaction–whether it’s been paid, partially paid, or is still pending. Adding a “payment received” section can help you keep a quick overview of what has been settled and what is still due.

Unique reference numbers are also useful for tracking purposes. Assigning a unique number to each document helps both you and your clients keep track of specific payments, especially if there are multiple transactions over time. This makes it easier to match payments to their corresponding records, reducing confusion.

Recording payment dates is another key method to track when each transaction occurred. By noting the exact date on which payment was made, you can easily refer back to the document and ensure that payments are processed on time. This also helps you spot any overdue payments and follow up promptly with clients.

By incorporating these elements into your payment requests, you create a comprehensive record that simplifies the tracking process and helps maintain a smooth cash flow for your business.

Best Practices for Billing Document Layout

Creating a well-organized and visually appealing document is essential for effective communication with clients. A clean and structured layout not only makes the document easier to read but also ensures that all necessary details are clear and accessible. By following a few best practices, you can enhance the professionalism and functionality of your financial records.

Key Design Elements

- Clear headings: Use bold and larger fonts for section titles, such as “Client Details” and “Payment Breakdown,” to make each section easily distinguishable.

- Logical flow: Arrange the information in a logical order, starting with your details, followed by the client’s information, session or service details, payment terms, and total amount due.

- Whitespace: Ensure there’s enough space between sections to avoid a cluttered appearance. This makes the document easier to read and more professional-looking.

Enhancing Readability and Professionalism

- Consistent font usage: Stick to simple, professional fonts (like Arial or Times New Roman) throughout the document to maintain consistency.

- Highlight key information: Use bold or italics to emphasize the most critical details, such as the total amount due or due date.

- Use of color: Incorporate subtle color accents to differentiate sections or to match your business’s branding, but avoid overuse, as it may distract from the main content.

By following these best practices, you can create a billing document that is both functional and visually appealing, helping ensure smooth transactions and clear communication with your clients.

Common Mistakes to Avoid in Billing

When managing payments, it’s easy to overlook certain details, leading to errors that can complicate the transaction process. Simple mistakes in creating your financial records can result in confusion, delayed payments, or even damaged client relationships. By being aware of common errors, you can ensure your records are accurate, clear, and professional.

Frequent Errors to Watch Out For

- Incorrect client information: Always double-check the details of your client, such as their name, address, and contact information. Missing or incorrect data can cause confusion and delay payments.

- Not including payment terms: Failing to clearly specify payment terms, such as due dates, late fees, or accepted payment methods, can lead to misunderstandings.

- Omitting tax and discount details: If applicable, make sure to include taxes, fees, or discounts. Not specifying these details can cause discrepancies when the client reviews the total amount due.

- Using unclear or inconsistent formatting: A cluttered or hard-to-read layout can confuse your client. Ensure your document is well-organized and that important information stands out clearly.

- Failure to track previous payments: Not noting which payments have already been made, or forgetting to include a balance forward, can lead to confusion and double payments.

How to Avoid These Pitfalls

- Review before sending: Always double-check your document for errors before you send it. It’s easy to overlook small mistakes that can have big consequences.

- Use a consistent format: Stick to a clear, standardized layout for every payment request to reduce the chances of mistakes.

- Clarify payment details: Include precise instructions for payments, including deadlines and accepted methods, to ensure clients understand the process.

By being mindful of these common mistakes, you can avoid delays and ensure that your financial transactions run smoothly and professionally.

Ensuring Accurate Billing for Sessions

Accurate billing is essential to maintaining trust and clarity with clients. When charging for your services, it’s important to ensure that all the details are correct, transparent, and well-documented. This includes accurately reflecting the time spent, the rate charged, and any additional fees or discounts. By keeping your records precise, you can avoid misunderstandings and ensure timely payments.

Key Elements for Accurate Session Billing

- Track the exact time: Make sure to record the precise duration of each session or service provided. Whether you charge by the hour or by the session, keeping an accurate log is crucial.

- Clearly state your rates: Ensure that your rates are explicitly stated in each document. This includes hourly rates, session fees, and any additional costs that may apply.

- Provide detailed breakdowns: Include a clear breakdown of each service provided, listing the session dates, duration, and corresponding charges. This transparency helps clients understand exactly what they are paying for.

- Include payment terms: Clearly define when payments are due and outline any penalties for late payments. This helps set clear expectations and encourages timely settlements.

Tips for Accurate Documentation

- Keep a detailed log: Maintain accurate records of the services you provide, including dates, times, and any changes to the initial agreement. This will help you when it’s time to prepare your billing records.

- Regularly update your records: Avoid any last-minute confusion by regularly updating your records. This way, when you prepare the billing document, all the details are readily available.

- Use a reliable tool: Utilize reliable tools or software to help generate and track your billing documents. This can minimize errors and make the process more efficient.

By following these practices, you can ensure that your billing process is accurate, clear, and professional, ultimately leading to smoother transactions and happier clients.

How to Modify Your Billing Document

Customizing your billing document allows you to tailor it to your specific needs, making sure all relevant information is included and formatted to your preference. Whether you’re adjusting for different services, clients, or business requirements, knowing how to modify your document effectively ensures it remains accurate and professional. Here’s how you can make necessary changes quickly and efficiently.

Basic Modifications to Make

- Edit text fields: Change the basic information, such as your business name, client details, session descriptions, and payment terms. This ensures the document is relevant to each new transaction.

- Adjust amounts: Update prices, session rates, and any applicable discounts or fees based on the services provided. This keeps the document accurate and reflective of the current charges.

- Change the layout: Customize the document’s appearance by adjusting the font style, size, and layout to match your branding or aesthetic preferences.

Advanced Customizations

- Incorporate additional sections: You can add extra fields for notes, late payment fees, or customized payment terms that reflect your business model.

- Insert a logo or branding elements: Add your business logo or colors to make the document look more professional and aligned with your brand identity.

- Include payment tracking fields: For better organization, you can add checkboxes or fields to track whether payments have been received, helping with record-keeping.

By following these steps, you can modify your billing document to suit your needs while ensuring consistency and professionalism. A well-crafted document not only facilitates smoother transactions but also strengthens your business’s credibility with clients.

Integrating Tax and Discounts in Billing Documents

Accurate financial documentation goes beyond just listing services and amounts. To ensure transparency and compliance, it’s crucial to correctly apply taxes and discounts to the overall charges. Whether you’re offering promotions or need to account for local tax rates, integrating these elements into your payment records simplifies calculations and avoids confusion for both you and your clients.

How to Add Taxes

- Specify tax rates: Clearly list the tax percentage applicable to your services. For example, if you’re required to collect sales tax, include the rate (e.g., 5%) alongside the subtotal.

- Calculate the tax amount: Multiply the subtotal by the tax rate to determine the amount that needs to be added to the total. This should be displayed as a separate line item on your document.

- Be transparent: Break down the tax calculation for your client to show how the final amount was reached. This builds trust and helps avoid confusion.

Applying Discounts

- Set discount terms: Specify the type of discount you’re offering (e.g., seasonal, promotional, or loyalty discount). Clearly mention the discount percentage or fixed amount.

- Show the discount amount: List the discount amount separately to show its impact on the overall charges. This allows the client to easily see how much they are saving.

- Ensure correct calculations: Apply the discount to the correct base amount before calculating taxes to ensure accuracy. The discount should be deducted from the subtotal before any taxes are added.

By properly integrating tax and discount details, you can create a clear, precise billing record that accounts for all relevant charges and adjustments. This not only ensures your calculations are accurate but also helps maintain professional and transparent communication with your clients.

Legal Considerations for Billing Documents

When creating billing documents for your services, it’s important to ensure that they meet all legal requirements. Having a well-documented record is not only a matter of professionalism, but also a way to protect your business and ensure compliance with local regulations. Whether you’re operating as a freelancer or running a small business, understanding the legal elements of payment records is crucial to avoid misunderstandings and disputes.

Essential Legal Elements to Include

- Accurate business details: Always include your business name, address, and contact information, as well as any relevant tax identification numbers. This helps verify your legitimacy and makes the document more professional.

- Clear payment terms: Clearly state payment deadlines, including the due date, and any penalties for late payments. This ensures that both you and your clients are on the same page regarding expectations.

- Tax compliance: Depending on your location, you may need to apply local taxes to your charges. Include the correct tax rate, and ensure that the tax amounts are clearly displayed. Failing to comply with tax regulations can result in legal penalties.

- Contractual obligations: If you have signed contracts with clients, make sure to reference the terms of the agreement on your document, especially when it comes to the scope of services provided and any discounts or special arrangements.

Additional Considerations

- Currency and payment methods: Be clear about the currency in which you expect payment, and list acceptable payment methods. This can help avoid confusion, especially if you’re working with international clients.

- Retention of records: It’s important to retain all financial records for a certain period, often dictated by local laws. Keep copies of your documents in case you need them for audits or legal purposes.

- Refund and dispute policy: Consider including a brief mention of your refund and dispute resolution process. Having this information in your document can help prevent conflicts down the road.

By ensuring that your billing documents adhere to legal requirements, you protect your business and create a solid foundation for professional and trustworthy relationships with your clients. This attention to detail will help you avoid potential legal issues and contribute to smoother financial transactions.

Free Resources for Billing Documents

When managing payment records for your services, having access to reliable, no-cost resources can significantly streamline the process. Whether you’re just starting or looking to improve your current system, there are many tools and platforms available that can help you generate professional payment documents without the need for expensive software or subscriptions. These resources often provide customizable options, making it easy to meet your specific needs while keeping costs low.

Online Platforms Offering Free Billing Tools

- Invoice Generator Websites: Several websites offer easy-to-use tools that allow you to create customized billing documents in minutes. These platforms often provide options for adding your business details, service descriptions, and payment terms, all without requiring any downloads or installations.

- Google Docs and Google Sheets: If you prefer a more hands-on approach, using Google Docs or Sheets can be a great option. Both tools allow you to create, save, and share your documents online, and they come with customizable templates that you can adapt to your needs.

- Microsoft Office Online: If you’re looking for an option similar to desktop software but without the cost, Microsoft offers free versions of Word and Excel through their online platform. These tools include pre-designed templates for creating payment records, and they allow easy editing and storage in the cloud.

Additional Resources for Customization

- Canva: Known for its graphic design capabilities, Canva also offers templates for creating professional-looking payment documents. While the platform is often used for visual content, it provides a range of customizable options for documents that can be tailored to your specific needs.

- Zoho Invoice: Zoho offers a free plan with basic features that allow you to generate and send payment requests. It includes options for customizing your document layout, applying taxes and discounts, and even tracking payments.

- Wave Accounting: For those who need more than just a simple payment document, Wave offers a full suite of free accounting tools, including the ability to create and manage detailed financial records for your services.

By leveraging these no-cost resources, you can easily create professional and accurate billing documents that suit your business needs. Whether you prefer a simple solution or a more robust platform, these tools help you maintain organization and professionalism without the added expense of paid software.

Tips for Sending Professional Billing Documents

Sending clear, professional payment requests is a key aspect of maintaining good client relationships and ensuring timely compensation. How you deliver your payment records reflects on your business and sets the tone for future transactions. Here are some best practices to help you send polished and effective documents that convey professionalism and encourage prompt payment.

Key Tips for Professional Presentation

- Double-check the details: Before sending your document, review all the information for accuracy. Ensure that your client’s name, service descriptions, rates, and payment terms are correct. Small errors can cause confusion and delay payment.

- Use clear, concise language: Be straightforward with your wording. Avoid unnecessary jargon or overly complicated terms. A simple, easy-to-read layout ensures that your client can quickly understand the charges and deadlines.

- Be polite and professional: Always maintain a courteous and respectful tone, even if the payment is overdue. A friendly yet professional message can help preserve a good working relationship while encouraging timely payments.

Best Practices for Delivery

- Send via email or secure platforms: The most efficient way to send payment requests is electronically. Email or professional platforms allow for quick delivery, and both parties can easily keep records. When using email, ensure your message is properly formatted and includes a clear subject line (e.g., “Payment Request for Services Provided in [Month]”).

- Include a payment method: Make it as easy as possible for your clients to pay by including clear instructions on how they can submit payment. This can include your bank details, PayPal information, or any other payment system you accept.

- Follow up when necessary: If a payment is overdue, send a polite reminder email or message. A gentle follow-up can help ensure that the payment is processed without causing tension.

By following these tips, you can ensure that your payment documents are not only clear and professional but also encourage timely payments and positive client interactions. The way you present your billing materials plays an important role in your overall business reputation.