Download the Best Tuition Invoice Template for Easy Payment Tracking

Managing financial transactions in educational institutions can be a complex process. Accurate documentation is essential for ensuring that both students and administrators are clear about payment amounts, deadlines, and terms. Using a structured approach to billing helps avoid misunderstandings and ensures smooth financial operations.

One of the most efficient ways to handle these processes is by using standardized documents that can be easily tailored to individual needs. These documents can simplify the payment tracking process and reduce the administrative burden, offering a more organized and professional way to manage fees.

In this guide, we will explore how to create and customize these essential financial documents, highlighting the key elements they should contain and best practices for their use. Whether you are managing a small tutoring business or overseeing a large educational institution, a well-designed payment statement can help ensure timely payments and proper record-keeping.

Tuition Invoice Template Overview

Effective financial management in educational settings requires clear, consistent documentation for billing purposes. A well-organized document serves as a formal record of fees due, payment deadlines, and the services rendered. It not only ensures transparency but also promotes timely payments and minimizes confusion between students and administrators.

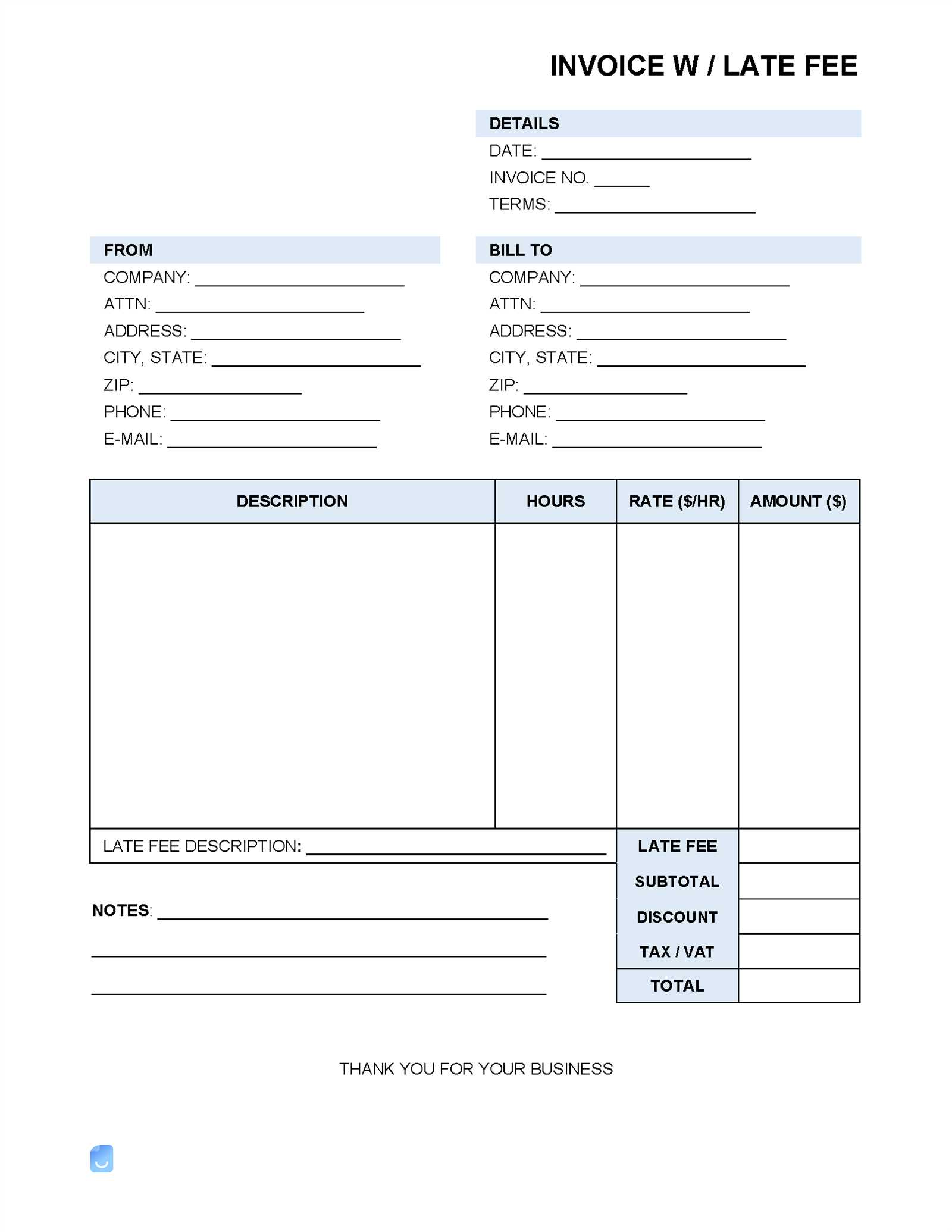

Key Components of a Billing Document

A properly designed financial statement should include essential details such as the recipient’s information, a breakdown of charges, payment terms, and methods. Each section plays a crucial role in providing clarity and preventing any potential misunderstandings. Key fields often include the institution’s name, the student’s details, and specific charges for classes or services provided.

Benefits of Using a Structured Document

Having a pre-designed structure for payment documentation allows for quick adaptation, whether for individual cases or recurring billing cycles. It ensures consistency across all communications and can be easily tailored to reflect specific circumstances or pricing schemes. This approach not only streamlines administrative tasks but also enhances professionalism in financial dealings.

Why Use a Tuition Invoice Template

Implementing a standardized approach to financial documentation offers numerous advantages in an educational environment. A pre-designed form allows for consistent, accurate billing while reducing the risk of errors. This structured method ensures that all necessary details are included and that payments are processed smoothly and efficiently.

Time-saving efficiency is one of the main benefits of using a structured document. Instead of creating new billing statements from scratch each time, educators or administrators can simply fill in the required information. This saves valuable time and reduces the chances of missing critical details that could delay payments.

Furthermore, a well-organized financial statement enhances professionalism and fosters trust between the institution and the student. With clear breakdowns of costs and payment terms, both parties are more likely to feel confident in their financial agreements. This transparency can improve communication and prevent disputes over charges.

Key Features of a Tuition Invoice

For an educational institution or service provider, a comprehensive financial document must include specific elements to ensure clarity and accuracy. These essential components help both the service provider and the recipient understand the payment terms, the breakdown of charges, and any necessary deadlines. Properly structured documents not only avoid confusion but also enhance the overall payment experience.

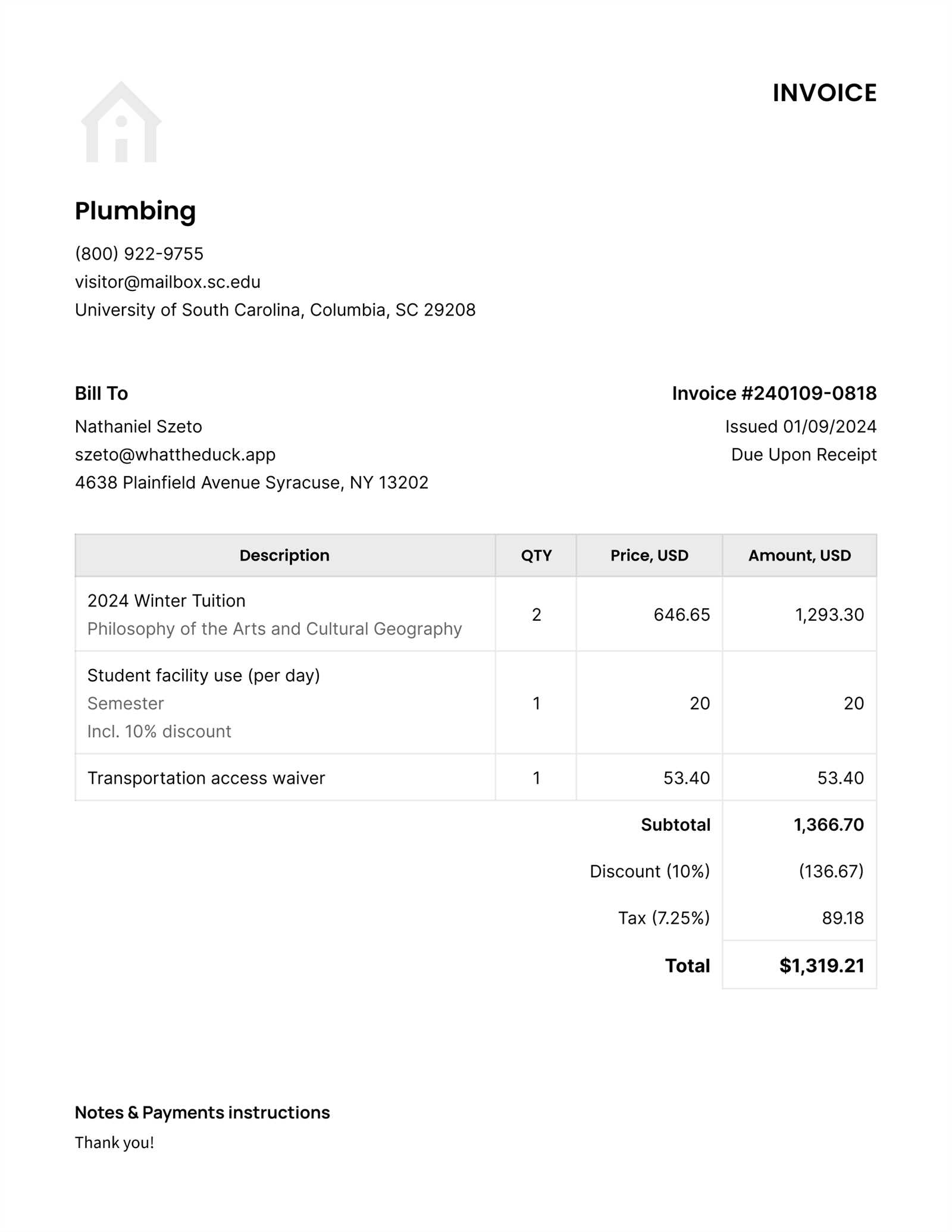

Essential Information to Include

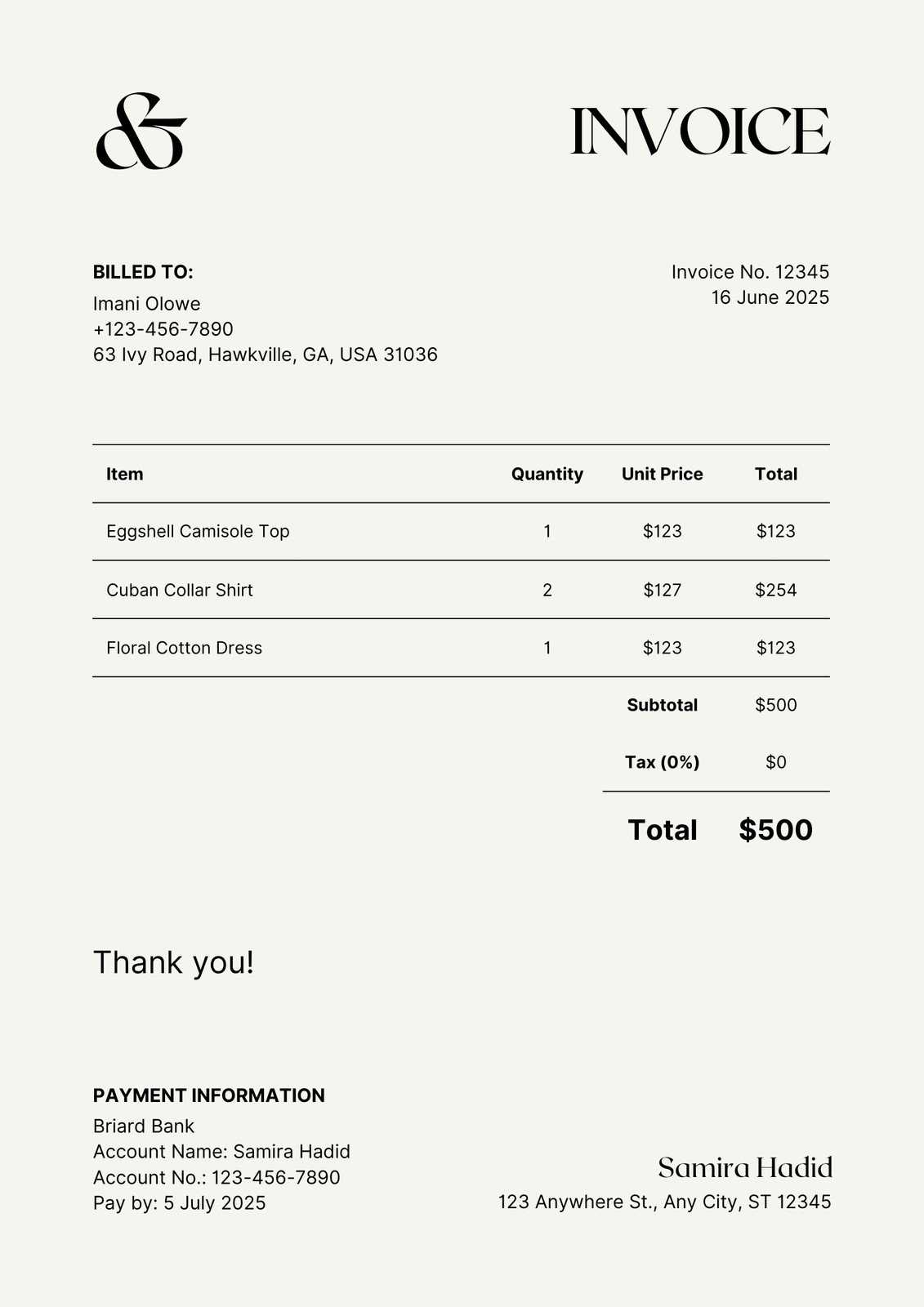

At a minimum, a well-organized document should include the names and contact details of both parties, along with a clear description of the services provided. This may include the course name, duration, or number of sessions. Additionally, the total amount due and any applicable taxes should be clearly displayed, ensuring there is no ambiguity about the payment required.

Payment Terms and Deadlines

One of the most important features of any financial statement is the inclusion of payment terms and due dates. Clearly stating the amount due, payment methods accepted, and the due date helps prevent delays and disputes. It’s also useful to specify any penalties for late payments or available discounts for early settlement, encouraging timely transactions.

How to Customize a Tuition Invoice

Customizing a financial document allows you to tailor it to your specific needs, ensuring it aligns with your institution’s requirements and reflects the unique details of each transaction. By modifying key elements, you can make the document more personalized, professional, and efficient in communicating payment expectations.

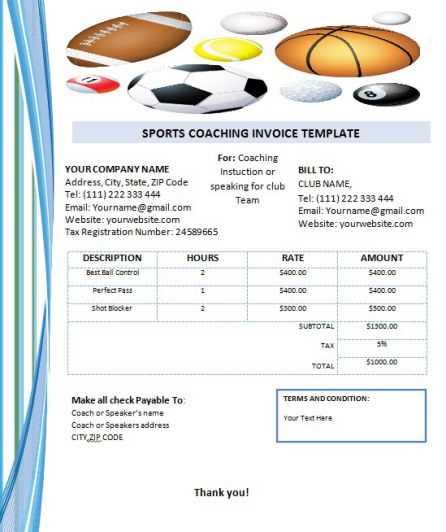

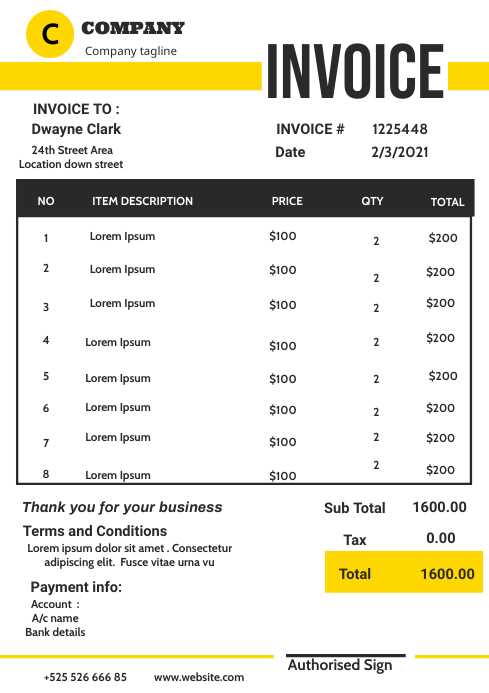

Adjusting Layout and Design

The first step in customization is adjusting the overall layout and design. You can choose the format that best represents your brand, including adding your logo, selecting the right fonts, and choosing a clean, easy-to-read structure. A professional appearance not only enhances the document’s impact but also makes it easier for students or clients to navigate the information.

Adding Specific Details

Personalize the content by adding relevant information, such as the exact services provided, dates of attendance, or special discounts. You can also include custom fields for payment terms, specific taxes, or additional fees. This level of detail ensures that the document reflects the full scope of the transaction and prevents confusion about charges or expectations.

Benefits of Using Templates for Billing

Streamlining the process of creating financial documents can significantly improve both efficiency and accuracy. By utilizing pre-designed formats, businesses can eliminate repetitive tasks and reduce the likelihood of human error. This not only saves time but also ensures consistency across all transactions, which is crucial for maintaining a professional image.

Time-saving: Using ready-made designs for billing allows for faster document creation. Instead of starting from scratch each time, users can fill in the necessary details, ensuring a quicker turnaround on tasks. This can be especially beneficial for organizations that handle numerous financial records on a regular basis.

Consistency: Templates ensure uniformity in all generated statements. The structure and design remain the same, which makes it easier for both clients and businesses to understand the provided details. Consistent formatting also helps establish a sense of professionalism and trustworthiness.

Accuracy: Pre-built layouts typically come with predefined fields and categories, which help to minimize mistakes. The use of these structures ensures that all required information is included, reducing the chance of omitting crucial details such as amounts, dates, or recipient information.

Customization: Many systems allow for easy adjustments to the provided structure, allowing users to tailor the document according to their specific needs. Whether it’s adjusting the appearance or adding custom terms, flexibility remains a key advantage of using these designs.

Cost-Effective: Many available solutions are either free or affordable, making them a cost-efficient alternative to hiring professionals or purchasing expensive software. Small businesses, in particular, can benefit from such resources without straining their budgets.

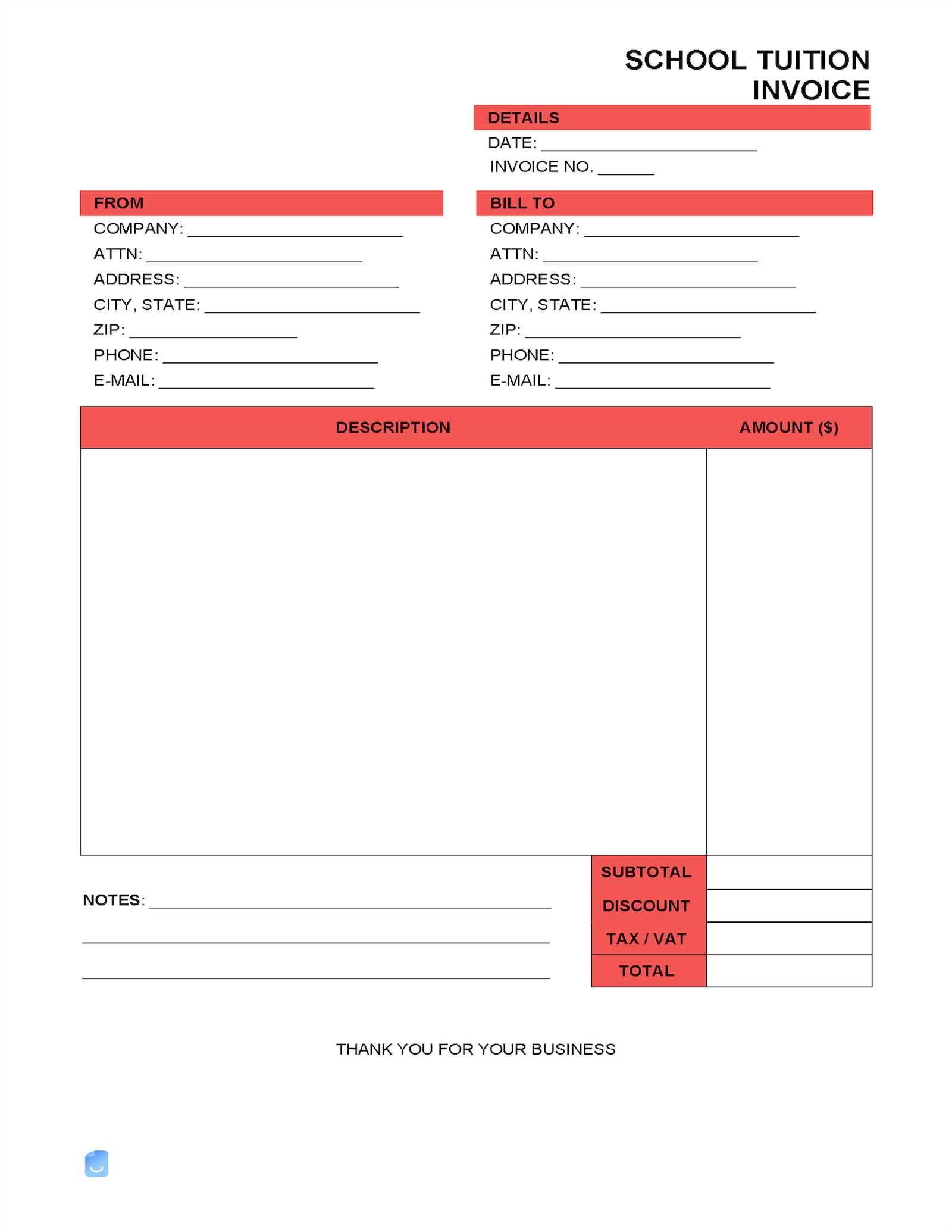

Types of Tuition Invoices for Schools

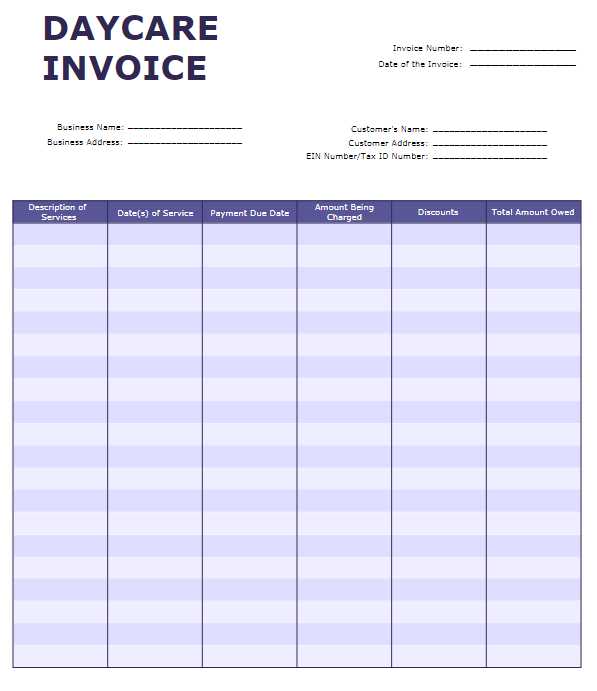

Educational institutions often utilize various formats for billing students or their families, depending on the type of services rendered and the payment schedules. Different structures help to address the needs of both the institution and the student, ensuring clarity and organization in financial transactions. These documents can vary in design, content, and delivery, offering flexibility in how payments are requested and tracked.

Standard Payment Requests

For many schools, a traditional bill is issued at the beginning of each term or semester. These requests typically outline the total amount due, listing all charges related to enrollment, academic fees, and other services. They often include payment due dates, options for partial payments, and instructions for how the funds should be transferred. This format is ideal for families who prefer a straightforward approach with clear expectations.

Installment Billing Statements

Another common format is the installment plan, where payments are broken down into smaller, more manageable amounts. This structure is helpful for families who need flexibility in how they pay over time. Each statement will specify the portion due within a specific time frame, along with the remaining balance. It ensures that both parties are aware of the payment schedule and any outstanding amounts, allowing for easier financial planning and budgeting.

Common Errors in Tuition Invoices

When creating financial documents for educational services, mistakes can lead to confusion or disputes between the institution and the families. These errors can range from minor miscalculations to major discrepancies that affect payment clarity. Identifying and correcting common issues can help ensure smoother transactions and a more professional experience for both parties.

Calculation Mistakes

One of the most frequent issues involves incorrect calculations of total charges. Whether it’s a miscalculation of fees or the wrong amount being applied to a discount, these errors can cause unnecessary confusion and delays in payment processing. Ensuring accurate arithmetic is essential to avoid conflicts and maintain trust.

Missing or Incorrect Details

Another common problem is the omission of important information or the inclusion of incorrect data, such as wrong student names, incorrect payment dates, or inaccurate fee descriptions. Such mistakes can lead to misunderstandings and delays in payments. Verifying all the details before sending any document is crucial to preventing these issues.

| Error Type | Impact | Solution |

|---|---|---|

| Calculation Mistakes | Confusion and delayed payments | Double-check all figures before finalizing |

| Missing Information | Delayed processing or disputes | Review for all essential details, such as dates and student names |

| Incorrect Payment Terms | Misunderstanding about due dates or payment structure | Ensure clarity on payment schedules and conditions |

How to Properly Format an Invoice

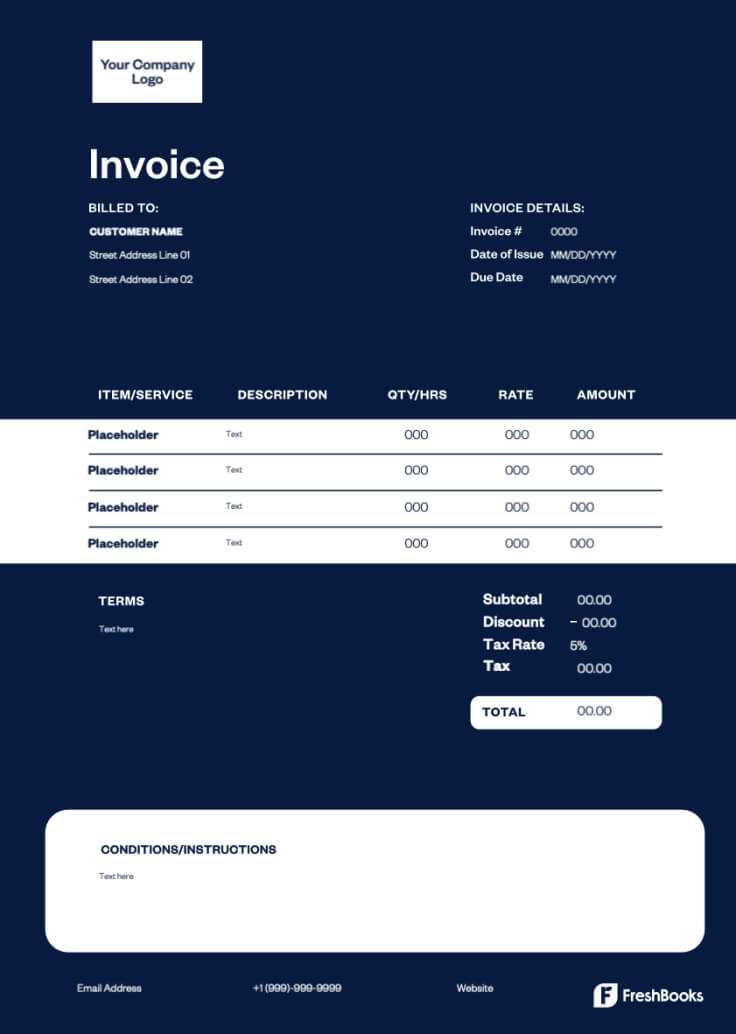

Creating a well-organized financial document is essential for clear communication between the educational institution and the payer. Proper structure ensures that all necessary information is included, making it easier for recipients to understand the charges and submit payments promptly. A correctly formatted statement helps to avoid confusion and promotes professionalism.

| Section | Description | ||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Header | Include the name of the institution, address, and contact information at the top of the document for easy identification. | ||||||||||||||||||||||

| Recipient Information | Clearly state the name and contact details of the person or entity responsible for the payment. | ||||||||||||||||||||||

| Date and Reference Number | Include the date the document is issued, along with a unique reference number to track the transaction. | ||||||||||||||||||||||

| List of Charges | Detail each charge or fee, specifying the amounts and any applicable discounts or adjustments. Break down costs to ensure transparency. | ||||||||||||||||||||||

| Total Amount Due | Clearly state the total amount that needs to be paid, making it easy to find on the document. | ||||||||||||||||||||||

| Payment Terms | Specify the payment due date, any late fees, and available payment methods to avoid confusion. | ||||||||||||||||||||||

| Footer | Include any relevant additional information, such as policies, instructions, or contact details for support. |

| Tracking Method | Description | Benefits |

|---|---|---|

| Manual Tracking | Using spreadsheets or paper records to log each payment and maintain a balance sheet. | Cost-effective and simple to implement, ideal for smaller institutions. |

| Accounting Software | Utilizing specialized financial software that automates tracking, generates reports, and integrates with payment systems. | Increased accuracy, real-time updates, and the ability to handle large volumes of data with minimal effort. |

| Cloud-Based Systems | Storing payment records and tracking information in the cloud, allowing access from multiple devices and locations. | Accessibility from anywhere, improved collaboration, and automatic backups to prevent data loss. |

Choosing the right method depends on the institution’s size, budget, and specific needs. For smaller schools, manual tracking may be sufficient, while larger institutions or those with complex needs might benefit from investing in specialized software or cloud-based systems for more efficient management.

Essential Information on a Tuition Invoice

For a financial document to be effective, it must include all the necessary details that both the institution and the payer need to understand the charges and facilitate payment. A well-structured record provides clarity, ensures transparency, and helps prevent confusion. Including the right information is key to maintaining smooth financial operations.

First, the document should clearly identify both the sender and recipient, including names, addresses, and contact details. This helps to confirm the parties involved in the transaction. Additionally, the date of issuance and a unique reference number are essential for tracking and organizing records.

Another critical element is a breakdown of the charges. This should detail the specific fees being assessed, such as registration, course materials, and other related costs. It is also important to include any discounts, payments received, or adjustments made to avoid confusion about the total amount due.

Lastly, the payment terms should be explicitly stated, including the due date, available payment methods, and any penalties for late payments. Having this information clearly outlined helps ensure that both sides understand their obligations and timelines.

Using Digital Invoices for Tuition

As educational institutions increasingly move towards digital solutions, using electronic records for financial transactions has become a common practice. Digital formats offer numerous benefits, from convenience to improved accuracy, making them an ideal choice for managing payments and records. Transitioning to digital documents not only streamlines administrative processes but also enhances the overall experience for both institutions and their clients.

Efficiency and Speed

One of the most significant advantages of using digital records is the speed at which they can be processed. Unlike traditional paper-based systems, digital documents can be created, sent, and received almost instantly. This means that recipients can quickly review their financial obligations and submit payments without delay. Additionally, digital documents can be stored and retrieved effortlessly, reducing the time spent managing physical records.

Environmental and Cost Benefits

By eliminating the need for paper, printing, and postage, electronic documents help educational institutions save on operational costs. The environmental impact is also reduced, as fewer resources are consumed in the creation and distribution of these records. Moreover, many digital solutions are cost-effective, offering scalable options that grow with the institution’s needs without significant financial investment.

Security and Tracking are additional benefits of digital records. With the right software, transactions can be tracked in real-time, ensuring both parties are always on the same page. Encryption and other security measures help protect sensitive financial data from unauthorized access.

Overall, adopting electronic billing systems provides institutions with a more modern, secure, and efficient way to manage financial records, benefiting both the school and the families it serves.

Creating Recurring Tuition Invoices

When educational institutions provide services on an ongoing basis, it is essential to establish a consistent and automated billing process. Recurring financial records help both the institution and families stay organized by setting clear expectations for regular payments. By setting up an automated system, schools can reduce administrative workload and avoid errors, while students and parents can easily manage their payment schedules.

Steps to Set Up Recurring Billing

To create an effective recurring payment system, there are several steps to follow:

- Define Payment Frequency: Decide how often payments should be issued (monthly, quarterly, annually). Ensure that the frequency aligns with the institution’s payment policies and the family’s preferences.

- Set Up Payment Amounts: Determine the amount due for each billing cycle. This may include base fees, additional charges, or discounts for early payments.

- Automate Reminders: Schedule automated reminders to notify families of upcoming payments. This ensures they have enough time to make necessary arrangements.

- Choose a Payment Method: Make sure the institution offers multiple payment methods (credit card, bank transfer, online platforms) to accommodate different preferences.

- Integrate with Software: Use specialized financial software or online platforms to manage recurring payments automatically. This allows for easy tracking, adjustments, and updates to payment schedules.

Benefits of Recurring Billing

- Consistency: Regular payments ensure the school’s cash flow remains steady, and families are reminded of their financial obligations without having to manually process each transaction.

How to Avoid Payment Disputes

Ensuring smooth financial transactions is essential for maintaining a professional relationship between service providers and clients. Disagreements over payments can arise from unclear expectations, misunderstandings, or lack of proper documentation. To prevent such issues, it’s crucial to establish clear communication and transparency from the outset.

Clear Terms and Conditions

One of the most effective ways to avoid payment-related conflicts is to set out precise terms and conditions. These should cover the agreed amount, deadlines, and the scope of the services provided. Both parties should have a thorough understanding of these details before any work begins. This eliminates the risk of one side expecting something different from the other.

Regular Communication

Regular updates and reminders are key to preventing disputes. Establish a communication plan to keep clients informed of progress and any changes that may affect the final amount due. If there are delays or changes to the scope of work, it is vital to discuss them promptly and adjust expectations accordingly.

Clear documentation is also essential in these situations. Having records of all agreements and correspondence can help resolve conflicts quickly if they arise. This ensures that both parties have a reference point to resolve any disagreements that might occur down the line.

Integrating Invoices with Accounting Software

Linking payment documents with accounting software can significantly streamline financial tracking and reporting. By automating data entry and synchronizing financial records, businesses can reduce errors and save time. This integration ensures that all transactions are accurately recorded, making the overall accounting process more efficient and reliable.

Benefits of Integration

Integrating payment records with accounting platforms offers several advantages, including:

| Benefit | Description |

|---|---|

| Time-saving | Automatic syncing of data reduces the need for manual entry, saving time and effort. |

| Accuracy | Integration minimizes human errors by ensuring consistent data flow between systems. |

| Improved Reporting | Real-time data updates enable more accurate financial reports, making analysis easier. |

| Compliance | Automated tracking helps maintain regulatory compliance with fewer risks of oversight. |

Setting Up Integration

To integrate your payment records with accounting software, first ensure that both systems are compatible. Most modern accounting platforms offer built-in integration with common tools. Once linked, you can automate the transfer of payment information directly into your financial system, ensuring that all transactions are logged correctly and up-to-date without the need for manual input.

Legal Considerations for Tuition Invoices

When providing services that involve financial transactions, it is essential to be aware of the legal aspects that govern these agreements. Proper documentation helps protect both the service provider and the client, ensuring that all terms are clear and enforceable. Understanding the legal requirements can prevent future disputes and ensure compliance with applicable laws.

Contractual Obligations

Before issuing any financial records, it is crucial to establish a clear contract or agreement that outlines the terms of payment. This should include the amount owed, payment due dates, any penalties for late payments, and the services provided. Both parties should agree to these terms in writing to avoid any confusion or misunderstandings down the line. In the event of a dispute, this written agreement will serve as a legal reference.

Tax Implications

Service providers must also be aware of the tax regulations applicable to the payments they receive. Different jurisdictions may have varying requirements for reporting income and issuing financial records. It is important to include the necessary tax information on any payment documents, such as the relevant tax rates or exemption statuses, to comply with local tax laws.

Best Practices for Sending Tuition Invoices

When handling financial records for educational or other services, it is important to follow best practices to ensure smooth transactions and maintain professionalism. Clear communication, timely delivery, and thorough documentation play a critical role in preventing confusion and ensuring both parties are satisfied with the payment process.

Timely Delivery

Sending payment documents promptly is essential for maintaining an organized financial system. Aim to deliver them at the agreed-upon time, whether it’s at the start of the term, upon completion of a service, or according to another schedule. Late delivery can create unnecessary stress and lead to delays in payment, which can impact cash flow.

Clear and Accurate Information

Ensure that all details are clearly outlined and accurate. This includes the amount due, due dates, and any relevant payment methods. Break down charges clearly, if necessary, so that recipients can easily understand the cost structure. Additionally, be sure to include contact information for inquiries, in case there are any questions or discrepancies. Accuracy and transparency are key to avoiding confusion and maintaining trust.