Best Tuition Fee Invoice Template for Easy Payment Management

Managing financial transactions in educational settings requires clear, organized documentation. Accurate records are essential for both institutions and students to ensure transparency in payments and to avoid misunderstandings. Whether for tuition costs, administrative charges, or other related services, having a reliable system for generating and sending statements is crucial for smooth operations.

One of the best ways to streamline the payment process is by using structured documents that outline the amounts owed, due dates, and payment methods. These documents not only simplify financial tracking but also provide students and parents with a clear understanding of their obligations. Customizing such documents to suit specific needs allows educational institutions to maintain professionalism and efficiency in their billing procedures.

In this guide, we will explore various aspects of creating and using such documents, offering tips on design, necessary components, and the benefits of digital solutions. By the end, you’ll have a comprehensive understanding of how to improve your institution’s billing system while reducing administrative workload and errors.

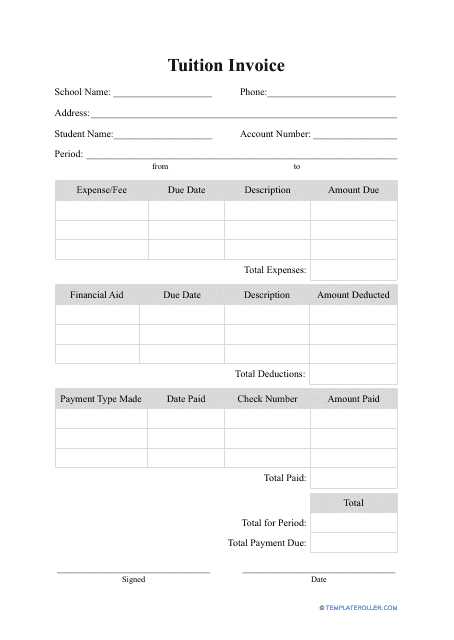

Tuition Fee Invoice Template Overview

Educational institutions rely on clear and effective documentation for managing payments and charges. The process of billing students for various services requires structured, professional documents that outline the financial obligations clearly. By using well-organized documents, schools and universities can ensure timely payments and minimize confusion for both the institution and the payer.

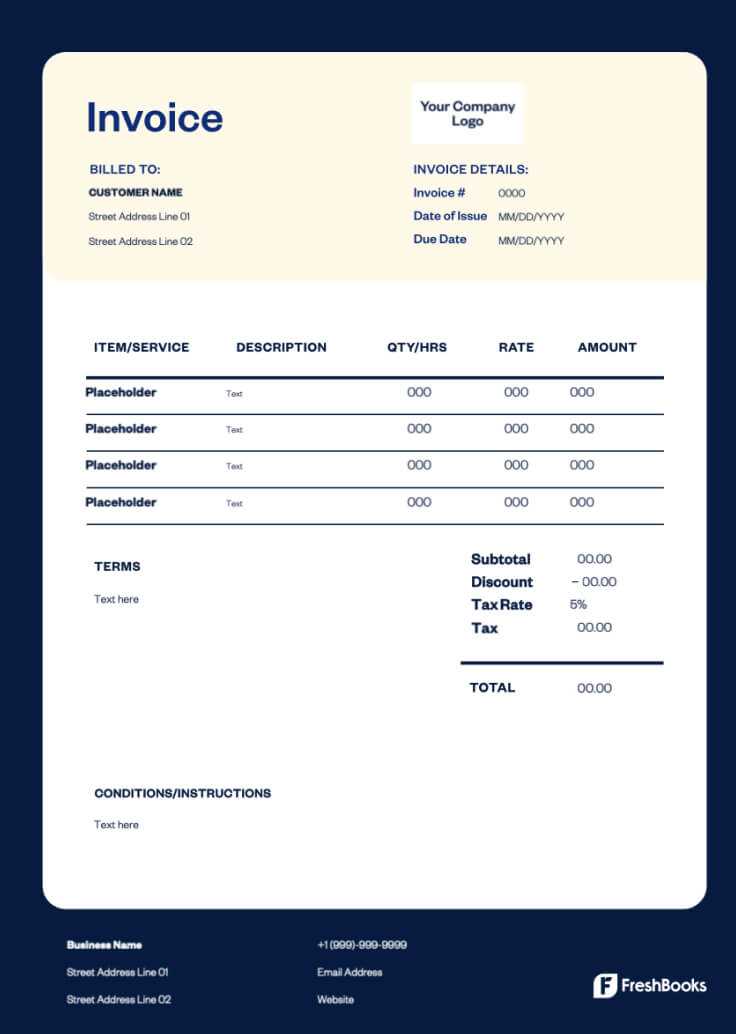

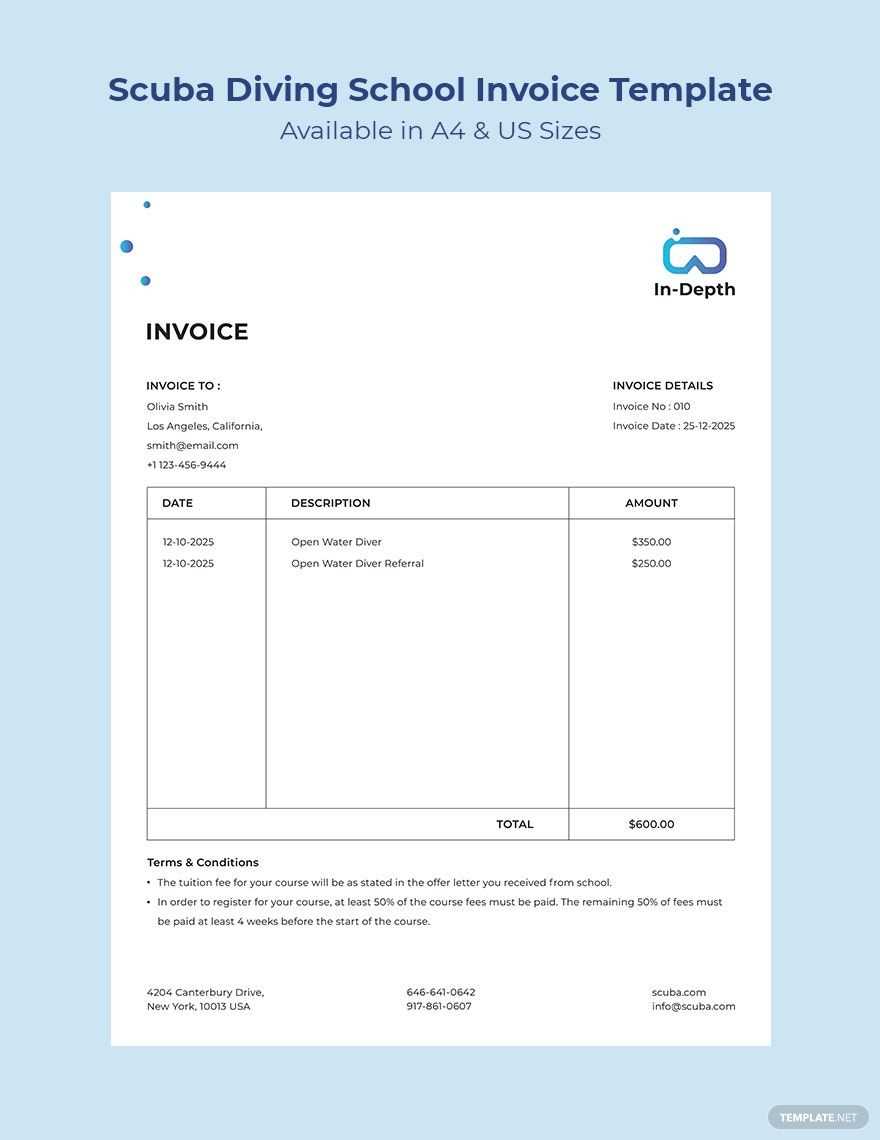

These documents typically contain all necessary details about the amounts owed, payment deadlines, and instructions on how to complete the transaction. A well-designed structure makes it easy for recipients to understand the breakdown of costs, such as tuition, administrative charges, and other applicable services. For educational organizations, having a standardized approach helps maintain consistency across transactions and improves financial record-keeping.

Key Features of a Billing Document

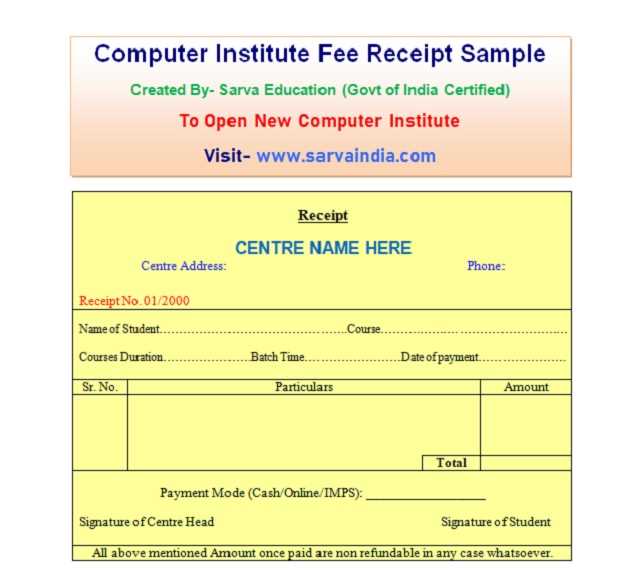

A comprehensive document should include essential elements such as the institution’s name and contact information, a detailed list of charges, and clear payment instructions. Additionally, it may include a space for payment tracking or any adjustments, such as discounts or scholarships. Including this information helps students and their families keep track of their obligations.

Customization and Flexibility

One of the greatest advantages of using a digital version of these documents is the ability to customize them based on specific requirements. Whether it’s adjusting the layout, adding institution-specific data, or including terms related to late payments, flexibility allows educational institutions to tailor each document to their needs. This adaptability ensures that the document remains functional and relevant for various educational levels and financial structures.

Why Use a Tuition Fee Invoice?

Clear and professional documentation is essential for ensuring smooth financial transactions between educational institutions and students. A structured document that outlines the costs and payment details provides clarity, minimizes errors, and fosters trust. It serves as a record of the financial obligations of both parties and acts as a reference for future communication and tracking.

Here are some key reasons why using such a document is essential for educational organizations:

- Clear Communication: A well-organized document clearly communicates the amount due, deadlines, and payment methods, leaving no room for confusion.

- Improved Organization: Using a standardized document helps institutions maintain a consistent and organized approach to managing multiple transactions.

- Legal Record: It serves as an official record of the agreement between the institution and the payer, which can be useful for auditing purposes or dispute resolution.

- Timely Payments: By outlining clear deadlines and payment instructions, such documents help encourage timely settlement of amounts due.

- Customizable Features: Institutions can tailor the document to include specific details such as discounts, scholarships, and late payment penalties.

Overall, using this type of documentation streamlines the financial process for both educational institutions and students, ensuring a smooth and professional transaction each time.

Key Elements of an Invoice Template

For an educational institution, a billing document must include certain essential details to ensure transparency and clarity. These elements not only make the document more professional but also help in avoiding confusion and ensuring that all necessary information is conveyed. A properly structured document can significantly streamline payment collection and financial tracking.

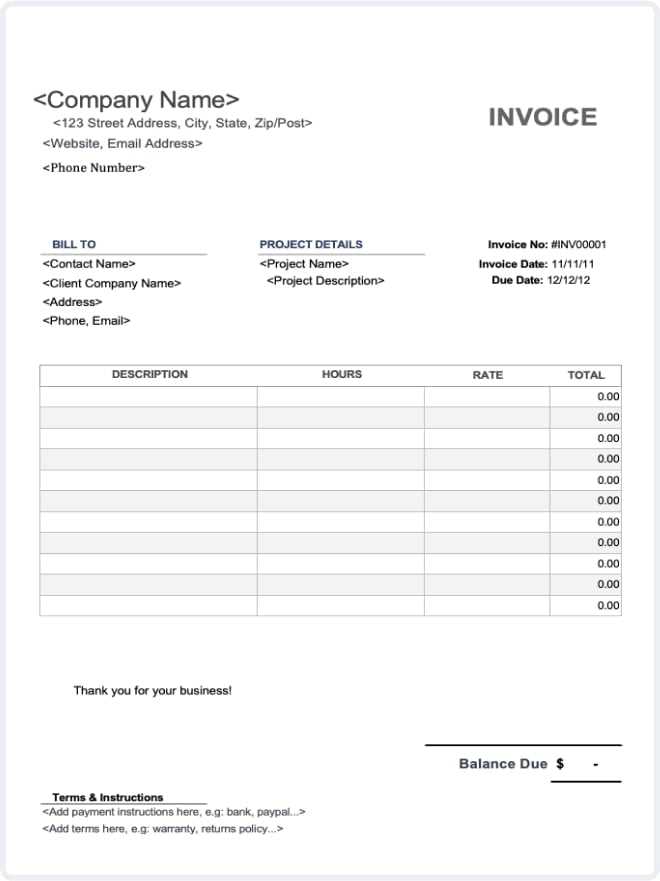

Below are the key components that should be included in every document to ensure completeness:

- Institution’s Information: Include the full name, address, and contact details of the educational institution. This provides clear identification of the entity issuing the document.

- Student’s Information: The student’s full name, address, and contact details should be clearly stated, ensuring there is no ambiguity regarding the recipient of the bill.

- Description of Charges: A detailed breakdown of all applicable costs, including the specific service, course, or program charges. This helps in providing clarity on what the student is being billed for.

- Total Amount Due: A clear statement of the total amount owed, ensuring the student or parent knows exactly what needs to be paid.

- Due Date: Specify the payment deadline to encourage timely settlement and avoid late fees. This is important for both parties to manage their schedules.

- Payment Instructions: Clear instructions on how the payment can be made, whether it’s via bank transfer, online payment, or another method. Including this information helps reduce delays and confusion.

- Late Payment Penalties: If applicable, details about any penalties for late payments should be clearly outlined to inform students of any potential extra costs.

- Unique Identifier: A reference or invoice number to uniquely identify the document for easier tracking and record-keeping.

Including these key elements ensures that the document is both professional and comprehensive, helping to maintain smooth financial operations and clear communication between the institution and its students.

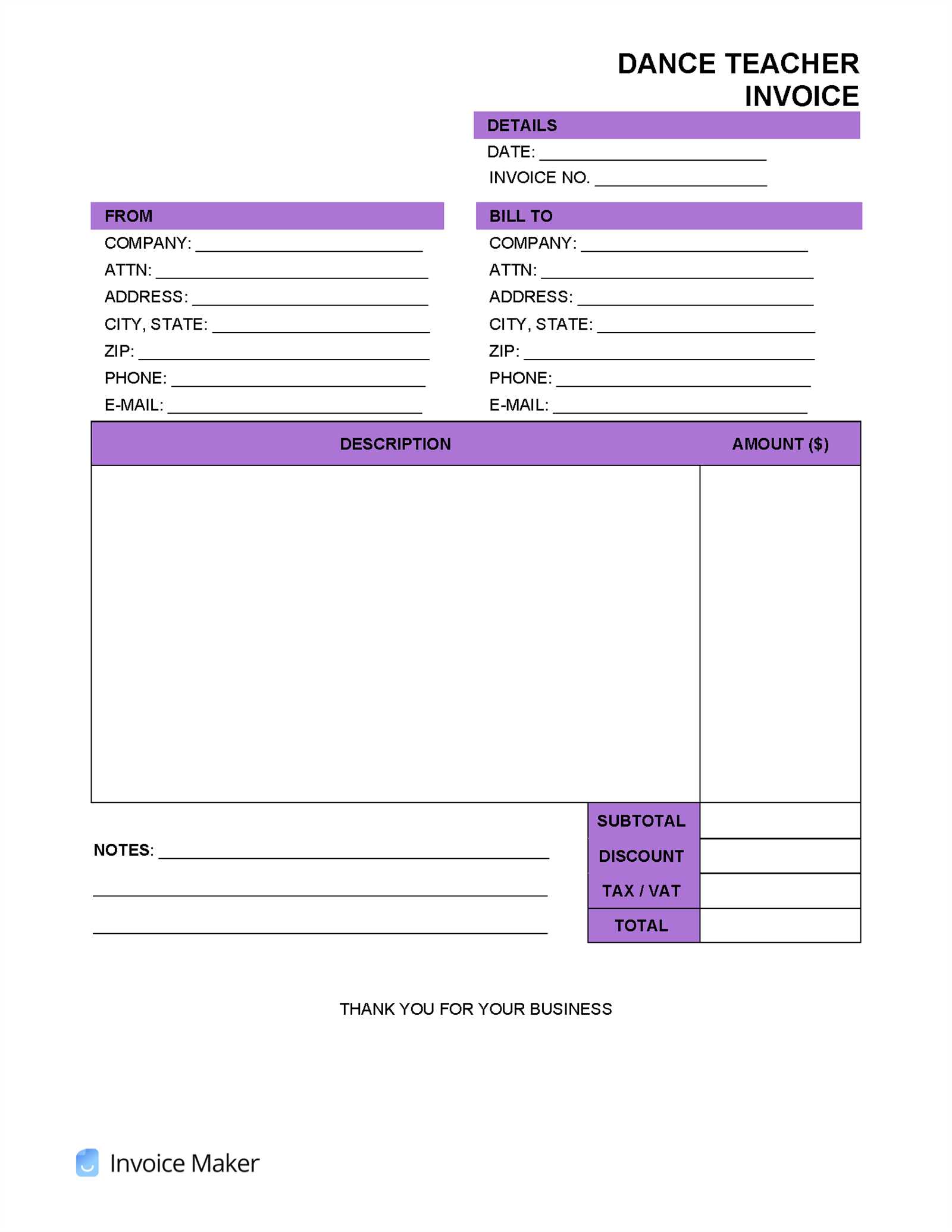

How to Create a Custom Invoice

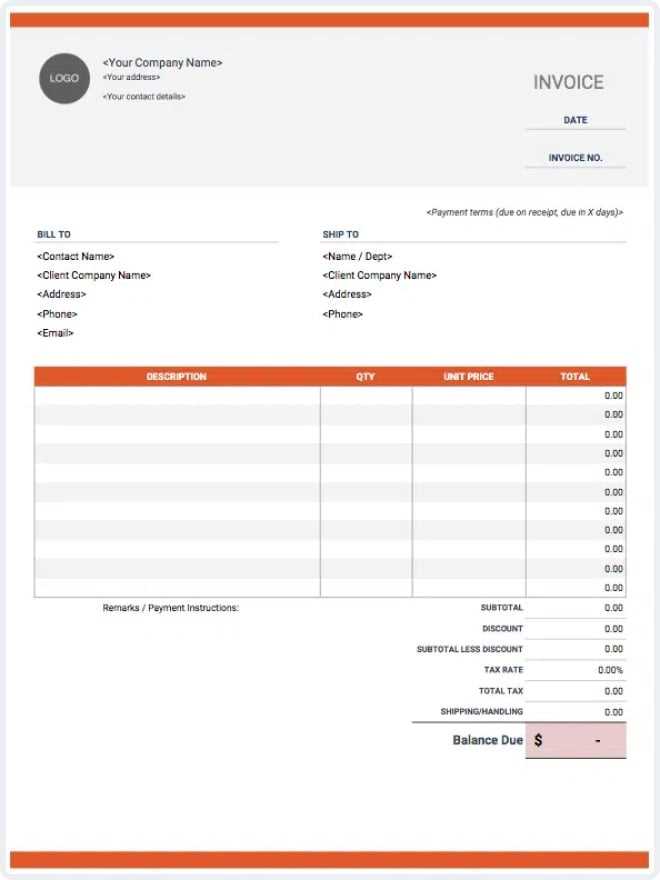

Designing a personalized document to manage payments allows educational institutions to tailor billing processes to their specific needs. By customizing each element, you can ensure that all necessary details are included and that the document aligns with your institution’s standards. The process of creating such a document is simple and can be done using various tools or software solutions.

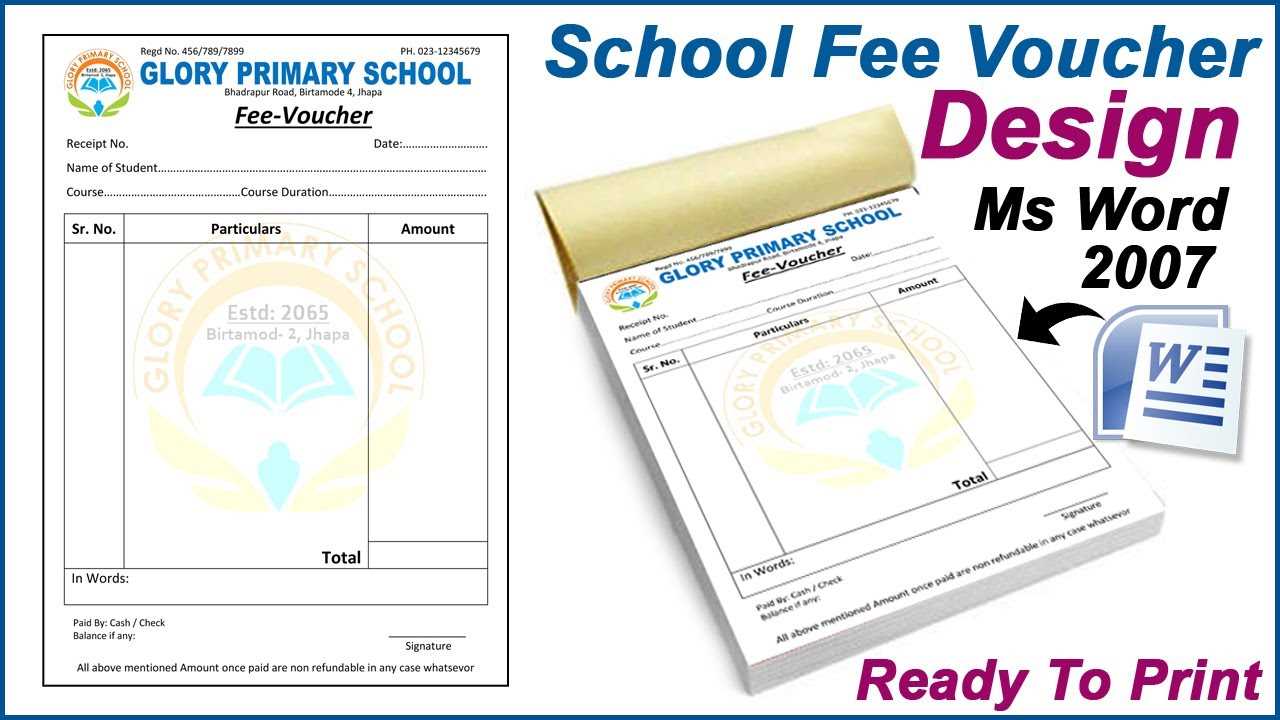

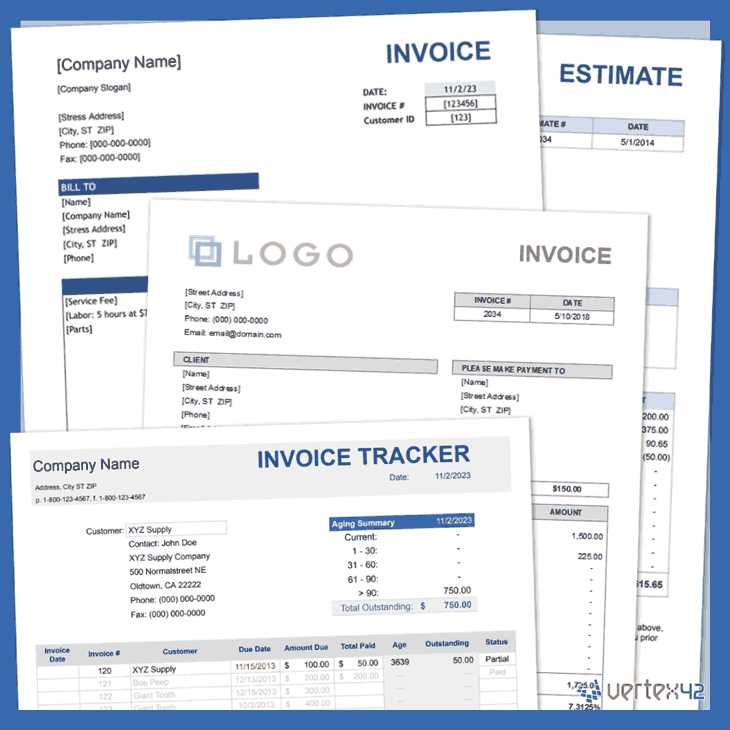

Step 1: Choose a Format

The first step in creating a custom billing document is to decide on the format. You can use a word processor, spreadsheet software, or online invoicing platforms that offer pre-designed layouts. Choose one that allows you to easily modify and update the content. Make sure the format is clean, professional, and easy to read, with ample space for all required details.

Step 2: Add Key Information

Ensure that your document includes the following essential elements:

- Institution’s Details: Include the name, address, and contact information of the institution.

- Recipient’s Information: Add the student’s full name, address, and any other identifying information.

- Breakdown of Charges: Provide a clear, itemized list of the services or programs for which the student is being charged.

- Amount Due: Clearly state the total amount owed and the due date.

- Payment Instructions: Detail the methods and steps for submitting the payment.

By including these components, you create a document that serves as a complete record of the transaction and can be used for tracking payments and resolving disputes if necessary.

Common Mistakes in Fee Invoices

While creating billing documents is an essential task for any educational institution, errors in these documents can lead to confusion, delayed payments, and unnecessary disputes. Even small mistakes can have significant consequences, affecting both the institution’s financial records and the student’s experience. It’s important to be aware of the common pitfalls to avoid when generating these documents.

1. Missing or Incorrect Contact Information

One of the most common mistakes is failing to include accurate contact information. Without the institution’s full details or the student’s correct information, the document can create confusion or delays in communication. Always double-check that the names, addresses, and phone numbers are correct before sending out the document.

2. Incomplete or Unclear Breakdown of Charges

Another frequent error is not providing a clear and detailed breakdown of the amounts due. Students need to understand exactly what they ar

Benefits of Using Templates for Billing

Standardizing billing documents offers significant advantages for educational institutions, making the entire payment process more efficient and organized. Using pre-designed structures ensures consistency, accuracy, and saves time. By relying on established formats, institutions can focus on managing the details without worrying about layout or missing critical information.

1. Time Efficiency

One of the primary benefits of using pre-built documents is the time saved in creating each one from scratch. Instead of manually designing each record, a template allows staff to fill in the necessary details and produce a professional document in just a few minutes. This reduces the administrative workload and accelerates the billing process.

2. Consistency and Professionalism

Using a standard format ensures that all documents look uniform and maintain a professional appearance. Whether it’s for course-related charges or other services, having a consistent design strengthens the institution’s brand and fosters trust. Students and parents can easily recognize official communications, which improves clarity and reduces errors.

- Solution: A uniform layout provides clarity and reduces confusion, ensuring students understand the billing document quickly and accurately.

3. Reduced Errors

Templates often include predefined fields that ensure all critical information is captured, minimizing the risk of forgetting essential details or making calculation errors. By following a clear structure, administrative staff are less likely to overlook or misplace important components, which helps maintain accuracy across all transactions.

4. Easier Customization

Pre-designed documents are highly customizable to fit the specific needs of an institution. Whether it’s adding new charge categories, adjusting payment instructions, or modifying terms and conditions, templates offer flexibility. Institutions can tailor them based on the student’s profile, program, or discounts, all while maintaining a professional look.

5. Streamlined Tracking and Record-Keeping

Templates often come with features that help track payment status and organize records efficiently. These systems allow institutions to quickly identify outstanding balances, ensure payments are processed on time, and keep detailed records for auditing purposes.

Overall, using structured billing documents simplifies the financial processes for both the ins

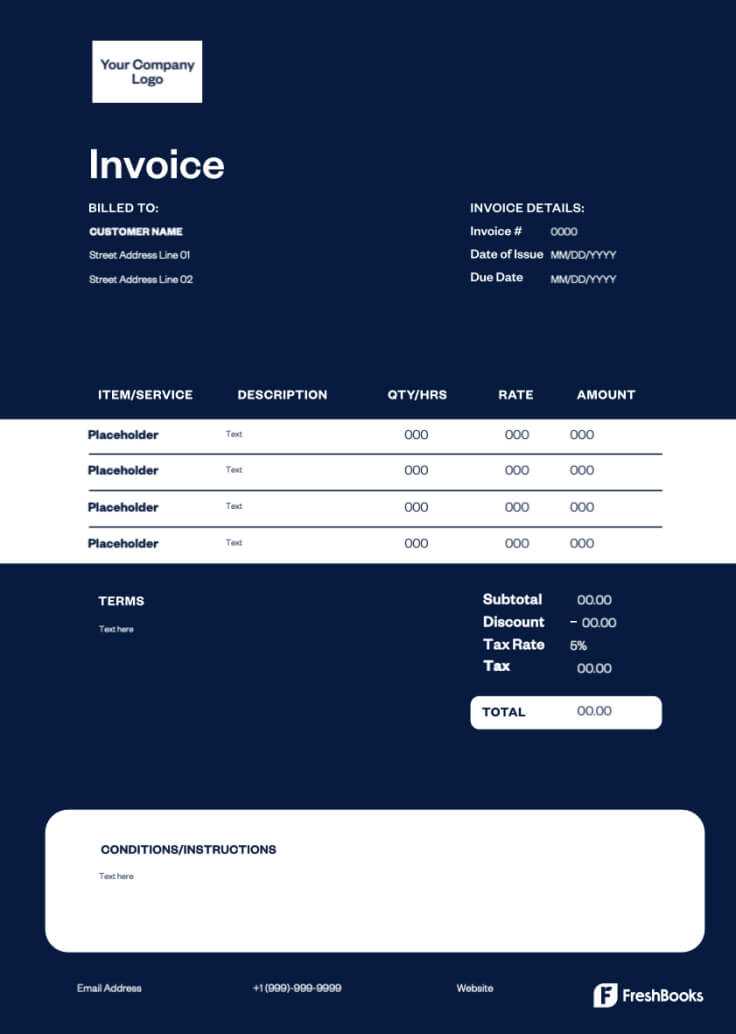

Best Practices for Invoice Formatting

Proper formatting of billing documents is essential for ensuring clarity and ease of understanding. A well-structured document not only looks professional but also enhances the efficiency of payment processing. The right layout ensures that all necessary information is presented in a logical and accessible manner, minimizing the chances of confusion or errors.

1. Prioritize Readability

The primary goal of any billing document is clarity. It should be easy for recipients to quickly scan and understand the charges and payment instructions. Use a clean, simple layout with enough white space to avoid clutter. Font size should be legible, and headings or key details should be highlighted for easy reference.

- Tip: Use bold text or underlining to emphasize critical details such as the amount due or payment deadlines.

2. Consistent Structure

A consistent format helps ensure that all necessary details are included and easy to find. Organize the content in a logical flow, starting with the institution’s and student’s contact information, followed by a breakdown of charges, payment instructions, and due date. This standard structure helps prevent omissions and makes the document easier to navigate.

- Tip: Group similar information together, such as itemized charges, discounts, and payment terms.

3. Use Clear and Descriptive Headings

Headings should be used to separate different sections of the document, making it easier for the reader to find the information they need. For example, use headings such as “Billing Details,” “Total Amount Due,” and “Payment Instructions.” This provides a logical flow and helps both students and administrative staff easily reference specific parts of the document.

4. Include Key Details in a Structured Format

- Institution Information: Always include the name, address, and contact details.

- Recipient Information: Ensure the student’s name, address, and contact details are clearly stated.

- Breakdown of Charges: List all items being billed, with clear descriptions and corresponding amounts.

- Payment Information: Provide clear instructions on how to make the payment, along with any deadlines or late payment penalties.

5. Keep it ProfessionalHow to Include Tax Information

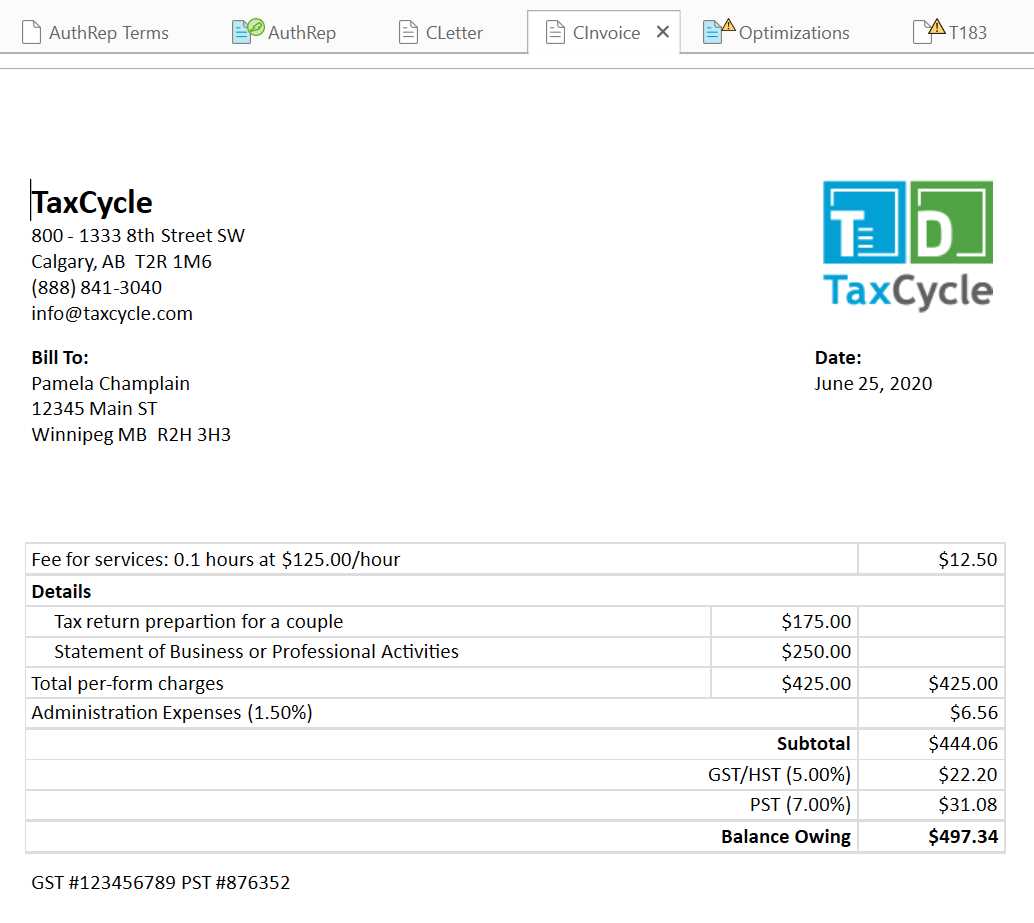

Incorporating tax details into billing documents is essential for compliance with local regulations and ensuring that both institutions and students understand the total cost of services provided. Accurate tax information helps prevent confusion and provides transparency in the billing process. It is important to clearly show how taxes are applied to the overall amount to avoid misunderstandings.

1. Identify Applicable Taxes

Before including tax information, determine which taxes are relevant to your institution’s services. This may vary depending on the region and the type of services offered. Some services may be tax-exempt, while others may be subject to sales tax, value-added tax (VAT), or other specific local taxes. Once you know which taxes apply, calculate the tax amount for each charge included in the billing document.

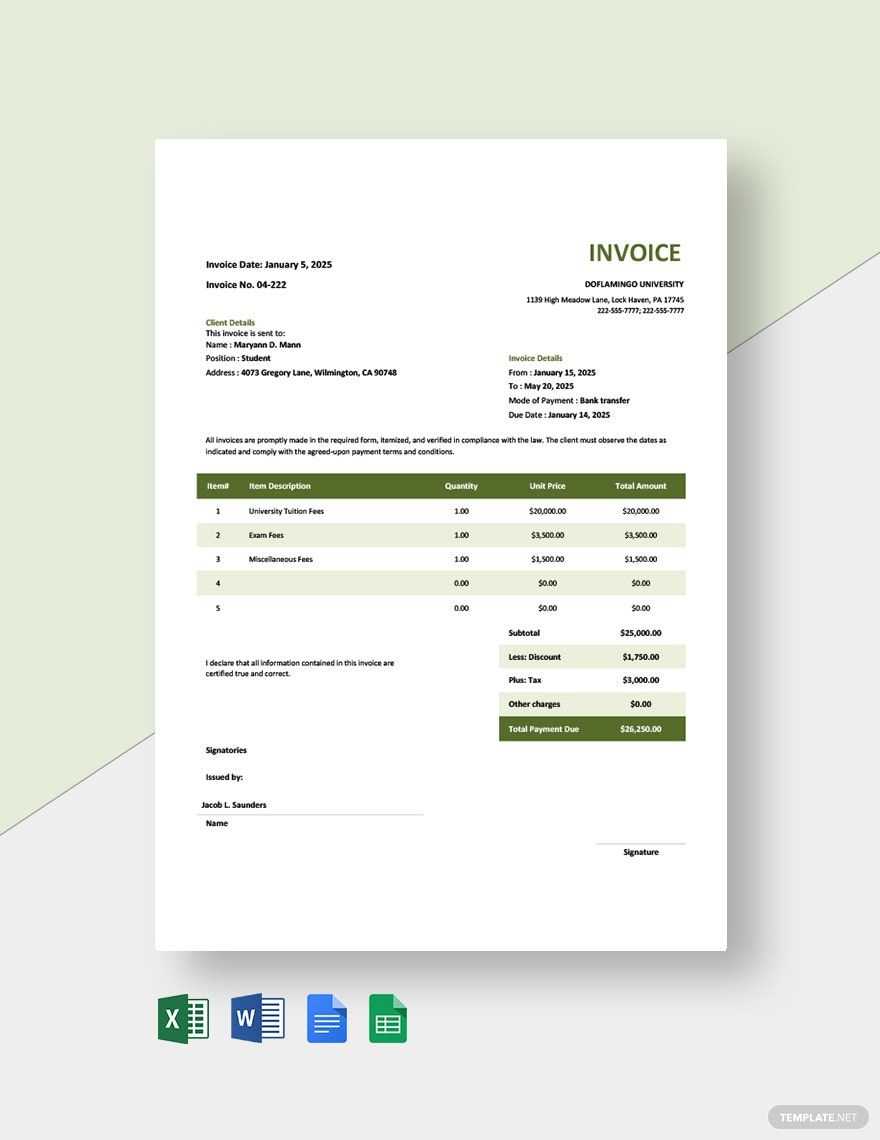

2. Display Tax Information Clearly

Once you’ve identified the appropriate taxes, include them in the document in a clear and easily understandable format. Typically, taxes should be displayed as a separate line item beneath the total amount due. Be sure to indicate the tax rate used and the exact amount of tax applied. For example:

- Tax Rate: 10%

- Tax Amount: $100

- Total Amount Due (Including Tax): $1,100

This ensures transparency and allows students to see how the final amount is derived, including any taxes applied to the base charges.

Ensuring Accuracy in Billing Statements

Accurate billing is crucial for maintaining trust and transparency between educational institutions and their students. Mistakes in financial documents can lead to confusion, delays, or disputes, which can damage relationships and create unnecessary administrative work. Ensuring precision in the information presented not only streamlines the payment process but also protects both parties from potential misunderstandings.

To achieve accuracy, institutions should implement a systematic approach to creating and reviewing these documents. This includes double-checking all charges, ensuring that calculations are correct, and confirming that the right details are included. Additionally, clear communication of payment terms and deadlines is essential to avoid any errors or delays in processing payments.

By prioritizing accuracy in billing statements, educational institutions can minimize administrative errors and foster better communication with students, leading to smoother financial transactions and a more positive experience for everyone involved.

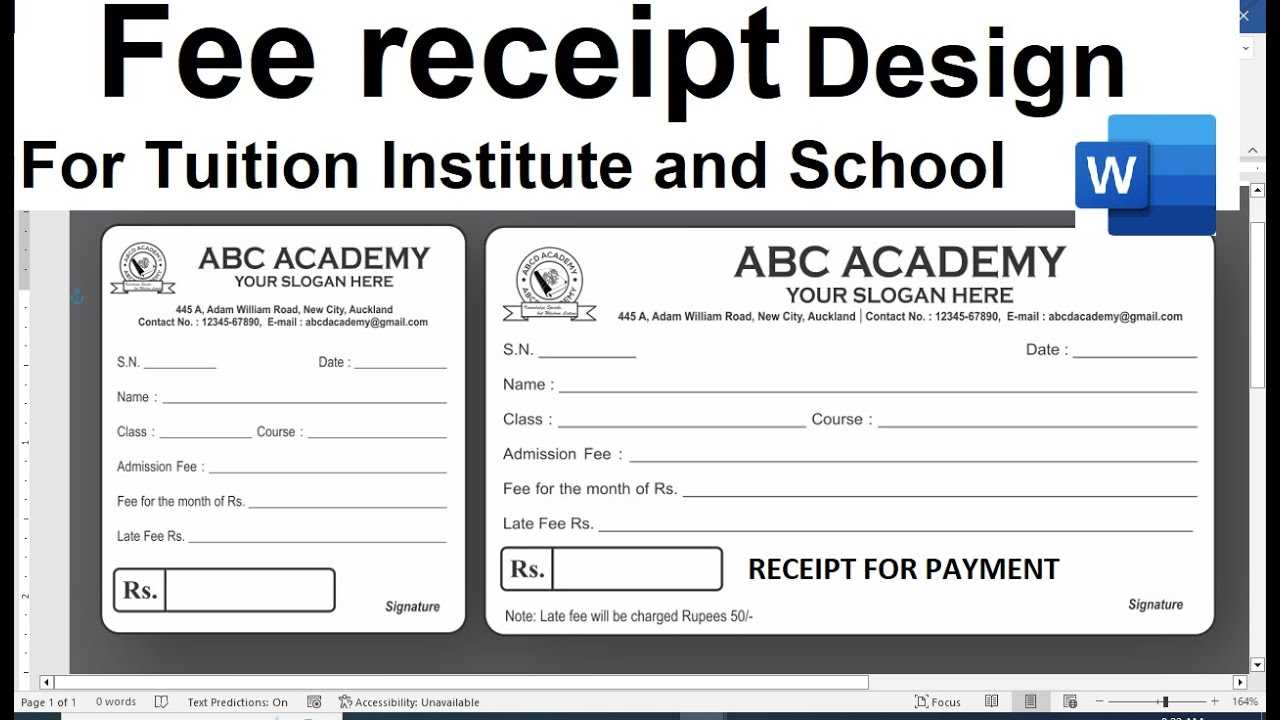

Customizing the Template for Institutions

Every educational institution has its unique structure and set of requirements when it comes to managing financial documents. Customizing billing records to reflect an institution’s specific needs can make the process more efficient and aligned with the institution’s practices. Personalization ensures that all necessary details are included while maintaining a professional appearance.

Customizing a billing document allows institutions to incorporate their branding, adapt it to various fee structures, and provide specific payment instructions. Here are some ways institutions can tailor their billing documents:

- Institution Branding: Include the institution’s logo, color scheme, and any other visual elements that represent its identity. This helps to maintain consistency and reinforces the institution’s professionalism.

- Charge Categories: Adjust the list of charges to reflect the services offered. For example, institutions may offer different programs or courses with varying rates, so these should be clearly itemized in the document.

- Payment Methods: Customize the payment instructions based on the available payment options. Whether it’s an online portal, bank transfer, or check, make sure the preferred methods are clearly indicated.

- Discounts and Scholarships: If applicable, include any scholarships, grants, or discounts the student qualifies for. This information should be clearly displayed to avoid confusion.

- Late Payment Terms: Specify any late fees or penalties in case of delayed payments. Providing this information in advance helps students understand the importance of timely payments.

By customizing billing documents to meet the specific needs of the institution, both the school and the students benefit from clear, consistent, and professional communication. Tailoring the structure helps avoid unnecessary complications and ensures smoother financial operations.

Legal Requirements for Tuition Invoices

Educational institutions must ensure that all financial documents comply with relevant legal standards to avoid potential disputes or penalties. Legal requirements can vary by jurisdiction, but certain elements are universally required to maintain transparency and ensure that both the institution and the student are protected. Understanding these legal obligations is crucial for proper document management and to ensure compliance with tax and financial regulations.

1. Essential Information for Legal Compliance

Each document should contain specific details that are required by law, whether it’s for tax purposes, financial reporting, or consumer protection. The following information is often mandated by law:

- Institution’s Information: Full legal name, address, and tax identification number of the educational institution must be included for identification and record-keeping purposes.

- Recipient’s Information: The student’s name and address should be clearly displayed to ensure there is no confusion about who is responsible for the payment.

- Description of Services: A detailed breakdown of the charges for services or programs provided. This includes clear descriptions and dates to ensure transparency in what is being billed.

- Payment Terms: Clearly state the amount due, any applicable taxes, payment due date, and accepted methods of payment to avoid confusion and ensure compliance with contract terms.

- Tax Information: Include applicable tax rates and amounts, as required by local tax laws. This ensures that both the institution and the student understand the total cost, including any applicable taxes.

- Late Fees or Penalties: If there are penalties for late payments, these must be clearly communicated to comply with consumer protection laws and avoid legal disputes.

2. Record-Keeping and Reporting Requirements

In addition to including the necessary information on the document itself, educational institutions must also follow certain rules for record-keeping and reporting. Many jurisdictions require institutions to maintain accurate records of all financial transactions for a specified period, typically ranging from three to seven years, depending on local regulations.

- Retention of Records: Institutions should store billing records in an organized manner for easy access during audits or inspections.

- Reporting to Tax Authorities: Ensure that all documents are available for submission during tax reporting periods, if applicable. This may include providing detailed records of payments, taxes collected, and services rendered.

By adhering to these legal requirements, educational institutions can avoid costly legal issues, maintain proper documentation, and ensure that their financial processes are in line with regulatory standards.

How to Handle Payment Terms

Clear and well-defined payment terms are essential for ensuring that both the institution and the student are aligned on financial expectations. These terms provide a framework for when and how payments should be made, helping to avoid confusion, disputes, and delays. Establishing transparent terms also ensures that the payment process is smooth and efficient for both parties involved.

1. Define the Payment Schedule

Establishing a clear payment schedule is one of the first steps in handling payment terms effectively. Whether payments are due in full upfront, in installments, or according to a specific timeline, this schedule should be clearly outlined on the billing document. Key details to include are:

- Due Date: Specify the exact date by which the payment must be made.

- Payment Frequency: If payments are to be made in installments, indicate the frequency (e.g., monthly, quarterly) and the total number of installments.

- Payment Start Date: If applicable, mention when the first payment is due and when subsequent payments should be made.

2. Clearly State Accepted Payment Methods

To avoid confusion, specify the methods by which payments can be made. This includes detailing whether payments can be made via bank transfer, credit card, checks, or through online platforms. Clearly listing these options provides students with flexibility and convenience, making it easier for them to meet the payment requirements.

- Bank Transfer: Provide the institution’s account details for wire transfers.

- Online Payments: Include links or instructions for making payments through online portals.

- Checks: If checks are accepted, clarify the payee’s name and the mailing address.

3. Address Late Payments and Penalties

Late payments can be a common issue, but they can be managed effectively with clear communication. Specify any penalties, fees, or interest charges that will apply if payments are not made on time. This helps ensure that students understand the consequences of missing payment deadlines.

- Incorporating Discounts and Scholarships

When managing financial documents, it is important to clearly outline any discounts or scholarships applied to the total amount. These deductions can significantly reduce the burden on students and help make education more affordable. Ensuring that these reductions are properly reflected in billing records not only provides transparency but also helps prevent any confusion or errors during payment processing.

1. Identifying Applicable Discounts

Educational institutions often offer various discounts to students based on different criteria, such as early payment, sibling enrollment, or special programs. These discounts should be clearly itemized to ensure the recipient understands how their total amount was adjusted.

- Early Payment Discounts: If students receive a discount for paying their balance before a specific deadline, this should be clearly stated along with the percentage or fixed amount.

- Sibling or Family Discounts: Offer a reduction in the total amount for families with multiple students enrolled. This should be clearly noted, including the amount or percentage of the discount applied.

- Referral Discounts: If discounts are given to students who refer others to the institution, list these separately with the applicable terms.

2. Applying Scholarships

Scholarships are an essential form of financial aid, and they should be carefully incorporated into billing documents. Whether awarded based on merit, need, or other criteria, scholarships reduce the overall cost, and it is vital to specify how they impact the total amount due.

- Merit-Based Scholarships: Clearly state the scholarship’s amount and the criteria for its award. If it covers only part of the cost, indicate the remaining balance after the scholarship has been applied.

- Need-Based Scholarships: If the scholarship is based on financial need, indicate the amount and how it is calculated. Be sure to provide details on how this affects the overall charges.

- External Scholarships: If students are awarded scholarships from external organizations, include the amount and any deadlines for confirming receipt of the funds.

3. Communicating the Total After Adjustments

Once disco

Managing Late Fees and Penalties

Handling late payments efficiently is crucial for maintaining financial stability and encouraging timely settlements. Clearly outlining late fees and penalties in billing documents helps set clear expectations and incentivizes prompt payments. By establishing transparent and fair policies for overdue balances, institutions can minimize disruptions and ensure consistent cash flow.

1. Setting Clear Late Payment Policies

One of the first steps in managing overdue payments is to set clear policies that are communicated upfront. Students should be fully aware of the consequences of late payments before they commit to the financial obligations. Some key details to include are:

- Due Date: Clearly specify the exact date by which payments must be received to avoid penalties.

- Grace Period: If applicable, outline any grace period provided before penalties start to accrue. This gives students a small window of flexibility.

- Penalty Charges: Clearly state the late payment penalties, whether they are a fixed amount or a percentage of the total due. Transparency helps students understand what to expect if payments are not made on time.

2. Calculating Late Penalties Fairly

To avoid disputes, penalties should be calculated consistently and in accordance with the institution’s policy. There are a variety of approaches to determining the amount of the late charge:

- Fixed Late Fee: A set amount added to the balance after the due date. For example, “A $50 late fee will be applied if payment is not received within 10 days of the due date.”

- Percentage-Based Penalty: A percentage of the outstanding balance is added for each day or week the payment is delayed. For instance, “A 2% penalty will be charged for each month the payment is overdue.”

- Interest Charges: In some cases, interest can be applied to overdue balances. Clearly state the interest rate and how it will be calculated (e.g., annually or monthly).

3. Communication and Reminders

Effective communication is key to managing late payments. Institutions should send out timely reminders to students about upcoming due dates and outstanding balances. Some best practices include:

- Reminder Notices: Send a friendly reminder several days before the payment is due to ensure the student is aware of the dea

Tracking Payments with Your Template

Efficiently tracking payments is essential for maintaining accurate financial records and ensuring that students fulfill their financial obligations. By utilizing a structured document, institutions can easily monitor paid and outstanding amounts, ensuring transparency and minimizing errors. Keeping track of payments helps institutions stay organized and provides students with clear information regarding their balance status.

1. Organizing Payment Information

To effectively manage payments, it is important to organize the payment details in a clear and consistent manner. Here are key elements to include in your document to track payments:

- Payment Date: Record the date each payment is made to track the timeliness of the transaction.

- Amount Paid: Specify the exact amount paid by the student to ensure proper crediting to their account.

- Remaining Balance: Clearly show the balance remaining after each payment is made to help students and the institution keep track of the total amount due.

- Payment Method: Include details about the payment method used (e.g., bank transfer, credit card, online payment) for future reference and verification.

2. Using a Payment Schedule

For institutions offering installment payments or deferred payment plans, a well-organized payment schedule is crucial. The schedule should track the following:

- Installment Dates: Clearly mark the due dates for each payment installment so that both the institution and student are aware of upcoming obligations.

- Paid Installments: Indicate which installments have been paid, and if any are overdue, to prevent confusion and allow for quick follow-up actions.

- Pending Installments: List the remaining amounts that are yet to be paid, allowing for easy tracking of overdue payments.

3. Handling Partial Payments

In cases where students make partial payments, it is important to accurately reflect these payments in the records. Here are some best practices for tracking partial payments:

- Track Partial Amounts: Break down partial payments by amount, showing exactly how much has been applied to the total balance.

- Update Remaining Balance: Each time a partial payment is made, update the remaining balance to reflect the new total due.

- Communicate wi

Tips for Sending Tuition Invoices

Efficiently sending financial statements to students is essential for ensuring timely payments and avoiding confusion. Clear communication and proper timing are key to making the payment process smooth for both the institution and the students. By following a few simple best practices, educational institutions can ensure that all charges are accurately reflected and delivered in a professional manner.

1. Timing is Key

When sending financial statements, the timing can greatly impact the effectiveness of the process. Here are a few considerations:

- Send Early: It’s best to send out statements well before the due date to give students ample time to review their balance and make arrangements.

- Set a Consistent Schedule: Establish a regular schedule for sending out financial documents (e.g., monthly or at the beginning of each term) so that students know when to expect them.

- Allow for Grace Periods: If payment is due on a specific date, consider sending out reminders in advance, followed by a formal statement once the deadline has passed.

2. Be Clear and Transparent

Clarity is essential to avoid any confusion about charges. The statement should be detailed and easy to understand, including all relevant financial information:

- Itemize Charges: List all the charges separately, such as tuition, materials, or other costs, so students can see exactly what they are being billed for.

- Include Payment Instructions: Clearly explain how payments can be made (e.g., online portal, bank transfer, etc.) and the preferred payment methods.

- Highlight Discounts and Adjustments: If any discounts or adjustments have been applied, make sure to clearly show them in the statement so students understand how their final balance was calculated.

3. Use Multiple Delivery Methods

To ensure students receive their statements, it’s important to utilize multiple delivery methods. This increase

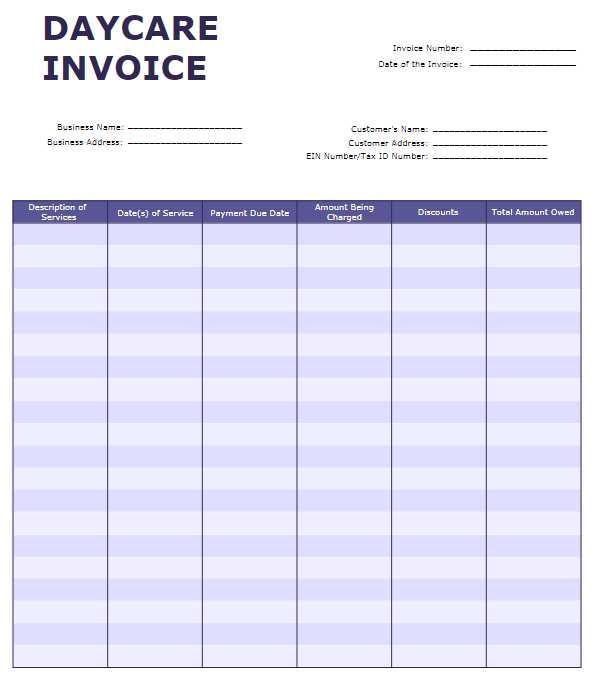

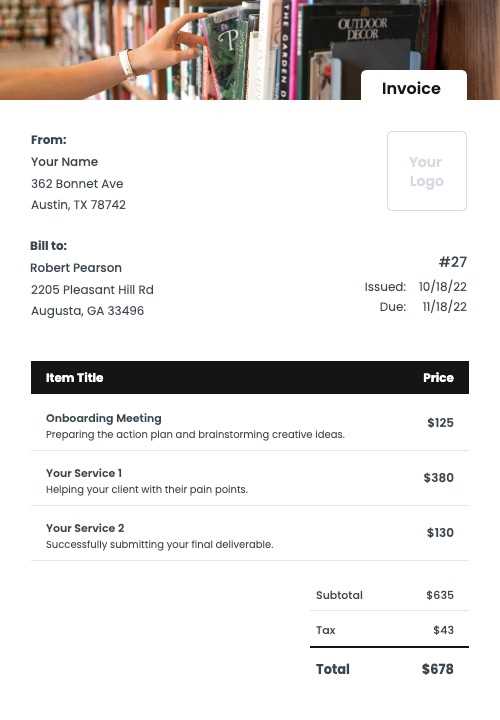

Free vs. Paid Invoice Templates

When it comes to creating financial statements for educational institutions, choosing between free and paid options can significantly impact the quality and functionality of your documents. Both options offer distinct advantages, and understanding these differences can help you make an informed decision based on your needs and budget. Below is a comparison of free and paid solutions to help you determine which works best for your institution.

Feature Free Options Paid Options Customization Basic customization options, may require manual editing Advanced customization with professional designs and features Design Quality Simple designs, may lack modern or professional appeal High-quality, polished designs suitable for professional use Features Limited features; may lack some essential elements Comprehensive set of features, such as automatic calculations and tax fields Ease of Use Basic functionality; may require manual input for complex calculations Easy to use with automated features and pre-filled data Support Minimal or no support available Customer support and updates available as part of the package Cost Free of charge Paid subscription or one-time fee Free options are often ideal for those on a tight budget or those who need a basic document without additional features. However, for institutions looking for a professional presentation, advanced functionality, and consistent support, investing in a paid solution can offer long-term value. Consider your institution’s specific needs, volume of statements, and design preferences before making a decision.

How to Automate Your Billing Process

Automating the billing process can save educational institutions a significant amount of time and effort, while also reducing the risk of human error. By leveraging technology, you can streamline financial transactions, ensure accuracy, and improve communication with students. Automated systems allow for recurring charges, reminders, and easy updates, helping your institution focus more on teaching and less on administrative tasks.

1. Choose the Right Software

The first step in automating your billing system is selecting the right software that meets your institution’s needs. Look for a platform that offers the following features:

- Recurring Billing: Allows for automatic billing on a set schedule (e.g., monthly, quarterly, or annually), eliminating the need for manual input each time.

- Customizable Templates: Enables you to adjust documents to your institution’s specifications, ensuring professional and consistent communication with students.

- Automated Reminders: Sends reminders to students before and after the due date, helping to reduce missed payments.

- Payment Processing Integration: Seamlessly integrates with various payment systems (e.g., credit cards, online portals, or bank transfers), ensuring easy and secure transactions.

2. Set Up Automated Workflows

Once you have the right software in place, the next step is to configure your automated workflows. This includes:

- Creating Payment Schedules: Set up recurring billing schedules for students based on their payment plans, whether monthly, per semester, or on another timeline.

- Configuring Notifications: Customize automated email or text notifications to inform students about upcoming payments, payment confirmations, or overdue balances.

- Tracking Payments: Set the system to automatically update student records upon receiving payments, eliminating manual tracking and ensuring accurate financial statements.

By automating these tasks, your institution can significantly reduce the administrative burden associate