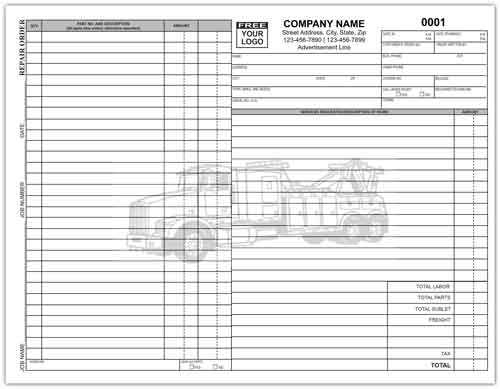

Free Truck Repair Invoice Template for Easy Customization

When managing a business focused on vehicle maintenance, having an organized and professional approach to billing is essential. Creating a clear document that details the services provided ensures transparency between you and your clients, fostering trust and minimizing disputes. This tool helps streamline the financial aspect of your work and can be customized to fit any specific requirements.

Customizing your billing forms allows for flexibility, enabling you to adjust fields for different job types, labor charges, and material costs. Whether you’re working on an urgent fix or a scheduled service, an effective document can help you keep track of payments and maintain accurate records. By including all necessary details in a structured manner, you can reduce confusion and provide your clients with a professional, easily understandable receipt of services rendered.

Having a ready-made system in place also saves time, allowing you to focus on your core tasks. With the right approach, these documents will serve not just as a financial record but as a key part of your communication strategy with clients. From offering clear terms to highlighting additional costs, a well-constructed document can strengthen your business operations.

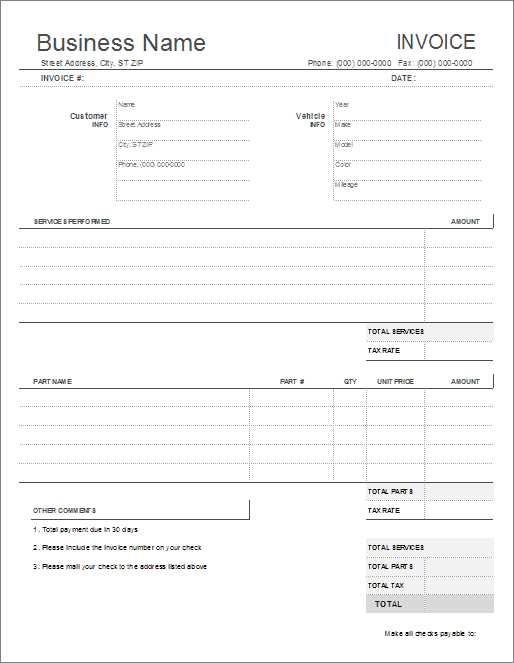

Vehicle Service Billing Document Overview

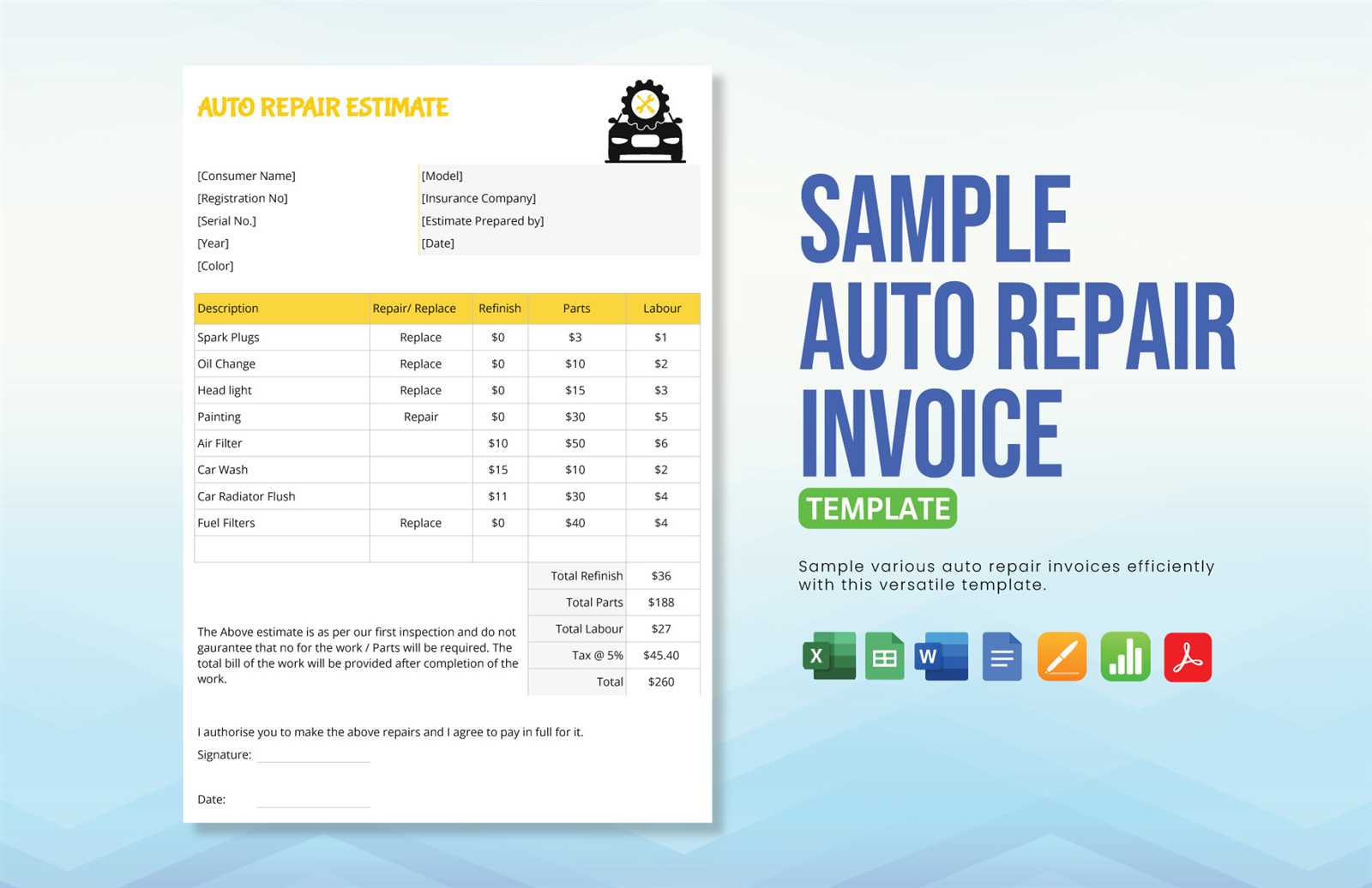

Creating a comprehensive billing document is crucial for any business providing vehicle maintenance or repair services. A well-structured form helps maintain clarity between service providers and customers, ensuring that all charges are accurately communicated. This type of document not only acts as a receipt but also serves as a detailed record of the services rendered, parts used, and any additional charges that may apply.

Such a document can be tailored to fit various service scenarios, from routine checks to complex fixes, and is designed to make the billing process seamless. It typically includes key sections that help both the service provider and the customer easily understand the breakdown of costs. By using this tool, businesses can ensure that they keep track of payments efficiently while maintaining professionalism in all their transactions.

Main Features of a Billing Document

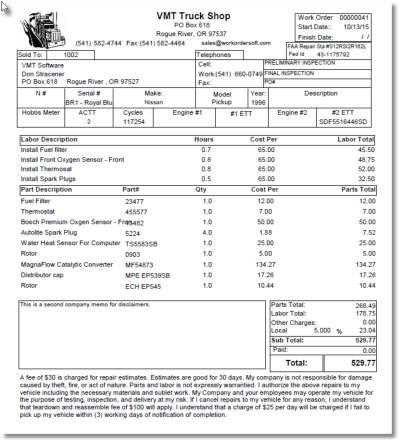

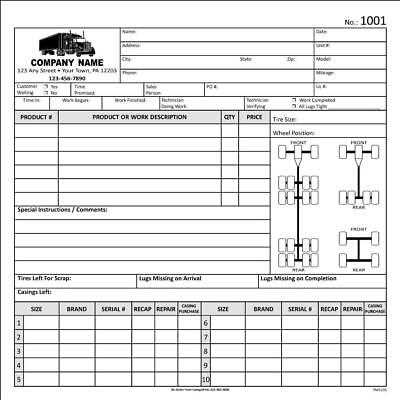

- Service details: A clear description of the work performed, including labor, parts, and any special tasks.

- Cost breakdown: Accurate itemization of charges for each service provided, including hourly rates and part prices.

- Payment terms: Clear information on payment due dates, accepted methods, and any late fees.

- Customer information: Space for client details, ensuring easy identification and communication.

- Business branding: Customizable fields for company logos and contact information to reinforce professional identity.

Why It’s Essential for Your Business

Using a well-organized billing document simplifies the administrative side of your business, allowing you to focus on the core tasks at hand. It also improves customer satisfaction by providing transparent, easy-to-understand records of the services provided. Moreover, this approach enhances the professionalism of your operations, helping you build trust with clients while ensuring that all financial transactions are clearly documented.

Why Use a Vehicle Service Billing Document

Having a structured billing form for any vehicle maintenance service is essential for businesses to maintain order and professionalism. It helps keep track of services provided, payments due, and ensures that customers are clearly informed about the work completed. A well-organized billing record not only simplifies financial transactions but also supports better business practices and communication between the service provider and the client.

There are several reasons why using a detailed and clear billing form is important for your business:

| Reason | Description |

|---|---|

| Clarity and Transparency | It provides customers with a clear breakdown of the services and costs involved, reducing misunderstandings. |

| Professionalism | A formal document adds a professional touch to your business, which can help build trust with clients. |

| Efficient Record Keeping | It helps you keep detailed records of all completed work, making it easier to track payments and resolve any disputes. |

| Legal Protection | A written document serves as legal proof of the transaction in case of disputes or claims. |

| Time-Saving | Having a pre-made form speeds up the billing process, saving time for both you and your customers. |

By implementing such a system, service providers can create a more organized, efficient, and customer-friendly environment, improving both operational workflow and client satisfaction.

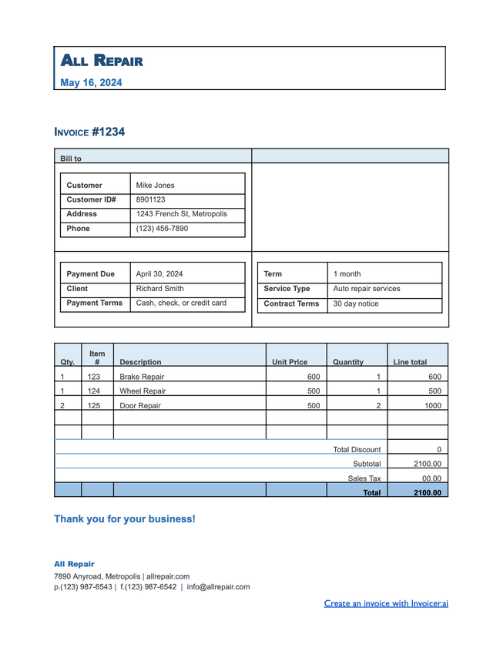

Key Elements of a Billing Document

To ensure clarity and professionalism, it’s essential that any document used for billing services includes all the necessary details. A well-structured document includes specific sections that help both the service provider and the client understand the scope of work and financial obligations. These elements not only streamline the process but also ensure transparency in the transaction.

Below are the key components that should be included in every billing document:

| Element | Description |

|---|---|

| Service Description | Clearly outlines the work performed, including specific tasks, labor hours, and materials used. |

| Itemized Costs | Lists all charges individually, such as labor rates, parts, and any additional fees, allowing for a detailed breakdown. |

| Business Information | Includes the service provider’s contact details, logo, and business name, establishing credibility and professionalism. |

| Client Information | Contains the customer’s name, address, and contact information, ensuring clear identification of the parties involved. |

| Payment Terms | Specifies the due date, accepted payment methods, and any late fees or discounts for early payment. |

| Invoice Number | A unique reference number assigned to each document for easy tracking and record-keeping. |

| Subtotal and Total | Shows the total amount due before and after taxes, including any applicable discounts or surcharges. |

| Tax Information | Details applicable taxes, including tax rates and amounts, to ensure compliance with local regulations. |

By incorporating these elements, businesses can provide clients with a clear, professional, and comprehensive financial record that promotes smooth transactions and supports good customer relationships.

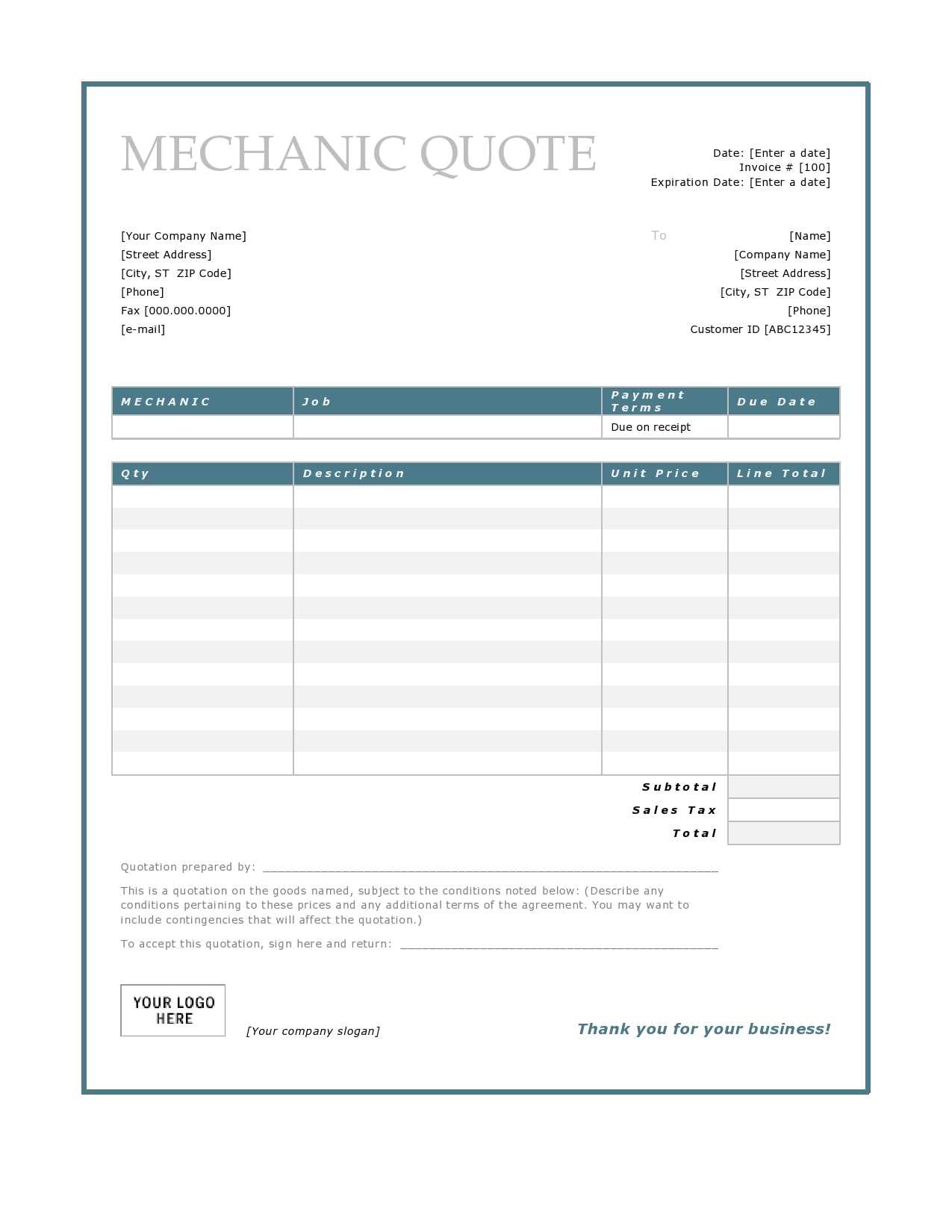

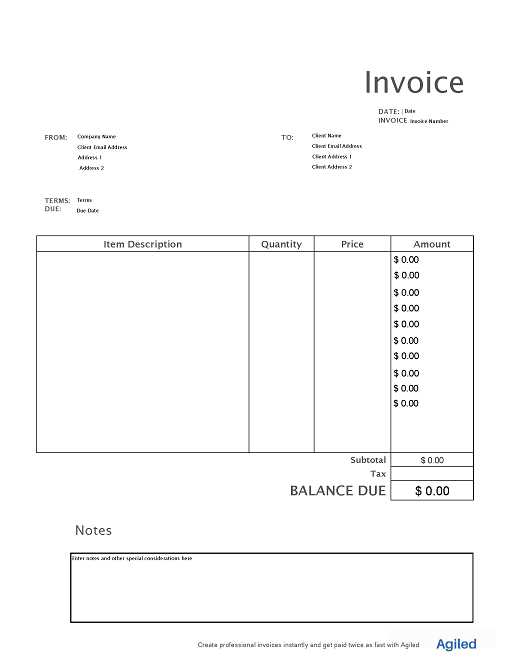

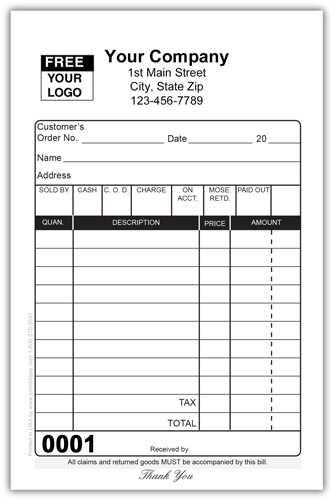

How to Create a Custom Billing Document

Creating a customized billing record allows you to tailor the document to your specific business needs. This flexibility enables you to adjust the structure, include relevant details, and ensure that the format aligns with your workflow. By following a few simple steps, you can create a professional and clear statement that both you and your clients will find easy to understand and use.

Steps to Design Your Document

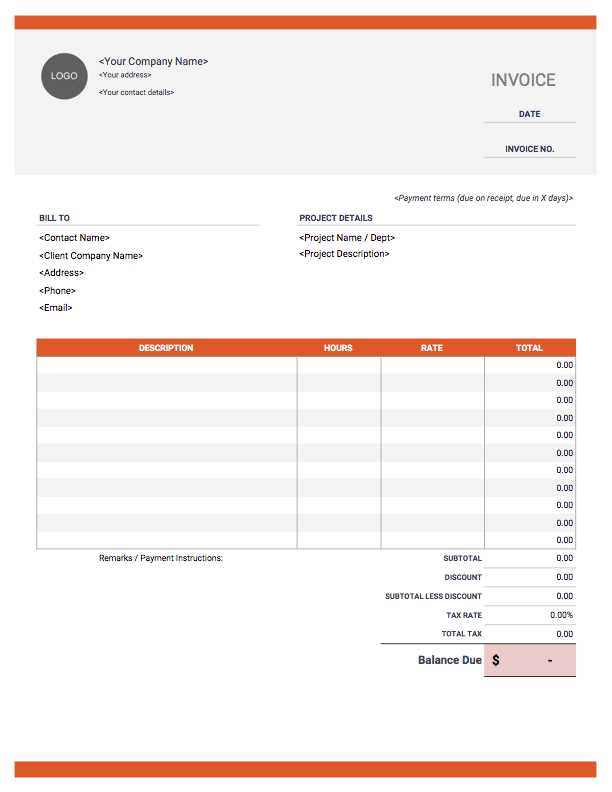

- Choose a Layout: Decide on a clean and simple layout that highlights important information such as services, costs, and contact details.

- Add Your Business Information: Include your company name, logo, address, phone number, and email at the top to ensure your business is easily identifiable.

- Include Client Information: Make space for the customer’s name, address, and contact details to personalize the document and maintain clear communication.

- Detail the Work Performed: Write a clear description of the tasks completed, including hours worked, parts used, and any special conditions that apply.

- List Costs: Break down the pricing for labor, materials, and any other charges so that clients can easily see the individual components of the total cost.

- Set Payment Terms: Specify payment methods, due dates, and any discounts or late fees to avoid confusion regarding financial expectations.

Additional Tips for Customization

- Include a Unique Reference Number: Assigning a unique code to each document helps with organization and future reference.

- Make It Professional: Keep the design simple but professional. A well-organized document reflects the quality of your services and strengthens your business’s image.

- Ensure Legal Compliance: Be sure to include any necessary tax details and adhere to local legal requirements for financial documentation.

By following these steps, you can create a customized document that not only makes the billing process easier but also improves client satisfaction and helps maintain accurate financial records.

Free vs Paid Billing Forms

When deciding on a document format for your business, you’ll likely face the choice between free and paid options. Both types of forms can serve your needs, but the features, customization options, and long-term benefits differ significantly. Understanding the differences between free and premium formats will help you make an informed decision based on your business requirements, budget, and desired level of professionalism.

Advantages of Free Billing Forms

Free documents are a great starting point for small businesses or those just getting started. They often come with basic features that can meet the needs of many service providers. Here are some of the benefits:

- Cost-Effective: As the name suggests, these options are free, making them ideal for businesses with limited budgets.

- Simple to Use: Free forms are generally easy to access and use with little setup required, ideal for quick and basic billing.

- Basic Features: Many free forms come with the essential sections like service descriptions, client info, and payment details, sufficient for straightforward transactions.

Advantages of Paid Billing Forms

On the other hand, premium billing documents often offer additional features and customization options that can enhance your business’s efficiency and professionalism. Consider the following benefits:

- Enhanced Customization: Paid options often allow for more flexible designs, enabling you to add unique fields, logos, and branding elements.

- Advanced Features: You can access additional tools such as automated calculations, tax adjustments, and integration with accounting software.

- Professional Appearance: Premium options tend to offer more polished, visually appealing designs, which can reflect positively on your brand.

- Customer Support: Paid formats often come with customer service, so you have assistance available when needed.

While free forms are a good starting point, investing in a premium option can offer long-term benefits, especially as your business grows and your needs become more complex. Ultimately, the choice between free and paid documents depends on your specific business goals and available resources.

Benefits of Using Templates for Billing

Using pre-designed documents for financial transactions offers a variety of advantages for service-based businesses. These ready-made solutions streamline the billing process, improve accuracy, and save valuable time. Whether you’re managing a small enterprise or a larger operation, incorporating a standardized format can lead to more efficient and professional financial management.

Consistency and Professionalism – By using a pre-designed form, you ensure that every transaction is handled in a consistent manner. This not only improves organization but also enhances your business’s professional image. Clients will appreciate receiving clear, structured documents that reflect your attention to detail.

Time Savings – Manually creating a new document for each transaction can be time-consuming. With a reusable format, you eliminate the need to start from scratch each time, allowing you to focus on providing services and managing other aspects of your business. Templates can be easily customized, making the process even faster.

Accuracy and Clarity – Using a consistent document format reduces the chances of errors in calculations, service descriptions, and client information. With set fields and sections, you minimize the risk of omitting important details or making mistakes that could lead to confusion or disputes.

Easy Customization – While templates offer structure, they also allow flexibility. You can easily adjust sections based on your specific needs, adding or removing information as required. This adaptability ensures that the form can accommodate different services, rates, or special conditions.

Legal Protection – A well-organized document can serve as proof of the transaction in case of any future disputes or legal issues. By keeping a consistent record of services and costs, you have a solid foundation should you need to resolve conflicts or clarify terms.

By implementing a pre-designed form for financial documentation, businesses can enjoy better organization, improved efficiency, and a more professional approach to managing client relationships.

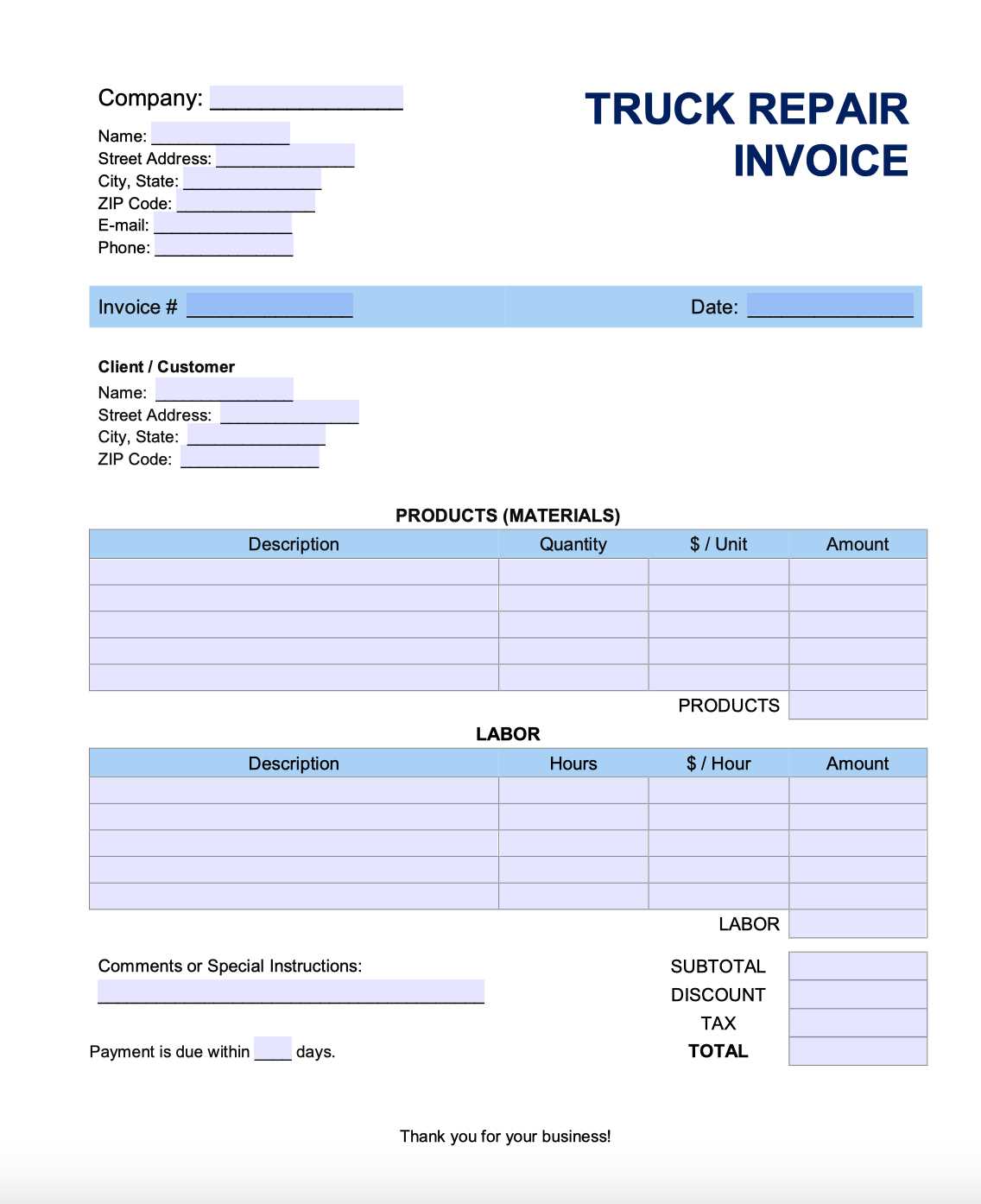

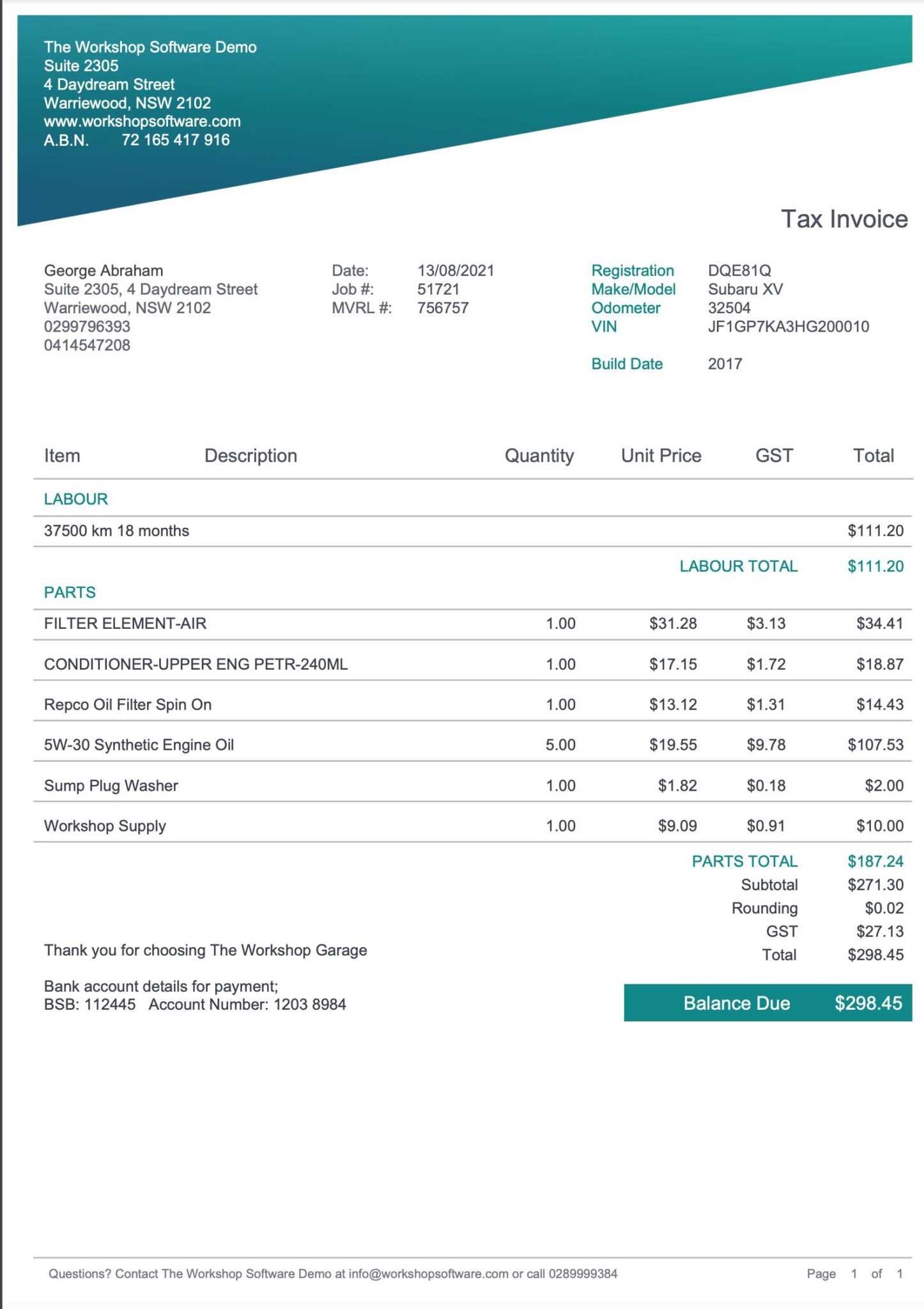

How to Add Labor and Parts Costs

Including labor and material costs in a billing document is essential to ensure transparency and accurate financial reporting. It is important to clearly outline the charges for both the work performed and the materials used. This not only helps clients understand the breakdown of costs but also ensures that you are compensated fairly for the services provided.

To add labor costs, start by specifying the hourly rate or flat fee for the work performed. Be sure to note the number of hours spent on the task or any specific jobs that were completed at a fixed price. For example, if you charge by the hour, you can multiply the number of hours worked by the rate to calculate the total labor cost. If a flat fee is applied, simply list the agreed-upon amount for the service.

For material costs, list each item or part used during the service. Include the name of the part, quantity, and unit price. If applicable, you can also add a brief description of the part to clarify its use. Once all the materials have been listed, multiply the quantity by the unit price to calculate the total cost for each part. Then, add up the total cost of materials and include it in the final billing amount.

Here’s a simple example of how to structure labor and material costs:

- Labor: 5 hours @ $50/hour = $250

- Parts:

- Brake Pads (2) @ $30 each = $60

- Oil Filter (1) @ $15 = $15

Adding these details to the billing document will ensure that your clients can easily see how the charges were calculated and will help prevent misunderstandings or disputes over pricing.

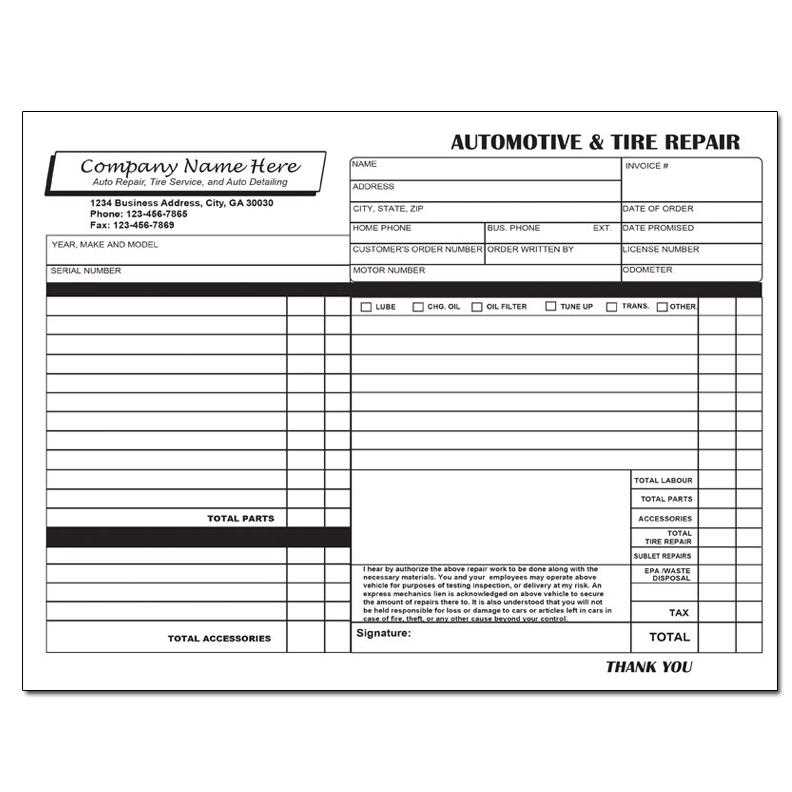

Best Practices for Billing Document Design

Designing a billing document that is both professional and easy to read is essential for maintaining good client relationships and ensuring smooth financial transactions. A well-organized document not only reflects the quality of your services but also improves clarity and reduces the risk of misunderstandings. Below are some best practices for creating a clean, efficient, and effective billing form.

1. Keep the Layout Simple and Clean

- Use clear headings: Organize the document into distinct sections such as services provided, costs, and payment details.

- Limit clutter: Avoid overwhelming the client with unnecessary information or excessive design elements. Focus on the essential details.

- Use white space: Adequate spacing between sections improves readability and makes the document feel less crowded.

2. Ensure Consistency in Font and Colors

- Choose legible fonts: Use easy-to-read fonts such as Arial or Times New Roman for the body text. Avoid overly decorative fonts.

- Limit font types: Stick to one or two fonts throughout the document to maintain consistency.

- Use colors wisely: Opt for neutral colors for the background and text to keep the document professional. Reserve bright colors for accents like headings or totals.

3. Prioritize Important Information

- Highlight totals: Make sure the total amount due is clearly visible by using bold text or a larger font size.

- Client and business details: Ensure that the customer’s information, as well as your own business details, are easily accessible at the top of the document.

- Payment terms: Include payment instructions and due dates in a prominent position to avoid confusion.

4. Make It Easy to Understand

- Use itemized lists: Break down services, parts, and charges in an organized manner. This ensures transparency and helps clients understand exactly what they are paying for.

- Avoid jargon: Keep the language simple and straightforward. Use plain terms rather than industry-specific jargon that the client may not understand.

- Provide clear payment instructions: List accepted payment methods, including any specific instructions for online payments or bank transfers.

5. Include Your Branding

- Logo and contact details: Include your business logo and ensure your contact information (phone number, email, website) is easily visible.

- Consistent branding: Ensure the overall design of the document reflects your brand’s identity, from the color scheme to the font choices.

By following these best practices, you can create a billing document that not only looks professional but is also user-friendly. A well-designed form improves communication with clients and helps ensure that financial transactions are handled smoothly and efficiently.

Including Tax and Discount Information

Accurate inclusion of taxes and discounts in any billing document is crucial for transparency and legal compliance. By clearly displaying tax rates and discount offers, you ensure that clients understand the full breakdown of the charges and feel confident in the transaction. Properly handling these elements can also help avoid disputes and keep financial records clear for both the business and the client.

How to Calculate and Display Taxes

To include tax information correctly, start by specifying the applicable tax rate for the service or products provided. This can vary depending on your location, industry, or the type of service rendered. Once the rate is determined, calculate the tax amount by multiplying the total cost of the services or goods by the tax rate.

- Example: If the total service cost is $200 and the tax rate is 10%, the tax amount will be $20.

- Clearly label the tax: Make sure to label the tax amount in the document with a clear description, such as “Sales Tax” or “Value Added Tax (VAT)”.

- Show the total amount: After adding the tax, display the new total at the bottom of the document to give the client a clear understanding of the final amount due.

How to Apply Discounts

Discounts can be applied to the total amount or to specific items, depending on the agreement with the client. Clearly showing any discounts applied helps build trust and ensures that the client is fully aware of the savings they are receiving. Discounts can be based on various factors such as promotional offers, early payment, or volume purchases.

- Example: A 10% discount on a $200 service would result in a $20 reduction in the total cost.

- List the discount separately: Make sure the discount is clearly labeled in the document and that the amount deducted is easy to spot.

- Final total after discount: After applying the discount, show the final amount due, ensuring that clients can easily calculate the total cost after the discount is applied.

By including these elements properly, businesses can ensure they are transparent with their clients about the cost breakdown, fostering trust and improving customer satisfaction.

Tracking Payments with Your Billing Document

Keeping track of payments is essential for managing cash flow and ensuring that you are paid on time. Including a payment tracking section in your billing document can help both you and your clients stay organized, reducing confusion and preventing missed payments. A well-structured record not only serves as a reminder for the client but also acts as an official document for your financial records.

To track payments effectively, it is important to include a section that allows you to record the payment status, date, and method of payment. This will help you monitor outstanding balances and determine if there are any discrepancies that need to be addressed.

| Payment Date | Amount Paid | Payment Method | Remaining Balance |

|---|---|---|---|

| MM/DD/YYYY | $100 | Credit Card | $150 |

| MM/DD/YYYY | $150 | Bank Transfer | $0 |

By including such a table, you can easily update the payment status as you receive payments, keeping both you and your clients informed about the outstanding balance. This transparency will help foster trust and ensure that the financial process remains smooth.

Billing Software for Vehicle Maintenance Services

Using specialized billing software can significantly streamline the process of managing payments and creating financial documents for your services. These tools are designed to simplify the creation, tracking, and organization of financial records, reducing the administrative burden and improving accuracy. For businesses offering vehicle maintenance, software tailored to your industry can help you maintain efficient workflows and ensure that all financial transactions are clearly documented.

Here are some key features to look for in billing software:

- Customization: Choose software that allows you to customize billing forms, so you can include specific services, labor, materials, and payment terms that apply to your business.

- Automation: Look for tools that can automatically calculate totals, taxes, and discounts, saving you time and reducing errors in your financial documents.

- Integration: Opt for software that integrates with your accounting or payment systems, enabling seamless syncing of payment data and ensuring that all records are up-to-date.

- Payment Tracking: The ability to track payment statuses in real-time can help you stay on top of outstanding balances and improve your cash flow management.

- Reporting Features: Choose software that provides detailed reports on your financial performance, helping you monitor trends and make data-driven decisions for your business.

Investing in billing software not only makes creating and tracking documents more efficient but also enhances the professionalism of your business. Clients appreciate timely, accurate, and clear financial records, and the right software can help you deliver just that.

Common Mistakes in Vehicle Service Billing Documents

Creating accurate and professional billing documents is crucial for maintaining good client relationships and ensuring timely payments. However, mistakes can easily occur, leading to confusion, delays, or even disputes. Understanding common errors can help you avoid them and ensure your financial records are clear, precise, and error-free.

1. Missing or Inaccurate Contact Information

One of the most frequent mistakes is neglecting to include or incorrectly listing contact details. It’s essential to provide accurate information for both the service provider and the client. Missing or incorrect phone numbers, email addresses, or business addresses can lead to communication issues and delay payments.

2. Not Detailing Services and Costs Clearly

Another common issue is failing to provide enough detail about the services rendered and associated costs. Generic or vague descriptions of work can lead to confusion and disputes later on. To avoid this, always itemize services, specifying the type of work performed, parts used, and labor hours charged. This transparency helps clients understand exactly what they are being billed for and ensures that there is no ambiguity about charges.

3. Failing to Include Payment Terms

Omitting or being unclear about payment terms is another common mistake. It’s important to specify the due date, payment methods accepted, and any late fees or penalties for overdue payments. Not including these terms can lead to misunderstandings or delays in receiving payment.

4. Incorrect Tax Calculations

Tax calculations are often overlooked or miscalculated, especially when different services or products are taxed at different rates. Always ensure that the correct tax rate is applied to each item and that the total tax amount is clearly visible. Double-checking these calculations can prevent potential issues and ensure compliance with tax laws.

5. Not Tracking Payments

Failing to keep track of payments can lead to confusion, especially when multiple payments are made for a single bill. It’s important to include a section that tracks payment amounts, dates, and any outstanding balances. This helps both parties stay organized and reduces the chance of missed or forgotten payments.

By avoiding these common mistakes, you can ensure that your billing documents are accurate, professional, and transparent. This not only improves cash flow but also enhances trust with clients, leading to better long-term relationships and smoother business operations.

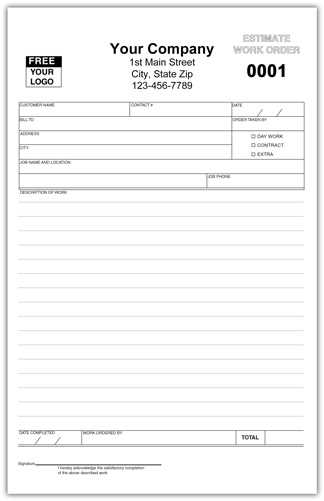

How to Format Your Billing Document Correctly

Proper formatting of a billing document ensures clarity, professionalism, and ease of understanding for both you and your client. A well-organized record allows your customer to quickly identify key information such as services provided, costs, payment terms, and deadlines. Formatting a financial document correctly is essential for maintaining smooth transactions and avoiding misunderstandings.

1. Start with Contact Information

At the top of your document, include your business name, logo, and contact information, followed by your client’s details. This section should be clearly visible and should include:

- Your business name, address, phone number, and email.

- Your client’s name and address.

- Any reference numbers, such as a job ID or client number.

2. Add a Clear Document Title

Make sure your billing document has a clear, prominent title such as “Billing Statement” or “Service Charge Summary.” This immediately informs the reader of the document’s purpose.

3. Organize the Breakdown of Services

Provide a detailed list of services, products, or labor charges, with each item clearly described. It’s essential to:

- Break down each task and material used.

- Show the quantity, unit price, and total for each item or service provided.

- Ensure each item is clearly distinguishable, making it easy for your client to understand the cost breakdown.

4. Include Payment Terms and Conditions

Clearly outline the payment terms and expectations. Include:

- The total amount due.

- Due date for payment.

- Accepted payment methods (e.g., credit card, bank transfer).

- Late fees or interest for overdue payments, if applicable.

5. Highlight the Total Amount Due

Ensure that the total amount due is clearly stated at the bottom of the document, in bold or a larger font. This helps the client easily identify the final balance and reduces the chance of confusion.

6. Include a Payment Tracking Section

If there are multiple payments or partial payments, include a section that tracks the amounts received and the outstanding balance. This is particularly useful for long-term projects or larger service agreements.

By following these formatting tips, you can ensure your billing documents are clear, professional, and easy to follow. A well-structured document not only improves your chances of getting paid on time but also enhances your business’s reputation for organization and p

Legal Requirements for Service Billing Documents

When providing services and creating corresponding financial documents, it’s essential to comply with legal standards to ensure transparency, accountability, and proper documentation. These legal requirements can vary by jurisdiction but generally include specific details that must be included in any billing record. Understanding and adhering to these regulations helps avoid disputes, ensures compliance with tax laws, and builds trust with clients.

Here are some common legal requirements that should be considered when creating service billing documents:

- Business Identification: The billing document must include the service provider’s full legal business name, address, and contact details. This ensures that clients know who they are doing business with and how to reach you if necessary.

- Client Information: It is important to list the client’s name or company, as well as their contact details. This ensures that the document is properly attributed to the correct party.

- Unique Identification Number: Each billing document should have a unique reference number. This helps you keep track of the records and provides an easy way to refer to the specific transaction if any issues arise.

- Detailed Service Description: A clear and comprehensive description of the services rendered is legally required in many places. This includes itemizing tasks, labor, and parts used, along with individual prices for each item or service provided.

- Tax Information: For many businesses, including the correct tax rate (such as VAT or sales tax) is mandatory. The tax rate should be clearly indicated alongside the cost of each item or service, with a total tax amount shown on the document.

- Total Amount Due: The total amount due must be clearly stated, including any applicable taxes, discounts, or additional charges. This makes the financial expectations clear to the client.

- Payment Terms: Including payment terms is often a legal requirement. This includes the payment due date, any late fees or interest on overdue amounts, and accepted payment methods (credit card, bank transfer, etc.).

- Compliance with Local Laws: Certain jurisdictions may have specific laws regarding what needs to be included in billing documents, such as licensing numbers, industry-specific disclaimers, or consumer protection information. It is important to research and comply with these laws to avoid potential legal issues.

By ensuring your service billing documents meet these legal requirements, you can avoid costly mistakes and build a foundation of trust with your clients. Proper documentation not only helps protect your business but also ensures that you remain compliant with the law, reducing the risk of fines or legal disputes.

How to Bill for Emergency Services

Emergency services often require prompt action, and the billing process needs to reflect the urgency and additional costs associated with such situations. When handling urgent requests, it’s essential to communicate clearly about the extra charges for quick response times, after-hours work, or specialized materials. A well-structured financial document ensures transparency for the client while protecting your business’s interests.

1. Clearly State the Emergency Nature of the Service

Make sure the document highlights that the service provided was an emergency. This helps the client understand the need for urgency and justifies any additional charges associated with the situation. You can include phrases such as “emergency service charge” or “after-hours service” to emphasize the nature of the work.

2. Detail the Services and Costs

As with any service, you should provide a clear breakdown of the tasks performed. For emergency situations, it’s especially important to be detailed and transparent about the labor involved, any expedited parts or equipment needed, and any additional costs due to the emergency. These costs may include:

- After-hours surcharges: Extra fees for working outside of normal business hours.

- Expedited shipping or special parts: Costs for rush delivery or uncommon materials that may have been required.

- Labor rates: Often, emergency services come with a higher labor rate due to the urgent nature of the work.

3. Include the Date and Time of Service

It’s important to clearly list the exact date and time when the emergency service was performed. This can help justify the timing of any additional charges and provide clarity in case the client questions the fees or needs to verify the work. Documenting the service period is essential, especially when dealing with higher labor rates for evenings or weekends.

4. Outline Payment Terms and Deadlines

Clearly indicate when payment is due for emergency services. Given the immediate nature of such requests, it’s often helpful to include a shorter payment window. If you offer discounts for quick payments or late payment penalties, ensure these terms are clearly outlined to prevent any confusion later on.

5. Communicate Extra Charges Upfront

Before starting the emergency work, make sure your client is aware of any additional charges that may apply. Providing an estimate or quote in advance can prevent misunderstandings and ensure that the client agrees to the higher costs associated with emergency services. Once the work is done, ensure that the final document reflects all agreed-upon charges, with no hidden costs.

By following these steps, you can ensure that your bil

Ensuring Accuracy in Billing

Accurate billing is essential for maintaining trust and transparency with clients. Even small errors in financial records can lead to misunderstandings, delayed payments, and damaged professional relationships. By implementing a few key practices, you can reduce mistakes and ensure your billing process is precise and reliable.

1. Double-Check Service Descriptions and Rates

One of the most common billing errors is incorrect or vague descriptions of the services provided. To avoid this, ensure that each task, product, or service is clearly listed with accurate details. Include:

- Specific descriptions of the work completed.

- Correct unit prices for materials and labor.

- Accurate quantities for parts used or hours worked.

Tip: Cross-reference your financial records with the actual work completed to confirm that the correct rates and items are listed.

2. Verify Calculations and Totals

Manual errors in totaling costs can lead to discrepancies in the final amount due. It’s crucial to carefully check the math for each item, including tax and any additional fees. Ensure that:

- Individual costs are added up correctly.

- Taxes or discounts are applied accurately.

- The final amount matches the sum of the individual items and fees.

Tip: Consider using digital tools that automatically calculate totals and taxes to eliminate the possibility of human error.

By following these simple steps, you can minimize the risk of billing errors and improve the efficiency of your financial processes. Accuracy in billing not only helps with cash flow but also fosters stronger relationships with clients, who will appreciate the professionalism and transparency of your business.

Using Billing Documents for Better Client Communication

Effective communication with clients is key to building long-lasting business relationships. A well-organized financial document not only helps in ensuring that payments are processed smoothly but also serves as a tool for clarifying any uncertainties or concerns your client may have. When used correctly, these documents can foster transparency, prevent misunderstandings, and even enhance customer satisfaction.

1. Provide Clear and Detailed Information

One of the main purposes of a billing document is to provide a clear breakdown of services or products provided, along with their associated costs. A detailed statement allows clients to understand exactly what they are being charged for. Ensure the document includes:

- Descriptions of the services performed or products delivered.

- Unit costs, quantities, and the final cost for each service or item.

- Any additional fees such as taxes, delivery charges, or emergency surcharges.

This level of detail reduces the likelihood of confusion or disputes about the charges and sets clear expectations for the client.

2. Use Billing Documents as a Follow-Up Tool

After the completion of a job or delivery, sending a detailed billing document not only serves as a reminder for payment but also acts as a follow-up to ensure client satisfaction. You can use the document as an opportunity to:

- Thank the client for their business.

- Ask for feedback on the services provided, which shows you care about their experience.

- Provide additional details about future services or maintenance options, if applicable.

Including a note or call to action can keep the lines of communication open, encouraging a positive ongoing relationship.

3. Clarify Payment Terms and Deadlines

Clear communication of payment terms is essential to avoid misunderstandings. Make sure that payment deadlines, methods, and any applicable late fees are prominently displayed on your billing documents. This gives your client a clear understanding of the following:

- The expected payment date.

- Accepted methods of payment (e.g., credit card, bank transfer, online payment platforms).

- Any consequences of late payments (e.g., interest charges or suspension of services).

By clearly stating these terms, you eliminate any confusion and provide a transparent, professional approach to managing payments.

4. Provide Contact Information for Queries

Sometimes, clients may have questions or concerns regarding the charges. Including your contact information or a dedicated support line on your billing documents makes it easy for them to reach out for clarification. This small step can:

- Show that you are available for assistance.

- Help resolve potential disputes before they escalate.

- Enhance the overall client experience by demonstrating proactive communication.

When clients feel that they can easily contact you for any issues, they are more likely to trust your business and maintain a positive relationship.

By using financial documents as a communication tool, you enhance transparency, build trust, and improve the

When to Update Your Billing Document Format

Keeping your financial records up to date is crucial for maintaining an efficient, professional, and legally compliant business. There are various instances where updating your billing documents is necessary. Regularly reviewing and revising the format can help ensure it remains aligned with changing regulations, evolving business needs, and improvements in your workflow.

Here are a few key moments when you should consider updating your billing document format:

1. Changes in Business Information

As your business grows, certain details such as contact information, business address, or company name might change. Whenever this occurs, it’s important to update your billing documents to reflect the new information. This ensures that clients have accurate details for communication, and it helps maintain the professional appearance of your business.

| Old Information | Updated Information |

|---|---|

| Business Address: 123 Old St. | Business Address: 456 New Ave. |

| Phone: (555) 123-4567 | Phone: (555) 765-4321 |

Regularly check your documents to make sure all company information is current and accurate.

2. Tax or Legal Regulation Changes

Legal requirements and tax laws can change frequently, and these changes often impact how billing documents should be formatted. For example, a new tax rate might be introduced, or new fields may be required to meet regulatory standards. Staying updated with local tax laws ensures that your billing documents remain compliant and that you’re correctly charging clients.

Incorporating changes such as:

- Adjusting for new tax rates or VAT changes.

- Including legally required disclaimers or consumer protection statements.

- Adding necessary fields to comply with industry-specific regulations.

3. Introducing New Services or Products

If you add new services or products to your offerings, you may need to adjust your billing document format to reflect these changes. For example, adding new categories or line items will help clearly communicate to clients what they are being charged for. This may also involve revising pricing structures, discounts, or packages.

Updating your billing document ensures that the new offerings are well represented and accurately priced, avoiding confusion or errors in client transactions.

4. Improving Business Operations

As your business becomes more streamlined, you may find better ways to present your billing documents. This could include:

- Adopting clearer descriptions for services.

- Changing the layout to improve readability.

- Using digital tools to automate calculations, reducing manual errors.

By upgrading your document format, you ensure that your business