Free Truck Rental Invoice Template for Easy and Accurate Billing

Managing payments for vehicle leasing or transportation services can be complex, especially when it comes to keeping track of financial records and ensuring accuracy. Having a structured and consistent approach to invoicing is crucial for any business in this industry. A well-organized document not only helps ensure clarity for both parties but also improves cash flow and reduces errors.

By utilizing a professional billing document, businesses can easily outline key details such as service periods, pricing, and payment terms. This simplifies the transaction process, making it easier for customers to understand their charges and for companies to receive payments promptly. With the right solution, you can enhance both your operational efficiency and customer satisfaction.

In this guide, we will explore various ways to create an effective billing system for your leasing services, focusing on the elements that make a document both functional and professional. Whether you’re looking to create one from scratch or use a pre-designed option, it’s important to understand the key components that will keep your financial transactions smooth and error-free.

Why Use a Billing Document for Vehicle Leasing

In the leasing industry, maintaining clear and accurate financial records is essential. A standardized method for documenting charges can help prevent confusion and ensure all necessary information is communicated effectively. By using a structured approach, businesses can easily track services provided, costs incurred, and payment deadlines.

One of the main reasons to adopt a structured billing document is its ability to save time. Instead of creating a new record from scratch for each transaction, a pre-designed solution allows you to quickly input the details and generate a consistent, professional document. This efficiency reduces administrative workload and speeds up the entire process, making it easier to focus on growing your business.

Another significant advantage is the level of professionalism it conveys. A well-formatted document helps establish trust with your clients, as it shows attention to detail and a commitment to transparency. Additionally, having all essential details clearly outlined–such as service duration, charges, and payment terms–minimizes the chance of disputes and misunderstandings.

Benefits of Customizable Billing Documents

Using flexible and adjustable billing formats can greatly improve the efficiency of your business operations. Customizable records allow you to tailor each document to the unique needs of your clients and services, ensuring that you provide the most accurate and relevant information. These documents can be adapted to reflect different pricing models, terms, and service details, making them a valuable tool for businesses of any size.

Enhanced Accuracy and Efficiency

Customizable documents help reduce errors and inconsistencies by allowing you to save preferred settings and regularly used data. This means you won’t have to repeatedly enter the same information for each transaction. By streamlining this process, you minimize human error and can focus on providing better services to your clients.

Professional Appearance and Branding

One of the significant benefits of using adaptable billing formats is the ability to customize the design to match your business’s branding. Whether it’s including your company logo, using specific color schemes, or tailoring the layout, a personalized appearance makes your documents more professional and helps strengthen your brand identity.

| Customization Feature | Benefit |

|---|---|

| Editable Fields | Allows for easy inclusion of specific details for each transaction |

| Flexible Layout | Ensures that the format suits your business style and client needs |

| Branding Options | Enhances professional image and consistency with your business identity |

| Quick Data Entry | Reduces time spent creating documents, increasing efficiency |

By utilizing customizable documents, businesses can better manage their transactions, ensure consistency, and present a more polished and professional image to their customers. The flexibility they offer makes them a key component of any successful administrative process.

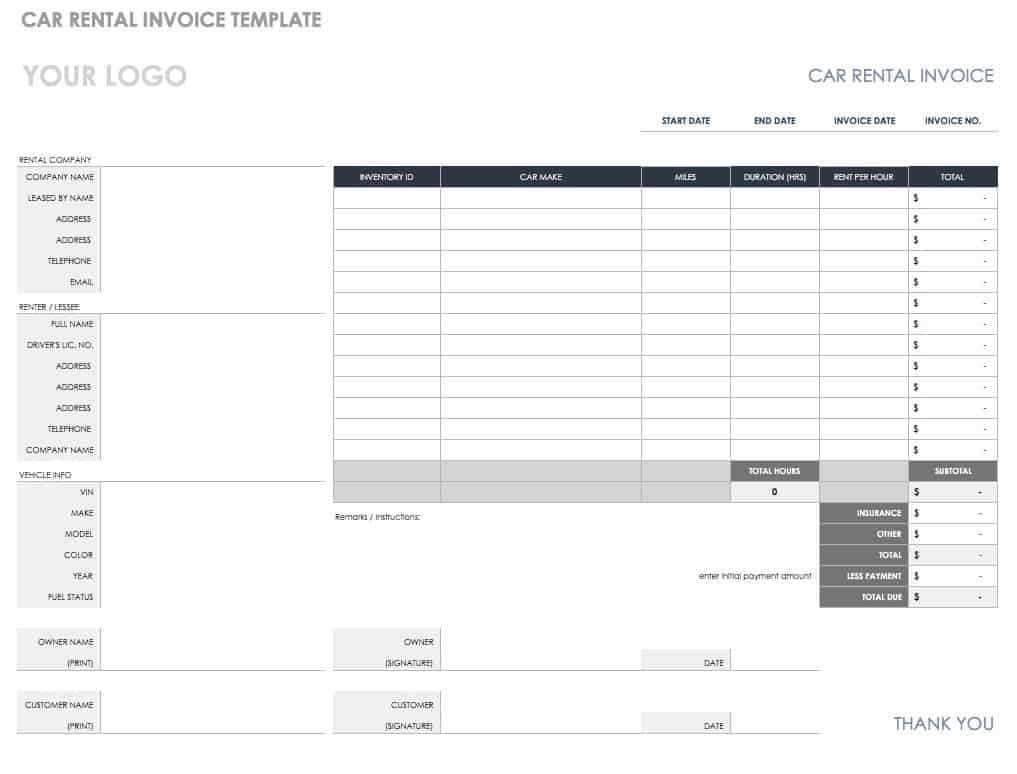

How to Create a Billing Document for Vehicle Leasing

Creating a professional billing document for your leasing services involves organizing key details clearly and concisely. This not only ensures that your customers understand their charges but also helps you maintain a smooth financial record. The process can be broken down into simple steps, each designed to capture all necessary information while making the document easy to understand.

Step 1: Gather Necessary Information

Before you begin drafting your document, collect all relevant details about the transaction. This will help you create a complete and accurate record for both your business and the client. Essential information includes:

- Client details: Name, address, and contact information.

- Service information: Dates of service, vehicle specifications, and usage hours.

- Pricing details: Charges for services, including daily or hourly rates, additional fees, and taxes.

- Payment terms: Due dates, accepted payment methods, and any penalties for late payments.

Step 2: Organize and Format the Document

Once you have the necessary information, it’s time to structure the document. A well-organized layout makes it easy to read and ensures that both parties have clear expectations. Here’s what to include:

- Header: Company name, logo, and contact information at the top of the document.

- Client and service det

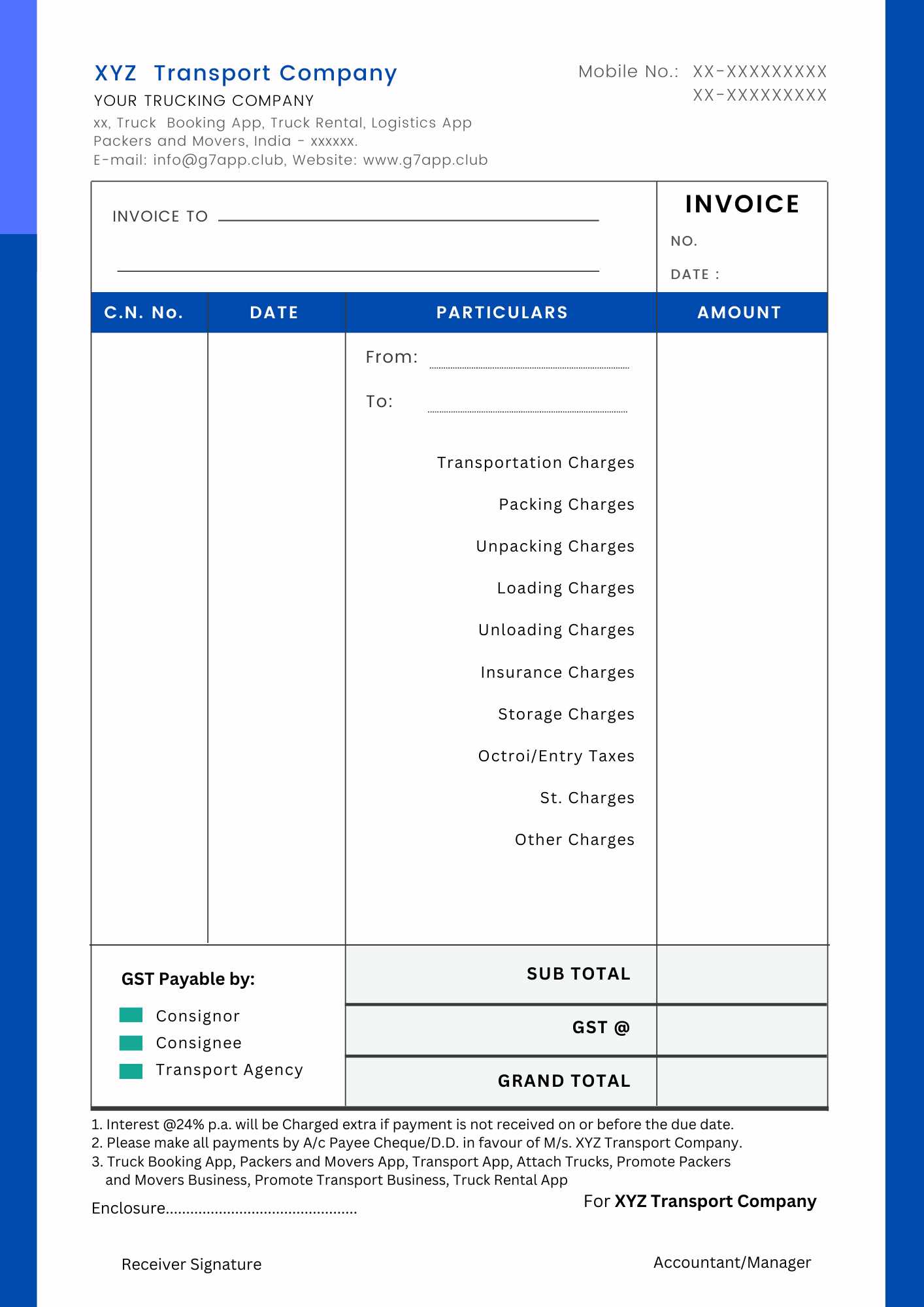

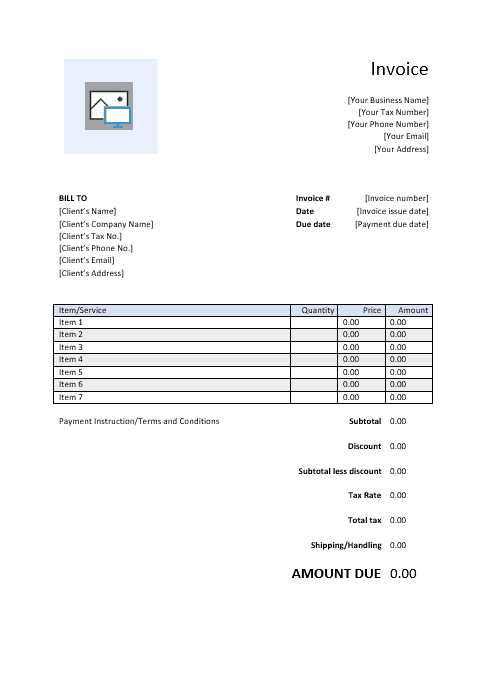

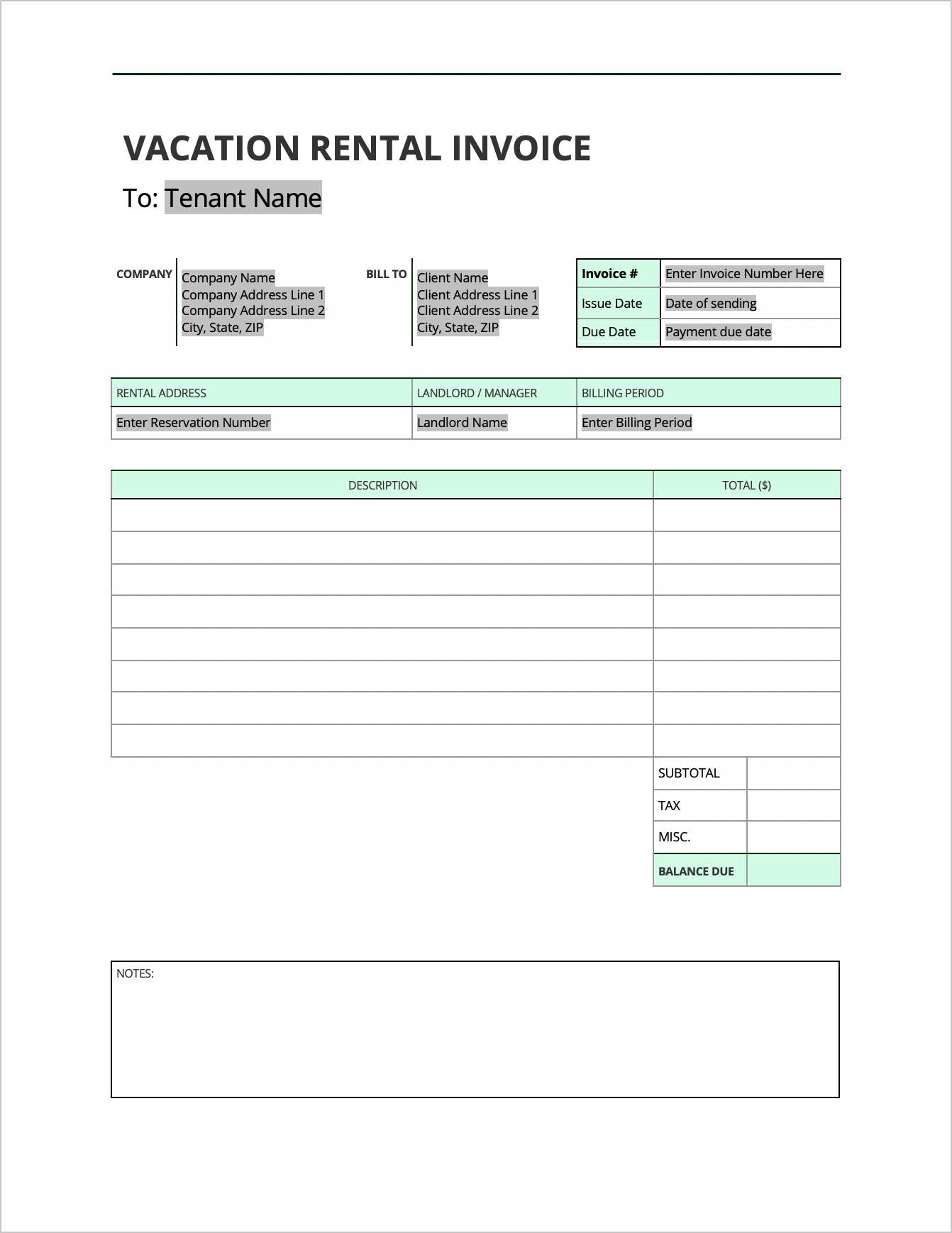

Essential Elements of a Billing Document for Vehicle Leasing

Creating a clear and accurate billing document is essential for smooth transactions between service providers and clients. To ensure transparency and avoid disputes, every document should include specific details that outline the nature of the services provided, the charges involved, and the payment terms. Below are the key elements that every professional document should contain.

1. Contact Information

Begin by including the contact information for both parties. This provides clarity and ensures that both you and the client know how to reach each other if any questions arise.

- Your business name and logo

- Your business address and phone number

- Client’s name and contact information

- Invoice date and reference number

2. Service Details

Clearly outline the services provided, including dates, duration, and any specific conditions of use. An itemized list helps to avoid misunderstandings.

- Service period: Start and end dates of the lease or use

- Type of vehicle: Description of the vehicle or equipment used

- Hourly/daily rate: The rate charged for the service

- Additional charges: Any extra fees, such as insurance or mileage

3. Payment Details

Provide a clear breakdown of the total amount due, including taxes, discounts, and any othe

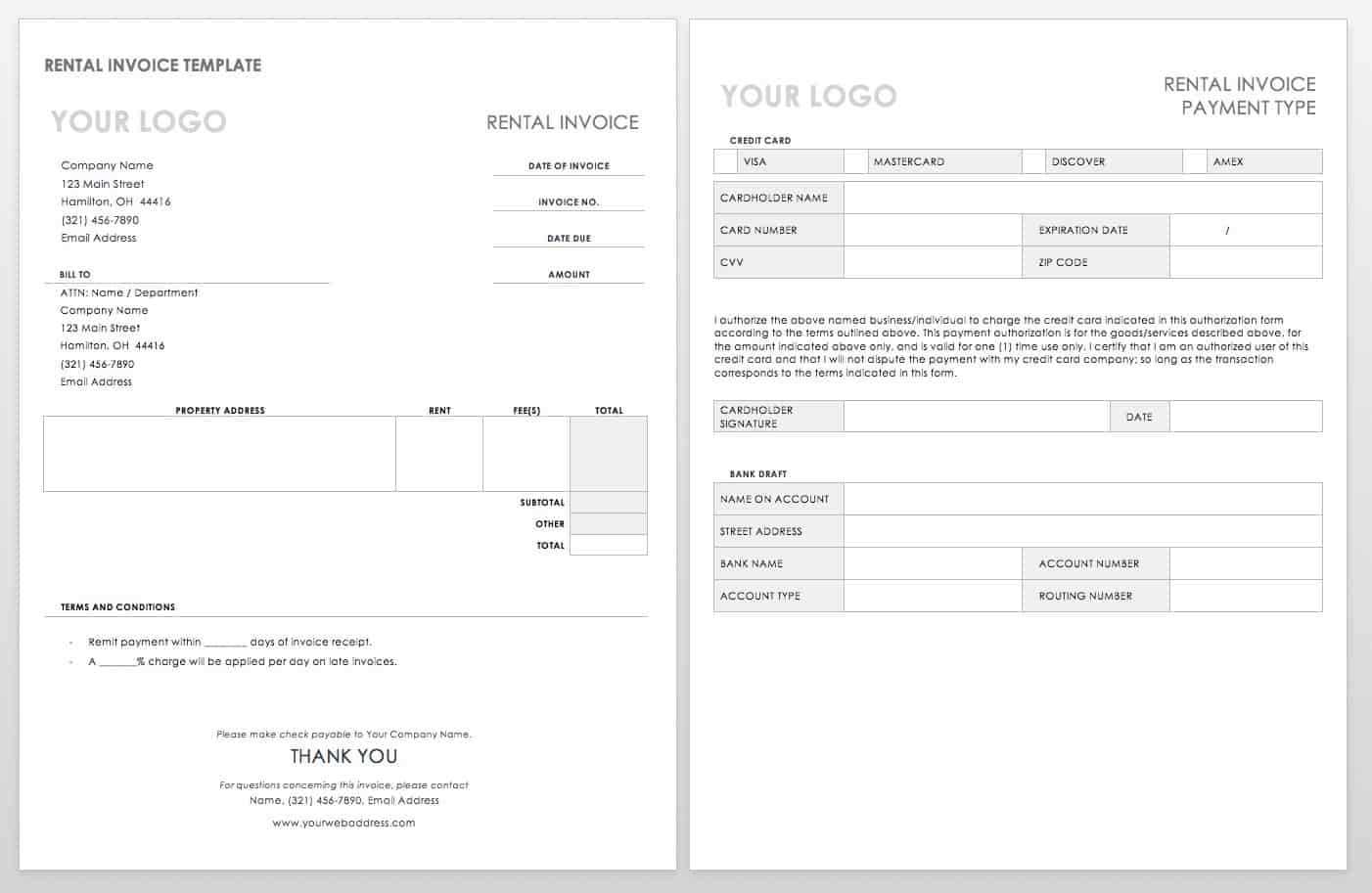

Choosing the Right Format for Your Invoice

When managing financial transactions for your services, selecting the appropriate structure for your documentation plays a crucial role in ensuring clarity and efficiency. A well-designed layout not only aids in tracking payments but also enhances professionalism and client trust. The format you choose should meet legal requirements, be easy to understand, and reflect the nature of the transaction clearly.

Factors to Consider

There are several elements to consider when deciding on the layout. For example, the level of detail required may vary depending on the type of service or agreement. Certain industries may demand more specific information such as itemized charges or terms of use. Additionally, the ease of navigation should be prioritized, so clients can quickly locate the necessary data such as pricing, service dates, or payment instructions.

Customization and Flexibility

Having the flexibility to adapt the design is another important factor. Whether you need to adjust for different clients or offer various options for payment, a customizable approach allows for smoother interactions. Using professional software or digital tools can help automate the process, saving both time and effort.

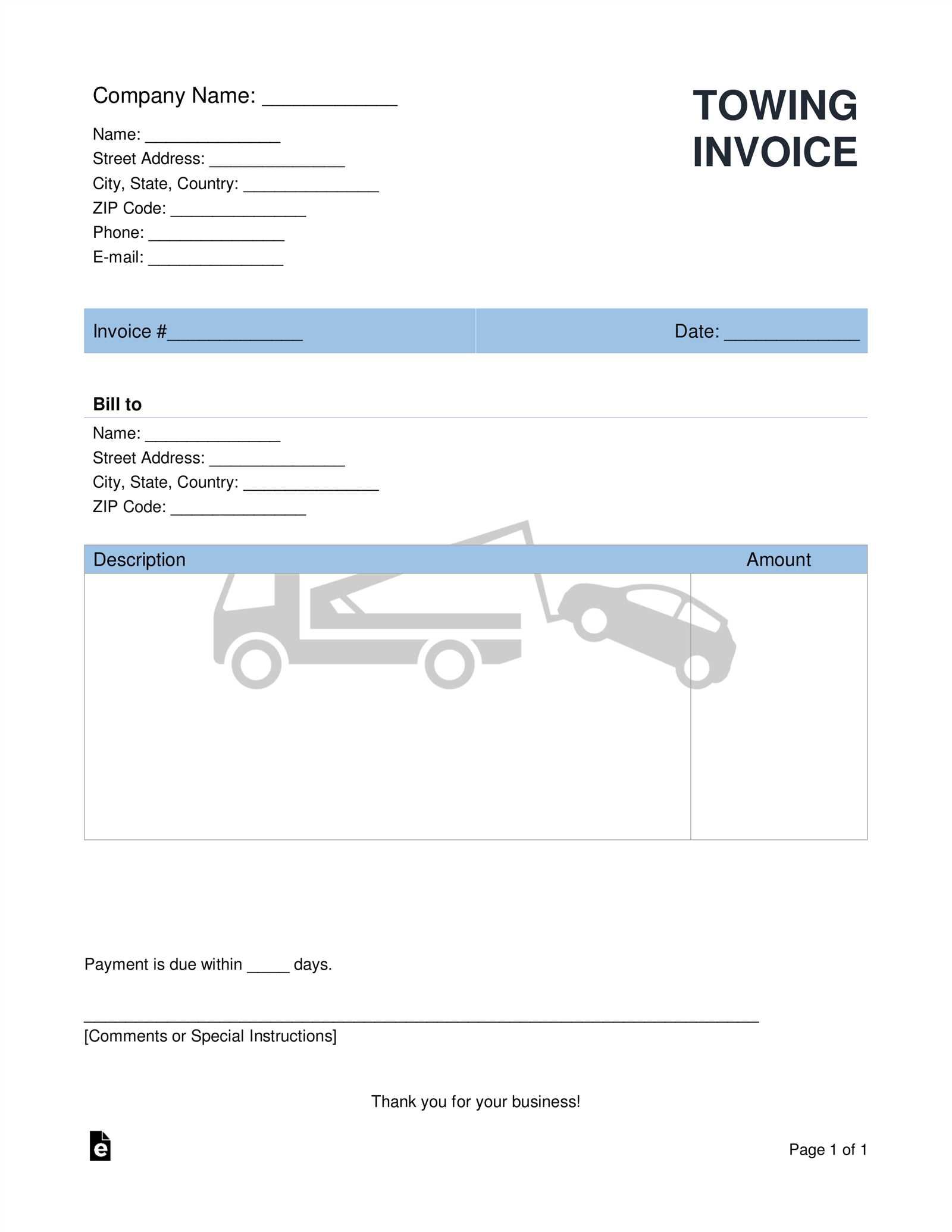

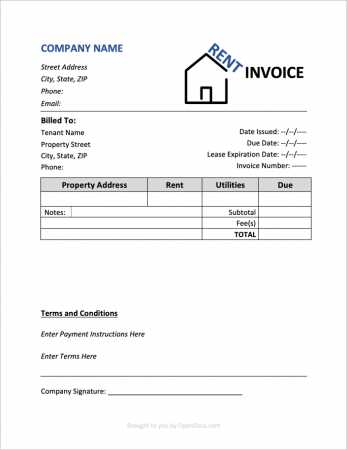

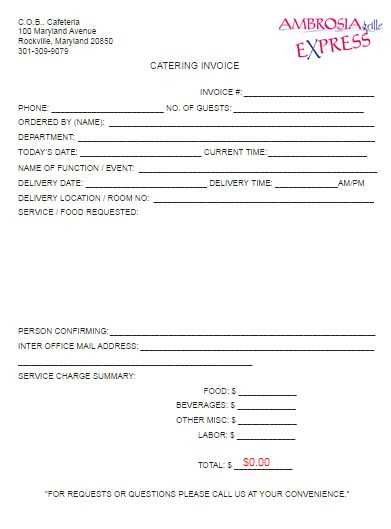

Free Vehicle Leasing Billing Formats Online

For businesses offering transportation services, utilizing ready-made documents for financial transactions can save significant time and effort. Free resources available online provide customizable options that allow you to quickly create and issue professional-looking receipts for any agreement. These formats help ensure that all essential information is included without the need to design from scratch.

Advantages of Using Free Resources

One of the main benefits of using online resources is accessibility. Many platforms offer easy-to-use designs that require no advanced technical skills, allowing anyone to generate documents in minutes. Moreover, these tools often come with pre-set fields for key details, ensuring consistency and reducing the chances of human error.

Customization and Flexibility

While these formats are free, they also offer a degree of flexibility. You can adjust the layout, add specific terms, or personalize the document according to your business needs. Whether you’re managing long-term agreements or short-term rentals, these options can be tailored to suit any type of transaction.

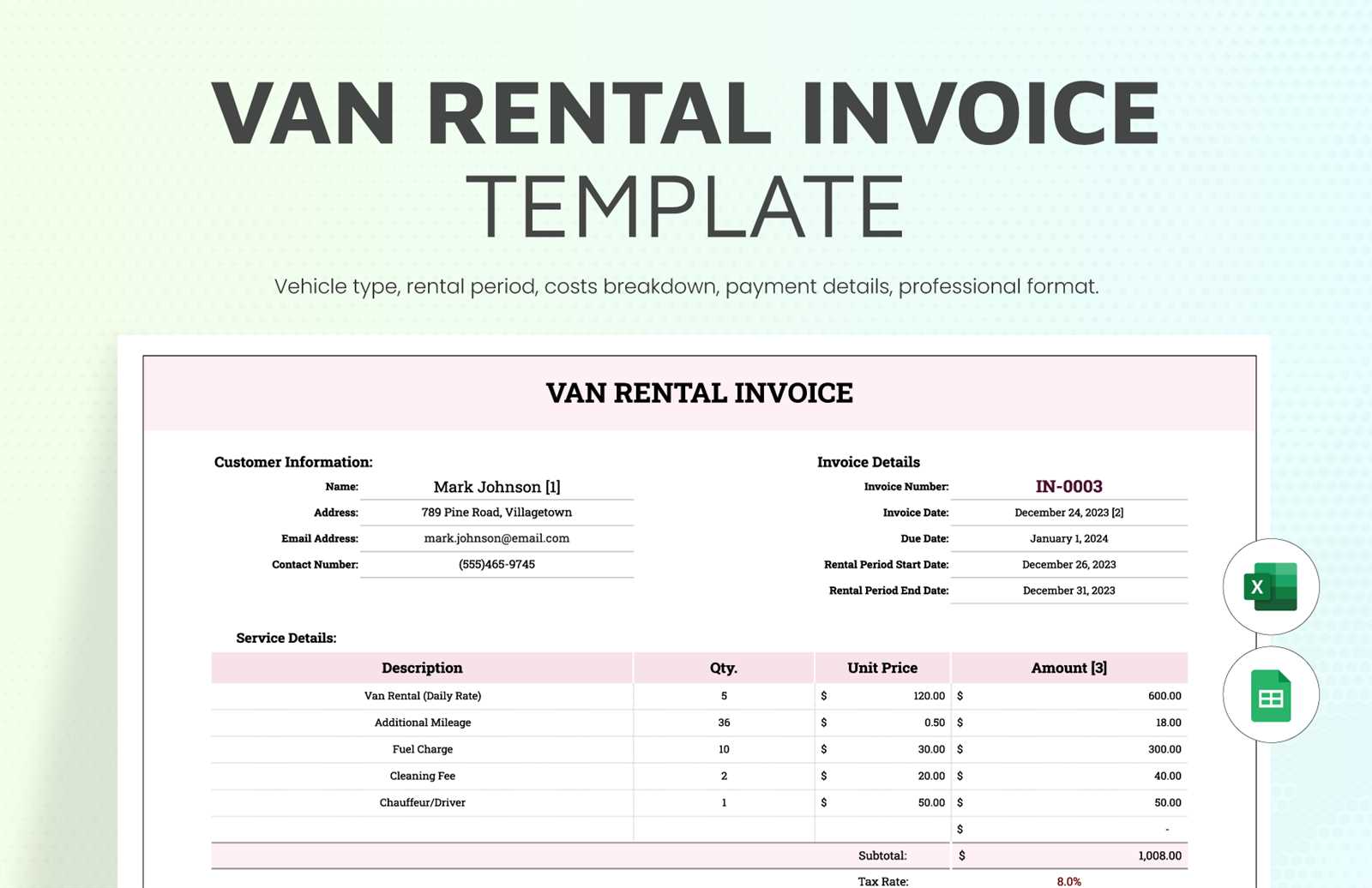

How to Include Rental Period and Rates

Clearly outlining the duration of the service and the corresponding fees is essential for transparent financial documentation. This information ensures that both parties are on the same page regarding timeframes and costs, reducing the likelihood of confusion or disputes. Including this data correctly is a vital step in formalizing any transaction related to temporary vehicle use.

Steps to Include the Duration

When specifying the period of use, it’s important to be precise and detailed. Consider the following points:

- Start and End Dates: Clearly state when the service begins and when it concludes. This helps both you and the client keep track of the agreement’s timeframe.

- Time of Use: If the service involves hourly or daily use, be specific about the time frame. For example, if the vehicle is available from 9 AM to 5 PM, indicate this.

- Extensions or Early Returns: If applicable, outline the conditions under which the period may be extended or shortened, and any related costs.

How to Present the Charges

After setting the period, it’s crucial to break down the costs clearly. Here’s how to list the rates:

- Daily or Hourly Rates: If the pricing is based on a daily or hourly rate, specify the exact amount for each period of time.

- Additional Fees: If there are extra charges, such as for insurance or mileage, include them as separate line items.

- Total Cost: Always provide a clear total amount at the end, including any taxes or extra services, so there’s no ambiguity about what the client owes.

Adding Taxes and Extra Charges to Invoices

In any transaction, it’s essential to account for additional fees, such as taxes or extra services. These charges ensure that the final amount reflects the full scope of the agreement. Properly including these costs in your documents not only helps maintain financial accuracy but also fosters transparency and trust with clients.

Understanding Extra Costs

Extra charges can include a variety of factors, depending on the nature of the agreement. Some common examples include:

- Insurance Fees: If coverage is provided, this should be clearly itemized.

- Late Fees: If the agreed period is exceeded, outline the additional cost for each day or hour.

- Additional Services: Fees for any extra features or services, such as delivery or pick-up, should also be mentioned.

Calculating Taxes

Taxes can vary depending on the location and the nature of the service provided. It is important to accurately calculate these amounts based on applicable rates in your jurisdiction. Below is an example of how you might present these charges in your document:

Description Amount Base Service Charge $200.00 Including Payment Terms and Due Dates

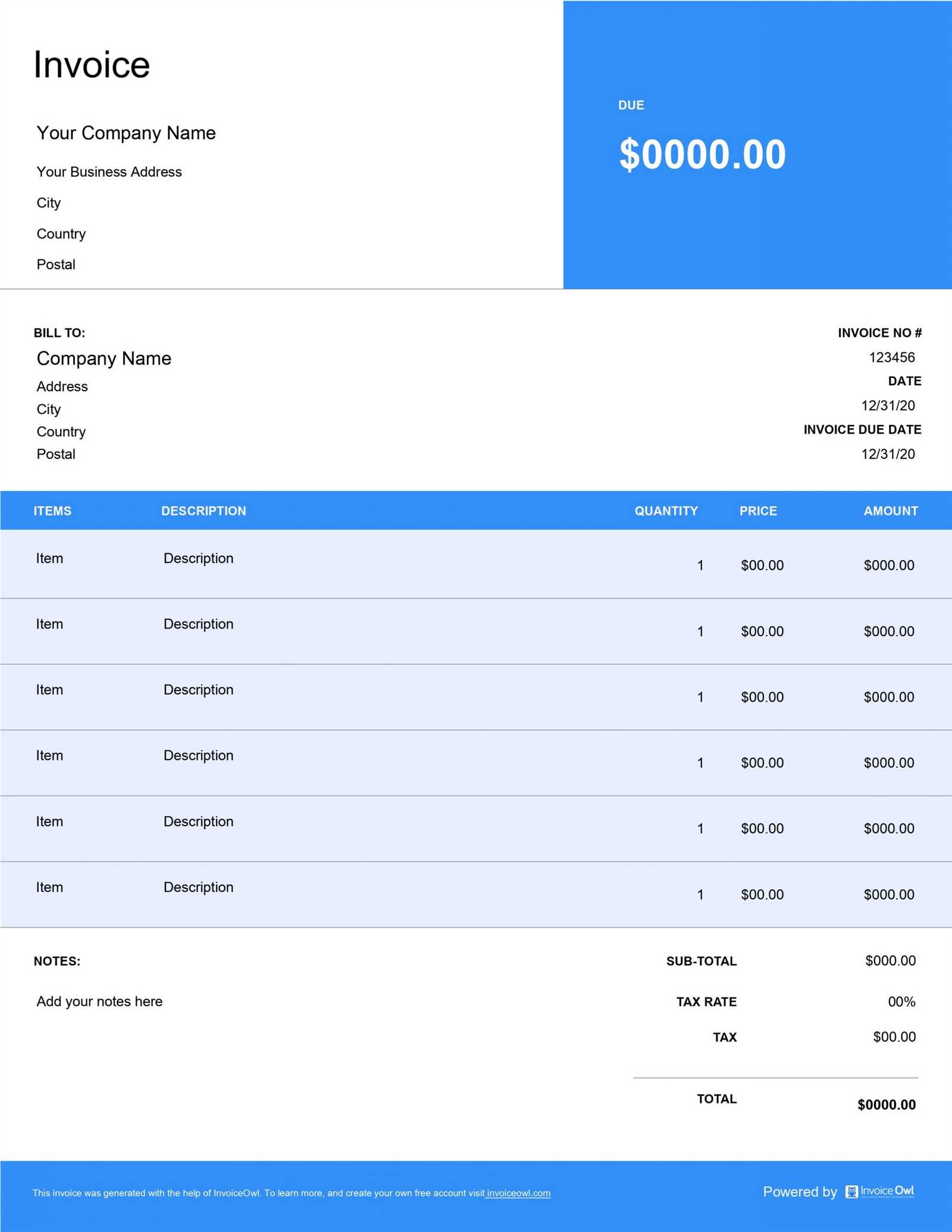

Clearly stating the payment conditions and deadlines is crucial for ensuring smooth transactions and timely payments. Properly outlining these details helps set expectations and avoids confusion or delays. By specifying when payments are due and under what terms, both parties can manage their financial obligations more efficiently.

Key Elements of Payment Terms

Payment terms define the conditions under which the payment is to be made. These can vary depending on the nature of the agreement and the preferences of both parties. Some important factors to include are:

- Payment Method: Specify which methods are accepted (e.g., credit card, bank transfer, cash).

- Installment Options: If the payment is to be made in multiple parts, outline the amounts and due dates for each installment.

- Late Payment Penalties: Include information about any fees or interest charges that apply if payment is not received on time.

Setting Due Dates

Establishing clear due dates is essential for managing cash flow. Here are some considerations when specifying when payments should be made:

- Immediate Payment: If payment is expected right after the service is provided, clearly state that the total is due upon receipt.

- Net Terms: Commonly, businesses use terms such as “Net 30” or “Net 60,” meaning the payment is due within 30 or 60 days from the service date.

- Specific Date: Alternatively, specify an exact due date (e.g., “Payment is due by December 15th”).

By clearly defining payment terms and due dates, you ensure both clarity and accountability, which helps prevent misunderstandings and promotes smoother business operations.

How to Track Payments with Invoices

Keeping accurate records of payments is essential for managing finances and maintaining healthy cash flow. By utilizing structured documents, you can easily track which amounts have been paid and which are still outstanding. Proper tracking ensures that you stay on top of your financial obligations and can quickly identify any overdue amounts.

Key Information to Include for Payment Tracking

To effectively track payments, certain details must be included in your documents. These elements allow you to monitor the status of each transaction accurately:

- Unique Reference Number: Assign a unique identifier to each document to easily match payments with the corresponding transaction.

- Amount Due: Clearly display the total amount owed to ensure there is no ambiguity regarding the payment amount.

- Amount Paid: Record the payments received so far, noting the amount and the date of payment.

- Outstanding Balance: Indicate the remaining amount, if any, that is still due.

- Payment Method: Document the method used for each payment (e.g., bank transfer, credit card, check) for reference.

Using a Payment Tracking System

In addition to including the necessary details in your documents, implementing a payment tracking system can further streamline the process. Here are a few strategies to help manage payments effectively:

- Automated Software: Utilize accounting or invoicing software that automatically updates payment status when a transaction is completed. This reduces manual errors and provides real-time tracking.

- Manual Record Keeping: For those who prefer paper or spreadsheet-based tracking, create a log that matches the unique reference numbers with payment records to stay organized.

- Payment Remind

Common Mistakes in Vehicle Leasing Billing Documents

Errors in financial documentation can lead to confusion, delayed payments, or even disputes with clients. It’s crucial to avoid common mistakes that can undermine the clarity and professionalism of the billing process. These issues often stem from simple oversights or misunderstandings, yet they can have significant consequences if not addressed properly.

1. Inaccurate or Missing Information

One of the most frequent mistakes is failing to provide complete or correct details in the document. This can include:

- Incorrect Service Dates: Ensure that the start and end dates of the agreement are accurate to avoid misunderstandings about the duration of the service.

- Wrong Charges: Double-check the pricing details, including hourly or daily rates, to confirm they match the agreed-upon terms.

- Missing Contact Details: Always include accurate contact information for both the service provider and the client to ensure easy communication.

2. Failure to Include Additional Costs

Omitting extra charges is another common error that can cause confusion. Always list any additional fees clearly, such as:

- Insurance Fees: If applicable, these should be explicitly stated, so the client is aware of the extra costs involved.

- Late Fees: If penalties apply for overdue payments, mention the amount and the circumstances under which they will be charged.

- Other Services: Fees for optional services, like delivery or pick-up, should be clearly outlined to avoid unexpected costs for the client.

3.

How to Handle Late Payments Effectively

Dealing with delayed payments is a common challenge for businesses, but it’s essential to handle the situation professionally to maintain a healthy cash flow. A proactive and clear approach can help resolve issues promptly and preserve positive relationships with clients. Setting clear expectations from the outset and following up appropriately can significantly reduce the risk of late payments.

1. Establish Clear Payment Terms

From the beginning of your agreement, clearly define payment expectations to avoid confusion. Key elements to include are:

- Due Dates: Specify the exact date when the full payment is expected.

- Accepted Payment Methods: List the available ways clients can make payments (e.g., bank transfer, credit card, online payments).

- Late Payment Penalties: Mention any fees or interest charges that will apply if the payment is delayed, and clarify how they will be calculated.

2. Send Timely Reminders

Once the payment due date has passed, send a gentle reminder. It’s important to maintain professionalism and politeness while requesting payment. Consider the following steps:

- First Reminder: A simple reminder a few days after the due date, often a polite email or message, can prompt the client to act quickly.

- Second Reminder: If payment remains unpaid, send a more formal reminder, possibly including details of the overdue balance and any late fees.

- Final Notice: As a last step, you may send a more urgent reminder, clearly outlining consequences if payment is not received within a specific timeframe.

3. Offer Payment Plans or Extensions

If a client is unable to pay the full amount at once, consider offering a structured payment plan. This can be a helpful option to maintain a good relationship while ens

Document Compatibility with Accounting Software

Integrating billing documents with accounting software can greatly streamline financial management and improve accuracy. Compatibility between your documents and the software you use ensures that all transaction details are accurately captured and processed, minimizing the risk of errors. This integration can automate many aspects of the accounting workflow, from tracking payments to generating reports.

Why Compatibility Matters

When your billing documents are compatible with your accounting software, it simplifies the entire process of managing finances. Key benefits include:

- Efficiency: Automatically transferring data from the document into the software eliminates the need for manual entry, saving time and reducing errors.

- Accuracy: By linking directly to your accounting system, the risk of incorrect entries or omissions is minimized.

- Real-time Updates: Payments, taxes, and other charges are reflected in your accounts as soon as they are recorded, providing an up-to-date view of your finances.

What to Look for in Compatible Documents

Not all documents are automatically compatible with all accounting systems. When selecting or designing documents for your business, consider these factors to ensure smooth integration:

- Standard Formats: Choose formats that are widely accepted by accounting software, such as CSV, Excel, or PDF with embedded data fields, for easy import.

- Clear Data Organization: Ensure the document is organized with clearly defined fields for client details, payment amounts, dates, and serv

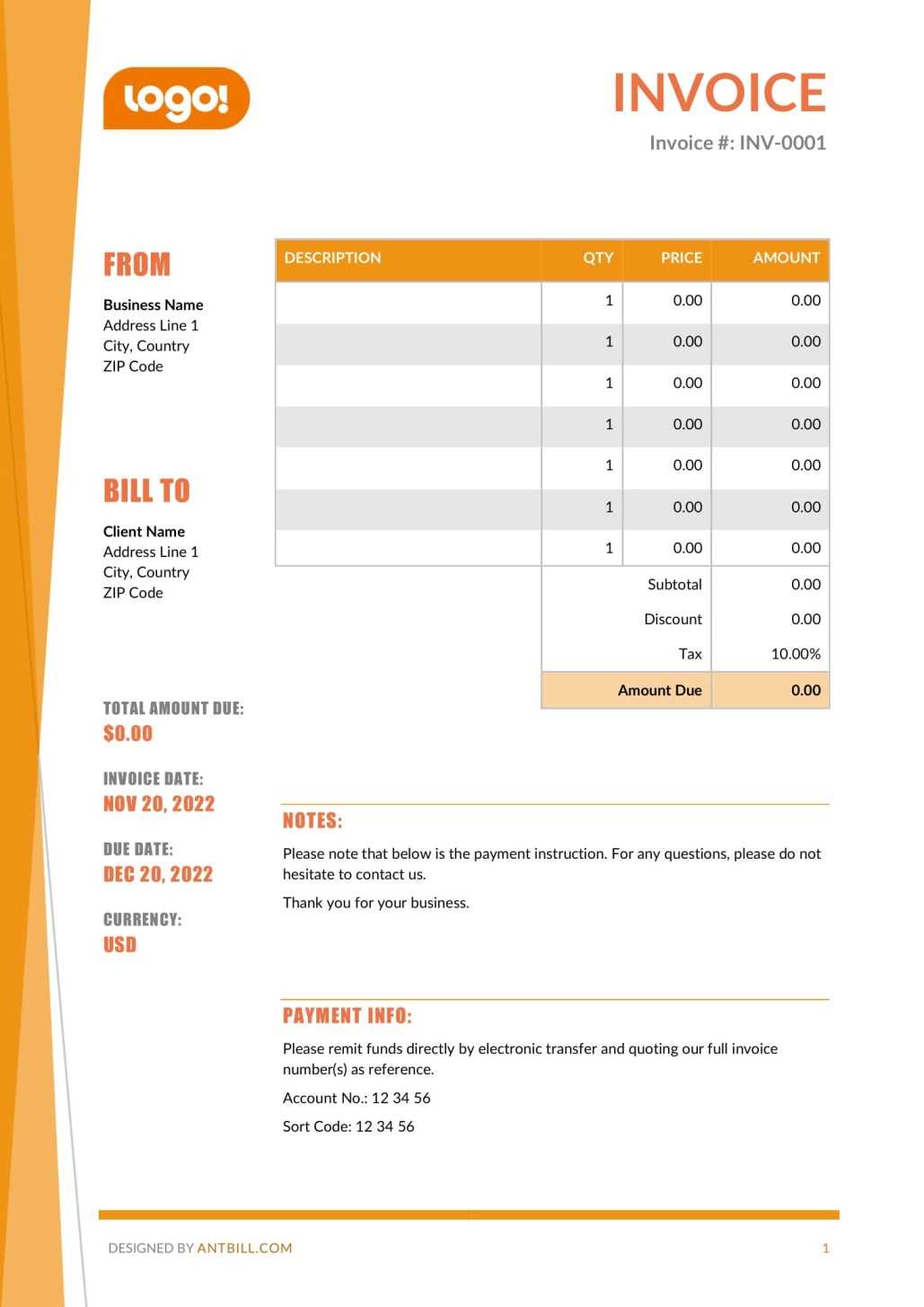

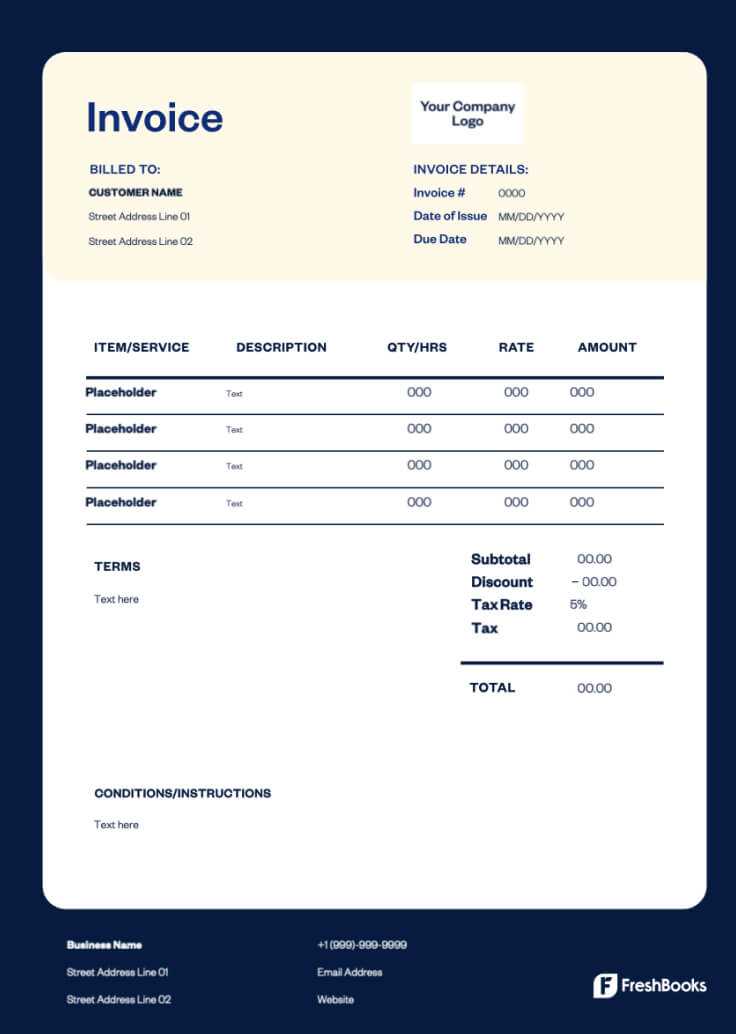

How to Design a Professional Invoice Layout

Creating a polished and clear document for billing purposes is crucial for maintaining professionalism in business transactions. A well-structured layout ensures that all necessary details are easy to read, and that clients can easily understand the charges and terms. The key is to maintain simplicity while including all essential information in an organized manner.

Key Elements to Include

- Contact Information: Ensure that both the issuer and recipient’s details are clearly listed at the top of the document.

- Services or Products Provided: List the services or items, including descriptions and quantities.

- Terms and Payment Details: Include payment methods, due date, and any applicable terms or conditions.

- Invoice Number: Always assign a unique identifier to help with future references and record-keeping.

- Taxes and Discounts: Clearly state any applicable taxes, discounts, or additional charges.

Design Considerations

- Alignment: Ensure that all text is aligned properly, with headings standing out, and details organized in a clean, readable format.

- Typography: Use professional fonts, with sufficient contrast between text and background, to enhance legibility.

- Spacing: Use enough spacing between sections to prevent the document from feeling cluttered.

- Color Scheme: Stick to a simple and professional color palette to avoid distracting from the key information.

Best Practices for Sending Rental Invoices

Efficiently delivering billing statements is an important aspect of business operations. Proper timing, method of delivery, and clarity all play a role in ensuring smooth transactions and prompt payments. Adhering to best practices not only improves professionalism but also strengthens client relationships.

Timely Delivery

- Send Early: Distribute the document as soon as the service is completed or the product is delivered. This helps clients keep track of payment schedules.

- Allow Adequate Time for Payment: Provide a reasonable timeframe for payment, ensuring clients are not rushed while maintaining efficient cash flow.

- Set Clear Deadlines: Always specify the due date clearly to avoid confusion or delayed payments.

Choosing the Right Method

- Digital Delivery: Emailing documents is the most efficient method, as it’s fast and allows for easy tracking.

- Paper Documents: For clients who prefer physical copies, ensure they are mailed promptly and securely.

- Automated Systems: Consider using online platforms that allow for automatic generation and sending of statements for added convenience.

Legal Requirements for Rental Invoices

Ensuring compliance with legal standards is essential when issuing financial documents for services. Specific regulations dictate the information that must be included, helping to maintain transparency and fulfill tax and reporting obligations. Understanding these requirements helps businesses avoid penalties and fosters trust with clients.

- Identification Details: Include the full legal names and contact information of both the service provider and the client, ensuring accuracy for official records.

- Unique Document Number: Assign a distinctive reference code to each document, which aids in organization and future audits.

- Description of Services: Provide a clear and concise summary of the services rendered, along with quantities, rates, and dates, as required by law.

- Faster Delivery: Sending documents electronically ensures immediate delivery, helping clients receive billing information without delays associated with mail.

- Reduced Errors: Digital platforms often include automated calculations and templates, minimizing the risk of manual entry mistakes.

- Improved Organization: Digital documents are easier to store, search, and retrieve, making it simple to keep records organized and accessible.

Why Digital Invoices Are More Efficient

Switching to electronic billing methods offers numerous advantages in terms of speed, accuracy, and convenience. By eliminating physical paperwork, digital processes streamline the entire transaction, reducing administrative tasks and allowing for faster, more reliable communication with clients.

Key Benefits of Digital Billing

Cost Savings and Environmental Impact